Abstract

This paper tries to examine how the COVID‐19 shock affects different countries through their regional integration and their exposure to Global Value Chains (GVCs). Using input–output tables from the EORA dataset, our contribution is threefold. First, we conceptually revise the approache to analyse input–output relationships and underline the difference between the bilateral flow of value added and trade and distinguish between the producers and consumers of value‐added. Second, we distinguish between the supply and demand channels through which these countries can be affected by the disruptions in GVCs. Third, we apply this empirical exercise on an understudied region, namely the Mediterranean region that is characterised by its involvement in several trade agreements that might boost their integration into GVCs. Our main findings show that, first, most of the countries have relatively larger backward GVC linkages than forward ones. Second, in the Northern shore of the Mediterranean, Italy and France are net suppliers of value added since they produce more value‐added absorbed abroad than the foreign value‐added they consume. Third, our results highlight also the limited integration between Southern shore partners, whose integration is almost completely driven by linkages with Southern European developed countries.

Keywords: COVID‐19, global value chains, regional integration

1. INTRODUCTION

The world has been hit by the unprecedented shock of the COVID‐19 pandemic that led to significant changes at the economic and social levels. In particular, it created a series of disruptions to Global Value Chains (GVCs) in both the short run (such as lockdowns) and the longer run (such as quarantines, travel bans and restrictions). Consequently, countries that are heavily involved in such GVCs were strongly hit by the shock (Baldwin & Freeman, 2020 and Strange, 2020). This paper, exploiting multi‐regional input–output tables, attempts to examine how the pandemic affects emerging markets through GVCs. We focus on some Euro‐Mediterranean countries that are well positioned to integrate and that have developed, to a certain extent, some GVCs between the two shores of the Mediterranean.

The disruptions implied by the pandemic contributed to the slowdown of the fragmentation of production and the ‘second unbundling’ (Baldwin, 2016) that had started in the 1980s and that led to the emergence of complex international production networks thanks to the Information and Communication Technology (ITC) revolution and trade liberalisation. These trends were sustained until the financial crisis of 2008–2009, but since then, with the great trade collapse and with an increasing protection at the world level, a sort of ‘slowbalisation’ was observed. The pandemic arrived in a peculiar time where trade wars were intense, the Brexit took place, and the multilateral system is on hold with the World Trade Organization Appellate Body crisis and the de facto failure of the Doha Development round. All these developments along with the pandemic led to more uncertainty. Consequently, firms could rethink their internationalisation strategies and several emerging markets can benefit or lose from their integration into GVCs.

This paper tries to examine how the COVID‐19 shock can affect different countries through their regional integration and their exposure to GVCs. Our contribution is threefold. First, building on Pahl et al. (2021), we conceptually revise the approaches to analyse input–output relationships. In particular, we underline the difference between the bilateral flow of value added and trade and distinguish between the producers and consumers of value added. This clarification is particularly useful to analyse the impact of shocks as well as to address whether there is any chance of increasing the regional integration within the South, within the North and between South and North. Second, we distinguish between the supply and demand channels through which these countries can be affected by the disruptions in GVCs. Third, we apply this empirical exercise on an understudied region, namely, the Mediterranean region for two reasons. First, the area includes a set of heterogeneous countries with different levels of industrialisation that, in theory, can be part of GVCs. Indeed, it includes advanced European countries in the northern shore, and middle‐income countries in the southern shore. Our analysis singles out eight countries: France, Greece, Italy and Spain for the northern shore (North); Egypt, Jordan, Morocco and Tunisia for the southern shore (South). Second, countries' selection reflects their involvement in trade agreements or regional integration plans for the area, namely Agadir agreement (between Egypt, Jordan, Morocco and Tunisia) and the bilateral European Association Agreements. With these considerations in mind, we measure the extent of Mediterranean regional integration and discuss what could be done (if something could be done) to enhance these linkages.

Standard trade statistics based on gross trade flows, while accurately tracking goods that enter or leave the country, are hardly informative about the international input–output linkages. To accurately measure GVCs, economists have developed, refined and increasingly exploited multi‐regional input–output tables. Thus, our analysis is conducted at the country level using input–output tables (Lenzen et al, 2012). Our main findings show that, first, most of the countries have relatively larger backward GVC linkages than forward linkages. Second, in the Northern shore of the Mediterranean, Italy and France are net suppliers of value added since they produce more value‐added absorbed abroad than the foreign value added they consume. Third, in the southern shore, Tunisia is the most integrated in GVCs but is also a net consumer of foreign value added. Morocco participates in GVCs but mainly in upstream segments. In contrast, Jordan and even more Egypt are less involved in GVCs. Fourth, our results also highlight the limited integration between Southern shore partners, whose integration is almost completely driven by linkages with Southern European developed countries.

From a policy perspective, this result suggests the importance of deepening the Agadir agreement to increase regional value chains between countries of the Southern shore of the Mediterranean on the one hand and with those of the Northern shore.

The paper is structured as follows. Section 2 presents the main channels through which COVID‐19 affects GVCs from the supply and demand perspectives. Section 3 explains our measures of GVCs. Section 4 assesses the structure, composition and exposure of GVCs in our countries of interest. Section 5 concludes and provides some policy recommendations.

2. HOW DID COVID‐19 AFFECT GVCS?

Let us briefly summarise the channels through which the COVID‐19 pandemic has affected the functioning of Global and Regional Value chains. More precisely, we single out the supply and the demand factors; we see what role they have played/could play and why we think that the COVID shock is intrinsically different from any other pandemic shock.

2.1. Supply side

2.1.1. Factors of production

Selective lockdowns, quarantines and confinement as well as reduced air travel have disrupted the smooth working of Global Value Chains all over the world and made it difficult for buyers to keep track of their suppliers. Consumers too had to face unexpected difficulties. Most variables have been affected: labour supply because workers have been sick, or in partial or full lockdowns and subject to social distancing rules. As per capital, capital owners have become illiquid, uncertain and possibly insolvent. This exerted a negative impact on production through delays, less investment projects or reduced output (Miroudot, 2020). Indeed, Zeshan (2021), using a Computable General Equilibrium Model (GTAP‐VA), introduces the impact of the pandemic by reducing the supply of factors of production (such as labour force, capital stock and land rents). These shocks led global welfare losses around 4.6 trillion (5.2% of global GDP). In the same vein, Eppinger et al. (2020), allowing for imperfect intersectoral mobility of labour, show that welfare losses are heterogeneous since they range from −30% for China, to −0.75% for Russia and +0.12% for Turkey.

2.1.2. Intermediate inputs

Obviously, intermediate inputs are the most important channel through which the COVID‐19 is likely to affect GVCs. When production in one location requires inputs from another location that is directly affected by the pandemic, supply chains could be severely interrupted. ILO (2020a) shows that this interruption has been aggravated through the ripple effects along supply chain and through shortages of parts and equipment to downstream industries (such as the automotive, chemicals, computer equipment, garments and textiles, machinery, metal and metal products industries, and those relating to precision instruments). This is why COVID‐19 has questioned the excessive reliance on China for supplies (Javorcik, 2020). Indeed, around 25% of intermediate inputs used in high‐tech exports (that include pharmaceuticals and chemical products, machinery, motor vehicles and other transport equipment) in the United States, Japan, Korea and Mexico come from China. Clearly, this negative effect is particularly pronounced for the lower tiers of supply chains where small and medium enterprises (SMEs) are present, notably in emerging economies. Baldwin and Freeman (2020) defines ‘supply chain contagion’ according to which the supply‐side disruption in China is being transmitted to other nations, notably for South Korea that is deeply integrated with China.

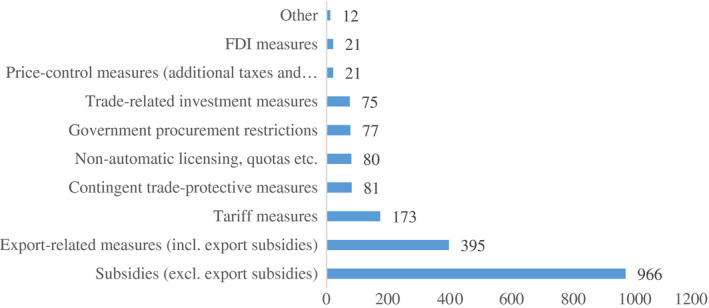

2.1.3. Trade policy related

Global value chains have been also affected by the growing number of protectionist measures that have been imposed by various countries (such as price controls, exports bans, quotas, etc.) as it is shown in Figure 1. Most of the measures dealt with exports (72% are related to subsidies and other export‐related measures). Clearly, in addition to the disruption related to the flow of intermediate inputs, protectionist measures aggravate the negative impact of the pandemic on GVCs through three main channels. First, some measures might increase costs of production (directly through tariffs or indirectly through subsidies and export‐related measures) and reduce a country's ability to compete in export markets (OECD, 2013). Second, other measures can limit the availability of inputs if they are prohibitive (such as export bans, quantitative restrictions, etc.). Third, such measures are also associated to a severe uncertainty, which makes production and investment difficult to plan. Consequently, it very difficult for the firms to resume business as usual, leading them to rethink their internationalisation strategies. For instance, in the case of USA, Caldara et al. (2020) show that trade policy uncertainty reduced American investment by about 1.5% in 2018.

FIGURE 1.

Harmful measured enacted by different countries—2020. Source: Global trade alert online dataset

2.1.4. Services provisions

Several services have been affected by the pandemic, namely transportation services reflected by more restrictions on the movement of people (especially those involved in the physical distribution of goods such as truck drivers, seafarers, pilots etc.), quarantine measures for air or sea crews and additional sanitary controls and requirements at the border for customs clearance and circumscribing of international air travel. Consequently, trading across borders has become more complicated and more expensive. This disruption in international transport networks directly affected GVCs that are highly dependent on transporting intermediate inputs from one region/country to another. This means that such a shock can affect also both domestic outsourcing and domestic transport networks (OECD, 2020a, 2020b).

2.2. Demand side

The pandemic also exerted a negative impact on demand through two main channels:

2.2.1. Labour market channels

First, with fewer exports and less production, labour demand decreases. This increases the risks of the most vulnerable workers such as women, migrants and informal workers who often do not have neither a contract nor a social protection scheme. For instance, according to UNESCWA (2020), the Arab region would lose at least 1.7 million jobs in 2020 with social distancing, reduction in working hours and millions of people who are pushed in working poverty. Second, the decrease in labour demand led to a downward pressure on the level or growth rate of average wages in most countries (especially in Japan, the Republic of Korea and the United Kingdom). In some European countries, workers would have lost 6.5% of their total wage bill between the first and second quarters of 2020 (ILO, 2020b) with also a difference between women and men (an average between 8.1% of losses for women and 5.4% for men). Yet, despite the fact that several countries introduced retention measures and increased unemployment pensions, several categories were adversely affected by the pandemic since their purchasing power declined leading to lower demand.

2.2.2. Demand of final goods

As a consequence of lower labour demand, severe sanitary containment measures and lower income levels, the demand for final goods has been affected through several channels. First, the structure of demand has shifted from some goods to others. For instance, while the demand for food products slightly declined with the closure of restaurants and hotels that of medical supplies has surged. Second, and because of the previous point, demand has become more volatile. Indeed, with income and production fluctuations, consumption of different products has been unpredictable (OECD, 2020a, 2020b). Third, with lower demand in different markets, firms are less likely to sell goods used as intermediate inputs in other countries. Fourth, this led to excess inventory (this is certainly the case for the automobile industry, oil and dairy products) leading to storage capacity shortages and the destruction of perishable products (ILO, 2020). Thus, these different channels exert a negative effect on welfare with a pronounced heterogeneity across countries (Eppinger et al., 2020). Following the model of Benguria and Taylor (2020), if we assume that the pandemic shock is similar to a financial crisis, history shows financial crises are predominantly a negative shock to demand where imports decline, exports remain stable and exchange rate depreciates.

In the next section, we explain how the latter is measured in our paper and we investigate and disentangle the effect of COVID‐19 through the supply and demand channels.

2.3. Future developments

After the Global Financial Crisis (GFC) of 2008 has slowed the era of hyper‐globalisation that started in the 1980s, the COVID‐19 crisis has hit the world system in a peculiar moment characterised by a lot of uncertainty. Indeed, several forces, such as automation and three‐dimension (3D) printing, or the surge of political views leaning towards protectionism, contribute to increased uncertainty. Given the fundamental role of international production networks for countries' economies and consumption, as well as for their relevance for shocks transmission, scholars and policymakers are wondering about the future of globalisation and GVCs, leading to an important debate at the academic and policy levels.

On the one side, some scholars argue that the post‐COVID‐19 era will be characterised by a wave of de‐globalisation or ‘slowbalisation’ (Javorcik, 2020, etc., UNCTAD, 2020). In this scenario, a retreat of GVCs may even take place. Firms could reshore or nearshore some foreign activities in order to reduce exposure to foreign shocks and protect themselves from the risk of disruption. On the other side, others argue that a drastic change in international relationships will hardly occur, since the shock, despite its strength, is perceived as transitory, and thus, there is a weak incentive for firms to tear down their network of cross‐borders linkages laboriously built up over time and at great cost, largely sunk (Antràs, 2020).

Both sides of debate bring solid arguments and some preliminary yet suggestive evidence either from surveys, case studies or anecdotal. However, aggregate data and reliable statistics are still missing, and no definite answers and visions have yet emerged. Indeed, there are no data yet that can allow us to describe the post‐COVID‐19 world, since we still are in the middle of the pandemic. Yet, we can build on structural trends related to input–output linkages between countries and then ‘shock’ these relations (for instance using the difference between the rate of growth for 2020 estimated in 2019, when COVID‐19 was not contemplated and the rate of growth estimated in 2020, once the pandemic had started) to build possible scenarios.

Considering pros and cons of different trajectories is paramount to design meaningful policies. Among the advantages, the existing literature has clearly shown that GVCs entail important long run benefits in terms of growth and development (see Antras, 2020; WDR, 2020). Nevertheless, a major disadvantage is that GVCs have often been a channel for the transmission of shocks, as during the GFC. However, some recent evidence for the COVID‐19 crisis suggests a reduced role of GVCs in the transmission of shocks with respect to the GFC, and towards beneficial effects since international linkages seem to have even ‘sheltered’ firms (Bonadio et al., 2020; Giovannetti et al., 2020, Giglioli et al., 2021).

3. GVC MEASURES

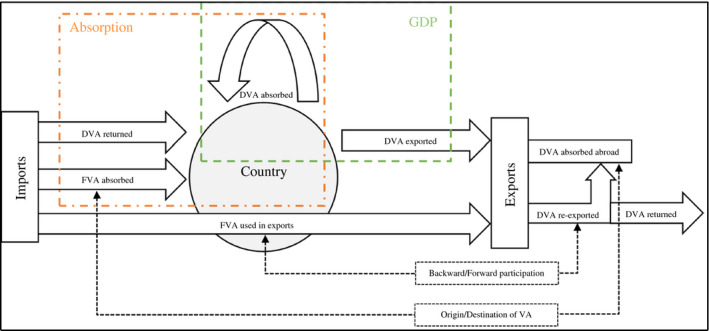

Before moving to the data, it is important to clarify relevant concepts and definitions and be explicit about what the different GVC indicators capture. In fact, several methodologies have been proposed (Johnson & Noguera, 2012; Koopman et al., 2014). In this paper, we follow the recent decomposition by Borin and Mancini (2019). In particular, we combine a more standard approach to GVC measurement, based on value‐added content of exports, with a different approach looking at value‐added absorption. The first approach, namely the value‐added content of exports one, helps capturing the input–output linkages of international production, hence for simplicity referred to as the supply side of GVC. Yet, the second approach, value‐added absorption, allows a characterisation of where the value‐added flowing through several countries along the global value chain is ultimately absorbed into final consumption, hence what we claim is the demand side of GVC.

To clarify what we mean, we refer to Figure 2. The diagram shows the inward and outward flows of a representative country. In what follows, we describe how those flows enter the GVC indicators that we use in this paper.

FIGURE 2.

International flows and GVC measures. Source: Authors' elaboration

3.1. Supply side: foreign value added for production

Our starting point is the decomposition of exports into its domestic and foreign contents. Exports today are seldom produced entirely with domestic inputs only. The direct or indirect use of foreign inputs implies that part of a country's export is made of foreign value added. The ‘foreign content of exports’ refers to the value added that has been produced abroad and is, therefore, due to the use of imported inputs used in production and further incorporated into exports (see ‘FVA used in export’ in Figure 2). The remaining part is the ‘domestic content of exports’, which refers to the value added that is domestically produced (see ‘DVA exported’ in Figure 2).

This export decomposition allows us to obtain a first measure of GVC participation. More specifically, the foreign content (or foreign value added) represents a measure of ‘backward participation’, being due to the use of foreign inputs in the production of exports. As the country uses foreign value added in the production of its exports, its exported value added can be used by third countries in the production of their exports (implying that the exported value added in turn re‐exported after being incorporated into export of others; this can happen several times). This perspective is obtained if we consider the exporting country as a supplier of intermediate products or value added for other countries exports. This second measure captures ‘forward participation’.

Backward and forward participation are the two most standard measures of GVC interactions among countries. They capture foreign value‐added flows used in the production of exports; therefore, they refer to goods that cross at least two borders (once when they are first exported and at least one other time when they are re‐exported) and are used as inputs in production (see Appendix S1).

3.2. Demand side: foreign value added for consumption

Looking at value added used in production is fundamental to capture the input–output linkages. Yet, this information must be complemented with an understanding of for whom goods are actually produced and who ultimately consumes them. Not all the foreign value‐added imported is used for production of exports and thus, part of it may never leave the country and thus be absorbed into final demand. Similarly, domestic value‐added exported may be consumed several steps down the direct trade partners and part of it may return home through imports. To capture this demand side of GVC, we need a different approach. In what follows, we propose a different GVC decomposition that looks at the origin and destination of value added.

To appreciate this perspective, consider the following example. Country A exports to country B and B exports to country C; trade thus follows the chain A–B–C. Considering the interconnections allows us to recognise that bilateral trade relations (A–B) may be affected by what happens to third countries (C). The GVC approach that we adopt in this paper helps us consider this kind of effects. Assume, for simplicity, that all A‐to‐B export is A's value added that B uses in producing its own exports to country C, which then consumes the goods. Country B thus plays the role of a processing export platform. In other words, all of A's exports to B is actually produced for C's consumers. It is clear that A is in fact exposed to demand shocks originating in C through GVC production relations that involve B; while a demand shock in B would instead be irrelevant, despite B being a trade partner. Note how we would fail to capture this linkage by looking only at gross bilateral exports: A and C do not trade and they would appear as unrelated, while the opposite is true. An economic shock in C, by reducing consumption in C, impacts A through a reduction of A's exports to B and B's exports to C. Similarly, an economic shock in A reduces the supply of value added and thus consumption possibilities in C, through reduced exports from A to B and from B to C. Both these channels have been at work in the COVID‐19 pandemic as it has been shown in Section 2.

Referring to Figure 2, we look at the foreign value added that is ultimately absorbed by the country (‘origin of value added’) and at the domestic value added that is ultimately absorbed abroad (‘destination of value added’).

It is important to note how all the value added produced by one country must equal its GDP. Similarly, all value added absorbed into final demand, either of domestic or foreign origin, equals aggregate spending. GVC flows are therefore fully consistent with national accounting identities. In particular, GDP, absorption and trade are linked by the following identity:

This stems from:

(i) the definition of GDP as value added produced as well as sum of private consumption, private investments, government spending and net export:

(ii) the definition of absorption as value added consumed:

(iii) the definition of export and import value‐added decomposition as:

In all our calculations, we use the most recent 2016 release of the UNCTAD Eora26 multi‐regional input–output table (Lenzen et al., 2012), which contains information for 189 countries and 26 industries. Indeed, to take into account all input–output relations, the calculation of GVC indicators requires the use of the entire matrix of country‐sector‐to‐country‐sector trade flows even if one is interested in only one country or sector.

4. GVC INTEGRATION IN THE MEDITERRANEAN

The conceptual contribution described above constitutes the starting point for our analysis of the production and trade linkages between Southern and Northern Mediterranean countries.

4.1. GVC participation of Mediterranean countries

Table 1 reports exports decomposition of the Mediterranean countries considered. Italy and France are by far the larger exporters, followed by Spain and Greece. In 2019, the share of manufactures exports to merchandise exports is 81% in France and 82% in Italy, whereas Spain and Greece's shares are much lower (66% and 34%, respectively). As far as the southern shore of the Mediterranean is concerned, Morocco and Egypt lead the group, followed by Tunisia and Jordan. While these figures are heavily connected to the value of national GDP, their decomposition provides interesting insights on international performances. In light of the approach discussed above, we decompose exports with two different perspectives. First, we look at the origin of value‐added exported, that is whether it is domestic or foreign. This allows us to understand how much countries' exports depend on the imports of foreign inputs. Higher foreign value added in exports means that countries increasingly use foreign inputs for their exports and thus, ceteris paribus, that they are more integrated into GVCs. The share of foreign value added in exports measures backward GVCs participation. All southern Europe (SE) countries denote lower levels of domestic value added in their exports than North African (NA) countries since they rely more on imported inputs. This shows to what extent the COVID‐19 shock can lead to stronger disruptions in SE countries, compared to NA ones. At country level, Egypt is the country with the highest share of domestic value added in Exports (almost 90%). To deepen the measurement of GVCs participation, we report also the decomposition of trade between GVCs related and not. GVCs related trade accounts for the share of exports which crosses at least another border with respect to the one considered. As just said, backward GVCs (GVCB) is a part of this account, since, by being FVA in exports, it crosses a border before the one considered. Complement to this figure is the share of domestic value added in exports that is further re‐exported by the importer, forward GVCs (GVCF). In this case, the second border crossed is the outgoing one of the importer. Looking at the figures in Table 1, southern Europe countries show a higher level of GVCs related trade. As far as countries in the Southern shore are concerned, Morocco and Tunisia are much more integrated than Egypt and Jordan, making the former countries more likely to be affected by the pandemic through the supply‐side channels presented in Section 2.

TABLE 1.

Mediterranean countries exports decomposition

| Egypt | Jordan | Morocco | Tunisia | Italy | Greece | Spain | France | |

|---|---|---|---|---|---|---|---|---|

| Gross exports (million $; GEXP) | 22,120 | 7313 | 22,717 | 12,947 | 924,361 | 38,331 | 471,226 | 967,415 |

| of which | ||||||||

| Domestic content (%; DC) | 88.81 | 77.54 | 83.86 | 74.49 | 72.49 | 65.85 | 68.36 | 69.89 |

| Foreign content (%; FC) | 11.19 | 22.46 | 16.14 | 25.51 | 27.51 | 34.15 | 31.64 | 30.11 |

| Total (%) | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

| of which | ||||||||

| GVC‐related trade (%; GVC) | 36.82 | 34.03 | 41.84 | 48.67 | 46.47 | 52.21 | 50.91 | 52.62 |

| GVC‐backward (%; GVCB) | 11.20 | 22.47 | 16.15 | 25.52 | 28.06 | 34.19 | 32.03 | 30.91 |

| GVC‐forward (%; GVCF) | 25.62 | 11.56 | 25.68 | 23.15 | 18.42 | 18.02 | 18.88 | 21.72 |

| Traditional trade | 63.18 | 65.97 | 58.16 | 51.33 | 53.53 | 47.79 | 49.09 | 47.38 |

| Total (%) | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

Bold numbers refer to totals.

Source: Authors' own elaboration using EORA dataset (Lenzen et al., 2012).

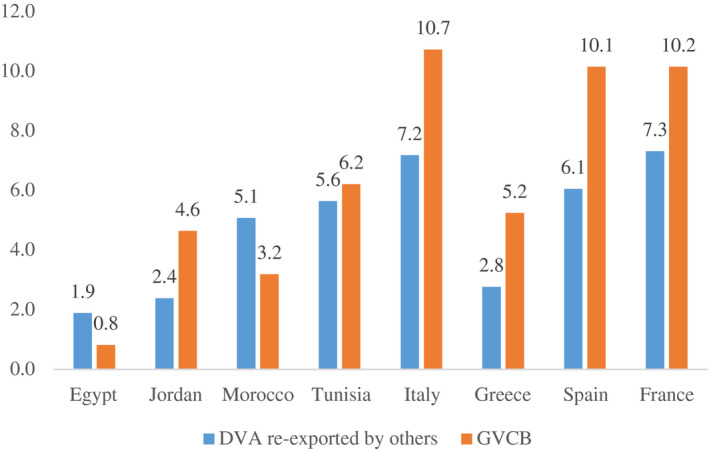

Interestingly, there are differences also concerning the relative importance of GVCB and GVCF (Figure 3) for Southern Europe countries. Indeed, GVCB is by far larger than GVCF, meaning that these countries are relatively closer to final demand, or in other words positioned downstream in the GVCs (Antràs et al., 2012). Thus, the demand channels are likely to exert an indirect negative effect on these countries since the pandemic shock leads to a lower demand for final goods. The contrary is true for countries in the Southern shore that are more affected by the supply channels: only Jordan has GVCB larger than GVCF, while Egypt and Morocco have much higher GVCF. Tunisia shares of GVCB and GVCF are almost equal. This means that these countries are positioned relatively upstream in GVCs, and further from final absorption of value added.

FIGURE 3.

GVCs backward and forward participation. Source: Authors' own elaboration using EORA dataset (Lenzen et al., 2012)

Notes: Values are in % of GDP

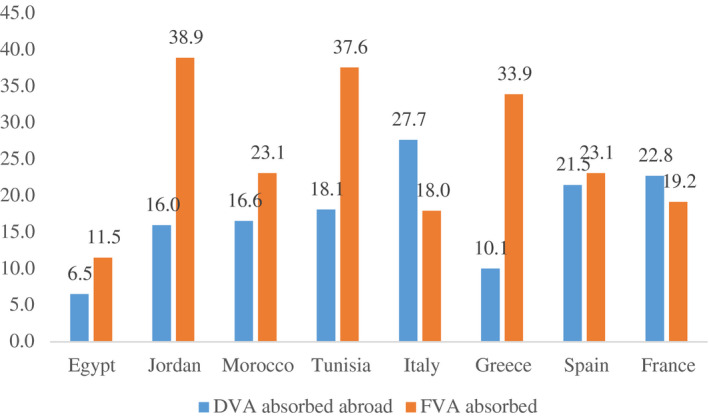

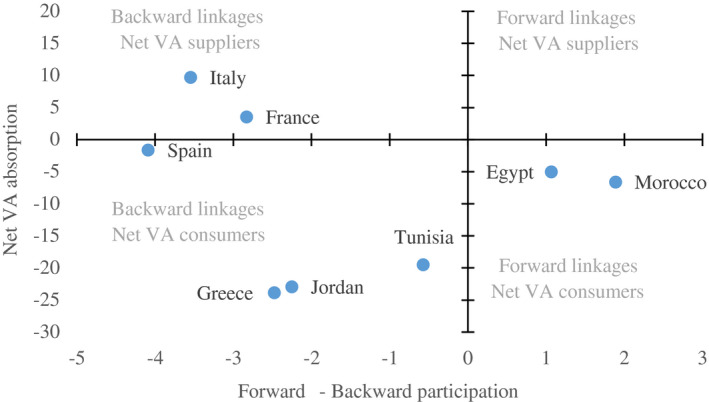

These data (and figures) show that some countries are ‘suppliers’ (GVCF) while others are ‘users’ (GVCB) of value added for production and exports. To complement this perspective, Figure 4 brings into the picture also the supply and use of VA for final demand. In this case, instead of considering the relative importance of forward vs backward GVCs participation, we compare for each country its production of value‐added absorbed abroad with its absorption of foreign value added, linking our analysis to the ‘demand channels’ described above.

FIGURE 4.

Value‐added absorption. Source: Authors' own elaboration using EORA dataset (Lenzen et al., 2012)

Combining the two measures just proposed we obtain a more comprehensive perspective of countries foreign exposure (see Figure 5). Almost all countries, as evidenced by Figure 3, have relatively larger GVCB than GVCF and therefore are positioned to the left of y‐axis. On the x‐axis, we report net value‐added absorption (i.e. the difference between DVA absorbed abroad and FVA absorbed domestically). Only Italy and France are net suppliers of VA: these two countries produce more value‐added absorbed abroad than the foreign value added they consume. All the other countries considered are instead ‘value‐added consumers’. In particular, Jordan, Greece and Tunisia denote the lowest values.

FIGURE 5.

GVCs participation and value‐added ‘balance’. Source: Authors' own elaboration using EORA dataset (Lenzen et al., 2012)

These figures provide interesting insights to characterise country international performances, given the large differences in positioning. Southern Europe countries, especially Italy and France, have high GVCs participation and are close to final demand. Furthermore, they also stand as ‘net value‐added suppliers’. Spain follows closely and the only exception is Greece, probably due to its relatively more distant geographical position and different specialisation pattern (less advanced manufacturing and less services, a part from shipping). Results are much less clear‐cut for countries of the Southern shore of the Mediterranean. Tunisia is the most integrated in GVCs but is also a ‘net consumer’ of foreign value added; Morocco participates in GVCs but mainly in upstream segments; Jordan is not so involved in GVCs, even if relatively downstream, but is a net consumer of foreign value added; finally Egypt is the least involved in GVCs.

It is crucial to note that, despite their relevance and ability to explain major patterns, these figures, being countries aggregate, do not provide a complete characterisation of the international relationships for our sample of countries. Indeed, trade partners matter since a bilateral perspective allows us to go deeply into the analysis of regional integration.

After presenting these backward and forward linkages, it is important to examine the exposure of various countries to the shock implied by the pandemic. Our approach is close to Pahl et al. (2021) that analyse the transmission of supply and demand shocks for developing countries at a global level. In their paper, they use trade in value‐added data for a sample of 12 developing countries in Sub‐Saharan Africa, Asia and Latin America in order to quantify their dependence on demand and supply from the three main hubs, namely China, Europe and North America. In our paper, we depart from their work since we focus on a regional dimension and propose a matrix approach that allows disentangling the proposed measures for Mediterranean partners. This helps us assess the extent of regional linkages, as well as to discuss future policies for improving countries' resilience when facing international shocks such as the COVID‐19. In particular, we first look at the supply side, that is we focus on the source of value added used in exports—as a proxy for production—and second we analyse the demand side, that is we focus on the destination of value added absorbed by foreign countries in final demand. This will help us examine how the pandemic can affect our countries of interest through the supply and demand channels described above.

4.2. Regional linkages

4.2.1. Supply side

Let us analyse how the countries in our sample are interconnected through supply linkages. To this aim, we construct Table 2 where, in the rows, we have countries that are the ‘source of VA’, further exported by countries in columns. This table helps us single out the impact of a shock in country i (in row) on the exports of country j (in column)—one could think of exports as a proxy for supply. Country j sources foreign VA for its production from countries i. It is important to note that shares are computed by column, since we are interested in weighting the importance of a shock of supply from i to j. To grasp the intuition behind the table, we rely on a simple example. Exports by Tunisia (Column 4) contain Foreign Value Added (FVA). The 42% of this FVA is produced in the Mediterranean Area (the 58% in the RoW). This 42% is the sum of all the countries in the area: France (19%) and Italy (16%) are by far the most important contributors. The role of value added from partners in the South shore of the Mediterranean is marginal (1% Egypt and 1% Morocco). This means that a shock that reduces supply in Italy by 10%, reduces the flow of VA to Tunisia, and therefore the foreign content of Tunisian exports by 1.6%, while a shock that reduces supply in Egypt by 10% has a negligible impact on the flow of VA to Tunisia.

TABLE 2.

Foreign supply exposure

| Foreign supply exposure | Exporter (j) | |||||||

|---|---|---|---|---|---|---|---|---|

| Egypt | Jordan | Morocco | Tunisia | Italy | Greece | Spain | France | |

| Source of VA (i) | ||||||||

| Egypt | . | 3% | 0% | 1% | 1% | 1% | 0% | 0% |

| Jordan | 1% | . | 0% | 0% | 0% | 0% | 0% | 0% |

| Morocco | 0% | 0% | . | 1% | 0% | 0% | 0% | 0% |

| Tunisia | 0% | 0% | 0% | . | 0% | 0% | 0% | 0% |

| Italy | 9% | 7% | 9% | 16% | . | 13% | 8% | 8% |

| Greece | 1% | 1% | 0% | 0% | 1% | . | 0% | 0% |

| Spain | 3% | 2% | 14% | 5% | 5% | 3% | . | 6% |

| France | 5% | 4% | 18% | 19% | 10% | 6% | 14% | . |

| Exposure to MED | 19% | 17% | 42% | 42% | 17% | 23% | 23% | 15% |

| To SMED | 1% | 3% | 0% | 2% | 1% | 1% | 0% | 0% |

| To NMED | 18% | 14% | 42% | 40% | 16% | 22% | 23% | 15% |

| Exposure to RoW | 81% | 83% | 58% | 58% | 84% | 77% | 77% | 85% |

In the rows, we have countries i that are the source of VA further exported by countries j in columns. It is important to note that shares are computed by column, since we are interested in weighting the importance of a shock of supply from i to j.

Source: Authors' own elaboration using EORA dataset (Lenzen et al., 2012).

4.2.2. Demand side

Table 2 shows a limited integration in the Mediterranean region in what concerns the supply side. All countries share of backward linkages in the area are indeed about the 20%; a stark difference exists for Morocco and Tunisia which source in the area more than the 40% of their FVA in exports. However, this is sourced almost entirely from southern Europe: France is the main source for both of these countries, while Italy and Spain stand as second source for respectively Tunisia and Morocco.

The leading role of southern Europe is found for all the countries: exposure to NMED account indeed for almost the 100% of the whole MED exposure. This highlights limited integration between Southern shore partners, which is almost completely driven by linkages with Southern European developed countries. As far as southern Europe is concerned, Italy and France are the least integrated in the area as users of FVA in exports: this suggests that their network is connected towards other international partners such as Germany, China and United States. Thus, the COVID‐19 shock will be transmitted more from the Northern to the Southern shore of the Mediterranean rather than between countries of south‐Med, given their limited integration, Table 3 analyses regional integration from the demand side. In the rows, we have the origin country of VA, in columns countries that are absorber of VA (final demand). This table helps us single out the impact of a shock in country j (in column) demand on country i (in row). Country j absorbs VA produced in country i. In contrast with Table 2, shares are now computed by row, since we are interested in a shock of demand from j to i. Let us refer to the same example as above to show the difference between the two perspectives. Tunisia (row 4) produces VA that is absorbed by foreign countries demand. The 43% of this VA is absorbed in the Mediterranean Area (the 57% in the RoW). Italy absorbs about 1/3 (15%) of Tunisian VA absorbed abroad, while France (21%) absorbs half of it. In addition, in this case, the demand from other countries in the Southern shore is limited. As above, a 10% contraction of demand in, say, Italy, ceteris paribus reduces consumption of VA from Tunisia, and therefore Tunisian GDP absorbed abroad by the 1.5%. Again, a contraction of demand in Egypt has a negligible impact on Tunisian GDP absorbed abroad.

TABLE 3.

Foreign demand exposure

| Foreign demand exposure | Destination of VA (j) | Exposure to Med | To SMED | To NMED | Exposure to RoW | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Egypt | Jordan | Morocco | Tunisia | Italy | Greece | Spain | France | |||||

| Origin of VA (i) | ||||||||||||

| Egypt | . | 1% | 0% | 1% | 9% | 2% | 3% | 5% | 21% | 2% | 19% | 79% |

| Jordan | 3% | . | 0% | 0% | 1% | 0% | 0% | 1% | 5% | 3% | 2% | 95% |

| Morocco | 0% | 0% | . | 1% | 5% | 1% | 11% | 18% | 36% | 1% | 35% | 64% |

| Tunisia | 0% | 0% | 1% | . | 15% | 1% | 6% | 21% | 44% | 1% | 43% | 57% |

| Italy | 0% | 0% | 0% | 0% | . | 2% | 5% | 8% | 16% | 0% | 16% | 85% |

| Greece | 1% | 0% | 0% | 0% | 9% | . | 3% | 4% | 18% | 1% | 17% | 83% |

| Spain | 0% | 0% | 1% | 0% | 7% | 1% | . | 12% | 22% | 1% | 21% | 78% |

| France | 0% | 0% | 1% | 1% | 7% | 1% | 7% | . | 16% | 2% | 14% | 84% |

Shares are now computed by row, since we are interested in a shock of demand from j to i.

Source: Authors' own elaboration using EORA dataset (Lenzen et al., 2012).

As in Table 2, also Table 3 shows the limited integration in the Southern shore of the Mediterranean. Besides, as above, the driver of this integration is characterised by the importance of Southern Europe countries for partners from the Southern shore. Indeed, France, Spain and Italy have an important role, especially for Morocco and Tunisia. A notable difference is represented by the much‐reduced importance of demand linkages with respect to supply linkages for Jordan.

4.2.3. Integration and exposure to shocks

The low regional integration in the Mediterranean area, especially of the countries in the Southern shore is not a new fact. To face this issue, in the last decade, governments have implemented several actions. Main efforts have been devoted toward creating favourable regulations of foreign business activity, including profits tax exemptions, tax‐free raw materials imports and investment subsidies that have contributed to attract manufacturing producers and foreign capital. In fact, an example of a successful story is the development of the Moroccan automotive industry. Nonetheless, despite the potential for integration and efforts made, some factors have limited the scope for developments of stronger links. Investment attractiveness is linked to human capital, infrastructure quality and an adequate business environment (Omri & Sassi‐Tmar, 2015). Mediterranean countries need to improve on all of these aspects, and recent economic and political insecurity has further contributed to weaken the linkages and increase exposure to shocks (Smith, 2015). To foster integration, increasing trade openness could be, in the short run, an important facilitator, also because FDI are likely to be a consequence of commercial relationship (Amendolagine et al., 2019; Conconi et al., 2016; Martínez‐Galán & Fontoura, 2019). Despite progress since the 1995 Barcelona agreement and the 2007 Agadir agreement,1 trade protection in some Mediterranean countries remains relatively high (Bown & Crowley, 2016; Caliendo et al., 2015). Del Prete et al. (2018) find that GVC participation (backward and forward) is negatively correlated with tariffs. Kowalski et al. (2015) estimate that Morocco and Tunisia could increase GVC participation by 15% with lower trade barriers. Finally, the policy agenda has not yet addressed in a comprehensive manner the issue of Non‐Tariff Measures (NTM). International regulatory cooperation (mutual recognition, adoption of international standards, common procedures etc.) can support GVC integration and facilitate building trust between firms in different countries. Compliance and reliability have increasingly become necessary conditions for firms to participate in GVCs (Nadvi, 2008). On the one side, given the relational specificity, imperfect or low‐quality intermediate inputs from a supplier can imply large costs for a buyer; on the other side, strict quality standards and certifications often requested by developed countries can represent an obstacle for developing countries and SMEs.

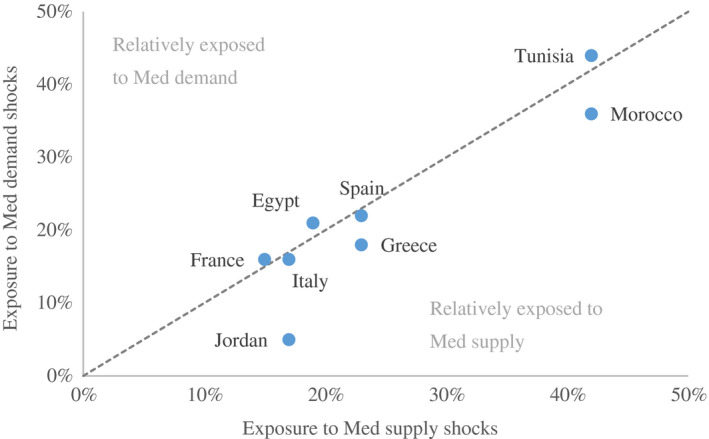

From a policy perspective, our results confirm to what extent the Agadir agreement failed to deepen their integration. Our approach gives a different explanation, linked to Global Value Chains, for this shallow integration. Figure 6 summarises the two perspectives presented above (supply exposure and demand exposure). The similarity of the numerical values of the two matrices implies that most countries are close to the 45° line: the countries most exposed to shocks in the area are Morocco and Tunisia, while Jordan is the least exposed since it is less integrated. Indeed, the trade partners of Jordan are mainly USA and Middle Eastern countries, so that Jordan is almost unaffected by demand side Mediterranean shock (and much less than to a supply shock).

FIGURE 6.

Supply and Demand side in Mediterranean area. Source: Authors' own elaboration using EORA dataset (Lenzen et al., 2012)

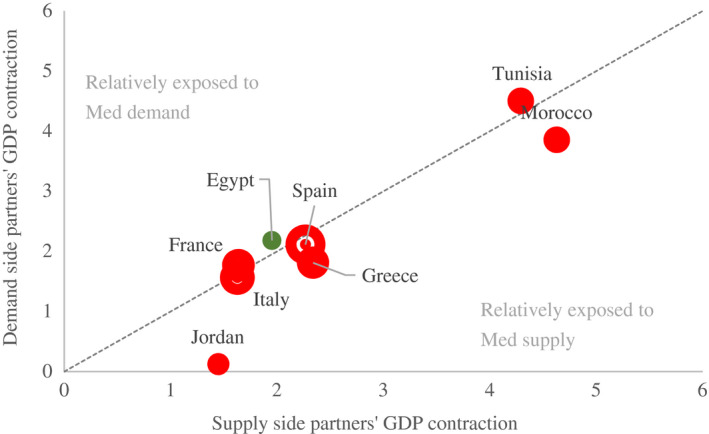

In light of the impact of COVID‐19 crisis on both demand and supply side, we provide evidence in Figure 7, of the average shock propagating from regional integration. We weight partner countries estimates of GDP growth2 with bilateral shares of supply and demand exposure. This gives us an estimate of the average foreign shock hitting each country in the area. Moreover, we complement this measure using own GDP growth for country indicator size. Morocco and Tunisia, given their high shares of linkages with strongly hit Southern Europe countries, stand as the most impacted countries, with an average partner contraction of about 4 percentage points for both supply and demand side. More concentrated are the rest of the counties, with an average partners' contraction between 1.5 and 2.5 percentage points. Among them Egypt exhibit much better results: first, it is the only country in the sample with expected positive GDP growth; second, being the least integrated, is going to be affected less by the shock. Jordan is found indeed to have the lowest partners' contraction since it is characterised by a lower integration and is connected to countries that are less affected.

FIGURE 7.

Supply and Demand side COVID‐19 shock in Mediterranean area

Notes: Authors' own elaboration using EORA dataset (Lenzen et al., 2012). GDP contraction sourced from IMF WEO October 2020 revision

In a nutshell, our results provide evidence on how the COVID‐19 shock can affect different countries through their integration into GVC. This effect depends on several factors, such as whether a country is deeply integrated with its partners, whether it is a supplier or a user of foreign value added, and whether it is positioned upstream or downstream the value chain.

5. CONCLUSIONS

This paper examines how the COVID‐19 shock affects different countries through their regional integration and their exposure to Global Value Chains (GVCs). Using input–output tables (Lenzen et al., 2012), we first distinguish between the producers and consumers of value added and second between the supply and demand channels through which these countries can be affected by the disruptions in GVCs. Our main findings show that, first, most of the countries have relatively larger backward GVC linkages than forward linkages. Second, in the Northern shore of the Mediterranean, Italy and France are net suppliers of value added since they produce more value added absorbed abroad than the foreign value added they consume. Third, in the southern shore, Tunisia is the most integrated in GVCs but is also a net consumer of foreign value added. Morocco participates in GVCs but mainly in upstream segments. In contrast, Jordan and Egypt are less involved in GVCs. Fourth, our results highlight also the limited integration between Southern shore partners, whose integration is almost completely driven by linkages with Southern European developed countries.

From a policy perspective, our results highlight several issues. First, it is clear that the Agadir agreement failed to deeply integrate countries of the Southern shore of the Mediterranean. Thus, if these countries are to develop regional or global value chains, a deeper approach is needed in order to increase their intra‐regional trade in general and that in intermediates in particular. This requires more coordination between industrial and trade policies at the regional level. Second, at the agreements level, if the interlinkages are high, specific legal clauses and policies are needed ex‐ante to prevent value chain disruptions, in particular for the trade of essential goods. Third, these countries are in dire need to increase foreign direct investment in the manufacturing sector instead of oil or primary sector since the former is more prone to the development of regional value chains. Fourth, if in case EU countries consider near‐shoring from Asia to South‐Med countries, the latter have to implement several structural reforms in order to reduce non‐tariff measures and improve their investment climate that are indispensable to boost GVCs (Dovis & Zaki, 2020). Clearly, Asian countries perform better when it comes to the ease of doing business.

However, it is important to note that, while massive waves of reshoring may not take place anytime soon (see Giovannetti et al., 2020; Giglioli et al., 2021, for some evidence with firm level survey data for Italy), firms may still evaluate a less impulsive and more thoughtful reconfiguration of their international networks, perhaps trading some production efficiency with resilience and robustness in order to build more sustainable GVCs. A feasible solution could imply the diversification of international partners and the introduction of new contractual clauses to avert value chain disruptions as a way to improve risk management. This solution could help facing supply disruptions and bottlenecks, while keeping alive the benefits from internationalisation. In this regard, the geographical dimension may be crucial. While technology has increased the scope for collaboration with geographically distant partners, international transport networks and people movements across borders are still needed for the unfolding of many GVCs operations (OECD, 2020a, 2020b). The COVID‐19 crisis, which induced a sudden and complete stop to people circulation, has spurred the digitalisation of some activities but has also showed how close interactions are still a vital necessity. Strengthening regional ties and designing opportunities imbedded in legal frameworks for stable integration may contribute to create resilient and sustainable GVCs.

Our research agenda includes several points. First, with the data at our disposal, we are not able to forecast the different scenarios that may arise in terms of reconfiguration of GVCs. In other words, we cannot say with certainty if there will be some suppliers' diversification nor how firms will be able to manage the increased uncertainty and react to mitigate its impact. Second, our paper adopted a macroeconomic approach. Clearly, the latter hides a lot of sectoral heterogeneity. An important question arises, if near‐shoring takes place, shall South‐Med countries consider traditional sectors (such as textile, ready‐made garments, chemicals) or non‐traditional ones (electronics, electrical products) or products that are vital for the current context (pharmaceuticals, medical equipment, etc.)? This needs a thorough a detailed analysis that is out of the scope of the current paper.

Supporting information

Appendix S1

ACKNOWLEDGEMENT

The authors are grateful to the editor and the anonymous referees of the World Economy journal for their constructive comments.

Ayadi, R. , Giovannetti G., Marvasi E., Vannelli G., & Zaki C. (2022). Demand and supply exposure through global value chains: Euro‐Mediterranean countries during COVID. The World Economy, 45, 637–656. 10.1111/twec.13156

Funding information

There is no funding information to disclose.

Footnotes

The Agadir agreement is a free trade agreement between Egypt, Jordan, Morocco and Tunisia (and from 2016 also Palestine and Lebanon). The agreement was launched in 2001 but came into force in 2007. One important feature is that the Agreement uses the EU's rules of origin.

GDP estimates for 2020 are sourced from IMF, WEO October 2020.

REFERENCES

- Amendolagine, V. , Presbitero, A. F. , Rabellotti, R. , & Sanfilippo, M. (2019). Local sourcing in developing countries: The role of foreign direct investments and global value chains. World Development, 113, 73–88. [Google Scholar]

- Antras, P. (2020). Conceptual aspects of global value chains. The World Bank. [Google Scholar]

- Antràs, P. (2020). De‐globalisation? Global value chain in the post‐COVID‐19 age. NBER Working Paper Series, 28115 (November). National Bureau of Economic Research. [Google Scholar]

- Antràs, P. , Chor, D. , Fally, T. , & Hillberry, R. (2012). Measuring the upstreamness of production and trade flows. American Economic Review, 102(3), 412–416. 10.1257/aer.102.3.412 [DOI] [Google Scholar]

- Baldwin, R. (2016). The great convergence: Information technology and the new globalisation. Harvard University Press. [Google Scholar]

- Baldwin, R. , & Freeman, R. (2020). Supply chain contagion waves: Thinking ahead on manufacturing ‘contagion and reinfection’ from the COVID concussion. Centre for Economic Policy Research. https://voxeu.org/article/covid‐concussion‐andsupply‐chain‐contagion‐waves [Google Scholar]

- Benguria, F. , & Taylor, A. M. (2020). After the panic: Are financial crises demand or supply shocks? Evidence from international trade. American Economic Review: Insights, 2(4), 509–526. [Google Scholar]

- Bonadio, B. , Huo, Z. , Levchenko, A. , & Pandalai‐Nayar, N. (2020). Global supply chains in the pandemic. NBER Working Paper No. 27224. National Bureau of Economic Research; [DOI] [PMC free article] [PubMed] [Google Scholar]

- Borin, A. , & Mancini, M. (2019). Measuring what matters in global value chains and value‐added trade. The World Bank. [Google Scholar]

- Bown, C. P. , & Crowley, M. A. (2016). The empirical landscape of trade policy. World Bank Policy Research Working Paper, (7620). The World Bank. [Google Scholar]

- Caldara, D. , Iacoviello, M. , Molligo, P. , Prestipino, A. , & Raffo, A. (2020). The economic effects of trade policy uncertainty. Journal of Monetary Economics, 109, 38–59. [Google Scholar]

- Caliendo, L. , Feenstra, R. C. , Romalis, J. , & Taylor, A. M. (2015). Tariff reductions, entry, and welfare: Theory and evidence for the last two decades (p. w21768). National Bureau of Economic Research. [Google Scholar]

- Conconi, P. , Sapir, A. , & Zanardi, M. (2016). The internationalization process of firms: From exports to FDI. Journal of International Economics, 99, 16–30. [Google Scholar]

- Del Prete, D. , Giovannetti, G. , & Marvasi, E. (2018). Global value chains: New evidence for North Africa. International Economics, 153, 42–54. 10.1016/j.inteco.2017.03.002 [DOI] [Google Scholar]

- Dovis, M. , & Zaki, C. (2020). Global value chains and local business environments: Which factors do really matter in developing countries? Review of Industrial Organization, 57, 481–513. [Google Scholar]

- Eppinger, P. , Felbermayr, G. , Krebs, O. , & Kukharskyy, B. (2020). Covid‐19 shocking global value chains. CESifo Working Paper No. 8572. Munich Society for the Promotion of Economic Research ‐ CESifo. [Google Scholar]

- Giglioli, S. , Giovannetti, G. , Marvasi, E. , & Vivoli, A. (2021). The resilience of global value chains during the Covid‐19 pandemic: The case of Italy. Working Papers No. 2021‐07. Universita’ degli Studi di Firenze, Dipartimento di Scienze per l'Economia e l'Impresa. [Google Scholar]

- Giovannetti, G. , Mancini, M. , Marvasi, E. , & Vannelli, G. (2020). The role of global value chains in the pandemic: Impact on Italian firms. Rivista di Politica Economica, 2/2020. Confindustria Servizi, Roma. [Google Scholar]

- International Labor Organization Note (2020). COVID‐19 and world of work: Impacts and responses. International Labor Organization Note. [Google Scholar]

- International Labour Office (2020a). The effects of COVID 19 on trade and global supply chains. Research Brief. International Labour Office. [Google Scholar]

- International Labour Office (2020b). Global Wage Report 2020–21: Wages and minimum wages in the time of COVID‐19. International Labour Office. [Google Scholar]

- Javorcik, B. (2020). Global supply chains will not be the same in the post‐COVID‐19 world. In Baldwin R. E. & Evenett S. J. (Eds.), COVID‐19 and trade policy: Why turning inward won't work. A Vox‐EU org book (pp. 111–116). Centre for Economic Policy Research. [Google Scholar]

- Johnson, R. C. , & Noguera, G. (2012). Proximity and production fragmentation. American Economic Review, 102(3), 407–411. 10.1257/aer.102.3.407 [DOI] [Google Scholar]

- Koopman, R. , Wang, Z. , & Wei, S. J. (2014). Tracing value‐added and double counting in gross exports. American Economic Review, 104(2), 459–494. 10.1257/aer.104.2.459 [DOI] [Google Scholar]

- Kowalski, P. , Gonzalez, J. L. , Ragoussis, A. , & Ugarte, C. (2015). Participation of developing countries in global value chains. OECD Trade Policy Paper, 179. OECD. [Google Scholar]

- Lenzen, M. , Kanemoto, K. , Moran, D. , & Geschke, A. (2012). Mapping the structure of the world economy. Environmental Science & Technology, 46(15), 8374–8381. 10.1021/es300171x [DOI] [PubMed] [Google Scholar]

- Martínez‐Galán, E. , & Fontoura, M. P. (2019). Global value chains and inward foreign direct investment in the 2000s. The World Economy, 42(1), 175–196. 10.1111/twec.12660 [DOI] [Google Scholar]

- Miroudot, S. (2020). Resilience versus robustness in global value chains: Some policy implications. In Baldwin R. E. & Evenett S. J. (Eds.), COVID‐19 and trade policy: Why turning inward won't work. A Vox‐EU org book (pp. 117–130). Centre for Economic Policy Research. [Google Scholar]

- Nadvi, K. (2008). Global standards, global governance and the organization of global value chains. Journal of Economic Geography, 8(3), 323–343. 10.1093/jeg/lbn003 [DOI] [Google Scholar]

- OECD (2013). Trade costs: What have we learned? A synthesis report. OECD Trade Policy Paper No. 150, Paris, France. [Google Scholar]

- OECD (2020a). COVID‐19 and global value chains: Policy options to build more resilient production networks. OECD. http://www.oecd.org/coronavirus/policy‐responses/covid‐19‐and‐global‐value‐chains‐policy‐options‐to‐build‐more‐resilient‐production‐networks‐04934ef4/ [Google Scholar]

- OECD (2020b). COVID‐19 and international trade: Issues and actions. OECD. https://read.oecd‐ilibrary.org/view/?ref=128_128542‐3ijg8kfswh&title=Covid‐19‐and‐international‐trade‐issues‐and‐actions [Google Scholar]

- Omri, A. , & Sassi‐Tmar, A. (2015). Linking FDI inflows to economic growth in North African countries. Journal of the Knowledge Economy, 6(1), 90–104. 10.1007/s13132-013-0172-5 [DOI] [Google Scholar]

- Pahl, S. , Brandi, C. , Schwab, J. , & Stender, F. (2021). Cling together, swing together: The contagious effects of COVID‐19 on developing countries through global value chains. The World Economy. 10.1111/twec.13094 [DOI] [Google Scholar]

- Smith, A. (2015). Economic (in)security and global value chains: The dynamics of industrial and trade integration in the Euro‐Mediterranean macro‐region. Cambridge Journal of Regions, Economy and Society, 8(3), 439–458. 10.1093/cjres/rsv010 [DOI] [Google Scholar]

- Strange, R. (2020). The 2020 Covid‐19 pandemic and global value chains. Journal of Industrial and Business Economics, 47, 455–465. 10.1007/s40812-020-00162-x [DOI] [Google Scholar]

- UNCTAD (2020). How COVID‐19 is changing global value chains. UNCTAD. [Google Scholar]

- UNESCWA (2020). COVID‐19 economic cost to the Arab region. Policy Brief No. 1. UNESCWA. [Google Scholar]

- World Development Report (2020). Trading for Development in the Age of Global Value Chains. The World Bank. [Google Scholar]

- Zeshan, M. (2021). Double‐hit scenario of Covid‐19 and global value chains. Environment, Development and Sustainability, 23, 8559–8572. 10.1007/s10668-020-00982-w [DOI] [PMC free article] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Appendix S1