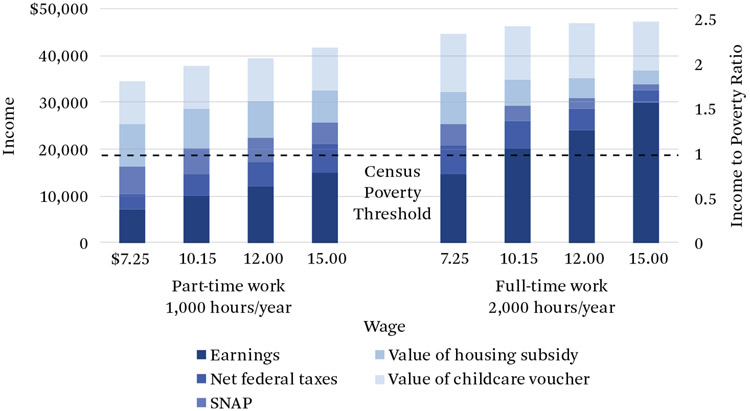

Figure 4. Earnings, Net Federal Taxes, SNAP, Housing, and Childcare Assistance.

Source: Authors’ calculations (see online appendix for details).

Note: Figures are earnings plus taxes and income support transfers at different minimum wage levels; one adult, two-child household, 2016 tax and benefit amounts. Net federal taxes include Earned Income Tax Credit, Child Tax Credit, income tax liability and worker’s nominal portion of FICA payroll tax. Supplemental Nutrition Assistance Program (SNAP) benefits calculated based on average of calculators for three states. Housing subsidy calculated from U.S. Department of Housing and Urban Development rules for Section 8 program, assuming median U.S. rent of $920 per month. Childcare voucher calculated from Child Care Aware data on costs of childcare in the United States and Washington State child subsidy co-pays. Because part-time workers are unlikely to qualify for full-time care, assumed costs of childcare are 0.75 of full value. The Poverty Threshold (2015) is calculated by the census and published each year.