Abstract

While out-of-network or potential “surprise” billing has garnered increasing attention, particularly in emergency department and inpatient settings, few national studies have examined out-of-network care overall or in other settings. We examined out-of-network spending and use among two large nationwide populations with employer-sponsored insurance. In a primary sample of 27,883,040 people in data for 2008–16 from the Truven MarketScan Commercial Claims and Encounters Database, we found that the unadjusted share of total spending that occurred out of network decreased from 7.0 percent in 2008–10 to 6.1 percent in 2014–16, an adjusted average decline of 0.10 percentage points per year. Using a secondary sample of 13,093,209 people in the Health Care Cost Institute database provided qualitatively similar results, including when provider charges (upper bound for balance billing) were used in place of observed out-of-network prices. In subgroup analyses of the primary sample, the share of out-of-network spending was stable or declined among all segments of care except hospitalist services, pathologist services, and laboratory tests across the study period. Out-of-network use demonstrated comparable patterns. Prices were higher out of network than in network. Policy makers should focus their efforts on protecting consumers from balance billing or potential surprise billing in clinical scenarios where patients often have little choice over their provider.

About half of the US population has employer-sponsored health insurance, in which patients are usually encouraged to seek care from within a network of contracted or “in-network” providers. When patients see an in-network provider, prices are typically lower for both patients and their insurers.1,2 However, it is not uncommon for patients to be treated by out-of-network providers, whose prices can be much higher, and in that case patients lack the financial protections afforded to them when they see in-network providers.3–5

Insurers create provider networks to enhance their bargaining power and help encourage enrollees to find lower-cost and higher-quality providers.6,7 Insurers pay in-network providers based on negotiated prices, whereas out-of-network providers are often paid a percentage of the provider charge—which tends to be higher than the in-network negotiated price.8 In addition, patients who receive out-of-network care may be directly billed by providers for the difference between what their insurer is willing to pay and what the provider charges, a process often referred to as “balance billing.”9 Because of the financial burdens levied by out-of-network bills, lawmakers have proposed legislation to protect patients and payers from the high costs of out-of-network care, especially in situations with potential “surprise” bills.10,11

An important set of studies has drawn attention to the prevalence of surprise out-of-network billing and its financial consequences for patients.8,12–14 While these studies tend to focus on patients who received out-of-network bills after going to an in-network hospital or emergency department (ED) (hence the “surprise”), patients in the US are treated out of network in a broader range of settings and circumstances—including, for example, the outpatient setting. The prevalence of out-of-network care across the full range of settings has been less well documented. As a result, policy decisions may be made without a complete understanding of the broader trends in the use of out-of-network care across the delivery system. This is concerning, as there are other understudied settings where patients don’t have the opportunity to choose their provider (for example, the pathologist who analyzes their specimens). We used data from two large nationwide data sets containing information about people with employer-sponsored insurance to examine trends in out-of-network care across a broader range of specialties, services, and time than has previously been done.

The employer-sponsored population is important to study because of its size (it is the largest population segment) and because out-of-network care can be up to three times more expensive for insurers and patients than in-network care for people who have employer-sponsored insurance.15 In addition, some state laws designed to protect consumers from exposure to out-of-network spending do not apply to people covered through self-insured employers.16

Although out-of-network care has received increased scrutiny in recent years, many patients do not know that they have been treated by an out-of-network provider until an unexpected or surprise bill arrives.13,17 About 40 percent of patients who saw an out-of-network physician received unexpected out-of-network bills,18 and 70 percent of patients who faced unaffordable out-of-network bills had been unaware that their provider was out of network.19

We examined trends in the share of spending that occurred out of network for more than twenty-seven million people in a stable sample of employers who provided employer-sponsored coverage in 2008–16. We identified major categories of services and settings and measured how the share of out-of-network spending and cost sharing has evolved. In addition, we added to the literature new evidence that prices for both insurers and patients are higher when services are delivered by out-of-network providers.

Study Data And Methods

Data

We analyzed information on populations with employer-sponsored insurance from two large nationwide claims data sets, using one for the primary analyses and the second for confirmatory analyses.

For the primary analyses, we used the Truven MarketScan Commercial Claims and Encounters Database.20 This data set is often used in policy-oriented research.21,22 Our sample included people who were enrolled in their employer-sponsored plan for at least one calendar year during the period 2008–16 and whose employer consistently contributed data to the database throughout this period. This allowed us to identify a stable sample of employers so that we could limit changes in the sample composition due to the entry and exit of employers from the database.

For the secondary analyses, we used data from the Health Care Cost Institute, whose database contains information on a similar national population with employer-sponsored insurance, for whom charges were available in addition to prices. We used these data for the period 2014–17, when an indicator for in-network versus out-of-network status was available.23 Similar to the primary data set, these data are widely used in research.24,25

Variables

We defined several outcomes of interest. First, we derived spending, using the paid “allowed amount” on claims—which reflects the negotiated prices between insurers and providers. Patient cost sharing (deductibles, copayments, and coinsurance) was included in spending and also analyzed separately. In using the allowed spending and cost-sharing amounts, our analyses did not include any additional out-of-pocket spending due to balance billing, which was unobservable in our primary data set.

In our secondary data set, however, we were able to study billed charges. These charges reflect the provider’s “list price” of care, which often exceeds the allowed payment. In the case of balance billing, patients are typically billed the difference between the charge and the allowed amount. By incorporating charges into secondary analyses, we could determine whether our primary results were driven by the fact that we did not observe balance billing (or a proxy for it).

We identified the network status of each claim using a unique flag that indicated whether it was paid out of network.26 We then calculated the share of spending out of network at the person-year level by dividing spending out of network by the sum of out-of-network and in-network spending.

Independent variables included age, sex, risk score, plan type, and region. We constructed each person’s risk score using the Diagnostic Cost Group (DxCG) model, which uses concurrent demographics and International Classification of Diseases diagnosis codes to calculate a score that reflects the person’s expected costs.27 The DxCG method is similar to the Hierarchical Condition Categories risk-adjustment model used by the Centers for Medicare and Medicaid Services and is commonly used by private insurers for risk adjustment.28

Plan types typically differ in their restrictiveness of access to providers (especially specialists) and coverage of out-of-network care. Health maintenance organization and point-of-service plans generally require enrollees to select a primary care physician, from whom referrals to specialists are required, and cost sharing is greater for out-of-network care. In comparison, preferred provider organization plans offer more generous coverage of specialty and out-of-network care. High-deductible and consumer-directed health plans usually offer lower premiums in exchange for a higher deductible.

We examined heterogeneity in out-of-network spending along two key dimensions: physician specialty and category of service. We identified physician specialties using the primary specialty code listed for the provider at the claims level. This analysis was restricted to professional fees but included claims with a place of service in both the inpatient and outpatient settings. Facility claims were excluded because of the difficulty of assigning the claim to a single provider specialty. We considered related specialties and subspecialties together and specified ten key specialty categories that captured distinct areas of clinical practice: in alphabetical order, anesthesiology, emergency medicine, hospitalist medicine, internal medicine (including internal medicine subspecialties), pathology, pediatrics or obstetrics-gynecology, primary care (including family medicine), psychiatry, radiology, and surgery (including surgical subspecialties).

We defined categories of service using the “type of service” field on each claim. We included both professional and facility fees, but we had to restrict this analysis to outpatient claims because only those claims contained the type of service field. We collapsed related services into common categories (analogous to related specialties) and specified twelve categories of services that accounted for the vast majority of billing codes: in alphabetical order, chemotherapy, consultations, durable medical equipment, ED visits, laboratory tests, obstetrics, office visits, procedures, psychiatric services, radiology, specialty drugs, and vascular interventions.

For the analyses of heterogeneity, our goal was not to capture each specialty or type of service in an exhaustive fashion, but rather to prespecify the major commonly known specialties and types of care, given prior evidence that the share of services received out of network varies across the health care system.29

Statistical Analysis

In unadjusted analyses, we plotted national trends in the average level of spending in and out of network per enrollee per year, as well as the share of spending out of network across our entire sample of enrollees. This was done for spending and cost sharing, as well as for each subgroup of physician specialty and category of service.

We estimated average annual changes in the share of spending and cost sharing out of network overall, by provider specialty, and by type of service using an ordinary least squares regression model. The key independent variable was a linear yearly trend, which allowed us to identify the average annual change in the outcome. In our adjusted specification, the model controlled for age categories, interactions between age categories and sex, risk score, and region, as well as for plan fixed effects that accounted for unobserved time-invariant attributes of the employer and plan. As a result, the findings aimed to capture changes in the share of out-of-network spending or cost sharing within employers and plans. Standard errors were clustered at the plan level. We weighted regressions for each category by a person’s annual spending in the category.

Sensitivity analyses tested the robustness of our results to alterations in the statistical model and measure of spending. In secondary analyses, we began by replicating our results using spending in the Health Care Cost Institute data. Then we examined charges to test whether our results were robust to incorporating a proxy for balance billing (because charges can be thought of as an upper bound on balance billing).

This research was approved by the Harvard Medical School Institutional Review Board.

Limitations

Our study had several limitations. First, our results might not be generalizable to all people with employer-sponsored insurance, even though we analyzed information from two of the largest databases of their kind, or to other insurance markets where provider networks are narrower—such as the nongroup (individual) market, Affordable Care Act Marketplaces, or Medicaid managed care.30 In California Medicaid, for example, more than 60 percent of ED visits have been out of network.31 With that said, we focused on a stable subset of employers in the Truven data to avoid confounding due to the entry and exit of employers from the data. This restriction was relevant, as the full sample of less stably reporting employers revealed compositional changes in the population.

Second, while our data pertain to populations with employer-sponsored insurance, a comparison of our results to those for other settings reveals qualitative similarities—including, for example, the fact that a large proportion of mental health visits are out of network.32–34 In addition to having broader networks, people with employer-sponsored insurance may have more generous coverage (lower copayments and cost sharing), compared to people with nongroup coverage. While these generalizability concerns are noted, about half of the population is covered by employer-sponsored insurance, which lends relevance to these findings. To the extent that characteristics of the study population evolved during the study period, we controlled for such potential confounders flexibly in our statistical analyses. However, unobserved confounding remained possible.

Third, while we observed whether a claim was paid as in or out of network, we did not have data on the full set of in-network providers for each plan. Therefore, we could not assess to what extent network breadth and stability contributed to our findings.35 We also did not observe the identities of insurers, although we did observe the full extent of cost sharing as defined by the insurer—notably, the deductible, copay, and coinsurance.

Study Results

Population

Our primary data were for 27,883,040 unique individuals enrolled in plans sponsored by employers that continuously contributed data to the Truven MarketScan Commercial Claims and Encounters Database in 2008–16. Characteristics of the population are in online appendix exhibit A1.36 In 2008–10 our study sample had an average age of 33.8 years, was 52 percent female, and had an average DxCG risk score of 0.9. The majority resided in the southern or north central US. From 2008–10 to 2014–16 there was a shift in employer-sponsored plan types away from health maintenance organization plans toward high-deductible and consumer-directed health plans.

Spending And Cost Sharing

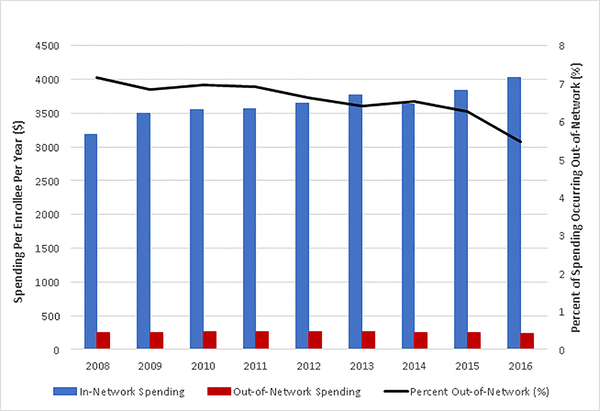

Given faster growth in in-network than in out-of-network spending, the share of spending that was out of network gradually declined (exhibit 1). In unadjusted analyses, this share of allowed spending out of network was 7.0 percent in 2008–10 and 6.1 percent in 2014–16 (exhibit 2). In adjusted analyses, this share declined 0.10 percentage points per year (p=0.02) over the study period (the regression coefficients are shown in appendix exhibit A2).36 This pattern was consistent with the share of people with any out-of-network allowed spending over the study period (appendix exhibit A3).36

Exhibit 1.

Spending In-Network and Out-of-Network, 2008–2016

Exhibit 2.

Levels of and trends in out-of-network spending and cost sharing, 2008–16

| Allowed out-of-network spending (unadjusted %) | Adjusted average annual change | ||||

|---|---|---|---|---|---|

| 2008–10 | 2011–13 | 2014–16 | Percentage point |

p value |

|

| All spending | 7.0 | 6.7 | 6.1 | −0.098 | 0.015 |

| Provider specialty | |||||

| Anesthesiology | 5.6 | 4.3 | 3.8 | −0.245 | <0.001 |

| Emergency medicine | 8.4 | 7.4 | 5.7 | −0.458 | <0.001 |

| Hospitalist medicine | 3.3 | 2.5 | 5.9 | 0.543 | 0.012 |

| Internal medicine | 3.3 | 2.9 | 3.0 | −0.007 | 0.826 |

| Pathology | 5.3 | 6.4 | 8.3 | 0.305 | <0.001 |

| Pediatrics or OB-GYN | 2.0 | 1.7 | 1.4 | −0.082 | <0.001 |

| Primary care | 5.2 | 4.5 | 4.2 | −0.122 | 0.005 |

| Psychiatry | 25.8 | 26.9 | 25.6 | −0.165 | 0.400 |

| Radiology | 3.6 | 3.0 | 2.7 | −0.074 | 0.071 |

| Surgery | 5.6 | 5.5 | 4.7 | −0.134 | <0.001 |

| Category of service | |||||

| Chemotherapy | 3.4 | 3.9 | 2.7 | −0.163 | 0.019 |

| Consultations | 3.7 | 2.9 | 2.1 | −0.221 | <0.001 |

| Durable medical equipment | 11.8 | 11.6 | 9.2 | −0.279 | <0.001 |

| ED visits | 4.9 | 3.7 | 3.0 | −0.328 | <0.001 |

| Laboratory tests | 5.2 | 7.7 | 11.5 | 0.803 | <0.001 |

| Obstetrics | 6.4 | 6.9 | 5.2 | −0.262 | <0.001 |

| Office visits | 3.4 | 3.0 | 2.9 | −0.038 | 0.082 |

| Procedures | 7.9 | 8.0 | 6.4 | −0.178 | <0.001 |

| Psychiatric services | 29.2 | 30.2 | 29.7 | −0.179 | 0.481 |

| Radiology | 3.7 | 3.1 | 2.4 | −0.135 | <0.001 |

| Specialty drugs | 6.5 | 5.4 | 4.7 | −0.187 | 0.016 |

| Vascular interventions | 2.5 | 2.8 | 2.0 | −0.031 | 0.514 |

| Cost sharing | 13.6 | 11.6 | 10.6 | −0.117 | 0.137 |

SOURCE Authors’ analysis of data for 2008–16 from the Truven MarketScan Commercial Claims and Encounters Database. NOTES Estimates of the average annual change were from an ordinary least squares regression model that adjusted for age categories, age categories interacted with sex, risk score, region, and plan fixed effects, with standard errors clustered by plan. Spending by provider specialty included inpatient and outpatient professional fees but not facility fees. Spending by category of service used only outpatient claims, with both professional and facility fees. OB-GYN is obstetrics-gynecology. ED is emergency department.

Analogously, unadjusted trends in allowed cost sharing in and out of network are shown in appendix exhibit A4.36 In our unadjusted analysis, the average proportion of allowed cost sharing that was out of network was 13.6 percent in 2008–10 and 10.6 percent in 2014–16. In our adjusted model, the average annual change was an insignificant −0.12 percentage points per year (exhibit 2).

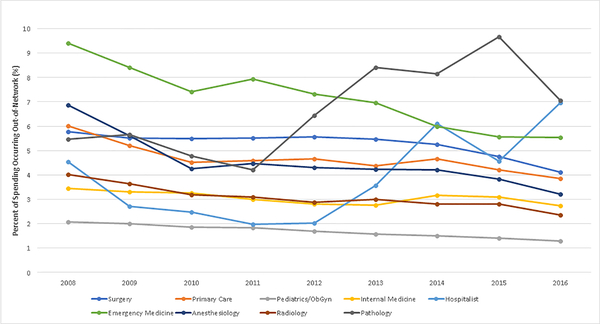

Provider Specialty

For the medical and procedural specialties we examined, the share of out-of-network spending declined or remained stable during the study period (exhibit 3). The exceptions were hospitalists and pathologists, for whom the shares rose sharply.

Exhibit 3.

Percent of Spending Out-of-Network by Provider Specialty, 2008–2016

The share of spending occurring out of network for hospital medicine (provided by hospitalists) increased sharply from 3.3 percent in 2008–10 to 5.9 percent in 2014–16, averaging an annual increase of 0.54 percentage points (exhibit 2). Similarly, the share of spending occurring out of network for pathology grew from 5.3 percent to 8.3 percent over this period, with an average annual increase of 0.31 percentage points. The steepest reductions in the share of spending out of network were for emergency medicine (−0.46 percentage points) and anesthesiology (−0.25 percentage points). The average annual changes for other specialties were smaller, and for internal medicine and psychiatry they were not significant. Sensitivity analyses produced qualitatively similar estimates (appendix exhibit A5).36 We observed a gradual increase in the share of people with out-of-network hospitalist care, which might in part explain the increase in allowed hospitalist out-of-network spending. However, the analogous increase in allowed pathology out-of-network spending was not driven by an increase in the share of people with any out-of-network pathologist services (appendix exhibit A6).36

The percentage of cost sharing that was out of network increased only for hospitalist medicine (1.71 percentage points per year; p=0.003), with cost sharing for pathology unchanged (0.19 percentage points per year; p=0.23) (appendix exhibit A7).36 Out-of-network cost sharing for all other specialties decreased or was unchanged over our study period.

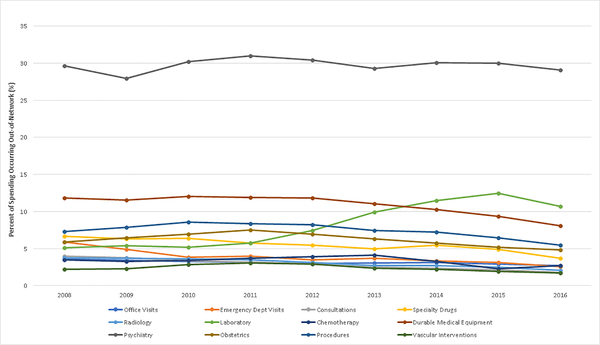

Category Of Service

There were sizable differences in the levels of out-of-network spending across services, with psychiatric services having the highest level (about 30 percent) (exhibit 4).33 However, the trends over time were unchanged or gradually decreased for most categories of services, similar to most of the specialties we examined above.

Exhibit 4:

Percent of Spending Out-of-Network by Category of Service, 2008–2016

Laboratory tests were an exception. The unadjusted share of spending occurring out of network for laboratory tests rose from 5.2 percent in 2008–10 to 11.5 percent in 2014–16 (exhibit 2). This amounted to an average increase of 0.80 percentage points per year—making the tests the fastest-growing out-of-network sector of outpatient spending. This was not driven by an increase in the share of people with any out-of-network spending on laboratory services (appendix exhibit A6).36

The share of spending occurring out of network for ED visits declined by 0.33 percentage points, and that for obstetrics declined by 0.26 percentage points (exhibit 2). The share of spending out of network for all other types of services similarly declined or was unchanged. The results from sensitivity analyses were consistent with our baseline results (appendix exhibit A5).36

Analogous to spending, the percentage of cost sharing that was out of network increased only for laboratory services (0.86 percentage points per year; p<0.001), with that for all other services declining or remaining unchanged (appendix exhibit A7).36

In-Network Versus Out-Of-Network Use

Changes in the share of use occurring out of network were generally consistent with changes in the share of spending out of network across most segments of care (appendix exhibit A8).36 However, hospitalists and pathologists did not demonstrate a significant increase in out-of-network use, which suggests that their rise in out-of-network spending was largely due to growth in prices. Use of out-of-network laboratory tests declined significantly, as did its spending analogue—which suggests that use was at least in part responsible.

In-Network Versus Out-Of-Network Prices

Average prices and cost sharing for common outpatient medical and laboratory services show that both patients and insurers face substantially higher costs when a service is provided out of network rather than in network (appendix exhibit A9).36 For patients, these observed differences in cost sharing represent a lower bound of the potential difference in patient out-of-pocket spending because of the possibility of balance billing.

Secondary Analyses Including Charges

Using Health Care Cost Institute data for 2014–17, we constructed an analogous sample of 13,093,209 unique individuals (appendix exhibit B1).36 Trends in spending in and out of network were similar to those in the primary data set (appendix exhibit B2).36

To provide an upper-bound estimate for how our findings would change if we were able to account for potential balance billing, we created a conservative proxy for balance billing as the full difference between out-of-network charges and out-of-network allowed spending. For this exercise we defined out-of-network spending as the sum of out-of-network charges and total spending as the sum of in-network allowed spending and out-of-network charges (on the assumption that there can be no balance billing for in-network claims). With these assumptions, we found that the share of spending that occurred out of network was approximately 12 percent in the period 2014–17 (appendix exhibit B4).36 While this is (mechanically) larger than our estimates that used only allowed spending out of network, it is consistent with our primary analyses in two ways. First, the upper-bound estimate of the share of spending that was out of network remained relatively low even when we assumed that patients would be balance billed for the full difference between the charge and the allowed amount. Second, the estimated share was relatively stable, a finding that is qualitatively similar to those of our primary analyses.

Across categories of service, the shares of spending and use occurring out of network were generally qualitatively similar across data sets. However, out-of-network laboratory spending and use in the later years appeared more volatile, relative to the results from our primary data set (appendix exhibit B3).36

Discussion

In a nationwide sample of people with employer-sponsored insurance, the share of spending on out-of-network care was relatively stable between 2008 and 2016. However, we identified several areas of the health care system in which the share of spending that occurred out of network was less stable over this period. Notably, the share of spending that was out of network for laboratory services and pathologists (hereafter referred to collectively as “laboratory”) rose sharply over the study period, although the share may have started to decline in the later years. In addition, we found an increase in the out-of-network share of spending for hospitalist services.

To our knowledge, this study provides the first national evidence of these divergent trends in laboratory spending out of network, though this work builds on an important literature documenting the prevalence of and trends in surprise out-of-network billing.8,12–14 While the causes of the fluctuation in out-of-network laboratory use in our sample are difficult to pinpoint, the results are broadly consistent with recent evidence that pathologists bill out of network from in-network hospitals at a higher rate than some other specialties (such as radiologists)8 do, and with qualitative evidence that laboratory services are increasingly contracted out to large regional or national suppliers—which remain out of network for many insurers.37 In addition, a lack of transparency about the network status of laboratories and the lack of discretion that patients have over who analyzes their specimens may be contributing factors, which would be consistent with evidence on surprise out-of-network billing in other settings.12 These findings are concerning in light of our findings (appendix exhibit A7)36 and prior work that prices and cost sharing for services are substantially higher when they are performed by out-of-network providers.11

While out-of-network laboratory and hospitalist care increased, the share of overall spending out of network did not grow during the study period. Instead, it trended slightly downward. This result may be surprising given the attention garnered by out-of-network billing, particularly in the ED.38,39 In our data sets, the share of ED and emergency physician spending occurring out of network either declined or was fairly stable. This is consistent with evidence that the frequency with which patients at in-network hospitals were treated by out-of-network emergency physicians has declined over time.13,14 Our findings complement the important work on surprise out-of-network billing, as we analyzed large samples to identify other areas of health care that should be monitored to protect consumers from the higher costs associated with receiving out-of-network services.

Our results shed new light on the evolution of out-of-network care in the US. For the roughly half of the population with employer-sponsored insurance, recent growth in the share of laboratory and hospitalist spending out of network translates into higher out-of-pocket spending for patients and overall spending for the health care system. Concerns over surprise billing for ED visits have led to policy efforts to address the problem. Patients similarly often have little choice over who provides them with laboratory or hospitalist care. Extending consumer protections to these settings offers one possible remedy for patients who face balance bills, especially when they are unexpected.40,41 Alternative proposals such as capping out-of-network prices at a percentage of in-network prices, using reference pricing, or providing additional protections for patients who are balance billed also warrant consideration as patients and employers struggle with the cost of out-of-network care.16,42,43

Supplementary Material

ACKNOWLEDGMENTS

An earlier version of this article was presented at the AcademyHealth Annual Research Meeting in Washington, D.C., June 4, 2019. Zirui Song reports receiving grants from the National Institutes of Health (NIH) and the NIH Director’s Early Independence Award (Award No. DP5-OD024564), as well as speaking fees from the International Foundation of Employee Benefit Plans that were outside the submitted work. The authors thank Timothy Lillehaugen for excellent research assistance and Andrew Hicks for the derivation of the Diagnostic Cost Group risk scores.

Contributor Information

Zirui Song, Harvard Medical School, a general internist at Massachusetts General Hospital, and faculty member in the Center for Primary Care at Harvard Medical School, in Boston, Massachusetts..

William Johnson, Health Care Cost Institute, in Washington, D.C..

Kevin Kennedy, Health Care Cost Institute..

Jean Fuglesten Biniek, Health Care Cost Institute..

Jacob Wallace, Department of Health Policy and Management, Yale School of Public Health, in New Haven, Connecticut..

Endnotes

- 1.Massachusetts Health Policy Commission. Out-of-network billing in Massachusetts [Internet]. Boston (MA): The Commission; 2017. November 1 [cited 2020 May 1]. Available from: https://www.mass.gov/doc/presentation-out-of-network-billingin-massachusetts/download [Google Scholar]

- 2.Center for Policy and Research. Charges billed by out-of-network providers: implications for affordability [Internet]. Washington (DC): America’s Health Insurance Plans; 2015. September [cited 2020 Apr 7]. Available from: https://www.ahip.org/wp-content/uploads/2015/09/OON_Report_11.3.16.pdf [Google Scholar]

- 3.Rosenthal E Insured, but not covered. New York Times [serial on the Internet]. 2015. February 7 [cited 2020 Apr 7]. Available from: https://www.nytimes.com/2015/02/08/sundayreview/insured-but-not-covered.html [Google Scholar]

- 4.Bernard TS. Out of network, not by choice, and facing huge health bills. New York Times [serial on the Internet]. 2013. October 18 [cited 2020 Apr 7]. Available from: https://www.nytimes.com/2013/10/19/yourmoney/out-of-network-not-bychoice-and-facing-huge-healthbills.html [Google Scholar]

- 5.Xu T, Park A, Bai G, Joo S, Hutfless SM, Mehta A, et al. Variation in emergency department vs internal medicine excess charges in the United States. JAMA Intern Med. 2017;177(8):1139–45. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Kyanko KA, Busch SH. The out-ofnetwork benefit: problems and policy solutions. Inquiry. 2012–2013; 49(4):352–61. [DOI] [PubMed] [Google Scholar]

- 7.Polsky D, Cidav Z, Swanson A. Marketplace plans with narrow physician networks feature lower monthly premiums than plans with larger networks. Health Aff (Millwood). 2016;35(10):1842–8. [DOI] [PubMed] [Google Scholar]

- 8.Cooper Z, Nguyen H, Shekita N, Morton FS. Out-of-network billing and negotiated payments for hospital-based physicians. Health Aff (Millwood). 2020;39(1):24–32. [DOI] [PubMed] [Google Scholar]

- 9.Massachusetts Health Policy Commission. Policy brief on out-ofnetwork billing [Internet]. Boston (MA): The Commission; 2016. January [cited 2020 Apr 7]. Available from: https://www.mass.gov/files/documents/2018/03/14/2015-ctrout-of-network.pdf [Google Scholar]

- 10.Congress.gov. S.3541—Reducing Costs for Out-of-Network Services Act of 2018 [Internet]. Washington (DC): US Congress; [cited 2020 Apr 7]. Available from: https://www.congress.gov/bill/115th-congress/senate-bill/3541 [Google Scholar]

- 11.Congress.gov. S.1266—Protecting Patients from Surprise Medical Bills Act [Internet].Washington (DC): US Congress; [cited 2020 Apr 7]. Available from: https://www.congress.gov/bill/116th-congress/senate-bill/1266 [Google Scholar]

- 12.Cooper Z, Scott Morton F. Out-ofnetwork emergency-physician bills— an unwelcome surprise. N Engl J Med. 2016;375(20):1915–8. [DOI] [PubMed] [Google Scholar]

- 13.Cooper Z, Scott Morton F, Shekita N. Surprise! Out-of-network billing for emergency care in the United States [Internet]. Cambridge (MA): National Bureau of Economic Research; [revised 2018 Jan; cited 2020 Apr 7]. (NBER Working Paper No. 23623). Available from: https://www.nber.-org/papers/w23623.pdf [Google Scholar]

- 14.Garmon C, Chartock B. One in five inpatient emergency department cases may lead to surprise bills. Health Aff (Millwood). 2017; 36(1):177–81. [DOI] [PubMed] [Google Scholar]

- 15.Pelech DM. Prices for physicians’ services in Medicare Advantage and commercial plans. Med Care Res Rev. 2018. June 25. [Epub ahead of print]. [DOI] [PubMed] [Google Scholar]

- 16.Hoadley J, Ahn S, Lucia K. Balance billing: how are states protecting consumers from unexpected charges? [Internet]. Washington (DC): Georgetown University Health Policy Institute; 2015. June [cited 2020 Apr 7]. Available from: https://georgetown.app.box.com/s/lqwno2cpc2u0yaan9064ohl7atr638u2 [Google Scholar]

- 17.Rosenthal E After surgery, surprise $117,000 medical bill from doctor he didn’t know. New York Times [serial on the Internet]. 2014. September 20 [cited 2020 Apr 7]. Available from: https://www.nytimes.com/2014/09/21/us/drive-by-doctoring-surprise-medicalbills.html [Google Scholar]

- 18.Kyanko KA, Pong DD, Bahan K, Curry LA. Patient experiences with involuntary out-of-network charges. Health Serv Res. 2013;48(5): 1704–18. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Pollitz K Surprise medical bills [Internet]. San Francisco (CA): Henry J. Kaiser Family Foundation; 2016. March [cited 2020 Apr 7]. (Issue Brief). Available from: http://files.kff.org/attachment/issue-briefsurprise-medical-bills [Google Scholar]

- 20.IBM Watson Health. IBM MarketScan Research Databases for health services researchers [Internet]. Somers (NY): IBM Watson Health; 2019. April [cited 2020 Apr 14]. (White Paper). Available from: https://www.ibm.com/downloads/cas/6KNYVVQ2 [Google Scholar]

- 21.Wallace J, Song Z. Traditional Medicare versus private insurance: how spending, volume, and price change at age sixty-five. Health Aff (Millwood). 2016;35(5):864–72. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 22.Song Z, Ji Y, Safran DG, Chernew ME. Health care spending, utilization, and quality 8 years into global payment. N Engl J Med. 2019; 381(3):252–63. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 23.Health Care Cost Institute. Data dictionary [Internet]. Washington (DC): The Institute; [cited 2020 Apr 7]. Available from: https://www.healthcostinstitute.org/images/pdfs/HCCI_Data_Dictionary_2019.pdf [Google Scholar]

- 24.Cooper Z, Craig S, Gray C, Gaynor M, Van Reenen J. Variation in health spending growth for the privately insured from 2007 to 2014. Health Aff (Millwood). 2019;38(2):230–6. [DOI] [PubMed] [Google Scholar]

- 25.Pelech D, Hayford T. Medicare Advantage and commercial prices for mental health services. Health Aff (Millwood). 2019;38(2):262–7. [DOI] [PubMed] [Google Scholar]

- 26.Truven Health Analytics. Commercial claims and encounters Medicare supplemental and coordination of benefits data dictionary. Greenwood Village (CO): Truven Health Analytics; 2015. [Google Scholar]

- 27.Pope GC, Ellis RP, Ash AS, Ayanian JZ, Bates DW, Burstin H, et al. Diagnostic Cost Group Hierarchical Condition Category models for Medicare risk adjustment: final report [Internet]. Baltimore (MD): Centers for Medicare and Medicaid Services; 2000. December 21 [cited 2020 Apr 7]. Available from: https://www.cms.gov/Research-StatisticsData-and-Systems/Statistics-Trendsand-Reports/Reports/downloads/pope_2000_2.pdf [Google Scholar]

- 28.Pope GC, Kautter J, Ellis RP, Ash AS, Ayanian JZ, Lezzoni LI, et al. Risk adjustment of Medicare capitation payments using the CMS-HCC model. Health Care Financ Rev. 2004; 25(4):119–41. [PMC free article] [PubMed] [Google Scholar]

- 29.Kyanko KA, Curry LA, Busch SH. Out-of-network provider use more likely in mental health than general health care among privately insured. Med Care. 2013;51(8):699–705. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 30.Dafny LS, Hendel I, Marone V, Ody C. Narrow networks on the health insurance Marketplaces: prevalence, pricing, and the cost of network breadth. Health Aff (Millwood). 2017;36(9):1606–14. [DOI] [PubMed] [Google Scholar]

- 31.Raven MC, Guzman D, Chen AH, Kornak J, Kushel M. Out-of-network emergency department use among managed Medicaid beneficiaries. Health Serv Res. 2017;52(6): 2156–74. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 32.Kyanko KA, Curry LA, Busch SH. Out-of-network physicians: how prevalent are involuntary use and cost transparency? Health Serv Res. 2013;48(3):1154–72. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 33.Song Z, Lillehaugen T, Busch SH, Benson NM, Wallace J. Out-ofnetwork spending on behavioral health, 2008–2016. J Gen Intern Med. 2020. January 28. [Epub ahead of print]. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 34.Claxton G, Rae M, Cox C, Levitt L. An analysis of out-of-network claims in large employer health plans [Internet]. San Francisco (CA): PetersenKFF Health System Tracker; 2018. August 13 [cited 2020 Apr 17]. Available from: https://www.healthsystemtracker.org/brief/an-analysis-of-outof-network-claims-in-largeemployer-health-plans/#item-start [Google Scholar]

- 35.Ndumele CD, Staiger B, Ross JS, Schlesinger MJ. Network optimization and the continuity of physicians in Medicaid managed care. Health Aff (Millwood). 2018;37(6):929–35. [DOI] [PubMed] [Google Scholar]

- 36. To access the appendix, click on the Details tab of the article online.

- 37.Schulte F An out-of-network lab, an elaborate urine test, and then a surprise bill. Shots (NPR) [serial on the Internet]. 2018. February 16 [cited 2020 May 1]. Available from: https://www.npr.org/sections/health-shots/2018/02/16/585548181/an-out-of-network-laban-elaborate-urine-test-and-then-asurprise-bill [Google Scholar]

- 38.Thompson TS. Out-of-network involuntary medical care: an analysis of emergency care provisions of the Patient Protection and Affordable Care Act [Internet]. Washington (DC): Bates White Economic Consulting; 2010. August 31 [cited 2020 May 1]. Available from: https://www.bateswhite.com/media/publication/26_media.352.pdf [Google Scholar]

- 39.New York State Department of Financial Services. Surprise medical bills and emergency services [Internet]. New York (NY): The Department; 2018. February 12 [cited 2020 May 1]. Available from: https://www.dfs.ny.gov/consumers/health_insurance/surprise_medical_bills [Google Scholar]

- 40.Murray R Hospital charges and the need for a maximum price obligation rule for emergency department and out-of-network care. Health Affairs Blog [blog on the Internet]. 2013. May 16 [cited 2020 Apr 7]. Available from: 10.1377/hblog20130516.031255/full/ [DOI] [Google Scholar]

- 41.Mattke S, White C, Hanson M, Kotzias VI. Evaluating the impact of policies to regulate involuntary outof-network charges on New Jersey hospitals. Rand Health Q. 2017; 6(4):7. [PMC free article] [PubMed] [Google Scholar]

- 42.Song Z Using Medicare prices— toward equity and affordability in the ACA Marketplace. N Engl J Med. 2017;377(24):2309–11. [DOI] [PubMed] [Google Scholar]

- 43.Robinson JC, Whaley C, Brown TT. Association of reference pricing for diagnostic laboratory testing with changes in patient choices, prices, and total spending for diagnostic tests. JAMA Intern Med. 2016; 176(9):1353–9. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.