Summary

In 2016, the South African government proposed a 20% sugar‐sweetened beverage (SSB) tax. Protracted consultations with beverage manufacturers and the sugar industry followed. This resulted in a lower sugar‐based beverage tax, the Health Promotion Levy (HPL), of approximately 10% coming into effect in April 2018. We provide a synthesis of findings until April 2021. Studies show that despite the lower rate, purchases of unhealthy SSBs and sugar intake consumption from SSBs fell. There were greater reductions in SSB purchases among both lower socioeconomic groups and in subpopulations with higher SSB consumption. These subpopulations bear larger burdens from obesity and related diseases, suggesting that this policy improves health equity. The current COVID‐19 pandemic has impacted food and nutritional security. Increased pandemic mortality among people with obesity, diabetes, and hypertension highlight the importance of intersectoral public health disease‐prevention policies like the HPL, which should be strengthened.

Keywords: equity, fiscal policy, health promotion, South Africa

1. INTRODUCTION

South Africa was the first African nation to initiate a tax on sugar‐sweetened beverages (SSBs) called the Health Promotion Levy (HPL) in April 2018. In this article, we provide an overview of South Africa's HPL, its origins, and a synthesis of the evidence until April 2021 around its impacts. We then discuss the additional challenges that COVID‐19 presents to NCD prevention in South Africa and thus the need to strengthen the HPL and the importance of more equitable intersectoral health promotion policies.

2. BACKGROUND ON SOUTH AFRICA'S HPL

Within Sub‐Saharan Africa, South Africa has one of the highest levels of burden related to noncommunicable diseases (NCDs); this occurred simultaneously with a rapid rise of SSB sales.1, 2 Concurrently, South Africa continues to battle HIV/AIDS, tuberculosis, and stunting.3 In addition, real uninsured healthcare expenditure remains stagnant since 2011/2012.4 Almost 17% of the population live under the international poverty line within the context of an inequality adjusted Human Development Index of 0.463,5 while 55.5% live below the current South African food poverty line of R585/capita/month (equivalent to 40 US dollars).6 In recognition of these factors, the Department of Health's National Health Strategic Plan of 2015–2020 priority areas for 2030 include “addressing the social determinants that affect health and diseases,” “preventing and reducing the disease burden and promote health,” and “financing universal healthcare coverage.”7

Sugar, particularly in liquid form from beverages, has been viewed as an important cause of increased risk of obesity, diabetes, hypertension, cardiovascular disease and many common cancers.8 Prospective simulated mathematical model‐based research show that a 20% price increase on SSBs would result in lowering obesity prevalence by 2.4%–3.8% points, averting 85,000 incident stroke cases, 550,000 stroke‐related disability adjusted life years (DALYs), and 72,000 deaths among South African adults. This translates to an estimated savings of over 5 billion South African Rand (ZAR) in healthcare costs over 20 years9, 10 while increasing tax revenue.

Moreover, the improvements would be greater for lower income individuals who have minimal access to healthcare resources and are least buffered against economic shocks. Lower income individuals without private health insurance who rely on public health services make up 85% of the population.11 Simulation studies show that SSB taxation could have a substantial distributional impact on obesity‐related premature deaths, cost savings to the government, and avert cases of poverty among the South Africa's population.12

Drawing on experiences in other settings, like Mexico and the United States,13, 14 which have demonstrated a positive impact of SSB taxes on purchases and consumption, the South African government announced at the 2016 February budget speech an intention to explore and implement a SSB tax within 12 months. This was followed by a white paper published in June 2016, which reviewed evidence and made recommendations for a sugar‐based tax at a rate of 0.028 South African Rand (ZAR) per gram of sugar, approximately 20% of the per liter price of the most popular soft drink.15 The initial tax design was based on the logic that to lower sugar intake, compared with a volumetric design, taxing SSBs according to their sugar content would better incentivize beverage manufacturers to reduce their products' sugar content in addition to any consumer responses.15

Draft legislation subsequently re‐titled the SSB tax the “Health Promotion Levy” (HPL) and was introduced in Parliament April 2017. This initiated a consultative period involving the sugar industry, beverage manufacturers, civil society groups, public health academics and advocates all attempting to influence the Ministry of Finance and the Parliament. The beverage and sugar industries both claimed that the HPL would result in massive job losses in their industries and argued for self‐regulation or voluntary measures. Industry groups commissioned reports by consulting groups (e.g., Oxford Economics) to challenge the efficacy of the tax.16, 17, 18, 19 Conversely, academics, government, and advocates argued for the tax in terms of reduced healthcare costs and potential income generation to fund health services. News media analyses over January 2017–June 2019 reflect such patterns and consistency in frequency with more supportive articles except during the month when the HPL was implemented.17

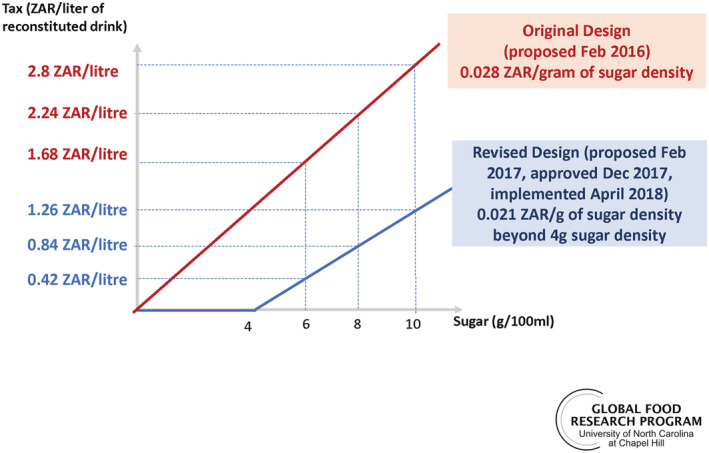

The delayed HPL was signed into law in December 2017 and formally implemented on April 1, 2018. This process resulted in concessions made to the sugar and beverage industries with the effective tax rate being reduced from 20% to approximately 10%.16 The HPL still depends on the sugar content of the beverage, at 0.021 ZAR per gram of sugar in excess of a threshold of 4 g of sugar per 100 ml.20 Small producers of taxable beverages using less than 500 kg of sugar per year are exempt from the HPL. The tax amount is to be adjusted annually to account for inflation to maintain the effective tax level (which has not been done however). Figure 1 illustrates the evolution of the proposed designs and tax rates per liter.

FIGURE 1.

Sugar density tax levels proposed for South Africa's sugar‐sweetened beverage tax

3. EVIDENCE OF THE EFFECTS OF THE HPL TO DATE

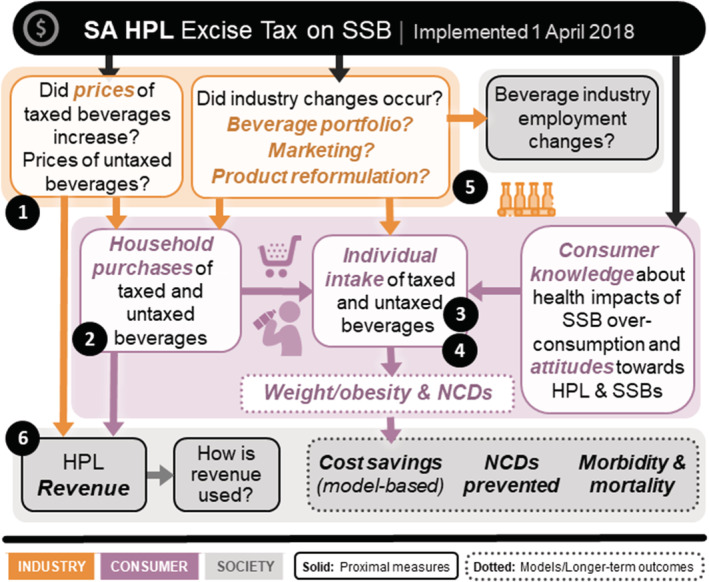

Following the HPL implementation, academic study of the policy begun. The areas of research follow the theory of change depicted in Figure 2, where measurements on the various pathways of change are being monitored and reported on with the corresponding numbered bullets below. As of April 2021, findings show the following:

Nationally, prices of taxable carbonated beverages rose whereas nontaxable beverage prices did not change meaningfully.21

Urban household purchases of taxable beverages post implementation fell by 29% with sugar from these purchases falling by 51%. Importantly, lower socioeconomic urban households reduced their volume and grams of sugar from SSBs by 32%% and 57%, respectively.22

A detailed collection of daily beverage intake from young (18–39 years) adults surveyed in Langa, a Western Cape township, showed a 37% reduction in volume and 31% in sugar.23 Furthermore, this paper estimated that about 30% of the sugar reductions from beverages were due to reformulations while 70% were due to behavior change.

A longitudinal survey between baseline and 12 months of adolescents and adults in Soweto, Johannesburg, found that SSB intake frequency fell by two times per week in medium‐intake consumers and seven times per week among high consumers. This was maintained 24 months post‐HPL implementation.24

Household beverage purchase and individual beverages intake data found consistent results in that overall sugar reductions were due to both sugar reduction in the formulation of SSBs by manufacturers and volume reductions by consumers.22, 23

The combined price increase and purchases/sales of SSBs together generated revenues of 5.8 billion ZAR over the first two fiscal years of the tax being in place (approximately 0.2% of total government revenue over the same period).25 The revenue has gone towards the country's general fund and was not earmarked.

Other aspects of this pathway of change still need to be monitored closely. For example, there is a need to better understand how much of the observed changes in sugar from taxed versus untaxed beverage purchases or intakes are due to lowered sugar content in beverages, new product entry versus product exit (industry reformulation and packaging response to HPL) versus reductions in volume of and substitutions across beverage types (consumer response to HPL). The Langa paper separated these two changes for dietary intake in this one sample, but the national sample of food purchase data can be used to focus on this across South Africa.23 One type of industry response includes replacing sugar with a variety of nonnutritive sweeteners (NNSs) as is the trend globally.22, 26 The longer term health implications of these NNS are inconclusive, and more research is needed, but there are concerns that early exposure to NNSs among children affects their sweetness preferences.27, 28 In South Africa, Regulation R733 requires that all packaged food products containing NNS indicate this by name in the list of ingredients. However, there are no front of pack warnings,29 so it is not yet possible to understand what a sugar reduction initiative like the HPL might mean for population level NNS intake. Additionally, package size changes and selective passing‐through of the tax are other industry responses that should be monitored as these may be strategies deployed by industry to minimize the effect of the HPL. Industry‐level employment trends are hard to infer from existing labor market surveys due to limited disaggregation in industry classifications; however, secular trends in employment and unemployment rates appear to have continued with the implementation of the HPL (although the subsequent COVID‐19 crisis has seen a significant increase in unemployment).30

FIGURE 2.

Conceptual framework for evaluation studies until April 2021. HPL, Health Promotion Levy; NCD, noncommunicable disease; SSB, sugar‐sweetened beverage

The public's understanding and attitudes about the harms of excessive sugar intake particularly in the form of SSBs are critical to continue gauging31 because these will both influence manufacturers' behaviors (e.g., their product portfolios) and government policies (whether there is public support for stronger regulations for example). How the HPL discussion is continued by the various stakeholders and how it is framed in the media17 provides contextual insight as to how the HPL is viewed and its ability to be maintained or evolve over time. While additional studies are needed, the findings so far are instructive for South Africa, the region, and the world. The data imply that despite the beverage industry's resistance, they were able to respond to the HPL by lowering the sugar content of their beverages to lower their tax liability.23 These studies also show that lower socioeconomic households and higher consuming or purchasers are indeed responding more in absolute terms in their reductions and thus address the health promotion goals of the HPL.22, 23, 24 At the same time, overall sugar intakes from beverages and SSB purchases fell considerably; thus, addressing the health risk that the policy was targeting. Translating these observed changes into adverted NCD, obesity and mortality cases, and their resultant productivity loses, healthcare costs to individuals and society are important next steps. Model‐based approaches to estimate 10‐ and 30‐year health and economic implications are underway.

4. COMORBIDITIES AND ECONOMIC IMPACTS DURING A TIME OF COVID‐19

There is a vast literature we do not cite that shows elevated risk of COVID‐19, particularly its complications and mortality, with obesity,32 diabetes, hypertension, and other key NCDs. Key challenges however are the implications for other comorbidities and health needs. Nation‐wide lockdown has resulted in both a demand and supply side shifts. On the supply side, human resources shifts have resulted in limited services for diagnosis, treatment, and prevention of communicable and NCDs. Those with certain uncontrolled comorbidities are at much high risk for death, especially individuals with obesity related conditions such as T2DM and hypertension.33 At a decisive moment that demonstrates the collision of COVID‐19 with obesity‐related NCDs,32 there should be no further delay in passing supportive and related policies to the HPL that would ensure both mandatory front‐of‐pack warning labels on food and beverages and bans on child‐directed marketing of food products that do not support healthy diets.

Beyond the direct impact of COVID‐19, the various lockdown measures to control the pandemic will aggravate dietary drivers of disease. The imposition of lockdown policies in South Africa, while praised for their impact on viral disease transmission during the early stages of the pandemic, simultaneously caused significant economic disruption. Between Quarter 3 of 2019 and Quarter 3 of 2020, the number of employed adults in South Africa decreased by 1.684 million, and the number of unemployed and not economically active adults increased by 2.269 million.30 Aggregate gross earnings paid to employees fell by 43.848 billion ZAR over the same period.34 The South African government responded to the welfare impacts of this economic crisis through increases in the value of existing social grants and the introduction of a temporary COVID‐19 relief of social distress cash grants for those not eligible for existing social support. However, these measures were not sufficient to prevent significant increases in food insecurity. Telephone surveys reveal 47% of households reporting not having enough money to buy food.35 In the absence of routine diet surveillance, it is too early to assess dietary impacts of the economic crisis. However, it is likely that there is a risk of increased obesity and diabetes incidence and prevalence through food insecurity. This can be attributed to rising food prices and subsequent consumption of nutrient‐poor, energy‐dense, cheap foods, which are often ultra‐processed.32, 36, 37 Both undernutrition and overnutrition play a significant role in the development and management of T2DM; therefore, efforts should maximize impact on all forms of malnutrition. These economic impacts of COVID‐19 on government resources also mean that revenue needs have risen quickly due to both higher financial needs and anticipated loss in income and corporate tax revenues. Health taxes such as the HPL can help address budgetary needs particularly if they are directed towards supporting health.

5. NEED TO STRENGTHEN THE HPL AND INTERSECTORAL HEALTH PROMOTION POLICIES

The health impacts from reduced SSB sugar intake could potentially be further magnified if the HPL is adjusted to the 20% rate originally proposed by the South African National Treasury, or at the very least adjusted annually for inflation as required, which has not been implemented in the past 2 years. Regardless, the HPL can also provide double‐duty benefits should the collected tax revenues be partially used to finance other health‐promoting and equity‐enhancing programs. These are needed even more during the COVID‐19 crisis. One salient program deserving of consideration is the National School Nutrition Programme (NSNP), which falls under the Department of Basic Education. The NSNP sees the provision of food to attendees of public schools servicing more deprived areas. There are also innovative mechanisms other countries have used for revenue from tobacco, alcohol, and SSB taxes. The Thai Health Promotion Foundation is a structure that has representation from multiple sectors and ministries that focus on a range of health targets that cannot be achieved by a single sector alone.38 The establishment of such a health promotion and development foundation in South Africa has previously been proposed and could be used to direct HPL revenue to health promotion in activities across ministries and sectors.39

6. SUMMARY

South Africa instituted a Health Promotion Levy in 2018. During the first year, this policy significantly reduced sugar consumption from SSBs, which may be coupled with important health gains in the future.40 This could be particularly critical for lower income South Africans who have poor access to quality healthcare services. This synthesis shows the impact of this gram of sugar tax on reformulation and potential for health effects in the longer term, which is consistent with what has been observed in the UK's tiered tax (using 5‐ and 8‐g sugar density as cutpoints).41, 42 This is in contrast to Mexico, the seven US cities, and in over 40 countries that have introduced a volumetric tax, which may generate a more predictable revenue stream but does not explicitly incentivize reformulation.43

At the end of the second year after the legislation of HPL, the COVID‐19 pandemic struck. The linkages between NCDs, obesity, and severity of COVID‐19 became clearer to not only South Africa but also all countries that faced major COVID‐19 infection levels. The higher mortality among people with obesity‐related NCDs and COVID‐19 has highlighted the importance of intersectoral health promotion policies. In the short term, the potential impacts of the HPL can be enhanced through increasing it to the 20% rate originally proposed by the National Treasury, with targeted use of its revenue to address food access and nutrition security deficiencies resulting from the economic crisis. In the longer term, the health‐promoting intent of the policy could also be strengthened through expanding its base to cover high‐sugar beverages (such as 100% fruit juice) currently exempt from subject to the levy. In addition to ensuring the HPL is increased and maintained at a sufficiently high level to address the ongoing obesity epidemic in South Africa, complementary policies are key. These are urgent and include bans on unhealthy food and beverage marketing to children and an evidence‐based front‐of‐package labeling system to identify unhealthy foods and beverages. While the lessons to date discussed here are focused on South Africa, countries can learn from the impact of a tax based on sugar density to design a tax depending on either a revenue or a health impact perspective. Greater gains from the health side will come if grams of sugar are taxed. In addition, many low‐ and middle‐income countries are facing similar tsunami of challenges (overburdened healthcare system, inadequate access to care, budget deficiencies, and massive economic and health inequalities) now exacerbated by COVID‐19.

CONFLICT OF INTEREST

All authors have completed the ICMJE uniform disclosure form and have declared funding sources. Otherwise, none of the authors have other declaration of interests of any type with respect to this manuscript.

FUNDING INFORMATION

Financial support comes from Bloomberg Philanthropies, with additional support from the International Development Research Centre (grant no. 108424‐001), the South African Medical Research Council (grant no. D1305910‐03) and the US NIH grant to CPC P2C HD050924. Funders had no role in the study design, analysis, manuscript preparation, or decision to publish.

AUTHOR CONTRIBUTIONS

K. H. led on conceptualization, acquisition of funding, and contributed to the drafting, interpretation, and critical revision of the manuscript; N. S. contributed to the interpretation and critical revision of the manuscript; E. C. S. contributed to the interpretation, acquisition of funding, and critical revision of the manuscript; B. M. P commented on the conceptualization, acquisition of funding, and contributed to the revisions; S. W. N. led on the supervision of the paper on a whole and contributed to the conceptualization, acquisition of funding, drafting of the manuscript, and critical revisions. All authors provided final approval of the manuscript for submission.

Hofman KJ, Stacey N, Swart EC, Popkin BM, Ng SW. South Africa's Health Promotion Levy: Excise tax findings and equity potential. Obesity Reviews. 2021;22:e13301. 10.1111/obr.13301

Funding information Bloomberg Philanthropies; International Development Research Centre, Grant/Award Number: 108424‐001; South African Medical Research Council, Grant/Award Number: D1305910‐03; US National Institutes of Health, Grant/Award Number: P2C HD050924

REFERENCES

- 1.Gouda HN, Charlson F, Sorsdahl K, et al. Burden of non‐communicable diseases in sub‐Saharan Africa, 1990–2017: results from the Global Burden of Disease Study 2017. Lancet Glob Health. 2019;7(10):e1375‐e1387. [DOI] [PubMed] [Google Scholar]

- 2.Singh GM, Micha R, Khatibzadeh S, et al. Estimated global, regional, and national disease burdens related to sugar‐sweetened beverage consumption in 2010. Circulation. 2015;132(8):639‐666. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Statistics South Africa . South Africa Demographic and Health Survey 2016: Key Indicators. Pretoria, South Africa and Rockville, Maryland, USA; 2017: Demographic Health Surveys; 2016. [Google Scholar]

- 4.Blecher M, Davéni J, Kollipara A, et al. Health spending at a time of low economic growth and fiscal constraint. In: Ashnie P, Barron P, eds. South African Health Review 2017 2017th edn. Durban, Soyth Africa; 2017:25‐40. [Google Scholar]

- 5.UNDP . Human Development Report 2019 inequalities in human development in the 21st century briefing note for countries on the 2019 Human Development Report: South Africa. Available at: http://hdr.undp.org/sites/all/themes/hdr_theme/country-notes/ZAF.pdf. 2019.

- 6.StatsSA . Poverty Trends in South Africa: An examination of absolute poverty between 2006 and 2015. Pretoria: Statistics South Africa; 2017. [Google Scholar]

- 7.South Africa National Department of Health . Strategic Plan 2015–2020. Available at: http://www.health.gov.za/index.php/2014-03-17-09-09-38/strategic-documents/category/229-2015str?download=1057:strategic-plan-2015. National Department of Health: Pretoria: 2015. [Google Scholar]

- 8.World Health Organization . Sugars Intake for Adults and Children Guideline. Vol. 49. Geneva, Switzerland; 2015. [Google Scholar]

- 9.Manyema M, Veerman LJ, Chola L, et al. The potential impact of a 20% tax on sugar‐sweetened beverages on obesity in South African adults: a mathematical model. PLoS ONE. 2014;9(8):1‐10, e105287. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Manyema M, Veerman LJ, Tugendhaft A, Labadarios D, Hofman KJ. Modelling the potential impact of a sugar‐sweetened beverage tax on stroke mortality, costs and health‐adjusted life years in South Africa. BMC Public Health. 2016;16(1):405‐504. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.National Department of Health . National Health Insurance for South Africa: Toward Universal Health Coverage. Pretoria, South Africa: Health NDo; 2015. [Google Scholar]

- 12.Saxena A, Stacey N, Puech PDR, Mudara C, Hofman K, Verguet S. The distributional impact of taxing sugar‐sweetened beverages: findings from an extended cost‐effectiveness analysis in South Africa. BMJ Glob Health. 2019;4(4):1‐13, e001317. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Colchero MA, Popkin BM, Rivera JA, Ng SW. Beverage purchases from stores in Mexico under the excise tax on sugar sweetened beverages: observational study. BMJ. 2016;352:1‐9, h6704. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Scarborough P, Adhikari V, Harrington RA, et al. Impact of the announcement and implementation of the UK Soft Drinks Industry Levy on sugar content, price, product size and number of available soft drinks in the UK, 2015–19: a controlled interrupted time series analysis. PLoS Med. 2020;17(2):1‐19, e1003025. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.National Treasury . Taxation of Sugar‐Sweetened Beverages (Policy Paper). Available at: http://www.treasury.gov.za/public%20comments/Sugar%20sweetened%20beverages/POLICY%20PAPER%20AND%20PROPOSALS%20ON%20THE%20TAXATION%20OF%20SUGAR%20SWEETENED%20BEVERAGES‐8%20JULY%202016.pdf. In: Treasury N . (ed.): Pretoria, South Africa, 2016. [Google Scholar]

- 16.Abdool Karim S, Kruger P, Hofman K. Industry strategies in the parliamentary process of adopting a sugar‐sweetened beverage tax in South Africa: a systematic mapping. Glob Health. 2020;16:1‐14. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.Essman M, Stoltze FM, Carpentier FD, Swart R, Taillie LS. Examining the news media reaction to a national sugary beverage tax in South Africa: a quantitative content analysis. Curr Dev Nutr. 2020;4(Supplement_2):1713‐1713. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Fooks GJ, Williams S, Box G, Sacks G. Corporations' use and misuse of evidence to influence health policy: a case study of sugar‐sweetened beverage taxation. Glob Health. 2019;15:1‐20, 56. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Mialon M, Crosbie E, Sacks G. Mapping of food industry strategies to influence public health policy, research and practice in South Africa. Int J Public Health. 2020;65(7):1027‐1036. [DOI] [PubMed] [Google Scholar]

- 20.National Treasury. Budget Review 2018. Available at: http://www.treasury.gov.za/documents/national%20budget/2018/review/FullBR.pdf. National Treasury: Pretoria, South Africa, 2018. [Google Scholar]

- 21.Stacey N, Mudara C, Ng SW, van Walbeek C, Hofman K, Edoka I. Sugar‐based beverage taxes and beverage prices: Evidence from South Africa's Health Promotion Levy. Soc Sci Med. 2019;238:1‐8, 112465. [DOI] [PubMed] [Google Scholar]

- 22.Stacey N, Edoka I, Hofman K, Popkin BM, Ng SW. Changes in beverage purchases following the announcement and implementation of South Africa's Health Promotion Levy: an observational study. Lancet Planet Health. 2021. (in press);5(4):e200‐e208. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 23.Essman M, Taillie LS, Frank T, Ng SW, Popkin BM, Swart EC. Taxed and untaxed beverage intake by South African young adults after a national sugar‐sweetened beverage tax: A before‐and‐after study. PLoS Med. 2021;18(5):1‐17, e1003574. 10.1371/journal.pmed.1003574 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 24.Wrottesley SV, Stacey N, Mukoma G, Hofman KJ, Norris SA. Assessing sugar‐sweetened beverage intakes, added sugar intakes and body mass index before and after the implementation of a sugar‐sweetened beverage tax in South Africa. Public Health Nutr. 2020;1‐26. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25.Treasury N . Budget Review 2020. Pretoria: National Treasury; 2020. [Google Scholar]

- 26.Popkin BM, Hawkes C. Sweetening of the global diet, particularly beverages: patterns, trends, and policy responses. The Lancet Diabetes Endocrinol. 2016;4(2):174‐186. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 27.Baker‐Smith CM, de Ferranti SD, Cochran WJ. The Use of Nonnutritive Sweeteners in Children. Pediatrics. 2019;144(5):e20192765. [DOI] [PubMed] [Google Scholar]

- 28.Ebbeling CB, Feldman HA, Steltz SK, Quinn NL, Robinson LM, Ludwig DS. Effects of sugar‐sweetened, artificially sweetened, and unsweetened beverages on cardiometabolic risk factors, body composition, and sweet taste preference: a randomized controlled trial. J Am Heart Assoc. 2020;9:e015668. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 29.National Department of Health Republic of South Africa . Regulations relating to the use of sweeteners in foodstuffs (R733/2012). National Department of Health: Government Gazette. 2012.

- 30.StatsSA . Quarterly Labour Force Survey, Quarter 3 2020. Pretoria: Statistics South Africa; 2020. [Google Scholar]

- 31.Bosire EN, Stacey N, Mukoma G, Tugendhaft A, Hofman K, Norris SA. Attitudes and perceptions among urban South Africans towards sugar‐sweetened beverages and taxation. Public Health Nutr. 2020;23(2):374‐383. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 32.Popkin BM, Du S, Green WD, et al. Individuals with obesity and COVID‐19: a global perspective on the epidemiology and biological relationships. Obes Rev. 2020;21:e13128. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 33.Erzse A, Fraser H, Levitt N, Hofman K. Prioritising action on diabetes during COVID‐19. South African Med J = Suid‐Afrikaanse Tydskrif Vir Geneeskunde. 2020;110(8):719‐720. [PubMed] [Google Scholar]

- 34.StatsSA . Quarterly employment statistics, September 2020. Pretoria: Statistics South Africa; 2020. [Google Scholar]

- 35.Wills G, Patel L, van der Berg S, Mpeta B. Household resource flows and food poverty during South Africa's lockdown: short‐term policy implications for three channels of social protection. NIDS‐CRAM; 2020. [Google Scholar]

- 36.Baker SR, Farrokhnia RA, Meyer S, Pagel M, Yannelis C. How does household spending respond to an epidemic? Consumption during the 2020 COVID‐19 pandemic. NBER Working Paper No 26949. 2020.

- 37.Di Renzo L, Gualtieri P, Pivari F, et al. Eating habits and lifestyle changes during COVID‐19 lockdown: an Italian survey. J Transl Med. 2020;18:1‐15. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 38.Pongutta S, Suphanchaimat R, Patcharanarumol W, Tangcharoensathien V. Lessons from the Thai Health Promotion Foundation. Bull World Health Organ. 2019;97(3):213‐220. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 39.Perez AM, Ayo‐Yusuf OA, Hofman K, et al. Establishing a health promotion and development foundation in South Africa. South African Med J = Suid‐Afrikaanse Tydskrif Vir Geneeskunde. 2013;103(3):147‐149. [DOI] [PubMed] [Google Scholar]

- 40.Popkin BM, Barquera S, Corvalan C, et al. Towards unified and impactful policies to reduce ultra‐processed food consumption and promote healthier eating. The Lancet Diabetes & Endocrinology. 2021;1‐9. 10.1016/S2213-8587(21)00078-4 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 41.Scarborough P, Adhikari V, Harrington RA, et al. Impact of the announcement and implementation of the UK Soft Drinks Industry Levy on sugar content, price, product size and number of available soft drinks in the UK, 2015–19: controlled interrupted time series analysis. PLoS Med. 2020;17(2):e1003025. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 42.Pell D, Mytton O, Penney TL, et al. Changes in soft drinks purchased by British households associated with the UK soft drinks industry levy: controlled interrupted time series analysis. BMJ. 2021;372:n254. [DOI] [PMC free article] [PubMed] [Google Scholar] [Retracted]

- 43.Allcott H, Lockwood BB, Taubinsky D. Should we tax sugar‐sweetened beverages? An overview of theory and evidence. J Econ Perspect. 2019;33(3):202‐227. [Google Scholar]