Abstract

Gold, which is accepted as a safe haven by households, is known as an investment tool that is preferred especially in times of crisis and uncertainty. Especially in recent days, the uncertainty caused by the COVID‐19 pandemic and the visible increase in Turkey's 5‐year CDS data has led investors in Turkey to grams of gold, which is considered a safe haven. In this context, this study aims to test the long‐term relationship between daily case‐related deaths and Turkey's 5‐year CDS data with gram gold prices in Turkish lira during the COVID‐19 pandemic. The long‐term relationship between the variables was tested with the autoregressive distributed lag bound test (ARDL bound test) applied to the daily data for the period March 17, 2020–April 11, 2020. For the application of ARDL bound test, the stationarity of the variables was tested with unit root tests such as augmented Dickey–Fuller test (ADF) and Phillips–Perron (PP). According to the ARDL bound test findings, there is a statistically significant and positive relationship between the number of case‐related deaths and the gram gold prices in Turkish lira in the long run. However, it has been found that Turkey's 5‐year CDS data does not have a significant long‐term relationship with gram gold prices in Turkish lira.

Keywords: ARDL Bound Test, CDS Premiums, COVID‐19, Gold

1. INTRODUCTION

The COVID‐19 pandemic has caused one of the most difficult social and economic crisis that humanity has tried to struggle since the Second World War (Folger‐Laronde et al., 2020, p. 1).

Since the beginning of the 1900s, mankind has been struggling with approximately 100 contagious diseases which caused the death of more than 110 million people. Throughout history, pandemics have had significant impacts on the world population and it has become inevitable for humanity to encounter major problems for many years in socioeconomic terms. Socioeconomic solutions for pandemic diseases that occurred even during the process of industry, technology, and the information revolution have drawn long‐term conclusions rather than short‐term. In the same line as the process following the declaration of the COVID‐19‐related pandemic by the World Health Organization on March 11, 2020. The COVID‐19 virus, which threatens human health to a great extent, also significantly affects the world trade volume and financial markets due to uncertainty. The shrinkage of global trade, adverse conditions, and high volatility in the financial markets turn into systematic risk and significantly affect investors' decisions. Investors in pursuit of a safe haven have reverted to gold in Turkey as in the rest of the world.

The rise in gold prices along with the increase in demand for gold within the COVID‐19 process is similar to the behaviors within the process of previous financial crises. Whether or not gold has been a safe haven during times of crisis and uncertainty has always been a matter of curiosity in terms of finance literature. In fact, Aggarwal and Lucey (2007) tested the impact of psychological factors on gold prices. The findings, on the other hand, increase the demand for gold due to the shocks in the economy, and such a situation causes the gold prices to rise. In a similar study, Arymbaev (2010), stated that gold and gold funds were used by Turkish investors to hedge against risks during the 2008 global crisis. The findings indicate that the increasing demand caused gold prices to rise. Baur and Lucey (2010), who drew similar conclusions, found that gold was perceived as a safe haven in developing countries. Joy (2011) concluded that gold was a safer investment tool than the US dollar. Similarly, Anand and Madhogaria (2012) determined gold as a safe investment tool in cases of shock.

As can be seen, the emerging financial crises, shocks, and uncertainties cause gold prices to demonstrate an upward trend. The most vital underlying reason is the trust of investors, who are the actors of the financial markets, towards gold.

As Kiraz and Yıldız Üstün (2020) demonstrates the COVID‐19 pandemic process, which affected the world, caused investors to encounter a great deal of uncertainty, similar to the 2001 oil crisis and the 2008 global crisis. The global crisis of 2008 caused the investment instruments to gain momentum in terms of diversity and resulted in the proliferation of investment instruments that could be an alternative to gold, which has been accepted as a safe haven. Therefore, long‐term impacts of the number of case‐related deaths and 5‐year CDS premiums denominated in the Turkish lira on gold prices in gram have been tested during the COVID‐19 pandemic process in Turkey. Thus, in the presence of uncertainty in the market, it would be tested whether or not Turkish investors accept gold as a safe haven same as before. As a result of the study, it is thought that the study would make a unique contribution to the literature in terms of obtaining findings that would indicate the ability of gold to be a safe haven during the COVID‐19 pandemic process, which is the most uncertain period of the last century. The study consists of five sections. The first section constitutes the introduction of the study, whereas the second section includes the indicators that affect gold prices and the literature review of empirical studies that test the relationship between COVID‐19 and financial markets. The third section of the study introduces the dataset and methodology, and the obtained findings of the conducted analysis are included in the fourth section. The last section of the study consists of an overall evaluation.

2. SIMILAR STUDIES CONDUCTED

This section includes empirical research on financial markets and instruments that the pandemic process can affect today and studies focusing on various indicators that may affect gold prices before the pandemic, and consists of two sections. In the first part, different indicators affecting gold prices and studies covering the findings of these indicators are included, while in the second part, studies on gold, oil, bitcoin, stock market indices, and various financial indicators that are thought to be affected by COVID‐19 are included.

2.1. Literature review of indicators affecting gold prices

In Abken's (1980) study, the determinants of gold prices were tried to be reached. The findings obtained as a result of the simple regression model applied show that gold prices move in the same direction as expected inflation rates. Baker and van Tassel (1985) is another study investigating the determinants of gold prices similarly and associating them with treasury bonds. The findings are that gold prices and treasury bonds yields move in the opposite direction.

Smith (2002), who deals with stock market indices, another variable that can affect the gold price, has tested the relationship between the stock market of 18 different countries and gold prices. As a result of the findings, it was found that gold prices were priced negatively with the stock markets in the short run. Finding similar results, Aksoy and Topçu (2013) found that gold and stock returns have negative behavior.

The psychology of trust in money was evaluated in the study of Wonneberger and Mieg (2011). The findings obtained show that these currencies differ significantly in terms of usage regarding trust. Of these currencies, in terms of gold storage, Euro is preferred for investment and purchase, and community currencies are preferred for donations.

In Reboredo's (2013) study, the ability of gold to be used as a protection instrument for a commodity with a volatile price such as oil was measured. In the study using weekly data, it is found that there is a positive relationship between gold and oil prices, and this indicates that gold can be used as a hedging tool against oil prices. In the study of Ciner et al. (2013), who reached a similar result, it was found that gold can be used as a hedging tool against the exchange rate.

In Sjaastad's (2008) study, the relationship between gold prices and the US dollar rate was tested. The findings obtained in the study using daily price movements have been found that the dollar exchange rate has a significant effect on gold prices.

2.2. Literature review linking COVID‐19 and financial markets

In the study of Albulescu (2020), the relationship between the number of COVID‐19 cases, the VIX Fear Index, and oil prices were tested on the ARDL model. Obtain the findings, on the other hand, it was found that the total number of COVID‐19 cases had a significant and negative effect on oil prices.

According to Sharif et al. (2020), the relationship between America's geopolitical risk index, oil prices, America's stock price index, and the number of COVID‐19 cases belonging to America was tested. The finding obtained as a result of the applied wavelet‐based Granger causality test has been reached that COVID‐19 has an impact on oil price shocks, economic policy uncertainty, geopolitical risk levels, and stock market volatility. In another study on gold prices in the COVID‐19 process (Dutta et al., 2020). In this study, the properties of gold and Bitcoin as safe havens in international oil markets were examined. As a result of the applied DCC‐GARCH model, it was found that gold is a safe instrument for WTI and crude oil markets, while Bitcoin is only a safe instrument for crude oil.

In the Sansa (2020) study, the relationship between the daily number of cases occurring during the COVID‐19 process in China and oil prices was tested. As a result of the regression analysis applied, it was found that the daily number of cases had a significant and negative effect on oil prices.

In the study of Sarı and Kartal (2020), the effect of COVID‐19 daily data on Brent oil, gold in ounce, and VIX, also known as the fear index, was tested. As a result of the ARDL bound tests applied, it was found that the number of COVID‐19 cases was not cointegrated with Brent oil, but it was found to be in a positive relationship with gold prices in ounce.

In the study of Şit and Telek (2020), the effect of daily deaths and cases on the US dollar index and gold prices in ounce during the COVID‐19 period was tested with Hatemi‐J asymmetric causality and Hatemi‐J Cointegration analysis. The findings revealed that positive shocks in the number of deaths and cases have an effect on gold prices in ounce and the dollar index.

In Demir et al.'s (2020) study, patients and death occurred during the COVID‐19 pandemic was tested in the course of the relationship between the number of cryptocurrencies via the wavelet coherence analysis. While the findings obtained indicate that the number of cases and deaths initially created a negative shock on Bitcoin prices, later on, the effect was found to be positive, indicating that Bitcoin assumed the role of protection in the COVID‐19 process.

Zaremba et al. (2020) found out that the impact of non‐drug policy responses on the stock market volatility during the COVID‐19 process. As a result of the research conducted for 67 countries, it was found that the interventions made by the government had a significant and negative impact on the stock market.

In the study of Liu et al. (2020), the effect of the COVID‐19 process on the stock market index of 21 different countries was tested. The findings revealed that the COVID‐19 process negatively affected the stock market indices of all selected countries. In a similar study, Zeren and Hızarcı (2020), it was tested whether the stock market indices of some selected countries were affected by the COVID‐19 case and death numbers. As a result of the unit root tests with structural break and the Maki cointegration analysis, a cointegration was found between the cases and the country's stock market indices, while it was found that there was no effect on investment decisions in countries such as Germany, France, and Italy.

In the study of Yan (2020), it can be seen that tests the relationship between the stock market index and the COVID‐19 process, the relationship between the Chinese stock market and COVID‐19 was tested. The findings obtained are that COVID‐19 causes significant changes in stock prices. Likewise, another study evaluating the effect of uncertainty and COVID‐19 on the stock market index is Zhang et al. (2020). In the study, it was stated that the stock market was in an unpredictable and volatile state, and this situation was caused by uncertainty due to the pandemic.

3. DATASET AND METHODOLOGY

Information about the variables used in the study is shown in Table 1 below.

TABLE 1.

Variables used in the study

| Data name | Symbol | Period | Data type | Resource |

|---|---|---|---|---|

| Gold gram Turkish lira | GAUTRY | 03.17.20–11.04.20 | Daily | www.investing.com |

| Total number of deaths due to COVID‐19 | C19 | 03.17.20–11.04.20 | Daily | https://covid19.saglik.gov.tr/ |

| Turkey CDS 5 years USD | CDS | 03.17.20–11.04.20 | Daily | www.investing.com |

The daily data for gram gold opening prices in Turkish lira, Turkey CDS 5 years USD and the total number of deaths due to the COVID‐19 virus cover the period between March 17, 2020–April 11, 2020 in Table 1. weekends, official holidays, and non‐trading days were not included in the analysis covering 167 days in total. The data were analyzed using the Eviews software package.

It would be appropriate to give brief information about the selection reasons for these variables used in the study. Turkish investors may tend to prefer safe investment instruments in an environment of uncertainty. It was thought that the COVID‐19 process created the ground for great uncertainty and that the CDS premiums, whose volatility increased during the pandemic period, would affect gold prices in the Turkish lira, and it was deemed appropriate to test the long‐term relationship between these variables. On the other hand, since the dependent variable in the study is gram gold prices in the Turkish lira, deaths due to COVID‐19 and CDS premium movements, which is one of the financial risk indicators of the country, were thought to affect the gram gold price and were used as independent variables.

The model established for this purpose is as follows:

| (1) |

In order to test the presence of the relationship among the data used in the study, it is necessary to first test the stationarity and find out the extent to which they are integrated. In order to test the stationarity of variables and the extent to which they are cointegrated, the augmented Dickey–Fuller test developed by Dickey and Fuller (1981) and the Phillips–Perron unit root test developed by Phillips and Perron (1988) are performed.

In order to test the existence of long‐term relationships among variables in the study, the autoregressive distributed lag (ARDL bound) model was developed by Pesaran et al. (2000) and Pesaran et al. (2001) is applied. The applied autoregressive distributed lag model provides a great advantage compared to the Johansen (1988) and Engle and Granger (1987) tests, upon considering its features as an analysis that can be applied for variables that are stationary at different levels. On the other hand, if the result of the obtained test statistic exceeds the upper bound, the short‐ and long‐term coefficients would be attained. The bound test models are based on the estimation of unrestricted error correction models using the ordinary least squares method. The method is presented in the following equation in which the symbols Δ, α, and denote the first differences of the variables, the constant term, and the error term, respectively.

| (2) |

Following the establishment of the regression equation, the lag lengths of the variables should be determined to perform the bound test. Upon determining the lag lengths, such criteria as the Akaike information criterion, Schwarz information criterion, Hannan–Quinn information criterion, and final prediction error should be utilized. In order to test whether or not cointegration exists among variables following the selected and applied information criterion, the significance level of the cointegration among variables is tested by performing the Wald test (F statistic) upon considering the lower and upper bound values determined by Pesaran et al. (2001). The established hypotheses for the obtained F statistics are as follows:

= = (There is no cointegration)

≠ ≠ (There is cointegration)

For the lower and upper critical values specified in Pesaran et al. (2001), the lower and upper bound values are assumed to be I(0) and I(1), respectively. If the obtained F statistic is higher than the upper bound critical value, the null hypothesis claiming no cointegration among the variables is rejected; if the lower bound is lower than the critical value, the null hypothesis, which implies no cointegration among the variables, is accepted. Upon rejecting the null hypothesis claiming the existence of no cointegration among the variables (the F statistic > I(1)), the long‐term model can be estimated with Equation (3).

| (3) |

3.1. Findings

In order for the applied ARDL bound test to reveal correct results, the time‐ series used must be stationary at the first difference degree at most. Therefore, unit root tests such as the ADF and PP are performed first and it is tested whether or not the variables are stationary. The findings obtained as a result of the performed unit root test are presented in Table 2.

TABLE 2.

Unit root findings

| ADF | PP | |||

|---|---|---|---|---|

| Variables | Constant | Constant and trend | Constant | Constant and trend |

| GAUTRY | −1.93 (0) | −2.23 (0) | −1.95 (6) | −2.23 (2) |

| C19 | 1.23 (0) | 0.33 (0) | 0.36 (9) | −0.84 (9) |

| CDS | −3.01 (0)** | −3.79 (0)** | −3.34 (6)** | −3.77 (6)** |

| ∆GAUTRY | −13.76 (0)* | −13.85 (0)* | −13.75 (5)* | −13.86 (6)* |

| ∆C19 | −9.05 (0)* | −9.10 (0)** | −10.93 (9)* | −10.99 (9)* |

| ∆CDS | −8.73 (0)* | −8.70 (0)* | −8.48 (0)* | −8.45 (3)* |

Note: Indicates significance * at 1%, ** at 5% and *** at 10% levels of significance, respectively. () Maximum lags determined by the AIC information criterion.

As a result of the ADF and PP unit root tests, it is seen that the H0 hypothesis claiming that the C19 and GAUTRY series contain unit roots at the level is accepted, whereas the H0 hypothesis for the CDS series is rejected. As a result of the ADF and PP unit root tests performed on the first differences of the series, it is found that the series is stationary and the H0 hypothesis is rejected. The results of both unit root tests indicate that the prerequisite for the ARDL test is fulfilled.

After fulfilling the prerequisite for the ARDL bound test, the maximum lag length should be determined to establish the ARDL model. In the study, the minimum AIC value is taken into account and the lag length is determined as 4. Following the determination of the lag length, the existence of cointegration among the variables is tested. The F statistic, which provides comprehension of lag length and cointegration among the variables, is presented in Table 3.

TABLE 3.

F statistics and critical values table

| Model | K | M | F statistics | Significant | I(0) | I(1) |

|---|---|---|---|---|---|---|

| 2 | 4 | 3.902126** | 1% | 4.13 | 5 | |

| ARDL(1,2,0) | 5% | 3.1 | 3.87 | |||

| 10% | 2.63 | 3.35 |

Note: K is the number of explanatory variables, M is the maximum lag, and ** is the 5% significance level. The values used for the lower and upper bound are the values used in Pesaran et al. (2001).

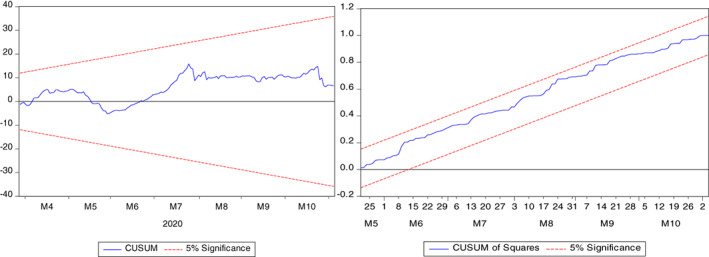

After determining the lag length and conducting the cointegration analysis, the ARDL bound test analysis is performed and the obtained findings are presented in Table 4. Following the ARDL bound test, the cumulative sum (CUSUM) and cumulative sum of squares (CUSUMQ) tests are performed to test whether or not a structural break of the variables exists, and the findings are illustrated in Figure 1.

TABLE 4.

ARDL model results

| Bağımlı Değişken: InGAUTRY | ||||

|---|---|---|---|---|

| Estimation Results of ARDL (1,2,0) Model | ||||

| Variable | Coefficient | SE | t‐statistic | Prob. |

| InGAUTRY(−1) | 0.9639* | 0.0155 | 62.1679 | 0.0000 |

| InC19 | 0.0051 | 0.0152 | 0.3380 | 0.0347 |

| InC19 (−1) | 0.0397** | 0.0195 | 2.0367 | 0.0433 |

| InC19 (−2) | −0.0338* | 0.0134 | −2.9254 | 0.0039 |

| InCDS | 0.0150 | 0.0115 | 1.3032 | 0.1944 |

| C | −0.0116 | 0.1578 | −0.0739 | 0.9412 |

| ARDL model long‐term forecast results | ||||

|---|---|---|---|---|

| Variables | Coefficient | SE | t‐statistic | Prob. |

| InC19 | 0.1540* | 0.0582 | 2.6433 | 0.0090 |

| InCDS | 0.4184 | 0.3552 | 1.1776 | 0.2407 |

| C | −0.3240 | 4.4438 | −0.0729 | 0.9420 |

| Descriptive statistics | ||||||

|---|---|---|---|---|---|---|

|

|

0.9850 |

|

0.8146 | [0.4447] | ||

| Adjusted | 0.9845 |

|

2.2171 | [0.5051] | ||

| F statistics (Probability) | 0.0000* |

|

0.6122 | [0.5782] | ||

| DW | 2.1354 |

|

1.7817 | [0.1839] | ||

Note: Indicates significance * at 1%, ** at 5% and *** at 10% levels of significance, respectively. : autocorrelation test, : heteroscedasticity test : Normality test, : modeling error in regression test.

FIGURE 1.

CUSUM and CUSUMQ

According to the selected AIC information criteria, the maximum lag length is determined as 4. On the other hand, since the obtained F statistic exceeds the upper bound value expressed as I(1) (F statistic = 3.902126), the null hypothesis claiming that no cointegration exists among the variables is rejected. Accordingly, cointegration is found to exist among the variables.

The findings of the descriptive tests for the performed ARDL bound test are presented in Table 4. As a result of the performed descriptive tests, the probability value of the Breusch–Godfrey test ( = 0.4447) indicates that no autocorrelation problem exists, whereas the Breusch–Pagan–Godfrey probability value ( = 0.5051) indicates that no heteroscedasticity problem exists. Nevertheless, the Jargue‐Bera probability value (, which is the normal distribution criterion, indicates the existence of a normal distribution, whereas the Ramsey reset test probability value = 0.1839) indicates that no modeling error exists.

According to the long‐term estimation results of the ARDL model in Table 4, the long‐term coefficients of the C19 and CDS variables were obtained as 0.1540, 0.4184, respectively. However, while the C19 variable was in a statistically significant and positive relationship with the GAUTRY variable in the long term, it was found that the CDS variable did not have a statistically significant relationship with the GAUTRY variable. This indicates that there is no long‐term relationship between changes in CDS premiums and gold prices in grams, while an increase in the number of deaths due to COVID‐19 may cause an increase in gold prices in grams in the long term.

Upon examining the CUSUM and CUSUMQ test results illustrated in Figure 1, no structural break is found in the variables over the period March 17, 2020–April 11, 2020. This situation indicates that the effective strength of the ARDL forecasting model.

4. CONCLUSION

Various situations such as economic and financial crises, wars, increasing geopolitical risks, and pandemics affect the markets and the decisions of investors, who are crucial actors of the market, and the impact on investment instruments may differ. Although such an impact on investment decisions may also tend to differ, it can be said that there is not much difference in purchase decisions for gold, which has been an important precious metal for centuries. When the markets plunge into a bad mood, in particular, investors demand gold, which is touted as a safe haven. Such increasing demand may lead to drastically soaring gold prices. On the other hand, studies such as Aggarwal and Lucey (2007), Arymbaev (2010), Baur and Lucey (2010), Joy (2011), and Anand and Madhogaria (2012) indicate that gold is accepted as a safe haven for investors hedging against risks within financial markets. Investors, should revert to the proper investment tools to protect themselves from the risk in the presence of uncertainty within the market. Especially for investors who invest in the financial markets of emerging economies with high volatility, it is quite essential to determine which of the investment instruments would be safe. Therefore, in the study, long‐term impacts of total number of deaths due to COVID‐19 and Turkey CDS 5 years USD on gold gram Turkish lira prices are tested during the COVID‐19 process over the period March 17, 2020–April 11, 2020.

As the result of the findings, it is seen that the C19 variable has a statistically significant and positive impact on the GAUTRY variable in the long‐run. On the other hand, the CDS variable does not have a statistically significant impact on GAUTRY in the long‐run. The findings, claiming the impact of the C19 variable on the GAUTRY variable, indicate that Turkish investors perceive gold as a safe haven, and they comply with the findings of such studies as Şit and Telek (2020), Sarı and Kartal (2020), and Dutta et al. (2020). Furthermore, the long‐term impact of C19 on GAUTRY indicates that Turkish investors direct their investments to gold gram Turkish lira in the long‐run despite the uncertainty that occurs whenever the uncertainty increases. Findings of the impact of C19 on GAUTRY are similar to of such studies as Albulescu (2020), Sharif et al. (2020), and Sarı and Kartal (2020) which tested the impact of the VIX fear index, geopolitical risk index, and other indicators such as COVID‐19 pandemic on gold prices.

As a result, it is reached that the increases in the total number of deaths due to COVID‐19 have long‐term effects on gram gold in Turkish lira. Gold, as a globally trusted investment tool, can also be regarded as a sound investment instrument by investors in Turkey. On the other hand, another reason underlying the increases in gold gram Turkish lira is the increases in XAU/USD and USD/TRY exchange rates, which are the main components of gold gram Turkish lira. The high level of trust in gold is an important factor in preventing financial losses, hedging investors against financial risks, and fostering the awareness of investors. Nonetheless, in the environment of uncertainty that occurs during the COVID‐19 process, huge gold or gold fund purchases may reduce purchases on investment tools such as stocks, bonds, and T‐bills, and this may cause a significant decrease in the securities market.

In similar studies to be conducted in future, testing whether or not there are price bubbles in gold gram Turkish lira throughout the COVID‐19 pandemic process, and determining the extent to which the periods of price bubbles relate to the US dollar exchange rate and gold prices in ounce would significantly contribute to the literature.

Biographies

Hakan Yildirim holds a PhD in Business Administration. Currently, he lectures as Associate Professor at Istanbul Gelisim University Department of Logistics Management. His research interests includes behavioral finance, financial forecasting and modelling, international finance and can be requested from hayildirim@gelisim.edu.tr.

Merve Boyaci Yildirim is a PhD candidate at Marmara University. Currently, she is a Research Assistant at Istanbul Gelisim University Department of Public Relations and Publicity.

Alihan Limoncuoğlu holds a PhD in Ethno Political Studies at University of Exeter. He is an Assistant Professor at Istanbul Aydin University. His research interests include Nationalism, Anti‐EU movements, Interbellum Political History.

Yildirim, H. , Boyaci Yildirim, M. , & Limoncuoğlu, A. (2021). Escape from COVID‐19 pandemic to safe haven. Journal of Public Affairs, 21(4), e2728. 10.1002/pa.2728

Contributor Information

Hakan Yildirim, Email: hayildirim@gelisim.edu.tr.

Merve Boyaci Yildirim, Email: mboyaci@gelisim.edu.tr.

Alihan Limoncuoğlu, Email: alihan.limoncuoglu@medipol.edu.tr.

DATA AVAILABILITY STATEMENT

The data that support the findings of this study are available from the corresponding author upon reasonable request.

REFERENCES

- Abken, P. A. (1980). The economics of gold price movements. Federal Reserve Bank of Richmond. [Google Scholar]

- Aggarwal, R. , & Lucey, B. M. (2007). Psychological barriers in gold prices. Review of Financial Economics, 16(2), 217–230. 10.1016/j.rfe.2006.04.001. [DOI] [Google Scholar]

- Aksoy, M. , & Topçu, N. (2013). Altın ile hisse senedi ve enflasyon arasındaki ilişki. Atatürk Üniversitesi İktisadi ve İdari Bilimler Dergisi, 1(27), 59–78. [Google Scholar]

- Albulescu, C. (2020). Coronavirus and Oil Price Crash. Available at SSRN: https://ssrn.com/abstract=3553452 or http://dx.doi.org/10.2139/ssrn.3553452

- Anand, R. , & Madhogaria, S. (2012). Is gold a ‘safe‐haven’? ‐ An econometric analysis. Procedia Economics and Finance, 1, 24–33. 10.1016/S2212-5671(12)00005-6. [DOI] [Google Scholar]

- Arymbaev, J. , (2010). In Turkey, the Istanbul gold exchange gold market restructuring the financial sector role and contribution (Master thesis). Istanbul: Yıldız Technical University Institute of Social Sciences.

- Baker, S. A. , & van Tassel, R. C. (1985). Forecasting the price of gold: A fundamentalist approach. Atlantic Economic Journal, 13, 43–51. [Google Scholar]

- Baur, D. G. , & Lucey, B. M. (2010). Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review, 45(2), 217–229. [Google Scholar]

- Ciner, C. , Gurdgiev, C. , & Lucey, B. M. (2013). Hedges and safe havens: An examination of stocks, bonds, gold, oil and exchange rates. International Review of Financial Analysis, 29, 202–211. [Google Scholar]

- Demir, E. , Bilgin, M. H. , Karabulut, G. , & Doker, A. C. (2020). The relationship between cryptocurrencies and COVID‐19 pandemic. SSRN 3585147.

- Dickey, D. , & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica, 49, 1057–1072. [Google Scholar]

- Dutta, A. , Das, D. , Jana, R. K. , & Vo, X. V. (2020). COVID‐19 and oil market crash: Revisiting the safe haven property of gold and bitcoin. Resources Policy. 69, 1–6. 10.1016/j.resourpol.2020.101816 [DOI] [PMC free article] [PubMed] [Google Scholar]

- Engle, R. F. , & Granger, C. W. J. (1987). Cointegration and error correction: Representation, estimation and testing. Econometrica, 55, 251–276. [Google Scholar]

- Folger‐Laronde, Z. , Pashang, S. , Feor, L. , & ElAlfy, A. (2020). ESG ratings and financial performance of exchange‐traded funds during the COVID‐19 pandemic. Journal of Sustainable Finance & Investment, 1–7. 10.1080/20430795.2020.1782814. [DOI] [Google Scholar]

- Johansen, S. (1988). Statistical analysis of cointegration vectors. Journal of Economic Dynamics and Control, 12(2‐3), 231–254. [Google Scholar]

- Joy, M. (2011). Gold and the US dollar: Hedge or haven? Finance Research Letters, 8(3), 120–131. [Google Scholar]

- Kiraz, Ş. E. , & Yıldız Üstün, E. (2020). COVID‐19 and force majeure clauses: An examination of arbitral tribunal's awards. Uniform Law Review, 25, 437–465. 10.1093/ulr/unaa027 [DOI] [Google Scholar]

- Liu, H. , Manzoor, A. , Wang, C. , Zhang, L. , & Manzoor, Z. (2020). The COVID‐19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health, 17(8), 1–19. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Pesaran, M. H. , Shin, Y. , & Smith, R. J. (2000). Structural analysis of vector error correction models with exogenous I(1) variables. Journal of Econometrics, 97(2), 293–343. 10.1016/S0304-4076(99)00073-1 [DOI] [Google Scholar]

- Pesaran, M. H. , Shin, Y. , & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16, 289–326. [Google Scholar]

- Phillips P. C. B., & Perron P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335–346. 10.1093/biomet/75.2.335. [DOI] [Google Scholar]

- Reboredo, J. C. (2013). Is gold a hedge or safe haven against oil price movements? Resources Policy, 38, 130–137. [Google Scholar]

- Sansa, N. A. (2020). Analysis for the Impact of the COVID‐19 to the Petrol Price in China. Available at SSRN: https://ssrn.com/abstract=3547413 or 10.2139/ssrn.3547413 [DOI]

- Sarı, S. S. , & Kartal, T. (2020). The relationship of COVID‐19 Pandemic with gold prices, oil prices and VIX index. Erzincan University Journal of Social Sciences Institute, 13(1), 93–109. 10.46790/erzisosbil.748181. [DOI] [Google Scholar]

- Sharif, A. , Aloui, C. , & Yarovaya, L. (2020). COVID‐19 pandemic, oil prices, stock market, geopolitical risk, and policy uncertainty nexus in the US economy: Fresh evidence from the waveletbased approach. International Review of Financial Analysis, 70, 101496. 10.1016/j.irfa.2020.101496. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Şit, A. , & Telek, C. (2020). Effects of Covid‐19 pandemic on gold ounce price and dollar index. Gaziantep University Journal of Social Sciences, 19 (COVID‐19 Special Issue), 1–13. 10.21547/jss.742110 [DOI] [Google Scholar]

- Sjaastad, L. A. (2008). The price of gold and the exchange rates: Once again. Resources Policy, 33(2), 118–124. [Google Scholar]

- Smith G. (2002). London gold prices and stock price indices in Europe and Japan. World Gold Council, 9(2), 1–30. http://www.spdrgoldshares.com/media/GLD/file/GOLD&EUJPStockIndicesFeb2002.pdf. [Google Scholar]

- Wonneberger, E. T. , & Mieg, H. A. (2011). Trust in money: Hard, soft and idealistic factors in Euro, gold and German community currencies. Journal of Sustainable Finance & Investment, 1(3‐4), 230–240. [Google Scholar]

- Yan, C. (2020). COVID‐19 Outbreak and stock prices: Evidence from China. Available at https://ssrn.com/abstract=3574374 or 10.2139/ssrn.3574374 [DOI]

- Zaremba, A. , Kizys, R. , Aharon, D. Y. , & Demir, E. (2020). Infected markets: Novel coronavirus, government interventions, and stock return volatility around the globe. Finance Research Letters, 35, 101597. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Zeren, F. , & Hızarcı, A. (2020). The impact of COVID‐19 coronavirus on stock markets: evidence from selected countries. Muhasebe ve Finans İncelemeleri Dergisi, 3(1), 78–84. 10.32951/mufider.706159. [DOI] [Google Scholar]

- Zhang, D. , Hu, M. , & Ji, Q. (2020). Financial markets under the global pandemic of COVID‐19. Finance Research Letters, 36, 101528. 10.1016/j.frl.2020.101528. [DOI] [PMC free article] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author upon reasonable request.