Abstract

Background:

Medical financial burden includes material, behavioral, and psychological hardship and has been under-investigated among adult survivors of childhood cancer.

Methods:

We analyzed a survey from 698 survivors and 210 siblings from the Childhood Cancer Survivor Study. We estimated the intensity of financial hardship across three domains of, 1) material, including conditions that arise from medical expenses; 2) behavioral, including coping behaviors to manage medical expenses, and: 3) psychological hardship resulting from worries about medical expenses and insurance) and the number of instances of each type of financial hardship (0, 1-2, and ≥3 instances). Multivariable logistic regressions among survivors examined clinical and sociodemographic predictors of experiencing financial hardship (0-2 vs. ≥3 instances).

Results:

Intensity of financial hardship did not significantly differ between survivors and siblings. Survivors reported more instances of material hardship than siblings (1-2 instances: 27.2% of survivors vs. 22.6% of siblings; ≥3 instances: 15.9% of survivors vs. 11.4% siblings; overall p=0.03). In multivariable regressions, insurance was protective against all domains of financial hardship (behavioral OR=0.12, 95% CI 0.06-0.22; material OR=0.37, 95% CI 0.19-0.71; psychological OR=0.10, 95% CI 0.05-0.21). Survivors who were older at diagnosis, female, and with chronic health conditions generally had higher levels of hardship. Brain radiation and alkylating agents were associated with higher levels of hardship.

Conclusions:

Material, behavioral, and psychological financial burden among childhood cancer survivors is common.

Keywords: Survivors of Childhood Cancer, Cancer Survivors, Financial Hardship

Precis:

Childhood cancer survivors are at risk for economic consequences of their cancer treatment that manifest through the domains of material, behavioral, and psychological hardship. We found that a high intensity of medical financial hardship is common among long-term childhood cancer survivors.

INTRODUCTION

With the continued advancement of life-saving therapies, most children with cancer survive into adulthood. Over 85% of children diagnosed with cancer become long-term survivors,1 and it is estimated that there are more than 500,000 survivors of childhood cancer living in the U.S. today.2 Many childhood cancer survivors face risks over their lifetime for morbidity and premature mortality due to the sequelae of their primary disease or its treatment, with 73% suffering from any chronic health condition and 42% suffering from a severe or life-threatening health condition in the decades following their cancer diagnosis.3–5

While the physical health of childhood cancer survivors has been well described, the effects on their financial outcomes have been under-investigated. Medical financial burden is an increasingly acknowledged problem, with studies estimating that almost half of cancer survivors experience some type of financial hardship.6 However, most literature to date has been in adult cancer.6–9 For childhood cancer survivors, the negative financial effects from cancer can last well into adulthood due to school and work disruptions,10,11 subsequent health problems,4 and high medical costs,12,13 affecting their access to health care. For example, an earlier report from the North American Childhood Cancer Survivor Study (CCSS) found that survivors who spend ≥10% of their income on medical out-of-pocket costs were more likely to report problems with paying medical bills and skipping health care due to cost than survivors who reported spending less than 10% of their income.12

Medical financial burden can manifest in multiple ways and includes aspects of material, behavioral, and psychological hardship.7 Material hardship comprises experiences such as inability to pay for medical care/debt, resource insecurity, and high out-of-pocket medical costs. Behavioral hardship includes delaying/forgoing medical care and non-adherence to medication due to costs. Psychological hardship encompasses worry regarding current and future finances and insurance coverage. Studies of adult cancer survivors demonstrate a high prevalence of all three domains of financial hardship compared to individuals without cancer.6,8,9,14 Among childhood cancer survivors, only one study from the St. Jude Lifetime cohort reported on medical financial burden, with 22.4% of survivors reporting material, 33.0% behavioral, and 51.1% psychological hardship.15 Compared to those without cancer, survivors are more likely to experience multiple domains of financial hardship.8,14 However, the intensity of medical financial burden for childhood cancer survivors compared to individuals without cancer remains unknown.

In this report, we investigated material, behavioral, and psychological financial hardship in the CCSS study. Similar in methodology to earlier studies of adult cancer survivors,8,15 we identified the intensity of financial hardship (that is, experiencing 0, 1, 2, or all 3 domains of financial hardship) and examined whether survivors are more likely to experience multiple hardships (0, 1-2, and ≥3 instances) within each domain compared to siblings. We investigated clinical and sociodemographic factors including the role that health insurance coverage and chronic conditions play with financial hardship to determine which survivors may be at greatest risk.

METHODS

Participants and Data Collection

Between May 2011 and April 2012, a cross-sectional insurance survey of a randomly selected, age-stratified (<30, 30-39, 40+) sample of CCSS survivors and siblings was performed. The CCSS is a multi-institutional, retrospective cohort study with longitudinal follow-up that was initiated in 1994 to determine health outcomes of adult survivors of childhood cancer. Eligible survivors were diagnosed with cancer between 1970 and 1986, were <21 years old at diagnosis, and had survived ≥5 years from diagnosis of leukemia, lymphoma, CNS malignancy, Wilms tumor, neuroblastoma, soft tissue sarcoma, and bone cancers. The eligible cohort had 14,357 survivors and a cohort of randomly-selected siblings (N=4,023).16

As previously described,17 the insurance survey was informed from national surveys and a qualitative assessment of CCSS participants.18 The medical financial burden items were adapted from a National Health Interview Survey and a Commonwealth Fund Health Insurance Survey that asked specific questions regarding delaying medical care because of costs, worries about medical costs and the impact on one’s financial resources, and stress/worries related one’s financial situation and insurance coverage. Surveys were cognitively tested with adult survivors of childhood cancer treated at Massachusetts General Hospital. Participants completed either an insured or uninsured version of the survey (https://ccss.stjude.org/documents/original-cohort-questionnaires). The survey was approved by St. Jude Children’s Research Hospital’s IRB; the overall CCSS study was approved at all sites and participants provided consent. The survivor response rate was 63.4% (698 participants/1,101 selected) and the sibling response rate was 58.3% (210 participants/360 selected).

Measures

Financial Hardship Outcomes:

Medical financial burden was assessed using the Material-Psychosocial-Behavioral Conceptual Model of Financial Hardship, which has been applied to earlier studies of cancer survivors.6,8,19 The framework was designed to capture the impact of direct and indirect costs of medical care.20

We identified Behavioral hardship (i.e., what one does with their resources, including delaying medical care) through an adapted Commonwealth Survey measure, which asks: In the past year, was there a time when you did any of the following because you were worried about the cost? Ten items included situations such as “Skipped a medical test, treatment, or follow-up that was recommended by a healthcare provider” and “Did not fill a prescription.” We grouped responses as either ‘Yes’ or ‘No’/‘Don’t know’ and summarized the prevalence of 0, 1-2, and ≥3 hardships within this domain.

Material hardship (i.e., the financial resources one has access to and having the financial resources to meet expenses) was assessed as: In the past year, have any of the following happened because of medical expenses? This included eight items such as “Been unable to pay for basic necessities like food, heat, or rent,” “Thought about filing for bankruptcy,” and “Spent more than 10% of your income on medical expenses.” We grouped responses as either ‘Yes’ or ‘No’/‘Don’t know’ and summarized the prevalence of 0, 1-2, and ≥3 hardships within this domain.

Psychological hardship (i.e., how one feels about financial resources and financial and insurance worry) was determined by four questions adapted from the National Health Interview Survey that asked about worries such as losing their jobs or being unable to pay medical bills in the past year. An additional four items were asked only among insured regarding worries about current insurance coverage (e.g., concern your health insurance will become so expensive you wouldn’t be able to afford it). We grouped responses as a ‘great deal’/‘a fair amount’ vs. ‘a little’/‘not at all’. For all participants, we created a summary psychological hardship measure of those indicating ‘great deal’/‘a fair amount’ (grouped as 0, 1-2, and ≥3) to the four questions on job and medical bill worries. We created an additional item “Psychological worries related to insurance” using all eight items limited to insured participants, grouped as 0, 1-2, and ≥3.

Overall Intensity of Financial Hardship:

We generated a dichotomous summary measure for the three financial hardship domains (report of 0 vs. 1 or more items for each domain) to create an overall intensity measure of experiencing 0, 1, 2, and all 3 domain(s) of medical financial hardship.8,14

Other Measures

The insurance survey assessed survivors’ current marital status, employment, household income, and insurance. Data on other factors such as race/ethnicity were obtained from CCSS baseline and follow-up surveys. We used the most recent CCSS follow-up survey to report the presence of any chronic health conditions. Cancer treatment was abstracted from medical records of those survivors who authorized release of their medical records, including cranial/brain radiation (yes/no) and chest radiation (yes/no), anthracyclines and alkylating agents modeled as no dose vs. increasing dose tertiles (see Supplementary table), which we anticipated would be most likely to affect financial hardship as these denote rigorous treatment with the potential for severe long-term health effects.

Statistical Analyses

We first estimated the proportion of survivors and siblings for the overall intensity of financial hardship (experiencing 0, 1, 2, or all 3 domains), as well as the proportion experiencing multiple instances of behavioral, material, and psychological financial hardship (0, 1-2, and ≥3 instances within each domain). To do this, we calculated marginal proportions from ordinal logistic regression models that adjusted for insurance, using a Wald test to compare survivors to siblings. We compared the intensity of financial hardship among survivors and siblings by insurance status (insured vs. uninsured) using chi-square tests. Additionally, we examined differences in Psychological worries related to insurance between insured survivors and siblings using chi-square tests.

Among survivors, we examined the proportion reporting financial hardship (0, 1-2, and ≥3 instances) by insurance status (insured vs. uninsured) and tested for significance using chi-square tests. Next, we fit logistic regression models to generate odds ratios and 95% confidence intervals to examine the associations between sociodemographic and clinical factors on the three financial hardship outcomes (behavioral, material, and psychological) as well as the psychological worries related to insurance, modeling the outcome as 0-2 vs. ≥3 instances. We used ≥3 instances to indicate survivors with the severest levels of financial hardship within each domain.

Separate models were run to examine the effects of treatment for each outcome while excluding diagnosis due to potential collinearity between diagnosis and treatment. Treatment models were also adjusted for the sociodemographic factors.

Statistical analyses were completed using Stata version 14.2 (College Station, TX) incorporating weighting to account for stratified sampling so that results are representative of the overall CCSS cohort age distribution. P values are two-sided and considered significant at P<.05.

RESULTS

Among 698 survivors and 210 siblings (Table 1), 10.2% of survivors and 7.9% of siblings were uninsured. Of insured survivors, almost 16% had public insurance (primarily Medicaid); 4.8% of siblings had public insurance. Survivors were 54.5% female, whereas 61.1% of siblings were female. Median time from diagnosis for survivors was 28.8 years (range: 23.1 to 41.7 years) (not shown in table).

Table 1.

Demographics and Clinical Characteristics of Childhood Cancer Survivor Study Survivors and Siblings

| Survivors N=698 | Siblings N=210 | |||

|---|---|---|---|---|

|

| ||||

| N | % (weighted)1 | N | % (weighted) 1 | |

|

| ||||

| Insurance status | ||||

| Uninsured | 79 | 10.2 | 21 | 7.9 |

| Insured | 619 | 89.8 | 189 | 92.2 |

| Insurance type (among insured) | ||||

| Private (Employer/military) | 462 | 77.3 | 161 | 87.5 |

| Private (Individual) | 46 | 7.1 | 17 | 7.7 |

| Public (Medicare/Medicaid/State) | 110 | 15.7 | 11 | 4.8 |

| Age at survey | ||||

| 22-29 | 214 | 11.3 | 61 | 13.5 |

| 30-39 | 228 | 42.3 | 68 | 33.6 |

| ≥40 | 256 | 46.4 | 81 | 52.9 |

| Sex | ||||

| Male | 314 | 45.5 | 82 | 38.9 |

| Female | 384 | 54.5 | 128 | 61.1 |

| Race/Ethnicity | ||||

| Non-Hispanic White | 646 | 93.6 | 185 | 93.5 |

| Other | 50 | 6.4 | 15 | 6.5 |

| Education attained | ||||

| ≤High school graduate | 166 | 29.8 | 64 | 32.7 |

| ≥College | 352 | 70.2 | 122 | 67.4 |

| Marital Status | ||||

| Not married | 299 | 38.7 | 68 | 26.4 |

| Married | 393 | 61.3 | 141 | 73.6 |

| Any Chronic Condition | ||||

| Yes | 587 | 84.8 | 142 | 67.7 |

| No | 111 | 15.2 | 68 | 32.3 |

| Cancer diagnosis | ||||

| Leukemia | 255 | 35.0 | ||

| Central Nervous System | 104 | 14.9 | ||

| Hodgkin Disease | 71 | 12.9 | ||

| Soft Tissue Sarcoma | 51 | 8.3 | ||

| Bone Cancer | 45 | 8.1 | ||

| Wilms | 66 | 8.1 | ||

| Non-Hodgkin Lymphoma | 39 | 6.7 | ||

| Neuroblastoma | 67 | 6.1 | ||

| Age at Diagnosis, years | ||||

| 0-5 | 404 | 46.4 | ||

| 6-10 | 104 | 19.1 | ||

| 11-15 | 109 | 19.8 | ||

| 6-20 | 81 | 14.7 | ||

| Second Cancer | ||||

| No | 668 | 94.9 | ||

| Yes | 30 | 5.1 | ||

| Recurrence | ||||

| No | 611 | 88.1 | ||

| Yes | 87 | 11.9 | ||

| Radiation | ||||

| No | 259 | 34.4 | ||

| Yes | 401 | 65.6 | ||

| Any Brain Radiation | ||||

| No | 436 | 65.5 | ||

| Yes | 212 | 34.5 | ||

| Chemotherapy | ||||

| No | 145 | 23.3 | ||

| Yes | 516 | 76.7 | ||

| Any anthracyclines | ||||

| No | 404 | 62.7 | ||

| Yes | 257 | 37.3 | ||

| Any alkylating agents | ||||

| No | 337 | 51.3 | ||

| Yes | 322 | 48.7 | ||

| Received neither chemotherapy or radiation Surgery | 60 | 8.1 | ||

| No | 145 | 20.0 | ||

| Yes | 515 | 80.0 | ||

Weights account for stratified sampling so that results represent CCSS age distribution

Financial Hardship Intensity among Survivors and Siblings

While survivors had a greater proportion with high intensity (all three domains; 25.0% vs. 20.4; p=0.07) compared to siblings this difference was not statistically significant (Table 2). Of the three domains, 29.4% of survivors reported 0 domains of financial hardship (vs. 35.3% of siblings), 24.6% reported 1 (vs. 25.2% of siblings), 21.0% reported 2 (vs. 19.1% of siblings). Over 50% of uninsured survivors and siblings reported experiencing all three domains of financial hardship compared to 22.7% of insured survivors (p<0.001) and 16.6% of siblings (p=0.003).

Table 2:

Proportions of Survivors and Siblings Reporting Overall Intensity of Financial Hardship during the Past Year

| Overall – adjusted for insurance1 (%) | By insurance status |

|||||

|---|---|---|---|---|---|---|

| Survivors (%)N=674 | Siblings (%)N=204 | |||||

|

| ||||||

| Intensity2 | Survivors | Siblings | Insured | Uninsured | Insured | Uninsured |

|

| ||||||

| 0 | 29.4 | 35.3 | 31.6 | 10.5 | 36.8 | 9.9 |

| 1 | 24.6 | 25.2 | 25.0 | 15.0 | 27.5 | 19.9 |

| 2 | 21.0 | 19.1 | 20.7 | 23.9 | 19.1 | 19.2 |

| 3 | 25.0 | 20.4 | 22.7 | 50.7 | 16.6 | 51.1 |

|

| ||||||

| p=0.07 | p<0.001 | p=0.003 | ||||

Marginal proportions calculated from ordinal logit model adjusting for insurance with Wald test to compare survivors to siblings.

Intensity measure of 0, 1, 2, and all 3 domain(s) of behavioral, material, and psychological financial hardship.

Behavioral, Material, and Psychological Financial Hardship among Survivors and Siblings

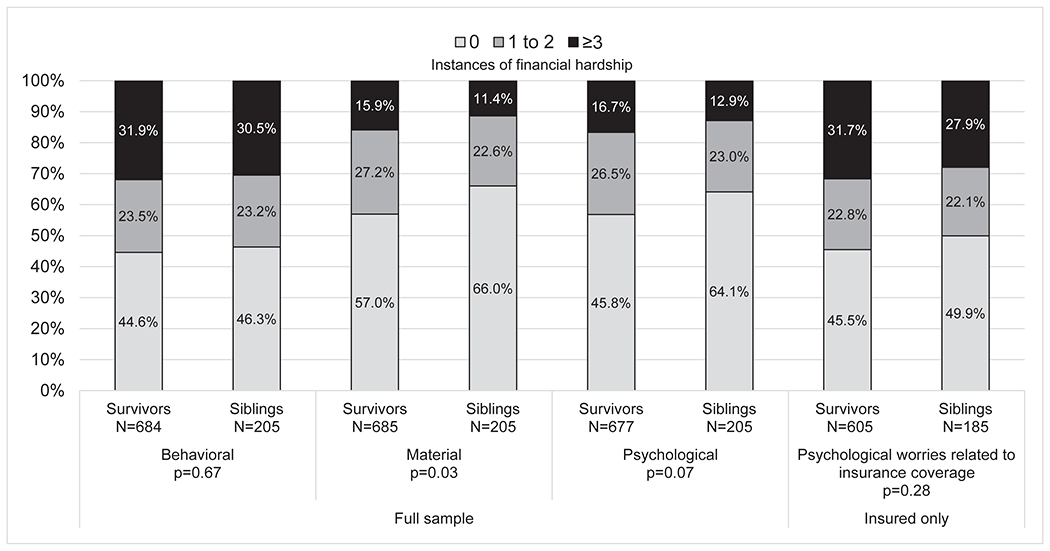

Proportions of behavioral (p=0.67) and psychological hardship (p=0.07) did not statistically differ between survivors and siblings (Figure 1). However, survivors reported more material hardship than siblings (1-2 instances: 27.2% of survivors vs. 22.6% of siblings; ≥3 instances: 15.9% of survivors vs. 11.4% siblings; overall p=0.03). Among insured, psychological worries regarding insurance coverage did not differ (p=0.28).

Figure 1:

Proportions of Survivors and Siblings Reporting Behavioral, Material, and Psychological Financial Hardship during the Past Year1 1Marginal proportions calculated from ordinal logit model adjusting for insurance with Wald test to compare survivors to siblings. The insured only model is not adjusted for insurance.

Behavioral, Material, and Psychological Financial Hardship among Survivor Subgroups

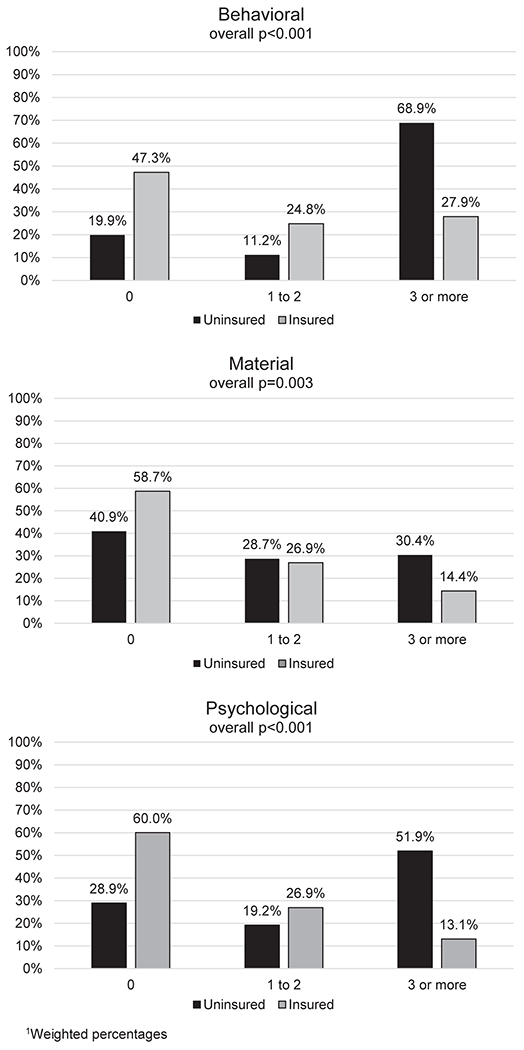

Uninsured survivors were more likely to report ≥3 instances of financial hardship across the three domains than insured survivors (Figure 2; behavioral: uninsured 68.9% vs 27.9% insured; P < .001; material: 30.4% vs 14.4% insured; P = .003; psychological: 51.9% vs. 13.1% insured, p<0.001). However, even among those insured, all three domains of financial hardship were common. In particular, over half of insured survivors (52.7%) reported at least 1 instance of behavioral hardship in the past year.

Figure 2.

Proportions of Survivors by Insurance Status Reporting Behavioral, Material, and Psychological Financial Hardship during the Past Year1 1Weighted percentages

We also examined differences by cancer diagnosis (Supplemental Figure). More than 50% of survivors in all disease groups, except leukemia, reported ≥1 instances of behavioral hardship. Material and psychological hardship were less prevalent, but still common, with at least 25% of survivors in each disease group reporting 1 or more instance. Psychological worries about insurance were common, with over 50% of survivors in each disease group except neuroblastoma reporting ≥1 instance.

For the regression analyses among the full sample of survivors, we grouped the domains of financial hardship into 0-2 vs. ≥3 more instances to identify severe hardship. In Table 3, insured survivors were significantly less likely to experience ≥3 more instances of behavioral (OR=0.12, 95% CI 0.06-0.22), material (OR=0.37, 95% CI 0.19-0.71), and psychological hardship (OR=0.10, 95% CI 0.05-0.21) compared to uninsured survivors. Younger age at diagnosis (0-4 years vs. 5-20 years) was associated with a lower odds of behavioral (OR=0.57, 95% CI 0.35-0.92) and psychological (OR=0.40, 95% CI 0.22-0.75) hardship. Years since diagnosis was marginally significant for elevated psychological hardship for those treated 30 or more years prior.

Table 3:

Multivariable Logistic Regressions of Sociodemographic Factors and Cancer Diagnosis Associated with ≥3 vs. 0-2 Behavioral, Material, and Psychological Hardships1 during the Past Year

| Full sample | Insured only | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

| ||||||||||||

| Behavioral (≥3 vs. 0-2) | Material (≥3 vs. 0-2) | Psychological (≥3 vs. 0-2) | Psychological worries related to insurance (≥3 vs. 0-2) | |||||||||

|

| ||||||||||||

| OR | 95% CI | p-value | OR | 95% CI | p-value | OR | 95% CI | p-value | OR | 95% CI | p-value | |

|

| ||||||||||||

| Insured | 0.12 | 0.06, 0.22 | <0.001 | 0.37 | 0.19, 0.71 | 0.003 | 0.10 | 0.05, 0.21 | <0.001 | -- | ||

| Age 0-4 years at diagnosis (vs. 5-20) | 0.57 | 0.35, 0.92 | 0.02 | 0.59 | 0.34, 1.03 | 0.06 | 0.40 | 0.22, 0.75 | 0.004 | 0.57 | 0.35, 0.92 | 0.02 |

| Years since diagnosis | ||||||||||||

| 21-29 (ref) | 1 | 1 | 1 | 1 | ||||||||

| 30 or more | 0.85 | 0.59, 1.24 | 0.40 | 0.94 | 0.58, 1.51 | 0.79 | 1.64 | 0.99, 2.70 | 0.05 | 1.68 | 1.12, 2.50 | 0.01 |

| Female | 1.86 | 1.26, 2.74 | 0.002 | 1.20 | 0.74, 1.94 | 0.46 | 2.19 | 1.30, 3.70 | 0.003 | 1.93 | 1.29, 2.89 | 0.002 |

| Non-Hispanic White | 0.74 | 0.35, 1.60 | 0.45 | 1.01 | 0.39, 2.61 | 0.99 | 0.40 | 0.17, 0.92 | 0.03 | 0.54 | 0.26, 1.11 | 0.09 |

| Any Chronic Condition | 2.13 | 1.14, 3.95 | 0.02 | 4.11 | 1.58, 10.69 | 0.004 | 0.92 | 0.44, 1.91 | 0.82 | 1.55 | 0.84, 2.86 | 0.16 |

| Married | 1.02 | 0.68, 1.53 | 0.93 | 0.79 | 0.47, 1.34 | 0.39 | 0.86 | 0.52, 1.43 | 0.56 | 0.86 | 0.56, 1.32 | 0.49 |

| Diagnosis | ||||||||||||

| Bone (ref) | 1 | 1 | 1 | 1 | ||||||||

| CNS | 1.51 | 0.62, 3.67 | 0.37 | 2.33 | 0.60, 9.00 | 0.22 | 2.74 | 0.85, 8.90 | 0.09 | 1.14 | 0.50, 2.62 | 0.76 |

| Hodgkin Disease | 2.05 | 0.86, 4.89 | 0.11 | 2.51 | 0.66, 9.57 | 0.18 | 2.35 | 0.72, 7.66 | 0.16 | 0.95 | 0.41, 2.18 | 0.90 |

| Wilms | 1.91 | 0.66, 5.51 | 0.23 | 2.14 | 0.44, 10.36 | 0.34 | 1.19 | 0.24, 5.90 | 0.83 | 0.80 | 0.29, 2.23 | 0.67 |

| Leukemia | 1.38 | 0.60, 3.16 | 0.45 | 5.16 | 1.46, 18.16 | 0.01 | 3.12 | 1.05, 9.27 | 0.04 | 1.10 | 0.52, 2.32 | 0.81 |

| NHL | 1.35 | 0.47, 3.87 | 0.57 | 3.01 | 0.68, 13.33 | 0.15 | 2.03 | 0.53, 7.76 | 0.30 | 1.12 | 0.42, 2.99 | 0.82 |

| Neuroblastoma | 1.45 | 0.48, 4.36 | 0.51 | 1.99 | 0.40, 9.76 | 0.40 | 2.72 | 0.62, 11.98 | 0.19 | 0.66 | 0.21, 2.08 | 0.48 |

| STS | 2.55 | 0.98, 6.65 | 0.06 | 2.15 | 0.48, 9.58 | 0.31 | 1.94 | 0.54, 6.93 | 0.31 | 0.81 | 0.31, 2.09 | 0.66 |

Behavioral Hardship (N=676), Material Hardship (N=677), Psychological Hardship (N=669); Psychological Hardship-insured only (N=598), due to missing data

OR=Odds ratio; 95% CI=95% Confidence Interval

Female survivors reported ≥3 instances behavioral and psychological hardship more often compared to their counterparts, whereas for survivors with any chronic conditions behavioral and material hardship were more common. For cancer diagnosis, only leukemia was statistically significant, with a 5-fold higher risk of material and 3-fold higher risk of psychological burden compared to bone tumor survivors. While not shown in Table 3, in separate regressions we investigated age at survey without age at diagnosis and time since diagnosis. Survivors ages 40 and older were more likely to report both material and psychological hardship (OR=2.25, 95% CI 1.18-4.28 and OR=3.12, 95% CI 1.56-6.26, respectively, vs. ages 20-29 years).

Among insured survivors (Table 3), younger age at diagnosis (0-4 years) was associated with a lower risk of psychological hardship (OR=0.57, 95% CI 0.35-0.92 vs. 5-20 years). Survivors 30 or more years from diagnosis (OR=1.68, 95% CI 1.12-2.50 vs. 21-29 years from diagnosis) and female (OR=1.93, 95% CI 1.29-2.89 vs. male) had ≥3 psychological worries related to insurance more than their counterparts. Chronic conditions and diagnosis were not significant. In a separate model without age at diagnosis or years since diagnosis, survivors ages 40 and older were more likely to report psychological hardship related to insurance (OR=2.96, 95% CI 1.64-5.33 vs. age 20-29 years).

Certain treatment factors were significant (Supplemental Table), with increasing tertiles of anthracycline doses associated with a lower odds of behavioral and psychological hardship compared to receiving no dose. Brain radiation was associated with greater odds of material hardship and increasing doses of alkylating agents with greater odds of psychological hardship.

DISCUSSION

Childhood cancer survivors are at risk for economic consequences of their cancer treatment that manifest through the domains of material, behavioral, and psychological hardship.7,15 We found that a high intensity of medical financial hardship is common among long-term childhood cancer survivors.8 Over half of survivors reported at least one behavioral hardship due to medical costs, such as skipping recommended medical care, and approximately 40% reported experiencing material hardship, such as having to borrow money. Psychological hardships such as worries about paying for insurance coverage or concerns about staying employed were also reported by approximately half of survivors. Our findings demonstrate high levels of medical financial hardship for survivors of childhood cancer, even decades after their cancer treatment ended.

Survivors did not differ from siblings regarding experiencing behavioral or psychological hardship. Survivors were, however, more likely to experience multiple material hardships in the past year compared to siblings. Material hardship captures problems due to medical expenses and unmet basic needs, as well as borrowing money, filing for bankruptcy, and having debt. Survivors of childhood cancer likely experience material hardship due to a confluence of socioeconomic experiences, including lack of comprehensive insurance coverage and lower income,13,21 leaving them less resilient to managing high medical costs. In the U.S., 58% of individuals who have problems paying medical bills or who have medical debt report being contacted by collection agencies. This information often is reported on credit reports22 and thus, material hardship could affect childhood cancer survivors’ financial health for years.

Health care is unaffordable for many insured and uninsured childhood cancer survivors.20 While we found that having any insurance was protective against all three domains of financial hardship for survivors in multivariable regressions, many insured survivors still experienced multiple financial hardships. A recent article on cancer survivors under the age of 65 found that even among insured, out-of-pocket costs not covered by insurance such as copays and deductibles led them to experience substantial financial sacrifice and burden.23 While insurance coverage options have increased substantially in the past several years due to the Affordable Care Act’s subsidized insurance and Medical expansion,24 many survivors remain uninsured, especially in non-expansion states.25 At the same time, underinsurance – that is, having continuous insurance coverage but still experiencing high out-of-pocket costs relative to income –is common among survivors,26 saddling them with high medical expenses even with insurance.

Earlier studies demonstrate that financial hardship is greater for adult cancer survivors who receive chemotherapy or radiation.27 We found that brain radiation and higher cumulative exposure to alkylating agents led to a greater odds of hardships, whereas anthracycline doses were associated with a lower odds of behavioral and psychological hardship. In addition, in the multivariable regressions, leukemia survivors had a higher level of material and psychological hardships when compared to bone cancer; no other diagnosis groups were significant. Survivors undergoing more rigorous treatment and diagnosed under five years of age, which is common for pediatric leukemia, tend to have poorer employment outcomes and greater levels of chronic health conditions,18,21,28 which could affect their insurance and medical costs. We found that survivors diagnosed at younger ages were less likely to report material and psychological hardship. These findings could reflect the cancers common in survivors diagnosed at earlier ages, such as Wilms tumor and neuroblastoma, which have a lower rate of late effects compared to other pediatric cancers, potentially reducing survivors’ risk of experiencing medical financial hardship as adults.29

We also found that survivors who had one or more chronic health conditions were more likely to report multiple instances of behavioral and material financial hardship than survivors with no chronic health conditions. These findings are similar to the St. Jude Lifetime cohort evaluation on financial burden among childhood cancer survivors15 and echoes evidence from adult survivors that chronic health conditions are associated with substantially higher annual medical expenditures.30 Given the high prevalence of chronic health conditions in survivors of childhood cancer, interventions to address financial hardship might be best targeted to chronically ill survivors. While there are a growing number of programs that provide financial support to patients during cancer treatment,31–33 there is limited support for long-term survivors of childhood cancer, who likely have different resource needs than newly diagnosed cancer patients.

Our study has certain limitations. This survey was completed when the ACA was in its nascence and should be confirmed in more recent samples. To ease interpretation across the behavioral, material, and psychological domains, we used the same cut-points (0, 1-2, and ≥3 hardships) although the number of items differed for each domain. Also, while the items we used to capture financial burden were similar to other studies among cancer survivors,6,8,14,15 differences in these outcomes limit direct comparison to earlier assessments of cancer survivors.

Finally, our assessment was limited to financial hardship in the past year although the financial effects of cancer treatment for survivors can develop during treatment34 and extend into adulthood. To disentangle the effects of cancer and treatment, as well as other factors such as age at diagnosis or pre-cancer socioeconomic status, studies that examine financial hardship longitudinally among childhood cancer survivors are needed to identify factors that may predispose them to financial stress to identify strategies for early intervention. There is overlap between type of cancer diagnosis and age at diagnosis, with greater number of survivors in our sample diagnosed ages 4 and under with cancers such as leukemia, Wilms, and neuroblastoma, as these cancers are more common in younger patients, which makes it difficult to identify the independent effects of age and diagnosis. At the same time, certain treatment regimens, such as brain radiation, are known to cause substantial late effects burden that likely affect economic stability through educational and employment issues.10,35 As such, interventions to mitigate financial hardship would likely be best targeted towards these high-risk childhood cancer survivors.

Our assessment demonstrates that medical financial burden is common for childhood cancer survivors and that it is expressed through behavioral, material, and psychological hardship. As nearly 3-in-4 childhood cancer survivors will develop at least one chronic health condition in the decades following their cancer diagnosis,3 their lifetime medical costs can be immense. Targeted programs are necessary to identify survivors at highest risk for financial distress, such as those with chronic health conditions, to ensure that financial support services can be directed to those most in need.7

Supplementary Material

Supplemental Figure: Proportions of Survivors by Cancer Diagnosis Material, Behavioral, and Psychological Financial Hardship during the Past Year

Acknowledgements:

Funding for this work was supported by the National Cancer Institute (CA55727, G.T. Armstrong, Principal Investigator). Support to St. Jude Children’s Research Hospital provided by the Cancer Center Support (CORE) grant (CA21765, C. Roberts, Principal Investigator) and the American Lebanese-Syrian Associated Charities (ALSAC). Support was provided to Dr. Park through the 1K24CA197382-01 award. Presented in abstract form at the 2016 American Society of Clinical Oncology Survivorship Symposium in San Francisco, CA.

Footnotes

There are no conflicts of interest to disclose.

References

- 1.Howlader N, Noone AM, Krapcho M, et al. SEER Cancer Statistics Review, 1975-2017. Bethesda, MD: 2020. [Google Scholar]

- 2.Robison LL HM. Survivors of childhood and adolescent cancer: life-long risks and responsibilities. Nat Rev Cancer 2014(14):61–70. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Oeffinger KC, Mertens AC, Sklar CA, et al. Chronic health conditions in adult survivors of childhood cancer. N Engl J Med. 2006;355(15):1572–1582. [DOI] [PubMed] [Google Scholar]

- 4.Armstrong GT, Kawashima T, Leisenring W, et al. Aging and risk of severe, disabling, life-threatening, and fatal events in the childhood cancer survivor study. J Clin Oncol. 2014;32(12):1218–1227. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Armstrong GT, Chen Y, Yasui Y, et al. Reduction in Late Mortality among 5-Year Survivors of Childhood Cancer. N Engl J Med. 2016;374(9):833–842. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Altice CK, Banegas MP, Tucker-Seeley RD, Yabroff KR. Financial Hardships Experienced by Cancer Survivors: A Systematic Review. J Natl Cancer Inst. 2017;109(2). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Nathan PC, Henderson TO, Kirchhoff AC, Park ER, Yabroff KR. Financial Hardship and the Economic Effect of Childhood Cancer Survivorship. J Clin Oncol. 2018;36(21):2198–2205. [DOI] [PubMed] [Google Scholar]

- 8.Han X, Zhao J, Zheng Z, de Moor JS, Virgo KS, Yabroff KR. Medical Financial Hardship Intensity and Financial Sacrifice Associated with Cancer in the United States. Cancer Epidemiol Biomarkers Prev. 2020;29(2):308–317. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.Yabroff KR, Zhao J, Han X, Zheng Z. Prevalence and Correlates of Medical Financial Hardship in the USA. Journal of General Internal Medicine. 2019. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Kirchhoff AC, Leisenring W, Krull KR, et al. Unemployment among adult survivors of childhood cancer: a report from the childhood cancer survivor study. Med Care. 2010;48(11):1015–1025. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Molcho M, D’Eath M, Alforque Thomas A, Sharp L. Educational attainment of childhood cancer survivors: A systematic review. Cancer Med. 2019;8(6):3182–3195. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.Nipp RD, Kirchhoff AC, Fair D, et al. Financial Burden in Survivors of Childhood Cancer: A Report From the Childhood Cancer Survivor Study. J Clin Oncol. 2017:Jco2016717066. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Park ER, Kirchhoff AC, Nipp RD, et al. Assessing Health Insurance Coverage Characteristics and Impact on Health Care Cost, Worry, and Access: A Report From the Childhood Cancer Survivor Study. JAMA Intern Med. 2017. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Zheng ZY, Jemal A, Han XS, et al. Medical financial hardship among cancer survivors in the United States. Cancer-Am Cancer Soc. 2019;125(10):1737–1747. [DOI] [PubMed] [Google Scholar]

- 15.Huang IC, Bhakta N, Brinkman TM, et al. Determinants and Consequences of Financial Hardship Among Adult Survivors of Childhood Cancer: A Report From the St. Jude Lifetime Cohort Study. JNCI: Journal of the National Cancer Institute. 2018:djy120–djy120. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 16.Robison LL, Armstrong GT, Boice JD, et al. The Childhood Cancer Survivor Study: a National Cancer Institute-supported resource for outcome and intervention research. J Clin Oncol. 2009;27(14):2308–2318. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.Park ER, Kirchhoff AC, Perez GK, et al. Childhood Cancer Survivor Study participants’ perceptions and understanding of the Affordable Care Act. J Clin Oncol. 2015;33(7):764–772. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Kirchhoff AC, Kuhlthau K, Pajolek H, et al. Employer-sponsored health insurance coverage limitations: results from the Childhood Cancer Survivor Study. 2013;21(2):377–383. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Tucker-Seeley RD, Thorpe RJ. Material-Psychosocial-Behavioral Aspects of Financial Hardship: A Conceptual Model for Cancer Prevention. Gerontologist. 2019;59(Suppl 1):S88–S93. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Nathan PC, Henderson TO, Kirchhoff AC, Park ER, Yabroff KR. Financial Hardship and the Economic Effect of Childhood Cancer Survivorship. Journal Of Clinical Oncology: Official Journal Of The American Society Of Clinical Oncology. 2018;36(21):2198–2205. [DOI] [PubMed] [Google Scholar]

- 21.Kirchhoff AC, Krull KR, Ness KK, et al. Occupational outcomes of adult childhood cancer survivors: A report from the childhood cancer survivor study. Cancer-Am Cancer Soc. 2011;117(13):3033–3044. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 22.L. H, Norton M, Pollitz K, Levitt L, Claxton G, Brodie M. The Burden of Medical Debt. https://www.kff.org/wp-content/uploads/2016/01/8806-the-burden-of-medical-debt-results-from-the-kaiser-family-foundation-new-york-times-medical-bills-survey.pdf. Published 2016. Accessed.

- 23.Banegas MP, Schneider JL, Firemark AJ, et al. The social and economic toll of cancer survivorship: a complex web of financial sacrifice. J Cancer Surviv. 2019;13(3):406–417. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 24.Mueller EL, Park ER, Davis MM. What the Affordable Care Act Means for Survivors of Pediatric Cancer. J Clin Oncol. 2014. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25.Han X, Jemal A, Zheng Z, Sauer AG, Fedewa S, Yabroff KR. Changes in noninsurance and care unaffordability among cancer survivors following the Affordable Care Act. J Natl Cancer Inst. 2019. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 26.Chino F, Peppercorn JM, Rushing C, et al. Out-of-Pocket Costs, Financial Distress, and Underinsurance in Cancer Care. JAMA oncology. 2017. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 27.Kent EE, Forsythe LP, Yabroff KR, et al. Are survivors who report cancer-related financial problems more likely to forgo or delay medical care? Cancer-Am Cancer Soc. 2013;119(20):3710–3717. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28.Diller L, Chow EJ, Gurney JG, et al. Chronic disease in the Childhood Cancer Survivor Study cohort: a review of published findings. J Clin Oncol. 2009;27(14):2339–2355. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 29.Gibson TM, Mostoufi-Moab S, Stratton KL, et al. Temporal patterns in the risk of chronic health conditions in survivors of childhood cancer diagnosed 1970-99: a report from the Childhood Cancer Survivor Study cohort. Lancet Oncol. 2018;19(12):1590–1601. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 30.Guy GP Jr., Yabroff KR, Ekwueme DU, Rim SH, Li R, Richardson LC. Economic Burden of Chronic Conditions Among Survivors of Cancer in the United States. J Clin Oncol. 2017;35(18):2053–2061. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31.Shankaran V, Leahy T, Steelquist J, et al. Pilot Feasibility Study of an Oncology Financial Navigation Program. J Oncol Pract. 2018;14(2):e122–e129. [DOI] [PubMed] [Google Scholar]

- 32.Yezefski T, Steelquist J, Watabayashi K, Sherman D, Shankaran V. Impact of trained oncology financial navigators on patient out-of-pocket spending. Am J Manag Care. 2018;24(5 Suppl):S74–s79. [PubMed] [Google Scholar]

- 33.Banegas MP, Dickerson JF, Friedman NL, et al. Evaluation of a Novel Financial Navigator Pilot to Address Patient Concerns about Medical Care Costs. Perm J. 2019;23. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 34.Warner EL, Kirchhoff AC, Nam GE, Fluchel M. Financial Burden of Pediatric Cancer for Patients and Their Families. J Oncol Pract. 2014. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35.Kirchhoff AC, Krull KR, Ness KK, et al. Physical, mental, and neurocognitive status and employment outcomes in the childhood cancer survivor study cohort. Cancer Epidemiol Biomarkers Prev. 2011;20(9):1838–1849. [DOI] [PMC free article] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Supplemental Figure: Proportions of Survivors by Cancer Diagnosis Material, Behavioral, and Psychological Financial Hardship during the Past Year