Abstract

Literature has revealed, recently, the importance of entrepreneurial orientation (EO) for supply chain resilience (SCR); however, doubts remain as to how EO could improve SCR exist due to the vagueness surrounding it. We examine absorptive capacity (AC) and innovation as two mechanisms that mediate the EO-SCR relationship. An empirical analysis was made of the proposed model, based upon survey data for 171 manufacturing SMEs in the Sana'a region, Yemen, using a structural equation model (SEM) with the SmartPLS. The results obtained have shown that EO positively affects SCR for SMEs and, most significantly, this relationship is indirect as it is fully mediated by AC and innovation. The findings have revealed that EO improves SCR when those firms make efforts in developing AC and innovation. EO is significant, but it may not be sufficient to improve SCR if the firm is unable to absorb external knowledge and innovate.

Keywords: Supply chain resilience, Entrepreneurial orientation, Absorptive capacity, Innovation, SMEs

Supply chain resilience, Entrepreneurial orientation, Absorptive capacity, Innovation, SMEs.

1. Introduction

Globally, small and medium enterprises (SMEs) have been viewed as a key driver behind the economic development of developed and developing countries because of their large number and rate of workforce participation in them. At the level of developing countries, SMEs account for at least 90% of firms, 40–60% of GDP, and provide nearly 40% of world industrial production and 35% of world exports as well (Asgary et al., 2020). In a developing country like Yemen, although the manufacturing sector is dominated by SMEs, they contribute little to the country's GDP (Al-Hattami et al., 2021; Goaill and Al-Hakimi, 2021). Where the manufacturing sector's contribution to the national GDP fell from 19% between 1990 and 1994 to 15% between 2005 and 2010, according to the (World Bank, 2015) report published in 2015. In 2020 (USAID, 2020), reported that manufacturing SMEs account for just 9.9% of Yemeni GDP, and employ just 4% of the workforce, which is a low percentage compared to other developing economies. This low performance of the SMEs in Yemen reflects a priority problem and a cause for academic researchers to examine the main factors underlying this status.

One of the main issues in the poor performance of Yemeni SMEs is the disruptions of the supply chain (SC) caused by the country's conflict and political crises, which include stringent inspection at seaports that limit imports, delayed delivery of raw materials, as well as expensive insurance and freight expenses (Morris et al., 2019; Tandon and Vishwanath, 2020). The disruptions, arising from the increasingly dynamic and complex business environment, have led to weakening SCs with constant risks and uncertainty. Where the disruptions endanger the SC and can influence firms' performance in the form of direct financial losses, loss of demand, as well as a bad reputation (Bier et al., 2020). As per surveys, 75% of firms face some kind of disruption in their SCs yearly (Scholten et al., 2020). The aforementioned situations illustrate the need to create more resilient SCs, particularly given the growing body of literature demonstrating the importance of resilience as an effective practice to face such risks (e.g., Carbonara and Pellegrino, 2018; Namdar et al., 2017). Supply chain resilience (SCR), which refers to, “the adaptive capability of the SC to prepare for unexpected events, respond to disruption and recover from them by maintaining continuity of operations at the desired level of connectedness and control over structure and function (Ponomarov and Holcomb, 2009)”, is an important dynamic capability in facing disruptions (Hohenstein et al., 2015; Rajesh, 2016; Sheffi and Rice, 2005). However, the huge magnitude of the disruptions facing firms may make reliance on resources alone or capabilities unviable in the long term. In this regard, a previous study has found that firm-level resources and capabilities enhance SCR, with reference to the overall importance of firm-level resources and capabilities (Cheng and Lu, 2017). In the current study, we focus on entrepreneurial orientation (EO)- one of the important strategic resources for firms, especially SMEs (Anderson and Eshima, 2013; Lisboa et al., 2011)- as a potential enabler of SCR through the mediation mechanisms of absorptive capacity (AC) and innovation. In doing so, we link AC and innovation as dynamic capabilities in examining EO's effect on SCR.

EO is vastly recognized as a strategic resource that enables firms to respond to disturbances and uncertainty by providing chances and assigning resources for investment for long-term growth and sustainability (e.g., Hitt et al., 2001; Hisrich et al., 2016). EO refers to “the behavioral tendencies, managerial philosophies, and strategic decision-making practices that are entrepreneurial in nature (Anderson and Eshima, 2013).” Despite the belief in the important role of EO for SMEs in mitigating environmental disruptions by enhancing their resilience, particularly in the rapidly changing business environment (Al-Hakimi and Borade, 2020; Coleman and Adim, 2019). Others observed the opposite (Mandal and Saravanan, 2019), leading some researchers to have made a call to continue studying the EO-SCR relationship (Al-Hakimi and Borade, 2020), in order to understand the mechanism behind that relation and the direct and/or indirect influences of EO on SCR.

Additionally, whereas SCR enhances alignment between a firm and the environment, and alignment as stated by Fiol and Lyles (1985) “implies that the firm must have the potential to learn, unlearn, or relearn” (p. 804). Therefore, we argue that AC, as considered one of the dynamic capabilities associated with learning and knowledge processes, is one potential way to boost SCR. Where AC generally refers to “organizations’ ability to absorb intangible resources (such as knowledge, know-how, and expertise) and transform them into unique dynamic capabilities, which are not easily imitated by competitors (Siachou et al., 2020).” Moreover, there is growing acknowledgment in the EO literature that AC represents an urgent need for entrepreneurial-oriented firms in the turbulent business environment since it enables those firms to reconfigure their resource bases rapidly and flexibly (Engelen et al., 2014; Sarsah et al., 2020). Nevertheless, innovation cannot be ignored when examining AC, as it is an integral part of the contexts in which it is applied (Cohen and Levinthal, 1990). Furthermore, innovation is seen as one of the core dynamic capabilities that make companies resilient in the face of disruption (Kamalahmadi and Parast, 2016). In this vein, Reinmoeller and Van (2005) stated that over 20 years, the resilient Dutch firms surveyed increasingly focused on innovation by 235%. As a result, a deeper understanding of the relationships between EO and AC, as well as innovation is needed to provide grounded arguments of SCR.

The aim of this study is to examine how AC and innovation, as dynamic capabilities, convey the impact of EO on SCR. Using data obtained from 171 manufacturing SMEs in the Sana'a region of Yemen, we tested our model that proposes AC and innovation as mediators to the relationship between EO and SCR.

This study contributes to the debate on the EO-SCR relationship by presenting empirical evidence from the developing countries’ context through a mediation model. First, to understand the mechanisms through which EO affects SCR, we propose that it is necessary to take into account the intermediate capabilities to AC and innovation. Second, our study has focused on AC in the context of SMEs, which was overlooked by the majority of studies (Zerwas, 2014), despite its importance for SMEs in order to adapt to increasing environmental disruptions under working with scarce resources (Limaj and Bernroider, 2017). Moreover, we respond to a call (Engelen et al., 2014), for further studies related to AC in the context of the EO field. Also, there has been an increased interest in the antecedents of SCR in developing countries (e.g. Mandal, 2020). Thus, this study fills the theoretical gap in the literature. By these contributions, we highlight the EO-SCR relation, and to our knowledge, this is the first research that examines AC and innovation as mediators of this relation. Hence, this study contributes to the literature on EO, SCR, and SMEs.

2. Theoretical concepts and literature review

In this section, we provide definitions of four major constructs (i.e. EO, AC, innovation, and SCR), followed by an overview of the key relevant literature (see Table 1). Table 1 also sheds light on the gaps this study fills in the literature.

Table 1.

Literature overview on EO, AC, innovation, and SCR.

2.1. Supply chain resilience

Under today's disorder business environment, building resilient SCs has become crucial to deal with risks and unforeseen disruptions, thus, continuing to provide products (Aslam et al., 2020). Drawing on the research work of Ponomarov and Holcomb (2009), the current study defines SCR as an “adaptive capability of the SC to prepare for unexpected events, respond to disruptions, and recover from them by maintaining continuity of operations at the desired level of connectedness and control over structure and function”. Previous studies (e.g. Al-Hakimi and Borade, 2020; Ponomarov and Holcomb, 2009) have regarded SCR as a dynamic capability that enables SC to adjust, respond to disruptions, and return to the normal state (Mallak, 1998; Yu et al., 2019). As such, SCR absorbing to unforeseen disruptions and returning the SC to its former state or a better state may lead to competitive advantages (Kamalahmadi and Parast, 2016; Yu et al., 2019).

2.2. Entrepreneurial orientation

EO is referred to as a strategic posture of entrepreneurship, which robustly distinguished by a willingness to proactively evaluate and seize emerging business opportunities (Kohtamäki et al., 2019; Rubin and Callaghan, 2019). Whereas, “an entrepreneurial' firm is one that engages in product market innovation, undertakes somewhat risky ventures and is first to come up with ‘proactive’ innovations, beating competitors to the punch” (Miller, 1983). Previous studies (e.g., Gatignon and Xuereb, 1997; Lisboa et al., 2011) have viewed EO as a vital strategic resource because it represents the firm's philosophy in how a business performs in proportion to the environment. As such, EO enables firms to respond to environmental disturbances by scouting new chances and offering creative solutions that differentiate the firm from its competitors in the marketplace (Al-Hakimi and Borade, 2020; Kropp et al., 2006). In line with the resource-based view (RBV), EO is a resource with only potential value; owning EO is required but insufficient prerequisite for value delivery (cf., Barney, 1991; Ferreira et al., 2011; Wu, 2007). In order to benefit from EO in gaining a competitive advantage and achieving the desired performance, a firm should take proper strategic actions (Lisboa et al., 2011). It is the capabilities by which the firms' resources are deployed, not the simple variance of resources, which explain the differences in firms' performance (e.g., Eisenhardt and Martin, 2000). In light of this, firms should develop dynamic capabilities to make use of the full potential of EO.

2.3. Absorptive capacity

Obtaining and managing external information is critical to any firm. AC has been gaining, therefore, an increasing interest among researchers especially after the valuable contribution of Cohen and Levinthal (1990), who defined it as “the ability to recognize the value of new information, assimilate it, and apply it to commercial ends” (p.128). Later, this definition was extended by Zahra and George (2002), adding that AC is “a set of organizational routines and processes by which firms acquire, assimilate, transform, and exploit knowledge to produce a dynamic organizational capability” (p. 186). In the context of SCs, existing studies on AC assume that the relationship between two firms can affect the transferred knowledge in terms of level and quality (Aljanabi, 2017; Andersen and Kaśk, 2012). As such, AC is an extended cross-border capability to access, process, and use the information involved in the firm's relationships as pertinent knowledge in cope with contingencies (Gölgeci and Kuivalainen, 2020). Although the concept of AC explicitly refers to acquiring and assimilating the knowledge from outside the firm, in particular inter-firm relationships, it further emphasizes learning processes within the firm gained from past experience and present behaviors (Nagati and Rébolledo, 2012). Thus, the AC of a firm is influenced by other collaborated firms within the SC and how the learning process takes place (Aljanabi, 2017). Prior literature (e.g. Ambulkar et al., 2016; Cheng and Lu, 2017; Cui et al., 2018) has viewed AC as a dynamic capability that helps the SC to effectively deal with disturbances by reducing environmental uncertainty, which can lead to competitive advantages.

2.4. Innovation

Innovation is a revolutionary requirement more than evolutionary, and it is an inevitability for survival and continuity under vigorous and uncertain environmental circumstances (Mafabi et al., 2015). Innovation is defined, in many ways, as generating of a new idea (McAdam et al., 1998), the effective application of a new process or product from the first time (Cumming, 1998; Ibidunni et al., 2020), and a new method of granting better value (Knox, 2002). However, most definitions of innovation are expressed through a new idea or behavior. Drucker (1954), a leading researcher in innovation, discussed the important role of innovation for firms and that they must innovate for surviving in volatile environments. In this sense, innovation is seen as a means through which firms respond to environmental changes (Miller and Friesen, 1982; Peters and Waterman, 1982). The firm's ability to innovate and constantly renew itself is a function of how the firm coordinates its processes, structure, and people to integrate and generate knowledge (O'Reilly and Tushman, 2008; Lisboa et al., 2011). In light of this, previous studies (e.g. Hamel and Valikangas, 2003; Kamalahmadi and Parast, 2016; O'Connor, 2008) have viewed innovation as a dynamic capability that enhances firms' ability to respond to environmental disruptions and variations, therefore, maintaining competitive advantages.

3. Research framework and hypotheses development

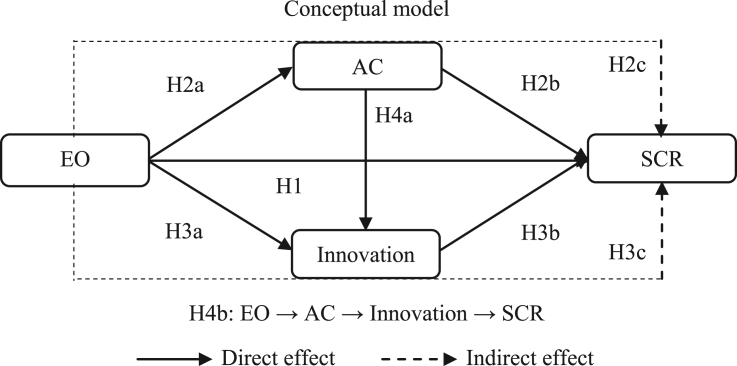

Although prior studies have considered EO as an important strategic resource in enhancing a firm's resilience in managing SC disruptions, there is limited research, with inconsistent results, regarding how firms enhance SCR through EO and the mechanisms by which it is done. The current study relies on the dynamic capabilities theory (DCT) for proposing an integrated conceptual framework that depicts the relations among EO, AC, innovation, and SCR (see Figure 1).

Figure 1.

Conceptual model.

3.1. Dynamic capabilities theory

The DCT argues that a firm pursuing a sustainable competitive edge should build and develop new capabilities and resources or redeploy current ones to cope with emergent opportunities (Eisenhardt and Martin, 2000; Yu et al., 2019). This theory emerged as an extension of RBV that assumes that firm performance can be interpreted by heterogeneity in possessing valuable, unique, rare, and indispensable resources (Liu et al., 2016). Whereas RBV lacks capabilities' adequate determination when disturbances occur in uncertain environments, DCT addresses the defect in RBV through properly planning the resources and capabilities in response to the changes in each status (Chowdhury and Quaddus, 2017). For SMEs, dynamic capabilities, which refer to the “firm's ability to integrate, build, and reconfigure internal and external competencies to address rapidly changing environments” (Teece et al., 1997, p. 516), are critical to adapt to changes in the business environment, due to their lack of adequate resources (Wang and Shi, 2011). According to Jantunen et al. (2005), EO may contribute to the dynamic capabilities of a firm, particularly for SMEs that operate in a dynamic environment (Helfat et al., 2007). However, in light of SCs disruptions, firms may not be able to count on existing resources to adapt to new market requirements and competition, which requires building and developing dynamic capabilities for survival. Whereas, they act as inner mechanisms for disseminating firms' resources in accordance with business environment and are inherently in-imitable because of their implicit (Teece et al., 1997). Accordingly, the integration of resources and capabilities generates competencies pertinent to sustaining the competitive advantage of a firm (Genç et al., 2013; Quaye and Mensah, 2019).

3.2. Hypotheses development

Depending on the RBV, previous literature has shown that firms' internal resources like EO (Covin and Slevin, 1989) are critical for possessing SCR (Al-Hakimi and Borade, 2020). Based on this perspective, entrepreneurial behavior assists in developing risk mitigation strategies that offer a rapid response to disruptions (Goaill and Al-Hakimi, 2021). Moreover, Li et al. (2008) claim that EO qualifies organizations to acquire dynamic capabilities (like resilience) in facing environmental uncertainty. In fact, entrepreneurial-oriented firms are more resilient in the face of environmental changes than other firms (Branicki et al., 2018). Al-Hakimi and Borade (2020) have recently emphasized this in their study that showed the positive impact of EO on SCR of SMEs. Therefore, we propose that:

Hypothesis 1

EO positively affects SCR.

Moreover, firms that engage in entrepreneurial behaviors that are risk-taking, innovativeness, and proactiveness, are better positioned to develop AC, as the firms' organizational searches for new external knowledge often entail high risk and unpredictable returns in exchange for possible innovative and proactive solutions (Cui et al., 2018). Firms with risk-taking instincts are more likely to tap into remote and unfamiliar external knowledge sources, which may lead to innovative improvements (Lisboa et al., 2011). Likewise, proactive firms incline to concentrate on generating new competencies rather than retaining the status quo, which requires them to search out and exploit new knowledge from outside outlets (Cui et al., 2018). Relating to this, Cohen and Levinthal (1990) reported that entrepreneurs' prior knowledge affects AC for their organizations to acquire new knowledge. Whereas Gellynck et al. (2014), Aljanabi (2017), and Sarsah et al. (2020) emphasized that exercising a high degree of EO leads to an increase in the AC of a firm. So, we suggest that:

Hypothesis 2a

EO positively affects AC.

On the other hand, it is generally recognized that firms that have the ability for acquiring, assimilating, and exploiting of external knowledge have a greater opportunity of operating within dynamic environments especially when firms cope with a barrage of disruptions and their presence is at stake (Gölgeci and Kuivalainen, 2020). Where firms inclined to organize themselves and stress various ways of integrating knowledge as per environmental conditions (Lane et al., 2006). Besides its relation to a broad range of phenomena, AC has been studied in relation to SC risk as well (Gölgeci and Kuivalainen, 2020; Ambulkar et al., 2016). In this vein, Ambulkar et al. (2016) found that AC contributes to decreasing uncertainties by narrowing the knowledge gap between available and necessary to deal with SC risks effectively. Therefore, when a firm experiences internal or external disruptions in the SC, AC may assist it in improving the processes that include acquiring, assimilating, transforming, and exploiting knowledge (Cheng and Lu, 2017). In the case of SMEs, it is very critical to develop inward organizational capabilities in absorbing knowledge in order to align firms to any disruptions in their external environment (Liao et al., 2003). In this sense, AC reflects the firm's capability within the SC to intentionally establish, expand, or adjust its resource base, which may aid the firm to improve SCR in a confrontation of environmental uncertainty. This has been recently confirmed by Gölgeci and Kuivalainen (2020) who found that AC reinforces the capability to mitigate SC risks effectively. Taking into account the above, we propose that:

Hypothesis 2b

AC positively affects SCR.

We find backing, however, to argue that this positive impact may be directly affected by EO. Indeed, a closer look at the EO-SCR relationship discloses that AC is the common thread running through several of EO's studies (Cui et al., 2018; Gellynck et al., 2014; Hernández-Perlines et al., 2017; Patel et al., 2015. Entrepreneurial-oriented firms can build capabilities necessary to understand and absorb external knowledge (Cui et al., 2018), and as a result, they become more resilient in coping with the environmental disturbances and uncertainty by reconfiguring current resource bases to adapt to new conditions (Engelen et al., 2014). In this sense, firms with advanced AC are better able to respond to different business environment circumstances. In this vein, Van-Doorn et al. (2017) claimed that firms with a high AC are highly prepared to deal with outside threats, upgrading to outside challenges via entrepreneurial behaviors, and curb the impact of disturbances. Besides, Rojo et al. (2018) illustrate that AC as a dynamic capability partially mediates between environmental dynamism and SC flexibility. While Gölgeci and Kuivalainen (2020) found in their empirical study on 265 Turkish firms that AC mediates the social capital-SCR relationship. The relevance of AC as a mediating mechanism derives from its role in the acquisition, assimilation, transformation, and exploitation of relevant external knowledge (Zahra and George, 2002).

Relating to that, Gölgeci and Kuivalainen (2020) claim that AC eases the flow of knowledge within SCs and enables the vigilance to unexpected disruptions, sustain open communication channels during external shocks, and take advantage of EO linked to firms' knowledge to face SC disturbances. Where AC helps to understand unforeseen changes in real-time, enables realizing the environmental disturbances implications and related opportunities, and offers the knowledge mechanisms to alleviate the disturbances when they emerge (Van-Doorn et al., 2017) to boost SCR. Considering the above, we hypothesize that:

Hypothesis 2c

AC mediates the EO-SCR relationship.

Further still, the entrepreneurial prevailing philosophy promotes businesses to experiment with new ideas constantly and implement innovations in which enhance their outcomes (Thoumrungrojé and Racela, 2013). Thence, EO can be considered as a prerequisite to attain outstanding performance by innovating. Indeed, Schüler (1986) claims that the rate of innovation is what differentiates entrepreneurial firms from others, and considers entrepreneurship as a practice for innovation. As such, EO is viewed as a precedent of innovation. Moreover, numerous studies have confirmed that entrepreneurial-oriented firms have higher levels of innovation (e.g., Oktavio et al., 2019; Swaminathan, 2014). In this vein, Yu et al. (2016) have elucidated how advanced enterprises that adopt EO have seen positive effects on their innovations. Additionally, Aljanabi (2017) found that EO has an important and direct impact on the technological innovation abilities of SMEs. Also, based on semi-structured personal interviews with CEOs of furniture firms from Italy, Finland, and Spain, Otero-Neira et al. (2013) found that firm's innovation influenced by their EO. These arguments lead us to suggest that:

Hypothesis 3a

EO positively affects innovation.

Besides that, innovation is one of the dynamic capabilities that add value and generate competitive advantages for the firm in a business environment that is differentiated by rapid change and uncertainty (Khan et al., 2020). In fact, Llorens Montes et al. (2004) claim that organizations with advanced innovation are better able to respond to different business environment circumstances. According to the argument that there is an association between firms' innovation and resilience (Malhotra et al., 1996), some researchers (e.g., Ambulkar et al., 2015; Helfat et al., 2007; Marsh and Stock, 2006) have viewed that a firm's survival in the business environment is related to its capability to respond and adapt to changes in the market, which in turn requires enhancing their capability to innovate by analyzing and reorganizing their resources and potentials and invest them optimally. In other words, a firm that can effectively manage its resources under the dynamic environmental changes has a greater opportunity to generate the necessary capabilities that mitigate the impact of turbulence (Eddleston et al., 2008; Sirmon and Hitt, 2003). In this sense, holding and utilizing effective dynamic capabilities like innovation are major to firms' success and survival in the long term, especially in constantly changing and volatile business environments (Helfat and Winter, 2011). In the same vein, Hamel and Valikangas (2003) in their study indicated that innovation is a core factor for increasing a flexibility strategy in order to face environmental disruptions and variations. Later, Olsson et al. (2010) reported that the capability of innovation allows firms to respond efficiently and effectively to the business environment disturbances and fluctuations. In light of this, some researchers hold that the capability to innovate is not only a good business strategy but also the key essence of accomplishing better performance (Hilman and Kaliappen, 2015). Therefore, we suggest that:

Hypothesis 3b

Innovation positively affects SCR.

We find backing, however, to argue that this positive impact can be directly affected by the EO. Indeed, a closer look at the EO-SCR relationship discloses that innovation is the common thread running through several of EO's studies (Baker and Sinkula, 2009; Helm et al., 2010; Swaminathan, 2014; Medina and Rufín, 2009). Entrepreneurial-oriented firms can build capabilities necessary to innovate (Aljanabi, 2017), and as a result become more resilient in response to environmental changes (Olsson et al., 2010). Related to this, and drawing on a sample of 818 SMEs, Kocak et al. (2017) empirically analyzed the impact of EO on firm performance through the mediating effects of innovation (incremental and radical), where the findings illustrated that EO directly affects performance, and indirectly via innovation. Wahyuni and Sara (2020) also concluded that EO indirectly affects business performance throughout the mediating role of innovation. Given the above, innovation can have a role in the relationship of EO to SCR, therefore, we propose the following:

Hypothesis 3c

Innovation mediates the EO-SCR relationship.

Furthermore, several previous studies have backed the idea that AC represents a direct driver of innovation (Aljanabi, 2017; Cohen and Levinthal, 1990; Gebauer et al., 2012; Tsai, 2001). In this vein, Zahra and George (2002) concluded by reviewing previous studies on AC, that innovation is positively correlated with AC, as these factors act together to achieve the competitive advantage of the firm. In fact, firms that are continually investing in their capabilities to absorb new external knowledge benefit from environmental disruptions by introducing innovative products (Kostopoulos et al., 2011; Lichtenthaler, 2009). In the same context, Nonaka and Takeuchi (1995) argue that merge newly acquired knowledge with current knowledge leads to innovative outcomes. Within this context, innovation does not rely on knowledge itself, but on the organizational capability to transform the inner and outer knowledge into performance, that is AC (Aljanabi, 2017). Likewise, Lee & Song (2015) claim that firms with a high AC can increase the benefits of externally generated knowledge and reinforce their innovation. In this sense, AC is a crucial component in fulfilling innovation (Liao et al., 2007). Taking into account the above, we suggest that:

Hypothesis 4a

AC positively affects innovation.

Hypothesis 4b

AC and innovation concurrently mediate the EO-SCR relationship.

4. Methodology

4.1. Study sample and data collection

As the present study aims to examine the mediation effects of AC and innovation in the EO-SCR relationship, the quantitative approach has been adopted, with a questionnaire developed to gather data from respondents (Kerlinger and Lee, 2007). The manufacturing sector was studied because the study examined the SCR, which manufacturing firms often seek to build-to cope with disruptions in the SCs-compared with service firms. The targeted population of this study covers many manufacturing industries including food and beverage, packaging, furniture, plastic, textiles, and chemical and petrochemical. The manager/owner of the SMEs represents the research's unit of analysis.

The current study adopted the “number of employees” criteria presented by the Yemeni Ministry of Industry and Trade -YMIT (2014) in the definition of SME, as firms with 4–9 employees were defined as small, while firms with 10–50 employees were defined as medium-sized. From the YMIT's database, which contains the firms' contact details, number of employees, and history of the establishment, the sample of SMEs from various manufacturing sectors in the Sana'a region of Yemen was drawn using simple random sampling. SMEs in the Sana'a region provide an excellent research case, especially they have common culture and homogeneity, and constitute nearly half of the number of SMEs in Yemen. In all, there are approximately 2,106 SMEs in the manufacturing sector in Yemen, 1,058 of which are located in the Sana'a region. Based on Krejcie and Morgan (1970) guidelines for determining sample size by the formula shown below, the sample size is 282. In order to solve the non-response issue and to reduce error, the initial sample size was increased to be 384 according to the researchers' potentials and based on the theoretical notion that “at least 384 sampling units need to be included in most studies to have a sampling error of 5% (Hair et al., 2012, p. 148).”

After that, SME managers were contacted in person by telephone, to clarify the objective of the research and ask for their participation, and part of them was also interviewed in the Sana'a Chamber of Commerce and Industry in Yemen, which is a forum for firms' owners and managers. 384 questionnaires were distributed to the participants via e-survey (by sending the e-link via WhatsApp) and part of them via e-mail. Since the respondents are of Arabic origin, the questionnaire was translated into the Arabic language (target language), then it was sent to two bilingual experts (English/Arabic) for accuracy. Then, another bilingual expert translated it back from the final Arabic version to the English language (source language) to eliminate the differences. After several telephone and email reminders, 188 questionnaires were received, however, 17 incomplete questionnaires were eliminated after preparing the data for analysis, and 171 remained (94 of which represented the small-sized firms) with a rate response of 45% of the overall sample size, which represents a high percentage compared to the ones reported in prior studies (e.g., Anderson and Eshima, 2013; Lisboa et al., 2011). Table 2 shows the characteristics of the sample.

Table 2.

The sample characteristics.

| Category | Frequency | Percentage |

|---|---|---|

| Job status: | ||

| Owner | 111 | 64.9 |

| Manager | 60 | 35.1 |

| Gender: | ||

| Male | 157 | 91.8 |

| Female | 14 | 8.20 |

| Education: | ||

| Secondary and below | 35 | 20.5 |

| Diploma | 9 | 5.30 |

| Bachelor | 95 | 55.5 |

| Master and above | 32 | 18.7 |

| Years of experience: | ||

| below 3 years | 7 | 4.10 |

| 4–6 years | 12 | 7.00 |

| 7–9 years | 133 | 77.8 |

| 10 years and above | 19 | 11.1 |

The questionnaire was developed based on published studies relevant to our study. It was divided into two parts, the first part looks at general information on firms (e.g., industry type and employees number) and respondents (e.g., job status, gender, education, and years of experience “Existence”). While the second part specifically investigates the study variables including EO, AC, innovation, and SCR (see Appendix 1).

4.2. Measures

Drawing on published literature relevant to our study, all the questionnaire items were developed. as well as in-depth interviews with managers of 20 firms to make sure that all items were understandable and relevant to the business environment in Yemen. Existing items have been adapted to fit the study's objective wherever possible.

-

•

EO variable: it was measured as a one-dimensional construct with 9 items that evaluated innovativeness, risk-taking, and proactiveness adapted from Al-Hakimi and Borade (2020) and Saha et al. (2017) based on Miller (1983) conceptualization of the three dimensions including innovativeness, proactiveness, and risk-taking.

-

•

SCR variable: it was measured by 6 items adapted from Al-Hakimi and Borade (2020), and Gölgeci and Ponomarov (2014) based on the scale proposed by Ponomarov (2012).

-

•

AC variable: it was measured based on the scale proposed by Cohen and Levinthal (1990) and Lane et al. (2006) that evaluates the capacities of acquiring, assimilating, transforming, and exploiting new knowledge, which many researchers relied on (e.g., Hernández-Perlines et al., 2017). The scale of AC used in the current study consists of seven items adapted to the studied SMEs context.

-

•

Innovation variable: in relation to innovation, it was measured in the literature in different ways based on the researchers' interests. In this study, the innovation variable was measured based on the scale established by OECD (2005), which many researchers relied on, in all or some of its dimensions (e.g., Maldonado-Guzmán et al., 2018). The scale of innovation used in the current study consists of five items that reflect product innovation, process innovation, and organizational innovation, which are considered most important for firms in building resilience to face disruptions.

In general, all items here were selected from existing literature measures in line with the operationalization and measurement of study variables. A 5-point Likert scale (1— Strongly Disagree to 5—Strongly Agree), was used to assess the responses for consistency between all items in the questionnaire.

4.3. Ethical considerations

The present study was conducted based on the opinions of owners and managers of SMEs in the Sana'a region of Yemen, according to their willingness to participate (voluntary) with anonymity and to ensure that all information was kept. As a study in social science, it is devoid of any human experiment and does not need ethical approval. Hence, the intuition did not require any ethical approval.

5. Data analysis and results

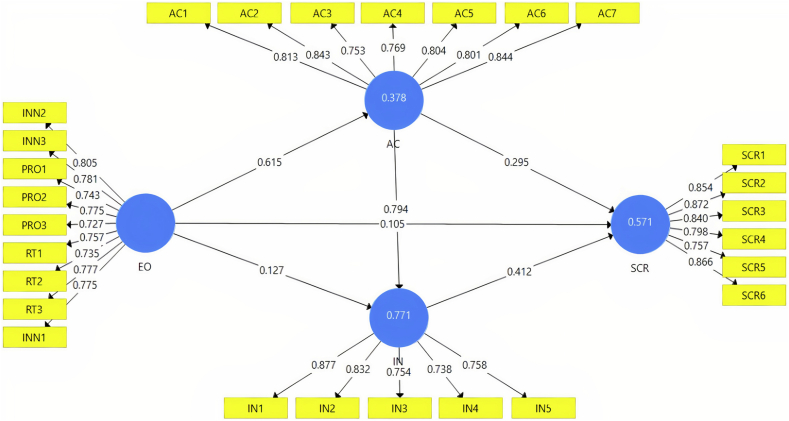

In this study, SEM by SmartPLS 3 was used for testing the proposed model, as recommended by (Ringle et al., 2005). PLS-SEM is regarded as an appropriate method for small samples (Henseler et al., 2009), as it exhibits more statistical power than the covariance-based SEM when applied to sophisticated models with small sample numbers (Al-Hattami, 2021). This is particularly pertinent in the current study, which has a sample size of 171 cases. The analysis is performed in the PLS model via both the measurement model and the structural model. Where the measurement model includes testing the model's reliability and validity, while the structural model involves hypotheses testing, the interpreted variance, and the model's predictive relevance (Q2).

5.1. Measurement model

The measurement model was evaluated in this study in terms of factor loadings, reliability, and validity. For each item, the factor loading value should be ≥0.70 (Hair et al., 2011). While the reliability is achieved when Cronbach's Alpha (α) and Composite Reliability (CR) values are ≥0.70 (Nunnally and Bernstein, 1994).

Furthermore, the construct validity was assessed using convergent validity and discriminant validity. Convergent validity can be confirmed by computing the average variance extracted (AVE) for each construct, which should be ≥0.50 (Hair et al., 2011). Whereas the discriminate validity is attained when the AVE's square root values are greater than the correspondent correlations of all factors (Fornell and Larcker, 1981), which means that the indices are related to their factors greater than others. As shown in Tables 3 and 4, all these criteria were met (i.e., loadings, reliability, and validity), supporting the measurement model.

Table 3.

Loadings, reliability, and convergent validity.

| Construct | Code of item | Factors loadings | CR (α) | AVE | Convergent validity |

|---|---|---|---|---|---|

| EO | INN1 | 0.778 | 0.926 (0.911) | 0.58 | Yes |

| INN2 | 0.809 | ||||

| INN3 | 0.781 | ||||

| RT1 | 0.748 | ||||

| RT2 | 0.726 | ||||

| RT3 | 0.778 | ||||

| PRO1 | 0.752 | ||||

| PRO2 | 0.774 | ||||

| PRO3 | 0.722 | ||||

| AC | AC1 | 0.813 | 0.928 (0.909) | 0.65 | Yes |

| AC2 | 0.843 | ||||

| AC3 | 0.753 | ||||

| AC4 | 0.769 | ||||

| AC5 | 0.804 | ||||

| AC6 | 0.801 | ||||

| AC7 | 0.844 | ||||

| Innovation | IN1 | 0.877 | 0.894 (0.852) | 0.63 | Yes |

| IN2 | 0.832 | ||||

| IN3 | 0.754 | ||||

| IN4 | 0.738 | ||||

| IN5 | 0.758 | ||||

| SCR | SCR1 | 0.854 | 0.930 (0.910) | 0.69 | Yes |

| SCR2 | 0.872 | ||||

| SCR3 | 0.840 | ||||

| SCR4 | 0.798 | ||||

| SCR5 | 0.755 | ||||

| SCR6 | 0.868 |

Table 4.

Analysis of discriminant validity.

| Construct | EO | AC | Innovation | SCR |

|---|---|---|---|---|

| EO | 0.763 | |||

| AC | 0.615 | 0.805 | ||

| Innovation | 0.615 | 0.802 | 0.794 | |

| SCR | 0.545 | 0.719 | 0.734 | 0.832 |

Notes: AVE's square root is shown in bold.

5.2. Structural model

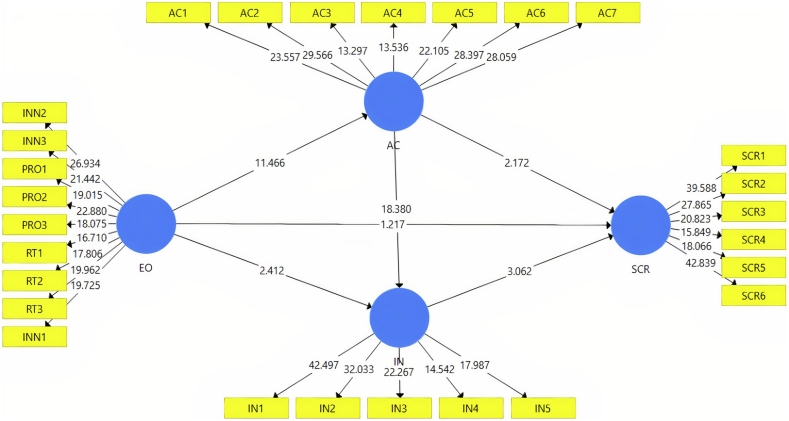

In this section, we will test the validity of the hypotheses and predictive relevance of the proposed model by using bootstrapping with 500 sub-samples and the blindfolding method. The path coefficients (β) values, t-statistics, p-values were employed to identify whether the links between constructs in the model (EO, innovation, AC, and SCR) are statistically significant (i.e., at p < 0.05, p < 0.01, or p < 0.001). Table 4 includes the results of hypotheses testing. R2 indicates the percentage of variance in the dependent variable that is jointly interpreted by the independent variables. Where R2 must greater than 0.10 to be substantial as suggested by (Falk and Miller, 1992). As described in Figure 2, the values of R2 for all variables are greater than 0.10 (see Figure 3).

Figure 2.

Measurement model.

Figure 3.

Structural model.

Furthermore, the effect size for the latent variables on the dependent variable has been estimated using f2 analysis, which supplements R2 (Chin, 2010). According to Cohen (2013), the p-value can show the existence of the impact, while it does not disclose the effect size, so, the values of f2 (between 0.02 and 0.15, from 0.15 to 0.35, and above 0.35) were employed to show the effect sizes of the predictive variables (small, medium, large respectively). Table 5 shows all f2 results as per the sizes of the effect: two relationships (large) and four (small).

Table 5.

Direct effect.

| H | Path | β | T-value | P-value | Result | Effect size | |

|---|---|---|---|---|---|---|---|

| H1 | EO → SCR | 0.105 | 1.217 | 0.225 | Not supported | 0.02 | Small |

| H2a | EO → AC | 0.615 | 11.466∗∗∗ | 0.000 | Supported | 0.61 | Large |

| H2b | AC → SCR | 0.295 | 2.172∗ | 0.031 | Supported | 0.05 | Small |

| H3a | EO → Innovation | 0.127 | 2.412∗ | 0.016 | Supported | 0.04 | Small |

| H3b | Innovation → SCR | 0.412 | 3.062∗∗ | 0.002 | Supported | 0.09 | Small |

| H4 | AC → Innovation | 0.794 | 18.380∗∗∗ | 0.000 | Supported | 1.71 | Large |

Recommended: t-values > 1.96.

Notes: ∗∗∗p < 0.001; ∗∗p < 0.01; ∗p < 0.05.

Besides, the Q2 was evaluated using the blindfolding method. The resulting Q2 values in Table 6 indicate that the model has a proper predictive quality given all the Q2 values are above 0.0000 as suggested by Hair et al. (2011).

Table 6.

The predictive quality of the Model.

| Total | SSO | SSE | Q2 = 1-SSE/SSO |

|---|---|---|---|

| AC | 1197.000 | 916.282 | 0.235 |

| Innovation | 855.000 | 449.675 | 0.474 |

| SCR | 1026.000 | 632.662 | 0.383 |

In addition, the hypotheses test results indicated in Table 5 reveal that EO positively affects SCR, but not significantly (β = 0.105, T = 1.217, p > .05), which does not support H1. The results also indicate that EO positively and significantly affects AC and innovation (β = 0.615, T = 11.466, p < .001 and β = 0.127, T = 2.412, p < .05 for AC and innovation, respectively). Thus, H2a and H3a were supported. Regarding the Hypothesis H2b and H3b, The results show that EO positively and significantly affects both AC and innovation (β = 0.615, T = 11.466, p < .001 and β = 0.127, T = 2.412, p < .05 for AC and innovation, respectively). Thus, H2b and H3b were supported. Besides, the results have confirmed that AC significantly and positively affects innovation (β = 0.794, T = 18.380, p < .001). Consequently, H4 was supported.

To test the mediation, bootstrapping procedures were employed (Genc et al., 2019). Precisely, we investigated the mediation of both AC and innovation on the EO-SCR relationship, and the findings were as follows: (direct effect = 0.105 at p > 0.05; indirect effect = 0.435 at p < 0.001; total effect = 0.540 at p < 0.001). Where the findings appear that EO on SCR through AC is 0.181, through innovation is 0.053, and through AC and innovation concurrently is 0.201 as shown in Table 7, and to assess its significance level, Sobel (1982) tests were performed. Sobel's tests denote that the EO's indirect effects on SCR through AC and innovation are statistically significant, affirming that the EO-SCR relationship is fully mediated by AC and innovation.

Table 7.

Indirect effect.

| H | Path | β | T-value | P-value | Result |

|---|---|---|---|---|---|

| H2c | EO → AC → SCR | 0.181 | 2.227∗ | 0.027 | Supported |

| H3c | EO → Innovation → SCR | 0.053 | 2.025∗ | 0.044 | Supported |

| H4b | EO → AC → Innovation → SCR | 0.201 | 2.510∗ | 0.013 | Supported |

Recommended: t-values > 1.96.

Note: ∗p < 0.05.

6. Discussion

In spite of studying the EO-SCR relationship (e.g., Al-Hakimi and Borade, 2020; Mandal and Saravanan, 2019), it still unclear what capabilities firms generate through EO, which improve their resilience. To understand such mechanisms, the mediators have to be investigated, which play a key role in transferring EO's effect on SCR. We deal with this gap with a question: What are the mechanisms for firms to boost improve SCR through EO?

First of all, our study emphasizes that EO has no direct effect on SMEs' SCR. However, unlike from the existent literature, our findings revealed that this effect is indirect. Our results denote that both AC and innovation fully mediate the EO-SCR relationship. This result implies that EO positively affects SCR of SMEs only if their entrepreneurial behaviors make them better able to absorb the business environment disruptions, and more innovative. This finding can assist in interpreting the inconclusive results on the important role of EO for SCR. While Al-Hakimi and Borade (2020) in fact found a positive and significant effect of EO on SCR, others found the opposite (Mandal and Saravanan, 2019). These discrepancies in results may be attributed to the distinct entrepreneurial behaviors in the context of different organizational environments. Furthermore, these conflicting results combined with our results refer that EO may not always affect SCR directly. Instead of that, it depends on firms' practice level of EO. The results obtained appear that SMEs, especially those operating in the Sana'a region in Yemen, should have AC and innovation capabilities in order to utilize the potential benefits of EO to enhance SCR. The results of this study confirm the importance of AC and innovation for entrepreneurial-oriented SMEs.

Additionally, the findings confirm that AC is positively affected by EO. The result supports the argument that EO is an important driver for AC. This means that innovativeness, risk-taking, and proactiveness enable a firm to knowledge acquisition, assimilation, transformation, and exploitation. This result reflects the fact that Yemeni SMEs are able to develop higher levels of AC by adopting a high level of EO. This finding is similar to the existent literature results (e.g., Aljanabi, 2017; Gellynck et al., 2014). Entrepreneurial-oriented firms are exposed to various disruptions within their SC, both domestically and internationally. Furthermore, firms face more volatile and uncertain environments (Genc et al., 2019). Entrepreneurial behaviors aid firms to understand and analyze the changes better and as a result to become more able to absorb and exploit the external knowledge (Aljanabi, 2017). It has been also found that SCR is highly associated with firms' ability to absorb knowledge. The results of this research support the previous studies (e.g., Cheng and Lu, 2017; Gölgeci and Kuivalainen, 2020; Rojo et al., 2018), and widen the findings of Barrales-Molina et al. (2013), who found that dynamic capabilities reinforce a firm's strategic, operational, and structural flexibility. The findings show that the implications of dynamic capabilities such as AC expand to the SCs, enhancing a resilient SC building. As such, the firm's capability to absorb the knowledge of their partners has to be developed for expediting capability development and assures the viability of SC (Cheng and Lu, 2017). For Yemeni SMEs in the Sana'a region, thus, SC's members need to concentrate on absorbing knowledge so that can build dynamic organizational abilities. This research, thence, completes previous research and broadens the understanding of the influence of dynamic capabilities (like AC) to include SCR. The findings thus affirm that one of the SCR's precedents is AC, in terms of its contribution to the inter-firm processes' resilience in SC, as AC enables the firm to learn about the culture and knowledge of its partners, and fully absorb them in order to respond effectively in line with the environment. This outcome traces the research stream (e.g., Cheng and Lu, 2017; Dobrzykỏwski et al., 2015) which has started to explore AC's role in the context of SCM. Our results generally present empirical support for the assumption that organizations should develop AC in order to improve SCR, particularly if working within extremely dynamic environments. In this sense, firms can improve SCR by developing specified dynamic capabilities as AC (Rojo et al., 2018).

Similarly, the drawn results reveal that the high level of the EO adopted by Yemeni SMEs' managers, in terms of the inclination to innovation and participation in risky projects and the ability to take the initiative in the market, will raise the level of the innovation capability of these firms, by introducing new or improving existing products and processes. This result confirms the previous research work of Genc et al. (2019) and Shaher and Ali (2020), which found that the EO-innovation relationship is positive in the manufacturing SMEs context in the United Arab Emirates and Kuwait respectively. Besides, innovation was found as an effective mechanism for improving SCR for SMEs, which correspond with the findings of the studies conducted by Ambulkar et al. (2015), Mafabi et al. (2015), Moore and Westley, 2011, and Sabahi and Parast (2019), which affirmed the importance of innovation in enhancing firms' resiliency in case of disturbances. As such, the organization's retention of dynamic capabilities like innovation is major to its success and survival in constantly changing business environments (Helfat and Winter, 2011). Thus, innovation is required for SCR. Firms' entrepreneurial-orientated are more likely to gain from disruptions by discovering pioneering chances early and seizing them through the use of innovation as a strategy to adapt to those disruptions. Regarding the Sana'a region, the EO for SMEs looks to be an efficient tool for increasing SCR, which may be related to the country's current precarious condition as a result of political and security upheaval.

Moreover, the findings of the current research clarify that AC has a positive and significant effect on innovation. This outcome supports the notion that AC positively affects innovation for many researchers (Cohen and Levinthal, 1990; Zahra and George, 2002), which empirically has been emphasized by Engelman et al. (2017), Gao et al. (2008), and Kostopoulos et al. (2011). This result implies that firms with a high AC have a better chance of successfully utilizing new knowledge in introducing more innovations. Following the general perception of AC as a dynamic capability (Zahra and George, 2002), enhancing firm's innovation (Kostopoulos et al., 2011), we exhibit that AC is a prerequisite for SCR. Therefore, AC and innovation complement each other in improving SCR for entrepreneurial-oriented SMEs, which is in line with the previous research work of Miroshnychenko et al. (2020). When firms adopt EO and practice a high level of entrepreneurial behaviors, they acquire skills in assimilating and exploiting the new knowledge related to environmental changes and disruptions. As a result, EO activities offer firms a learning edge that makes them more innovative and resilient. Firms that engage in entrepreneurial projects can benefit from the success and error trial and become better able to absorb and understand the business environment, thus responding to disturbances better. For SMEs, AC rises their capability to reach, assimilate, and take advantage of new knowledge, and their resilience as well.

7. Conclusion and implications

This paper examines an unexplored issue and suggests a new model that offers a broader view of the EO-SCR relationship for developing-country SMEs. In general, the findings indicate that SCR is positively affected by EO, and more importantly, this research clarifies that this relation is indirect as it is fully mediated by AC and innovation. Thus, AC and innovation are the two key pillars of improving SCR for entrepreneurial-oriented SMEs.

7.1. Theoretical implications

Theoretically, current research contributes to the literature on SC and strategic management by examining the synergy of EO, AC, and innovation on SCR. In addition, the study suggests a model that combines EO, AC, innovation, and SCR from the developing country perspective, which achieves an equipoise between literature. Besides, the mediating effects of AC and innovation on the EO-SCR relation have not been explored which acts, as a major theoretical contribution of this research work. The findings add to the literature by clarifying that EO indirectly affects SCR of SMEs, via AC and innovation. This means that the firms' decision with regard to investing in AC and innovation is largely induced by the firms’ pursuing to practice EO to improve SCR. Further, the current study contributes to answering the questions on how firms benefit from strategic resources and dynamic capabilities to adapt to disruptions that may occur in their SCs. While previous empirical studies focus on the antecedents of SCR that could be either resources or capabilities (Al-Hakimi and Borade, 2020; Gölgeci and Ponomarov, 2014; Mandal, 2020; Mandal and Saravanan, 2019; Sabahi and Parast, 2019), the current study concentrates on their combined effect. Where the present study addressed the effects of EO (as a valuable strategic resource), AC, and innovation (as dynamic capabilities) on SCR. Moreover, our study focused on AC in the context of SMEs, which was overlooked by the majority of studies (Zerwas, 2014), despite its importance for SMEs in order to adapt to increasing environmental disruptions under working with scarce resources (Limaj and Bernroider, 2017). Once again, the research responds to the call for further studies on the EO-AC relationship (Engelen et al., 2014).

7.2. Practical implications

The study has reached a set of implications for managers. Nowadays, many SMEs strive to adopt EO to survive in the dynamic business environment. The business environment is characterized by complexity and intense competition, and many firms fail to survive. Even so, other than successful performance, there are many benefits to EO like improving resilience. These findings have specific implications for SMEs' managers in developing countries (such as Yemen) to survive, as these firms usually cope with negative disruptions-of-SC effects, and thus, managers need to realize the potential benefits of EO in terms of resilience in facing those disruptions by discovering promising opportunities, taking more risks to invest in them, and introducing innovative products. One of the most important points that can be leveraged is the positive impact of EO on the SCR of SMEs in developing countries. Yemeni SMEs in the Sana'a region should look at EO not only as a means for innovation but also as a way for improving the resilience of a firm towards environmental disruptions in general and SC disruptions specifically, however, managers must be wary that this relation is not direct and relies on how EO is practiced by firms. This research reflects the SMEs' need to embrace innovation and to develop AC in order to improve SCR. In light of these results, enjoying a high level of SCR in the context of SME requires making more effort to acquire, assimilate, transform and exploit new knowledge outside the firm, integrate it with knowledge within the firm, and being more innovative. For this reason, top management should invest in capabilities (like AC and innovation in our case) that make SMEs more able to absorb disruptions in the business environment and more innovative.

8. Limitations and future research

In spite of its valuable contributions, this study still has some limitations that need to be explored by future research. First, the results of this study are based on the perceptions of SMEs managers in the manufacturing sector and, therefore, are critically applicable only in the context of manufacturing SMEs in the Sana'a region of Yemen. However, future studies can increase the scope of respondents from other sectors or regions, in order to generalize the results, thus creating a greater understanding of the relationship among EO, AC, innovation, and SCR in similar cases or environments. Second, since the sample scope was limited to SMEs, therefore, future studies can concentrate on large firms, family firms, or even micro, small, and medium enterprises (MSMEs). Third, the proposed study model can be applied in other environments within the context of developing and developed countries or gather data from both developing and developed countries and compare between them. Forth, this study addressed both AC and innovation as mediators of the EO-SCR relationship, so, future research may consider other factors that may mediate that relationship. Fifth, this study relied on the DCT in developing the theoretical framework. Instead, future research can consider the diffusion of Innovation theory, or organizational theory. Moreover, the current study has used PLS–SEM for analyzing the data; hence, future studies may use covariance-based SEM.

Declarations

Author contribution statement

Mohammed A. Al-Hakimi: Conceived and designed the experiments; Performed the experiments; Analyzed and interpreted the data; Contributed reagents, materials, analysis tools or data; Wrote the paper.

Moad Hamod Saleh: Analyzed and interpreted the data; Contributed reagents, materials, analysis tools or data; Wrote the paper.

Dileep B. Borade: Conceived and designed the experiments.

Funding statement

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Data availability statement

Data will be made available on request.

Declaration of interests statement

The authors declare no conflict of interest.

Additional information

No additional information is available for this paper.

Appendix A. Supplementary data

The following is the supplementary data related to this article:

References

- Al-Hakimi M.A., Borade D.B. The impact of entrepreneurial orientation on the supply chain resilience. Cog. Busin. Manag. 2020;7(1):1–18. [Google Scholar]

- Al-Hattami H.M. Validation of the D&M IS success model in the context of accounting information system of the banking sector in the least developed countries. J. Manag. Control. 2021;32(1):127–153. [Google Scholar]

- Al-Hattami H.M., Hashed A.A., Kabra J.D. Effect of AIS success on performance measures of SMEs: evidence from Yemen. Int. J. Bus. Inf. Syst. 2021;36(1):144–164. [Google Scholar]

- Aljanabi A.R.A. The mediating role of absorptive capacity on the relationship between entrepreneurial orientation and technological innovation capabilities. Int. J. Entreoren. Beh. Res. 2017;24(4):818–841. [Google Scholar]

- Ambulkar S., Blackhurst J.V., Cantor D.E. Supply chain risk mitigation competency: an individual-level knowledge-based perspective. Int. J. Prod. Res. 2016;54(5):1398–1411. [Google Scholar]

- Ambulkar S., Blackhurst J., Grawe S. Firm's resilience to supply chain disruptions: scale development and empirical examination. J. Oper. Manag. 2015;33–34:111–122. [Google Scholar]

- Andersen J., Kaśk J. Asymmetrically realized absorptive capacity and relationship durability. Manag. Decis. 2012;50(1):43–57. [Google Scholar]

- Anderson B.S., Eshima Y. The influence of firm age and intangible resources on the relationship between entrepreneurial orientation and firm growth among Japanese SMEs. J. Bus. Ventur. 2013;28(3):413–429. [Google Scholar]

- Asgary A., Ozdemir A.I., Özyürek H. Small and medium enterprises and global risks: evidence from manufacturing SMEs in Turkey. Int. J. Disas. Risk Sci. 2020;11(1):59–73. [Google Scholar]

- Aslam H., Khan A.Q., Rashid K., Rehman S.U. Achieving supply chain resilience: the role of supply chain ambidexterity and supply chain agility. J. Manuf. Technol. Manag. 2020;31(6):1185–1204. [Google Scholar]

- Baker W.E., Sinkula J.M. The complementary effects of market orientation and entrepreneurial orientation on profitability in small businesses. J. Small Bus. Manag. 2009;47(4):443–464. [Google Scholar]

- Barney J. Firm resources and sustained competitive advantage. J. Manag. 1991;17(1):99–120. [Google Scholar]

- Barrales-Molina V., Bustinza Ó.F., Gutiérrez-Gutiérrez L.J. Explaining the causes and effects of dynamic capabilities generation: a multiple-indicator multiple-cause modelling approach. Br. J. Manag. 2013;24(4):571–591. [Google Scholar]

- Bier T., Lange A., Glock C.H. Methods for mitigating disruptions in complex supply chain structures: a systematic literature review. Int. J. Prod. Res. 2020;58(6):1835–1856. [Google Scholar]

- Branicki L.J., Sullivan-Taylor B., Livschitz S.R. How entrepreneurial resilience generates resilient SMEs. Int. J. Entreoren. Beh. Res. 2018;24(7):1244–1263. [Google Scholar]

- Carbonara N., Pellegrino R. Real options approach to evaluate postponement as supply chain disruptions mitigation strategy. Int. J. Prod. Res. 2018;56(15):5249–5271. [Google Scholar]

- Cheng J.H., Lu K.L. Enhancing effects of supply chain resilience: insights from trajectory and resource-based perspectives. Supply Chain Manag.: Int. J. 2017;22(4):329–340. [Google Scholar]

- Chin W.W. In: Handbook of Partial Least Squares. first ed. Vinzi V.E., Chin W.W., Henseler J., Wang H., editors. Springer; Berlin, Heidelberg: 2010. How to write up and report PLS analyses; pp. 655–690. [Google Scholar]

- Chowdhury M.M.H., Quaddus M. Supply chain resilience: conceptualization and scale development using dynamic capability theory. Int. J. Prod. Econ. 2017;188:185–204. [Google Scholar]

- Cohen J. Academic Press; 2013. Statistical Power Analysis for the Behavioral Sciences. [Google Scholar]

- Cohen W.M., Levinthal D.A. Absorptive capacity: a new perspective on learning and innovation. Adm. Sci. Q. 1990;35(1):128–152. [Google Scholar]

- Coleman R.O., Adim C.V. Entrepreneurial proactiveness and organizational resilience in mobile telecommunication firms in Rivers State, Nigeria. Strateg. J. Busin. Change Manag. 2019;6(3):454–465. [Google Scholar]

- Covin J.G., Slevin D.P. Strategic management of small firms in hostile and benign environments. Strat. Manag. J. 1989;10(1):75–87. [Google Scholar]

- Cui L., Fan D., Guoa F., Fan Y. Explicating the relationship of entrepreneurial orientation and firm performance: underlying mechanisms in the context of an emerging market. Ind. Market. Manag. 2018;71:27–40. [Google Scholar]

- Cumming B.S. Innovation overview and future challenges. Eur. J. Innovat. Manag. 1998;1(1):21–29. [Google Scholar]

- Dobrzykỏwski D.D., Leuschner R., Hong P.C., Roh J.J. Examining absorptive capacity in supply chains: linking responsive strategy and firm performance. J. Supply Chain Manag. 2015;51(4):3–28. [Google Scholar]

- Drucker P.F. Harper and Row Publishers; New York: 1954. The Practice of Management. [Google Scholar]

- Eddleston K.A., Kellermanns F.W., Sarathy R. Resource configuration in family firms: linking resources, strategic planning and technological opportunities to performance. J. Manag. Stud. 2008;45(1):26–50. [Google Scholar]

- Eisenhardt K.M., Martin J.A. Dynamic capabilities: what are they? Strat. Manag. J. 2000;21(10-11):1105–1121. [Google Scholar]

- Engelen A., Kube H., Schmidt S., Flatten T.C. Entrepreneurial orientation in turbulent environments: the moderating role of absorptive capacity. Res. Pol. 2014;43(8):1353–1369. [Google Scholar]

- Engelman R.M., Fracasso E.M., Schmidt S., Zen A.C. Intellectual capital, absorptive capacity and product innovation. Manag. Decis. 2017;55(3):474–490. [Google Scholar]

- Falk R.F., Miller N.B. University of Akron Press; US: 1992. A Primer for Soft Modeling. [Google Scholar]

- Ferreira J.J., Azevedo S.G., Ortiz R.F. Contribution of resource-based view and entrepreneurial orientation on small firm growth. Cuadernos de Gestión. 2011;11(1):95–116. https://www.redalyc.org/pdf/2743/274319549005 Retrieved March 22, 2021, from: [Google Scholar]

- Fiol C.M., Lyles M.A. Organizational learning. Acad. Manag. Rev. 1985;10(4):803–813. [Google Scholar]

- Fornell C., Larcker D.F. Structural equation models with unobservable variables and measurement error: algebra and statistics. J. Market. Res. 1981;18(2):382–388. [Google Scholar]

- Gao S., Xu K., Yang J. Managerial ties, absorptive capacity, and innovation. Asia Pac. J. Manag. 2008;25(3):395–412. [Google Scholar]

- Gatignon H., Xuereb J.M. Strategic orientation of the firm and new product performance. J. Market. Res. 1997;34(1):77–90. [Google Scholar]

- Gebauer H., Worch H., Truffer B. Absorptive capacity, learning processes and combinative capabilities as determinants of strategic innovation. Eur. Manag. J. 2012;30(1):57–73. [Google Scholar]

- Gellynck X., Cárdenas J., Pieniak Z., Verbeke W. Association between innovative entrepreneurial orientation, absorptive capacity, and farm business performance. Agribusiness. 2014;31(1):91–106. [Google Scholar]

- Genc E., Dayan M., Genc O.F. The impact of SME internationalization on innovation: the mediating role of market and entrepreneurial orientation. Ind. Market. Manag. 2019;82:253–264. [Google Scholar]

- Genç N., Özbağ G.K., Esen M. Resource based view and the impacts of marketing and production capabilities on innovation. J. Glob. Strateg. Manag. 2013;7(2):24–35. [Google Scholar]

- Goaill M.M., Al-Hakimi M.A. Does absorptive capacity moderate the relationship between entrepreneurial orientation and supply chain resilience? Cog. Busin. Manag. 2021;8(1):1–19. [Google Scholar]

- Gölgeci I., Kuivalainen O. Does social capital matter for supply chain resilience? The role of absorptive capacity and marketing-supply chain management alignment. Ind. Market. Manag. 2020;84:63–74. [Google Scholar]

- Gölgeci I., Ponomarov S.Y. How does firm innovativeness enable supply chain resilience? The moderating role of supply uncertainty and interdependence. Technol. Anal. Strat. Manag. 2014;27(3):267–282. [Google Scholar]

- Hair J.F., Celsi M., Ortinau D.J., Bush R.P. third ed. McGraw-Hill/Irwin; New York, NY: 2012. Essentials of Marketing Research. [Google Scholar]

- Hair J.F., Ringle C.M., Sarstedt M. PLS-SEM: indeed a silver bullet. J. Market. Theor. Pract. 2011;19(2):139–151. [Google Scholar]

- Hamel G., Valikangas L. The quest for resilience. Harv. Bus. Rev. 2003;81(9):355–358. [PubMed] [Google Scholar]

- Helfat C.E., Finkelstein S., Mitchell W., Peteraf M., Singh H., Teece D., Winter S.G. first ed. Blackwell Publishing; USA: 2007. Firm Growth and Dynamic Capabilities. Dynamic Capabilities: Understanding Strategic Change in Organizations; pp. 100–114. [Google Scholar]

- Helfat C.E., Winter S.G. Untangling dynamic and operational capabilities: strategy for the (N) ever-changing world. Strat. Manag. J. 2011;32(11):1243–1250. [Google Scholar]

- Helm R., Mauroner O., Dowling M. Innovation as mediator between entrepreneurial orientation and spin-off venture performance. Int. J. Enterpren. Small Bus. 2010;11(4):472–491. [Google Scholar]

- Henseler J., Ringle C.M., Sinkovics R.R. Vol. 20. Emerald Group Publishing Limited; 2009. The use of partial least squares path modeling in international marketing; pp. 277–319. (New Challenges to International Marketing). [Google Scholar]

- Hernández-Perlines F., Moreno-García J., Yáñez-Araque B. Family firm performance: the influence of entrepreneurial orientation and absorptive capacity. Psychol. Market. 2017;34(11):1057–1068. [Google Scholar]

- Hilman H., Kaliappen N. Innovation strategies and performance: are they truly linked? Worl. J. Entrepren.: Manag. Sustain. Dev. 2015;11(1):48–63. [Google Scholar]

- Hisrich R.D., Peters M.P., Shepherd D. tenth ed. McGraw-Hill Education; New York, NY: 2016. Entrepreneurship. [Google Scholar]

- Hitt M.A., Ireland R.D., Camp S.M., Sexton D.L. Strategic entrepreneurship: entrepreneurial strategies for wealth creation. Strat. Manag. J. 2001;22(6-7):479–491. [Google Scholar]

- Hohenstein N.O., Feisel E., Hartmann E., Giunipero L. Research on the phenomenon of supply chain resilience. Int. J. Phys. Distrib. Logist. Manag. 2015;45(1/2):90–117. [Google Scholar]

- Ibidunni A.S., Kolawole A.I., Olokundun M.A., Ogbari M.E. Knowledge transfer and innovation performance of small and medium enterprises (SMEs): an informal economy analysis. Heliyon. 2020;6(8) doi: 10.1016/j.heliyon.2020.e04740. 1-9. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Jantunen A., Puumalainen K., Saarenketo S., Kyläheiko K. Entrepreneurial orientation, dynamic capabilities and international performance. J. Int. Enterpren. 2005;3(3):223–243. [Google Scholar]

- Kamalahmadi M., Parast M.M. A review of the literature on the principles of enterprise and supply chain resilience: major findings and directions for future research. Int. J. Prod. Econ. 2016;171:116–133. [Google Scholar]

- Kerlinger F.N., Lee H.B. fourth ed. Wadsworth publishing; 2007. Foundations of Behavioral Research. [Google Scholar]

- Khan W.A., Hassan R.A., Arshad M.Z., Arshad M.A., Kashif U., Aslam F., Wafa S.A. The effect of entrepreneurial orientation and organisational culture on firm performance: the mediating role of innovation. Int. J. Innovat.: Creativit. Changes. 2020;13(3):652–677. [Google Scholar]

- Knox S. The boardroom agenda: developing the innovative organization. Corp. Govern. 2002;2(1):27–36. [Google Scholar]

- Kocak A., Carsrud A., Oflazoglu S. Market, entrepreneurial, and technology orientations: impact on innovation and firm performance. Manag. Decis. 2017;55(2):248–270. [Google Scholar]

- Kohtamäki M., Heimonen J., Parida V. The nonlinear relationship between entrepreneurial orientation and sales growth: the moderating effects of slack resources and absorptive capacity. J. Bus. Res. 2019;100:100–110. [Google Scholar]

- Kostopoulos K., Papalexandris A., Papachroni M., Ioannou G. Absorptive capacity, innovation, and financial performance. J. Bus. Res. 2011;64(12):1335–1343. [Google Scholar]

- Krejcie R.V., Morgan D.W. Determining sample size for research activities. Educ. Psychol. Meas. 1970;301:607–610. [Google Scholar]

- Kropp F., Lindsay N.J., Shoham A. Entrepreneurial, market, and learning orientations and international entrepreneurial business venture performance in South African firms. Int. Market. Rev. 2006;23(5):504–523. [Google Scholar]

- Lane P.J., Koka B.R., Pathak S. The reification of absorptive capacity: a critical review and rejuvenation of the construct. Acad. Manag. Rev. 2006;31(4):833–863. [Google Scholar]

- Lee E.S., Song D.W. The effect of shipping knowledge and absorptive capacity on organizational innovation and logistics value. Int. J. Logist. Manag. 2015;26(2):218–237. [Google Scholar]

- Li Y., Liu Y., Duan Y., Li M. Entrepreneurial orientation, strategic flexibilities and indigenous firm innovation in transitional China. Int. J. Technol. Manag. 2008;41(1-2):223–246. [Google Scholar]

- Liao J., Welsch H., Stoica M. Organizational absorptive capacity and responsiveness: an empirical investigation of growth–oriented SMEs. Enterpren. Theor. Pract. 2003;28(1):63–86. [Google Scholar]

- Liao S.H., Fei W.C., Chen C.C. Knowledge sharing, absorptive capacity, and innovation capability: an empirical study of Taiwan's knowledge-intensive industries. J. Inf. Sci. 2007;33(3):340–359. [Google Scholar]

- Lichtenthaler U. Absorptive capacity, environmental turbulence, and the complementarity of organizational learning processes. Acad. Manag. J. 2009;52(4):822–846. [Google Scholar]

- Limaj E., Bernroider E.W. The roles of absorptive capacity and cultural balance for exploratory and exploitative innovation in SMEs. J. Bus. Res. 2017;94:137–153. [Google Scholar]

- Lisboa A., Skarmeas D., Lages C. Entrepreneurial orientation, exploitative and explorative capabilities, and performance outcomes in export markets: a resource-based approach. Ind. Market. Manag. 2011;40(8):1274–1284. [Google Scholar]

- Liu H., Wei S., Ke W., Wei K.K., Hua Z. The configuration between supply chain integration and information technology competency: a resource orchestration perspective. J. Oper. Manag. 2016;44:13–29. [Google Scholar]

- Llorens Montes F.J., Ruiz Moreno A., Miguel Molina Fernández L. Assessing the organizational climate and contractual relationship for perceptions of support for innovation. Int. J. Manpow. 2004;25(2):167–180. [Google Scholar]

- Mafabi S., Munene J.C., Ahiauzu A. Creative climate and organizational resilience: the mediating role of innovation. Int. J. Organ. Anal. 2015;23(4):564–587. [Google Scholar]

- Maldonado-Guzmán G., Garza-Reyes J.A., Pinzón-Castro S.Y., Kumar V. Innovation capabilities and performance: are they truly linked in SMEs? Int. J. Innovat. Sci. 2018;11(1):48–62. [Google Scholar]

- Malhotra M.K., Grover V., Desilvio M. Reengineering the new product development process: a framework for innovation and flexibility in high technology firms. Omega. 1996;24(4):425–441. [Google Scholar]

- Mallak L. Industrial Management-Chicago Then Atlanta; 1998. Putting Organizational Resilience to Work; pp. 8–13. [Google Scholar]

- Mandal S. Impact of supplier innovativeness, top management support and strategic sourcing on supply chain resilience. Int. J. Prod. Perform. Manag. 2020:1–21. (In press) [Google Scholar]

- Mandal S., Saravanan D. Exploring the influence of strategic orientations on tourism supply chain agility and resilience: an empirical investigation. Tours. Plann. Develop. 2019;16(6):612–636. [Google Scholar]

- Marsh S.J., Stock G.N. Creating dynamic capability: the role of intertemporal integration, knowledge retention, and interpretation. J. Prod. Innovat. Manag. 2006;23(5):422–436. [Google Scholar]

- McAdam R., Armstrong G., Kelly B. Investigation of the relationship between total quality and innovation: a research study involving small organisations. Eur. J. Innovat. Manag. 1998;1(3):139–147. [Google Scholar]

- Medina C., Rufín R. The mediating effect of innovation in the relationship between retailers' strategic orientations and performance. Int. J. Retail Distrib. Manag. 2009;37(7):629–655. [Google Scholar]

- Miller D. The correlates of entrepreneurship in three types of firms. Manag. Sci. 1983;29(7):770–791. [Google Scholar]

- Miller D., Friesen P.H. Innovation in conservative and entrepreneurial firms: two models of strategic momentum. Strat. Manag. J. 1982;3(1):1–25. [Google Scholar]

- Miroshnychenko I., Strobl A., Matzler K., De Massis A. Absorptive capacity, strategic flexibility, and business model innovation: empirical evidence from Italian SMEs. J. Bus. Res. 2020;130:670–682. [Google Scholar]

- Moore M.L., Westley F. Surmountable chasms: networks and social innovation for resilient systems. Ecol. Society. 2011;16(1):1–13. [Google Scholar]

- Morris C.N., Lopes K., Gallagher M.C., Ashraf S., Ibrahim S. When political solutions for acute conflict in Yemen seem distant, demand for reproductive health services is immediate: a programme model for resilient family planning and post-abortion care services. Sexual Reproduc. Heal. Matter. 2019;27(2):100–111. doi: 10.1080/26410397.2019.1610279. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Nagati H., Rébolledo C. The role of relative absorptive capacity in improving suppliers' operational performance. Int. J. Oper. Prod. Manag. 2012;32(5):611–630. [Google Scholar]

- Namdar J., Li X., Sawhney R., Pradhan N. Supply chain resilience for single and multiple sourcing in the presence of disruption risks. Int. J. Prod. Res. 2017;56(6):2339–2360. [Google Scholar]

- Nonaka I., Takeuchi H. Oxford University Press; 1995. The Knowledge-Creating Company: How Japanese Companies Create the Dynamics of Innovation. [Google Scholar]

- Nunnally J.C., Bernstein I. third ed. McGraw-Hill Education; New York, NY: 1994. Psychometric Theory. [Google Scholar]

- O'Connor G.C. Major innovation as a dynamic capability: a systems approach. J. Prod. Innovat. Manag. 2008;25(4):313–330. [Google Scholar]

- OECD . OECD; Paris: 2005. Oslo Manual: Proposed Guidelines for Collecting and Interpreting Technology Innovation Data. [Google Scholar]

- Oktavio A., Kaihatu T.S., Kartika E.W. Learning orientation, entrepreneurial orientation, innovation and their impacts on new hotel performance: evidence from surabaya. Jurnal Aplikasi Manajemen. 2019;17(1):8–19. [Google Scholar]

- Olsson A., Wadell C., Odenrick P., Bergendahl M.N. An action learning method for increased innovation capability in organisations. Action Learn. Res. Pract. 2010;7(2):167–179. [Google Scholar]

- O’Reilly C.A., III, Tushman M.L. Ambidexterity as a dynamic capability: resolving the innovator's dilemma. Res. Organ. Behav. 2008;28:185–206. [Google Scholar]

- Otero-Neira C., Arias M.J.F., Lindman M.T. Market orientation and entrepreneurial proclivity: antecedents of innovation. Global Bus. Rev. 2013;14(3):385–395. [Google Scholar]

- Patel P.C., Kohtamäki M., Parida V., Wincent J. Entrepreneurial orientation-as-experimentation and firm performance: The enabling role of absorptive capacity. Strat. Manag. J. 2015;36(11):1739–1749. [Google Scholar]

- Peters T., Waterman R. Search of Excellence, Lessons from America’s Best-Run Companies. Harper & Row; New York, NY: 1982. [Google Scholar]

- Ponomarov S. University of Tennessee; 2012. and Consequences of Supply Chain Resilience: a Dynamic Capabilities Perspective.https://trace.tennessee.edu/utk_graddiss/1338 PhD diss. [Google Scholar]

- Ponomarov S.Y., Holcomb M.C. Understanding the concept of supply chain resilience. Int. J. Logist. Manag. 2009;20(1):124–143. [Google Scholar]

- Quaye D., Mensah I. Marketing innovation and sustainable competitive advantage of manufacturing SMEs in Ghana. Manag. Decis. 2019;57(7):1535–1553. [Google Scholar]

- Rajesh R. Forecasting supply chain resilience performance using grey prediction. Electron. Commer. Res. Appl. 2016;20:42–58. [Google Scholar]

- Reinmoeller P., Van B.N. The link between diversity and resilience. MIT Sloan Manag. Rev. 2005;46(4):61–66. [Google Scholar]

- Ringle C.M., Wende S., Will A. 2005. SmartPLS 2.0 (Beta)http://www.smartpls.de/ Retrieved December 12, 2020, from: [Google Scholar]

- Rojo A., Stevenson M., Montes F.J.L., Perez-Arostegui M.N. Supply chain flexibility in dynamic environments. Int. J. Oper. Prod. Manag. 2018;38(3):636–666. [Google Scholar]

- Rubin A., Callaghan C.W. Entrepreneurial orientation, technological propensity and academic research productivity. Heliyon. 2019;5(8) doi: 10.1016/j.heliyon.2019.e02328. 1-11. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Sabahi S., Parast M.M. Firm innovation and supply chain resilience: a dynamic capability perspective. Int. J. Logist. Res. Appl. 2019;23(3):254–269. [Google Scholar]

- Saha K., Kumar R., Dutta S.K., Dutta T. A content adequate five-dimensional Entrepreneurial Orientation scale. J. Bus. Ventur. Insights. 2017;8:41–49. [Google Scholar]

- Sarsah S.A., Tian H., Dogbe C.S.K., Bamfo B.A., Pomegbe W.W.K. Effect of entrepreneurial orientation on radical innovation performance among manufacturing SMEs: the mediating role of absorptive capacity. J. Strat. Manag. 2020;13(4):551–570. [Google Scholar]

- Scholten K., Stevenson M., van Donk D.P. Dealing with the unpredictable: supply chain resilience. Int. J. Oper. Prod. Manag. 2020;40(1):1–10. [Google Scholar]