Abstract

The paper aims to investigate the existence of financial contagion between China and its major trading partners during the ongoing COVID-19 pandemic using the multivariate ADCC-EGARCH model. The analysis results reveal significant financial contagion in most developed and emerging markets having significant trade relationships with China during COVID-19 syndrome. The evidence about financial contagion is vital for regulators and different classes of market participants for varying purposes, and hence the results should find practical implications similar to policymakers, investors, and risk managers.

Keywords: Futures market, COVID-19, Asymmetric DCC EGARCH, Financial contagion

1. Introduction

In 2002 the world saw the Severe Acute Respiratory Syndrome Coronavirus (SARS-CoV), which impacted more than twenty-nine countries worldwide (Shaw, 2006), and in 2012, the emergence of the Middle East Respiratory Syndrome Coronavirus (MERS-CoV) was reported (Al-Tawfiq and Auwaerter, 2019). Since then, the world has always feared such a novel pathogen's recurrence that may cause a global contagion. The fear turned into reality when the novel Coronavirus (COVID-19) surfaced in Wuhan province in China. Little was anticipated that the COVID-19, in such a short span, would turn into a global menace, a "Black Swan" with severe economic and financial repercussions (Goodell, 2020). The vulnerability of the situation can be assessed by how the financial markets responded to this new development by recording a steep fall in all the benchmark indices, indicating the financial markets' fragility (Akhtaruzzaman et al., 2020).

Past research documented stock markets' responses to such outbreaks (Bhuyan et al., 2010), reporting that the infected country's asset returns exhibited increased cross-market linkages. Moreover, given the size of the pandemic's impact, it is imperative to study its aftermath on financial markets as it may provide new clues about how contagion can flow in through alternate channels contributing to financial upheavals.

Forbes and Rigobon (2002)1 define financial contagion as a significant increase in market co-movement after a shock to one country and differentiates it from interdependence. Research into financial contagion has spoken about contagion either in equity markets (Kenourgios et al., 2011) or the commodity market (Wang et al., 2019). Further attempts were made to study contagion through the trade links channel ( Akhtaruzzaman and Shamsuddin, 2016; Akhtaruzzaman et al., 2021 ) but practically remained silent about the derivative markets. Against Akhtaruzzaman et al. (2021)'s previous work exploring the contagion's flow during economic downturns caused by the financial crisis, especially the global financial crisis, the current paper analyzed contagion result of the sudden development of the COVID-19 syndrome, a major health hazard that emanated from China and spillovers to its major trading partners. Thus, it would be interesting to document such contagion effects in derivative markets, more so through the lens of financial market imperfections (Kaminsky and Reinhart, 2002) and thru periods of a worldwide pandemic. For the stated reason, the paper develops a framework to answer these questions; whether there is a significant increase in cross-market linkages during crises.

This paper enriches the literature by unveiling new evidence of financial contagion in the futures market by studying the seventeen different countries (Developed and Emerging), which are China's main trading partners. Furthermore, the study documents the contagion effect of COVID-19 on most countries. The empirical results are based on examining the three-block set-up. First, analyzing the entire period covering from 1st August 2015 to 31st July 2020. Second, the tranquil period from 1st August to 30th November 2019, and lastly, the crises period of 1st December 2019 to 31st July 2020.2 The period was mainly considered to isolate the transmission of China's contagion on its trading partners resulting from the COVID-19 pandemic and avoid any other events that may have impacted the study's results and robustness. Against the popularly used spot markets, this paper uses the futures markets. As it is well-documented in the literature that the futures market disseminates information faster into the prices than the spot market and hence aid in effective price discovery and thus serve as a better representative for asset markets (Banerjee et al., 2020; Bohl et al., 2011; Wu et al., 2005; Xu and Wan, 2015).

The study uses a bivariate asymmetric dynamic conditional correlation (ADCC) GARCH framework against the VAR framework used by Arezki and Liu (2020) as it falls short of capturing volatility dependence during a crisis (Hu, 2006). The DCC GARCH, unlike constant conditional correlation (CCC) GARCH and BEKK GARCH specification (Engle 2002; Tse and Tsui, 2002), as previous literature has unveiled that dynamic conditional correlation (DCC) GARCH yielded a more accurate estimation of conditional variances, whereas the study by Cappiello et al. (2006) showed that asymmetric dynamic conditional correlation (ADCC) GARCH model outclasses the DCC GARCH model with lower Bayesian Information Criterion (BIC) and higher log-likelihood value, and better adaptive to model the time-varying market integration. Besides, DCC GARCH does not account for asymmetries in conditional variances, covariances, and correlations, leading to an incorrect specification of the conditional variance-covariance matrix (Cappiello et al., 2006 ; de Goeij and Marquering, 2009). Following Cappiello et al. (2006) and Hou and Li (2016), this paper used the Asymmetric DCC GARCH model (ADCC), which incorporates the leverage effect into the conditional correlations. The rest of the paper's organization is as follows: Section 2 presents the data and descriptive statistics. Section 3 describes the methodology. Section 4 of the empirical results are presented, and Section 5 concludes the paper.

2. Data and descriptive statistics

The paper investigates financial contagion with the onset of COVID-19 between China and its main trading partners in index futures markets, using the major benchmark index futures contracts' daily prices. The sample period is from 1st August 2015 to 31st July 2020, which contains the daily end closing prices obtained from the Bloomberg database. The dataset contains the closing prices, volume, and open interest positions of each contract, and the daily returns are computed as the natural log of closing prices multiplied by 100 were the closing prices are Pt and P t − 1. Following Akhtaruzzaman and Shamsuddin (2016) and Forbes and Rigobon (2002), the future prices are recorded in local currencies. Mink (2015) highlighted that returns converted into common currency against local currency were shown to bias the contagion test outcomes. Further, incorporating foreign exchange (FX) rates may spike additional volatility from the foreign exchange markets that might not be related to volatility in the index futures market (Sim and Zurbreugg, 1999). Studies by Hou and Li (2016) and Mink (2015) suggested that currency hedging in the forward markets may moderate the currency risk. Given this, the incorporation of the FX rate is evaded. China's main trading partners are presented in Fig. 1 . Table 1 reports the descriptive statistics of each index's future returns. The JB statistics suffices all the return series exhibit skewness and excess kurtosis and the non-normality condition.

Fig. 1.

China and its major trading partners.

Table 1.

Descriptive statistics of returns of China and other countries index futures contracts.

| Mean | Median | Std. | Skewness | Kurtosis | JB statistics | |

|---|---|---|---|---|---|---|

| CSI 300 | 0.0208 | 0.0414 | 1.5151 | −1.1746 | 17.5524 | 10,719.76⁎⁎⁎ |

| S&P 500 | 0.0393 | 0.0501 | 1.2397 | −0.8800 | 20.8515 | 15,874.23⁎⁎⁎ |

| Nikkei 225 | −0.3147 | −0.5059 | 4.1495 | 0.4934 | 12.7291 | 4614.20⁎⁎⁎ |

| KOSPI 200 | 0.018 | 0.067 | 1.173 | 0.022 | 15.001 | 7122.87⁎⁎⁎ |

| DAX 30 | 0.0134 | 0.0518 | 1.3166 | −0.6389 | 15.2691 | 7259.50⁎⁎⁎ |

| Nifty 50 | 0.022 | 0.041 | 1.229 | −1.711 | 27.553 | 29,473.69⁎⁎⁎ |

| AEX In. Fut. | 0.0103 | 0.0647 | 1.1930 | −0.9817 | 15.9356 | 8537.90⁎⁎⁎ |

| FTSE In. Fut. | −0.0092 | 0.0071 | 1.1621 | −0.8879 | 14.7273 | 7151.40⁎⁎⁎ |

| SGX In. Fut. | 0.0221 | 0.0660 | 1.2458 | −1.9278 | 30.7669 | 40,276⁎⁎⁎ |

| TAIEX | 0.0325 | 0.0545 | 1.1088 | −0.2788 | 8.7079 | 1681.60⁎⁎⁎ |

| MOEX In. Fut. | 0.0494 | 0.0615 | 1.1359 | −0.9576 | 12.6946 | 4850.1⁎⁎⁎ |

| SPI ASX 200 | 0.0046 | 0.0651 | 1.1829 | −1.1324 | 17.1787 | 10,411⁎⁎⁎ |

| TSX 60 | 0.0136 | 0.0713 | 1.1895 | −1.3842 | 44.8860 | 87,004⁎⁎⁎ |

| IBrX 50 | 0.0202 | 0.0412 | 2.5975 | −1.0133 | 19.5678 | 14,139⁎⁎⁎ |

| CAC 40 | 0.0063 | 0.0430 | 1.3000 | −1.3255 | 18.2284 | 11,917⁎⁎⁎ |

| SET 50 | −0.0039 | 0.0312 | 1.2836 | −1.7912 | 26.8045 | 27,719⁎⁎⁎ |

| FTSE MIB | −0.0056 | 0.0500 | 1.6159 | −4.2504 | 85.7363 | 34,184⁎⁎⁎ |

| IBEX 35 | −0.0310 | 0.0230 | 1.3762 | −1.6861 | 22.1543 | 18,866⁎⁎⁎ |

Note: The descriptive statistics values provided are reported only for the full sample period.

Indicate the significance level at 1%.

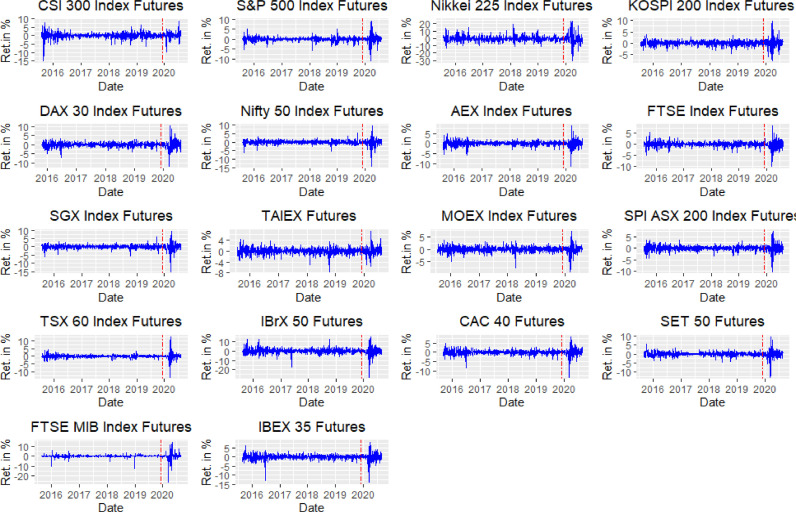

Fig. 2 presents the daily index futures returns of the CSI 300 against the trading partners' index futures market. China's index futures returns are more volatile in the pre-crisis period against the trading partners' ones. As seen in Fig. 2, the trading partners' returns exhibit an abrupt surge and all the more volatile against the CSI 300 daily in the crisis period, which may be attributed to the sudden development of uncertainty arising out of the COVID-19 crisis.

Fig. 2.

Index futures return series.

3. Methodology

In this study, first, the returns are modeled using a vector autoregressive (VAR) framework. The model is then extended to a bivariate asymmetric dynamic conditional (ADCC) GARCH framework to investigate the time-varying volatility spillovers in the index futures market.

The conditional mean of a bivariate VAR model is specified as follows:

Here represents the CSI 300 index futures returns and are the future returns of trading partner countries. ao and are the intercept of each equation. and are the lagged returns and ai, , aj, are the corresponding coefficients of the lag returns. and are the error terms of each equation assumed to be distributed with zero mean and constant variance with (i, j) lag order. And the optimal lag length of the model is determined using the Akaike Information Criterion (AIC) and Likelihood ratio (LR).

Second, to investigate the cross-market linkages in the second moment, the VAR framework is extended to conditional heteroscedastic error structure to extrapolate the conditional variance-covariance matrix. Thus, as Cappiello et al. (2006) proposed, the ADCC GARCH model is employed to account for the time-varying correlation between the assets and capture the asymmetric impact of negative and positive news. The error structure is respecified as follows: where Ht = DtRtDt with are the time-varying standard deviations obtained from the GARCH model and and where Qt defines the covariance of the standardized residuals ut, is the unconditional covariance matrix of ut . And a and b are the non-negative scalars such that a + b < 1 to ensure stationarity and positive definiteness of .

The error term εt follows a Student's t distribution with mean zero and conditional variance-covariance matrix Ht .The advantage of assuming error terms to follow Student's t distribution is that it accommodates the innovation's excess kurtosis (Baillie and Bollerslev, 1989) and thus serves robust estimation in deviations from normality (Tse, 1999). Ωt − 1 is the information set till time instant (t − 1). κ is the degree of freedom for Student's t distribution controlling for the tail behavior.

The conditional heteroscedastic process is specified as follows:

Basically, h i,t follows the EGARCH process developed by Nelson (1991), and the specification ensures that the conditional variance is always positive with no restrictions imposed on the coefficients. αi′s and βi′s captures the ARCH and the GARCH effects, and γ is the representative of the asymmetry that is to incorporate the leverage effect of positive and negative shocks in the conditional volatility as failing to capture asymmetry leads to misspecification of the volatility process.

To calibrate the asymmetric volatility and the time-varying conditional correlation, DCC extends to the ADCC EGARCH framework following Cappiello et al. (2006) with the dynamics of Qt expressed as follows:

where A, B, and G (A = a 2, B = b 2, G = c 2) are the N × N parameters matrices, ut denotes the standardized residuals, and the unconditional matrices of ut, kt = I[ut < 0] is equal to 1 or 0 otherwise. To have Qt positive-definite the intercept term must be positive semidefinite along with the initial covariance matrix Q 0 should be positive definite.

3.1. Test for the contagion effect

Following Celik (2012), the contagion effect is tested using the t-statistics to investigate the consistency of dynamic correlation between the index futures markets in the pre-crises and crises period, with the t –statistics3 specified as follows:

where and the mean values of the dynamic conditional coefficients, and the correlation coefficients in the pre and during crises period, and and are the sample variances for both the DCC series (crises and pre-crises period) and ncrises and n pre − crises are the sample size for the crises and pre-crises period.

4. Empirical results

At first, the paper begins with the estimation of the VAR model. Before estimating the VAR model, the stationarity condition for all the index futures return series is tested. Table 2 presents the stationarity test results using the Augmented Dickey-Fuller (ADF) and Philip-Perron (PP) tests. The results reject the null hypothesis of the ADF test and PP tests of the presence of unit root in all the index futures return series, and then they are used in the estimation of the VAR model. The best lag order is selected using the Final Prediction Error (FPE) criterion, Akaike Information Criterion (AIC), and Likelihood Ratio Criterion (LR) criterion for the VAR model. After VAR modeling,4 diagnostic tests have been performed on residuals to check for serial correlation and ARCH effect. The results of the test indicate that the residuals are free from serial and ARCH effects. After the VAR model's calibration, the next step is to run the ADCC EGARCH on the VAR equations' residuals.

Table 2.

Unit root test for the index futures return series.

| ADF test | PP test | |

|---|---|---|

| CSI 200 | −17.780⁎⁎⁎ | −30.882⁎⁎⁎ |

| S&P 500 | −10.403⁎⁎⁎ | −39.336⁎⁎⁎ |

| Nikkei 225 | −9.205⁎⁎⁎ | −29.206⁎⁎⁎ |

| KOSPI 200 | −9.658⁎⁎⁎ | −38.064⁎⁎⁎ |

| DAX 30 | −9.629⁎⁎⁎ | −33.547⁎⁎⁎ |

| Nifty 50 | −8.777⁎⁎⁎ | −37.621⁎⁎⁎ |

| AEX In. Fut. | −10.449⁎⁎⁎ | −33.669⁎⁎⁎ |

| FTSE In. Fut | −9.7318⁎⁎⁎ | −36.612⁎⁎⁎ |

| SGX In. Fut. | −9.502⁎⁎⁎ | −40.548⁎⁎⁎ |

| TAIEX | −10.320⁎⁎⁎ | −36.468⁎⁎⁎ |

| MOEX In. Futures | −10.235⁎⁎⁎ | −34.364⁎⁎⁎ |

| SPI ASX 200 | −8.732⁎⁎⁎ | −40.242⁎⁎⁎ |

| TSX 60 | −9.001⁎⁎⁎ | −41.450⁎⁎⁎ |

| IBrX 50 | −8.756⁎⁎⁎ | −38.256⁎⁎⁎ |

| CAC 40 | −10.069⁎⁎⁎ | −34.374⁎⁎⁎ |

| SET 50 | −9.076⁎⁎⁎ | −38.905⁎⁎⁎ |

| FTSE MIB | −7.204⁎⁎⁎ | −37.714⁎⁎⁎ |

| IBEX 35 | −9.837⁎⁎⁎ | −34.478⁎⁎⁎ |

Note: The ADF and PP test results are reported only for the entire sample.

Indicate the significance level at 1%.

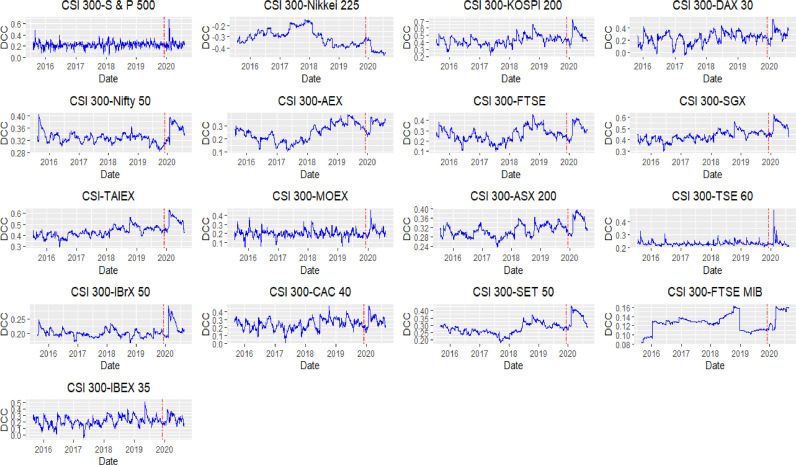

Table 3 presents the results of presents the results ADCC EGARCH (1,1) model for the full period following (Arouri et al., 2011). The results show that the ARCH and GARCH effects parameters, α and β are significant at an appropriate significance level, and their sum is less than one, thus sufficing the necessary condition of the finiteness of the conditional variances. Further, β is higher than α in all the series, indicating that the past variances tend to dominate the current variances. The leverage effect coefficient γ is positive and statistically significant at appropriate levels indicating that the negative shocks have a higher impact than the positive shocks. Both the ADCC parameters a and b are positive, and the sum is less than one to ensure positive definiteness. Parameters a and b, which are associated with short and long-term persistence of shocks on the dynamic conditional correlations, are significant. The exception being South Korea, Netherlands, and Canada was the short-term volatility persistence coefficient is found insignificant. The high values of b indicate the long-run persistence of volatility spillover among China's major trading partners. The joint distribution coefficient of shape (m) supports the best fit of the ADCC EGARCH based on Student-t distribution for both marginal and joint distribution represented by low values of the information criterion of AIC, BIC, and HQ. And that ADCC EGARCH is a better fit to model the time-varying conditional variances. The paper graphs the DCC in Fig. 3 .

Table 3.

Results of the ADCC EGARCH model.

| US | Japan | South Korea | Germany | India | Netherlands | UK | Singapore | Taiwan | |

| Conditional variance | |||||||||

| Const | −0.0137*** | 0.1918 | −0.0003 | 0.0010 | 0.0305*** | −0.0097** | −0.0046* | −0.0042 | −0.0007 |

| Arch (α) | −0.1794*** | 0.1427*** | −0.0965*** | −0.1536*** | 0.0011*** | −0.1893*** | −0.1513*** | −0.1284** | −0.0777*** |

| Garch (β) | 0.9722*** | 0.9109*** | 0.9715*** | 0.9817*** | 0.8831*** | 0.9732*** | 0.9824*** | 0.9786*** | 0.9744*** |

| Leverage (γ) | 0.2174*** | 0.2394* | 0.1369*** | 0.0854*** | 0.1709*** | 0.1198*** | 0.0719*** | 0.0873*** | 0.0990*** |

| Joint | |||||||||

| a | 0.0436** | 0.0061** | 0.0121 | 0.0290** | 0.0084** | 0.0077 | 0.0127* | 0.0094** | 0.0102* |

| b | 0.6476*** | 0.9885*** | 0.9462*** | 0.9349*** | 0.9582*** | 0.9860*** | 0.9741*** | 0.9186*** | 0.9737*** |

| Shape | |||||||||

| m | 4.6590*** | 4.8427*** | 4.2386*** | 4.5358*** | 5.0969*** | 4.7551*** | 4.8731*** | 5.3304*** | 4.9432*** |

| Information Criterion | |||||||||

| AIC | 5.5780 | 8.0185 | 5.7731 | 5.9508 | 5.7735 | 5.7618 | 5.7782 | 5.8353 | 5.8029 |

| BIC | 5.8224 | 8.2978 | 6.0170 | 6.2018 | 5.9358 | 6.0040 | 6.0167 | 6.0723 | 6.0404 |

| HQ | 5.6701 | 8.1247 | 5.8650 | 6.0456 | 5.8348 | 5.8530 | 5.8680 | 5.9425 | 5.8922 |

| Log-likelihood | |||||||||

| LL | −3245.185 | −3960.274 | −3369.342 | −3349.812 | −3285.67 | −3391.411 | −3467.674 | −3531.722 | −3503.069 |

| Russia | Australia | Canada | Brazil | France | Thailand | Italy | Spain | ||

| Conditional variance | |||||||||

| Const | −0.0054 | −0.0048 | −0.0140*** | 0.0257*** | −0.0013 | −0.0001 | 0.0460 | 0.0053 | |

| Arch (α) | −0.0433** | −0.1145*** | −0.1397*** | −0.0671*** | −0.1591** | −0.0566** | 0.1059* | −0.1131*** | |

| Garch (β) | 0.9695*** | 0.9827*** | 0.9794*** | 0.9824*** | 0.9707*** | 0.9902*** | 0.9577*** | 0.9673*** | |

| Leverage (γ) | 0.1081*** | 0.1114*** | 0.1474*** | 0.1170*** | 0.1391*** | 0.1627*** | 0.1960*** | 0.1446*** | |

| Joint | |||||||||

| a | 0.0088* | 0.0055** | 0.0000 | 0.0090** | 0.0224*** | 0.0051*** | 0.0010** | 0.0228* | |

| b | 0.8141*** | 0.9784*** | 0.8492*** | 0.9655*** | 0.9340*** | 0.9840*** | 0.9952*** | 0.9149*** | |

| Shape | |||||||||

| m | 5.6673*** | 5.4730*** | 5.3405*** | 4.7176*** | 4.9015*** | 4.5301*** | 4.0000*** | 5.4170*** | |

| Information criterion | |||||||||

| AIC | 5.9152 | 5.7409 | 5.4475 | 7.4825 | 5.9009 | 5.8285 | 6.0361 | 6.1319 | |

| BIC | 6.1876 | 5.9807 | 5.6918 | 7.7214 | 6.1432 | 6.0791 | 6.2801 | 6.3742 | |

| HQ | 6.0186 | 5.8312 | 5.5396 | 7.5724 | 5.9922 | 5.9231 | 6.1281 | 6.2232 | |

| Log-likelihood | |||||||||

| LL | −3001.550 | −3421.964 | −3170.657 | −4419.824 | −3474.708 | −3288.573 | −3522.385 | −3612.957 | |

Note: The results of the ADCC EGARCH model are for the full period of study.

***, ** and * indicate the significance level at 1%, 5%, 10% respectively.

Fig. 3.

DCC estimates of ADCC EGARCH model.

Table 4 shows the mean and variance of DCC values pre and during the crisis period, along with the contagion t-statistics. The mean and variance of the DCC for the crisis period are higher than that of the pre-crisis period. And the study finds empirical evidence of the contagion effect as a result of the COVID-19 crises emanating from China. Most developed and emerging markets, including the US, South Korea, Germany, India, Singapore, Taiwan, Russia, Australia, Canada, Brazil, Thailand, Italy, and Spain, have suffered contagion. The exception is Japan, Netherlands, the UK, France, where it was more interdependent than contagion. Therefore, the paper documents the contagion effect of COVID-19 on most of the developed and emerging futures markets that have trading relations with China.

Table 4.

Asymmetric dynamic correlation coefficient and contagion test.

| Mean | Variance | |t statistics| | |

|---|---|---|---|

| Pre-crises China-US | 0.1924 | 0.0009 | 1.77** |

| Crises China-US | 0.3172 | 0.0010 | |

| Pre-crises China-Japan | −0.2753 | 0.0037 | 0.07 |

| Crises China-Japan | −0.5024 | 0.1136 | |

| Pre-crises China-South Korea | 0.3991 | 0.0063 | 3.69*** |

| Crises China-South Korea | 0.5693 | 0.0019 | |

| Pre-crises China-Germany | 0.2026 | 0.0086 | 13.60*** |

| Crises China-Germany | 0.5454 | 0.0045 | |

| Pre-crises China-India | 0.3128 | 0.0020 | 6.13*** |

| Crises China-India | 0.4243 | 0.0012 | |

| Pre-crises China-Netherlands | 0.2235 | 0.0078 | 0.49 |

| Crises China-Netherlands | 0.4363 | 0.0343 | |

| Pre-crises China-UK | 0.2460 | 0.0030 | 0.77 |

| Crises China-UK | 0.4680 | 0.0113 | |

| Pre-crises China-Singapore | 0.3938 | 0.0029 | 22.20*** |

| Crises China-Singapore | 0.4440 | 0.0000 | |

| Pre-crises China-Taiwan | 0.3938 | 0.0029 | 3.55*** |

| Crises China-Taiwan | 0.5761 | 0.0030 | |

| Pre-crises China-Russia | 0.1733 | 0.0005 | 3.77*** |

| Crises China-Russia | 0.3109 | 0.0259 | |

| Pre-crises China-Australia | 0.2800 | 0.0000 | 257.00*** |

| Crises China-Australia | 0.3955 | 0.0000 | |

| Pre-crises China-Canada | 0.1881 | 0.0000 | 14.40*** |

| Crises China-Canada | 0.5417 | 0.0193 | |

| Pre-crises China-Brazil | 0.1614 | 0.0000 | 140.00*** |

| Crises China-Brazil | 0.3967 | 0.0000 | |

| Pre-crises China-France | 0.2226 | 0.0062 | 1.17 |

| Crises China-France | 0.3742 | 0.0190 | |

| Pre-crises China-Thailand | 0.3938 | 0.0029 | 4.86*** |

| Crises China-Thailand | 0.3912 | 0.0059 | |

| Pre-crises China-Italy | 0.0738 | 0.0000 | 4.79*** |

| Crises China-Italy | 0.2952 | 0.1300 | |

| Pre-crises China-Spain | 0.1845 | 0.0047 | 1.81** |

| Crises China-Spain | 0.2911 | 0.0316 |

Note: pre-crisis period is from 02.07.2015 to 29.11.2019. The crisis period is from 02.12.2019 to 31.07.2020.

***, ** and * indicate the significance level at 1%, 5%, 10% respectively.

5. Conclusions

This paper aims to test the existence of financial contagion between China and its trading partners during the COVID-19 crisis. The paper's main findings are that there is significant evidence of a sudden surge in correlation during the crisis period presenting evidence of contagion during the spread of the COVID-19 from China to these countries. Another finding is that both developed and emerging markets seem to suffer equally from the contagion effect. However, the analysis of the ADCC provides no evidence in favor of Japan, the Netherlands, the UK, and France.

This paper has important policy implications that channels of contagion may not only arise out of financial crises, but a pandemic situation like COVID-19 can also have severe repercussions for the economy and financial markets, which policymakers need to take note of. Further, the paper's findings may be of interest to policymakers, investors, risk, and portfolio managers.

The current study has examined contagion through cross-market linkages. Moreover, the COVID-19 crisis presented a unique opportunity to look at the alternative channels for contagion's flow. It would be interesting to test how contagion transmission can happen through trade intensity which is not a part of the current study. Future research, therefore, warrants exploring the transmission of contagion through the trading channels from China to its trading partner.

Author statement

Conception and design, Data acquisition, Analysis and interpretation of data, Drafting of the manuscript, Revision of the manuscript critically for important intellectual content.

Footnotes

See Forbes and Rigoban's (2002) paper for understanding the key difference between contagion and interdependence

The month of December 2019 was taken as a natural choice as World Health Organization (WHO) officially reported the presence of Novel Corona Virus. The data comprises of seventeen major trading partner of China except Vietnam and Malaysia for non-presence futures contracts during the entire period of study.

The degree of freedom is calculated as follows: The results of the VAR model is not reported in the paper for the sake of brevity.

The results of the VAR model is not reported in the paper for the sake of brevity.

References

- Akhtaruzzaman M., Shamsuddin A. International contagion through financial versus non-financial firms. Econ. Model. 2016;59:143–163. [Google Scholar]

- Akhtaruzzaman M., Boubaker S., Sensoy A. Financial contagion during COVID–19 crisis. Finance Res. Lett. 2020 doi: 10.1016/j.frl.2020.101604. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Akhtaruzzaman M., Abdel-Qader W., Hammami H., Shams S. Is China a source of financial contagion? Finance Res. Lett. 2021 doi: 10.1016/j.frl.2020.101604. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Al-Tawfiq J.A., Auwaerter P.G. Healthcare-associated infections: the hallmark of Middle East respiratory syndrome coronavirus with review of the literature. J. Hosp. Infect. 2019;101(1):20–29. doi: 10.1016/j.jhin.2018.05.021. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Arezki R., Liu Y. On the (Changing) Asymmetry of Global Spillovers: emerging Markets vs. Advanced Economies. J. Int. Money Finance. 2020 [Google Scholar]

- Arouri M.E.H., Jouini J., Nguyen D.K. Volatility spillovers between oil prices and stock sector returns: implications for portfolio management. J. Int. Money Finance. 2011;30(7):1387–1405. [Google Scholar]

- Baillie R.T., Bollerslev T. Common stochastic trends in a system of exchange rates. J. Finance. 1989;44(1):167–181. [Google Scholar]

- Banerjee A.K., Pradhan H.K., Tripathy T., Kanagaraj A. Macroeconomic news surprises, volume and volatility relationship in index futures market. Appl. Econ. 2020;52(3):275–287. [Google Scholar]

- Bhuyan R., Lin E.C., Ricci P.F. Asian stock markets and the Severe Acute Respiratory Syndrome (SARS) epidemic: implications for health risk management. Int. J. Environ. 2010;4(1):40–56. [Google Scholar]

- Bohl M.T., Salm C.A., Schuppli M. Price discovery and investor structure in stock index futures. J. Futures Mark. 2011;31(3):282–306. [Google Scholar]

- Cappiello L., Engle R.F., Sheppard K. Asymmetric dynamics in the correlations of global equity and bond returns. J. Financ Econ. 2006;4(4):537–572. [Google Scholar]

- Celık S. The more contagion effect on emerging markets: the evidence of DCC-GARCH model. Econ. Model. 2012;29(5):1946–1959. [Google Scholar]

- de Goeij P., Marquering W. Stock and bond market interactions with level and asymmetry dynamics: an out-of-sample application. J. Empir. Finance. 2009;16(2):318–329. [Google Scholar]

- Engle R. New frontiers for ARCH models. J. Appl. Econom. 2002;17(5):425–446. [Google Scholar]

- Forbes K.J., Rigobon R. No contagion, only interdependence: measuring stock market co-movements. J. Finance. 2002;57(5):2223–2261. [Google Scholar]

- Goodell J.W. COVID-19 and finance: agendas for future research. Finance Res. Lett. 2020 doi: 10.1016/j.frl.2020.101512. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hou Y., Li S. Information transmission between US and China index futures markets: an asymmetric DCC GARCH approach. Econ. Model. 2016;52:884–897. [Google Scholar]

- Kaminsky G.L., Reinhart C.M. Financial markets in times of stress. J. Dev. Econ. 2002;69(2):451–470. [Google Scholar]

- Kenourgios D., Samitas A., Paltalidis N. Financial crises and stock market contagion in a multivariate time-varying asymmetric framework. J. Int. Money Finance. 2011;21(1):92–106. [Google Scholar]

- Mink M. Measuring stock market contagion: local or common currency returns? Emerg. Mark. Rev. 2015;22:18–24. [Google Scholar]

- Nelson D.B. Conditional heteroskedasticity in asset returns: a new approach. Econometrica, 1991;59(2):347–370. [Google Scholar]

- Shaw K. The 2003 SARS outbreak and its impact on infection control practices. Public Health. 2006;120(1):8–14. doi: 10.1016/j.puhe.2005.10.002. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Sim A.B., Zurbreugg R. Intertemporal volatility and price interactions between Australian and Japanese spot and futures stock index markets. J. Futures Mark. 1999;19(5):523–540. [Google Scholar]

- Tse Y. Price discovery and volatility spillovers in the DJIA index and futures markets. J. Futures Mark. 1999;19(8):911–930. [Google Scholar]

- Tse Y.K., Tsui A.K.C. A multivariate generalized autoregressive conditional heteroscedasticity model with time-varying correlations. J. Bus. Econ. Stat. 2002;20(3):351–362. [Google Scholar]

- Wang X., Liu H., Huang S., Lucey B. Identifying the multiscale financial contagion in precious metal markets. Int. Rev. Financial Anal. 2019;63:209–219. [Google Scholar]

- Wu C., Li J., Zhang W. Intradaily periodicity and volatility spillovers between international stock index futures markets. J. Futures Mark. 2005;25(6):553–585. [Google Scholar]

- Xu F., Wan D. The impacts of institutional and individual investors on the price discovery in stock index futures market: evidence from China. Finance Res. Lett. 2015;15:221–231. [Google Scholar]