Abstract

Medicare fraud has been the cause of up to $60 billion in overpaid claims in 2015 alone. Upcoding occurs when a healthcare provider has submitted codes for more severe conditions than diagnosed for the patient to receive higher reimbursement. The purpose of this study was to assess the impact of Medicare and Medicaid fraud to determine the magnitude of upcoding inpatient and outpatient claims throughout reimbursements.

The methodology for this study utilized a literature review. The literature review analyzed physician upcoding throughout present on admission infections, diagnostic related group upcoding, emergency department, and clinic upcoding. It was found that upcoding has had an impact on Medicare payments and fraud. Medicare fraud has been reported to be the magnitude of upcoding inpatient and outpatient claims throughout Medicare reimbursements. In addition, fraudulent activity has increased with upcoding for ambulatory inpatient and outpatient charges for patients with Medicare and Medicaid.

Keywords: billing, charges, fraud, Medicare, upcoding, waste

Introduction

Medicare fraud has been defined by the Centers for Medicare and Medicaid Services (CMS) as submitted or caused to have been submitted, false acquisitions, or misrepresentations of facts that have obtained federal health care payment for which no entitlement would have otherwise existed.1 In 2011, $2.27 trillion was spent on healthcare, and more than 4 billion health insurance claims were processed in the United States.2 It has been reported that Medicare lost funds that totaled up to $60 billion by improperly paid use in 2015.3

In the United States, Medicare is the health insurance for people ages 65 years or older and End Stage Renal Disease. Also, qualify younger populations with specific disabilities.4 Medicare Part A has generally covered hospital care, skilled nursing facility care, nursing home care, hospice, and home health services for the beneficiaries.5 Medicare Part B has paid for a portion of physicians' visits, some parts of home health care, outpatient procedures, ambulance services, rehabilitation therapy, laboratory tests, and X-rays.6 Part C is the Medicare Advantage Plan similar to a health maintenance organization that provides extra coverage to the beneficiary such as vision and dental insurance.7 Medicare Part D is a voluntary benefit for prescription drugs for people with Medicare who receive additional plan availability, enrollment, and financing for prescription drugs.8

Medicare fraud has been determined throughout billing for unnecessary procedures, falsified claims or diagnoses, participating in illegal kickbacks or referrals, or providers prescribed unnecessary medication, also known as upcoding.9 Upcoding occurs when a healthcare provider submits codes for more severe and expensive diagnoses or procedures than the provider diagnosed or performed.10 A current procedural terminology (CPT) code is a medical code set utilized to describe diagnostic medical and surgical procedures and services a that a physician has performed to allow them to bill insurance companies whether commercial or governmental plans.11 Evaluation and management codes have been used for patient visits for most family physician practices.12 The American Society of Anesthesiologists (ASA) reported as “gaming the system” when providers had ASA risk scores.13 The implementation of an electronic medical record (EMR) has been reported to have improved the efficiency of care and increased the accuracy of diagnoses to patient cases.14 Furthermore, reimbursements should be accounted for quality, quantity, and complexity of care and eliminated upcoding and under-treatment based on the patients' conditions. Present on Admission (POA) infections reported the method for determination in administrative data between complications that developed pre-existing to the hospitalization or infections that had been developed throughout the hospitalization.15

Bundled payments have been classified as single payments for all services related to a specific treatment or condition and have created incentives for providers to eliminate unnecessary services and reduce costs.17 The payment system set for the operating costs of acute care hospital inpatients has stayed under Medicare Part A based on a set rate referred to as the prospective payment system (PPS). Under the PPS, each case has been categorized into a diagnosis-related group (DRG) that has a weight assigned to it based on the average resources used to treat Medicare patients in that DRG18. Upcoding is a severe problem provoked by employer reimbursement formulae that pay clinicians based on relative value units (RVUs). As a result, clinicians often are concerned that data-based compensation adjustments will lower their pay and thus must be offset by more aggressive coding16.

ProPublica examined provider billing patterns for routine office visits in Medicare and found more than 490,000 providers billed the program for standard office visits for at least 11 patients in 2015. Of those, more than 1,250 providers billed for every office visit using the 99215 code, which is only to be utilized for visits that require more intensive examination and often consume more time.

Furthermore, 1,825 health professionals billed Medicare for the costliest office visits for established patients approximately 90 percent of the time in 2015

The Health Insurance Portability and Accountability Act (HIPAA) was established under the joint direction of the attorney general and the Secretary of the Department of Health and Human Services(HHS), a national Health Care Fraud and Abuse Control Program (HCFAC, or the Program) to coordinate federal, state, and local law enforcement activities concerning health care fraud and abuse.19

The purpose of this study was to assess the impact of Medicare and Medicaid fraud to determine the magnitude of upcoding inpatient and outpatient claims throughout reimbursements.

Methodology

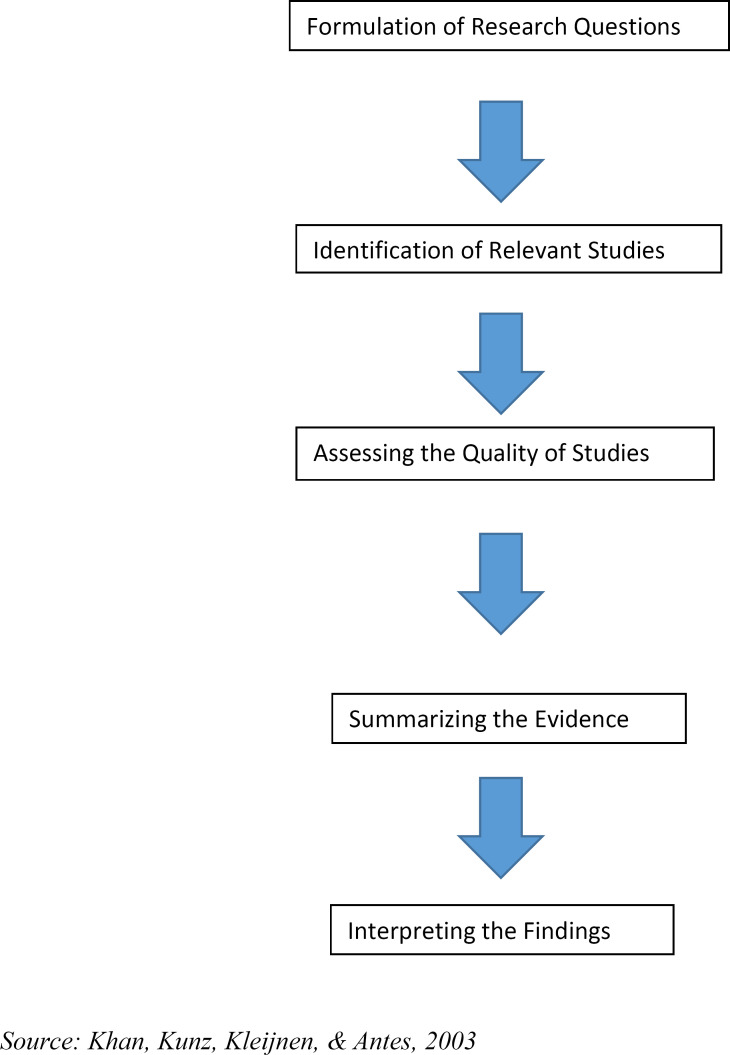

The primary hypothesis of this study was that fraudulent activity has increased with upcoding for ambulatory inpatient and outpatient charges for patients with Medicare and Medicaid. The methodology for this research analysis utilized a literature review of academic sources. The literature review was conducted in three individual stages: 1) developing a search strategy and gathering data for the case study; 2) determining and analyzing the relevant literature; 3) delegating literature to appropriate categories. The five-step approach proposed by Khan et al.20 was adopted for this research. The approach consists of five necessary steps, which are depicted in Figure 1. Formulation of the research question meant the research problem was specified in the questions. Identification of relevant studies included a detailed search of relevant literature that was produced. Assessing the qualities of the studies meant that all studies were analyzed to select the references relevant to fraud, waste, and abuse detected in healthcare21.

Figure 1.

The Research Framework

Step 1: Literature Identification and Collection

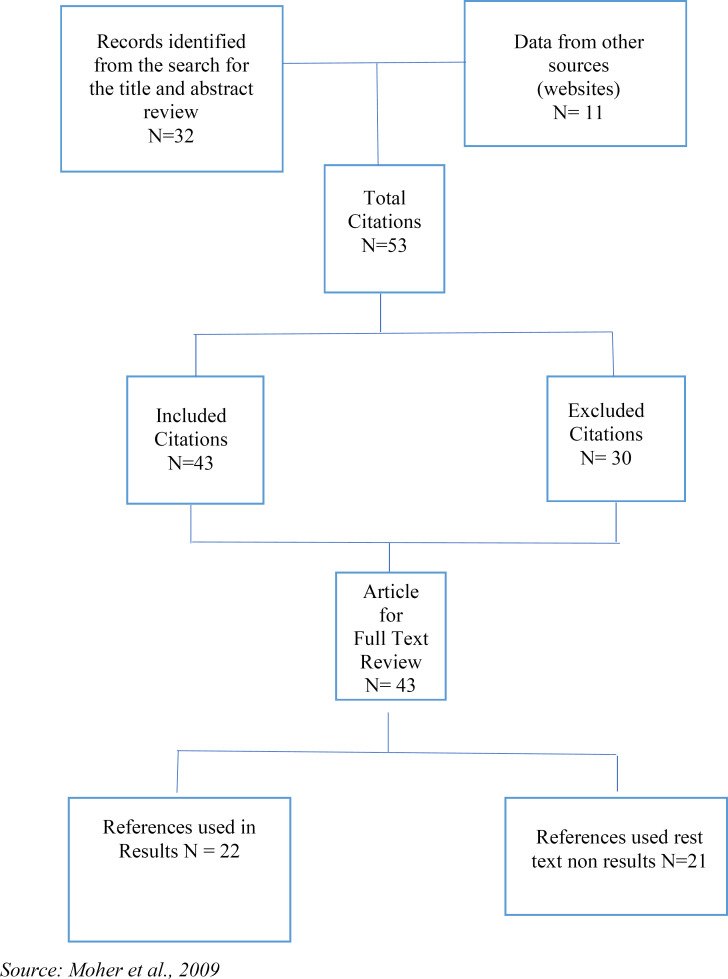

When conducting this research, critical terms included were: “Medicare”OR “Medicaid”OR “Inpatients”OR “Outpatients”OR “Charges” and “Upcoding”OR “Fraud” and “CPT”OR “ICD-10-CM”OR “ICD-10-PCS”OR “Billing”OR “DRG.”These keywords were the criteria for inclusion in the study. The electronic databases of Jamia, Elibrary, PubMed, Medline, and Google Scholar were utilized to obtain academic peer-reviewed literature. Following a PRISMA diagram refthe search identified 54 relevant citations and excluded articles (n=31) if they did not meet inclusion principles. Articles were included (n=32) if they described access to Medicare fraud and upcoding charges: articles from other sources such as The New England Journal of Medicine and The International Journal of Health Policy and Management (n=11) were also included in this search. These 43 references were subject to full-text review, and these 43 citations were included in the data abstraction and analysis. Only 22 references were used in the results section (see Figure 2).

Figure 2.

Overview of Literature Evaluation

Step 2: Literature Analysis

Medicare and Medicaid upcoding has become essential because of its impact on hospitals with inpatient and outpatient charges fraud. Therefore, the literature analyzed focused on the following key areas: Medicare and Medicaid upcoding and fraud; inpatient and outpatient charges; and billing, CPTs, and DRGs affiliated with these charges. In an attempt to collect the most recent data, onlysources from 2008-2021 written in English were used. Primary and secondary data from articles, literature reviews, research studies, and reports written in the United States were included in this research. The literature review included 38 references, which were assessed for information about this research project. W.L., L.N., V.W. conducted the literature search, and it was validated by A.C., who acted as the second reader and double-checked if references met the inclusion criteria of the research study.

Step 3: Literature Categorization

The following subheadings were included in the research: Present on Admission Upcoding/Hospital Acquired Infections with Upcoding in Hospitals; Diagnosis Related Group Upcoding in Hospitals; Upcoding with Surgeries and Anesthesia; Emergency Department Upcoding; and Insurance Upcoding in Clinics and Hospitals.

Results

Present on Admission/Hospital-Acquired Conditions with Upcoding in Hospitals

Medicare legislation has been directed at improving patient care quality by stopping reimbursement of hospital-acquired conditions; however, this policy has been undermined because providers still upcoded diagnoses for higher reimbursement. One study estimated that 10,000 out of 60,000 claims were reimbursed for POA infections, and 18.5 percent of claims were upcoded hospital-acquired infections, costing Medicare $200 million.22 Another article reported that POA infections had decreased reimbursement in facilities when the DRG and regulatory steps did not meet specific criteria, which prompted hospitals to upcode to increase reimbursement.23

CMS has created a POA indicator used on all claims that involved Medicare inpatient admissions to general inpatient prospective payment system acute care hospitals.24 Table 1 displays the indicators, description, and payment for POA factors healthcare facilities have used to report hospital-acquired infections throughout stays. If the patient's diagnosis was present at the time of inpatient admission and the code was Yes (Y), CMS paid for the complication/comorbidity (CC) or significant complication/comorbidity (MCC) diagnosis. If the diagnosis was not present at the time of inpatient admission and the code was No (N), CMS did not pay for the CC or MCC diagnosis. Also, if documentation was insufficient and marked Unknown (U), CMS did not pay for the diagnosis, and if the POA was clinically undetermined and marked Undetermined (W), CMS paid for the CC or MCC diagnosis.25

Table 1.

Present on Admissions for Fiscal Year 2018

| Indicator | Description | Payment |

|---|---|---|

| Yes (Y) | The diagnosis was present at the time of inpatient admission. | Payment is made for the condition when HAC is present. |

| No (N) | The diagnosis was not present at the time of inpatient admission. | No payment is made for the condition when HAC is present. |

| Unknown (U) | Documentation was insufficient to determine if the condition was present at the time of inpatient admission. | No payment was made for the condition when a HAC was present. |

| Undetermined (W) | Clinically undetermined. The provider was unable to clinically determine whether the condition was present at the time of inpatient admission. | Payment is made for the condition when HAC is present. |

In 2012, the Office of Inspector General (OIG) reported an estimate that 13.5 percent of Medicare beneficiaries hospitalized in October 2008 experienced adverse events, and hospital coders incorrectly reported 3 percent of 5,941 present on admission indicators, which has resulted in at least one incorrect indicator on each of the claims.26 If the hospital upcoded the diagnosis code withestablished complications for the patient, the hospital received an average of $6,398.27

Diagnosis-Related Group Upcoding in Hospitals

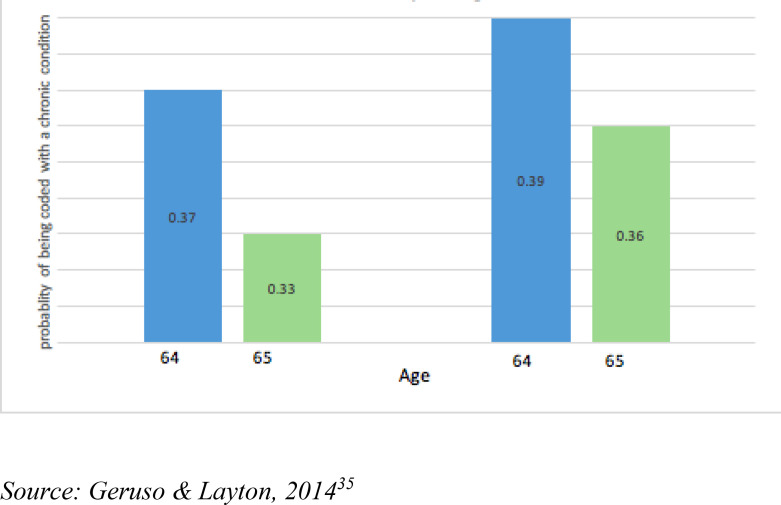

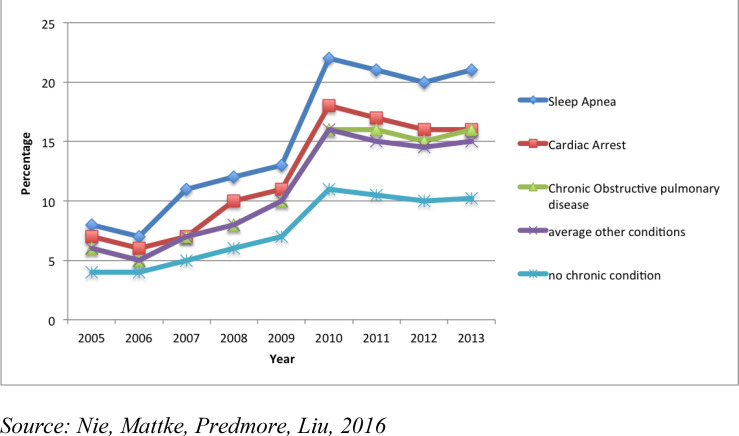

Some scholars have determined that hospitals have responded by recommended types of admission and treatment plans.28 Figure 3 displays the probability of upcoding with chronic conditions in Medicare with fee-for-service versus Medicare Advantage plans by the probability of the patient being coded with a chronic condition comparable to the patient's age.

Figure 3.

Medicare Upcoding with Chronic Conditions

In 2016, Nie, Mattke, Predmore, and Liu reviewed the likelihood of upcoding for high anesthesia risks and sleep apnea from 2005 to 2013 as upcoding a patient at a high risk ensured increased payment of the claim. They found that Medicare reported paying steadily for medical qualifying high-risk procedures.29 Furthermore, the ASA risk score increased from 2.9 percent in 2005 to 13.2 percent in 2013. The proportion of patients' risks increased from 11.6 percent to 18.9 percent and high-risk anesthesia increased from 11.6 percent to 18.9 percent. Sleep apnea patients increased from 8.8 percent to 20.8 percent throughout the same period. Also, upcoding could be determined throughout this study with gastrointestinal endoscopy procedures and anesthesia. Furthermore, these researcher reported the extreme progression of pulmonary disease, and sleep apnea to increase revenue within the period; Figure 4 describes the upcoding with high anesthesia charges, pulmonary disease, and sleep apnea to increase revenue.30

Figure 4.

Trends of Possible Upcoding for High-Risk Anesthesia Risk Conditions from 2005 to 2013

In 2014, Duke University settled for $1 million in lawsuits for unbundled cardiac and anesthesia services that had been performed together.31 A case reviewed upcoding cardiology in Florida, in which the physician was performing unnecessary tests that he knew Medicare would pay more for.32 Dr. Asad Qamar received $18.2 million in 2012 with reimbursement from Medicare, which was reported higher than other cardiologists in the US, as the second-highest total was $4.5 million in reimbursement.33

Diagnosis-Related Group Upcoding in Hospitals

Some scholars have determined that hospitals have responded by encouraging types of admission and treatment plans.34 Geruso and Layton reported that, in 2014, upcoding could have cost Medicare $10.5 billion, or $640 per Medical Advantage enrollee.35

Emergency Department Upcoding

From 2001 to 2009, Pitts reported that emergency department discharge patients have increased by 18 percent annually, but Medicare patients discharged had decreased, with 38 percent of Medicare emergency department patients younger than 65 years old and 19 percent of ED patients of age forMedicare.36 In 2008, Baylor Medical Center reported to bill eight out of 10 Medicare patients for the two most expensive levels of treatment in the emergency room; and from 2001 to 2008, the use of the top expensive codes for ED visits doubled from 25 percent to 45 percent, and most cases reported the patients were not life-threatening cases.37 Furthermore, increased emergency room Medicare billing with more than $1 billion was added to taxpayers' costs.

High-intensity ED visits in non-federal acute care hospitals for elderly beneficiaries grew from 45.8 percent in 2006 to 57.8 percent in 2012, and the most frequently used code was 99285, which was a level five visit, the highest, most comprehensive, and expensive visit for an emergency room.38 Ahlman et al. 2018 reported five E&M codes for emergency department services depending on the complexity of the visit.39 The procedure 99285 has been a high-level emergency department visit code for evaluating and managing a patient, which requires comprehensive history, comprehensive examination, and comprehensive medical decision-making. In addition, CPT 99285 represented 39.7 percent in 2006 and 49.4 percent in 201240.,

The use of CPT 99281, which is described as an emergency department visit for the evaluation and management of a patient and required three components: a problem-focused history, problem-focused examination, and straightforward medical decision making, increased from 5.0 percent in 2006 to 7.6 percent in 2012.41

Burke et al. also reported an observation of a decrease in low-intensity CPT code use, which were 99281 and 99282 CPTs for low-complexity visits.42 Kliff reported that in 2009, 50 percent of ED facility fee charges were for level four and five codes, which rose to 59 percent of the codes used in 2015.43 Columbia Hospital Corporation admitted filing false claims to Medicare and other federal programs and reported to pay $1.7 billion in 2000 and 2002 for criminal fines and penalties with the US Department of Justice.44

Insurance Upcoding in Clinics and Hospitals

The Tenet Healthcare Corporation reported fraudulent charges in 2006 for $900 million that resulted from assigned incorrect diagnosis codes to Medicare and Medicaid specifically to increase reimbursement, which is a more severe diagnosis than what the patient would actually have.45 An example of the diagnosis upcoding would be a patient coming in for a cough and fever and the physician assigning J18.9 (pneumonia) when the patient has not been tested for this diagnosis. Also, a psychiatrist was fined $400,000 and was permanently excluded from taking part in Medicare and Medicaid.46 The psychiatrist billed insurance for 30-60 minutes sessions, but they were only 15-minute sessions.47 Medicare has paid E&M codes for new patients at higher rates than establishedpatients, and upcoding has occurred with Medicare when the provider has billed an established patient office visit with a new patient evaluation and management code.48

It was discovered that the AmeriGroup in Illinois fraudulently skewed enrollment into their Medicaid HMO program by refusing to register pregnant women and individuals with preexisting conditions. Under the False Claims Act and the Illinois Whistleblower Reward and Protection Act, AmeriGroup paid $144 million in damages to Illinois and the US government and $190 million in civil penalties.49 Medicare and Medicaid fraud was estimated in 2014 to range from $82 billion to $272 billion and involved spending $1.4 billion to account for it.50

Discussion

The purpose of this study was to assess the impact of Medicare fraud to determine the magnitude of upcoding inpatient and outpatient claims throughout Medicare reimbursements. The result of this literature review suggests that fraudulent activity has increased with upcoding for ambulatory inpatient and outpatient charges for patients with Medicare and Medicaid.

In 2009, Garrett reported that when DRG and other regulatory steps did not meet specific criteria, physicians were prompted by the hospital to upcode diagnoses and CPT codes in order for them to keep their high reimbursement. Garrett also reported that hospitals had faced penalties when the reimbursement quota was not met; in addition, the physicians kept upcoding.

In 2018, the National Bureau of Economic Research reported that specific diagnoses were considered more profitable, and hospitals responded by suggesting types of admission and treatment plans that have increased these diagnoses. In 2014, Geruso and Layton examined that upcoding had cost Medicare $10.5 billion, or $640 per Medicare Advantage enrollee; but since the deflator was applied uniformly, upcoders retained a large share of their charge.

In addition to upcoding to avoid penalties, the results showed it was up to physicians to classify the patient's status within the coding system. For example, Nie et al. reported an increase of upcoding a patient's status to ASA high risk to receive higher Medicare reimbursement, and a study determined anesthesia claims had been upcoded to high ASA risk when the patient was not high ASA risk. Pitts also found similar results of high-risk anesthesia upcoding as well as upcoded CPT code ED visits.

Procedure code 99285 was found to be more commonly used because it was coded as a high level (level five) emergency department visit for evaluation and management or a patient that had required comprehensive history, examination, and medical decisionmaking.51 This procedure code was used more frequently than CPT code 99281, which was for low complexity visits, due to the fact it was a higher intensity and coded the evaluation as high compared to low so the physicians and facility could have a higher reimbursement rate. Newman explored a hospital that openly admitted filing false claims to Medicare and other federal programs by billing the highest CPT code, whichwas a level five, for the claim, and found the hospital at fault of fraudulent billing. CMS has stated that upcoding CPT codes for patients as “new patients”have been reported to provide higher reimbursement; therefore, providers have changed their code to a new patient incorrectly to receive higher reimbursement.52

Upcoding has been one of the most expensive and pervasive examples of healthcare fraud. Between 2002 and 2012, it was one of the costliest publicly funded medical assistance programs with an estimated $11 billion. These are not victimless crimes, as they place unnecessary strain on a social safety net that many millions of individuals rely on for their essential medical needs.

Limitations

This research study was not conducted without limitations. This literature review was restricted due to search strategies such as distinguishing between keywords, the number of databases accessed, or the sources used, which might have impacted the quality and availability of the research. Also, research and publication bias were a limitation during this study.

Practical Implications

Continual participation with Medicare, Medicaid, and inpatient and outpatient facilities throughout the coming years will provide more data for the future. The reporting measurements have contributed to a lower quantity of fraudulent claims in outpatient and inpatient settings. Further research should include analysis of claims data against provider documentation/coded data to determine the extent of upcoding in inpatient and outpatients claims throughout Medicare and Medicaid reimbursements.

Conclusion

Upcoding Medicare claims to receive higher reimbursement has shown an increase in payments from Medicare. This review has ascertained that upcoding has occurred too often throughout healthcare practices, suggesting CMS fraud and abuse. Continuous training must be performed to healthcare providers to avoid engaging in upcoding. In addition, the current reward system to encourage whistleblowers to disclose this type of fraud should be promoted within the healthcare and patient community.

Author Biographies

Alberto Coustasse, DrPH, MD, MBA, MPH, (coustassehen@marshall.edu) is a professor of management and Administration Division at the Lewis College of Business | Brad D. Smith Schools of Business at Marshall University. He teaches at the Graduate MS Health Care and Health Informatics programs.

Whitney Layton, MS, Alumna Health care Administration, Lewis College of Business | Brad D. Smith Schools of Business at Marshall University.

Laykin Nelson, MS, Alumna Health Care Administration, Lewis College of Business | Brad D. Smith Schools of Business at Marshall University.

Victoria Walker MS Alumna Health Care Administration, Lewis College of Business | Brad D. Smith Schools of Business at Marshall University.

Notes

- 1.Centers for Medicare and Medicaid Services “Medicare Fraud & Abuse: Prevention, Detection, and Reporting.”. 2017a https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/Downloads/Fraud-Abuse-MLN4649244.pdf . [Google Scholar]

- 2.National Healthcare Anti-Fraud Association (NHCAA) “The Challenge of Healthcare Fraud.”. 2018 https://www.nhcaa.org/resources/health-care-anti-fraud-resources/the-challenge-of-health-care-fraud.aspx . [Google Scholar]

- 3.Avila J., Marshall S., Kaul G. “Medicare Funds Totaling $60 Billion Improperly Paid, Report Finds.”. American Broadcasting Company News. 2015 July 23; https://abcnews.go.com/Politics/medicare-funds-totaling-60-billion-improperly-paid-report/story?id=32604330 . [Google Scholar]

- 4.Social Security Administration (SSA) “Medicare Benefits.”. 2018 https://www.ssa.gov/benefits/medicare/ [Google Scholar]

- 5.Medicare “What Part A Covers.”. 2018 https://www.medicare.gov/what-medicare-covers/what-part-a-covers . [Google Scholar]

- 6.American Association of Retired Partners (AARP) “The Medicare Plans (Yes, Plans). American Association of Retired Partners. 2011 https://www.aarp.org/health/medicare-insurance/info-012011/understanding_medicare_the_plans.html . [Google Scholar]

- 7.US Department of Health and Human Services “What is Medicare Part C?”. 2018 https://www.hhs.gov/answers/medicare-and-medicaid/what-is-medicare-part-c/index.html . [Google Scholar]

- 8.Kaiser Family Foundation “An Overview of the Medicare Part D Prescription Drug Benefit.”. 2018 https://www.kff.org/medicare/fact-sheet/an-overview-of-the-medicare-part-d-prescription-drug-benefit/ [Google Scholar]

- 9.Beaton T. “Top 5 Most Common Healthcare Provider Fraud Activities. HealthPayer Intelligence.”. 2017 November 13; https://healthpayerintelligence.com/news/top-5-most-common-healthcare-provider-fraud-activities . [Google Scholar]

- 10.Phillips & Cohen “Upcoding & Unbundling: Healthcare Medicare Fraud.” Fighting forWhistleblowers for 30 Years. 2018 https://www.phillipsandcohen.com/upcoding-unbundling-fragmentation/ [Google Scholar]

- 11.Torrey T. “What is Upcoding in Medical Billing?” Verywell Health. 2018 https://www.verywellhealth.com/what-is-upcoding-2615214 . [Google Scholar]

- 12.American Academy of Family Physicians (AAPF) “Coding for Evaluation and Management Services.”. 2018 https://www.aafp.org/practice-management/payment/coding/evaluation-management.html . [Google Scholar]

- 13.Horowitz J. “Anesthesiologists are Gaming the System.” The Hill. 2013 July 4; http://thehill.com/blogs/congress-blog/healthcare/309183-anesthesiologists-are-gaming-the-system . [Google Scholar]

- 14.Britton J. “Healthcare Reimbursement and Quality Improvement: Integration Using Electronic Medical Record.”. International Journal of Health Policy and Management. 2015;4((8)):549–551. doi: 10.15171/ijhpm.2015.93. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Goldman E., Chu P., Osmond D., Bindman A. “The Accuracy of Present on Admission Reporting in Administrative Data.”. Health Services Research. 2011;46((1)):1946–1962. doi: 10.1111/j.1475-6773.2011.01300.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 16.Loria K. “Why is There a Problem with Upcoding and Overbilling?” Medical Economics. 2018 http://www.medicaleconomics.com/health-law-and-policy/why-there-problem-upcoding-and-overbilling . [Google Scholar]

- 17.Research and Development “Analysis of Bundled Payment.” Research and Development Corporation. 2018 https://www.rand.org/pubs/technical_reports/TR562z20/analysis-of-bundled-payment.html . [Google Scholar]

- 18.American Hospital Directory (AHD) Medicare Inpatient Prospective Payment System. 2018 https://www.ahd.com/ip_ipps08.html . [Google Scholar]

- 19.United States Department of Justice (DOJ) “Health Care CEO and Four Physicians Charged in Superseding Indictment in Connection with $200 Million Health Care Fraud Scheme Involving Unnecessary Prescription of Controlled Substances and Harmful Injections.”. 2018 https://www.justice.gov/opa/pr/health-care-ceo-and-four-physicians-charged-superseding-indictment-connection-200-million . [Google Scholar]

- 20.Khan K.S., Kunz R., Kleijnen J., Antes G. “Five Steps to Conducting a Systematic Review.”. Journal of the Royal Society of Medicine. 2003 March;vol. 96:pp. 118–121. doi: 10.1258/jrsm.96.3.118. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21.Ikono R., Iroju O., Olaleke J., Oyegoke T. “A Meta-Analysis of Fraud, Waste, and Abuse Detection Methods in Healthcare.”. Nigerian Journal of Technology. 2019;Vol. 28(No. 2) https://www.researchgate.net/publication/332319919_Meta-analysis_of_fraud_waste_and_abuse_detection_methods_in_healthcare/figures?lo=1 . [Google Scholar]

- 22.Bastani H., Goh J., Mohsen B. “Evidence of Upcoding in Pay-for-Performance Programs.”. Stanford University Graduate School of Business Research Paper. 2015;43((15)):22–25. [Google Scholar]

- 23.Garrett G. “Present on Admission: Where We Are Now.”. Journal of AHIMA. 2009;80(7):22–26. [PubMed] [Google Scholar]

- 24.Centers for Medicare and Medicaid (CMS) “Hospital-Acquired Conditions and Present on Admission Indicator Reporting Provision. Centers for Medicare & Medicaid.”. 2017b https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/Downloads/wPOA-Fact-Sheet.pdf . [Google Scholar]

- 25.Ibid. [Google Scholar]

- 26.Office of Inspector General “Memorandum Report: Assessment of Hospital Reporting of Present on Admission Indicators on Medicare Claims.”. Department of Health and Human Services. 2012 https://oig.hhs.gov/oei/reports/oei-06-09-00310.pdf . [Google Scholar]

- 27.Asakura K. “Beware of Leading Queries.” Today's Hospitalist. 2011 September; https://www.todayshospitalist.com/beware-of-leading-queries/ [Google Scholar]

- 28.National Bureau of Economic Research (NBER) “How Hospitals Respond to Changes in Medicare Reimbursement.” NBER 2018. >https://www.nber.org/aginghealth/fall03/w9972.html [PubMed] [Google Scholar]

- 29.Nie X., Mattke S., Predmore Z., Liu H. “Upcoding and Anesthesia Risk in Outpatient Gastrointestinal Endoscopy Procedures.”. JAMA Network. 2016;176((6)):855–856. doi: 10.1001/jamainternmed.2016.1244. [DOI] [PubMed] [Google Scholar]

- 30.Ibid. [Google Scholar]

- 31.Gibbs Low Group “Medical Billing Fraud: Upcoding & Unbundling.”. Girad Gibbs. (2018):1–8. [Google Scholar]

- 32.Gentry C. “Prominent Cardiologist Sued for Fraud.”. Health News, Florida. 2015 January 6; http://health.wusf.usf.edu/post/prominent-cardiologist-sued-fraud#stream/0 . [Google Scholar]

- 33.Robles F., Lipton E. “Political Ties of Top Billers for Medicare.”. The New York Times. April 9, 2014 https://www.nytimes.com/2014/04/10/business/doctor-with-big-medicare-billings-is-no-stranger-to-scrutiny.html?action=click&contentCollection=Opinion&module=MostEmailed&version=Full®ion=Marginalia&src=me&pgtype=article&_r=0 . [Google Scholar]

- 34.NBER. [Google Scholar]

- 35.Geruso M., Layton T. “Upcoding Evidence from Medicare on Risk Adjustment.”. The National Bureau of Economic Research. Working Paper No. 21222. Cambridge, MA. 2014 https://www.nber.org/digest/sep15/w21222.html . [Google Scholar]

- 36.Pitts S.R. “Higher-complexity ED billing codes: Sicker patients, More Intensive Practice, or Improper Payments?”. New England Journal of Medicine. 2012;367((26)):2465–2467. doi: 10.1056/NEJMp1211315. [DOI] [PubMed] [Google Scholar]

- 37.Eaton J., Donald D. “Hospitals Grab at Least $1 Billion in Extra Fees for Emergency Room Visits.”. The Center for Public Integrity. 2012 https://www.publicintegrity.org/2012/09/20/10811/hospitals-grab-least-1-billion-extra-fees-emergency-room-visits . [Google Scholar]

- 38.Burke L., Wild R., Orav J., Hsia R. “Are Trends in Billing for High-Intensity Emergency Care Explained by Changes in Services Provided in the Emergency Department? An Observational Study Among U.S. Medicare Beneficiaries”. British Medical Journal Open. 2018;((8)):1–019357. doi: 10.1136/bmjopen-2017-019357. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 39.Ahlman J., Attale T., Bell J., Besleaga A, Boudrea A., Jay T., et al. “CPT 2018 Standard”. American Medical Association. 2018:Page 16. [Google Scholar]

- 40.Ibid. [Google Scholar]

- 41.Ibid. [Google Scholar]

- 42.Burke. [Google Scholar]

- 43.Kliff S. “Emergency Rooms Are Monopolies. Patients Pay the Price.” Vox Media. December 4, 2017 https://www.vox.com/health-care/2017/12/4/16679686/emergency-room-facility-fee-monopolies . [Google Scholar]

- 44.Newman, Jeffrey “Emergency Room Billing Upcoding Schemes Making a Comeback.” Jeffrey Newman Law. February 6, 2018 https://www.whistleblowerlawyernews.com/emergency-room-billing-upcoding-schemes-making-comeback/. [Google Scholar]

- 45.Gibbs Low Group [Google Scholar]

- 46.Ibid. [Google Scholar]

- 47.O'Reilly K. “8 Medical Coding Mistakes that could Cost You.”. American Medical Association. August 14, 2018 https://wire.ama-assn.org/practice-management/8-medical-coding-mistakes-could-cost-yoi . [Google Scholar]

- 48.Centers for Medicare and Medicaid Services (CMS) “Avoiding Medicare Fraud & Abuse: A Roadmap for Physicians.”. Centers for Medicare and Medicaid Services, Medical Learning Network Booklet. 2017c. https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/Downloads/Fraud-Abuse-MLN4649244-Print-Friendly.pdf . [Google Scholar]

- 49.Rudman WJ., Eberhardt JS, 3rd, Pierce W., Hart-Hester S. Healthcare fraud and abuse. PubMed. 2009 https://www.ncbi.nlm.nih.gov/pubmed/20169019 . [PMC free article] [PubMed] [Google Scholar]

- 50.Coustasse A., Frame M., Mukherjee A. “Is Upcoding Anesthesia Time the Tip of theIceberg in Insurance Fraud?”. JAMA Network. 2018 doi: 10.1001/jamanetworkopen.2018.4302. https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2713030 . [DOI] [PubMed] [Google Scholar]

- 51.Ahlman. [Google Scholar]

- 52.CMS 2017c [Google Scholar]