Abstract

In response to the COVID-19 crisis, the U.S. government passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act on March 27, 2020, creating the Paycheck Protection Program (PPP), among others, to aid small businesses and their employees. Most PPP loans were administered by commercial banks in return for fees, and the banks bore little monitoring costs or risks, since PPP loans were forgivable by the government. I analyze if PPP loans of up to $1 million were net substitutes or complements for conventional small business loans of the same size for the PPP-issuing banks. The $1 million upper bound roughly corresponds to credits to the smallest firms that are often financially constrained. Using Call Report data through 2020:Q4, I find significant net complementarities. An additional dollar of PPP credit of up to $1 million had multiplier effects on conventional loans to the smallest firms of about an extra dollar.

Keywords: Banks, Small business loans, CARES act, Paycheck Protection Program, PPP, COVID-19

1. Introduction

In “This Time is Different: Eight Centuries of Financial Folly,” Reinhart and Rogoff (2009) analyze the history of crises and suggest that crises have more in common in terms of default than they differ from one another. Other crisis studies, such as Demirgüç-Kunt and Detragiache (1998), Berger and Bouwman (2013) and Laeven and Valencia (2020), classify some fundamentally different crisis categories based on their origins, such as crises in exchange markets, capital markets, or banking markets.

The crisis caused by the COVID-19 pandemic, however, can be argued to be really different and may have vastly different consequences. As discussed in Berger et al. (2021), the virus created public health shocks and government activity restriction shocks that harmed the real economy and were unrelated to any financial markets or institutions. In fact, prior to the crisis, the financial picture in the U.S. was so robust that the Federal Reserve decided to roll back its massive balance sheet and started to increase interest rates. The U.S. banks had ample liquidity and equity in early January 2020, and as soon as the virus hit the world, the structure of the banking industry allowed their workforce to quickly adopt the new normal of working remotely.

Although the crisis did not originate from the banks, it still threatened them because a weak real economy can result in significant loan losses and other problems that can quickly reduce the equity capital of banks, which are generally very highly leveraged. Thus, while the banks faced threats, they were from a completely different origin than in other crises, so we may expect different responses, and there is some extant evidence on this issue. For example, Berger et al. (2021) find that commercial borrowers with banking relationships fare worse than other borrowers during the COVID-19 crisis–a sharp departure from the findings in the literature for both normal times (e.g., Kysucky and Norden (2016)) and prior crises (e.g., Bolton et al. (2016)).

Early in the COVID-19 crisis, the U.S. government officials quickly came to realize that the widespread transformation in social behavior would lead to failing businesses, high unemployment, and a dramatic economic slowdown, and that the country would need an urgent stimulation to prevent an even deeper economic and social depression. As a result of a powerful bipartisan effort, the U.S. government passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act at the end of March 2020, providing a massive $2.2 trillion lifeline to the economy. Following the Act, the U.S. Department of the Treasury with the U.S. Small Business Administration (SBA) established the Paycheck Protection Program (PPP) to provide loans to help struggling businesses and their employees through banks and other financial institutions.1

Due to the design of the CARES Act, a firm that qualifies for a PPP loan would almost surely find it preferable to a conventional small business bank loan, since the forgivability of PPP loans would more than offset the additional paperwork costs in virtually all circumstances. Thus, PPP loans might be expected to substitute for conventional bank loans for many small businesses, resulting in a reduction in such conventional loans. The PPP credits may also complement conventional bank credit in some cases. The PPP loans may act as subsidies to the borrowing firms that improve their creditworthiness, making them more attractive candidates for additional conventional bank loans. Moreover, the banks may be enriched by the better performance of their PPP borrowers and/or the fee income provided by the program, increasing resources for loans to both PPP and non-PPP borrowers. Therefore, the overall effects of PPP loans on conventional small business bank loans can potentially go either way.

In this paper, I investigate to what extent the substitution versus complementarity between the PPP loans and conventional small business bank loans dominates the data. I particularly focus on the PPP loans under $1 million, which constitute about 99% of all PPP loans, and the conventional small business loans of the same size. I select $1 million as the threshold amount, as it is approximately the upper bound of loans to the most financially constrained smallest firms (e.g., Fazzari et al. (1988)). These firms are also the main target for support by the government policies. Fortunately, the Call Report schedule dedicated to loans to small businesses (Schedule RC-C) also has an upper limit of $1 million. These loans to the smallest firms are often relationship loans made by small banks with total assets under $1 billion, who have comparative advantages in these types of credits (e.g., Berger et al. (2005) and (2017a)). Since I analyze the entire set of U.S. commercial banks –most of which are under $1 billion– all these small banks are included in this paper. To put my research in context, Chodorow-Reich et al. (2020) analyze a similar question, but focus on commercial loans over $1 million made by the banks with over $100 billion in total assets. For that subset of data, they provide evidence that the PPP recipient firms reduced their non-PPP bank borrowings.

Using Call Report data through 2020:Q4, my results provide strong evidence that there are statistically and economically significant net complementarities between the PPP loans of up to $1 million and conventional small business bank loans of the same size. I find that an additional dollar of PPP credit resulted in $0.91 to $1.27 increase in total small business bank loans. Therefore, the PPP loans under $1 million had a substantial multiplier effect in generating additional small business portfolio loans of about the same size on average by the PPP-issuing banks. I check and verify that these findings are robust to various alternative specifications.

It is important to note that banks bore risks associated with these additional small business loans and the direct effect of the pandemic on small business bank loans was not economically significant. Therefore, the PPP can be viewed as a government subsidy program for small businesses that also fruitfully stimulated the banks to make small business loans with their own resources to help the survival of small businesses and their employees. Furthermore, the PPP multiplier effect measured in this paper may be understated to some extent since the PPP perhaps generated positive externalities that resulted in unmeasurable additional credits issued by non-PPP banks. All in all, the results presented in this paper would have some important policy implications for the future economic endeavors.

1.1. About the paycheck protection program

With the help of the CARES act, the U.S. Department of Treasury and the U.S. Small Business Administration (SBA) established a $659 billion loan initiative for small businesses called the Paycheck Protection Program (PPP) as a direct incentive to keep their workers on the payroll. With the amendment of Title 15 of the United States Code for the commerce and trade, PPP funds originally became available for loans created between February 15, 2020, and June 30, 2020. Hours before that original deadline, the Senate extended the PPP application deadline until the end of August 8, 2020. Then, the program ended on that new deadline by law and stopped accepting new applications by participating lenders. Most small businesses with less than 500 employees per physical location of the business were deemed as eligible borrowers, including businesses operating in industries with NAICS code 72, such as restaurants. Importantly, $10 million had been set to be the upper bound of a PPP loan that an eligible small business could borrow to retain employees, and the salaries were capped at $100,000. The SBA announced that the loans would be forgiven if the loan spending criteria were met by the borrowers.

All existing SBA-certified lenders were deemed eligible to process PPP loans, and all federally insured banks and credit unions, as well as farm credit systems and non-bank, non-insured depository institutions, were welcome to become a PPP lender with an application conditional on approval. The SBA guaranteed 100% of the balances, waived all guaranty fees, and compensated the lenders by paying them fees for processing PPP loans. In addition, in order to bolster the efficiency of the PPP, the Federal Reserve Board authorized all Federal Reserve Banks to institute their PPP Liquidity Facilities (PPPLF) to provide liquidity to financial institutions authorized to make PPP loans. Since the inception of the PPP through its end in August, more than five thousand participating lenders issued over $5.2 million in approved loans with an average loan size of about $100,000, which left some unused $134 billion within the program's budget. Total outstanding advances from the PPPLF throughout this program was about $67.5 billion.

Surveys show that PPP has been successful in helping borrowers. The COVID-19 Small Business Survey of the National Federation of Independent Business (2020) indicates that 78% of the respondents submitted an application for a PPP loan, almost all of their applications were approved, and 96% of the PPP applicants have been satisfied with the program to some extent. Also, the Small Business Credit Survey of the Federal Reserve System (2021) presents that firms that received PPP funds were more likely to retain their employees or attempt to rehire them. Importantly, 71% of the firms that did not receive PPP funds took action to reduce employment, whereas 46% of the firms that received all the PPP funds that they applied for took action to reduce employment. Similarly, while 44% of the firms that did not receive PPP funds attempted to rehire employees, 77% of the firms that received all the PPP funds that they applied for attempted to rehire employees.

1.2. The pandemic literature on the paycheck protection program

Berger and Roman (2020) provide an extensive review of the literature prior to the pandemic on theoretical and empirical evidence on bailouts and bail-ins through government sponsored programs. Concurrent pandemic literature on the various economic and social outcomes of the Coronavirus pandemic includes Baker et al. (2020a, 2020b, 2020c), Barrios et al. (2020), Bartik et al. (2020a), Beggs and Harvison (2020), Brunnermeier and Krishnamurthy (2020), English and Liang (2020), Erel and Liebersohn (2020), Hanson et al. (2020), Kaufmann (2020), Li et al. (2020) and Vardoulakis (2020).

Looking at contemporaneous papers on PPP, Li and Strahan (2020) examine the determinants of PPP lending and present the importance of relationships on PPP lending. Similarly, Amiram and Rabetti (2020) show that relationships increase the amount and approval speed of PPP loans. On the other hand, Berger et al. (2021) analyze if relationship borrowers do better or worse than other borrowers during the pandemic, and present that relationship borrowers have been subject to harsher contractual terms.

Several other studies analyze various aspects of the PPP, as well as bank lending during the pandemic. For example, Granja et al. (2020) examine if the PPP hit its targets, and present that the funds were actually provided to less damaged areas, and there were a substantial heterogeneity across banks providing those funds. Chodorow-Reich et al. (2020) analyze Y-14 data on the loans over $1 million made by the banks with over $100 billion in total assets and find that increases in bank credit were mostly from drawdowns by large firms on commitments. They also provide some evidence that the PPP recipient firms reduced their non-PPP bank borrowings. Levine et al. (2020) show that in countries with relatively more small banks, revenues of small firms and employment of low-income workers fall by relatively less in response to COVID-19. James et al. (2020) examine if community banks responded faster to the PPP loan requests than larger banks, and they present distance-based evidence consistent with their hypothesis. Similarly, Marsh and Sharma (2020) present that community banks played a substantial role in distribution of PPP funds. Bartik et al. (2020a) find that PPP loans increase a business's expected survival rate. Balyuk et al. (2020) present that some firms appear as unwilling to use PPP loans, larger firms received priority with access to early-stage PPP funds, and banking with large banks augmented this priority effect. Bartlett and Morse (2020) provide evidence that the PPP has helped the survival of the microbusinesses in the medium-run, but this result does not hold for larger small businesses. Atkins et al. (2021) offer evidence of discrimination in PPP lending and that the design of the program resulted in about 50% less funds for Black-owned businesses compared to the funds received by comparable white-owned businesses. Core and De Marco (2020) analyze the Italian Guarantee Fund, which is similar to the PPP, and show that larger banks and banks with better technologies make more guaranteed loans. Finally, Hasan et al. (2020) study the determinants of global syndicated loan prices during the pandemic. Their findings show strong evidence of increased spreads in response to the exposure to COVID-19 by the lenders and borrowers.

The literature on the Paycheck Protection Program and bank lending during the pandemic has been constantly growing over the last few months, as reviewed above. However, to the best of my knowledge, none of the concurrent research concentrates on a full-fledged analysis of the multiplier effects of the PPP on conventional small business bank loans under $1 million made by the complete set of banks in the Call Reports. The findings of Chodorow-Reich et al. (2020), as noted above, are for larger loans by the largest banks, which suggest that there may be a significant heterogeneity in the results of the program by loan size and bank size.

2. Methodology

2.1. Main data and variables

My analysis in this research paper employs the Consolidated Reports of Condition and Income, shortly known as the Call Reports, as the main source of data. I collect the quarterly Call Report data of all federally regulated U.S. banks from the Public Data Distribution website of the Federal Financial Institutions Examination Council (FFIEC) Central Data Repository. I use the bank structure files provided by the Federal Reserve Bank of Chicago to identify the structure and geographical variables of the banks in my main data. This main dataset includes 270,831 observations of 7891 entities between 2010:Q1 and 2020:Q4. I use this dataset to create most of the main bank variables in this paper, including the small business bank loans and gross total assets. I adjust all nominal values in this paper to the 2010 prices using the Consumer Price Indices (CPI) of the Bureau of Labor Statistics (BLS). Table 1 provides brief definitions of the variables in my models.

Table 1.

Variable definitions.

| Variable | Definition |

|---|---|

| C&I-S-loans | Total outstanding small commercial and industrial business loans with original amounts of $100,000 or less. |

| C&I-M-loans | Total outstanding small commercial and industrial business loans with original amounts of more than $100,000 to $250,000. |

| C&I-L-loans | Total outstanding small commercial and industrial business loans with original amounts of more than $250,000 to $1000,000. |

| CRE-S-loans | Total outstanding small business commercial real estate loans secured by non-farm non-residential properties with original amounts of $100,000 or less. |

| CRE-M-loans | Total outstanding small business commercial real estate loans secured by non-farm non-residential properties with original amounts of more than $100,000 to $250,000. |

| CRE-L-loans | Total outstanding small business commercial real estate loans secured by non-farm non-residential properties with original amounts of more than $250,000 to $1000,000. |

| PPP | Total amount of Paycheck Protection Program (PPP) loans made by the bank. |

| CORONA | Coronavirus pandemic time dummy. |

| GTA | Gross total assets: Total bank assets + allowance for loan and lease losses + the allocated transfer risk reserve. |

| CDEP | Core deposits: Transaction deposits + savings deposits + small time deposits |

| REPO | Repurchase agreements. |

| HOTM | Hot money: Brokered deposits + liability for short positions + other trading liabilities + other borrowed money with a remaining maturity less than 1 year. |

| FHLB | Federal home loan bank borrowings. |

| LARGE | Large bank (GTA > $1 billion) dummy. |

| BH | Part of a bank holding company dummy. |

| FORN | Mostly foreign-owned (> 50%) dummy. |

| LISTED | Listed bank dummy. |

| SWAP | Credit default swap spread available dummy. |

| FRS | Primarily regulated by the Federal Reserve System dummy. |

| FDIC | Primarily regulated by the FDIC dummy. |

| HHI | Herfindahl-Hirshman index of market concentration by counties. Based on total deposits. |

| ROE | Return on equity. |

| ROASD8 | Moving standard deviation of return on assets over last 8 quarters. |

| CASES | Total quarterly coronavirus cases in a county in 2020:Q1 per population. |

| VUL | County COVID-19 Vulnerability Index in 2019. |

The small business bank loans data come with the Call Reports. Prior to the last financial crisis of 2007–2009, the Federal Deposit Insurance Corporation (FDIC) used to collect information on small business bank loans once a year in the second quarter. During the crisis, however, the FDIC realized the importance of and the need for having the small business bank loans data on a more frequent basis and started requesting them quarterly just like other key bank data. In the FFIEC 041 form, loans to small businesses are separated into two big borrower-based categories: commercial real estate (CRE) loans secured by non-farm non-residential properties, and commercial and industrial (C&I) loans. Within these two categories, quantities and currently outstanding total amounts of the bank loans are asked under three amount-based categories: loans with original amounts of $100,000 or less, loans with original amounts of more than $100,000 through $250,000, and loans with original amounts of more than $250,000 through $1000,000.

Looking at Table 2 , banks held about 24 million small business loans in 2020:Q1, and the same statistic was about 25.1 million small business loans a year earlier in 2019:Q1.2 The total outstanding amount of small business bank loans in 2020:Q1 was about $560.9 billion, and in 2019:Q1, it was $542.7 billion. In 2020:Q2, on the other hand, banks held about 26.8 million small business loans, and the total outstanding amount of small business bank loans was $726.7 billion3 . Therefore, the total amount of small business bank loans was substantially larger in 2020:Q2 than in prior quarters.

Table 2.

Small business bank loans and PPP loans.

| Number of small business bank loans | Total amount of small business bank loans | Number of PPP bank loans | Total amount of PPP bank loans | |

|---|---|---|---|---|

| 2019:Q1 | 25,073,588 | 542,723,200 | - | - |

| 2019:Q2 | 23,233,116 | 542,662,016 | - | - |

| 2019:Q3 | 23,411,452 | 537,578,560 | - | - |

| 2019:Q4 | 23,370,900 | 540,359,872 | - | - |

| 2020:Q1 | 23,947,744 | 560,926,848 | - | - |

| 2020:Q2 | 26,773,100 | 726,728,896 | 4363,602 | 405,811,136 |

| 2020:Q3 | 26,555,012 | 732,310,720 | 4601,619 | 407,986,592 |

| 2020:Q4 | 26,590,582 | 688,824,704 | 3996,112 | 338,671,584 |

Notes: Monetary values are in thousands of 2010 U.S. dollars.

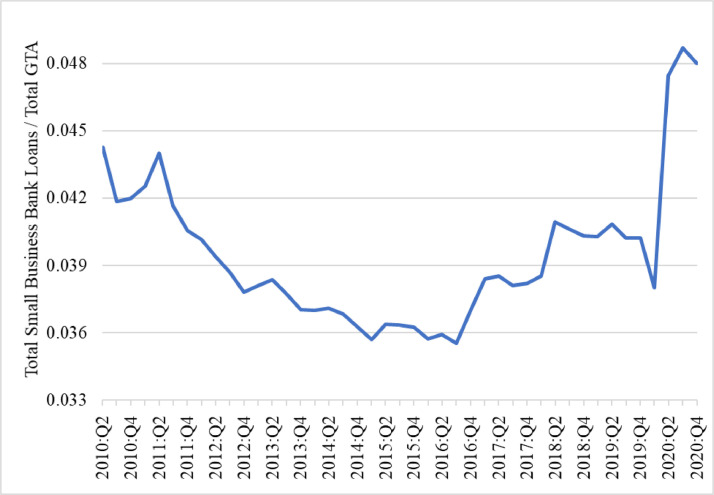

In Fig. 1 , I present the quarterly ratio of total small business bank loans with respect to gross total assets of all banks. As shown, in 2019:Q4, right before the COVID-19 shock, this ratio is about 0.040. Then in 2020:Q1, there is a sharp decline in this ratio to 0.038. In the quarters following the decline, the ratio increases dramatically to about 0.049. In 2020:Q4, it starts declining slowly.

Fig. 1.

Total Small Business Bank Loans over Total Gross Total Assets (GTA). Notes: This figure presents the ratio of the quarterly total of small business bank loans over the quarterly total of gross total assets of the banks. The volume of total small business loans in the figure does not include the PPP loans made by the banks.

Some PPP loan data, such as the total outstanding balance of PPP loans of a bank, are available from the Call Reports in a new memorandum started in 2020:Q2 that constitute the main PPP data. However, for the econometric analyses in this paper, there is a need to know the total amount of PPP loans that is recorded in different size categories of small business bank C&I loans.4 Hence, to supplement that data, I also collect the PPP loan data from the website of the Small Business Administration (SBA). The SBA PPP database includes all PPP loans that have been approved since the beginning of the program in April 4, 2020 until the end of the program on August 8, 2020. This dataset has some basic information about the PPP loans and the borrowers, and limited information about the lenders, which are banks and non-bank financial institutions approved by the SBA. The SBA PPP data do not provide any identification numbers of the lenders. In order to merge the PPP data with the Call Reports data, I program a matching algorithm based on the names and locations of the lenders. I also crosscheck the SBA PPP data with the PPP data from the Call Reports and verify the match.5

Overall, 5460 lenders, including banks and other financial institutions, participated in the PPP program, and they made 5212,128 PPP loans that are worth approximately $525 billion total. About 99% of all PPP loans are of sizes smaller than $1000,000, with the smallest loans under $50,000 being the most popular (about 69%). So, with respect to the size of the loans, PPP loans are quite similar to the small business bank loans. Banks were the dominant players in the PPP market. For example, 94% percent of all PPP loans were created by banks and the top ten PPP lenders were all banks. According to my data, out of 5127 banks, 4234 of them (82.58%) made at least one PPP loan in 2020. Table 2 shows that in 2020:Q2, the total number of outstanding bank PPP loans were about 4.4 million, and the total outstanding balance of bank PPP loans were about $405.8 billion.

Based on the NAICS codes in the data, most PPP loans created by banks were secured by construction companies (12.01%) including non-residential building construction and building equipment contractors; professional, scientific, and technical services (10.17%) including legal services; and other service companies (11.62%) including automotive repair and maintenance, and personal care services. Health care and social assistance companies are the second biggest PPP borrowers in terms of total loan amount ($7.04 billion) following the construction companies ($7.71 billion).

Finally, the pairwise correlation between the number of bank PPP loans and the number of small business bank loans is 0.6162, and the pairwise correlation between the amount of bank PPP loans and the amount of small business bank loans is 0.8972. These fairly high, positive correlations provide preliminary evidence of the relationship between the bank PPP loans and small business bank loans. In the following section, I set up an econometric model to analyze this relationship in detail.

2.2. Baseline empirical model

For my baseline empirical model, I use a modified bank loan production model similar to that presented by Berger et al. (2017a). In my model outlined below, banks collect and use deposits and other resources to make loans.

| (1) |

The difference operator in Eq. (1) refers to the change in a variable since the same quarter of the previous year6 . variable is bank i’s total small business loans at year-quarter t. Following the Call Reports, small business loans are categorized in six categories based on two borrower types (CRE and C&I), and three amount intervals ($100,000 or less; $100,000 to $250,000; $250,000 to $1000,000). It is important to note that these conventional small business bank loans do not include PPP loans.7 stands for the quarter-lagged gross total assets that I use to normalize monetary values. Table 3 provides the descriptive statistics of the variables that I use in the empirical model above.

Table 3.

Descriptive statistics.

| Variable | Mean | Standard deviation | 5th Percentile | 95th Percentile |

|---|---|---|---|---|

| C&I-S-loans | 18.73 M | 346.41 M | 0 | 20 M |

| C&I-M-loans | 8.81 M | 86.21 M | 0 | 20 M |

| C&I-L-loans | 20.15 M | 170.30 M | 0 | 51 M |

| CRE-S-loans | 2.02 M | 8.09 M | 0 | 6 M |

| CRE-M-loans | 7.53 M | 38.41 M | 0 | 20 M |

| CRE-L-loans | 35.69 M | 219.89 M | 0 | 99 M |

| PPP | 5.05 M | 165.46 M | 0 | 0 |

| CORONA | 0.075 | 0.263 | 0 | 1 |

| GTA | 2347.94 M | 40,742.93 M | 28.73 M | 2289.29 M |

| CDEP | 1381.81 M | 23,111.62 M | 21 M | 1571 M |

| REPO | 44.41 M | 1800.18 M | 0 | 2 M |

| HOTM | 191.60 M | 3483.06 M | 0 | 92 M |

| FHLB | 62.04 M | 855.34 M | 0 | 89 M |

| LARGE | 0.082 | 0.275 | 0 | 1 |

| BH | 0.808 | 0.394 | 0 | 1 |

| FORN | 0.007 | 0.084 | 0 | 0 |

| LISTED | 0.081 | 0.272 | 0 | 1 |

| SWAP | 0.003 | 0.053 | 0 | 0 |

| FRS | 0.130 | 0.336 | 0 | 1 |

| FDIC | 0.630 | 0.483 | 0 | 1 |

| HHI | 0.4411 | 0.2814 | 0.0948 | 1.0000 |

| ROE | 0.0255 | 0.2552 | -0.0057 | 0.0604 |

| ROASD8 | 0.0017 | 0.0533 | 0.0002 | 0.0037 |

| CASES | 0.1891 | 1.1372 | 0.0000 | 0.2095 |

| VUL | 91.1933 | 20.9850 | 58.3500 | 122.1400 |

Number of observations = 270,831.

Notes: M stand for millions. Monetary values are in 2010 U.S. dollars.

The key right-hand side variable is , which is a bank's outstanding total balance of PPP loans of up to $1 million. Right-hand side variables also include a Coronavirus pandemic time dummy variable, CORONA, to measure the direct effects of the pandemic on the small business bank loans. Other right-hand side variables include core deposits, repos, and other hot money as resource variables. I have also included a resource variable based on Federal Home Loan Bank borrowings.8

In the literature, many studies including Berger and Black (2011) and Almanidis et al. (2019) indicate that large banks have different production technologies. To control for that effect, I include a dummy variable, LARGE, that is equal to 1 if the gross total assets of a bank is greater than $1 billion. Some other bank-specific dummy variables that I include in the model are a swap dummy variable that is 1 if credit default swap spread is available to a bank, and a bank holding company dummy variable that is 1 if a bank is a part of a bank holding, which would control for if bank holding companies act as internal capital markets for allocating funds across their subsidiaries. Also, in order to account for the regulatory environment in which the bank operates, I include a foreign-owned dummy variable that is 1 if the ownership of the bank is at least 50% foreign, as well as two dummy variables controlling if the primary regulator of the bank is the Federal Reserve System (FRS) or Federal Deposit Insurance Corporation (FDIC) omitting one last dummy variable based on the Office of the Comptroller of the Currency (OCC) as the primary regulator to avoid the dummy trap.

Moreover, I include some bank and market-risk related variables in the model. The LISTED variable controls for if a bank is listed publicly at a point in time. To create the LISTED variable, I use the CRSP-FRB link data supplied by the Federal Reserve Bank of New York.9 The LISTED variable is equal to 1 if a bank has been publicly listed at least for one day in a given quarter. Following the literature on the potential effects of market competition on production such as Berger and Bouwman (2013), Berger et al. (2016), and Karakaplan et al. (2019), I add a Herfindahl-Hirshman Index (HHI) of market concentration in my model. To calculate the HHI, I used total deposits data that I collected from the Statistics on Depository Institutions (SDI) of the Federal Deposit Insurance Corporation (FDIC). Finally, the model includes the return on equity and the moving standard deviation of return on assets of a bank over the last 8 quarters.

3. Baseline estimation results

All regression tables presented below report OLS estimates of the effects of PPP loans on small business bank loans as outlined in Eq. (1). Also, all estimations include bank and time fixed effects, which are not presented in the tables for brevity. Lastly, all regression tables present robust standard errors clustered at the bank-level.

3.1. Small business bank loans for commercial and industrial businesses

Table 4 presents the estimation results for the model with three different size categories of the small business commercial and industrial (C&I) loans as the dependent variable.

Table 4.

Estimation results – small business C&I Bank loans.

| (C&I-S-loans / GTA) | (C&I-M-loans / GTA) | (C&I-L-loans / GTA) | ||||

|---|---|---|---|---|---|---|

| (PPP / GTA) | 0.2687*** | (0.059) | 0.1407*** | (0.023) | 0.2209*** | (0.022) |

| CORONA | 0.0128*** | (0.003) | 0.0061*** | (0.001) | 0.0098*** | (0.001) |

| (CDEP / GTA) | 0.0000 | (0.000) | 0.0000 | (0.000) | 0.0001 | (0.000) |

| (REPO / GTA) | 0.0016 | (0.001) | 0.0031** | (0.001) | 0.0109*** | (0.004) |

| (HOTM / GTA) | -0.0001 | (0.000) | 0.0005 | (0.000) | 0.0014 | (0.001) |

| (FHLB / GTA) | 0.0053* | (0.003) | 0.0058*** | (0.002) | 0.0199*** | (0.003) |

| LARGE | -0.0002 | (0.000) | -0.0000 | (0.000) | 0.0001 | (0.000) |

| BH | -0.0004** | (0.000) | -0.0001 | (0.000) | 0.0001 | (0.000) |

| FORN | 0.0002 | (0.000) | -0.0000 | (0.000) | -0.0004** | (0.000) |

| LISTED | -0.0003*** | (0.000) | -0.0002*** | (0.000) | -0.0002* | (0.000) |

| SWAP | 0.0003 | (0.000) | 0.0001 | (0.000) | 0.0004** | (0.000) |

| FRS | -0.0001 | (0.000) | -0.0001* | (0.000) | -0.0002* | (0.000) |

| FDIC | -0.0001 | (0.000) | -0.0000 | (0.000) | 0.0001 | (0.000) |

| HHI | 0.0002* | (0.000) | 0.0003*** | (0.000) | 0.0007*** | (0.000) |

| ROE | 0.0001* | (0.000) | 0.0001 | (0.000) | -0.0000 | (0.000) |

| ROASD8 | 0.0000 | (0.000) | 0.0000 | (0.000) | -0.0001 | (0.000) |

| Constant | -0.0003 | (0.000) | -0.0003*** | (0.000) | -0.0008*** | (0.000) |

| Observations | 239,121 | 239,121 | 239,121 | |||

Notes: This table reports the OLS estimates of the effect of PPP loans on commercial and industrial (C&I) small business bank loans. The panel data is from 2010:Q1 to 2020:Q4. Small business bank loans are categorized into three amount intervals: $100,000 or less (S-loans), $100,000 to $250,000 (M-loans), and $250,000 to $1000,000 (L-loans). The difference operator stands for the change in a variable since the same quarter of the previous year. The dependent variable and the PPP variable are normalized with respect to lagged GTA. All other control variables are one-period lagged. All estimations include bank and time fixed effects, which are not presented for brevity. Robust standard errors are clustered by banks and presented in parentheses. Asterisks indicate significance at the 1% (***), 5% (**) and 10% (*) levels.

As discussed above, conventional small business loans for which the banks bear the credit risk and PPP loans may be either substitutes or complements, and the results for small business C&I loans shown in Table 4 provide strong evidence suggesting that they are primarily complements. The estimated effects of the PPP loans on small business C&I loans are positive and statistically significant at the 1% level in all columns of Table 4, consistent with the empirical dominance of complementarities over potential substitutions. The estimated effects are also quite strong economically, suggesting that an additional dollar of PPP credit results in an estimated increase in small-sized, medium-sized, and large-sized small business C&I loans by 27, 14, and 22 cents, respectively. The total effect is about 63 cents of additional total C&I loans for every dollar of PPP credit. This PPP multiplier effect is an important indication of how successful the PPP was in stimulating small business C&I loans.

Moreover, the effect of PPP loans on the smallest-sized small business C&I loans (C&I-S-loans) is greater than that of the larger-sized small business C&I loans (C&I-M-loans and C&I-L-loans). That difference may be due to the fact that the PPP loans that are designed to be limited in size may be complemented by smallest-sized small business bank loans better than the larger-sized loans. As indicated above, the complementarities may be due to the establishment or reinforcement of a lending relationship through the PPP, or due to the strengthened creditworthiness of the PPP borrowers, yielding more conventional bank credits. Investigation of the source of such complementarities, however, is beyond the scope of this paper due to lack of detailed data on borrower risks.

The effect of the Coronavirus pandemic dummy variable CORONA is positive and significant at the 1% level, which is an indication of the direct positive impact of the pandemic on commercial and industrial small business bank loans. But the effect is economically small (less than 0.013 in all columns), which would mean that the direct effect of the pandemic probably did not stimulate the banks too much to increase their small business C&I loans. Compared to the effect of the PPP intervention term, the small magnitude of CORONA may be a sign of the banks’ unwillingness to lend conventional bank loans to risky small businesses.

3.2. Small business bank loans for commercial real estate

Table 5 presents the estimation results for the model with three size categories of the small business commercial real estate (CRE) bank loans as the dependent variable.

Table 5.

Estimation results – small business CRE bank loans.

| (CRE-S-loans / GTA) | (CRE-M-loans / GTA) | (CRE-L-loans / GTA) | ||||

|---|---|---|---|---|---|---|

| (PPP / GTA) | 0.1204*** | (0.027) | 0.0605*** | (0.011) | 0.0905*** | (0.011) |

| CORONA | 0.0018** | (0.001) | 0.0027*** | (0.000) | 0.0059*** | (0.000) |

| (CDEP / GTA) | 0.0000 | (0.000) | 0.0000 | (0.000) | 0.0001 | (0.000) |

| (REPO / GTA) | 0.0014 | (0.001) | 0.0026** | (0.001) | 0.0124** | (0.005) |

| (HOTM / GTA) | 0.0001 | (0.000) | 0.0004 | (0.000) | 0.0015 | (0.001) |

| (FHLB / GTA) | 0.0029** | (0.001) | 0.0054*** | (0.001) | 0.0269*** | (0.004) |

| LARGE | 0.0003*** | (0.000) | 0.0003*** | (0.000) | 0.0009*** | (0.000) |

| BH | -0.0003*** | (0.000) | -0.0002*** | (0.000) | -0.0005*** | (0.000) |

| FORN | 0.0004*** | (0.000) | 0.0004*** | (0.000) | 0.0003 | (0.000) |

| LISTED | 0.0001* | (0.000) | 0.0001*** | (0.000) | 0.0002* | (0.000) |

| SWAP | 0.0003*** | (0.000) | 0.0002* | (0.000) | 0.0007** | (0.000) |

| FRS | -0.0001* | (0.000) | -0.0001*** | (0.000) | -0.0005*** | (0.000) |

| FDIC | -0.0001** | (0.000) | -0.0001** | (0.000) | -0.0002** | (0.000) |

| HHI | -0.0001 | (0.000) | 0.0001* | (0.000) | 0.0009*** | (0.000) |

| ROE | 0.0000 | (0.000) | -0.0000 | (0.000) | -0.0001 | (0.000) |

| ROASD8 | 0.0001*** | (0.000) | 0.0001** | (0.000) | 0.0001 | (0.000) |

| Constant | 0.0001 | (0.000) | 0.0002*** | (0.000) | 0.0005** | (0.000) |

| Observations | 239,121 | 239,121 | 239,121 | |||

Notes: This table reports the OLS estimates of the effect of PPP loans on small business CRE bank loans. The panel data is from 2010:Q1 to 2020:Q4. Small business bank loans are categorized into three amount intervals: $100,000 or less (S-loans), $100,000 to $250,000 (M-loans), and $250,000 to $1000,000 (L-loans). The difference operator stands for the change in a variable since the same quarter of the previous year. The dependent variable and the PPP variable are normalized with respect to lagged GTA. All other control variables are one-period lagged. All estimations include bank and time fixed effects, which are not presented for brevity. Robust standard errors are clustered by banks and presented in parentheses. Asterisks indicate significance at the 1% (***), 5% (**) and 10% (*) levels.

Looking at the estimated effects of the PPP loans on small business CRE loans, they are positive and statistically significant at the 1% level in all columns in Table 5, providing empirical evidence of how complementarities between PPP loans and small business CRE loans dominate potential substitutions of PPP loans for small business CRE loans. Also, the magnitudes of the effect are important economically that for every additional dollar of PPP credit, the small-sized, medium-sized, and large-sized small business CRE loans increase by 12, 6, and 9 cents, respectively. That is about 27 cents total of additional small business CRE loans for every dollar of PPP credit. The degree of this PPP multiplier effect provides an empirical evidence of how well the PPP stimulated small business CRE loans.

Furthermore, the coefficients of the PPP in Table 5 indicate that the PPP loans increase the smallest-sized small business CRE loans (CRE-S-loans) more than that of the larger-sized small business CRE loans (CRE-M-loans and CRE-L-loans). Once again, this outcome may be due to the fact that PPP loans come with usage and size restrictions and the smallest-sized conventional small business CRE loans would better complement the restricted PPP loans than the larger-sized small business CRE loans. As discussed above, the complementarities between the PPP loans and small business CRE loans may be due to the relationships that are either newly founded or bolstered between the borrowers and banks through PPP loans, or due to the improved creditworthiness of the PPP borrowers as a result of the virtually risk-free nature of the PPP loans. However, the origins of these complementarities are not analyzed in this paper due to lack of data.

Lastly, the effect of the dummy variable CORONA in Table 5 is positive and significant at the 1% level. The magnitude of the effect, however, is economically minuscule (less than 0.006 in all columns). So, when all other determinants of the small business bank loans are controlled for, the direct effect of the pandemic on the small business CRE bank loans is almost non-existent. This outcome provides a clue of how banks would be hesitant to make loans to risky small CRE businesses if banks were left on their own by the government without any stimulation.

3.3. Total small business bank loans

In order to analyze the effects of the PPP on the total small business bank loans, I aggregate small business bank loans under three categories: total small businesses C&I loans, total small business CRE loans, and the overall total of small business loans of a bank, which is the sum of the former two categories. Table 6 reports the effects of the PPP on these aggregated small business bank loan categories.

Table 6.

Estimation results – total small business bank loans.

| (Total C&I loans / GTA) | (Total CRE loans / GTA) | (Total C&I and CRE loans / GTA) | ||||

|---|---|---|---|---|---|---|

| (PPP / GTA) | 0.6302*** | (0.049) | 0.2869*** | (0.026) | 0.9171*** | (0.075) |

| CORONA | 0.0287*** | (0.003) | 0.0039*** | (0.001) | 0.0326*** | (0.004) |

| (CDEP / GTA) | 0.0001 | (0.000) | 0.0001 | (0.000) | 0.0002 | (0.000) |

| (REPO / GTA) | 0.0155*** | (0.006) | 0.0166** | (0.006) | 0.0321*** | (0.012) |

| (HOTM / GTA) | 0.0018 | (0.002) | 0.0021 | (0.002) | 0.0039 | (0.004) |

| (FHLB / GTA) | 0.0310*** | (0.007) | 0.0356*** | (0.007) | 0.0666*** | (0.013) |

| LARGE | -0.0001 | (0.000) | 0.0014*** | (0.000) | 0.0013*** | (0.000) |

| BH | -0.0004 | (0.000) | -0.0011*** | (0.000) | -0.0014*** | (0.000) |

| FORN | -0.0002 | (0.000) | 0.0011*** | (0.000) | 0.0008 | (0.001) |

| LISTED | -0.0007*** | (0.000) | 0.0004** | (0.000) | -0.0003 | (0.000) |

| SWAP | 0.0008** | (0.000) | 0.0012** | (0.000) | 0.0020*** | (0.001) |

| FRS | -0.0004* | (0.000) | -0.0008*** | (0.000) | -0.0012*** | (0.000) |

| FDIC | -0.0000 | (0.000) | -0.0004*** | (0.000) | -0.0004 | (0.000) |

| HHI | 0.0011*** | (0.000) | 0.0009*** | (0.000) | 0.0021*** | (0.000) |

| ROE | 0.0001 | (0.000) | -0.0001 | (0.000) | 0.0001 | (0.000) |

| ROASD8 | 0.0000 | (0.000) | 0.0003* | (0.000) | 0.0003 | (0.000) |

| Constant | -0.0014*** | (0.000) | 0.0008*** | (0.000) | -0.0006 | (0.001) |

| Observations | 239,121 | 239,121 | 239,121 | |||

Notes: This table reports the OLS estimates of the effect of PPP loans on total small business bank loans. The panel data is from 2010:Q1 to 2020:Q4. Total small business bank loans are categorized into three groups: total small business C&I loans (Total C&I loans), total small business CRE loans (Total CRE loans), and overall total of the small business loans of a bank (Total C&I and CRE loans). The difference operator stands for the change in a variable since the same quarter of the previous year. The dependent variable and the PPP variable are normalized with respect to lagged GTA. All other control variables are one-period lagged. All estimations include bank and time fixed effects, which are not presented for brevity. Robust standard errors are clustered by banks and presented in parentheses. Asterisks indicate significance at the 1% (***), 5% (**) and 10% (*) levels.

In all columns of Table 6, the coefficients of the PPP term are positive and statistically significant at the 1% level, which is in line with the empirical evidence presented earlier that the complementarities between the PPP loans and small business bank loans dominate their substitutability. Moreover, the estimated effects of the PPP are economically significant, too. In the first column of Table 6, an extra dollar of PPP credit results in an extra 63 cents of total small business C&I bank loans. In addition to that, the second column of Table 6 shows that an extra dollar of PPP credit results in an extra 29 cents of total small business CRE bank loans. Hence, as presented in the third column, the estimated overall total effect of an extra dollar of PPP credit is an extra 92 cents of total small business bank loans. In other words, the PPP multiplier effect on total small business bank loans is 92%, which can reasonably be considered as successful. This multiplier effect may also be underestimated to some extent due to the fact that the PPP probably generated positive economic externalities that resulted in some additional credits issued by non-PPP banks that are not measurable in the current setting.

It is also important to note that the estimated multiplier effect of the PPP on total small business C&I bank loans is about twice as large as the multiplier effect of the PPP on total small business CRE loans. This difference may be due to the fact that while CRE loans require a tangible real estate collateral, C&I loans are much more affected by relationship lending as analyzed by Berger and Black (2011). So, if the complementarities between the PPP loans and small business loans are due to the initiation or fortification of a borrower-lender relationship through the PPP that catalyzes other small business loans between them, then it would be expected for the PPP loans to increase the C&I loans more than the CRE loans. Once again, a few other factors, such as improved creditworthiness of the PPP-borrowers, are probably at the heart of the complementarities between the PPP loans and conventional total small business bank loans. However, as explained above, since the relevant data is not completely available, exploring the origins of these complementarities is beyond the scope of this paper.

In all columns of Table 6, the CORONA coefficient is positive and significant at the 1% level, which measures the direct influence of the pandemic on total conventional small business bank loans. The magnitude of this effect, however, is less than 0.033 in each column, which is substantially smaller than the positive effect of the PPP term in the corresponding column. Therefore, when all other factors are taken into account, the isolated effect of the pandemic on the total small business bank loans are economically trivial. That is, in the absence of government intervention through the PPP, small business bank loans would not increase much solely due to the pandemic, probably since those loans are considered riskier by the banks without the PPP stimulation.

4. Models for robustness check

In this section, I check the robustness of the results discussed in the previous section by modifying the model specified in Eq. (1).

4.1. Total small business loans with unused commitments

As documented by the Federal Reserve in the April 2020 Senior Loan Officer Opinion Survey on Bank Lending Practices, since the pandemic started, banks had been tightening the standards across many loan categories, including small business bank loans. Firms, on the other hand, have been drawing down a lot of liquidity from their revolving lines of credit as presented by Glancy et al. (2020). Hence, some of the bank lending during the pandemic has probably been involuntary on the banks’ side.10 In order to account for these preexisting commitments that have been established by the banks prior to the pandemic, I follow Cornett et al. (2011), Berger et al. (2017a) and Acharya et al. (2018), and modify the model to include unused commitments in corresponding small business bank loan categories.11 Table 7 reports the effects of the PPP on the aggregated small business bank loans and unused commitments.

Table 7.

Estimation results – total small business loans with unused committments.

| (Total C&I loans with UC / GTA) | (Total CRE loans with UC / GTA) | (Total C&I and CRE loans with UC / GTA) | ||||

|---|---|---|---|---|---|---|

| (PPP / GTA) | 0.6329*** | (0.047) | 0.2823*** | (0.026) | 0.9079*** | (0.073) |

| CORONA | 0.0282*** | (0.003) | 0.0057*** | (0.001) | 0.0351*** | (0.005) |

| (CDEP / GTA) | 0.0002 | (0.000) | 0.0002 | (0.000) | 0.0004 | (0.000) |

| (REPO / GTA) | 0.0206* | (0.012) | 0.0216** | (0.010) | 0.0346* | (0.021) |

| (HOTM / GTA) | 0.0025 | (0.003) | 0.0029 | (0.003) | 0.0057 | (0.006) |

| (FHLB / GTA) | 0.0441*** | (0.012) | 0.0477*** | (0.008) | 0.0938*** | (0.022) |

| LARGE | 0.0001 | (0.000) | 0.0025*** | (0.000) | 0.0024*** | (0.001) |

| BH | -0.0000 | (0.001) | -0.0010*** | (0.000) | -0.0004 | (0.001) |

| FORN | -0.0025 | (0.002) | 0.0006 | (0.000) | -0.0026 | (0.004) |

| LISTED | 0.0002 | (0.000) | 0.0010*** | (0.000) | 0.0009 | (0.001) |

| SWAP | 0.0001 | (0.002) | 0.0007 | (0.001) | -0.0016 | (0.004) |

| FRS | 0.0001 | (0.000) | -0.0004** | (0.000) | -0.0000 | (0.001) |

| FDIC | 0.0006** | (0.000) | -0.0001 | (0.000) | 0.0008* | (0.000) |

| HHI | 0.0010** | (0.000) | 0.0007*** | (0.000) | 0.0020*** | (0.001) |

| ROE | 0.0017 | (0.001) | 0.0002 | (0.000) | 0.0021 | (0.001) |

| ROASD8 | -0.0014** | (0.001) | 0.0000 | (0.000) | -0.0029*** | (0.001) |

| Constant | 0.0017 | (0.002) | 0.0004 | (0.000) | 0.0028 | (0.002) |

| Observations | 239,121 | 239,121 | 239,121 | |||

Notes: This table reports the OLS estimates of the effect of PPP loans on total small business bank loans with unused commitments (UC). The panel data is from 2010:Q1 to 2020:Q4. Total small business bank loans are categorized into three groups: total small business C&I loans (Total C&I loans), total small business CRE loans (Total CRE loans), and overall total of the small business loans of a bank (Total C&I and CRE loans). The difference operator stands for the change in a variable since the same quarter of the previous year. The dependent variable and the PPP variable are normalized with respect to lagged GTA. All other control variables are one-period lagged. All estimations include bank and time fixed effects, which are not presented for brevity. Robust standard errors are clustered by banks and presented in parentheses. Asterisks indicate significance at the 1% (***), 5% (**) and 10% (*) levels.

The estimated effect of the PPP variable in Table 7 is quite similar to that in Table 6. In all columns of Table 7, the PPP is positive and statistically significant at the 1% level, indicating that even when unused commitments are taken into account, complementarities between the PPP and total small business bank loans dominate possible substitutions. Economically, the estimated effects of the PPP in Table 7 are within the 1% range of that in Table 6. That is, an additional dollar of PPP credit results in an estimated increase by 63 cents in total small business C&I loans, 28 cents in total small business CRE loans, and 91 cents in overall total of small business bank loans. Hence, the results discussed in Section 3 for the effects of the PPP are not sensitive with respect to modifying the baseline model to account for the unused commitments.

4.2. Total small business loans with unused commitments by bank size

In Table 8 , I aggregate all small business C&I and CRE bank loans and unused commitments and look at the effects of the PPP on the total amount of small business bank loans by bank size. The findings show that the effects of the PPP on total small business bank loans that I discussed in the previous section are mostly prevalent across banks of different sizes.

Table 8.

Estimation results – small business loans with unused commitments by bank size.

| (Total C&I and CRE with UC / GTA) Small Banks | (Total C&I and CRE with UC / GTA) Large Banks | (Total C&I and CRE loan with UC / GTA) Largest Banks | ||||

|---|---|---|---|---|---|---|

| (PPP / GTA) | 0.9126*** | (0.074) | 0.6060*** | (0.107) | 0.4976 | (0.504) |

| CORONA | 0.0368*** | (0.005) | 0.0091 | (0.006) | 0.0169 | (0.011) |

| (CDEP / GTA) | 0.0003 | (0.000) | 0.2026*** | (0.037) | 0.2834*** | (0.077) |

| (REPO / GTA) | 0.0352* | (0.019) | 0.1682*** | (0.053) | 0.0560 | (0.154) |

| (HOTM / GTA) | 0.0043 | (0.005) | 0.1340*** | (0.027) | 0.1637*** | (0.027) |

| (FHLB / GTA) | 0.0751*** | (0.014) | 0.1542*** | (0.043) | 0.1106 | (0.069) |

| BH | -0.0005 | (0.001) | 0.0030* | (0.002) | -0.0267** | (0.010) |

| FORN | -0.0005 | (0.001) | -0.0192** | (0.008) | 0.0160* | (0.009) |

| LISTED | 0.0008 | (0.001) | 0.0002 | (0.001) | -0.0026 | (0.009) |

| SWAP | 0.0146** | (0.007) | 0.0051 | (0.004) | -0.0121** | (0.005) |

| FRS | -0.0001 | (0.001) | 0.0012 | (0.002) | 0.0002 | (0.006) |

| FDIC | 0.0009** | (0.000) | 0.0011 | (0.002) | -0.0089* | (0.005) |

| HHI | 0.0019*** | (0.001) | 0.0009 | (0.002) | 0.0110 | (0.008) |

| ROE | 0.0023 | (0.002) | 0.0013*** | (0.000) | 0.1047 | (0.065) |

| ROASD8 | -0.0025** | (0.001) | 0.0223 | (0.130) | 1.9413* | (1.146) |

| Constant | 0.0030* | (0.002) | -0.0010 | (0.003) | 0.0099 | (0.013) |

| Observations | 219,519 | 17,839 | 1763 | |||

Notes: This table reports the OLS estimates of the effect of PPP loans on total small business bank loans with unused commitments (UC) by bank size. The panel data is from 2010:Q1 to 2020:Q4. Banks are categorized into three size groups: banks with GTA less than $1 billion (Small Banks), banks with GTA greater than $1 billion and less than $50 billion (Large Banks), and banks with GTA greater than $50 billion (Largest Banks). The difference operator stands for the change in a variable since the same quarter of the previous year. The dependent variable and the PPP variable are normalized with respect to lagged GTA. All other control variables are one-period lagged. All estimations include bank and time fixed effects, which are not presented for brevity. Robust standard errors are clustered by banks and presented in parentheses. Asterisks indicate significance at the 1% (***), 5% (**) and 10% (*) levels.

The results in the first column of Table 8 are for small banks with gross total assets less than $1 billion, which mostly resemble the results in the third column of Table 7 for the same dependent variable but for all banks. This resemblance would be expected since most observations in the regression sample of Table 7 (219,519 out of 239,121) are from small banks. The coefficient of the PPP term is large and positive, and significant at the 1% level, indicating that an extra dollar of PPP credit increases the total small business bank loans of the small banks by 91 cents. Moreover, the direct effect of the pandemic on total small business bank loans of small banks measured by the CORONA variable is positive and significant at the 1% level, but its magnitude is comparatively very small.

The second column of Table 8, on the other hand, is for large banks with gross total assets more than $1 billion and less than $50 billion. Comparing the effects of the PPP on total small business loans by small banks versus large banks presented in the first and second columns, they are both positive and statistically significant at the 1% level. Their magnitudes, however, are considerably different: The effect of additional PPP lending on small business bank loans is smaller for large banks compared to that of small banks. That is, for every additional dollar of PPP credit, the total small business bank loans of large banks increase by 61 cents, which is still economically significant but less than the 91 cents increase in the total small business loans of small banks as discussed above. Lastly, the third column of Table 8 presents the results for the largest banks with gross total assets greater than $50 billion. The effect of PPP lending on their total small business loans is positive, but relatively smaller and statistically not significant.

These findings would indicate that while the complementarities between the PPP lending and small business bank lending still dominate the substitutability between them, the magnitude and statistical significance of the PPP multiplier effect are sensitive to the size of the bank. The PPP lending complements the small business loans of small banks substantially more than that of larger banks, and for the largest banks, there is not a statistically significant outcome. These results are consistent with how small banks would be specialized in small business lending as argued by Berger et al. (2005).

Finally, the magnitudes of the isolated effect of the pandemic on total small business lending of small and large banks measured by the CORONA dummy variable are positive but small. Yet, there is an economic difference between this small size of the direct pandemic effect on the small business loans of small banks versus large banks: While the direct effect of the pandemic on small bank loans is 0.0368 for small banks and significant, it is 0.009 for the large banks and statistically not significant. So, compared to large banks, small banks have been less avoidant of small business bank loans that were directly an outcome of the isolated effect of the pandemic. This outcome is also in line with small banks’ specialization in small business lending discussed by Berger et al. (2005). Lastly, the isolated effect of the pandemic on small business loans of the largest banks is also not significant. The difference in the significance of this direct effect of the pandemic on the small business loans of the larger banks may be due to how they perceive the risks associated with small business bank loans substantially different than smaller banks.

4.3. Shorter time series with differences since the prior quarter

An alternative approach to the baseline model can be using a shorter time series to concentrate on the periods just before and after the shock. Also, with a shorter time series, it would be more reasonable to focus on the quarterly changes in difference variables. So, in this section, I rescale the difference operator with respect to the changes since the prior quarter and concentrate on the data from 2019:Q1 to 2020:Q4. Table 9 presents the results based on this specification.

Table 9.

Estimation results – shorter time series with differences since prior quarter.

| (Total C&I loans with UC / GTA) | (Total CRE loans with UC / GTA) | (Total C&I and CRE loans with UC / GTA) | ||||

|---|---|---|---|---|---|---|

| (PPP / GTA) | 0.8214*** | (0.047) | 0.4419*** | (0.018) | 1.2659*** | (0.064) |

| CORONA | 0.0470*** | (0.003) | 0.0907*** | (0.002) | 0.1348*** | (0.005) |

| (CDEP / GTA) | 0.0007 | (0.001) | 0.0002 | (0.001) | 0.0014 | (0.002) |

| (REPO / GTA) | -0.0004 | (0.007) | -0.0021 | (0.010) | -0.0042 | (0.014) |

| (HOTM / GTA) | 0.0740* | (0.043) | 0.0470** | (0.022) | 0.1103 | (0.072) |

| (FHLB / GTA) | 0.0205 | (0.025) | 0.0757*** | (0.019) | 0.0915** | (0.044) |

| LARGE | 0.0000 | (0.000) | 0.0001 | (0.000) | 0.0002 | (0.001) |

| BH | 0.0005 | (0.001) | -0.0008*** | (0.000) | 0.0002 | (0.001) |

| FORN | 0.0028** | (0.001) | 0.0008 | (0.001) | 0.0047* | (0.002) |

| LISTED | -0.0002 | (0.000) | -0.0002 | (0.000) | -0.0006 | (0.001) |

| SWAP | -0.0060** | (0.003) | 0.0006 | (0.001) | -0.0065* | (0.004) |

| FRS | -0.0009** | (0.000) | -0.0007*** | (0.000) | -0.0016*** | (0.001) |

| FDIC | -0.0004 | (0.000) | -0.0005*** | (0.000) | -0.0009* | (0.000) |

| HHI | 0.0010 | (0.001) | 0.0010*** | (0.000) | 0.0019* | (0.001) |

| ROE | -0.0045 | (0.003) | -0.0011 | (0.002) | -0.0069* | (0.004) |

| ROASD8 | 0.0015*** | (0.000) | 0.0023*** | (0.000) | 0.0036*** | (0.001) |

| Constant | -0.0352*** | (0.001) | -0.0483*** | (0.001) | -0.0818*** | (0.002) |

| Observations | 41,420 | 41,420 | 41,420 | |||

Notes: This table reports the OLS estimates of the effect of PPP loans on total small business bank loans with unused commitments (UC). The panel data is from 2019:Q1 to 2020:Q4. Total small business bank loans are categorized into three groups: total small business C&I loans (Total C&I loans), total small business CRE loans (Total CRE loans), and overall total of the small business loans of a bank (Total C&I and CRE loans). The difference operator stands for the change in a variable since the prior quarter. The dependent variable and the PPP variable are normalized with respect to lagged GTA. All other control variables are one-period lagged. All estimations include bank and time fixed effects, which are not presented for brevity. Robust standard errors are clustered by banks and presented in parentheses. Asterisks indicate significance at the 1% (***), 5% (**) and 10% (*) levels.

The estimated effects of the PPP variable in Table 9 are comparable with that in Table 6. In all columns of Table 9, the PPP is positive and statistically significant at the 1% level, showing that concentrating on a shorter interval of time before and after the shock and rescaling the difference operator do not change the qualitative finding that the complementarities between the PPP and total small business bank loans dominate potential substitutions. It is actually quite the opposite: The size of the PPP's multiplier effect is larger in each column. In Table 9, an additional dollar of PPP credit results in an extra 82 cents of total small business C&I loans and an extra 44 cents of total small business CRE loans. So, the total effect of an extra dollar of PPP credit on the overall total of small business loans is about $1.27.

Furthermore, even though the statistically significant positive effect of the CORONA variable is larger in Table 9 compared to its effect in Table 6, it is still extremely small, especially when compared to the effects of the PPP term. When all other factors are controlled for, the isolated effect of the pandemic is about 0.05 on the small business C&I loans, and 0.09 on the small business CRE loans. The effect of CORONA on the overall total of small business loans is 0.14. Therefore, while the magnitudes of the key variables in Table 9 are larger than that in Table 6, the qualitative findings are not sensitive to focusing on a shorter time interval and redefining the difference operator as changes since the prior quarter.

4.4. Additional local environmental variables

Finally, additional environmental variables from local demand and supply can be added to the model to check the sensitivity of the results with respect to controlling for local settings. So, I add the following two local environmental variables in the model specified above in Section 4.3.

The first local environmental variable that I use is based mostly on the demand-side disruption: the total number of Coronavirus cases in the county of a bank per county population (CASES). In order to calculate this measure, I gather the county-level coronavirus cases data from the New York Times repository on GitHub, which has been tracked and compiled around the clock from the federal, state, and local governments, universities such as Johns Hopkins and the University of Washington, and health institutions such as the Centers for Disease Control and Prevention. I collect the county-level population data from the U.S. Census Bureau.

The second local environmental variable that I use is based mostly on the supply-side disruption: the COVID-19 Economic Vulnerability Index by counties in 2019 (VUL) developed by Chmura economics team led by Dr. Christine Chmura and Dr. Xiaobing Shuai. This index measures the degree of predisposition of a county to the negative impact of the Coronavirus pandemic based on the county's composition of businesses and their industries in 2019. Table 10 presents the estimation results with these two additional local environmental variables.

Table 10.

Estimation results – additional local environmental variables.

| (Total C&I loans with UC / GTA) | (Total CRE loans with UC / GTA) | (Total C&I and CRE loans with UC / GTA) | ||||

|---|---|---|---|---|---|---|

| (PPP / GTA) | 0.8216*** | (0.047) | 0.4421*** | (0.018) | 1.2663*** | (0.064) |

| CORONA | 0.0472*** | (0.003) | 0.0908*** | (0.002) | 0.1352*** | (0.005) |

| (CDEP / GTA) | 0.0007 | (0.001) | 0.0002 | (0.001) | 0.0014 | (0.002) |

| (REPO / GTA) | -0.0004 | (0.007) | -0.0021 | (0.010) | -0.0042 | (0.014) |

| (HOTM / GTA) | 0.0740* | (0.043) | 0.0469** | (0.022) | 0.1102 | (0.072) |

| (FHLB / GTA) | 0.0197 | (0.025) | 0.0750*** | (0.019) | 0.0900** | (0.044) |

| LARGE | 0.0004 | (0.000) | 0.0004* | (0.000) | 0.0010 | (0.001) |

| BH | 0.0003 | (0.001) | -0.0010*** | (0.000) | -0.0001 | (0.001) |

| FORN | 0.0043*** | (0.001) | 0.0021*** | (0.001) | 0.0076*** | (0.003) |

| LISTED | -0.0000 | (0.000) | 0.0001 | (0.000) | -0.0002 | (0.001) |

| SWAP | -0.0062** | (0.003) | 0.0004 | (0.001) | -0.0069* | (0.004) |

| FRS | -0.0009*** | (0.000) | -0.0008*** | (0.000) | -0.0017*** | (0.001) |

| FDIC | -0.0005* | (0.000) | -0.0006*** | (0.000) | -0.0011** | (0.000) |

| HHI | 0.0004 | (0.001) | 0.0003 | (0.000) | 0.0005 | (0.001) |

| ROE | -0.0044 | (0.003) | -0.0010 | (0.002) | -0.0067* | (0.004) |

| ROASD8 | 0.0017*** | (0.000) | 0.0025*** | (0.000) | 0.0041*** | (0.000) |

| CASES | -0.0032*** | (0.001) | -0.0027*** | (0.001) | -0.0059*** | (0.001) |

| VUL | -0.0033*** | (0.001) | -0.0046*** | (0.001) | -0.0087*** | (0.002) |

| Constant | -0.0338*** | (0.002) | -0.0465*** | (0.001) | -0.0784*** | (0.002) |

| Observations | 41,420 | 41,420 | 41,420 | |||

Notes: This table reports the OLS estimates of the effect of PPP loans on total small business bank loans with unused commitments (UC). The panel data is from 2019:Q1 to 2020:Q4. Total small business bank loans are categorized into three groups: total small business C&I loans (Total C&I loans), total small business CRE loans (Total CRE loans), and overall total of the small business loans of a bank (Total C&I and CRE loans). The difference operator stands for the change in a variable since the prior quarter. The dependent variable and the PPP variable are normalized with respect to lagged GTA. All other control variables are one-period lagged. All estimations include bank and time fixed effects, which are not presented for brevity. Robust standard errors are clustered by banks and presented in parentheses. Asterisks indicate significance at the 1% (***), 5% (**) and 10% (*) levels.

The size and statistical significance of the PPP term in Table 10 is quite similar to that in Table 9. Once again, the findings present that the positive multiplier effect of the PPP on total small business bank loans is prominent, and this effect is not sensitive to including additional variables in the model from the local environments. In Table 10, the total effect of an additional dollar of PPP credit on the overall total of small business loans is $1.27, providing supplementary empirical evidence that the complementarities between the PPP loans and small business bank loans dominate their potential substitutability.

Moreover, the effect of the CORONA variable in Table 10 is almost identical to that in Table 9, indicating that even when the sensitivity of the findings is checked by adding pandemic-related local environmental variables to the model, the statistically significant isolated effect of the pandemic on small business bank loans remains about the same.

Finally, the coefficients of additional local environmental variables, CASES and VUL, are negative and statistically significant at the 1% level in all columns of Table 10. This outcome is expected in that both local numbers of Coronavirus cases and the COVID-19 vulnerability of the local industries increase the risks associated with the small business bank loans, and as a result, banks would be less interested in making small business bank loans to small businesses in those riskier localities.

5. Concluding remarks

After the U.S. government passed the Coronavirus Aid, Relief, and Economic Security Act in March 2020, several financial programs, including the Paycheck Protection Program, have been established in order to inject an unprecedented amount of liquidity in the U.S. economy to support households, businesses, and other important economic sectors. The U.S. banks, on the other hand, found themselves in a very different setting than that of the crisis of 2007–2009. After being under a decade-long strict scrutiny, banks have been well-capitalized and well-covered should another crisis somehow arrive. Indeed, a few years ago, the Federal Reserve was so pleased with the big picture, they started to unwind their enormous balance sheet in 2017. Then in 2020, the Coronavirus pandemic impacted the globe, shrinking the aggregate demand and supply. So, this time, the crisis was not due to a weakness in the financial system or a financial innovation. Instead of looking for bailouts, the U.S. banks were in a very crucial position to help save the economy: by channeling what the CARES Act provided with the Paycheck Protection Program, which were completely backed by the government; and perhaps by providing some of their own conventional bank loans to small businesses, for which the banks would bear the risks.

Prior to an analysis, it is not clear if the PPP loans and small business bank loans were mostly complements or substitutes. Hence, in this paper, I examine the effects of the PPP loans on small business bank loans. I specifically concentrate on the PPP loans of up to $1 million and the small business loans of the same size since $1 million is approximately the upper limit of the loans to the financially constrained smallest firms, who are also generally aimed by the government policies for financial support. My empirical findings show that the complementarities between the PPP loans and small business bank loans dominated their substitutability. Banks making an extra dollar of PPP credit made $0.91 to $1.27 extra of their small business bank loans. So, the multiplier effect of the PPP loans on small business bank loans was roughly 1-dollar-for-1-dollar on average. I also present that the direct effect of the pandemic on small business bank loans was not economically significant, which may be an indication of the potential reluctance of banks to make loans to risky small businesses in a pandemic setting with no intervention. Finally, I check the sensitivity of my findings to various different specifications and find that the results are quite robust.

In conclusion, the Paycheck Protection Program can be reasonably assessed as a government subsidy program for small businesses that also successfully stimulated the banks to contribute generously with their own conventional small business bank loans to help the survival of small businesses and their employees. Nevertheless, it is probably too soon to view this assessment as causal and definitive since, as discussed by Berger et al. (2021), the PPP may eventually lead to some negative consequences or unintended long-term effects yet to surface. There would be risks associated with additional small business bank loans complementing the PPP loans, and we do not know to what extent they would turn into loan losses. However, examining those potential effects in a comprehensive cost-benefit analysis is beyond the scope of this paper. The results that I present in this paper offer a timely policy evaluation of the ongoing economic efforts and help shape the economic stimulus packages that would be designed for further relief in the future.

Author's statement

Solo-authored paper.

Declaration of Competing Interest

None

Acknowledgement

I would like to thank two anonymous referees for their helpful comments and suggestions to improve this manuscript.

Footnotes

All PPP balances were guaranteed by the SBA, and all guaranty fees were waived. Also, the PPP lenders were compensated by paying them fees for processing PPP loans.

Some banks are not required to report their small business loan data in the first and third quarters due to changes in the filing requirements over time. The missing loan observations are interpolated by taking the average of the 1-period lagging and leading quarters of the missing quarter.

It is important to note that the PPP is established in the beginning of 2020:Q2, but the total small business bank loans documented in Table 2 and Fig. 1 do not include the PPP loans made by the banks.

C&I loans in the Call Reports actually include PPP loans. Therefore, for the econometric analysis, the total amount of PPP loans in each size category has to be subtracted from the corresponding size category of the small business C&I loans separately.

The verification process of my matching algorithm involves picking a 20% random sample of the matched data and crosschecking and verifying the match of each observation in that sample manually.

In the baseline model, I scale the difference operator with respect to changes since the same quarter of the previous year to mitigate econometric issues that can arise due to seasonality. In Section 4, as a robustness check, I rescale the difference operator with respect to changes since the prior quarter, and my general findings do not change qualitatively.

As explained in the previous sections, C&I loans in the Call Reports actually include PPP loans, but using the SBA data, I subtracted the total amount of PPP loans in each size category from the corresponding size category of the small business C&I loans of a bank separately.

Adding Federal Home Loan Bank borrowings in the bank loan production function is based on Ashcraft et al. (2010) and others in the literature emphasizing the importance of Federal Home Loan Bank System.

The data are provided at https://www.newyorkfed.org/research/banking_research/datasets by the Federal Reserve Bank of New York.

See Ivashina and Scharfstein (2010) and Acharya and Mora (2015) for more about involuntary bank lending due to preexisting lines of credit.

Call Report instructions for the reported small business loans are to include the commitments, which may ameliorate the concerts about “involuntary lending” to some extent. But the formal analysis conducted in this section is still useful to demonstrate that the overall results of this paper do not change due to this phenomenon.

References

- Acharya V.V., Berger A.N., Roman R.A. Lending implications of US bank stress tests: costs or benefits? J. Financ. Intermed. 2018;34:58–90. [Google Scholar]

- Acharya V.V., Mora N. A crisis of banks as liquidity providers. J. Finance. 2015;70:1–43. [Google Scholar]

- Almanidis P., Karakaplan M.U., Kutlu L. A dynamic stochastic frontier model with threshold effects: US bank size and efficiency. J. Prod. Anal. 2019;52:69–84. [Google Scholar]

- Amiram, D., Rabetti, D., 2020. The relevance of relationship lending in times of crisis. Available at SSRN 3701587.

- Ashcraft A., Bech M.L., Frame W.S. The federal home loan bank system: the lender of next-to-last resort? J. Money Credit Bank. 2010;42:551–583. [Google Scholar]

- Atkins, R., Cook, L.D., Seamans, R., 2021. Discrimination in lending? Evidence from the paycheck protection program. Available at SSRN. [DOI] [PMC free article] [PubMed]

- Baker S.R., Bloom N., Davis S.J., Terry S.J. National Bureau of Economic Research; 2020. COVID-Induced Economic Uncertainty. [Google Scholar]

- Baker S.R., Farrokhnia R.A., Meyer S., Pagel M., Yannelis C. National Bureau of Economic Research; 2020. How does Household Spending Respond to an Epidemic? Consumption during the 2020 COVID-19 Pandemic. [Google Scholar]

- Baker S.R., Farrokhnia R.A., Meyer S., Pagel M., Yannelis C. National Bureau of Economic Research; 2020. Income, Liquidity, and the Consumption Response to the 2020 Economic Stimulus Payments. [Google Scholar]

- Balyuk, T., Prabhala, N.R., Puri, M., 2020. Indirect costs of government aid and intermediary supply effects: lessons from the paycheck protection program.

- Barrios, J.M., Minnis, M., Minnis, W.C., Sijthoff, J., 2020. Assessing the payroll protection program: a framework and preliminary results. Available at SSRN.

- Bartik A.W., Bertrand M., Cullen Z.B., Glaeser E.L., Luca M., Stanton C.T. National Bureau of Economic Research; 2020. How are Small Businesses Adjusting to COVID-19? Early Evidence from a Survey. [Google Scholar]

- Bartlett R.P., Morse A. Evidence from Oakland; 2020. Small Business Survival Capabilities and Policy Effectiveness. [Google Scholar]

- Beggs, W., Harvison, T., 2020. Fraud and abuse in the PPP? Evidence from investment advisory firms. Available at SSRN.

- Berger A.N., Black L.K. Bank size, lending technologies, and small business finance. J. Bank. Finance. 2011;35:724–735. [Google Scholar]

- Berger A.N., Black L.K., Bouwman C.H., Dlugosz J. Bank loan supply responses to Federal Reserve emergency liquidity facilities. J. Financ. Intermed. 2017;32:1–15. [Google Scholar]

- Berger A.N., Bouwman C.H. How does capital affect bank performance during financial crises? J. Financ. Econ. 2013;109:146–176. [Google Scholar]

- Berger, A.N., Bouwman, C.H., Norden, L., Roman, R.A., Udell, G.F., Wang, T., 2021. Is a friend in need a friend indeed? How relationship borrowers fare during the COVID-19 crisis. Available at SSRN.

- Berger A.N., Demirgüç-Kunt A., Moshirian F., Saunders A. 2021. Banking Research in the Time of COVID-19. Working Paper. [Google Scholar]

- Berger A.N., Imbierowicz B., Rauch C. The roles of corporate governance in bank failures during the recent financial crisis. J. Money Credit Bank. 2016;48:729–770. [Google Scholar]

- Berger A.N., Miller N.H., Petersen M.A., Rajan R.G., Stein J.C. Does function follow organizational form? Evidence from the lending practices of large and small banks. J. Financ. Econ. 2005;76:237–269. [Google Scholar]

- Berger A.N., Roman R.A. Academic Press; 2020. TARP and other Bank Bailouts and Bail-Ins around the World: Connecting Wall Street, Main Street, and the Financial System. [Google Scholar]

- Bolton P., Freixas X., Gambacorta L., Mistrulli P.E. Relationship and transaction lending in a crisis. Rev. Financ. Stud. 2016;29:2643–2676. [Google Scholar]

- Brunnermeier M., Krishnamurthy A. BPEA Conference. 2020. Corporate debt overhang and credit policy. [Google Scholar]

- Chodorow-Reich G., Darmouni O., Luck S., Plosser M.C. National Bureau of Economic Research; 2020. Bank Liquidity Provision Across the Firm Size Distribution. [Google Scholar]

- Core, F., De Marco, F., 2020. Public guarantees for small businesses in Italy during COVID-19. Available at SSRN.

- Cornett M.M., McNutt J.J., Strahan P.E., Tehranian H. Liquidity risk management and credit supply in the financial crisis. J. Financ. Econ. 2011;101:297–312. [Google Scholar]

- Demirgüç-Kunt A., Detragiache E. The determinants of banking crises in developing and developed countries. Staff Papers. 1998;45:81–109. [Google Scholar]

- English W.B., Liang N. Hutchins Center Working Paper; 2020. Designing the Main Street Lending Program: Challenges and Options. [Google Scholar]

- Erel I., Liebersohn J. National Bureau of Economic Research; 2020. Does FinTech Substitute for Banks? Evidence from the Paycheck Protection Program. [Google Scholar]