Abstract

We investigate the impact of the COVID-19 pandemic on liquidity interlinkages of US industry groups. We employ a lead-lag liquidity network method that allows us to analyse liquidity interrelationships beyond contemporaneous spillover effects. We document that sectors differ in their liquidity interactions during the pre-COVID period, with some sectors more interlinked than others. We also document that the crisis induced by COVID had a significant effect on the liquidity network, with all sectors becoming more interconnected relative to the pre-COVID period. The effect varies across industries, with the utilities sector being the most affected, and telecommunication services the least.

Keywords: COVID-19 pandemic, Liquidity interconnectedness, Lead-lag liquidity network, Granger-causality, Sector analysis

1. Introduction

Traders and investors have faced considerable liquidity challenges as a result of the COVID-19 outbreak. Bid-ask spreads of S&P 100 stocks have increased almost four times compared to the levels in January this year, with a similar pattern in Russell 2000 stocks (Mittal et al., 2020). Moreover, they report that the average cost for a fixed available amount of liquidity was 20.5 basis points during the outbreak, compared to the usual 2.9.

Variability and uncertainty of liquidity is one of the principal challenges for market participants, and current literature either focuses on co-movement between an asset and market liquidity or liquidity spillover (Chordia et al., 2001; Huberman and Halaka, 2001; Cespa and Focault, 2014). The fact that liquidity co-moves and propagates from one asset to others implies connectivity. Hence, we model market liquidity as a network to detect how the network components (firms) exchange liquidity with one another, and how this has changed in the current COVID-19 crisis. To that end, we employ a lead-lag liquidity network method proposed by Billio et al. (2012) to compare the liquidity interrelationship across firms in the US stock market pre- and during the COVID-19 effect.

Assets connectivity is a risk factor which makes portfolio diversification of market participants ineffective during market distress. COVID-19 has a ripple effect on economies because of global interlinkages of supply chains and trading activities (Ozili and Arun, 2020). Some recent studies analyse the spillover effects of COVID-19 on global stock markets and identify transmission channels in terms of returns and volatility, at firm and market-level (Akhtaruzzaman et al., 2020; Selmi and Bouoiyour, 2020). However, the impact of the pandemic on the liquidity network hasn't been the centre of much attention. Network analysis reveals the patterns of liquidity interactions across firms and over time. It enables us to investigate whether the liquidity transmission channel has changed from the normal market condition due to the pandemic effect.

Considering the spillover characteristics of liquidity, we believe a firm that has its liquidity less connected with other firms in the market during the pandemic may act as a safe haven for investors in times of crisis. Our study examines the impact of COVID-19 on the liquidity network of S&P 500 firms and the shift in network characteristics across sectors in the US before and during the COVID-19 period. More specifically, we focus on two network characteristics – liquidity that a particular sector sends to others (Out-to-Others), and liquidity that it receives from other sectors (In-from-Others).

The crisis brought by the pandemic has affected various sectors differently. Early analysis of the pandemic has documented that in the first two months of 2020, prices for Energy, Retailing, and Transportation decreased substantially compared to the Healthcare sector (Ramelli and Wagner, 2020). According to Mazur et al. (2020), stocks in Natural Gas, Food, Healthcare, and Software industries have earned positive returns during the market crash of March 2020, as compared to the Petroleum, Real Estate, Entertainment, and Hospitality sectors. There is also evidence of asymmetry in reaction and recovery across and within asset classes (Yarovaya et al., 2020). This further motivates us to perform the analysis at the industry level. However, as industry constituents are often very few, we use industry-groups (sub-sectors).

We expect to see an increase in the liquidity linkages across the sectors due to the pandemic effect, both in terms of Out-to-Others and In-from-Others. However, the composition of this change is expected to vary across the sectors. We conjecture that well-interconnected firms significantly disseminate liquidity shocks to other firms in the network. Hence, if negatively impacted industries have strong lead-lag interlinkages within the network, they are likely to contribute to increasing illiquidity in the market significantly (increased Out-to-Others). On the other hand, the least affected industries are expected to be the source of liquidity transmission within the network.

We believe the network transformation reflects how liquidity providers and active institutional investors react towards the uncertainty caused by COVID-19. Liquidity providers have a specific inventory level that is adjusted based on a normal market condition. To facilitate liquidity with their limited inventory, they increase their premium. Therefore, asset liquidity becomes negatively correlated with market volatility. This might lead to an assets’ pairwise correlation (Vayanos, 2004). There is empirical evidence of the COVID-19 effect on the market liquidity caused by the withdrawal of liquidity suppliers (Foley et al., 2020). The authors show that this liquidity supply withdrawal is correlated with the increase in margin requirement by 400%. They also show this effect is more pronounced in indexed securities that electronic market makers provide their liquidity. Investors, on the other hand, become more risk-averse and gravitate their portfolios towards liquid assets, which in turn, put selling pressure on illiquid assets even more (Ben-Rephael, 2017). We expect to see that the liquidity network will be influenced by the complex interplay between the liquidity demanders and suppliers in during the crisis. Our results illustrate that COVID-19 significantly influences the liquidity interconnectedness across the industry groups.

2. Data and methodology

We investigate how the COVID-19 shock impacts the liquidity network across USA industry groups. We consider a sample of all firms listed on the S&P 500 Index from January 1st, 2012 to July 17th, 2020, incorporating additions and deletions as obtained from the Compustat Capital IQ database. We collect daily total returns data, and share trading volume from the Datastream and Bloomberg databases, respectively. After adjusting for missing observations and errors, we have a sample of 704 firms. For our industry conditional analysis, we assign firms into one of the 24 Industry groups according to the Global Industry Classification Standard (GICS) code.

2.1. Liquidity measure and linear Granger-causality

To measure stock liquidity, we base the liquidity measure on Amihud (2002). This measure is widely used to capture systematic risk and commonality in liquidity.1 It is the daily ratio of absolute stock return to dollar volume, and adheres to the notion of a liquid market as one that facilitates trading with the least price impact. Following Lee et al. (2014), we calculate liquidity as:

| (1) |

where R i,d is abs(return), P i,d is the adjusted closing price, and VO i,d is the trading volume of stock i at day d. We calculate weekly liquidity as the average of daily liquidity each week. Weekly frequency enables us to capture the dynamics of the COVID-19 impact, while avoiding the noise in higher frequency data.

For our primary analysis, we follow the Granger-causality network method proposed by Billio et al. (2012), conducting a pairwise linear Granger-causality test to investigate the lead-lag relationship among all the firms in our sample. The following model presents the linear interrelationship between two stationary time series.2 Time series j Granger-causes time series i if past values of j contain information that aid the prediction of i above and beyond the information contained in past values of i alone.

| (2) |

where and are the weekly liquidity at time t for firm i and j respectively, αi and αj are constants and βiy, βj,γij,γji are coefficients of the model, and and account for uncorrelated white noise.3 In this equation, there exists a lead-lag relationship among the series when γij and γji are different from zero. Following Billio et al. (2012), we define a causality indicator (j → i), which is 1 if j Granger-causes i, and 0 otherwise.

Next, we calculate the Degree of Granger-causality (DGC) to measure the fraction of statistically significant Granger-causal relationships (at 5%) among all N(N-1) pairs of securities available in each period:

| (3) |

where N is the number of security pairs in each period, and (j → i) is the causality indicator.

To observe the dynamics of DGC over time, we use a 13-week rolling window, calculating pairwise Granger-causality of those 13 weeks’ DGC4 . Higher DGC among assets is evidence of higher liquidity interconnections across the firms.

2.2. Industry-conditional number of connections

As we are interested in investigating the liquidity interactions across different industries, we calculate DGC separately for (j → i), when firms i and j are in different Industry Groups. Given 24 Industry Groups indexed by ∝, β = 1, …, 24, within the system of S, we then compute the following three measures:

Out-to-others (Out):

| (4) |

In-from-others (In):

| (5) |

In+Out-Others (In&out):

| (6) |

where Out-to-Others is the percentage of firms in other industry groups that are significantly Granger-caused by group j, In-from-Others is the percentage of firms in group j that are significantly Granger-caused by firms in other groups, and In+Out-Others is the sum of the two. ∝ represents the group that firm j belongs to in the system of S. β is the group that firm i belongs to, and N is the number of pairs of securities. For simplicity and ease of exposition, we define “send” to mean “Granger-causes”, and “receive” to mean “Granger-caused by” and use those terms throughout the paper.

3. Results

3.1. The degree of liquidity network across firms

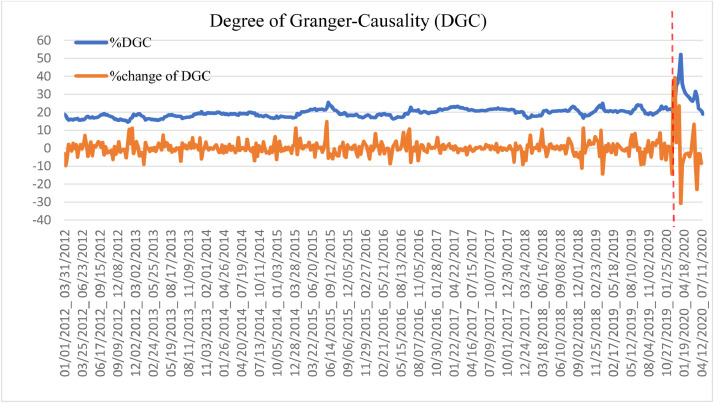

Fig. 1 illustrates the dynamics of DGC and its percentage change across all the firms our sample. Aside from a few small spikes, it is relatively stable until the first week of March 2020 when it jumps 35% and then 39% the following week, suggesting a significant COVID-19 impact. We followed this up with a series of t-tests, using 2012–2019 as the base, to confirm that the abnormal DGC impact was during that time.5

Fig. 1.

Degree of Granger-causality Over Time.

Notes: Time series of Degree of Granger-causality (DGC) with 13-weeks rolling-window from 08Jan2012 to 17July2020.%DGC is the fraction (in percentage) of statistically significant (at 5%) pairwise linear Granger-causal relationships among weekly liquidity of N (N-1) pairs of those stocks available in each period.%change of DGC is the percentage change of Degree of Granger-causality.

3.2. Liquidity network characteristics

Table 1 reports descriptive statistics of the liquidity network metrics for each industry group during the pre-COVID period, and Table 2 for the COVID period. In Panel A of both tables are descriptive statistics for all firms in our sample. There is compelling evidence of an overall increase in interconnectedness, as evidenced by an increase in mean (In&Out) from 40.1% to 62.7%.

Table 1.

Pre-COVID-19 period liquidity network characteristics.

| Panel A: Descriptive Statistics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Mean | Median | SD | Min | Max | P25 | P75 | ||

| Out | 19.2% | 19.2% | 2.7% | 13.2% | 27.9% | 17.2% | 21.1% | |

| In | 20.8% | 18.6% | 8.8% | 9.5% | 69.9% | 14.5% | 24.3% | |

| In+out | 40.1% | 38.0% | 9.5% | 25.3% | 90.9% | 33.5% | 44.4% |

| Panel B: Network ranking | ||||||||

|---|---|---|---|---|---|---|---|---|

| Industry Groups | In+out | Rank | Out | Rank | In | Rank | %Dif In&Out | Rank |

| Telecommunication Services | 65.2% | 1 | 18.3% | 24 | 46.9% | 1 | −87.7% | 24 |

| Banks | 49.7% | 2 | 18.6% | 22 | 31.1% | 2 | −50.6% | 23 |

| Media & Entertainment | 49.2% | 3 | 18.9% | 21 | 30.3% | 3 | −46.2% | 22 |

| Pharmaceuticals, Biotechnology | 45.6% | 4 | 19.3% | 12 | 26.4% | 4 | −31.1% | 21 |

| Food & Staples Retailing | 45.1% | 5 | 19.1% | 15 | 25.9% | 5 | −30.2% | 20 |

| Household & Personal Products | 44.6% | 6 | 19.6% | 2 | 24.8% | 6 | −23.0% | 19 |

| Semiconductors | 43.8% | 7 | 19.5% | 7 | 24.3% | 7 | −21.6% | 18 |

| Technology Hardware & Equipmen | 42.7% | 8 | 19.5% | 10 | 23.2% | 8 | −17.2% | 16 |

| Software & Services | 42.0% | 9 | 19.1% | 19 | 22.9% | 9 | −18.1% | 17 |

| Consumer Services | 39.5% | 10 | 19.1% | 17 | 20.3% | 10 | −6.1% | 15 |

| Retailing | 39.0% | 11 | 19.2% | 14 | 19.7% | 11 | −2.7% | 14 |

| Food, Beverage & Tobacco | 38.1% | 12 | 19.1% | 16 | 19.0% | 12 | 1.0% | 13 |

| Energy | 37.5% | 13 | 19.6% | 4 | 17.8% | 13 | 9.6% | 11 |

| Capital Goods | 36.9% | 14 | 19.5% | 8 | 17.4% | 15 | 11.8% | 9 |

| Automobiles & Components | 36.9% | 15 | 19.1% | 18 | 17.7% | 14 | 7.7% | 12 |

| Diversified Financials | 36.1% | 16 | 19.0% | 20 | 17.0% | 16 | 10.9% | 10 |

| Health Care Equipment & Servic | 35.5% | 17 | 19.5% | 9 | 15.9% | 17 | 20.3% | 8 |

| Transportation | 34.6% | 18 | 19.8% | 1 | 14.8% | 18 | 28.7% | 7 |

| Materials | 33.7% | 19 | 19.6% | 5 | 14.2% | 19 | 32.1% | 6 |

| Utilities | 33.6% | 20 | 19.6% | 3 | 13.9% | 21 | 33.8% | 3 |

| Insurance | 33.5% | 21 | 19.6% | 6 | 13.9% | 22 | 34.1% | 1 |

| Consumer Durables & Apparel | 33.5% | 22 | 19.4% | 11 | 14.0% | 20 | 32.2% | 5 |

| Real Estate | 33.0% | 23 | 19.3% | 13 | 13.7% | 23 | 33.8% | 2 |

| Commercial & Professional Serv | 31.8% | 24 | 18.5% | 23 | 13.3% | 24 | 33.3% | 4 |

Notes: Panel A presents the summary statistics of linear Granger-causality relationships (at the 5% level of statistical significance) among the weekly liquidity of all the firms included in S&P500 during the estimation period of 08/01/2012 to 29/12/2019. Panel B reports the industry-wise mean and industry-wise ranking of mean values for all the variables during the estimation period. Out, In, and In+Out variables are the average percentage of other industry groups in the system that are significantly Granger-caused by an industry group j, the average percentage of other industry groups in the system that significantly Granger-cause industry group j, and the summation of the two, respectively.%Dif In&Out is the percentage difference between In and Out calculated as. The ranks are assigned in descending order. The table is sorted by rank of In+out. All the measures are winsorised at the 5th and 95th percentile.

Table 2.

COVID-19 impact period liquidity network characteristics.

| Panel A: Descriptive Statistics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Mean | Median | SD | Min | Max | P25 | P75 | ||

| Out | 32.1% | 31.1% | 8.1% | 13.4% | 61.8% | 26.3% | 36.7% | |

| In | 30.6% | 29.6% | 8.6% | 14.2% | 58.8% | 23.9% | 36.2% | |

| In+out | 62.7% | 61.4% | 11.1% | 40.9% | 95.5% | 54.3% | 70.7% |

| Panel B: Network ranking | ||||||||

|---|---|---|---|---|---|---|---|---|

| Industry Groups | In+out | Rank | Out | Rank | In | Rank | %Dif In&Out | Rank |

| Media & Entertainment | 71.4% | 1 | 29.3 | 17 | 42.1% | 1 | −36.0% | 24 |

| Retailing | 70.1% | 2 | 31.4% | 14 | 38.6% | 3 | −20.5% | 20 |

| Software & Services | 68.0% | 3 | 39.4% | 2 | 28.5% | 13 | 32% | 6 |

| Telecommunication Services | 67.7% | 4 | 28.8% | 18 | 38.9% | 2 | −30% | 22 |

| Technology Hardware & Equipmen | 67.4% | 5 | 32.7% | 9 | 34.7% | 5 | −5.9% | 15 |

| Semiconductors & Semiconductor | 66.7% | 6 | 40.0% | 1 | 26.7% | 20 | 39.8% | 2 |

| Utilities | 66.3% | 7 | 28.5% | 21 | 37.8% | 4 | −28.1% | 21 |

| Automobiles & Components | 65.7% | 8 | 38.3% | 3 | 27.4% | 16 | 33.1% | 4 |

| Consumer Services | 63.9% | 9 | 37.1% | 4 | 26.8% | 19 | 32.3% | 5 |

| Health Care Equipment & Servic | 63.2% | 10 | 28.5% | 20 | 34.7% | 6 | −19.4% | 19 |

| Banks | 62.9% | 11 | 35.1% | 7 | 27.8% | 14 | 23.1% | 9 |

| Capital Goods | 61.8% | 12 | 28.6% | 19 | 33.2% | 9 | −14.7% | 17 |

| Materials | 61.6% | 13 | 30.1% | 16 | 31.6% | 10 | −5.0% | 14 |

| Real Estate | 61.6% | 14 | 28.0% | 22 | 33.6% | 8 | −18.3% | 18 |

| Pharmaceuticals, Biotechnology | 61.5% | 15 | 31.5% | 13 | 30.0% | 12 | 4.6% | 13 |

| Insurance | 60.4% | 16 | 35.8% | 5 | 24.6% | 22 | 37.2% | 3 |

| Diversified Financials | 59.5% | 17 | 31.7% | 12 | 27.8% | 15 | 13.4% | 12 |

| Food, Beverage & Tobacco | 59.4% | 18 | 32.1% | 10 | 27.4% | 17 | 15.9% | 10 |

| Commercial & Professional Serv | 59.3 | 19 | 34.3% | 8 | 25.0% | 21 | 31.3% | 7 |

| Household & Personal Products | 59.3% | 20 | 32.0% | 11 | 27.3% | 18 | 15.7% | 11 |

| Consumer Durables & Apparel | 59.1% | 21 | 24.7% | 24 | 34.5% | 7 | −33.2% | 23 |

| Energy | 57.5% | 22 | 26.8% | 23 | 30.7% | 11 | −13.8% | 16 |

| Food & Staples Retailing | 56.9% | 23 | 35.2% | 6 | 21.7% | 24 | 47.5% | 1 |

| Transportation | 53.7% | 24 | 30.7% | 15 | 22.9% | 23 | 29.1% | 8 |

Notes: Panel A presents the summary statistics of linear Granger-causality relationships (at the 5% level of statistical significance) among the weekly liquidity of all the firms included in S&P500 during the impact period of 08/03/2020 to 20/06/2020. Panel B reports the industry-wise mean and industry-wise ranking of mean values for all the variables during the impact period. The percentage difference between In and Out is also reported. Out, In, and In+Out are the average percentage of other industry groups in the system that are significantly Granger-caused by an industry group j, the average percentage of other industry groups in the system that significantly Granger-cause group j, and the summation of the two, respectively.%Dif In&Out is the percentage difference between In and Out calculated as. The ranks are assigned in descending order. The table is sorted by rank of%Dif In&out. All the measures are winsorised at the 5th and 95th percentile.

In Panel B for both tables, we consider averages for industry groups. In the pre-COVID period Telecommunication Services is the most connected industry group (In&Out = 65.2%), while the least connected is Commercial and Professional Services (In&Out = 31.8%).6 The last column reports the percentage difference in In & Out (%Dif In&Out). The strongest net sender is Insurance with the difference at 34.1%, and the biggest net receiver is Telecommunication Services with the difference at −87.7%.

During the COVID-19 period (Table 2), Media and Entertainment is the most connected (In&Out = 71.4%), and Transportation the least connected (In&Out = 53.7%). Food and Staples Retailing is the strongest net sender (47.5%) and Media and Entertainment is the strongest net receiver (−36%).

3.3. Changes in liquidity network, pre- to COVID-19 period

Comparing Tables 1 and 2, the main story is the uniform increase in connectedness for all industry groups. From pre-COVID to COVID, virtually all metrics for all industry groups have increased. Consistent with that, the mean for each metric has increased. Further, a difference-in-means test shows that for all metrics the differences are significant at a 1% level.

Table 3 looks at the change in metrics directly. All industry groups have experienced an increase in connectedness according to both Out and In&Out metrics. The In metric has increased for 21 out of 24 industries. This further demonstrates that market wide connectedness has increased during the COVID period.

Table 3.

Liquidity Network Change Analysis.

| Industry Groups | %change In+out | Rank | %change out | Rank | %change In | Rank |

|---|---|---|---|---|---|---|

| Utilities | 97.3 | 1 | 45.3 | 21 | 171.2 | 1 |

| Real Estate | 86.6 | 2 | 45.3 | 22 | 145.5 | 2 |

| Commercial & Professional Serv | 86.3 | 3 | 84.8 | 6 | 88.7 | 8 |

| Materials | 82.7 | 4 | 53.5 | 18 | 122.9 | 4 |

| Insurance | 80.2 | 5 | 82.9 | 8 | 77.1 | 9 |

| Retailing | 79.9 | 6 | 63.7 | 12 | 95.8 | 6 |

| Health Care Equipment & Servic | 78.1 | 7 | 46.2 | 20 | 117.7 | 5 |

| Automobiles & Components | 78.0 | 8 | 100.3 | 3 | 55.0 | 12 |

| Consumer Durables & Apparel | 76.6 | 9 | 26.8 | 24 | 145.4 | 3 |

| Capital Goods | 67.6 | 10 | 46.7 | 19 | 91.2 | 7 |

| Diversified Financials | 64.7 | 11 | 66.8 | 11 | 62.8 | 11 |

| Software & Services | 62.0 | 12 | 106.6 | 1 | 24.7 | 18 |

| Consumer Services | 61.7 | 13 | 94.1 | 4 | 31.8 | 17 |

| Technology Hardware & Equipmen | 57.9 | 14 | 67.9 | 9 | 50.0 | 14 |

| Food, Beverage & Tobacco | 56.0 | 15 | 67.6 | 10 | 44.3 | 15 |

| Transportation | 54.9 | 16 | 55.2 | 16 | 54.6 | 13 |

| Energy | 53.3 | 17 | 36.5 | 23 | 72.5 | 10 |

| Semiconductors & Semiconductor | 52.1 | 18 | 104.5 | 2 | 9.9 | 21 |

| Media & Entertainment | 45.2 | 19 | 54.8 | 17 | 39.2 | 16 |

| Pharmaceuticals, Biotechnology | 34.8 | 20 | 63.2 | 13 | 13.9 | 19 |

| Household & Personal Products | 32.9 | 21 | 62.7 | 14 | 10.3 | 20 |

| Banks | 26.4 | 22 | 88.9 | 5 | −10.7 | 22 |

| Food & Staples Retailing | 26.0 | 23 | 83.8 | 7 | −16.4 | 23 |

| Telecommunication Services | 3.9 | 24 | 57.3 | 15 | −16.9 | 24 |

Notes: Industry-wise percentage change between pre-COVID period to COVID impact period of all the liquidity network metrics resulted from the linear Granger-causality relationships (at the 5% level of significance). The sample consists of all the firms included in S&P500 during pre-COVID period of 08/01/2012 to 29/12/2019 and the COVID-19 impact period from 08/03/2020 to 20/06/2020.

%ChangeOut reports industry-wise percentage change between Out pre-COVID period to COVID-19 period.

%ChangeIn presents industry-wise percentage change between In pre-COVID period to COVID-19 period, and%Change In+Out shows the industry-wise percentage change between averaged Out+In pre-COVID period to COVID-19 period. The difference is calculated from COVID-19 minus Pre-COVID. The ranks are assigned in descending order. The table is sorted by rank of%Change In+Out.

As a robustness check, we re-estimate connectedness measures using proportional bid-ask spread. The results are consistent. Mean connectedness as measured by In&Out increases from 40.6% to 78.7%.

4. Conclusions

We analyse the impact of the COVID-19 pandemic on liquidity interconnectedness. We employ a lead-lag liquidity network method, allowing us to examine liquidity interactions beyond contemporaneous spillover effect. We use a Granger-causality methodology to measure connections of liquidity, utilizing S&P 500 firms, divided into industry-groups.

We document that the degree of liquidity interconnectedness varies across industries in the pre-COVID period. Telecommunication Services is the most interconnected sector within the liquidity network, while Commercial and Professional Services is the least connected. Differences in connectedness are related to firm-level differences in market capitalization. We also document that interconnectedness has increased substantially between pre-COVID and COVID periods, with all industry-groups increasing in their overall connectivity measure. The impact of the COVID-19 pandemic is similarly uneven, with Utilities being the most affected and Telecommunication Services the least.

As a result of higher interconnectedness, liquidity risk became harder to diversify. As a potential consequence, return correlations have increased in the COVID period for the majority of industries.7 Some earlier work (e.g., Driessen and Laeven, 2007) shows that benefits of international diversification have been declining over the past decades. Our findings suggest that benefits of cross-industry diversification have declined as well, making investors potentially more exposed to further market downturns.

A number of observations may provide venues for future research. First, industries that were less connected in pre-COVID period tended to experience higher growth in connectedness. Second, net senders in the network appear to become more interconnected than net receivers in the COVID period.

Author statement

Yasmine Farzami: All aspects of the paper, from idea formulation to analysis and presentation.

Associate Professor Russell Gregory-Allen: All aspects of the paper, from idea formulation to analysis and presentation.

Professor Alexander Molchanov: All aspects of the paper, from idea formulation to analysis and presentation.

Dr. Saba Sehrish: All aspects of the paper, from idea formulation to analysis and presentation.

Footnotes

(See, e.g., Hasbrouk & Seppi, 2001; Acharya & Pedersen, 2005; Kamara, Lou, & Sadka, 2008).

We use the Augmented Dickey–Fuller (ADF) test on our panel data, finding no evidence of a unit root.

We use the “Bayesian Information Criterion” (BIC; see Schwarz, 1978) as the model-selection criterion to determine the optimal number of lags for each security pair. Then we generalize the outcome using the mode of BIC for the entire sample period.

We eliminate pairs with less than 12 weeks of observations.

We ran a simulation, to confirm the veracity of these results.

Market capitalization appears to be the main variable explaining the differences in interconnectedness. Firm size has been proven to be one of the main variables explaining synchronicity in liquidity (see, for example, Kamara, Lou, and Sadka, 2008; Koch, Ruenzi, and Starks, 2016).

Unreported results are available upon request.

Appendix A. COVID effect on liquidity pre to COVID

Table A.1, reports industry-wise liquidity (Aliq) and its percentage change (%change Aliq) in an industry-wise manner. It is evident that the shock induced by the COVID-19 pandemic has resulted in large dry ups of liquidity across the industry groups. Comparing pre-COVID with COVID impact period Telecommunication Services is the only industry that experience an increase in liquidity by (%change Aliq =%−28.864). We ranked the%change Aliq from 1 to 24 in descending order to make the comparison across the industries relatable. Industries ranked within the range of rank 1 to 7 all lost their liquidity by more than 200% with consumer Durable& Apparel become illiquid (decrease in liquidity) by%change Aliq=324.239%. There are Only 5 industries that lost liquidity less than%change Aliq =%50, two of which are Pharmaceuticals, Biotechnolgy, Food, beverage & Tobacco.

Table A.1.

Liquidity Change Analysis Pre-COVID and COVID Period.

| Industry Groups | Pre-COVID | COVID | COVID to pre-COVID | |||

|---|---|---|---|---|---|---|

| Aliq* | Rank | Aliq* | Rank | %change Aliq* | Rank | |

| Consumer Durables & Apparel | −1.231 | 20 | −5.221 | 24 | 324.239 | 1 |

| Household & Personal Products | −0.602 | 2 | −2.256 | 13 | 275.027 | 2 |

| Banks | −0.794 | 8 | −2.818 | 17 | 255.118 | 3 |

| Energy | −1.016 | 15 | −3.522 | 21 | 246.757 | 4 |

| Media & Entertainment | −1.233 | 21 | −4.188 | 23 | 239.640 | 5 |

| Insurance | −1.079 | 18 | −3.609 | 22 | 234.425 | 6 |

| Automobiles & Components | −0.995 | 12 | −3.037 | 19 | 205.148 | 7 |

| Real Estate | −1.003 | 13 | −2.923 | 18 | 191.441 | 8 |

| Retailing | −0.792 | 7 | −1.956 | 11 | 146.961 | 9 |

| Technology Hardware & Equipmen | −1.057 | 16 | −2.597 | 14 | 145.646 | 10 |

| Capital Goods | −1.073 | 17 | −2.635 | 16 | 145.480 | 11 |

| Materials | −1.252 | 23 | −3.064 | 20 | 144.756 | 12 |

| Utilities | −0.941 | 10 | −1.929 | 10 | 104.946 | 13 |

| Diversified Financials | −1.009 | 14 | −2.008 | 12 | 98.964 | 14 |

| Health Care Equipment & Servic | −0.788 | 6 | −1.529 | 8 | 94.037 | 15 |

| Software & Services | −0.801 | 9 | −1.546 | 9 | 92.941 | 16 |

| Transportation | −0.772 | 5 | −1.366 | 5 | 76.994 | 17 |

| Commercial & Professional Serv | −1.649 | 24 | −2.621 | 15 | 58.961 | 18 |

| Pharmaceuticals, Biotechnology | −0.687 | 3 | −1.030 | 4 | 49.979 | 19 |

| Food, Beverage & Tobacco | −0.964 | 11 | −1.412 | 6 | 46.492 | 20 |

| Food & Staples Retailing | −0.462 | 1 | −0.626 | 1 | 35.509 | 21 |

| Consumer Services | −1.211 | 19 | −1.478 | 7 | 22.090 | 22 |

| Semiconductors & Semiconductor | −0.713 | 4 | −0.841 | 2 | 17.914 | 23 |

| Telecommunication Services | −1.235 | 22 | −0.879 | 3 | −28.864 | 24 |

Notes: Following Lee et al. (2014), the liquidity ratio is calculated as follows:.

The liquidity is referred as Aliq. Pre-COVID Aliq and Pre-COVID Rank are the weekly average of Aliq and its relative rank for all the firms included in S&P500 over the period of 08/01/2012 to 29/12/2019, respectively. COVID Aliq and COVID Rank are the weekly average of Aliq and its relative rank for all the firms included in S&P500 over the period of 08/03/2020 to 20/06/2020, respectively.%Change reports the percentage change in the Aliq of COVID to pre-COVID period. The difference is calculated as COVID minus Pre-COVID. The table is sorted according to the rank of%Change in descending order. Aliq* is Aliq rescaled by 10,000.

References

- Acharya V.V., Pedersen L.H. Asset pricing with liquidity risk. J. Financ. Econ. 2005;77(2):375–410. [Google Scholar]

- Akhtaruzzaman M., Boubaker S., Sensoy A. Financial contagion during COVID–19 crisis. Financ. Res. Lett. 2020 doi: 10.1016/j.frl.2020.101604. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Amihud Y. Illiquidity and stock returns: cross-section and time-series effects. J. Financ. Mark. 2002;5(1):31–56. [Google Scholar]

- Ben-Rephael A. Flight-to-liquidity, market uncertainty, and the actions of mutual fund investors. J. Financ. Intermed. 2017;31:30–44. [Google Scholar]

- Billio M., Getmansky M., Lo A., Pelizzon L. Econometric measures of connectedness and systemic risk in the finance and insurance sectors. J. Financ. Econ. 2012;104(3):535–559. [Google Scholar]

- Cespa G., Foucault T. Illiquidity contagion and liquidity crashes. Rev. Financ. Stud. 2014;27(6):1615–1660. [Google Scholar]

- Chordia T., Subrahmanyam A., Anshuman V.R. Trading activity and expected stock returns. J. Financ. Econ. 2001;59(1):3–32. [Google Scholar]

- Driessen J., Laeven L. International portfolio diversification benefits: cross-country evidence from a local perspective. J. Bank. Financ. 2007;31(6):1693–1712. [Google Scholar]

- Foley, S., Kwan, A., Philip, R., & Ødegaard, B.A. (2020). Contagious margin calls: how Covid-19 threatened global stock market liquidity. Available at SSRN 3646431.

- Hasbrouck J., Seppi D. Common factors in prices, order flows, and liquidity. J. Financ. Econ. 2001;59(3):383–411. [Google Scholar]

- Huberman G., Halka D. Systematic liquidity. J. Financ. Res. 2001;24(2):161–178. [Google Scholar]

- Kamara A., Lou X., Sadka R. The divergence of liquidity commonality in the cross-section of stocks. J. Financ. Econ. 2008;89(3):444–466. [Google Scholar]

- Koch A., Ruenzi S., Starks L. Commonality in liquidity: a demand-side explanation. Rev. Financ. Stud. 2016;29(8):1943–1974. [Google Scholar]

- Lee H.C., Tseng Y.C., Yang C.J. Commonality in liquidity, liquidity distribution, and financial crisis: evidence from country ETFs. Pac.-Basin Financ. J. 2014;29:35–58. [Google Scholar]

- Mazur M., Dang M., Vega M. COVID-19 and the March 2020 stock market crash: evidence from S&P1500. Financ. Res. Lett. 2020 doi: 10.1016/j.frl.2020.101690. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Mittal, H., Saraiya, N., & Berkow, K., (2020, April 08). US Equity Liquidity in the Covid-19 Crisis. Retrieved from https://www.marketsmedia.com/u-s-equity-liquidity-in-the-covid-19-crisis.

- Ozili, P.K., & Arun, T. (2020). Spillover of COVID-19: impact on the global economy. Available at SSRN 3562570.

- Ramelli, S., & Wagner, A.F. (2020). Feverish stock price reactions to COVID-19. CEPR Discussion Paper No. DP14511.

- Selmi, R., & Bouoiyour, J. (2020). Global market's diagnosis on coronavirus: a tug of war between hope and fear. HAL working paper no. 02514428. Retrieved from https://hal.archives-ouvertes.fr/hal-02514428/.

- Vayanos D. Flight to quality, flight to liquidity, and the pricing of risk (No. w10327) Natl. Bur. Econ. Res. 2004 [Google Scholar]

- Yarovaya, L., Matkovskyy, R., & Jalan, A. (2020). The COVID-19 black swan crisis: reaction and recovery of various financial markets. Available at SSRN 3611587.