Abstract

The paper examines the United States 2020 presidential election drivers and effects, under the uncertainty caused by COVID-19. By considering news-based, financial markets, and coronavirus specific inputs in panel data framework, the results reveal that COVID-19 affects candidates’ chances. Biden's electorate reacts positive to news regarding unemployment or healthcare, stress level on financial markets or Country Sentiment Index. Trump's opportunities increase with coronavirus indicators or news about populism. However, President-elect Biden must provide solutions for national economy issues like unemployment, budget deficit or healthcare inequalities. Simultaneously, having extensive prerogatives on trade and investment partnerships, influences mitigation of COVID-19 global effects.

Keywords: United States presidential election, COVID-19 pandemic, Global economy, Financial market, Uncertainty, News-based variable

1. Introduction

United States (US) presidential election is a global event, with impact on both global economy and financial markets. According to UBS (2020), more than half of MSCI All Country World index is represented by US and 9 out of 10 currency transactions worldwide involves US dollar. Moreover, the US economy had 15.9% contribution to global aggregated GDP in 2019, having the highest influence of an advanced economy as presented by IMF (2020). Besides this, US have extensive trade relations with the European Union, largest trade and investments partner to each other according to Amundi (2020a), and China.

Nevertheless, US presidential election 2020 was marked by uncertainty, due to COVID-19 pandemic. Current literature measures the effect of this pandemic to economic uncertainty and the evolution of financial markets as presented by Baker et al., (2020a; 2020b), world output as demonstrated by Caggiano et al. (2020), or forecasting the US recessions as proposed by Ercolani and Natoli (2020). Moreover, uncertainty in volatility of stock markets during scrutiny window is analyzed by Mnasri and Essaddam (2020). Additionally, economic, political, and financial uncertainties (Goodell and Vähämaa, 2013; Goodell et al., 2020), or swing states (Howard et al., 2018), also impacted US presidential election result and effects.

Considering the economic conditions of United States in the first three quarters of 2020, two digits unemployment rates and GDP decreases (CBO, 2020), the turnout was at 62%, its highest level since 1952, (Amundi, 2020b). In this environment, Biden became the President-elect of US, while Trump is one of the sixth Presidents who were not elected for a second term since 1900 (Investopedia, 2020b). In all cases, economic issues were a relevant reason for voters’ choice. This time, coronavirus crisis aggravated other existing issues, like access to healthcare services, twin deficits, or income inequality in a nationalist and racist context.

President Biden's day one agenda is already settled. It includes the major topics representing points in campaign and concerns of Americans, like combating coronavirus, limiting the economic damage, repairing US's reputation as trusted ally, and start restoring protections for Americans. He has already approached them by nominating key members in his administration for domains like economy, health, national security, climate, or domestic as presented by Build Back Better (2020).

In this paper, two major angles of US presidential election 2020 impact are covered with contributions to literature. First, it investigates the outcomes of this scrutiny on national economy and global financial markets, offering a broad view for US decision - makers. Second, for political parties it explains the main drivers of voters by considering data from 51 American states, including specific effects. Both perspectives are captured under the unprecedented uncertainty determined by COVID-19, a state of crisis with significant difference from a stable environment. The rest of the paper is organized as follows: Section 2 introduces the data; Section 3 describes the methodological approach; Section 4 reflects the results; Section 5 concludes.

2. The data

To investigate the relevant topics of the new US president agenda for reducing the impact of COVID-19 on economy, a balanced panel is considered, including 70 working days from July 17, 2020 to October 23, 2020. The period starts one month before the announcement of the Republican nominee and ends on the day with the highest COVID-19 cases. The dependent variable represents the daily chances of each candidate in every state.

Election related variables are extracted from RavenPack analytics tool. It provides daily media analytics on US election, coronavirus and a prediction model on chances of candidates, validated on previous US elections. It reaches trusted sources such as Dow Jones Newswire, StockTwits, or Wallstreet Journal, among many others (Blitz et al., 2019). The paper investigates the major topics of competitors’ campaigns: healthcare, nationalism, populism, together with economic topics such as budget deficit or unemployment. As news-based variables, they capture the presence of above-mentioned topics, correlated with one of the candidates, in media publications. Additionally, people's behavior is also included by indexes like: Sentiment, Country Sentiment Index (CSI). The power of sentiment in decision-making process was also analyzed by Cepoi (2020), using the same data source. He concluded on the relevance of CSI for financial markets evolution during COVID-19 outbreak. Consequently, the financial market impact on US election is covered by OFR Financial Stress Index (FSI) and evolution of trading volumes on S&P 500. Additionally, COVID-19 impact is measured by a news-based variable. Table 1 provides detailed data description.

Table 1.

Data description.

| Variable | Description and source |

|---|---|

| Chance | Indicates competitor's projected chance of winning at State level according to RavenPack's model. They are presented in level form (from 0 to 100), with the sum of both candidates equal to 100. Source: RavenPack (2020a)https://election.ravenpack.com/united-states. |

| Sentiment | Represents the relative sentiment score between Biden and Trump. This score incorporates sentiment surrounding the presidential candidates and their campaigns, together with sentiment regarding the current socio-economic situation. Values are at state level, expressed as relative score between 0 and 100. Source: RavenPack (2020a)https://election.ravenpack.com/united-states. |

| Coronavirus | Represent the daily ratio of news stories mentioning each topic to all stories mentioning each candidate. Trendingc,i, t, s = News storiesc,i, t, s / All news storiesc,t, s, where c is the candidate (Biden, Trump), i is the topic listed in the left side of this definition, t represents the day in the sample, and s represents the state. Level form data is included, with a range between 0 and 100. Source: RavenPack (2020a)https://election.ravenpack.com/united-states. |

| Budget Deficit | |

| Unemployment | |

| Medicare | |

| Nationalism | |

| Populism | |

| OFR Financial Stress Index (FSI) | Indicates the level of daily market - based stress in global financial markets. The index is positive when stress level is above average and negative when stress is below average. Source: Office of Financial Research (2020)https://www.financialresearch.gov/financial-stress-index/. |

| Country Sentiment Index (CSI) | Measures the level of sentiment across all entities mentioned in the news alongside the coronavirus. The range is between -100 (most negative) and 100 (most positive) sentiment, with 0 being neutral. Source: RavenPack (2020b)https://coronavirus.ravenpack.com/. |

| S&P Volumes | Marks daily evolution of S&P 500 index trading volumes. It is calculated as: , where is the trading volume in the day t. The data is included in level form. Source: Yahoo Finance (2020) |

3. Methodology

Two models are employed, one for each candidates’ chances of winning. Before model selections, the combined p-value test, proposed by Maddala and Wu (1999), is computed for unit root detection. According to results, the null hypothesis is rejected by 5% significance, all variables being I(0). Moreover, the series were tested for multicollinearity phenomenon by calculating Variance Inflation Factor (VIF). Afterwards, for selecting the proper model to be included, the Hausman test, as proposed by Hausman and Taylor (1981), was applied. In the light of findings reported in Appendix A, random effects (RE) regression model, as presented by Baltagi (2005), is employed for baseline and robustness models. Thus, model's equation is:

| (1) |

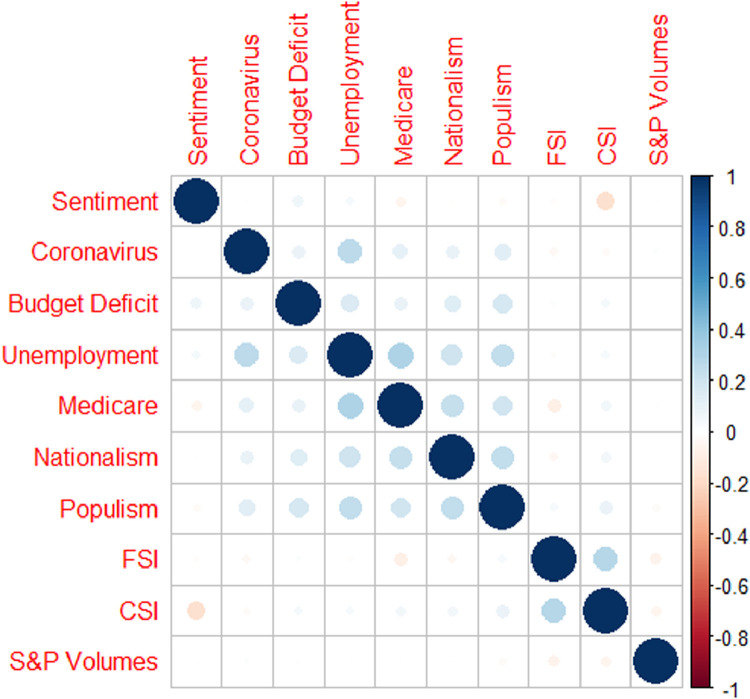

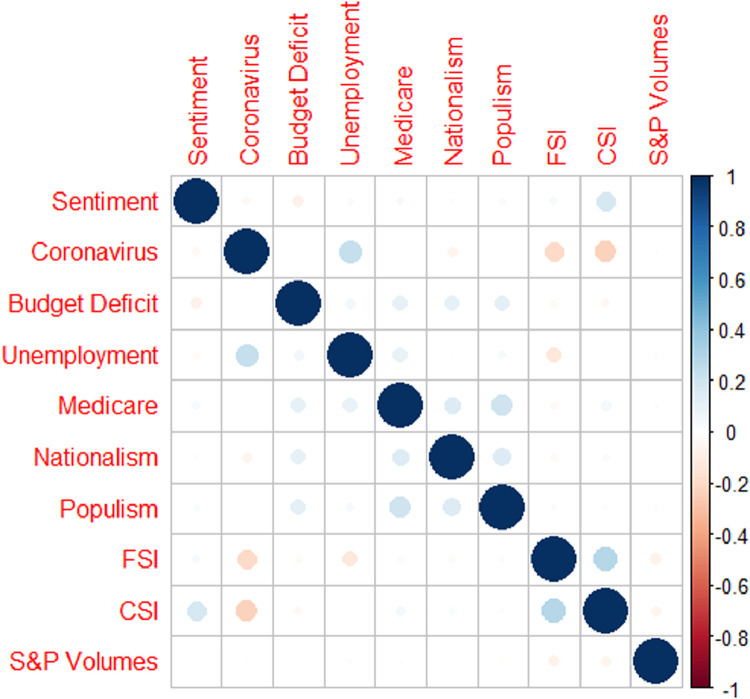

where y c,it represents the chances of candidate c in state i at time t, αc is the constant term in model of candidate c, X c,it is the time-variant 1 × K (the number of independent variables) exogenous regressors for model of candidate c, βc is a K × 1 vector of parameters for candidate c, μc,i indicates the unobserved specific effect for state i and candidate c, and errors for model of candidate c. More details on methodology are presented in Appendix A. Before final estimations, the results of RE regressions are checked for heteroskedasticity1 , serial correlation2 and cross-sectional dependence3 . In the light of results, coefficients are estimated with robust standard errors developed by Driscoll and Kraay (1998). This approach offers a robust to serial correlation and cross-sectional dependence of the error structure. Moreover, the approach is confirmed by Baltagi (2005), indicating the absence of relevance for cross-sectional dependence in limited time series panels, Topcu and Gulal (2020) by utilizing the method on a similar structure panel data for stock markets evolution during COVID-19, or Hoechle (2007) in Stata programming. In addition, the correlation matrix of covariates is presented in Appendix B, Fig. B.1 and Fig. B.2.

Fig. B.1.

Biden model.

Fig. B.2.

Trump model.

Besides the statistically tests performed in methodology selection, state specific effects are also validated by the diversity identified in American states in terms of culture, economic development, legislation, and voters’ preferences. Moreover, the decision is defended by the presence of political polarization (Baker et al., 2020d) and the swing states effect on final results (Howard et al., 2018; Antoniades and Calomiris, 2020).

4. Results

Table 2 presents estimated coefficients for variables included in baseline models. To assess the robustness of results, a new dependent variable was derived as follows:

| (2) |

Table 2.

Results estimation. Note: t-statistics in parenthesis. ***, **, and * denote statistical significance at the 1%, 5%, and 10% levels, respectively.

| Candidate | BIDEN | TRUMP | ||

|---|---|---|---|---|

| Methodology | Random effects regression model | Random effects regression model | ||

| Variable \ Model Type | BASELINE | ROBUSTNESS | BASELINE | ROBUSTNESS |

| Intercept | 36.8493 | 1.0019 | 43.8243 | 0.0002 |

| (0.0001)*** | (0.0005)*** | (0.0000)* | (0.0498)** | |

| Sentiment | 0.2056 | 0.0022 | 0.1561 | 0.0017 |

| (0.0001)*** | (0.0055)*** | (0.0001)*** | (0.0070)*** | |

| Coronavirus | -0.0084 | -0.0002 | 0.0184 | 0.0004 |

| (0.0000)*** | (0.0000)*** | (0.0005)*** | (0.0001)*** | |

| Budget Deficit | -0.0229 | -0.0002 | -0.3317 | -0.0072 |

| (0.0107)** | (0.0975)* | (0.0019)*** | (0.0159)** | |

| Unemployment | 0.0296 | 0.0005 | -0.0176 | -0.0004 |

| (0.0000)*** | (0.0000)*** | (0.0020)*** | (0.0009)*** | |

| Medicare | 0.0230 | 0.0002 | -0.0408 | -0.0005 |

| (0.0649)* | (0.0829)* | (0.0165)** | (0.0299)** | |

| Nationalism | 0.0400 | 0.0006 | -0.1755 | -0.0025 |

| (0.0000)*** | (0.0000)*** | (0.0036)*** | (0.0000)*** | |

| Populism | -0.0767 | -0.0013 | 0.1612 | 0.0027 |

| (0.0030)*** | (0.0010)*** | (0.0400)** | (0.0209)** | |

| FSI | 0.6459 | 0.0045 | -0.6965 | -0.0029 |

| (0.0905)* | (0.3314) | (0.0981)* | (0.4192) | |

| CSI | 0.0924 | 0.0018 | -0.0729 | -0.001 |

| (0.0000)*** | (0.0000)*** | (0.0000)*** | (0.0000)*** | |

| S&P Volumes | 0.0096 | 0.0001 | -0.0125 | -0.0001 |

| (0.0168)** | (0.0662)* | (0.0212)* | (0.0948)* | |

| Statistics | ||||

| R -squared | 0.82500 | 0.77004 | 0.75612 | 0.73721 |

| F - statistics | 339.734 | 206.04 | 299.247 | 226.942 |

| (0.0000)*** | (0.0000)*** | (0.0000)*** | (0.0000)*** | |

| Nr. of periods (T) | 70 | 70 | 70 | 70 |

| Nr. of cross sections (N) | 51 | 51 | 51 | 51 |

| Nr. of observations (NxT) | 3570 | 3570 | 3570 | 3570 |

According to estimations, most of variables considered are statistically significant and robust. Relevant facts come to light and before presenting them, it is useful to state the major subjects proposed in campaigns. Biden focused on economic policy (“Build Back Better”), healthcare, racial justice and morality. The opponent ran for the second term with law and order, China, and Biden's fitness for office.

First, US voters care for their own problems and expect solutions from the new president. Within the context of COVID-19 effects on economy, elections are marked by a great attention to inequalities in social determinants of health, such as education, employment, and access to affordable health care (Norris and Gonzales, 2020). Social distancing measures and temporary business closures determined millions of Americans to lose their jobs. However, the virus proceeded to range out of control, with tens of thousands new cases. The recovery is slow (Baker at al., 2020b), hopefully expected a v-shaped revival, but most probably replaced by w-shaped double-dip recession. Given the estimations, Unemployment indicator generates a positive influence for Biden to be elected, with opposite result for the competitor. The reason is that except the addendums of legislation, no new stimulus packages passed since March. Contrariwise, the Democrats have pushed for more individual aid to ensure families can afford daily activities and consumer spending, which were highly affected by pandemic, as presented by Baker et al. (2020c).

Besides, The Federal Reserve (FED) introduced fiscal and monetary stimulus trying to reduce the effects of COVID-19. Usual objectives were converted to re-emergence of twin deficits and escalating of debt/GDP ratio. According to estimations, Budget Deficit indicator induces a negative shape of both candidate's chances, correlated with their states on fiscal policy. Biden plans fiscal stimulus packages to diminish the crisis. Simultaneously, Trump wants to maintain the Tax Cuts program. By generating additional costs for managing the coronavirus crisis the voters’ confidence is affected with direct impact on candidates’ chances. Moreover, both competitors try to avoid vote swings as presented by Antoniades and Calomiris (2020).

Additionally, healthcare represents one major concern in current US scenery. According to The Lancet (2020), 30 million Americans do not have health insurance coverage even if the Affordable Care Act (ACA) was adopted in 2010. In estimations, healthcare in US presidential election was identified by Medicare topic. The variable offers a positive and relevant effect on healthcare. During COVID-19 outbreak, importance of a healthcare for all Americans increased (Norris and Gonzales, 2020) and is clearly stated on Biden's agenda. Contrary, Medicare diminished Trump's chances as Republicans are expected to further challenge the ACA and devolve decisions at state level (The Lancet, 2020).

Besides major concerns on US economy, there are other relevant topics largely discussed and continuously present in Trump's term. Nationalism and Populism could lead to a period of momentous changes in US. Extremist proposals of Trump affect his second term chances. The reference here is the trade and investment isolation strategies and statements on World Health Organization, BREXIT, or NATO. This behavior is expressed by the performance of these representative variables. Trump's likelihood is reduced when news about him and Nationalism appear. However, Trump enjoys a positive reaction on populism, as his proposals influence a large pool of people.

Second, coronavirus outbreak caused significant financial turmoil, volatility on markets, and disruption in liquidity. Although the impact of COVID-19 on financial markets was identified between March and April (Liu et al., 2020; Mazur et al., 2020), recovery was considerable and no extreme events occurred during the analyzed period. From my perspective, the paper considers FSI as a proxy for stress in financial markets and S&P 500 volumes to measure the magnitude of activities in US capital markets.

A positive correlation between stress in financial markets and Biden's chances is discovered. The democrat mitigates for Environmental, Social and Governance (ESG) investing, which already gained increasing traction globally. Furthermore, investors took refuge in ESG portfolios during crisis periods, as demonstrated by Singh (2020). Differing is Trump, promoting rollback of regulations on ESG and loosening of environmental oversight, which justify the results of a negative impact on Trump's chances. In addition, the importance of election-driven policy uncertainty, mainly determined by the likelihood of a replacement party, to financial stress as demonstrated by Goodell et al. (2020), appears. Relevance of this indicator decreases in robustness check since only half of Americans own stocks (Investopedia, 2020a). Likewise, increases in daily S&P trading volume determine growth of Biden's chances and negative effects in Trump's probabilities. The fact is sustained by the monetary stimulus proposed by FED and the short-term recovery of financial markets after the lockdown. Moreover, Biden could be impeded by the Senate to pass stimulus. This leads to a better performance of tech and health stocks with a large share in S&P 500. This confidence level of 10% is justified by the fact stocks will become more attractive based on election results.

Third, COVID-19 represents an unprecedented health-care emergency. It influences the way US economy adapts to business restrictions or, recently, re-openings, and the wider than ever gap between the stock market and the overall economy. In addition, the perception of all entities regarding the country perspective around COVID-19 crisis becomes a relevant indicator. Increase of CSI represents a positive belief on Coronavirus and tenders a better economic forecasts and reduction of policy uncertainty, which were part of Biden's campaign (“Build Back Better”). Current model confirms this fact. Contrary, for the opponent, CSI determines decreases of chances since the perception is positive. This is since Trump enjoyed a positive net approval rating on his capacity of handling the economy (Amundi, 2020a). Additionally, Republican voters tend to stay less at home and have lower levels of social distancing, as demonstrated by Baker et al. (2020c).

Furthermore, Coronavirus variable included has the same meaning as CSI, which mainly validates national expectations around COVID-19. The results disclose a positive effect on Trump's second term and negative on Biden's opportunity due to Trump's coronavirus infection in October and his fast recovery, together with Biden's limited exposure to voters on campaign trail. Finally, as expected, sentiment indicator is positively correlated with both candidates’ chances and associated with higher chances for victory of the popular vote.

5. Conclusions

This study provides empirical evidence on the US presidential election 2020 drivers and the way the result can influence the evolution of US economy and global financial markets within COVID-19 framework. With powerful policy implications, the findings could be also used by political parties in future campaigns for responding to voters’ needs, especially under stressed scenarios. By considering a panel data from 51 American states, it evidences that, for US voters, unemployment and health are critical topics with positive effect on Biden's chances for presidency and negative for Trump, while budget deficit is negative correlated with both competitors’ probabilities. Thus, Biden administration should focus on supporting the unemployed, helping small businesses recover, debt forgiveness, healthcare reforms, smart taxes plan, everything under an uncertain environment caused by the ongoing pandemic and bearing in mind the reduction of inequalities. From another perspective, increasing stress on global financial markets is correlated with Biden's opportunity, because both candidate and investors are positive with an ESG approach. In addition, increases of trading volumes determine more chances for Biden because of monetary stimulus proposed and the positive trend of tech and health stocks. Moreover, after Biden's confirmation Bitcoin, S&P 500, and other global indices had price increases, while US Dollar got weaken, which leads to positive effect on budget deficit. Further researches could include comparisons of voters’ drivers under stable versus stressed scenarios, or test and apply this approach on other elections worldwide.

Funding

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Table A.1.

Variance inflation factor for testing multicollinearity.

| Variable | VIF | |

|---|---|---|

| BIDEN | TRUMP | |

| Sentiment | 1.0386 | 1.0414 |

| Coronavirus | 1.1051 | 1.2016 |

| Budget Deficit | 1.0272 | 1.0130 |

| Unemployment | 1.1563 | 1.1145 |

| Medicare | 1.0261 | 1.0172 |

| Nationalism | 1.0200 | 1.0068 |

| Populism | 1.0738 | 1.0336 |

| FSI | 1.0554 | 1.0904 |

| CSI | 1.0901 | 1.1249 |

| S&P Volumes | 1.0074 | 1.0082 |

Table A.2.

Results of statistics test applied on series.

| Variables / Model | Candidate model | Test | Hypotheses | p-value | Interpreting the results | Decision |

|---|---|---|---|---|---|---|

| Baseline Model; all variables included | BIDEN | Maddala-Wu test |

Null hypothesis (H0): existence of unit root Alternative hypothesis(H1): stationary series I(0) |

0.01 | p-value < 0.05, the decision is to reject the null hypothesis | Stationary variables |

| Hausman test |

Null hypothesis (H0): random effects model (unique errors are not correlated with the regressors) Alternative hypothesis(H1): fixed effects model (unique errors are correlated with the regressors) |

0.999 | p-value > 0.05, the decision is to accept the null hypothesis | Usage of Random effects model | ||

| Hausman test |

Null hypothesis (H0): pooled OLS regression model Alternative hypothesis(H1): random effects model |

0.0000 | p-value < 0.05, the decision is to reject the null hypothesis | Usage of Random effects model | ||

| F test for time effects |

Null hypothesis (H0): Random effects regression model to be used Alternative hypothesis(H1): time effects to be included |

0.2006 | p-value >0.05, acceptance of null hypothesis | Usage of Random effects model | ||

| Baseline Model; all variables included | TRUMP | Maddala-Wu test |

Null hypothesis (H0): existence of unit root Alternative hypothesis(H1): stationary series I(0) |

0.01 | p-value < 0.05, the decision is to reject the null hypothesis | Stationary variables |

| Hausman test |

Null hypothesis (H0): random effects model (unique errors are not correlated with the regressors) Alternative hypothesis(H1): fixed effects model (unique errors are correlated with the regressors) |

1.000 | p-value > 0.05, the decision is to accept the null hypothesis | Usage of Random effects model | ||

| Hausman test |

Null hypothesis (H0): pooled OLS regression model Alternative hypothesis(H1): Random effects model |

0.0000 | p-value < 0.05, the decision is to reject the null hypothesis | Usage of Fixed effects model | ||

| F test for time effects |

Null hypothesis (H0): Random effects regression model to be used Alternative hypothesis(H1): time effects to be included |

0.1534 | p-value >0.05, acceptance of null hypothesis | Usage of Random effects model |

Table A.3.

Components of the Eq. (1).

| Indicator | Details | Values | |

|---|---|---|---|

| BIDEN | TRUMP | ||

| Type of panel data | The structure of panel data in terms of cross – section and time periods. Balanced panel data is a dataset in which every cross section is observed every time period | Balanced panel data | |

| N | Number of cross - sections (American states) | 51 | |

| T | Number of periods (in days) | 70 | |

| N x T | Number of observations | 3570 | |

| K | Number of exogenous variables | 10 | |

| c | US presidential election candidate | 1 | 2 |

Table A.4.

Expected sign of independent variables.

| Variable | Expected sign | |

|---|---|---|

| BIDEN | TRUMP | |

| Sentiment | + | + |

| Coronavirus | - | + |

| Budget Deficit | - | - |

| Unemployment | + | - |

| Medicare | + | - |

| Nationalism | + | - |

| Populism | - | + |

| FSI | + | - |

| CSI | + | - |

| S&P Volumes | + | - |

CRediT authorship contribution statement

Ionuț Daniel Pop: Conceptualization, Methodology, Data curtion, Software, Writing – original draft, Writing – review & editing.

Declaration of Competing Interest

Manuscript title: COVID-19 crisis, voters’ drivers, and financial markets consequences on US presidential election and global economy

The author, Ionuț – Daniel Pop, certify that I have NO conflicts of interest with the journal Finance Research Letters.

Acknowledgments

I express my gratitude to Mr. Samuel Vigne, Editor-in-Chief and anonymous reviewer for their vigorous and robust review. I consider their comments valuable with a crucial role in the research value added to the literature. Bides the impact of academic review, appreciations go to RavenPack for the data package. Especially consideration goes to Mr. Ian McLaren for his continuous support and advice.

Footnotes

By applying Breusch-Pagan test the null hypothesis of homoskedasticity is accepted with p-value of 0.3425 for BIDEN and 0.2071 for TRUMP

By computing Breusch-Godfrey/Wooldridge test, the null hypothesis of no serial correlation is rejected with p-values lower than 0.0001 for both models

By considering Breusch-Pagan LM test and Pesaran CD test, the null hypothesis of no cross-sectional dependence is rejected with p-values lower than 0.0001 for both models.

Appendix A. Methodological implications

The detailed Eq. (1) is presented below:

| (A.1) |

where Chance c,it indicates the chances of candidate c in state i during the day t, μc,i is the unobserved state i specific effect for candidate c, represents the estimated coefficient for independent variable j, remainder errors for candidate c, state i at time t.

Appendix B. The correlation matrix of independent variables within the model

Colors should be used in print for figures in Appendix B

References

- Amundi, 2020a. US Presidential Election: How It Will Impact US Economy and Financial Markets. https://research-center.amundi.com/page/Article/Amundi-Views/2020/09/US-presidential-election-how-it-will-impact-US-economy-and-financial-markets (accessed October 23,2020).

- Amundi, 2020b. 2020 post-election analysis: Biden wins, but the United States remains divided. https://www.amundi.com/globaldistributor/Common-Content/Distributor/News/2020-post-election-analysis-Biden-wins-but-the-United-States-remains-divided (accessed December 23, 2020).

- Antoniades A., Calomiris C.W. Mortgage market credit conditions and U.S. Presidential elections. Eur. J. Political Econ. 2020;64 doi: 10.1016/j.ejpoleco.2020.101909. [DOI] [Google Scholar]

- Baker S.R., Bloom N., Davis S.J., Terry S.J. National Bureau of Economic Research, Working Paper. 2020. COVID-induced economic uncertainty; p. 26983. [DOI] [Google Scholar]

- Baker S.R., Bloom N., Davis S.J., Terry S.J. National Bureau of Economic Research, Working Paper. 2020. Using Disasters to Estimate the Impact of Uncertainty; p. 27167. [DOI] [Google Scholar]

- Baker S.R., Farraokhnia R.A., Meyer S., Pagel M., Yannelis C. National Bureau of Economic Research, Working Paper. 2020. How does household spending respond to an epidemic? Consumption during the 2020 COVID-19 pandemic; p. 26949. DOI 10.3386/w26949. [Google Scholar]

- Baker S.R., Baksy A., Bloom N., Davis S.J., Rodden J.A. National Bureau of Economic Research, Working Paper. 2020. Elections, political polarization, and economic uncertainty; p. 27961. [DOI] [Google Scholar]

- Baltagi Badi H. Third Edition. John Wiley & Sons, Ltd; 2005. Econometric Analysis of Panel Data. [Google Scholar]

- Blitz D., Huisman R., Swinkels L., van Vliet P. Media attention and the volatility effect. Finance Res. Lett. 2019;101317 doi: 10.1016/j.frl.2019.101317. [DOI] [Google Scholar]

- Build Back Better, 2020. Nominees and Appointees. https://buildbackbetter.gov/nominees-and-appointees/( accessed December 27, 2020).

- Caggiano G., Castelnuovo E., Kima R. The global effects of Covid-19-induced uncertainty. Econom. Lett. 2020;194 doi: 10.1016/j.econlet.2020.109392. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Cepoi C. Asymmetric dependence between stock market returns and news during COVID-19 financial turmoil. Finance Res. Lett. 2020;36 doi: 10.1016/j.frl.2020.101658. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Congressional Budget Office (CBO), 2020. Interim Economic Projections for 2020 and 2021. https://www.cbo.gov/publication/56368#_idTextAnchor043 (accessed October 28, 2020).

- Driscoll J.C., Kraay A.C. Consistent covariance matrix estimation with spatially dependent panel data. Rev. Econ. Stat. 1998;80(4):549–560. doi: 10.1162/003465398557825. [DOI] [Google Scholar]

- Ercolani V., Natoli F. Forecasting US recessions: the role of economic uncertainty. Econom. Lett. 2020;193 doi: 10.1016/j.econlet.2020.109302. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Goodell J.W., Vähämaa S. US presidential elections and implied volatility: the role of political uncertainty. J. Bank. Finance. 2013;27:1108–1117. doi: 10.1016/j.jbankfin.2012.12.001. [DOI] [Google Scholar]

- Goodell J.W, McGee R.J., McGroarty F. Election uncertainty, economic policy uncertainty and financial market uncertainty: a prediction market analysis. J. Bank. Finance. 2020;110 doi: 10.1016/j.jbankfin.2019.105684. [DOI] [Google Scholar]

- Hausman J.A., Taylor W.E. Panel data and unobservable individual effects. Econometrica. 1981;49:1377–1398. https://www.jstor.org/stable/1911406 [Google Scholar]

- Hoechle D. Robust standard errors for panel regressions with cross-sectional dependence. Stata J. 2007;7(3):281–312. doi: 10.1177/1536867X0700700301. [DOI] [Google Scholar]

- Howard P.N., Kollanyi B., Bradshaw S., Neudert L.M. Social media, news and political information during the US election: was polarizing content concentrated in swing States? Data Memo 2017. 2018;8 https://arxiv.org/abs/1802.03573 Oxford Project on Computational Propaganda. [Google Scholar]

- International Monetary Fund (IMF), 2020. World Economic Outlook, October 2020: A Long and Difficult Ascent. https://www.imf.org/en/Publications/WEO/Issues/2020/09/30/world-economic-outlook- october-2020 (accessed October 23, 2020).

- Investopedia, 2020a. 2020 Election: The Key Economic Issues Explained. https://www.investopedia.com/democratic-debate-policy-cheat-sheet-4691340 (accessed October 29, 2020).

- Investopedia, 2020b. 6 Presidents Who Couldn't Win a Second Term. https://www.investopedia.com/financial-edge/0812/5-presidents-who-couldnt-secure-a-second-term.aspx (accessed December 23,2020).

- Liu H., Manzoor A., Wang C., Zhang L., Manzoor Z. The COVID-19 outbreak and affected countries stock markets response. Int. J. Environ. Res. Public Health. 2020;17:2800. doi: 10.3390/ijerph17082800. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Maddala G.S., Wu S. A comparative study of unit root tests with panel data and a new simple test. Oxf. Bull. Econom. Stat. 1999;61:631–652. doi: 10.1111/1468-0084.0610s1631. [DOI] [Google Scholar]

- Mazur M., Dang M., Vega M. COVID-19 and the march 2020 stock market crash. Evidence from S&P1500. Finance Res. Lett. 2020;101690 doi: 10.1016/j.frl.2020.101690. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Mnasri A., Essaddam N. Impact of U.S. presidential elections on stock markets’ volatility: does incumbent president's party matter? Finance Res. Lett. 2020;101622 doi: 10.1016/j.frl.2020.101622. [DOI] [Google Scholar]

- Norris K., Gonzales C. COVID-19, health disparities and the US election. E Clin. Med. 2020;000 doi: 10.1016/j.eclinm.2020.100617. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Office of Financial Research OFR Financial Stress Index. OFR. 2020 https://www.financialresearch.gov/financial-stress-index/ updated daily. accessed September 29, 2020. [Google Scholar]

- RavenPack, 2020a. Coronavirus news monitor. https://coronavirus.ravenpack.com/usa (accessed September 29, 2020).

- RavenPack, 2020b. Election 2020. https://election.ravenpack.com/(accessed September 29, 2020).

- Singh A. COVID-19 and safer investment bets. Finance Res. Lett. 2020;36 doi: 10.1016/j.frl.2020.101729. [DOI] [PMC free article] [PubMed] [Google Scholar]

- The Lancet Public health must be a priority in the 2020 US election. Lancet Public Health. 2020;5(10):e512. doi: 10.1016/S2468-2667(20)30214-0. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Topcu M., Gulal O.S. The impact of COVID-19 on emerging stock markets. Finance Res. Lett. 2020;36 doi: 10.1016/j.frl.2020.101691. [DOI] [PMC free article] [PubMed] [Google Scholar]

- UBS, 2020. The Global Impact of the US election. https://www.ubs.com/global/en/wealth-management/chief-investment-office/market-insights/regional-outlook/us-elections/2020/the-global-impact-of-the-us-election.html (accessed October 23, 2020).

- Yahoo Finance, 2020. https://finance.yahoo.com/(accessed September 29, 2020).