Significance

People’s beliefs about why the rich are richer than the poor have the potential to affect both policy attitudes and economic development. We provide global evidence showing that where the fortunes of the rich are perceived to be the result of selfish behavior, inequality is viewed as unfair, and there is stronger support for income redistribution. However, we also observe that belief in selfish rich inequality is highly polarized in many countries and thus a source of political disagreement that might be detrimental to economic development. We find systematic country differences in the extent to which people believe that selfishness is a source of inequality, which sheds light on international differences in public morality, civic virtues, and redistributive policies.

Keywords: selfishness, inequality, redistribution

Abstract

We report on a study of whether people believe that the rich are richer than the poor because they have been more selfish in life, using data from more than 26,000 individuals in 60 countries. The findings show a strong belief in the selfish rich inequality hypothesis at the global level; in the majority of countries, the mode is to strongly agree with it. However, we also identify important between- and within-country variation. We find that the belief in selfish rich inequality is much stronger in countries with extensive corruption and weak institutions and less strong among people who are higher in the income distribution in their society. Finally, we show that the belief in selfish rich inequality is predictive of people’s policy views on inequality and redistribution: It is significantly positively associated with agreeing that inequality in their country is unfair, and it is significantly positively associated with agreeing that the government should aim to reduce inequality. These relationships are highly significant both across and within countries and robust to including country-level or individual-level controls and using Lasso-selected regressors. Thus, the data provide compelling evidence of people believing that the rich are richer because they have been more selfish in life and perceiving selfish behavior as creating unfair inequality and justifying equalizing policies.

The idea of the selfish rich has a long history in science, politics, and religion (1). Adam Smith argued that the “natural selfishness and rapacity” of the rich benefits society (2). Others have argued that the selfish rich cause inequality and unfairness, by “pulling the ladder of opportunity away from ordinary people” (3, 4).

A growing literature has studied empirically whether the rich are more selfish than the poor, both in behavior and in underlying preferences. The evidence is mixed: Some studies report more selfishness among the rich (5–7), others that the rich are not different from the rest of society or even less selfish (8–11). Previous work has also provided diverse evidence on the causal effect of being rich on selfishness. It has been shown that making people feel richer or think about money causes them to behave more selfishly (6, 12), but at the same time, there is some experimental evidence suggesting that becoming rich makes you behave less selfishly (13–15). The causal link from selfishness to being rich may appear more straightforward. Selfish people are likely more willing to exploit both legal and illegal opportunities to become rich, including, as shown in a laboratory experimental study, to work harder to earn more money (16). Finally, there is recent evidence suggesting that selfish behavior among the rich is contagious and increases selfish behavior among the poor (17).

The present study focuses on people’s beliefs about the rich, rather than the actual behavior of the rich. These beliefs are likely to shape inequality acceptance and support for redistribution in society. Evidence from a US sample (students and nonstudents) suggests that perceptions of the rich matter for policy preferences: People who view the rich as selfish are more likely to support taxation of the rich (18). There is also global evidence from 38 countries (students and nonstudents) on whether people have conflicting stereotypes of the rich, focusing on the personality dimensions warmth (friendly, sincere) and competence (capable, skilled) (19). This evidence suggests that people view the rich as cold and competent and shows that there is more ambivalence in how people view others in countries with an intermediate level of conflict or high inequality. It has been shown that there is a close association between a cold personality and selfishness (20), and, thus, the existing global evidence is suggestive of people considering the rich as more selfish than the poor (SI Appendix).

We advance the literature in two ways. First, we focus on people’s belief about differences in selfishness as a source of inequality in society. The empirical and experimental literature on the source of inequality has mainly focused on investigating people’s views on the role of luck versus effort in determining income inequality, while the role of selfish behavior has been, in comparison, highly overlooked (21–25). We study whether people believe that selfish behavior among the rich is a source of inequality, which we refer to as the selfish rich inequality hypothesis.

Selfish Rich Inequality Hypothesis. The rich are richer than the poor because they have been more selfish in life than the poor.

Second, we provide large-scale global data from 60 countries (nationally representative samples) that allow for both between- and within-country analysis of people’s belief in the selfish rich inequality hypothesis.

There may be systematic between-country variation in support for the selfish rich inequality hypothesis because countries are likely to differ in the opportunity for and reward from selfish behavior. In particular, it has been argued that nonproductive grabbing behavior may be particularly profitable in countries with poor institutions, where outcomes are more down to personal factors and networks, due to a weak rule of law, malfunctioning bureaucracy, and corruption (26). In contrast, good institutions may attract selfish individuals into productive activities that are beneficial for society. Hence, people in countries with poor institutions may be more likely to believe that the rich have become rich because they have been involved in selfish grabbing activities, while people in countries with good institutions may be more likely to believe that the rich have become rich through activities that have benefited society.

There may also be important within-country variation in the belief in the selfish rich inequality hypothesis, since people differ in their experiences and information about the rich, or they may have self-serving beliefs (27, 28). For example, the rich may be less in agreement with the selfish rich inequality hypothesis than the poor because they have more information compared to the poor about the reasons for why they are rich. It may also be favorable for the rich to preserve a positive view of themselves and inequality in society and beneficial for the nonrich to picture the rich in a negative way. Finally, self-selection may affect the association between income rank and the belief in selfish rich inequality, since some people may decide not to pursue wealth because they believe that they have to engage in selfish behavior to become rich.

We further consider the relationship between people’s belief in the selfish rich inequality hypothesis and their acceptance of inequality. Are people who believe in the selfish rich inequality hypothesis more likely to consider inequality in their country to be unfair and be more in support of redistribution? The answers to these questions are not straightforward and likely depend on whether selfish behavior of the rich is seen as taking opportunities away from others or as promoting the interests of society.

The study shows strong support for the selfish rich inequality hypothesis at the global level, but also substantial between- and within-country variation. Belief in the selfish rich inequality hypothesis is related both to the circumstances in the country, particularly the corruption level, and to people’s position in the income distribution. These beliefs strongly predict people’s inequality acceptance and support for redistribution. Hence, people’s views on the selfish rich inequality hypothesis may play an important role in shaping how societies across the world address inequality.

Study Design

We report on a large-scale global study of people’s belief in the selfish rich inequality hypothesis, using a sample of more than 26,000 individuals in 60 countries. It was implemented as part of the Fairness-Across-the-World module in the 2018 Gallup World Poll. The national samples are probability-based and nationally representative of the resident population aged 15 and older (see SI Appendix, Table S1).

The key question in the present study is whether the respondent agrees with the following statement: “In [name of country of the respondent], one of the main reasons for the rich being richer than the poor is that the rich have been more selfish in life than the poor.” This question was asked of a random subsample of 40% of the 65,856 respondents who took part in the 2018 Gallup World Poll in these 60 countries. The data were collected on a discrete 5-point ordinal scale from “strongly agree” to “strongly disagree” and assigned numerical values from 1 (strongly disagree) to 5 (strongly agree). In the analysis, we also use questions on whether they think the rich are richer than the poor because they have been more involved in illegal activities, whether they think inequality in their society is unfair, whether they support redistribution, a set of individual background variables, and a set of country background variables. A further description of the study, the data sources, and the empirical specifications is provided in SI Appendix. The study was approved by the institutional review boards of Gallup and NHH Norwegian School of Economics.

Results

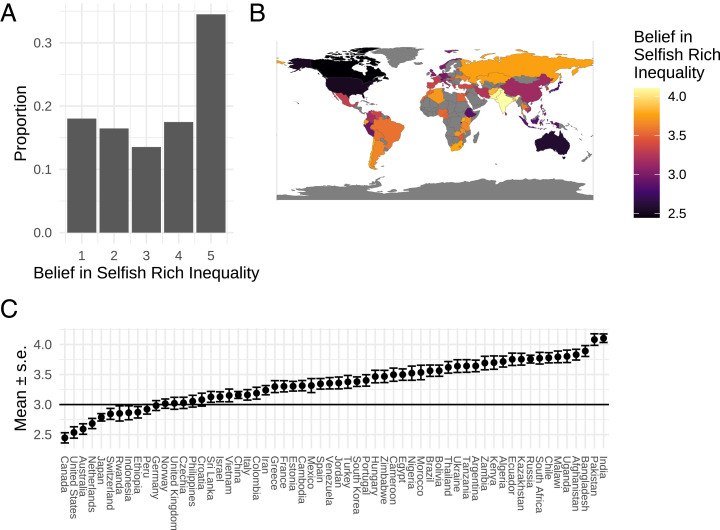

In Fig. 1, we provide an overview of people’s belief in the selfish rich inequality hypothesis. We observe strong support for this hypothesis at the global level. As shown in Fig. 1A, the majority of respondents agree with the selfish rich inequality hypothesis (52.0%); the mode in the pooled sample is to strongly agree (34.5%). However, we also note that there is a large minority who disagree with such a view of inequality in society. Fig. 1B provides a global map that gives an overview of the level of support for the selfish rich inequality hypothesis across the world. The strongest support for the hypothesis is found in South America, southern Europe, Africa, and parts of Asia, while there is less support in North America, northern Europe, and Australia. In Fig. 1C, we report a ranking of the countries based on the extent to which the average response in the country is in agreement with the selfish rich inequality hypothesis; SI Appendix, Fig. S2 provides the histograms of responses by country. We find that 49 countries have an average response in agreement with the selfish rich inequality hypothesis, while only 11 countries have an average response against it. In fact, in 39 countries, the mode is to strongly agree with the selfish rich inequality hypothesis, while in only 7 countries is the mode to strongly disagree with it. The hypothesis has the most support in India and Pakistan, with about 60% of the respondents strongly agreeing with it, and the least support in the United States and Canada, with the majority disagreeing with it. These descriptive statistics are summarized in our first main result:

Fig. 1.

“Belief in selfish rich inequality” around the world. Note: The figure provides an overview of support for the selfish rich inequality hypothesis. Respondents answered the belief in selfish rich inequality question on a discrete 5-point scale from “strongly disagree” (1) to “strongly agree” (5). A shows the distribution of belief in selfish rich inequality in the pooled global sample; B shows how the level of agreement varies by country (countries not in our sample are shown in gray); and C shows the estimated, population-weighted, average belief in selfish rich inequality and its SE for each country.

Result 1.

There is strong support for the selfish rich inequality hypothesis at the global level, but also significant variation in the level of support across countries.

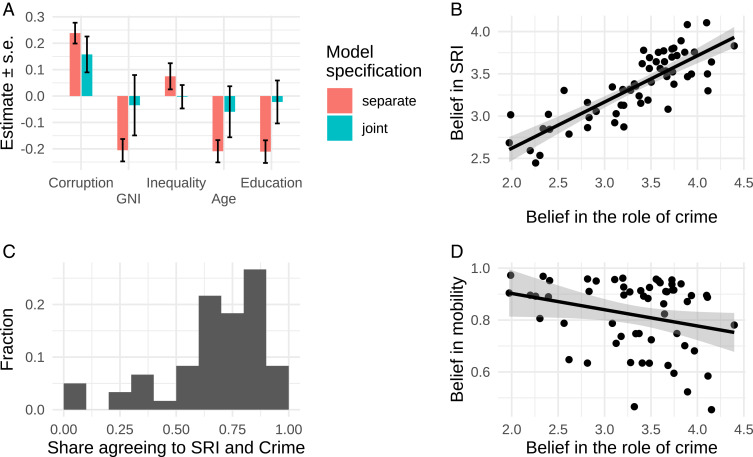

We now turn to an analysis of the between-country variation in the belief in the selfish rich inequality hypothesis. In Fig. 2A, we report regression coefficients from country-level regressions of the belief in the selfish rich inequality hypothesis on a corruption indicator for the country (see also SI Appendix, Table S2). We observe a highly significant positive relationship: The support for the selfish rich inequality hypothesis is increasing with the level of corruption in the country (, P < 0.001). This relationship holds when we control for other country characteristics, including gross national income, income inequality, mean years of schooling, and mean age. Separately, each of these other country characteristics is significantly associated with the belief in the selfish rich inequality hypothesis, but only corruption remains significant in a joint regression (, P = 0.024). In SI Appendix, Table S3, we show that the relationship between belief in selfish rich inequality and corruption is robust to alternative measures of corruption and to including a measure of national conflict, the Global Peace Index, or a broad measure of a country’s development, the Human Development Index, in the analysis.

Fig. 2.

Between-country variation in beliefs. Note: A shows coefficients from a regression of country-level average belief in selfish rich inequality on country indices of corruption (58, 59); (log) gross national income per capita (GNI) (59); income inequality (Gini) from the World Income Distribution (60); average age (from the Gallup World Poll 2018 data); and average years of schooling (61). All explanatory variables have been standardized to unit variance. Estimates are reported for both separate bivariate and a joint specification (with all variables included). See SI Appendix, Table S2 for the complete specifications. B shows the country-level relationship between belief in selfish rich inequality (SRI) and “belief in the role of crime” (which is coded the same way as belief in selfish rich inequality). C shows the country-level distribution of the share of those who believe in selfish rich inequality that also believe in illegal activity being an important cause of inequality. D shows the country-level relationship between belief in the role of crime and belief in economic mobility (“Can people in this country get ahead by working hard, or not?”, yes/no).

We further investigate how the belief in selfish rich inequality in a country relates to other governance indicators. We find that the relationship between belief in the selfish rich inequality hypothesis and institutional quality is robust to considering institutional quality in terms of government effectiveness, political stability, regulatory quality, rule of law, voice, and accountability (SI Appendix, Table S4; in all cases, P < 0.001). However, in a regression including jointly the corruption indicator and all the other governance indicators, we observe that only the corruption indicator is significant (, P = 0.011). The corruption indicator also explains more of the cross-country variation in the support for the selfish rich inequality hypothesis than a governance index based on the first principal component of all the indicators. Finally, we consider how the belief in the selfish rich inequality hypothesis relates to measures of organized crime and the size of the shadow economy in the country (SI Appendix, Table S5). We find that the belief in selfish rich inequality is positively associated with the size of the shadow economy (, P < 0.001) and organized crime (, P = 0.036). However, also in this analysis, we find that only the corruption indicator is significant in a joint regression (, P < 0.001).

The fact that the belief in the selfish rich inequality hypothesis is strongly associated with corruption is suggestive of the respondents partly considering rich people to be sufficiently selfish to violate laws for personal gain (29). In Fig. 2B, we provide evidence corroborating this interpretation. We show at the country level how the belief in the selfish rich inequality hypothesis is associated with the view that the rich are richer than the poor because they have been more involved in crime. We observe that there is a strong positive association between these two beliefs: Agreement with the selfish rich inequality hypothesis is much greater in countries where people believe that rich people have been more involved in crime than poor people (, P < 0.001). In Fig. 2C, we show the country-level distribution of the share of those who believe in selfish rich inequality that also believe in illegal activities being an important cause of economic inequality (for further details, see SI Appendix, Fig. S3A). We observe that in 50 countries, the majority of those who believe in selfish rich inequality also believe that the rich are richer than the poor because they have been involved in illegal activities. Hence, the evidence suggests that the between-country variation in the support for the selfish rich inequality hypothesis is partly driven by variation in corruption and institutional quality across countries.

Result 2.

Support for the selfish rich inequality hypothesis is stronger in countries with more corruption and weaker institutions.

This result suggests that in countries with more corruption and weaker institutions, it is a common view that the existing inequality reflects selfish behavior that has been destructive for society. In Fig. 2D, we show that there is a significant negative relationship between the belief in the rich being richer because they have been involved in crime and the extent to which people believe that there is economic mobility in society (, P = 0.047). Hence, it appears that many consider the selfish behavior of the rich to have reduced the opportunities for most people. However, it should be noted that a substantial minority of people who believe in the selfish rich inequality hypothesis do not share this view. In 14 countries, primarily advanced economies with strong institutions, we find that more than 30% of those who believe in selfish rich inequality do not believe that the rich are richer because they have been involved in criminal activity (SI Appendix, Figs. S3B and S4B).

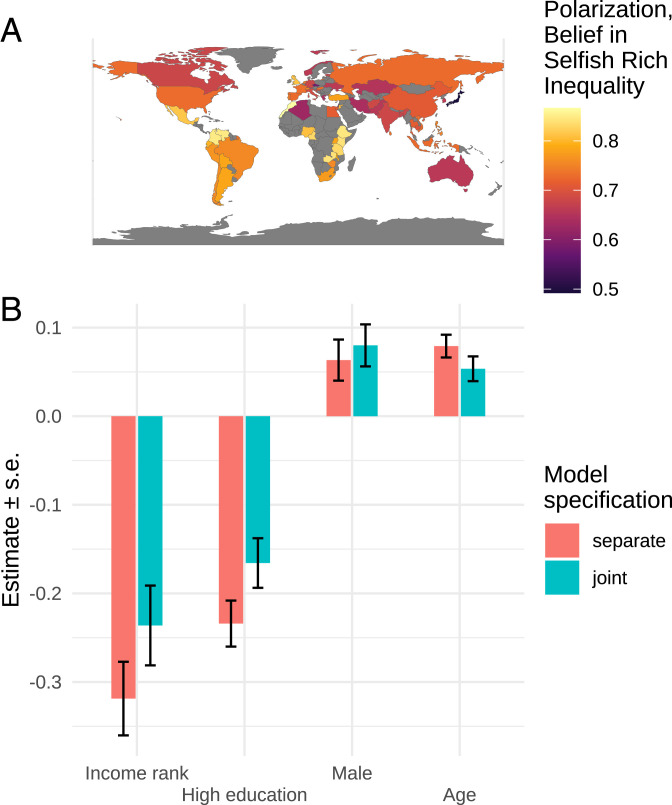

We find substantial within-country variation in support for the selfish rich inequality hypothesis. In Fig. 3A, we provide a global map of how polarized countries are in their view of the rich (see also SI Appendix, Fig. S5). In almost all countries, we find substantial polarization, with a large share of the respondents agreeing with the selfish rich inequality hypothesis and another large share of respondents disagreeing with it. In 21 countries, the two most frequent responses are to strongly disagree or to strongly agree with the selfish rich inequality hypothesis, and only in Croatia, Czechia, and Japan is the mode to be neutral.

Fig. 3.

Within-country variation in beliefs. Note: A shows a map of the polarization in belief in selfish rich inequality. Polarization is measured as the SD of reported support within each country relative to the maximum SD possible (scaled zero to one). B reports estimated coefficients from regressing belief in selfish rich inequality on individual characteristics of the respondent: income rank of the household within country (using the square root equivalence scale and scaled from lowest: zero, to highest: one); an indicator for the respondent having high education relative to the national distribution of reported education; an indicator for the respondent being male; and age. High education and gender (male) are coded binary zero/one, while age is standardized to unit variance. Estimates are reported both for separate bivariate specifications and a joint specification (with all variables included, including some nonreported controls; see SI Appendix, Table S4 for the complete specifications). All specifications with country-specific intercepts. Estimates are population-weighted, with weights scaled such that each country has equal weight. Sandwich SEs account for primary sampling unit clustering and weighting.

We further investigate how the belief in selfish rich inequality relates to the respondent’s income rank in their country. In Fig. 3B, we report regression coefficients from regressions of the belief in the selfish rich inequality hypothesis on the respondent’s rank in the income distribution with country fixed effects (see also SI Appendix, Table S6). We find that the belief in the selfish rich inequality hypothesis is negatively associated with the respondent’s rank in the income distribution in their country (, P < 0.001). This relationship is highly significant also when including other background characteristics in a joint regression (, P < 0.001). We further observe that the belief in the selfish rich inequality hypothesis is negatively associated with education level (, P < 0.001) and positively associated with being male (, z = 2.73, P = 0.006) and older (, z = 6.16, P < 0.001). In SI Appendix, Fig. S6, we report the estimated regression coefficient for income rank separately for each country. We find a negative relationship between the belief in the selfish rich inequality hypothesis and income rank in the majority of the countries, with the strongest association being in the United States. Only in a few countries do we find a positive relationship.

Result 3.

There is less support for the selfish rich inequality hypothesis among richer and more educated people and more support among males and older people.

Finally, we consider the relationship between the selfish rich inequality hypothesis and people’s views on inequality and unfairness in society, both within and between countries. In the upper part of Table 1, we show that the belief in the selfish rich inequality hypothesis is significantly positively associated with agreeing that inequality in their country is unfair (, P < 0.001) and in the lower part of Table 1 that it is significantly positively associated with agreeing that the government should aim to reduce inequality (, P < 0.001). These relationships are highly significant both across and within countries and robust to including country-level or individual-level controls and using Lasso-selected regressors (in all cases, P < 0.001). In SI Appendix, Fig. S7, we report the regression coefficients for the individual-level analysis separately for each country. We observe a highly significant positive relationship between belief in the selfish rich inequality hypothesis and attitudes on inequality for almost all the countries in the study, with the associations being particularly strong in the United States. Thus, the data provide strong evidence of selfishness among the rich being perceived as creating unfair inequality and justifying equalizing policies.

Table 1.

Unfairness and inequality

| Between-country variation | Within-country variation | |||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Agreement with “Current inequality is unfair” | ||||||

| Belief in selfish rich inequality | 0.620 | 0.919 | 0.814 | 0.228 | 0.231 | 0.233 |

| (0.124) | (0.152) | (0.111) | (0.008) | (0.008) | (0.006) | |

| Controls (not reported) | No | Yes | Yes | No | Yes | Yes |

| Lasso selection of controls | No | No | Yes | No | No | Yes |

| Observations | 60 | 57 | 57 | 23,103 | 23,103 | 23,103 |

| Agreement with “Government should aim to reduce economic differences” | ||||||

| Belief in selfish rich inequality | 0.482 | 0.707 | 0.606 | 0.148 | 0.150 | 0.149 |

| (0.096) | (0.121) | (0.097) | (0.007) | (0.007) | (0.006) | |

| Controls (not reported) | No | Yes | Yes | No | Yes | Yes |

| Lasso selection of controls | No | No | Yes | No | No | Yes |

| Observations | 60 | 57 | 57 | 23,103 | 23,103 | 23,103 |

Notes. Columns 1–3 report between-country regressions of the (country average) “current inequality is unfair”/”government should aim to reduce economic differences” on the (country average) belief in selfish rich inequality and a set of controls. See SI Appendix, Table S7A for the complete specifications. Columns 4–6 report the corresponding within-country regressions (with country-specific intercepts); see SI Appendix, Table S7B for the complete specifications. Column 3 and 6 report regressions with Lasso-selected regressors (selecting from a set of control variables and a quadratic form in these) and, for column 6, always including country-specific intercepts (62). SEs are in parentheses.

Result 4.

People who believe in the selfish rich inequality hypothesis are more likely to consider inequality as unfair and to support that the government should aim to reduce inequality in their country.

Discussion

The present study reports from a global dataset on people’s beliefs about the extent to which selfishness among the rich has caused inequality. It shows substantial support among people for the hypothesis that the rich are richer than the poor because they have been more selfish in life. We find that people’s belief in the selfish rich inequality hypothesis is related both to societal circumstances—in particular, the corruption level in their country—and to their income rank in the country. Finally, we show that the belief in the selfish rich inequality hypothesis is predictive of people’s views on whether inequality in society is unfair and whether the government should aim to reduce inequality.

These findings contribute to a number of literatures. They highlight how people’s perception of the rich may affect the political economy of redistribution and economic development (30–37). If the fortunes of the rich are perceived to be the result of selfish behavior, then our evidence suggests that there will be substantial support for redistribution. However, we observe that the belief in the selfish rich inequality hypothesis is highly polarized in many countries and thus likely to be a source of political disagreements. In this respect, it is interesting to observe that the United States is one of the most polarized countries in our study and the country in which the belief in the selfish rich inequality hypothesis is most predictive of people’s attitudes toward inequality. Disagreement on the selfish rich inequality hypothesis among Americans may thus be a contributing factor to the present challenging political situation in the United States. More broadly, these beliefs may affect economic development by shaping the trust people have in the rich and in companies and other institutions often headed by people perceived to be among the rich.

This study further contributes to the important literature in psychology and economics on motivated beliefs, which has shown that people engage in self-enhancing attributions (27, 38–44). There is considerable evidence suggesting that people are predictably biased in how they gather and process information to preserve a self-image of being moral and not self-interested (43, 45–52). The present study provides evidence consistent with such a self-serving bias in beliefs, even though we cannot rule out that the observed association between income rank and the belief in selfish rich inequality may be driven by the rich and the poor having access to different information. Finally, the paper speaks to the large literature in moral psychology and behavioral economics studying the role of nonselfish motivation in explaining human behavior (23, 45, 53–55). We provide large-scale evidence showing that people across the world believe there to be heterogeneity in the extent to which individuals behave nonselfishly.

An interesting question is how the belief in selfish rich inequality relates to the actual selfishness of the rich. To shed some light on this relationship, we use self-reported data from the 2018 Gallup World Poll on whether people last month donated money to a charity. In most countries, we find that the rich are more likely to have donated money than the poor, which is not surprising, given that the rich have more money than the poor. However, in SI Appendix, Fig. S8, we show that there is a negative relationship between the belief in selfish rich inequality and the extent to which donating money correlates with the income rank in society (, P = 0.014). Hence, the data suggest that the rich are less willing to donate money in countries where people believe there to be selection of selfish people into becoming rich.

People’s beliefs in the selfish rich inequality hypothesis shed light on how we think society works and may shape the kind of life we want to live. These beliefs may also play a fundamental role in determining public morality and civic virtues (56) and therefore represent an essential ingredient in our understanding of human behavior and the organization of society.

Materials and Methods

Survey Sampling and Weights.

The study was based on telephone interviews in countries where telephone coverage at the time of the survey represented at least 80% of the population (15 countries) and face-to-face interviews in the other countries (45 countries). Verbal consent to participate was given to Gallup interviewers.

Weights were generated to correct for household size; these were combined with poststratification weights constructed such that the survey can reproduce official population level statistics on demographics and socioeconomic characteristics. SI Appendix, Fig. S1 illustrates the effect of the resulting population weights. We rescaled the population weights by country such that all countries got equal weight both in the individual-level analysis and in the cross-country analysis.

Analysis.

The regression estimates reported for the between-country analysis were calculated with ordinary least squares. The regression estimates reported for the within-country analysis were calculated applying survey weights and with SE corrections for cluster sampling. For details, see SI Appendix, section H.

Supplementary Material

Acknowledgments

The project was supported by the Research Council of Norway through its Centres of Excellence Scheme, FAIR Project 262675 and Research Grants 236995 and 250415, and administered by FAIR—The Choice Lab. The experiment is registered in the Registry for Randomized Controlled Trials operated by the American Economic Association.

Footnotes

The authors declare no competing interest.

This article is a PNAS Direct Submission.

This article contains supporting information online at https://www.pnas.org/lookup/suppl/doi:10.1073/pnas.2109690119/-/DCSupplemental.

Data Availability

Some study data are available: There are no restrictions on the data used in this paper that were collected as part of the Fairness-Across-the-World module; these outcomes are publicly released with a core set of individual background variables. Survey and external macro data have been deposited in the Harvard Dataverse, https://doi.org/10.7910/DVN/ZEGFIT (57). The remaining set of background variables will be made available upon request; other Gallup World Poll variables are subject to licensing from Gallup.

References

- 1.Andreoni J., Nikiforakis N., Stoop J., “Are the rich more selfish than the poor, or do they just have more money? A natural field experiment” (NBER Working Paper 23229, National Bureau of Economic Research, Cambridge, MA, 2017; https://www.nber.org/papers/w23229). [Google Scholar]

- 2.Smith A., The Theory of Moral Sentiments (Millar A., Edinburgh, ed. 2, 1761). [Google Scholar]

- 3.The Economist, Egalitarianism: Inequality could be lower than you think. The Economist, 28 November 2019, vol. 433, pp. 15–16. https://www.economist.com/leaders/2019/11/28/inequality-could-be-lower-than-you-think. Accessed 28 December 2021. [Google Scholar]

- 4.Piketty T., Capital in the Twenty-First Century (Belknap Press, Cambridge, MA, 2014). [Google Scholar]

- 5.Piff P. K., Kraus M. W., Côté S., Cheng B. H., Keltner D., Having less, giving more: The influence of social class on prosocial behavior. J. Pers. Soc. Psychol. 99, 771–784 (2010). [DOI] [PubMed] [Google Scholar]

- 6.Piff P. K., Stancato D. M., Côté S., Mendoza-Denton R., Keltner D., Higher social class predicts increased unethical behavior. Proc. Natl. Acad. Sci. U.S.A. 109, 4086–4091 (2012). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Stellar J. E., Manzo V. M., Kraus M. W., Keltner D., Class and compassion: Socioeconomic factors predict responses to suffering. Emotion 12, 449–459 (2012). [DOI] [PubMed] [Google Scholar]

- 8.Andreoni J., Nikiforakis N., Stoop J., Higher socioeconomic status does not predict decreased prosocial behavior in a field experiment. Nat. Commun. 12, 4266 (2021). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.Trautmann S. T., van de Kuilen G., Zeckhauser R. J., Social class and (un)ethical behavior: A framework, with evidence from a large population sample. Perspect. Psychol. Sci. 8, 487–497 (2013). [DOI] [PubMed] [Google Scholar]

- 10.Smeets P., Bauer R., Gneezy U., Giving behavior of millionaires. Proc. Natl. Acad. Sci. U.S.A. 112, 10641–10644 (2015). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Schmukle S. C., Korndörfer M., Egloff B., No evidence that economic inequality moderates the effect of income on generosity. Proc. Natl. Acad. Sci. U.S.A. 116, 9790–9795 (2019). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.Vohs K. D., Mead N. L., Goode M. R., The psychological consequences of money. Science 314, 1154–1156 (2006). [DOI] [PubMed] [Google Scholar]

- 13.Chowdhury S. M., Jeon J. Y., Impure altruism or inequality aversion? An experimental investigation based on income effects. J. Public Econ. 118, 143–150 (2014). [Google Scholar]

- 14.Bartling B., Valero V., Weber R. A., “Is social responsibility a normal good?” (CESifo Working Paper No. 7263, CESifo, Munich, 2018; https://www.cesifo.org/en/publikationen/2018/working-paper/social-responsibility-normal-good).

- 15.Andersen A. G., et al., “Does wealth reduce support for redistribution? Evidence from an Ethiopian housing lottery” (NHH Department of Economics Discussion Paper No. 18/2020, NHH Norwegian School of Economics, Bergen, Norway, 2020; https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3694901).

- 16.Erkal N., Gangadharan L., Nikiforakis N., Relative earnings and giving in a real-effort experiment. Am. Econ. Rev. 101, 3330–3348 (2011). [Google Scholar]

- 17.Rockenbach B., Tonke S., Weiss A. R., Self-serving behavior of the rich causes contagion effects among the poor. J. Econ. Behav. Organ. 183, 289–300 (2021). [Google Scholar]

- 18.Ragusa J. M., Socioeconomic stereotypes: Explaining variation in preferences for taxing the rich. Am. Polit. Res. 43, 327–359 (2015). [Google Scholar]

- 19.Durante F., et al., Ambivalent stereotypes link to peace, conflict, and inequality across 38 nations. Proc. Natl. Acad. Sci. U.S.A. 114, 669–674 (2017). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Raine A., Uh S., The selfishness questionnaire: Egocentric, adaptive, and pathological forms of selfishness. J. Pers. Assess. 101, 503–514 (2019). [DOI] [PubMed] [Google Scholar]

- 21.Fong C., Social preferences, self-interest, and the demand for redistribution. J. Public Econ. 82, 225–246 (2001). [Google Scholar]

- 22.Konow J., Fair and square: The four sides of distributive justice. J. Econ. Behav. Organ. 46, 137–164 (2001). [Google Scholar]

- 23.Cappelen A. W., Drange Hole A., Sørensen E. Ø., Tungodden B., The pluralism of fairness ideals: An experimental approach. Am. Econ. Rev. 97, 818–827 (2007). [Google Scholar]

- 24.Alesina A., Giuliano P., “Preferences for redistribution” in Handbook of Social Economics, Benhabib J., Bisin A., M. O. Jackson, Eds. (Elsevier, Amsterdam, 2011), vol. 1, pp. 99–131. [Google Scholar]

- 25.Almås I., Cappelen A. W., Tungodden B., Cutthroat capitalism versus cuddly socialism: Are Americans more meritocratic and efficiency-seeking than Scandinavians? J. Polit. Econ. 128, 1753–1788 (2020). [Google Scholar]

- 26.Mehlum H., Moene K. O., Torvik R., Institutions and the resource curse. Econ. J. (Lond.) 116, 1–20 (2006). [Google Scholar]

- 27.Miller D. T., Ross M., Self-serving biases in the attribution of causality: Fact or fiction? Psychol. Bull. 82, 213–225 (1975). [Google Scholar]

- 28.Bénabou R., The economics of motivated beliefs. Rev. Econ. Polit. 125, 665–685 (2015). [Google Scholar]

- 29.Gächter S., Schulz J. F., Intrinsic honesty and the prevalence of rule violations across societies. Nature 531, 496–499 (2016). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 30.Piketty T., Social mobility and redistributive politics. Q. J. Econ. 110, 551–584 (1995). [Google Scholar]

- 31.Alesina A., Angeletos G. M., Fairness and redistribution. Am. Econ. Rev. 95, 960–980 (2005). [Google Scholar]

- 32.Bénabou R., Tirole J., Belief in a just world and redistributive politics. Q. J. Econ. 121, 699–746 (2006). [Google Scholar]

- 33.Algan Y., Cahuc P., Inherited trust and growth. Am. Econ. Rev. 100, 2060–2092 (2010). [Google Scholar]

- 34.Algan Y., Cahuc P., Trust and growth. Annu. Rev. Econ. 5, 521–549 (2013). [Google Scholar]

- 35.Kuziemko I., Norton M. I., Saez E., Stantcheva S., How elastic are preferences for redistribution? Evidence from randomized survey experiments. Am. Econ. Rev. 105, 1478–1508 (2015). [Google Scholar]

- 36.Alesina A., Stantcheva S., Teso E., Intergenerational mobility and preferences for redistribution. Am. Econ. Rev. 108, 521–554 (2018). [Google Scholar]

- 37.Roth C., Wohlfart J., Experienced inequality and preferences for redistribution. J. Public Econ. 167, 251–262 (2018). [Google Scholar]

- 38.Weiner B., An attributional theory of achievement motivation and emotion. Psychol. Rev. 92, 548–573 (1985). [PubMed] [Google Scholar]

- 39.Babcock L., Loewenstein G., Explaining bargaining impasse: The role of self-serving biases. J. Econ. Perspect. 11, 109–126 (1997). [Google Scholar]

- 40.Kunda Z., Motivated inference: Self-serving generation and evaluation of causal theories. J. Pers. Soc. Psychol. 53, 636–647 (1987). [Google Scholar]

- 41.Bénabou R., Tirole J., Self-confidence and personal motivation. Q. J. Econ 117, 871–915 (2002). [Google Scholar]

- 42.Bénabou R., Mindful economics: The production, consumption, and value of beliefs. J. Econ. Perspect. 30, 141–164 (2016). [Google Scholar]

- 43.Gino F., Norton M. I., Weber R. A., Motivated Bayesians: Feeling moral while acting egoistically. J. Econ. Perspect. 30, 189–212 (2016). [Google Scholar]

- 44.Zimmermann F., The dynamics of motivated beliefs. Am. Econ. Rev. 110, 337–361 (2020). [Google Scholar]

- 45.Konow J., Fair shares: Accountability and cognitive dissonance in allocation decisions. Am. Econ. Rev. 90, 1072–1091 (2000). [Google Scholar]

- 46.Dana J., Weber R. A., Kuang J. X., Exploiting moral wiggle room: Experiments demonstrating an illusory preference for fairness. Econ. Theory 33, 67–80 (2007). [Google Scholar]

- 47.Haisley E. C., Weber R. A., Self-serving interpretations of ambiguity in other-regarding behavior. Games Econ. Behav. 68, 614–625 (2010). [Google Scholar]

- 48.Tella R. Di, Perez-Truglia R., Babino A., Sigman M., Conveniently upset: Avoiding altruism by distorting beliefs about others’ altruism. Am. Econ. Rev. 105, 3416–3442 (2015). [Google Scholar]

- 49.Gneezy U., Saccardo S., Serra-Garcia M., van Veldhuizen R., Bribing the self. Games Econ. Behav. 120, 311–324 (2020). [Google Scholar]

- 50.Deffains B., Espinosa R., Thöni C., Political self-serving bias and redistribution. J. Public Econ. 134, 67–74 (2016). [Google Scholar]

- 51.Grossman Z., van der Weele J. J., Self-image and willful ignorance in social decisions. J. Eur. Econ. Assoc. 15, 173–217 (2017). [Google Scholar]

- 52.Cassar L., Klein A. H., A matter of perspective: How failure shapes distributive preferences. Manage. Sci. 65, 5050–5064 (2019). [Google Scholar]

- 53.Fehr E., Schmidt K. M., A theory of fairness, competition and cooperation. Q. J. Econ. 114, 817–868 (1999). [Google Scholar]

- 54.Bolton G. E., Ockenfels A., ERC: A theory of equity, reciprocity, and competition. Am. Econ. Rev. 90, 166–193 (2000). [Google Scholar]

- 55.Charness G., Rabin M., Understanding social preferences with simple tests. Q. J. Econ. 117, 817–869 (2002). [Google Scholar]

- 56.Sandel M. J., What Money Can’t Buy: The Moral Limits of Markets (Farrar, Straus and Giroux, New York, 2012). [Google Scholar]

- 57.Almås I., Cappelen C. A., Sørensen E. Ø., Tungodden B., Global evidence on the selfish rich inequality hypothesis. Harvard Dataverse. 10.7910/DVN/ZEGFIT. Deposited 9 November 2021. [DOI] [Google Scholar]

- 58.Kaufmann D., Kraay A., Mastruzzi M., “The worldwide governance indicators” (World Bank Policy Research Working Paper 5430, The World Bank, Washington, DC, 2010; https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2894745).

- 59.World Bank, World Development Report 2020: Trading for Development in the Age of Global Value Chains (World Bank, Washington, DC, 2020). [Google Scholar]

- 60.Milanovic B., Description of All the Ginis Dataset (Stone Center on Socio-Economic Inequality, New York, 2019). https://stonecenter.gc.cuny.edu/files/2019/02/Milanovic-all-the-ginis-dataset-description.pdf. Accessed 28 December 2021.

- 61.Barro R. J., Lee J. W., A new data set of educational attainment in the world, 1950–2010. J. Dev. Econ. 104, 184–198 (2013). [Google Scholar]

- 62.Chernozhukov V., et al., Double/debiased machine learning for treatment and structural parameters. Econom. J. 21, C1–C68 (2018). [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Data Availability Statement

Some study data are available: There are no restrictions on the data used in this paper that were collected as part of the Fairness-Across-the-World module; these outcomes are publicly released with a core set of individual background variables. Survey and external macro data have been deposited in the Harvard Dataverse, https://doi.org/10.7910/DVN/ZEGFIT (57). The remaining set of background variables will be made available upon request; other Gallup World Poll variables are subject to licensing from Gallup.