Abstract

Starting from December 2019, the novel COVID-19 threatens human lives and economies across the world. It was a matter of grave concern for the governments of all the countries as the deadly virus started expanding its paws over neighboring regions of infected areas. The spread got uncontrollable, thereby leaving no choice for the nations but to impose and observe nationwide lockdown. The lockdown further sorely hit many sectors, which in turn impacted the economy. Manufacturing, agriculture, and the service sector - the three pillars of the economy - have been adversely affected giving a major slow down to the economy belonging to every nation. Several schemes and policies were introduced by different state and central governments to absorb the impact of subsequent lockdowns on individuals. In this paper, we present a then and now analysis of the economy using a socioeconomic framework focusing on factors- unemployment, industrial production, import-export trade, equity markets, currency exchange rate, and gold and silver prices. For all these, we consider India as a case study because the Indian sub-continent has a wide landscape and rich cultural heritage presenting itself as a potential hub for economic activities. A thorough assessment has been made for the period January 2020- June 2020. The assessment will be beneficial to observe the long-term impact of any infectious disease outbreak such as COVID-19 locally and globally.

Keywords: COVID-19; GDP; Economy; Industrial production, Stock market, Unemployment, India

1. Introduction

The socioeconomic and global impact of the novel COVID-19 has been disastrous. COVID-19 has come up as a major challenge not just for the medical and research community but for the entire world. Beyond the transmission of the disease, the coronavirus pandemic has had far-hitting consequences.8 Predicted to be the worst economic crunch since the Great Depression of 1930, COVID-19 is probable to cause much greater hardships than any other disease. Some of the worst-hit countries including the United States, Brazil, United Kingdom, and India imposed nationwide lockdowns to contain the virus from spreading. Also, several governments enforced travel restrictions and entry bans from infected areas which impacted the tourism industry. As a result of travel restrictions, several countries had to evacuate their citizens including students, diplomats from foreign grounds. Affecting over 1.5 billion students worldwide, the pandemic imposed lockdown has harmed the education system which if continued for a longer period can even hamper the mental and social growth of students. Furthermore, the circulation of misinformation on various social media platforms regarding the coronavirus has created a sense of unrest and panic amongst people especially young and frolic minds (specifically students).

Talking about the social impact of COVID-19, it has been evident that this disease is putting a check on social and cultural functions and marriage parties. Gold and silver form an important part of a social setup like India where people purchase and gift ornaments in functions. Thus, this paper discusses the hike in gold and silver prices due to Covid-19. Additionally, the essence of society is marred by the increase in the unemployment rate in a country Both these sub-factors contribute to the societal factor, which has been studied in this paper.

Needless to say, the global economy has been affected the most. The countries have gone through a period of economic slowdown during the pandemic showing marked changes In several factors such as unemployment, industrial production, consumer spending, and foreign trade. The beginning of the oil war between Saudi Arabia and Russia, the largest oil-producing countries followed by a sharp decrease in the global demand for oil due to restriction on movement during COVID-19 induced lockdown led to a steep price crash in the global market (Oil prices, 2020). In many countries including the United States (US) and India (Prices of agricultural, 2020), the agriculture sector has also suffered huge losses owing to a decrease in local demand and declined foreign trade (CME Closing, 2020). Not only lower incomes, but unprecedented conditions also forced businesses to lay off employees in large numbers across the world. Needless to say, manufacturing and industrial sectors employ a significant number of people directly or indirectly. An increase in industrial production is a sign of a stronger economy. However, the manufacturing sector, one of the hardest hit due to the COVID-19 pandemic, is estimated to cause the world Foreign Direct Investment (FDI) to shrink by 5% to 15% (Impact of COVID-19, 2020).

Declining growth in industrial production had severely impacted the livelihood of workers leaving millions of people unemployed. With no income and almost zero savings, the migrant laborers and daily wage earners struggled for a livelihood. IIP for all goods except consumer non-durables reduced to more than 50 percent as that of prior lockdown. While the production of non-essential items declined abruptly due to a fall in demand, the production of basic and essential commodities including food and pharmaceutical products-maintained normalcy even in the lockdown. Foreign trade is an important aspect in determining a country's GDP. A surplus trade balance contributes to the positive growth of the economy but the limited industrial production and lesser demand in foreign markets have caused a decline in the export trade. This decrease in foreign trade has skeptically affected global supply chains and the economy. To some relief, the export of commodities like cereals, drugs, pharmaceutical products, and iron ore recorded positive growth in April and May. With a direct impact on foreign trade, a depreciation in the currency exchange rate promotes the export business in the international market. For example, during the pandemic, the value of the Indian currency dropped from 70.68 to the dollar in January to 77.01 to the dollar in April 2020. This economic crisis is considered to be one of the worst recessions in Indian history, affecting the country's Gross Domestic Product (GDP) per capita and global supply chains. India's GDP may contract by 40% in the year 2021. With a loss of around Rs.32,000 crore daily in the first lockdown period, the growth of the Indian economy slowed. The unemployment rate, Index of Industrial Production (IIP), foreign trades, and currency exchange rates are a few of the key factors determining the economy of a nation. Due to the adoption of social distancing and movement restrictions by different state governments, most of the operations involving the flow of goods and services came to a standstill. A cut down in the foreign investments and negative revenues resulted in most of the emerging startups being vulnerable to the financial crunch and at risk of shutting down. While the IT, telecommunication, and medicine industry have seen an appreciable increase in demand, most of the services-based companies suffered heavy losses due to movement restrictions.

Nevertheless, with the reducing air and water pollution levels, the otherwise positive impact of COVID-19 induced lockdowns on the environment and the ecosystem is worth a mention (Chaudhary, Gupta, Jain, & Santosh, 2021). With the industries getting a restart and migrant workers coming back to find a livelihood, a gradual improvement in the manufacturing sector is foreseen and this unlock in the economy is anticipated to have a pragmatic impact on the rupee, international trade, and unemployment rates.

In this paper, variations in the Indian economy during the pandemic are analyzed and discussed in the three phases - pre-lockdown (01-January to 24-March), lockdown (24-March to 31-May) and unlock (01-June to 31-July). The impact of various socioeconomic factors have been studied on the Indian economy, including

-

•

Increase in the unemployment rate;

-

•

Low Industrial production;

-

•

Trade deficit Balance;

-

•

Fluctuations/movements in equity markets;

-

•

Declining Foreign exchange rates; and

-

•

Hike in prices of gold and silver.

Furthermore, we have investigated remedial policies initiated by various institutions that contributed to the rebound of the Indian economy.

With over 100 countries under strict lockdown restrictions, more than 900 million students and learners are estimated to be affected due to the temporary shutdown of educational institutes (UNESCO, 2020). In countries like the United Kingdom (DHSC, 2020) and the United States (NIH Shifts, 2020), active decisions are being taken by the research support and funding committee to halt all non-crucial research and invest all resources in COVID-related studies. Imports of pharmaceutical products from China to the United States declined from 39.3% to 13% during this pandemic whereas India and European Union countries accounted for 18% and 26%, respectively (COVID-19 USA, 2020). Evaluating the effects of the COVID-19 emergency on social orders, economies, and vulnerable groups is essential to advise and tailor governments’ responses and accomplices to recuperate from the emergency and guarantee that nobody is deserted in this exertion.9

This paper develops a framework for socioeconomic factors majorly impacted by the pandemic and further elaborates on the policies enacted and/or extended by the government to control the disruption to the lives of people as well as businesses. More specifically, we present a thorough assessment of socioeconomic impact due to COVID-19, particularly for India. The conducted assessment will prove helpful in the future to analyze the long-term impact of any infectious disease outbreak (such as COVID-19) on a country's society and economy. The motivation behind selecting India as a case study for this kind of analysis is multifold and can be briefly explained as below:-

-

•

Indian economy is one of the major pillars of the global economy since India is the world's largest democracy.10 According to the World Bank,11 over the past decade, India's integration into the global economy has been accompanied by economic growth. Thus, India has now emerged as a global player.

-

•

India has a wide landscape making the economic impact assessment conducted in this study to be vital not just for the country itself but for Asia in its entirety.12

-

•

India ranks number two in the list of worldwide countries by population and accounts for 17.7% of the total world population.13

-

•

India has a rich cultural heritage involving multiple religions and various ethnicities presenting itself as a potential hub for economic activities. Currently, India has around 38 UNESCO world heritage sites contributing to the global economy through tourism.14

-

•

The economic crisis caused by COVID-19 is one of the worst recessions in Indian history, affecting the country's Gross Domestic Product (GDP) per capita and global supply chains. According to the International Monetary Fund, India currently stands at fifth position in GDP (Nominal) and third position in GDP (Purchasing Power Parity)15 out of 195 countries across the world.

-

•

India has developed as the quickest developing prominent economy on the globe and is expected to be one of the main three economic forces in the world by the following 10–15 years,16 upheld by its robust democracy and strong associations.

All these facts indicate the importance of the Indian economy in light of the global economy.

The rest of the paper has been arranged in the following manner. Section 2 presents the related studies on this pandemic. Section 3 puts forward the impact of various factors on the Indian economy. Section 4 reflects upon the findings and analysis conducted in the paper regarding the socioeconomic impact of COVID-19 imposed a nationwide lockdown on the Indian economy. Lastly, Section 5 presents the conclusion.

2. Related studies

Multiple studies have been conducted on the detrimental impacts of a pandemic or epidemic or natural disaster on a nation's economy. For instance, Bonaccorsi et al. (2020) focuses on Italian mobility data affected due to pandemic lockdown. The authors analyze variations in mobility relate to some fundamental economic variables and show how the reduction in connectivity leads to economic instability. Padli, Habibullah, and Baharom (2010) understands meaningful relationships between the economic impact of natural disasters and economic conditions. Three different points of time were regressed- 1985, 1995, and 2005 covering 73 countries. With the onset of COVID-19, the research and analysis on its impact on different sections of society have become a topic of interest for researchers and scholars around the world. A comprehensive analysis of diverse factors affected by the COVID-19 pandemic will help us understand the setbacks and blessings offered by the disease rationally. An overview of the existing literature discussing the impacts of coronavirus on various fronts is discussed in this section.

Several contributions in the health sector studied and put forward their diagnosis of COVID-19 through chest X-rays (Khattak et al., 2021; Saberi-Movahed et al., 2021) and CT scans (Fouladi, Ebadi, Safaei, Bajuri, & Ahmadian, 2021). Authors use advanced techniques of deep learning, matrix factorization, and Spatial Convolutional Neural Networks.

Analyzing the impact of COVID-19 induced lockdown on the educational system in West Bengal, India, Kapasia et al. (2020) recorded a dataset of 232 students using an online questionnaire. With over 70% of the undergraduate and postgraduate students involved in online education, the majority of the learners reported issues including social anxiety, depression, and a troublesome study environment at home. Kapasia et al. (2020) also describes the challenges faced by students from remote areas in adjusting to online learning. On the other side, Shenoy, Mahendra, and Vijay (2020) discuss the sudden change in the dynamics of schooling and analyze the reaction of universities in Egypt due to the COVID-19 pandemic. It also describes the use of various video conferencing and social media platforms for online classes, seminars, and meetings.

Gössling, Scott, and Hall (2020) compares the devastating impacts of COVID-19 and previous epidemics (September 2001 terrorist attack, SARS, 2008 economic slowdown, and MERS) on the tourism sector. The imposition of measures like social distancing, self-isolation, and movement restrictions across borders had affected the revenue of hotels, restaurants, and airline companies across the globe. Events like concerts, conferences, and huge gatherings were prohibited. The authors also discuss the reconsideration of the growing tourism model recommended by tourism organizations all over the world in the COVID-19 pandemic.

Based on the travel and movement restrictions imposed on the account of lockdown, a significant improvement in the air quality is observed. Sharma, Zhang, Gao, Zhang, and Kota (2020) have analyzed the concentration of pollutants identified as - PM10, PM2.5, CO, NO2, SO2, and ozone in India covering 22 cities. As stated, an overall dip of 31% in PM10, 43% in PM2.5, 10% in CO, and 18% in NO2 whereas an increment of 17% in O3 is studied using the Air Quality Dispersion Modelling System (AERMOD). The data for analyzing the air quality is provided by the Research data archive.17 Whereas Dutta, Dubey, and Kumar (2020) have analyzed the impact of successive lockdowns on the water quality of the river Ganga. Due to industrial slowdown, the discharge of wastewater in river bodies reduced to a minimum leading to an increase in dissolved oxygen (DO) levels and nitrate reduction (NO3-), Biological Oxygen Demand (BOD), coliform, and total Faecal coliform concentration.

Examining the adverse effects on the agriculture sector and perishable services, Rawal, Kumar, Verma, and Pais (2020) discuss the severe challenges in rural employment due to massive loss of crops, disruption in food supply chains, and delay in procurement. The data was collected from the food corporation of India (FCI), Agmarknet,18 and the Department of Food and Public Distribution. Cumulative arrivals of tomato, cauliflower, and key agriculture commodities are analyzed from March 25 to May 17 of the year 2019 and 2020 for different states. Emphasizing the use of food stocks in the COVID-19 crisis, in schemes like PM garib kalyan ann yojana (PMGKAY) and National Food Security Act, distribution of food grains is discussed. In a bid to analyze socioeconomic factors all over the world, Nicola et al. (2020) have summarized the socioeconomic effects of COVID-19 on primary, secondary, and tertiary sectors of the world economy. The paper talks about the need for an expansive socioeconomic improvement plan that supports entrepreneurship are additionally required so that smart business models can prosper.

Dev and Sengupta (2020); Singh and Neog (2020) have analyzed the impacts of COVID-19 on the Indian economy based on factors including - tourism, human capital, trade, transportation, and few others. In contrast to the above-mentioned studies, this paper presents a thorough analysis of pre, during, and post lockdown periods on few major factors contributing to the Indian economy identified as - unemployment, industrial production, import-export trade, equity markets, currency exchange rate, and gold and silver prices. To do so, this paper borrows from the socioeconomic framework developed by Roztocki, Soja, and Weistroffer (2019). The impact of different factors on each other and the economy has been determined and plotted using the data provided by varied government online portals and the policies implemented by the government have been charted during the noted period. Due to these unprecedented and erratic situations caused by COVID-19, this paper attempts to showcase a then and now analysis of the Indian economy.

3. Factors influencing the indian economy

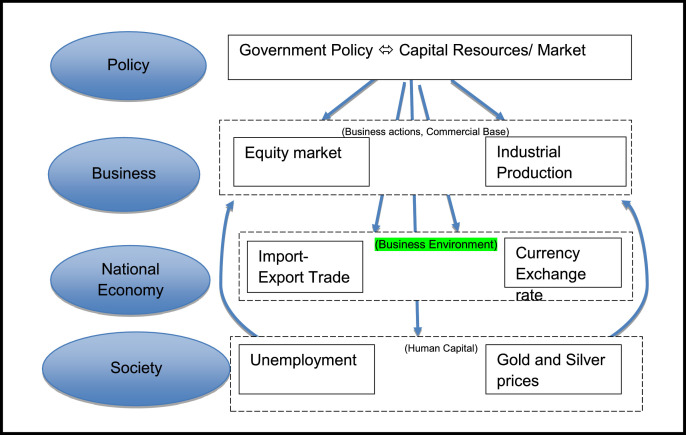

We adapt the socioeconomic framework as propounded by Roztocki et al. (2019) to develop a framework that incorporates the role of government policy and capital resources/market on various businesses. economic, and sociological indicators affected due to the onset of the Covid-19 pandemic (as shown in Fig. 1 ). For analysis of the COVID-19 imposed a lockdown on the Indian economy, we consider the following factors- human capital, business actions, commercial base, capital markets/ resources, government policy, and business environment. These factors serve as an overarching theme for us to select several sub-factors such as an increase in the unemployment rate, low Industrial production, trade deficit balance, fluctuations/movements in equity markets, declining foreign exchange rates, and hike in prices of gold and silver.

Fig. 1.

Framework outlining the policy interventions on socioeconomic factors.

The rationale behind selecting these sub-factors are the following:

-

•

Unemployment is a measurable variable that surges and declines following the changing social and economic conditions. In a highly populated country like India, where a large pool of population is employed on daily wages, it is highly essential to study the impact on unemployment during the COVID-19 period.

-

•

Industrial production forms the backbone of a nation. A step-up in industrial production is an indicator of a strengthening economy. Moreover, being highly sensitive to consumer demand, industrial production is also used as a measure of consumption and brisk inflation. All these factors make industrial production a significant tool for determining the economic performance of a country.

-

•

A positive balance of trade contributes to the economic growth of the country in terms of GDP, inflation levels, exchange rates, and interest rates. Positive net exports show a trade surplus while negative net exports show a trade deficit. Increasing the number of exports contributes to the flow of funds in the country.

-

•

The stock market is a pivotal part of the economy of a country. Boosting equity in the economy can promote social bonding and stimulates long-term growth for the economy which in turn can serve as a stimulus to the eradication of poverty present in a nation.

-

•

Exchange rates are important to a country's economy as they affect trade and financial flows with other countries. The exchange rate is an important mechanism for helping an economy adjust to large economic events.

-

•

Gold and Silver form a significant part of a social set-up as found in India, where exchange of jewelry items and ornaments is often seen in marriage functions and social gatherings.

3.1. Unemployment rate

The unemployment rate can be defined as the section of the labor pool that is out of a job, given as a percentage. The basic four categories of unemployment include Demand deficient unemployment, Frictional unemployment, Structural unemployment, and Voluntary unemployment. Among these, demand deficient unemployment is the biggest cause of unemployment that develops during a recession or economic crisis due to insufficient demand for products and services to maintain full employment. Due to the nationwide lockdown imposed by different governments to curb the spread of coronavirus, the production of goods reduced drastically leading to lower demand for workers consequently increasing the unemployment rates.

Costs of unemployment are visible in the economic health of the country as well as its people. Economic contraction and unemployment directly impact each other, explicitly according to Okun's law, ‘To achieve a one percentage point decline in the unemployment rate in the course of a year, real GDP must grow approximately two percentage points faster than the rate of growth of potential GDP over that period.

3.1.1. Unemployment rate variations with lockdown

During the lockdown, an estimated 140 million people lost employment while salaries were cut for many others. Unemployment in India rose from 6.7% on 15 March to 26% on 19 April and then back down to pre-lockdown levels by mid-June.

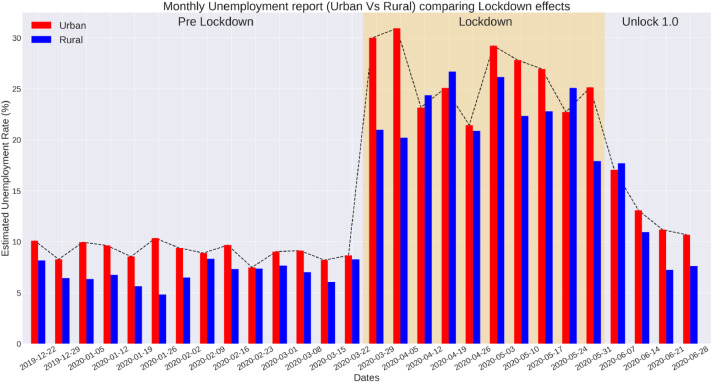

With the enforcement of a nationwide lockdown starting from March 25, production of almost all non-essential products was discontinued affecting approximately (28 million) informal workers in the urban areas. As shown in Fig. 2 , the unemployment rate for urban areas increased from an average value of 7% before lockdown to 27% during the lockdown, whereas the unemployment rate for rural areas surged from an average value of 6% before lockdown to 23% in the months of March, April, and May. The impact on 92% of informal workers involved in the non-agricultural sector in urban areas is seemingly more by the lockdown due to a halt in economic activities in cities including industrial and business ventures. The major five sectors involving informal workers in urban areas include manufacturing, hotel and restaurant, construction, transport and, real estate, and among them, construction is the most affected sector due to the unreliable nature of their jobs and daily-wage reimbursement. Left with no capital, small-scale businesses and startups are on the verge of shutdown. As given in Fig. 2, the unemployment rate almost remained at a high of 26% in the months of March, April, and May where lockdown was implemented in four phases, and with the loosening of restrictions in the month of June, the unemployment rates recovered to the pre-lockdown levels but still higher.

Fig. 2.

Variation of Estimated Unemployment Rate (%) with Lockdowns in Urban and Rural areas.1

3.1.2. Unemployment rate state-wise comparison

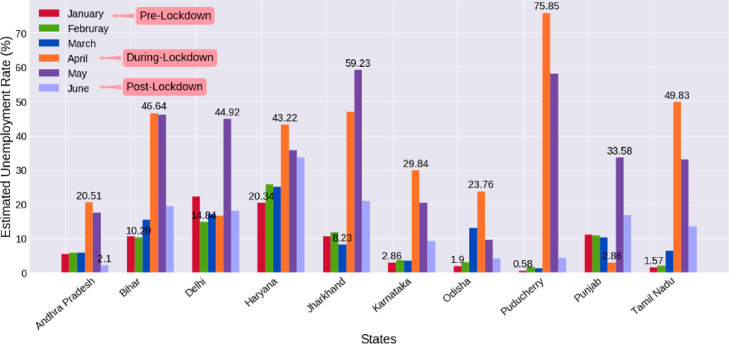

In the wake of nationwide lockdowns, the state-wise unemployment rate varied widely. Puducherry in South India observed the highest unemployment rate of 75.8% in the month of April compared to the lowest incidence of unemployment in hilly states like Himachal Pradesh with an unemployment rate of 2.2%. In the month of May 2020, the unemployment rate for many cities including Delhi, Maharashtra, Jharkhand, and Punjab went up whereas others including Puducherry, Odisha, and Tamil Nadu witnessed a dip in the unemployment rate as compared to the initial lockdown levels observed in April 2020.

Fig. 3 depicts the worst-hit Indian states due to nationwide lockdown. The lockdown also made the lives of economically exposed people such as daily-wage earners, industrial workers, and informal laborers much more difficult. As inferred from Fig. 3, high levels of unemployment were reported from the major states including Delhi (44.2), Tamil Nadu (49.83), and Haryana (43.22) with a strong industrial presence. The primary reasons include a halt in the production and manufacturing of goods in the month of April and May. The same goes for the other manufacturing hubs including Maharashtra (20.9), Gujrat (18.7), and Karnataka (29.8) which witnessed a more than threefold increase in the unemployment rate owing to the industrial laborer are being laid off. Migrant states including Bihar (46.64) and Jharkhand (59.23) have reported the highest unemployment rates due to the exodus of migrant workers from cities back to their home states.

Fig. 3.

Worst hit Indian states due to nationwide lockdown (Unemployment rate)11.

Trapped in deeper poverty, daily wage workers and migrant laborers are some of the worst affected during the lockdown. With the introduction of schemes like Pradhan Mantri Garib Kalyan Anna Yojana (Food scheme), PM-KISAN scheme (minimum income support scheme), the government aims to support the vulnerable people in times of humanitarian crisis.

3.2. Industrial production

Industrial production is the real output in the manufacturing, mining, electronics, and oil industry for the country and can be measured through the Index for Industrial Production(IIP), a monthly economic indicator assessing the produce of a country.

3.2.1. Industrial production for use-based classification

IIP is a key indicator in tracking the manufacturing activity in different sectors of an economy. Compiled and published by the Central Statistical Organization (CSO), IIP constituents fall in three broad sectors, namely electricity, mining, and manufacturing with weights as 8%, 14.4%, and 77.6% respectively. Based on the use-based classification, goods are classified into six categories:

-

•

Primary Goods consisting of electricity, mining, and fuels with a weight of 34% (maximum of all categories).

-

•

Capital Goods consisting of machinery items.

-

•

Intermediate Goods consisting of chemicals, yarns, etc.

-

•

Infrastructure Goods consisting of bricks, paints, tiles, etc.

-

•

Consumer Durables consisting of garments, telephones, etc.

-

•

Consumer Non-durables consisting of food items, medicines, etc.

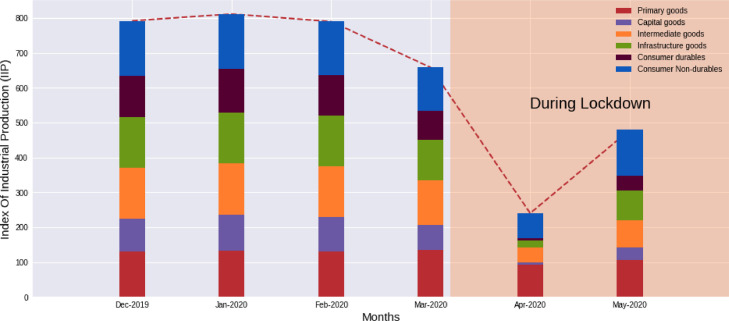

By providing a lot of job opportunities, manufacturing industries play an important role in the economic progress of a country, but the pandemic has disturbed the industry. Lockdown restrictions imposed by the government have put a lot of stress on the manufacturing industry. Lower offtake resulting in lower production, reduction in the scale of operations thereupon affecting the cost and quality, break in the supply chain are a few of the ways in which Industrial production has taken a toll. As can be inferred from Fig. 4 , the IIP for non-essential items including capital goods and consumer durables dropped down to 7.1 and 5.1 respectively during lockdown whereas IIP for essential items including consumer non-durables like food items and medicines did not observe a steep fall and hovered over an average value of 71.8 in the month of April. IIP for primary goods was reduced by only a little amount during lockdown compared to drastic falls in infrastructure and intermediate goods. With the ease of lockdown restrictions, industrial production picked up in India by the end of May.

Fig. 4.

Monthly IIP comparison as per use-based classification for Pre and during lockdown periods.2

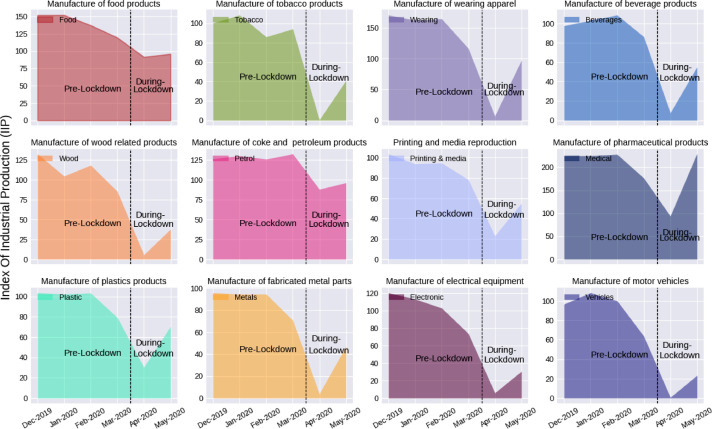

3.2.2. Industrial production for different goods and items

As a part of preventive measures to curb the spread of the COVID-19 pandemic, a majority of the manufacturing sector was shut from the last week of March 2020 onwards, terribly impacting the production of different commodities during the periods of lockdown. For several industries including the Indian automotive industry, facing a pre-lockdown decline in demand and production, the IIP values have reduced to a low of 0.5 during the lockdown.

As shown in Fig. 5 , the index for the manufacture of non-essential items including tobacco, electrical equipment, textiles, and leather-related products have drastically reduced to lower values owing to a halt in production and supply of these items by different state governments during the lockdown. Manufacture of pharmaceutical and medical products has ramped up giving a boost to the indigenous production of medical equipment including N95 masks, Personal protective equipment (PPE) kits, and COVID-19 test kits, and reducing the dependency on foreign countries for these items.

Fig. 5.

Monthly Sectoral Indices of industrial production comparing IIP in pre and during lockdown periods12.

A slight reduction in the production of essential items like food products is observed in the initial period of lockdown caused by the mass movement of daily-wage workers and interruption in the supply chain which then recovered back to normalcy in the month of May as restrictions overproduction and supply of essential items were removed. Index for the manufacture of rubber and plastic products reduced to 30.1 in the month of April but then regained to 70.2 in the month of May owing to an increase in demand for face masks and shields in the health sector. Demand for oil and petroleum-based products has been increasing in India for the last few decades, but due to the pandemic-induced lockdown in the month of April, the demand for fuel and related products went down by almost 50% of the pre-lockdown levels.

As the lockdown restrictions are lifted and industrial production for essential and non-essential items restart, a high degree of uncertainty lies with respect to MSMEs’ ability to deliver the products in a very tight and capital-constrained market. Moreover, it will be a challenge to assure industrial workers migrating back to their hometowns a livelihood again after laying them off in the first place. Also, a break in the supply chain makes MSMEs dependent on foreign raw materials vulnerable to more losses.

3.3. Import-Export trade

According to the expenditure approach, a country's GDP depends on the following factors - Personal consumption expenditure on goods and services(C), Gross Domestic Investment (I), Government Consumption and Investment on goods and services(G), Export Trade (EX), and Import Trade (IM) as

| (1) |

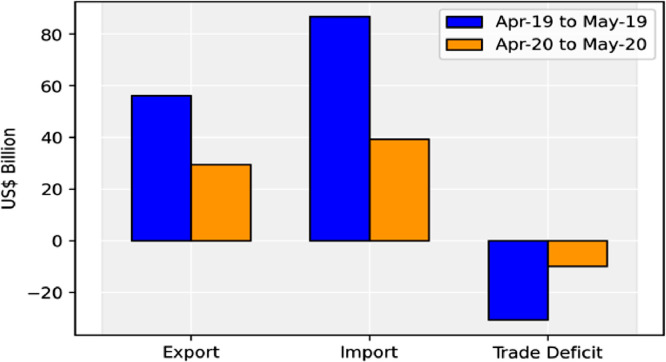

Fig. 6 depicts the trade performance during April to May 2019 and April to May 2020. The term (EX-1 M) represents net exports. A net positive balance of trade contributes to the economic growth of the country in terms of GDP, inflation levels, exchange rates, and interest rates. Positive net exports show a trade surplus and on the other hand, negative net exports show a trade deficit. A trade surplus balance contributes to the economic growth of a nation. Increasing the number of exports will lead to growth in industrial production and manufacturing and employment among people which contributes to the flow of funds in the country.

Fig. 6.

Trade Performance during April to May in 2019 and 2020.3

But for the past few decades, India has been a trade deficit country. During the lockdown period, India's trade balance has increased to −9790 US $ Million in March 2020, −6765 US $ Million in April 2020, and −3147 US $ Million in May 2020. As inferred from Fig. 6, the growth rate of trade balance in the month of April-May had declined from −30.68 in 2019 to −9.91 in 2020. The falloff in foreign trade has worsened the global supply chain and resulted in economic recessions across the nation. Despite this trade deficiency in the lockdown period, India recorded a benchmark trade surplus of 790 US $ Million in June 2020 (Unlock period).

3.3.1. Impact on trade in goods due to COVID-19

The commodities exported by India can be categorized into three categories:

-

•

Essential commodities which include drugs, pharmaceutical products, cereals, and other food-related goods,

-

•

Non-essential commodities include organic and inorganic chemicals, engineering and electronic goods, iron ore and steel, aluminum, copper, plastic, tobacco, and manufactured tobacco substitutes.

-

•

Luxury commodities include gems and jewelry.

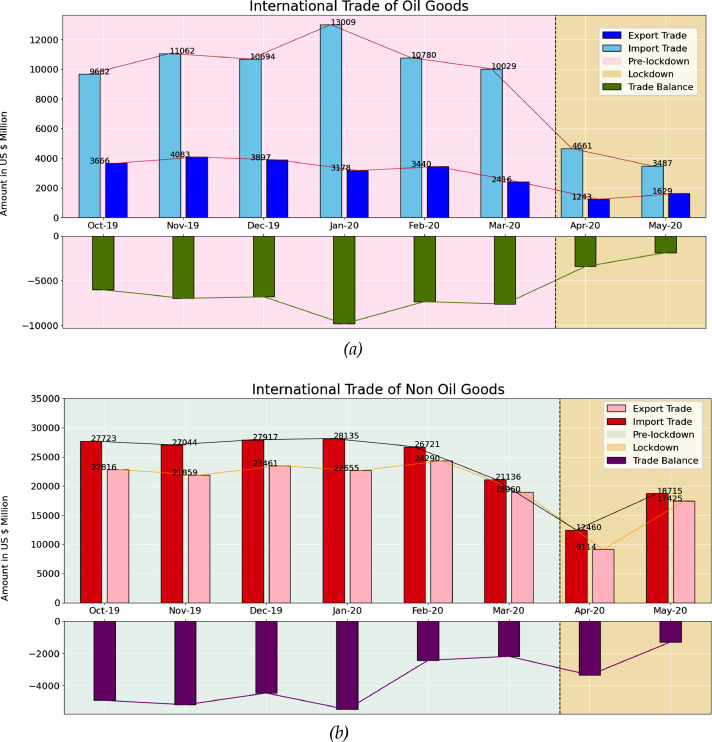

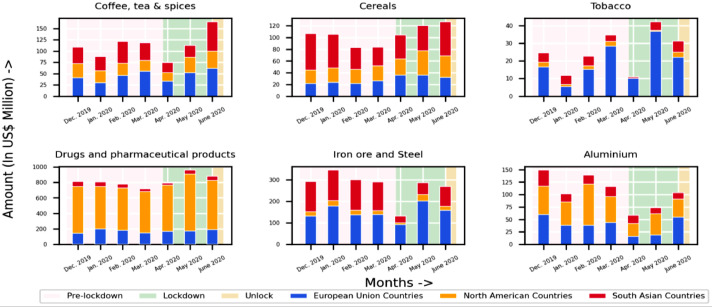

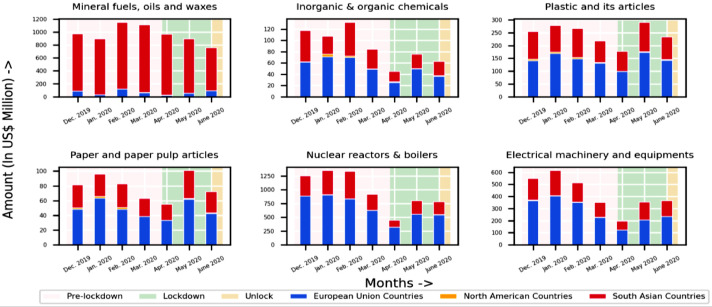

Fig. 7 depicts amount of India's International Trade of Oil and Non-oil goods from October 2019 to May 2020. Fig. 8 visualizes the comparison of India's Export Trade for different commodities in pre-lockdown, lockdown, and unlock phases. Further Fig. 9 shows the comparison of India's Import Trade for different commodities in pre-lockdown, lockdown, and unlock phases.

Fig. 7.

(a-b): Amount of India's International Trade of Oil and Non-oil goods from October 2019 to May 20204.

Fig. 8.

Comparison of India's Export Trade for different commodities in pre-lockdown, lockdown, and unlock phases.5

Fig. 9.

Comparison of India's Import Trade for different commodities in pre-lockdown, lockdown, and unlock phases15.

In the COVID-19 crisis, India continued to increase its export trade growth in essential commodities- drugs, pharmaceutical products, and cereals (mainly rice). The exportation of rice to the European Union, North American South Asian countries has increased more than before the pre-lockdown period. Due to the heavy production of Hydroxychloroquine (anti-malarial drug), which is considered to be a constituent of the COVID-19 vaccine, India exported Hydroxychloroquine tablets and other virus-fighting drugs to more than 55 countries which includes United States, UAE, Mauritius, and many more for vaccine trials.

Apart from the basic and essential commodities, India failed or lost in the exportation of non-essential and luxury commodities like plastics, gems, jewelry, steel, aluminum, tobacco, copper, rubber, and cotton, either due to delays in the orders or decline in the industrial production and demand of the commodities. Exportation of gems and jewelry declined the most, followed by petroleum products, electronic and engineering goods, chemicals, and plastics. Export of organic and inorganic chemicals (aluminum, copper) have declined except iron ore. Although the growth rate in export trade of iron ore has declined in April-May 2020 as compared to April-May 2019. Iron Ore was one of the major commodities whose exportation has contributed to the Indian economy in this crisis. The closing of fashion industries in the United States, European Union Countries, and other countries led to the cancelation of fabric and garment shipments from India. Manufacturers of garment and textile industries may have to face heavy losses in the coming months as the summer apparel and garments which were to be shipped in March, April and May would not be able to find a profitable market in the winter season due to the extension of lockdown and alteration in seasons. India is the second-largest tobacco producer and exporter across the globe. Due to delay or cancelation in the shipping of tobacco and manufactured tobacco substitutes, farmers can suffer bankruptcy. Tobacco, being a Kharif crop, is to be harvested in July-August and there is a weak demand for tobacco from traders and manufacturers during this situation. If this demand continues to be low in the coming months, the livelihood of tobacco farmers from Andhra Pradesh, Karnataka, Telangana, and Gujarat will be at a higher risk. Exports of oil goods (products obtained by refinement of crude oil) had started declining since February 2020 from 3440 US $ Million to 1243 US $ Million in April 2020.

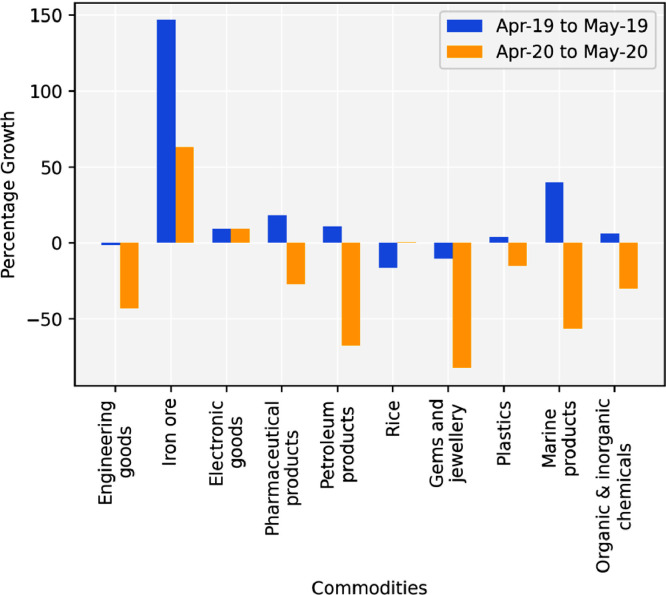

Fig. 10 shows the comparison of the growth rate of the top 10 commodities of India's export trade performance during this pandemic. India achieved a positive growth rate from April to May in the exportation of essential goods like rice (0.58%), drugs and pharmaceutical products (9.21%), and Iron ore (62.97%) whereas the rest all commodities recorded negative growth.

Fig. 10.

Growth Rate of Export Trade of Top 10 commodities from April to May in the year 2019 and 202,013.

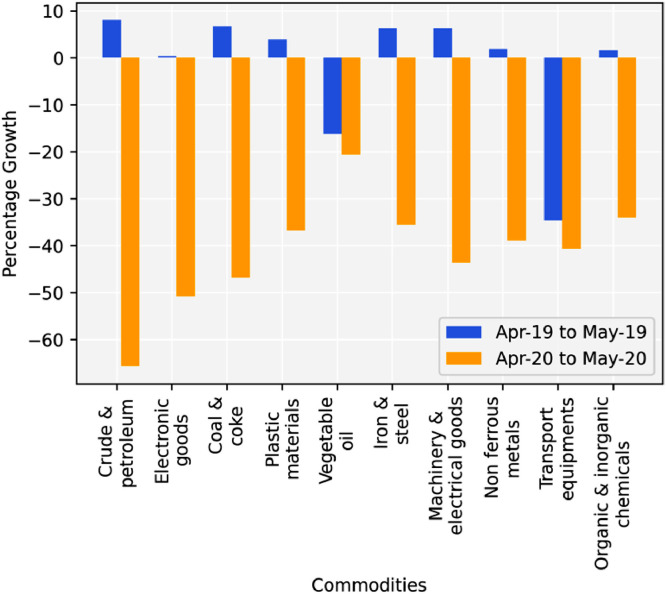

On the other hand, the import trade of India had drastically declined from the month of January. As the COVID-19 cases started arising in early January 2020 across the globe, many countries had closed their borders for foreign trade, and shipments get delayed. This had affected India's import trade too. Import of both oil and non-oil goods has decreased from 41 US $ Billion in January 2020 to 17 US $ Billion in April 2020. As inferred from Fig. 11 , the top 10 commodities imported to India had a negative growth rate in April-May in the year 2020 as compared to the year 2019 due to the depressed requirement of goods in Indian markets. In April, Imports of electronic goods declined the most by −62.72%, followed by petroleum, crude and products (−59%), machinery, electrical and non-electrical goods (−53.91%), and coal and coke (−48.83%).

Fig. 11.

Growth Rate of Import Trade of Top 10 commodities from April to May in the year 2019 and 202,013.

Depreciated demand for imports of products like petroleum products, electronic goods, nuclear reactors, furniture, machinery parts, and chemicals from other countries showed a less contribution to the growth of the Indian economy. But due to the drastic decline in exports of non-essential commodities, the Indian economy was badly affected from March to May in terms of unemployment, farmers, traders, and manufacturers due to loss of profit in foreign markets. Continuing the less import trade in India, the nation became a trade surplus in June 2020 of 790 US $ Million in the last 18 years.

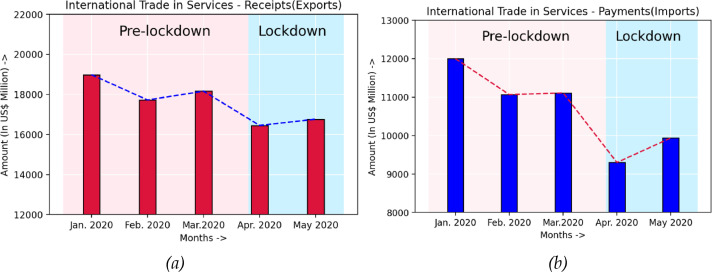

3.3.2. Impact on trade in services due to COVID-19

Trade of services consists of services traded or exchanged provided by foreign-based companies. These services include education, construction, communication, energy, travel, tourism, transport, health, social services, and many more. It also contributes to the country's GDP and exchange rates. Unlike trade-in goods, trade-in services have become a trade surplus from the past ten years.

Fig. 12 shows the decrease in the amount of India's trade in services in the year 2020 for each month from January to May. Exports in services decreased from 18.16 US $ Billion to 16.45 US $ Billion in April 2020. Also, imports show a negative growth of 16 percent in the month of April as compared to March 2020. As lockdown begins across the globe, services like travel, tourism, and transport, mainly airline and maritime paused due to the social distancing measures, orders for the closing of borders of many states, and other movement restrictions imposed by the country. Unlike before, the travel and tourism sector had a negative impact on the country's economy. Hotels, restaurants, and tourist places were shut down. Construction services got stopped in the lockdown badly impacting workers and laborers. Whereas services like education and Information Technology (IT) continued in the lockdown period through online services provided by the institutions and organizations. Teachings and study materials were provided in online mode to the students worldwide. Employees in the IT sector managed their work remotely. Telecommunication services were in high demand due to the increase in remote work culture. People also avoided going to markets due to social distancing measures and promoted E-shopping during the lockdown. Educational, IT, telecommunication, online shopping services generated good revenues through foreign trade.

Fig. 12.

India's International Trade in services during pre-lockdown and lockdown phases.6

Although overall trade in services declined due to the enforcement of nationwide lockdown, trade in services became a trade surplus in the months from March to May 2020, therefore generating more revenues in the country.

3.4. Equity markets

An Equity market is a public stock exchange market where stocks or equities of business companies are traded by investors. These stocks represent fractional ownership and securities of a company. The main purpose of the stock market is to provide capital and funds to the companies in the form of shares invested by the shareholder. The companies can expand or grow their businesses and pay off debts. The shareholders either got profit or loss from the shares invested and company dividend payments according to the market capitalization of the company. The capital of a company depends upon the consumer and business which can directly impact a country's GDP.

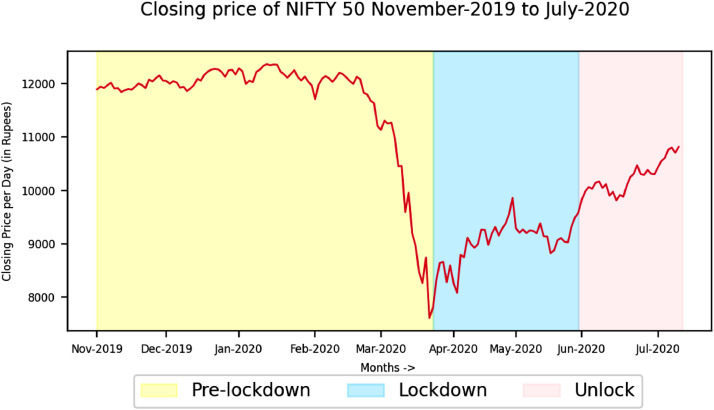

National Stock Exchange (NSE) is one of the leading stock exchanges in India. National Stock Exchange Fifty (NIFTY 50), a stock market index of NSE, comprise stocks of the top 50 companies of India. In January 2020, the index- NIFTY 50 went high up to 12,389.05 Rupees. The stock prices lined up around the previous values of November and December 2019. Fig. 13 shows the decline in stock prices of NIFTY 50 from November 2019 to July 2020. As the COVID-19 cases started increasing in India, the equity markets in India started falling sharply. The equity markets fell abruptly before the announcement of the lockdown on 24 March 2020. However, the fall in the market was less as compared to the market crash in the year 2008, which recovered almost two years later. On March 24, NIFTY 50 fell to 7801.05 Rupees.

Fig. 13.

Closing prices (in Rupees) of NIFTY 50 from Nov. 2019 to July 2020,.7

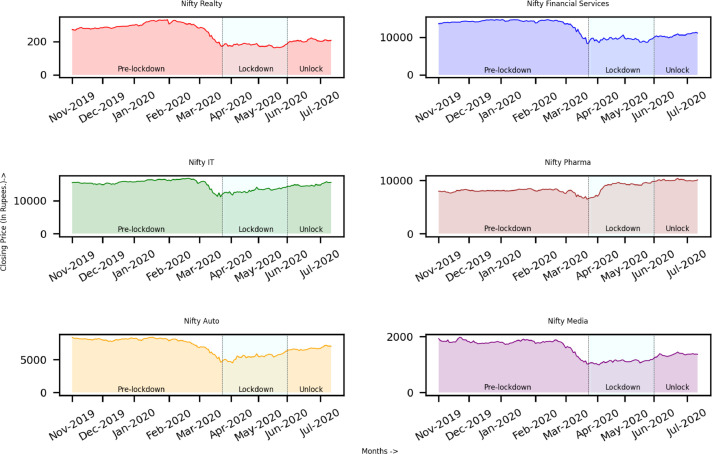

Table 1 represents the highs and lows as well as the highest percentage rise and fall in different NIFTY indices from February to March 2020. A decline in industrial production, low revenues in businesses, and pause in worldwide trading lead to low market values of companies listed in NSE. Also, pessimistic thinking, debt uncertainty, and a negative approach towards equity markets influenced investors and venture capitalists to restrict their investment from bearish stock. Many companies including startups laid off their staff due to excess debt burden and low revenue amid COVID-19. As inferred from Fig. 14 , almost all of the NIFTY indices except NIFTY Pharma fall during the month of February and March in 2020.

Table 1.

Highest percentage rise and fall between closing prices of two consecutive days of various stock market indices from February to March in the year 202,017.

| Stock Market Indices | High (in Rupees) | Low (in Rupees) | Highest percentage rise between closing prices of two consecutive days | Highest percentage loss between closing prices of two consecutive days |

|---|---|---|---|---|

| NIFTY-50 | 12,246.7 | 7511.1 | 6.62 | −12.98 |

| NIFTY Realty | 336.35 | 165.35 | 6.11 | −11.35 |

| NIFTY Financial Services | 14,747.7 | 7984.2 | 9.31 | −15.93 |

| NIFTY IT | 16,882.45 | 10,991.25 | 9.02 | −9.57 |

| NIFTY Pharma | 8473.8 | 6242.85 | 5.11 | −8.92 |

| NIFTY Auto | 8212.2 | 4452.2 | 5.17 | −13.84 |

| Nifty Media | 1906.1 | 979.05 | 3.87 | −10.32 |

Reasons for fall in various NIFTY's indices are explained as follows –.

Fig. 14.

Comparison of Closing prices (in Rupees) of different NIFTY indices from Nov. 2019 to July 202,017.

I. Nifty reality

The real estate market is among one of the sectors which got severely impacted as people are more interested in investing in liquid assets. Brokers and sellers are looking for potential buyers who can either buy the property or pre-book the same for some initial deposit. Due to social distancing measures, property views and tours got extended. Closing of registrar offices paused the registry work of many properties. Construction work that got delayed had impacted the lives of the laborer's on daily wages. The stock price of companies in NIFTY Reality went down by more than 30 percent in March as compared to January.

II. Nifty financial services

COVID-19 had a great impact on the companies offering financial services. Stock prices in NIFTY Financial Services had suffered a loss in the lockdown period because of the announcement of the moratorium period by the Reserve Bank of India (RBI) on 27 March 2020 for three months - April, May, and June. The moratorium policies were offered to the borrowers who are facing financial issues during the lockdown period. The duration of this policy is further extended till August 2020 resulting in time extension of Equated Monthly Installments (EMI's) which reduces the credit generating ability of the banking sector. Hence, creating a negative outlook in the mind of the investor. Rise in Non-Performing Assets (NPA) is also the contributory factor for the fall of NIFTY Bank. IndusInd Bank Limited, RBL Bank Limited, and HDFC Bank Limited are some of the top companies whose stock prices get affected badly and lead to the market slowdown.

III. Nifty IT

Sectors like Information Technology do not get much impacted during the lockdown. In this situation, many companies like Tata Consultancy Services Limited had promoted work from home culture. IT companies’ employees managed all their work from remote places. This maintained continuity in their work which sustained the company revenue to a major extent. Some companies dismissed their employees. In the post lockdown period, growth in the IT sector has recovered as of January.

IV. Nifty pharma

Progress in the pharmaceutical sector was at a boom during this world crisis. Face Masks, Personal Protective Equipment kits, sanitizers, and Isopropyl Alcohol were in great demand. Trails for the coronavirus vaccine were going on all over the world. India is considered to be a high producer of Hydroxychloroquine chemicals which was considered to be a major component of the coronavirus vaccine. COVID-19 tests required more equipment and chemicals. This pushed the revenue for the pharmacy industry which attracted many investors to invest in NIFTY Pharma companies like - Dr. Reddy's Laboratories Limited, Biocon Limited, as the stock price of most companies went up even in the lockdown period.

V. Nifty auto

The stock price of automobile companies demonstrated negative growth. Highest and lowest stock price recorded from January to March is 8463.25 and 4452.2 Rupees respectively. This major difference in stock price is due to the low demand for automobiles during the COVID-19 period and automobile, being a depreciating asset, investors may not find profits to invest in NIFTY Auto.

VI. Nifty media

The media industry in India includes companies like Dainik Bhaskar Group Limited, Zee Entertainment Enterprises, Hathway Cable, and Datacom Limited. Due to social distancing measures, most of the TV serials involving video recording got delayed, affecting Target Rating Point (TRP). Shutting down of cinemas led to low revenues resulting in loss of stock price.

Despite the downfall in the stock prices of most of the companies in the lockdown period, companies have started generating more revenue in the -post-lockdown period. This will attract more investors and venture capitalists to invest in Indian companies resulting in an increasing GDP of the country.

3.5. Currency exchange rate

In relation to another nation's currency, the exchange rate gives the value of one country's currency over the other. It gives the price at which another currency can be bought. For instance, the amount of Indian Rupee (INR) required to buy one US Dollar ($) is the currency exchange rate for the two countries. Dependent on the market trends, exchange rates can rise or fall. Factors governing the exchange rate between two countries include inflation rate, the balance of payments, and interest rate (see below):

-

•

Inflation rate - The purchasing power of money drops in countries with high inflation, thereby depreciating the domestic currency.

-

•

Balance of payments - High international balance of payments, increases In foreign exchange rate allowing the currency to depreciate.

-

•

Interest rate - Higher domestic interest rates induce capital inflow which in turn increases the demand for national currency.

3.5.1. Economical effects of fluctuating currency

A changing currency has a direct impact on the country's economy. Assuming currency to depreciate, exports are made at lower prices in the world market thereby stimulating the exports along with depreciating imports which leads to decreasing trade deficits for the country. A higher value of net exports ensures higher GDP and growth rate but causes more inflation. Whereas in an appreciating currency, net import exceeds the total exports as foreign products look cheaper than indigenously created ones. This inwards shift in the demand curve restricts the growth rate but ensures a low inflation rate.

3.5.2. Impact of COVID-19 on rupee's exchange rate

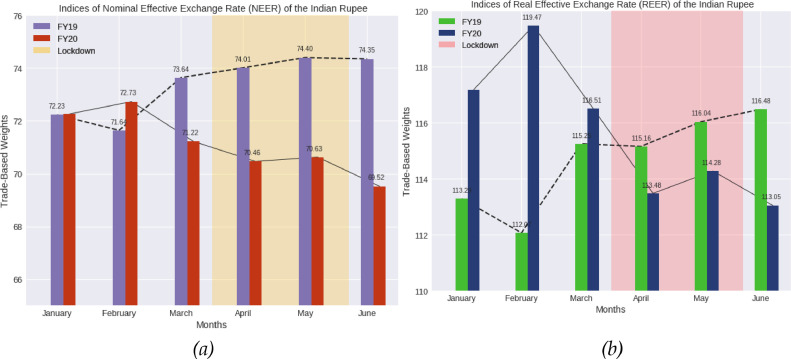

COVID-19 induced economic shock had a major impact on the rupee's exchange rate. With financial shareholders pulling back investments and the majority of industrial production coming to a halt, the impact of COVID-19 on the Indian rupee has been lethal. The Indian currency fell from 71.5 to the dollar on February 16 to 77.2 to the dollar on April 15. From being positive before lockdown, the net foreign portfolio investments (FPI) turned abruptly negative in the months of March and April. The sudden turnaround and depreciation in the currency are to some extent neutralized by the fall in oil prices thereby aiding India's balance of payments and scaling down the demand for dollars. To study the competitiveness of Indian currency with respect to other major currencies, the exchange rate can be classified as Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER). Organized by the Reserve Bank of India (RBI), NEER and REER are the weighted indices that portray the change in national currency in comparison to India's trade partners.

As inferred from the NEER indices in Fig. 15 (a), the rupee has been constantly losing its value and has dropped from a peak of 74.9 in February to its lowest of 70.4 in the month of June. The dip observed in March and the following months of lockdown are presumably affected by the total outflow of foreign portfolio investments (FPI) from the market. Also, as can be observed in Fig. 15(a), the Indian currency held up its ground in the Financial Year 2019 (FY19) unlike constantly depreciating in the year 2020. As REER takes into consideration the domestic inflation in different economies, it is considered to be an improvement over NEER and is, therefore, an important factor in analyzing the fluctuation in the currency. As shown in Fig. 15(b), even in terms of REER, the Indian rupee has steadily depreciated in the month of March and contracted to lower values in the following months of lockdown in the year 2020 likely due to rising inflation in few essential commodities in the Health and Food sectors. The trends observed in NEER and REER in Fig. 15(a) and (b) respectively differ due to lower values of domestic inflation in India corresponding to other countries.

Fig. 15.

(a-b): Compares the NEER and REER indices of the Indian rupee for the FY19 and FY2016.

3.6. Hike in gold and silver prices

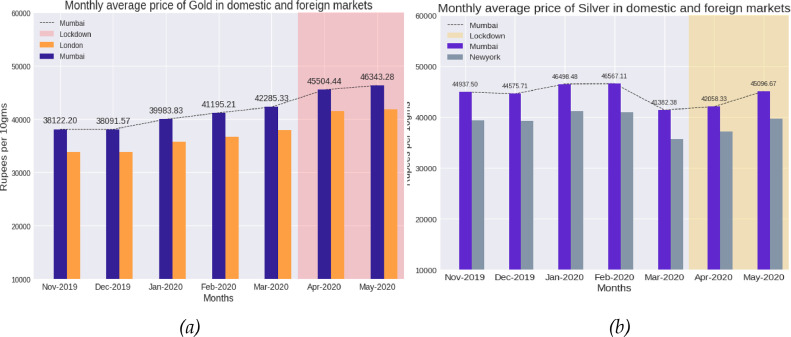

Along with equity markets, gold, and silver, either in physical or Exchange-Traded Funds, are another option to consider the investment. India is the second-largest consumer of gold, importing around an average of 800–1000 tonnes per year. Gold assets have given 9 percent returns per annum for the past 10–15 years. Gold and Silver prices mainly depend upon the good or poor signs of the economy, inflation rates, and the price of the US Dollar. More demand for gold will increase the market price of gold. Demand for gold can be increased due to inflation, festive seasons in India, and lower interest rates on loans by banks. When inflation rises, currency value decreases, hence people opt for investing money in the form of gold and silver, which pushes their prices more during inflation. Gold and silver are much safer investments than equity markets and real estate due to economic uncertainties. People tend to invest in gold when market values of other assets start declining. Rural people, mainly farmers, play a significant role in the gold exchange. If crops yield good, farmers purchase gold as assets otherwise, they sell the gold for funds.

3.6.1. Impact of COVID-19 on gold and silver prices

In the period of global crisis, due to reduction in consumer spending, industrial production, and foreign trading, many companies were not able to generate revenue as before, resulting in low turnovers and a fall in share prices. Investors avoid investing in equity markets and real estate due to uncertainty of the economy and slowdown due to the COVID-19 crisis. Gold and Silver were proven to be a much safer alternative. People sold their bearish stocks and started investing in these precious metals. Now, the demand for gold and silver are rising and also, imports for the same are decreasing, therefore the prices of gold and silver tend to increase in domestic and international markets. The monthly average of gold in May 2020 was 46,343.28 Rupees per 10 gs which had increased by 15 percent as compared to January 2020. As inferred from Fig. 16 , prices of gold were increasing steadily from January 2020 to May 2020. On the other hand, people invested less in silver because being a volatile asset, less liquidity in the market, and uncertain movements in industrial purposes. Therefore, Silver prices went up to 45,096.67 Rupees per 10 gs in May 2020 by an increase of 8.9 percent as compared to March 2020. Prices of gold went up more increasingly as compared to silver. In this unexpected economic crisis, assets like gold and silver have proven to be more reliable stores of money than equity markets.

Fig. 16.

Monthly Average of Gold and Silver in domestic and foreign markets16.

4. Reflections

Triggering catastrophic economic and social disruption globally, COVID-19 has become enormous health and humanitarian threat confronted by the world since the Great Depression of 1930. Several countries had enforced lockdown restrictions intending to ramp up the medical facilities and more importantly flattening the soaring curve. The economic impact of the COVID-19 has been overwhelming for most of the infected countries, sparking a dark economic recession around the world. With a rise in unemployment and interruption in industrial production, international trade has been adversely affected, giving a major blow to the developing economies globally. Proactive implementation of successive lockdowns assisted in controlling the spread of the disease in India but had adverse repercussions on its economy. While operations in the manufacturing and agricultural sector came to a standstill due to the unavailability of informal workers and disruption in the supply chain, the IT industry continued to flourish and observed a rise in the market capital for major businesses. Unlike non-essentials, the manufacturing of food and medicine-related products increased due to a surge in demand for essential items.

To counter these issues, a befitting response from the government including the Pradhan Mantri Garib Kalyan Anna Yojana (Food scheme), Ujwala scheme (for women Below Poverty Line), and PM-KISAN scheme acted as a buffer for rural India. Also, reduced interest rates and deferral of the tax return deadlines are some of the tax relaxation measures taken by the government. Atma Nirbhar Bharat Abhiyan towards self-sufficient India aims to reduce the over-reliance on foreign trade for different goods and services and identify new manufacturing capabilities in the country. Moreover, ‘The Make In India’ initiative will help stimulate local and foreign investments in the country.

Nevertheless, an amendment in budget expenditures, prioritizing improvement in medical infrastructure and facilities will be the key for modern development. Also, encouraging emerging manufacturing projects will help in vitalizing the Indian industrial sector furthermore giving a vital boost to the Indian economy.

The trends and the analysis as depicted in this paper serve the purpose of visual summaries and the subsequent discussions indicate the causes and policy Interventions behind those trends. The conducted assessment developed using the frameworks adopted in this study will prove helpful in the future to analyze the long-term impact of any crisis on a country's society and economy.

The framework described in Fig. 1 and its corresponding explanation (refer to Section 3), specifies the role of government policy and capital market in the changes observed in various socioeconomic measures in various stages of the Covid-19 pandemic. Thus, we adopt the Institutional design and change summary suggested by Duman and Kureková (2012) and adapted the same to reflect the policy interventions undertaken by Indian institutions in Table 2 . In terms of Government policy, we consider the policy interventions made by the Government of India. Additionally, in line with the recommendations of (Roztocki et al., 2019), we considered the Reserve Bank of India (RBI) as the capital resources/ market enabler. RBI Is the central bank of India with its chief banker and other employees are appointed by GoI. RBI governor Shaktikant Das said that “monetary policy needs to proactively arrest any deterioration in aggregate demand, and create enabling conditions for businesses to normalize production and supply chains”.19

Table 2.

Selected policy measures introduced to promote socioeconomic stabilization and growth.

| Typology | Factor | Policy launched by Government | Major changes |

|---|---|---|---|

| Sociological | Unemployment (https://pib.gov.in/PressReleasePage.aspx?PRID=1703744) | Pradhan Mantri Garib Kalyan Anna Yojana -Food scheme | Distribution of free pulses, wheat, and rice from Public Distribution Scheme (PDS) |

| Direct benefit transfer | People from senior citizens, widows, disabled sections to get monetary benefits | ||

| Atmanirbhar Bharat Rozgar Yojana | Programs and funds were created to motivate and encourage entrepreneurial small, medium enterprises. Benefits on enrolling employees on employee provident fund. | ||

| Income Tax | Reduction in tax rates; deferral in tax filing dates | ||

| PM-KISAN scheme | Minimum income support scheme for farmers with the first installment of INR 6000/- disbursed in April 2020 | ||

| Mahatma Gandhi National Rural Employment Guarantee Act(MNREGA) | Minimum wage increased from INR 182/- to INR 202/- | ||

| Economic | Industrial production | Emergency Credit Line Guarantee Scheme (ECLGS) (https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1742684) | Extension of liquidity (through emergency credit line) to stressed industrial sectors |

| Indian Development and Economic Assistance Scheme (IDEAS) (https://pib.gov.in/PressReleasePage.aspx?PRID=1672529) | Extension of the line of credit for promotion of exports | ||

| Production Linked Incentive (PLI) (https://pib.gov.in/PressReleasePage.aspx?PRID=1741568) | Incentives for the manufacturing sector to boost and encourage the production | ||

| Insolvency and Bankruptcy Code (https://pib.gov.in/PressReleasePage.aspx?PRID=1706640) | The threshold of default increased from Rs 100,000 to Rs 10 million; Admitting fresh insolvency cases suspended by six months; relaxation of the loans taken by firms during Covid9 | ||

| Economic | Import-Export trade | Fast track mechanism for trade remedy (Government of India, 2020–21) | The Ministry of Commerce initiated and extended several digital endeavors to ease the incoming and outgoing trade from the nation, in terms of: |

| Enhanced Ease of Doing Business through electronic governance and trade facilitation (Government of India, 2020–21) | Electronic platform for Preferential Certificate of Origin (COO) | ||

| Transparency in Public Procurement through Government e-Marketplace (GeM) (Government of India, 2020–21) | Digitally encrypted paper-less authorizations Creation and strengthening of Government e-Marketplace (GeM) | ||

| Remission of Duties and Taxes on Exported Products (RoDTEP) (Government of India, 2020–21) | Digital refund to exporters, duties, and taxes levied at the Central, State, and local levels | ||

| Economic | Equity markets | Ease of liquidity available in the market (https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=3853, https://www.rbi.org.in/Scripts/bs_viewcontent.aspx?Id=3859) | Reduction of the repo rate to 4% from 4.4%; reverse repo rate to 3.35% from 3.75% (which was reduced from 4%). Increase liquidity in the market; increase consumption in the market |

| Economic | Currency exchange rate (https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=19961) | Selling US Dollars in the Over-the-Counter (OTC)(https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=19961#SE3) | RBI sold USD OTC to curb increasing volatility; USD-INR sell-buy swaps to enhance USD liquidity in the market |

| Buy-side intervention (https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=19961#SE3) | Gradual increase in the inflow of Foreign Portfolio Investment by April ‘20 after sudden outflow as the lockdown was announced | ||

| Sociological/Eco | Hike in Gold and Silver prices | Sovereign Gold Bond(https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=49794) (https://rbi.org.in/Scripts/NotificationUser.aspx?Id=11864&Mode=0) | The government of India issued gold bonds at discounted prices multiple times within the observed time period |

(Authors' synthesis from Government of India (2020–21)).

5. Conclusion and future research directions

India is endowed with the availability of cheap labor owing to its largely young population. The ICT penetration in India is growing at a fast rate owing to it being the least expensive in the world. This has led to the developed economies outsourcing their non-primary activities to India. This has also seen a shift as more and more primary activities are being moved to India. Thus, it is evident that India has become a major player in the global economy and any disruption affects the growth prospects of the global economy.

Interestingly, there is a ray of hope and can be attributed to the governmental intervention as discussed in this paper, While discussing the economic recovery towards the fourth quarter of 2020, OECD (p. 22) avers that “the rebound has been relatively fast in several large emerging-market economies. Activity moved above pre-pandemic levels in China, India, and Turkey, helped by strong fiscal and quasi-fiscal measures and a recovery in manufacturing and construction” (OECD, 2021).

Overall, our study presents a framework that can be adapted and further refined by future researchers to study similar situations globally. Although every effort has been made to depict the temporal variation In the socioeconomic framework by depicting the then and now analysis across a period of three months, the framework developed in this paper does not take into account the dynamism accounted for between the different periods. This can be attributed to wide variation and largely uncertain and complex situations owing to COVID-19. Future studies can keep this point in mind and take this aspect further. Additionally, while this study focuses on the socioeconomic aspects from the macro (institutional) lens of Covid-19 and the policy intervention under the socioeconomic framework, future studies can also focus on the firm-level and citizen-level impacts of Covid-19.

Author statement

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed. All authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Acknowledgements

The authors of this paper are thankful for the data on the Index of Industrial Production made public by the Ministry of Statistics and Programme Implementation (MOSPI), the Government of India, Reserve Bank of India (RBI), and Database of Indian Economy (DBIE) for providing transparent and well-processed data on International trade of goods and services, Rupee's exchange rate, Gold and Silver prices. Also, the authors would like to extend their gratitude towards the Directorate General of Commercial Intelligence and Statistics (DGCI&S) for providing data for import-export trade of different commodities, National Stock Exchange (NSE) for making stock market prices accessible to the general public. Also a special thanks to the center for Monitoring Indian Economy(CMIE),20 which forms a part of all material related to unemployment rates in which the information is included.

References

- Bonaccorsi, Giovanni, Pierri, Francesco, Cinelli, Matteo, Porcelli, Francesco, Galeazzi, Alessandro, & Flori, Andrea et al."(2020).Evidence of economic segregation from mobility lockdown during COVID-19 epidemic." arXiv preprint arXiv:2004.05455.

- Chaudhary A., Gupta V., Jain N., Santosh K.C. COVID-19: Prediction, decision-making, and its impacts. Springer; Singapore: 2021. COVID-19 on air quality index (AQI): A necessary evil? pp. 127–137. [Google Scholar]

- CME Closing (2020).Trading floors indefinitely amid coronavirus concerns, crain's chicago business, [cited (2020). Mar 23]. [Internet]. Available from: https://www.chicagobusiness.com/finance-banking/cme-closing-trading-floorsindefinitely-amid-coronavirus-concerns.

- COVID-19 USA:(2020). coronavirus outbreak measures and effect on the US, [Internet]. [cited Mar 20]. Available from: https://www.pharmaceutical-technology.com/features/coronavirus-affected-countries-usa-covid-19-measures-impactpharma-hotel-tourism-medical/.

- Dev S.M., Sengupta R. Indira Gandhi Institute of Development Research; Mumbai: 2020. Covid-19: Impact on the indian economy. April. [Google Scholar]

- DHSC (2020).Issues guidance on the impact of COVID-19 on research funded or supported by NIHR, [Internet]. [cited Mar 21]. Available from: https://www.nihr.ac.uk/news/dhsc-issues-guidance-on-the-impact-on-covid-19-on-research-funded-orsupported-by-nihr/24469.

- Duman A., Kureková L. The role of state in development of socio-economic models in Hungary and Slovakia: The case of industrial policy. Journal of European Public Policy. 2012;19(8):1207–1228. doi: 10.1080/13501763.2012.709018. [DOI] [Google Scholar]

- Dutta V., Dubey D., Kumar S. Cleaning the river Ganga: Impact of lockdown on water quality and future implications on river rejuvenation strategies. Science of The Total Environment. 2020 doi: 10.1016/j.scitotenv.2020.140756. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Fouladi S., Ebadi M.J., Safaei A.A., Bajuri M.Y., Ahmadian A. Efficient deep neural networks for classification of COVID-19 based on CT images: Virtualization via software defined radio. Computer Communications. 2021 doi: 10.1016/j.comcom.2021.06.011. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Gössling S., Scott D., Hall C.M. Pandemics, tourism and global change: A rapid assessment of COVID-19. Journal of Sustainable Tourism. 2020:1–20. [Google Scholar]

- Government of India (2020-21).Undated. Annual Report, Ministry of Commerce and Industry, Government of India. (https://commerce.gov.in/wp-content/uploads/2021/03/Commerce-English-2020-21.pdf).

- Impact of COVID-19 (2020).On the process manufacturing industry; 2020, [Internet], [cited July 1]. Available from: https://www.manufacturingtomorrow.com/article/2020/06/impact-of-covid-19-on-the-process-manufacturing-industry-2020/15487.

- Kapasia N., Paul P., Roy A., Saha J., Zaveri A., Mallick R., et al. Impact of lockdown on learning status of undergraduate and postgraduate students during COVID-19 pandemic in West Bengal, India. Children and Youth Services Review. 2020 doi: 10.1016/j.childyouth.2020.105194. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Khattak M.I., Al-Hasan M.A., Jan A., Saleem N., Verdú E., Khurshid N. Automated detection of COVID-19 using chest x-ray images and CT scans through multilayer-spatial convolutional neural networks. International Journal of Interactive Multimedia & Artificial Intelligence. 2021;6(6) [Google Scholar]

- Nicola M., Alsafi Z., Sohrabi C., Kerwan A., Al-Jabir A., Iosifidis C., et al. The socio-economic implications of the coronavirus pandemic (COVID-19): A review. International journal of surgery (London, England) 2020;78:185. doi: 10.1016/j.ijsu.2020.04.018. [DOI] [PMC free article] [PubMed] [Google Scholar]

- NIH Shifts (2020).Non-mission-critical laboratory operations to minimal maintenance phase, national institutes of health (NIH),, [Internet], [cited 2020 Mar 21]. Available from: https://www.nih.gov/news-events/news-releases/nih-shiftsnon-mission-critical-laboratory-operations-minimal-maintenance-phase.

- OECD (2021)., OECD Economic Outlook, Interim Report March (2021)., OECD Publishing, Paris, 10.1787/34bfd999-en. [DOI]

- Oil prices (2020).stocks plunge after Saudi Arabia stuns the world with massive discounts, [Internet]. NPR.org. [cited Mar 23]. Available from: https://www.npr.org/2020/03/08/813439501/saudi-arabia-stuns-world-with-massive-discount-in-oilsold-to-asia-europe-and-u-.

- Padli J., Habibullah M.S., Baharom A.H. Economic impact of natural disasters' fatalities. International Journal of Social Economics. 2010 [Google Scholar]

- Prices of agricultural (2020).commodities drop 20% post COVID-19 outbreak - rediff Realtime News, [Internet]. [cited Mar 20]. Available from: https://realtime.rediff.com/news/india/Prices-of-agricultural-commodities-drop-20-postCOVID19-outbreak/955078599584b749?src=interim_alsoreadimage.

- Rawal V., Kumar M., Verma A., Pais J. COVID-19 Lockdown: Impact on Agriculture and Rural Economy. Society for Social and Economic Research. 2020 [Google Scholar]

- Roztocki N., Soja P., Weistroffer H.R. The role of information and communication technologies in socioeconomic development: Towards a multi-dimensional framework*. Information Technology for Development. 2019;25(2):171–183. doi: 10.1080/02681102.2019.1596654. [DOI] [Google Scholar]

- Saberi-Movahed, F., Mohammadifard, M., Mehrpooya, A., Rezaei-Ravari, M., Berahmand, K., & Rostami, M. et al. (2021).Decoding clinical biomarker space of covid-19: exploring matrix factorization-based feature selection methods. medRxiv. [DOI] [PMC free article] [PubMed]

- Sharma S., Zhang M., Gao J., Zhang H., Kota S.H. Effect of restricted emissions during COVID-19 on air quality in India. Science of the Total Environment. 2020;728 doi: 10.1016/j.scitotenv.2020.138878. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Shenoy M.V., Mahendra M.S., Vijay M.N. COVID 19–Lockdown: Technology Adaption, Teaching, Learning, Students Engagement and Faculty Experience. Mukt Shabd Journal. 2020:9. [Google Scholar]

- Singh M.K., Neog Y. Contagion effect of COVID-19 outbreak: Another recipe for disaster on Indian economy. Journal of Public Affairs. 2020:e2171. doi: 10.1002/pa.2171. [DOI] [PMC free article] [PubMed] [Google Scholar]

- COVID-19 Educational Disruption and Response, UNESCO (2020)., [Internet], [cited 2020 Mar 20]. Available from: Https://en.unesco.org/themes/education-emergencies/coronavirus-schoolclosures.