Abstract

We examine possible reallocation effects generated by the COVID-19 outbreak by analyzing the patterns of venture capital (VC) investments around the globe. Using transaction-level data and exploiting the staggered nature of the spread of the virus, we document a shift in VC portfolios towards firms developing technologies relevant to an environment of social distancing and health pandemic concerns. A difference-in-differences analysis estimates significant increases in invested amount and number of deals in such areas. We show heterogenous effects related to the experience of VC investors, as well as their size and organizational form.

Keywords: Venture capital, Investment, COVID-19, Healthcare, Pandemic

1. Introduction

The outbreak of the COVID-19 pandemic and the resultant social distancing measures caused a sudden and unprecedented stop to economic activity and a global contraction in GDP.1 It is widely recognized that the economic effects of the pandemic are not restricted to the severe recessionary twin supply-demand shock but also include significant changes in the distribution of income and resources across sectors, firms, and households (Barrero et al., 2020; Eurostat 2020; OECD 2020). It is less clear, however, whether the redistributive effects are temporary or have a more permanent nature. Has COVID-19 triggered fundamental changes in economic activity that created unique investment opportunities? Has the pandemic induced a structural shift of resources towards businesses developing technologies to meet the needs of firms, organizations, and individuals in a (possibly lasting) environment of elevated risk of health pandemics and life guided by principles of social distancing?

As the coronavirus spread across the world, investors faced changes in market conditions and investment opportunities. The uncertainty generated by the pandemic, and the global economic slowdown, affected stock markets, leading to reduction in available capital for many sectors of the economy (Alfaro et al., 2020; Baker et al., 2020a; 2020b). At the same time, novel investment opportunities related to the fight against the virus or in fields that could shape the post-pandemic world emerged. This signaled a potential for reallocation of resources within many capital markets (Hassan et al., 2020; Pagano et al., 2020; Ramelli and Wagner 2020).

In this paper, we empirically examine whether and how the COVID-19 pandemic induced a reallocation of financial resources by investigating the flow of venture capital investments during the spread of the virus around the world. Compared to stock markets and banking markets, the VC market is less affected by possible uninformed and speculative behavior of individual investors or exposure to borrowers, and offers an ideal setting for assessing potential reallocation effects. VCs typically take equity stakes in young and innovative firms in rapidly changing markets, and their ability to generate returns is related to these firms’ potential to affect the future of industries and markets (Gompers 1995; Gompers and Lerner 2001; Da Rin et al. 2013). The investment decisions of VCs also have lasting impact on the aggregate productivity, innovation, and job creation capacity of a country through funded firms (Kortum and Lerner 2000; Davila et al., 2003; Engel and Keilbach 2007; Hirukawa and Ueda 2008; Samila and Sorenson 2010; 2011; Puri and Zarutskie 2012; Bernstein et al., 2016). It is well documented that VCs rapidly shift investments in portfolio firms and fund new ventures in response to changing conditions (Gompers and Lerner 2004; Kaplan and Strömberg 2004; Gompers et al., 2008; Gompers et al., 2020a; Li et al., 2020b). Thus, it is not surprising that at the time, some claimed that “while traditional VC investment is expected to slow significantly…there are several niche segments of the market that could remain attractive to investors due to their applicability in the current environment” (KPMG 2020).2

We investigate whether the onset of the COVID-19 pandemic led to reallocation effects in the global VC market by examining shifts in VC investment towards ventures developing technologies (directly or indirectly) related to an environment characterized by heightened risk of health pandemics and social distancing. We employ a staggered difference-in-differences (DiD) strategy that allows us to capture the causal effects of the diffusion of COVID-19. To this end, we construct a sample of VC deals that took place in 126 countries around the world from January 2018 till the end of July 2020. The data come from Zephyr, a Bureau van Dijk database, that includes detailed information on VC investors, deal nature, etc. The advantage of the database is that it offers deal synopsis that can be used to identify scope, activity, and target customers/markets of the entrepreneurial firm. We use textual analysis (Fairclough 2003) to distinguish investments in firms with pandemic-related activities from non-pandemic ones, where the former group relates to technologies and operations for addressing needs that may arise in times of pandemics and social distancing.3 This strategy follows a body of research that uses textual information for quantitative analysis (Frésard et al. 2020; Hoberg and Phillips 2010, 2016; Kim et al., 2016).

Our DiD analysis compares investment in firms with pandemic-related and non-pandemic activities before and after the onset of the spread of COVID-19. Hence, we arrange our data in a panel setting with both time-series and cross-sectional dimensions. For the former, we use periods of two weeks as the temporal unit, for a total of 62 bi-monthly periods.4 For the latter, we aggregate all deals into pandemic-related and non-pandemic categories for each of the 62 temporal units for each country. The approach assumes that VC firms are global investors acting worldwide (Devigne et al., 2018) and investment choices respond to COVID-19 cases in the country of the company receiving the funding.5 We take into account the staggered nature of COVID-19 diffusion across countries and capture the onset of the spread of the virus with the first confirmed case in each country.

The analysis points to a significant reallocation effect of the spread of COVID-19 on the VC market. With the onset of the pandemic, VCs invest up to 44% more capital in pandemic-related fields, while the number of deals increases by up to 5.8%. In addition to documenting the reallocation of capital on average, we explore possible heterogenous effects to offer insights into the underlying mechanisms and channels.

First, we investigate whether the reallocation could be driven by a rational response of VCs to novel investment opportunities or “overreaction”. We show that the effects are more pronounced for older VCs and VCs with more focused activity. To the extent that both reflect the experience and expertise of VCs, the results are more aligned with a rational response. This is consistent with Gompers et al. (2008) who show a greater investment response to changing market opportunities by more experienced VCs. We also investigate whether the reallocation could be due to fads and shifts in investor attention (Chemmanur et al., 2019). We use Google Trends to identify “fad deals” characterized by words attracting attention on the web (Da et al., 2011; Liu et al., 2014). We find that VCs do not invest incrementally more in such deals. This further supports the view that the reallocations following the outbreak of COVID-19 are not mainly driven by fads, but likely reflect a rational response to novel investment opportunities.

Second, we recognize that the observed effects could be due to a demand-side reaction of firms switching towards pandemic-related activities or to a supply-side reaction of VCs shifting capital. To explore, we compare early-stage investments, which more likely represent new demand for capital to fund new projects, and late-stage ones, which more likely reflect the intentions of VCs to complete projects previously started by providing additional funds to the target firms. The effects we estimate are comparable across stages, which suggests that both demand and supply of VC funding might have shifted.

Third, we investigate whether the size and organizational form of VCs affect the estimated effects. On the one hand, larger VCs and corporate VCs (CVC) are better positioned, in terms of resources, to seize emerging investment opportunities. On the other hand, these VCs suffer from organizational frictions and slow decision-making. We show that the effects are concentrated within smaller VCs. This underscores the importance of quick decision-making in our context and in the VC market in general.

We subject our inferences to several checks to ensure their validity. We perform a placebo treatment test and verify the common trends assumption following Autor (2003) and Gertler et al. (2016). We confirm that our results indeed reflect global dynamics and not investment patterns of a couple major markets such as China and the US. We examine the robustness of the construction of our treated group of pandemic-related investment by: 1) excluding one by one groups of keywords used in the definition of pandemic-related; 2) broadening and narrowing our baseline definition of pandemic-related activities; 3) restricting the analysis to a subsample of firms that receive VC funding prior to the outbreak of COVID-19; and 4) including social-distancing technologies. Last, while our main analysis focuses on volume and number of deals, we also use as outcome variables the percentage contribution of pandemic-related investments to the overall VC activity.

Our paper contributes to a rapidly growing literature that explores the reaction of investors and capital providers to the pandemic, and resultant economic effects (Oldekop et al., 2020). Extant studies focus on banking systems (Beck 2020; Greenwald et al., 2020; Francis et al., 2020; Hoseini and Beck 2020; Li et al., 2020a; Dursun-de Neef and Schandlbauer 2020) or stock markets (Alfaro et al., 2020; Baker et al., 2020a; Pagano et al., 2020; Ramelli and Wagner 2020). By contrast, the effects on the VC market are less explored, with the notable exceptions of recent work by Gompers et al. (2020b) and Howell et al. (2020).

Surveying over 1000 VCs at more than 900 firms, Gompers et al. (2020b) investigate how VCs change investment strategy due to COVID-19. While the study documents a slowdown in investment, it also shows that approximately half of the respondents indicate a positive impact, thus highlighting the potential reallocation effects of the pandemic. We explore these effects using actual transaction data in a cross-country setting and empirical strategy that relies for identification on the staggered spread of the virus. We provide direct quantitative evidence of reallocation of venture capital towards pandemic-related ventures and technologies, which is broadly consistent with the findings of Gompers et al. (2020b) They also suggest that their results are consistent with an effect of national and international channels, and we explicitly incorporate this in our empirical strategy based on cross-country variation. We also explore additional sources of heterogeneity (e.g., VC age). Along the same lines, Howell et al. (2020) use data from Pitchbook and CB Insights to analyze the dynamics of VC transactions in the US. The study documents that in the two months starting from March 2020, when the majority of the states already experienced a confirmed case of COVID-19, the number of early-stage deals declined by 38% on average. By contrast, late-stage deals remained mostly unaffected.6 This is consistent with the dynamics of VC investment observed in past recessions. We complement this by considering a large sample of deals around the world and analyzing both investment amount and number of deals. By examining VC age and organizational form, among others, we build upon Howell et al. (2020) whose focus is on investment stage as a source of heterogeneity.

More generally, our paper contributes to extant studies that explore how VCs respond to market signals and episodes of uncertainty and economic crises. Gompers et al. (2008) show that the investment activity of VCs with industry-specific experience reacts to public market signals for firms in that industry. Conti et al. (2019) show that in times of liquidity supply shocks during the global financial crisis, VCs allocate more capital to ventures operating in their core sectors. We complement these studies by adopting a cross-country perspective, characterizing investments based on specific purpose rather than on the industry of the funded firm, and exploring reallocation effects of the shock created by the staggered global spread of COVID-19.

The rest of the paper is structured as follows. Section 2 describes the dataset and empirical strategy. Section 3 presents the main results and discusses tests of validity of our strategy. Section 4 explores underlying channels and mechanisms by estimating heterogenous effects. Section 5 offers robustness tests, while Section 6 concludes.

2. Data and empirical strategy

2.1. Data sources and structure

To estimate the reallocation effects of COVID-19, we assemble a dataset that includes at the transaction level detailed information about deal characteristics and covers a period of time sufficient to allow comparisons of the market before and after the outbreak.

We start with all VC funding deals that took place between January 2018 and July 2020 in 126 countries around the world available on Zephyr, a Bureau van Dijk database.7 The database provides information about VC deals (e.g., amount, date, and deal description), VC investors (e.g., name and place of origin), and firms raising capital (e.g., name, industry, and place of origin). The main advantage of the database is that it offers deal synopsis. The synopsis can be used to identify deals involving “pandemic-related” activities: technologies, products, or services suited to address an environment of elevated risk of health pandemics and possible prolonged social-distancing periods.

To capture the spread of the virus, and the date of the first detected case of COVID-19 by country, we use the public database “Daily confirmed COVID-19 cases” of the European center for Disease Prevention and Control (ECDC) and hosted by Our World in Data – a data repository of the University of Oxford.8

Our empirical strategy, discussed in detail in the following sub-sections, uses a difference-in-differences approach. We arrange the data in a panel setting with time-series and cross-sectional dimensions. As temporal units, we adopt periods of two weeks, for a total of 62 bi-monthly periods. Alternatively, a daily or weekly frequency would lead to insufficient number of deals within a temporal unit and a few large deals can affect our results. On the other hand, a monthly or longer frequency would treat deals completed 30 or more days apart as part of the same temporal unit, which may not be appropriate given the COVID-19 diffusion process.

With regard to the cross-sectional dimension, for each temporal unit we aggregate all deals into two groups – pandemic-related and non-pandemic – for each country based on place of origin of the funded firm.9 The resultant dataset allows us to explore the staggered spread of COVID-19 across countries in a DiD framework.

2.2. Treatment and outcomes

In our main analysis, we categorize as treated group VC investments in ventures with pandemic-related activities: projects and technologies related to pandemic needs (e.g., disease prevention, diagnosis, treatment). In the robustness section, we extend the definition to include social distancing issues. Our classification based on characteristics of the funded project, rather than industry of the firm undertaking the project, allows us to mitigate a shortcoming present in traditional sectoral classifications (e.g., NACE or SIC). With such classifications a firm is assigned to a sector, which makes it impossible to properly capture comparable projects aimed at similar needs or similar products by firms from different industries (Hoberg and Phillips 2010; 2016).10

To determine if an investment involves pandemic-related activities, we use an “Information Extraction from Text” method (Jiang 2012). We analyze three textual fields for each deal: deal editorial, comments, and rationale. Deal editorial and comments are provided by Zephyr analysts and describe main features of the deal, including information about the firm and its projects (Reiter 2013). Deal rationale is sourced from press releases or communication by the firm (Florio et al., 2018). An investment is pandemic-related if at least one of the textual fields mentions at least one word from a list of predetermined keywords. The list has five groups of keywords related to “biology”, “chemistry and pharmaceuticals”, “health”, “healthcare supply chain”, and “medical science”.11 We then create an indicator, Treated, that takes the value of 1 for investments in ventures with pandemic-related activities, and 0 otherwise. To not undermine our DiD strategy, we use only words that can be found in the textual fields before the novel coronavirus was isolated by the Chinese center for Disease Control and Prevention in January 2020 under the provisional name 2019-nCoV. Hence, we exclude words typically used to designate the pandemic, such as novel or new coronavirus, 2019-nCoV, COVID, COVID-19, SARS, and SARS-CoV-2. In robustness tests we explore social distancing issues by adding four groups of keywords related to “E-Commerce”, “Remote work and videoconferencing”, “Media and Broadcasting”, and “Information Technology and Telecommunication”.

An alternative approach is to categorize sectors as pandemic-related based on technological characteristics that make them more sensitive to a health pandemic or social distancing, and use the sector of the target firm to assign treatment.12 However, standard industry classifications cannot perfectly capture the economic activity of firms (Gentzkow et al., 2019). Moreover, categorizing a sector based on average characteristics of the constituent firms cannot incorporate intra-sector heterogeneity and can lead to measurement errors in our context. For example, projects related to health pandemics may be developed by firms operating in sectors other than healthcare. By contrast, some projects launched by firms in the healthcare sector might be non-pandemic.13

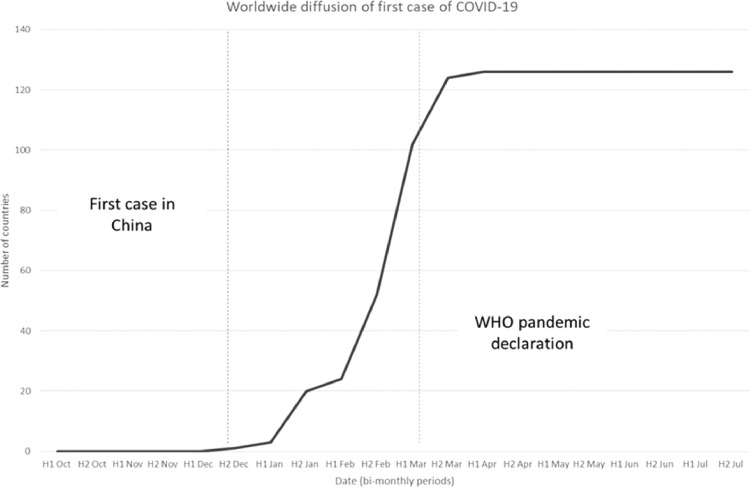

Identification of pre- and post-treatment periods is based on the date of the first officially confirmed COVID-19 case in a country as a proxy for the beginning of the spread of the pandemic in that country Fig. 1. offers a snapshot of the global evolution of the pandemic by showing over time the number of countries with a COVID-19 case. The first confirmed case is on December 31, 2019 in China, even though according to media, Chinese authorities identified virus cases earlier.14 By mid-March 2020 when World Health Organization officially declares the status of a pandemic, most countries (about 80%) have faced the disease. For the rest, the first COVID-19 case is in April 2020. The time-series pattern suggests that while the diffusion of COVID-19 is quick, there is variation in its spread across countries. Given that our temporal unit is a period of 2-weeks, we construct an indicator, First Case, that takes the value of 1 for periods after the 2-week period in which the first COVID-19 case for a country is confirmed.

Fig. 1.

Diffusion of (First Cases) COVID-19 at the Global Level. The graph shows the diffusion of COVID-19, captured through first confirmed case for each country, over time.

We focus on two outcome variables. The first is invested amount. We aggregate the total amount of capital invested by VCs in each category – pandemic-related and non-pandemic – for each 2-week period for each country. The second outcome is number of transactions. It measures how many deals are completed in each category during each period. In the analysis, we take a logarithmic transformation of the variables.

2.3. Econometric strategy

To identify the effect of the spread of COVID-19 on VC investment, we adopt a difference-in-differences methodology. We compare VC investment in pandemic-related (treated) and non-pandemic (control) activities before and after the onset of the virus spread (treatment event).15 We perform country-level estimation relying on the staggered diffusion of COVID-19.16 The model is specified as follows:

| (1) |

where d denotes group (treated or control), i country, t bi-monthly period, and Y is one of the outcome variables. We control for unobservable heterogeneity via country-group fixed effect, μdi, along with time fixed effects, τt, to account for shocks at time t, and country-group trends (μdi Trend). In the baseline specification we exclude the trends. We cluster the errors, ε dit, at country level.17 The main effect on Treated is subsumed in the group fixed effect. In the model, the coefficient γ represents the estimate of the reallocation effect of COVID-19 on the VC market. Support for the reallocation argument implies a positive and statistically significant point estimate. This would indicate a relative increase in pandemic-related investments after the spread of COVID-19.

3. Results

3.1. Baseline DiD analysis

Table 1 reports the results of the estimation of Eq. (1) at the country level.18 For each dependent variable, we estimate one specification with linear trend at the country-group level and one without.19 In column (1) we find that the diffusion of COVID-19 is associated with an increase of 0.27 in the amount of pandemic-related investment and the estimate is significant at 5% level. In column (2) we augment the specification with country-group trends. The estimated effect of 0.44 is significant at 1% level. In columns (3) and (4), we show a positive reallocation effect of COVID-19 between 0.050 and 0.058 on the number of pandemic-related investments. These estimates are significant at 1% level. Overall, the analysis reveals a shift towards pandemic-related investments by VCs with the outbreak of COVID-19.

Table 1.

Baseline Results – Country-level Analysis. The analysis covers 62 bi-monthly periods from 01/01/2018 to 07/31/2020 and 126 countries. Treated is an indicator that takes the value of 1 for investments in ventures with pandemic-related activities, and 0 otherwise. First Case is an indicator that takes the value of 1 for periods after the beginning of the spread of COVID-19 (i.e., after the first confirmed case) in country c, and 0 otherwise. The table reports coefficient estimates followed by standard errors, clustered at country level, in parentheses. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

| VC invested amount |

Number VC transactions |

|||

| Dependent Variable | (1) | (2) | (3) | (4) |

| Treated × First Case | 0.272** | 0.438*** | 0.050*** | 0.058*** |

| (0.112) | (0.140) | (0.018) | (0.018) | |

| Observations | 15,624 | 15,624 | 15,624 | 15,624 |

| Adjusted R-squared | 0.669 | 0.661 | 0.857 | 0.859 |

| Country-Deal Category Fixed Effects | Yes | Yes | Yes | Yes |

| Time Fixed Effects | Yes | Yes | Yes | Yes |

| Country-Deal Category Trend | No | Yes | No | Yes |

3.2. DiD identification: common trend assumption and placebo tests

A key assumption of the DiD approach is common trends in the outcomes for treated and control groups pre-treatment. In our context, this implies that pandemic-related investments exhibit the same trend as non-pandemic ones in the pre-COVID period. To corroborate the validity of our research design we perform several tests.

Following Autor (2003) we introduce interaction terms of the treatment indicator and time-dummies for the pre-treatment periods. If treated and control groups have parallel pre-trends, the interactions should not be significant. We estimate the following model:

| (2) |

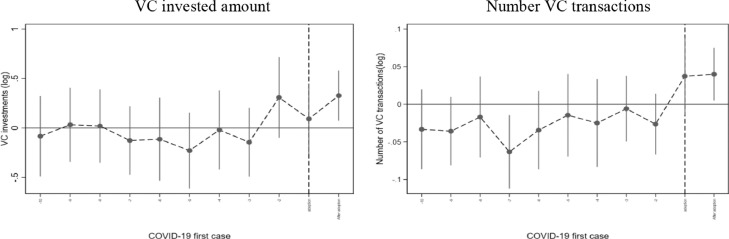

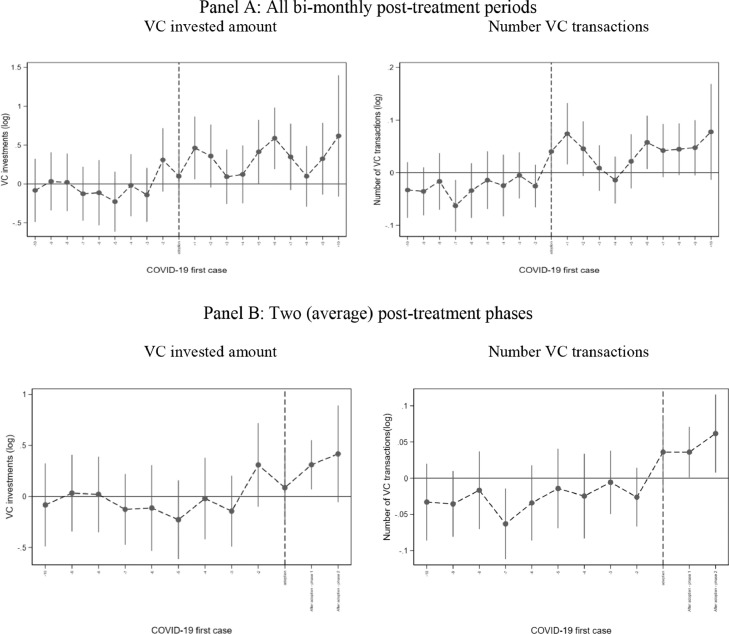

The coefficients αt on the pre-treatment periods, with t going from 48 bi-monthly periods to 2 bi-monthly periods before the first case of COVID-19 in country i, allow us to explore the possibility of non-parallel trends prior to outbreak. Coefficient estimates and their 90% confidence intervals are plotted in Fig. 2 . The vertical dashed line indicates time of treatment.20 With the exception of one coefficient in the analysis of number of deals, which has a negative sign, all αt coefficients are insignificant.

Fig. 2.

Common Trend Assumption (Autor test). The graphs use estimates from Eq. (2) to plot period-by-period coefficients up to treatment date, the coefficient of the average post-treatment effect, and the 90% confidence intervals of the coefficient estimates. Treatment time is denoted by the vertical dashed line.

We also conduct a test of equal trends as in Gertler et al. (2016). The test explores whether changes in VC investment for the two groups would have moved together in the same direction in absence of the pandemic. Specifically, the test compares the changes in average growth rates of the dependent variables across groups for pre-treatment periods. Table 2 shows that the growth rates are not significantly different across categories prior to the COVID-19 outbreak.

Table 2.

Test of the Assumption of Equal Trends. This test follows Gertler et al. (2016) and compares the average growth rate of the dependent variables between treated and untreated groups in the pre-treatment periods. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

| Treated | Untreated | Difference | P-value | |

| VC invested amount | −0.045 (0.003) | −0.036 (0.049) | 0.009 (0.049) | 0.856 |

| Number VC transactions | −0.026 (0.005) | −0.032 (0.009) | −0.006 (0.010) | 0.544 |

We run placebo tests by introducing treatment at times other than the actual treatment time. First, we construct two placebo treatment indicators, Falseit, which take the value of 1 during the 1 and 2 bi-monthly periods, respectively, before the first globally confirmed case, and 0 otherwise. Note that by introducing treatment in periods that precede the actual treatment time, the extent of false treatment is greater for countries affected by COVID-19 in later periods. Table 3 provides the estimation results. All coefficients are insignificant.

Table 3.

Placebo Treatment. The analysis covers 62 bi-monthly periods from 01/01/2018 to 07/31/2020 and 126 countries. Treated is an indicator that takes the value of 1 for investments in ventures with pandemic-related activities, and 0 otherwise. False (1 period before) is an indicator that takes the value of 1 one period before the first confirmed case of COVID-19 globally, and 0 otherwise. False (2 periods before) is an indicator that takes the value of 1 two periods before the first confirmed case of COVID-19 globally, and 0 otherwise. The table reports coefficient estimates followed by standard errors, clustered at country level, in parentheses. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

| VC invested amount |

Number VC transactions |

|||

| Dependent Variable | (1) | (2) | (3) | (4) |

| Treated × False (1 period before) | −0.065 | −0.004 | ||

| (0.143) | (0.019) | |||

| Treated × False (2 periods before) | −0.155 | −0.011 | ||

| (0.129) | (0.018) | |||

| Observations | 15,624 | 15,624 | 15,624 | 15,624 |

| Adjusted R-squared | 0.661 | 0.661 | 0.859 | 0.859 |

| Country-Deal Category Fixed Effects | Yes | Yes | Yes | Yes |

| Time Fixed Effects | Yes | Yes | Yes | Yes |

| Country-Deal Category Trend | Yes | Yes | Yes | Yes |

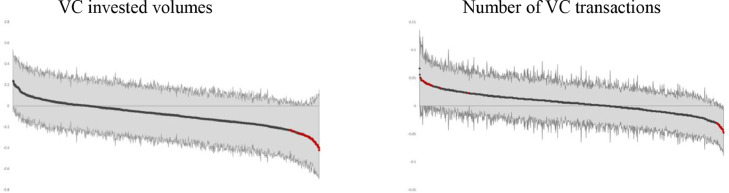

Following Christensen et al. (2016), we randomly assign to each country a date of pseudo treatment prior to its first COVID-19 case and repeat the estimation of Eq. (1) using these pseudo treatment dates and the specifications with time and country fixed-effects. We repeat the process 1000 times and plot the coefficients of the DiD estimates of these 1000 estimations and their 90% confidence intervals in Fig. 3 . Our actual estimates from columns (1) and (3) of Table 1 exceed the cut-offs for the 99% tail of the distributions of coefficients generated via the pseudo-treatment process. Overall, all tests support the validity of our empirical strategy.

Fig. 3.

Randomized Placebo. The graphs plot coefficients and 90% confidence intervals of 1000 estimations of Eq. (1) based on random pseudo treatment dates. In each estimation, the pseudo treatment date is randomized by country and starting period subject to the requirement that it is not after the first global COVID-19 case in December 2020. The red dots are the statistically significant coefficients.

4. Mechanisms and channels

We examine heterogenous effects based on deal and investor characteristics to offer some insights into possible mechanisms driving the observed shift in VC investments. We note that the drivers we explore are not mutually exclusive.

4.1. Investor experience

Extant research suggests that VC funding may be driven by factors such as overreaction to perceived investment opportunities or changes in fundamentals of firms or sectors (Gupta 2000; Gompers and Lerner 2004). Gompers et al. (2008) show greater responses to market conditions by more experienced VCs, consistent with a rational response to investment opportunities rather than “overreaction”. Hence, we investigate whether VC experience affects the reallocation effects.

First, we construct an indicator Generalist VC that takes the value of 1 if a VC invests in multiple NACE sectors, and 0 if the VC specializes in a single sector. We augment Eq. (1) with the triple interaction term Treated × First Case × Generalist VC. The estimation results are in columns (1) and (4) of Table 4 . The coefficients of the interaction Treated × First Case are positive and significant at 1% level, while the coefficients of the triple interaction are negative. The linear combination terms (A) + (B), which show the effect for VCs that invest in multiple sectors, are positive but only marginally significant at 10% level in column (1). This indicates that the reallocation effects are driven by VCs with focused investments and expertise in a specific sector.

Table 4.

Mechanisms and Channels – Investor Experience. The analysis covers 62 bi-monthly periods from 01/01/2018 to 07/31/2020 and 126 countries. Treated is an indicator that takes the value of 1 for investments in ventures with pandemic-related activities, and 0 otherwise. First Case is an indicator that takes the value of 1 for periods after the beginning of the spread of COVID-19 (i.e., after the first confirmed case) in country c, and 0 otherwise. Generalist VC is an indicator that takes the value of 1 for VCs that have completed deals in more than 1 NACE sector, and 0 otherwise. Young VC is an indicator that takes the value of 1 for VCs in the bottom quartile of the age distribution of all VC firms, and 0 otherwise. Fad is an indicator that takes the value of 1 for pandemic-related deals that contain words that attract a lot of attention on the web (words with above-median search amount). For each bi-monthly period, we use Google Trends to capture number of searches for all keywords from our definition of pandemic-related deal and set Fad equal to 1 if the Google Trends index of the keywords in the deal synopsis is greater than 50, and 0 otherwise. The linear combinations of coefficients show point estimates, and statistical significance, of the treatment effect on the outcome variables for delas with generalist VCs (A) + (B), young VCs (A) + (C), or deals containing words that attract a lot of attention (A) + (D), respectively. The table reports coefficient estimates followed by standard errors, clustered at country level, in parentheses. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

| VC invested amount |

Number VC transactions |

||||||

| Dependent Variable | (1) | (2) | (3) | (4) | (5) | (6) | |

| Treated × First Case | (A) | 0.359*** | 0.308*** | 0.461*** | 0.053*** | 0.037*** | 0.064*** |

| (0.109) | (0.085) | (0.133) | (0.016) | (0.012) | (0.027) | ||

| Treated × First Case × Generalist VC | (B) | −0.177 | −0.041** | ||||

| (0.135) | (0.019) | ||||||

| Treated × First Case × Young VC | (C) | −0.144** | −0.017** | ||||

| (0.073) | (0.007) | ||||||

| Treated × First Case × Fad | (D) | −0.063 | −0.009 | ||||

| (0.099) | (0.013) | ||||||

| Linear Combination (A) + (B) | 0.182* | 0.013 | |||||

| Linear Combination (A) + (C) | 0.164* | 0.019 | |||||

| Linear Combination (A) + (D) | 0.398*** | 0.054*** | |||||

| Observations | 31,248 | 31,248 | 23,436 | 31,248 | 31,248 | 23,436 | |

| Adj. R-squared | 0.597 | 0.577 | 0.665 | 0.757 | 0.732 | 0.859 | |

| Country-Deal Category Fixed Effects | Yes | Yes | Yes | Yes | Yes | Yes | |

| Time Fixed Effects | Yes | Yes | Yes | Yes | Yes | Yes | |

| Country-Deal Category Trend | Yes | Yes | Yes | Yes | Yes | Yes | |

Second, we construct an indicator Young VC that takes the value of 1 for deals where the VC is in the bottom quartile of the age distribution of all sample VCs. We augment Eq. (1) with the triple interaction Treated × First Case × Young VC. The coefficient of Treated × First Case shows the effect for more experienced VCs, while the coefficient of the triple interaction term reflects the effect for less experienced VCs.21 The results are in columns (2) and (5) of Table 4. More experienced VCs significantly increase the amount of their pandemic-related investment as the coefficient of Treated × First Case in column (2) is positive and significant at 1% level. The negative coefficient of the triple interaction suggests that the effect is reduced for less experienced VCs. The linear combination term in column (2) is positive and significant but at 10% level only. Thus, while younger VCs also increase their pandemic-related investment, the reallocation is driven by more experienced and older VCs. Likewise, column (5) shows that more experienced VCs increase the number of their deals in pandemic-related activities. The coefficient of Treated × First Case is positive and significant at 1% level. The differential effect for younger VCs is negative and significant at 5% level, which implies that young VCs undertake fewer pandemic-related deals than the older ones. Finally, the insignificant linear combination term in column (5) indicates that COVID-19 has no discernable effect for young VCs in terms of number of deals.

Our analysis suggests that the COVID-related effects in the VC market are concentrated within the group of more experienced and focused VCs. In line with Gompers et al. (2008) and Sorensen (2007), to the extent that these VCs are more likely to “rationally react” to changes in fundamentals, rather than “overreact” to fads and sentiment, these investment shifts reflect newly created investment opportunities stemming from the spread of the virus.

In an attempt to more formally explore whether the reallocation of VC investments reflects shifts in sentiment and attention, we construct an indicator Fad that takes the value of 1 for deals with the most frequently searched words using Google Trends (Da et al., 2011). We downloaded the trends for each word used in the pandemic-related definition during each bi-monthly period. The trend index captures global search intensity and ranges from 0 to 100, with 100 being the highest intensity. We identify fad-pandemic words in each period as those with an index greater than 50. We construct the Fad indicator that takes the value of 1 for pandemic-related investments whose deal synopses contain at least one fad-pandemic word, and add the triple interaction Treated × First Case × Fad to Eq. (1).

The results are in columns (3) and (6) of Table 4. The coefficient of Treated × First Case is positive and significant at 1% level. Thus, following the onset of the spread of the virus, VCs increase investment amounts and number of deals in pandemic-related activities that do not attract a lot of attention on the web. The coefficients of the triple interactions are not significant, which suggests that VCs do not invest incrementally more in attention-attracting activities. Thus, it seems that the reallocation effects of COVID-19 are driven by fundamentals and not simply by shifts in investor attention and fads.

4.2. Investment round

We investigate heterogenous effects related to stage of financing by distinguishing between early and late funding rounds. During recessions, uncertainty created by economic slowdowns can lead VCs to a more cautious investment approach. This, in turn, could affect funding of early-stage deals or VCs specializing in such transactions more (Kaplan and Schoar 2005; Gompers et al., 2008; Townsend 2015; Howell et al., 2020). We explore investment stage to also offer insights into the relevance of demand-side and supply-side factors. Early-stage deals are more likely to reflect demand for funding by firms with novel projects and a relative increase in early-stage deals would signify a demand-driven reallocation.22

To analyze the effects for investments at different stage, we construct an indicator, Later Stage, which takes the value of 1 for later-stage deals, and 0 otherwise, and add to Eq. (1) the triple interaction Treated × First Case × Later Stage. We consider the seed stage, as well as the 1st and 2nd investment rounds, as early-stage. We deem as later stage all stages from the 3rd to 8th rounds. The results are in columns (1) and (4) of Table 5 . The coefficient of Treated × First Case in column (1) is significant. This suggests that the spread of the virus is associated with an increase in pandemic-related early-stage investment. We find no difference between early-stage and late-stage deals as the coefficient of Treated × First Case × Later Stage is insignificant. In column (4) we find consistent results for the number of deals. As the estimated effects for early and late rounds are similar, we conclude that both demand-driven and supply-driven capital reallocation could be at work.

Table 5.

Mechanisms and Channels – Investment Stage and VC Type. The analysis covers 62 bi-monthly periods from 01/01/2018 to 07/31/2020 and 126 countries. Treated is an indicator that takes the value of 1 for investments in ventures with pandemic-related activities, and 0 otherwise. First Case is an indicator that takes the value of 1 for periods after the beginning of the spread of COVID-19 (i.e., after the first confirmed case) in country c, and 0 otherwise. Later Stage is an indicator that takes the value of 1 for deals that are later stage investments, and 0 for early-stage investments. CVC is an indicator that takes the value of 1 for corporate VCs, and 0 for independent VCs. Large VC is an indicator that takes the value of 1 for VCs with a number of employees in the top quartile of the distribution, and 0 otherwise. The linear combinations of coefficients show point estimates, and statistical significance, of the treatment effect on the outcome variables for later investment rounds (A) + (B), deals completed by corporate VCs (A) + (C), and deals completed by large VCs (A) + (D), respectively. The table reports coefficient estimates followed by standard errors, clustered at country level, in parentheses. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

| VC invested amount |

Number VC transactions |

||||||

| Dependent Variable | (1) | (2) | (3) | (4) | (5) | (6) | |

| Treated × First Case | (A) | 0.291*** | 0.288*** | 0.261** | 0.030** | 0.038*** | 0.027** |

| (0.091) | (0.100) | (0.101) | (0.011) | (0.011) | (0.012) | ||

| Treated × First Case × Later Stage | (B) | 0.063 | 0.005 | ||||

| (0.079) | (0.009) | ||||||

| Treated × First Case × CVC | (C) | −0.101 | −0.008 | ||||

| (0.117) | (0.013) | ||||||

| Treated × First Case × Large VC | (D) | −0.219** | −0.025** | ||||

| (0.103) | (0.012) | ||||||

| Linear combination (A) + (B) | 0.355*** | 0.035*** | |||||

| Linear combination (A) + (C) | 0.187* | 0.030** | |||||

| Linear combination (A) + (D) | 0.041 | 0.002 | |||||

| Observations | 31,248 | 31,248 | 31,248 | 31,248 | 31,248 | 31,248 | |

| Adjusted R-squared | 0.616 | 0.628 | 0.507 | 0.790 | 0.842 | 0.626 | |

| Country-Deal Category Fixed Effects | Yes | Yes | Yes | Yes | Yes | Yes | |

| Time Fixed Effects | Yes | Yes | Yes | Yes | Yes | Yes | |

| Country-Deal Category Trend | Yes | Yes | Yes | Yes | Yes | Yes | |

4.3. Type of investor

We also analyze heterogenous effects due to type of investor. We distinguish between independent VCs (IVCs) and CVCs. The uncertainty associated with COVID-19 may induce different responses by these two types given their different organization, incentives, mode of operation, investment objectives, and constraints. IVCs aim at increasing the value of the portfolio companies prior to exit (Gompers and Lerner 2001). CVCs might be more likely to invest in ventures that develop technologies complementary to that of their corporate parent (Dushnitsky and Lenox 2006; Da Rin et al. 2013; Maula et al., 2013) or lead to strategic partnerships (Gompers and Lerner 2000). CVCs might also have a more bureaucratic organizational structure and slower decision-making process. However, their corporate parents can provide additional funding and capital if needed. Hence, we create an indicator, CVC, that takes the value of 1 for deals involving a corporate VC, and 0 for independent VC, and augment Eq. (1) with the triple interaction Treated × First Case × CVC.

The results in columns (2) and (5) of Table 5 show that IVCs increase pandemic-related investment along both outcome dimensions. The coefficient of Treated × First Case is positive and significant at 1% level in both columns. However, CVCs do not react in a different manner as the coefficients on the triple interaction terms Treated × First Case × CVC are insignificant. In line with survey results by Gompers et al. (2020b), we conclude that investor type may be relevant but is not a primary determinant of reallocation effects in the VC market induced by COVID-19.

Motivated by arguments related to organizational efficiency and resources, we also explore size effects. Large VCs could be characterized by more organizational frictions than small VCs but could also have an easier access to financial resources. We create an indicator Large VC, which takes the value of 1 for VCs with a number of employees in the top quartile of the distribution, and add the triple interaction Treated × First Case × Large VC. The results are in columns (3) and (6). The coefficient on Treated × First Case, which shows the effect for smaller VCs, is positive and significant at 5% level. This indicates that smaller VCs increase investment in pandemic-related activities. Interestingly, the coefficients on the triple interaction in columns (3) and (6) are negative and significant at 5% level, with an insignificant overall effect. Hence, it appears that large VCs do not respond to the shock created by COVID-19, which could possibly reflect organizational frictions and sluggish decision-making.

5. Robustness tests

5.1. Major markets

We first test whether our results are confined to major markets for venture capital or reflect a truly global investment pattern by examining a differential impact for entrepreneurial firms and VCs in the US and China. Both countries have the largest number of investors and funded firms, representing majority of the deals. Moreover, the median deal size in China is much larger than in the rest of the world, especially for pandemic-related investments.23 The difference in required financial resources can affect the response of VCs. On the one hand, this can hinder reallocation of capital. On the other hand, a few large deals may be sufficient to significantly shift investment. Another differentiating factor, especially for China, is the degree of government involvement and influence in the VC market (Zhang et al., 2007; Brander et al., 2015; Suchard et al., 2021). Government-owned or funded VCs may be slower to respond to the novel context but with financial support by the government, they could better withstand funding shocks, internalize the social value of novel technologies, and switch towards pandemic-related investments (Bayar et al., 2019).

To check whether our results are driven by these markets, we add triple interactions Treated × First Case × US and Treated × First Case × CN, where US (CN) takes the value of 1 if the funded firm is in the US (China), and 0 otherwise. In this setting, the coefficient on Treated × First Case shows the average effect for the rest of the world. We also test whether investment decisions of US and Chinese VCs differ. For this analysis, the outcome variables are aggregated at country of the investor, and VC US and VC CN are indicators for deals with US and Chinese investors, respectively. For a deal with multiple VCs from different countries, we attribute the deal to the country of the first VC listed in Zephyr, which corresponds to the lead VC.

The results in Table 6 show that the coefficients on Treated × First Case are positive and significant at 1% level in all columns. The impact of COVID-19 is confirmed after accounting for the US and China in the analysis, which suggests that the reallocation effect is a global investment phenomenon and not driven by these two major markets.

Table 6.

Excluding Major VC Markets. The analysis covers 62 bi-monthly periods from 01/01/2018 to 07/31/2020 and 126 countries. Treated is an indicator that takes the value of 1 for investments in ventures with pandemic-related activities, and 0 otherwise. First Case is an indicator that takes the value of 1 for periods after the beginning of the spread of COVID-19 (i.e., after the first confirmed case) in country c, and 0 otherwise. US (CN) are indicators that take the value of 1 for deals involving entrepreneurial firms in US (China). VC US (VC CN) are indicators that take the value of 1 for deals by VC firms from US (China). The table reports coefficient estimates followed by standard errors, clustered at country level, in parentheses. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

| VC invested amount |

Number VC transactions |

|||

| Dependent Variable | (1) | (2) | (3) | (4) |

| Treated × First Case | 0.432*** | 0.472*** | 0.060*** | 0.064*** |

| (0.141) | (0.148) | (0.018) | (0.017) | |

| Treated × First Case × US | 0.280** | −0.166*** | ||

| (0.113) | (0.015) | |||

| Treated × First Case × CN | 0.441*** | −0.034** | ||

| (0.130) | (0.017) | |||

| Treated × First Case × VC US | 0.206 | −0.099*** | ||

| (0.135) | (0.017) | |||

| Treated × First Case × VC CN | 0.259* | −0.035* | ||

| (0.147) | (0.018) | |||

| Observations | 15,624 | 15,624 | 15,624 | 15,624 |

| Adjusted R-squared | 0.669 | 0.661 | 0.857 | 0.859 |

| Country-Deal Category Fixed Effects | Yes | Yes | Yes | Yes |

| Time Fixed Effects | Yes | Yes | Yes | Yes |

| Country-Deal Category Trend | Yes | Yes | Yes | Yes |

5.2. Portfolio composition

Our analysis focuses on invested amount and number of deals. We re-estimate Eq. (1) using as dependent variables two measures that account for the percentage contribution of pandemic-related investment to overall VC activity. The first variable is the amount invested in pandemic-related deals as a fraction of total investment during a bi-monthly period in a country. The second variable is the share of pandemic-related deals of the total number of deals. Table 7 shows that the estimated effect is positive and significant at 1% level in all specifications.

Table 7.

Proportion of Deals. The analysis covers 62 bi-monthly periods from 01/01/2018 to 07/31/2020 and 126 countries. Treated is an indicator that takes the value of 1 for investments in ventures with pandemic-related activities, and 0 otherwise. First Case is an indicator that takes the value of 1 for periods after the beginning of the spread of COVID-19 (i.e., after the first confirmed case) in country c, and 0 otherwise. The table reports coefficient estimates followed by standard errors, clustered at country level, in parentheses. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

| Pandemic-related volume contribution |

Pandemic-related transaction contribution |

|||

| Dependent Variable | (1) | (2) | (3) | (4) |

| Treated × First Case | 0.046*** | 0.067*** | 0.039*** | 0.053*** |

| (0.014) | (0.018) | (0.013) | (0.017) | |

| Observations | 15,624 | 15,624 | 15,624 | 15,624 |

| Adjusted R-squared | 0.492 | 0.478 | 0.526 | 0.514 |

| Country-Deal Category Fixed Effects | Yes | Yes | Yes | Yes |

| Time Fixed Effects | Yes | Yes | Yes | Yes |

| Country-Deal Category Trend | No | Yes | No | Yes |

5.3. Keyword groups

In our analysis, we define the treated group based on whether deal synopses contain at least one word from 5 groups of keywords. We check whether our results are driven by a single group of words. In Table 8 , we repeat our analysis with a modified Treated variable that excludes, one at a time, each of the groups.24 The estimates are comparable to those obtained in the main analysis, both in terms of direction and magnitude. Hence, our results do not seem to be driven by a specific group of words used in the pandemic-related definition.

Table 8.

Alternative Operationalization of Treatment – Excluding Groups of Words from the Pandemic-related Definition. The analysis covers 62 bi-monthly periods from 01/01/2018 to 07/31/2020 and 126 countries. Treated (–“group i”) is an indicator that takes the value of 1 for investments in ventures with pandemic-related activities (excluding the respective group of words “group i” from the definition of pandemic-related), and 0 otherwise. First Case is an indicator that takes the value of 1 for periods after the beginning of the spread of COVID-19 (i.e., after the first confirmed case) in country c, and 0 otherwise. The table reports coefficient estimates followed by standard errors, clustered at country level, in parentheses. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

| VC invested amount |

Number VC transactions |

|||||||||

| Dependent Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

| Treated (–“biology”) × First Case | 0.474*** | 0.064*** | ||||||||

| (0.141) | (0.015) | |||||||||

| Treated (–“pharmaceutical”) × First Case | 0.462*** | 0.064*** | ||||||||

| (0.142) | (0.015) | |||||||||

| Treated (–“medicine”) × First Case | 0.402*** | 0.059*** | ||||||||

| (0.131) | (0.014) | |||||||||

| Treated (–“health”) × First Case | 0.367*** | 0.044*** | ||||||||

| (0.136) | (0.014) | |||||||||

| Treated (–“supply chain”) × First Case | 0.481*** | 0.064*** | ||||||||

| (0.141) | (0.016) | |||||||||

| Observations | 15,624 | 15,624 | 15,624 | 15,624 | 15,624 | 15,624 | 15,624 | 15,624 | 15,624 | 15,624 |

| Adjusted R-squared | 0.663 | 0.659 | 0.661 | 0.666 | 0.662 | 0.498 | 0.484 | 0.503 | 0.516 | 0.489 |

| Country-Deal Category Fixed Effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Fixed Effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Country-Deal Category Trend | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

5.4. Measurement errors

Inevitably, any text-based classification is subject to type-I and type-II errors, where non-pandemic investments are erroneously categorized as pandemic-related, while projects related to a pandemic environment are erroneously deemed non-pandemic. We pursue several strategies to mitigate the concern. First, to reduce the likelihood of false positives we consider a deal pandemic-related if the textual fields mention at least 2 or at least 3 words from the list of keywords. We build two indicators Treated(2 w) and Treated(3 w) that take values of 1 if the synopsis mentions at least 2 or 3 words, respectively.

Second, we adopt industry-based categorization to reduce the likelihood of false negatives. If the number or share of pandemic-related investments in a 4-digit NACE sector exceeds a certain threshold, all deals in the sector (even those whose synopses do not contain pandemic-related keywords) are considered pandemic-related. We then construct an indicator Sector (top 10) that takes the value of 1 for sectors among the top 10 sectors based on the proportion of pandemic-related investment during the pre-COVID period (from 01/01/2018 to 12/15/2019). We also construct Sector (All) that takes the value of 1 for sectors with at least one pandemic-related investment during the pre-COVID period.

Third, we recognize that the textual analysis could be affected by disclosure bias. Indeed, after the onset of COVID-19, firms might strategically use pandemic-related terms and re-label projects. To check whether our results are robust, we restrict our analysis to a subset of firms that receive VC funding prior to the diffusion of COVID-19. Thus, we analyze only firms tagged as pandemic-related before the onset of the pandemic. The results of these tests are presented in Table 9 .

Table 9.

Alternative Operationalization of Treatment – Treatment Based on Industry Sectors (NACE) and Probit analysis. The analysis covers 62 bi-monthly periods from 01/01/2018 to 07/31/2020 and 126 countries. Treated (2 w) is an indicator that takes the value of 1 for deals that have in their synopsis at least 2 pandemic-related keywords, and 0 otherwise. Treated (3 w) is an indicator that takes the value of 1 for deals that have in their synopsis at least 3 pandemic-related keywords, and 0 otherwise. Sector (top 10) is an indicator that takes the value of 1 for deals from a sector among the top 10 sectors based on proportion of pandemic-related deals of all deals in the sector. Sector (All) is an indicator that takes the value of 1 for deals from a sector with at least one pandemic-related deal, and 0 otherwise. Sectors are defined at NACE 4-digit level. Column (9) shows results of a Probit analysis at the VC-backed firm level on the sub-sample of firms that have a funding deal before the onset of the pandemic. The dependent variable, Funding, is an indicator that takes the value of 1 if the firm receives VC funding after the onset of the pandemic, and 0 otherwise (the firm receives VC funding only during the pre-pandemic period). Treated Firm Level is an indicator that takes the value of 1 if the firm has at least one investment in pandemic-related activities before the onset of the pandemic, and 0 otherwise (all deals for the firm during the pre-pandemic period are non-pandemic). First Case is an indicator that takes the value of 1 for periods after the beginning of the spread of COVID-19 (i.e., after the first confirmed case) in country c, and 0 otherwise. The table reports coefficient estimates followed by standard errors, clustered at country level, in parentheses. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

| VC invested amount |

Number VC transactions |

Funding | |||||||

| Dependent Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

| Treated (2 w) × First Case | 0.485*** | 0.059*** | |||||||

| (0.131) | (0.021) | ||||||||

| Treated (3 w) × First Case | 0.273** | 0.040* | |||||||

| (0.126) | (0.022) | ||||||||

| Sector (top 10) × First Case | 0.353*** | 0.048*** | |||||||

| (0.128) | (0.016) | ||||||||

| Sector (All) × First Case | −0.068 | −0.008 | |||||||

| (0.141) | (0.015) | ||||||||

| Treated Firm Level | 0.094*** | ||||||||

| (0.030) | |||||||||

| Observations | 15,624 | 15,624 | 15,252 | 15,252 | 15,624 | 15,624 | 15,252 | 15,252 | 32,642 |

| Adjusted R-squared | 0.674 | 0.605 | 0.693 | 0.664 | 0.866 | 0.697 | 0.832 | 0.807 | 0.014 |

| Time Fixed Effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Country-Deal Category Fixed Effects | Yes | Yes | No | No | Yes | Yes | No | No | No |

| Country-Deal Category Trend | Yes | Yes | No | No | Yes | Yes | No | No | No |

| Country-Industry Sectors Fixed Effects | No | No | Yes | Yes | No | No | Yes | Yes | No |

| Country-Industry Sector Trend | No | No | Yes | Yes | No | No | Yes | Yes | No |

| Country Fixed Effects | No | No | No | No | No | No | No | No | Yes |

The coefficients of the interaction Treated(2 w) × First Case are positive and significant. The magnitude is similar to the baseline estimates. This suggests that our results are not driven by investments categorized as pandemic-related due to a single word. The coefficients of Treated(3 w) × First Case are also positive and significant, albeit at lower levels. This might partly reflect the fact that the approach implicitly considers 1-word and 2-words pandemic-related investments as non-pandemic, inflating the effect of false negatives.

In columns (3) and (7) we report results of estimations that use Sector (top 10) and the coefficients are positive and significant, while in columns (4) and (8) we show results using Sector (All) and the coefficients are insignificant. These findings combined suggest that the reduction of type-II error is compensated by an increase in the number of false pandemic-related investments.

Last, we conduct the test to partially address concerns about a possible disclosure bias. We focus on firms that raise venture capital prior to the spread of COVID-19. We create two indicators: 1) Funding that takes the value of 1 if the firm also receives venture capital after the spread and 2) Treated Firm that takes the value of 1 if the firm raised capital in at least one pandemic-related deal before the spread. In column (9), we report results of the estimation a firm-level Probit model for the likelihood of the firm receiving funding after the onset of the pandemic (Funding = 1). The coefficient of Treated Firm is positive and significant. Firms with pandemic-related projects before the pandemic are more likely to continue to receive funding afterwards, which suggests that our findings are robust to possible strategic communication by firms after the onset of COVID-19.

5.5. Reallocation effects in healthcare-related and non-healthcare sectors

Some observers suggest that the pandemic can exacerbate an adverse trend in the healthcare sector as non-COVID healthcare consumption shrinks due to customer preferences or government restrictions. By contrast, others argue that certain segments can be positively affected (e.g., testing, technology). Some of the words we use to define pandemic-related activities also describe products in the healthcare sector, even though their focus is not exclusively on pandemic issues.25 Hence, it is important to explore the effect within the healthcare sector and whether investment opportunities are concentrated within this sector.

We categorize all NACE sectors into healthcare-related and non-healthcare and then split all deals from each sector into pandemic-related and non-pandemic using our text-based definition. We consider as healthcare the following NACE codes: 21, 32.5, 72.1, 86, 87, and 88.1. We create five treatment indicators based on different groups. Treated (Group 1) takes the value of 1 for all investments in the healthcare sector, and 0 otherwise. Treated (Group 2) takes the value of 1 for investments in ventures with pandemic-related activities in the healthcare sector, and 0 otherwise. Treated (Group 3) takes the value of 1 for investments in ventures with non-pandemic activities in the healthcare sector, and 0 otherwise. Treated (Group 4) takes the value of 1 for investments in ventures with pandemic-related activities in the non-healthcare sector, and 0 otherwise. Treated (Group 5) takes the value of 1 for investments in ventures with non-pandemic activities in the non-healthcare sector, and 0 otherwise. We estimate Eq. (1) using these treated groups.

We present the results in Table 10 . Column (1) shows that the amount of VC investment in the healthcare sector remains unchanged after the beginning of the pandemic. Columns (2) and (4) indicate that the amount of pandemic-related investment in both healthcare and non-healthcare sectors increases with the pandemic. The coefficients of the interactions Treated (Group 2) × First Case and Treated (Group 4) × First Case are positive and significant at 1% level. By contrast, we find no significant effect on the amount of non-pandemic investment in the healthcare sector in column (3). Importantly, non-pandemic investment in the non-healthcare sector decreases. The coefficient of Treated (Group 5) × First Case in column (5) is negative and significant, albeit at 10% level. We obtain similar results when we examine investment in terms of number of deals in columns (6) to (10). We conclude that the reallocation effect is especially significant within the non-healthcare sectors with a shift from non-pandemic to pandemic-related investment, even though the latter also increases in the healthcare sector.26

Table 10.

Alternative Operationalization of Treatment – Reallocation Effects in Healthcare and Non-healthcare Sectors. The analysis covers 62 bi-monthly periods from 01/01/2018 to 07/31/2020 and 126 countries. The analysis is based on five “treatment” groups. Treated (Group 1) takes the value of 1 for deals in the healthcare sector (NACE codes 21, 32.5, 72.1, 86, 87, and 88.1), and 0 otherwise. Treated (Group 2) takes the value of 1 for investments in ventures with pandemic-related activities in the healthcare sector, and 0 otherwise. Treated (Group 3) is an indicator that takes the value of 1 for investments in ventures with non-pandemic activities in the healthcare sector, and 0 otherwise. Treated (Group 4) is an indicator that takes the value of 1 for investments in ventures with pandemic-related activities in the non-healthcare sector, and 0 otherwise. Treated (Group 5) is an indicator that takes the value of 1 for investments in ventures with non-pandemic activities in the non-healthcare sector, and 0 otherwise. First Case is an indicator that takes the value of 1 for periods after the beginning of the spread of COVID-19 (i.e., after the first confirmed case) in country c, and 0 otherwise. The table reports coefficient estimates followed by standard errors, clustered at country level, in parentheses. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

| VC invested amount |

Number VC transaction |

|||||||||

| Dependent Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

| Treated (Group 1) × First Case | 0.211 | 0.038* | ||||||||

| (0.175) | (0.020) | |||||||||

| Treated (Group 2) × First Case | 0.375*** | 0.056*** | ||||||||

| (0.135) | (0.017) | |||||||||

| Treated (Group 3) × First Case | 0.178 | 0.031 | ||||||||

| (0.170) | (0.021) | |||||||||

| Treated (Group 4) × First Case | 0.420*** | 0.052** | ||||||||

| (0.141) | (0.022) | |||||||||

| Treated (Group 5) × First Case | −0.290* | −0.043** | ||||||||

| (0.165) | (0.020) | |||||||||

| Observations | 15,624 | 15,624 | 15,624 | 15,624 | 15,624 | 15,624 | 15.624 | 15,624 | 15,624 | 15,624 |

| Adjusted R-squared | 0.638 | 0.666 | 0.634 | 0.674 | 0.641 | 0.848 | 0.866 | 0.846 | 0.863 | 0.850 |

| Country-Group Fixed Effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time Fixed Effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Country-Group Trend | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

5.6. Social distancing technologies

As another robustness test, we adopt a broader measure of pandemic-related activities that takes into account development of technologies intended to address needs in the context of social distancing. We examine if the textual fields mention at least one word from a set of keywords related to “E-Commerce”, “Remote work and videoconferencing”, “Information Technology and Telecommunication”, and “Media and Broadcasting”. We build an indicator, Social Distancing, that takes the value of 1 for deals where at least one of the words is present. We also build a second variable, Broad Treated, that takes the value of 1 if a deal belongs either to the original pandemic-related category or to the new category related to social distancing.

The estimation results are in Table 11 . The estimated effects are positive and significant for both invested amount and number of deals when we use the broader definition. The magnitudes are slightly larger, pointing to positive reallocation effects related to social-distancing. We also estimate a model that incorporates both measures, Treated and Social Distancing. The coefficients on both Treated × First Case and Social Distancing × First Case are positive and significant. We conclude that the onset of COVID-19 generated significant reallocation effects for both pandemic-related investments and investments related to social distancing.

Table 11.

Alternative Operationalization of Treatment – Extending the Pandemic-related definition. The analysis covers 62 bi-monthly periods from 01/01/2018 to 07/31/2020 and 126 countries. Broad Treated is an indicator that takes the value of 1 for investments in ventures with pandemic-related activities based on a broader definition of pandemic-related to include activities that could be affected not only by the spread of COVID-19 but also by the resultant lockdowns, and 0 otherwise. Treated is an indicator that takes the value of 1 for investments in ventures with pandemic-related activities, and 0 otherwise. Social Distancing is an indicator that takes the value of 1 for investments in ventures with social-distancing activities, and 0 otherwise. First Case is an indicator that takes the value of 1 for periods after the beginning of the spread of COVID-19 (i.e., after the first confirmed case) in country c, and 0 otherwise. The table reports coefficient estimates followed by standard errors, clustered at country level, in parentheses. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively.

| VC invested amount | Number VC transactions | |||

| Dependent Variable | (1) | (2) | (3) | (4) |

| Broad Treated × First Case | 0.515*** | 0.065*** | ||

| (0.145) | (0.018) | |||

| Treated × First Case | 0.485*** | 0.062*** | ||

| (0.138) | (0.017) | |||

| Social Distancing × First Case | 0.496*** | 0.069*** | ||

| (0.139) | (0.020) | |||

| Observations | 15,624 | 23,436 | 15,624 | 23,436 |

| Adjusted R-squared | 0.649 | 0.640 | 0.855 | 0.848 |

| Country-Deal Category Fixed Effects | Yes | Yes | Yes | Yes |

| Time Fixed Effects | Yes | Yes | Yes | Yes |

| Country-Deal Category Trend | Yes | Yes | Yes | Yes |

6. Conclusions

We explore possible reallocation effects in the VC market created by the global spread of the COVID-19 pandemic by examining whether and how VCs adjust their investments. Using a difference-in-differences estimation approach, and the staggered spread of the pandemic across countries, we detect significant shifts in the flow of venture capital.

We document a significant positive empirical relationship between the spread of COVID-19 and VC investment in ventures with pandemic-related activities. The finding is robust to a variety of tests related to alternative pandemic-related definitions, assumptions underlying the empirical strategy, measurement errors, and timing conventions.

To offer insights into some of the mechanisms possibly driving the reallocation effects, we explore heterogenous effects underlying the average estimates. We show that the magnitude of the effect might depend on the experience and expertise of the VCs, organizational form and size, as well as investment stage. Thus, our analysis highlights the implications of the global pandemic for the functioning of the VC market.

Appendix

Table A.1., Table A.2., Table A.3., Table A.4., Table A.5., Table A.6., Table A.7., Table A.8.

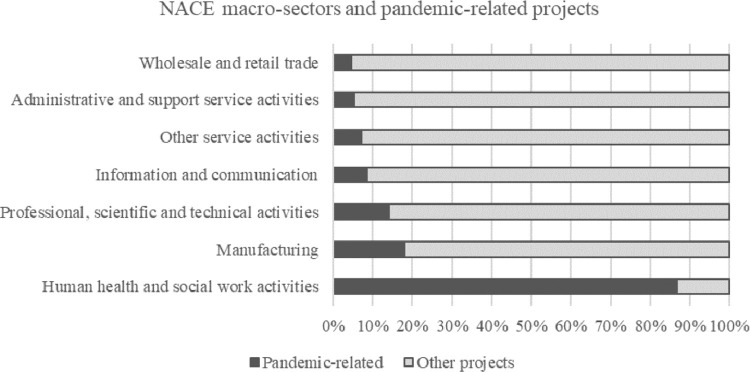

Fig. A.1.

Distribution of Pandemic-related Deals across NACE Macro-sectors. The figure shows the share of pandemic-related deals (as a fraction of all deals) during the period from January 2018 to July 2020, by top macro-sectors. Macro-sectors are identified by the “broad structure” of sectors according to NACE Rev. 2 European Commission definition (2008). Top macro-sectors are those for which the pandemic-related share is at least 5% of the total projects.

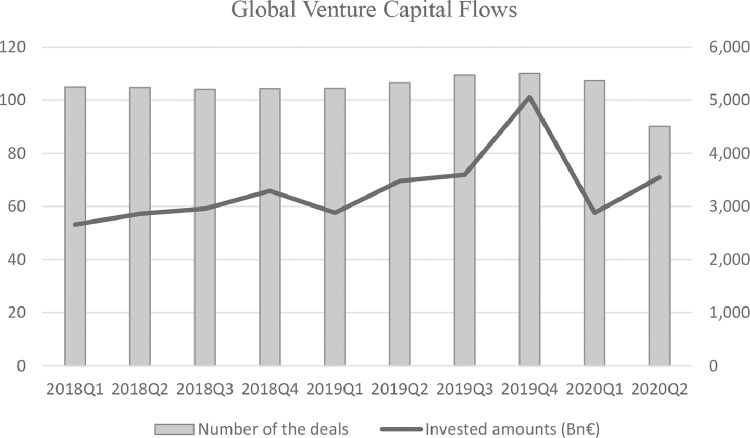

Fig. A.2.

Evolution of Global VC Financing (from Q1 2018 to Q2 2020). The figure shows number of VC deals and investment amount per quarter from quarter 1 of 2018 to quarter 2 of 2020.

Fig. A.3.

Alternative Specifications of the Autor test. The graphs use estimates from Eq. (2) to plot period-by-period coefficients and 90% confidence intervals up to the treatment date, as well as post-treatment. In panel (A), we plot the full set of post-treatment period-by-period coefficients. In panel (B), we plot coefficients for two average post-treatment phases (the first phase covers the first 8 bi-monthly periods and the second phase covers the second 7 bi-monthly periods).

Table A.1.

Evolution of Global VC Investments. The table shows average total amount (€ billion) of global VC investment per bi-monthly period, average number of deals per period and median amount (€ million) of VC investments per deal during the pre-treatment (01/01/2018–12/15/2019) and post-treatment timeframe (12/16/2019–07/31/2020). The column “Growth rate” reports the growth rate from the pre-treatment to the post-treatment figure across each deal category. The column “Difference” reports the difference between “Growth rate” of pandemic-related and non-pandemic deals. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively, of t-tests of equality of growth rates across the two groups.

| Before |

After |

Growth rate |

Difference | |||||||

| Total | Pandemic-related | Non-pandemic | Total | Pandemic-related | Non-pandemic | Total | Pandemic-related | Non-pandemic | ||

| Total Amount | 10.924 | 1.384 | 9.540 | 12.169 | 1.853 | 10.316 | 11% | 34% | 8% | 26%** |

| Number of Deals | 883 | 86 | 797 | 831 | 90 | 741 | −6% | 4% | −7% | 11%*** |

| Median Amount | 2.004 | 3.458 | 1.914 | 2.274 | 4.407 | 2.164 | 13% | 27% | 13% | 14%** |

Table A.2.

Evolution of VC Investments in the United States and China. Panel A shows average total amount (€ billion) of VC investment per bi-monthly period during the pre-treatment time (01/01/2018–12/15/2019 for China; 01/01/2018–15/01/2020 for the US) and post-treatment time (12/16/2019–07/31/2020 for China; 01/16/2020–07/31/2020 for the US). Panel B shows average number of deals per period, while Panel C shows median amount (€ million) of VC investments per deal. The column “Growth rate” reports the growth rate from the pre-treatment to the post-treatment figure across each deal category. The column “Difference” reports the difference between “Growth rate” of pandemic-related and non-pandemic deals. ***, **, and * indicate statistical significance at the 1%, 5%, and 10% level, respectively, of t-tests of equality of growth rates across the two groups.

| Panel A Total Amount | ||||||||||

| Before |

After |

Growth rate |

Difference | |||||||

| Total | Pandemic-related | Non-pandemic | Total | Pandemic-related | Non-pandemic | Total | Pandemic-related | Non-pandemic | ||

| US | 6.259 | 0.723 | 5.535 | 7.670 | 1.127 | 6.543 | 23% | 56% | 18% | 38%* |

| China | 2.343 | 0.299 | 2.044 | 1.555 | 0.402 | 1.153 | −34% | 34% | −44% | 78%*** |

| Panel B Number of Deals | ||||||||||

| Before |

After |

Growth rate |

Difference | |||||||

| Total | Pandemic-related | Non-pandemic | Total | Pandemic-related | Non-pandemic | Total | Pandemic-related | Non-pandemic | ||

| US | 624 | 54 | 570 | 558 | 51 | 507 | −11% | −5% | −11% | 6%** |

| China | 48 | 8 | 39 | 42 | 9 | 33 | −12% | 11% | −17% | 28%*** |

| Panel C Median Amount | ||||||||||

| Before |

After |

Growth rate |

Difference | |||||||

| Total | Pandemic-related | Non-pandemic | Total | Pandemic-related | Non-pandemic | Total | Pandemic-related | Non-pandemic | ||

| US | 2.016 | 2.879 | 1.943 | 2.434 | 3.821 | 2.307 | 21% | 33% | 19% | 14%* |

| China | 6.574 | 12.554 | 6.368 | 10.440 | 13.038 | 6.544 | 59% | 4% | 3% | 1%** |

Table A.3.

Groups of Keywords for the Strict and Broad Definitions of Pandemic-related Activities. The table lists the groups of keywords used to define pandemic-related activities based on strict and broad definitions, respectively.

| Definition | Groups | Sub-groups | Words |

| Strict | Biology | Biology as a discipline | Biology; Biotech; Genetic; Laboratory; Mutation; R&D Biology; Sampling; Sequencing; in Vitro |

| Human body | Blood; Plasma; DNA/RNA; Enzyme; Gene; Genome; Molecule; Proteine | ||

| Virus | Antibody; Antigen; Antiviral; Clonal; Monoclonal; Spike; Vaccine; Viral; Virologist; Virus | ||

| Chemistry and Pharmaceuticals | Chemistry as a discipline | Chemicals; Chemistry; Molecule; Oxygen; Posology; Reagent; Receptor; R&D Chemistry; | |

| Pharmaceutical | Biopharma; Drug; FDA; Pharma; Pharmacy; R&D Pharmaceuticals | ||

| Medical Science | Disease and symptoms | Breath; Cancer; Contagious; Cough; Disease; Fever; Flu; Illness; Immune; Immunity; Influenza; Infection; Infectious; Lung; Pneumonia; Sore throat | |

| Medicine as a discipline | Clinical; Cure; Diagnosis; Inhale; Medicine; Patient; Placebo; Preclinical; Screening; Syndrome; Symptom; Therapy; Therapeutic; Telemedicine | ||

| Health | Hygiene | Epidemic; Hygiene; Pandemic, Sanitary; Sanitize | |

| Public Health | Care; Death; Health; Health-care; Hospital; Hospitalization; Lockdown; Plague; Public health; Quarantine; Triage | ||

| Healthcare Supply Chain | Medical tools | Disinfectant; Health-tech; Mask; Medical tool; Pad; Patch; Protective equipment; Respiratory; Tampon; Ventilator | |

| Broad | Groups in the "Strict" definition + the following five sub-groups | E-Commerce | Delivery; E-commerce; Online commerce; Online shopping |

| Remote work and videoconferencing | Remote working; Teleworking; Smart working; Smart mobility; Videoconferencing | ||

| IT & Telecommunication | Digital payment; Digital currency; E-wallet; Electronic transaction; Internet; Information Technology; Online payment; Social media; Social network; Streaming; Telecommunication; Wireless | ||

| Media and broadcasting | Broadcasting; Radio; Television; Television programming | ||

Table A.4.

Examples of Pandemic-related (Non-pandemic) Deals in Non-health (Health) Sectors. The table provides selected example of (A) Transactions that involve firms in NACE sectors not related to healthcare and hospital activities that have pandemic-related project and (B) Transactions that involve firms in NACE sectors related to healthcare and hospital activities that have non-pandemic project.

| Case | Company name | Description of the deal |

| (A) Pandemic-related deals for firms operating in non-health sectors | Pharmapacks LLC | This US company raised approximately $150 M in July 2020 in a funding round led by GPI Capital LP and JP Morgan. The investment was in a deal to fund a project aimed at providing online pharmacy services, specifically related to the delivery of pharmaceutical products ordered via the web portal of the firm. Based on our textual analysis, this deal falls in the pandemic-related category. However, the NACE macro-sector of Pharmapacks is “Wholesale and retail trade”, which is not directly related to healthcare. More information about the nature of the deal can be found at https://www.prnewswire.com/news-releases/pharmapacks-announces-growth-financing-by-gpi-capital-and-jpmorgan-chase-bank-301101320.html). |

| Xiaochuan Chuhai Education Technology (Beijing) Co., Ltd | This Chinese firm raised about $750 M in June 2020 from an investment team led by FountainVest Partners and Tiger Global Management. The funding was intended to facilitate development of an online education mobile application (Zuoyebang) that helps with remote learning during COVID-19 lockdown While the firm belongs to the “Information and communication” NACE macro-sector, our textual analysis considers the deal as part of the pandemic-related category. More information about the deal can be found at https://www.reuters.com/article/us-zuoyebang-fundraiisng/chinese-online-tutor-zuoyebang-raises-750-million-in-fresh-round-idUSKBN240093). | |

| (B) Non-pandemic deals for firms operating in the health sector | Grupo Dental Tecnologico Mexicano SAPI de CV | This company raised two funding rounds of investments on January 27th and March 3rd, 2020. The rounds were valued $5 M and $.15 M, respectively, and were led by Tuesday Capital, Jaguar Ventures, Foundation Capital LLC and Y Combinator Management. The funds were to develop the provision of orthodontics services. |

| Vision Care Connect LLC | This US-based ophthalmology firm received $.15 M of seed funding in May 2019 by Jumpstart Foundry LP to provide ophthalmology services. | |

| Apricity Fertility UK Ltd | This UK-based start-up provides fertility treatment advisory services. It received €6 M in June 2019 in a Series A funding round by Kamet Ventures to accelerate market entry strategy. | |

Table A.5.

Test of Differences in the Means of Outcome Variables. The table reports summary statistics for the outcome variables for different groups: treated (pandemic-related) vs. untreated (non-pandemic). The last column shows p-values of t-tests of equality of means of each variable across the two groups.

| Variable | All |

Treated |

Untreated |

Means difference | |||

| Mean | S.D. | Mean | S.D. | Mean | S.D. | p-value | |