Abstract

Has the relatively low number of COVID-19 cases and deaths saved Africa from the disease’s economic and financial consequences ? This article assesses the impact of the pandemic on the volatility of major African stock markets using a panel data model. Like other financial markets worldwide, Africa’s have been characterised by increased volatility during the pandemic. The markets appear to respond to the external shocks caused by the health crisis, and Google search volume activity related to the COVID-19 virus, which is treated here as a proxy for panic and fear, is associated with an increase in market volatility of around 7%. For health data, only increases in confirmed cases appear to impact the stability of African markets, and the relatively low fatality rate has had no influence on market dynamics. However, Political responses are associated with a drop in volatility, while the fear of global financial markets exacerbates it. These results have several implications in terms of risk management.

Keywords: Coronavirus, Stock market, Volatility, Google trends, Panel data

1. Introduction

The uncertainty caused by the COVID-19 epidemic and the speed with which the novel coronavirus spread around the world created a panic in global financial markets. Within a month, the S&P 500 had lost a third of its market value, and the French stock market index (CAC 40) closed the 12 March 2020 session with a decrease of 12.25%, setting a new record for a one-day decline. Also, for the first time ever, the price of a barrel of crude oil on the US futures market fell below zero, reaching USD -37.63 on 21 March 2020.

African countries, which were already under pressure before the health crisis, are characterised by failing health systems, insufficient health infrastructure and huge gaps in medical personnel. The spread of the virus across the continent could therefore have had more serious consequences than in developed countries, with disastrous economic losses.

As in the rest of the world, most African governments have instituted COVID-19 precautions, ranging from social distancing to border and travel restrictions. South Africa’one of the worst-affected countries’implemented a 21-day full lockdown. Other countries, such as Nigeria, Ghana, Egypt, Morocco, Senegal and Ivory Coast, have also opted for confinement, which is, at this stage, the most effective way to contain the pandemic. A year after the start of the epidemic, the WHO has estimated there have been about 1.8 million deaths from COVID-19 around the world. Except for South Africa, African countries are doing quite well on the health front so far. The economic effects of the COVID-19 pandemic have been the subject of significant study, especially relating to financial markets (Zaremba et al. (2020); Ozili and Arun (2020); Ashraf (2020a); Albulescu (2020); Ashraf (2020b), Goodell (2020); Xu (2020); Zhang et al. (2020); Costola et al. (2020); Lyócsa et al. (2020); Costola et al. (2020) Ahundjanov et al. (2020); Engelhardt et al. (2020); Topcu and Gulal (2020); Al-Awadhi et al. (2020)). However, very few studies have focused on African countries.

Africa is the continent least affected by this health crisis; according to official statistics from the WHO, the number of COVID-19 deaths in the Africa region as of 28 December 2020 was 40,552’about fourteen times fewer deaths than in Europe and 21 times fewer than in North America. This could explain the lack of interest and minimal contributions from Africa with respect to this debate. Has the relatively low number of cases and deaths saved Africa from economic and financial consequences ? This article seeks to answer this question and to assess, using panel data modelling, the impact of the COVID-19 pandemic on the volatility of the eleven major African financial markets.

Studies on the effects of COVID-19 on financial markets have used three main approaches. The first is to assess the impact of COVID-19 public policy responses on financial markets (Zaremba et al. (2020); Ozili and Arun (2020); Ashraf (2020a)). The second is to use health data (cases or deaths) to estimate the impact on financial markets (Albulescu (2020); Xu (2020); Zhang et al. (2020); Ali et al. (2020)). The third is to assess the impact of perceived risk on market volatility following the announcement of the pandemic state by the WHO, using Google searches related to the COVID-19 pandemic (Costola et al. (2020); Lyócsa et al. (2020); Ahundjanov et al. (2020)).

In this study, we will use the latter two approaches. More specifically, we will assess whether panic and fear ultimately had more impact on African financial markets than health realities. Our study covers the eleven major African financial markets; this is different from Adenomon et al. (2020), who examined only the Nigerian market, but similar to Takyi and Bentum-Ennin (2020), who found that COVID-19 had a negative impact on stock market performance in Africa. However, the question remains as to whether the decline in stock index performance was linked to increases in cases or deaths or to panic and fear due to COVID-19. Our study attempts to answer this question by focusing on market volatility during the COVID-19 outbreak and its relationship with both health data and a proxy of panic and fear’specifically, Google search volume activity, as used by Lyócsa et al. (2020).

The rest of the paper is structured as follows : Section 2 describes the data and methodology; Section 3 presents the empirical results; and the conclusion is presented in Section 4.

2. Data and preliminary analysis

2.1. Data and methodology

To assess the impact of the health crisis caused by the coronavirus, we use the main indexes of the eleven African stock markets : the Johannesburg Stock Exchange Top 40 Index (JSE40), Egyptian Exchange 30 Price Index (EGX30), Moroccan All Shares Index (MASI), Nigeria Stock Exchange All Shares Index (NSEASI), MSCI Kenya Index, Namibia Stock Exchange Overall Index (NSX), Ghana Stock Exchange Composite (GSE-CI), Tanzania All Share Index (DSEI), Uganda All Share Index (ALSI), Botswana Stock Exchange Index (DCI) and West African Security Exchange (BRVM 10). The daily data from 27 January 2020 to 22 October 2020 were obtained from S&P Capital IQ platform (2020). To capture fear related to the coronavirus, we use the Google search volume index (SVI), which allows us to determine the volume of searches for COVID-19 in a given area on a given day. From this index, we can calculate the abnormal search volume, as in Da et al. (2011) the abnormal search volume :

| (1) |

Where is a measure of the attention of the public (panic and fear) in area i at time j. The ASVA (abnormal search volume activity) variable has the advantage of suppressing temporal trends and other low-frequency seasonality (Da et al. (2011)). It is unsurprising that the frequency of Google searches related to COVID-19 exploded. The interest can be explained by a number of factors, including curiosity, the search for practical information and the understandable fear of the damage caused by the coronavirus, which is of great concern in developed countries, with ultramodern health infrastructures, but even more so in African countries, whose health infrastructures are very insufficient, thus prompting pessimistic forecasts from experts and international organizations (WHO, UN). Indeed, in addition to considerable human losses, the UN has predicted that about 20 million more people could slide into poverty, with an aggravation of food insecurity. Furthermore, unlike in developed countries, which have put in place policies to support companies and ensure that individuals have a stable income, most African countries have implemented containment without financial assistance. Therefore, as in Lyócsa et al. (2020), we treat the ASVA variable as an indicator that captures panic and fear of the negative consequences of the COVID-19 pandemic.

We also use the case fatality rate (CFR) and the new infections rate (NIR), calculated from WHO (2020) data, as the measures of deaths and cases, respectively, in order to assess the effects of the real risks of COVID-19 :

| (2) |

| (3) |

To analyse the effects of the pandemic on the volatility of African financial markets, we estimate the following regressions :

| (4) |

| (5) |

| (6) |

Where is the ASVA at , is the daily realized volatility at t-1, is the CFR at et is the NIR at .

, are parameters to be estimated; , , represents financial market individual effect for the three models respectively (which is either a fixed or random effect) and , , are error term for the three regressions respectively.

We also include in this study some control variables like stringency index which measures the strength of government restrictions to fight covid-19. This composite indicator was proposed by Hale and Webster (2020) as part of the Oxford COVID-19 government response monitoring project. In particular, it takes into account restrictions on public gatherings, restrictions on internal movement, control of international movement and closures of public places, workplaces and schools. The index takes values between 0 and 100, with 100 indicating more stringent restrictive measures. The VIX volatility index (VIX) obtained from FRED Economic Data database is also included to take into account the impact of global financial uncertainty on african financial markets.

2.2. Preliminary analysis

The COVID-19 epidemic grew from a localised epidemic to a global pandemic in only a few months. Europe was the second continent to experience a wave of COVID-19; in only a few weeks, the virus invaded Western Europe and cases quickly spread and began to increase exponentially in the United States. The uncertainty over political decisions and the lack of a vaccine or effective treatment led to a global stock market crash.

After the United States, Latin America was declared by the WHO as a new epicenter of the pandemic. For specialists, the worst fear would be for the epicenter of the pandemic to move to Africa, given the fragility of its health system (one doctor for every 985 inhabitants and one nurse for every 3324 inhabitants). In comparison, Europe and North America, whose health systems were swamped by the first wave of COVID-19, have one doctor for every 123 inhabitants and 120 inhabitants, respectively, and one nurse for 293 inhabitants and 417 inhabitants. The spread of the virus on the African continent would therefore have greater consequences than in developed countries.

Despite the relatively low number of cases, African countries have been weakened by the current situation. The crisis’of rare magnitude and rare depth that goes beyond socio-economic effects’shows the weaknesses and fragility of African countries. According to the World Bank, economic growth in sub-Saharan Africa will fall from 2.4% in 2019 to between -2.1% and -5.1% in 2020, which will be the first recession in the region for 25 years.

South Africa, Morocco and Egypt are the most affected African countries; South Africa has more than 700,000 infected and more than 18,000 deaths, with estimates of more than 100,000 cases and 6000 deaths for Egypt and more than 15,000 cases and 3000 deaths for Morocco [Table 1]. The ASVA has also been higher, on average, in these countries during this period.

Table 1.

Summary statistics of selected variables.

| Botswana | Egypt | Ghana | Kenya | Namibia | Morocco | Nigeria | South Africa | Tanzania | WAEMU | Uganda | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Volatility | Mean | 0.028 | 0.353 | 0.167 | 0.359 | 0.460 | 0.000 | 0.222 | 0.346 | 0.139 | 0.216 | 0.256 |

| SD | 0.014 | 0.275 | 0.103 | 0.203 | 0.339 | 0.291 | 0.128 | 0.301 | 0.073 | 0.138 | 0.149 | |

| Min | 0.003 | 0.088 | 0.062 | 0.107 | 0.124 | 0.028 | 0.020 | 0.100 | 0.049 | 0.056 | 0.064 | |

| Max | 0.053 | 1.248 | 0.493 | 0.949 | 1.430 | 1.235 | 0.522 | 1.399 | 0.359 | 0.629 | 0.672 | |

| ASVA | Mean | 0.019 | 0.042 | 0.039 | 0.036 | 0.009 | 0.043 | 0.042 | 0.053 | 0.050 | 0.046 | 0.038 |

| SD | 0.226 | 0.180 | 0.224 | 0.208 | 0.269 | 0.212 | 0.194 | 0.189 | 0.233 | 0.205 | 0.183 | |

| Min | -0.602 | -0.265 | -0.408 | -0.426 | -0.868 | -0.301 | -0.325 | -0.176 | -0.602 | -0.259 | -0.395 | |

| Max | 0.699 | 0.778 | 0.908 | 0.845 | 0.778 | 0.954 | 0.699 | 0.903 | 0.845 | 1.041 | 0.740 | |

| New cases | Mean | 31 | 292 | 145 | 127 | 37 | 536 | 168 | 1 662 | 3 | 151 | 31 |

| SD | 178 | 444 | 294 | 205 | 67 | 841 | 206 | 2 686 | 17 | 172 | 57 | |

| Max | 1 820 | 1 576 | 1 883 | 1 332 | 316 | 3 577 | 675 | 12 757 | 180 | 901 | 317 | |

| Cumulative cases | Mean | 728 | 38 566 | 15 474 | 10 859 | 2 321 | 27 249 | 19 290 | 201 851 | 283 | 16 540 | 1 537 |

| SD | 1 365 | 44 415 | 19 167 | 15 698 | 4 041 | 46 542 | 23 837 | 278 924 | 245 | 18 892 | 2 840 | |

| Max | 5 609 | 105 883 | 47 461 | 46 144 | 12 406 | 182 580 | 61 667 | 708 359 | 509 | 49 975 | 10 933 | |

| New deaths | Mean | 0 | 18 | 1 | 2 | 0 | 10 | 3 | 50 | 0 | 3 | 0 |

| SD | 0 | 24 | 2 | 3 | 1 | 16 | 6 | 75 | 1 | 3 | 1 | |

| Max | 3 | 94 | 9 | 16 | 6 | 70 | 45 | 414 | 6 | 13 | 3 | |

| Cumulative deaths | Mean | 3 | 2 026 | 94 | 196 | 23 | 493 | 391 | 4 479 | 11 | 306 | 13 |

| SD | 5 | 2 421 | 118 | 275 | 43 | 797 | 455 | 6 557 | 10 | 325 | 28 | |

| Max | 21 | 6 155 | 312 | 858 | 133 | 3 097 | 1 125 | 18 741 | 21 | 841 | 98 |

Notes: This table provides descriptive statistics for variables such as volatility, ASVA as well as the number of confirmed cases and the number of deaths of COVID-19, used to calculate CFR and NIR.

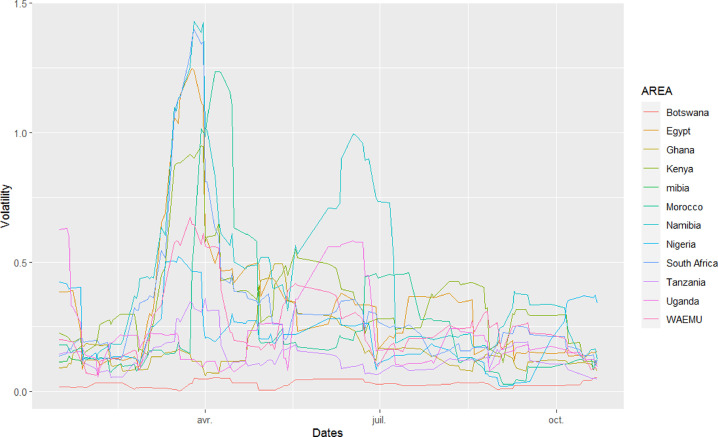

Like international financial markets, African markets have been characterised by increased volatility during the pandemic. The markets seem to react to external shocks caused by the health crisis, but the precise market response depends on the country [Fig. 1 ]. Between the identification of the first case in Africa and the announcement of the pandemic by the WHO, financial markets experienced a dramatic increase in volatility, except for the Botswana and West African security exchanges. The Egyptian and South African financial markets recorded the greatest instability during this period (459% and 323%, respectively [Table 2 ]).

Fig. 1.

Evolution of African financial markets volatility during COVID-19.

Table 2.

Change in volatility in African financial markets during COVID-19.

| Realized volatility |

||||||

|---|---|---|---|---|---|---|

| First case |

Pandemic |

containment |

Variation |

|||

| Area | 17/02 | 11/03 | 24/03 | (1) | (2) | |

| Botswana | 0.034 | 0.014 | 0.032 | -59% | -6% | |

| Egypt | 0.123 | 0.689 | 1.233 | 459% | 899% | |

| Ghana | 0.103 | 0.150 | 0.146 | 45% | 41% | |

| Kenya | 0.299 | 0.482 | 0.917 | 61% | 206% | |

| Namibia | 0.182 | 0.603 | 1.252 | 231% | 588% | |

| Morocco | 0.157 | 0.581 | 1.235 | 269% | 686% | |

| Nigera | 0.135 | 0.500 | 0.474 | 271% | 252% | |

| South Africa | 0.122 | 0.517 | 1.302 | 323% | 967% | |

| Tanzania | 0.055 | 0.186 | 0.346 | 240% | 531% | |

| WAEMU | 0.219 | 0.217 | 0.124 | -1% | -43% | |

| Uganda | 0.132 | 0.413 | 0.672 | 212% | 409% | |

Notes: This table provides the realized volatility at the identification of the first case of COVID19 in Africa, during the WHO pandemic announcement and the lockdown period. (1) The variation between the appearance of the first case and the announcement of the pandemic by the WHO. (2) The variation between the appearance of the first case and the start of containment in Africa.

3. Empirical results

We consider the pooled model, fixed effects model and random effects model, with two specifications for each [Table 3 ]. In Panel A, specification (1a) takes into account only the volatility at t-1, while specification (2a) takes into account the ASVA variable. Unlike Panel A, Panel B takes into account the CFR (1b) and NIR (2b) variables. The analysis shows that the volatility of the financial markets is strongly linked to the volatility of the previous day. Similarly, the coefficient associated with the ASVA variable is positive and significant for all models. The coefficients associated with the CFR are negative for all models, and those associated with the NIR are positive and significant for all models.

Table 4.

Estimates of the Panel data model.

| Realizes volatility | |||

| (Pooling) | (Fixed effect) | (Random effect) | |

| 0.9362 | 0.9070 | 0.9362 | |

| (0.0081) | (0.0122) | (0.0081) | |

| - 0.4613 | - 0.2956 | - 0.4613 | |

| (0.4075) | (0.8812) | (0.4075) | |

| Politic | - 0.0006 | - 0.0014 | - 0.0006 |

| (0.0006) | (0.0006) | (0.0006) | |

| 0.0852 | 0.1250 | 0.0852 | |

| (0.0293) | (0.0401) | (0.0293) | |

| Constant | - 0.3533 | - 0.3533 | |

| (0.0892) | (0.0892) | ||

Notes: heteroscedasticity-consistent (HC) standard errors are in parentheses; , and denote statistical significance at 10%, 5%, and 1%, respectively.

Table 3.

Estimates of the Panel data model.

| Panel A - Realized volatility |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Pooled OLS |

Fixed effects |

Random effects |

|||||||

| Coeffi | (1a) | (2a) | (3a) | (1a) | (2a) | (3a) | (1a) | (2a) | (3a) |

| Constant | -0.068 | -0.068 | -0.420 | -0.068 | -0.068 | -0.420 | |||

| (0.012) | (0.013) | (0.113) | (0.012) | (0.013) | (0.113) | ||||

| 0.964 | 0.964 | 0.930 | 0.924 | 0.920 | 0.895 | 0.964 | 0.964 | 0.930 | |

| (0.007) | (0.009) | (0.012) | (0.015) | (0.015) | (0.014) | (0.007) | (0.012) | (0.012) | |

| 0.064 | 0.057 | 0.070 | 0.039 | 0.064 | 0.057 | ||||

| (0.028) | (0.023) | (0.024) | (0.023) | (0.028) | (0.023) | ||||

| Politic | -0.001 | -0.001 | -0.001 | ||||||

| (0.000) | (0.000) | (0.000) | |||||||

| 0.102 | 0.152 | 0.102 | |||||||

| (0.034) | (0.040) | (0.034) | |||||||

| 0.931 | 0.930 | 0.900 | 0.847 | 0.845 | 0.872 | 0.931 | 0.935 | 0.900 | |

| 0.931 | 0.930 | 0.900 | 0.846 | 0.843 | 0.870 | 0.931 | 0.930 | 0.900 | |

| Fstat | 16116.7 | 7581.5 | 1918.8 | 6520.6 | 3050.45 | 1431.5 | 16116.7 | 15163.0 | 7675.1 |

| N | 1188 | 1135 | 856 | 1188 | 1135 | 856 | 1188 | 1135 | 856 |

| Panel B - Realized volatility | |||||||||

| Pooled OLS | Fixed effects | Random effects | |||||||

| Coeffi | (1b) | (2b) | (3b) | (1b) | (2b) | (3b) | (1b) | (2b) | (3b) |

| Constant | -0.060 | -0.077 | -0.325 | -0.060 | -0.077 | -0.325 | |||

| (0.010) | (0.012) | (0.090) | (0.010) | (0.017) | (0.090) | ||||

| 0.965 | 0.964 | 0.938 | 0.935 | 0.928 | 0.907 | 0.965 | 0.964 | 0.938 | |

| (0.008) | (0.008) | (0.009) | (0.011) | (0.011) | (0.013) | (0.008) | (0.008) | (0.009) | |

| -0.375 | -0.533 | -0.375 | |||||||

| (0.191) | (0.506) | (0.191) | |||||||

| 0.133 | 0.076 | 0.183 | 0.063 | 0.133 | 0.076 | ||||

| (0.063) | (0.077) | (0.070) | (0.066) | (0.071) | (0.077) | ||||

| Politic | -0.001 | -0.002 | -0.001 | ||||||

| (0.001) | (0.000) | (0.001) | |||||||

| 0.075 | 0.118 | 0.075 | |||||||

| (0.030) | (0.037) | (0.030) | |||||||

| 0.936 | 0.936 | 0.906 | 0.867 | 0.867 | 0.878 | 0.936 | 0.936 | 0.906 | |

| 0.936 | 0.936 | 0.905 | 0.865 | 0.866 | 0.876 | 0.936 | 0.936 | 0.905 | |

| Fstat | 6571.2 | 6589.0 | 1908.0 | 2883.2 | 2900.7 | 1409.6 | 13142.5 | 13178 | 7632.2 |

| N | 899 | 899 | 799 | 899 | 899 | 799 | 899 | 899 | 799 |

Notes: heteroscedasticity-consistent (HC) standard errors are in parentheses; , and denote statistical significance at 10%, 5%, and 1%, respectively.We consider the pooled model, fixed effect and random model and three specifications for each class of models. On Panel A, specification (1a) takes into account only the volatility at t-1, specification (2a) takes into account the ASVA variable and in specification (3a) we add control variables (Policy and VIX index). Panel B takes into account the CFR specification (1b) and NIR specification (2b); We add control variables (Policy and VIX index) in specification (2b) to have specification (3b). The results of the specification taking into account the CFR variable and the control variables are in the appendix [Table 4]

However, comparing the fixed and random effect models using the Hausman test leads to the choice of the fixed effect model for all specifications. Indeed, the statistics associated test are and for the specifications (1a) and (2a), respectively; and and for specifications (1b) and (2b), respectively.

The coefficient associated with the ASVA index is positive and significant, and this result is robust to the length of the rolling window (5 days, 6 days, 8 days). An increase of one unit in search activity linked to the COVID-19 virus is associated with an increase in volatility of about 7%. African financial markets, like international financial markets, are sensitive to the public attention given to the pandemic, and Google searches for coronavirus are not only correlated, but also predict variance in the future (Lyócsa et al. (2020)). The public interest in the pandemic can be explained by the uncertainty associated with both fear of the disease and the socio-economic consequences of the lockdown’public fear and the implementation of restrictions and lockdowns seem to contribute to the illiquidity and instability of markets (Baig et al. (2020)). However, while fear seems to amplify market volatility, the fatality rate does not impact African financial markets. This is in contrast to the findings of Albulescu (2020) and Baig et al. (2020) regarding the American financial markets.

This result could be explained by the relatively low mortality rate in African countries, which in turn could be due to the absence of the factors that have been identified as significant predictors of COVID-19 mortality (Lawal (2020)). However, the coefficient associated with the increase in cases is positive and significant (), suggesting that an increase in the number of cases would have a positive effect on the instability of African financial markets.

Regarding the control variables, we remark that the coefficients associated with the Government Response Stringency Index are negative for all specifications but it is only significant when it is associated with ASVA or the NIR variable (3a and 3b). The coefficients associated with the VIX index are positive and significant. These results suggest that African financial markets are sensitive to restrictive policies aimed at curbing the spread of the virus. Higher Government Response Stringency Index is associated with lower volatility for African financial market. However, the fear of global financial markets causes an amplification of the volatility of African financial market.

4. Conclusion

This article contributes to the literature related to the effects of COVD-19 on the volatility of financial markets by focusing on the case of African countries. Two major results should be noted. First, the volatility of African financial markets over the period from 27 January 2020 to 22 October 2020 is positively and significantly affected both by fear linked to the COVID-19 pandemic and by the progression of the disease on the African continent. The results show that African financial markets have reacted more to the disease’s progression than to panic and fear. Second, the fatality rate negatively affects the volatility of African financial markets, but the coefficient is not significant. This could be explained by the relatively low death rate in these countries, because the factors that predict deaths from the coronavirus are relatively uncommon in Africa. This leads us to think that the markets have integrated information about the structure of the African population as a determining factor in resistance to COVID19. However, a second wave has recently been identified in these countries, accompanied by a mutation of the virus that appears more virulent. The death rate now stands at 2.5% of confirmed cases, above the world average of 2.2%. It remains to be seen whether this new trend will be a source of instability in the financial markets.

These results have several implications, particularly in terms of risk management. In times of uncertainty or crisis, the volume of Google searches could be a decisive predictor of the risks of African financial markets.

CRediT authorship contribution statement

Gaye Del Lo: Conceptualization, Methodology, Data curation, Writing - review & editing. Théophile Basséne: Conceptualization, Methodology, Data curation, Writing - review & editing. Babacar Séne: Conceptualization, Methodology, Data curation, Writing - review & editing.

Footnotes

Supplementary material associated with this article can be found, in the online version, at 10.1016/j.frl.2021.102148

Appendix A. Supplementary materials

Supplementary Raw Research Data. This is open data under the CC BY license http://creativecommons.org/licenses/by/4.0/

Supplementary Raw Research Data. This is open data under the CC BY license http://creativecommons.org/licenses/by/4.0/

References

- Adenomon M.O., Maijamaa B., et al. On the effects of covid-19 outbreak on the nigerian stock exchange performance: evidence from garch models. J. Econ. Bus. 2020 [Google Scholar]

- Ahundjanov B.B., Akhundjanov S.B., Okhunjanov B.B. Information search and financial markets under covid-19. Entropy. 2020;22(7):791. doi: 10.3390/e22070791. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Al-Awadhi A.M., Alsaifi K., Al-Awadhi A., Alhammadi S. Death and contagious infectious diseases: impact of the covid-19 virus on stock market returns. J. Behav. Exp. Finance. 2020;27:100326. doi: 10.1016/j.jbef.2020.100326. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Albulescu C.T. Covid-19 and the united states financial markets’ volatility. Finance Res. Lett. 2020:101699. doi: 10.1016/j.frl.2020.101699. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ali M., Alam N., Rizvi S.A.R. Coronavirus (covid-19)-an epidemic or pandemic for financial markets. J. Behav. Exp. Finance. 2020;27:100341. doi: 10.1016/j.jbef.2020.100341. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ashraf B.N. Economic impact of government interventions during the covid-19 pandemic: international evidence from financial markets. J. Behav. Exp. Finance. 2020;27:100371. doi: 10.1016/j.jbef.2020.100371. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ashraf B.N. Stock markets’ reaction to covid-19: cases or fatalities? Res. Int. Bus. Finance. 2020;54:101249. doi: 10.1016/j.ribaf.2020.101249. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Baig A.S., Butt H.A., Haroon O., Rizvi S.A.R. Deaths, panic, lockdowns and us equity markets: the case of covid-19 pandemic. Finance Res. Lett. 2020:101701. doi: 10.1016/j.frl.2020.101701. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Costola M., Iacopini M., Santagiustina C.R. Google search volumes and the financial markets during the covid-19 outbreak. Finance Res. Lett. 2020:101884. doi: 10.1016/j.frl.2020.101884. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Da Z., Engelberg J., Gao P. In search of attention. J. Finance. 2011;66(5):1461–1499. [Google Scholar]

- Engelhardt N., Krause M., Neukirchen D., Posch P.N. Trust and stock market volatility during the covid-19 crisis. Finance Res. Lett. 2020:101873. doi: 10.1016/j.frl.2020.101873. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Goodell J.W. Covid-19 and finance: agendas for future research. Finance Res. Lett. 2020;35:101512. doi: 10.1016/j.frl.2020.101512. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hale T., Webster S. 2020. Oxford covid-19 government response tracker. [DOI] [PubMed] [Google Scholar]

- Lawal Y. Africa’S low covid-19 mortality rate: a paradox? Int. J. Infect. Dis. 2020;102:118–122. doi: 10.1016/j.ijid.2020.10.038. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lyócsa Š., Baumöhl E., Vỳrost T., Molnár P. Fear of the coronavirus and the stock markets. Finance Res. Lett. 2020;36:101735. doi: 10.1016/j.frl.2020.101735. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ozili P.K., Arun T. Spillover of covid-19: impact on the global economy. Available at SSRN 3562570. 2020 [Google Scholar]

- platform(2020), S. C. I.,. Sp capital iq platform.

- Takyi P.O., Bentum-Ennin I. The impact of covid-19 on stock market performance in africa: a bayesian structural time series approach. J. Econ. Bus. 2020:105968. doi: 10.1016/j.jeconbus.2020.105968. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Topcu M., Gulal O.S. The impact of covid-19 on emerging stock markets. Finance Res. Lett. 2020;36:101691. doi: 10.1016/j.frl.2020.101691. [DOI] [PMC free article] [PubMed] [Google Scholar]

- WHO . 2020. World Health Organization. [Google Scholar]

- Xu L. Stock return and the covid-19 pandemic: evidence from canada and the us. Finance Res. Lett. 2020:101872. doi: 10.1016/j.frl.2020.101872. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Zaremba A., Kizys R., Aharon D.Y., Demir E. Infected markets: novel coronavirus, government interventions, and stock return volatility around the globe. Finance Res. Lett. 2020;35:101597. doi: 10.1016/j.frl.2020.101597. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Zhang D., Hu M., Ji Q. Financial markets under the global pandemic of covid-19. Finance Res. Lett. 2020;36:101528. doi: 10.1016/j.frl.2020.101528. [DOI] [PMC free article] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Supplementary Raw Research Data. This is open data under the CC BY license http://creativecommons.org/licenses/by/4.0/

Supplementary Raw Research Data. This is open data under the CC BY license http://creativecommons.org/licenses/by/4.0/