Abstract

This study presents a thorough investigation of the relationship between the coronavirus disease 2019 (COVID-19) and daily stock price changes. We use several types of COVID-19 patients as indicators for exploring whether stock prices are significantly affected by COVID-19’s impact. In addition, using the Chinese stock market as an example, we are particularly interested in the psychological and industrial impacts of COVID-19 on the financial market. This study makes two contributions to the literature. First, from a theoretical perspective, it shows a novel quantitative relationship between the psychological response to the pandemic and stock prices. In addition, it depicts the mechanism of the shock to the stock market by pointing out the specific functional expression of the impulse reaction. To our knowledge, this is the first theoretical calculation of the impulse of a shock to the financial market. Second, this study empirically estimates the marginal effect of the COVID-19 pandemic on fluctuations in stock market returns. By controlling for stock fundamentals, this study also estimates diverse industrial responses to pandemic stock volatility. We confirm that the COVID-19 pandemic has caused panic in the stock market, which not only depresses stock prices but also inflates volatility in daily returns. Regarding the impulse of the shock, we identify the cumulative level of the pandemic variables as well as their incremental differences. As shown by our empirical results, the terms for these differences will eventually dominate the marginal effect, which confirms the fading impulse of the shock. Finally, this study highlights some important policy implications of stock market volatility and returns to work in the industry.

Keywords: Black swan event, COVID-19, Psychological and industrial impacts, Shocks, Stock market reaction

Introduction

On November 26, 2021, the newly emerged variant of SARS-CoV-2 (B.1.1.529), which was formally named by the World Health Organization (WHO) as “Omicron,” shocked the global stock markets. It was supposed to be the “Black Friday” for shopping in the U.S. and many other places. Instead, it became a real “Black Friday,” as panic caused a global stock market collapse.

This “Black Friday” reminds us of the crash of the American stock market beginning on February 26, 2020, as the daily rates of infection of coronavirus disease 2019 (COVID-19) began to increase in many regions around the globe. In February 2020, as the number of COVID-19 infections began to rise in many regions around the globe, the US stock market indices dropped sharply, and on June 26, 2020, this scenario was repeated, corresponding to a recent spike in infection rates in the US and elsewhere. This close relationship between stock market performance and evolution in the COVID-19 pandemic has attracted attention in academia and industry, as well as from social policymakers.

In recent decades, several pandemics (e.g., H1N1, SARS, and Ebola) have broken out, but none with the far-reaching, global, and colossal impact of COVID-19. Therefore, an analysis of the economic and financial impacts of COVID-19 makes for a unique contribution in understanding their intrinsic mechanisms as well as the complex relationship. In addition, because China has mostly contained the COVID-19 pandemic, whereas in many other regions it continues to spread widely, using the Chinese stock market as a research sample for studying the shock to the financial market from the pandemic can yield illuminating results for stock markets in other regions.

In December 2019, Wuhan became the epicenter of an outbreak of viral pneumonia in China, which was later formally called COVID-19 by the WHO. To prevent the further spread of infection, on January 23, 2020, the Chinese government implemented isolation measures in several provinces and cities, such as Beijing and Shanghai, in addition to Wuhan. The WHO subsequently classified the event as a public health emergency of international concern.1 The rapid spread of COVID-19 has already threatened hundreds of thousands of residents and has damaged the economy in China and the rest of the world. Restaurants are closed, and enterprises have reduced their operations. Moreover, the growing public concern over the breadth of the pandemic quickly spread to the stock market, with negative effects. For example, in China, on February 3, 2020, the opening day after the national holiday of the 2020 Spring Festival, the pandemic led to a drop of 7.7% in the Shanghai Composite Index and 8.5% in the Shenzhen Composite Index. To address this, the China Securities Regulatory Commission (CSRC) suspended all sales of securities.2

In February, as COVID-19 continued to evolve, the Chinese government launched several preventive and control measures. However, delaying the return to work and increasing traffic control in China may have periodic impacts on economic growth. For example, many industries in consumer retail and transportation are significantly affected by the pandemic. According to a report quoted by Standard and Poor's global rating, if consumer spending falls by 10%, China's overall gross domestic product (GDP) growth will fall by approximately 1.2%.3 On the one hand, every year, the Spring Festival (i.e., Chinese New Year) involves the largest population movement in China, which could accelerate the spread of COVID-19, making it more difficult to control. On the other hand, the Spring Festival is also associated with the year’s peak consumption. However, in 2020, the pandemic hit the service industries severely, as they were preparing for tourists at hotels, transportation, catering, entertainment, retail, and so on. All of these industries suffered significant losses.

The economic impact of COVID-19 is directly and indirectly affected by restrictions on population flow. According to data released by the Ministry of Transportation of the People’s Republic of China, the overall transportation volume dropped 28.8% on the first day of the Chinese lunar new year in 2020 compared to the prior year.4 The number of people traveling during the Spring Festival also declined dramatically: 415 million in 2019, but only 152 million in 2020.5 The Chinese government halted domestic group tourism, which closed nearly 20% of domestic routes because of the sharp drop in the number of passengers. In addition, domestic consumption, one of the most important driving forces of China's economy, inevitably experienced huge losses. According to the China Cuisine Association, during the Spring Festival, 78% of the catering enterprises lost 100% of their revenue in 2020 compared with 2019. In the first quarter of 2019, turnover in the accommodations and catering industry was RMB 423.4 billion but, for the first quarter of 2020, it was expected to lose about RMB 210 billion.6

China’s stock market is thus strongly affected. On the first trading day after the Spring Festival in 2020, the Shanghai stock index dropped by 8.5%, with more than 3,000 stocks falling. Similarly, in March 2003, when infections with SARS-CoV surged, the Stock Exchange of Hong Kong fell by about 10%7 and sent the MSCI China index tumbling by 8.6%. It increased by 14.7% in a month and 30.9% over three months.8 In 2016, the Zika virus spread in Brazil, and the MSCI Brazil index fell by approximately 3%. However, it increased by 14.8% after one month and 35.4% after three months.9 In 2018, the Ebola virus spread in the Congo, and the MSCI World Index fell by 7% in one month.10 A look at similar events and trends in history indicates that the impact of major pandemics on the stock market is complex. A comparison of COVID-19 and SARS shows totally different economic cycles and external environments. Around 2003, the trade growth of China and the world was very strong. In 2001, after China's accession to the World Trade Organization (WTO), the rate of total foreign trade growth increased from 21.8% in 2002 to 37.1% in 2003 but decreased from 9.6% in 2018 to 3.4% in 2019. Therefore, after the SARS epidemic in 2003, the economy recovered quickly.11 In 2003, China's investment and industrial growth fell briefly in the second quarter, followed by an upward trend. The rebound in trade and industry was very strong.12 The real estate suffered a clear decline, but it rebounded strongly afterward. Nevertheless, according to data from China's National Bureau of Statistics, the SARS epidemic reduced China's GDP growth rate by 0.8% in 2003.13

In recent years, “black swan” events have occurred more frequently. Each leads to an immediate reaction to international stock markets, foreign exchange markets, and various commodity markets. For instance, on June 24, 2016, Britain held a referendum on membership to the European Union, and those who supported leaving the EU won, with 51.9% of the vote. After the results were announced, the British pound dropped more than 10% in a single day, plunging to its lowest level in 31 years.14 On December 5, 2016, a referendum on constitutional amendments was held in Italy, and it was rejected. leading the country’s prime minister, Matteo Renzi, to announce his resignation. That day, the euro fell 1.4%, to its lowest level since March 2015, and the Italian 10-year bond yield exceeded 2% for the first time.15

Over the past few decades, China has experienced several black swan events in the financial market. Crises over “toxic infant formula [milk powder],” “toxic capsules,” “ineffective vaccines” and financial fraud produced significant losses for their investors in the stock market, as well as the corresponding food and drug industries. Although these events led to many short-term fluctuations in the financial market, many domestic investors are still unaware of how to identify and deal with uncertainty under certain market conditions. Black swan events lead to public panic. However, if the public overreacts to these events, the entire capital market suffers. Thus, appropriate policy interventions are needed, such as policies to prevent liquidity problems in the market. To address the negative impacts of the COVID-19 pandemic, many enterprises have accelerated product innovation and changes in their business models and organizational management models. Corporate social responsibility (CSR) has also been studied (Bae et al. 2021). In addition, both the central and local governments have actively introduced various measures to stabilize growth, which are expected to compensate for the loss of economic growth caused by the pandemic.

Although various types of economic shocks, particularly to stock markets, are familiar to us, the COVID-19 pandemic, which has huge and far-reaching impacts, has introduced several new challenges. As we have seen, different industries behave diversely in response to the pandemic, and the mechanism of the transmission of these shocks remains a mystery. When this mechanism is combined with psychological impacts, the relationship is much more difficult to comprehend. Undoubtedly, the COVID-19 pandemic is a disaster, and it requires new insights to understand many things that we thought were already largely known. Therefore, this study digs deeper into the specific mechanisms through which the pandemic affects stock prices and volatility.

Will the psychological issues arising from COVID-19 affect the stock market? Currently, we are not certain. Will the news about medical workers’ fight against COVID-19 as well as the rate of recovery or deaths affect the performance of the stock market? We do not know this either. Notably, along with quarantine activities, does the number of suspected COVID-19 infections affect investor behavior in the stock market? Currently, there is scant evidence in the literature to answer this question.

Using China as an example, this study conducts a deeper analysis of the impact of the COVID-19 outbreak on the stock market. Everything is intertwined during that period, so this is a very challenging problem to tackle. Therefore, we must isolate the impact of the COVID-19 pandemic from other possible influential factors. This study thoroughly investigates the relationship between COVID-19 and changes in daily stock prices. We use various types of COVID-19 patients as indicators to explore whether stock prices are significantly affected by COVID-19. In addition, we are particularly interested in the psychological and industrial impacts of COVID-19 on the financial market using samples from the Chinese stock market.

This study makes two contributions to the literature. First, it contributes theoretically in the sense that it shows a novel quantitative relationship between the psychological response to a pandemic and stock prices, perhaps the first study to do so. In addition, it depicts the mechanism of a shock to the stock market by pointing out the specific functional expression of the impulse reaction. To our knowledge, this might also be the first time that the impulse of a shock to the financial market has been calculated from a theoretical perspective. Second, this study empirically estimates the marginal effect of the COVID-19 pandemic on fluctuations in stock market returns. By controlling for stock fundamentals, this study estimates the effect of diverse industrial responses to the pandemic on stock volatility as well. Finally, this study has important policy implications regarding stock market volatility and the resumption of industrial work.

The paper is structured as follows. A literature review is presented in Sect. 2. Section 3 describes a novel theoretical framework that links the psychological and industrial impacts of COVID-19. Section 4 presents the study’s data. Section 5 presents the empirical arguments with the factors used as variables that might affect the daily returns on stock market prices, according to the theory. Section 6 discusses several important issues regarding empirical methods and corresponding results. Finally, the conclusions are presented in Sect. 7.

Literature review

Shocks to the stock market

The literature on stock market fluctuations is extensive (Barsky and Long 1993; Barlevy and Veronesi 2003; Engle et al. 2013). One of the most important driving forces in fluctuations is the shock to the stock market. The literature describes various types of shocks to the economy, including aggregate shocks (Hahn et al. 2020), shocks to exports (Amiti and Weinstein 2011; Caliendo et al. 2019), commodity prices (Hastings and Shapiro 2013), labor supply (Dustmann et al. 2017; Kim et al. 2018; Kong and Prinz 2020), dual-earner couples (Crawford et al. 2019), personal financial wealth (Bleakley and Ferrie 2016), and other financial markets, such as those for exchange rates (Eichenbaum and Evans 1995). Moreover, this strand of study also covers information shocks (Hung et al. 2015; Berger et al. 2020). Even investment bankers’ careers are linked to shocks to the stock market (Oyer 2008).

Black Swan events and the financial market

Concerning the shock to the financial market associated with black swan events, some scholars find that uncertainty shocks cause fluctuations in consumption, investment, productivity, and stock market volatility (Beaudry and Portier 2004; Berger et al. 2015; Basu and Bundick 2017). Reactions to monetary and fiscal policies regarding the stock market have also been discussed (Hassett and Metcalf 1999; Mueller 2001; Rigobon and Sack 2003; Christiano et al. 2005; Fratzscher and Rieth 2019). In addition, stock market reactions to political shocks are also significant factors (Kaustia and Torstila 2011; Wagner et al. 2018). The existence of a wealth shock to the stock market cannot be overlooked (Gormley et al. 2010). In addition, both investment shocks (Papanikolaou 2011) and credit shocks (Khan and Thomas 2013) were found to be important. Moreover, Forbes and Rigonbon (2002) show that financial contagion leads to a significant increase in cross-market linkages after a shock or financial crisis in a country. Finally, social movements are also found to affect stock price returns (King and Soule 2007).

To further investigate the stock market’s reaction to black swan events, studies explore the impact of these events, which are composed of economic events, social events, acts of terrorism, and natural disasters.

To begin with, studies have investigated the reaction of stocks to major international terrorist events, and they have found that most of them have mildly positive or negative effects on stocks in the long run. Although significant effects are found in the short run, the stock market recovers quickly. The only event with a significant effect was the attack on 9/11 (Nikkinen et al. 2008; Brounrn and Derwall 2010; Hanabusa 2010; Liargovas and Repousis 2010; Zopiatis et al. 2017). Karolyi and Martell (2005) indicate that attacks in more advanced countries are associated with larger negative share price reactions.

Moreover, scholars have also discussed the impact of natural disasters on stock markets. Baker and Bloom (2013) investigate the impact of natural disasters, terrorist attacks, and unexpected political shocks on economic growth. They find that the impact is the largest in countries with less developed financial markets and stiffer labor markets. Some researchers find no significant impact on market returns (Worthington 2008) or negative returns only on the day of the event (Caporale et al. 2019). Other scholars find negative stock price reactions to natural disasters, which cause great damage to the economy (Yamori and Kobayashi 2002; Wang and Kutan 2013; Tavor and Teitler-Regev 2019). Worthington and Valadkhani (2004) analyzed different genres of natural disasters and found that different kinds of natural disasters have different impacts on the Australian equity market.

Other common types of influential shocks

Furthermore, major world news is also an influential factor in stock markets. Scholars who have analyzed stock market reactions to world news believe that major news about wars, politics, financial policies and sudden public scandals affect stock prices (Niederhoffer 1971; Zhou and Zhao 2013). The difference in total stock returns can be attributed to various types of news (Cutler et al. 1989). Stock prices may also depend on the stock trading activity. Robinson and Bangwayo-Skeete (2017) show that stock prices in markets that are less active do not react to the vast majority of major news events. In this strand of the literature, major events in the stock market, such as a link between poison pills and stock market reactions, have been studied (Rhee and Fiss 2014; Dorobantu et al. 2017).

Energy accidents that cause fluctuations in the stock market have also been considered. It appears that the stock market, in general, did not show a significant reaction to major energy accidents from 1907 to 2007 (Sovacool et al. 2008). Scholtens and Boersen (2011) support Sovacool et al., who conclude that stock prices did not react significantly to environmental accidents at energy firms that occurred between 1907 and 2007.

The shock of COVID-19 to the economy and the financial markets

The COVID-19 pandemic has evolved very quickly, and so has the academic understanding of its complex impact on the economy as well as financial markets.

Now, the terminology of “COVID-19 shock” has been formally proposed in the financial academia (Caballero and Simsek 2021). The pandemic has triggered shocks to technology, finance, the economy, and government policy (Gu et al. 2020; Haroon and Rizvi 2020; Tisdell 2020; Zaremba et al. 2020; Sharma et al. 2021), often accompanied by capital underutilization, manufacturing output decline, production cost inflation, and a decrease in demand for certain services. Satif et al. (2021) described the possible impact of COVID-19 on bilateral trade. A negative trend is observed in the supply of and demand for labor, which harms the service sector, leading to further discussion about the security of all sectors and the prevention of unemployment (Ceylan et al. 2020).

Observing the relationship between oil prices and stock returns also allows us to see whether the COVID-19 pandemic has changed. The implications of the impacts on financial markets, that is, stock returns, of the pandemic have provided preliminary insights. Inspired by the cash-flow hypothesis, the increase in production cost leads to an increase in oil prices; therefore, the dividends of cash flows decline and, as a result, stock returns. Zhang et al. (2021) demonstrate that, because of COVID-19, the influence of oil prices on stock returns decreased by approximately 89.5%.

Researchers have studied the impact of COVID-19 on financial markets from several perspectives (Gu et al. 2020; Heyden and Heyden 2020; Apostolakis et al. 2021; Liu et al. 2021; Nigmonov and Shams 2021). Existing literature shows that COVID-19 affects the stock market. Some find that the total number of infections and deaths have negative effects on stock market returns (Al-Awadhi et al. 2020; Ashraf 2020a; Zhang et al. 2021) and a significant long-term impact on the most affected countries (Sharma et al. 2021). However, the evidence shows that the impact on the Chinese stock market is short-lived because of the implementation of government policies (Hu et al. 2020). The short-term reactions of the stock market around the world during the COVID-19 pandemic have also been examined (Heyden and Heyden 2020; Rahman et al. 2020). COVID-19 hurts solar energy stock prices in both the short and long run, but the effects are not significant in non-OECD countries (Wei et al. 2021).

Theoretically, investors are likely to overreact and adopt a conservative approach to investment decisions because of COVID-19 (Shear et al. 2020; Aslam et al. 2021). Huber et al. (2021) indicate that higher risk aversion during a pandemic might reduce investment, even though experimental assets are less risky. However, Angrisani et al. (2020) believe that the increase in risk premia during the pandemic is due to a change in beliefs, but not due to changes in market participants’ appetite for risk.

As the disease has caused a continuous decline around the world, some scholars have analyzed the feelings of panic and constructed a global fear index for COVID-19 to use as an indicator of investment decisions (Haroon and Rizvi 2020; Papadamou et al. 2020; Salisu and Akanni 2020; Liu et al. 2021). The continuous decline in the global market has a financial risk spillover effect that devastates the entire financial system through negative returns, increased uncertainty, and higher volatility (Ashraf 2020b; Goodell and Goutte 2020; Sharif et al. 2020; Li et al. 2021; Yang and Yang 2021). The spillover effect during the COVID-19 pandemic has been examined, including the spillover between financial technology stocks and other financial assets (Lan et al. 2021) and volatility spillovers among European stock markets (Aslam et al. 2021; Youssef et al. 2021).

Research gap

Finally, the absence of management in the study of financial crises is abnormal (Starkey 2015). In fact, crisis management is an important part of management (Pearson 2010; Bundy et al. 2017), especially at a time of a global financial crisis (DesJardine et al. 2019). Here, we attempt to add to the existing scholarship on the issue.

To our knowledge, few studies have been conducted on shocks to the financial market due to a pandemic, and most of them are only empirical. Therefore, the theoretical mechanism of how and why a pandemic causes a shock to the stock market remains unclear. Therefore, this study contributes to the literature by revealing the hidden mechanism in shocks as well as its empirical application to the financial market using the Chinese stock market as an example. Unlike the extant literature on similar topics, this study performs detailed mathematical modeling to depict the impact mechanism of a shock from a pandemic to the stock market; a significant theoretical contribution. In addition, the empirical section of this study employs comprehensive examinations and regressions.

Theoretical framework

Here, we consider three categories of influential factors. The first is the fundamentals, which include the macroeconomic situation as well as the basic operating status of listed companies. The macroeconomic situation reflects the overall operating performance of listed companies and determines the further development of listed companies. The macroeconomic situation is closely related to listed companies and their corresponding stock prices. The basic operating status of listed companies includes their financial condition, profitability, market share, and management system.

The second category comprises psychological factors, which are mainly reflected by changes in stock prices. If people feel panic, they have negative attitudes toward the stock market, and thus prices fall. However, if people find out that they have overreacted to the pandemic or recovery rates increase, then they will regain confidence about the stock market, and stock prices will rebound.

The third category is industry factors. From our perspective, industries have different influences on stock price changes. Theoretically, after the outbreak of COVID-19, stock prices in health-related industries have risen because medical supplies are urgently needed. By contrast, stock prices in industries related to entertainment fell because people went to movie theaters, clubs, and theme parks much less often.

Hence, we introduce the following equation:

| 1 |

where P is the firm-level stock price, f(·) is the function whose details are still unknown, Fund is firm-level fundamentals, Psy is psychological factors, and Ind is industry factors. All these functions are assumed to be continuous, and twice differentiable.

Differentiating this function with respect to time yields:

| 2 |

As our primary research interest is in the percentage change in firm-level stock prices, we divide by P on both sides of the equation and obtain:

| 3 |

where GP is the growth rate or the rate of change in firm-level stock prices.

The right-hand side of the equation shows that over a short period, firm-level fundamentals do not change substantially, nor are they reflected in publicly released reports on corporations. Therefore, for simplicity, we substitute . However, for Psy and Ind, things are much more complicated. Based on facts during the pandemic, we assume the following:

| 4 |

| 5 |

where Epi represents the COVID-19 pandemic. If we differentiate these two equations with respect to time, we have:

| 6 |

| 7 |

Substituting Eqs. (6) and (7) into Eq. (3) and rearranging the terms, we have

| 8 |

Now, we take the logarithm on both sides of the equation and obtain:

| 9 |

As shown, this equation has very close empirical implications. However, because many of the related functional forms are still unknown, we cannot directly apply them to empirical analysis.

We further define and then differentiate Y with respect to , obtaining:

| 10 |

This equation is the second-order derivative of Y with respect to Ind, thus obtaining the following relationship:

| 11 |

Now, we integrate both sides of Eq. (10) and obtain:

| 12 |

where C1 is the integration constant.

By combining Eqs. (11) and (12), we obtain:

| 13 |

After rearranging terms, we obtain:

| 14 |

Now, we get to the “tricky” part. If we take the exponential form on both sides of Eq. (14), we obtain

| 15 |

Thus, we obtain:

| 16 |

To determine the key function of Psy(Epi), we need to integrate Eq. (16) on both sides as follows:

| 17 |

Focusing on the term and considering all the second-order terms constants for simplicity, we have

| 18 |

where C2 and C3 are the integration constants in these steps. Substituting Eq. (18) into Eq. (17), we obtain:

| 19 |

where .

After some complex derivations (see the mathematical appendix for details), we obtain:

| 20 |

Although we have made a relatively strong assumption that all the second-order terms are constants, Eq. (20) offers a novel perspective for depicting the quantitative relationship between stock prices and the psychological response to a pandemic. If the specific functional forms of Psy and Ind are in quadratic form, then the assumption of constant second-order terms is reasonable, because the first-order condition of a typical quadratic function is linear.

By differentiating both sides of Eq. (20), we obtain

| 21 |

Then, we take the logarithm on both sides of Eq. (21), and we obtain

| 22 |

Now, if we substitute Eq. (22) into Eq. (9), we obtain:

| 23 |

Finally, by rearranging the terms, we obtain:

| 24 |

The constant term in the regression is:

, and the estimation coefficient for Epi is , which is easy to understand and has a meaningful economic interpretation.

Moreover, to use the logarithm of real-world data in which some of the numerical values for the rate of change are negative, we multiply both sides of Eq. (24) by 2 and obtain:

| 25 |

which is,

| 26 |

Equation (26) suggests the combined use of the quadratic form of certain variables with the log form. This is the final expression that we obtain theoretically, which has meaningful practical empirical implications.

Data

The choice of time period

The use of daily data to study the volatility in the stock market has a long tradition (Turner and Weigel 1992). The period of our study was February 3–25, 2020. This period was selected for two reasons. First, Wuhan was officially sealed off on January 23, followed by the planned seven-day national holiday for the Chinese New Year, during which the stock market in China was closed but reopened on January 31. However, due to COVID-19, the reopening date was postponed to the following Monday, February 3, 2020. Second, as COVID-19 worsened outside China in late February, the US stock market fell on February 26, 2020, setting off a “chain reaction” first in global financial markets and later in China. Therefore, to isolate the outside interference to the Chinese stock markets, we stopped updating our data on February 25. As a result, the study period systematically reflects the local impact of COVID-19 on the Chinese stock market.

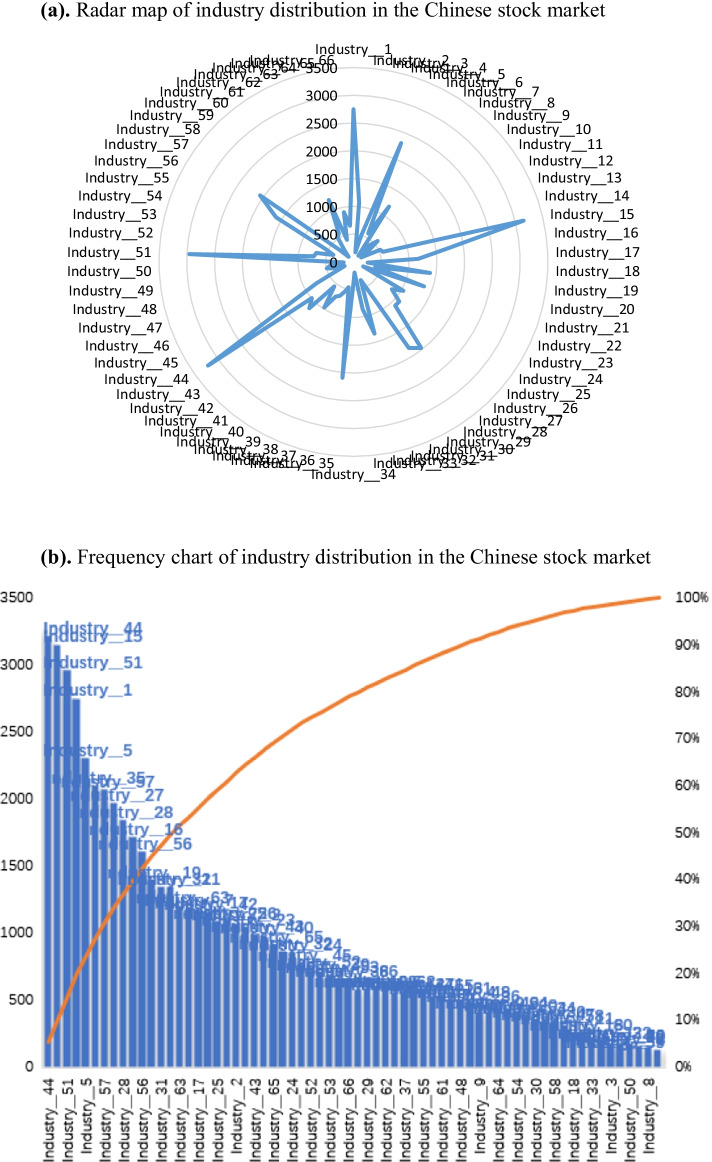

The additional reason that we select this period is that we are particularly interested in what happens after the “black swan” event mentioned in the introduction. After the Chinese stock market reopened, with a massive drop in value, on February 3, 2020, the stock prices of listed firms began to rise in some industries, continued to drop in others, and were neutral in other industries. As shown in Fig. 1a, b, after February 3, the stock market indices in China generally rose. After February 26, the stock market indices in Shanghai and Shenzhen both began to drop again, which confirms that the Chinese stock market is also affected by a crash in the US stock market. Therefore, the data after February 26 would be misleading.

Fig. 1.

a The trend of Shanghai Stock Index, China in February 2020. b The trend of Shenzhen Stock Index, China in February 2020.

Source: East Money

The data set is structured as a panel that includes 3,759 individually listed companies as well as 16 trading dates. As mentioned earlier, we include the following three types of variables:

COVID-19 patients

We extracted data on the pandemic from the National Health Commission of the People’s Republic of China (NHC),16 which comprises rates of infection, suspected infection, ICU patients, death, and recovery on a daily basis. Those who had a cough, fever, or breathlessness and had contact with someone infected with COVID-19 or returned from a high-risk area in the 14 days before the onset of symptoms were considered to have a suspected infection.

Stock market variables

Our main purpose here is to discover the impact of COVID-19 shocks on the Chinese stock market, which means that the volatility of stock market variables is of great importance. In this study, research on the volatility of the stock market mainly focuses on changes in stock market prices, which is used as the main indicator to measure volatility in the stock market. Theoretically, stock market fluctuations consist of changes in stock prices caused by changes in a stock’s intrinsic value and external factors. Stock market prices change rapidly, but the basis of the stock price for listed companies is their financial performance; therefore, fluctuations in the stock market should be based on financial performance. Thus, as an important part of the stock market, listed companies’ financial performance is expected to have an important impact on stock market volatility. Based on the experience of mature markets, the performance of listed companies is the basis for the stable development of the stock market. If the overall performance of listed companies declines, the market foundation becomes unstable, which increases the risk and volatility of the entire market.

As we know, the intrinsic value of a stock is directly proportional to the earnings per share of the listed company, that is, if the company's operating performance is good, then the intrinsic value of its stock is correspondingly high; otherwise, it is low. Considering that the financial independence and complementarity of each index need to be displayed, we use total revenue, operating cost, and operating profit as proxies for the company’s market value, operating ability, profitability, and other aspects. The annual financial reports were obtained from the East Money database.17 Considering the practical value of the study and the validity of the data, we use the period covered by the financial report, which ended on December 31 in the year before the outbreak of COVID-19.

In addition, we use the buying volume, price-to-book ratio, total market capitalization, changes and percentage changes in daily returns as direct external factors in stock performance. The change in trading volume gives us important information about changes in market sentiment; hence, we use the buying volume to represent the market attitude. Furthermore, total market capitalization refers to how much a company is valued as determined by the stock market, and it is defined as the total market value of all outstanding shares. Using total market capitalization to show the size of a company is important because company size is a basic determinant of various characteristics in which investors are interested. Moreover, the price-to-book ratio (P/B) reflects the value that market participants place on a company’s equity relative to the book value of its equity. A stock’s market value is a forwarding-looking metric that reflects a company’s future cash flows. It is helpful to identify some general parameters or a range of P/B values, and then consider various other factors and valuation measures that more accurately interpret the P/B value and forecast a company’s potential for growth. Here, we gather stock shares listed on the Shanghai Stock Exchange (SHSE) and Shenzhen Stock Exchange (SZSE), which are the main stock exchanges in China. The data were also obtained from East Money.

Industry variables

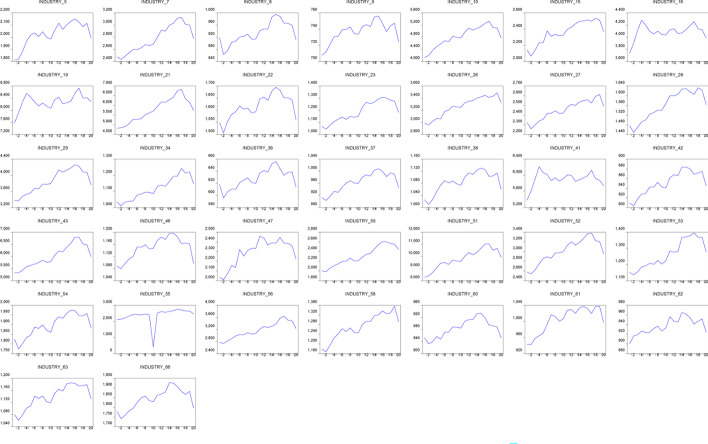

Industries are divided into 66 different sectors according to the CSRC, and the industry distributions are shown in Fig. 2a, b. The names of the 66 specific industries are listed in Table 1. In this study, we created dummy variables to examine whether the target industry was significantly affected by the pandemic. That is, =1 if it is in the industry and 0 otherwise, where N = 1, 2,…,66.

Fig. 2.

a Radar map of industry distribution in the Chinese stock market. b Frequency chart of industry distribution in the Chinese stock market. Note: See Table 1 for the specific names of the 66 industries

Table 1.

Specific names of industrial dummy variables

| Industrial dummy | Specific name | Industrial dummy | Specific name | Industrial dummy | Specific name |

|---|---|---|---|---|---|

| Industry_1 | Specialized equipment | Industry_23 | National defense | Industry_45 | White goods |

| Industry_2 | Traditional Chinese medicine | Industry_24 | Basic chemistry | Industry_46 | Petroleum mining |

| Industry_3 | Transportation equipment service | Industry_25 | Household light industry | Industry_47 | Planting and forestry |

| Industry_4 | Instruments and apparatuses | Industry_26 | Building materials | Industry_48 | Textile manufacturing |

| Industry_5 | Media | Industry_27 | Building decoration | Industry_49 | Comprehensive |

| Industry_6 | Insurance and others | Industry_28 | Real estate development | Industry_50 | Audio-visual equipment |

| Industry_7 | Optics and optoelectronics | Industry_29 | New materials | Industry_51 | Computer application |

| Industry_8 | Public transport | Industry_30 | Tourism | Industry_52 | Computer equipment |

| Industry_9 | Highway and railway transportation | Industry_31 | Non-ferrous smelting and processing | Industry_53 | Securities |

| Industry_10 | Other electronics | Industry_32 | Clothing and home textile | Industry_54 | Trade |

| Industry_11 | Breading industry | Industry_33 | Airport shipping | Industry_55 | Communication service |

| Industry_12 | Agricultural service | Industry_34 | Automobile | Industry_56 | Communication equipment |

| Industry_13 | Agricultural products process | Industry_35 | Auto parts | Industry_57 | General equipment |

| Industry_14 | Packaging and printing | Industry_36 | Port shipping | Industry_58 | Papermaking |

| Industry_15 | Chemical products | Industry_37 | Coal mining and processing | Industry_59 | Hotel and catering |

| Industry_16 | Chemical pharmacy | Industry_38 | Gas and water affairs | Industry_60 | Mining service |

| Industry_17 | Chemical synthetic materials | Industry_39 | Logistics | Industry_61 | Steel |

| Industry_18 | New chemical materials | Industry_40 | Environmental protection engineering | Industry_62 | Bank |

| Industry_19 | Medical equipment services | Industry_41 | Biological products | Industry_63 | Retail |

| Industry_20 | Pharmaceutical business | Industry_42 | Electric power | Industry_64 | Non-automobile transportation |

| Industry_21 | Semiconductor and its components | Industry_43 | Electronic manufacturing | Industry_65 | Food processing manufacturing |

| Industry_22 | Park development | Industry_44 | Electrical equipment | Industry_66 | Beverage manufacturing |

Source: China Securities Regulatory Commission

The dependent and independent variables

The dependent variable in this study is the daily rate of return, which is calculated using the following simple method:

| 27 |

where is the closing price of the stock on day t, and is the closing price of the stock on day t-1.

The explanatory variables were divided into four groups. The first group is the financial performance of the listed indicators, including the total revenue, operating cost, and operating profit. The second group is the performance of the stock market, in which the variables include the P/B ratio, buying volume, total market capitalization, change and percentage change in the price of a stock. The third group covered COVID-19 conditions, such as daily rates of infection, suspected infection, ICU patients, deaths, and recovery. The fourth group concerns how industries are distributed, as categorized by the CSRC.

Table 2 presents the descriptive statistics of the main variables used.

Table 2.

Summary statistics

| Variable | Explanation | Unit | Max | Min | Mean | Std |

|---|---|---|---|---|---|---|

| Daily_infection | Daily rates of infection of COVID-19 (i.e., confirmed cases) | Cases | 77,262 | 17,238 | 51,105.063 | 21,523.618 |

| Suspected_infection | Total number of suspected infection of COVID-19 | Cases | 26,359 | 3,434 | 15,511 | 8,368.905 |

| ICU_patients | Total number of ICU patients of COVID-19 | Cases | 11,977 | 2,296 | 7,640.875 | 3,358.452 |

| Death_cases | Total number of death cases of COVID-19 | Cases | 2,595 | 361 | 1,310.938 | 701.169 |

| Recovery | Total number of recovery of COVID-19 | Cases | 24,758 | 475 | 7,906.188 | 7,181.045 |

| Total_revenue | The overall measure of all sources of a company's income | RMB 10,000 yuan | 97,360,000 | − 36,100 | 854,738.899 | 4,046,225.602 |

| Operating_cost | Costs incurred by the enterprise in all its business | RMB 10,000 yuan | 91,950,000 | 769 | 752,321.270 | 3,472,541.850 |

| Operating _profit | Profits obtained by the enterprise in all its business | RMB 10,000 yuan | 31,210,000 | − 385,100 | 116,538.292 | 985,136.004 |

| Price_to_book_ratio | A stock's capitalization divided by its book value | % | 278.600 | 0.321 | 4.049 | 8.592 |

| Buy_vol | Number of stocks bought in marketplaces on a daily basis | 100 shares | 90,989,970 | 50 | 353,349.360 | 2,304,268.882 |

| Total_market_capitalization | Total value of a company's securities as quoted on a stock market | RMB yuan | 1.94E + 12 | 729,540,000 | 18,372,506,705 | 73,987,013,699 |

| Change | The size of change in the price of a stock | RMB yuan per share | 63.520 | − 49.800 | 0.117 | 1.624 |

| Pct_chg | The percentage change in the price of a stock | % | 108.544 | − 27.120 | 0.477 | 4.149 |

| Close | The daily closing price of a stock | RMB yuan per share | 1,118.000 | 1 | 17.071 | 32.231 |

Results

The estimation process is not easy for this study. Since the sample size is relatively large, substantial time is needed to run each round of estimation. For example, it may take tens of minutes even for the simplest ordinary least squares (OLS) regression in a high-configuration desktop computer. After numerous rounds of tests, we present the following empirical results.

Pure empirical results

To present the influence of COVID-19 on the Chinese stock market at a glance, we first show a group of estimation results without any guidance from the theoretical model. The purpose of this section is to determine whether our “intuition” works in reality.

In Table 3, we show a group of models using selected variables for stock fundamentals, as well as introduce the log forms for the pandemic variables. As shown in Table 3, the variables for the COVID-19 pandemic are very significant, although some of the signs are not consistent with our expectations. Interestingly, after adding the AR (1) term to the models, the signs of the pandemic variables are more consistent with our expectations. Logically speaking, we expect negative signs for daily rates of infection, suspected infection, ICU patients, and death. Indeed, the negative signs here are strong signals of a panicked attitude toward the COVID-19 pandemic. In contrast, the coefficient of recovery is positive, showing promises or optimistic attitudes regarding the pandemic.

Table 3.

Empirical estimation results with dependent variable Pct_chg of pooled or panel least square with or without AR(1) term (n = 60,144)

| Model (3–1) (Pooled least squares) |

Model (3–2) (Cross-section random effects) |

Model (3–3) (Cross-section weights) |

Model (3–4) (Period weights) |

Model (3–5) (Period SUR) |

Model (3–6) (Pooled least squares with AR(1)) |

Model (3–7) (Cross-section weights with AR(1)) |

|

|---|---|---|---|---|---|---|---|

| ln(Daily_infection) |

− 0.881*** (− 4.536) |

− 0.881*** (− 4.490) |

− 1.749*** (− 13.043) |

− 3.073*** (− 17.921) |

− 1.599*** (− 10.288) |

− 3.559*** (− 18.671) |

− 3.844*** (− 31.033) |

| ln(Suspected_infection) |

0.941*** (18.893) |

0.941*** (18.705) |

1.039*** (30.261) |

0.294*** (5.996) |

0.714*** (15.472) |

− 0.386*** (− 6.726) |

− 0.118*** (− 3.177) |

| ln(ICU_patients) |

− 3.282*** (− 19.063) |

− 3.282*** (− 18.874) |

− 1.445*** (− 12.163) |

− 1.612*** (− 10.461) |

− 2.283*** (− 15.709) |

− 1.835*** (− 11.289) |

− 0.390*** (− 3.637) |

| ln(Death_cases) |

− 3.379*** (− 44.406) |

− 3.379*** (− 43.964) |

− 2.895*** (− 55.124) |

− 2.682*** (− 39.619) |

− 2.847*** (− 44.881) |

− 2.098*** (− 28.328) |

− 1.885*** (− 36.972) |

| ln(Recovery) |

3.882*** (53.032) |

3.882*** (52.504) |

3.400*** (67.299) |

3.248*** (47.551) |

3.411*** (53.808) |

2.656*** (36.069) |

2.379*** (48.062) |

| Total_revenue |

− 1.09E−08** (− 2.129) |

− 1.09E−08** (− 2.108) |

− 5.85E−09** (− 2.124) |

− 1.08E−08** (− 2.281) |

− 9.53E−09** (− 2.350) |

− 1.14E−08** (− 2.179) |

− 6.22E−09** (− 2.347) |

| Operating_cost |

− 0.051*** (− 3.011) |

− 0.051*** (− 2.981) |

− 0.032*** (− 2.734) |

− 0.049*** (− 3.182) |

− 0.039*** (− 2.999) |

− 0.039** (− 2.323) |

− 0.035*** (− 3.387) |

| Operating_profit |

− 3.45E−08* (− 1.649) |

− 3.45E−08* (− 1.633) |

− 1.79E−08* (− 1.819) |

− 2.34E−08 (− 1.210) |

− 3.16E−08* (− 1.909) |

− 1.56E−08 (− 0.728) |

− 6.57E−09 (− 0.702) |

| ln(Price_to_Book_Ratio) |

0.212*** (8.256) |

0.212*** (8.174) |

0.134*** (6.989) |

0.199*** (8.399) |

0.198*** (9.737) |

0.195*** (7.411) |

0.121*** (7.061) |

| ln(Buy_vol) |

0.046*** (6.480) |

0.046*** (6.416) |

0.019*** (3.479) |

0.059*** (8.986) |

0.039*** (6.977) |

0.072*** (9.813) |

0.039*** (7.940) |

| ln (Total_market_capitalization) |

0.158*** (7.043) |

0.158*** (6.973) |

0.084*** (5.289) |

0.077*** (3.735) |

0.123*** (6.923) |

0.015 (0.643) |

− 0.006 (− 0.455) |

| Industry_2 |

− 0.761*** (− 6.444) |

− 0.761*** (− 6.379) |

− 0.561*** (− 5.913) |

− 0.949*** (− 8.678) |

− 0.696*** (− 7.443) |

− 1.145*** (− 9.481) |

− 0.885*** (− 10.626) |

| Industry_7 |

0.325*** (3.689) |

0.416*** (3.890) |

0.299*** (3.277) |

0.419*** (3.547) |

0.452*** (5.727) |

||

| Industry_9 |

− 0.679*** (− 3.891) |

− 0.679*** (− 3.852) |

− 0.438*** (− 5.168) |

− 0.762*** (− 4.712) |

− 0.626*** (− 4.522) |

− 0.815*** (− 4.559) |

− 0.602*** (− 7.364) |

| Industry_10 |

0.375** (2.465) |

0.375** (2.440) |

0.384*** (2.709) |

0.375*** (2.661) |

0.297** (2.462) |

0.297* (1.906) |

0.426*** (3.941) |

| Industry_16 |

− 0.472*** (− 4.648) |

− 0.472*** (− 4.601) |

− 0.336*** (− 3.771) |

− 0.654*** (− 6.952) |

− 0.476*** (− 5.909) |

− 0.831*** (− 7.993) |

− 0.714*** (− 9.303) |

| Industry_19 |

− 0.471*** (− 4.329) |

− 0.471*** (− 4.287) |

− 0.298*** (− 2.985) |

− 0.657*** (− 6.517) |

− 0.525*** (− 6.092) |

− 0.793*** (− 7.114) |

− 0.589*** (− 6.457) |

| Industry_20 |

− 0.863*** (− 4.874) |

− 0.863*** (− 4.826) |

− 0.669*** (− 4.612) |

− 0.997*** (− 6.077) |

− 0.868*** (− 6.185) |

− 1.156*** (− 6.382) |

− 0.864*** (− 6.526) |

| Industry_21 |

0.791*** (7.055) |

0.791*** (6.984) |

1.048*** (10.079) |

0.976*** (9.391) |

0.755*** (8.501) |

0.933*** (8.131) |

1.108*** (11.187) |

| Industry_22 |

− 0.619** (− 2.528) |

− 0.619** (− 2.503) |

− 0.413*** (− 2.809) |

− 0.513** (− 2.259) |

− 0.482** (− 2.479) |

− 0.434* (− 1.728) |

− 0.269** (− 2.103) |

| Industry_25 |

− 0.305** (− 2.569) |

− 0.305** (− 2.543) |

− 0.194** (− 2.479) |

− 0.274** (− 2.492) |

− 0.225** (− 2.387) |

− 0.258** (− 2.122) |

− 0.197** (− 2.793) |

| Industry_27 |

− 0.334*** (− 3.406) |

− 0.334*** (− 3.372) |

− 0.212*** (− 3.581) |

− 0.309*** (− 3.400) |

− 0.277*** (− 3.562) |

− 0.266*** (− 2.652) |

− 0.203*** (− 3.839) |

| Industry_28 |

− 0.436*** (− 4.345) |

− 0.436*** (− 4.302) |

− 0.288*** (− 4.605) |

− 0.398*** (− 4.286) |

− 0.310*** (− 3.902) |

− 0.403*** (− 3.924) |

− 0.316*** (− 5.528) |

| Industry_29 |

0.289* (1.923) |

0.289* (1.904) |

0.437*** (3.356) |

0.419*** (3.011) |

0.265** (2.231) |

0.330** (2.149) |

0.441*** (3.891) |

| Industry_32 |

− 0.385*** (− 3.012) |

− 0.385*** (− 2.982) |

− 0.274*** (− 3.286) |

− 0.421*** (− 3.556) |

− 0.411*** (− 4.062) |

− 0.398*** (− 3.042) |

− 0.339*** (− 4.579) |

| Industry_33 |

− 0.600** (− 2.444) |

− 0.600** (− 2.419) |

− 0.325* (− 1.832) |

− 0.581** (− 2.552) |

− 0.349* (− 1.795) |

− 0.532** (− 2.114) |

− 0.311* (− 1.823) |

| Industry_36 |

− 0.838*** (− 5.051) |

− 0.838*** (− 5.000) |

− 0.544*** (− 5.867) |

− 0.703*** (− 4.573) |

− 0.635*** (− 4.832) |

− 0.649*** (− 3.827) |

− 0.447*** (− 5.341) |

| Industry_37 |

− 0.367** (− 2.384) |

− 0.367** (− 2.360) |

− 0.261*** (− 3.324) |

− 0.388*** (− 2.715) |

− 0.243** (− 1.989) |

− 0.395** (− 2.503) |

− 0.353*** (− 4.611) |

| Industry_38 |

− 0.423** (− 2.969) |

− 0.423*** (− 2.940) |

− 0.326** (− 4.071) |

− 0.468*** (− 3.542) |

− 0.405*** (− 3.585) |

− 0.446*** (− 3.053) |

− 0.385*** (− 5.547) |

| Industry_39 |

− 0.284*** (− 1.998) |

− 0.284** (− 1.978) |

− 0.197* (− 1.924) |

− 0.265** (− 2.013) |

|||

| Industry_41 |

− 0.670** (− 4.331) |

− 0.670*** (− 4.288) |

− 0.296* (− 1.959) |

− 0.799*** (− 5.574) |

− 0.748*** (− 6.104) |

− 0.957*** (− 6.034) |

− 0.644*** (− 4.785) |

| Industry_42 |

− 0.512*** (− 4.394) |

− 0.512*** (− 4.350) |

− 0.321*** (− 5.095) |

− 0.531*** (− 4.919) |

− 0.445*** (− 4.819) |

− 0.559*** (− 4.687) |

− 0.437*** (− 7.288) |

| Industry_43 |

0.254** (2.053) |

0.254** (2.033) |

0.489*** (5.095) |

0.319*** (2.788) |

0.338*** (3.450) |

0.360*** (2.844) |

0.522*** (6.279) |

| Industry_46 |

− 0.566** (− 2.213) |

− 0.566** (− 2.191) |

− 0.431*** (− 2.704) |

− 0.606** (− 2.558) |

− 0.488** (− 2.409) |

− 0.606** (− 2.315) |

− 0.455*** (− 3.207) |

| Industry_49 |

− 0.362** (− 2.032) |

− 0.362** (− 2.012) |

− 0.305** (− 2.566) |

− 0.472*** (− 2.859) |

− 0.356** (− 2.522) |

− 0.385** (− 2.315) |

− 0.240** (− 2.313) |

| Industry_50 |

0.618** (2.424) |

0.618** (2.399) |

0.404* (1.914) |

0.651*** (2.756) |

0.620*** (3.071) |

0.621** (2.381) |

0.524*** (2.933) |

| Industry_51 |

0.575*** (6.464) |

0.575*** (6.399) |

0.687*** (9.381) |

0.633*** (7.676) |

0.448*** (6.356) |

0.555*** (6.097) |

0.655*** (10.012) |

| Industry_52 |

0.498*** (3.619) |

0.498*** (3.583) |

0.595*** (4.881) |

0.687*** (5.391) |

0.467*** (4.288) |

0.684*** (4.863) |

0.679*** (6.771) |

| Industry_53 |

0.453*** (2.908) |

0.235** (2.115) |

|||||

| Industry_54 |

− 0.462** (− 2.508) |

− 0.462** (− 2.483) |

− 0.291** (− 2.529) |

− 0.449*** (− 2.627) |

− 0.441*** (− 3.019) |

− 0.434** (− 2.302) |

− 0.307*** (− 2.957) |

| Industry_55 |

0.495*** (3.171) |

0.495*** (3.139) |

0.529*** (4.026) |

0.452*** (3.126) |

0.431*** (3.481) |

0.476*** (2.981) |

0.490*** (3.830) |

| Industry_56 |

0.473*** (4.527) |

0.473*** (4.482) |

0.594*** (6.744) |

0.521*** (5.383) |

0.442*** (5.346) |

0.607*** (5.681) |

0.728*** (9.998) |

| Industry_59 |

− 0.810*** (− 2.739) |

− 0.810*** (− 2.711) |

− 0.476* (− 1.852) |

− 0.764*** (− 2.788) |

− 0.594** (− 2.534) |

− 0.642** (− 2.119) |

|

| Industry_60 |

− 0.693*** (− 3.242) |

− 0.693*** (− 3.209) |

− 0.477*** (− 3.324) |

− 0.589** (− 2.978) |

− 0.613*** (− 3.622) |

− 0.613*** (− 2.801) |

− 0.413*** (− 3.214) |

| Industry_61 |

− 0.401** (− 2.528) |

− 0.401** (− 2.502) |

− 0.266*** (− 3.110) |

− 0.508*** (− 3.452) |

− 0.216*** (− 1.716) |

− 0.476*** (− 2.930) |

− 0.350*** (− 4.214) |

| Industry_62 |

− 0.651*** (− 3.784) |

− 0.651*** (− 3.746) |

− 0.326*** (− 4.898) |

− 0.680*** (− 4.267) |

− 0.492*** (− 3.606) |

− 0.693*** (− 3.932) |

− 0.542*** (− 6.326) |

| Industry_63 |

− 0.390*** (− 3.399) |

− 0.390*** (− 3.746) |

− 0.272*** (− 3.932) |

− 0.424*** (− 3.986) |

− 0.376*** (− 4.133) |

− 0.384*** (− 3.268) |

− 0.343*** (− 5.374) |

| Industry_66 |

− 0.762*** (− 5.339) |

− 0.762*** (− 5.286) |

− 0.451*** (− 5.425) |

− 0.728*** (− 5.505) |

− 0.594*** (− 5.249) |

− 0.609*** (− 4.169) |

− 0.438*** (− 5.944) |

| AR(1) |

0.068*** (16.825) |

− 0.002 (− 0.566) |

|||||

| Random effect (Cross) | Yes | ||||||

| Adjusted R2 | 0.076 | 0.076 | 0.108 | 0.095 | 0.086 | 0.103 | 0.143 |

The values of the constant terms are not reported. t statistics in parentheses. For industrial variables, only those who are statistically significant are reported in the table

***p ≤ 0.01, ** 0.01 < p < 0.05, *0.05 < p < 0.1

Fortunately, many of the industry dummies are significant, which is a promising result, even in our casual attempt. As shown in the last column of Table 3, for the model with both the AR (1) term and cross-section weights, all five pandemic variables are statistically significant, and the signs are exactly as expected. Although the AR (1) term is not significant here, it brings us the largest adjusted R2 value in this group of models, which has been our best fit so far.

Estimation with partial theoretical guidance

The guidance of the theoretical model shown earlier makes us more confident about the variables to be included. However, many variables have a value that is either negative or zero, so we cannot take the log form of all the variables, as suggested by the theory. For example, the change in the number of suspected infections, as well as that of ICU patients, has some zero values. Therefore, we have to seek a compromise in which we do not take the log form for some key variables. Hence, we consider this group of model estimations with “partial” theoretical guidance.

As shown in Table 4, the overall fitness of this group of models is much better, as the adjusted R2 values tend to be much larger. Notably, models (4–7) presented in the last column of Table 4 show an adjusted R2 value of 0.333, which is considered extraordinarily high in stock market studies. However, in this group of models, the signs of the estimation coefficients are not easy to understand. According to Eq. (24) in the theoretical section, for all their original forms, we would expect a negative sign for daily rates of infection, suspected infection, ICU patients, as well as deaths, and a positive sign for recovery. In addition, we would expect a positive sign for the log of the difference in the pandemic variable(s), regardless of the specific variables we use here. As shown in Table 4, the one with only AR (1) appears to have a better sign in the log of the difference in the daily rates of infection. However, the signs of death and recovery are not consistent with our expectations. Moreover, although the theory suggests that the log of the stock price (i.e., “close” as the variable name) be negative, we end up with a positive coefficient in all the models in this group.

Table 4.

Empirical estimation results with dependent variable Pct_chg of pooled or panel least square with or without AR(1) term with partial theoretical guidance (n = 60,144)

| Model (4–1) (Pooled Least Squares) |

Model (4–2) (Cross-section random effects) |

Model (4–3) (Cross-section weights) |

Model (4–4) (Period weights) |

Model (4− 5) (Period SUR) |

Model (4–6) (Pooled least squares with AR(1)) |

Model (4–7) (Cross-section weights with AR(1)) |

|

|---|---|---|---|---|---|---|---|

| ln(Close) |

0.409*** (21.608) |

0.409*** (22.533) |

0.264*** (17.958) |

0.296*** (17.059) |

0.332*** (21.147) |

0.257*** (13.575) |

0.409*** (21.608) |

| Daily_infection |

7.56E−05*** (3.980) |

7.56E−05*** (4.150) |

0.000*** (14.494) |

− 0.000*** (− 14.692) |

− 8.76E−05*** (− 4.825) |

− 0.000*** (− 40.643) |

7.56E−05*** (3.980) |

| ln(Daily_infection) |

− 1.067*** (− 18.045) |

− 1.067*** (− 18.817) |

− 1.066*** (− 41.924) |

− 0.615*** (− 11.808) |

− 0.905*** (− 17.276) |

0.271*** (4.832) |

− 1.067*** (− 18.045) |

| Suspected_infection |

− 5.67E−05*** (− 4.704) |

− 5.67E−05*** (− 4.906) |

− 6.56E−05*** (− 8.408) |

− 0.000*** (− 17.494) |

− 0.000*** (− 11.284) |

− 0.001*** (− 48.273) |

− 5.67E−05*** (− 4.704) |

| ∆Suspected_infection |

5.51E−05** (2.065) |

5.51E−05** (2.153) |

− 7.81E−05** (− 4.521) |

0.000*** (14.279) |

0.000*** (7.582) |

0.001*** (41.419) |

5.51E−05** (2.065) |

| ICU_patients |

− 0.001*** (− 33.086) |

− 0.001*** (− 34.502) |

− 0.001*** (− 35.557) |

− 0.001*** (− 39.914) |

− 0.001*** (− 32.301) |

− 0.002*** (− 57.220) |

− 0.001*** (− 33.086) |

| ∆ICU_patients |

0.001*** (22.335) |

0.001*** (23.291) |

0.001*** (20.854) |

0.002*** (34.307) |

0.001*** (25.006) |

0.001*** (22.335) |

0.001*** (22.335) |

| Death_cases |

− 0.000 (− 0.106) |

− 0.000 (− 0.111) |

− 0.009*** (− 10.677) |

0.021*** (16.966) |

0.009*** (7.597) |

− 0.000 (− 0.106) |

− 0.000 (− 0.106) |

| ln(∆Death_cases) |

− 2.349*** (− 20.847) |

− 2.349*** (− 21.739) |

− 1.501*** (− 20.568) |

− 1.226*** (− 11.346) |

− 1.586*** (− 15.268) |

− 2.349*** (− 20.847) |

− 2.349*** (− 20.847) |

| Recovery |

− 4.61E−05 (− 0.783) |

− 4.61E−05 (− 0.816) |

0.000*** (5.475) |

− 0.001*** (− 17.720) |

− 0.000*** (− 9.512) |

− 4.61E−05 (− 0.783) |

− 4.61E−05 (− 0.783) |

| ln(∆Recovery) |

3.086*** (35.279) |

3.086*** (36.789) |

3.123*** (55.130) |

1.990*** (23.765) |

2.487*** (31.882) |

3.086*** (35.279) |

3.086*** (35.279) |

| Total_revenue |

− 1.09E−08** (− 2.170) |

− 1.09E−08** (− 2.263) |

− 5.47E−09** (− 2.163) |

− 1.09E−08** (− 2.367) |

− 9.36E−09** (− 2.259) |

− 1.09E−08** (− 2.170) |

− 1.09E−08** (− 2.170) |

| ln(Operating_cost) |

− 0.028** (− 2.555) |

− 0.028*** (− 2.665) |

− 0.026*** (− 3.651) |

− 0.058*** (− 5.881) |

− 0.027*** (− 3.014) |

− 0.028** (− 2.555) |

− 0.028** (− 2.555) |

| Operating_profit |

− 2.09E−08 (− 1.035) |

− 2.09E−08 (− 1.079) |

− 1.58E−08 (− 1.734) |

− 2.22E−08 (− 1.200) |

− 2.16E−08 (− 1.294) |

− 2.09E−08 (− 1.035) |

− 2.09E−08 (− 1.035) |

| ln(Buy_vol) |

0.117*** (14.523) |

0.117*** (15.145) |

0.067*** (11.331) |

0.112*** (15.116) |

0.097*** (14.458) |

0.117*** (14.523) |

0.117*** (14.523) |

| Industry_2 |

− 0.781*** (− 6.769) |

− 0.781*** (− 7.058) |

− 0.582*** (− 6.389) |

− 0.938*** (− 8.857) |

− 0.702*** (− 7.348) |

− 1.168*** (− 10.135) |

− 0.881*** (− 12.056) |

| Industry_7 |

0.309*** (2.764) |

0.309*** (2.882) |

0.308*** (3.766) |

0.483*** (4.703) |

0.342*** (3.693) |

0.436*** (3.892) |

0.462*** (6.415) |

| Industry_9 |

− 0.521*** (− 3.086) |

− 0.521*** (− 3.219) |

− 0.329*** (− 4.384) |

− 0.738*** (− 4.759) |

− 0.543*** (− 3.881) |

− 0.807*** (− 4.782) |

− 0.550*** (− 7.754) |

| Industry_10 |

0.339** (2.312) |

0.339** (2.411) |

0.310** (2.427) |

0.312** (2.315) |

0.308** (2.537) |

0.261* (1.778) |

0.429*** (4.494) |

| Industry_12 |

− 0.552** (− 2.311) |

− 0.409* (− 1.902) |

− 0.548** (− 2.109) |

− 0.397** (− 2.093) |

|||

| Industry_16 |

− 0.484*** (− 4.896) |

− 0.484*** (− 5.105) |

− 0.352*** (− 4.106) |

− 0.678*** (− 7.479) |

− 0.455*** (− 5.562) |

− 0.853*** (− 8.633) |

− 0.716*** (− 10.474) |

| Industry_19 |

− 0.501*** (− 4.721) |

− 0.501*** (− 4.923) |

− 0.286*** (− 2.997) |

− 0.635*** (− 6.524) |

− 0.486*** (− 5.535) |

− 0.839*** (− 7.922) |

− 0.579*** (− 7.429) |

| Industry_20 |

− 1.017*** (− 5.886) |

− 1.017*** (− 6.138) |

− 0.778*** (− 5.705) |

− 1.062*** (− 6.703) |

− 0.970*** (− 6.785) |

− 1.205*** (− 6.982) |

− 0.824*** (− 7.554) |

| Industry_21 |

0.738*** (6.808) |

0.738*** (7.099) |

1.003*** (9.825) |

0.903*** (9.073) |

0.755*** (8.406) |

0.869*** (8.026) |

1.101*** (11.566) |

| Industry_22 |

− 0.544** (− 2.281) |

− 0.544** (− 2.3678) |

− 0.375*** (− 2.929) |

− 0.375*** (− 2.939) |

− 0.456** (− 2.307) |

− 0.478** (− 2.003) |

− 0.289*** (− 3.049) |

| Industry_23 |

0.395*** (3.688) |

0.164* (1.691) |

0.255** (2.189) |

0.167** (2.351) |

|||

| Industry_25 |

− 0.335*** (− 2.920) |

− 0.335*** (− 3.045) |

− 0.217*** (− 3.082) |

− 0.276** (− 2.622) |

− 0.266** (− 2.803) |

− 0.279** (− 2.381) |

− 0.188*** (− 3.258) |

| Industry_27 |

− 0.294*** (− 3.076) |

− 0.294*** (− 3.208) |

− 0.202*** (− 3.759) |

− 0.279*** (− 3.175) |

− 0.268*** (− 3.379) |

− 0.218** (− 2.283) |

− 0.169*** (− 3.803) |

| Industry_28 |

− 0.313*** (− 3.211) |

− 0.313*** (− 3.349) |

− 0.218*** (− 3.773) |

− 0.364*** (− 4.070) |

− 0.257*** (− 3.185) |

− 0.362*** (− 3.708) |

− 0.271*** (− 5.432) |

| Industry_29 |

0.338** (2.308) |

0.339** (2.407) |

0.460*** (3.624) |

0.433*** (3.220) |

0.318** (2.618) |

0.344** (2.348) |

0.491*** (4.934) |

| Industry_32 |

− 0.358*** (− 2.868) |

− 0.358*** (− 2.991) |

− 0.269*** (− 3.625) |

− 0.399*** (− 3.481) |

− 0.394*** (− 3.811) |

− 0.372*** (− 2.983) |

− 0.293*** (− 4.751) |

| Industry_33 |

− 0.551** (− 2.296) |

− 0.551** (− 2.394) |

− 0.327** (− 1.999) |

− 0.591*** (− 2.685) |

− 0.361* (− 1.818) |

− 0.568** (− 2.369) |

− 0.287** (− 1.958) |

| Industry_36 |

− 0.615*** (− 3.800) |

− 0.615*** (− 3.963) |

− 0.419*** (− 5.131) |

− 0.553*** (− 3.724) |

− 0.504*** (− 3.764) |

− 0.568*** (− 3.510) |

− 0.399*** (− 5.762) |

| Industry_37 |

− 0.290* (− 1.929) |

− 0.290** (− 2.012) |

− 0.234*** (− 3.337) |

− 0.356*** (− 2.578) |

− 0.221* (− 1.771) |

− 0.360** (− 2.393) |

− 0.336*** (− 5.274) |

| Industry_38 |

− 0.353** (− 2.535) |

− 0.353** (− 2.644) |

− 0.279*** (− 3.948) |

− 0.429*** (− 3.356) |

− 0.374*** (− 3.239) |

− 0.418** (− 3.003) |

− 0.344*** (− 6.209) |

| Industry_41 |

− 0.652*** (− 4.381) |

− 0.652*** (− 4.569) |

− 0.341** (− 2.370) |

− 0.836*** (− 6.119) |

− 0.691*** (− 5.609) |

− 0.987*** (− 6.629) |

− 0.647*** (− 5.427) |

| Industry_42 |

− 0.351*** (− 3.086) |

− 0.351*** (− 3.218) |

− 0.231*** (− 4.012) |

− 0.441*** (− 4.228) |

− 0.337*** (− 3.576) |

− 0.489*** (− 4.311) |

− 0.377*** (− 7.458) |

| Industry_43 |

0.207* (1.734) |

0.207* (1.808) |

0.432*** (4.660) |

0.374*** (3.410) |

0.325*** (3.280) |

0.322*** (2.695) |

0.523*** (6.985) |

| Industry_46 |

− 0.489* (− 1.958) |

− 0.489** (− 2.042) |

− 0.390** (− 2.736) |

− 0.597*** (− 2.609) |

− 0.465** (− 2.249) |

− 0.617** (2.474) |

− 0.435*** (− 3.432) |

| Industry_50 |

0.722*** (2.897) |

0.722*** (3.021) |

0.462*** (2.302) |

0.741** (3.238) |

0.707*** (3.424) |

0.722*** (2.899) |

0.620*** (3.901) |

| Industry_51 |

0.546*** (6.364) |

0.546*** (6.637) |

0.636*** (9.240) |

0.599*** (7.601) |

0.467*** (6.573) |

0.504*** (5.880) |

0.616*** (10.844) |

| Industry_52 |

0.525*** (3.910) |

0.525*** (4.078) |

0.589*** (4.988) |

0.682*** (5.544) |

0.514*** (4.630) |

0.676*** (5.040) |

0.667*** (7.340) |

| Industry_54 |

− 0.328* (− 1.868) |

− 0.328* (− 1.948) |

− 0.217** (− 2.179) |

− 0.285* (− 1.772) |

− 0.325** (− 2.236) |

− 0.169** (− 2.089) |

|

| Industry_55 |

0.491*** (3.265) |

0.491*** (3.405) |

0.583*** (5.018) |

0.496*** (3.589) |

0.447*** (3.586) |

0.436*** (2.899) |

0.480*** (4.361) |

| Industry_56 |

0.421*** (4.169) |

0.421*** (4.347) |

0.563*** (6.618) |

0.519*** (5.616) |

0.431*** (5.158) |

0.555*** (5.507) |

0.719*** (10.672) |

| Industry_59 |

− 0.568** (− 1.962) |

− 0.568** (− 2.046) |

− 0.572** (− 2.154) |

− 0.419* (− 1.752) |

|||

| Industry_60 |

− 0.469** (− 2.239) |

− 0.469** (− 2.336) |

− 0.321** (− 2.407) |

− 0.438** (− 2.284) |

− 0.434** (− 2.505) |

− 0.463** (− 2.215) |

− 0.316*** (− 3.143) |

| Indusytu_61 |

− 0.281* (− 1.180) |

− 0.281* (− 1.888) |

− 0.193* (− 2.502) |

− 0.422*** (− 2.959) |

− 0.395** (− 2.539) |

− 0.297*** (− 3.860) |

|

| Industry_62 |

− 0.525*** (− 3.179) |

− 0.525*** (− 3.315) |

− 0.359*** (− 4.746) |

− 0.611*** (− 4.028 |

− 0.425*** (− 3.110) |

− 0.736*** (− 4.458) |

− 0.555*** (− 8.023) |

| Industry_63 |

− 0.332*** (− 2.971) |

− 0.332*** (− 3.098) |

− 0.255*** (− 4.087) |

− 0.359*** (− 3.506) |

− 0.347*** (− 3.747) |

− 0.332*** (− 2.977) |

− 0.297*** (− 5.592) |

| Industry_66 |

− 0.754*** (− 5.414) |

− 0.754*** (− 5.645) |

− 0.443*** (− 5.864) |

− 0.734*** (− 5.739) |

− 0.614*** (− 5.322) |

− 0.641*** (− 4.605) |

− 0.423*** (− 6.798) |

| AR(1) |

0.072*** (18.198) |

− 0.005 (− 1.413) |

|||||

| Random effect (Cross) | Yes | ||||||

| Adjusted R2 | 0.113 | 0.113 | 0.198 | 0.154 | 0.129 | 0.186 | 0.333 |

The values of the constant terms are not reported. t statistics in parentheses. For industrial variables, only those who are statistically significant are reported in the table

***p ≤ 0.01, ** 0.01 < p < 0.05, *0.05 < p < 0.1

Estimation with complete theoretical guidance

To support and examine the theoretical model at its full strength, we used a bit of sleight of the hand. First, we introduce the quadratic form to the variables with negative values, the transformation of which is shown in Eq. (26), in the theoretical section. Second, we “manipulate” the data slightly by changing all the zero values of the key variables to a tiny value of 0.001. This manipulation does not change the essence of the data set but enables us to take the log forms. The results for this group of models are presented in Table 5.

Table 5.

Empirical estimation results with dependent variable ln((Pct_chg)2) of pooled or panel least square with or without AR(1) term with complete theoretical guidance (n = 60,144)

| Model (5–1) (Pooled least squares) |

Model (5–2) (Cross-section random effects) |

Model (5–3) (Cross-section weights) |

Model (5–4) (Period weights) |

Model (5–5) (Period SUR) |

Model (5–6) (Pooled least squares with AR(1)) |

Model (5–7) (Cross-section weights with AR(1)) |

|

|---|---|---|---|---|---|---|---|

| ln((Close)2) |

0.235*** (25.978) |

0.254*** (21.598) |

0.164*** (24.739) |

0.177*** (20.876) |

0.168*** (16.306) |

0.246*** (24.736) |

0.169*** (23.246) |

| Daily_infection |

− 1.49E−05 (− 0.945) |

− 1.51E−05 (− 0.996) |

− 2.34E−05** (− 2.157) |

− 3.43E−05** (− 2.150) |

− 4.88E−05 (− 3.279) |

5.44E−05*** (2.777) |

5.82E−05*** (4.378) |

| ln(∆Daily_infection2) |

0.091*** (2.582) |

0.091*** (2.685) |

0.105*** (4.337) |

0.102*** (2.826) |

0.104*** (2.927) |

0.062* (1.752) |

0.064*** (2.668) |

| Suspected_infection |

− 0.000*** (− 33.811) |

− 0.000*** (− 35.152) |

− 0.000*** (− 46.005) |

− 0.000*** (− 43.731) |

− 0.000*** (− 43.146) |

− 0.000*** (− 19.818) |

− 0.000*** (− 26.181) |

| ln((∆Suspected_infection_new)2) |

0.023*** (2.959) |

0.023*** (3.079) |

0.024*** (4.495) |

0.039*** (5.168) |

0.036*** (5.049) |

− 0.003 (− 0.388) |

− 0.008 (− 1.313) |

| ICU_patients |

0.000*** (12.227) |

0.000*** (12.696) |

0.000*** (17.467) |

0.000*** (10.443) |

0.000*** (11.104) |

0.000*** (10.779) |

0.000*** (15.095) |

| ln((∆ICU_patients_new)2) |

− 0.055*** (− 6.115) |

− 0.055*** (− 6.355) |

− 0.053*** (− 8.563) |

− 0.072*** (− 7.891) |

− 0.066*** (− 7.608) |

− 0.029*** (− 3.049) |

− 0.023*** (− 3.494) |

| Death_cases |

− 0.009 (− 11.660) |

− 0.009 (− 12.102) |

− 0.008*** (− 15.112) |

− 0.009*** (− 10.205) |

− 0.008*** (− 9.604) |

− 0.012*** (− 13.024) |

− 0.011*** (− 18.265) |

| ln((∆Death_cases)2) |

0.772*** (12.361) |

0.773*** (12.845) |

0.632*** (14.677) |

0.734*** (11.831) |

0.712*** (11.287) |

0.779*** (12.457) |

0.661*** (15.612) |

| Recovery |

0.000*** (9.244) |

0.000*** (9.589) |

0.000*** (12.040) |

0.000*** (7.429) |

0.000*** (6.812) |

0.000*** (10.804) |

0.000*** (15.612) |

| ln((∆Recovery)2) |

− 0.050 (− 1.241) |

− 0.051 (− 1.298) |

− 0.016 (− 0.566) |

0.016 (0.429) |

0.014 (0.405) |

− 0.019 (− 0.454) |

0.014 (0.516) |

| Total_revenue |

− 9.97E−09*** (− 2.082) |

− 1.03E−08*** (− 1.649) |

− 8.55E−09** (− 2.153) |

− 1.01E−08** (− 2.261) |

− 9.42E−09* (− 1.725) |

− 6.21E−09 (− 1.178) |

− 5.29E−09 (− 1.507) |

| ln(Operating_cost) |

− 0.107*** (− 10.388) |

− 0.109*** (− 8.129) |

− 0.101*** (− 14.053) |

− 0.111*** (− 11.538) |

− 0.107*** (− 9.121) |

− 0.101*** (− 8.929) |

− 0.094*** (− 12.039) |

| Operating_profit |

− 7.28E−08*** (− 3.767) |

− 7.42E−08*** (− 2.957) |

− 8.74E−08*** (− 4.204) |

− 7.02E−08*** (− 3.889) |

− 6.96E−08*** (− 3.163) |

− 8.94E−08*** (− 4.206) |

− 1.09E−07** (− 4.967) |

| ln(Buy_vol) |

0.147** (19.098) |

0.156*** (15.568) |

0.551*** (9.512) |

0.124*** (17.105) |

0.123*** (13.926) |

0.668*** (7.007) |

0.152*** (24.806) |

| Industry_5 |

0.655*** (7.554) |

0.656*** (5.823) |

− 0.176* (− 1.876) |

0.575*** (7.091) |

0.507*** (5.136) |

0.465*** (3.946) |

0.574*** (9.018) |

| Industry_7 |

0.416*** (3.879) |

0.408*** (2.925) |

0.369*** (5.031) |

0.345*** (3.439) |

0.364*** (2.977) |

− 0.932*** (− 3.234) |

− 0.191** (− 1.918) |

| Industry_8 |

− 0.794*** (− 3.028) |

− 0.767** (− 2.253) |

− 0.548** (− 2.235) |

− 0.932*** (− 3.234) |

0.392*** (4.894) |

||

| Industry_9 |

− 1.513*** (− 9.354) |

− 1.489*** (− 7.089) |

− 1.301*** (− 8.246) |

− 1.597*** (− 10.559) |

− 1.601*** (− 8.691) |

− 1.444*** (− 8.119) |

− 1.208*** (− 7.289) |

| Industry_10 |

0.590*** (4.200) |

0.574*** (3.144) |

0.505*** (5.143) |

0.496*** (3.771) |

0.474*** (2.961) |

0.613*** (3.964) |

0.532*** (4.936) |

| Industry_15 |

0.177** (2.202) |

0.175* (1.683) |

0.158** (2.100) |

0.209** (2.379) |

0.105* (1.688) |

||

| Industry_16 |

0.225** (2.375) |

0.211* (1.718) |

0.141** (2.059) |

0.247** (2.376) |

0.176** (2.449) |

||

| Industry_19 |

0.238*** (2.343) |

0.241*** (3.299) |

0.196** (2.068) |

0.248** (2.221) |

0.264*** (3.257) |

||

| Industry_21 |

0.524*** (5.047) |

0.484*** (3.591) |

0.525*** (7.094) |

0.379*** (3.905) |

0.363*** (3.068) |

0.571*** (5.001) |

0.586*** (7.132) |

| Industry_22 |

− 0.627*** (− 2.744) |

− 0.625** (− 2.105) |

− 1.029*** (− 6.274) |

− 0.502** (− 2.351) |

0.379*** (2.976) |

− 0.694*** (− 2.761) |

− 1.068*** (− 5.909) |

| Industry_23 |

0.267** (2.385) |

0.252* (1.734) |

0.131* (1.681) |

0.343*** (3.276) |

− 0.319** (− 2.546) |

0.279** (2.269) |

0.148* (1.723) |

| Industry_26 |

− 0.205* (− 1.867) |

− 0.365*** (− 4.907) |

− 0.300*** (− 2.919) |

− 0.319** (− 2.546) |

− 0.368*** (− 4.498) |

||

| Industry_27 |

− 0.589*** (− 6.437) |

− 0.575*** (− 4.831) |

− 0.583* (− 8.891) |

− 0.562*** (− 6.559) |

− 0.514*** (− 4.922) |

− 0.590*** (− 5.864) |

− 0.574*** (− 8.145) |

| Industry_28 |

− 0.714*** (− 7.644) |

− 0.694*** (− 5.723) |

− 0.634*** (− 8.891) |

− 0.824*** (− 9.438) |

− 0.778*** (− 7.313) |

− 0.718*** (− 6.993) |

− 0.621*** (− 7.677) |

| Industry_29 |

0.579*** (4.122) |

0.569*** (3.120) |

0.442*** (4.761) |

0.505*** (3.847) |

0.459*** (2.869) |

0.618*** (4.004) |

0.492*** (4.792) |

| Industry_31 |

− 0.201*** (− 2.663) |

− 0.202** (− 2.092) |

− 0.289** (− 2.037) |

− 0.153* (− 1.841) |

|||

| Industry_34 |

0.330* (1.953) |

0.199** (1.701) |

0.277* (1.753) |

0.346* (1.798) |

0.244* (1.960) |

||

| Industry_36 |

− 1.037*** (− 6.693) |

− 1.015*** (− 5.042) |

− 0.759*** (− 6.339) |

− 0.802*** (− 5.541) |

− 0.551*** (− 3.123) |

− 1.124*** (− 6.602) |

− 0.819*** (− 6.253) |

| Industry_37 |

− 0.757*** (− 5.256) |

− 0.736*** (− 3.933) |

− 0.849*** (− 8.504) |

− 0.763*** (− 5.661) |

− 0.722*** (− 4.401) |

− 0.679*** (− 4.285) |

− 0.769*** (− 7.432) |

| Industry_38 |

− 0.785*** (− 5.887) |

− 0.771*** (− 4.451) |

− 0.894*** (− 9.921) |

− 0.721*** (− 5.781) |

− 0.661*** (− 4.353) |

− 0.813*** (− 5.545) |

− 0.902*** (− 9.297) |

| Industry_42 |

− 1.004*** (− 9.224) |

− 0.983*** (− 6.952) |

− 0.809*** (− 9.501) |

− 0.959*** (− 9.429) |

− 0.876*** (− 7.066) |

− 0.957*** (− 7.995) |

0.350*** (3.414) |

| Industry_43 |

0.328*** (2.859) |

0.299** (2.013) |

0.274*** (3.543) |

0.333*** (3.107) |

0.391*** (2.998) |

0.348*** (2.766) |

0.306*** (3.628) |

| Industry_46 |

0.453*** (2.908) |

− 0.928*** (− 2.988) |

− 0.565*** (− 2.899) |

− 0.894*** (− 4.001) |

− 0.820*** (− 3.013) |

− 0.882*** (− 3.356) |

− 0.554*** (− 2.651) |

| Industry_47 |

0.555*** (3.133) |

0.557** (2.419) |

0.486*** (4.178) |

0.534*** (3.224) |

0.556*** (2.755) |

0.625** (3.208) |

0.559*** (4.365) |

| Industry_50 |

0.565** (2.365) |

0.572* (1.844) |

0.503*** (2.817) |

0.593*** (2.658) |

0.603** (2.216) |

0.271* (1.647) |

0.535*** (2.721) |

| Industry_51 |

0.691*** (8.408) |

0.666*** (6.239) |

0.667*** (11.864) |

0.592*** (7.709) |

0.564*** (6.027) |

0.741*** (8.202) |

0.732*** (11.871) |

| Industry_52 |

0.842*** (6.559) |

0.827*** (4.957) |

0.608*** (7.442) |

0.592*** (7.709) |

0.675*** (4.612) |

0.889*** (6.299) |

0.656*** (7.231) |

| Industry_53 |

− 0.523*** (− 3.899) |

− 0.536** (− 3.077) |

− 0.509*** (− 4.790) |

− 0.348*** (− 2.773) |

− 0.279* (− 1.827) |

− 0.456*** (− 3.093) |

− 0.443*** (− 3.754) |

| Industry_54 |

− 0.499*** (− 2.976) |

− 0.476** (− 2.184) |

− 0.384*** (− 2.764) |

− 0.485*** (− 3.391) |

− 0.416** (− 2.175) |

− 0.524*** (− 2.839) |

− 0.378** (− 2.484) |

| Industry_55 |

0.591*** (4.102) |

0.574*** (3.065) |

0.619*** (6.328) |

0.519*** (3.859) |

0.483*** (2.947) |

0.668*** (4.219) |

0.702*** (6.531) |

| Industry_56 |

0.600*** (6.219) |

0.584*** (4.660) |

0.476*** (7.112) |

0.551*** (6.103) |

0.593*** (5.394) |

0.609*** (5.742) |

0.488*** (6.581) |

| Industry_58 |

− 0.576*** (− 3.174) |

− 0.561** (− 3.067) |

− 0.541*** (− 3.630) |

− 0.376* (− 1.819) |

− 0.558*** (− 2.799) |