Abstract

How much the largest worldwide companies, belonging to different sectors of the economy, are suffering from the pandemic? Are economic relations among them changing? In this paper, we address such issues by analyzing the top 50 S&P companies by means of market and textual data. Our work proposes a network analysis model that combines such two types of information to highlight the connections among companies with the purpose of investigating the relationships before and during the pandemic crisis. In doing so, we leverage a large amount of textual data through the employment of a sentiment score which is coupled with standard market data. Our results show that the COVID-19 pandemic has largely affected the US productive system, however differently sector by sector and with more impact during the second wave compared to the first.

Keywords: COVID-19 pandemic, Textual analysis, Financial risk, Network model, Big data analytics

1. Introduction

Covid-19 is not the first pandemic that the world has been experiencing but the conditions we are in, changed our lives permanently and have consequences in every field. If, from the social point of view, the generated change is visible, the impact triggered at the macroeconomic level needs some time to be appreciated and quantified. As never before, the “on-line” life is so intensive, the entire world has the urgency to communicate. From the perspective of the economic market, as information spreads out, the associated sentiments change and increase the impact on the market trends. In the era of social networks, the information moves instantaneously and can amplify or damper the dynamics of the financial markets. Not only purely financial information that has an impact on the economic trend, but the price is also more and more affected by the sentiment of people. The mechanisms involved are many, from the purely economic aspects to the sociological and psychological ones. This is the reason why, at the beginning of the 2000s, sentiment analysis has been developed and largely employed, involving different sectors from marketing to politics, passing through psychology and finance.

This paper focuses specifically on the latter and, indeed, it is well known that market prices originate from complex interaction mechanisms that often reflect speculative behaviors, rather than the fundamentals of the companies to which they refer. Market models and, specifically, financial network models based on market data may, therefore, reflect spurious components that could bias results and relative discussion. This weakness of the market suggests to enrich financial market data with data coming from other, complementary, sources. It is a fact that, market prices represent only one source of information, used for evaluating financial institutions; other relevant ones include ratings issued by rating agencies, reports of qualified financial analysts and opinions of influential and specialized media. Most of the previous sources are private, not available for data analysis. However, summary reports from them are now typically reported, almost in real time, in social networks and, in particular, in Twitter and Stocktwits.

Hereafter, we aim at investigating how and how much the interconnections among largest USA companies (top 50), have been impacted, modified and eventually reshaped, both from the financial market and the public sentiment perspectives because of the COVID-19 pandemic outbreak. To achieve the full and deep understanding of the market reactions to external shocks, we take advantage of advanced graphical models to efficiently estimate the interconnections among companies leveraging and comparing the two data sources. We completely exploit the temporal dimension by using appropriate rolling windows that reflect the market dynamics and the public perception shaping mechanism. Moreover we compare the pre-Covid-19 pandemic period with the still ongoing one, considering the 2 waves of the outbreak which have affected the USA. Data are updated till the second hitting phase of the pandemic, namely November 17th, 2020. Our results clearly show a number of interesting facts:

-

•

Financial market data and sentiment based data induce different behaviors in the networks structure either before and during the pandemic;

-

•

The density of the networks evidently increases with the outbreak of the pandemic suggesting that an exogenous and rather homogeneous diffused shock produces more interconnections among the entities which may lead to a more vulnerable financial system in terms of systemic risk;

-

•

It appears how the system shows a certain amount of resilience as the first wave comes but, with the second one, the interconnections among the agents change largely.

-

•

It is evident a difference among the sectors that reacts in their own ways considered the relative core business and the role played in the pandemic.

-

•

The shock produces an effect in the positioning of the companies within the network: hub and authority scores experience not only a change in the top 5 rankings but also the appearance of now comers.

The paper is organized as follows: Section 2 presents the literature review, Section 3 presents the network VAR model and discusses the Bayesian estimation mechanism. Section 4 presents a description of the data, in Section 5 we report the results and in Section 6 we discuss our findings.

2. Literature review

Numerous studies analyze the impact of sentiment in finance. Important papers on the statistical/econometric analysis of non conventional data are available: see, for example, Bollen et al., 2011, Bordino et al., 2012, Cerchiello and Giudici, 2016c, Choi and Varian, 2012 and Feldman (2013), who all show the added value of tweets and, more generally, of textual data, in economics and finance. Loughran and McDonald (2016) review textual analysis literature in accounting and finance, Tetlock, Saar-Tsechansky, and Macskassy (2008) find that language content is able to capture relevant information, not otherwise captured, which is incorporated into stock prices quickly. Cerchiello and Giudici (2016a) demonstrate how tweet data can be relevant in determining systemic risk networks and stress that such type of data has the great advantage of being able to include even unlisted institutions in the networks.

Aste (2019), analyzing the cryptocurrency market, demonstrates how prices affect sentiment and vice versa, with differences in intensity and number of significant interactions. Souza, Kolchyna, Treleaven, and Aste (2015), analyzing listed retail brands, demonstrate through twitter analysis that social media are very important in financial dynamics even in comparison to more traditional news sources such as newspapers. Tetlock (2007) analyzes the link between media and stock market pointing out pessimism and demonstrating the relationship between pessimism and a decrease in stock prices and pessimism and an increase in trading volume. Joshi, N, and Rao (2016) study the relationship between news and stock trends noting that the polarity of news (positive and negative) impacts the market. Ranco, Aleksovski, Caldarelli, Grčar, and Mozetič (2015) analyze relationships between 30 stock companies from Dow Jones Industrial Average (DJIA) index and the blogging platform Twitter and find a significant dependence particularly during the peaks of Twitter volume.

Algaba, Ardia, Bluteau, Borms, and Boudt (2020) recently presented an overview of sentiment analysis related to the econometric field calling this specific research stream “sentometrics”. Larsen and Thorsrud (2019), using textual analysis on a Norwegian newspaper, construct a new index and prove that it can be useful to predict key quarterly economic variables, including assets.

Our paper supports the recent literature on the impact of Covid-19 using text analysis. More in general, the role played by textual analysis in offering new insights to tackle real data problems, has proved its relevance in several settings (Cerchiello and Giudici (2012), Magliacani, Madeo, and Cerchiello (2018)). We focus on the most recent papers which takes explicitly into account the effects of Covid-19 pandemic. Costola, Nofer, Hinz, and Pelizzon (2020) examined the relationship between stock market reactions and news of COVID-19 obtained from three platforms: MarketWatch.com, Reuters.com, and NYtimes.com. They report a positive association between sentiment score and market returns and illustrate this result also applying principal component analysis on the sentiment database showing that the first principal component is positively related to the financial market. Looking at the Bitcoin market, Chen, Liu, and Zhao (2020) studied the impact of fear sentiment, affected by pandemic, on Bitcoin prices in a period from 15 January 2020 to 24 April 2020, using vector autoregressive (VAR) models and show that the fear related to pandemic channels to negative Bitcoin returns and high trading volume. Using twitter platform, Derouiche and Frunza (2020) studied the relationship between tweets sentiment, related to sports companies and their stock prices using the Granger causality test of tweets on stocks and the event study related to Covid-period. Valle-Cruz, Fernandez-Cortez, López-Chau, and Sandoval-Almazan (2020) analyzed the link between some twitter accounts and financial indices. They show that the market reaction is delayed by 6–13 days after the information publication and that the link between these two actors is very high. Considering the statistical analysis of the twitter messages, Yin, Yang, and Li (2020) analyzing 13 million of tweets for 2 weeks, noted a stronger ratio of positive sentiment than negative one with particular attention to some specific topics such as “staying at home”. Rajput, Grover, and Rathi (2020), considering tweets from January 2020 until March 2020, show that most of the tweet are positive, only about 15% negative.

Considering the Italian stock market, Colladon, Grassi, Ravazzolo, and Violante (2020) propose a new textual index (ERKs) able to predict stock market prices and demonstrate the improvement using a forecasting model. Mamaysky (2020) examining the financial markets, note that until mid-March 2020 the markets are hypersensitive, that is very volatile and overreacting to news. From mid-March on-wards, the markets show a structural break reducing largely the hypersensitive trait. Gormsen and Koijen (2020), analyzing equity market and dividend futures, show how these move in response to investors’ expectations of economic growth. They note that the programs implemented by governments have not improved growth expectations in the short term. Baker et al. (2020), analyzing the previous pandemics (1918, 1957 and 1968), show how the Covid-19 pandemic has unprecedented effects on the US market. The authors note that this is imputable to government restrictions on commercial activities and social distancing. The socioeconomic effects of Covid-19 on every aspect of the economy have been reviewed by Nicola, Alsafi et al. (2020) and Zhang, Hu, and Ji (2020) map general risk patterns and systemic risks in markets around the world. We pay particular attention to the recent literature that has studied the impact of the pandemic on the US market with a specific focus on sub sectors specificity. Lee (2020) explored the correlation between sentiment score and 11 sector indices of the US Market through a set of t-test with different lags. Results demonstrate that all sectors present a significant boost in volatility due to the pandemic. Looking at correlation between Covid-19 sentiment and stock prices, they show that the link is different across sectors, in particular, consumer, industrial, energy and communication services are in the group of the high-medium level of correlation, utility sector in the low-level group, while tech and healthcare in the high, medium, and low group. The impact of Covid-19 was stressed also from Federal reserve in some notes. Chen et al. (2020) show the “disconnection” between stock market and real economy. High price stocks, in particular tech stocks (Facebook, Amazon, Apple, Netflix, and Google), have performed better throughout the pandemic while low price stocks performed worse, losing the 10% of their values pre-pandemic. Ahmed et al. (2020) analyze the impact of Covid-19 on Emerging Market Economies (EMEs) in particular relationship between pandemic outcomes and financial developments considering 22 financial indicators. They show that the access of EMEs to international capital markets is determined by the spread of the virus and in particular by the lockdown measures adopted to deal with it, rather than by the strength of their economies.

2.1. Background: Network models

We studied the impact of Covid-19 on stocks’ relationship through the application of network model. Boccaletti, Latora, Moreno, Chavez, and Hwang (2006) review the structure of the networks and the applications in the different fields. Related to the financial area, Pantaleo, Tumminello, Lillo, and Mantegna (2011) build a network structure based on covariance estimators to improve the portfolio optimization. Peralta and Zareei (2016) propose a portfolio optimization strategy through network-based method in which the securities are the nodes of the network and the links are the correlations of returns. Pozzi, Aste, Rotundo, and Di Matteo (2008) compare the stability of two graph methods: the Minimum Spanning Tree and the Planar Maximally Filtered Graph using financial data.

Network models approach are commonly used in the field of systemic risk. Eisenberg and Noe, 2001, Sheldon et al., 1998, Upper and Worms (2004) and in particular, frequently, are based on correlations between agents. There is a myriad of studies on the application of network models to uncover these vulnerabilities in financial systems to identify channels of shock transmission among financial institutions and markets (Acemoglu et al., 2015, Battiston et al., 2012, Billio et al., 2012, Cerchiello et al., 2017, Diebold and Yilmaz, 2014, Elliott et al., 2014, Nicola, Cerchiello et al., 2020, Scaramozzino et al., 2021).

Mantegna (1999), studying daily time series, finds a hierarchical arrangement between them through the construction of a graph calculated on the correlations between each pair of actions. Onnela, Kaski, and Kertész (2004) construct a network using return correlations and explain the methodology for constructing asset graphs. Giudici and Abu-Hashish (2019) propose a correlation network VAR model to explain the structure between bitcoin prices and classic asset. Steinbacher, Steinbacher, and Steinbacher (2013) studied network-based model of credit contagion related to the banking system to analyze the effect of shocks to the financial system. Billio et al. (2012) construct a Granger-causality networks on hedge funds, banks, broker/dealers, and insurance companies showing that banks are the most important actor in transmitting shocks than others, Giudici and Spelta (2016) improve financial network model applying static and dynamic Bayesian graphical models. Ahelegbey et al., 2016a, Ahelegbey et al., 2016b proposed a Bayesian graphical VAR (BGVAR) model to identify channels of financial interconnectedness for systemic risk analysis. Bouri, Gupta, Hosseini, and Lau (2018) applied the BGVAR model to examine the predictive power of implied volatility in the commodity and major developed stock markets. Souza and Aste (2019) demonstrate the predictability of future stock market using a network approach that combines textual information and financial data. Giudici, Hadji-Misheva, and Spelta (2020) propose a model for improving the credit risk of peer-to-peer platforms by exploiting the topological information embedded in similarity networks.

This work contributes to the literature specifically devoted to the assessment of the impact of the Covid-19 pandemic by means of network models. In particular, Shahzad, Bouri, Kristoufek, and Saeed (2021) recently analyzed the reactions of the US stock market. They extend the Diebold–Yilmaz spillover index to quantile analysis showing that the network of sectorial connections is solid but changes in reaction to unfavorable market shocks but also to favorable ones. In the case of the pandemic period, the structure of the network has undergone a change leading to a closer connection between the closest clusters. In a further work, Shahzad, Hoang, and Bouri (2021) still focuses on the US market with a specific interest on the tourism sector. They analyze 95 US tourism companies through tail risk spillover analysis showing that the whole sector was negative affected by the crisis. However, they found an increase in the importance of the small tourism firms. In both cases, the analysis of the pandemic impact is achieved through network models. The main difference with our work lies in the type of data as we consider explicitly public sentiment measured through textual data. Given the huge impact of the pandemic on people daily life and the high levels of uncertainty about the future and the evolution of the pandemic itself, we deem crucial to take directly into account opinions and sentiments.

The impact of the crisis on the Chinese stock market is analyzed by Shahzad, Naeem, Peng, and Bouri (2021) who examined the asymmetric volatility spillover among sectors using a VAR model. They highlight the sectors, such as industries, utilities, energies and materials, to which governments should pay more attention to maintain the stability of the Chinese stock market since they experience high volatility spillovers. From policy-making perspective, Bouri, Cepni, Gabauer, and Gupta (2021) analyzed the changes in the connections of the returns of assets such as gold, crude oil, USD index, bond index, and MSCI World index, during the epidemic. They show how the network is affected by the epidemic, in particular, MSCI World and USD index appear as primary transmitters of shock before the pandemic while the bond index appears primary transmitter during the Covid-19 period. These papers differ from our work in the choice of the modeling approach. The methodology used in the former is a VAR model to calculate the spillover asymmetry measure, while the latter apply a TVP-VAR by modeling the coefficients as a stochastic process. This work, instead applies the BGVAR model in Ahelegbey et al., 2016a, Ahelegbey et al., 2021 to analyze the intra- and inter-layer connectivity between return indexes and sentiments of different industries.

In this paper, we propose a network model to stress the relationship among companies in different sectors, considering the dynamic pre and during Covid-19 pandemic. Our study focuses on the top 50 world companies due to their important role in the entire world economy and also due to the amount of available textual information. We want to assess how much the largest worldwide companies are suffering from the pandemic and whether the relationship between them is changing. To answer these questions we build a network model that considers two sources of information: textual data from news and blog and financial stock prices. We decided to analyze separately the different sectors to stress in which sector the pandemic affects more and how.

3. Methodology

3.1. Network VAR model formulation

Let denote the returns of the stock market indices of institutions at time , and denote the sentiment of the institutions. Let be a vector whose dynamic evolution can be described by a VAR() process:

| (1) |

| (2) |

where is the lag order, is matrix of coefficients with measuring the effect of on , is a vector independent and identically normal residuals with covariance matrix , is a zero diagonal matrix where records the contemporaneous effect of a shock to on , and is a vector of orthogonalized disturbances with covariance matrix . From (2), the can be expressed in terms of and as

| (3) |

A network model is a convenient representation of the relationships among a set of variables. They are defined by nodes joined by a set of links, describing the statistical relationships between a pair of variables. The use of networks in VAR models helps to interpret the temporal and contemporaneous relationships in a multivariate time series. To analyze (1), (2) through networks, we assign to each coefficient in a corresponding latent indicator in , such that for , and :

| (4) |

where means that does not influence at lag . We define two matrices and such that

| (5) |

where is the indicator function, i.e., unity if and zero otherwise, and are sub-matrices of that measure the cumulative effect of and on for , respectively. The sub-matrices of reports the following:

| (6) |

| (7) |

where exist if there is a contemporaneous or lagged directed link from to . Similar reasoning holds for , , and . Thus, specifies adjacency matrix of equity-to-equity connections, for sentiment-to-equity, for equity-to-sentiment, and for sentiment-to-sentiment linkages. specifies the weights of the relationship in obtained as a sum of the estimated contemporaneous and lagged coefficients. The correspondence between and is such that the former captures the short-run dynamics in while the latter can be viewed as long-term direct relationships when . Defining a sparse structure on induces parsimony of the short-run model and sparsity on the long-run relationship matrices .

3.2. Bayesian graphical vector autoregression

The model specification in (1), (2) combines to form the structural VAR model which is well documented to exhibit identifiability problems. To circumvent this problem, we apply the Bayesian graphical vector autoregressive (BGVAR) approach of Ahelegbey et al. (2016a) to separate and estimate the contemporaneous and lagged interactions associated with the VAR. We apply the BGVAR to study the intra- and inter-layer connectivity between return indexes and sentiments of different industries. We build on the collapsed Gibbs algorithm in Ahelegbey et al. (2016a) and Ahelegbey et al. (2021) by sampling the temporal dependence from its marginal distribution and the contemporaneous network from its conditional distribution. We complete the Bayesian formulation with prior specification and posterior approximations to draw inference on the model parameters.

3.2.1. Prior specification

We specify the prior distributions of as follows:

where , and are hyper-parameters. The specification for is a discrete uniform prior on the set . The specification for conditional on follows a normal distribution with zero mean and variance . Thus, relevant explanatory variables that predict a response variable must be associated with coefficients different from zero and the rest (representing not-relevant variables) are restricted to zero. We consider as Bernoulli distributed with as the prior probability. We assume is Wishart distributed with prior expectation and the degrees of freedom parameter.

3.2.2. Posterior approximation

Let be an vector of lagged observations, denote with a matrix collection of all observations, and be an matrix collection of lagged observations. We fixed to allow us select the relevant variables in different equations of the system. Following the Bayesian framework of Geiger and Heckerman (2002), we integrate out the structural parameters analytically to obtain a marginal likelihood function over graphs. Following Ahelegbey and Giudici (2020), we approximate inference of the parameters via a collapsed Gibbs sampler such that the algorithm proceeds as follows:

-

1.Sample via a Metropolis-within-Gibbs by

-

(a)Sampling from the marginal distribution:

-

(b)Sampling from the conditional distribution:

-

(a)

-

2.Sample from by iterating the following steps:

-

(a)Sample where

where corresponds to (), is the th diagonal element of , and is the number of covariates in .(8) -

(b)Sample where

where , is the set of contemporaneous predictors of that corresponds to (), and is the number of covariates in(9) -

(c)Sample where

(10)

-

(a)

See Ahelegbey and Giudici (2020) for a detailed description of the network sampling algorithm and convergence diagnostics.

For our empirical application, we set the hyper-parameters as follows: (which leads to a uniform prior on the graph space), and . We set the number of MCMC iterations to sample 200,000 graphs and we ensured that the convergence and mixing of the MCMC chains are tested via the potential scale reduction factor (PSRF) of Gelman and Rubin (1992).

4. Data

For our analysis, we focus on some of the most important American companies: the top 50 of the S&P. We obtain the daily stock prices of these companies from yahoo finance covering a period that ranges from August 2016 to November 17th, 2020. We also employ a sentiment index referred to the same companies and period produced by Brain1 a research company.

Brain is a research company specialized in the production of alternative datasets and in the development of proprietary algorithms for investment strategies on financial markets. The Brain Sentiment Indicator dataset comprises of a daily sentiment indicator for the largest listed worldwide companies. Such indicator represents a score that ranges between −1 and +1 and is based on financial news and blogs written in English. Each news is pre-analyzed to assign the corresponding company through the use of a dictionary of company names; then news are categorized using syntactic rules or machine learning classifiers. If this step fails a dictionary based approach is used.

The final dataset is composed of 1021 observations and 100 variables (for each company we have two columns: one for the closing market price and one for the sentiment score). The complete list of companies is available in Table 1. Since the companies under analysis belong to different sectors, we have divided them into sub groups according to the S&P’s division that considers 11 sectors: Communication Services, Consumer Discretionary, Consumer Staples, Energy, Financials, Health Care, Industrials, Materials, Real Estate, Technology, Utilities. 3 sectors (namely materials, real estate and utilities) are not represented in our dataset, in addition we decided to unify the two consumer categories thus obtaining 7 final groups.

Table 1.

Detailed description of the top 50 S&P companies.

| No. | Stock | Ticker |

|---|---|---|

| Communication | ||

| 1 | AT & T Inc. | T |

| 2 | Verizon Comm. Inc. | VZ |

| Consumer | ||

| 3 | Amazon.com Inc. | AMZN |

| 4 | Comcast Corp. | CMCSA |

| 5 | Walt Disney Co. | DIS |

| 6 | Home Depot Inc. | HD |

| 7 | McDonald’s Corp. | MCD |

| 8 | Netflix Inc. | NFLX |

| 9 | Costco Wholesale Corp. | COST |

| 10 | Coca-Cola Co. | KO |

| 11 | PepsiCo Inc. | PEP |

| 12 | Procter & Gamble Co. | PG |

| 13 | Philip Morris Int. Inc. | PM |

| 14 | Walmart Inc. | WMT |

| Financial | ||

| 15 | Bank of America Corp | BAC |

| 16 | Berkshire Hathaway Inc. | BRK.B |

| 17 | Citigroup Inc. | C |

| 18 | JPMorgan Chase & Co. | JPM |

| 19 | Wells Fargo & Co. | WFC |

| Industrial | ||

| 20 | Boeing Co. | BA |

| 21 | Honeywell Int. Inc. | HON |

| 22 | Union Pacific Corp. | UNP |

| 23 | Raytheon Technologies | RTX |

| Energy | ||

| 24 | Chevron Corp. | CVX |

| 25 | Exxon Mobil Corp. | XOM |

| Health care | ||

| 26 | AbbVie Inc. | ABBV |

| 27 | Abbott Laboratories | ABT |

| 28 | Amgen Inc. | AMGN |

| 29 | Bristol-Myers Squibb Co. | BMY |

| 30 | Johnson & Johnson | JNJ |

| 31 | Medtronic Plc | MDT |

| 32 | Merck & Co. Inc. | MRK |

| 33 | Pfizer Inc. | PFE |

| 34 | Thermo Fisher Scientific Inc. | TMO |

| 35 | UnitedHealth Group Inc. | UNH |

| Tech | ||

| 36 | Apple Inc. | AAPL |

| 37 | Accenture Plc | ACN |

| 38 | Adobe Inc. | ADBE |

| 39 | Broadcom Inc. | AVGO |

| 40 | Salesforce.com inc. | CRM |

| 41 | Cisco Systems Inc. | CSCO |

| 42 | Facebook Inc. | FB |

| 43 | Alphabet Inc. | GOOGL |

| 44 | Intel Corp. | INTC |

| 45 | Mastercard Inc. | MA |

| 46 | Microsoft Corp. | MSFT |

| 47 | NVIDIA Corp. | NVDA |

| 48 | Oracle Corp. | ORCL |

| 49 | PayPal Holdings Inc. | PYPL |

| 50 | Visa Inc. | V |

Table 2 reports the summary statistics of the first four moments (i.e., mean, standard deviation, skewness and excess kurtosis) of the equity returns and sentiment scores. The statistics show that almost all the equity returns and sentiment scores have a near-zero mean. The equity returns, however, appear more volatile than the sentiment scores. That is, the standard deviation of the equity returns are relatively higher (greater than 1) compared to that of the sentiment scores (less than 1). A greater majority of the returns and sentiments exhibit fairly symmetric behavior, i.e., they are characterized mostly by small but consistent positive outcomes and, occasionally, large negative returns. The excess kurtosis of the sentiment scores are largely less than 3, which indicates that the sentiments data are approximately normal (via skewness–kurtosis summary), while that of the equity returns confirms the stylized facts of leptokurtic behavior of daily return series.

Table 2.

Descriptive statistics for equity returns and sentiment scores.

| Equity returns |

Sentiment scores |

||||||||

|---|---|---|---|---|---|---|---|---|---|

| Mean | Std | Skew | Kurt | Mean | Std | Skew | Kurt | ||

| AAPL | 0.14 | 1.94 | −0.38 | 7.76 | S_AAPL | 0.06 | 0.12 | −0.62 | 1.43 |

| ABBV | 0.06 | 1.87 | −1.12 | 16.06 | S_ABBV | 0.16 | 0.28 | −0.85 | 0.78 |

| ABT | 0.09 | 1.60 | −0.11 | 7.29 | S_ABT | 0.21 | 0.28 | −0.88 | 0.79 |

| ACN | 0.08 | 1.61 | 0.00 | 9.24 | S_ACN | 0.27 | 0.26 | −0.71 | 1.11 |

| ADBE | 0.14 | 2.08 | −0.01 | 10.02 | S_ADBE | 0.18 | 0.27 | −0.74 | 0.72 |

| AMGN | 0.04 | 1.67 | 0.13 | 6.62 | S_AMGN | 0.18 | 0.26 | −0.48 | 0.34 |

| AMZN | 0.13 | 1.90 | 0.09 | 4.31 | S_AMZN | 0.14 | 0.27 | −0.61 | 0.53 |

| AVGO | 0.09 | 2.29 | −1.33 | 15.83 | S_AVGO | 0.14 | 0.29 | −0.45 | −0.04 |

| BA | 0.05 | 3.01 | −0.61 | 19.53 | S_BA | 0.03 | 0.21 | 0.03 | −0.28 |

| BAC | 0.06 | 2.19 | −0.12 | 13.08 | S_BAC | 0.10 | 0.20 | −0.32 | 0.48 |

| BMY | 0.02 | 1.67 | −1.51 | 11.08 | S_BMY | 0.17 | 0.29 | −0.77 | 0.30 |

| BRK.B | 0.04 | 1.40 | −0.41 | 13.60 | S_BRK.B | 0.13 | 0.30 | −0.51 | −0.39 |

| C | 0.02 | 2.38 | −0.81 | 16.76 | S_C | 0.08 | 0.27 | −0.55 | 0.35 |

| CMCSA | 0.04 | 1.67 | −0.11 | 6.16 | S_CMCSA | 0.14 | 0.26 | −0.54 | 0.32 |

| COST | 0.09 | 1.37 | −0.17 | 8.80 | S_COST | 0.13 | 0.28 | −0.48 | 0.09 |

| CRM | 0.11 | 2.15 | 0.50 | 17.83 | S_CRM | 0.15 | 0.31 | −0.76 | 0.61 |

| CSCO | 0.04 | 1.77 | −0.57 | 10.44 | S_CSCO | 0.19 | 0.23 | −0.74 | 0.95 |

| CVX | 0.00 | 2.13 | −1.44 | 35.74 | S_CVX | 0.07 | 0.29 | −0.49 | −0.09 |

| DIS | 0.04 | 1.76 | 0.24 | 14.49 | S_DIS | 0.09 | 0.21 | −0.40 | 1.05 |

| FB | 0.07 | 2.11 | −1.20 | 14.38 | S_FB | −0.07 | 0.16 | 0.16 | −0.23 |

| GOOGL | 0.07 | 1.71 | −0.43 | 6.85 | S_GOOGL | 0.04 | 0.15 | −0.18 | 0.51 |

| HD | 0.07 | 1.70 | −2.15 | 34.62 | S_HD | 0.16 | 0.25 | −0.60 | 0.66 |

| HON | 0.07 | 1.64 | −0.27 | 14.71 | S_HON | 0.20 | 0.27 | −0.74 | 0.87 |

| INTC | 0.04 | 2.18 | −0.85 | 18.17 | S_INTC | 0.11 | 0.19 | −0.29 | 0.00 |

| JNJ | 0.03 | 1.31 | −0.68 | 11.50 | S_JNJ | 0.13 | 0.28 | −0.62 | 0.32 |

| JPM | 0.06 | 1.95 | −0.12 | 16.96 | S_JPM | 0.08 | 0.24 | −0.43 | 0.80 |

| KO | 0.03 | 1.31 | −1.03 | 11.96 | S_KO | 0.13 | 0.25 | −0.48 | 0.29 |

| MA | 0.12 | 1.89 | 0.03 | 11.77 | S_MA | 0.20 | 0.24 | −0.87 | 1.21 |

| MCD | 0.07 | 1.51 | −0.29 | 35.34 | S_MCD | 0.03 | 0.27 | 0.05 | −0.10 |

| MDT | 0.03 | 1.60 | −0.54 | 12.25 | S_MDT | 0.20 | 0.28 | −0.39 | 0.08 |

| MRK | 0.04 | 1.41 | −0.20 | 6.33 | S_MRK | 0.21 | 0.24 | −0.65 | 0.61 |

| MSFT | 0.13 | 1.78 | −0.36 | 12.06 | S_MSFT | 0.15 | 0.15 | −0.56 | 2.27 |

| NFLX | 0.15 | 2.49 | 0.24 | 4.76 | S_NFLX | 0.09 | 0.18 | −0.38 | 0.62 |

| NVDA | 0.21 | 3.10 | −0.14 | 10.20 | S_NVDA | 0.16 | 0.21 | −0.66 | 0.87 |

| ORCL | 0.04 | 1.68 | 0.49 | 23.15 | S_ORCL | 0.16 | 0.26 | −0.86 | 1.08 |

| PEP | 0.04 | 1.37 | −0.65 | 25.77 | S_PEP | 0.14 | 0.28 | −0.56 | 0.19 |

| PFE | 0.02 | 1.43 | −0.19 | 7.41 | S_PFE | 0.16 | 0.24 | −0.63 | 0.75 |

| PG | 0.06 | 1.32 | 0.23 | 14.34 | S_PG | 0.14 | 0.31 | −0.54 | 0.03 |

| PM | 0.00 | 1.74 | −1.76 | 17.71 | S_PM | 0.07 | 0.32 | −0.52 | −0.30 |

| PYPL | 0.15 | 2.18 | 0.01 | 8.84 | S_PYPL | 0.15 | 0.27 | −0.69 | 0.52 |

| RTX | 0.01 | 2.03 | −0.38 | 14.71 | S_RTX | 0.14 | 0.30 | −0.54 | 0.02 |

| T | −0.01 | 1.53 | −0.64 | 8.04 | S_T | 0.10 | 0.21 | −0.24 | 0.09 |

| TMO | 0.11 | 1.61 | −0.26 | 5.14 | S_TMO | 0.21 | 0.28 | −0.91 | 1.13 |

| UNH | 0.09 | 1.89 | −0.56 | 16.71 | S_UNH | 0.17 | 0.28 | −0.55 | 0.30 |

| UNP | 0.08 | 1.80 | −0.64 | 11.80 | S_UNP | 0.11 | 0.31 | −0.40 | −0.41 |

| V | 0.09 | 1.68 | −0.22 | 13.19 | S_V | 0.15 | 0.27 | −0.77 | 1.08 |

| VZ | 0.03 | 1.23 | 0.16 | 5.42 | S_VZ | 0.14 | 0.23 | −0.48 | 0.52 |

| WFC | −0.05 | 2.17 | −0.49 | 12.61 | S_WFC | −0.01 | 0.24 | −0.02 | 0.40 |

| WMT | 0.08 | 1.41 | 0.70 | 15.61 | S_WMT | 0.08 | 0.23 | −0.48 | 0.73 |

| XOM | −0.06 | 1.83 | −0.24 | 11.34 | S_XOM | 0.04 | 0.25 | −0.15 | −0.06 |

5. Results

We apply the BGVAR estimation methodology to study the dynamics of interconnectedness among the top 50 of S&P companies and the sub-sectors via a two-and-half year (approximately 504 days) rolling window. Our choice of window size is motivated by the need to have enough data points to capture 24-months dynamic dependence among the companies. We set the increments between successive rolling windows to one month. The first window covers August 2016–July 2018, followed by September 2016–August 2018, and the last from December 2018–November 2020. In total, we have 29 rolling windows.

To unify the dataset, we compute the daily returns as the log difference of successive daily adjusted close prices of the companies equities. Since stock prices are not recorded for weekends, we consider the weekend sentiment scores in the computation of the Monday sentiment via a simple mean of the three days. In this way, both and express time variations: in the equity price and in the sentiment scores, respectively, for each company.

We study the equity-sentiment interconnectedness of the top 50 of S&P companies by considering them jointly as well as sub-sectors separately. Following the sector division of the companies in Table 1, we created five categories, namely: Consumer, Financial, Health Care, Tech and Miscellaneous and analyzed the interconnectedness for each sub-sector. Due to the low number of companies in the communication, energy and industrial sector, we combined them to create a unique sub-sector, which we refer to as “Miscellaneous”.

We compare the sub-period networks, the pre-COVID-19 phase and the COVID-19 (Wave-1 and Wave-2) phase in terms of the number of links, the network density, the average degree, the clustering coefficient, and the average path length. We characterize, through numerical summaries, the time-varying nature of interconnections by monitoring the network density, average degree, clustering coefficient and average path length. In Fig. 1, we report the evolution of the density of equity-sentiment interconnectedness along the analyzed period. Two curves are compared, different in terms of employed lags, 1 vs 5. It clearly emerges the presence of two separated periods as of starting from late June 2020. The density increases by a factor of 6.5–8 points. As the pandemic enters in the most hitting phase, all the connections increase greatly, meaning that the exogenous shock affects the entire system as a whole, increasing the vulnerability as well. Indeed, a more interconnected system amplifies more and more any impact through a contagion spreading mechanism (see Cerchiello & Giudici, 2016b).

Fig. 1.

Density of equity-sentiment interconnectedness among top 50 S&P companies.

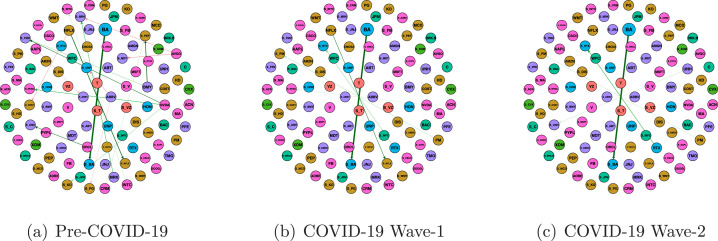

If we focus on the three periods of the data at hand (pre-pandemic, first wave, second wave), we can visualize the networks in Fig. 2 and the metrics in Table 3. If the difference between the pre-covid and the first wave is not so evident, we notice a change in the values of the number of links, the density, average degree and average path length during the second wave. This suggest that, although the system appears resilient as the first wave arrives, with the prolongation of the pandemic, companies cannot stand any longer the shock.

Fig. 2.

Sub-period network before and during COVID-19 period.

Table 3.

The network statistics for sub-period interconnectedness before and during COVID-19 period.

| Period | Links | Density | Average degree | Clustering coefficient | Average path length |

|---|---|---|---|---|---|

| Pre-COVID-19 | 2437 | 24.616 | 24.37 | 0.964 | 1.451 |

| COVID-19 wave-1 | 2401 | 24.253 | 24.01 | 0.994 | 1.131 |

| COVID-19 wave-2 | 2335 | 23.586 | 23.35 | 0.991 | 1.139 |

5.1. Equity-to-equity networks

To further analyze the Covid-19 pandemic effects on the system, we split the analysis in the two components: equity data on one hand and sentiment data on the other. In particular we investigate what happens to the Equity to Equity connections, that is focusing only on the intra-equities layer linkages.

As far as we are concerned with the equity market, Fig. 3 and Table 4 report the results. In particular, Table 4 discloses the pattern of the network along the three periods: similarly to previous results the financial market reacts more during the second wave. As we would have expected, there is a huge number of links which remains rather stable, confirming once again the deep interconnection of the financial market.

Fig. 3.

Equity-to-Equity sub-period network before and during COVID-19 period.

Table 4.

Statistics for sub-period Equity-to-Equity interconnectedness before and during COVID-19 period.

| Period | Links | Density | Average degree | Clustering coefficient | Average path length |

|---|---|---|---|---|---|

| Pre-COVID-19 | 2392 | 97.633 | 47.84 | 0.997 | 1.024 |

| COVID-19 wave-1 | 2395 | 97.755 | 47.90 | 0.999 | 1.022 |

| COVID-19 wave-2 | 2330 | 95.102 | 46.60 | 0.995 | 1.049 |

In Fig. 4 and Table 5 we report another set of results looking at the effect of equity markets on sentiments, that is capturing sentiment reactions to changes in financial market performance. In this case, the analysis considers a different perspective: the explored links are directed from equity market data to sentiment indicator. From a computational point of view the number of possible links is lower, as only one specific direction is explored.

Fig. 4.

Equity-to-Sentiments sub-period network before and during COVID-19 period.

Table 5.

Statistics for sub-period Equity-to-Sentiment network before and during COVID-19 period.

| Period | Links | Density | Average degree |

|---|---|---|---|

| Pre-COVID-19 | 17 | 0.68 | 0.34 |

| COVID-19 wave-1 | 5 | 0.20 | 0.10 |

| COVID-19 wave-2 | 4 | 0.16 | 0.08 |

The reader can immediately notice a number of relevant facts: the total number of links is much less. That is to say that the financial market has a lower impact on sentiments and this is consistent along the whole time horizon. However, there is a clear difference in the three periods: the pre-covid period recorded three times higher sentiment reactions to changes in financial market indexes than in the Covid-19 periods. We could say that the influence from the financial world to the public perception one has been frozen by the virus, lowering down largely the influence channel. Such apparently weird result can be explained by considering the type of shock affecting the system. The pandemic has a completely different nature, it is an exogenous diffused and pervasive shock which cannot be assimilated to other system perturbations like the financial ones. Modern populations and economies are not prepared or used to cope with so impacting restrictions and limitations of daily life. Results in Fig. 4 and Table 5 and similarly in Fig. 5 and Table 6 seem to suggest that the companies reacted by lowering down the interrelations, that is to say that the system was frozen and in attendance of the events. Companies became isolated entities waiting for a clearer evolution of the virus spread, blocking investments and activities planning and this is reflected in basically no correlations in either directions (equity to sentiment or sentiment to equity).

Fig. 5.

Sentiment-to-Equity sub-period network before and during COVID-19 period.

Table 6.

Statistics for sub-period Sentiment-to-Equity network before and during COVID-19 period.

| Period | Links | Density | Average degree |

|---|---|---|---|

| Pre-COVID-19 | 28 | 1.12 | 0.56 |

| COVID-19 wave-1 | 1 | 0.04 | 0.02 |

| COVID-19 wave-2 | 1 | 0.04 | 0.02 |

Such phenomenon is even more evident if we consider the opposite direction of transmission: from sentiment to equity. Fig. 5 and Table 6 contain relative results and confirm the important dampening effect of the pandemic. Just one connection survives during the first and the second wave. In the first wave, the only surviving linkage is , and survived in the second wave. The reaction of Netflix and Adobe to sentiments associated with Philip Morris Int. - a tobacco company, are the only surviving linkages during the Covid pandemic.

However, it is important to stress that such first analysis was run on the whole dataset, with no distinction made on the business sectors and looking at only one influence direction at the time (either equity to sentiment or sentiment to equity). That is to say that possible peculiar behaviors can occur sector by sector as we are going to discuss in the following.

Given the heterogeneity of the activities of the 50 companies at hand, it is relevant to deepen the analysis with regards to each specific sub-sector. Starting from the Financial sector, we notice from Fig. 6 and Table 7 that all the indexes remains exactly the same.

Fig. 6.

Sub-period Financial sub-sector network before and during COVID-19 period.

Table 7.

Statistics for sub-period Financial sub-sector network before and during COVID-19 period.

| Period | Links | Density | Average degree | Clustering coefficient | Average path length |

|---|---|---|---|---|---|

| Pre-COVID-19 | 20 | 22.222 | 2 | 1 | 1 |

| COVID-19 wave-1 | 20 | 22.222 | 2 | 1 | 1 |

| COVID-19 wave-2 | 20 | 22.222 | 2 | 1 | 1 |

Our analysis reveals that the linkage among the financial institutions revolve around their equity market performance with no effect from sentiments. Thus, the change in the networks structure that we have noticed in the previous tables, is not driven by the financial companies. We, however, notice that although the connections remain unchanged during the pre-covid and covid periods, the sign and magnitude of the interactions seems to change over the sub-periods. More specifically, Citigroup (C) and Berkshire Hathaway (BRK.B) seem to exhibit bi-directional relationship through out all periods. However, the pre-covid reported an almost equally positive link. The first and second wave of the Covid, however, recorded a positive impact of C on BRK.B, and a negative reverse impact of BRK.B on C. A look at the centrality of the network in terms of Hub and Authority scores (in Table 8) shows that of the 5 companies, Citigroup was central to risk transmission during the pre-covid period, while JPM dominate in the Covid period.

Table 8.

Hub and Authority Centrality of Financial sector network before and during COVID-19 period.

| Pre-COVID-19 | COVID-19 wave-1 | COVID-19 wave-2 | ||||

|---|---|---|---|---|---|---|

| Top 5 Hub-Centrality Score | ||||||

| 1 | C | (0.579) | JPM | (0.684) | JPM | (0.758) |

| 2 | JPM | (0.500) | WFC | (0.496) | BAC | (0.413) |

| 3 | BAC | (0.484) | BAC | (0.423) | C | (0.339) |

| 4 | WFC | (0.343) | BRK.B | (0.275) | BRK.B | (0.297) |

| 5 | BRK.B | (0.250) | C | (0.180) | WFC | (0.228) |

| Top 5 Authority-Centrality Score | ||||||

| 1 | BAC | (0.572) | C | (0.656) | C | (0.712) |

| 2 | JPM | (0.480) | BAC | (0.441) | WFC | (0.550) |

| 3 | WFC | (0.438) | WFC | (0.435) | BAC | (0.354) |

| 4 | C | (0.407) | JPM | (0.388) | JPM | (0.233) |

| 5 | BRK.B | (0.292) | BRK.B | (0.187) | BRK.B | (0.110) |

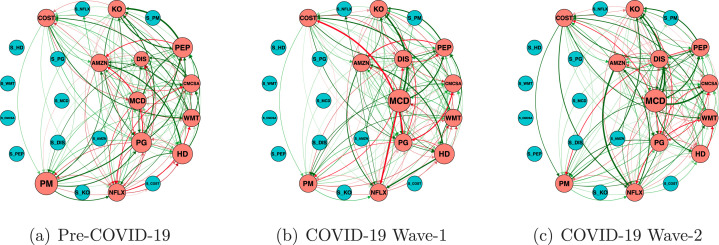

In analyzing the Consumer sub-sector, Fig. 7 shows the resulting network structure over the three sub-periods. Unlike, the Financial sub-sector, the Consumer sub-sector network record links are at all levels: equity-equity, equity-sentiment, sentiment-equity. For instance, the sentiment associated with Netflix (S_NFLX) react strongly positive to the equity performance of Netflix (NFLX) during the pre-covid, which reduced slightly in the first wave of the Covid but varnished in the second wave. We also observe a reaction from Netflix (NFLX) to the sentiment associated with Philip Morris Int. (S_PM).

Fig. 7.

Sub-period Consumer sub-sector network before and during COVID-19 period.

From Table 9, we notice a slight variation in the metrics of the second wave Consumer sub-sector network. In particular the clustering coefficient increases and the average path length decreases. Table 10 confirms the different behavior of the consumer sub-sector: the hub companies during the pandemic change and increase in coefficient magnitude. The consumer system appears less resilient in comparison to the financial one. McDonalds, which is not in the top 5 hubs before the pandemics, not only appears all of a sudden, but it is also first ranked. Also Comcast Corp. and Amazon enter the ranking.

Table 9.

Statistics for sub-period Consumer sub-sector network before and during COVID-19 period.

| Period | Links | Density | Average degree | Clustering coefficient | Average path length |

|---|---|---|---|---|---|

| Pre-COVID-19 | 132 | 23.913 | 5.500 | 0.950 | 1.219 |

| COVID-19 wave-1 | 132 | 23.913 | 5.500 | 0.954 | 1.231 |

| COVID-19 wave-2 | 129 | 23.370 | 5.375 | 0.984 | 1.104 |

Table 10.

Hub and Authority Centrality of Consumer sector network before and during COVID-19 period.

| Pre-COVID-19 | COVID-19 wave-1 | COVID-19 wave-2 | ||||

|---|---|---|---|---|---|---|

| Top 5 Hub-Centrality Score | ||||||

| 1 | PM | (0.489) | MCD | (0.578) | MCD | (0.618) |

| 2 | PG | (0.421) | HD | (0.395) | PM | (0.293) |

| 3 | PEP | (0.343) | PG | (0.339) | PEP | (0.278) |

| 4 | HD | (0.304) | CMCSA | (0.266) | PG | (0.276) |

| 5 | KO | (0.279) | PEP | (0.264) | AMZN | (0.263) |

| Top 5 Authority-Centrality Score | ||||||

| 1 | PEP | (0.400) | NFLX | (0.436) | KO | (0.454) |

| 2 | AMZN | (0.384) | KO | (0.385) | CMCSA | (0.353) |

| 3 | NFLX | (0.362) | AMZN | (0.338) | PEP | (0.345) |

| 4 | PG | (0.349) | PM | (0.289) | DIS | (0.326) |

| 5 | KO | (0.340) | CMCSA | (0.288) | NFLX | (0.310) |

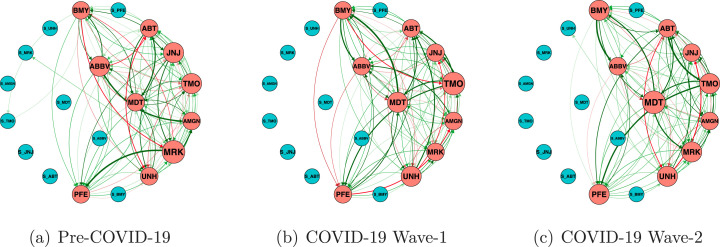

The Health-Care sub-sector network, represented in Fig. 8 and Table 11, presents a pattern rather unstable. The indexes change without a common pattern, albeit showing an apparent drop in the magnitude during wave 1 and increasing again in wave 2.

Fig. 8.

Sub-period Health-Care sub-sector network before and during COVID-19 period.

Table 11.

Statistics for sub-period Health-Care sub-sector network before and during COVID-19 period.

| Period | Links | Density | Average degree | Clustering coefficient | Average path length |

|---|---|---|---|---|---|

| Pre-COVID-19 | 93 | 24.474 | 4.65 | 0.952 | 1.24 |

| COVID-19 wave-1 | 90 | 23.684 | 4.50 | 1.000 | 1.00 |

| COVID-19 wave-2 | 88 | 23.158 | 4.40 | 0.976 | 1.12 |

Similarly to consumer sub-sector, the links in Fig. 8 are mixed and both the hub and the authority indexes in Table 12 tend to change, not only the rankings, but also the relevant companies. This suggest that the pandemic has deeply affected the health care sub-sector, as it is plausible to expect.

Table 12.

Hub and Authority scores of health-care sector network before and during COVID-19 period.

| Pre-COVID-19 | COVID-19 wave-1 | COVID-19 wave-2 | ||||

|---|---|---|---|---|---|---|

| Top 5 Hub-Centrality Score | ||||||

| 1 | MRK | (0.495) | TMO | (0.545) | MDT | (0.455) |

| 2 | ABBV | (0.407) | MDT | (0.459) | TMO | (0.399) |

| 3 | JNJ | (0.394) | UNH | (0.396) | PFE | (0.334) |

| 4 | TMO | (0.361) | MRK | (0.266) | MRK | (0.327) |

| 5 | UNH | (0.273) | BMY | (0.262) | UNH | (0.302) |

| Top 5 Authority-Centrality Score | ||||||

| 1 | AMGN | (0.465) | ABT | (0.403) | ABT | (0.378) |

| 2 | PFE | (0.437) | BMY | (0.392) | BMY | (0.369) |

| 3 | BMY | (0.356) | JNJ | (0.367) | JNJ | (0.344) |

| 4 | MDT | (0.349) | PFE | (0.343) | MDT | (0.333) |

| 5 | MRK | (0.276) | ABBV | (0.325) | PFE | (0.333) |

Fig. 9 and Table 13 reports the network structure and its summary statistics for the Tech sector over the three sub-periods. What immediately emerges is the presence of much more connected networks regardless the period. The indexes are coherent and decrease as the periods pass by.

Fig. 9.

Sub-period Tech sub-sector network before and during COVID-19 period.

Table 13.

Statistics for sub-period Tech sub-sector network before and during COVID-19 period.

| Period | Links | Density | Average degree | Clustering coefficient | Average path length |

|---|---|---|---|---|---|

| Pre-COVID-19 | 212 | 24.368 | 7.067 | 0.98 | 1.117 |

| COVID-19 wave-1 | 207 | 23.793 | 6.900 | 0.99 | 1.080 |

| COVID-19 wave-2 | 204 | 23.448 | 6.800 | 1.00 | 1.029 |

Table 14 confirms the change in the network structure: in particular two new players in the pandemic, namely Apple Inc. and Adobe Inc. for the hub score and Broadcom Inc. and Alphabet Inc. (Google) for the authority score.

Table 14.

Hub and Authority Centrality of Tech sector network before and during COVID-19 period.

| Pre-COVID-19 | COVID-19 wave-1 | COVID-19 wave-2 | ||||

|---|---|---|---|---|---|---|

| Top 5 Hub-Centrality Score | ||||||

| 1 | CRM | (0.458) | AAPL | (0.542) | CRM | (0.511) |

| 2 | NVDA | (0.453) | NVDA | (0.541) | NVDA | (0.390) |

| 3 | ORCL | (0.371) | CRM | (0.318) | ADBE | (0.290) |

| 4 | INTC | (0.280) | MSFT | (0.236) | MSFT | (0.289) |

| 5 | MSFT | (0.265) | INTC | (0.181) | AAPL | (0.282) |

| Top 5 Authority-Centrality Score | ||||||

| 1 | PYPL | (0.387) | PYPL | (0.357) | AAPL | (0.311) |

| 2 | ADBE | (0.325) | MA | (0.346) | PYPL | (0.302) |

| 3 | MA | (0.305) | CSCO | (0.344) | V | (0.295) |

| 4 | V | (0.295) | V | (0.329) | MA | (0.277) |

| 5 | AAPL | (0.288) | AVGO | (0.318) | GOOGL | (0.275) |

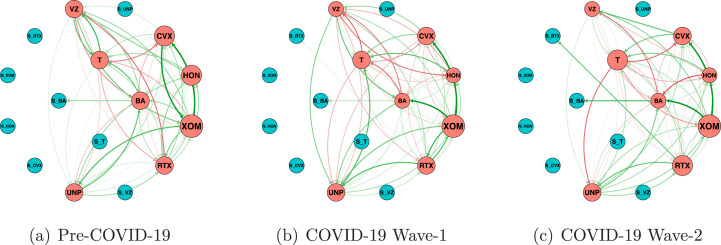

The result of the miscellaneous sector which comprises Industrial, Communication and Energy companies are reported in Fig. 10, Table 15, Table 16. We observe that similar to the Financial sub-sector, network among the group of companies in the miscellaneous sector is centered around the equity market performance, except for a links depicting the reaction of S_BAC (the sentiment associated with Bank of America) to the equity market performance of BAC (Bank of America).

Fig. 10.

Sub-period network of Miscellaneous sub-sector before and during COVID-19 period.

Table 15.

Statistics for sub-period Miscellaneous sub-sector network before and during COVID-19 period.

| Period | Links | Density | Average degree | Clustering coefficient | Average path length |

|---|---|---|---|---|---|

| Pre-COVID-19 | 56 | 23.333 | 3.500 | 0.960 | 1.125 |

| COVID-19 wave-1 | 58 | 24.167 | 3.625 | 0.923 | 1.194 |

| COVID-19 wave-2 | 56 | 23.333 | 3.500 | 0.923 | 1.222 |

Table 16.

Centrality of Miscellaneous sectors network before and during COVID-19 period.

| Pre-COVID-19 | COVID-19 wave-1 | COVID-19 wave-2 | ||||

|---|---|---|---|---|---|---|

| Top 5 Hub-Centrality Score | ||||||

| 1 | XOM | (0.567) | XOM | (0.782) | XOM | (0.680) |

| 2 | HON | (0.377) | RTX | (0.419) | T | (0.471) |

| 3 | CVX | (0.36) | T | (0.284) | RTX | (0.394) |

| 4 | UNP | (0.354) | CVX | (0.235) | UNP | (0.289) |

| 5 | T | (0.294) | UNP | (0.194) | CVX | (0.203) |

| Top 5 Authority-Centrality Score | ||||||

| 1 | CVX | (0.578) | CVX | (0.510) | CVX | (0.555) |

| 2 | XOM | (0.382) | UNP | (0.425) | BA | (0.459) |

| 3 | BA | (0.334) | BA | (0.422) | UNP | (0.404) |

| 4 | VZ | (0.325) | RTX | (0.359) | VZ | (0.324) |

| 5 | UNP | (0.321) | HON | (0.340) | HON | (0.283) |

The centrality ranking of the companies in this sub-sector shows that despite some slight changes in the top 5 companies, XOM (Exxon Mobile) and CVX (Chevron Corp.) remain the most central in terms of shock transmission and receiving risk, respectively, over the three sub-periods.

All the previous analysis can have important implications both for institutions and policy makers. It is well know in the literature (Cerchiello and Giudici, 2016b, Cerchiello et al., 2017, Nicola, Cerchiello et al., 2020) that the interconnections among actors belonging to an economic system play a crucial role during turbulence and crisis phases. A strongly interconnected network of companies can be considered either more resilient or vulnerable to shocks according to such events nature. In periods of financial crisis, arising from both real economy or financial markets, a high degree of interconnections can exert an extremely impacting systemic risk, which can cause a collapse of the whole sector given the strong dependencies among the actors. On the contrary, exogenous diffused shocks, not originally related to financial causes like the pandemic ones, can be much more impacting on poorly interconnected systems in which isolated companies can likely experience lack of aid from economic and sector peers increasing their probability of failure. Nevertheless, crisis not induced by real economy or equity markets can trigger very quickly consequent financial crisis, making even more difficult the evaluation of the optimal interconnections degree of a sector. That said, it is evident the reason why the monitoring and assessment of the levels of interconnection of the economic sectors should represent one of the main concern for regulators and supervisors. In case of downturns, it is important to quantify and monitor the level of vulnerability of the systems. To the same aim, the clear identification of pivotal actors (measured through hubs and authorities scores) can help in avoiding the activation of domino effects by supplying financial aids or cutting down connections. Moreover, the breakdown of the analysis in waves, is not only interesting from a descriptive point of view but it can represent a useful monitoring tool for non economically driven crisis like the pandemics. As the virus spreading moves on, the crisis becomes progressively and rapidly double-edged: epidemic and economic. Lastly, by directly leveraging also on the public sentiment, we account for the moods and perceptions of populations rather than only for speculators and investors. Such implementation allows for a more comprehensive and holistic view of the economic status, putting policy makers in an informed and aware framework.

6. Conclusions

The Covid-19 pandemic has deeply affected the population and all the relative activities. Health impact, social restrictions, economic downturn, overall instability are all direct consequences of the spread of the virus. Researchers worldwide have focused on studying, measuring and assessing such consequences at the different levels. In this paper we cope with the analysis of the economic impact of the pandemic, looking at the US top 50 companies of S&P market. In particular we employ advanced network models able to leverage the temporal-dynamic dimension of the phenomenon through a novel specification of a Bayesian graphical vector autoregressive (BGVAR) approach. Moreover, we do not only rely on market data but emphasize the population perception and opinions by adding to the analysis a sentiment index built upon blogs and regular news. The analysis has revealed several interesting findings. First of all, the American top 50 companies market appears rather resilient as the first wave arrives but it is not able to stand the second one. The shock hits the whole system, increasing the interconnections and consequently the associated system risk. However the sub-sectors, which the 50 companies belong to, show different reactions, fully dependent on the involved type of business. The Financial sector shows a particular resilience since all the indexes remains exactly the same. The linkage among the financial institutions revolve around their equity market performance with no effect from sentiments. Differently from the financial sector, the consumer one witnesses the strong interconnection between the equity and the sentiment components. Moreover, we notice clear signs of reactions as the pandemic moves on. The Health-Care sector is, as we would expect, affected by the instability induced by the pandemic. There is no a clear common pattern in the evolution of the networks, but it definitely reacts to the turbulence especially if we look at the most important hubs and authorities. Regarding the big Tech we obtain much more connected networks regardless the period. It is interesting to notice two new central players in the pandemic, namely Apple Inc. and Adobe Inc. for the hub score and Broadcom Inc. and Google for the authority score. Moreover, We contribute to the ongoing discussions on the spillover effects of news and investors sentiment on equity returns in financial markets and interconnectedness among sectors. Some of our findings are as follows: from the equity-sentiment nexus there is evidence of more equity-to-sentiment pre-Covid than during the Covid-19 pandemic outbreak. There is more sentiment-to-equity pre-Covid-19 than during the Covid-19 pandemic outbreak, before Covid-19, more sentiment-to-equity influence than equity-to-sentiment. Finally, during the Covid-19 pandemic, more equity-to-sentiment than sentiment-to-equity influence. For what concerns the sectoral interconnectedness, we found that there is no significant difference in total interconnectedness among Financial, Consumer and Miscellaneous sub-sectors. A drop in interconnectedness among Health and Tech sub-sectors, but with a much closely connected community and faster rate of shock propagation in COVID-19 Wave-1 and Wave-2, respectively.

Further improvement of this study would consider up to date data, as the pandemic keeps on hitting the whole system. Indeed, the recent start of the vaccination campaign would be a further variable of interest that for sure would impact, not only the virus diffusion, but also the renovate confidence of the economic sectors and the population sentiment. Moreover, an analogous study with comparative purposes would be extremely useful on top 50 European companies.

CRediT authorship contribution statement

Daniel Felix Ahelegbey: Methodology, Software, Visualization. Paola Cerchiello: Conceptualization, Supervision, Writing – review & editing. Roberta Scaramozzino: Data curation, Investigation, Writing – original draft.

Acknowledgements

This research has received funding from the European Union’s Horizon 2020 research and innovation program “PERISCOPE: Pan European Response to the ImpactS of COvid-19 and future Pandemics and Epidemics”, under the Grant Agreement No. 101016233, H2020-SC1-PHE-CORONAVIRUS-2020-2-RTD.

Footnotes

References

- Acemoglu D., Ozdaglar A., Tahbaz-Salehi A. Systemic risk and stability in financial networks. American Economic Review. 2015;105(2):564–608. [Google Scholar]

- Ahelegbey D.F., Billio M., Casarin R. Bayesian graphical models for structural vector autoregressive processes. Journal of Applied Econometrics. 2016;31(2):357–386. [Google Scholar]

- Ahelegbey D.F., Billio M., Casarin R. Sparse graphical vector autoregression: A Bayesian approach. Annals of Economics and Statistics. 2016;123/124:333–361. [Google Scholar]

- Ahelegbey D.F., Giudici P. 2020. NetVIX - A network volatility index of financial markets. SSRN 3693806 (Accessed 7 November 2020) [Google Scholar]

- Ahelegbey D.F., Giudici P., Hashem S.Q. Network VAR models to measure financial contagion. The North American Journal of Economics and Finance. 2021;55 [Google Scholar]

- Ahmed S., Hoek J., Kamin S.B., Smith B., Yoldas E., et al. Board of Governors of the Federal Reserve System (US); 2020. The Impact of COVID-19 on Emerging Markets Economies’ Financial Conditions. [Google Scholar]

- Algaba A., Ardia D., Bluteau K., Borms S., Boudt K. Econometrics meets sentiment: An overview of methodology and applications. Journal of Economic Surveys. 2020 [Google Scholar]

- Aste T. Cryptocurrency market structure: Connecting emotions and economics. Digital Finance. 2019;1(1–4):5–21. [Google Scholar]

- Baker S.R., Bloom N., Davis S.J., Kost K.J., Sammon M.C., Viratyosin T. National Bureau of Economic Research; 2020. The unprecedented stock market impact of COVID-19. [Google Scholar]

- Battiston S., Gatti D.D., Gallegati M., Greenwald B., Stiglitz J.E. Liaisons dangereuses: Increasing connectivity, risk sharing, and systemic risk. Journal of Economic Dynamics and Control. 2012;36(8):1121–1141. [Google Scholar]

- Billio M., Getmansky M., Lo A.W., Pelizzon L. Econometric measures of connectedness and systemic risk in the finance and insurance sectors. Journal of Financial Economics. 2012;104(3):535–559. [Google Scholar]

- Boccaletti S., Latora V., Moreno Y., Chavez M., Hwang D.-U. Complex networks: Structure and dynamics. Physics Reports. 2006;424(4–5):175–308. [Google Scholar]

- Bollen J., Mao H., Zeng X. Twitter mood predicts the stock market. Journal of Computer Science. 2011;2(1):1–8. [Google Scholar]

- Bordino I., Battiston S., Caldarelli G., Cristelli M., Ukkonen A., Weber I. Web search queries can predict stock market volumes. PLoS One. 2012;7(7) doi: 10.1371/journal.pone.0040014. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bouri E., Cepni O., Gabauer D., Gupta R. Return connectedness across asset classes around the COVID-19 outbreak. International Review of Financial Analysis. 2021;73 [Google Scholar]

- Bouri E., Gupta R., Hosseini S., Lau C.K.M. Does global fear predict fear in BRICS stock markets? Evidence from a Bayesian graphical structural VAR model. Emerging Markets Review. 2018;34:124–142. [Google Scholar]

- Cerchiello P., Giudici P. Non parametric statistical models for on-line text classification. Adv Data Anal Classif. 2012;6:277–288. doi: 10.1007/s11634-012-0122-2. [DOI] [Google Scholar]

- Cerchiello P., Giudici P. Big data analysis for financial risk management. Journal of Big Data. 2016;3(1):18. [Google Scholar]

- Cerchiello P., Giudici P. Conditional graphical models for systemic risk estimation. Expert Systems with Applications. 2016;43:165–174. [Google Scholar]

- Cerchiello P., Giudici P. How to measure the quality of financial tweets. Quality & Quantity. 2016;50(4):1695–1713. [Google Scholar]

- Cerchiello P., Giudici P., Nicola G. Twitter data models for bank risk contagion. Neurocomputing. 2017;264:50–56. doi: 10.1016/j.neucom.2016.10.101. [DOI] [Google Scholar]

- Chen C., Liu L., Zhao N. Fear sentiment, uncertainty, and bitcoin price dynamics: The case of COVID-19. Emerging Markets Finance and Trade. 2020;56(10):2298–2309. [Google Scholar]

- Choi H., Varian H. Predicting the present with Google trends. Economic Record. 2012;88(s1):2–9. [Google Scholar]

- Colladon A.F., Grassi S., Ravazzolo F., Violante F. 2020. Forecasting financial markets with semantic network analysis in the COVID-19 crisis. arXiv preprint arXiv:2009.04975. [Google Scholar]

- Costola, M., Nofer, M., Hinz, O., & Pelizzon, L. (2020). Machine learning sentiment analysis, Covid-19 news and stock market reactions. SAFE, Working Paper. [DOI] [PMC free article] [PubMed]

- Derouiche K., Frunza M. 2020. How did COVID-19 shaped the tweets sentiment impact upon stock prices of sport companies? Available at SSRN 3649726. [Google Scholar]

- Diebold F., Yilmaz K. On the network topology of variance decompositions: Measuring the connectedness of financial firms. Journal of Econometrics. 2014;182(1):119–134. [Google Scholar]

- Eisenberg L., Noe T.H. Systemic risk in financial systems. Management Science. 2001;47(2):236–249. [Google Scholar]

- Elliott M., Golub B., Jackson M.O. Financial networks and contagion. American Economic Review. 2014;104(10):3115–3153. [Google Scholar]

- Feldman R. Techniques and applications for sentiment analysis. Communications of the ACM. 2013;56(4):82–89. [Google Scholar]

- Geiger D., Heckerman D. Parameter priors for directed acyclic graphical models and the characterization of several probability distributions. The Annals of Statistics. 2002;30(5):1412–1440. [Google Scholar]

- Gelman A., Rubin D.B. Inference from iterative simulation using multiple sequences, (with discussion) Statistical Science. 1992;7:457–511. [Google Scholar]

- Giudici P., Abu-Hashish I. What determines bitcoin exchange prices? A network VAR approach. Finance Research Letters. 2019;28:309–318. [Google Scholar]

- Giudici P., Hadji-Misheva B., Spelta A. Network based credit risk models. Qual. Eng. 2020;32(2):199–211. doi: 10.1080/08982112.2019.1655159. [DOI] [Google Scholar]

- Giudici P., Spelta A. Graphical network models for international financial flows. Journal of Business & Economic Statistics. 2016;34(1):128–138. [Google Scholar]

- Gormsen N.J., Koijen R.S.J. 2020. Coronavirus: Impact on stock prices and growth expectations. [Google Scholar]

- Joshi K., N B., Rao J. Stock trend prediction using news sentiment analysis. International Journal of Computer Science and Information Technology. 2016;8:67–76. [Google Scholar]

- Larsen V.H., Thorsrud L.A. The value of news for economic developments. Journal of Econometrics. 2019;210(1):203–218. [Google Scholar]

- Lee H.S. Exploring the initial impact of COVID-19 sentiment on US stock market using big data. Sustainability. 2020;12(16):6648. [Google Scholar]

- Loughran T., McDonald B. Textual analysis in accounting and finance: A survey. Journal of Accounting Research. 2016;54(4):1187–1230. [Google Scholar]

- Magliacani M., Madeo E., Cerchiello P. From ‘listener’ to ‘speaker’ museum visitors: guest book as a means of dialogue. Museum Management and Curatorship. 2018;33(5):467–483. [Google Scholar]

- Mamaysky H. 2020. Financial markets and news about the coronavirus. Available at SSRN 3565597. [Google Scholar]

- Mantegna R.N. Hierarchical structure in financial markets. The European Physical Journal B. 1999;11(1):193–197. [Google Scholar]

- Nicola M., Alsafi Z., Sohrabi C., Kerwan A., Al-Jabir A., Iosifidis C., et al. The socio-economic implications of the coronavirus pandemic (COVID-19): A review. International Journal of Surgery. 2020;78:185. doi: 10.1016/j.ijsu.2020.04.018. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Nicola G., Cerchiello P., Aste T. Information network modeling for U.S. banking systemic risk. Entropy. 2020;22(11):1331. doi: 10.3390/e22111331. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Onnela J.-P., Kaski K., Kertész J. Clustering and information in correlation based financial networks. The European Physical Journal B. 2004;38(2):353–362. [Google Scholar]

- Pantaleo E., Tumminello M., Lillo F., Mantegna R.N. When do improved covariance matrix estimators enhance portfolio optimization? An empirical comparative study of nine estimators. Quantitative Finance. 2011;11(7):1067–1080. [Google Scholar]

- Peralta G., Zareei A. A network approach to portfolio selection. Journal of Empirical Finance. 2016;38:157–180. [Google Scholar]

- Pozzi F., Aste T., Rotundo G., Di Matteo T. Vol. 6802. International Society for Optics and Photonics; 2008. Dynamical correlations in financial systems; p. 68021E. (Complex systems II). [Google Scholar]

- Rajput N.K., Grover B.A., Rathi V.K. 2020. Word frequency and sentiment analysis of twitter messages during coronavirus pandemic. arXiv preprint arXiv:2004.03925. [Google Scholar]

- Ranco G., Aleksovski D., Caldarelli G., Grčar M., Mozetič I. The effects of Twitter sentiment on stock price returns. PLoS One. 2015;10(9) doi: 10.1371/journal.pone.0138441. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Scaramozzino R., Cerchiello P., Aste T. Information theoretic causality detection between financial and sentiment data. Entropy. 2021;23(5) doi: 10.3390/e23050621. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Shahzad S.J.H., Bouri E., Kristoufek L., Saeed T. Impact of the COVID-19 outbreak on the US equity sectors: Evidence from quantile return spillovers. Financial Innovation. 2021;7(1):1–23. doi: 10.1186/s40854-021-00228-2. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Shahzad S.J.H., Hoang T.H.V., Bouri E. From pandemic to systemic risk: Contagion in the US tourism sector. Current Issues in Tourism. 2021:1–7. [Google Scholar]

- Shahzad S.J.H., Naeem M.A., Peng Z., Bouri E. Asymmetric volatility spillover among Chinese sectors during COVID-19. International Review of Financial Analysis. 2021;75 doi: 10.1016/j.irfa.2021.101754. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Sheldon G., Maurer M., et al. Interbank lending and systemic risk: An empirical analysis for Switzerland. Swiss Journal of Economics and Statistics. 1998;134:685–704. [Google Scholar]

- Souza T.T.P., Aste T. Predicting future stock market structure by combining social and financial network information. Physica A: Statistical Mechanics and its Applications. 2019;535 [Google Scholar]

- Souza T.T.P., Kolchyna O., Treleaven P.C., Aste T. 2015. Twitter sentiment analysis applied to finance: A case study in the retail industry. arXiv preprint arXiv:1507.00784. [Google Scholar]

- Steinbacher M., Steinbacher M., Steinbacher M. University Library of Munich, Germany; 2013. Credit contagion in financial markets: A network-based approach. [Google Scholar]

- Tetlock P.C. Giving content to investor sentiment: The role of media in the stock market. The Journal of Finance. 2007;62(3):1139–1168. [Google Scholar]

- Tetlock P.C., Saar-Tsechansky M., Macskassy S. More than words: Quantifying language to measure firms’ fundamentals. The Journal of Finance. 2008;63(3):1437–1467. [Google Scholar]

- Upper C., Worms A. Estimating bilateral exposures in the German interbank market: Is there a danger of contagion? European Economic Review. 2004;48(4):827–849. [Google Scholar]

- Valle-Cruz D., Fernandez-Cortez V., López-Chau A., Sandoval-Almazan R. 2020. Does Twitter affect stock market decisions? Financial sentiment analysis in pandemic seasons: A comparative study of H1N1 and COVID-19. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Yin H., Yang S., Li J. 2020. Detecting topic and sentiment dynamics due to COVID-19 pandemic using social media. arXiv preprint arXiv:2007.02304. [Google Scholar]

- Zhang D., Hu M., Ji Q. Financial markets under the global pandemic of COVID-19. Finance Research Letters. 2020 doi: 10.1016/j.frl.2020.101528. [DOI] [PMC free article] [PubMed] [Google Scholar]