Abstract

The COVID-19 pandemic has affected supply and demand to a large extent. Declining demand for firms' output has caused significant financial stress for all kinds of firms worldwide. Production that requires environmental measures usually gets constrained when firms, especially small and medium-sized firms (SMEs), have difficulty in accessing credit. Firms thus face the dilemma of whether to continue environmental behaviors or to fulfill financial commitments to suppliers, employees, and so on. As such, an empirical question is whether the economic consequences of COVID-19 vary by firms’ types and their environmental behaviors. Using 4,888 sample firms from 14 EU member states, this study finds evidence that the severity of damage caused by COVID-19 depends on firm size and whether firms invested in pollution abatement techniques. Specifically, eco-friendly firms perform better during the COVID-19 pandemic, and SMEs are less vulnerable than large firms. In particular, eco-friendly SMEs are less affected by the pandemic than conventional SMEs and large firms. These findings are probably related to the efficacy of government relief programs targeted to eco-friendly SMEs and/or the healthy financial status of these firms prior to the pandemic.

Keywords: COVID-19, Environment, Pollution prevention measures, Environmental disclosure, SMEs, EU

1. Introduction

The outbreak of the COVID-19 pandemic has had an extreme effect on the consumption of goods and services and has caused supply-side disruptions (De Sousa Jabbour et al., 2020; Belhadi et al., 2021; Brodeur et al., 2021). It has resulted in tremendous financial stress for different types of firms due to revenue reductions, raising the demand for financial liquidity (Acharya and Steffen, 2020; Coibion et al., 2020; Ding et al., 2021; Gu et al., 2020; Juergensen et al., 2020; Kraus et al., 2020; Rizvi et al., 2020; Shen et al., 2020). The pandemic may also cause shifts in firms' environmental behaviors since green practices are subject to financing access and the pandemic has caused credit shortages for many firms (Andersen, 2017; Kim, 2015; Luo et al., 2012; Tian and Lin, 2019; Zhang and Vigne, 2021). Hence, the uncertainty induced by economic crises increases social concerns about not only the economy's recovery but also its sustainable transition (He and Harris, 2020; Katsikeas et al., 2016; Kim, 2015; Musa and Chinniah, 2016; Triguero et al., 2013).

Firms' environmental behaviors are important for fostering the transition to a sustainable economy as well as increasing firms’ revenue gains (Ammenberg and Hjelm, 2003; Dean et al., 2000; Jain et al., 2017; Leonidou et al., 2019; Przychodzen and Przychodzen, 2015). However, previous studies provide ambiguous evidence of the direct causality between environmental and financial performance. Other factors, such as environmental regulations, business environment, and external pressures, can also significantly affect corporate environmental practices (Katsikeas et al., 2016; Leonidou et al., 2016). A lack of economic incentives for large and small firms might halt the transition to sustainability, the consistency of which matters greatly to the success of a green economy. Therefore, investigating whether eco-friendly firms have more difficulty recovering from the pandemic provides significant policy implications with respect to government relief programs.

While eco-friendly firms are likely to be more resilient to financial risks due to their better business performance after green transitions (Leonidou et al., 2019; Przychodzen and Przychodzen, 2015), the association between risk and resilience may also depend on firm size. Ahmadi and Bouri (2017) and Gjergji et al. (2021) find that smaller firms have a higher risk of failing and take a longer time to recover when facing business crises. The COVID-19 pandemic may raise the vulnerability of small and medium-sized firms (SMEs) due to its repercussions on the business environment and financial pressure. For instance, the disclosure of environmental performance increases capital costs for SMEs, while overall business benefits tend to decline during the pandemic (Gourinchas et al., 2020; Greenwood et al., 2020). This increases the barriers for SMEs to be green. The environmental impacts of SMEs can be huge, as SMEs are responsible for a large share of the economic contribution (Brammer et al., 2012; Cernat et al., 2020; Del Brío and Junquera, 2003). More than 90% of businesses in EU countries are SMEs, and more than 60% of the workforce in the private sector is employed by SMEs (Auzzir et al., 2018; Brammer et al., 2012; Hillary, 2004; Juergensen et al., 2020; Viesi et al., 2017). This highlights the significance of SMEs' green investment and environmental practices in contributing to society's sustainable transition (Baden and Prasad, 2016).

Firms' environmental performance depends highly on external pressures and government support (Blanchi and Noci, 1998; Del Brío and Junquera, 2003; King and Lenox, 2000). In response to the COVID-19 outbreak, governments worldwide have initiated many relief programs to help firms recover from the pandemic and provide financial support for sustainable practices (Dhahri et al., 2021; European Commission, 2021; Li, 2020). For example, the EU has offered many relief programs to stimulate economic recovery to mitigate the negative consequences of COVID-19 on the firms' green transition during the pandemic (Dhahri et al., 2021; European Commission, 2021). Such programs provide strong support to the life cycle of green products, which would otherwise likely collapse due to firms' discontinuous technology development during the pandemic. This is particularly important for the EU, which is the largest region that has proposed legislation of a climate-neutral economy by 2050 in the current works. One of the goals of creating such an economy is to reduce the negative environmental impacts of firms on society (Brown and Rocha, 2020; Cacciapaglia et al., 2020). However, few studies have investigated the relationship between environmental attributes and firms’ recovery from the pandemic, which can be an essential indicator of the necessity of government relief programs in preventing the stagnation of sustainable development.

This study examines the impact of COVID-19 on firms' business performance and investigates whether the severity of this impact depends on firms' environmental performance. Considering that different types of firms experience financial stress and liquidity problems to different degrees, we further test whether the severity of COVID-19's impact depends on firm size and its interaction with environmental variables. Using data on sample firms from 14 EU member states collected by the regular World Bank Enterprise Surveys and follow-up surveys for the economic consequences of the COVID-19 pandemic, we apply an ordinal logit model and a binary logit model for empirical analysis. We find that eco-friendly firms are likely to be less affected by the pandemic than conventional firms. In particular, eco-friendly SMEs are less vulnerable than conventional SMEs and large firms. Our findings add to the literature advocating government relief programs during the crisis for eco-friendly firms, especially eco-friendly SMEs.

The rest of this paper is organized as follows: The hypotheses and background on the studies of eco-friendly firms will be introduced in Section 2. Section 3 will describe the data and models, followed by the empirical results in Section 4. After the discussion of the results in Section 5, the final section concludes this study.

2. Conceptualization

The impacts of COVID-19 on business performance may differ between eco-friendly and conventional firms. Eco-friendly firms are likely to have better financial performance and easier access to financing than conventional firms, significantly reducing the likelihood of being severely affected by the pandemic. This section reviews previous studies and shows the derivation of the hypotheses from the theoretical framework.

2.1. Context and hypotheses

Society's environmental concerns have resulted in considerable attention being given to corporate sustainable development practices, which, accompanied by increasing green demand, incentivizes firms to adopt green practices (Dhahri and Omri, 2018; King and Lenox, 2001; Purvis et al., 2019; Rahdari and Rostamy, 2015; Roheim and Zhang, 2018; Simpson et al., 2004). Making environmental commitments can be an economically viable option for cost-saving and revenue-maximization (Katsikeas et al., 2016; Leonidou et al., 2016), in line with stakeholder theory (Deng et al., 2013; Luo and Bhattacharya, 2009). According to this theory, a firm has extensive recognition of environmental and other social responsivities through marketing efforts and innovation when stakeholders are environmentally conscious, leading to risk-reduction benefits and raising shareholder wealth.

However, investment in pollution prevention initiatives has a long payback period that lowers the overall returns. Hence, while industry growth can accelerate the depreciation of long-term investment in the capital of pollution prevention and lower the costs of environmental investment, the impacts of green behavior advocates are limited when the green endeavor is not mandatory. Many studies have indicated that the relationship between environmental and financial performance is uncertain, and commitments to green behaviors are challenging as the environmental and financial performance relationship is also affected by many other factors, such as innovation ability, firm characteristics, employee involvement, and firm size (Brammer et al., 2012; Earnhart et al., 2014; Leonidou et al., 2019; Przychodzen and Przychodzen, 2015; Rehman and Yu, 2021; Singh et al., 2020; Thakur and Mangla, 2019; Treacy et al., 2019).

The various relations between environmental and financial performance can be explained by Bromiley and Rau's (2014) practice-based view theoretical lens, which has been recently applied by Rehman and Yu (2021) to assess eco-environmental performance. Different from a resource-based view that focuses on a firm's inimitable practices, a practice-based view focuses on imitable practices, such as environmental activities. Environmental activities are generally imitable and transferrable across firms. Bromiley and Rau (2014) propose two effects regarding the impact of imitable practices on firm performance, a first-order effect and a second-order effect. The first-order effect is between firms adopting the imitable practices and those not adopting them. The second-order effect depends on how firms implement those practices, the interactions between those practices and other practices, and the behavior of competitors. As such, firms' innovation ability, firm characteristics such as firm size and firm age, and location may affect the environmental and financial performance relationship.

In addition to its impact on financial performance under stakeholder theory and practical-based view theory, environmental performance also affects firms' access to finance under the asymmetry information theory. Myers and Majluf (1984) indicate that financial institutions generally require an adverse selection risk premium due to information asymmetry between firms' managers and outside investors. Stakeholders’ environmental concerns highlight the increasing importance of environmental information. Better environmental performance and environmental disclosure overcome information asymmetry hence addressing the agent problem due to increased transparency. The positive impact of environmental performance on access to finance and the costs of debt is well documented in the literature (e.g., Wellalage and Kumar, 2021; Zhang, 2021). Additionally, environmental investment is seen as a future investment and may affect human capital and business competition (Yang et al., 2019). Above all, eco-friendly firms are probably more financially healthy, therefore, more likely to resist future instability risks during economic crises.

The pandemic accelerates uncertainty in firms' operating activities and revenue, resulting in unstable environmental behaviors. Amankwah-Amoah (2020) and Mukanjari and Sterner (2020) find that the impact of the pandemic on firms' environmental performance varies by firms' financial status and their green needs, which are probably attributed to firms’ different environmental behaviors. For example, industries or firms with high energy-generated emissions tend to implement energy-saving practices to address environmental concerns (Marques et al., 2019; Trianni et al., 2013). Moreover, firms consider the tradeoffs between capital flows and desired environmental performance when deciding whether to implement pollution prevention measures (Henderson and Millimet, 2007). These studies show that environmental performance varies by firm depending on external factors. Hence, testing the impacts of the exogenous shocks induced by the pandemic on financial performance for eco-friendly and conventional firms provides rigorous evidence of the nexus between environmental and financial performance.

There are different evaluation methods for environmental performance related to emissions, environmental disclosure, or environmental performance indices (Tian and Lin, 2019). While technological development has highly contributed to increasing resource productivity and the efficiency of resource and energy use (Fujii et al., 2013; Heikkurinen et al., 2019; Leonidou et al., 2019; Marques et al., 2019), information revelation to consumers is vital to stimulate the demand for green products. The degree of information accessibility of environmentally friendly behaviors is represented by environmental disclosure. Unlike pollution prevention measures, environmental disclosure is generally voluntary, with the content and scope of the disclosure being decided by firms. Therefore, the level of environmental disclosure highly depends on firms’ choices (Ahmadi and Bouri, 2017; Guidry and Patten, 2012; Patten, 2002). Firms with poor environmental performance may be under societal pressures and undertake environmental disclosure (Doan and Sassen, 2020). Therefore, the impacts of COVID-19 may differ across firms depending on whether they adopt pollution prevention measures or environmental disclosure. Moreover, firms adopting both pollution prevention measures and environmental disclosure may respond differently to the pandemic compared to firms with a low level of environmental activities.

To test the impact of COVID-19 on eco-friendly firms regarding environmental measures and environmental disclosure, we first posit the following hypotheses (stated as an alternative to their null):

Hypothesis 1

Firms with environmental measures have a low probability of being severely affected by COVID-19.

Hypothesis 2

Firms with environmental disclosure have a low probability of being severely affected by COVID-19.

To test the joint effect of the environmental measures and the environmental disclosure, we derive the third hypothesis as follows (stated as an alternative to its null):

Hypothesis 3

There is a joint impact of environmental measures and environmental disclosure on firms' probability of being severely affected by COVID-19.

2.2. SMEs in sustainable transition

SMEs play significant roles in most European countries as well as other countries. However, SMEs are perceived as small players in achieving society's goal of sustainability, and they are under-emphasized in terms of their importance in fostering the sustainable development of the economy (Del Brío and Junquera, 2003; Baden and Prasad, 2016). One of the environmental challenges for SMEs is their commitment to comply with eco-friendly behaviors, which is commonly found to be weak without mandatory regulations (Leonidou et al., 2016; Lynch-Wood and Williamson, 2014; Tilley, 2000; Williamson and Lynch-Wood, 2001). Also, many SMEs lag in their adoption of environmentally friendly behaviors, as they are more flexible in response to environmental challenges compared to large companies (Brammer et al., 2012; Masurel, 2007). Understanding the barriers that prevent SMEs from following environmental practices in normal situations and during the pandemic will provide supportive information about establishing effective government support programs to improve SMEs' eco-friendly behaviors and thus foster society's green transition.

The challenges for SMEs to be green are mainly attributable to financial factors. SMEs are generally constrained by access to financing due to a lack of good credit of fixed assets for collateral (Huang et al., 2019; Zhang, 2022). Financing requirements are even higher for SMEs with capital investment in environmental technologies (Tian and Lin, 2019). This increases business risks and undoubtedly lowers SMEs’ rate of commitment to sustainable practices. Also, many SMEs lack awareness in this area and fail to see the economic benefits and future increase in resilience to risks that a green transition would provide (Beliaeva et al., 2020; Marques et al., 2019; Revell and Blackburn, 2007; Trianni et al., 2013). Hence, many SMEs give less value to their environmental reputation and are less likely to reveal environmental performance information to the public compared to large firms (Agan et al., 2013; Chaklader and Gulati, 2015; Gjergji et al., 2021; Graafland, 2018; Leonidou et al., 2019; Lin et al., 2019; Petitjean, 2019). Commonly occurring obstacles in real business also add pressures on SMEs complying with green practices, such as unclear obligations for staff in SMEs to conduct eco-friendly behaviors, and different attitudes of managers in SMEs due to a disparity between expectations and perceived environmental outcomes (Leonidou et al., 2016; Lynch-Wood and Williamson, 2014). In most cases, the most efficient way to implement environmentally friendly programs in SMEs is to impose regulation pressures (Gjergji et al., 2021; Leonidou et al., 2016, 2019; Moore and Manring, 2009). This highlights the importance of government relief programs to support eco-friendly firms during the pandemic when business performance is severely affected. As Kraus et al. (2020) point out, many SMEs are likely to have a weak willingness to achieve environmental performance, as there are many unexpected challenges due to the COVID-19 pandemic.

This study further investigates the impacts of environmental measures and environmental disclosure on SMEs’ performance during the pandemic. We apply each of the three hypotheses above to SMEs and test the different impacts of COVID-19 on eco-friendly SMEs, conventional SMEs, and large firms.

3. Data and model

3.1. Data sources

The sample countries include 14 EU member states, namely Bulgaria, Croatia, the Czech Republic, Greece, Hungary, Italy, Poland, Latvia, Lithuania, Poland, Portugal, Romania, Slovakia, and Slovenia. The firm-level data of these countries collected by the World Bank Enterprise Surveys in 2019 cover firms in the service and manufacturing sectors (https://www.enterprisesurveys.org). The service and manufacturing sectors' value-added makes up a large portion of the total economy (Viesi et al., 2017), and the financial stress of firms in these countries is increasingly high during the pandemic (Gourinchas et al., 2020). The World Bank defines firms having up to 99 employees as SMEs. A follow-up survey for firms covered in the regular Enterprise Surveys was conducted during the second half of 2020, providing references on the economic consequences of COVID-19. We combine the regular and follow-up survey data to evaluate how environmental activities and firm characteristics affect the severity of COVID-19's impact. In the sample, the average response rate of follow-up surveys in these 14 countries is about 80%, and the total number of valid observations is 4,888. Here, we delete observations with missing values to alleviate dataset contamination. Table 1 and Table A1 in the Appendix report the sample distribution by country and industrial sector.

Table 1.

Sample distribution by sector.

| ISIC | Description | No. | per cent |

|---|---|---|---|

| 15 | Food and including tobacco (ISIC 16) | 643 | 13.2% |

| 17 | Textiles | 86 | 1.76% |

| 18 | Garments | 189 | 3.87% |

| 19 | Leather | 51 | 1.04% |

| 20 | Wood | 123 | 2.52% |

| 21 | Paper | 58 | 1.19% |

| 22 | Publishing, printing, and Recorded media | 102 | 2.09% |

| 23 | Refined petroleum product and including chemicals (ISIC 24) | 92 | 1.88% |

| 25 | Plastics & rubber | 162 | 3.31% |

| 26 | Non metallic mineral products | 113 | 2.31% |

| 27 | Basic metals | 62 | 1.27% |

| 28 | Fabricated metal products | 570 | 11.66% |

| 29 | Machinery and equipment | 468 | 9.57% |

| 30 | Office machinery and including electronics (ISIC 31), communication (ISIC 32), precision instruments (ISIC 33) | 146 | 2.99% |

| 34 | Motor vehicles and including other transport equipment (ISIC 35) | 114 | 2.33% |

| 36 | Furniture | 156 | 3.19% |

| 37 | Recycling | 52 | 1.06% |

| 45 | Construction Section F | 383 | 7.84% |

| 50 | Services of motor vehicle | 217 | 4.44% |

| 51 | Wholesale | 335 | 6.85% |

| 52 | Retail | 869 | 17.8% |

| 55 | Hotel and restaurants: section H | 293 | 5.99% |

| 60 | Transport Section I: (60–64) | 273 | 5.59% |

| 72 | IT | 143 | 2.93% |

| sum | 4,888 | 100% |

Notes: ISIC represents the International Standard of Industrial Classification codes.

Government mandates such as travel restrictions and lockdowns, which highly depend on the COVID-19 cases, can severely affect firm performance during the pandemic. Accordingly, we collected the numbers of COVID-19 cases in sample countries from the World Health Organization and merged them with the survey data by survey date and country.

3.2. Identifying eco-friendly firms

In the World Bank Enterprise Surveys, firms reported whether they invested in energy efficiency measures and ten environmentally friendly measures (see Table A2 in the Appendix). The survey data also revealed whether firms completed an external audit of their environmental performance, such as energy consumption, water usage, CO2 emissions, and other pollutants (see Table A2 in the Appendix). Firms seek ways to improve energy efficiency and reduce emissions with pollution abatement capital, which is further revealed in environmental disclosure. In this study, two variables representing environmental performance are defined below:

Measures =

and.

Disclosure =

We tabulated firm distribution according to the values of Measures and Disclosure below:

| Disclosure = 1 | Disclosure = 0 | |

|---|---|---|

| Measures = 1 | 689 | 3257 |

| Measures = 0 | 34 | 908 |

As shown in the table, only 14.1% of firms that invested in pollution abatement measures issued an external audit of their environmental performance; 66% of firms that invested in pollution abatement measures did not provide environmental disclosures. To test the joint impact of Measures and Disclosure, we created three variables: Measures-Only for firms with Measures = 1 and Disclosure = 0; Disclosure-Only for firms with Measures = 0 and Disclosure = 1; Measures & Disclosure for firms with Measures = 1 and Disclosure = 1. For these dummies, the base is firms with Measures = 0 and Disclosure = 0.

3.3. Econometric models

In this study, the vulnerability of firms during the pandemic is measured by the time required for them to recover to the normal sales level. The relevant survey question is, “In how many months is it expected that this establishment's sales will get back to normal?” Among the sample firms, 41.3% answered ‘Current sales are as normal,’ 11.4% answered ‘Never,’ and the rest of the firms reported the number of months in the range between 1 and 60. As such, we created an ordinal variable, Impact, with four categories:

‘No impact’ –– For firms that reported: ‘Current sales are as normal.’

‘Minor’ –– For firms that reported a certain number of months for recovery that was less than the average of the numeric answers.

‘Moderate’ –– For firms that reported a certain number of months for recovery that was greater than the average of the numeric answers.

‘Severe’ –– For firms whose sales will never get back to their pre-pandemic level.

The ordinal logit model estimates a score, denoted as S, which is a linear function of environmental variables and control variables:

| (1) |

where i denotes the ith firm in the cross-section, represent the control variables, and is the error term. The dummy variables for countries (Country) and industrial sectors (Sector) control for heterogeneity in these two dimensions. There are three ordinal models depending on the use of the environmental variables, namely Model A with Measures, Model B with Disclosure, and Model C with interaction terms between them.

The ordinal logit model estimates three cutpoints (intercepts according to the comparison between the four categories: ‘No impact,’ ‘Minor,’ ‘Moderate,’ and ‘Severe’). These cutpoints serve as thresholds of the choices between lower categories and higher ordinal categories. Take the choice of ‘No impact’ and ‘Minor’ as an example. The predicted probability is estimated as:

| (2) |

| (3) |

This means the impact of COVID-19 belongs to the first ordered category (‘No Impact’) if , and the choice belongs to the second category (‘Minor’) if .

To perform a robustness check, we transform the ordinal impacts of COVID-19 into a binary dummy variable:

Impact =

To estimate the impacts of environmental performance on business recovery measured as a binary dummy, a binary logit model is applied, which is specified as follows:

| (4) |

where is the logarithmic odds ratio between lower impact (‘No impact’ and ‘Minor’) and higher impact (‘Moderate’ and ‘Severe’). Three logit models are applied to provide consistent references with the ordinal logit models, namely Model D with Measures, Model E with Disclosure, and Model F with interaction terms between them.

The control variables are identified based on data availability and the literature (Gourinchas et al., 2020; Li, 2020). The government prevention measures depend on the number of confirmed COVID-19 cases and negatively affect consumption and production. The spread of COVID-19 and government prevention measures vary according to the size of the city where firms are located. Hence, the number of COVID-19 cases (Cases) and the location of firms (Location) with respect to population density are included in the regression equations. As discussed above, SMEs may lack liquidity and are more vulnerable during the crisis, and SMEs are commonly in the early stage of their business life and have not accumulated earnings for risk management. Hence, we include the firm size (SME) and age of firms (Age) in the model. Moreover, labor-intensive firms are difficult to effectively adjust their operations in response to lockdowns. In general, labor-intensive firms are more likely to be constrained by access to credit. Additionally, the pandemic triggers liquidity issues more often for firms that were constrained by access to credit before the pandemic. As such, dummies for labor-intensive firms (Labor) and credit-constrained firms (Credit-Constrained) are incorporated into the models. Firms with a better financial performance in previous years, represented by Sales, may resist the economic consequences of the pandemic. Table 2 demonstrates the definitions of variables and their descriptive statistics.

Table 2.

Definitions of variables and descriptive statistics.

| Variable | Definition | Mean | SD |

|---|---|---|---|

| Impact | Impact of COVID-19, ordinal variable with 4 categories in the ordinal logit model and binary variable in the logit model. | ||

| Measures | = 1 for firms with any type of measures, and 0 otherwise. | 0.807 | 0.394 |

| Disclosure | = 1 for firms with any type of environmental disclosures, and 0 otherwise. | 0.148 | 0.355 |

| Measures-Only | = 1 for firms with Measures = 1 and Disclosure = 0, and 0 otherwise. | 0.666 | 0.472 |

| Disclosure-Only | = 1 for firms with Disclosure = 1 and Measures = 0, and 0 otherwise. | 0.007 | 0.083 |

| Measures & Disclosure | = 1 for firms with Measures = 1 and Disclosure = 1, and 0 otherwise. | 0.141 | 0.348 |

| Sales | Firms' sales reported in the regular surveys, in Euro and logarithm. | 13.75 | 2.527 |

| Labor | Labor cost/cost of sales. | 0.602 | 0.297 |

| Credit-Constrained | = 1 for credit-constrained firms, and 0 otherwise. | 0.087 | 0.281 |

| SME | = 1 for SMEs, and 0 otherwise. | 0.786 | 0.410 |

| Age | Firm age in years and logarithm. | 2.948 | 0.657 |

| Cases | Total COVID-19 cases per 100,000 population until the survey date | 308 | 216 |

| Location-Small | = 1 for firms in the location with population less than 50,000. | 0.524 | 0.499 |

| Location-Medium | = 1 for firms in the location with population between 50,000 and 250,000 | 0.267 | 0.442 |

| Location-Large | = 1 for firms in the location with population between 250,000 and 1 million. | 0.132 | 0.339 |

4. Empirical results

This section presents the findings from the ordinal and binary logit models and compares the impacts of COVID-19 on small and large firms and on eco-friendly and conventional firms.

4.1. Estimation results of the ordinal logit models

Table 3 reports the estimation results of three ordinal logit models. In Models A, B, and C, the estimates of cutpoints indicate that there is a significant difference between ‘No Impact’ and ‘Minor’ and between ‘Minor’ and ‘Moderate.’ However, the variation is insignificant between ‘Moderate’ and ‘Severe.’ The impact of COVID-19 on sales (for example, from ‘No Impact’ to ‘Moderate’) relies on the estimated cutpoints. Take Model A as an example. The impact of COVID-19 would be minor or more severe (rather than ‘No Impact’) if S + U > −2.43. The impact belongs to the second category (‘Minor’) if −1.06 > S + U > −2.43. The insignificant cutpoint between ‘Moderate’ and ‘Severe’ implies that the environmental variables and other control factors do not cause a significant difference between the moderate and severe impacts of COVID-19.

Table 3.

Estimation results of the ordinal logit models.

| Variable | Model A | Model B | Model C | |||

|---|---|---|---|---|---|---|

| Measures | −0.2077 | *** | ||||

| [0.0721] | ||||||

| Disclosure | 0.0444 | |||||

| [0.0800] | ||||||

| Measures-Only | −0.2233 | *** | ||||

| [0.0740] | ||||||

| Disclosure-Only | −0.0821 | |||||

| [0.3437] | ||||||

| Disclosure & Measures | −0.1387 | |||||

| [0.1013] | ||||||

| Sales | −0.1124 | *** | −0.1194 | *** | −0.1151 | *** |

| [0.0216] | [0.0218] | [0.0218] | ||||

| Labor | 0.0151 | 0.0061 | 0.0164 | |||

| [0.1345] | [0.1345] | [0.1348] | ||||

| Credit-Constrained | 0.1794 | * | 0.1871 | * | 0.1785 | * |

| [0.0971] | [0.0970] | [0.0973] | ||||

| SME | −0.1739 | ** | −0.1704 | * | −0.1686 | * |

| [0.0881] | [0.0883] | [0.0883] | ||||

| Age | 0.0964 | ** | 0.0927 | ** | 0.0951 | ** |

| [0.0427] | [0.0427] | [0.0427] | ||||

| Cases | 0.0007 | * | 0.0007 | * | 0.0007 | * |

| [0.0004] | [0.0004] | [0.0004] | ||||

| Location-Small | −0.1948 | * | −0.1963 | * | −0.1974 | * |

| [0.1163] | [0.1163] | [0.1164] | ||||

| Location-Medium | 0.0465 | 0.043 | 0.0431 | |||

| [0.1156] | [0.1157] | [0.1157] | ||||

| Location-Large | −0.0645 | −0.0509 | −0.0669 | |||

| [0.1301] | [0.1300] | [0.1303] | ||||

| No impact | Minor | −2.4261 | *** | −2.373 | *** | −2.4619 | *** |

| [0.4118] | [0.4122] | [0.4135] | ||||

| Minor | Moderate | −1.0552 | ** | −1.004 | ** | −1.0909 | *** |

| [0.4107] | [0.4112] | [0.4124] | ||||

| Moderate | Severe | 0.2208 | 0.2704 | 0.1853 | |||

| [0.4112] | [0.4117] | [0.4129] | ||||

| Country effects | Yes | Yes | Yes | |||

| Sector effects | Yes | Yes | Yes | |||

| Pseudo R2 | 0.056 | 0.0554 | 0.0561 | |||

| Observations | 4,888 | 4,888 | 4,888 | |||

Notes: *** p < 0.01, ** p < 0.05, and * p < 0.1. Standard errors are in brackets. Dependent variable refers to the ordinal impacts of COVID-19 with 4 categories: ‘No impact’, ‘Minor’, ‘Moderate’, and ‘Severe’.

From the regression results of Model A, we notice that firms with eco-friendly measures are less likely to be negatively affected by the pandemic than conventional firms, indicating the failure to reject Hypothesis 1. The estimation results of Model B show that environmental disclosure is not a significant factor influencing firms’ performance during the pandemic, suggesting the rejection of Hypothesis 2. This finding is consistent with the study of Doan and Sassen (2020), who find that poor environmental performers may increase their level of environmental disclosure to alleviate societal pressures. In Model C, the stand-alone Disclosure and its interaction with Measures are insignificant; however, Measures-Only in Model C is firmly significant. As such, we further reject Hypothesis 3 of a joint effect of pollution prevention measures and environmental disclosure.

For control variables, the results are consistent in Models A, B, and C. This shows that an increasing number of COVID-19 cases result in the negative business performance of firms. Firms with lower probabilities of being severely affected by COVID-19 include those with great sales in previous years, SMEs, and younger firms. Firms in small cities are less significantly affected by COVID-19, probably due to less restrictive prevention measures in those places. Also, labor cost structure does not significantly affect the business performance of firms during the COVID-19 pandemic. This is not surprising as Chrisman et al. (2017) find that the causal relationship between labor productivity and financial performance varies by firm and industry.

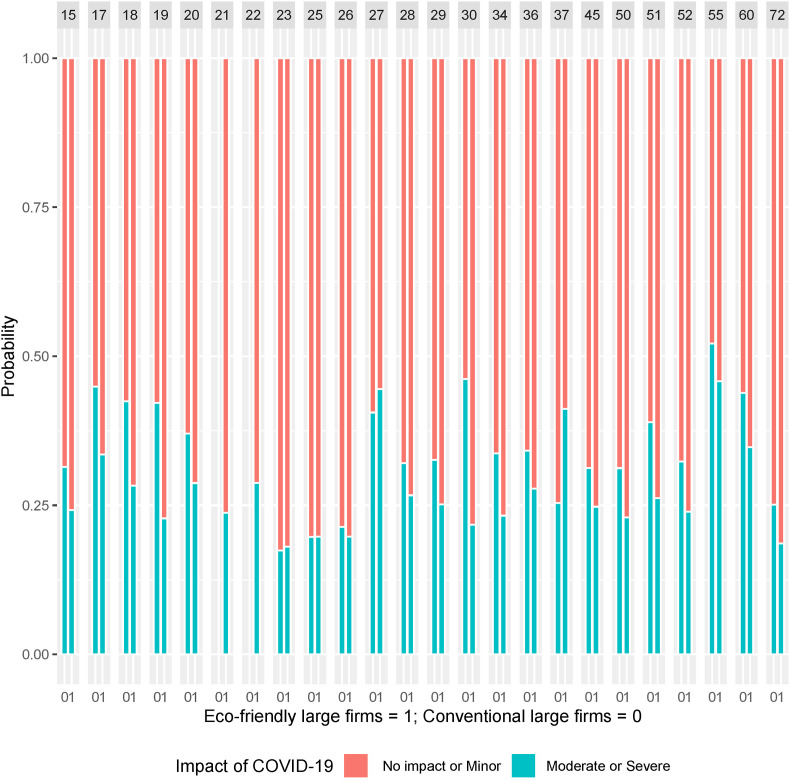

Based on the estimations of Model A, we further calculate the predicted probabilities of being severely impacted by COVID-19 for SMEs (Fig. 1 ) and large firms (Fig. 2 ). For brevity, we aggregate the ordinal variable, Impact, into two groups: less severe impact for ‘No impact’ and ‘Minor’ and more severe impact for ‘Moderate’ and ‘Severe.’ As shown in Fig. 1, for all 24 sectors, conventional SMEs are more likely to be severely affected by the pandemic than eco-friendly SMEs. On average, the probability of being severely affected by the pandemic is 35.67% for conventional SMEs, while this number drops to 28.32% for eco-friendly SMEs. In addition, the consequences of the pandemic vary significantly between manufacturing and service industries. For SMEs, the probability of being severely affected by the pandemic for manufacturing is much smaller than that for the service industry (34.5% versus 39.2 for the conventional SME group and 26.7% versus 33.7% for the eco-friendly SME group). In the group of large firms, ISICs 21 and 22 consist of only eco-friendly large firms. Of the 22 sectors with both conventional and eco-friendly large firms, there are 18 sectors in which conventional large firms are more likely to be severely affected by the pandemic than eco-friendly large firms. Additionally, the probability of being severely affected by COVID-19 is marginally greater for SMEs than for large firms (28.32% versus 27.28%). For this comparison, we assume the same impact of environmental performance on financial performance regardless of firm size. We will test this assumption below.

Fig. 1.

Estimated probabilities of the COVID-19 impact on SMEs by environmental performance and industrial sector.

Notes: See Table 1 for the definitions of ISIC sectors.

Fig. 2.

Estimated probabilities of the COVID-19 impact on large firms by environmental performance and industrial sector.

Notes: See Table 1 for the definitions of ISIC sectors.

4.2. Estimation results of the binary logit models

Table 4 shows the estimation results of the binary logit models, reporting the marginal effects and robust standard errors.

Table 4.

Estimation results of the binary logit models.

| Variable | Model D | Model E | Model F | |||

|---|---|---|---|---|---|---|

| Measures | −0.0462 | ** | ||||

| [0.0182] | ||||||

| Disclosure | −0.0068 | |||||

| [0.0201] | ||||||

| Measures-Only | −0.0494 | *** | ||||

| [0.0182] | ||||||

| Disclosure-Only | −0.0792 | |||||

| [0.0657] | ||||||

| Disclosure & Measures | −0.0414 | |||||

| [0.0233] | ||||||

| Sales | −0.0234 | *** | −0.0244 | *** | −0.0234 | *** |

| [0.0053] | [0.0054] | [0.0054] | ||||

| Labor | −0.0008 | −0.0007 | 0.0012 | |||

| [0.0327] | [0.0327] | [0.0328] | ||||

| Credit-Constrained | 0.0181 | 0.0219 | 0.0191 | |||

| [0.0242] | [0.0244] | [0.0243] | ||||

| SME | −0.0465 | ** | −0.0474 | ** | −0.0464 | ** |

| [0.0232] | [0.0233] | [0.0233] | ||||

| Age | 0.0254 | ** | 0.0252 | ** | 0.0256 | ** |

| [0.0108] | [0.0108] | [0.0108] | ||||

| Cases | 0.0001 | 0.0001 | 0.0001 | |||

| [0.0001] | [0.0001] | [0.0001] | ||||

| Location-Small | −0.0438 | * | −0.0427 | −0.0431 | ||

| [0.0273] | [0.0273] | [0.0273] | ||||

| Location-Medium | −0.016 | −0.0147 | −0.0153 | |||

| [0.0265] | [0.0266] | [0.0266] | ||||

| Location-Large | −0.0316 | −0.0277 | −0.0311 | |||

| [0.0287] | [0.0289] | [0.0287] | ||||

| Country effects | Yes | Yes | Yes | |||

| Sector effects | Yes | Yes | Yes | |||

| Pseudo R2 | 0.0744 | 0.0734 | 0.0747 | |||

| Observations | 4,888 | 4,888 | 4,888 | |||

Notes: *** p < 0.01, ** p < 0.05, and * p < 0.1. Standard errors are in brackets. Dependent variable is a dummy, Impact, which equals 1 for ‘Moderate’ or ‘Severe’, and 0 for ‘No impact’ or ‘Minor’.

Many results in the binary logit models are consistent with those in the ordinal logit models. It shows that environmental measures (Measures) significantly affect the risk of being affected by the pandemic. Eco-friendly firms have a 4.63% lower probability of being severely affected by COVID-19 than conventional firms, and firms with only measures are at 4.94% less risk of being severely affected by COVID-19 than firms without any environmental behaviors (the base). For SMEs, the probability of being severely affected by the pandemic is about 4.7% lower than that for large firms. However, the number of COVID-19 cases and credit constraints have insignificant impacts in the binary logit models, suggesting a poor model fit for sample data. The logit model considers a dichotomous impact of COVID-19, while the ordinal model includes four categories that may capture COVID-19's impact more accurately.

4.3. Robustness checks

The robustness of the estimation results is checked by controlling for endogeneity, subsample analysis, and especially an alternative model specification with regard to the intersection between environmental performance and firm size. First, for Models A–F, we estimate the robust and country-level clustered standard errors. The significant levels of the environmental variables and most of the control variables are consistent with those in the main results.

In our models, some unobserved factors may affect both firms’ environmental behavior and the economic consequences of COVID-19, indicating an endogeneity issue. Since the environmental variables (Measures and Disclosure) are dummy variables, we use a control function (Wooldridge, 2015) to test endogeneity. We first estimate a logit model for Measures (Disclosure) and then incorporate the predicted probability into Models A and D (Models B and E). The coefficient of the predicted probability tests for the null hypothesis of no endogeneity. The control function approach needs instrumental variables for identification. We follow Wellalage and Kumar (2021) and use the locality-industry average of environmental performance as an instrument of firm-level environmental performance. The test results indicate the rejection of the endogeneity at the above 0.10 level of significance.

Our sample is composed of high-polluting heavy industry, light industry, and service industry. The light industry and service industry are probably different from heavy industry regarding the amounts of environmental investments required to meet environmental regulations. We further conduct subsample analysis by excluding high-polluting heavy industry from the sample and re-estimate Models A–F. The estimation results, unreported for brevity, indicate that for either Models A–C or Models D–F, the coefficients of Measures and Measures-Only are significant with a magnitude marginally greater than their counterparts in the main results. Therefore, our original test results for the hypotheses remain intact.

Finally, to test whether eco-friendly SMEs are more vulnerable during the pandemic than conventional SMEs or large firms, we expand Models A and D (with Measures) by including three interaction dummies: Eco-Friendly-SME for SMEs investing in pollution prevention measures, Conventional-SME for SMEs not investing in pollution prevention measures, and Eco-Friendly-Large for large firms investing in pollution prevention measures. These dummies compare to the base, the large firms not investing in pollution prevention measures. Table 5 reports the estimation results.

Table 5.

Estimation results of ordinal logit model and logit model with interactions between firm size and Measure.

| Variable | Ordinal logit model | Logit model | ||

|---|---|---|---|---|

| Eco-Friendly-SME | −0.4446 | *** | −0.1007 | ** |

| [0.1659] | [0.0404] | |||

| Conventional-SME | −0.2523 | −0.0531 | ||

| [0.1740] | [0.0369] | |||

| Eco-Friendly-Large | −0.2859 | * | −0.0532 | |

| [0.1664] | [0.0356] | |||

| Sales | −0.1121 | *** | −0.0234 | *** |

| [0.0216] | [0.0053] | |||

| Labor | 0.0129 | −0.001 | ||

| [0.1345] | [0.0327] | |||

| Credit-Constrained | 0.1781 | * | 0.0179 | |

| [0.0971] | [0.0243] | |||

| Age | 0.0963 | ** | 0.0254 | ** |

| [0.0427] | [0.0108] | |||

| Cases | 0.0007 | * | 0.0001 | |

| [0.0004] | [0.0001] | |||

| Location-Small | −0.1974 | * | −0.0439 | * |

| [0.1164] | [0.0273] | |||

| Location-Medium | 0.0445 | −0.016 | ||

| [0.1156] | [0.0265] | |||

| Location-Large | −0.0681 | −0.0318 | ||

| [0.1302] | [0.0287] | |||

| No impact | Minor | −2.4942 | *** | ||

| [0.4306] | ||||

| Minor | Moderate | −1.1233 | *** | ||

| [0.4296] | ||||

| Moderate | Severe | 0.1528 | |||

| [0.4299] | ||||

| Country effects | Yes | Yes | ||

| Sector effects | Yes | Yes | ||

| Pseudo R2 | 0.0559 | 0.0751 | ||

| Observations | 4,888 | 4,888 | ||

Notes: *** p < 0.01, ** p < 0.05, and * p < 0.1. Standard errors are in brackets.

As shown in Table 5, there is no significant difference in firms’ responses to the pandemic between conventional SMEs and conventional large firms (the base) in both models. It is also shown that eco-friendly SMEs are less likely to be severely affected by COVID-19 than conventional large firms (the base) and conventional SMEs. In the logit model analysis, the probability of being severely affected by COVID-19 for eco-friendly SMEs is about 10% less than that for conventional SMEs. Moreover, in the ordinal logit model analysis, eco-friendly SMEs are the least vulnerable firms during the pandemic compared to both eco-friendly and conventional large firms. Overall, the robustness check verifies the results of the initial models and validates the credibility of the ordinal logit model compared to the binary logit model.

5. Discussions

Using the World Bank Enterprise Surveys for sample firms in 14 EU member states, this study evaluates the severity of COVID-19's impact on firm performance and whether environmentally friendly firms are more vulnerable during the pandemic. In particular, we focus on SMEs. SMEs' environmental practices depend on their financial status, which could become extremely poor due to the interruption and reduction in operational activities, caused by government mandates during the pandemic for safety, such as cross-border closures and lockdowns. The economic consequences of COVID-19 are investigated by the survey question: “In how many months will the firm's sales get back to normal?”

We identify eco-friendly firms according to whether they implement pollution prevention measures and whether they issue environmental disclosure. These environmental practices improve firm reputation, increasing the demand of customers with environmental concerns (Dhahri and Omri, 2018; Purvis et al., 2019) and making access to bank loans easier due to low environmental risk (Zhang, 2021). In addition, the benefits of pollution prevention measures depend on the input-output conversion and the business cycle. The pandemic may change the consumption pattern and the preferences for green products and collapse a technology's life cycle, resulting in a lower prospective return on environmental investment. Previous studies have also documented that SMEs have different environmental behaviors regarding pollution prevention measures and environmental disclosure, which further alters the relationship between environmental and financial performance (Brammer et al., 2012; Masurel, 2007). Above all, eco-friendly SMEs may respond to COVID-19 in a different way compared to conventional SMEs and large firms.

COVID-19's impact on firm performance is estimated by an ordinal logit model (for the ordinal measure of the impact with four categories) and a binary logit model (for a dichotomous measure of the impact). Our results from the ordinal logit model show that investment in pollution control measures reduces the probability of being severely affected by COVID-19, and that SMEs are expected to recover from the pandemic much faster than large firms. Environmental disclosure does not affect the severity of COVID-19 damage, and there is no joint effect of the environmental variables. The estimation results from the binary logit model verify that SMEs and firms that invest in pollution abatement measures are less likely to be severely affected by the pandemic. We further test whether the impact of environmental performance (represented by pollution abatement measures) on the economic consequences of COVID-19 depends on firm size by incorporating the interaction terms between firm size and environmental performance into the model specifications. The estimation results from the ordinal and binary logit models indicate that eco-friendly SMEs have a substantially smaller probability of being severely affected by COVID-19 than conventional SMEs and eco-friendly and conventional large firms.

There are several possible explanations for the estimated results. Firstly, revenue reduction induced by COVID-19 distrains firm liquidity for all kinds of firms. Eco-friendly firms, especially eco-friendly SMEs, are generally constrained by access to credit due to the lack of collateral, which may worsen the economic consequences of the pandemic. However, eco-friendly SMEs may have a lower environmental risk, raising the probability of being granted bank loans. The rejection of the hypothesis indicates that eco-friendly SMEs may not have been constrained by credit access before the pandemic. Our sample firms are from EU member states, which are high-income countries with a high degree of financial development. Moreover, the EU's target of a climate-neutral economy may force member states to remove financing barriers to green practices for SMEs.

Secondly, eco-friendly SMEs may have a better financial performance, which alleviates the liquidity pressure, especially at the earlier stage of the pandemic. The economic benefits of green practices depend on the demand for green products, customers’ willingness to pay for a price premium of those products, and the marginal cost of the green content relative to the price premium. Compared to eco-large firms, SMEs are more likely to adopt proactive environmental practices in response to customer demand, leading to a desirable payback of the environmental costs. On the other hand, large firms need to invest more in pollution abatement technologies, which may not bring enough extra revenue from environmentally conscious customers, at least in the short run.

Finally, our sample firms are from EU member states. In response to the COVID-19 outbreak, the EU government has initiated a range of credit programs to mitigate the impact of COVID-19. Given the important role that SMEs play in sustainable economic development and the vulnerability of eco-friendly SMEs, governments may prioritize eco-friendly SMEs when designing relief programs. Eco-friendly SMEs with credit support may perceive a small negative impact of COVID-19 on their financial performance.

6. Conclusion

COVID-19 may seriously hinder the transition to a sustainable economy by interrupting environmental practices for all kinds of firms. Its impact on SMEs' environmental behaviors can be even more severe since SMEs are normally young, have not yet accumulated earnings for risk management, and have limited access to credit. However, eco-friendly SMEs may benefit from their environmental behaviors regarding access to finance and business competition, mitigating the negative impact of the COVID-19 pandemic. In addition, small firms are likely to adjust operations in response to market shocks more quickly than large firms. This paper attempts to assess the extent to which firm size and environmental activities are associated with the severity of COVID-19's impact on firms' financial performance. In other words, we investigate whether eco-friendly SMEs are less vulnerable during the COVID-19 pandemic than conventional SMEs and large firms. To answer these questions, we conduct empirical analyses using the World Bank Enterprise Survey data and the follow-up surveys on the economic consequences of COVID-19, focusing on 14 EU member countries.

Our estimation results from various econometric models uncover evidence that SMEs and eco-friendly firms are less likely to be severely affected by the pandemic, and eco-friendly SMEs have a substantially lower probability of being severely affected by COVID-19 than conventional SMEs and all types of large firms. Our empirical findings can probably be explained by eco-friendly SMEs’ healthy financial status before the pandemic, noting that our sample firms are from EU member states with a high level of financial development.

In this study, we derive our hypotheses from three theories: stakeholder theory regarding the impact of environmental performance on firm wealth, practice-based view regarding the relationship between environmental and financial performance, and asymmetry information theory regarding the impact of environmental performance on financing. Based on these theoretical concepts, we conduct empirical analysis using the firm-level data and provide insights into these theories' propositions during the crisis. The summarized empirical results above explain the impact of stakeholders' environmental concerns on the length of firm recovery from the pandemic. The significant impacts of environmental performance and firm-specific variables on financial performance align with the practice-based view. Moreover, environmental performance's risk-reduction benefits under asymmetry information theory are probably stronger in the early stage of the pandemic than in a normal situation.

Since COVID-19 is still ongoing, this study proposes several practical suggestions to address the environmental concerns in the current crisis and potentially other economic crises in the future. First, the vulnerability of eco-friendly SMEs changes over time, and they are likely to become more vulnerable later while they are currently in a good financial condition. Therefore, government relief programs are important for eco-friendly SMEs when an economic crisis occurs and the business environment changes. Second, the efficacy of the current European relief programs has been low and the bulk of the support has not gone to the hardest-hit firms (Gourinchas et al., 2020). This study identifies the risky firms, contributing to improving the efficacy of the relief programs by targeting the firms in need. Third, consistent environmental behaviors of SMEs in the EU represent one of the most important elements influencing the EU's climate-neutral strategy. The evidence on the impact of the pandemic on eco-friendly SMEs facilitates policymakers in evaluating the process of the transition to a sustainable economy in the long run. Finally, from the firms' perspective, the investigation of firm-specific characteristics guides them in combining environmental practice and other features to ensure firm performance and resist potential instability risks during economic crises.

Researchers have assessed the impact of COVID-19 on SMEs in Europe (Gourinchas et al., 2020) as well as in the US (Li, 2020) and Asian countries (Islam et al., 2021). This study complements previous research on the impact of COVID-19 on firms in Europe and especially small EU state members. This study's insights are likely to be applicable to other firms in different regions. However, cases should be independently discussed as national/regional disparities can result in significant variations. The relationship between environmental and financial performance and the impact of environmental performance on financing depend on industry structure, market mechanisms, the level of economic development, and intuitional factors, which may affect the impact of COVID-19 on eco-friendly and conventional firms. Future research for other regions can provide policy advice on improving the efficacy of relief programs and improve the performance of eco-friendly firms, particularly eco-friendly SMEs under the pandemic and other economic crises.

CRediT authorship contribution statement

Dengjun Zhang: Writing – original draft, Conceptualization, Methodology, Data curation, Investigation, Writing – review & editing. Yingkai Fang: Writing – original draft, Conceptualization, Methodology, Investigation, Writing – review & editing.

Declaration of competing interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Handling Editor: Mingzhou Jin

Appendix.

Table A1.

Sample distribution by country and industrial sector.

| ISIC | Bulgaria | Croatia | Czech | Estonia | Greece | Hungary | Italy | Latvia | Lithuania | Poland | Portugal | Romania | Slovak | Slovenia | sum |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 15 | 64 | 31 | 41 | 14 | 98 | 79 | 50 | 14 | 11 | 30 | 70 | 65 | 53 | 8 | 643 |

| 17 | 7 | 3 | 7 | 4 | 6 | 7 | 4 | 0 | 3 | 2 | 11 | 8 | 4 | 3 | 86 |

| 18 | 11 | 6 | 1 | 11 | 5 | 9 | 5 | 4 | 9 | 20 | 71 | 14 | 5 | 0 | 189 |

| 19 | 5 | 1 | 0 | 2 | 1 | 4 | 3 | 0 | 1 | 1 | 5 | 7 | 2 | 0 | 51 |

| 20 | 8 | 6 | 2 | 7 | 4 | 7 | 4 | 17 | 16 | 2 | 15 | 6 | 5 | 4 | 123 |

| 21 | 4 | 2 | 0 | 2 | 8 | 5 | 1 | 2 | 1 | 2 | 1 | 3 | 2 | 4 | 58 |

| 22 | 6 | 4 | 3 | 4 | 5 | 6 | 7 | 7 | 3 | 5 | 8 | 10 | 7 | 5 | 102 |

| 23 | 8 | 10 | 8 | 1 | 13 | 5 | 7 | 3 | 0 | 0 | 4 | 5 | 2 | 3 | 92 |

| 25 | 13 | 9 | 18 | 2 | 15 | 12 | 3 | 3 | 2 | 24 | 11 | 6 | 9 | 10 | 162 |

| 26 | 11 | 4 | 7 | 2 | 6 | 4 | 4 | 3 | 2 | 3 | 25 | 6 | 5 | 5 | 113 |

| 27 | 2 | 3 | 2 | 0 | 4 | 2 | 6 | 0 | 2 | 0 | 2 | 3 | 5 | 4 | 62 |

| 28 | 18 | 19 | 61 | 15 | 73 | 88 | 51 | 5 | 8 | 26 | 73 | 75 | 18 | 12 | 570 |

| 29 | 42 | 16 | 57 | 6 | 18 | 69 | 55 | 2 | 4 | 15 | 83 | 51 | 15 | 6 | 468 |

| 30 | 10 | 5 | 15 | 7 | 5 | 14 | 6 | 5 | 2 | 6 | 19 | 9 | 7 | 6 | 146 |

| 34 | 1 | 4 | 11 | 1 | 3 | 12 | 6 | 3 | 0 | 2 | 22 | 7 | 5 | 3 | 114 |

| 36 | 8 | 6 | 10 | 13 | 9 | 4 | 7 | 6 | 7 | 24 | 15 | 10 | 1 | 0 | 156 |

| 37 | 0 | 1 | 0 | 1 | 0 | 0 | 0 | 0 | 1 | 9 | 1 | 0 | 1 | 1 | 52 |

| 45 | 25 | 32 | 23 | 46 | 35 | 24 | 16 | 24 | 14 | 18 | 11 | 29 | 17 | 24 | 383 |

| 50 | 19 | 9 | 3 | 8 | 12 | 22 | 9 | 11 | 11 | 7 | 22 | 15 | 9 | 10 | 217 |

| 51 | 11 | 39 | 33 | 12 | 35 | 25 | 17 | 13 | 13 | 7 | 19 | 22 | 19 | 19 | 335 |

| 52 | 52 | 75 | 40 | 48 | 111 | 90 | 53 | 28 | 58 | 14 | 67 | 63 | 82 | 36 | 869 |

| 55 | 7 | 27 | 16 | 18 | 41 | 20 | 15 | 8 | 15 | 1 | 24 | 10 | 22 | 14 | 293 |

| 60 | 25 | 21 | 14 | 20 | 12 | 20 | 7 | 10 | 13 | 6 | 7 | 21 | 16 | 21 | 273 |

| 72 | 1 | 5 | 11 | 2 | 5 | 5 | 4 | 3 | 3 | 2 | 1 | 10 | 11 | 8 | 143 |

| Sum | 358 | 338 | 383 | 246 | 524 | 533 | 340 | 171 | 199 | 226 | 587 | 455 | 322 | 206 | 4888 |

Notes: See Table 1 for the definitions of ISIC sectors.

Table A2.

List of types of environmental disclosure and eco-friendly measures.

| Measures and Disclosure | per cent |

|---|---|

| Energy efficiency measures | 38.7% |

| All environmental-friendly measures | |

| Heating and cooling improvements | 15.7% |

| More climate-friendly energy generation on site | 51.1% |

| Machinery and equipment upgrades | 30.2% |

| Energy management | 54.6% |

| Waste minimization, recycling and waste management | 15.0% |

| Air pollution control measures | 19.4% |

| Water management | 39.1% |

| Upgrades of vehicles | 51.1% |

| Improvements to lighting systems | 10.4% |

| Other pollution control measures | 37.2% |

| External audit of energy consumption | 12.2% |

| External audit of water usage | 3.42% |

| External audit of CO2 emissions | 4.26% |

| External audit of other pollutants | 2.09% |

References

- Acharya V.V., Steffen S. National Bureau of Economic Research; 2020. The Risk of Being a Fallen Angel and the Corporate Dash for Cash in the Midst of COVID. NBER Working Papers 27601. [Google Scholar]

- Agan Y., Acar M.F., Borodin A. Drivers of environmental processes and their impact on performance: a study of Turkish SMEs. J. Clean. Prod. 2013;51:23–33. [Google Scholar]

- Ahmadi A., Bouri A. The relationship between financial attributes, environmental performance and environmental disclosure: empirical investigation on French firms listed on CAC 40. Manag. Environ. Qual. Int. J. 2017;28(4):490–506. [Google Scholar]

- Amankwah-Amoah J. Stepping up and stepping out of COVID-19: new challenges for environmental sustainability policies in the global airline industry. J. Clean. Prod. 2020;271:123000. doi: 10.1016/j.jclepro.2020.123000. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ammenberg J., Hjelm O. Tracing business and environmental effects of environmental management systems? A study of networking small and medium-sized enterprises using a joint environmental management system. Bus. Strat. Environ. 2003;12(3):163–174. [Google Scholar]

- Andersen D.C. Do credit constraints favor dirty production? Theory and plant-level evidence. J. Environ. Econ. Manag. 2017;84:189–208. [Google Scholar]

- Auzzir Z., Haigh R., Amaratunga D. Impacts of disaster to SMEs in Malaysia. Procedia Eng. 2018;212:1131–1138. [Google Scholar]

- Baden D., Prasad S. Applying behavioural theory to the challenge of sustainable development - using hairdressers as diffusers of more sustainable hair-care practices. J. Bus. Ethics. 2016;133(2):335–349. [Google Scholar]

- Belhadi A., Kamble S., Jabbour C.J.C., Gunasekaran A., Ndubisi N.O., Venkatesh M. Manufacturing and service supply chain resilience to the COVID-19 outbreak: lessons learned from the automobile and airline industries. Technol. Forecast. Soc. Change. 2021;163:120447. doi: 10.1016/j.techfore.2020.120447. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Beliaeva T., Shirokova G., Wales W., Gafforova E. Benefiting from economic crisis? Strategic orientation effects, trade-offs, and configurations with resource availability on SME performance. Int. Enterpren. Manag. J. 2020;16(1):165–194. [Google Scholar]

- Blanchi R., Noci G. Greening” SMEs' competitiveness. Small Bus. Econ. 1998;11(3):269–281. [Google Scholar]

- Brammer S., Hoejmose S., Marchant K. Environmental management in SMEs in the UK: practices, pressures and perceived benefits. Bus. Strat. Environ. 2012;21(7):423–434. [Google Scholar]

- Brodeur A., Gray D., Islam A., Bhuiyan S. A literature review of the economics of COVID‐19. J. Econ. Surv. 2021;35(4):1007–1044. doi: 10.1111/joes.12423. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bromiley P., Rau D. Towards a practice‐based view of strategy. Strat. Manag. J. 2014;35(8):1249–1256. [Google Scholar]

- Brown R., Rocha A. Entrepreneurial uncertainty during the Covid-19 crisis: mapping the temporal dynamics of entrepreneurial finance. Journal of Business Venturing Insights. 2020;14 [Google Scholar]

- Cacciapaglia G., Cot C., Sannino F. Second wave COVID-19 pandemics in Europe: a temporal playbook. Sci. Rep. 2020;10(1):1–8. doi: 10.1038/s41598-020-72611-5. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Cernat L., Jakubiak M., Preillon N. The role of SMEs in extra-EU exports: key performance indicators. DG TRADE Chief Economist Notes 2020-1, Directorate General for Trade, European Commission. 2020 [Google Scholar]

- Chaklader B., Gulati P.A. A study of corporate environmental disclosure practices of companies doing business in India. Global Bus. Rev. 2015;16(2):321–335. [Google Scholar]

- Chrisman J.J., Devaraj S., Patel P.C. The impact of incentive compensation on labor productivity in family and nonfamily firms. Fam. Bus. Rev. 2017;30(2):119–136. [Google Scholar]

- Coibion O., Gorodnichenko Y., Weber M. National Bureau of Economic Research; 2020. Labor Markets during the Covid-19 Crisis: a Preliminary View. NBER Working Paper No. W27017. [Google Scholar]

- De Sousa Jabbour A.B.L., Jabbour C.J.C., Hingley M., Vilalta-Perdomo E.L., Ramsden G., Twigg D. Sustainability of supply chains in the wake of the coronavirus (COVID-19/SARS-CoV-2) pandemic: lessons and trends. Modern Supply Chain Res. Appl. 2020;2(3):117–122. [Google Scholar]

- Dean T.J., Brown R.L., Stango V. Environmental regulation as a barrier to the formation of small manufacturing establishments: a longitudinal examination. J. Environ. Econ. Manag. 2000;40(1):56–75. [Google Scholar]

- Del Brío J.Á., Junquera B. A review of the literature on environmental innovation management in SMEs: implications for public policies. Technovation. 2003;23(12):939–948. [Google Scholar]

- Deng X., Kang J.K., Low B.S. Corporate social responsibility and stakeholder value maximization: evidence from mergers. J. Financ. Econ. 2013;110(1):87–109. [Google Scholar]

- Dhahri S., Omri A. Entrepreneurship contribution to the three pillars of sustainable development: what does the evidence really say? World Dev. 2018;106:64–77. [Google Scholar]

- Dhahri S., Slimani S., Omri A. Behavioral entrepreneurship for achieving the sustainable development goals. Technol. Forecast. Soc. Change. 2021;165:120561. [Google Scholar]

- Ding W., Levine R., Lin C., Xie W. Corporate immunity to the COVID-19 pandemic. J. Financ. Econ. 2021;141(2):802–830. doi: 10.1016/j.jfineco.2021.03.005. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Doan M.H., Sassen R. The relationship between environmental performance and environmental disclosure. J. Ind. Ecol. 2020;24:1140–1157. [Google Scholar]

- Earnhart D.H., Khannay M., Lyonz T.P. Corporate environmental strategies in emerging economies. Rev. Environ. Econ. Pol. 2014;8(2):164–185. [Google Scholar]

- European Commission . 2021. Recovery Plan for Europe | European Commission.https://ec.europa.eu/info/strategy/recovery-plan-europe_en [Google Scholar]

- Fujii H., Iwata K., Kaneko S., Managi S. Corporate environmental and economic performance of Japanese manufacturing firms: empirical study for sustainable development. Bus. Strat. Environ. 2013;22(3):187–201. [Google Scholar]

- Gjergji R., Vena L., Sciascia S., Cortesi A. The effects of environmental, social and governance disclosure on the cost of capital in small and medium enterprises: the role of family business status. Bus. Strat. Environ. 2021;30(1):683–693. [Google Scholar]

- Gourinchas P.O., Kalemli-Özcan Ṣ., Penciakova V., Sander N. NBER Working Paper; 2020. Covid-19 and SME Failures. No. w27877. [Google Scholar]

- Graafland J. Does corporate social responsibility put reputation at risk by inviting activist targeting? An empirical test among European SMEs. Corp. Soc. Responsib. Environ. Manag. 2018;25(1):1–13. [Google Scholar]

- Greenwood R.M., Iverson B.C., Thesmar D. NBER Working Paper; 2020. Sizing up Corporate Restructuring in the Covid Crisis. No. w28104. [Google Scholar]

- Gu X., Ying S., Zhang W., Tao Y. How do firms respond to COVID-19? First evidence from Suzhou, China. Emerg. Mark. Finance Trade. 2020;56(10):2181–2197. [Google Scholar]

- Guidry R.P., Patten D.M. Voluntary disclosure theory and financial control variables: an assessment of recent environmental disclosure research. Account. Forum. 2012;36(2):81–90. [Google Scholar]

- He H., Harris L. The impact of Covid-19 pandemic on corporate social responsibility and marketing philosophy. J. Bus. Res. 2020;116:176–182. doi: 10.1016/j.jbusres.2020.05.030. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Heikkurinen P., Young C.W., Morgan E. Business for sustainable change: extending eco-efficiency and eco-sufficiency strategies to consumers. J. Clean. Prod. 2019;218:656–664. [Google Scholar]

- Henderson D.J., Millimet D.L. Pollution abatement costs and foreign direct investment inflows to US states: a nonparametric reassessment. Rev. Econ. Stat. 2007;89(1):178–183. [Google Scholar]

- Hillary R. Environmental management systems and the smaller enterprise. J. Clean. Prod. 2004;12(6):561–569. [Google Scholar]

- Huang J., Yang W., Tu Y. Supplier credit guarantee loan in supply chain with financial constraint and bargaining. Int. J. Prod. Res. 2019;57(22):7158–7173. [Google Scholar]

- Islam A., Jerin I., Hafiz N., Nimfa D.T., Wahab S.A. Configuring a blueprint for Malaysian SMEs to survive through the COVID-19 crisis: the reinforcement of quadruple helix innovation model. J. Entrepreneurship Bus. Econ. 2021;9(1):32–81. [Google Scholar]

- Jain P., Vyas V., Roy A. Exploring the mediating role of intellectual capital and competitive advantage on the relation between CSR and financial performance in SMEs. Soc. Responsib. J. 2017;13(1):1–23. [Google Scholar]

- Juergensen J., Guimón J., Narula R. European SMEs amidst the COVID-19 crisis: assessing impact and policy responses. J. Ind. Bus. Econ. 2020;47(3):499–510. [Google Scholar]

- Katsikeas C.S., Leonidou C.N., Zeriti A. Eco-friendly product development strategy: antecedents, outcomes, and contingent effects. J. Acad. Market. Sci. 2016;44(6):660–684. [Google Scholar]

- Kim Y. Environmental, sustainable behaviors and innovation of firms during the financial crisis. Bus. Strat. Environ. 2015;24(1):58–72. [Google Scholar]

- King A.A., Lenox M.J. Industry self-regulation without sanctions: the chemical industry's responsible care program. Acad. Manag. J. 2000;43(4):698–716. [Google Scholar]

- King A.A., Lenox M.J. Does it really pay to be green? An empirical study of firm environmental and financial performance: an empirical study of firm environmental and financial performance. J. Ind. Ecol. 2001;5(1):105–116. [Google Scholar]

- Kraus S., Clauss T., Breier M., Gast J., Zardini A., Tiberius V. The economics of COVID-19: initial empirical evidence on how family firms in five European countries cope with the corona crisis. Int. J. Entrepreneurial Behav. Res. 2020;26(5):1067–1092. [Google Scholar]

- Leonidou L.C., Christodoulides P., Thwaites D. External determinants and financial outcomes of an eco-friendly orientation in smaller manufacturing firms. J. Small Bus. Manag. 2016;54(1):5–25. [Google Scholar]

- Leonidou L.C., Christodoulides P., Thwaites D. Determinants and financial outcomes of an eco-friendly orientation in smaller manufacturing firms. J. Small Bus. Manag. 2019;54(1):5–25. [Google Scholar]

- Li M. Did the Small Business Administration's COVID-19 assistance go to the hard hit firms and bring the desired relief? J. Econ. Bus. 2020:105969. doi: 10.1016/j.jeconbus.2020.105969. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lin W.L., Cheah J.H., Azali M., Ho J.A., Yip N. Does firm size matter? Evidence on the impact of the green innovation strategy on corporate financial performance in the automotive sector. J. Clean. Prod. 2019;229:974–988. [Google Scholar]

- Luo X., Bhattacharya C.B. The debate over doing good: corporate social performance, strategic marketing levers, and firm-idiosyncratic risk. J. Market. 2009;73(6):198–213. [Google Scholar]

- Luo L., Lan Y.C., Tang Q. Corporate incentives to disclose carbon information: evidence from the CDP global 500 report. J. Int. Financ. Manag. Account. 2012;23(2):93–120. [Google Scholar]

- Lynch-Wood G., Williamson D. Understanding SME responses to environmental regulation. J. Environ. Plann. Manag. 2014;57(8):1220–1239. [Google Scholar]

- Marques A.C., Fuinhas J.A., Tomás C. Energy efficiency and sustainable growth in industrial sectors in European Union countries: a nonlinear ARDL approach. J. Clean. Prod. 2019;239:118045. [Google Scholar]

- Masurel E. Why SMEs invest in environmental measures: sustainability evidence from small and medium-sized printing firms. Bus. Strat. Environ. 2007;16(3):190–201. [Google Scholar]

- Moore S.B., Manring S.L. Strategy development in small and medium sized enterprises for sustainability and increased value creation. J. Clean. Prod. 2009;17(2):276–282. [Google Scholar]

- Mukanjari S., Sterner T. Charting a “green path” for recovery from COVID-19. Environ. Resour. Econ. 2020;76(4):825–853. doi: 10.1007/s10640-020-00479-0. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Musa H., Chinniah M. Malaysian SMEs development: future and challenges on going green. Proc. Social Behavioral Sci. 2016;224:254–262. [Google Scholar]

- Myers S.C., Majluf N.S. Corporate financing and investment decisions when firms have information that investors do not have. J. Financ. Econ. 1984;13(2):187–221. [Google Scholar]

- Patten D.M. The relation between environmental performance and environmental disclosure: a research note. Account. Org. Soc. 2002;27(8):763–773. [Google Scholar]

- Petitjean M. Eco-friendly policies and financial performance: was the financial crisis a game changer for large US companies? Energy Econ. 2019;80:502–511. [Google Scholar]

- Przychodzen J., Przychodzen W. Relationships between eco-innovation and financial performance - evidence from publicly traded companies in Poland and Hungary. J. Clean. Prod. 2015;90:253–263. [Google Scholar]

- Purvis B., Mao Y., Robinson D. Three pillars of sustainability: in search of conceptual origins. Sustain. Sci. 2019;14(3):681–695. [Google Scholar]

- Rahdari A.H., Rostamy A.A.A. Designing a general set of sustainability indicators at the corporate level. J. Clean. Prod. 2015;108:757–771. [Google Scholar]

- Rehman S.A., Yu Z. Assessing the eco-environmental performance: an PLS-SEM approach with practice-based view. Int. J. Logist. Res. Appl. 2021;24(3):303–321. [Google Scholar]

- Revell A., Blackburn R. The business case for sustainability? An examination of small firms in the UK's construction and restaurant sectors. Bus. Strat. Environ. 2007;16(6):404–420. [Google Scholar]

- Rizvi S.K.A., Mirza N., Naqvi B., Rahat B. Covid-19 and asset management in EU: a preliminary assessment of performance and investment styles. J. Asset Manag. 2020;21(4):281–291. [Google Scholar]

- Roheim C.A., Zhang D. Sustainability certification and product substitutability: evidence from the seafood market. Food Pol. 2018;79:92–100. [Google Scholar]

- Shen H., Fu M., Pan H., Yu Z., Chen Y. The Impact of the COVID-19 pandemic on firm performance. Emerg. Mark. Finance Trade. 2020;56(10):2213–2230. [Google Scholar]

- Simpson M., Taylor N., Barker K. Environmental responsibility in SMEs: does it deliver competitive advantage? Bus. Strat. Environ. 2004;13(3):156–171. [Google Scholar]

- Singh S.K., Giudice M. Del, Chierici R., Graziano D. Green innovation and environmental performance: the role of green transformational leadership and green human resource management. Technol. Forecast. Soc. Change. 2020;150:119762. [Google Scholar]

- Thakur V., Mangla S.K. Change management for sustainability: evaluating the role of human, operational and technological factors in leading Indian firms in home appliances sector. J. Clean. Prod. 2019;213:847–862. [Google Scholar]

- Tian P., Lin B. Impact of financing constraints on firm's environmental performance: evidence from China with survey data. J. Clean. Prod. 2019;217:432–439. [Google Scholar]

- Tilley F. Small firm environmental ethics: how deep do they go? Bus. Ethics Eur. Rev. 2000;9(1):31–41. [Google Scholar]

- Treacy R., Humphreys P., McIvor R., Lo C. ISO14001 certification and operating performance: a practice-based view. Int. J. Prod. Econ. 2019;208:319–328. [Google Scholar]

- Trianni A., Cagno E., Worrell E. Innovation and adoption of energy efficient technologies: an exploratory analysis of Italian primary metal manufacturing SMEs. Energy Pol. 2013;61:430–440. [Google Scholar]

- Triguero A., Moreno-Mondéjar L., Davia M.A. Drivers of different types of eco-innovation in European SMEs. Ecol. Econ. 2013;92:25–33. [Google Scholar]

- Viesi D., Pozzar F., Federici A., Crema L., Mahbub M.S. Energy efficiency and sustainability assessment of about 500 small and medium-sized enterprises in Central Europe region. Energy Pol. 2017;105:363–374. [Google Scholar]

- Wellalage N.H., Kumar V. Environmental performance and bank lending: evidence from unlisted firms. Bus. Strat. Environ. 2021;30(7):3309–3329. [Google Scholar]

- Williamson D., Lynch-Wood G. A new paradigm for SME environmental practice. TQM Mag. 2001;13(6):424–432. [Google Scholar]

- Wooldridge J.M. Control function methods in applied econometrics. J. Hum. Resour. 2015;50(2):420–445. [Google Scholar]

- Yang D., Wang Z., Lu F. The influence of corporate governance and operating characteristics on corporate environmental investment: evidence from China. Sustainability. 2019;11(10):2737. [Google Scholar]

- Zhang D. How environmental performance affects firms' access to credit: evidence from EU countries. J. Clean. Prod. 2021;315:128294. [Google Scholar]

- Zhang D. Capacity utilization under credit constraints: a firm-level study of Latin American Manufacturing. Int. J. Finance Econ. 2022;27:1367–1386. [Google Scholar]

- Zhang D., Vigne S.A. How does innovation efficiency contribute to green productivity? A financial constraint perspective. J. Clean. Prod. 2021;280:124000. [Google Scholar]