Abstract

Introduction

Several low-income and middle-income countries (LMICs) have implemented health insurance programmes to foster accessibility to healthcare and reduce catastrophic household health expenditure. However, there is little information regarding the population coverage of health insurance schemes in LMICs and on the relationship between coverage and health expenditure. This study used open-access data to assess the level of health insurance coverage in LMICs and its relationship with health expenditure.

Methods

We searched for health insurance data for all LMICs and combined this with health expenditure data. We used descriptive statistics to explore levels of and trends in health insurance coverage over time. We then used linear regression models to investigate the relationship between health insurance coverage and sources of health expenditure and catastrophic household health expenditure.

Results

We found health insurance data for 100 LMICs and combined this with overall health expenditure data for 99 countries and household health expenditure data for 89 countries. Mean health insurance coverage was 31.1% (range: 0%–98.7%), with wide variations across country-income groups. Average health insurance coverage was 7.9% in low-income countries, 27.3% in lower middle-income countries and 52.5% in upper middle-income countries. We did not find any association between health insurance coverage and health expenditure overall, though coverage was positively associated with public health spending. Additionally, health insurance coverage was not associated with levels of or reductions in catastrophic household health expenditure or impoverishment due to health expenditure.

Conclusion

These findings indicate that LMICs continue to have low levels of health insurance coverage and that health insurance may not necessarily reduce household health expenditure. However, the lack of regular estimates of health insurance coverage in LMICs does not allow us to draw solid conclusions on the relationship between health insurance coverage and health expenditure.

Keywords: Health insurance, Health economics, Health systems

WHAT IS ALREADY KNOWN ON THIS TOPIC

Out-of-pocket payments (OOPs) are major sources of healthcare spending in low-income and middle-income countries (LMICs).

Several LMICs have implemented health insurance schemes as a means of reducing the burden of OOPs on households.

WHAT THIS STUDY ADDS

This study performed an exhaustive search for health insurance coverage data from LMICs, finding that coverage is generally quite low.

OOPs on health by households do not appear to be associated with a country’s level of health insurance coverage.

HOW THIS STUDY MIGHT AFFECT RESEARCH, PRACTICE AND/OR POLICY

There are limited current data on health insurance coverage in LMICs, so improvements in the reporting of health insurance coverage could improve estimates of its impact on health expenditure.

Introduction

In recent years, promoting universal health coverage (UHC) has become a key policy focus globally and is now a target of the Sustainable Development Goals (SDGs).1–3 UHC is defined as the aspiration that all people receive the quality health services they need without suffering financially as a result of seeking healthcare.2 This goal requires not only reaching the people so far not benefiting from quality health services but also ensuring that they can access these services without incurring access fees that worsen their financial situation.4 5

Today, health expenditure by households in the form of out-of-pocket payments (OOPs) is an important source of funding for healthcare in many low-income settings, representing 40% of total health expenditure in low-income countries.6–8 However, OOPs create a significant barrier to accessing healthcare and impose a disproportionately high financial burden on poor and vulnerable populations.6 9 To address this, low-income and middle-income countries (LMICs) across the globe have been implementing health insurance schemes that aim to adequately pool resources and risks while providing sufficient financial protection for individuals and households.10–12

Past research has used household surveys and systematic reviews to look at health insurance coverage across LMICs; however, while rigorous in their analysis and inclusion criteria, they included data on relatively few countries.13 14 Furthermore, to date, relatively little is known regarding the current coverage of health insurance programmes in LMICs, and even less is known regarding the relationship between insurance coverage, heath expenditure and the financial burden faced by households.15 In this study, we try to address both these gaps. We first combined all available open-access data on health insurance coverage in LMICs. We then combined these data with data on health expenditure to investigate the relationship between health insurance coverage and health expenditure and households’ financial protection against health expenditure.

Methods

Data

Health insurance data in LMICs

We combined all publically available nationally representative data on health insurance coverage, country-level sources of health expenditure and financial protection indicators. For the 137 countries classified as low, lower-middle or upper-middle income in 2015, in January 2020 we began to search for health insurance coverage data from the Demographic and Health Survey (DHS), Multiple Index Cluster Surveys (MICS), national census data, WHO reports, World Bank reports and other grey literature publications and documents.

The DHS and the MICS served as the ‘gold standard’ for nationally representative health insurance coverage data,16 17 so we first began our data search using the ‘DHS Program STATcompiler’,16 and the UNICEF MICS data repository.18 In the case of countries for which DHS or MICS surveys were not available, we conducted searches for English, French, Spanish and Portuguese language reports and documents in the Pan-American Health Organization, World Bank and WHO Digital Libraries. If we were still unable to locate health insurance coverage estimates via these sources, we searched for census data and other health insurance coverage estimates on the webpages of countries’ respective ministries of health, social welfare and statistics. Lastly, we used PubMed, Web of Science and Google Scholar to search for peer-reviewed studies providing estimates of health insurance coverage for remaining countries (online supplemental table S1). While searching for health insurance coverage data, we noted the year of health insurance schemes’ introduction so that we could compare the number of years of scheme implementation to the level of population coverage achieved by the scheme.

bmjgh-2022-008722supp001.pdf (117.9KB, pdf)

Health expenditure data for LMICs

We also obtained open-access data from the WHO Global Health Observatory data repository in the year 2020 to analyse country-level health expenditure in relation to health insurance coverage.19 The repository contained health expenditure data for 99 of the included countries for indicators related to current health expenditure (CHE) as a percentage of gross domestic product (GDP), including government spending as a portion of CHE, private household spending as a portion of CHE and external spending, such as international development assistance, as portion of CHE. The repository also included the incidence of catastrophic household expenditures on health (n=89 countries) and the incidence of households being pushed into poverty by health expenditures (n=85 countries) (online supplemental table S1).

Statistical analysis

We analysed the health insurance coverage levels reached and sources of health financing in LMICs using descriptive statistics. We began by assessing the achieved level of health insurance coverage, while investigating differences in health insurance coverage between country income group and geographic region. Preliminary exploratory analysis visualised the difference in sources of health financing between levels of health insurance coverage. In order to facilitate the visualisation of the relative contributions of government, private and external expenditure to CHE with respect to health insurance coverage, health insurance coverage was categorised using k-means clustering. The resulting three categories were low coverage (0%–23.3%), middle coverage (23.3%–58.5%) and high coverage (58.5%–98.7%). When possible, the year of introduction of a country’s predominant health insurance scheme was also used to assess coverage growth over time (n=59).

Lastly, we sought to investigate whether having higher levels of health insurance coverage is associated with lower levels of OOPs and catastrophic household expenditure on health. Including countries’ income (Gross National Income (GNI) per capita in purchasing power parity-adjusted international dollars (PPP Int $)) as a control variable, we used linear regression models to investigate whether a country’s level of health insurance coverage explains:

OOPs as a share of CHE.

Private expenditure on health as a share of CHE.

Catastrophic household expenditures on health at the 10% and 25% of household income spending thresholds.

Incidence of impoverishment due to household expenditure on healthcare at the $1.90 /day and $3.20 /day poverty line thresholds.

For countries with more than 1 year of data for health insurance coverage and health expenditure data available (n=25), we used country-level income-adjusted linear regression models to investigate whether changes in health insurance coverage over time were associated with corresponding changes in either government, OOP or private expenditure on health over time.

Results

Health insurance coverage in LMICs

We found health insurance coverage data for 100 out of 137 countries classified as LMICs, with the year of data ranging from 2001 to 2020. The DHS contributed the most coverage data (n=56), while other nationally representative household surveys such as the MICS, national census data, WHO reports and other publications and official documents supplied the remaining data (online supplemental table S1).

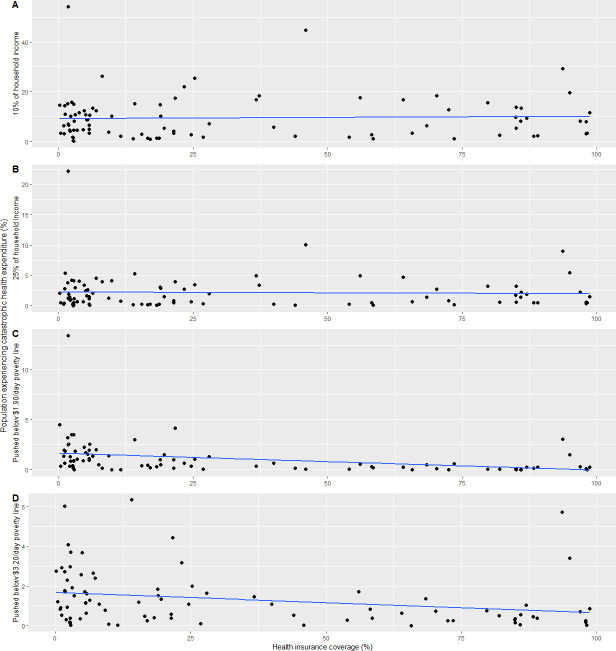

Overall, the mean level of health insurance coverage in LMICs was 31.1% (95% CI: 24.5 to 37.7), with wide variations across country-income groups. Average health insurance coverage was 7.9% (95% CI: 1.2 to 14.5) in low-income countries, 27.3% (95% CI: 17.6 to 36.9) in lower middle-income countries and 52.5% (95% CI: 40.8 to 64.1) in upper middle-income countries (figure 1). Health insurance coverage varied widely even within the income groups, especially for middle income countries (figure 1).

Figure 1.

Proportion of population covered by health insurance by World Bank country income group (A) and continent (B) (n=100).

At the regional/continental level, coverage ranged from a mean of 12.8% (range: 0%–73.5%) in Africa to 28.0% (range: 0.15%–85%) in Asia, 39.2% (range: 0%–98.7%) in the Americas, 53.3% (range: 4.4%–95%) in the Western Pacific and 71.7% (range: 2.85%–98.2%) in Europe (figure 1).

For countries with multiple years of health insurance coverage data available, we found the mean change in coverage per year elapsed to be a +1.01% change in population coverage, ranging from a difference of −3% per year (Ghana) to a difference of +10.3% per year (Peru) (online supplemental figure S1).

Health insurance coverage and health expenditure

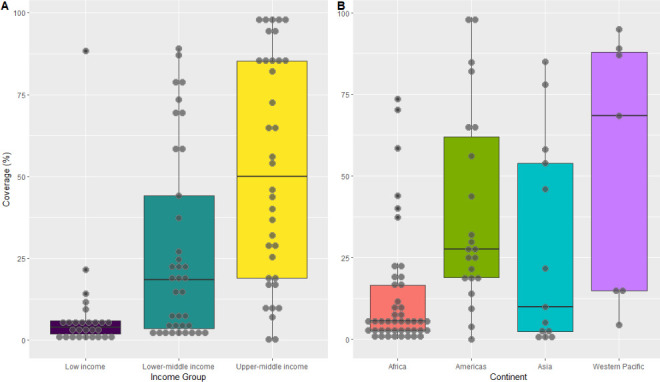

We did not find any bivariate association between a country’s level of health insurance coverage and a country’s overall health expenditure (p=0.175) (online supplemental table S2, figure 2).

Figure 2.

Total current health expenditure as a portion of country gross domestic product (GDP) relative to proportion of the population covered by health insurance (n=99).

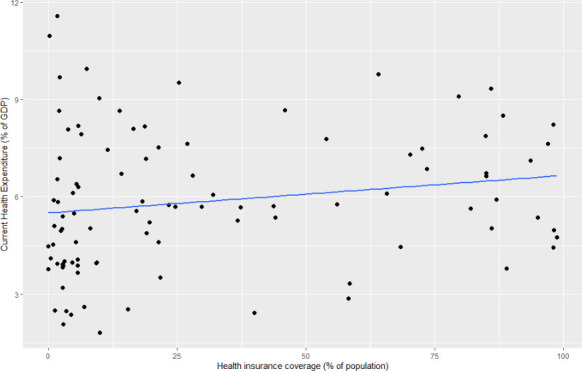

The relative share of government, private and external expenditure as portions of CHE appeared notably different depending on a country’s level of health insurance coverage (figure 3). However, unadjusted linear regression models indicated that health insurance coverage was only associated with government and external expenditures on health (online supplemental table S3, p<0.001), while when adjusting for a country’s income, health insurance coverage only remains associated with domestic government expenditures on health (p<0.001).

Figure 3.

The proportions of total current health expenditure accounted for by government expenditure, private expenditure and external expenditure (n=99).

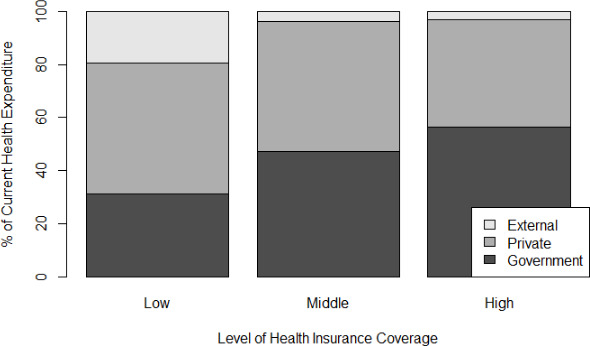

Out-of-pocket expenditure accounted for 39.9% (95% CI: 36.2 to 43.5) of CHE across included countries, which translated to 9.4% (95% CI: 7.6 to 11.3) of households incurring health expenditure exceeding 10% of household income, while 2.1% (95% CI: 1.5 to 2.7) incurred health expenditures exceeding 25% of household income. Adjusted linear regression models indicated that a country’s level of health insurance coverage was not associated with the incidence of catastrophic health expenditure among its population (figure 4), at either the 10% (p=0.451) or the 25% (p=0.601) of income spending thresholds (online supplemental table S4).

Figure 4.

Scatter plots of country-level health insurance coverage in relation to the proportion of the population spending more than 10% (A) and 25% (B) of household income on health (n=89). Scatter plots of country-level health insurance coverage in relation to the proportion of the population pushed below $1.90/day poverty line (C) and $3.20/day poverty line (D) as a result of household expenditure on healthcare services (n=85). Note the varying scales of the y-axes.

On the other hand, adjusted linear regression models did indicate a relationship between health insurance coverage and the incidence of impoverishment due to health expenditures at both the $1.90 /day threshold (p=0.001) and the $3.20 /day threshold (p=0.049)(figure 4). Though in both cases the association was only modest, as most variability in impoverishment incidence was accounted for by GNI rather than health insurance coverage, consistent with the catastrophic expenditure findings described above (online supplemental table S5).

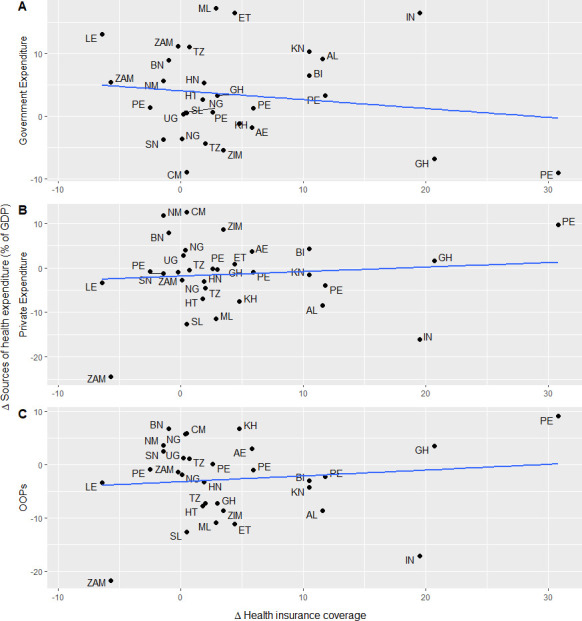

For those countries with more than 1 year of health insurance coverage and health expenditure data available (n=25), country-level income-adjusted linear models indicated that changes in health insurance coverage over time are not associated with corresponding changes in either government (p=0.72), private (p=0.86) or OOP (p=0.78) expenditure on health over time (online supplemental table S6, figure 5, country code abbreviations can be found in online supplemental appendix I).

Figure 5.

Scatter plots showing the change in country-level health insurance coverage between observation years in relation to the proportion of health expenditure accounted for by government expenditure (A), private expenditure (B) and out-of-pocket expenditure (C) (n=25). For legend of country abbreviations, see online supplemental appendix I. GDP, gross domestic product.

bmjgh-2022-008722supp002.pdf (14.8KB, pdf)

Discussion

Scaling up health insurance coverage is a major health financing strategy adopted by LMICs to move towards UHC. We found health insurance coverage data for 100 LMICs, which had a mean coverage level of 31%. Despite a wide variation in health insurance coverage between countries, our analyses did not indicate a relationship between health insurance coverage and any of the included measures of overall health expenditure or household health expenditure.

The infrequency of health insurance coverage estimates make it difficult to assess health insurance schemes in LMICs and their relation to healthcare-related financial risk. Nevertheless, in this analysis, we acquired health insurance coverage and health expenditure data for most LMICs. A recent study using DHS data estimated that population coverage of health insurance in sub-Saharan Africa is generally low, with 28 of the 36 included countries having less than 10% of their population covered by health insurance.13 Our analysis shows similar levels of coverage in Africa at 12% on average and coverage across LMICs in general at 31% on average.

A recent systematic review has explored reasons for the slow uptake of health insurance in LMICs, describing the unaffordability of premiums and poor perceived quality of care as substantial barriers to attracting and keeping members of health insurance schemes.20 In order to be sustainable and effective, insurance schemes and health systems should address issues regarding the quality of healthcare services in order to attract a larger portion of the population. Unfortunately, as it stands, insurance schemes in LMICs are far from reaching sufficient levels of population coverage to be sustainable on their own.21–23 We expected that the share of government expenditure on health would be higher in countries with higher levels of health insurance coverage due to the subsidisation of health insurance schemes and that private households would in turn bear a lower proportion of health expenditure. However, one must also consider the possibility that this relationship could be bidirectional in that higher levels of government investment in health insurance schemes could play a role in promoting and increasing enrolment. Overall, we did not observe a relationship between health insurance coverage and health expenditure as a portion of GDP (figure 2). While government health spending as a share of overall health expenditure was positively associated with health insurance coverage, household health expenditure as a portion of overall health spending remained stable across levels of health insurance (figure 3).

While our findings indicated that countries with higher levels of health insurance have not alleviated the burden of OOPs on households, the inverse also seems true in that households in countries with low levels of health insurance do not seem to bear a relatively greater burden of OOPs. A recent systematic review of health expenditure in LMICs also found that higher spending on voluntary health insurance schemes did not necessarily correspond to a lower burden of OOPs.7 As such, health insurance is not likely a useful proxy measure for evaluating progress towards the achievement of SDG 3.8.2: ‘proportion of the population that spends a large amount of household income on health’.2

Similarly, we also expected that in countries with higher population coverage by health insurance, a lower proportion of households would incur catastrophic health expenditures. However, our analysis indicates that residents of LMICs with high levels health insurance coverage experience catastrophic expenditure and impoverishment at a similar rate to residents of LMICs with lower levels of health insurance coverage. However, at the household level, there is evidence that having health insurance can confer financial risk protection in LMICs, but that not all socioeconomic groups benefit equally.24–26

Inequities in the protective effect of health insurance in LMICs tend to favour urban, better-off population groups.27–29 Assessments of a health insurance scheme in Mexico emphasise that the financial protection of health insurance beneficiaries may depend on the quality of nearby health facilities and services, especially in rural areas where beneficiaries were found to be not as well protected as those living in urban areas.28 Similarly, studies in the context of Ghana’s National Health Insurance Scheme indicate that between 6% and 18% of insured households in rural, resource-constrained districts continue to suffer from catastrophic expenditure on health.27 29

However, our analysis did not include estimates of healthcare utilisation or estimates of the share of the population that forgoes using necessary health service due to financial barriers to access. As such, future analyses should attempt to determine if residents of countries with higher levels of health insurance coverage use healthcare at higher rates than those in countries with lower levels of health insurance coverage.

For those countries with more than 1 year of health insurance coverage and health expenditure data available, our analysis indicates that at the country-level, there is little growth in health insurance over time and that any change in coverage over time is not associated with corresponding changes in either government, private or OOP spending (online supplemental table S6, figure 5). While we cannot make any conclusions from this analysis due to the small sample size of countries with longitudinal data available, several factors may explain the lack of growth in health insurance coverage. For countries relying on voluntary community health funds as their primary health insurance scheme, beneficiaries’ perception that the poor quality of care offered in many contexts is not worth the cost of the premium stagnant growth could partially explain the low enrolment rates and high dropout rates associated with these schemes.23 30 While typically offering better benefits packages than voluntary community-based health insurance, social security and other formal employment-based schemes would not easily allow coverage expansion due to the large informal economic sector often present in LMICs.31

Conclusion

This study used all available open-access data to assess the most current levels of health insurance coverage in LMICs. Our main findings are that health insurance coverage is still quite low in LMICs and that there is not a clear empirical relationship between health insurance coverage and either overall health spending, private expenditure or catastrophic household expenditure on health. However, OOPs are a major source of health financing in LMICs, and the regressive nature of this financing mechanism forces households to forgo seeking healthcare or to incur catastrophic expenditure on health and even impoverishment due to spending on health. Health insurance may still prove to be an effective mechanism for removing financial barriers to accessing healthcare and protecting households against costs of healthcare. However, this is likely to require wide health system strengthening efforts to improve the quality and accessibility of health services. Moreover, the irregularity with which countries collect and report health insurance coverage and health expenditure data makes it difficult to estimate the effectiveness of these schemes and monitor progress toward UHC. Therefore, countries should collect data more regularly in order to allow more accurate assessments of the progress toward UHC and to identify which policies should be prioritised to meet this goal.

Footnotes

Handling editor: Edwine Barasa

Contributors: This study was conceived and designed by all authors. BH and DOA performed the data search. BH performed the data analysis and produced the first draft of the manuscript. DOA, GF and FT critically reviewed the manuscript and contributed to the writing and finalising of the manuscript. Guarantor: BH

Funding: This manuscript is part of the research project ‘Health systems governance for an inclusive and sustainable social health protection in Ghana and Tanzania’ funded via the Swiss Programme for Research on Global Issues for Development (R4D), a joint research funding programme of the Swiss National Science Foundation and the Swiss Agency for Development and Cooperation (Grant #: 183760).

Competing interests: None declared.

Patient and public involvement: Patients and/or the public were not involved in the design, or conduct, or reporting, or dissemination plans of this research.

Provenance and peer review: Not commissioned; externally peer reviewed.

Supplemental material: This content has been supplied by the author(s). It has not been vetted by BMJ Publishing Group Limited (BMJ) and may not have been peer-reviewed. Any opinions or recommendations discussed are solely those of the author(s) and are not endorsed by BMJ. BMJ disclaims all liability and responsibility arising from any reliance placed on the content. Where the content includes any translated material, BMJ does not warrant the accuracy and reliability of the translations (including but not limited to local regulations, clinical guidelines, terminology, drug names and drug dosages), and is not responsible for any error and/or omissions arising from translation and adaptation or otherwise.

Data availability statement

All data relevant to the study are included in the article or uploaded as supplementary information.

Ethics statements

Patient consent for publication

Not applicable.

Ethics approval

Not applicable.

References

- 1.WHO . World health report 2013: research for universal health coverage. Geneva: World Health Organization, 2013. [Google Scholar]

- 2.Transforming our world: the 2030 agenda for sustainable development. GA Res A/70/L1, United nations 2015.

- 3.Wagstaff A, Neelsen S. A comprehensive assessment of universal health coverage in 111 countries: a retrospective observational study. Lancet Glob Health 2020;8:e39–49. 10.1016/S2214-109X(19)30463-2 [DOI] [PubMed] [Google Scholar]

- 4.McIntyre D, Garshong B, Mtei G, et al. Beyond fragmentation and towards universal coverage: insights from Ghana, South Africa and the United Republic of Tanzania. Bull World Health Organ 2008;86:871–6. 10.2471/BLT.08.053413 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.World Health O, Carrin G, James C. Achieving universal health coverage: developing financing system. Geneva: World Health Organization, 2005. [Google Scholar]

- 6.Ghosh S. Catastrophic payments and Impoverishment due to out-of-pocket health spending. Economic and Political Weekly 2011;46:63–70 https://www.jstor.org/stable/41720524 [Google Scholar]

- 7.Pettigrew LM, Mathauer I. Voluntary health insurance expenditure in low- and middle-income countries: exploring trends during 1995-2012 and policy implications for progress towards universal health coverage. Int J Equity Health 2016;15:67. 10.1186/s12939-016-0353-5 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Xu K, Soucat A, Kutzin J. New perspectives of global health spending for universal health coverage. Geneva: World Health Organization, 2018. [Google Scholar]

- 9.Wagstaff A, Eozenou P, Smitz M. Out-Of-Pocket expenditures on health: a global Stocktake. World Bank Res Obs 2020;35:123–57. 10.1093/wbro/lkz009 [DOI] [Google Scholar]

- 10.Dieleman JL, Sadat N, Chang AY, et al. Trends in future health financing and coverage: future health spending and universal health coverage in 188 countries, 2016–40. The Lancet 2018;391:1783–98. 10.1016/S0140-6736(18)30697-4 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Kutzin J. Health financing for universal coverage and health system performance: concepts and implications for policy. Bull World Health Organ 2013;91:602–11. 10.2471/BLT.12.113985 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.WHO . World health report 2010: health system financing: the path to universal health coverage. Geneva: World Health Organization, 2010. [Google Scholar]

- 13.Barasa E, Kazungu J, Nguhiu P, et al. Examining the level and inequality in health insurance coverage in 36 sub-Saharan African countries. BMJ Glob Health 2021;6:e004712. 10.1136/bmjgh-2020-004712 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Osei Afriyie D, Krasniq B, Hooley B, et al. Equity in health insurance schemes enrollment in low and middle-income countries: a systematic review and meta-analysis. Int J Equity Health 2022;21:21. 10.1186/s12939-021-01608-x [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Zhao L, Cao B, Borghi E, et al. Data gaps towards health development goals, 47 low- and middle-income countries. Bull World Health Organ 2022;100:40–9. 10.2471/BLT.21.286254 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 16.ICF . The DHS program STATcompiler: funded by USAID, 2012. [Google Scholar]

- 17.UNICEF . Multiple indicator cluster surveys.

- 18.UNICEF . Surveys - UNICEF MICS 2021. Available: http://mics.unicef.org/surveys

- 19.WHO . Global health Observatory data Repository. [DOI] [PubMed]

- 20.Adebayo EF, Uthman OA, Wiysonge CS, et al. A systematic review of factors that affect uptake of community-based health insurance in low-income and middle-income countries. BMC Health Serv Res 2015;15:543. 10.1186/s12913-015-1179-3 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21.Borghi J, Maluka S, Kuwawenaruwa A, et al. Promoting universal financial protection: a case study of new management of community health insurance in Tanzania. Health Res Policy Syst 2013;11:21. 10.1186/1478-4505-11-21 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 22.Renggli S, Mayumana I, Mshana C, et al. Looking at the bigger picture: how the wider health financing context affects the implementation of the Tanzanian community health funds. Health Policy Plan 2019;34:12–23. 10.1093/heapol/czy091 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 23.Umeh CA. Challenges toward achieving universal health coverage in Ghana, Kenya, Nigeria, and Tanzania. Int J Health Plann Manage 2018;33:794–805. 10.1002/hpm.2610 [DOI] [PubMed] [Google Scholar]

- 24.Fang H, Eggleston K, Hanson K, et al. Enhancing financial protection under China’s social health insurance to achieve universal health coverage. BMJ 2019;l:2378. 10.1136/bmj.l2378 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25.Fiestas Navarrete L, Ghislandi S, Stuckler D, et al. Inequalities in the benefits of national health insurance on financial protection from out-of-pocket payments and access to health services: cross-sectional evidence from Ghana. Health Policy Plan 2019;34:694–705. 10.1093/heapol/czz093 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 26.Thuong NTT, Huy TQ, Tai DA, et al. Impact of health insurance on health care utilisation and out-of-pocket health expenditure in Vietnam. Biomed Res Int 2020;2020:1–16. 10.1155/2020/9065287 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 27.Akazili J, McIntyre D, Kanmiki EW, et al. Assessing the catastrophic effects of out-of-pocket healthcare payments prior to the uptake of a nationwide health insurance scheme in Ghana. Glob Health Action 2017;10:1289735. 10.1080/16549716.2017.1289735 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28.Grogger J, Arnold T, León AS, et al. Heterogeneity in the effect of public health insurance on catastrophic out-of-pocket health expenditures: the case of Mexico. Health Policy Plan 2015;30:593–9. 10.1093/heapol/czu037 [DOI] [PubMed] [Google Scholar]

- 29.Okoroh J, Essoun S, Seddoh A, et al. Evaluating the impact of the National health insurance scheme of Ghana on out of pocket expenditures: a systematic review. BMC Health Serv Res 2018;18:426. 10.1186/s12913-018-3249-9 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 30.Macha J, Harris B, Garshong B, et al. Factors influencing the burden of health care financing and the distribution of health care benefits in Ghana, Tanzania and South Africa. Health Policy Plan 2012;27 Suppl 1:i46–54. 10.1093/heapol/czs024 [DOI] [PubMed] [Google Scholar]

- 31.Acharya A, Vellakkal S, Taylor F, et al. The impact of health insurance schemes for the informal sector in low- and middle-income countries: a systematic review. World Bank Res Obs 2013;28:236–66. 10.1093/wbro/lks009 [DOI] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

bmjgh-2022-008722supp001.pdf (117.9KB, pdf)

bmjgh-2022-008722supp002.pdf (14.8KB, pdf)

Data Availability Statement

All data relevant to the study are included in the article or uploaded as supplementary information.