Abstract

The outbreak of the novel coronavirus (Covid-19) has led to a global public health disaster and global economic crisis and significantly impacted industries across the world. As China was the first to feel the effects of the Covid-19 outbreak, it was also the first to overcome the effects and resume economic production. To understand the impact of the Covid-19 pandemic on SMEs in China and suggest public policies to deal with the negative effects, in February 2020, this paper examined the impacts on 3194 SMEs from primary, manufacturing, wholesale and retail trade, hospitality (accommodation and catering), and new economy industries in Sichuan, China using an online survey and follow-up interviews. It was found that the effects differed by industry sector: the primary industry sector by poor logistics; the manufacturing industry sector by supply chain management problems; the wholesale and retail trade industry sector by the need to accelerate their online services; the hospitality industry sector, the most severely affected sector, by cash flow pressure; and the new economy industry sector by short-term pressures. Short-term revenue declines and an inability to resume work and production were common problems faced by all surveyed SMEs. These findings from Sichuan, China provide some valuable references for global industry recovery.

Keywords: Covid-19, Perceived impact, Industry sectors, SMEs, China

1. Introduction

The Covid-19 outbreak started in China in early January 2020 and spread across the world in the following three months [1]. On 11 March, 2020, the World Health Organization (WHO) announced that Covid-19 was a pandemic. As Covid-19 spread, governments began implementing strict measures to save lives, such as prohibiting live events, asking citizens to stay indoors, and shutting down businesses, all of which slowed the Covid-19 spread and prevented the overload of national healthcare systems. However, these measures also threatened the survival of many firms and industries in all sectors on a global scale, which in turn could have potentially devastating individual, societal, and economic outcomes, such as massive unemployment and social precarity [2].

In the early days of the outbreak, the Chinese government adopted strict measures to curb the spread of the pandemic. On January 23, 2020, all buses, subways, ferries and long-distance passenger transportation in Wuhan were suspended, and the departure channels of airports and railway stations were also closed, that is, a city of more than 10 million people was completely closed off from the rest of China and the world. To contain the virus spread, a high-level public health emergency response was launched nationwide shortly after the Wuhan lockdown, at which time China took unprecedented defensive measures, such as banning live parties and meetings, sealing off urban and rural areas, and closing factories and shopping malls. During the most serious period of the pandemic, resident activities were also restricted to prevent community transmission, and in many provinces including Sichuan, companies were not allowed to resume operations until February 10, with many factories and companies across the country staying closed for most of February [3].

To deal with Covid-19, which is both a health and an economic crisis, many countries have used a combination of containment and mitigation [4]. Although China's efforts successfully controlled the pandemic, doubts were expressed as to whether these actions could be successful in other countries [5]. However, when the pandemic became unmanageable in Italy, on March 9, 2020, the Italian government imposed a nationwide lockdown to forcibly limit human movements, a policy which then became the standard practice in Spain, France, Germany and the UK, all of which imposed nationwide lockdowns in March 2020. Lockdown measures were then also adopted in most countries in Asia, Africa, and the Americas.

Although these strict measures have largely curbed the spread of the pandemic, many industries have been affected [6]. Loayza et al. [7], found, however, that disasters have different effects on different economic sectors. The shutdown of factories, enterprises and shops has had a significant impact on the manufacturing, retail, tourism and other industry sectors that rely on physical stores, and the voluntary and involuntary restrictions on the physical movement of people has potentially reduced consumer spending. The longer the restrictions remain on the movement of people, the larger the impact on personal and firm level behaviors [8]. It has already been found that consumer confidence has dramatically declined in some economies, which has led to a significant reduction in private consumption spending, especially in the tourism and hospitality sectors [9]. Services involving face-to-face contact have also been dealt a severe blow by the widespread fear of infection from these types of interactions; however, the demand for e-commerce, online education, and online meetings has increased significantly because many people have been working from home [10]. The health care demands caused by the pandemic have also put pressure on the medical and health sectors [11]. Therefore, as different industries have been affected differently by the outbreak, and others have been given opportunities, it is necessary to explore how severely the industry sectors have been affected by the global Covid-19 pandemic.

Many studies have examined the impact of pandemics and disasters on business. Tourism, in particular, has been found to be highly vulnerable to pandemics [[12], [13], [14]], and the impact of natural hazards on the retail industry has also been examined [[15], [16], [17]] from which it was found that natural hazards most often result in a high retail shop closure ratio [18], a general decrease in the number of small retailers [19], and a significant reduction in private consumption spending [20]. Some studies have examined the impact on agriculture and manufacturing sectors [[21], [22], [23]] and even though it has been found that pandemics and disasters have varied effects on different economic sectors, there have been few studies that have examined multiple industry sectors [24].

However, compared with previous pandemics and disasters, Covid-19 had new characteristics. For example, though less fatal than the SARS epidemic, Covid-19 is more widespread and more contagious [25]. Its impact was first felt in China's tourism and consumption economy before the Spring Festival in late January, after which the effects began to be felt by other industries.

Because the Covid-19 pandemic has affected economies in many countries and resulted in continuing and significant losses to many industries and enterprises, this paper sought to determine the Covid-19 impact on Chinese industries. However, because of the lack of SME data in the different industry sectors in Sichuan Province, China, a comprehensive online survey in early February, 2020, was employed to directly ask the SMEs about the specific Covid-19 effects they had experienced. The research was driven by the following research questions:

RQ1. What was the specific impact of the Covid-19 crisis on the different industry sectors?

RQ2. What difficulties were the industry sectors facing in recovering from Covid-19? What policy assistance did they need?

RQ3. As the Chinese government released its macroeconomic data for the first quarter on 17 April, what were the similarities and differences between the perceived Covid-19 impacts and the actual impacts?

Therefore, this study explored the perceived impacts of the Covid-19 crisis on SMEs in different industry sectors in Sichuan Province, China. As China was the first to be affected by the Covid-19 outbreak, it was also the first to effectively control the virus and resume economic activities. The chosen case area, Sichuan Province, which leads economic development in western China, is relatively close to Wuhan, Hubei Province, the epicenter of the pandemic, and therefore was moderately affected by the initial Covid-19 outbreak in January. However, Sichuan Province was also one of the first provinces in China to resume work, with a small number of SMEs resuming work on February 3 (the second week after the event date). As in most market-oriented economies, Chinese SMEs, most of which are private companies, are a driving force behind China's economic growth, and therefore have the same barriers as SMEs in other countries. However, SMEs are often the most vulnerable in major public crises [26] as evidenced by the Covid-19 crisis in China, in which the SMEs were some of the hardest hit [27]. Therefore, this study could provide a valuable reference for industry sector recovery in other countries.

2. Data and method

The initial data were extracted from an online survey given to 6034 enterprises in Sichuan Province in February, 2020, that sought information on the possible difficulties and pressures these SMEs were facing and their policy demands for recovery. Due to the need to continue pandemic prevention and control measures, the data were collected in two contactless approach phases: an online survey period from February 3 to 10, and semi-structured telephone interviews, which were held from February 10 to 16.

The survey focused on four aspects: (1) work resumption and challenges; (2) the main pressures and challenges faced by the enterprises; (3) required supportive policies; and (4) enterprise characteristics. The interviews were also conducted around these four themes to verify the survey results. To explore the impact of the pandemic on SMEs in Sichuan [3], 6,243 surveys were sent to SME business owners or executive officers in early February by the General Association of Sichuan Entrepreneurs, a local, non-profit social organization jointly established by domestic and foreign Sichuan entrepreneurs, and 6,034 valid surveys were returned.

As this study sought to analyze the similarities and differences in the perceived impact of the Covid-19 crisis in the different industry sectors, five representative industries were selected from the 19 industries represented in the collected data to conduct further in-depth thematic analyses. To ensure representativeness and convenience, the selection criteria were: (1) representative primary, secondary and tertiary industry proportions for Sichuan Province; (2) sample sizes for the selected industries larger than 300; and (3) the hardest hit industry SMEs based on a preliminary judgment of the survey results.

China's national economic industry classifies the primary sector as the agriculture, forestry, animal husbandry, and fishery industries; therefore, these were chosen to represent the primary sector. The secondary sector embraces the manufacturing, mining, construction, and power, heat, gas, and water production and supply industries. However, as only the manufacturing industries had a large enough sample, this was selected as the representative secondary sector industry. From the tertiary sector, the hospitality (accommodation and catering) and wholesale and retail industries were selected because: (1) the tertiary sector in Sichuan in 2019 made up 52.4% of GDP, most of which were contributed by these two industries; (2) these two industries together were a relatively big sample; and (3) based on the preliminary results, these two industries were two of the hardest hit.

Special attention was also paid to the effects of the pandemic on the new economy, which is defined in this paper as SMEs driven by information technology and high-tech products or production, that is, industries that connect the virtual economy to the real economy, integrate capital and technology, and interact with scientific, technological, and institutional innovations.

As China's economic development moves from “high speed” to “high quality”, the new economy has begun to receive more attention, with the new economy industry in Chengdu, the capital city of Sichuan Province, having good development momentum. As the first city in China to systematically propose new economy development, Chengdu has explored several new economy development paths. As of September 2019, there were 347,000 new economy enterprises in Chengdu, the regional GDP for which in 2018 was 1.53 trillion CNY, ranking 8th of all cities in China.

A sample of the 3194 SMEs in these five industry sectors was finally selected, the characteristics for which are shown in Table 1 . The interviewees were then randomly selected from 40 of the SMEs from these five industries, the characteristics for which are shown in Table 2 .

Table 1.

Characteristics of the sample SMEs.

| Industry Indicator |

Employee numbers |

Annual turnover (CNY) |

Total | ||||

|---|---|---|---|---|---|---|---|

| <50 | 50–100 | 100–500 | <5 million | 5 - 20 million | 20 - 300 million | ||

| Primary industry sector | 342 (68.5%) | 106 (21.2%) | 51 (10.2%) | 264 (52.9%) | 133 (26.7%) | 102 (20.4%) | 499 |

| Manufacturing | 467 (39.2%) | 368 (30.9%) | 355 (29.8%) | 300 (25.2%) | 328 (27.6%) | 562 (47.2%) | 1190 |

| Wholesale and retail trade | 437 (76.4%) | 95 (16.6%) | 40 (7%) | 300 (52.4%) | 140 (24.5%) | 132 (23.1%) | 572 |

| Hospitality (accommodation and catering) | 209 (63.5%) | 67 (20.4%) | 53 (16.1%) | 223 (67.8%) | 83 (25.2%) | 23 (7%) | 329 |

| New economy | 393 (65.1%) | 123 (20.4%) | 88 (14.6%) | 335 (55.5%) | 144 (23.8%) | 125 (20.7%) | 604 |

Table 2.

Characteristics of the interviewees.

| Industry Indicator |

Employee numbers |

Total | ||

|---|---|---|---|---|

| <50 | 50–100 | 100–500 | ||

| Primary industry sector | A1-A2 | A3-A4 | A5-A7 | 7 |

| Manufacturing | B1 | B2 | B3–B12 | 12 |

| Wholesale and retail trade | C1–C4 | C5 | C6 | 6 |

| Hospitality (accommodation and catering) | D1-D5 | D6 | D7-D10 | 10 |

| New economy | E1 | E2-E3 | E4-E7 | 7 |

3. Results

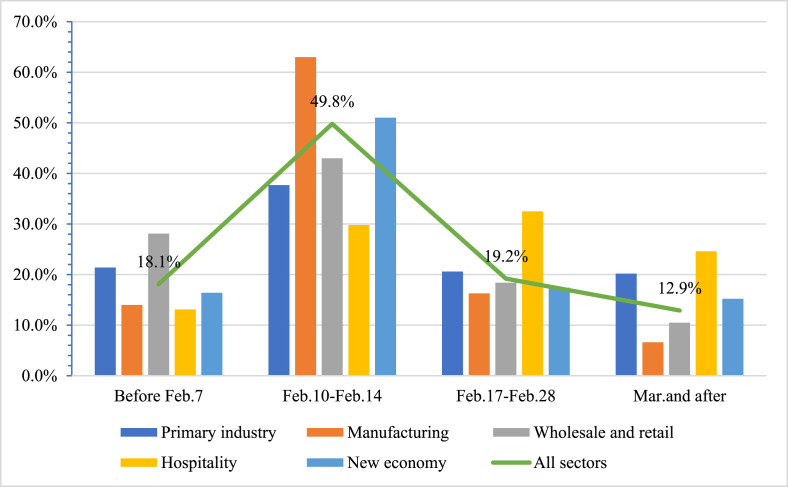

3.1. Impact on work resumption

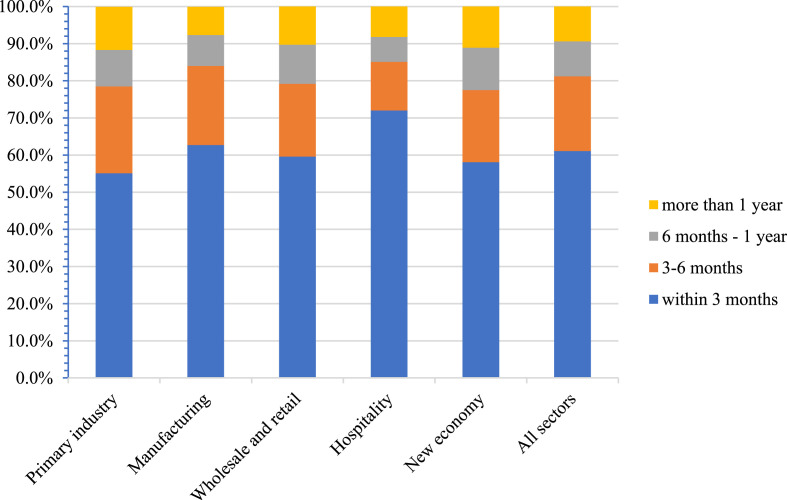

As shown in Fig. 1 , many SMEs were eager to resume work as soon as possible, with 81.9% of the sample planning to resume work in February. However, at a significance of suggested that different industries had different plans for resuming work. The manufacturing industries were scheduled to resume work the earliest,followed by the new economy, with the hospitality (accommodation and catering) industries scheduled to resume work last. There was a weak correlation found between industry sector and resumption plans: , . A possible reason for this difference was that the manufacturing industries were unable to operate online. The interviews revealed that most catering industries had not resumed work and only some were offering take-out services; however, most new economy enterprises had opened remote online offices and continued operations.

Fig. 1.

Work resumption plan by sector.

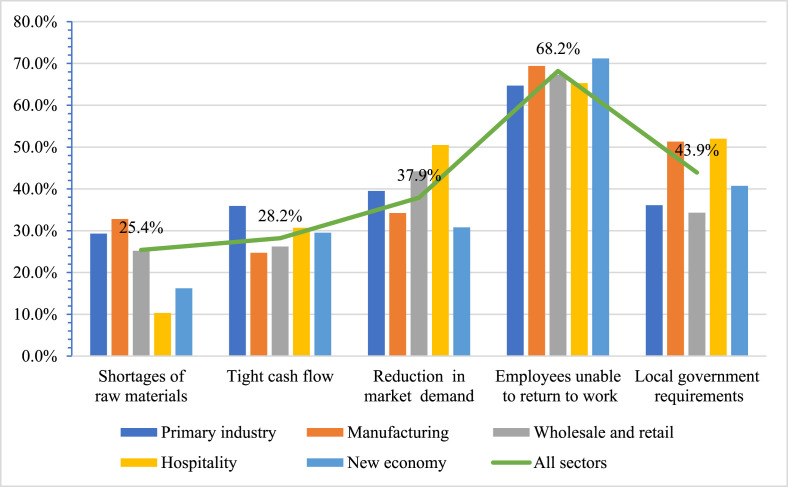

As shown in Fig. 2 , the main reason for the delays in resuming work was employee difficulties in returning to work, with this being a difficulty for 60% of the SMEs in the sample. The other factors hindering work resumption differed across the industries at a significance of . The manufacturing industries were more susceptible to raw material and supply chain constraints (adjusted residual = 7.4); however, the hospitality (adjusted residual = −6.6) and new economy enterprises (adjusted residual = −5.8) did not have these problems. Manufacturing had a shortage of raw materials and supply chain fractures, and hospitality (accommodation and catering) industries had significant market demand reductions. Primary industry was more affected by cash flow problems, and the wholesale and retail industries were especially affected by falling demand.

Fig. 2.

Main reasons for delayed work resumption by sector.

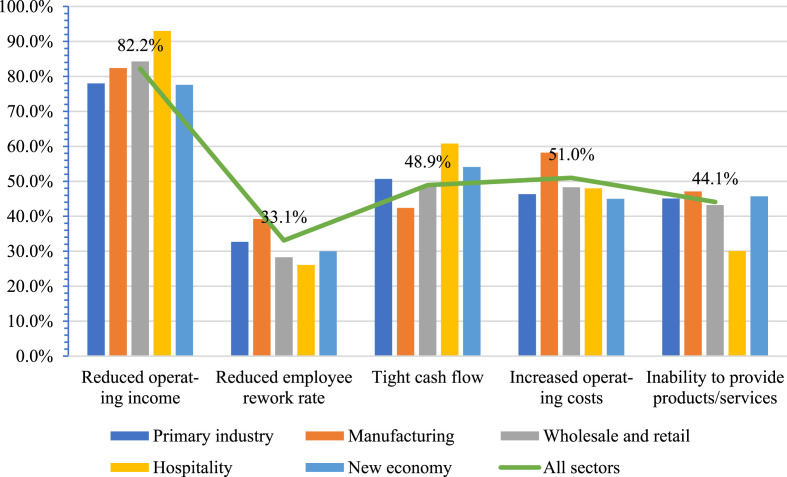

3.2. Short-term impact and main pressures

As shown in Fig. 3 , the SMEs’ operating income generally suffered short-term declines, which was especially evident in the hospitality (accommodation and catering) industries, which suffered from more than a 90% decrease in operating income (adjusted residual = 5.4); however, the new economy industries were relatively less affected (adjusted residual = −3.3).

Fig. 3.

Main impacts of the pandemic by sector.

Manufacturing industries were more affected by low rework rates (adjusted residual = 5.6) and increased operating costs (adjusted residual = 6.3) but less by restricted cash flow (adjusted residual = −5.7). Hospitality (accommodation and catering) industries, however, were more vulnerable to cash flow constraints (adjusted residual = 4.6) and were less able to provide their normal products or services (adjusted residual = −5.4).

In general, hospitality (accommodation and catering) industries were the most affected and suffered the greatest revenue losses. Even though these industries could have provided their normal products and services, the market demand had fallen dramatically and work resumption had to be delayed; however, the SMEs still had to cover their fixed operating costs, which resulted in tight cash flow situations. Despite the relatively abundant cash flow in the manufacturing industries, the low rate of employees returning to work and the increased operating costs made it difficult to resume full production. If the pandemic had continued to spread, many enterprises would have had to close due to bankruptcy.

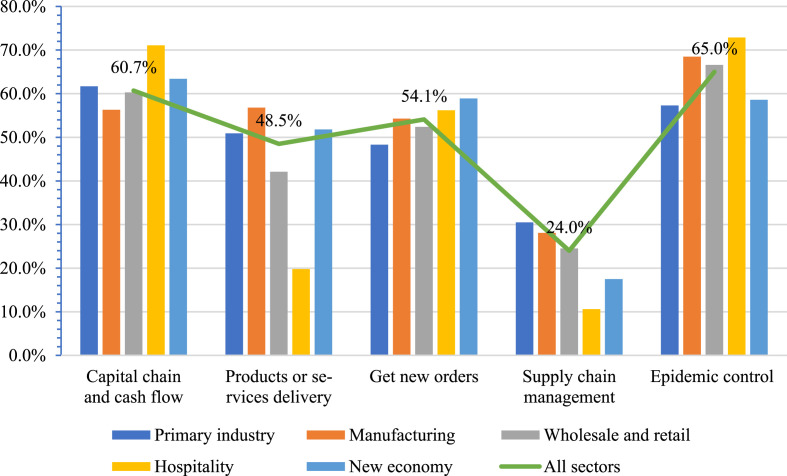

As shown in Fig. 4 , while the hospitality (accommodation and catering) industries were under greater financial pressure (adjusted residual = 4.1), there was less pressure on the delivery of products or services (adjusted residual = −11); however, the manufacturing industries were less likely to face financial pressures (adjusted residual = −4.1), but more likely to face product delivery (adjusted residual = 7.2) and supply chain pressures (adjusted residual = −4.1). The wholesale and retail industries did not have any product delivery pressures (adjusted residual = −3.4).

Fig. 4.

Main pressures on the SMEs by sector.

3.3. SME confidence

As shown in Fig. 5 , over 70% of the SMEs expected the pandemic to last longer than 3 months, 61.1% of which claimed that if this were the case, they would survive no more than 3 months under their current cash flow conditions, which was consistent with previous findings.

Fig. 5.

SME survival expectations by sector.

A chi-square test of independence showed that there was a significant association between industry sector and pandemic duration expectations; , ; and enterprise survival with existing funds; , . Hospitality (accommodation and catering) industries had the most pessimistic expectations, with many believing that the pandemic effects could last 6 months to 1 year (adjusted residual = 3.7), and that they would survive less than 3 months with their existing funds (adjusted residual = 4.3).

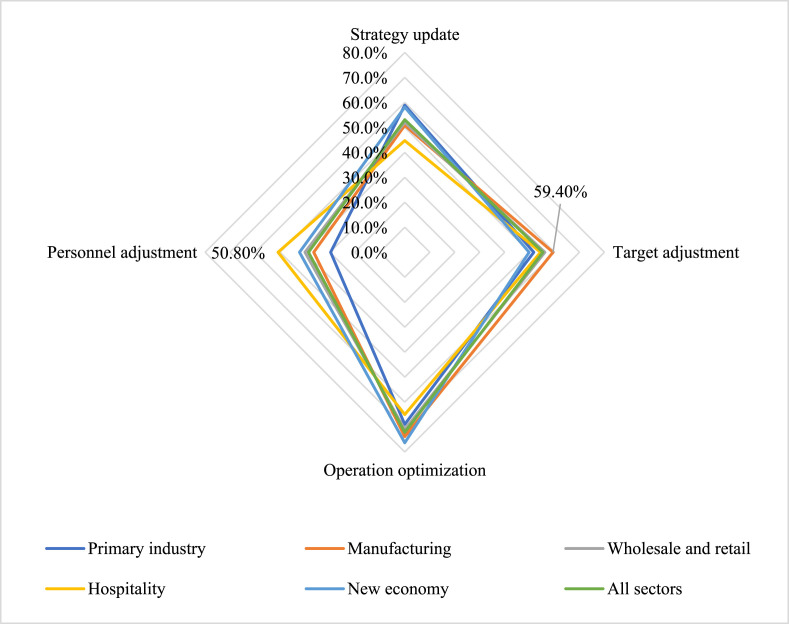

3.4. Response measures

As shown in Fig. 6 , most sampled industries adopted relatively moderate operational optimization strategies to cope with the pandemic impact; however, there were significant differences across the sectors at . The hospitality (accommodation and catering) industries tended to adopt personnel adjustment measures (adjusted residual = 4.8), which was not the case in the primary industries (adjusted residual = −4.5). The primary and new economy industries strategic adjustment ratios were relatively high, and the manufacturing industries were more likely to adjust their targets to account for the pandemic (adjusted residual = 3.6); however, the hospitality (accommodation and catering) industries were less likely to make strategic updates (adjusted residual = −3.2).

Fig. 6.

Response measures adopted by sector.

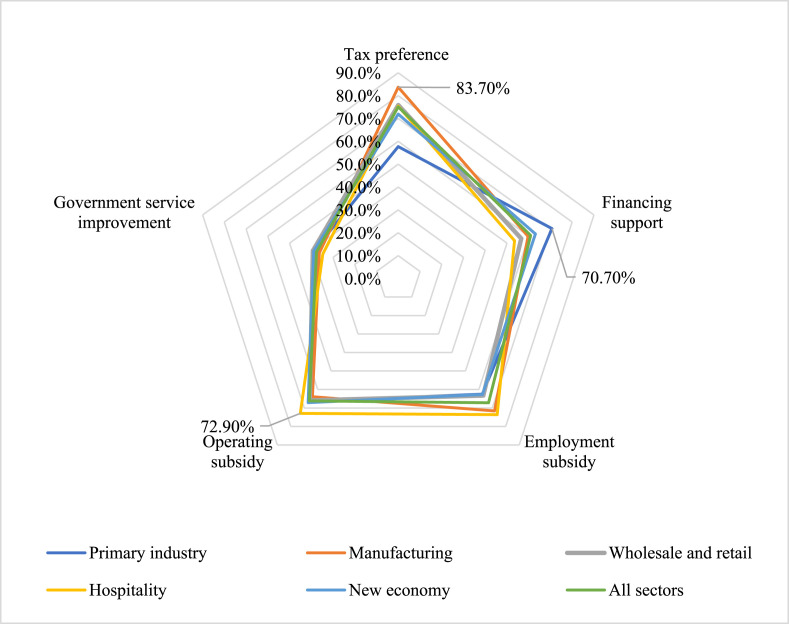

3.5. Supportive policies requested

Just over 83% of the sample industries indicated that they needed government assistance, and 40% also mentioned they needed assistance from their industry associations.

As shown in Fig. 7 , the support policies requested were tax preferences, financial support, employment subsidies and operating subsidies; however, there were obvious differences across the sectors. The demand for government service improvements was not high, and there were no obvious sector differences.

Fig. 7.

Support policies considered most effective.

The primary industries preferred financial support (adjusted residual = 4.9) over tax preferences (adjusted residual = −9.8), but the manufacturing industries preferred tax preferences (adjusted residual = 8.6) and employment subsidies (adjusted residual = 4.1).

4. Discussion

On April 17, the Chinese National Bureau of Statistics of China released key macroeconomic data for the first quarter, which indicated that the GDP for most industries in China fell, but at different rates: 2.8% in the primary industry sector; 10.2% in the manufacturing sector; 17.8% in the wholesale and retail trade industries; and 35.3% in the hospitality (accommodation and catering) industries. Therefore, on the whole, while traditional service industries such as hospitality (accommodation and catering), wholesale and retail trade, transportation, warehousing, and postal services all declined significantly, the faster growth experienced in information, finance, public administration and health services helped offset these declines. In particular, non-profit services such as public administration and health had been growing steadily.

In general, the SMEs’ perceived impact of Covid-19 and the actual impact reported in the National Bureau of Statistics data were similar. The hospitality (accommodation and catering) industries were the most affected because of the reduction in market demand, the inability to resume work, and the lack of cash flow, which meant that a percentage of these hospitality (accommodation and catering) enterprises went out of business (D6, D7, D8). Large wholesale and retail trade enterprises were expected to survive and even benefitted, partly because their turnover grew in the short term from the increased (online) demand (C6). However, the GDP decline in the whole sector was significant, which, according to previous research was due to the high ratio of retail shop closures [18] and the general decrease in the number of small retailers [19]. The manufacturing industry was the main government focus and was the first to resume work (Fig. 1). With the assistance of government policies, SME production activities and the supply chain were gradually restored after the enterprises resumed work, which was consistent with the expectations of the sample SMEs. In addition, the primary industry sector GDP also declined, but this was not significant. The new economy sector SMEs, however, appeared to have benefitted from Covid-19, even though it had brought significant inconvenience to their operations (E2).

The good news was that China's SMEs were showing signs of recovery, with many activities having recommenced by February 12, 2020 (the third week after the event date) [28]. In the second quarter of 2020, most industries were showing a positive trend. The key second quarter macroeconomic data released by the Chinese National Bureau of Statistics revealed that except for the hospitality industry sector and other service sectors, the other sectors all had added value and positive growth. The value-added growth in the primary industry sector, the manufacturing industry sector, and the wholesale and retail trade industry sector were respectively 3.4%, 4.4% and 1.2%, which may have been related to the resumption plans in the different industries (Fig. 1), as the manufacturing industries were the first to resume work, while the hospitality enterprises were the last.

Based on the SME survey data analysis, an outline of the perceived impacts of Covid-19 on the different industry sectors was obtained in early February. More detail on these impacts and the expected longer-term effects were revealed in the follow-up interviews in mid and late February.

4.1. Primary industry: restricted by poor logistics

In addition to the cash flow shortages and pandemic control restrictions experienced in all industry sectors (Fig. 4), supply chain management (Fig. 4) and product transportation (A5, A6, A7) were the main problems in the primary industries. Although these industries are at the top of the industrial supply chain, there were still risks associated with supply disruptions, especially for the primary industry breeding enterprises. A5 and A6 stated that during the early outbreak stage, the road controls and a shortage of people prevented the transportation of feed materials, finished products, and farm animals, which affected feed supplies and increased costs. At the same time, the poor logistics situation meant that finished products could not be shipped on time even if they had orders, which increased sales difficulties and resulted in inventory overstocking (A5).

Lack of liquidity was a common challenge in the primary industry sector (A1, A3, A5). A1 claimed that although the government had issued a series of financial support policies, few could be truly implemented in the SMEs. The government was expected to build finance platforms and channels and then post practical preferential tax, industrial and commercial policy procedures (A2).

4.2. Manufacturing industry: supply chain management issues

The low resumption of work rate resulting from the Covid-19 restrictions significantly disrupted the supply chain management of manufacturing industries. As the pandemic led to a nationwide shut down that blocked transportation across the country, asynchronous work resumption on upstream and downstream industrial chains and cross-provincial and cross-regional logistics difficulties significantly impacted supply chains (B4). B3 claimed that the supply chain disruption put the SMEs in a very awkward position as even though they had orders, they were unable to procure the raw materials and key components, which in turn made production impossible. The situation was even more acute for SMEs that imported source materials from other countries or sold products to other countries. Some of these SMEs said they may be forced to seek new suppliers and buyers at home or within the province, but that establishing these new trade relationships would not be easy, especially during the pandemic period (B7). However, B5 was more optimistic, saying that if the whole country could resume production as soon as possible and the supply chain were unblocked, the affected output was expected to recover.

Generally speaking, the interviewed SMEs emphasized the need to resume work to expedite recovery (B2, B3, B6, B9). While the government had introduced tax reduction policies, these were based on work resuming and income being generated. If staff were not able to resume work, with no revenue and no orders, tax cuts made no sense. B8 believed that the government needed to strengthen market leadership and accelerate the implementation of projects that had already been approved. While the introduction of support policies could assist the enterprises in the short term, enterprises needed to get enough orders for long term health.

In the manufacturing industries sample of 1,190, there were some differences found between the 36 health-related manufacturers and other manufacturing industries. The most significant difference was in their plans to return to work, with all 36 enterprises planning to return to work by March, with 61.1% of them either already doing so or planning to do so by February 7. When asked how long they believed their companies could survive with their existing funds, 25% claimed they could survive for more than a year, which was a significantly larger percentage than other manufacturing industries (5%). Further, only 16.7% of the health-related enterprises were experiencing reduced demand compared to 34.2% of other manufacturing industries (Fig. 2). Although health-related manufacturers had higher perceived expectations than the whole manufacturing sector, their overall perceived expectations remained pessimistic, with 75% believing that the pandemic would reduce their revenue.

4.3. Wholesale and retail trade industry: online transformation

Covid-19 had a distinct impact on the wholesale and retail industry sector. As the number of confirmed cases soared, people gradually shifted their focus from masks to stocking up on necessities such as vegetables and convenience foods. While the pandemic restrictions forced large shopping malls and supermarkets with high population densities to close their doors, the turnover of small and medium-sized supermarket chains increased in a short period of time (C6). In addition, C6 pointed out that under the pressure of the pandemic, traditional retail enterprises such as theirs accelerated their online presence; therefore, Covid-19 forced many traditional retail enterprises into developing online retail platforms.

However, for discretionary retailers, the situation was tough because there was a significant reduction in offline retail market consumption, with the blocking of logistics, freight and other channels making the situation worse. Therefore, many SMEs were unable to carry on business, which resulted in cash flow constraints that put many on the verge of bankruptcy (C4, C5). Retailers who kept their businesses open to serve individual consumers and communities rather than closing or moving out of the pandemic-affected areas for profit-driven motives were perceived as being loyal and won great trust from their customers [29]. True loyal relationships (business and customers reciprocating loyalty) strengthened the business’ long-term competitive advantages, proving that crises can also create opportunities for businesses to take actions to gain long-term benefits.

4.4. Hospitality (accommodation and catering) sector: cash flow dilemma

Cash flow management was the primary pressure in the hospitality (accommodation and catering) industries (Fig. 4). Hospitality (accommodation and catering) industries are both investment-intensive and labor-intensive and are under significant financial pressure to cover their rent, fixed costs and employee salaries. Therefore, the Covid-19 crisis brought both internal capital and external market pressures on the hospitality (accommodation and catering) industries, with many SMEs having to cease normal operations for the whole period. Due to the Covid-19 restrictions, work could not resume, but the fixed costs had to be covered, which put significant financial pressure on the enterprises (D2). The short- and long-term industry is also unsure as it may be difficult for consumer confidence to recover and as people may remain fearful of eating out, consumer behaviors may change [20].

While some measures had been taken by the SMEs to make up for their losses, the results had not been as good as expected. D10 said that they had distributed a large amount of the food prepared for the peak consumption period during the Spring Festival to their employees and customers, and D7 and D9 had commenced online sales operations after their offline stores had been forced to close; however, these efforts had not been enough to support overall enterprise operations.

Although the hospitality (accommodation and catering) industries were the most significantly affected based on the Chinese National Bureau of Statistics, D7 and D9 said that there had been no effective policies to assist the sector survive the pandemic. While the government had introduced tax reduction and financial support policies, similar to the interviewed primary industries, if there is no income, the hospitality (accommodation and catering) industry benefits were limited. It was also revealed that the financial support implementation was inconsistent, with many SMEs having to apply for new loans to support their existing loans (D7); however, as the approvals were based on their future cash flows and many hospitality (accommodation and catering) industries were unable to resume work, they could not guarantee any income, which meant they were unable to receive any bank loans.

4.5. New economy sector: short-term pressure and long-term opportunity

The new economy sector appeared to benefit from the pandemic. In general, while the sector suffered from some short-term pressures, the Covid-19 crisis gave rise to several long-term opportunities. E2 and E3 said that most employees had been able to work normally but remotely online, with only around 10% being unable to return to work. During the lockdown period, the demand for e-commerce, online education, online meetings and remote diagnosis and treatment information increased significantly, with information services based on internet technologies such as cloud computing growing rapidly.

Over the short term, E6 pointed out that customers had demanded more services, which had led to increased pressure on the research and development side of the enterprise, which attracted little profit; however, these new services and businesses were expected to be profitable over the long term. E2 said that because of the difficulties associated with new market expansion and marketing, it was difficult to predict possible future income, particularly as the technical personnel accounted for a relatively large proportion of the new economy sector enterprise expenses because of the relatively high salaries; therefore, some new economy enterprises suffered from cash flow problems.

5. Conclusion

Based on a survey of 6034 SMEs in Sichuan, China, this paper selected 3194 enterprises as samples to explore the impact of the Covid-19 crisis on SMEs in the primary, secondary and tertiary industry sectors. SMEs were asked about the perceived impact of the Covid-19 crisis in February 2020, which was in most serious days of the outbreak, the results from which had strong contingent properties, and reflected the SME's initial perceptions of the pandemic before any policy interventions. Although the results were drawn from that period, they were also in line with the impacts reflected in the macro data released by the National Bureau of Statistics on 17 April, which proved that this work is durable. Interviews with SME entrepreneurs were then conducted to elucidate more detail about the impacts and the perceived longer-term effects.

It was found that while the pandemic had variously affected the different industry sectors, a decline in short-term revenue and an inability to resume work and production had been common problems. The main reasons most SMEs were unable to resume work were because of a lack of employees, most of whom had been strictly confined by government regulations, reduced market demand, and a shortage of pandemic prevention products. Studies on SMEs in Malaysia affected by the pandemic also found that finance related problems, such as cash flow, access to stimulus packages, and risk of bankruptcy, were common business challenges [30,31]. However, besides these common elements, the pandemic had different impacts on the different sectors (Fig. 3), which was also found in Gu et al.’s [28] empirical study in Jiangsu Province. Fig. 4 shows that even though the hospitality (accommodation and catering) industries were severely affected by the pandemic and had significant cash flow pressures, their supply chain management and product delivery were not badly affected. However, the manufacturing industries, which had fewer financial challenges, had supply chain problems.

The specific assistance measures highlighted by the sample SMEs were tax preferences such as tax rebates, tax subsidies or tax rate reductions, and financial support such as loan interest subsidies or reductions. Some SMEs requested assistance in expanding their finance channels or establishing special enterprise development funds. Hospitality (accommodation and catering), wholesale and retail and the new economy industries requested operational subsidies such as office rent or daily expense water and electricity reductions. The demand for pandemic prevention materials such as masks and disinfectant in the manufacturing industries was relatively high. For employment subsidies, most SMEs generally preferred social insurance exemptions and for government services, the SMEs mainly required specific service improvements related to the pandemic. Therefore, it was revealed that to fully assist the industry sectors affected by the pandemic, the government needed to formulate differentiated policies based on the industry sector characteristics.

The Chinese government took a series of positive steps to assist the economy overcome the economic impact of the pandemic, such as value added tax exemptions, reductions for SMEs, and reductions in social security fees and rents for enterprises to reduce their operating costs.

As the first country to suffer from the Covid-19 pandemic, China was also the first large economy to attempt reopening after lockdown. Faced with the dilemma of saving lives or saving the economy, China rolled out perhaps the most ambitious, agile, and aggressive disease containment effort in history [5]. However, strict containment measures have had a significant impact on the China's economy. Data released by the National Bureau of Statistics on April 17, 2020 reported that China's first quarter GDP shrank by 6.8%, which was the first contraction in China's economy since official quarterly GDP records began in 1992. Despite the high rate of work resumption, Chinese enterprise production, and the measures taken by the government to assist SMEs recover [32], the effects of the pandemic have not yet been eliminated, primarily because the pandemic has not yet been brought under control in most of the world.

As this research effort was an empirical exploration, there were several limitations. First, the empirical analysis built on a relatively modest evidence base (from Sichuan, China). Additional corroborative research from other parts of China and other parts of the world would justify the conclusions. Second, this research focused on the impact of Covid-19 pandemic on SMEs from an industry perspective. Due to the time constraints, a survey containing a complete classification of Chinese industries would impose too great a burden on respondents; therefore, future research plans to examine the Covid-19 impact differences on SMEs in the same industry sectors. More work is also needed to clarify and validate the possible reasons for the differences and whether these differences are related to SME resilience.

Declaration of competing interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Acknowledgements

This research was supported by Sichuan Science and Technology Program (Grant No. 2021JDR0165), Humanity and Social Science Youth Foundation of Ministry of Education of China (Grant No. 17YJC630096) and the Major Program of the Social Science Foundation of Sichuan (Grant No. SC18EZD026).

References

- 1.Wang C., Horby P.W., Hayden F.G., Gao G.F. A novel coronavirus outbreak of global health concern. Lancet. 2020;395(10223):470–473. doi: 10.1016/S0140-6736(20)30185-9. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Ozili P.K., Arun T. 2020. Spillover of COVID-19: Impact on the Global Economy. MPRA Paper No. 99850.https://mpra.ub.uni-muenchen.de/99850/ Online at. [Google Scholar]

- 3.Lu Y., Wu J., Peng J., Lu L. The perceived impact of the Covid-19 epidemic: evidence from a sample of 4807 SMEs in Sichuan Province, China. Environ. Hazards. 2020 doi: 10.1080/17477891.2020.1763902. [DOI] [Google Scholar]

- 4.Bedford J., Enria D., Giesecke J., Heymann D.L., Ihekweazu C., Kobinger G., et al. COVID-19: towards controlling of a pandemic. Lancet. 2020;395(10229):1015–1018. doi: 10.1016/S0140-6736(20)30673-5. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Kupferschmidt K., Cohen J. Can China's COVID-19 strategy work elsewhere? Science. 2020;367(6482):1061–1062. doi: 10.1126/science.367.6482.1061. [DOI] [PubMed] [Google Scholar]

- 6.Nicola M., Alsafi Z., Sohrabi C., Kerwan A., Al-Jabir A., Iosifidis C., et al. The socio-economic implications of the coronavirus and COVID-19 pandemic: a review. Int. J. Surg. 2020;78:185–193. doi: 10.1016/j.ijsu.2020.04.018. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Loayza N.V., Olaberría E., Rigolini J., Christiaensen L. Natural disasters and growth: going beyond the averages. World Dev. 2012;40(7):1317–1336. [Google Scholar]

- 8.Alon I. COVID-19 and international business: a viewpoint. FIIB Business Review. 2020 doi: 10.1177/2319714520923579. [DOI] [Google Scholar]

- 9.Gössling S., Scott D., Hall C.M. Pandemics, tourism and global change: a rapid assessment of COVID-19. J. Sustain. Tourism. 2020 doi: 10.1080/09669582.2020.1758708. [DOI] [Google Scholar]

- 10.Cohen M.J. Does the COVID-19 outbreak mark the onset of a sustainable consumption transition? Sustain. Sci. Pract. Pol. 2020;16(1):1–3. [Google Scholar]

- 11.Keesara S., Jonas A., Schulman K. Covid-19 and health care's digital revolution. N. Engl. J. Med. 2020 doi: 10.1056/NEJMp2005835. [DOI] [PubMed] [Google Scholar]

- 12.Page S., Yeoman I., Munro C., Connell J., Walker L. A case study of best practice - visit Scotland's prepared response to an influenza pandemic. Tourism Manag. 2006;27(3):361–393. [Google Scholar]

- 13.Wilder-Smith A. The severe acute respiratory syndrome: impact on travel and tourism. Trav. Med. Infect. Dis. 2006;4(2):53–60. doi: 10.1016/j.tmaid.2005.04.004. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Lee C.K., Song H.J., Bendle L.J., Kim M.J., Han H. The impact of non-pharmaceutical interventions for 2009 H1N1 influenza on travel intentions: a model of goal-directed behavior. Tourism Manag. 2012;33(1):89–99. doi: 10.1016/j.tourman.2011.02.006. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Pearson M.M., Hickman T.M., Lawrence K.E. Retail recovery from natural disasters: new Orleans versus eight other United States disaster sites. Int. Rev. Retail Distrib. Consum. Res. 2011;21(5):415–444. [Google Scholar]

- 16.Liu C., Black W.C., Lawrence F.C., Garrison M.B. Post-disaster coping and recovery: the role of perceived changes in the retail facilities. J. Bus. Res. 2012;65(5):641–647. [Google Scholar]

- 17.Forbes S.L. Post-disaster consumption: analysis from the 2011 Christchurch earthquake. Int. Rev. Retail Distrib. Consum. Res. 2017;27(1):28–42. [Google Scholar]

- 18.Wasileski G., Rodríguez H., Diaz W. Business closure and relocation: a comparative analysis of the Loma Prieta earthquake and Hurricane Andrew. Disasters. 2011;35(1):102–129. doi: 10.1111/j.1467-7717.2010.01195.x. [DOI] [PubMed] [Google Scholar]

- 19.Chang S.E. Urban disaster recovery: a measurement framework and its application to the 1995 Kobe earthquake. Disasters. 2010;34(2):303–327. doi: 10.1111/j.1467-7717.2009.01130.x. [DOI] [PubMed] [Google Scholar]

- 20.Kennett-Hensel P.A., Sneath J.Z., Lacey R. Liminality and consumption in the aftermath of a natural disaster. J. Consum. Market. 2012;29(1):52–63. [Google Scholar]

- 21.Shaari M.S.M., Karim M.Z.A., Hasan-Basri B. Does flood disaster lessen GDP growth? Evidence from Malaysia's manufacturing and agricultural sectors. Malays. J. Econ. Stud. 2017;54(1):61–81. [Google Scholar]

- 22.Parwanto N.B., Oyama T. Investigating the impact of the 2011 Great East Japan Earthquake and evaluating the restoration and reconstruction performance. Journal of Asian Public Policy. 2015;8(3):329–350. [Google Scholar]

- 23.Lin H.C., Kuo Y.L., Shaw D., Chang M.C., Kao T.M. Regional economic impact analysis of earthquakes in northern Taiwan and its implications for disaster reduction policies. Nat. Hazards. 2012;61(2):603–620. [Google Scholar]

- 24.De Mel S., McKenzie D., Woodruff C. Enterprise recovery following natural disasters. Econ. J. 2012;122(559):64–91. [Google Scholar]

- 25.Meo S.A., Alhowikan A.M., Al-Khlaiwi T., Meo I.M., Halepoto D.M., Iqbal M., et al. Novel coronavirus 2019-nCoV: prevalence, biological and clinical characteristics comparison with SARS-CoV and MERS-CoV. Eur. Rev. Med. Pharmacol. Sci. 2020;24(4):2012–2019. doi: 10.26355/eurrev_202002_20379. [DOI] [PubMed] [Google Scholar]

- 26.Runyan R.C. Small business in the face of crisis: identifying barriers to recovery from a natural disaster. J. Contingencies Crisis Manag. 2006;14(1):12–26. [Google Scholar]

- 27.Baker T., Judge K. vol. 620. Columbia Law and Economics Working Paper; 2020. (How to Help Small Businesses Survive COVID-19). [Google Scholar]

- 28.Gu X., Ying S., Zhang W., Tao Y. How do firms respond to COVID-19? First evidence from Suzhou, China. Emerg. Mark. Finance Trade. 2020;56(10):2181–2197. [Google Scholar]

- 29.Peterson M., Ekici A., Hunt D.M. How the poor in a developing country view business' contribution to quality-of-life 5 years after a national economic crisis. J. Bus. Res. 2010;63(6):548–558. [Google Scholar]

- 30.Ratnasingam J., Khoo A., Jegathesan N., Chee Wei L., Abd Latib H., Thanasegaran G., Choon Liat L., Yan Yi L., Othman K., Amir M. How are small and medium enterprises in Malaysia's furniture industry coping with COVID-19 pandemic? Early evidences from a survey and recommendations for policymakers. Bio. 2020;15(3):5951–5964. [Google Scholar]

- 31.Omar A.R.C., Ishak S., Jusoh M.A. The impact of Covid-19 Movement Control Order on SMEs' businesses and survival strategies. Malaysian Journal of Society and Space. 2020;16 doi: 10.17576/geo-2020-1602-11. [DOI] [Google Scholar]

- 32.Normile D. As normalcy returns, can China keep COVID-19 at bay? Science. 2020;368(6486):18–19. doi: 10.1126/science.368.6486.18. [DOI] [PubMed] [Google Scholar]