Abstract

Objectives:

The objective of this study was to examine racial/ethnic differences in enrollment trends for supplemental insurance coverage among traditional Medicare (TM) and Medicare Advantage (MA) beneficiaries.

Study Design:

We employed a retrospective cohort study design using the 2010–2016 Medicare Current Beneficiary Survey.

Methods:

We included two types of outcomes: 1) seven exclusive types of insurance coverage in a given year and 2) changes in insurance coverage in the next year for those with each of the seven exclusive types of insurance coverage. Our primary independent variable was race/ethnicity. We conducted regression while controlling for demographic, socioeconomic, and health characteristics. We calculated the adjusted value of the outcome by race/ethnicity after adjusting for demographic, socioeconomic, and health status characteristics.

Results:

We found substantial racial/ethnic differences in supplemental insurance coverage among TM and MA beneficiaries. Compared to White beneficiaries, racial/ethnic minority beneficiaries had lower adjusted rates of enrollment in Medigap among TM beneficiaries and higher enrollment in Medicaid among both TM and MA beneficiaries. Trends in enrollment differed by supplemental insurance coverage, but an increasing trend in enrollment among MA beneficiaries without supplemental insurance coverage and MA beneficiaries with Medicaid was notable. Overall trends were consistent across all racial/ethnic groups. Finally, most beneficiaries were less likely to change insurance coverage in the next year, but a distinct phenomenon was observed among Black beneficiaries with the lowest rates of remaining in Medigap or MA only.

Conclusions:

Our findings indicate the minority Medicare beneficiaries may not have equitable access to supplemental insurance coverage.

Keywords: Medicare, Supplemental insurance, Medigap, Medicare Advantage, racial/ethnic disparities

Medicare beneficiaries have various types of insurance choices. First, beneficiaries can choose to either enroll in traditional Medicare (TM) or Medicare Advantage (MA). While TM is administered by the federal government, MA is operated by private health plans. Due to gaps in and costs associated with Medicare coverage, beneficiaries can obtain supplemental coverage to limit their exposure to risk. Supplemental coverage generally covers the beneficiary’s cost-sharing, reducing out-of-pocket (OOP) spending. However, there are differences in eligibility criteria and coverage. If a beneficiary chooses TM, they have the option to individually purchase a Medicare supplemental insurance plan, often called a Medigap plan [1]. Medigap plans are offered by private insurers that are paid a premium by beneficiaries and in return cover some out-of-pocket (OOP) costs. Across both MA and TM, two types of additional supplemental insurance are employer-sponsored insurance (ESI) and Medicaid. ESI is only available for the employed and may not be offered by all employers. Beneficiaries with high income are the most likely to have ESI [2]. On the other hand, eligibility for Medicaid is mainly based on income level and/or disability status. Thus, Medicaid covers enrollees who are low income or disabled and covers most OOP spending for dually enrolled beneficiaries.

Evidence suggests that there are substantial differences in supplemental coverage by sociodemographic status, but more pronounced by race/ethnicity.[3] Understanding racial/ethnic differences in Medicare supplemental coverage is of high policy relevance as racial/ethnic disparities in insurance coverage account for a sizable share of differences in access to health care.[4] Older adults (65 and over ) are less likely to be uninsured, however, many may still underinsured due to access in supplemental coverage.[5] Indeed, racial/ethnic minority beneficiaries are less likely to have supplemental coverage than White beneficiaries. Compared to White beneficiaries, racial/ethnic minority beneficiaries were less likely to have ESI or Medigap and more likely to have Medicaid [2, 3, 6–8]. Differences in supplemental insurance coverage may be driven by differences in demographic, socioeconomic, and health characteristics [2]. A similar finding was observed even after adjusting for demographic, socioeconomic, and health characteristics [6–8].

However, much remains unknown about racial/ethnic differences in enrollment trends for supplemental coverage. First, most prior studies focused on a specific type of supplemental coverage, and thus there is limited information about racial/ethnic differences in enrollment across supplemental coverage (i.e., ESI, Medigap, and Medicaid). Second, prior studies relied on relatively old data, and thus their findings may be less informative. This is particularly true as MA enrollment has nearly doubled over the last decade,[9] and enrollment is more prevalent among racial/ethnic minority beneficiaries.[10, 11] Finally, prior studies mainly focused on differences among newly eligible beneficiaries, but less is known about changes in supplemental insurance among enrolled beneficiaries. Supplemental insurance may incur higher OOP costs without improving care quality or beneficiary experiences, especially for racial/ethnic minority beneficiaries, leading to changes in insurance coverage in the next year.

In this study, we examined racial/ethnic differences in enrollment trends for supplemental coverage among TM and MA beneficiaries. First, we examined adjusted rates of supplemental coverage by race/ethnicity. Second, we examined trends in supplemental coverage by race/ethnicity from 2010 to 2016. Finally, we examined changes in supplemental coverage in the next year by race/ethnicity.

METHODS

Data and Sample

We used 2010–2016 data from the Medicare Current Beneficiary Survey (MCBS). The MCBS is an annual nationally representative survey of the Medicare population. The data combines information from Medicare claims and administrative data with a computer-assisted personal interview survey providing a comprehensive picture of insurance coverage for TM and MA beneficiaries. The MCBS was not released in 2014 so we could not include that year of data in our analysis.

We identified Medicare beneficiaries 65 years or older with 12 calendar months of continuous enrollment (Parts A and B). We excluded those whose original Medicare eligibility was attributable to disability or end-stage renal disease (N=630) as these beneficiaries have substantially different care needs than those who are eligible by age. We excluded those who died within the year (N=2,692) because incomplete follow-up and end-of-life health care use may result in bias. We also excluded those with both MA and Medigap as that combination is not permitted and likely represents inaccurate reporting (N=504). Finally, we excluded those with more than three types of insurance coverage (N=38) mainly due to simplicity in analysis and interpretation.

Variables

We included two primary outcomes. First, we measured the following seven exclusive types of insurance coverage in a given year: 1) TM only; 2) TM + ESI; 3) TM + Medicaid; 4) TM + Medigap; 5) MA only; 6) MA + ESI; 7) and MA + Medicaid. We defined TM beneficiaries if they were enrolled in TM for all 12 months of the calendar year and defined MA beneficiaries if they were enrolled in MA for all 12 months of the calendar year. We defined TM beneficiaries with Medigap if TM beneficiaries had self-purchased private health insurance. Second, we measured changes in insurance coverage in the next year for those with each of the seven exclusive types of insurance coverage described above. We created four two-year panels so that we could compare changes in insurance coverage between the first and second year of each set (2010–2011, 2011–2012, 2012–2013, and 2015–2016). For each group, we then assessed if they changed to any other type of insurance coverage in the following year. We defined changes in insurance coverage as changes in enrollment at any time in the following year.

Our primary independent variable was self-reported race/ethnicity. The MCBS asked beneficiaries’ own race and ethnicity. This is considered as the gold standard for race/ethnicity classification and is more accurate than Medicare administrative records.[12] Using the self-reported race/ethnicity information, we categorized race/ethnicity into the following four mutually exclusive groups: 1) non-Hispanic White, 2) non-Hispanic Black, 3) Hispanic, and 4) others. To control for differences in characteristics by race/ethnicity, we included age, sex, education, income, marital status, residence in a metropolitan area, comorbidities, activities of daily living limitations, and self-reported health (hardening of arteries, hypertension, myocardial infarction, stroke, angina/coronary heart disease, cancer, rheumatoid arthritis, emphysema/asthma/chronic obstructive pulmonary disease, diabetes, mental illness, or Alzheimer’s disease and other related dementias).

Statistical Analysis

We summarized sample characteristics and outcomes by race/ethnicity. We then estimated adjusted outcomes using regression models. We first conducted multinomial logit models for insurance coverage while controlling for variables described above as well as race/ethnicity. To make findings more interpretable,, we calculated the adjusted mean value of the outcome by race/ethnicity. Since health status may be main sources of selection into insurance coverage, we conducted a sensitivity analysis by stratifying the analysis described above by self-reported health (poor [poor or fair] versus good [excellent, very good, or good]). Specifically, we conducted multinomial logit models while controlling for variables described above as well as race/ethnicity and the interaction term between race/ethnicity and self-reported health status. Then, we calculated the adjusted mean value of the outcome by race/ethnicity and self-reported health status. Since there may be differences in eligibility for insurance coverage by dual eligibility status, we performed a sensitivity analysis by limiting to nondual Medicare beneficiaries. The Affordable Care Act (ACA) was implemented in 2014, which may have led to changes in insurance coverage over time among racial and ethnic minority and/or dual eligible beneficiaries. To examine trends in insurance coverage by race/ethnicity, we conducted multinomial logit models while controlling for variables described above as well as race/ethnicity and the interaction term between race/ethnicity and year. Finally, we conducted linear probability models for changes in insurance coverage in the next year for those with each of the seven exclusive types of insurance coverage in the first year. Then, we calculated the adjusted mean value of the outcome by race/ethnicity. For all analyses, we used survey weights and year and state fixed effects. All analyses were conducted using Stata statistical software version 16.1 (Stata Corporation, College Station, Texas, USA). All P values were from 2-sided tests, and results were deemed statistically significant at P < .05

RESULTS

Our sample included a total of 26,077 TM beneficiaries (20,478 White beneficiaries (weighted N=105,816,267), 2,139 Black beneficiaries (weighted N=10,604,441), 2,360 Hispanic beneficiaries (weighted N=12,005,779), and 1,100 other beneficiaries (weighted N=6,662,206) (Table). Unadjusted outcomes by race/ethnicity are presented in Appendix Table A.

Table A.

Sample characteristics of Medicare beneficiaries by race/ethnicity.

| % |

||||

|---|---|---|---|---|

| Variables | White (n=20478) | Black (n=2139) | Hispanic (n=2360) | Others (n=1100) |

| Age | ||||

| 65–69 | 17.8 | 22.6 | 20.8 | 19.5 |

| 70–74 | 22.0 | 22.8 | 23.3 | 20.7 |

| 75–79 | 20.6 | 19.8 | 20.7 | 23.6 |

| >=80 | 39.6 | 34.9 | 35.2 | 36.2 |

| Female | 57.9 | 62.3 | 56.6 | 54.5 |

| Education | ||||

| Less than high school | 16.1 | 43.9 | 53.9 | 32.1 |

| High school completion | 37.1 | 30.1 | 24.3 | 27.1 |

| Some college or associate's degree | 20.8 | 13.6 | 10.9 | 14.8 |

| Bachelor's degree | 13.6 | 5.8 | 5.9 | 15.4 |

| Advanced degree | 12.1 | 5.9 | 4.4 | 10.2 |

| Family income | ||||

| <$25000 | 34.8 | 66.8 | 69.8 | 56.6 |

| $25000-$40000 | 34.4 | 20.6 | 18.6 | 22.2 |

| >$40000 | 28.2 | 10.5 | 9.8 | 19.0 |

| Married | 55.2 | 32.7 | 51.3 | 51.4 |

| Metro | 71.4 | 79.3 | 92.5 | 75.3 |

| Comorbidity | ||||

| Hardening of arteries | 10.6 | 7.2 | 11.5 | 12.5 |

| Hypertension | 69.4 | 86.9 | 76.7 | 75.2 |

| Myocardial infarction | 13.1 | 9.8 | 13.1 | 16.3 |

| Stroke | 10.7 | 14.5 | 9.7 | 12.8 |

| Angina/coronary heart disease | 11.8 | 8.7 | 10.8 | 13.3 |

| Cancer | 43.4 | 16.9 | 22.6 | 26.9 |

| Rheumatoid arthritis | 13.3 | 25.3 | 21.6 | 22.5 |

| Osteoporosis | 24.1 | 13.5 | 27.6 | 21.4 |

| Emphysema, asthma, or COPD | 25.0 | 39.0 | 38.3 | 40.3 |

| Diabetes | 18.7 | 14.4 | 18.1 | 21.2 |

| Mental illness | 22.8 | 17.4 | 29.8 | 24.1 |

| ADRD | 5.7 | 8.9 | 9.4 | 9.5 |

| ADL limitations | ||||

| No | 52.7 | 46.3 | 44.7 | 45.1 |

| Yes | 47.3 | 53.7 | 55.3 | 54.9 |

| Self-reported general health | ||||

| Good (including very good and excellent) | 84.7 | 73.7 | 67.3 | 77.9 |

| Poor (including fair) | 15.3 | 26.3 | 32.7 | 22.1 |

Abbreviations: COPD, chronic obstructive pulmonary disease; ADRD, Alzheimer's disease and other related dementias; ADL, activity of daily living.

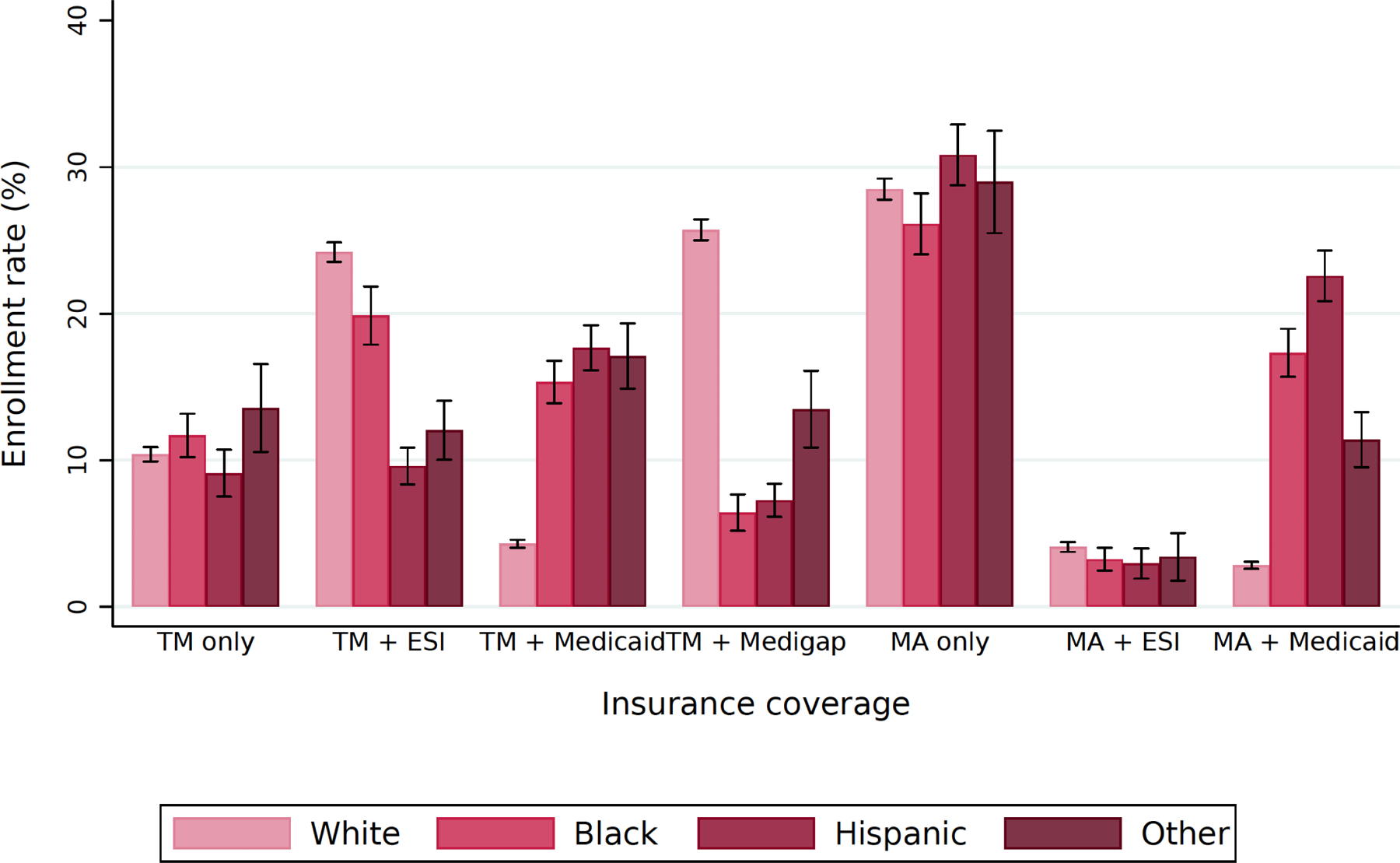

Our adjusted analyses showed substantial racial/ethnic variations in supplemental coverage (Figure 1). Compared to White beneficiaries, all racial/ethnic minority beneficiaries had substantially lower adjusted rates of TM + ESI enrollment (24.2% [95% CI: 23.5–24.9] for White beneficiaries, 19.9% [95% CI: 17.9–21.9] for Black beneficiaries, 9.6% [95% CI: 8.3–10.8] for Hispanic beneficiaries, and 12.0% [95% CI: 10.0–14.0] for other beneficiaries) and TM + Medigap enrollment (25.7% [95% CI: 25.0–26.4] for White beneficiaries, 6.4% [95% CI: 5.2–7.7] for Black beneficiaries, 7.3% [95% CI: 6.1–8.4] for Hispanic beneficiaries, and 13.5% [95% CI: 10.9–16.1] for other beneficiaries). However, compared to White beneficiaries, all racial/ethnic minority beneficiaries had substantially higher adjusted rates of TM + Medicaid enrollment (4.3% [95% CI: 4.0–4.6] for White beneficiaries, 15.3% [95% CI: 13.9–16.8] for Black beneficiaries, 17.7% [95% CI: 16.1–19.2] for Hispanic beneficiaries, and 17.1% [95% CI: 16.1–19.2] for other beneficiaries) and MA + Medicaid enrollment (4.3% [95% CI: 4.0–4.6] for White beneficiaries, 15.3% [95% CI: 13.9–16.8] for Black beneficiaries, 17.7% [95% CI: 16.1–19.2] for Hispanic beneficiaries, and 17.1% [95% CI: 16.1–19.2] for other beneficiaries). There was a substantial gap between White and racial/ethnic minority beneficiaries with TM + Medigap, ranging from a 12.2 to a 19.3 percentage point lower enrollment for racial/ethnic minority beneficiaries than White beneficiaries. Regression results from multinomial logit models are presented in Appendix Table B.

Figure 1.

Adjusted rates of insurance coverage among Medicare beneficiaries by race/ethnicity.

Abbreviations: TM, traditional Medicare; ESI, employer-sponsored insurance; MA, Medicare Advantage.

We estimated adjusted outcomes using multinomial logit regression while controlling for variables described as well as race/ethnicity. Then, we calculated the adjusted mean value of the outcome by race/ethnicity. For all analyses, we used survey weights and included year and state fixed effect.

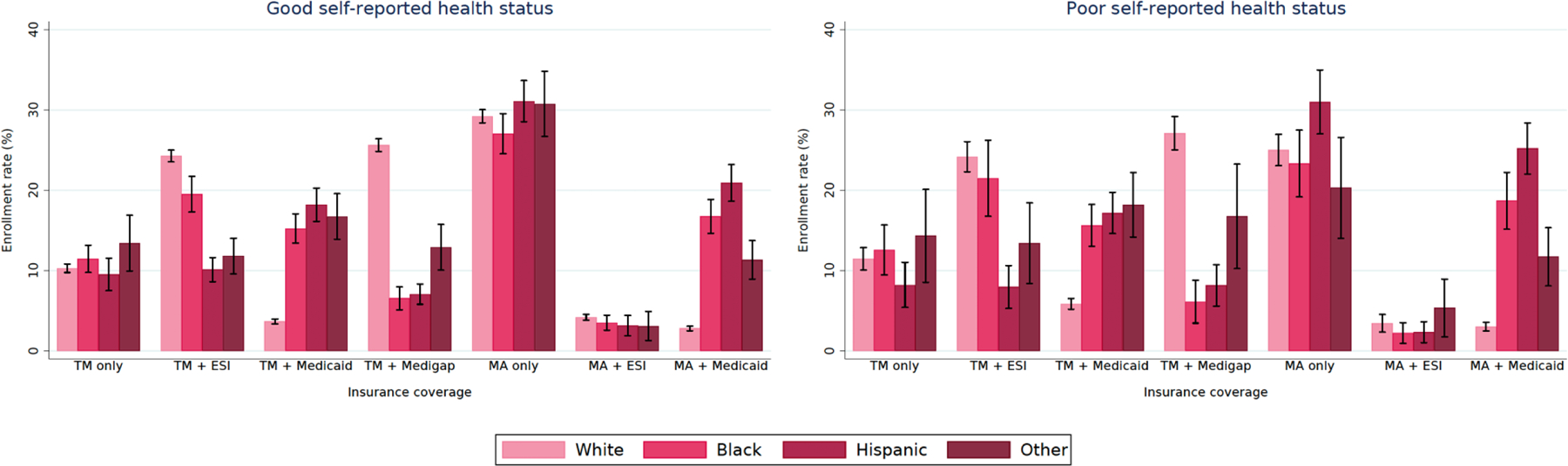

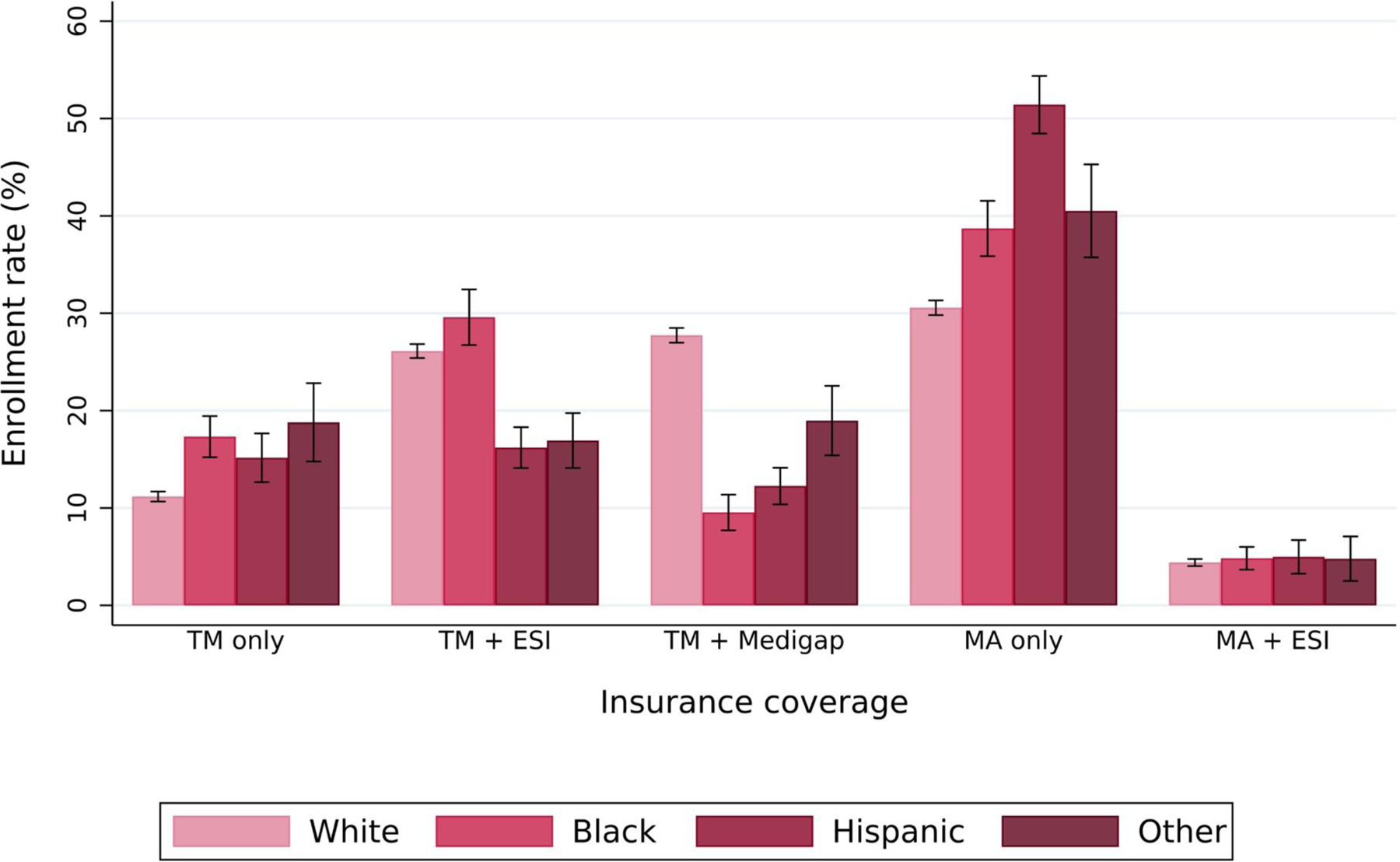

Our findings were robust to sensitivity analyses. First, we observed a similar pattern when we stratified by self-reported health status (Figure 2). Adjusted rates of enrollment in MA only were lower among those with poor self-reported health status than those with good self-reported health status in almost all racial/ethnic groups (29.2% [95% CI: 28.4–30.0] vs.25.0% [95% CI: 23.1–27.0] for White beneficiaries, 27.0% [95% CI: 24.5–29.5] vs.23.3% [95% CI: 19.2–27.5] for Black beneficiaries, and 30.8% [95% CI: 26.7–34.8] vs.20.3% [95% CI: 14.0–26.6] for other beneficiaries) except for Hispanic beneficiaries (31.1% [95% CI: 28.5–33.6] vs. 31.0% [95% CI: 27.0–35.0]). Medigap enrollment was also higher among those with poor self-rated health status, however, racial/ethnic disparities persisted. Second, a similar finding was found after limiting to nondual Medicare beneficiaries (Figure 3). However, it was notable that nondual racial/ethnic beneficiaries were more likely to enroll in TM + ESI or MA only.

Figure 2.

Adjusted rates of insurance coverage among Medicare beneficiaries by race/ethnicity and self-reported health status.

Abbreviations: TM, traditional Medicare; ESI, employer-sponsored insurance; MA, Medicare Advantage.

We estimated adjusted outcomes using multinomial logit regression while controlling for variables described above as well as race/ethnicity and the interaction term between race/ethnicity and self-reported health status (good vs. poor). Then, we calculated the adjusted mean value of the outcome by race/ethnicity and self-reported health status. For all analyses, we used survey weights and included year and state fixed effects.

Figure 3.

Adjusted rates of insurance coverage among non-dual Medicare beneficiaries by race/ethnicity.

Abbreviations: TM, traditional Medicare; ESI, employer-sponsored insurance; MA, Medicare Advantage.

We estimated adjusted outcomes using multinomial logit regression while controlling for variables described above as well as race/ethnicity. Then, we calculated the adjusted mean value of the outcome by race/ethnicity. For all analyses, we used survey weights and included year and state fixed effects.

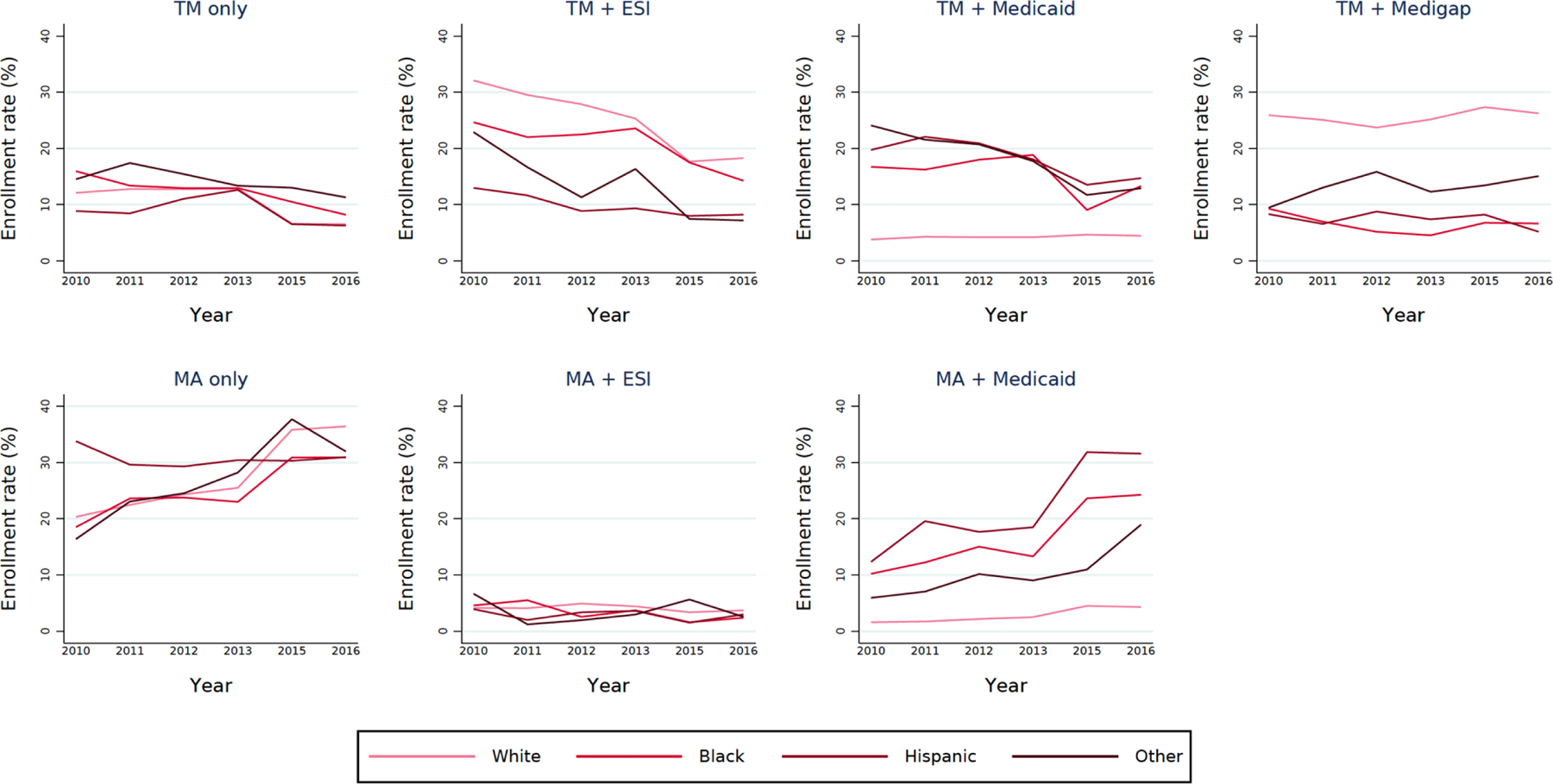

Our trend analyses found that enrollment trends varied by supplemental coverage, but the trends were relatively consistent across almost all racial/ethnic groups (Figure 4). A decreasing trend was observed in enrollment in TM only, TM + ESI, and TM + Medicaid in almost all racial/ethnic groups except for TM + Medigap among White beneficiaries. The magnitude of the decrease was more pronounced in enrollment in TM + ESI (32.1% in 2010 to 18.3% in 2016 for White beneficiaries, 24.7% in 2010 to 14.3% in 2016 for Black beneficiaries, 13.0% in 2010 to 8.2% in 2016 for Hispanic beneficiaries, and 22.9% in 2010 to 7.2% in 2016 for other beneficiaries). However, an increasing trend was observed in enrollment in MA only and MA + Medicaid in all racial/ethnic groups except for enrollment in MA only among Hispanic beneficiaries. Specifically, adjusted rates of enrollment in MA only increased from 20.3% in 2010 to 36.4% in 2016 for White beneficiaries, 18.5% in 2010 to 30.9% in 2016 for Black beneficiaries, and 16.4% in 2010 to 32.0% in 2016 for other beneficiaries. However, the magnitude of the increase was more salient in enrollment in MA + Medicaid (1.6% in 2020 to 4.3% for White beneficiaries, 10.2% in 2010 to 24.3% in 2016 for Black beneficiaries, 12.3% in 2010 to 31.6% in 2016 for Hispanic beneficiaries, and 5.9% in 2010 to 19.0% in 2016 for other beneficiaries). On the other hand, adjusted rates of enrollment in TM only, TM + Medigap, and MA + ESI were relatively constant over time. Adjusted rates of enrollment in TM + Medicaid and MA + Medicaid enrollment among White beneficiaries were relatively low and remained stable over time.

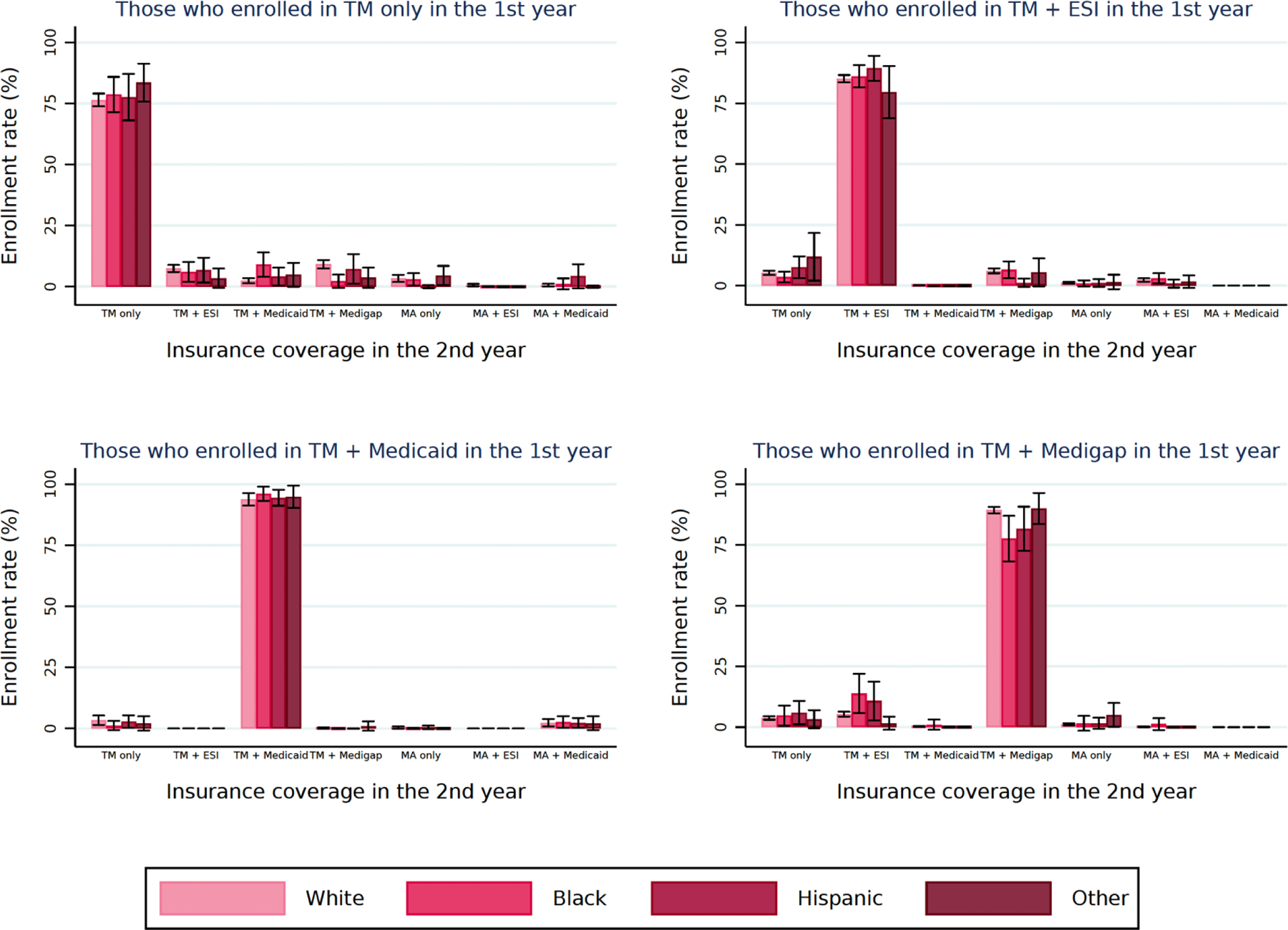

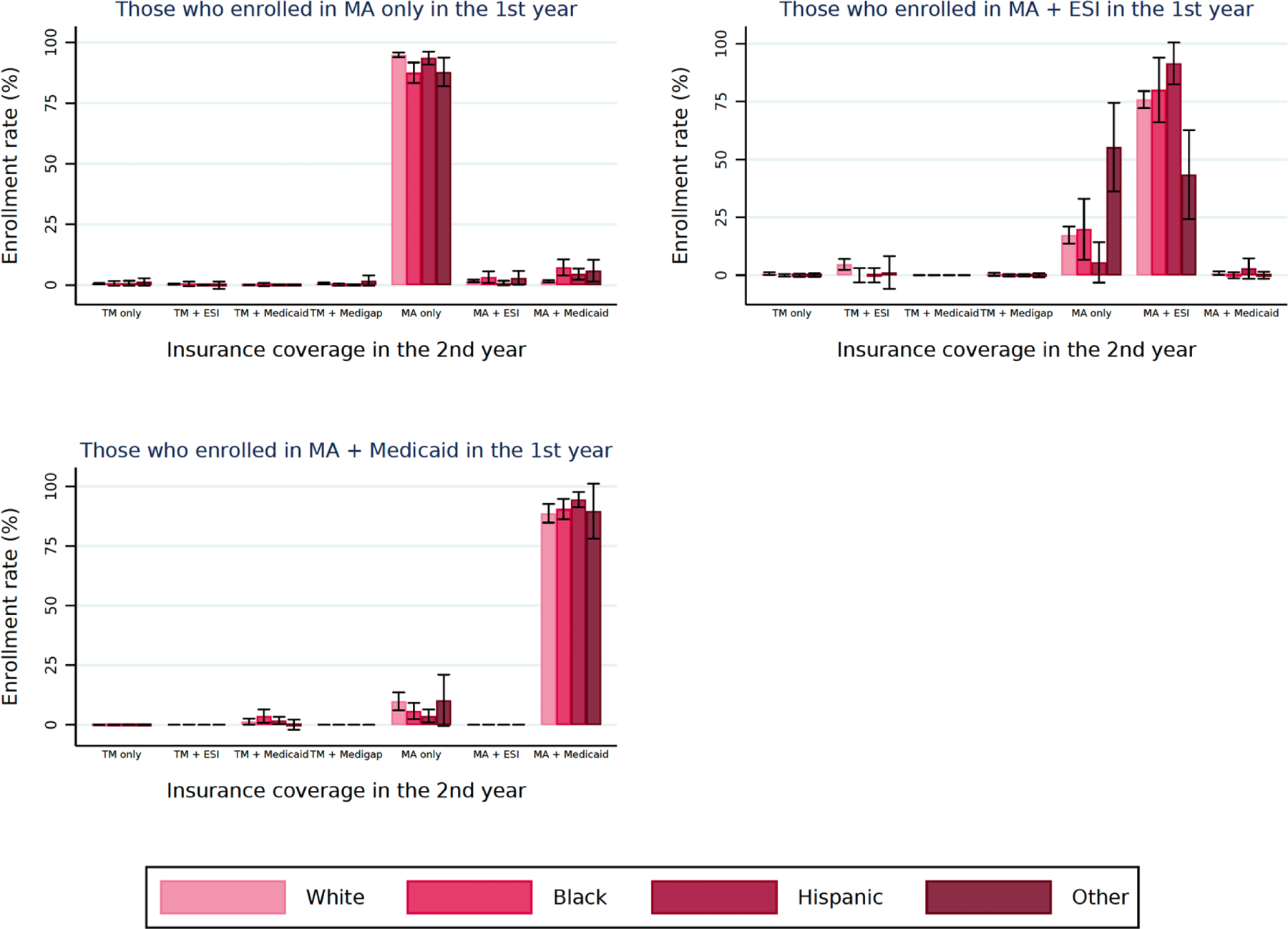

Figure 4.

Adjusted rates of changes in insurance coverage in the second year by race/ethnicity.

Abbreviations: TM, traditional Medicare; ESI, employer-sponsored insurance; MA, Medicare Advantage.

For each cohort (i.e., those with the same insurance type in the 1st year), we estimated adjusted outcomes using linear probability models while controlling for variables described above as well as race/ethnicity. Then, we calculated the adjusted mean value of the outcome by race/ethnicity. For all analyses, we used survey weights and included year and state fixed effects.

Our analysis of enrollment changes showed that rates of changing insurance were low among almost all groups (Figure 5). While patterns of changes in insurance coverage in the next year remained similar among White, Hispanic, and other beneficiaries, a distinct phenomenon was observed among Black beneficiaries. For those who enrolled in TM only in the first year, adjusted rates of switching to TM + Medicaid in the second year were higher among Black beneficiaries than White, Hispanic, and other beneficiaries (9.0% [95% CI: 3.9–14.0] vs. 2.4% [95% CI: 1.3–3.5], 4.1% [95% CI: 0.5–7.8], and 4.8% [95% CI: −0.1.3–9.8]). For those who enrolled in TM + Medigap in the first year, adjusted rates of remaining Medigap in the second year were lower among Black beneficiaries than White, Hispanic, and other beneficiaries (77.6% [95% CI: 68.2–87.0] vs. 89.3% [95% CI: 88.0–90.6], 81.7% [95% CI: 72.6–90.7], and 90.0% [95% CI: 83.6–96.4]). For those who enrolled in MA only in the first year, adjusted rates of remaining in MA only in the second year were lower among Black and other beneficiaries than White and Hispanic beneficiaries (87.5% [95% CI: 83.3–91.8] and 87.9% [95% CI: 81.9–93.8] vs. 94.9% [95% CI: 94.0–95.8] and 93.6% [95% CI: 91.0–96.3]). Also, adjusted rates of switching to MA + Medicaid in the second year were higher among Black and other beneficiaries than White and Hispanic beneficiaries (7.3% [95% CI: 3.9–10.6] and 6.0% [95% CI: 1.5–10.5] vs. 1.6% [95% CI: 1.1–2.1] and 4.6% [95% CI: 2.3–6.9]). Marginal and/or insignificant differences were observed in other outcomes.

Figure 5.

Trends in adjusted rates of insurance coverage among Medicare beneficiaries by race/ethnicity.

Abbreviations: TM, traditional Medicare; ESI, employer-sponsored insurance; MA, Medicare Advantage.

We estimated adjusted outcomes using multinomial logit regression while controlling for variables described above as well as race/ethnicity, year, and the interaction term between race/ethnicity and year. Then, we calculated the adjusted mean value of the outcome by race/ethnicity and year. For all analyses, we used survey weights and included state fixed effects.

DISCUSSION

We present four main findings. First, there were substantial racial/ethnic differences in supplemental coverage among TM and MA beneficiaries. Second, racial/ethnic minority beneficiaries in TM had substantially lower Medigap enrollment than White beneficiaries in TM, leading to the largest racial/ethnic differences in TM + Medigap enrollment. Third, enrollment trends varied by supplemental coverage, but an increasing trend in enrollment in MA only and MA + Medicaid was notable. Overall trends were relatively consistent across almost all racial/ethnic groups. Fourth, while most beneficiaries did not change insurance in the following year, Black beneficiaries were much more likely to switch coverage.

Compared to White beneficiaries, all racial/ethnic minority beneficiaries had lower enrollment in TM + ESI and TM + Medigap and higher enrollment in TM + Medicaid and MA + Medicaid. This finding may reflect inequities in socioeconomic characteristics as beneficiaries with higher incomes tend to have coverage through ESI or Medigap, but those with lower incomes tend to receive assistance with premiums and cost-sharing from Medicaid.[2] Evidence suggests that there is a substantial and persistent gap in wealth between Black and White Americans.[13] Specifically, the net worth of a typical White family is nearly ten times greater than of a Black family in 2016 ($171,000 vs. $17,150). This wealth gap may contribute to lower enrollment in supplemental coverage and higher enrollment in MA which may have lower premiums.

Our study provides evidence of the largest racial/ethnic disparities in Medigap enrollment. Consistent with prior research,[7] racial/ethnic minority beneficiaries had nearly half the rate of Medigap enrollment as White beneficiaries. There may be several explanations for this trend. Medigap policies are costly,[14] and thus may be unaffordable for racial/ethnic minority beneficiaries who tend to have lower annual incomes. This barrier could continue since racial/ethnic disparities in income have only increased over time.[15] In addition, limited Medigap consumer protections may lead to higher risks of coverage denial,[16] especially for racial/ethnic minority beneficiaries who tend to have pre-existing health conditions.

Our finding showed that there were different enrollment patterns by supplemental insurance, but a relatively consistent trend was observed by race/ethnicity. Overall TM enrollment decreased over time. However, the magnitude of the decrease was more pronounced in TM + ESI enrollment. This aligns with prior research that indicates fewer employers are providing supplemental insurance for their retirees due to economic pressure on employers.[2] Consistent with prior literature[9], we found that overall MA enrollment increased over time. This may be due to affordable MA coverage.[9] Since MA plans may be less expensive while providing additional benefits,[17, 18] this may lead to Medicare beneficiaries to enroll in MA plans. Also, enrollment in TM + Medicaid for racial/ethnic minority beneficiaries slightly increased after 2015. This finding is particularly notable given that the ACA was implemented during our study period, suggesting that the implementation of the ACA may have increased access to supplemental insurance coverage among racial/ethnic minority beneficiaries.

Our study demonstrates that changes in insurance coverage in the next year were the most noticeable among Black beneficiaries. Black beneficiaries had the lowest rates of remaining in TM + Medigap or MA only. There may be multiple explanations for this finding. First, this finding may be partly driven by high dissatisfaction with care in Medigap or MA. Although most prior research did not distinguish by Medigap or MA, evidence suggests that Black beneficiaries experienced more problems with care coordination than white beneficiaries,[19] potentially increasing their risk of hospital readmissions and adverse health outcomes. However, this finding should be interpreted with a caution because changes in income level may lead to changes in insurance coverage. For example, Black beneficiaries may have decreased income over time, possibly resulting in more Medicaid enrollment. As we could not examine the underlying mechanisms for this finding due to data limitation, however, further research is warranted to identify the cause of these disparities and understand targeted policies to reduce racial/ethnic disparities in health care for TM beneficiaries with Medigap and MA beneficiaries.

Our findings have important policy implications. First, there is a need to improve access to Medigap for racial/ethnic minority beneficiaries. Medigap is costly and generally does not cover long-term care, dental care, and prescription drugs. In 2015, the average annual Medigap premium was $2,200.[20] In particular, the average annual premium was high for the most popular Medigap plan ($3,912 in 2020).[21] In addition, Medigap premiums can vary by age, health conditions, locations, and plan type.[22] There is an ongoing discussion on how to improve Medigap, but more attention has been paid to improving efficiency rather than reducing racial/ethnic disparities in access and health care outcomes.[23, 24] For example, imposing a tax on Medigap premiums is considered as a way to reduce excessive health care use.[24] However, this may raise financial burden and further prevent racial/ethnic minority beneficiaries from purchasing Medigap. Recently, the Medigap Consumer Protection Act was proposed to ensure that all beneficiaries, regardless of age, disability, or pre-existing conditions, have ease in accessing information on Medigap options and in purchasing them. This is particularly important because confusion and lack of knowledge about Medicare insurance coverage may lead to suboptimal decision-making.[25] However, the proposal still lacks direct approaches to reducing racial/ethnic disparities. Thus, policymakers should simultaneously consider more comprehensive approaches to reducing racial/ethnic disparities and improving access to care while reducing OOP spending. Attention should be paid to the different reasons that could be contributing to these racial/ethnic disparities such as language and communication issues, low health literacy, differential access to or selection into low-quality or low-premium coverage, and financial and cultural barriers. Particularly, evidence suggests that there is a substantial and persistent gap in wealth between Black and White Americans, and the gap increases with age, suggesting the importance of addressing equality of wealth.[26] Further investigation is warranted to identify and develop comprehensive policies to ensure that racial/ethnic minority beneficiaries with and without Medigap have equitable access to health care.

Our study has several limitations. First, we accounted for a variety of demographic, socioeconomic, and health factors, but there is still the potential for residual confounding due to unobservable factors. Second, we used self-reported outcomes, and therefore our findings may be subject to reporting bias. The self-report data we used also has the advantage of including self-reported race/ethnicity data which is considered the preferred source, if available, by researchers who have accessed claims and self-reported raca/ethnicity data in Medicare.[12] Third, our findings are associational in nature and should not be interpreted causally.

Conclusion

Our findings provide evidence that there were substantial racial/ethnic differences in supplemental coverage among TM and MA beneficiaries. Findings provide a basis for understanding racial/ethnic differences in supplemental coverage in TM and MA. Future studies should identify the cause of these disparities and develop targeted policies to reduce racial/ethnic disparities in insurance access and/or coverage for Medicare beneficiaries.

Supplementary Material

Funding:

This work was supported by grants R01 AG049815 and 5K01AG057822-02 from the National Institute of Aging, National Institutes of Health.

Footnotes

Conflict of interest:

None

Availability of data and material:

Upon request

Code availability:

Upon request

Ethics approval:

This study was approved by the University of Pennsylvania’s institutional review board and received a waiver of informed consent and HIPPA authorization because the data were deidentified.

Consent to participate:

N/A

Consent for publication:

Yes

REFERENCES

- 1.Cubanski J, et al. , Sources of supplemental coverage among Medicare beneficiaries in 2016. 2018, Kaiser Family Foundation. [Google Scholar]

- 2.Davis K, Willink A, and Schoen C, How the erosion of employer-sponsored insurance is contributing to Medicare beneficiaries’ financial burden. 2019, The Commonwealth Fund. [Google Scholar]

- 3.Pourat N, et al. , Socioeconomic differences in Medicare supplemental coverage. Health Aff (Millwood), 2000. 19(5): p. 186–96. [DOI] [PubMed] [Google Scholar]

- 4.Lillie-Blanton M and Hoffman C, The role of health insurance coverage in reducing racial/ethnic disparities in health care. Health Aff (Millwood), 2005. 24(2): p. 398–408. [DOI] [PubMed] [Google Scholar]

- 5.Collins SR, Gunja MZ, and Doty MM, How well does insurance coverage protect consumers from health care costs? 2017, The Commonwealth Fund: Washington, DC. [Google Scholar]

- 6.Brunt CS, Supplemental insurance and racial health disparities under Medicare Part B. Health Serv Res, 2017. 52(6): p. 2197–2218. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Keane MP and Stavrunova O, Adverse selection, moral hazard and the demand for Medigap insurance. J Econom, 2016. 190(1): p. 62–78. [Google Scholar]

- 8.Fang H, Keane MP, and Silverman D, Sources of advantageous Selection: Evidence from the Medigap insurance market. J Polit Econ, 2008. 116(2): p. 303–350. [Google Scholar]

- 9.Jacobson G, Damico A, and Neuman T, A dozen facts about Medicare Advantage in 2020. 2021, Kaiser Family Foundation. [Google Scholar]

- 10.Neuman P and Jacobson GA, Medicare Advantage checkup. N Engl J Med, 2018. 379(22): p. 2163–2172. [DOI] [PubMed] [Google Scholar]

- 11.Meyers DJ, et al. , Growth in Medicare Advantage greatest among Black and Hispanic enrollees. Health Aff (Millwood), 2021. 40(6): p. 945–950. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.Jarrin OF, et al. , Validity of race and ethnicity codes in Medicare administrative data compared with gold-standard self-reported race collected during routine home health care visits. Med Care, 2020. 58(1): p. e1–e8. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.McIntosh K, et al. , Examining the Black-white wealth gap. 2020, The Commonwealth Fund. [Google Scholar]

- 14.Department of Health and Human Services, Variation and trends in Medigap premiums. 2011, Department of Health and Human Services. [Google Scholar]

- 15.Jacobson G, et al. , Income and assets of Medicare beneficiaries, 2016–2035. 2017, Henry J. Kaiser Family Foundation: Menlo Park, CA. [Google Scholar]

- 16.Meyers DJ, Trivedi AN, and Mor V, Limited Medigap consumer protections are associated with higher reenrollment in Medicare Advantage plans. Health Aff (Millwood), 2019. 38(5): p. 782–787. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.Park S, Langellier BA, and Burke RE, Telehealth benefits offered by Medicare Advantage plans in 2020. Med Care, 2021. 59(1): p. 53–57. [DOI] [PubMed] [Google Scholar]

- 18.Meyers DJ, et al. , Early adoption of new supplemental benefits by Medicare Advantage plans. JAMA, 2019. 321(22): p. 2238–2240. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Martino SC, et al. , Racial/ethnic disparities in Medicare beneficiaries’ care coordination experiences. Med Care, 2016. 54(8): p. 765–71. [DOI] [PubMed] [Google Scholar]

- 20.Medicare Payment Advisory Commission, Trends in Medigap enrollment, 2010 to 2015. 2017, Medicare Payment Advisory Commission: Washington, DC. [Google Scholar]

- 21.Bunis D, Medigap plans help bridge gap of original Medicare costs. 2020, AARP: Washington, DC. [Google Scholar]

- 22.Huang JT, et al. , Medigap: Spotlight on enrollment, premiums, and recent trends. 2013, Henry J. Kaiser Family Foundation: Melro Park, CA. [Google Scholar]

- 23.Duchovny N, et al. , CBO’s Medicare beneficiary cost-sharing model: A technical description. 2019, Congressional Budget Office Washington, DC. [Google Scholar]

- 24.Cabral M and Mahoney N, Externalities and taxation of supplemental insurance: A study of Medicare and Medigap. Am Econ J: Appl Econ, 2019. 11(2): p. 37–73. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25.Rivera-Hernandez M, et al. , Plan switching and stickiness in Medicare Advantage: A qualitative interview with Medicare Advantage beneficiaries. Med Care Res Rev, 2020: p. 1077558720944284. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 26.McIntosh K, et al. , Examining the Black-white wealth gap. 2020, The Brookings Institution: Washington, DC. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.