Abstract

Insurance is typically viewed as a mechanism for transferring resources from good to bad states. Insurance, however, may also transfer resources from high-liquidity periods to low-liquidity periods. We test for this type of transfer from health insurance by studying the distribution of Social Security checks among Medicare recipients. When Social Security checks are distributed, prescription fills increase by 6–12 percent among recipients who pay small copayments. We find no such pattern among recipients who face no copayments. The results demonstrate that more-complete insurance allows recipients to consume healthcare when they need it rather than only when they have cash.

There exists broad agreement among economists that health insurance ought to involve some form of cost sharing: copayments, coinsurance rates, or deductibles. Theory suggests that cost sharing can limit moral hazard (Zeckhauser, 1970), and empirical evidence confirms that cost sharing reduces spending (Manning et al., 1987; Aron-Dine, Einav and Finkelstein, 2013; Shigeoka, 2014; Brot-Goldberg et al., 2017). Indeed, motivated by that evidence, high-deductible health insurance plans have become increasingly common in the United States. Over only ten years, the share of firms offering such plans increased from 4 percent to nearly 30 percent (Kaiser Family Foundation, 2018).

Those cost-sharing mechanisms may introduce a particular challenge for low-income consumers. A large literature suggests that many low-income households wait to consume until their income arrives. Olafsson and Pagel (2018), for instance, find that low-income consumers purchase 70 percent more goods on days when they receive their paychecks. That finding is consistent with many other studies: consumption responds to both predictable and unanticipated changes in income.1 One might call such a pattern “liquidity sensitivity:” consumers often delay many of their purchases until their income arrives.

Liquidity sensitivity may be especially problematic in the context of healthcare. In healthcare, consumers are advised to purchase treatments at a time determined by medical necessity, not determined by the arrival of their income. And yet, a third of Americans report that in the past year they “skipped filling a prescription due to its cost” (Goetz, 2018). That pattern is not entirely driven by the uninsured. Among Americans who report being in poor health but are covered by health insurance, 15 percent report that in the past year they “delayed medical care due to cost.”2

There exists, however, little credible evidence of liquidity sensitivity in healthcare. And yet, such evidence could have implications for how economists view the benefits of health insurance. Typically, the benefits of health insurance are seen as coming from a transfer of resources from healthy (low-marginal utility) to sick (high-marginal utility) states. However, evidence of liquidity sensitivity would suggest another benefit of health insurance: more-generous coverage allows consumers to avoid having to delay their healthcare until the receipt of their income. With generous coverage, recipients can consume healthcare when they need it, rather than waiting for their income to arrive.3 In other words, health insurance also facilitates transfers of resources from liquid (low-marginal utility) to illiquid (high-marginal utility) periods.

In this paper, we provide empirical evidence of liquidity sensitivity in healthcare consumption.4 Specifically, we estimate how the prescription fills of Medicare recipients are affected by income receipt. To do so, we leverage the distribution of Social Security checks. Since 1997, Social Security recipients have received their monthly checks on a pre-determined schedule based on the day of the month that they were born. This system allows researchers to compare Social Security recipients who just received their checks to recipients who are quasi-randomly assigned to receive their checks a week or two later.5 We compare the prescription-drug purchases of each Medicare recipient around the day they receive their checks to the healthcare consumption of two control groups. First, we study similar Medicare recipients who receive their checks on a different date. Second, we study Medicare recipients who are enrolled in a program that fully subsidizes their copayments. These comparisons allow us to isolate the effect of receiving Social Security checks on the consumption of Medicare-covered drugs.

The results, first and foremost, reject the hypothesis that the receipt of income has no effect on healthcare consumption. Prescription drug fills for low-income Medicare Part D recipients increase by over 10 percent on the day they receive their Social Security checks. We observe that effect overall, for all drugs, and also for drugs for which short-term non-adherence can have important health consequences: blood thinners, insulin, and anti-seizure medications. We also observe this effect for a recipient’s first fill of a drug, not just for refills, implying that recipients are not only delaying purchases but also consumption. By contrast, when recipients enroll in a different part of the program that provides zero out-of-pocket prices, their fills exhibit no such increase on the day they receive their checks. Further, a particular feature of the Social Security check-distribution schedule provides an additional source of variation: two-thirds of checks arrive 28 days after the previous check, and the remaining one-third of checks arrive 35 days after the previous check. We find a larger increase in prescriptions filled when checks arrive after 35 days rather than after 28 days. We also find a clear gradient in the size of the effect by income: Medicare recipients who live in the lowest-income ZIP Codes increase their prescription fills when they receive their Social Security checks by roughly five times more than those living in the highest-income ZIP Codes.

These results provide clear evidence that healthcare consumption is sensitive to liquidity among low-income households. Importantly, this liquidity sensitivity exists despite these households facing only nominal copayments of $2 to $6 per prescription. This raises questions about the precise mechanism behind the results. The results rule out one potential mechanism: a “bus fare” effect where there are fixed costs of “shopping” that induce consumers to do all of their shopping when they receive their Social Security checks. Such behavior would mean that recipients would pick up their prescriptions on days when they buy other goods and services. If that were the mechanism behind the results, however, we would expect to see a similar increase in prescription fills among recipients not facing copayments. And yet, we see no change in prescription fills on Social Security paydays for recipients who face no copayments. That indicates that the liquidity sensitivity we document among recipients facing nominal copayments is due specifically to those copayments.

This leaves two possible explanations for the results. First, recipients could face real liquidity constraints. Liquidity-sensitive recipients may have so little cash in the days just prior to the receipt of their Social Security checks that it is impossible for them to pay $2 to $6 in copayments until their checks are deposited. On the other hand, the sensitivity of healthcare consumption to income may be due to psychological frictions. For instance, recipients may maintain a “mental account” dedicated to healthcare costs, and then they may act as though they are liquidity-constrained even if they hold cash on hand, but in other mental accounts (Thaler, 1985, 1999). The results do not allow us to differentiate between these two explanations, and both may be relevant, though for different recipients.

Ultimately, we view these results as an “existence proof” of liquidity effects in healthcare consumption. Liquidity-related frictions may exist even in the absence of the treatment effects we document. Suppose that some consumers are so liquidity-constrained that the receipt of their Social Security check does not provide sufficient liquidity to purchase drugs. Such consumers would not purchase drugs prescribed to them in the days leading up to Social Security check receipt or in the days after receipt. Instead, they may only purchase drugs when they receive larger income transfers or when their consumption commitments drop such that Social Security checks provide sufficient liquidity for them to purchase drugs. For such recipients, we would not observe an effect of Social Security checks, even though they are liquidity constrained. This paper’s results may thus be viewed as “sufficient” but not “necessary” evidence of liquidity effects.

Importantly, it is unclear what these results imply for Medicare recipients’ welfare. The estimates demonstrate that some Medicare recipients delay healthcare consumption until their Social Security check arrives. The associated welfare costs could be either trivial or enormous. For instance, delaying the consumption of a statin once for a day or two has little effect on health or, presumably, utility. Alternatively, the cumulative health effects of delaying statins for several days each month may be much larger. At the extreme, delaying the consumption of a blood thinner could, in some cases, lead to a fatal blood clot.6 Further, the true welfare effects depend on how these consumers value their health, and the degree to which they value the risk of an injury to their health. That valuation we, of course, do not observe. In that sense, the evidence of liquidity sensitivity we report here is insufficient to assess welfare consequences.

This paper contributes to several areas of research. First, we are aware of only one study that documents liquidity sensitivity in healthcare: a concurrent working paper by Lyngse (2020). That study uses data from Denmark and a similar, but distinct, identification strategy as we employ to come to similar overall conclusions for a younger population.7 Second, this paper contributes to a growing literature on insurance as a mechanism to transfer resources across time and not just across states of the world. Most closely related to this paper, Ericson and Sydnor (2018) and Malani and Jaffe (2018) explore theoretical models of health insurance and liquidity constraints. Also related, Casaburi and Willis (2018) show the importance of intertemporal transfers for take-up of crop insurance in Kenya. A related issue is the “access motive” for health insurance: the idea that health insurance not only protects against financial risks but also makes otherwise-unaffordable healthcare accessible (de Meza, 1983; Nyman, 1999). Third, our results also contribute to a growing literature on insurance’s role in correcting consumption distortions caused by behavioral biases. For instance, Baicker, Mullainathan and Schwartzstein (2015) discuss optimal cost-sharing mechanisms when healthcare consumption is shaped by behavioral biases, similar to the liquidity-related frictions we document. Fourth, this paper contributes to a line of research that studies the demand-response of healthcare consumption to insurance coverage.8 Specifically, we identify a potential mechanism for the observed demand-response to insurance coverage: the implicit relaxation of liquidity-related frictions. Fifth, this paper contributes to research on the optimal design of social insurance programs. Most of the previous studies on liquidity and social insurance focus on unemployment insurance (Chetty and Finkelstein, 2013). This paper provides evidence that liquidity-related issues also exist in the context of health insurance. Finally, this paper contributes to a large body of research that documents the relationship between the timing of income and consumption.9 In particular, previous studies have focused on food consumption for recipients of the Supplemental Nutrition Assistance Program over the pay cycle (Shapiro, 2005; Beatty et al., 2019). We contribute to this literature by exploring this relationship between consumption and income in the context of healthcare.

I. Background

A. Data

To study prescription drug consumption, we use data on a 20-percent sample of recipients enrolled in Medicare Part D, a federal program which provides insurance for prescription drugs to elderly and disabled Americans. In Medicare Part D, recipients choose among private plans, but the federal government provides subsidies for premiums and cost sharing for low-income households via the Low Income Subsidy (LIS) program.

We rely on several datasets for our analysis: the Medicare Beneficiary Summary File (100 percent) and the Medicare Part D Event File (20 percent). Those datasets cover the years 2006 through 2015. We observe recipients’ exact dates of birth in the Beneficiary Summary File which allows us to determine when recipients likely receive their Social Security checks. We also observe each recipient’s ZIP Code, as well as whether they enroll in Medicare Parts A, B, C, and D. Importantly, we observe, for each month, whether they receive premium and copayment subsidies via the Medicare Part D Low Income Subsidy (LIS) program, as well as which tier of the program they are in and thus the extent of those subsidies.

B. The LIS Program

The LIS program subsidizes premiums and copayments to varying degrees. We divide recipients into three main categories. First, there are recipients who face no copayments. That group consists of individuals enrolled in both Medicare and Medicaid. These individuals receive full premium subsidies and are not required to pay a copayment when filling a prescription. We call this group the “no-copay group.” Second, there are recipients who face subsidized copayments. These recipients are sufficiently low income to qualify for subsidized copayments, but not Medicaid. This group actually consists of two separate categories. Some recipients are sufficiently low income to face heavily subsidized copayments: about $2 for generic drugs and about $6 for branded drugs. Other recipients have slightly higher incomes and so receive smaller subsidies. For simplicity, we combine all recipients receiving partial copayment subsidies into one group we refer to as the “subsidized-copay” group.10 Finally, third, there are all other recipients not enrolled in the LIS program, who face full copayments. We call this last group the “full-copay group.”11

Table 1 presents summary statistics for these three groups. The no-copay group fills slightly more prescriptions than the groups paying copayments. That difference may reflect a demand response to the lower out-of-pocket prices. But, of course, the difference could be driven by variation in health status across these groups, other differences in recipients’ characteristics, or some combination of factors. The difference in out-of-pocket prices across the groups paying some copayments is clear in the table, with the average annual out-of-pocket spending equal to approximately $183 in the subsidized-copay group, and $551 in the full-copay group.

Table 1—:

Summary Statistics

| No Copay | Subsidized Copay | Full Copay | |

|---|---|---|---|

| Number of beneficiaries in 20% sample in 2006 | 213,080 | 20,305 | 479,900 |

| Number of beneficiaries in 20% sample in 2015 | 678,447 | 143,779 | 3,788,347 |

| Mean total scripts per year | 52.48 | 44.08 | 29.11 |

| Mean out-of-pocket spending per year | $0 | $183.38 | $550.67 |

| Mean out-of-pocket spending per script | $0 | $4.45 | $20.19 |

| Mean share filling a script each day | 0.064 | 0.058 | 0.047 |

| Share male | 0.367 | 0.392 | 0.447 |

| Average age | 70.35 | 70.31 | 70.71 |

| Average number of chronic conditions | 4.40 | 3.99 | 3.64 |

| Share white | 0.578 | 0.694 | 0.883 |

Note: This table presents summary statistics for the copay groups used in the analysis below.

Two other patterns in Table 1 are noteworthy. First, we observe substantially more people in the full-copay group versus the other groups: over 3.7 million people in 2015 in the full-copay group, versus well under a million in the other two groups, combined. In the paper’s empirical results, this leads to much narrower confidence intervals for estimates based on the full-copay group than for estimates based on the other groups.

Second, note that the average copayment faced by those in the subsidized-copay group is remarkably low: an average of $4.45 per script. The 99th percentile of the out-of-pocket-cost distribution is only $25.67, and more than 90 percent of fills cost less than $9. Appendix Figure A8 presents a histogram of these copayments, revealing that beneficiaries in this group generally pay around $2 for generic drugs and around $6 for branded drugs, with these amounts varying slightly year-to-year. The small magnitude of the out-of-pocket costs these recipients face is important in interpreting some of the results below. Even though these recipients face relatively small out-of-pocket costs, some still seem to wait until their Social Security payday to fill their prescriptions.

C. Social Security Payments

Since 1997, Social Security benefits have been distributed to recipients according to a schedule that is based on recipients’ dates of birth. Recipients with birthdays on the 1st through the 10th of the month receive their checks on the second Wednesday of each month; recipients with birthdays on the 11th through 20th of the month receive their checks on the third Wednesday of each month; and recipients with birthdays on the 21st through 31st of the month receive their checks on the fourth Wednesday of each month. The only deviations occur when federal holidays fall on Wednesdays. In those rare cases, payments are made one day early.

Two-thirds of checks arrive 28 days after the previous check, but one-third of checks arrive 35 days after the previous check. Checks would always arrive after 28 days were all months to have precisely 28 days. The irregular structure of the calendar leads to occasional five-week gaps between the second, third, or fourth Wednesday of one month and the corresponding Wednesday of the next month. For example, in 2015 recipients received their paychecks after five weeks in January, May, August, and October.

The schedule differs for individuals who began receiving benefits prior to 1997 and for those who are eligible for both Supplemental Security Income (SSI) and Social Security. Those who are eligible for both Social Security and SSI and those who began receiving their benefits prior to May 1997 are paid on the third of the month. Those eligible for SSI separately receive their SSI payments on the first of the month. We eliminate from the sample Medicare recipients who are old enough to be paid on the pre-1997 payment schedule. The payment of SSI benefits likely only affects a minority of recipients who are in the no-copayment group.

Since March of 2013, all Social Security recipients have been required to receive their benefits electronically, via direct deposit. Even before that law went into effect, most recipients relied on direct deposit. In early 2012, 94 percent of Social Security checks were distributed via direct deposit (O’Carroll, 2012). The funds flow electronically from the Social Security Administration to recipients’ banks. Banks then make the funds available to recipients on their scheduled paydays. However, there exists one complication. Some banks provide funds to recipients when the bank receives the funds, often the day before payday, rather than on the official payday itself.12 As a result, there exists some measurement error in the day payments are received, providing a possible explanation for why we find some response to Social Security paychecks the day before payments are supposed to be distributed.

II. The Liquidity Sensitivity of Prescription Drug Fills

A. Main Results

To measure the liquidity sensitivity of prescription drug fills, we compare prescription fills for groups of Part D recipients who just received their Social Security checks to those who have not yet received theirs. We begin with a regression specification meant to assess the overall change in prescription fills when Social Security checks are distributed. The regression compares utilization across 31 birthday groups, with each group defined by the day of month of the Medicare recipient’s birthday.13 Denote the drug consumption on calendar-day t by birthday group g ∈ {1, 2,…, 31} as Ytg. We assign each birthday group an event time for each calendar day, with event time, τ, ranging from −5 to 5, relative to the group’s nearest check date. We then estimate the event-study regression:

| (1) |

Here, is an indicator function equal to one if calendar-day t is τ days away from the date of Social Security check receipt for those in birthday group g. The variable αg represents a fixed effect for each of the 31 “birthday groups” and αt represent fixed effects for every calendar date in the sample.

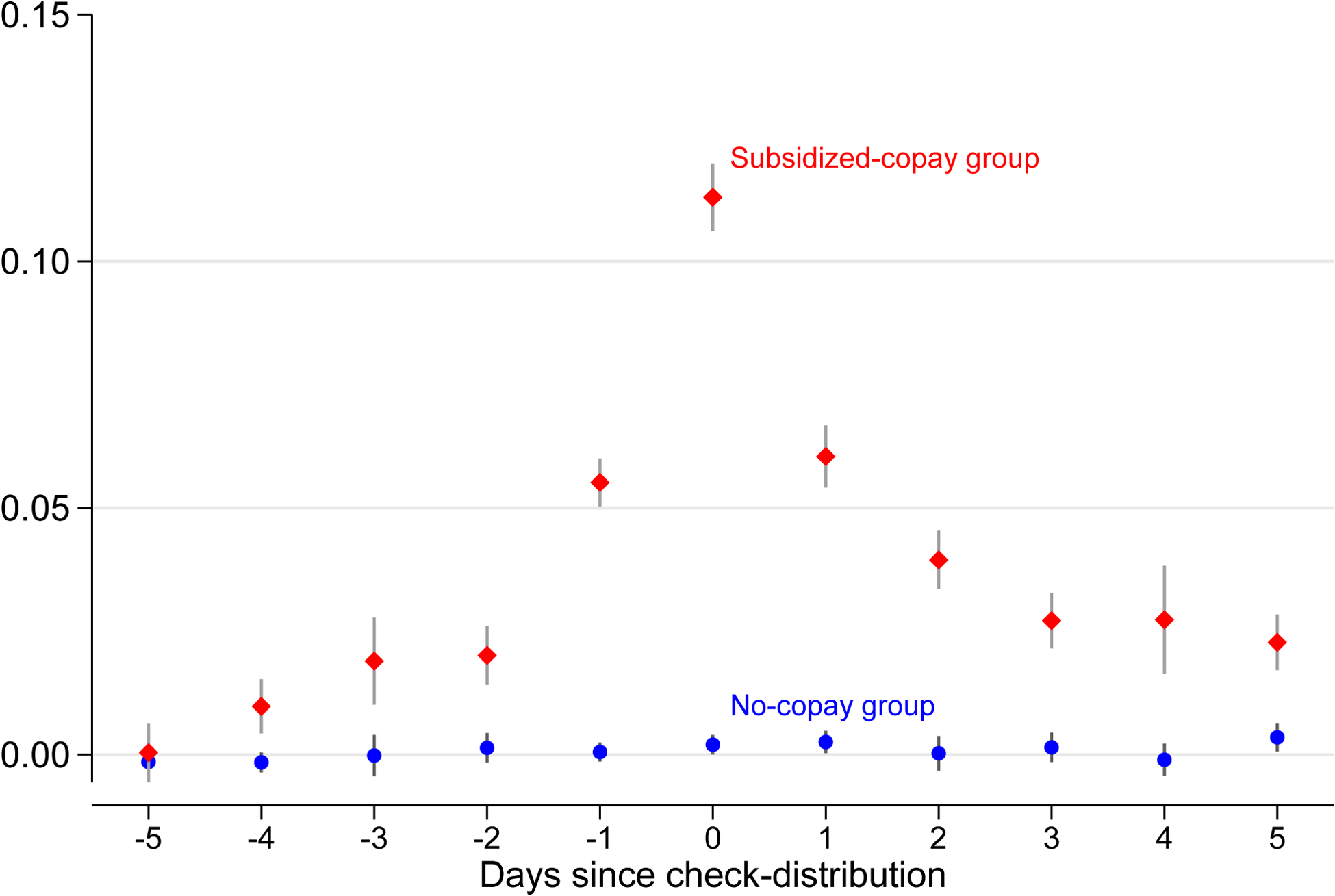

Figure 1 presents estimates of the βτ’s for the subsidized-copayment group when the outcome of interest is the logarithm of the number of scripts filled. The point estimates suggest a statistically significant effect of Social Security checks. The number of prescriptions filled begins increasing on day −1, hits a maximum on payday, and then declines. The magnitude of the day-zero estimate, β0, suggests an 11-percent increase in scripts.14 As a point of comparison, the figure presents the same exercise for the no-copayment group. The circular-shaped markers in Figure 1 plot the regression coefficients for those recipients. For that group, there is no differential change in prescriptions filled when checks are distributed. Importantly, these recipients still receive Social Security checks on the same schedule—the key difference is that they are not required to pay copayments.

Figure 1. :

The Effect of Social Security Checks on Total Scripts

Note: This figure plots estimates of equation (1), event-study estimates of the logarithm of total scripts filled for each event-time day relative to check receipt for the no-copay group and the subsidized-copay group. The vertical lines across each marker plot 95-percent confidence intervals based on standard errors that are clustered at the level of the birthday group.

B. Purchases versus Consumption

Figure 1 provides clear evidence that drug purchases are sensitive to liquidity: prescription-drug fills increase by roughly 11 percent when Medicare recipients in the subsidized-copay group receive their Social Security checks. A natural, immediate question is whether that pattern suggests a change in actual consumption resulting in real utility consequences, or whether it merely reflects the re-timing of purchases. Figure 2 presents several pieces of evidence that suggest that the increase in fills is a matter of not just the timing of purchases, but of actual consumption.

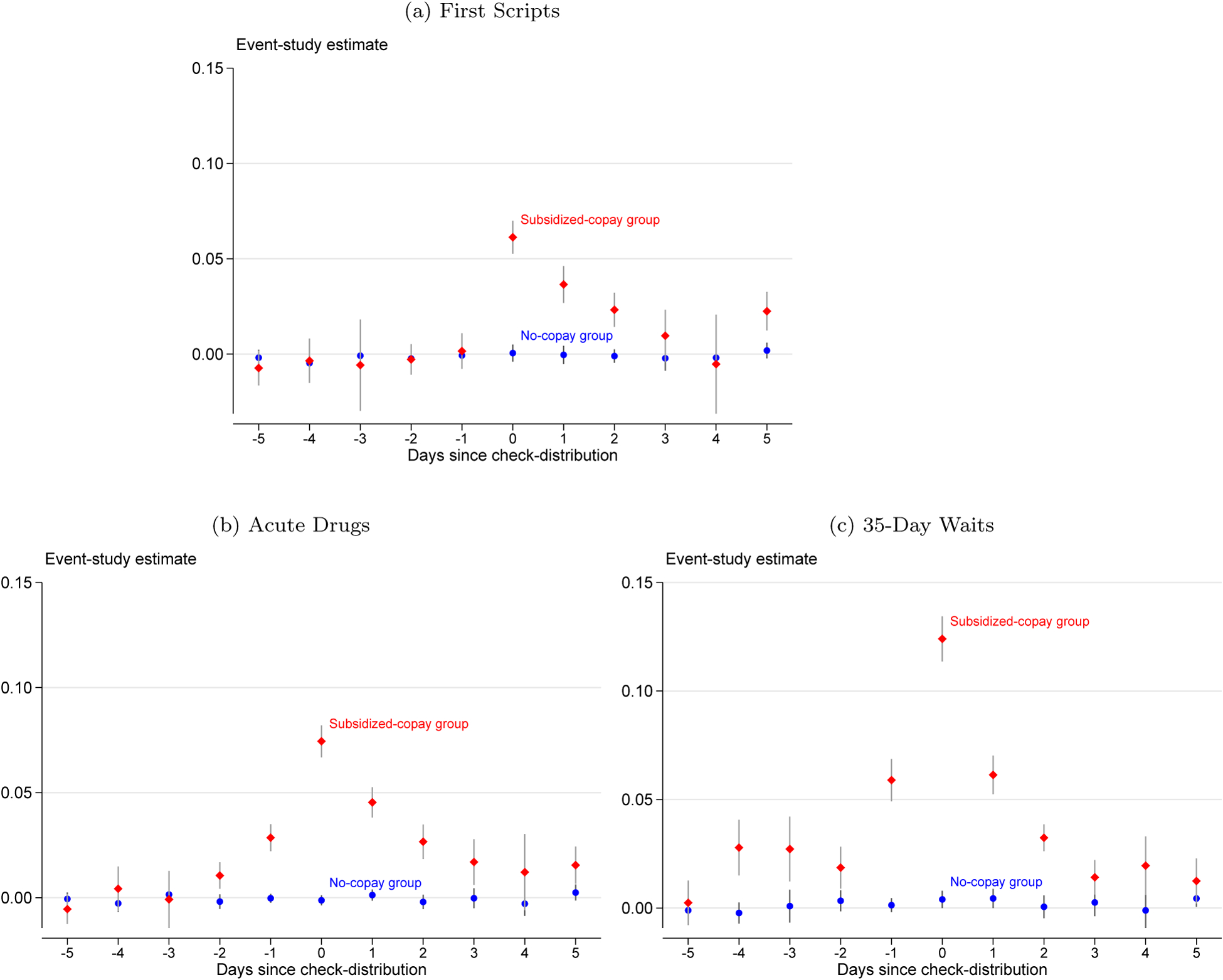

Figure 2. :

The Effect of Social Security Checks on Total Scripts

Note: These figures plot estimates of equation (1): event-study estimates of the logarithm of total scripts filled for each event-time day relative to check receipt for the no-copay group and the subsidized-copay group. The vertical lines across each marker plot 95-percent confidence intervals based on standard errors that are clustered at the level of birthday group. Panel (a) restricts the sample to first scripts, panel (b) restricts the sample to acute drugs, and panel (c) restricts the sample to Social Security checks that arrive 35 days after the previous check.

The first panel of Figure 2 presents the same event-study estimates as above, but when the sample is restricted to a recipient’s first prescription fill of a drug.15 We observe an increase in first fills when Social Security checks arrive that is smaller than the increase in all fills, but still statistically and clinically significant. Importantly, upon first filling a drug, recipients cannot possibly access a stockpile of pills from previous fills of the drug. Therefore, this pattern suggests a change in actual consumption, not solely a re-timing of purchases.

The next panel of Figure 2 presents event-study estimates when the sample is restricted to acute drugs.16 We find a statistically significant effect of Social Security checks on fills of those drugs, taken only occasionally for acute conditions. That result further suggests that Social Security checks affect drug consumption and not just the timing of purchases—recipients are less likely to enjoy access to a stockpile of pills for acute drugs. Further, consumption of these drugs is plausibly non-trivial to re-time.

Finally, the last panel of Figure 2 presents event-study estimates solely for Social Security checks that arrive 35 days after the previous check. The plot exhibits a larger increase in prescription fills after receipt of those Social Security checks.17 That pattern suggests that the increase in fills is not simply driven by recipients following a “refill every 28 days” strategy or some other routine.18 Together, these results suggest that the payday effect we present in Figure 1 is not solely driven by the re-timing of purchases but also reflects a re-timing of consumption.

C. Heterogeneity

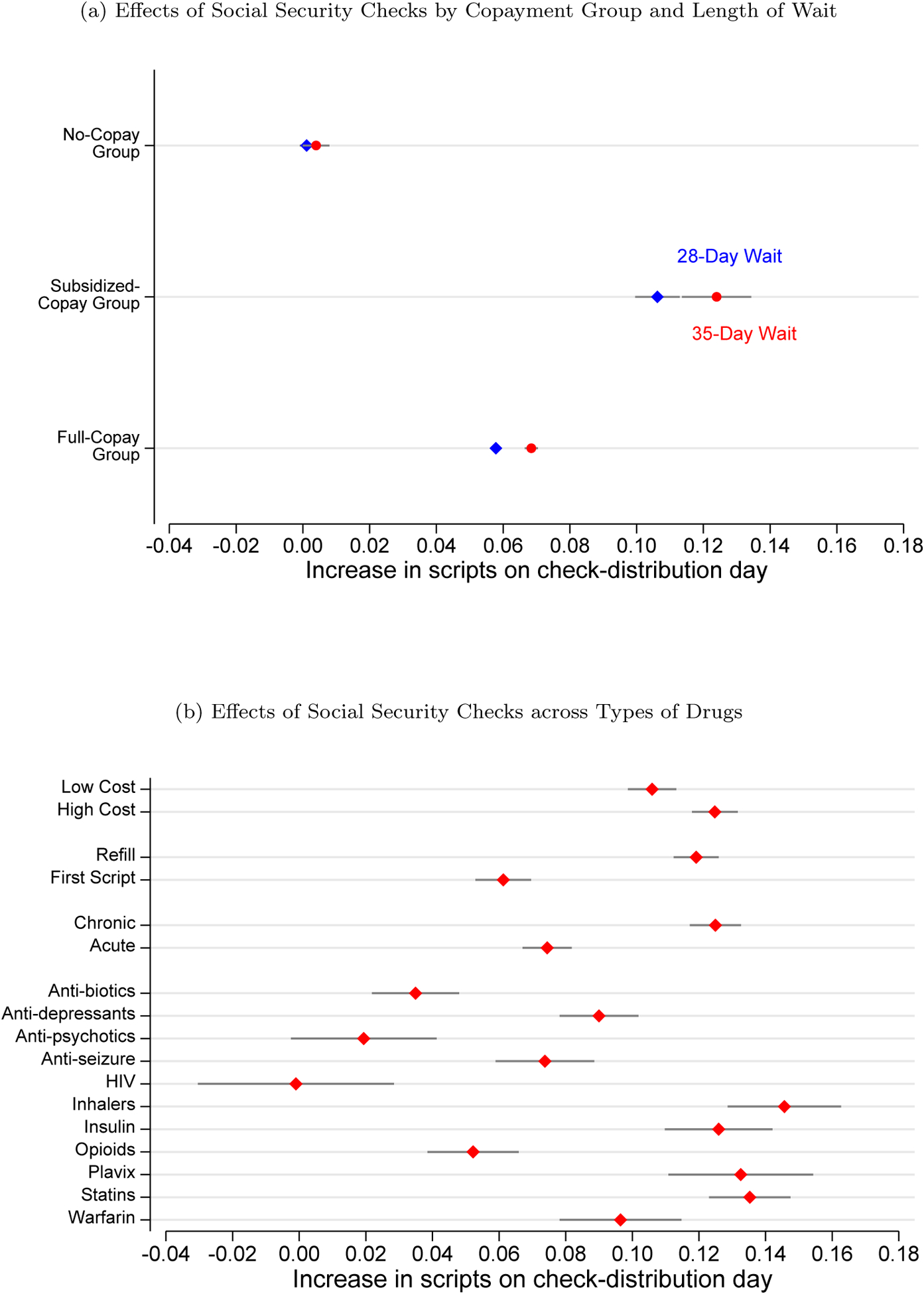

Figure 3 plots estimates of β0 from equation (1) when the logarithm of total fills is the outcome of interest. The first panel of the figure plots those estimates for each of three groups: those who face no copayments, those who face subsidized copayments, and those who face full copayments. For the group that does not pay copayments, we estimate a precise zero effect: the confidence interval rules out increases in fills larger than 0.4 percent. The effects for the other two groups are both economically and statistically significant: we estimate an increase in prescription fills of 11.3 percent for the subsidized-copay group and an increase of 6.1 percent for the full-copay group.

Figure 3. :

Heterogeneity in The Change in Scripts Filled on Social Security Payday

Note: These figures plot estimates of β0 from equation (1): the event-study coefficient for check-distribution day when the outcome is the logarithm of the total scripts filled. The first panel stratifies the sample by copay group (no-copay group, subsidized-copay group, and full-copay group) and days since the last check (28-day wait and 35-day wait). The second panel stratifies the sample by characteristics of the drugs purchased. The horizontal lines along each marker plot 95-percent confidence intervals based on standard errors that are clustered at the level of the birthday group.

The panel also presents effects across the two different waiting-period lengths: checks that arrive after a 28-day wait and checks that arrive after a 35-day wait. We observe a larger increase in prescription-drug fills when it has been longer since recipients’ received their last check.

A remaining question involves treatment-effect heterogeneity. To explore heterogeneity, the second panel of Figure 3 provides estimates for other strata in the data, focusing on the subsidized-copay group.19 The first two rows of the second panel of Figure 3 demonstrate that, on Social Security paydays, fills increase more for drugs with large out-of-pocket costs than for drugs with low out-of-pocket costs.20 The next two rows present estimates that stratify drug purchases by whether the purchase is a recipient’s first fill of the drug, or whether it is a refill. And the two rows after that present estimates for acute drugs versus chronic drugs. As is clear in Figure 2, the results here indicate a statistically significant effect for all types of prescription fills: first fills, refills, acute drugs, and chronic drugs.

The remaining rows in Figure 3 present estimates of the effect of Social Security checks on prescription fills for particular drugs. We interviewed a panel of physicians and asked for examples of common drugs that lead to severe, short-term consequences if patients do not adhere to their prescriptions. The physicians suggested the following drugs: blood thinners (Warfarin and Plavix); antiretrovirals (HIV); anti-psychotics; anti-seizure medications; anti-biotics; insulin; statins; and inhaler-based medications. We add to this list one more class of drugs, opioid pain-killers. Opioids are an interesting case study, because delaying consumption of opioids leads to the recurrence of pain and thus may be extremely salient to patients. Overall, Figure 3 suggests some heterogeneity across these drugs. Blood thinners, insulins, statins, and inhalers exhibit the largest effects. Those effects are troubling to physicians: these drugs tend to be seen as high value by physicians and important for the health of the patient.

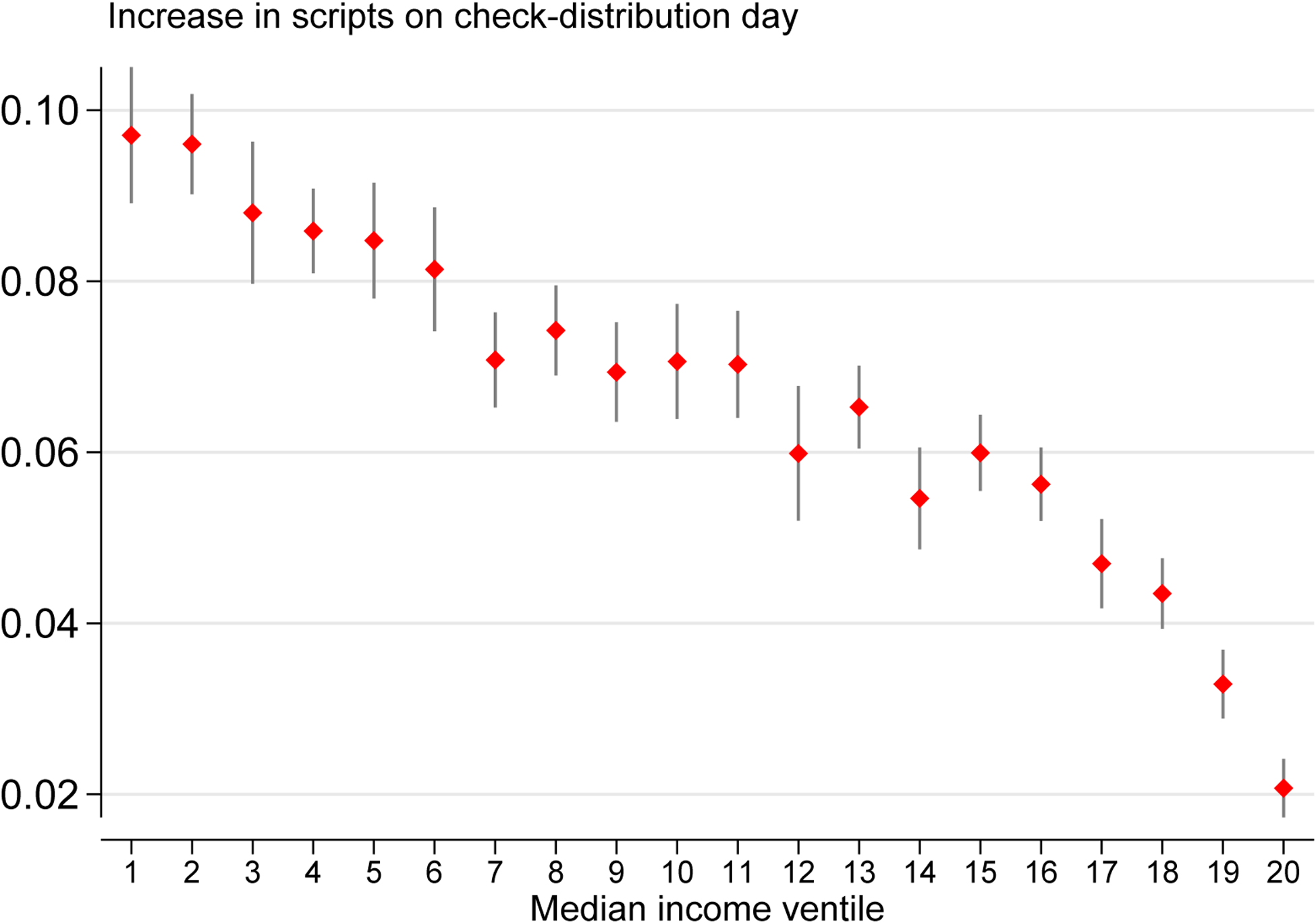

Finally, Figure 4 investigates the role of socioeconomic status. The figure divides the full-copay group by ventiles of income and plots estimates of β0 from equation (1). As a proxy for household income, we link every ZIP Code of residence in the data to the median household income as measured by the 2006–2010 American Community Survey. The figure suggests a clear gradient, with larger effects of Social Security checks for recipients living in lower-income ZIP Codes. The payday effect for the lowest-income ventile (just under 10 percent) is five times as large as the payday effect for the highest-income ventile (roughly 2 percent).

Figure 4. :

Heterogeneous Effects By Income

Note: This figure plots estimates of β0 from equation (1): the estimated event-study coefficient on check-distribution day for the logarithm of total scripts filled, by ventile of median income for each recipient’s ZIP Code of residence. The sample is restricted to the full-copay group. The vertical lines through each marker plot 95-percent confidence intervals based on standard errors that are clustered at the level of the birthday group.

Appendix B studies recipients who transition across copayment groups in order to measure how the elimination of copayments changes inter-temporal consumption patterns. Those results indicate that the transition onto the no-copay group eliminates liquidity effects.

These results indicate a high level of sensitivity to liquidity across many Medicare recipients and drugs. The effects do not seem to be driven solely by healthy recipients or by low-value drugs. Instead, we estimate significant effects for medically vulnerable recipients and for drugs for which non-adherence can have severe short-term consequences. Such recipients seem to be delaying or forgoing filling prescriptions until they receive their Social Security checks.

III. Discussion

This paper offers two key results. First, the prescription drug fills of Medicare recipients increase on the day they receive their Social Security checks, even when the out-of-pocket payment for those drugs is just $2 to $6. Second, that pattern disappears when recipients transition onto a program that fully subsidizes out-of-pocket costs.

There are three potential explanations for the increase in prescription fills when Social Security checks are distributed. First, recipients may wait until their Social Security checks arrive to do all of their shopping. For instance, if Social Security beneficiaries have to pay a fare for the bus to travel to retailers, then they may wait until their check arrives so that they only have to pay that fare once. That hypothesis, however, is easy to reject: recipients in the no-copayment group still receive Social Security checks but do not increase their drug fills on payday.

An alternative hypothesis is that Medicare recipients face real liquidity constraints. Such a possibility is consistent with the empirical effects we document. For instance, we find larger effects for more-expensive drugs and in lower-income ZIP Codes. However, recipients in the subsidized-copayment group face copayments of only $2 for generic drugs, and thus it is surprising that liquidity constraints prevent that small of a purchase.

Third, the liquidity sensitivity we observe may be driven by behavioral biases. In particular, Medicare recipients may delay filling their prescriptions based on a type of mental accounting (Thaler, 1985). They may not be truly liquidity constrained, so much as that the mental account that they devote to medical expenses may be empty. Unlike liquidity constraints, mental accounting does not imply large financial costs to accessing the cash necessary for copayments; rather, it implies large psychological costs. Ultimately, we cannot reject either liquidity constraints or mental accounting as the mechanism driving the income-timing effects we document. It is possible that both mechanisms are empirically relevant, though for different recipients.

Regardless of whether liquidity constraints or mental accounting drive the effects we document, the results suggest a benefit of insurance that is often not discussed. Typically, insurance is viewed as providing risk protection at the expense of moral hazard. Generous insurance also provides an additional benefit: it allows healthcare consumption to be less liquidity sensitive. That benefit can be seen in the results above. Recipients who pay $2 to $6 per prescription forgo or delay filling prescriptions until they receive their social security checks, but recipients whose copayments are eliminated (i.e. who have full insurance) do not engage in such intertemporal substitution. In other words, when consumers are provided with more-generous insurance, their healthcare consumption becomes less dependent on the timing of their income.

Ericson and Sydnor (2018) study how rational consumers choose health insurance plans when they are liquidity constrained. Liquidity-constrained households value plans that require premiums to be paid at short intervals rather than in lump sums. That preference is driven not by risk aversion but due to the financing role of insurance. Our results, along with the concurrent results of Lyngse (2020), provide the first empirical evidence—of which we are aware—for that financing role.

The paper’s findings thus suggest an interaction between a person’s finances and their response to copayments. Many policies affect a person’s finances: the offering of additional credit, changes in how often Social Security checks are sent, “nudges” to overcome psychological frictions, and so on. This paper suggests that those policies would affect the healthcare utilization of low-income households and thus matter for the design of health insurance programs for those households. This paper does not provide guidance as to the welfare-importance of that interaction between finances and utilization, it only demonstrates that the interaction exists.

The results also speak to the nature of what health insurance offers its beneficiaries. Typically, economists view health insurance as allowing consumers to transfer resources across states of the world. This paper suggests an additional benefit of health insurance: more-generous coverage allows consumers to avoid having to delay their healthcare until the receipt of their income. With generous coverage, recipients can consume healthcare when they need it, rather than waiting for their income to arrive.

In that sense, this paper relates to the work of Casaburi and Willis (2018), who emphasize the inter-temporal transfers facilitated by insurance. Those authors point out that, typically, consumers pay a premium for insurance early on, and only enjoy benefits at a later date. As a result, health insurance not only transfers resources across states of the world but also across time. Similarly, our results suggest that generous health insurance coverage shifts the timing of healthcare consumption. It allows for transfers from high-liquidity (low marginal utility) periods to low-liquidity (high marginal utility) periods. Generous health insurance may thus improve welfare in two ways, by transferring resources across both time and states.

That said, this paper’s results do not provide guidance regarding the extent to which these intertemporal transfers matter for welfare. Future research is necessary to determine the importance of liquidity sensitivity for welfare. And, more importantly, future research is necessary to understand the corresponding implications for policy: how should health insurance plans be structured for low-income, liquidity-sensitive beneficiaries?

Supplementary Material

Acknowledgments

We are grateful to Amy Finkelstein for thoughtful comments and guidance and to four anonymous referees who also provided important insights. Additionally, we thank Phil Armour, Anikó Bíró, Amitabh Chandra, Rena Conti, Keith Ericson, Salama Freed, Andrew Goodman-Bacon, Jon Gruber, Ben Handel, Anupam Jena, Daniel Kaliski, Michael McWilliams, Sarah Miller, Tom Mroz, Joe Newhouse, Matt Notowidigdo, Analisa Packham, Maria Polyakova, Elena Prager, Mark Shepard, Liyang Sun, Amanda Starc, Justin Sydnor, Boris Vabson, and seminar participants at Duke Fuqua, the Federal Reserve Bank of Boston, Harvard Medical School, the University of Hong Kong, the Whistler Health Economics Summit, the BU-Harvard-MIT Health Economics Seminar, Georgia State University, APPAM, ASHEcon, the Notre Dame Health Economics Conference, the Annual Health Economics Conference at the University of California, San Francisco, the Annual Southeastern Health Economics Study Group at the University of Tennessee, Knoxville, the Hungarian Economic Association Annual Conference, the Midwest Health Economics Conference at the University of Wisconsin, Madison, the International Online Public Finance Seminar, the RAND Behavioral Finance Forum, the ASSA Annual Meeting, the University of Cambridge Healthcare, Education, and Labour Markets Conference, the NBER Aging Meeting, and the Johannes Kepler University Linz for useful feedback. Julia Yates provided superb research assistance. Research reported in this publication was supported by the National Institute on Aging of the National Institutes of Health under Award Number P30AG012810 through the National Bureau of Economic Research Center for Aging and Health Research. The content is solely the responsibility of the authors and does not necessarily represent the official views of the National Institutes of Health.

Footnotes

See the work of Parker (1999), Souleles (1999), Stephens (2003), Johnson, Parker and Souleles (2006), Agarwal, Liu and Souleles (2007), Parker et al. (2013), Agarwal and Qian (2014), Gross and Tobacman (2014), Baugh and Wang (2018), and Gross, Notowidigdo and Wang (2020).

Authors’ calculations based on the 2017 National Health Interview Survey.

Ericson and Sydnor (2018) and Malani and Jaffe (2018) develop theoretical models of this.

We use the phrase “liquidity sensitivity” throughout the paper, rather than referring to liquidity constraints. We do so because the results indicate that drug consumption is “sensitive” to liquidity, but they do not prove the existence of a binding constraint—behavioral frictions related to mental accounting could also explain the results.

Stephens (2003), Evans and Moore (2011), Leary and Wang (2016), and Baugh and Wang (2018) use the distribution of Social Security checks to study outcomes other than healthcare consumption.

In addition, some liquidity-sensitive recipients may forgo scripts entirely when they receive the prescriptions prior to receiving their Social Security checks. In that case, the welfare consequences could also be large.

In addition, in a white paper for the JP Morgan Chase Institute, Farrell, Greig and Hamoudi (2018) document how tax refunds affect healthcare spending.

Einav and Finkelstein (2018) provide a review of this literature.

See the work of Stephens (2003), Leary and Wang (2016), Baugh and Wang (2018), Berniell (2019), Johnson, Parker and Souleles (2006); Agarwal, Liu and Souleles (2007); Bertrand and Morse (2009); Mastrobuoni and Weinberg (2009); Agarwal and Qian (2014); Baugh, Ben-David and Park (2014); Carvalho, Meier and Wang (2016); Baker and Yannelis (2017); Zhang (2017); Vellekoop (2018); Gelman et al. (2020).

Appendix Figure A5 presents the main results for those two sub-groups separately.

There exists an additional group of recipients who pay zero copays and zero premiums. This group consists of Medicaid-Medicare-enrolled individuals who are institutionalized. We exclude from the sample recipients in this group, since they are institutionalized and thus have limited discretion over the timing of their prescription-drug fills.

We verified this phenomenon in discussions with experts at the Consumer Financial Protection Bureau.

The day of the month in which each recipient was born is the level of variation: the SSA matched those 31 groups to dates on which to distribute checks. And so we cluster the standard errors on those 31 groups (Abadie et al., 2017).

Prescription fills also increase the day before Social Security checks are distributed. We believe that occurs because some banks provide recipients with the funds when the bank receives them, rather than on the official payday.

First scripts are defined as prescriptions filled in a therapeutic class that had no fills in the last six months for a given recipient. For this analysis, we restrict the data to begin on June 1, 2006.

We define a drug as “acute” if the median number of fills of the drug in a year among people with at least one fill of the drug is less than or equal to 2 (Einav, Finkelstein and Schrimpf, 2015).

The increase in scripts filled on Social Security check day after 35-day waits is 12.4 log points versus 10.6 log points for 28-day waits, a roughly 17-percent difference.

A “refill every 28 days” strategy would result in the increase in fills occurring on “day minus seven” for Social Security checks that arrive 35 days after the previous check, rather than on “day zero” where we observe it.

Appendix A presents similar results for the full-copayment group.

For each drug, we calculate the average out-of-pocket cost for all Medicare recipients. We then categorize a drug as expensive if the average out-of-pocket cost is above the mean of this variable.

Contributor Information

Tal Gross, Boston University and NBER.

Timothy J. Layton, Harvard University and NBER

Daniel Prinz, Institute for Fiscal Studies and Harvard University.

REFERENCES

- Abadie Alberto, Susan Athey, Imbens Guido W, and Jeffrey Wooldridge. 2017. “When Should You Adjust Standard Errors for Clustering?” National Bureau of Economic Research Working Paper 24003. [Google Scholar]

- Agarwal Sumit, and Wenlan Qian. 2014. “Consumption and Debt Response to Unanticipated Income Shocks: Evidence from a Natural Experiment in Singapore.” American Economic Review, 104(12): 4205–4230. [Google Scholar]

- Agarwal Sumit, Chunlin Liu, and Souleles Nicholas S. 2007. “The Reaction of Consumer Spending and Debt to Tax Rebates Evidence from Consumer Credit Data.” Journal of Political Economy, 115(6): 986–1019. [Google Scholar]

- Aron-Dine Aviva, Liran Einav, and Amy Finkelstein. 2013. “The RAND Health Insurance Experiment, Three Decades Later.” Journal of Economic Perspectives, 27(1): 197–222. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Baicker Katherine, Sendhil Mullainathan, and Joshua Schwartzstein. 2015. “Behavioral Hazard in Health Insurance.” Quarterly Journal of Economics, 130(4): 1623–1667. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Baker Scott R., and Constantine Yannelis. 2017. “Income Changes and Consumption: Evidence from the 2013 Federal Government Shutdown.” Review of Economic Dynamics, 23(1): 99–124. [Google Scholar]

- Baugh Brian, and Jialan Wang. 2018. “When Is It Hard to Make Ends Meet?” Mimeo. [Google Scholar]

- Baugh Brian, Itzhak Ben-David, and Hoonsuk Park. 2014. “Disentangling Financial Constraints, Precautionary Savings, and Myopia: Household Behavior Surrounding Federal Tax Returns.” National Bureau of Economic Research Working Paper 19783. [Google Scholar]

- Beatty Timothy K.M., Bitler Marianne P., Cheng Xinzhe Huang, and Cynthia van der Werf. 2019. “SNAP and Paycheck Cycles.” Southern Economic Journal, 86(1): 18–48. [Google Scholar]

- Berniell Inés. 2019. “Pay Cycles: Individual and Aggregate Effects of Paycheck Frequency.” Mimeo. [Google Scholar]

- Bertrand Marianne, and Adair Morse. 2009. “What Do High–Interest Borrowers Do with Their Tax Rebate?” American Economic Review, 99(2): 418–423. [Google Scholar]

- Brot-Goldberg Zarek C., Amitabh Chandra, Handel Benjamin R., and Kolstad Jonathan T.. 2017. “What Does a Deductible Do? The Impact of Cost–Sharing on Health Care Prices, Quantities, and Spending Dynamics.” Quarterly Journal of Economics, 132(3): 1261–1318. [Google Scholar]

- Carvalho Leandro S., Stephan Meier, and Wang Stephanie W.. 2016. “Poverty and Economic Decision–Making: Evidence from Changes in Financial Resources at Payday.” American Economic Review, 106(2): 260–284. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Casaburi Lorenzo, and Jack Willis. 2018. “Time versus state in insurance: Experimental evidence from contract farming in Kenya.” American Economic Review, 108(12): 3778–3813. [Google Scholar]

- Chetty Raj, and Finkelstein Amy. 2013. “Social Insurance: Connecting Theory to Data.” In Handbook of Public Economics, Volume 5., ed. Auerbach Alan J., Chetty Raj, Feldstein Martin and Saez Emmanuel, 111–193. Elsevier. [Google Scholar]

- de Meza David. 1983. “Health Insurance and the Demand for Medical Care.” Journal of Health Economics, 2(1): 47–54. [DOI] [PubMed] [Google Scholar]

- Einav Liran, Finkelstein Amy, and Schrimpf Paul. 2015. “The Response of Drug Expenditure to Non–Linear Contract Design: Evidence from Medicare Part D.” Quarterly Journal of Economics, 130(2): 841–899. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Einav Liran, and Finkelstein Amy. 2018. “Moral Hazard in Health Insurance: What We Know and How We Know It.” Journal of the European Economic Association, 16(4): 957–982. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ericson Keith Marzilli, and Sydnor Justin R.. 2018. “Liquidity Constraints and the Value of Insurance.” National Bureau of Economic Research Working Paper 24993. [Google Scholar]

- Evans William N., and Moore Timothy J.. 2011. “The Short–Term Mortality Consequences of Income Receipt.” Journal of Public Economics, 95(11–12): 1410–1424. [Google Scholar]

- Farrell Diana, Greig Fiona, and Hamoudi Amar. 2018. “Deferred Care: How tax Refunds Enable Healthcare Spending.” JPMorgan Chase Institute. [Google Scholar]

- Gelman Michael, Kariv Shachar, Shapiro Matthew D., Silverman Dan, and Tadelis Steven. 2020. “How Individuals Respond to a Liquidity Shock: Evidence from the 2013 Government Shutdown.” Journal of Public Economics, 189(1): 103917. [Google Scholar]

- Goetz Thomas. 2018. “Health Insurance Aside, Americans Still Struggle To Pay for Their Medications.” https://www.goodrx.com/blog/health-insurance-aside-americans-still-struggle-to-pay-for-their-medications/.

- Gross Tal, and Tobacman Jeremy. 2014. “Dangerous Liquidity and the Demand for Health Care Evidence from the 2008 Stimulus Payments.” Journal of Human Resources, 49(2): 424–445. [Google Scholar]

- Gross Tal, Notowidigdo Matthew J., and Wang Jialan. 2020. “The Marginal Propensity to Consume Over the Business Cycle.” American Economic Journal: Macroeconomics, 12(2): 351–384. [Google Scholar]

- Johnson David S., Parker Jonathan A., and Souleles Nicholas S.. 2006. “Household Expenditure and the Income Tax Rebates of 2001.” American Economic Review, 96(5): 1589–1610. [Google Scholar]

- Kaiser Family Foundation. 2018. “Employer Health Benefits.” http://files.kff.org/attachment/Report-Employer-Health-Benefits-Annual-Survey-2018.

- Leary Jesse B., and Wang Jialan. 2016. “Liquidity Constraints and Budgeting Mistakes: Evidence from Social Security Recipients.” Mimeo. [Google Scholar]

- Lyngse Frederik Plesner. 2020. “Liquidity Constraints and Demand for Healthcare: Evidence from Danish Welfare Recipients.” Mimeo. [Google Scholar]

- Malani Anup, and Jaffe Sonia. 2018. “The Welfare Implications of Health Insurance.” National Bureau of Economic Research Working Paper 24851. [Google Scholar]

- Manning Willard G., Newhouse Joseph P., Duan Naihua, Keeler Emmett B., and Leibowitz Arleen. 1987. “Health Insurance and the Demand for Medical Care: Evidence from a Randomized Experiment.” American Economic Review, 77(3): 251–277. [PubMed] [Google Scholar]

- Mastrobuoni Giovanni, and Weinberg Matthew. 2009. “Heterogeneity in intra-monthly consumption patterns, self-control, and savings at retirement.” American Economic Journal: Economic Policy, 1(2): 163–89. [Google Scholar]

- Nyman John A. 1999. “The Value of Health Insurance: The Access Motive.” Journal of Health Economics, 18(2): 141–152. [DOI] [PubMed] [Google Scholar]

- O’Carroll Patrick. 2012. “Hearing on the Direct Deposit of Social Security Benefits.” Social Security Administration Office of the Inspector General https://oig.ssa.gov/newsroom/congressional-testimony/hearing-direct-deposit-social-security-benefits. [Google Scholar]

- Olafsson Arna, and Pagel Michaela. 2018. “The Liquid Hand-to-Mouth: Evidence from Personal Finance Management Software.” Review of Financial Studies, 31(11): 4398–4446. [Google Scholar]

- Parker Jonathan A. 1999. “The Reaction of Household Consumption to Predictable Changes in Social Security Taxes.” American Economic Review, 89(4): 959–973. [Google Scholar]

- Parker Jonathan A., Souleles Nicholas S., Johnson David S., and Robert McClelland. 2013. “Consumer Spending and the Economic Stimulus Payments of 2008.” American Economic Review, 103(6): 2530–2553. [Google Scholar]

- Shapiro Jesse M. 2005. “Is there a Daily Discount Rate? Evidence from the Food Stamp Nutrition Cycle.” Journal of Public Economics, 89(2): 303–325. [Google Scholar]

- Shigeoka Hitoshi. 2014. “The Effect of Patient Cost Sharing on Utilization, Health, and Risk Protection.” American Economic Review, 104(7): 2152–2184. [Google Scholar]

- Souleles Nicholas S. 1999. “The Response of Household Consumption to Income Tax Refunds.” American Economic Review, 89(4): 947–958. [Google Scholar]

- Stephens Melvin Jr. 2003. “‘3rd of tha Month:’ Do Social Security Recipients Smooth Consumption Between Checks?” American Economic Review, 93(1): 406–422. [Google Scholar]

- Thaler Richard H. 1985. “Mental Accounting and Consumer Choice.” Marketing Science, 4(3): 177–266. [Google Scholar]

- Thaler Richard H. 1999. “Mental Accounting Matters.” Journal of Behavioral Decision Making, 12(3): 183–206. [Google Scholar]

- Vellekoop Nathanael. 2018. “Explaining Intra–Monthly Consumption Patterns: The Timing of Income or the Timing of Consumption Commitments?” SAFE Working Paper 237. [Google Scholar]

- Zeckhauser Richard. 1970. “Medical Insurance: A Case Study of the Tradeo Between Risk Spreading and Appropriate Incentives.” Journal of Economic Theory, 2(1): 10–26. [Google Scholar]

- Yiwei Zhang C.. 2017. “Consumption Responses to Pay Frequency: Evidence from ‘Extra’ Paychecks.” Advances in Consumer Research, 45: 170–174. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.