Abstract

Non-performing assets (NPAs) have long been one of the most visible and frightening issues that have shaken the whole banking industry around the world. As a result, the study's primary goal is to elucidate the facts surrounding NPAs, which have harmed the Indian banking industry's soundness, profitability, and performance between 1998–1999 and 2019–2020. The future trends NPAs across ownership types and sectoral groups were also explored. The estimations of NPAs drivers are examined in the second stage regression analysis, which takes into account factors such as innovative COVID-19 and policy initiatives. Later, a clear ranking for 52 samples in Indian banks was utilised to verify stability using the ratio of net NPAs to net advances. During the pre-crisis and crisis periods, gross NPAs and net NPAs as a percentage of gross advances both fell dramatically, according to the trend analysis. During turbulent years, however, they significantly rose. Finally, we noticed that the asset quality of scheduled commercial banks and public sector banks is improving following a seven-year gap during the COVID-19 years. In a Phase II regression analysis, this scenario was thoroughly explored for Indian banks and statistically proved that severe policy actions and the negligible influence of the unique COVID-19 crisis contributed to a decrease in their NPAs ratio during 1999–2020. Credit expansion, recognition and resolution of non-performing assets via the Insolvency and Bankruptcy Code Act, recapitalization of PSBs, and ongoing reforms in the COVID-19 period are all major contributors to sporadic credit default in SCBs and PSBs' balance sheets—which began in 2017–2018 and continued in 2019–2020.

Keywords: Non-performing assets, Sustainability, Evolution and ranking, OLS, Indian banks, COVID-19

Introduction

COVID-19 has emerged as the "Black Swan" event of the century for the global financial system, with disastrous consequences for India [17, 37, 63, 77, 78].1 COVID-19's exponentially negative spread has contributed to a huge drop in major financial system indicators in India, while having a small influence on the banking system's soundness [11, 14, 15, 47]. In 2019–2020, the Indian banking system as a whole, and scheduled commercial banks in particular, showed resiliency, with asset quality, capital status, and profitability all improving. Official statistics issued by the Reserve Bank of India (RBI) confirm this fact, indicating that the ratio of gross NPAs to gross advances was 8.20% in 2019–2020, somewhat lower than the value of 11.20% in 2017–2018. However, the numbers on commercial banks' gross non-performing assets (GNPAs) continue to show a tense and alarming situation for policymakers and the Reserve Bank of India. The Indian banking system is likely to suffer from increased asset quality deterioration as a result of the COVID-19 pandemic's escalating scenario and may record more NPAs in following years.2

In a bank-based economy, sound asset quality and less NPAs in the banking system are an imperative prudential indicator for efficient financial intermediation in the context of their overall growth and stability [10, 26, 56, 74]. Accumulated NPAs are becoming a burden and a hindrance to the sound functioning of the banking system, thereby tremendously affecting their efficiency. Apart from asset quality, NPAs signify credit risk management and efficacy in operational efficiency, which in turn impacts profitability, interest income, provisions, liquidity, solvency, overall banking efficiency, and financial stability in India [4, 26–28, 34, 36, 74]. However, COVID-19 induced uncertainty; thereby, the asset quality of the banking system could deteriorate sharply in the coming years. Therefore, it has become imperative for researchers and academics to see and delineate the decade-long scenario of NPAs in the Indian banking system, which will assist policy makers to take an initial cure on pending dues at bank (micro) level in the coming years.

Non-performing assets are a vital indication to depict the sound functioning of the Indian banking system, according to the literature (see [2, 10, 19, 25, 26, 31, 34, 63, 74, 76]. The ratio of non-performing loans (NPLs) to total debt has been widely used in the banking literature to assess underlying asset quality and financial volatility, and this risk proxy can be used in both single-country and cross-country studies. As a common screening tool for the banking system's outlook, central banks in the most countries include this ratio as a key indicator of asset quality via the Financial Stability Report [42]. Therefore, this study employs the ratio of gross non-performing assets to gross advances and net non-performing assets to net advances to illustrate and examine the facts about NPAs during and before the COVID-19 era.

To initiate this, the study aims to elucidate the evolution of non-performing assets in the Indian banking industry over a longer time horizon covering four phases of asset crisis: (1) the pre-crisis period (1998/1999–2006/2007), (2) the crisis period (2007/2008–2008/2009), (3) the post-crisis (turbulent) period (2008/2009–2016/2017), and (4) COVID-19 era. Trends in NPAs are also shown for several ownership types (public, private, and foreign banking groups) and sectoral groups (priority and non-priority sectors for each ownership group). This study answers the following critical questions: first, would the asset quality of Indian banks be stable between 1999 and 2020? If not, what are the reasons for the rise in NPAs, particularly in the years following the global financial crisis until COVID-19/20? Along with displaying ownership and sectoral trends, the study also discusses the possible causes of rising NPA levels in India, particularly after the crisis and through the COVID-19/20 years, including whether it was due to the global financial crisis or any other internal concern affecting the performance of Indian banks. The current study then employed the ratio of net NPAs to net advances of 52 samples of Indian commercial banks, including public sector banks, private banks, and foreign banks, to assess the sustainability of Indian banks for the financial year 2019/2020.

Second, how have NPAs evolved during the period spanning from 1998/1999 to 2019/2020 in India? For this, the study presents a set of stylized facts about NPAs in India over the past three decades. The sample period is split into four sub-periods: pre-crisis, crisis, post-crisis (turbulent), and COVID-19 periods to compare the NPA variations in the distinct sub-periods. Additionally, to understand whether the phenomenon of rising NPAs is consistent across all the commercial banking groups in India. Furthermore, in order to determine the real sector that contributes to the formation of NPAs, the study compares the trends in NPAs by sector (priority and non-priority areas) during the pre-crisis and post-crisis eras. Third, are COVID-19 and Policy measures play an important role to influence the level of NPAs during 1999/2020. Finally, the article discusses policy measures implemented at the centralised (i.e. by the Reserve Bank of India and/or the Government of India (GOI)) and decentralised levels (such as at the bank level) to address the problem of NPAs throughout the research period. Such a comparison would aid bank managers in determining the existing situation and various options for dealing with the high level of NPAs.

In terms of micro-level perspectives, a detailed explanation of this paper will be useful for regulators, policymakers, and bank managers, so that they can take initial steps to improve the deteriorating asset quality level. Moreover, the ownership-wise ranking of NPAs during the onset of the COVID-19 crisis will assist the branch manager in terms of prudent lending growth to ailing sectoral groups and maintaining the viable performance of banks in terms of asset quality in the future. To the best of our knowledge, taking into account the NPA behaviour of Indian banks, this assessment of drivers, trends, and rankings is completely new to the banking literature.

The remainder of the paper is organised in the following manner. In “Conceptual framework and related literature on non-performing assets” section discusses the relevant literature review on NPAs from both a national and international perspective. In “Evolution of non-performing assets (NPAs) in the Indian banking industry” section examines the evolution of non-performing assets in the banking industry in India, based on different ownership types and sectoral groups. In the Phase II regression analysis of “Evolution of non-performing assets (NPAs) in the Indian banking industry” section, a concrete conceptual model that empirically investigates the influence of trends, novel coronavirus, and policy measures indicators on NPA across ownership groups in India is also presented. In “Resolution practices for non-performing assets: key policy initiatives” section summarises the centralised and decentralised policy actions taken to address NPA. In “Conclusion and a way forward” section brings the discussion to a close and offers recommendations for the future.

Conceptual framework and related literature on non-performing assets

Non-performing assets are prevalent in the banking industry across the globe since they stop generating income for financial institutions, either in the form of interest or principal payments. The term “NPAs” refers to a situation in which debtors are causing defaults on their loans, such as failure to pay their full or partial dues, whether intentionally or unintentionally. The bank’s performance is harmed in such circumstances due to partial or non-recovery of loan amounts, which eventually show up on the balance sheet and profit and loss statement [5, 69]. The sensitive issue of NPAs has long been one of the most prominent and challenging issues that has shaken the whole banking industry across nations (see [2, 10, 19, 25–28, 31, 34, 63, 74, 76]). Researchers have performed numerous studies on the topic of NPAs at both the national and international levels, which are mentioned in “Indian and International studies” and “Causes for NPAs across nations” sections. The research gaps for the current study are investigated based on two ideologies: first, the evolution of non-performing assets across nations, including India, which has attracted attention since the 1990s. Second, we determined the causes and influencing elements that lead to the development of NPAs.

Indian and international studies

The asset quality of banks in India has received attention, particularly in the post-liberalization era. Several policy initiatives were taken based on the recommendations of the Committee on the Financial System [49] and the Committee on Banking Sector Reforms (Ministry of Finance, 1998), which suggested strengthening the asset classification and provisioning norms for NPAs in the Indian banking industry. In the aftermath of policy reforms, several academic researchers’ have built a discussion on various issues surrounding non-performing assets. Rajaraman et al. [60] empirically explain the inter-bank variations in NPAs in the year 1996/1997. Sharma [68] examines the trends in NPAs across banks during the late 1990s. Rajeev and Mahesh [64] ponder the evolution, trends, and strategies in resolving the problem of NPAs over the period 2002–2009. Gowri et al. [24] examine the developments in NPAs for India’s public sector banks from 2006 to 2011. Between 2008 and 2013, Das and Dutta [13] investigate the mean disparities in NPA levels across the State Bank of India and nationalised banking groups in the Indian public sector banking industry. According to Mahajan [35] and Pandey et al. [43], asset quality improved from 1997 to 2008, owing mostly to the Reserve Bank of India’s adoption of prudential regulations.

Lokare [34] finds that public and old private banks had greater NPAs in priority sectors between 2001 and 2013, while foreign and new private banks had large NPAs in non-priority sectors. Sengupta and Vardhan [70] have discussed the two phases of India’s NPA issue (i.e. Phase I: 1997–2002 and Phase II: 2008-following the years of the global financial crisis). Few studies have been conducted to examine the institutional and legal systems for managing and dealing bad loans (see, for example [25, 64, 68]). Proper credit screening, according to Ghosh [18, 20], Padhi [44], and Goswami [25], is the best cure for dealing with the issue of problem loans while sanctioning loans. Nidugala and Pant [39] and Goswami [25] present a dialogue between the Government of India (GOI) and the Reserve Bank of India (RBI) on the crisis management framework (RBI). They notice that, in comparison with private banks in India, the decline in asset quality has become a severe worry for public sector banks. Past research on the evolution and definition of non-performing assets has concluded that policy actions implemented in the 1980s and 1990s improved bank asset quality. However, in the years following the global financial shock, the problem of bad loans has intensified across nations. The studies report that policymakers have launched a series of reforms to clean up NPAs from the bank’s balance sheets and prevent the level of future NPAs in the industry. It is seen that the shroud of bad loans is settling, and the adopted policy actions have contributed to a slight improvement in the asset quality condition in recent years [61]. However, continuous efforts are required to maintain the level of asset quality.

On an international level, using data from 1995 to 1997, Lou [33] explains the causes and severity of the problem of non-performing loans in the state-commercial banks in China. His study points out that since the 1990s, the ongoing concern about NPLs has not only been a threat to the banking system but has also affected economic growth in China.For the US banking system, Stiroh and Metli [71] demonstrate that the problem of bad loans improved in 2002 as compared to the period of the banking crisis of the late 1980s and early 1990s. Parven [45] discusses the trends of NPLs in the Bangladesh banking sector over the period from 1990 to 2011. He reveals that the ratio of NPLs to total loans fell from 41.11% in 1999 to 6.59% in 2011 in Bangladesh. The report reveals that while Bangladesh’s banking system has not been able to totally eliminate the problem of bad loans, significant progress has been made over the study period. According to the study of International Monetary Fund (2017), the ratio of non-performing loans to total loans in Bulgaria’s banking sector has increased during 2016, when compared to other European countries. As a result, the Bulgarian authorities were obligated to take the appropriate resolution measures (such as collateral evaluation and effective risk management procedures) to address the problem of rising NPLs. Similarly, Castano and Traverso [8] report that the banking system in Spain has experienced a significant increase in NPLs in 2014, primarily due to the country’s real estate crisis, while the study by Rawal [65] shows that Greece experienced higher NPLs, mainly coming from non-priority sectors, including construction, housing, real estate, manufacturing, and trade sectors.

According to Rawal and Silva [66], the global financial crisis impacted asset quality in the Portuguese banking system, and as a result, the European Central Bank and the International Monetary Fund injected a 78 billion bailout package to successfully reduce NPL levels. Plekhanov and Skrzypińska [46] advocate that immediately after the global financial crisis of 2008/2009, banks’ balance sheets in many advanced and emerging economies have been affected by non-performing loans. Lee and Rosenkranz [32] provide the evolution of NPLs as a percentage of gross loans across Asian economies, covering Central Asia, East Asia, South Asia, and North Asia from 1999 to 2017. They report that the ratio of NPLs as a percentage of gross debt has been declining since 1998/1999, but from 2010 onward it started ballooning in many countries, such as Bangladesh and India in South Asia, among others.

Causes for NPAs across nations

Borrower defaults on credit have a negative impact on the bank's financial situation. The reason for this, according to Ahmad [1], is the borrowers' more prone temperament, in which they are unwilling to pay off the loan amount with reckless abandon. Okorie [40] even said that the type of credit given and the performance of the credit disbursing institutions had an impact on repayment capacity and default rates. On the other hand, Balogun and Alimi [3] have stated that high-interest rates, age of the borrowers, loss-making businesses, small business holdings, and advance deficiencies are few possible reasons for the incidence of NPAs. Lokare [34], Samantaraya [67], Chavan and Gambacorta [9], Goyal [21, 23], Goswami [25] have recently discovered evidence of procyclicality in bank lending behaviour, which explains high credit growth during economic upturns (2006–2011) and subsequent impairment in asset quality during the post-crisis years. Olomola [41] supports this viewpoint, stating that a long delay in loan distribution and a high repayment rate might raise transaction costs, making it difficult for borrowers to repay their loans. The Reserve Bank of India [59] also points out that in the post-crisis years, the procyclical pattern of credit growth leads to a considerable increase in the amount of NPAs, particularly in public sector banks.

Research gap

This study presents a robust conceptual framework based on the literature survey, which consists of two novel aspects, namely the COVID-19 problem and governmental interventions. The impact of emerging coronaviruses and other policy interventions on the NPA ratio in Indian banks has received little attention in the literature. Previous research has primarily concentrated on explaining information about NPAs prior to the global financial crisis, with little attention paid to the facts concerning NPA behaviour across Indian banks during and immediately prior to the COVID-19 period. The check on the viability of Indian scheduled commercial banks at the start of the COVID-19 crisis is likewise unsolved.

Evolution of non-performing assets (NPAs) in the Indian banking industry

This section demystifies the trends of NPAs of public, private, foreign, and all the commercial banks in India during 1999/2020 using the ratio of gross NPAs and net NPAs to total advances and gross NPAs and net NPAs to total assets. By considering the prolonged data period, policymakers will attain a real picture of rising NPA figures and issues and will formulate micro-level strategies to address this issue accordingly in the future. The sub-divisional data period will also address if the issue of NPAs is a concern for India's central bank. If that's the case, which industries are to blame for the rising NPAs? The study also used a second stage regression analysis to see how the novel coronavirus crisis and various policy initiatives by each affected the ratio of NPAs. Furthermore, by providing a ranking of NPA ratios, this paper clarifies the long-term viability of public, private, and foreign banks in India at the start of the COVID-19 crisis.

Trends in NPAs at the industry level

From the estimates of the average annual growth rate of NPAs in Tables 1 and 2, we note that Indian banks have seen a growth of 17.97% in gross NPLs and 19.67% in net NPLs during the entire study period. Without a doubt, asset quality has remained a major concern for Indian banks throughout the study period; thus, the study divides NPL trends into three distinct phases: (1) the crisis period (1998/1999–2006/2007), (2) the crisis period (2007/2008–2008/2009), and (3) the post-crisis period (2008/2009–2016/2017). Regarding the pre-crisis era, we observe that the entire banking system in India witnessed a sharp dip in the ratio of gross and net NPLs as a percentage of total advances from 15.93% and 7.45% in 1998/1999 to 2.55% and 1.02% in 2006/2007, respectively (see Tables 1, 2). The novel financial reforms introduced by the Narasimham committee in 1991, effective screening and monitoring of the borrowers, more provisioning and write-offs, and adoption of better credit risk management practices contributed to lower gross and net NPL ratios in the pre-crisis era. This view is also supported by Gulati et al. [29] and Goswami [26, 27]. Similar to the pre-crisis years, the trend in improvement of asset quality remained during the crisis years for Indian banks. The statistics of gross and net NPAs ratios reported a further decline to 2.28% and 1.0% in 2007/2008, respectively. During the global financial turbulence years in India, pro-active regulatory steps implemented by Indian banks in the pre-crisis years resulted in lower NPA ratios, such as effective provisioning and restructuring strategies, and limited exposures in toxic assets, resulting in lower NPA ratios. The Reserve Bank of India [59] and Goswami [25] both support this.

Table 1.

Gross NPAs in the Indian banking industry: gross exposure from 1998/1999–2019/2020.

Source: Author’s elaboration from various issues of Report on Trend and Progress of Banking in India

| Year | Ownership groups | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Public sector banks (PSBs) | Private banks (PBs) | Foreign banks (FBs) | All commercial banks | ||||||||||||||

| Gross NPA (Nominal value) | AGR (%) | RGNTA | RGNPA | Gross NPA (Nominal value) | AGR (%) | RGNTA | RGNPA | Gross NPA (Nominal value) | AGR (%) | RGNTA | RGNPA | Gross NPA (Nominal value) | AGR (%) | RGNTA | RGNPA | ||

| 1998/1999 | 496,032 | – | 0.06 | 16.68 | 42,630 | – | 0.04 | 10.04 | 22,066 | – | 0.03 | 6.95 | 560,728 | – | 0.06 | 15.93 | |

| 1999/2000 | 527,132 | 6.27 | 0.06 | 14.97 | 47,501 | 11.43 | 0.03 | 8.52 | 25,893 | 17.34 | 0.03 | 6.54 | 600,526 | 7.10 | 0.05 | 13.68 | |

| 2000/2001 | 546,745 | 3.72 | 0.05 | 13.19 | 59,665 | 25.61 | 0.04 | 8.77 | 30,429 | 17.52 | 0.03 | 6.76 | 636,838 | 6.05 | 0.05 | 12.19 | |

| 2001/2002 | 564,990 | 3.34 | 0.05 | 11.75 | 116,683 | 95.56 | 0.04 | 10.02 | 27,313 | − 10.24 | 0.02 | 5.26 | 708,985 | 11.33 | 0.05 | 11.00 | |

| 2002/2003 | 540,871 | − 4.27 | 0.04 | 9.85 | 118,079 | 1.20 | 0.04 | 8.50 | 28,393 | 3.95 | 0.02 | 5.19 | 687,342 | − 3.05 | 0.04 | 9.30 | |

| 2003/2004 | 515,373 | − 4.71 | 0.04 | 8.15 | 103,802 | − 12.09 | 0.03 | 6.09 | 28,389 | − 0.01 | 0.02 | 4.59 | 647,564 | − 5.79 | 0.03 | 7.51 | |

| 2004/2005 | 483,994 | − 6.09 | 0.03 | 5.67 | 87,822 | − 15.40 | 0.02 | 3.98 | 22,627 | − 20.30 | 0.01 | 2.79 | 594,442 | − 8.20 | 0.03 | 5.18 | |

| 2005/2006 | 413,585 | − 14.55 | 0.02 | 3.74 | 78,108 | − 11.06 | 0.01 | 2.50 | 19,274 | − 14.82 | 0.01 | 1.89 | 510,967 | − 14.04 | 0.02 | 3.42 | |

| 2006/2007 | 389,684 | − 5.78 | 0.02 | 2.71 | 92,553 | 18.49 | 0.01 | 2.23 | 22,629 | 17.40 | 0.01 | 1.74 | 504,866 | − 1.19 | 0.01 | 2.55 | |

| 2007/2008 | 404,523 | 3.81 | 0.01 | 2.25 | 129,974 | 40.43 | 0.01 | 2.51 | 28,594 | 26.36 | 0.01 | 1.70 | 563,092 | 11.53 | 0.01 | 2.28 | |

| 2008/2009 | 449,570 | 11.14 | 0.01 | 1.99 | 169,266 | 30.23 | 0.02 | 2.94 | 64,445 | 125.38 | 0.01 | 3.89 | 683,282 | 21.34 | 0.01 | 2.30 | |

| 2009/2010 | 599,273 | 33.30 | 0.01 | 2.22 | 176,400 | 4.21 | 0.02 | 2.79 | 71,336 | 10.69 | 0.02 | 4.30 | 847,008 | 23.96 | 0.01 | 2.43 | |

| 2010/2011 | 746,639 | 24.59 | 0.01 | 2.26 | 182,386 | 3.39 | 0.01 | 2.29 | 50,687 | − 28.95 | 0.01 | 2.60 | 979,711 | 15.67 | 0.01 | 2.28 | |

| 2011/2012 | 1,172,620 | 57.05 | 0.02 | 3.02 | 187,678 | 2.90 | 0.01 | 1.94 | 62,966 | 24.23 | 0.01 | 2.79 | 1,423,264 | 45.27 | 0.02 | 2.81 | |

| 2012/2013 | 1,644,618 | 40.25 | 0.02 | 3.68 | 207,623 | 10.63 | 0.01 | 1.82 | 79,771 | 26.69 | 0.01 | 3.03 | 1,932,012 | 35.75 | 0.02 | 3.30 | |

| 2013/2014 | 2,280,741 | 38.68 | 0.03 | 4.47 | 245,424 | 18.21 | 0.01 | 1.83 | 115,790 | 45.15 | 0.02 | 3.98 | 2,641,955 | 36.75 | 0.02 | 3.92 | |

| 2014/2015 | 2,784,679 | 22.10 | 0.03 | 5.09 | 341,062 | 38.97 | 0.01 | 2.15 | 107,610 | − 7.06 | 0.01 | 3.29 | 3,233,352 | 22.38 | 0.03 | 4.95 | |

| 2015/2016 | 5,399,550 | 93.90 | 0.06 | 9.76 | 561,857 | 64.74 | 0.02 | 2.74 | 158,052 | 46.88 | 0.02 | 4.27 | 6,119,459 | 89.26 | 0.05 | 5.60 | |

| 2016/2017 | 6,846,770 | 26.80 | 0.07 | 11.70 | 932,092 | 65.89 | 0.03 | 4.20 | 136,291 | − 13.77 | 0.02 | 4.00 | 7,915,153 | 29.34 | 0.06 | 10.19 | |

| 2017/2018 | 8,956,010 | 23.55 | 0.09 | 14.60 | 1,293,350 | 27.93 | 0.03 | 4.70 | 138,490 | 1.590 | 0.02 | 3.80 | 10,396,790 | 23.87 | 0.07 | 11.20 | |

| 2018/2019 | 7,395,410 | − 17.43 | 0.07 | 11.60 | 1,836,040 | 41.96 | 0.03 | 5.30 | 122,420 | − 11.60 | 0.01 | 3.00 | 9,353,870 | − 10.03 | 0.06 | 9.10 | |

| 2019/2020 | 7,178,500 | − 2.930 | 0.07 | 10.30 | 2,095,680 | 14.14 | 0.04 | 5.50 | 102,080 | − 16.61 | 0.01 | 2.30 | 9,376,260 | 0.240 | 0.05 | 8.20 | |

| Average annual growth rate | 15.84 | 22.73 | 11.42 | 16.07 | |||||||||||||

(1) The nominal values of gross NPAs of public, private, foreign, and all the commercial banks in India are in millions; (2) AGR denotes average growth rate (in percent) of the ratio of gross NPAs to gross advances; (3) RGNTA represents ratio of gross NPAs to total assets; and (4) RGNPA represents ratio of gross NPAs to total advances

Table 2.

Net NPAs in the Indian banking industry: gross exposure from 1998/1999 to 2019/2020.

Source: Author’s elaboration from various issues of Report on Trend and Progress of Banking in India

| Year | Ownership groups | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Public sector banks (PSBs) | Private banks (PBs) | Foreign banks (FBs) | All commercial banks | ||||||||||||||

| Net NPA (Nominal value) | AGR (%) | RNNTA | RNNPA | Net NPA (Nominal value) | AGR (%) | RNNTA | RNNPA | Net NPA (Nominal value) | AGR (%) | RNNTA | RNNPA | Net NPA (Nominal value) | AGR (%) | RNNTA | RNNPA | ||

| 1998/1999 | 2,42,184 | − | 0.03 | 8.84 | 25,315 | − | 0.02 | 5.96 | 7,985 | − | 0.01 | 2 | 2,75,484 | − | 0.03 | 7.45 | |

| 1999/2000 | 2,61,877 | 8.13 | 0.03 | 7.54 | 30,040 | 18.66 | 0.02 | 5.39 | 7,973 | − 0.15 | 0.01 | 2.4 | 2,99,889 | 8.86 | 0.03 | 6.76 | |

| 2000/2001 | 2,79,784 | 6.84 | 0.03 | 7.36 | 30,078 | 0.13 | 0.02 | 4.42 | 7,759 | − 2.68 | 0.01 | 1.9 | 3,17,621 | 5.91 | 0.02 | 6.04 | |

| 2001/2002 | 2,79,735 | − 0.02 | 0.02 | 6.16 | 39,412 | 31.03 | 0.01 | 3.38 | 8,920 | 14.97 | 0.01 | 1.9 | 3,28,066 | 3.29 | 0.02 | 5.07 | |

| 2002/2003 | 2,49,625 | − 10.76 | 0.02 | 4.58 | 61,071 | 54.96 | 0.02 | 4.4 | 8,688 | − 2.60 | 0.01 | 1.8 | 3,19,385 | − 2.65 | 0.02 | 4.31 | |

| 2003/2004 | 1,88,597 | − 24.45 | 0.01 | 2.69 | 41,779 | − 31.59 | 0.01 | 2.45 | 8,882 | 2.23 | 0.01 | 1.5 | 2,39,258 | − 25.09 | 0.01 | 2.77 | |

| 2004/2005 | 1,69,035 | − 10.37 | 0.01 | 1.95 | 42,116 | 0.80 | 0.01 | 1.91 | 6,377 | − 28.20 | 0.00 | 0.9 | 2,17,528 | − 9.08 | 0.01 | 1.89 | |

| 2005/2006 | 1,45,655 | − 13.83 | 0.01 | 1.27 | 31,703 | − 24.72 | 0.01 | 1.01 | 8,076 | 26.64 | 0.00 | 0.8 | 1,85,434 | − 14.75 | 0.01 | 1.22 | |

| 2006/2007 | 1,53,250 | 5.21 | 0.01 | 0.92 | 40,282 | 27.06 | 0.01 | 0.97 | 9,270 | 14.79 | 0.00 | 0.7 | 2,02,801 | 9.37 | 0.01 | 1.02 | |

| 2007/2008 | 1,78,365 | 16.39 | 0.01 | 0.77 | 56,469 | 40.19 | 0.01 | 1.09 | 12,466 | 34.48 | 0.00 | 0.8 | 2,47,300 | 21.94 | 0.01 | 1 | |

| 2008/2009 | 2,11,554 | 18.61 | 0.01 | 0.74 | 74,120 | 31.26 | 0.01 | 1.29 | 29,967 | 140.39 | 0.01 | 1.8 | 3,15,642 | 27.64 | 0.01 | 1.05 | |

| 2009/2010 | 2,96,434 | 40.12 | 0.01 | 0.98 | 65,060 | − 12.22 | 0.01 | 1.03 | 29,772 | − 0.65 | 0.01 | 1.8 | 3,91,266 | 23.96 | 0.01 | 1.12 | |

| 2010/2011 | 3,60,546 | 21.63 | 0.01 | 1.01 | 44,318 | − 31.88 | 0.00 | 0.56 | 13,125 | − 55.92 | 0.00 | 0.67 | 4,17,988 | 6.83 | 0.01 | 0.97 | |

| 2011/2012 | 5,91,622 | 64.09 | 0.01 | 1.47 | 44,012 | − 0.69 | 0.00 | 0.46 | 14,126 | 7.63 | 0.00 | 0.6 | 6,49,760 | 55.45 | 0.01 | 1.28 | |

| 2012/2013 | 9,00,369 | 52.19 | 0.01 | 1.99 | 59,944 | 36.20 | 0.00 | 0.52 | 26,628 | 88.51 | 0.00 | 1 | 9,86,941 | 51.89 | 0.01 | 1.68 | |

| 2013/2014 | 13,06,237 | 45.08 | 0.02 | 2.8 | 88,611 | 47.82 | 0.00 | 0.66 | 31,724 | 19.14 | 0.00 | 1.1 | 14,26,572 | 44.54 | 0.01 | 2.12 | |

| 2014/2015 | 15,99,511 | 22.45 | 0.02 | 3.21 | 1,41,283 | 59.44 | 0.01 | 0.89 | 17,617 | − 44.47 | 0.00 | 0.5 | 17,58,411 | 23.26 | 0.01 | 2.69 | |

| 2015/2016 | 32,03,744 | 100.30 | 0.04 | 5.7 | 2,66,774 | 88.82 | 0.01 | 1.32 | 27,669 | 57.06 | 0.00 | 0.8 | 34,98,187 | 98.94 | 0.03 | 4.4 | |

| 2016/2017 | 38,30,428 | 19.56 | 0.04 | 6.9 | 4,77,802 | 79.10 | 0.01 | 2.15 | 21,406 | − 22.64 | 0.00 | 0.6 | 43,29,636 | 23.77 | 0.03 | 7.45 | |

| 2017/2018 | 45,44,730 | 15.72 | 0.05 | 8 | 6,43,800 | 25.78 | 0.01 | 2.4 | 15,480 | − 38.28 | 0.00 | 0.4 | 52,08,380 | 16.87 | 0.03 | 6 | |

| 2018/2019 | 28,51,220 | − 37.26 | 0.03 | 4.8 | 6,73,090 | 4.55 | 0.01 | 2 | 20,510 | 32.49 | 0.00 | 0.5 | 35,44,820 | − 31.94 | 0.02 | 3.7 | |

| 2019/2020 | 23,09,180 | − 19.01 | 0.02 | 3.7 | 5,57,460 | − 17.18 | 0.01 | 1.5 | 20,840 | 1.61 | 0.00 | 0.5 | 28,87,480 | − 18.54 | 0.02 | 2.8 | |

| Average annual growth rate | 15.27 | 20.36 | 11.64 | 15.26 | |||||||||||||

(1) The nominal values of net NPAs of public, private, foreign, and all the commercial banks in India are in millions; (2) AGR denotes average growth rate (in percent) of the ratio of net NPAs to net advances; (3) RGNTA represents ratio of net NPAs to total assets; and (4) RGNPA represents ratio of net NPAs to net advances

This phenomenon, however, has not been consistent in the post-crisis years. The Indian banking industry has seen a perceptible fall in the quality of asset portfolios of banks, particularly from 2010/2011 to 2016/2017. In particular, the gross and net NPL ratios rose to 10.19% and 7.45% of total advances in 2016/2017 from the levels reported in 2007/2008. This troubling situation was most likely caused by Indian banks’ increased exposure to stressed sectors, particularly the power and airline sectors, during the economic boom period, which harmed borrowers’ loan-repaying capacity during the economic downturn and, as a result, the NPL level loomed large in the later years of the study period [54]. Other reasons could be lower provisioning coverage ratio, fall in the restructuring asset ratio, and asset quality review that was conducted by the Reserve Bank in order to bring transparency in the banks’ balance sheets in India that depict a clear picture of NPAs ratio, which resulted in a rise in both the NPAs ratio immediately following the global financial crisis [25, 58].

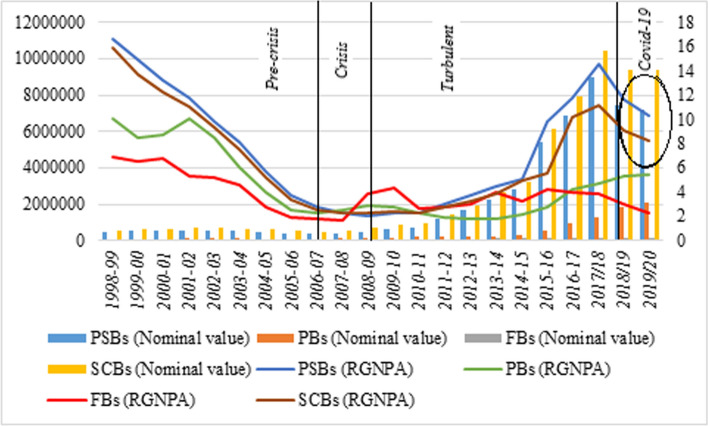

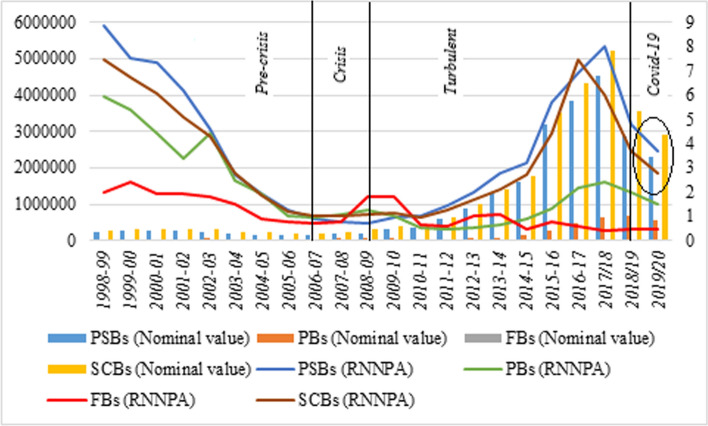

Trends in NPAs by ownership types

On comparing the NPA ratio across distinct bank ownership groups in India, we note that the public sector banks (PSBs) exhibited a significant decline in their gross and net NPA levels from 16.68% and 8.84% in 1998/1999 to 1.99% and 0.74% in 2008/2009 during the pre-crisis and crisis years. It suggests that PSBs performed well in maintaining their asset quality level relative to their counterparts in both the pre-crisis and crisis years in India. An effective financial reform of the 1990s, as well as revisions in prudential norms implemented by the RBI in India in 2004, contributed to a lower NPA ratio for the PSBs group during the pre-crisis and crisis years in India. Furthermore, it is worth noting that private and foreign banks in India experienced the greatest increase in their gross and net NPA ratios during and immediately after the global financial crisis (see Figs. 1, 2). This could be due to the greater exposure of the private banks (i.e. 52.39%) and FBs (i.e. 35.59%) toward sensitive sectors, particularly in housing loans, retail loans, and capital markets in 2006/2007, which led to a significant deterioration in their asset quality in the following years [9, 25, 51].

Fig. 1.

Evolution of a gross non-performing asset in the Indian banking industry and across ownership groups-1998/1999–2019/2020.

Source: Author’s own creation

Fig. 2.

Evolution of a net non-performing assets in the Indian banking industry and across ownership groups-1998/1999–2019/2020.

Source: Author’s own creation

In the subsequent years from 2011/2012 to 2016/2017, the distress was more pronounced in PSBs than in private and foreign banks in India. This is marked by the banks’ group level facts, where we observe an upsurge in gross and net NPAs of PSBs from 3.02% and 1.47% in 2009/2010 to 11.70% and 6.90% in 2016/2017. Furthermore, during the financial crisis, private and foreign banks witnessed a significant improvement in asset quality from 2010/2011 to 2013/2014, after which it soon began to decline, but less dramatically than PSBs in the years following the study period (see Figs. 1, 2). The steep rise in NPAs during 2012–2017 was due to the following reasons: (1) higher growth of restructured advances by public sector banks, particularly nationalised banks; (2) greater exposure of PSBs, especially of the SBI group, to the priority sector and stressed sectors (like infrastructure, iron and steel, textiles, coal mining, and aviation) during the high credit growth phase; and (3) the rise in interest rates for small and medium enterprises in the years following the crisis may probably have contributed to loan delinquencies in the later years of the study period. These factors are also supported by Bhagwati [6], who stated that the slack in economic growth stalled large infrastructure projects (i.e. due to the Supreme Court decision on banning for iron, ore, and coal mining industries), which limited the capacity of the big borrowers to repay their debts on time, and thus NPAs increased rapidly after the crisis years in India.

Going forward, SCBs in general and PSBs in particular demonstrated rigidity in terms of robustness in asset quality during the COVID-19 pandemic. This is statistically proven in Table 5 (Phase II regression analysis), which found an insignificant effect of the novel coronavirus crisis on the proportion of NPAs in the ownership groups and banking industry in India. Another striking point is that private and foreign banks were the only bank groups that managed their level of gross NPAs well in the post-crisis and COVID-19 era. Adoption of better risk management practices, an effective credit appraisal process, and lower exposure of private banks in the less risky corporate portfolios (such as retail, creditworthy borrowers, and multinational corporations) resulted in better recovery of NPAs for PBs in the latter years of the study period [20, 21, 23, 38]. Furthermore, the ratio of recovery of NPAs was higher in private banks during 2015/2017 (i.e. 41.0%) as compared to PSBs (i.e. 25.1%) and the banking system as a whole in India (i.e. 26.4%) [59], p. 55). The recently published RBI Statistical Report 2018–2020 also states that the resolution efforts via higher write-offs for large NPA accounts have resulted in improved asset quality in PBs and FBs in India in the last years of the study period.

Table 5.

Drivers of NPAs during 1999/2020: second-stage regression analysis across banking ownership groups in India.

Source: Author’s calculations

| Independent variables | Dependent variables | |||||||

|---|---|---|---|---|---|---|---|---|

| Ratio of gross NPAs (RGNPA) | Ratio of net NPAs (RNNPA) | |||||||

| Ownership groups | ||||||||

| Public sector banks (PSBs) | Private banks (PBs) | Foreign banks (FBs) | Scheduled commercial banks (SCBs) | Public sector banks (PSBs) | Private banks (PBs) | Foreign banks (FBs) | Scheduled commercial banks (SCBs) | |

| Constant |

3.208*** (0.269) |

2.784*** (0.218) |

2.057*** (0.219) |

3.130*** (0.238) |

2.500*** (0.340) |

0.238*** (0.261) |

0.959*** (0.228) |

2.341*** (0.272) |

| Time |

− 0.825*** (0.130) |

− 0.745*** (0.105) |

− 0.401*** (0.106) |

− 0.807*** (0.115) |

− 0.884*** (0.165) |

− 0.610*** (0.126) |

− 0.393*** (0.110) |

− 0.819*** (0.131) |

| C-19 crisis |

0.255 (0.346) |

0.610** (0.280) |

− 0.314 (0.282) |

0.264 (0.306) |

− 0.156 (0.438) |

0.252 (0.336) |

− 0.047 (0.294) |

− 0.274 (0.349) |

| Policies |

1.460*** (0.258) |

0.578** (0.209) |

0.455** (0.210) |

1.240*** (0.228) |

1.808*** (0.326) |

1.014*** (0.250) |

− 0.399* (0.219) |

1.616*** (0.261) |

| N | 1,320 | 1,320 | 1,320 | 1,320 | 1,320 | 1,320 | 1,320 | 1,320 |

| F statistics | 17.52*** | 17.66*** | 5.42*** | 19.13*** | 13.63*** | 21.24*** | 12.88*** | 17.26*** |

| R2 | 0.7449 | 0.7464 | 0.4747 | 0.7612 | 0.6943 | 0.7798 | 0.6822 | 0.7420 |

(1) RGNPA: ratio of gross non-performing asset to gross advances; RNNPA: ratio of net non-performing asset to gross advances; Time: log of total assets; C/19 crisis: dummy of novel COVID-19 crisis; Policies: dummy of policy measures; N: total number of observations; (2) *, **, and *** statistically significant at 10%, 5%, and 1% levels, respectively; and (3) figure in parentheses in columns (1) and (2) are clustered standard errors, respectively

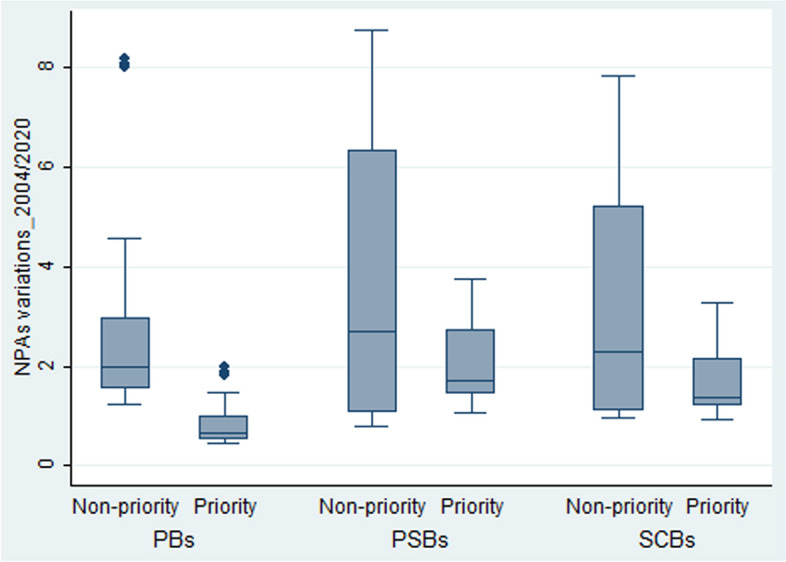

Trends in NPAs by sectoral groups

The Reserve Bank of India has divided loan distribution into two categories: priority and non-priority industries. Agriculture and related activities, micro- and small-scale firms (including manufacturing and services), and other sectors (such as housing, microcredit, education loans, weaker sections, export credit, and state-sponsored organisations for Scheduled Caste (SC)/Scheduled Tribes (ST)) are among the priority sectors. Industry (including small, medium, and large scale), services (including transport operators, computer software, tourism, hotels & restaurants, shipping, professional services, trades (including both wholesale and retail), non-banking financial companies (NBFCs), and the commercial sector (including real estate and other services)) are examples of non-priority sectors. The risk of loan defaults is not uniform across priority and non-priority lending by distinct ownership groups. Thus, it is difficult to find out which sector the NPA is coming from. Therefore, to address this problem, the following section gazes at the sector-wise classification of NPAs across distinct ownership groups as well as for the entire banking system in India (see Table 3). As shown in Table 3 and Fig. 3, we believe that in both the priority (i.e. from 3.05% in 2004 to 1.02% in 2010) and non-priority sectors, all commercial banks recorded a decline in the ratio of gross NPAs during the pre- and crisis years, while seeing a significant rise, particularly in the NPA from non-priority sector relative to priority sector, following the global crisis era. It reflects that the non-priority sector was mainly responsible for the rise in the ratio of NPAs as compared to the priority sectors immediately following the crisis years. This is in line with the Reserve Bank of India [59] and Goswami [25], which confirm that the non-priority industry has contributed more NPAs than the priority one, particularly in the aftermath of the crisis of 2007–2009 in India. Similarly, we observe that the NPA ratio of PSBs under priority sectors was recorded higher from 2003/2004 to 2010/2011 as compared to non-priority sectors in India. As per the Reserve Bank of India’s guidelines, the public sector banks in India have mandated 40% lending to the priority sectors, including agriculture, small and medium enterprises, and weaker sections of society, etc., that contributed to a higher NPA ratio in PSBs from the priority sector during 2003/2004 to 2010/2011. Additionally, the loan waiver scheme, as announced by the RBI for less credit-worthy farmers in 2008, also led to significant growth in NPAs from PSB’s priority sector following the years of GFCs in India [20, 25, 52].

Table 3.

Tends of NPAs across priority and non-priority sectors for the entire banking industry and distinct ownership groups in India.

Source: Author’s calculations

| Year | Ownership groups | |||||

|---|---|---|---|---|---|---|

| Public sector banks (PSBs) | Private banks (PBs) | All commercial banks (SCBs) | ||||

| Priority | Non-priority | Priority | Non-priority | Priority | Non-priority | |

| 2003/2004 | 3.77 | 4.06 | 1.46 | 4.58 | 3.05 | 3.88 |

| 2004/2005 | 2.74 | 2.79 | 0.99 | 2.98 | 2.22 | 2.64 |

| 2005/2006 | 2.02 | 1.69 | 0.73 | 1.77 | 1.63 | 1.60 |

| 2006/2007 | 1.59 | 1.05 | 0.70 | 1.53 | 1.30 | 1.09 |

| 2007/2008 | 1.41 | 0.79 | 0.66 | 1.84 | 1.16 | 0.96 |

| 2008/2009 | 1.08 | 0.85 | 0.63 | 2.29 | 0.93 | 1.08 |

| 2009/2010 | 1.14 | 0.96 | 0.76 | 1.99 | 1.02 | 1.10 |

| 2010/2011 | 1.25 | 0.90 | 0.60 | 1.65 | 1.07 | 1.00 |

| 2011/2012 | 1.45 | 1.45 | 0.53 | 1.37 | 1.21 | 1.37 |

| 2012/2013 | 1.50 | 1.99 | 0.45 | 1.29 | 1.23 | 1.77 |

| 2013/2014 | 1.55 | 2.70 | 0.45 | 1.24 | 1.27 | 2.29 |

| 2014/2015 | 1.71 | 3.09 | 0.46 | 1.54 | 1.37 | 2.62 |

| 2015/2016 | 2.29 | 6.69 | 0.52 | 1.97 | 1.75 | 5.22 |

| 2016/2017 | 2.78 | 8.76 | 0.60 | 2.73 | 2.07 | 6.75 |

| 2017/2018 | 2.22 | 7.78 | 1.80 | 8.20 | 2.15 | 7.85 |

| 2018/2019 | 2.99 | 7.01 | 1.90 | 8.10 | 2.77 | 7.23 |

| 2019/2020 | 3.67 | 6.33 | 1.97 | 8.03 | 3.28 | 6.72 |

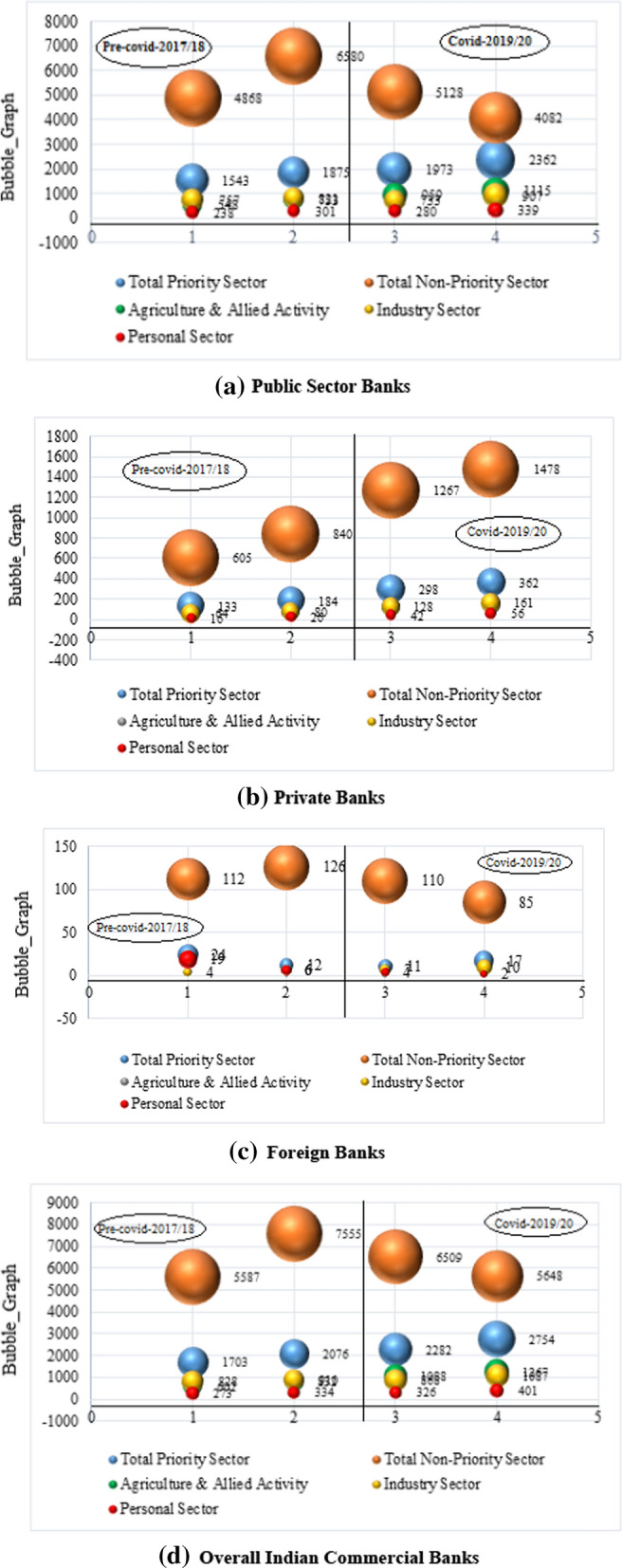

Fig. 3.

Trends of NPAs across priority and non-priority sectors for PBs, PSBs, and Overall SCBs in India during 2004/2020.

Source: Author’s own creation

However, the declining trend of NPA for PSBs from the non-priority sector demonstrates a reversal and reports a higher NPA ratio of 8.76% in 2016/2017 from 1.45% in 2011/2012 relative to priority sectors in India (see Fig. 3). To support this, Figs. 3 and 4 show that industry sectors in priority and non-priority sectors are more guilty of generating higher NPAs in the PSBs and commercial banking industry than other sectors in the last four years of the study period relative to their counterparts. However, the impact of NPAs is more pronounced in non-priority areas relative to priority sectors in India, mainly during the latter years of the study period. The trends indicate that PSBs are mainly responsible for the higher ratio of NPAs in the non-priority sector as compared to the overall Indian banking industry. Higher exposure to stressed sectors like textiles, iron, and steel by the PSBs increased the ratio of NPAs from the non-priority segment [20, 25]. The economic slowdown and pressured financial conditions of corporate sectors were noticed, with interest expenses growing at a quicker rate than interest income, resulting in a drop in profitability and an increase in dues at the same time. In this context, the RBI’s Financial Stability Report, 2015, states that the public sector banks accounted for 53.1% of the stressed advances in non-priority sectors (infrastructure, mining, textiles, power generation, telecom, aviation, iron, and steel) followed by all commercial banks, FBs, and PBs, i.e. 51.1, 40, and 34.1%, respectively. This signifies that the fragile condition of the stressed sectors significantly affected the profitability of PSBs, and thus, their standard advances turned into stressed advances and became NPAs in the later years of the study period. These findings are consistent with Fig. 4, which highlights that major industry and service sectors are the two sectors as compared with others that contributed more NPAs in the PSBs and SCBs relative to their peer groups in the non-priority sector in India following the years of global financial turmoil.

Fig. 4.

Sectors and sub-sectors wise NPAs variations across distinct ownership groups and overall banking industry in India during 2017/2020.

Source: Author’s own creation

For private banks, we find a lower ratio and flat pattern for NPAs from the priority sector during the entire study period as compared with their other peer groups (see Fig. 4a–d). This indicates that private banks remain leaders in managing their asset quality levels relative to their counterparts during the entire study period. The slight variations in the NPAs of PBs from the priority sector were primarily due to their lower exposure of PBs toward priority sector lending and sensitive sectors in India. No doubt, the crisis years adversely influenced the NPAs of the non-priority sector, as reflected by the NPA ratio of the crisis years, i.e. 2.29% in 2008/2009, yet they immediately controlled it after the post-crisis years. This is due to the fact that private banks had less exposure to stressed sectors and loaned to the less risky retail sector than public sector banks, resulting in a lower NPA ratio [25, 38, 55]. Overall, NPAs of bank groups increased in both the priority and non-priority sectors over the research period. However, in India, the weightage of NPAs in bank groups’ non-priority sectors was larger than in priority sectors.

On comparing different sectoral groups of NPAs using Bubble_graph, broadly, we found that the NPA ratio is more pronounced in non-priority sectors relative to priority sectors in India. Low credit demand, coupled with corporate deleveraging, partly reflects elevated levels of non-priority sectoral NPAs. During the COVID-19 epidemic, the radius of Bubbles of non-priority sector NPAs grew dramatically in comparison with the overall NPA during 2017–2018, but then began to decline (see Fig. 4's graphs a, c, and d). The industrial sector’s contribution of three-fourths of 37.30% to NPA during 2017–2018 is mainly due to better identification of stressed assets.3 Among the overall industrial sectors, the retail sector, medium-sized sector, and gems and jewellery sector were faced with an uptick in GNPA ratio during 2017–2018 because of the unearthing of frauds. Incidentally, in the case of the jewellery sector, fraud in public sector banks (93% of frauds in the amount of more than 0.1 million INR) and private banks (6% of frauds) increased sharply in 2017–2018. However, the size of the bubble of NPAs in non-priority sectors has decreased during 2019/2020 as a result of the reconciliation of large borrower accounts facilitated by restructuring lending policies. The pick-up in resolution and the decline in the slippage ratio of new NPAs in non-priority sectors helped alleviate stress in large accounts. In contrast, the bubble size of priority sector NPAs in terms of total NPAs of PSBs, PBs, and SCBs has accumulated during 2017–2020. In the priority sector, only the agricultural sector posted an uptick in the ratio of NPAs, possibly because of debt waivers initiated by several states.

Conceptual model

To depict a concrete picture of the trends in NPAs during 1999–2020, we estimated the trend growth rate of NPAs for the Indian banking industry and ownership groups for the entire study period (see Table 5). The study uses an additional novel COVID-19 crisis and policy measures as exogenous factors that are perhaps responsible for instigating NPA levels in Indian banks since 1999–2020 in the Phase II regression analysis.

The OLS regression equation that examines the trend growth rate of NPAs considering the dummy of COVID-19 crisis and policy measures for Indian banks is given below:

| 1 |

The subscripts j and t denote the cross-sectional and time-dimensions of the panel, respectively. Here, is the dependent variable that representing the ratio of gross and net NPAs. The is a log of trend characteristics (j) of ith bank in the tth period, is the crisis dummy variable (d) for the ith bank in the t period, and is the vector of policies’ dummy variable (d) for the ith bank in the t period, respectively. The ’s are the coefficients to be estimated using simple OLS.

Data and variables information

The required bank-level data of net NPAs, gross NPAs to total advances and total assets have been extracted from the annual editions of "Statistical Table Relating to Banks in India", which is available on the official website of the Reserve Bank of India (RBI).

Variables information

Table 4 presents the variable specifications, brief descriptions, and projected outcomes on RGNPA and RNNPA through time to help you learn more about the variables under investigation.

Table 4.

Description of variables.

Source: Author’s elaboration

| Variables | Code | Definition | Expected sign | Mean | SD |

|---|---|---|---|---|---|

| Dependent variables | |||||

| RGNPA | Y1 | Ratio of net non-performing assets to total advances for jth bank in the tth year | 6.787 | 4.230 | |

| RNNPA | Y2 | Ratio of net non-performing assets to total advances for jth bank in the tth year | 3.308 | 2.265 | |

| Independent variables | |||||

| Time | T | Log of time for jth bank in the tth year | + | 11.5 | 6.493 |

| COVID-19 crisis | C-19 CRISIS | Dummy of COVID-19 crisis for jth bank in the tth year | ( ±) | 0.090 | 0.294 |

| Policies | P | Dummy of policy initiatives | − | 0.272 | 0.455 |

SD standard deviation of the dependent and independent variables

As it can be seen in Table 4, to test the impact of the novel COVID-19 crisis on the ratios of NPAs of Indian banks, we use a dummy variable C-19 CRISIS with a value of 1 for the year 2019/2020 and 0 otherwise. Similarly, to see if the Government of India's and/or the Reserve Bank of India's policy actions, which were different for each banking group, had a causal effect on the NPA ratio? The study also constructed a dummy of policy measures with a value of 1 for the year 2014/2020 and 0 otherwise. During the entire sample period, the policy dummy is designed with the treatment group (such as PSBs) as banks with improved credit risk monitoring rules and the other control group (such as private and international banks) as remaining institutions with looser lending norms.

Empirical findings and discussions

In Table 5, estimates of NPAs drivers are performed in the II-stage OLS regression analysis. It can be seen that the value of F-statistics is statistically significant across all panel model specifications, which suggests that the combined set of explanatory variables significantly affected the ratio of gross and net NPAs during 1999–2020.

In view of growth rate analysis (time), the study assesses the declining positive rate of GNPA and NNPA of PSBs, PBs, FBs, and overall SCBs in India during the period of analysis. It suggests that the GNPAs and NNPAs in the Indian banking industry declined at an average rate of 8.07% and 8.19%, respectively, during the entire study period. While comparing across ownership groups, PSBs reported the highest decline in their NPA growth rate, followed by PB and FBs in India over a period of time. This is mainly because of the effective provisioning and stringent measures for controlling NPAs that have been implemented by the central bank on these bank groups in India over the period of analysis (Reserve Bank of India, 1999–2020). Using the policies’ dummy in Eq. (1), the given statement has also been proven, in which all of the extracted data points to the same conclusion. The negative and statistically significant coefficients of policies on NPAs reveal that each ownership group's application of distinct policy initiatives was crucial in reducing NPAs during the analysis period. Furthermore, we can see that, with the exception of private banks, all Indian scheduled commercial banks and their sub-ownership groups remained immune to the novel coronavirus's negative effects and maintained their NPA ratios at that time. COVID-19 provisions, dividend reinvestment, mega-mergers to strengthen capital position, regulatory tightening (i.e. resolution of large borrower accounts via the Insolvency and Bankruptcy Code), and successful write-offs have all become necessary tools to stem the rise in non-performing assets in the study period's final years [61, 63]. Despite the COVID-19 pandemic factor, the improvements in credit risk soundness continued till 2020 from 2017–2018 due to the loan moratorium and restructuring policies initiated by the Honourable Supreme Court and Reserve Bank of India in the beginning of COVID-19 crisis.

Identifying sustainability of Indian banks during COVID 19–20

Table 6 ranks 52 Indian banks for the fiscal year 2019–2020 based on the ratio of net NPAs to net advances (i.e. between 1 and 10%). Such a ranking would allow the policymakers to formulate a good strategy at the bank level, which would assist them to arrest rising and accumulating NPAs in the succeeding years.

Table 6.

Ranking of public, private and foreign banks in India using an NPAs ratio: A sustainability check during COVID-19 crisis.

Source: Author’s evaluation

| Ownership_wise banks’ name | NPAs ratio | Rank |

|---|---|---|

| Ranking of public sector banks (PSBs) during COVID-19 crisis | ||

| PUNJAB AND SIND BANK | 8.03 | 2 |

| CENTRAL BANK OF INDIA | 7.63 | 3 |

| PUNJAB NATIONAL BANK | 5.78 | 4 |

| ALLAHABAD BANK | 5.66 | 5 |

| UNION BANK OF INDIA | 5.49 | 6 |

| UCO BANK | 5.45 | 7 |

| INDIAN OVERSEAS BANK | 5.44 | 8 |

| ORIENTAL BANK OF COMMERCE | 5.01 | 10 |

| ANDHRA BANK | 4.92 | 11 |

| CORPORATION BANK | 4.91 | 12 |

| BANK OF MAHARASHTRA | 4.77 | 14 |

| UNITED BANK OF INDIA | 4.73 | 15 |

| SYNDICATE BANK | 4.61 | 17 |

| CANARA BANK | 4.22 | 19 |

| BANK OF INDIA | 3.88 | 22 |

| BANK OF BARODA | 3.13 | 26 |

| INDIAN BANK | 3.13 | 27 |

| STATE BANK OF INDIA | 2.23 | 32 |

| Ranking of private banks (PBs) during COVID-19 crisis | ||

| LAKSHMI VILAS BANK LTD | 10.04 | 1 |

| YES BANK LTD | 5.03 | 9 |

| NAINITAL BANK LTD | 4.89 | 13 |

| IDBI BANK LIMITED | 4.19 | 20 |

| KARUR VYSYA BANK LTD | 3.92 | 21 |

| JAMMU & KASHMIR BANK LTD | 3.48 | 23 |

| SOUTH INDIAN BANK LTD | 3.34 | 24 |

| KARNATAKA BANK LTD | 3.08 | 28 |

| CITY UNION BANK LIMITED | 2.29 | 31 |

| RBL BANK LIMITED | 2.05 | 33 |

| CSB BANK LIMITED | 1.91 | 34 |

| TAMILNAD MERCANTILE BANK LTD | 1.80 | 35 |

| AXIS BANK LIMITED | 1.62 | 36 |

| THE DHANALAKSHMI BANK LTD | 1.55 | 37 |

| ICICI BANK LIMITED | 1.54 | 38 |

| FEDERAL BANK LTD | 1.31 | 39 |

| DCB BANK LIMITED | 1.16 | 41 |

| IDFC FIRST BANK LIMITED | 0.94 | 42 |

| INDUSIND BANK LTD | 0.91 | 44 |

| KOTAK MAHINDRA BANK LTD | 0.71 | 46 |

| BANDHAN BANK LIMITED | 0.58 | 47 |

| HDFC BANK LTD | 0.36 | 50 |

| Ranking of foreign banks (FBs) during COVID-19 crisis | ||

| BANK OF CEYLON | 4.68 | 16 |

| SONALI BANK | 4.53 | 18 |

| COOPERATIEVE RABOBANK U.A | 3.14 | 25 |

| SBM BANK (INDIA) LIMITED | 2.90 | 29 |

| KEB HANA BANK | 2.30 | 30 |

| DEUTSCHE BANK AG | 1.31 | 40 |

| AMERICAN EXPRESS BANKING CORP | 0.92 | 43 |

| STANDARD CHARTERED BANK | 0.80 | 45 |

| CITIBANK N.A | 0.56 | 48 |

| DBS BANK INDIA LTD | 0.47 | 49 |

| BANK OF BAHRAIN & KUWAIT B.S.C | 0.35 | 51 |

| HONGKONG AND SHANGHAI BANKING CORPN.LTD | 0.16 | 52 |

While looking at Table 6, we can say that Lakshmi Vilas Bank LTD. has secured the highest rank in gaining net NPAs during the COVID years, followed by Punjab and Sind Bank, Central Bank of India, Punjab National Bank, and Allahabad Bank. This indicates that most of the public sector banks ranked in the top five in terms of the decline in asset quality levels in 2019/2020 as compared to their counterparts. In addition, some private banks and foreign banks appeared as the best banks in terms of maintaining the level of asset quality during the COVID-19 years. In particular, HONGKONG AND SHANGHAI BANKING CORPN. LTD, BANK OF BAHRAIN & KUWAIT B.S.C., HDFC BANK LTD., DBS BANK INDIA LTD., and CITIBANK N.A attained top five positions for controlling NPAs during COVID years. These banks can be used as a benchmark for other commercial bank groups to follow when it comes to credit risk management. This brief exercise indicates that international banks and private banks fared better than public sector banks in terms of asset quality during the COVID-19/20 years in India.

Resolution practices for non-performing assets: key policy initiatives

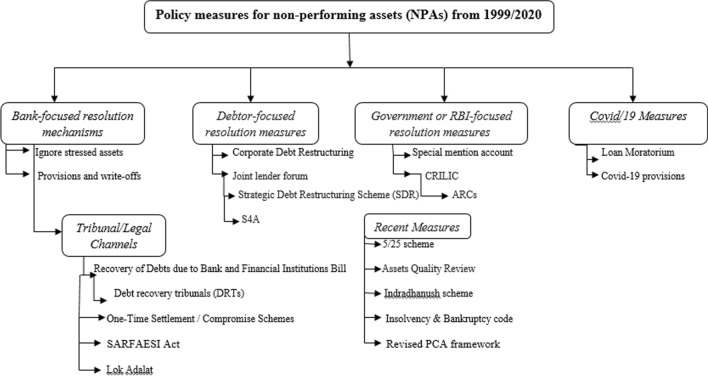

This sub-section narrates the various policy initiatives taken by policymakers to resolve the problem of NPAs in India during 1999–2020. As noted in “Evolution of non-performing assets (NPAs) in the Indian banking industry” section, the public sector banks’ group is a dominant group, which has suffered from a massive pile of NPAs in the last decade. This serious condition of the deteriorating asset quality of Indian banks, particularly in PSBs, calls for the immediate attention of policymakers toward the recovery of NPAs in the banking industry. In this context, various policy measures have been adopted, which include: (1) bank-focused resolution mechanisms, (2) debtor-focused resolution measures; and (3) the GOI and RBI-focused policy interventions. The schematic representation of measures adopted as a part of these schemes is illustrated in Fig. 5 and Table 9. A detailed explanation of these measures is given below.

Fig. 5.

NPAs policy measures in India since 1990s till now.

Source: Author’s own creation

Table 9.

Policy measures taken by the authority to resolve NPAs during 1999–2017.

Source: Author’s elaboration

| Year | Average annual growth in nominal value of Gross NPAs | Movement in the nominal value of Gross NPAs | Policy actions taken to resolve NPAs |

|---|---|---|---|

| 1998/1999 | – | – |

Establishment of early warning signals at a bank-level in 1999 through Asset-Liability Management Committees (ALCOs) Setting up of Debt recovery tribunal by the GOI in 1992 In 2001, the Government of India issued recommendations for PSBs to review their NPAs, which were mostly generated by corporate lending of up to INR 50 billion and small and marginal farmer financing of INR 25,000 to 50,000, known as the compromise scheme One time settlement scheme also introduced by the GOI in 2001 |

| 1999/2000 | 3.17 | ↑ | |

| 2000/2001 | 5.75 | ↑ | |

| 2001/2002 | 10.99 | ↑ |

The GOI introduced corporate debt restructuring (CDR), Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFESI) Act and Assets Reconstruction Company (ARC) in 2002 RBI issued guideline to commercial banks and other financial institutions to use the Lok Adalat in 2003 to deal the matter of NPLs |

| 2002/2003 | − 3.09 | ↓ | |

| 2003/2004 | − 5.72 | ↓ | |

| 2004/2005 | − 8.13 | ↓ |

NPAs recognition norms reduced from 180 to 90 days in 2004 Doubtful assets recognition norms reduced from 24 to 18 month in 2001 that further declined to 12 months in 2005 Settlement Advisory Committee set up by the RBI and the central bank in 2005 |

| 2005/2006 | − 12.94 | ↓ | |

| 2006/2007 | − 2.56 | ↓ | |

| 2007/2008 | 11.78 | ↑ | Tightening interest rate environment |

| 2008/2009 | 22.22 | ↑ | |

| 2009/2010 | 22.87 | ↑ | |

| 2010/2011 | 15.55 | ↑ | The RBI in 2011 set up a committee known as Shri M.V. Nair to revise the guidelines for priority sector lending classification |

| 2011/2012 | 45.32 | ↑ | |

| 2012/2013 | 36.33 | ↑ | |

| 2013/2014 | 36.19 | ↑ |

In 2014, the RBI launched a variety of programmes to prevent credit quality degradation, including Early Recognition of Financial Distress, the Central Repository of Information on Large Credits (CRILIC), and the 5/25 Refinancing Scheme The RBI announced the “Strategic Debt Restructuring Scheme” in June 2015 Assets Quality Review was conducted by the RBI in October 2015 for PSBs The GOI launched ‘Indradhanush Scheme’ for PSBs on August 14, 2015 RBI introduced the Scheme for Sustainable Structuring of Stressed Assets (S4A) in June 2016 The Insolvency and Bankruptcy Code (IBC) was passed by the parliament in May 2016 Revised prompt Corrective Action (PCA) framework by the RBI in 2017 |

| 2014/2015 | 22.38 | ↑ | |

| 2015/2016 | 88.30 | ↑ | |

| 2016/2017 | 30.40 | ↑ | |

| 2017/2018 | 23.55 | ↓ | Implementation of 4Rs by the Government of India (i.e. recognition, resolution, recapitalization and reforms) |

| 2018/2019 | − 17.43 | ↓ | Reclassification of IDBI Bank Ltd. as a private bank w.e.f January 21, 2019 |

| 2019/2020 | − 2.930 | ↓ |

Moratorium on loan payment COVID-19 provisions and plough back of dividend Indian banks seek voluntary write-offs of NPAs to repair balance sheets, obtain tax benefits, and maximise capital utilisation Internal assessment at bank level to control bankruptcy |

Bank-focused resolution mechanisms for recovery of NPAs

The general approach of Indian bankers has been to avoid stressed and/or non-performing accounts, resulting in the accumulation of a large volume of stressed assets over time. Other mechanisms that are adopted by banks to contain the level of NPAs include provisioning and write-offs.

Provisioning and write-offs

In India, banks must set aside funds to cover potential future debt losses. When the income or recovery from the loan is less expected, the level of loan provisioning rises. If the bank does not make provision for bad loans in a timely manner, it may go bankrupt. From 2001 to 2017, Table 7 provides significant evidence regarding the provisions made by banks for prospective loan losses. The statistics show that the loan provisions and write-offs against NPAs for the banking industry and public sector banks were reduced between 2004–2005 and 2006–2007 compared to the initial years and subsequent years of the study period. We note that PSBs have made higher provisioning and write-offs to absorb the loan losses, followed by the PBs and FBs throughout the study period. This reflects that the route of provisions and write-offs of NPAs remains an important measure adopted by the Indian commercial banks for maintaining their asset quality during the study period. However, it increased significantly for overall SCBs4 including PBs in 2018–2019. PSBs’ gross NPAs were dropping at a faster rate than PBs’. In 2019–2020, similar trends were visible as well.

Table 7.

Provisioning and write-offs in the Indian banking industry and across distinct ownership groups.

Source: Various issues of Performance Highlights of Public, Private and Foreign Banks in India, 1999–2020

| Year | Public sector banks | Private banks | Foreign banks | All commercial banks | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Provisions | Write-offs | RPTA | Provisions | Write-offs | RPTA | Provisions | Write-offs | RPTA | Provisions | Write-offs | RPTA | |

| 2000/2001 | 2,66,961 | 77 | 0.03 | 29,587 | 18 | 0.02 | 22,670 | 10 | 0.02 | 3,19,217 | 105 | 0.02 |

| 2001/2002 | 2,85,255 | 608 | 0.02 | 77,271 | 56 | 0.03 | 18,393 | 32 | 0.02 | 3,80,919 | 696 | 0.02 |

| 2002/2003 | 2,91,246 | 913 | 0.02 | 57,008 | 234 | 0.02 | 19,705 | 13 | 0.02 | 3,67,957 | 1160 | 0.02 |

| 2003/2004 | 3,26,776 | 1087 | 0.02 | 62,023 | 258 | 0.02 | 19,507 | 50 | 0.01 | 4,08,306 | 1395 | 0.02 |

| 2004/2005 | 3,14,959 | 940 | 0.02 | 45,706 | 300 | 0.01 | 16,250 | 72 | 0.01 | 3,76,914 | 1312 | 0.02 |

| 2005/2006 | 2,67,930 | 980 | 0.01 | 46,405 | 182 | 0.01 | 11,198 | 53 | 0.01 | 3,25,533 | 1215 | 0.01 |

| 2006/2007 | 2,36,434 | 1017 | 0.01 | 52,271 | 179 | 0.01 | 13,359 | 14 | 0.00 | 3,02,065 | 1210 | 0.01 |

| 2007/2008 | 2,26,158 | 1077 | 0.01 | 73,505 | 215 | 0.01 | 16,128 | 56 | 0.00 | 3,15,792 | 1348 | 0.01 |

| 2008/2009 | 2,38,016 | 1007 | 0.01 | 95,146 | 596 | 0.01 | 34,478 | 65 | 0.01 | 3,67,640 | 1668 | 0.01 |

| 2009/2010 | 3,02,839 | 1229 | 0.01 | 1,11,340 | 878 | 0.01 | 41,564 | 144 | 0.01 | 4,55,742 | 2251 | 0.01 |

| 2010/2011 | 3,86,093 | 2064 | 0.01 | 1,38,068 | 414 | 0.01 | 37,562 | 122 | 0.01 | 5,61,723 | 2600 | 0.01 |

| 2011/2012 | 5,80,998 | 1906 | 0.01 | 1,43,666 | 511 | 0.01 | 48,840 | 179 | 0.01 | 7,73,504 | 2596 | 0.01 |

| 2012/2013 | 7,44,249 | 3017 | 0.01 | 1,47,679 | 652 | 0.01 | 53,143 | 124 | 0.01 | 9,45,071 | 3793 | 0.01 |

| 2013/2014 | 9,74,504 | 4142 | 0.01 | 1,56,813 | 929 | 0.01 | 84,066 | 162 | 0.01 | 12,15,383 | 5233 | 0.01 |

| 2014/2015 | 11,85,168 | 5671 | 0.01 | 1,99,779 | 929 | 0.01 | 89,993 | 296 | 0.01 | 14,74,941 | 6896 | 0.01 |

| 2015/2016 | 21,95,806 | 6264 | 0.02 | 2,95,083 | 1374 | 0.01 | 1,30,383 | 169 | 0.02 | 26,21,272 | 7807 | 0.02 |

| 2016/2017 | 30,16,342 | 9005 | 0.03 | 4,54,290 | 2469 | 0.01 | 1,14,885 | 721 | 0.01 | 35,85,517 | 12,195 | 0.03 |

| 2017/2018 | 31,79,850 | 12,111 | 0.03 | 1,53,500 | 2989 | 0.00 | 9,07,770 | 650 | 0.10 | 58,28,220 | 13,647 | 0.04 |

| 2018/2019 | 33,65,510 | 10,008 | 0.03 | 2,03,591 | 3032 | 0.00 | 14,88,010 | 666 | 0.14 | 67,33,350 | 15,809 | 0.04 |

| 2019/2020 | 29,18,930 | 11,954 | 0.03 | 2,36,229 | 3425 | 0.00 | 25,76,320 | 694 | 0.20 | 87,00,480 | 20,073 | 0.05 |

The value of provision and write-off of public, private, foreign, and all the commercial banks in India are in millions

Legal channels

Debt recovery tribunal (DRTs)

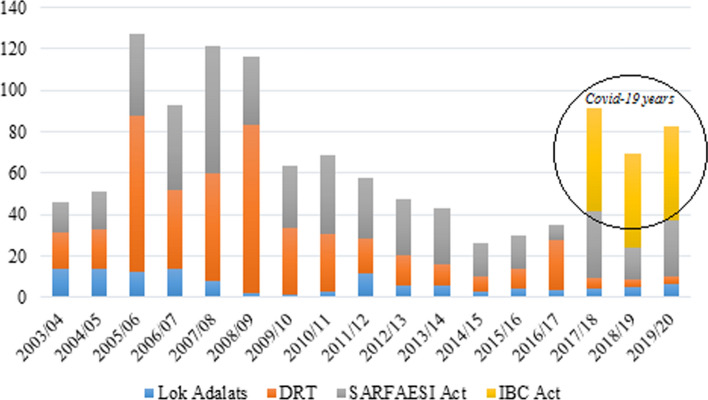

A rapid rise in NPAs in the late 1990s and early 2000s, particularly in the PSBs, attracted the attention of the Government of India to constitute a tribunal to deal with the issue of debt overdue and expedite the loan recovery process. As a result, in 1993, India's Parliament passed the Recovery of Debts Due to Bank and Financial Institutions Bill (RDDBFI). Debt recovery tribunals (DRTs) were established under the RDDBFI Act to deal with NPAs, including secured and unsecured debtors, with loan amounts of more than INR 1 million [6]. Under this, banks and financial institutions can also file debt recovery cases with DRTs that are expected to settle within 180 days. Table 6 and Fig. 6 reveal that the percentage amount of recovery of NPA through the DRTs increased from 17.20 in 2003–2004 to 81.07 in 2008–2009 and around 24.40 in 2016–2017. This DRT plan, however, had several faults, including delayed decisions due to lawyers requesting extra time to produce documents, case adjournment due to a lack of lawyers, insufficient understanding of the tribunal, and corporate business reasons. Hearings in DRT are occasionally held after a six-month to one-year interval due to a significant volume of pending cases [50].

Fig. 6.

Recovery of Gross NPAs from various legal channels (in percent)

Lok Adalat

According to Reserve Bank guidelines issued in 2003 to commercial banks and financial institutions, the use and participation in Lok Adalats, which were convened by various DRTs/Debt Recovery Appellate Tribunals (DRATs) in order to resolve and mitigate NPA cases involving INR 1 million and above, has increased [50]. In the year 2000, the GOI also provided guidelines and opportunities in favour of the PSBs’ borrowers for compromise and settlement of old NPAs up to INR 50 million, known as the “One-Time Settlement/Compromise Scheme”. The proportion of recovery through Lok Adalat was relatively low compared to DRTs (see Table 8 and Fig. 6). The revised guidelines applied to all the sectors where NPAs were formed in PSBs, including small industry. However, cases of wilful default, fraud, and malfeasance were not covered.

Table 8.

Percentage of NPAs recovered through legal channels.

Source: Author’s calculations

| Year | Lok Adalats | DRT | SARFAESI Act | IBC Act |

|---|---|---|---|---|

| 2003/2004 | 14.02 | 17.20 | 14.73 | – |

| 2004/2005 | 14.11 | 18.77 | 18.08 | – |

| 2005/2006 | 12.36 | 75.48 | 39.49 | – |

| 2006/2007 | 13.98 | 37.82 | 41.39 | – |

| 2007/2008 | 08.22 | 51.90 | 60.98 | – |

| 2008/2009 | 02.39 | 81.07 | 33.00 | – |

| 2009/2010 | 01.55 | 31.98 | 29.96 | – |

| 2010/2011 | 02.87 | 27.89 | 37.78 | – |

| 2011/2012 | 11.76 | 17.01 | 28.61 | – |

| 2012/2013 | 06.06 | 14.19 | 27.17 | – |

| 2013/2014 | 06.00 | 10.00 | 27.00 | – |

| 2014/2015 | 03.00 | 07.00 | 16.00 | – |

| 2015/2016 | 04.40 | 09.20 | 16.50 | – |

| 2016/2017 | 03.60 | 24.40 | 06.90 | – |

| 2017/2018 | 04.00 | 05.40 | 32.20 | 49.60 |

| 2018/2019 | 05.10 | 03.90 | 15.00 | 45.70 |

| 2019/2020 | 06.20 | 04.10 | 26.70 | 45.50 |

The percentage amount of NPAs recovered calculated as the amount recovered of NPAs as a percentage of the amount involved of NPAs

Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act

Based on the recommendations of Narasimham Committee I and II, and the Andhyarujina Committee 2002, an act was enacted called the “Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act” in 2002 in order to capture securities and sell financial assets by the banks to securitization companies (SCs) and/or reconstruction companies (RCs). In addition, the act gives PSBs and other financial organisations the authority to collect debts without the involvement of courts or tribunals. Furthermore addition, the government published the Security Interest (Enforcement) Rules in 2002 to allow secured creditors to recover debts from borrowers. The PSBs are advised to take action and prepare a report on defaulters under the Act, according to the RBI’s compliance. The pre-crisis period saw the highest level of NPA recovery through the SARFAESI Act, with banks recovering 60.98% of NPAs through this method until 2007–2008. The percentage of NPAs recovered through debt recovery tribunals was higher, followed by the SARFESI Act and Lok Adalats. This indicates that the DRTs were the most effective legal channel for the recovery of NPAs during the study period. The opening of new tribunals, strengthening of existing infrastructure, and computerized processing of court cases were some of the reasons that had improved the effectiveness of DRTs in the handling of bad loan issues [59]. Furthermore, the SARFESI Act appears to be a more visible conduit for recovering NPAs. Lok Adalats, on the other hand, were least effective in resolving larger NPAs because they primarily deal with matters relating to small outstanding loans [6]. In the last years of the study period, especially from 2018 to 2020, we can see that the percentage of improvement in asset quality is more in SCBs under the IBC Act, followed by SARFAESI, DRTs, and Lok Adalat Act, reflecting the resolution of large NPA accounts through the Insolvency and Bankruptcy Code Act (Table 9).

Debtor-focused resolution measures

As a part of debtor-focused measures, the Corporate Debt Restructuring (CDR) scheme was enacted in 2001. The purpose was to timely restructure corporate debts of viable entities, which were beyond the scope of the Board for Industrial and Financial Restructuring (BIFR), DRT, and other legal channels. A High-Level Group was headed under the chairmanship of Shri. Vepa Kamesam was set up to revamp the previous guidelines of the CDR mechanism in 2003 [50]. In the CDR Act, banks provide concessions to their borrowers, by changing their repayment period, repayable amount, rate of instalments, and rate of interest. This includes several banking accounts/syndication/consortium accounts where the total investment outstanding of all banks/financial institutions is INR 100 million and above [18, 22].

As of February 2014, the RBI mandated the banks to form a committee called the Joint Lenders’ Forum (JLF) immediately upon seeing the signs of distress from the borrowers with a credit of INR 1 billion. However, the approach of forming the forum and dealing with the situation of distress accounts was not able to generate the favourable outcomes due to operational and managerial inefficiencies. As a result, the RBI implemented the Strategic Debt Restructuring Scheme (SDR) in 2015, which allows the joint forum to collectively hold more than 51% equity, and lenders must divest holdings to a new buyer within 18 months, or the asset will be considered NPA, and bank provisioning criteria will apply [6]. However, the SDR process is found to be insufficient in addressing the NPA problem due to the difficulty of divesting the stressed assets to new buyers. To deal with these concerns, later in 2016, the RBI came up with a Scheme for Sustainable Structuring of Stressed Assets (S4A), especially for borrowers with a credit risk of more than INR 5 billion.

Government and/or RBI-focused policy interventions—some recent measures

In order to transfer the NPAs from banks and from other financial institutions, and to develop a market for secured loans, the Narasimham Committee II recommended the formation of asset reconstruction companies (ARCs) in 2002. Banks can sell their non-performing assets to ARCs under the SARFESI Act, and companies can buy NPAs from banks either by paying in cash, by issuing debentures, bonds, or any other financial security, or by putting them up for auction with reserve prices for selling to the highest bidder ARCs’ in the market [6]. As per the revised guidelines issued by the RBI in 2016, (1) banks can distribute and sell the loan loss to the ARC over two years, and (2) ARCs need to secure receipts from the rating agencies registered by the SEBI at regular intervals. Additionally, for the early detection of stressed assets and timely action by banks, the RBI classified stressed assets into sub-categories of special mention accounts (SMA).5 Such a special mention account cannot be effective without accurate information about the borrowers across the banks. Therefore, Credit Information Companies (CICs) were formed in 2005 by the RBI to disseminate the credit quality of the borrowers to the lenders. The other initiatives taken by the RBI include the 5/25 Refinancing of Infrastructure Scheme, introduced in June 2014. The focus of the scheme is to allow banks to extend the amortisation period of loans to borrowers from the infrastructure sector from 5 to 25 years and to adjust the interest rate every five years. In February 2014, the Reserve Bank of India set up the ‘Central Repository of Information on Large Credits (CRILC)’ to resolve the issue of large borrowers. The lenders shall report credit information to the CRILC regarding all borrowers having aggregate exposure of INR 50 million or above. The CRILC enables the RBI and banks to get a comprehensive review of the banking system about the movement of large funds of the same borrower from one bank to another so that they can really evaluate these risks and prevent future defaults. In 2015, the Government of India introduced the recapitalization scheme named the Indradhaunsh Scheme to revive the functioning of public sector banks by infusing a capital amount of INR 700 billion over four years. Besides, the RBI enforced the Assets Quality Review for PSBs in 2016 in order to identify the actual position of non-performing asset and/or stressed asset in the banks’ loan books. Following the AQR, the RBI recommended the PSBs to reclassify their restructured loans into NPAs and adjust the adequate provisions to cover their stressed loans. As a result of the AQR, the accurate level of ratio of gross NPA appeared to 11.8% in September 2016 against 5.40% in March 2015 [58]. In parallel to the AQR by the RBI, the GOI introduced the Insolvency and Bankruptcy Code in 2016 as “a single law that deals with the insolvency and bankruptcy by consolidating and amending various laws relating to reorganization and insolvency resolution” [59]. The goal had been to have specialists speed the resolution of bank insolvency in a time range of 180 days. For this, the IBC was dependent on insolvency professionals, information utilities, adjudicating authorities like National Company Law Tribunal and Debt Recovery Tribunal, and the Insolvency and Bankruptcy Board of India. In addition, the revised framework for Prompt Corrective Action (PCA) was notified in 2017 by the RBI, to improve NPAs, capital erosion, decline in profitability and over-leveraged corporate sector. The RBI approved the rule-based Prompt Corrective Action (PCA) framework for timely liquidation of failing institutions and early intervention in the problem banks as a resolution standard in 2002 and amended it in 2004. Recently, the RBI has revised the existing guidelines of PCA framework w.e.f. from April 1, 2017. However, in the post-crisis period, the deteriorating asset quality, declining profitability and capital adequacy compliance issues of Indian banks have led many Indian banks to fall under PCA framework. For example, since 2015, the RBI has taken ‘PCA’ on state-run Indian Overseas Bank, Dena Bank, Corporation Bank, Central Bank of India, IDBI Bank, UCO Bank, United Bank of India, Bank of Maharashtra, and Oriental Bank of Commerce with the view to improve their internal processes to deal with mounting non-performing assets. RBI placed Bank of India within the PCA framework in December 2017 [for additional information on India's bank resolution process, see Reserve Bank of India [56]].

Alongside, to deal with the problem of stressed assets and to meet the need for additional capital by the PSBs, the GOI directed mega-merger of PSBs with four large banks in 2017. With this, the Ministry of Finance and the RBI believed that the Indian banking system would become better if some PSBs are merged and consolidated into fewer but healthier banks. As a result of resolution measures adopted from time to time, the average annual growth rate of gross NPAs lowered in the pre-crisis period from 1998–1999 to 2006–2007, but has increased from 3.17% in 2000 to 30.40% in 2017. This indicates that although several policies have been initiated by the RBI and the Government of India to improve the NPAs position and to pressurize wilful defaulters; however, still more is needed at policy front to strengthen further banks’ ability so that they can resolve bad loans in a stipulated time frame.

Conclusion and a way forward