Abstract

The spread of COVID-19 increased general interest in the effects of pandemics on stock markets. We believe it is interesting to analyze emerging countries due to their role in future economies. The announcement of the H1N1 and COVID-19 pandemics instigated observable effects on the stock market. Our goal is to measure and compare the effects of these announcements, specifically for the BRIC bloc, using the event study method. We find evidence that these stock markets exhibited more negative abnormal returns at the announcement of COVID-19 than at the announcement of H1N1. However, Russia and China seem to cope better with COVID-19, having already experienced H1N1. Due to the possibility of a new pandemic and for the sake of the future participation of emerging countries, it is recommended to deepen this line of research.

Keywords: H1N1, COVID-19, BRIC, Event study, Pandemics

1. Introduction

In the first 20 years of the 21st century, we have experienced four pandemics (Huremović, 2019, Sampath et al., 2021) but it was the aggressive spread of COVID-19 that increased interest in studying the consequences of these epidemic events (Verma and Gustafsson, 2020), including those felt in the financial markets (Chin et al., 2020, Ma et al., 2020, Chen et al., 2007). Liu et al. (2020) point out that, with the spread of COVID-19, stock markets are increasingly risky, highly volatile and unpredictable (Chen et al., 2007, Ichev and Marinč, 2018). Following this line of research, we aim to show that the pandemic announcement by the World Health Organization (WHO) is a signal recognized by the BRIC bloc’s1 emerging financial markets, thereby broadening the spectrum of countries studied and accounting for the fact that Russia and China could lead the global economy for the next 50 years (Gusarova, 2019).

We found evidence that the pandemic announcements made by the WHO for both H1N1 (June 11, 2009) and COVID-19 (March 11, 2020) had negative effects on the daily returns of the BRIC stock market indices, albeit with different patterns for each country and pandemic. This suggests that the pandemic announcement is recognized by investors as a legitimate market signal. On the other hand, there are two major factors that differentiate this work from that of authors such as Akhtaruzzaman et al., 2021, Ashraf, 2020, Liu et al., 2020, Ramelli and Wagner, 2020. Firstly, these studies focus on the financial consequences of the spread of COVID-19, while we focus on the effect of the announcements themselves, which occurred before at least 100 confirmed COVID-19 cases had been reported (Arteaga-Garavito et al., 2020). Secondly, we include the H1N1 pandemic in our analysis because, in addition to being recent, it also generated significant damage on the financial markets and is therefore an excellent comparison event to strengthen and better understand our findings. Alfaro et al. (2020) include the 2003 SARS pandemic, but their work focused only on China, while we consider the whole BRIC bloc to allow for a more comprehensive analysis of our findings.

Pandemics will continue to intensify due to global warming (Berlemann and Eurich, 2021, Chin et al., 2020) and globalization (Saunders-Hastings and Krewski, 2016), so pandemics should be considered an emerging element in human interaction (Chin et al., 2020). As they evidently have major consequences on the financial landscape (Ma et al., 2020), it is pressing to develop tools and strategies that allow us to deal with them more effectively. However, the convergence of these expectations is based on the rationality of investors and the absence of information asymmetries (Tetlock, 2010). Therefore, an early and legitimate signal that is easily recognizable by investors would support their ability to retain lessons learned (Malmendier et al., 2020), allowing them to take preventive actions and decreasing the need for corrective actions by regulators in the face of increasingly frequent contagions (Ashraf, 2020), providing more long-term stability in emerging financial markets.

2. Empirical strategy

BRIC stock market data (from 2005 to 2020) were extracted from a public source.2 The price indices used correspond to: BOVESPA for Brazil, MOEX for Russia, NSEI for India and SZSE for China. To address the effect of the WHO pandemic announcements, we will use the event study method with dummy variables (Karafiath, 1988, Binder, 1985, Malatesta, 1986), described in Eq. (1).

| (1) |

Where represents the daily return of the stock market of each BRIC country on day measured in percentage points; corresponds to the first lag of the stock return, a variable that allows the momentum effect to be controlled.3 is the daily market return represented by the S&P500; and is a binary variable that takes the value 1 for each day of the event within the window of size . Within each window mentioned, the subscript represents the day the pandemic was announced. The estimation window for normal returns contemplates a total of 90 days, from lag 11 to 101 with respect to the date of the event. We included returns from the Chicago Board Options Exchange Market Volatility Index (VIX), to control for the volatility in the estimates. The parameter identifies the abnormal return that occurred on day , which is coefficient under study. The accumulated sum represents the Cumulative Abnormal Return (CAR) for the various windows in the analysis.

3. Results

The estimates of the model described in Eq. (1) for the announcement of the H1N1 pandemic are summarized in Table 1. These results show that China had the best performance of the BRIC block, with CARs of little significance, while Russia had the worst performance of the group, with a record loss of 23.6% in the largest study window and with no signs of contraction. Listing the BRIC countries from least to most affected in terms of return losses and speed of recovery, China leads the pack, followed by Brazil, India and Russia. India had the most unstable CARs, but its accumulated loss is still not as high as for Russia.

Table 1.

BRIC CARs on the announcement of the H1N1 pandemic.

| Window | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| CAR | Brazil | Russia | India | China |

| −2.2722*** | −2.4759 | −4.1594*** | −1.8543* | |

| (−3.2708) | (−1.2842) | (−4.1357) | (−1.8147) | |

| −2.2855** | −7.0806*** | −1.1906 | −2.2369 | |

| (−2.3095) | (−2.8495) | (−0.7010) | (−1.4781) | |

| −4.5254*** | −15.6177*** | −10.3018*** | 1.0991 | |

| (−3.0460) | (−3.9920) | (−3.8756) | (0.4352) | |

| −5.9557*** | −20.3139*** | −9.5483*** | 1.3666 | |

| (−3.3982) | (−4.1068) | (−2.7942) | (0.4312) | |

| −8.9499*** | −23.5887*** | −10.8027 | 3.5705 | |

| (−2.7532) | (−2.8728) | (−1.5566) | (0.6185) |

Note: This table reports the results of the CARs for Eq. (1) around the time of announcement of the H1N1 pandemic. Wald test, in parentheses. */**/*** significant at 10%/5%/1%, respectively.

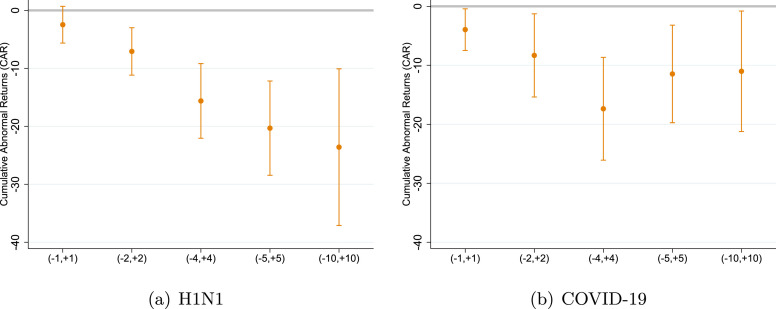

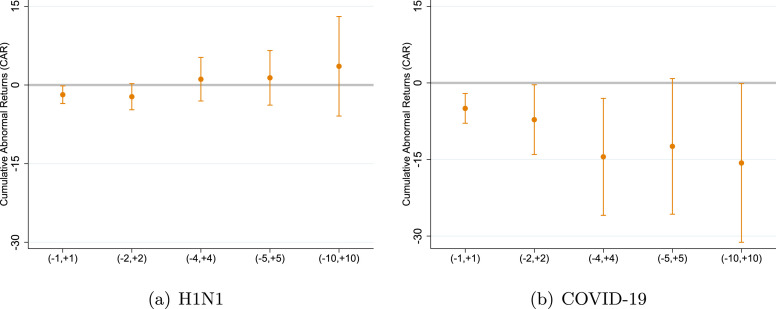

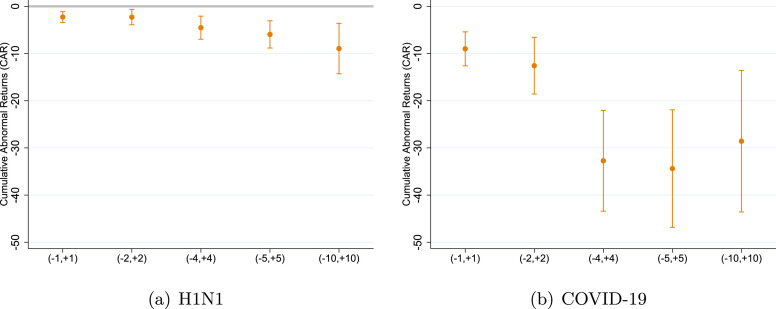

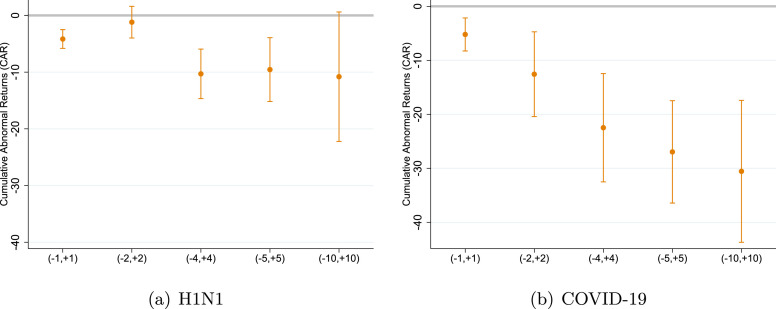

The estimated CARs of the BRIC group for the COVID-19 pandemic are summarized in Table 2. On this occasion, all the countries show significant losses in their returns, but now Russia is the country that responds with lowest losses, also reducing its recovery time. Russia is followed by China with a similar but more unstable behavior, as can be seen in Figs. 2 y 4. These countries are then followed by India and Brazil, the latter having the highest loss in returns within the study period, with (see Figs. 1 y 3).

Table 2.

BRIC CARs on the announcement of the COVID-19 pandemic.

| Window | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| CAR | Brazil | Russia | India | China |

| −9.0047*** | −3.9468* | −5.2086*** | −4.9907*** | |

| (−4.1164) | (−1.8413) | (−2.8015) | (−2.8169) | |

| −12.5744*** | −8.3170* | −12.5717*** | −7.1967* | |

| (−3.4388) | (−1.9406) | (−2.6334) | (−1.7326) | |

| −32.7233*** | −17.3642*** | −22.4764*** | −14.4767** | |

| (−5.0381) | (−3.2765) | (−3.6862) | (−2.0781) | |

| −34.3821*** | −11.4609** | −26.9494*** | −12.4262 | |

| (−4.5411) | (−2.2796) | (−4.6775) | (−1.5380) | |

| −28.5712*** | −11.0105* | −30.5520*** | −15.6840* | |

| (−3.1332) | (−1.7731) | (−3.8231) | (−1.6604) |

Note: This table reports the results of the CARs for Eq. (1) around the time of announcement of the COVID-19 pandemic. Wald test, in parentheses. */**/*** significant at 10%/5%/1%, respectively.

Fig. 2.

Russia CARs on the announcement of the H1N1 and COVID-19 pandemics.

Fig. 4.

China CARs on the announcement of the H1N1 and COVID-19 pandemics.

Note: The vertical axis reports the CARs in percentage points and with a 90% confidence interval, with Figure (a) showing results for the H1N1 pandemic and (b) for COVID-19. The horizontal axis indicates the size of the windows that grow to the right.

Fig. 1.

Brazil CARs on the announcement of the H1N1 and COVID-19 pandemics.

Fig. 3.

India CARs on the announcement of the H1N1 and COVID-19 pandemics.

It should be noted that in Russia, upon the announcement of H1N1, the losses of the returns accumulated in a negative and progressive way (see Fig. 2a), on the announcement of COVID-19 the CARs are also negative but show a recovery on the fourth day after the announcement, with its highest return loss being 17.4% (see Fig. 2b). However, for India, the inverse process is observed: a good performance for H1N1 (see Fig. 3a) and a progressive decrease in returns for COVID-19 (see Fig. 3b).

Our results show that the response of the Chinese financial market to the H1N1 announcement resembles that of an efficient market, as shown in Fig. 4a, but for COVID-19 the CARs were negative, although less so than the BRIC group average and more controlled after the fourth day (see Fig. 4b). In the case of Brazil, losses in returns are also observed, exceeding those of China by more than double (see Fig. 1), although their overall behavior seems to be similar, reporting worsening performance in the face of pandemic announcements.

4. Conclusions

After the announcements of the H1N1 and COVID-19 pandemic made by the WHO, we found evidence that the financial markets belonging to the BRIC group of emerging countries registered more negative accumulated stock returns for the announcement of COVID-19 than for H1N1, demonstrating a worsening overall effect on stock markets. This could be an indication that there was no learning on the part of investors, but it could also be related to the different scopes that each pandemic reached or even progressively increasing sensitivity to pandemics. Notwithstanding, our evidence suggests that the stock markets of Russia and China had the best returns and recovery within the BRIC group for COVID-19 after experiencing H1N1, possibly because previous experience provided knowledge that allowed them to better face the second pandemic. However, in the case of China, the substitutability (He et al., 2020) and flexibility (Liu et al., 2021) of its producers must also be considered in its adaptive response to pandemics, as well as the idea that China exerts important indirect influence on the economies of the other countries in our analysis (Belke et al., 2019) that is difficult to quantify but would allow it to face these market shocks more pliably.

Our evidence proposes a possible assimilation of the experience of pandemics among the BRIC stock markets, applying lessons learned in the next wave. However, if we compare Russia with India, they seem to have opposing lines of learning, while China seems to be more successful in facing the second pandemic if we compare it with Brazil, whose negative CARs are more exacerbated. Within the BRIC bloc, India and Brazil are those with the worst affected stock markets. Therefore, we can infer that the behavior of investors there is more influenced by impulsive decisions, especially in the short term. This discourages experiential learning and the incorporation of previous pandemic lessons as an asset valuation element.

It is noteworthy that the mere announcement of the pandemic caused a drop in stock returns, even though the number of infected at the time were extremely low, and deaths close to zero. This complements the study by Ashraf (2020), where he points out that the negative response of financial markets may be sustained by an increase in the number of people affected by COVID-19. The potential future status of the BRIC group as developed countries generates an extra element of attraction to this field of study, if we consider that the bloc led by China and Russia could lead the global economy for the next 50 years (Gusarova, 2019).

We recommend continuing to investigate the financial effects of pandemics on stock markets to maximize the lessons we can learn and to allow the development of more resilient investment tools in the face of this type of phenomenon. Once COVID-19 is over, it is expected that we will have to face a new pandemic, particularly in a context of increasingly frequent natural/biological disasters. This causes concern among markets and authorities (Del Rio et al., 2021) due to a possibly increased level of contagiousness and resistance to existing vaccines (Hoffmann et al., 2021), making it impossible to ignore the role it will have in world economics. Therefore, the results and discussion points of this study lay the foundation to understand and address a momentous, nascent state of normality among financial markets.

Footnotes

BRIC, the grouping acronym for the countries of Brazil, Russia, India and China, which are deemed to be developing countries.

The momentum effect refers to the inertia that prices carry due to the trend (Zaremba et al., 2021).

Appendix.

Table 3.

Panel estimate of abnormal returns after the H1N1 announcement.

| VARIABLES | (1) Brazil | (2) Russia | (3) India | (4) China |

|---|---|---|---|---|

| −0.0072 | −0.0291 | −0.0016 | 0.1052 | |

| (−0.1363) | (−0.2758) | (−0.0202) | (1.0088) | |

| 0.8562*** | 0.6574** | 0.3819** | 0.3533** | |

| (8.6310) | (2.2289) | (2.0816) | (2.2692) | |

| −0.0170 | −0.0235 | −0.0203 | 0.1181* | |

| (−0.4665) | (−0.2099) | (−0.2185) | (1.9082) | |

| 0.7720*** | −0.0354 | 0.3935 | −1.0417*** | |

| (3.8482) | (−0.0749) | (0.6555) | (−2.7008) | |

| −1.2598*** | 2.7807*** | 1.4471* | 0.7127* | |

| (−4.2125) | (3.7420) | (1.7107) | (1.7458) | |

| 0.0132 | 5.1404*** | 0.5088 | 1.2946** | |

| (0.0306) | (4.0070) | (0.5811) | (2.0213) | |

| −1.3353*** | −1.1517 | −0.6054 | −0.0178 | |

| (−7.7474) | (−1.4192) | (−1.4894) | (−0.0512) | |

| −2.6143*** | −7.2522*** | 0.3395 | 1.6228*** | |

| (−11.3538) | (−11.5044) | (0.8699) | (4.8765) | |

| 1.2956*** | −0.5835 | 0.0279 | −0.5181 | |

| (4.6991) | (−0.6266) | (0.0691) | (−1.5481) | |

| −0.2914 | 1.7395*** | −0.0313 | −0.7456** | |

| (−1.5792) | (3.8542) | (−0.0782) | (−2.2973) | |

| 0.3703** | −2.5111*** | −3.8355*** | −0.8910*** | |

| (2.2301) | (−5.4316) | (−12.3966) | (−2.8453) | |

| −1.5329*** | −1.5711** | 2.0496*** | 1.3318*** | |

| (−7.7166) | (−2.5467) | (3.8272) | (3.1536) | |

| 0.5167*** | 1.4769*** | 2.0150*** | 0.2534 | |

| (2.8489) | (3.3499) | (5.0905) | (0.9334) | |

| −0.6451*** | −0.4685 | −1.0340*** | −1.6830*** | |

| (−3.8503) | (−1.1440) | (−2.3585) | (−6.1892) | |

| −0.9351*** | −4.2288*** | −1.6309*** | −2.0166*** | |

| (−3.2782) | (−4.5816) | (−5.3138) | (−5.9642) | |

| −0.6920** | 2.2214** | −1.4945** | 1.8453*** | |

| (−2.1008) | (2.4156) | (−2.2209) | (3.2379) | |

| −0.5300** | −6.0817**** | 0.9538* | −0.6360* | |

| (−2.4844) | (−11.1071) | (1.7736) | (−1.6977) | |

| −1.3469*** | −3.2058*** | −4.0638*** | 2.2567*** | |

| (−7.3314) | (−4.0869) | (−8.2075) | (6.0131) | |

| 0.2696 | −1.2491 | −3.2616*** | 0.6384 | |

| (1.0815) | (−1.6189) | (−6.7214) | (1.6216) | |

| −1.1390*** | −6.4357*** | 0.7848 | 1.0131** | |

| (−3.6996) | (−6.2636) | (1.1626) | (2.0387) | |

| 0.1224 | −3.1230*** | −0.8274 | −1.1302** | |

| (0.4411) | (−3.1894) | (−1.1638) | (−2.1652) | |

| −1.1885*** | 5.9099*** | −0.2548 | −0.8025** | |

| (−6.2668) | (10.3719) | (−0.7491) | (−2.5221) | |

| 1.3956*** | −4.3147*** | 0.3219 | 2.3003*** | |

| (5.3175) | (−4.4149) | (0.5915) | (5.7605) | |

| −0.1950 | −0.6452 | −2.6054*** | −0.2163 | |

| (−0.9090) | (−1.2658) | (−3.0839) | (−0.3959) | |

| Constant | 0.2635 | 0.5308 | 0.4021 | 0.4122 |

| (1.6624) | (1.3123) | (1.3091) | (1.4540) | |

| Observations | 112 | 112 | 112 | 112 |

| R-squared | 0.7642 | 0.3798 | 0.2149 | 0.1073 |

Note: This table reports the panel estimates for abnormal returns from Eq. (1). The dependent variable () is the stock percentage return of each BRIC country. is the first lag of the stock return. represents the derived market return of the in percentage points. is the percentage return of the VIX. , with , is a binary variable that takes the value 1, individualizing each day of the H1N1 event window. -statistic in parentheses. */**/*** significant at 10%/5%/1%, respectively.

Table 4.

Panel estimate of abnormal returns from the COVID-19 announcement.

| VARIABLES | (1) Brazil | (2) Russia | (3) India | (4) China |

|---|---|---|---|---|

| −0.0939 | 0.0844 | −0.0464 | 0.0522 | |

| (−1.0380) | (0.8343) | (−0.3585) | (0.2443) | |

| 0.4954* | 0.3627* | 0.2398 | −0.0231 | |

| (1.8998) | (1.8156) | (0.8845) | (−0.0784) | |

| −0.0321 | −0.0100 | −0.0100 | −0.0510 | |

| (−1.1977) | (−0.5268) | (−0.4586) | (−0.8459) | |

| −0.1828 | −0.5736 | 0.4515 | −3.4381*** | |

| (−0.5564) | (−0.6614) | (0.6751) | (−14.8627) | |

| −1.7135 | 0.8198** | −0.9772*** | 1.8968 | |

| (−0.8552) | (2.0932) | (−5.5108) | (0.8694) | |

| 0.6498 | −1.5581** | 0.9703 | −5.0972*** | |

| (0.6811) | (−2.5795) | (1.5549) | (−19.3375) | |

| −0.4355 | −4.0574*** | −3.6038*** | 2.7477* | |

| (−0.5311) | (−9.7896) | (−16.3749) | (1.9792) | |

| 0.8606 | −2.2062*** | −2.0826* | 0.8691 | |

| (1.3066) | (−2.8019) | (−1.8718) | (0.9519) | |

| −1.0649 | 3.0980*** | 2.2440*** | −0.8606 | |

| (−1.3593) | (6.2458) | (3.7042) | (−0.8680) | |

| −2.2773*** | −1.6552** | −1.5526* | 2.6215** | |

| (−3.4586) | (−2.5660) | (−1.8975) | (2.2965) | |

| −3.7004*** | 0.9631* | 1.1512** | −1.2196** | |

| (−5.9322) | (1.9536) | (2.0440) | (−2.3520) | |

| −8.6822*** | −2.8789*** | −2.0633*** | −3.2409 | |

| (−5.0635) | (−8.9459) | (−5.3241) | (−1.6327) | |

| 2.7830* | −7.0071*** | −3.0089* | 1.9622 | |

| (1.8367) | (−10.9815) | (−1.8366) | (1.3733) | |

| −4.4517*** | 2.3367* | −0.1595 | −1.6542 | |

| (−3.5029) | (1.8772) | (−0.2310) | (−1.2880) | |

| −10.7641*** | −4.7456*** | −5.9594*** | −1.0275 | |

| (−4.8544) | (−2.9708) | (−2.8421) | (−0.4063) | |

| 6.2110*** | −1.5379 | 0.9104 | −2.3091 | |

| (2.7170) | (−0.9434) | (0.3771) | (−1.0945) | |

| −6.3527*** | 2.6369 | −4.3542 | −4.1682 | |

| (−2.1527) | (1.2498) | (−1.4841) | (−1.3495) | |

| 0.1100 | −3.9751*** | −4.4137** | −0.7784 | |

| (0.0575) | (−3.8433) | (−2.3155) | (−0.3860) | |

| −7.8763*** | −3.1563*** | −4.5790*** | −2.0410 | |

| (−5.2516) | (−2.8346) | (−3.1771) | (−1.3415) | |

| 0.6186 | 7.5585*** | −2.9204*** | −0.5710 | |

| (0.6211) | (13.8121) | (−3.6274) | (−1.4006) | |

| 0.1971 | 3.2392** | 6.5043*** | 0.4854 | |

| (0.1395) | (2.5149) | (4.6652) | (0.2971) | |

| −4.3399*** | −2.6924*** | −13.0249*** | −5.3836*** | |

| (−4.4138) | (−3.4680) | (−10.2090) | (−4.2932) | |

| 4.2501* | 3.9222** | −0.3469 | 2.5334 | |

| (1.7934) | (2.1855) | (−0.1060) | (0.8239) | |

| 7.5899*** | 0.4587 | 6.2627*** | 2.9893*** | |

| (8.8679) | (0.6286) | (14.6334) | (5.5786) | |

| Constant | 0.0556 | 0.0822 | 0.0279 | 0.2683 |

| (0.4709) | (0.9290) | (0.3049) | (1.5710) | |

| Observations | 112 | 112 | 112 | 112 |

| R-squared | 0.9530 | 0.9045 | 0.9146 | 0.4938 |

Note: This table reports the panel estimates for abnormal returns from Eq. (1). The dependent variable () is the stock percentage return of each BRIC country. is the first lag of the stock return. represents the derived market return of the in percentage points. is the percentage return of the VIX. , with , is a binary variable that takes the value 1, individualizing each day of the H1N1 event window. -statistic in parentheses. */**/*** significant at 10%/5%/1%, respectively.

Data availability

Data will be made available on request.

References

- Akhtaruzzaman M., Boubaker S., Sensoy A. Financial contagion during COVID-19 crisis. Finance Res. Lett. 2021;38 doi: 10.1016/j.frl.2020.101604. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Alfaro L., Chari A., Greenland A.N., Schott P.K. National Bureau of Economic Research; 2020. Aggregate and Firm-Level Stock Returns During Pandemics, in Real Time: Technical Report. [Google Scholar]

- Arteaga-Garavito, M.J., Croce, M.M.M., Farroni, P., Wolfskeil, I., 2020. When the Markets Get COVID: Contagion, Viruses and Information Diffusion. CEPR Discussion Paper No. DP14674.

- Ashraf B.N. Stock markets’ reaction to COVID-19: Cases or fatalities? Res. Int. Bus. Finance. 2020;54 doi: 10.1016/j.ribaf.2020.101249. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Belke A., Dreger C., Dubova I. On the exposure of the BRIC countries to global economic shocks. World Econ. 2019;42(1):122–142. [Google Scholar]

- Berlemann M., Eurich M. Natural hazard risk and life satisfaction–empirical evidence for hurricanes. Ecol. Econ. 2021;190 [Google Scholar]

- Binder J.J. On the use of the multivariate regression model in event studies. J. Account. Res. 1985;23:370–383. [Google Scholar]

- Chen M.H., Jang S.S., Kim W.G. The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach. Int. J. Hosp. Manag. 2007;26(1):200–212. doi: 10.1016/j.ijhm.2005.11.004. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Chin A., Simon G.L., Anthamatten P., Kelsey K.C., Crawford B.R., Weaver A.J. Pandemics and the future of human-landscape interactions. Anthropocene. 2020;31 [Google Scholar]

- Del Rio C., Omer S.B., Malani P.N. Winter of Omicron—the evolving COVID-19 pandemic. JAMA. 2021;327(4):319–320. doi: 10.1001/jama.2021.24315. [DOI] [PubMed] [Google Scholar]

- Gusarova S. Role of China in the development of trade and FDI cooperation with BRICS countries. China Econ. Rev. 2019;57 [Google Scholar]

- He P., Sun Y., Zhang Y., Li T. COVID-19’s impact on stock prices across different sectors — An event study based on the Chinese stock market. Emerg. Mark. Finance Trade. 2020;56(10):2198–2212. [Google Scholar]

- Hoffmann M., Krüger N., Schulz S., Cossmann A., Rocha C., Kempf A., Nehlmeier I., Graichen L., Moldenhauer A.S., Winkler M.S., Lier M., Dopfer-Jablonka A., Jäck H.M., Behrens G.M.N., Poöhlmann S. The Omicron variant is highly resistant against antibody-mediated neutralization: Implications for control of the COVID-19 pandemic. Cell. 2021;185:447–456. doi: 10.1016/j.cell.2021.12.032. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Huremović D. Psychiatry of Pandemics. Springer; 2019. Brief history of pandemics (pandemics throughout history) pp. 7–35. [Google Scholar]

- Ichev R., Marinč M. Stock prices and geographic proximity of information: Evidence from the Ebola outbreak. Int. Rev. Financ. Anal. 2018;56:153–166. doi: 10.1016/j.irfa.2017.12.004. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Karafiath I. Using dummy variables in the event methodology. Financ. Rev. 1988;23(3):351–357. [Google Scholar]

- Liu H., Manzoor A., Wang C., Zhang L., Manzoor Z. The COVID-19 outbreak and affected countries stock markets response. Int. J. Environ. Res. Public Health. 2020;17(8):2800. doi: 10.3390/ijerph17082800. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Liu H., Yi X., Yin L. The impact of operating flexibility on firms’ performance during the COVID-19 outbreak: Evidence from China. Finance Res. Lett. 2021;38 doi: 10.1016/j.frl.2020.101808. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ma C., Rogers J.H., Zhou S. Global economic and financial effects of 21st century pandemics and epidemics. Covid Econ. 2020;5:56–78. [Google Scholar]

- Malatesta P.H. Measuring abnormal performance: The event parameter approach using joint generalized least squares. J. Financ. Quant. Anal. 1986;21(1):27–38. [Google Scholar]

- Malmendier U., Pouzo D., Vanasco V. Investor experiences and financial market dynamics. J. Financ. Econ. 2020;136(3):597–622. [Google Scholar]

- Ramelli S., Wagner A.F. Feverish stock price reactions to COVID-19. Rev. Corp. Finance Stud. 2020;9(3):622–655. [Google Scholar]

- Sampath S., Khedr A., Qamar S., Tekin A., Singh R., Green R., Kashyap R. Pandemics throughout the history. Cureus. 2021;13(9) doi: 10.7759/cureus.18136. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Saunders-Hastings P.R., Krewski D. Reviewing the history of pandemic influenza: Understanding patterns of emergence and transmission. Pathogens. 2016;5(4):66. doi: 10.3390/pathogens5040066. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Tetlock P.C. Does public financial news resolve asymmetric information? Rev. Financ. Stud. 2010;23(9):3520–3557. [Google Scholar]

- Verma S., Gustafsson A. Investigating the emerging COVID-19 research trends in the field of business and management: A bibliometric analysis approach. J. Bus. Res. 2020;118:253–261. doi: 10.1016/j.jbusres.2020.06.057. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Zaremba A., Mikutowski M., Szczygielski J.J., Karathanasopoulos A. The alpha momentum effect in commodity markets. Energy Econ. 2021;93 [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Data Availability Statement

Data will be made available on request.