Abstract

This research asks: To what extent has America's reliance on the global supply network aggravated the country's public health and economic crisis; and how did the American government respond to supply chain weaknesses during the early years of the Covid‐19 pandemic? This study first assesses important conceptual considerations that explain the expansion of global value chains and the growth of trade interdependencies among nations. Next, an analytical case study observes (1) America's supply chain vulnerability through three major waves of infection, (2) the difficulty to mend weaknesses in the supply linkages once the novel coronavirus spread globally and (3) American government's failures to both anticipate and respond to supply shortages, especially in the health sector. Trump administration's policies failed to ensure a reliable supply of simple personal protective equipment (PPE) for healthcare professionals and hospitals throughout the first three waves of infection. Moreover, state and federal governments' substantial reliance on large manufacturers who have established procurement relationship with government led to continuous nationwide supply shortages throughout 2020. The federal government's inability to engage small and medium manufacturers in the production of critical supplies of PPE and diagnostic tests deepened and prolonged the devastating impacts of the pandemic. Our case study demonstrates that the American government needs to rethink the country's substantial reliance on the global supply chain, and the specific requirements to boost domestic manufacturing capacity. The revitalisation of America's manufacturing ability and the local supply networks will boost the productive power of the nation, strengthen resiliency, reduce vulnerability in disruptive times and prepare the nation for future crises.

Keywords: American economy, coronavirus, global pandemic, global value chain, healthcare sector, supply chain network, supply chain vulnerability

1. INTRODUCTION

On 11 March 2020, the World Health Organization (WHO) declared the rapidly spreading Covid‐19 outbreak which originated in Wuhan, China, a global pandemic. Since then, Covid‐19 has escalated into full‐blown economic and health crises and triggered tremendous damages worldwide as nations take steps to implement strategies to contain the spread of the disease. As a result of the global lockdown and closure of production centres, the supply of a wide range of raw materials, intermediate components and finished goods has been halted. Compounded with export restriction measures, one immediate consequence that has received substantial attention in the early years of the pandemic is the widespread shortage of essential medical supplies throughout 2020, which left frontline health workers worldwide dangerously ill‐equipped to care for Covid‐19 patients. Most recently, the global shortage in semiconductors – key components for many electronic devices and automobiles – has reached a crisis point, due to factory shutdowns when the pandemic first hit, followed by a new surge in demand when car production rebounded. From these perspectives, the Covid‐19 pandemic exposed the risks underlying the interconnected supply chains eliciting a rethinking of global value chains and forcing nations to recalibrate their production strategies.

The rapid rise of the global value chains (GVCs) in the last four decades has dramatically changed the organisation of the international production of goods and services. The fragmentation of production inherent in GVCs has had remarkable effects on productivity and labour market development. Setting up production networks spanning the globe and locating different stages of manufacturing across different countries enhance firm competitiveness, boost employment growth through access to cost‐effective inputs and accelerate technological progress. For decades, the U.S. has become comfortable offshoring manufacturing to large centrally located facilities in foreign countries, sourcing foreign‐made inputs and allowing firms to reap the benefits from participation in GVCs. From 2000 to 2010, American industrial sectors shed 5.7 million manufacturing jobs – more than a third of the manufacturing workforce – as companies abandoned plants and workers in favour of low‐cost foreign destinations (Tita, 2016).

In recent years, U.S. manufacturing has shown signs of improvement, as domestic plants became more cost‐competitive with countries that have seen increased manufacturing costs due to higher wages and the U.S.–China tariff war. Nevertheless, Covid‐19 revealed serious deficiencies in the domestic manufacturing sector's ability to provide products to confront national needs. A consequence of these dependencies is a deep tiering of supply chains with suppliers scattered around the world. With heavy reliance on global suppliers, America struggled to secure the necessary equipment and protective gear when the health crisis hit and disrupted nearly every link in the global supply chain.

The current pandemic‐related shortages have fuelled calls for the U.S. to reduce its dependence on foreign inputs and revamp its national manufacturing capacity. Given the challenges associated with the issue, this research article asks: First, to what extent did America's reliance on the global supply network aggravate the country's public health and economic crisis? Second, how did the American government respond to supply chain weaknesses throughout the three major waves of infection during 2020–2021?

This study demonstrates the disastrous consequences of America's excessive dependence on global value chains. Prior to the pandemic, America had become increasingly dependent on foreign markets for critical medical supplies. When this flow was abruptly staunched during the first wave of Covid‐19, from January to May 2020, the American healthcare system faced a dire shortage of ventilation machines, protective gear and medical safety garments. During the second wave, while enough ventilators were amassed, a lack of protective equipment and testing supplies persisted from June to September 2020. This was due to President Trump's refusal to harness the full power of the Defence Production Act (DPA) to expedite the production of critical medical supplies. 1 During the deadly third wave, the persistent shortage of PPE was attributed to not only the flu and holiday seasons but also a lack of coordination from the federal government to help small manufacturers support mask making.

This research provides a critical assessment of supply chain impacts on the health and safety of America and its economy during the pandemic. The research methodology involves an analytical case study that encapsulates America's experience through three major waves of infection. Following this introduction, the study surveys the literature to highlight important theoretical conceptions and empirical trends shifting the American economy towards GVC integration. The empirical sections that follow investigate supply chain disruptions across healthcare and pharmaceutical industries during the pandemic. In addition, the case study assesses the Trump administration's responses to mitigate supply chain bottlenecks and their failures. In the concluding section, we offer a summary of research findings, analytical observations and contributions.

Overall, the Trump administration's failure to address supply chain problems throughout 2020 not only shows its unpreparedness to handle the supply crisis but also the difficulty of revamping production once manufacturing capacity had depleted from the U.S. industrial base. The pandemic period provides important lessons for America, both in its vulnerabilities and inadequate policy approach. This study argues that global trade must be pursued with the inclusion (rather than exclusion) of strengthened domestic capacity of American industries.

2. INTEGRATION AND FRAGMENTATION OF PRODUCTION: THEORETICAL CONCEPTIONS

2.1. Comparative advantage, economies of scale, and fragmentation of production

The Heckscher–Ohlin (H‐O) model has long been the key tenet of international trade theory. It proposes that patterns of trade are determined by relative factor endowments of different nations. It takes the position that countries should ideally export materials and resources of which they have in excess, while proportionately importing goods utilising resources they lack. However, hinging on the classical premises that homogeneous producers operate at constant returns to scale in a perfectly competitive market, while countries have identical production functions and trade only final products, the H‐O theory hardly offers a complete explanation of international trade patterns (Inomata, 2017; Krugman, 2008; Subasat, 2003).

It was not until the late 1970s that the theory of intra‐industry trade was clearly articulated and integrated in a new theoretical framework known as New Trade Theory. Krugman (1979, 1980) pinpointed that economies of scale and product differentiation within the monopolistically competitive market can facilitate trade, even in the absence of traditional (H‐O) comparative advantage. Thus, international trade allows countries to reap advantages from economies of scale, without reducing the diversity of goods available for local consumption and the competitive pressure essential for continuous innovation (Helpman & Krugman, 1985; Krugman, 1980).

More importantly, scholars in international trade point out that intra‐industry trade takes place not only when countries trade with each other over final goods but also intermediary inputs giving rise to fragmentation of production. As firms split up the value chain, international trade often does not involve the whole finished product assumed in the classical model, but rather immediate goods and inputs (Campa & Goldberg, 1997; Feenstra & Hanson, 1996). Proposed by Jones and Kierzkowski (1990), the division of labour in which workers specialise in particular tasks enables firms to develop unique products, many of which are highly specialised components. This allows for the production of a final product to be divided into different stages among suppliers located in countries where tasks can be most efficiently performed. In this framework, fragmentation of production implies that the cost of coordinating multiple activities in their respective low‐cost locations is lower than the cost of integrated production in a single location by taking advantage of dissimilarities of input prices among regions (Jones & Kierzkowski, 1990). Thus, disintegrating the production process into separate stages unlocks new possibilities for exploiting gains from intra‐industry trade.

2.2. Factors contributing to the rise of GVCs in global trade

As the production of intermediary inputs becomes fragmented and takes place in a number of countries, added factors contribute to the creation of GVCs. First, concurrent advances in information, telecommunications and transportation technologies are integral in the development of dispersed production activities and coordination of highly complex GVCs. Hummels (2007) points out that the use of bulk shipping and standardised containers provides cost savings by allowing goods to be packed once and moved over long distances. In a paper pertaining to the impact of information and communication technologies on offshoring services, Hillberry (2011) postulates that cheaper and more efficient telecommunications led to advancement in the information technology sector, allowing for improved global logistics services. This facilitates the timely and efficient exchange of intermediate goods as they ‘allow firms to better track and schedule their shipments of goods’ (Hillberry, 2011, p. 81).

Second, vertical specialisation has become increasingly prominent in that tasks undertaken in various countries are vertically linked, so that one country takes some inputs, adds value and then sends those inputs to another country for further processing, which are then exported to another country (Hummels et al., 2001). The feature that sets vertical specialisation apart from other concepts such as outsourcing is that only imported goods that are later used as inputs in the country's exported goods are measured in the vertical specialisation. Using input–output (I‐O) analysis, Hummels et al. (2001) estimate that vertical specialisation accounts for up to 30% of countries' exports between 1970 and 1990. Chen et al. (2005) update Hummels et al. (2001) using more recent I‐O tables and conclude that vertical specialisation has increased over time. Furthermore, an increasingly significant fraction of U.S. exports do not go directly to foreign markets; rather, they go to the foreign affiliates of U.S. multinationals. These inputs, then, engage in further production before the final goods enter the market. Taken together, vertically specialised processes increase complexity and the potential for cost‐saving benefits in the growth of foreign trade.

Third, the rapid decline in geo‐political and economic barriers among nations has also been a driver of GVCs. A small decrease in the tariff rate on foreign imports can lower overall trade costs and produce a large effect on trade volume. Looking at the aggregate U.S. trade since the early 1960s, Yi (2003) finds that over 50% of the trade expansion can be explained by increased vertical specialisation brought about by tariff reductions. In addition to a general fall in tariffs, regional trade agreements and economic associations stimulate the creation of multilateral production networks among members of a supply chain (Baldwin, 2012; Orefice & Rocha, 2014).

2.3. Social and economic outcomes

While a majority of benefits go to global producers in the form of profit, productivity, technological capacity and market expansion, workers in developed economies face harsh transitions from manufacturing jobs to others, as well as increases in inequality. First, the proliferation of GVCs has resulted in redistribution of employment opportunities and wages. Spence (2011) observes that GVCs led to a fall in employment in virtually all manufacturing sectors. In addition, many U.S. job opportunities are shifting away from the tradable sector towards non‐tradable sectors such as finance, computer design and engineering (Spence, 2011). The remaining areas in which the U.S. economy continues to have a comparative advantage are on the top end of the manufacturing chain which generally employ highly educated workers. As a result, his finding suggests rising income and employment disparities across the U.S. economy. In addition, Bernard et al. (2018) point out that increased production fragmentation leads to increased wage inequality in both advanced and less‐developed countries, as firms in GVCs tend to adopt more capital‐intensive techniques than comparable domestic firms. Thus, exporting firms produce more jobs for skilled workers (Bernard et al., 2018). More importantly, Gereffi (2014) and Henderson et al. (2002) suggest that participating in GVCs does not necessarily generate good jobs or stable wages for unskilled workers. In the worst case, the economic upgrading associated with GVC integration may be linked to ‘a significant deterioration of labour conditions and other forms of social downgrading’ in both developed and developing countries (Gereffi, 2014, p. 18). 2

Beyond their direct impacts on jobs and wages, GVCs are also a key channel for the transmission of technologies from developed to developing countries, which could result in additional spillovers in terms of learning and skill upgrading (Hollweg, 2019; World Bank, 2020). However, this acceleration of technological progress could lead to a reduction in demand for labour in both developed and developing economies mentioned above. Hallward‐Driemeier and Nayyar (2017) suggest that the adoption of industrial automation and digitalisation are transforming the manufacturing process and replacing the low‐skilled assembly jobs. Indeed, studies by the World Bank (2016) estimate that automation has the potential to replace up to 55% of jobs in Cambodia, 70% in Nepal and 80% in Ethiopia in the next decade. This imposes a challenge for developing countries if they want to take advantage of their low‐cost unskilled labour to get a foot in the door of GVCs. New emerging trends, including automation and digitisation, further amplify these effects on the labour market (Hallward‐Driemeier & Nayyar, 2017; Hollweg, 2019; Rodrik, 2018; Salvatore, 2019).

Finally, it is crucial to emphasise that technological change led by specialisation via GVCs has exacerbated uneven employment opportunities and wage inequality. Research on the type of jobs gained and jobs lost by Salvatore (2019) and Stansbury and Summers (2018) indicates technological change creates non‐routine employment in advanced manufacturing but causes a rapid decline in routine employment in light manufacturing that is heavily biased against low‐skilled workers. Looking into the impact of technology on employment in China, De Vries et al. (2016) find similarly that improvements in GVC technology lowered demand for production by 55 million workers in China, but hardly affected demand for knowledge‐intensive activities such as R&D and headquarter jobs.

3. COVID‐19 IN AMERICA: SUPPLY CHAIN DISRUPTIONS AND GOVERNMENT RESPONSES IN HEALTHCARE SECTOR

As of 1 June 2022, the coronavirus pandemic has claimed 6.29 million lives globally, many of which could have been saved were the world and national governments better prepared (WHO Coronavirus Dashboard, 2022). This section analyses the impacts of global trade disruption in the U.S. during 2020–2021, the early stage of the pandemic. The analytical objective is to demonstrate America's dependence on the GVC amid the health crisis and its consequences. In addition, this section also assesses how the U.S. government responded to the supply shortage through three major waves of infection from March 2020 to January 2021, and aggravated infection and fatality severity. This analytical case study illustrates the extent that Covid‐19 exposed vulnerabilities in countries' reliance on fragmented, and global production networks, and the relative risks involved in such excessive.

Before the novel coronavirus hit America, the country relied heavily on medical devices and protective garments from abroad. A neighbouring low‐cost manufacturing base for U.S. companies, Mexico, was the leading supplier of medical devices in 2018. Mexican suppliers specialise in consumables, notably syringes, needles and catheters. Prior to the pandemic, the U.S. also imported medical devices from the EU‐28, with Germany as the largest European producer. Germany has a well‐established, high‐quality medical equipment market with an emphasis on diagnostic imaging equipment, precision medical instruments, and digital health solutions. For personal protective equipment (PPE), China topped the foreign supplier list providing 48% of U.S. total imports of face shields, protective garments, gloves and goggles in 2018 (Brown, 2020).

However, America's reliance on foreign imports in the medical field is not limited to medical equipment. Ninety‐seven per cent of antibiotics come from China (Joyce, 2020). Approximately 72% of U.S. active pharmaceutical ingredients (APIs) are foreign sourced, primarily from China and India (FTI Consulting, 2020). The two countries also account for about 90% of the generic prescription drugs taken by Americans. The U.S. imports almost all of its over‐the‐counter pain medications from China, including 70% of acetaminophen and 95% of ibuprofen. Apart from those produced in China and India which offer cost advantages, America also heavily imports drugs that are innovative and research oriented from European countries, with more than 52% of those drugs imported from Germany, Ireland, Switzerland and Israel in 2017 (Seth, 2017).

3.1. First wave of Covid‐19 infection (January 2020–May 2020)

The coronavirus outbreak was triggered in December 2019 in the city of Wuhan, in the Hubei province of China. The virus quickly spread across all provinces of mainland China and across the entire world. The Centers for Disease Control and Prevention (CDC) confirmed the first U.S. case on 21 January 2020, and subsequently the first human‐to‐human transmission on 30 January 2020 (CDC, 2020). Declaring the outbreak a public health emergency, the Trump administration belatedly enacted travel restrictions to and from China, effective from 2 February 2020. In March 2020, as cases concentrated in the American Northeast with infection rates peaking at 32,000 new cases a day or nearly 10 cases per 100,000 residents, state and local government‐issued prohibitions and cancellations of large‐scale gatherings, stay‐at‐home orders, school closures and restaurant and bars shutdowns through mid‐March and early April (Wilson, 2020). By 28 April 2020, the total number of confirmed cases across the country surpassed 1 million (Almasy et al., 2020).

3.1.1. Supply chain interruptions

From the very beginning, the coronavirus drastically upended the American economy, disrupting nearly every link in the global supply chain and shutting down major economic sectors. While all industries suffered from pandemic repercussions, industries hit hardest were in the manufacturing sector. Specifically, Covid‐19 highlighted U.S. critical dependencies on global manufacturers for personal protective equipment (PPE), medical devices and pharmaceutical drugs. More seriously, China was also the largest supplier of medical consumables – supplying over 70% of U.S. imports of textile face masks, 55% of protective eyewear and 55% of protective garments in 2019 (Congressional Research Service, 2020).

Since the pandemic began in China, it severely curtailed China's ability to supply PPE to the rest of the world. Prior to the emergence of infection clusters in the U.S., the Chinese government already organised a large‐scale purchase of PPE for China in the global market and nationalised control of the production and distribution of domestic medical supplies, thereby depleting existing supplies in America (Congressional Research Service, 2020). Throughout March and April, China imposed several export restrictions on PPE, as part of its efforts to meet the spiking domestic demand, leaving American companies and healthcare systems facing a critical shortage in protective gear and medical garments (Brown, 2020; Evenett et al., 2021).

In March 2020, the Strategic National Stockpile (SNS) contained only about 30 million surgical masks and 12 million respirators in reserves –1.2% of the 3.5 billion masks that the Trump administration estimated would be necessary if the coronavirus evolves into a pandemic (House Committee on Oversight and Reform, 2020). Worse, the rapid increase in global demand for PPE met with closed factories in China and other major manufacturing hubs. Factory closures also exacerbated America's shortage of Covid‐19 test kits and physical components including extraction kits, reagents and test swabs which significantly delayed the testing process (Conklin, 2020). This severely hindered America's ability to test, trace and limit the infection. As a result, most U.S. hospitals experienced testing shortages and extended wait times for test results (U.S. Department of Health and Human Services, Office of Inspector General (HHS‐OIG), 2020).

At the beginning of March, many generic antibiotics also saw shortages. Following an announcement from the U.S. Food and Drug Administration (FDA) alerting to the shortages of drugs, India announced the restriction of 26 drug ingredients from export, further aggravating extant shortages (Taplin & Grant, 2020). Meanwhile, European countries were also severely affected by the pandemic by mid‐March, which also undermined America's ability to secure critical drugs to battle the first wave of Covid‐19 (Schondelmeyer et al., 2020).

3.1.2. Policy response

At the start of the pandemic, the U.S. government did not establish a coherent national strategy but left states to fend for themselves. Trump told states it was primarily their responsibility to acquire the needed supplies, quipping that the federal government was ‘not a shipping clerk’ (Phillips et al., 2020). That left many states competing with one another on the open market for protective gear and, on occasion, facing federal government seizure of shipments they had ordered for themselves (Phillips et al., 2020). States also had to work together, ‘whether forming regional alliances to create greater purchasing power or sending excess supplies to hot spots’, given the federal government's inequitable distribution of medical supplies from the stockpile (Mulvihill, 2020). Furthermore, without detailed federal guidelines and national standards, directions varied widely from state to state on the implementation of lockdowns and mask mandates (Johnson, 2020).

Through March and April, Congress passed legislation providing funding to help government agencies, states, localities, businesses and individuals respond to the coronavirus (Table 1).

TABLE 1.

Three major phases of fiscal supports during the first wave of the pandemic

| Phase | Legislation | Amount | Objectives |

|---|---|---|---|

| 1 | Coronavirus Preparedness and Response Supplemental Appropriations Act | $8.3 billion | Emergency funding for testing, vaccine research and medical supply procurement |

| 2 | Families First Coronavirus Response Act | $104 billion | Paid sick leave and unemployment benefits for workers and families |

| 3 | Coronavirus Aid, Relief, and Economic Security Act (CARES Act) | $2.2 trillion | Economic stimulus to support the economy during the pandemic covering a wide range of supports for businesses and American families |

Spending for CARES ACT primarily included one‐time $1200 payments to individual Americans, supplemental unemployment benefits and forgivable loans to small businesses, corporations and state and local governments (Snell, 2020). To weather the supply chain disruption, the CARES Act also allocated $500 billion to help businesses stay afloat, $10 billion in loans to keep the USPS last‐mile service moving, $7 billion for cargo airlines to move freight and $60 million to help small‐ and medium‐sized manufacturers to recover and innovate (Forde, 2020). Finally, the CARES Act specifically applied to the domestic production of medical devices and drugs in two key ways: it allocated $1 billion to the Defense Production Act (DPA) fund for the production, purchase and prioritising distribution of medical supplies, and $10 billion for the Operation Warp Speed (OWS) to accelerate the development, manufacturing and distribution of Covid‐19 vaccines and therapeutics.

Although President Trump announced that he was invoking the DPA on 18 March, he was reluctant to force companies to begin producing PPE or ventilators and said he would only use it in a ‘worst‐case scenario’ (Bown & Bollyky, 2021; Cathey & Arnholz, 2020). It was not until 27 March, amidst mounting calls from national security officials urging the president to take full advantage of the DPA, did the president report that he had used the act to spur GM to make ventilators. Facing criticism for not putting it into action earlier, Trump defended his decision, insinuating that wielding DPA authority would be tantamount to nationalising business (Moore, 2020). Eventually, President Trump invoked the DPA several more times and delegated the execution of authorities to several federal agencies (for more details, see Bown & Bollyky, 2021).

To accelerate the development of Covid‐19 vaccines, OWS – a partnership among components of the HHS – selected the most promising countermeasure candidates and provided coordinated government support to the chosen vaccine developers. By May, three vaccine agreements were awarded to AstraZeneca, Moderna and Johnson & Johnson. Meanwhile, as an initial effort to help decrease the U.S. dependence on offshore supply chains of medical‐grade injection devices, the DOD and HHS under OWS awarded a $138 million contract with ApiJect for more than 100 million prefilled syringes for vaccine distribution across the U.S. by the end of 2020 (DOD, 2020a, 2020b, 2020c, 2020d). As a (relatively late) first step to restore drug production, the Biomedical Advanced Research and Development Authority (BARDA), under HHS, awarded a 4‐year $354 million contract to Phlow Corporation to produce a variety of generic drugs and APIs on 19 May (HHS, 2020a, 2020b). 3

Under the principles of market economy, it is logical that American companies would not pivot production for APIs, medical equipment and PPE, unless they could see profit potential. In this early phase of the pandemic, it was uncertain how long and severe the pandemic would become. Thus, it would be risky for companies to rearrange their operations to produce medical equipment, drugs and PPE in the U.S. This is especially the case after decades of outsourcing production to foreign destinations, production facilities, know‐how, skilled workers, and expertise were no longer readily available making the tasks costly and time‐consuming. Hence, it was crucial that the American government act decisively to support new production by providing companies with the inputs and acting as a guarantor for purchases. Trump's reluctance to force more domestic production using the DPA failed to fulfil this critical role. Although the president eventually backtracked his early approach by utilising both DPA and creating the OWS, it was rather late. By the end of May, 2020, 115,163 American lives were lost (CDC, 2021a, 2021b), and a widespread sense of helplessness infected the American healthcare system severely short of equipment, drugs and tools needed to treat patients.

3.2. Second wave of Covid‐19 infection (June 2020–September 2020)

A second rise in infections began in June 2020, following business re‐openings and relaxed occupancy restrictions in several states, with cases surpassing 2 million by 10 June (Chappell, 2020). By mid‐July, infection rates far outpaced the first wave, peaking at 67,000 cases per day or 20.5 infections per 100,000 residents (Wilson et al., 2020). While cases steadily decreased in early hot spots like New York and New Jersey, the South and large parts of the West known as the Sunbelt saw a sharp uptick in cases. Younger people made up a growing percentage of coronavirus cases in the South and the West where cases were surging. Since many states reopened bars, restaurants and offices, people in their 20s and 30s were more likely to socialise, allowing the virus to spread more widely across communities (Bosman & Mervosh, 2020). In response to the resurgence of Covid‐19, states in hot spot areas instituted strict measures including social distancing, masking, testing and contact tracing with some pulling back their reopening plan. Such measures led to a steady drop in Covid‐19 cases nationwide in late July (Lopez, 2020a, 2020b, 2020c).

As large manufacturers ramped up ventilator production under DPA, HHS said it accumulated enough ventilators that it is cancelling some of the contracts (Armour, 2020). However, the lack of PPE continued across America. According to the U.S. Government Accountability Office (GAO), as of 26 July, about 22% of nursing homes reported a severe PPE shortage, with 1 week or less of available supply (GAO, 2020a, 2020b). Get Us PPE, a leading non‐profit organisation that connects health providers to available medical gear, reported that in August, 77% of clinics, long‐term care facilities and rural hospitals reported running out of at least one essential PPE item, up from 65% in June (Get Us PPE, 2020). This led to dangerous rationing and efforts by medical providers to disinfect or reuse equipment. About 87% of hospital nurses had to reuse at least one type of single‐use PPE, according to a National Nurses United survey (Stein et al., 2020).

Meanwhile, shortages in testing supplies continued as flu season approached, schools reopened and new testing requirements took effect. Health offices in cities like San Antonio and Austin were forced to limit testing because of swab and reagents shortages (Mervosh & Fernandez, 2020). During July and August 2020, the U.S. Government Accountability Office interviewed officials from eight states, seven of which experienced ongoing shortages of testing supplies throughout this period (GAO, 2020a, 2020b). In many states such as Pennsylvania, residents had to wait 2–5 days to get tested and another 2–5 days to receive results, rendering testing ineffective to contain the virus from community transmission. The testing shortages severely undermined states' ability to quickly identify new infections, prevent the spread of the virus and assist business operations.

3.2.1. Policy response

During the second wave, the Trump administration continued to invoke DPA to secure the domestic production of medical devices. In June 2020, the DOD announced a collaboration with the U.S. International Development Finance Corporation (DFC) to restore critical healthcare production capacity using DPA – a task that usually takes years to bear fruit (DOD, 2020a, 2020b, 2020c, 2020d). Leveraging funds from the CAREs Act, the DOD and HHS collaborated throughout June and July to provide capital investments for CrossTex International and Renco Corporation to procure additional machine lines needed to produce surgical masks and gloves (The White House, 2020). Yet, these lines would not be delivered and fully operational until November 2021, making them useless to fight two of the most severe periods of the pandemic – the second and third waves. This offers an example of the difficulty in ramping up manufacturing production at a critical time, when the U.S. no longer has the infrastructure and expertise due to a prolonged period of outsourcing industrial production.

In terms of vaccination, OWS and their private partners continued to coordinate development, production and distribution. By August 2020, eight companies were awarded $11 billion to expedite the development and large‐scale manufacturing of their respective vaccine candidates, including AstraZeneca, Moderna, Johnson & Johnson, Novavax, Pfizer/BioNTech and Sanofi/GlaxoSmithKline (Higgins‐Dunn, 2020). To expand domestic manufacturing capacity for vials needed for vaccines injections and treatments, on 11 June 2020, HHS announced $204 million in funding to Corning Incorporated to expand domestic production of their valour glass vials, and $143 million to SiO2 Materials Science to ramp up capacity of the glass‐coated plastic vial (HHS, 2020a, 2020b). Furthermore, the DOD spent $100 million to secure over 500 million safety syringes within a year to the SNS (DOD, 2020a, 2020b, 2020c, 2020d). To further help expedite the domestic production of drugs and reduce America's reliance on foreign sources, the U.S. International Development Finance Corporation (DFC) offered a $765 million loan to Eastman Kodak to produce the chemical ingredients needed for critical pharmaceutical drugs (DFC, 2020).

Overall, during the second wave, the Trump administration did not deploy the DPA to the extent that it could and should have. In normal times, the DOD places approximately 300,000 DPA orders each year to ensure contractors prioritise government orders, and the Federal Emergency Management Agency (FEMA) employs DPA routinely for relief and recovery efforts following hurricanes and other national disasters (Jacobs, 2020a, 2020b, 2020c). However, during the coronavirus pandemic, the DOD only awarded seven contracts out of the 80 times it exerted the DPA to alleviate shortages of masks and other medical supplies (Kavi, 2020). In fact, the last time DOD issued a contract under the DPA to produce additional masks was in May 2020 – before the beginning of the second wave, not during or after and not during the third wave – despite America's continuing PPE shortage. In addition, the one and only time DOD issued a contract under DPA was to produce swabs in late April 2020. Therefore, as cases surged across the country and demand for testing soared, the rate of infections quickly outpaced production of protective gear and test supplies. Suggesting that the federal government's struggle to supply swabs, testing materials and protective gear might portend difficulties in distributing a vaccine, former legal adviser to the National Security Council Jamie Baker questioned, ‘If we cannot figure out how to produce enough swabs or tests, will we figure out how to produce enough vaccine or treatments?’ (Kavi, 2020, para. 23).

As it turned out, the reason why DOD did not exercise DPA authorities in support of the public health industrial base 4 was that it prioritised Covid‐19's funding for the defence industrial base. 5 In June 2020, when states and healthcare workers continued to face medical supply shortages, the DOD reversed its plan to allocate approximately 75% of the $1 billion in DPA funds for health resources, and instead allocated $688 million for defence industrial base investments (Congressional Research Service, 2020). The Trump administration justified the decision, pointing out that supply chain vulnerabilities caused by Covid‐19 warranted reshoring for both medical devices and national security. Criticism mounted quickly. ‘What's more important? Building an aircraft carrier or a frigate using priority ratings or saving 100,000 lives using priorities for medical supplies?’ wondered Larry Hall, former director of the DPA programme division at FEMA (Kanno‐Youngs & Swanson, 2020). In July 2020, House Committees leaders released a letter addressed to HHS and DOD secretaries to raise concerns over the use of DPA appropriations, underscoring that funds should be reserved for health and medical base, not for defence industrial base (U.S. Congress, 2020).

Already too late and sporadic in its implementation, the Trump administration again failed to employ DPA authorities to expedite PPE production. In contrast with its decisive actions to secure ventilators by ramping up domestic production to full capacity, the government mostly used DPA authority to allow PPE producers to scale up as they saw fit (Contrera, 2020). Therefore, Trump's policy response to the health crisis throughout the second wave was ‘totally inadequate’, according to a letter to the president written by nine prominent U.S. Senators on 6 May (U.S. Senate, 2020, p. 2). This is especially relevant as America was facing the risk of yet a bigger wave of infection as fall and winter approached that could intensify the demand for PPE.

In addition, Trump appeared to pay lip service to America's supply chain issues. Reversing four decades of established supply chain network and outsourcing takes time, commitment and resources. The administration may have had some resources, but it lacked commitment, time and coordination capacity. While it is a tremendously difficult task to overhaul America's supply chain in normal times, it became ever more challenging during the global health crisis. From this perspective, the administration should have focused resources and attention to boost the public health industrial base, rather than taking on other sectors such as defence. Instead, emergency funds to fight the pandemic were appropriated for DOD's defence priorities. The failure aggravated pain and loss among Americans who lost businesses, lives, jobs, physical health, mental health and loved ones to the raging force of the pandemic throughout the summer of 2020.

3.3. Third wave of Covid‐19 infection (September 2020–March 2021)

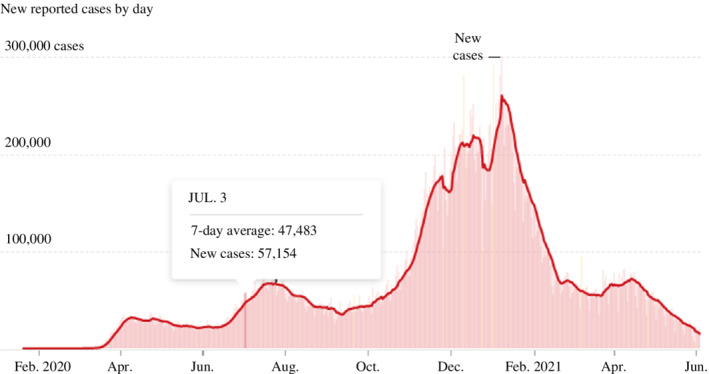

In mid‐September, spikes in parts of the Midwest and the South following businesses and school reopenings showed that the pandemic in America was by no means over. Although infection rates remained lower nationally than at their midsummer peak, it was still much higher than at the spring peak (Figure 1). Yet, states declared victory and continued to reopen anyway. Thus, cases rapidly climbed and surpassed the mid‐July peak with 23 infections per 100,000 residents just days before the Presidential Election (Wilson, 2020). Experts pointed to colleges and universities as drivers of the surge in the fall, as students patronised bars, clubs and indoor restaurants. Entering the winter months, colder temperatures pushed more people indoors, where the coronavirus is much more likely to spread (Lopez, 2020a, 2020b, 2020c). At the same time, as Thanksgiving rolled around, followed by Christmas, Hanukkah and New Year, families and friends came together from around the country, carrying the coronavirus across state borders, causing a much more dispersed epidemic than the U.S. had seen so far. On 8 December 2020, America passed 15 million cases, and the number rapidly rose as days passed (Bacon et al., 2020; Figure 1).

FIGURE 1.

The spread of the virus over three major waves, February 2020–June 2021. Source: New York Times (2021).

On 29 December, Colorado health officials reported the first known case in the U.S. of the new Covid‐19 variant B.1.1.7 (the Alpha variant) that was initially discovered in the United Kingdom (Feuer, 2020). According to the modelling study of CDC, B.1.1.7 is up to 50% more transmissible than the other variants, exacerbating the virus's spread and putting even more strain on America's already heavily burdened healthcare systems (CDC, 2021a, 2021b). While fewer than 100 cases involving B.1.1.7 were reported in the U.S. by 16 January, it became the predominant strain by early April 2021 (Chow, 2021). It accounts for 26% of Covid‐19 cases circulating across the nation, with Florida having the most confirmed cases, followed closely by Michigan, Wisconsin, California and Colorado according to the CDC data (Lovelace, 2021). Other variants circulating globally included the new strains detected in Brazil and South Africa, called P.1. (the Gamma variant) and B.1.351 (the Beta variant), respectively, which did not gain a strong foothold in America.

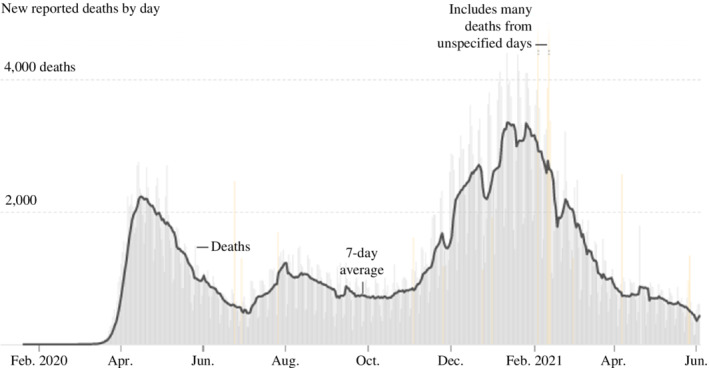

As the virus was transmitted widely, states faced a fierce wave of hospitalisations amid the new surge in cases after the holidays. By January 2021, over 130,000 people were hospitalised with Covid‐19 in America – more than the peak of the spring and summer surges combined, leaving hospitals in some regions of the country without enough intensive care unit (ICU) beds to meet patient needs (The COVID Tracking Project, 2021). The situation was further constrained by staffing shortages as healthcare workers were either exposed to or infected with Covid‐19. In North Dakota, while 91% of ICU beds were occupied, 35% of facilities were reporting a ‘critical nursing shortage’ (Glenza, 2020). As a consequence, California had to announce stay‐at‐home orders for regions where ICUs had <15% capacity. Rapidly rising demand for the most intensive care in hospitals was crowding specialised units, coupled with a critical staffing shortage, leaving doctors to triage those in greatest need and transfer patients who had less severe symptoms across state lines (Evans, 2020). The national mood was weary and dark when America celebrated Christmas and the New Year of 2021 (Figures 1 and 2). By the end of February 2021, 534,292 American lives were lost to the novel coronavirus (CDC, 2021a, 2021b).

FIGURE 2.

Covid‐19 deaths that coincides with three major waves of infection. Source: New York Times (2021).

3.3.1. Supply shortages during the third wave

Entering Fall 2020, states and federal governments initially claimed they were prepared for the winter surge, the so‐called ‘third wave’ of infection. In October 2020, GAO surveyed public health and emergency management officials from all states on the availability of PPE and testing supplies. Most states reported no shortages of swabs or transport media, but about one‐third to one‐half reported shortages in other types of testing supplies (GAO, 2020a, 2020b). In terms of PPE, a majority of states in the survey indicated that they resolved the critical shortages of PPE in the summer; however, availability constraints continued with some specific PPE, such as nitrile gloves (GAO, 2020a, 2020b). In addition, HHS further claimed that the federal government had the system and supplies needed to get the nation through the expected winter Covid‐19 surge, noting 93% of states had at least a 30‐day supply of medical gloves, placing it in a better position to handle a surge than it was at the start of the year (Basen, 2020).

However, by December 2021, the U.S. continued to face daunting shortages of masks and other PPE. According to Get Us PPE, requests for help more than tripled in the first half of December as compared with the same period in November (Jacobs, 2020a, 2020b, 2020c). Meanwhile, states did not get the PPE they requested from the federal government or received damaged goods. Others replaced efforts to procure medical gear from the national stockpile with PPE from private vendors. For example, in early December, Maine made three requests to the federal government for nitrile gloves; all went unfilled. New Mexico requested gloves from FEMA; after months of waiting, they arrived damaged. Concurrently, Washington state turned to private vendors with only 11% of its PPE supplies provided by the federal government, since the beginning of the pandemic (Armour et al., 2020).

In terms of ventilators, a burst of production since April 2020 solved the dire shortage that defined the first and second waves. However, as record numbers of Covid‐19 cases overwhelmed hospitals, states were facing a different problem. That is, they had enough ventilators, but not nearly enough intensivists and respiratory therapists to operate the machines and provide constant care for critically ill patients (Jacobs, 2020a, 2020b, 2020c). With the pandemic out of control, the shortage of testing supplies was intensifying again. Although millions of swabs, vials and other testing supplies were already shipped to states, half of labs reported shortages of test kits and two‐thirds reported shortages of crucial chemicals (American Society for Microbiology, 2021). As with the second wave, Americans faced difficulties getting Covid‐19 tests and the lab results took days to arrive, once again undermining states' ability to contain the spread.

3.3.2. Policy response

Following up on the CARES Act from March 2020, Congress approved a new $900 billion stimulus package named ‘Consolidated Appropriations Act’, also known as the ‘CARES Act 2’ which was signed into law on 27 December 2020, covering the same buckets of money set aside in the first CARES Act (Montague, 2020). Specifically, the legislation set aside nearly $70 billion for a range of public health measures, including coronavirus testing and vaccine distribution.

During the third wave, the new surge in cases following schools reopening and families gathering for the holidays was compounded by the appearance of multiple new variants. This further strained the healthcare system, despite the government's claim that the nation was well‐equipped to respond to any hotspots. One key policy failure was the Trump administration's inability to utilise small manufacturing firms to accelerate the production of critical medical supplies. As demand started to exceed production capacity of big manufacturers, it was essential to repurpose or scale‐up some small and mid‐sized manufacturers. Although the Trump Administration worked with some of the largest privately held companies to ramp up domestic production of respirator masks, there was almost no central coordination to help small manufacturers jump into mask making, regardless of their available production lines (Rose, 2020). In addition, there was no centralised database of American manufacturers or nationwide mechanism for identifying and activating suppliers who could help (Alter, 2020). For the small and medium manufacturers who attempted to contribute, they lacked clarity on how to produce standardised products. They also struggled to penetrate existing supply chain networks, leaving their PPE output and production capacity on the sideline of the public‐health crisis (Alter, 2020; Rose, 2020). Without government coordination and redirection, these small manufacturers missed the opportunity to support and to create a permanent and sustainable domestic supply chain for critical inputs.

Overall, the U.S. government was unprepared and continued its reliance on the established global value chain, throughout the third and most severe wave of infection among the three waves. Despite being more than 6 months into the pandemic, the government was unable to tap into manufacturing capacities of American small and medium firms to reduce shortages that were critical to fighting the pandemic. There was a potential to redirect the supply chain network to boost domestic suppliers and strengthen America's manufacturing capability. However, the opportunity was lost.

4. CONCLUSION AND ANALYTICAL OBSERVATIONS

This research article asks: To what extent did America's reliance on the global supply network aggravate the country's public health and economic crisis, and how did the American government respond to supply chain weaknesses? Our case study of the earliest three waves of infection demonstrates America's supply chain vulnerability, the difficulty in mending weaknesses in supply linkages once a crisis breaks out and the failures of the U.S. government to both anticipate and respond to supply shortages, especially in the healthcare sector. Throughout the three waves of infection, there were glaring deficiencies in the domestic manufacturing ability to provide necessary supplies. Moreover, states and federal reliance on large manufacturers with established procurement relationships with the government led to serious failure to address shortages. Had they found a way to expand existing supply chain networks to include small and medium American manufacturing firms and utilise their productive capacity, more PPE and testing materials could have been produced domestically. From this perspective, policy responses throughout 2020–2021 are responsible for the persistent shortage of PPE, Covid‐19 tests, and the subsequent high death rates.

Although the Trump administration's efforts to boost production of ventilators and vaccine research and development were effective (Bown & Bollyky, 2021), they failed to ensure a reliable supply of PPE throughout the three waves. Right from the start, President Trump did not implement a centralised national strategy to ramp up America‐based manufacturing capacity in response to bottlenecks in the medical global supply chain. Instead, Trump forced states to fend for themselves, competing against each other and the federal government in cutthroat global markets for protective gear with inflated prices and uneven distribution. After weeks of hesitation, the administration deployed the DPA to replenish gaps in supply of masks, gowns and face shields to protect healthcare workers. However, the administration did not wield the tool effectively. Despite soaring demand, use of the DPA was sporadic, with most of the $1 billion allocated under the CARES Act for purchases of medical equipment shifted to the defence department for shipbuilding and space surveillance. A devastating policy choice was to allow American PPE producers to scale up as they saw fit, which would happen too late to contain the health crisis.

Above all, the federal government's inability to engage small and medium manufacturers in the production of critical supplies further deepened and prolonged impacts of the pandemic. Across the history of industrial development, nations take decades to build and develop manufacturing capacity, especially in research‐intensive products such as medical equipment and pharmaceutical drugs. Compared to medical equipment and drug treatment, it is easier to develop manufacturing capacity to produce PPE. However, since there were few domestic manufacturers making PPE, American manufacturers required the right set of incentives and pressures to mass produce them in a short period of time. With the pandemic raging across three major waves, America faced significant pressure, but local manufacturers lacked incentives, regulatory know‐how and supply relationships to penetrate decades‐old government's supply chain network (Jacobs, 2021). It is the very context where free‐market economy principles do not work, and highlights the essential role of government to coordinate production, procurement and distribution.

Finally, the Covid‐19 pandemic has brought the fragility of global supply chains into sharp focus, exposing American dependence on the interconnected global supply chains. This research's conceptual, analytical and empirical analyses offer nuanced support for government interventions to redesign and strengthen domestic supply chains in the long term. The U.S. government needs to focus on the specific requirements to boost domestic manufacturing capacity, such as the constraints that American small and medium manufacturers will face to restore production. Partnership between companies and educational institutions should be fostered to identify skill gaps and design job training programmes specifically for the manufacturers' needs. For small businesses should be supported through more intensive, publicly supported R&D institutions, thereby giving them a greater role in the nation's manufacturing base. Revitalising America's domestic manufacturing capability is key to reducing vulnerability in disruptive times. It helps boost the productive power of the nation, strengthen resiliency and prepare the nation for future crises. Most importantly, cultivating stronger relationships between businesses in the domestic supply chain will have profound positive impacts on jobs creation, equality in income and opportunities, social inclusion and community development across America.

ACKNOWLEDGEMENTS

None.

Ngo, C. N. , & Dang, H. (2022). Covid‐19 in America: Global supply chain reconsidered. The World Economy, 00, 00–00. 10.1111/twec.13317

Footnotes

An investigation by The Guardian suggests that more than 3600 U.S. healthcare workers died of Covid‐19 in the first year of the pandemic, a majority of expressed worry about inadequate personal protective equipment (“Lost on The Frontline,” 2021).

Inomata (2017), however, suggests that the declining relative wage does not necessarily make unskilled workers worse off, as the increased supply of goods brought about by finer division of labor may lower goods prices in both countries through GVC participation, perhaps offsetting the nominal wage reduction.

Outside of the OWS, the federal government only gave funding to two pharmaceutical companies, one during the first wave, Phlow Corporation, and one during the second wave, Eastman Kodak.

Public health industrial base is defined as the facilities and associated workforces within the U.S., including research and development facilities, which help produce essential medicines, medical countermeasures and critical inputs for the healthcare and public health sector (The Bureau of Industry and Security, 2020).

Defence industrial base is defined as the industrial complex that enables research and development, as well as design, production, delivery and maintenance of military weapons systems, subsystems and components or parts, to meet U.S. military requirements (Cybersecurity & Infrastructure Security Agency, 2020).

DATA AVAILABILITY STATEMENT

None.

REFERENCES

- Almasy, S. , Maxouris, C. , & Chavez, N. (2020, April 29). CNN . https://edition.cnn.com/2020/04/28/health/us‐coronavirus‐tuesday/index.html

- Alter, C. (2020, March 24). “It's mass confusion.” Small manufacturers look for leadership as they make medical supplies to fight coronavirus. Time. https://time.com/5808500/small‐manufacturers‐coronavirus/

- American Society for Microbiology . (2021, January 19). Supply shortages impacting COVID‐19 and non‐COVID testing . https://asm.org/Articles/2020/September/Clinical‐Microbiology‐Supply‐Shortage‐Collecti‐1

- Armour, S. (2020, September 2). COVID‐19 ventilator orders canceled by trump administration. Wall Street Journal. https://www.wsj.com/articles/COVID‐19‐ventilator‐orders‐canceled‐by‐trump‐administration‐11599075158 [Google Scholar]

- Armour, S. , Mckay, B. , & Pulliam, S. (2020, December 9). U.S. supplies of COVID‐19 PPE fall short of targets. The Wall Street Journal. https://www.wsj.com/articles/u‐s‐supplies‐of‐COVID‐19‐ppe‐fall‐short‐of‐targets‐11607509800 [Google Scholar]

- Bacon, J. , Aspegren, E. , & Hauck, G. (2020, December 8). Coronavirus updates: Joe Biden pledges to deliver 100M doses in 100 days; U.S. reaches 15M infections; Ohio‐state Michigan football game off. USA Today. https://www.usatoday.com/story/news/health/2020/12/08/COVID‐news‐britain‐vaccine‐wyoming‐california‐donald‐trump/6481339002/

- Baldwin, R . (2012). Global supply chains: Why they emerged, why they matter, and where they are going . CEPR Discussion Papers 9103, C.E.P.R. Discussion Papers. https://ideas.repec.org/p/cpr/ceprdp/9103.html

- Basen, R. (2020, December 10). HHS says nation equipped to weather COVID surge. Medpage Today. https://www.medpagetoday.com/infectiousdisease/COVID‐19/90139

- Bernard, A. B. , Jensen, J. B. , Redding, S. J. , & Schott, P. K. (2018). Global firms. Journal of Economic Literature, 56(2), 565–619. [Google Scholar]

- Bosman, J. , & Mervosh, S. (2020, June 25). As virus surges, younger people account for ‘disturbing’ number of cases. New York Times. https://www.nytimes.com/2020/06/25/us/coronavirus‐cases‐young‐people.html

- Bown, C. P. , & Bollyky, T. J. (2021). How COVID‐19 vaccine supply chains emerged in the midst of a pandemic. The World Economy. 10.1111/twec.13183 [DOI] [PMC free article] [PubMed] [Google Scholar]

- Brown, C. P. (2020, March 26). COVID‐19: China's exports of medical supplies provide a ray of hope. Peterson Institute for International Economics. https://www.piie.com/blogs/trade‐and‐investment‐policy‐watch/COVID‐19‐chinas‐exports‐medical‐supplies‐provide‐ray‐hope [Google Scholar]

- Bureau of Industry and Security . (2020, February 2). Notice of request for public comments on condition of the public health industrial base and recommend policies and actions to strengthen the public health industrial base to ensure essential medicines, medical countermeasures, and critical inputs are made in the United States. Federal Register. https://www.govinfo.gov/content/pkg/FR‐2020‐12‐02/pdf/2020‐26609.pdf

- Campa, J. , & Goldberg L. (1997). The evolving external orientation of manufacturing industries: Evidence from four countries . NBER Working Paper No. 5919. https://www.nber.org/papers/w5919

- Cathey, L. , & Arnholz, J. (2020, March 19). Trump signed the Defense Production Act 'in case we need it.' But what is it? ABC News. https://abcnews.go.com/Politics/trump‐signed‐defense‐production‐act‐case/story?id=69670828

- Centers for Disease Control and Prevention (CDC) . (2020, January 21). First travel‐related case of 2019 novel coronavirus detected in United States . https://www.cdc.gov/media/releases/2020/p0121‐novel‐coronavirus‐travel‐case.html

- Centers for Disease Control and Prevention (CDC) . (2021a). COVID data tracker . https://covid.cdc.gov/covid‐data‐tracker/#datatracker‐home

- Centers for Disease Control and Prevention (CDC) . (2021b, January 22). Emergence of SARS‐CoV‐2 B.1.1.7 Lineage—United States, December 29, 2020–January 12, 2021 . https://www.cdc.gov/mmwr/volumes/70/wr/mm7003e2.htm?s_cid=mm7003e2_w [DOI] [PMC free article] [PubMed]

- Chappell, B. (2020, June 10). U.S. hits 2 million coronavirus cases as many states see a surge of patients. NPR. https://www.npr.org/sections/coronavirus‐live‐updates/2020/06/10/873473805/u‐s‐hits‐2‐million‐coronavirus‐cases‐as‐many‐states‐see‐a‐surge‐of‐patients

- Chen, H. , Kondratowicz, M. , & Yi, K.‐M. (2005). Vertical specialization and three facts about U.S. international trade. The North American Journal of Economics and Finance, 16, 35–59. 10.1016/j.najef.2004.12.004 [DOI] [Google Scholar]

- Chow, D. (2021, April 7). U.K. coronavirus variant is now the dominant strain in the U.S., CDC says. NBC News. https://www.nbcnews.com/science/science‐news/uk‐coronavirus‐variant‐now‐dominant‐strain‐us‐rcna606

- Congressional Research Service . (2020, December 7). COVID‐19 and domestic PPE production and distribution: Issues and policy options. Congressional Research Service. https://crsreports.congress.gov/product/pdf/R/R46628 [Google Scholar]

- Conklin, A. (2020, April 7). Why is there still a coronavirus test kit shortage in the U.S.? Fox Business. https://www.foxbusiness.com/lifestyle/coronavirus‐test‐kit‐shortage

- Contrera, J. (2020, September 21). The N95 shortage America can't seem to fix. The Washington Post. https://www.washingtonpost.com/graphics/2020/local/news/n‐95‐shortage‐covid/

- COVID Tracking Project . (2021, January 8). The most reliable pandemic number keeps getting worse. The Atlantic. https://www.theatlantic.com/health/archive/2021/01/pandemic‐cases‐hospitalizations‐record‐south/617589/

- Cybersecurity & Infrastructure Security Agency . (2020). Defense industrial base sector. Cybersecurity and Infrastructure Security Agency. https://www.cisa.gov/defense‐industrial‐base‐sector#:~:text=The%20Defense%20Industrial%20Base%20Sector,to%20meet%20U.S.%20military%20requirements [Google Scholar]

- De Vries, G. J. , Chen, Q. , Hasan, R. , & Li, Z. (2016). Skills and activity upgrading in global value chains: Trends and drivers for Asia . Asian Development Bank Economics Working Paper Series (No. 496). https://www.adb.org/sites/default/files/publication/190439/ewp‐496.pdf

- Evans, M. (2020, December 3). COVID‐19 Hospitalizations, single‐day deaths hit new U.S. highs. Wall Street Journal. https://www.wsj.com/articles/as‐COVID‐19‐patients‐stretch‐hospitals‐some‐doctors‐ration‐intensive‐care‐11607022592 [Google Scholar]

- Evenett, S. , Fiorini, M. , Fritz, J. , Hoekman, B. , Lukaszuk, P. , Rocha, N. , Ruta, M. , Santi, F. , & Shingal, A. (2021). Trade policy responses to the COVID‐19 pandemic crisis: Evidence from a new data set. The World Economy, 45, 342–364. 10.1111/twec.13119 [DOI] [PMC free article] [PubMed] [Google Scholar]

- Feenstra, R. C. , & Hanson, G. H. (1996). Foreign investment, outsourcing, and relative wages (Working Paper No. 5121). National Bureau of Economic Research. https://www.nber.org/system/files/working_papers/w5121/w5121.pdf [Google Scholar]

- Feuer, W. (2020, December 30). CDC says new COVID strain in U.S. could further stress ‘already heavily burdened’ hospitals. CNBC. https://www.cnbc.com/2020/12/30/cdc‐says‐new‐COVID‐strain‐in‐us‐could‐stress‐heavily‐burdened‐hospitals.html

- Forde, M. (2020, April 1). How the CARES Act will affect supply chains. Supply Chain Dive. https://www.supplychaindive.com/news/coronavirus‐cares‐act‐supply‐chains/575262/

- FTI Consulting . (2020, March 31). COVID‐19: Impact on global pharmaceutical and medical product supply chain constrains U.S. production . https://www.fticonsulting.com/~/media/Files/us‐files/insights/articles/2020/mar/COVID‐19‐impact‐global‐pharmaceutical‐medical‐product‐supply‐chain

- Gereffi, G. (2014). Global value chains in a post‐Washington consensus world. Review of International Political Economy, 21(1), 9–37. 10.1080/09692290.2012.756414 [DOI] [Google Scholar]

- Get Us PPE . (2020, September 2). Get Us PPE's new shortage index confirms ongoing national PPE crisis . https://getusppe.org/get‐us‐ppes‐new‐shortage‐index‐confirms‐ongoing‐national‐ppe‐crisis/

- Glenza, J. (2020, November 19). U.S. hospitals face influx of patients and staffing shortages amid worsening pandemic. The Guardian. https://www.theguardian.com/world/2020/nov/19/us‐hospitals‐coronavirus‐latest‐spike‐staffing‐shortages‐patients

- Hallward‐Driemeier, M. , & Nayyar, G. (2017). Trouble in the making?: The future of manufacturing‐led development. World Bank. [Google Scholar]

- Helpman, E. , & Krugman, P. (1985). Market structure and foreign trade. MIT Press. [Google Scholar]

- Henderson, J. , Dicken, P. , Hess, M. , Coe, N. , & Yeung, H. W. C. (2002). Global production networks and the analysis of economic development. Review of International Political Economy, 9(3), 436–464. 10.1080/09692290210150842 [DOI] [Google Scholar]

- Higgins‐Dunn, N. (2020, August 14). The U.S. has already invested billions in potential coronavirus vaccines. Here's where the deals stand. CNBC. https://www.cnbc.com/2020/08/14/the‐us‐has‐already‐invested‐billions‐on‐potential‐coronavirus‐vaccines‐heres‐where‐the‐deals‐stand.html

- Hillberry, R. (2011). Causes of international production fragmentation: Some evidence. In Sydor A. (Ed.), Global value chains: Impacts and implications (pp. 77–101). Minister of Public Works and Government Services Canada. [Google Scholar]

- Hollweg, C. H. (2019). Global value chains and employment in developing economies. In WTO et al., Global Value Chain Development Report 2019 (pp. 63–82).

- House Committee on Oversight and Reform . (2020, April 8). New document shows inadequate distribution of personal protective equipment and critical medical supplies to states . https://oversight.house.gov/news/press‐releases/new‐document‐shows‐inadequate‐distribution‐of‐personal‐protective‐equipment‐and

- Hummels, D. (2007). Transportation costs and international trade in the second era of globalization. Journal of Economic Perspectives, 21, 131–154. 10.1257/jep.21.3.131 [DOI] [Google Scholar]

- Hummels, D. , Ishii, J. , & Yi, K. M. (2001). The nature and growth of vertical specialization in world trade. Journal of International Economics, 54, 75–96. 10.1016/S0022-1996(00)00093-3 [DOI] [Google Scholar]

- Inomata, S. (2017). Analytical frameworks for global value chains: An overview. In WTO et al., Global Value Chain Development Report 2017 (pp. 15–35).

- Jacobs, A. (2020a, December 20). Health care workers still face daunting shortages of masks and other P.P.E. New York Times. https://www.nytimes.com/2020/12/20/health/COVID‐ppe‐shortages.html

- Jacobs, A. (2020b, November 22). Now the U.S. has lots of ventilators, but too few specialists to operate them. New York Times. https://www.nytimes.com/2020/11/22/health/Covid‐ventilators‐stockpile.html

- Jacobs, A. (2020c, September 22). Despite claims, trump rarely uses wartime law in battle against Covid. New York Times. https://www.nytimes.com/2020/09/22/health/Covid‐Trump‐Defense‐Production‐Act.html

- Jacobs, A. (2021, February 10). Can't find an N95 mask? This company has 30 million that it can't sell. New York Times. https://www.nytimes.com/2021/02/10/health/covid‐masks‐china‐united‐states.html?referringSource=articleShare

- Johnson, M. (2020, October 14). The U.S. was the world's best prepared nation to confront a pandemic. How did it spiral to 'almost inconceivable' failure? Milwaukee Journal Sentinel. https://www.jsonline.com/in‐depth/news/2020/10/14/america‐had‐worlds‐best‐pandemic‐response‐plan‐playbook‐why‐did‐fail‐coronavirus‐COVID‐19‐timeline/3587922001/ [Google Scholar]

- Jones, R. , & Kierzkowski, H. (1990). The role of services in production and international trade: A theoretical framework. In Jones R. & Kruger A. (Eds.), The political economy of international trade (pp. 31–48). Blackewell. 10.1142/9789813200678_0014 [DOI] [Google Scholar]

- Joyce, D. (2020, July 8). Our frightening reliance on China must come to an end. Crain's Cleveland Business. https://www.crainscleveland.com/guest‐blogger/our‐frightening‐reliance‐china‐must‐come‐end

- Kanno‐Youngs, Z , & Swanson, A . (2020, April 1). Wartime production law has been used routinely, but not with coronavirus. Chicago Tribune. https://www.chicagotribune.com/coronavirus/sns‐nyt‐defense‐production‐act‐coronavirus‐20200401‐f7l26ongn5dh5pppkvgtomr5ma‐story.html

- Kavi, A. (2020, July 22). Virus surge brings calls for Trump to invoke Defense Production Act. New York Times. https://www.nytimes.com/2020/07/22/us/politics/coronavirus‐defense‐production‐act.html

- Krugman, P. (1979). Increasing returns, monopolistic competition, and international trade. Journal of International Economics, 9, 469–479. 10.1016/0022-1996(79)90017-5 [DOI] [Google Scholar]

- Krugman, P. (1980). Scale economies, product differentiation, and the pattern of trade. American Economic Review, 70(5), 950–959. [Google Scholar]

- Krugman, P. (2008). Trade and geography: Economies of scale, differentiated products and transport costs. The Royal Swedish Academy of Sciences. https://www.nobelprize.org/uploads/2018/06/advanced‐economicsciences2008.pdf [Google Scholar]

- Lopez, G. (2020a, June 27). The U.S.’s new surge in coronavirus cases, explained. Vox. https://www.vox.com/2020/6/27/21302495/coronavirus‐pandemic‐second‐wave‐us‐america

- Lopez, G. (2020b, November 9). America's third COVID‐19 surge, explained. Vox. https://www.vox.com/21523039/COVID‐coronavirus‐third‐wave‐fall‐winter‐surge

- Lopez, G. (2020c, September 14). Why COVID‐19 case numbers are falling in the US. Vox. https://www.vox.com/future‐perfect/2020/9/14/21432199/coronavirus‐COVID‐19‐decline‐statistics‐chart

- Lovelace, B. (2021, April 7). CDC says variant from the U.K. is now the most common strain circulating in the U.S. CNBC. https://www.cnbc.com/2021/04/07/cdc‐says‐variant‐from‐the‐uk‐is‐now‐the‐most‐common‐strain‐circulating‐in‐the‐us.html

- Mervosh, S. , & Fernandez, M. (2020, July 6). Months into virus crisis, U.S. cities still lack testing capacity. New York Times. https://www.nytimes.com/2020/07/06/us/coronavirus‐test‐shortage.html

- Montague, Z. (2020, December 22). The second stimulus package: Here's what's included. New York Times. https://www.nytimes.com/2020/12/22/us/politics/second‐stimulus‐whats‐included.html

- Moore, M. (2020, March 24). Coronavirus crisis: Trump confirms he's sending 400 ventilators to NYC. New York Post. https://nypost.com/2020/03/24/coronavirus‐crisis‐trump‐confirms‐hes‐sending‐400‐ventilators‐to‐nyc/

- Mulvihill, G. (2020, April 10). U.S. states share, get creative in hunt for medical supplies. Ap News. https://apnews.com/article/nd‐state‐wire‐wa‐state‐wire‐ar‐state‐wire‐ia‐state‐wire‐virus‐outbreak‐bba8c890271ed9651d7682e81ce2c5e4

- Orefice, G. , & Rocha, N. (2014). Deep integration and production networks: An empirical analysis. The World Economy, 37, 106–136. 10.2139/ssrn.1904845 [DOI] [Google Scholar]

- Phillips, A. M. , Wilber, D. Q. , & Zou, J. J. (2020, April 10). States do battle for coronavirus protective gear in a market driven by chaos and fear. Los Angeles Times. https://www.latimes.com/politics/story/2020‐04‐10/states‐battle‐coronavirus‐protective‐gear‐market

- Rodrik, D . (2018). New technologies, global value chains, and developing economies (NBER Working Paper No. 25164). National Bureau of Economic Research. https://www.nber.org/papers/w25164 [Google Scholar]

- Rose, J. (2020, September 16). NPR probes why personal protective equipment is still in short supply. NPR. https://www.npr.org/2020/09/16/913448230/npr‐investigates‐why‐the‐shortages‐of‐personal‐protective‐equipment

- Salvatore, D. (2019). Overview of technology, productivity, trade, growth, and jobs in the United States and the world. Journal of Policy Modeling, 41(3), 435–443. 10.1016/j.jpolmod.2019.03.012 [DOI] [Google Scholar]

- Schondelmeyer, S. , Seifert, J. , Margraf, D. J. , Mueller, M. , Williamson, I. , Dickson, C. , Dasararaju, D. , Caschetta, C. , Senne, N. , & Osterholm, M. T. (2020). Ensuring a resilient US prescription drug supply. COVID‐19: The CIDRAP Viewpoint. https://www.cidrap.umn.edu/sites/default/files/public/downloads/cidrap‐covid19‐viewpoint‐part6.pdf

- Seth, S. (2017, January 20). United States imports only 25% of its drugs. Investopedia. https://www.investopedia.com/news/united‐states‐imports‐only‐25‐its‐drugs/

- Snell, K. (2020, March 26). What's inside the Senate's $2 crillion coronavirus aid package. NPR. https://www.npr.org/2020/03/26/821457551/whats‐inside‐the‐senate‐s‐2‐trillion‐coronavirus‐aid‐package

- Spence, M. (2011). The impact of globalization on income and employment: The downside of integrating markets. Foreign Affairs, 90(4), 28–41. [Google Scholar]

- Stansbury, A. , & Summers, L. H. (2018). Productivity and pay: Is the link broken? (Working Paper No. 18‐5). Peterson Institute for International Economics. 10.2139/ssrn.3192609 [DOI] [Google Scholar]

- Stein, S. , Newkirk, M. , & Baker, D. R. (2020, August 1). Nurses' pleas spur U.S. pledge to tap 44 million‐mask stockpile. Bloomberg. https://www.bloomberg.com/news/articles/2020‐07‐31/nurses‐pleas‐spur‐u‐s‐pledge‐to‐tap‐44‐million‐mask‐stockpile

- Subasat, T. (2003). What does the Heckscher‐Ohlin model contribute to international trade theory? A critical assessment. Review of Radical Political Economics, 35(2), 148–165. 10.1177/0486613403035002003 [DOI] [Google Scholar]

- Taplin, N. , & Grant, C. (2020, March 5). If coronavirus‐stricken China can't export medicine, the world is in trouble. Wall Street Journal. https://www.wsj.com/articles/if‐coronavirus‐stricken‐china‐cant‐export‐medicine‐the‐world‐is‐in‐trouble‐11583372431 [Google Scholar]

- The White House . (2020, August). How president trump uses the Defense Production Act to protect America from the China virus. Office of Trade and Manufacturing Policy. https://www.documentcloud.org/documents/7036228‐OTMP‐DPA‐Report‐FINAL‐8‐13‐20.html [Google Scholar]

- Tita, B. (2016, June 7). How to revitalize U.S. manufacturing. Wall Street Journal. https://www.wsj.com/articles/how‐to‐revitalize‐u‐s‐manufacturing‐1465351501 [Google Scholar]

- U.S. Congress (2020, July 14). U.S. Congress to Hon. Mark T. Esper, Secretary of Defense, and Hon. Alex Azar, Secretary of Health and Human Services, July 14, 2020 [Letter] . https://financialservices.house.gov/uploadedfiles/ltr_to_hhs_and_fema_7142020.pdf

- U.S. Department of Defense (DOD) . (2020a, August 5). DOD awards $104 million for procurement of syringes in support of U.S. COVID‐19 vaccination campaign . https://www.defense.gov/Newsroom/Releases/Release/Article/2302139/dod‐awards‐104‐million‐for‐procurement‐of‐syringes‐in‐support‐of‐us‐covid‐19‐va/

- U.S. Department of Defense (DOD) . (2020b, June 22). DOD, DFC sign memorandum of agreement on Defense Production Act . https://www.defense.gov/Newsroom/Releases/Release/Article/2228045/dod‐dfc‐sign‐memorandum‐of‐agreement‐on‐defense/

- U.S. Department of Defense (DOD) . (2020c, May 12). DOD awards $138 million contract enabling prefilled syringes for future COVID‐19 vaccine . https://www.defense.gov/Newsroom/Releases/Release/Article/2184808/dod‐awards‐138‐million‐contract‐enabling‐prefilled‐syringes‐for‐future‐COVID‐19/

- U.S. Department of Defense (DOD) . (2020d, May 28). DOD announces Defense Production Act Title 3 COVID‐19 PPE project: $2.2 million investment will increase U.S. domestic production of N95 mask respirator and mask ventilator filter production by over 30 million combined over the next 120 days . https://www.defense.gov/Newsroom/Releases/Release/Article/2200654/dod‐announces‐defense‐production‐act‐title‐3‐COVID‐19‐ppe‐project‐22‐million‐in/

- U.S. Department of Health and Human Services (HHS) . (2020a, June 11). Operation warp speed ramps up U.S.‐based manufacturing capacity for vials for COVID‐19 vaccines and treatments. https://www.hhs.gov/about/news/2020/06/11/operation‐warp‐speed‐ramps‐up‐us‐based‐manufacturing‐capacity‐for‐vials‐for‐COVID‐19‐vaccines‐and‐treatments.html

- U.S. Department of Health and Human Services (HHS) . (2020b, May 19). HHS, industry partners wxpand U.S.‐based pharmaceutical manufacturing for COVID‐19 response . https://www.hhs.gov/about/news/2020/05/19/hhs‐industry‐partners‐expand‐us‐based‐pharmaceutical‐manufacturing‐COVID‐19‐response.html

- U.S. Department of Health and Human Services, Office of Inspector General (HHS‐OIG) . (2020, April 6). Hospital experiences responding to the COVID‐19 pandemic: Results of a National Pulse survey, March 23–27, 2020 . https://oig.hhs.gov/oei/reports/oei‐06‐20‐00300.pdf

- U.S. Government Accountability Office (GAO) . (2020a, November 30). COVID‐19: Urgent actions needed to better ensure an effective federal response . https://www.gao.gov/reports/GAO‐21‐191/#top

- U.S. Government Accountability Office (GAO) . (2020b, September 21). COVID‐19: Federal efforts could be strengthened by timely and concerted actions . https://www.gao.gov/reports/GAO‐20‐701/#fnref258

- U.S. International Development Finance Corporation (DFC) . (2020, July 28). DFC to sign letter of interest for investment in Kodak's expansion into pharmaceuticals . https://www.dfc.gov/media/press‐releases/dfc‐sign‐letter‐interest‐investment‐kodaks‐expansion‐pharmaceuticals

- U.S. Senate . (2020, May 6). U.S. Senate to President Donald J. Trump [Letter]. https://www.vanhollen.senate.gov/imo/media/doc/2020%2005%2006%20POTUS%20re%20DPA%20Title%20III%5B1%5D.pdf

- WHO Coronavirus Dashboard . (2022). World Health Organization. https://covid19.who.int/

- Wilson, C. (2020, October 25). The third wave of COVID‐19 in the U.S. is officially worse than the first two. Times. https://time.com/5903673/record‐daily‐coronavirus‐cases/

- World Bank . (2016). World development report 2016: Digital dividends. World Bank Publications. https://www.worldbank.org/en/publication/wdr2016 [Google Scholar]

- World Bank . (2020). World development report 2020: Trading for development in the age of global value chains. World Bank Publications. https://www.worldbank.org/en/publication/wdr2020 [Google Scholar]

- Yi, K. (2003). Can vertical specialization explain the growth of world trade? Journal of Political Economy, 111(1), 52–102. 10.1086/344805 [DOI] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Data Availability Statement

None.