Abstract

The world is facing the problem of resource scarcity and environmental degradation. Improving energy efficiency is an effective way to reduce energy consumption and reduce pollutant emissions. Based on relevant data from 30 Chinese provinces from 2011 to 2019, this paper constructs energy efficiency indicators by establishing a super-efficient three-stage SBM-DEA model. It explores the impact of digital finance on energy efficiency using a systematic generalized moment estimation method and constructs an analytical framework for the impact of digital inclusive finance on energy efficiency from the breadth of coverage, depth of use, and degree of digitization of digital inclusive finance. In addition, this paper examines the differences in the impact of digital inclusive finance on energy efficiency from a sub-regional perspective. Research indicates the following: (1) At the national level, the relationship between digital inclusive finance development and energy efficiency in China shows an inverted “U”-shape; the breadth of digital financial coverage, the use of digital insurance services and digital credit services, and the degree of digitalization of digital finance all have significant effects on energy efficiency. (2) From a regional perspective, the impact of digital inclusive finance on energy efficiency has regional heterogeneity. Based on this finding, first, the government should speed up the construction of digital financial infrastructure to promote the further development of digital finance. Second, the government should take appropriate measures to regulate industry giants. Third, the government should adjust measures to local conditions when formulating policies. The above research has certain implications for improving the targeting of digital finance–related policies and promoting the high-quality development of China’s economy.

Keywords: Digital finance, Energy efficiency, Super-efficient three-stage SBM-DEA, Systematic generalized moment estimation method

Introduction

Improving energy utilization efficiency is an effective way to solve the problems of the global resource shortage and deteriorating living environment at the source (Dahir and Mahi 2022). The spread of the new coronavirus has further alerted people to change the traditional crude energy consumption and improve the efficiency of energy use (Chang et al. 2022). Since the reform and opening up, China’s economy has shown a sustained and rapid growth trend. However, behind the “miracle of economic growth” are the cost of environmental damage and a waste of resources (Zhang et al. 2020a, b). The Fifth Plenary Session of the 19th Central Committee of the Communist Party of China clearly proposed to “comprehensively improve the efficiency of resource utilization”. Digital finance is a combination of digital technologies such as information, big data, cloud computing, and financial innovation. It not only expands the coverage of financial services, allowing more related companies to enjoy financial services, but also has lower time and money costs than traditional financial services. It eases the financing constraints of innovative enterprises and green enterprises (Zhong 2022; Liu et al. 2022a, b, c). In order to be more competitive in the market, enterprises will expand their R&D investment to identify more efficient production methods and management methods thereby increasing energy efficiency. At the same time, digital finance can use computer technologies such as big data to alleviate the phenomenon of information asymmetry in the market, improve the efficiency of market capital allocation, and improve energy utilization efficiency. In addition, various digital financial products in the digital financial market, such as digital credit and digital insurance, can greatly reduce the operational risks borne by technology-based companies and green companies. This is conducive to the stable development of technology-based enterprises and green enterprises, and subsequently, through technological innovation and green innovation, to the improvement of energy efficiency (Liu et al. 2022a, b, c). However, when the development of digital finance is too high, while enjoying the convenience brought by digital financial services, it brings more complex and costly risks than traditional finance, and innovative and green enterprises may suffer capital losses and face more difficult R&D capital constraints, thus hindering the improvement of energy efficiency. The existence of network externalities accelerates the monopoly of the digital finance industry, which directly or indirectly hinders the improvement of energy efficiency by mismatching resources, suppressing innovation, and nurturing corruption. As a new proposition under the global sustainable development goals, it is particularly important to explore how digital finance affects energy efficiency.

Existing literature studies a large number of factors affecting energy efficiency, such as technological progress, industrial structure, energy price systems, energy consumption (Fisher et al. 2006; Richard and Adam 1999; Birol and Keppler 2000; Chen and Hu 2007). However, there is little literature examining its impact on energy efficiency from the perspective of digital finance.

How digital finance affects energy efficiency and through what mechanisms, as well as how the degree of impact varies across regions, are topics that are not well understood. In order to explore these issues, this paper constructs a systematic GMM model to study the general indicators of digital finance, the coverage of digital financial inclusion, the depth of use, and the correlation and transmission mechanism between the degree of digitalization and energy efficiency and further explores how the impact of digital finance on energy efficiency differs across regions. The results show that the relationship between the development of digital financial inclusion and energy efficiency in China presents an inverted “U” shape. The breadth of digital finance coverage, the use of digital insurance services and digital credit services, and the degree of digitization of digital finance all have a significant impact on energy efficiency. Furthermore, the impact of digital financial inclusion on energy efficiency is regionally heterogeneous. The promotion effect of digital finance on energy efficiency is least in the eastern region, and the promotion effect of digital finance on energy efficiency in the central region is the largest.

The contributions of this paper are as follows: First, the previous literature lacks the use of the super-efficiency three-stage SBM-DEA model to construct energy efficiency indicators. In this paper, the investigation of energy efficiency is more systematic and in-depth. It enriches and improves the definition, measurement, and theoretical research system of energy efficiency. Second, this paper uses a systematic GMM model to explore the impact mechanism of digital financial inclusion development, digital financial inclusion coverage, digital insurance, digital credit services, and digitalization degree on energy efficiency. It confirms the rationality and feasibility of improving energy efficiency by influencing digital finance. Thirdly, the impact of digital finance on energy efficiency is discussed at the sub-regional level. It will help the local government to adapt to local conditions and take more efficient measures to promote energy efficiency. In-depth research on the above issues can help clarify the specific mechanism of the impact of digital finance on energy efficiency. The fourth point is to test the robustness by replacing the model, the explained variable, and the control variable, thus making the research conclusions more reliable. Fifth, this paper enriches the theory that digital financial inclusion promotes sustainable development. It improves the targeting of digital financial support policies and provides a theoretical basis for policymakers to formulate sustainable development strategies. It is an important cornerstone for high-quality economic development.

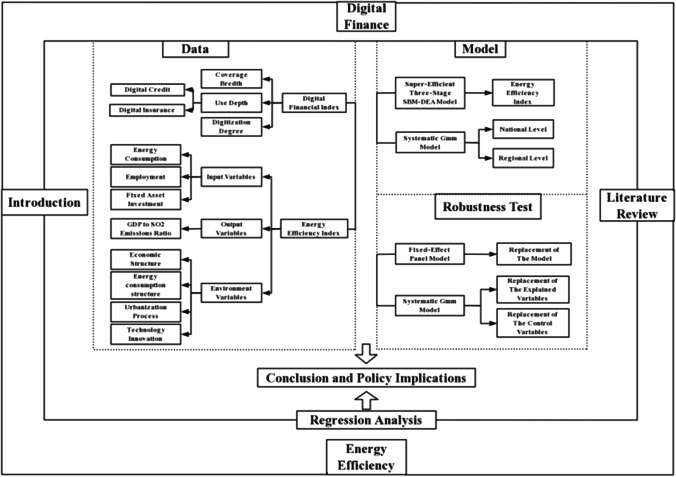

The following is organized as follows: “Literature review and research hypothesis” describes the existing relevant literature and research hypotheses. “Variable selection, model construction, and data sources” explains the data sources, variable definitions, and empirical models. “Empirical analysis and discussion” is the benchmark empirical results and their analysis. “Results of systematic GMM estimation of national energy efficiency impact factors” is the heterogeneity analysis. “Robustness test” is the robustness test. “Conclusion and policy implication” is the research conclusion. Figure 1 shows the research framework.

Fig. 1.

Research framework

Literature review and research hypothesis

Energy efficiency is defined as having less energy input for the same output (Patterson, 1996). In recent years, the focus of research on energy efficiency has been on the measurement of energy efficiency indicators and the factors influencing energy efficiency. For the measurement of energy efficiency indicators, Patterson (1996) expressed energy efficiency through the ratio of energy inputs to energy outputs. Although this method is easy to apply, it has been criticized because the input factors are too singular. Hu and Wang (2006), based on this method, proposed the incorporation of factors of production, such as capital and labor, into the construction system of energy efficiency indicators, which provides more dimensions and is more comprehensive and is favored by most scholars. In terms of the influencing factors of energy efficiency, Fisher et al. (2006) took large- and medium-sized industrial enterprises in China from 1997 to 1999 as their research objects and concluded that technological progress can reduce energy consumption and thus improve energy efficiency. Richard and Adam (1999) argued that in the process of industrial upgrading, factors of production will flow from inefficient sectors and inefficient industries to efficient sectors and industries, thus improving energy use efficiency. Birol and Keppler (2000) used economics-related theories to conclude that improvements in the energy price system can reduce energy intensity, reduce energy waste, and increase energy efficiency. Chen and Hu (2007) used cross-country data to conclude that as a country’s conventional energy consumption rises, its energy efficiency decreases.

Existing research on finance and energy efficiency suggests that financial development can contribute to economic growth and industrial restructuring, thereby improving energy efficiency (Greenwood and Jovanovic 1990). Pagano (1993) developed a theoretical framework for economic growth that details how financial development can affect energy efficiency by acting on technological progress through functions such as information generation (Pagano 1993). King and Levine (1993) shctimal productive sector and effectively diversify the risks associated with this process, thereby increasing the likelihood of innovation and promoting energy efficiency.

Digital finance, as a product of the deep integration of digital technology and financial services, includes both relevant financial services provided by emerging internet enterprises and traditional financial services transformed by digitalization, lowering the threshold of financial services, improving the efficiency of financial services, and further influencing energy use efficiency on the basis of traditional financial models (Beck et al. 2018). The theory of sustainable development holds that contemporary human beings cannot harm the living conditions of future generations while meeting their survival needs. Digital finance transfers offline financial services and transactions to online. The waste of resources is reduced, the pollution to the environment is reduced, and the efficiency of energy utilization is improved. The moral hazard and adverse selection problems caused by information asymmetry will seriously hinder the optimal allocation of funds and reduce the efficiency of energy utilization. From the perspective of the customer, digital finance provides a platform for network information sharing, encouraging technology companies and green R&D institutions to actively disclose their own information (Rao et al. 2022). This not only reduces the lending risk of financial institutions due to information asymmetry, but helps individuals and institutions with investment willingness to identify investment opportunities, so that small technology innovation enterprises can have the opportunity to enjoy the corresponding financial services. It has promoted the development of small technology enterprises, the adjustment of industrial structure, and the rational allocation of factors such as knowledge, labor, and capital, and improved energy efficiency (Kambara 1992; Zhou et al. 2020; Wang and Liu 2020).

However, blindly improving the development level of digital finance cannot always promote the improvement of energy efficiency. The digital financial platform promotes the rapid growth of various businesses through the integrated innovation and associated growth mechanism of financial and non-financial businesses. It reduces the switching cost for consumers and merchants among various businesses and improves user stickiness. Both sides of the transaction depend on the payment platform, forming an all-encompassing digital financial platform (Armstrong 2006). The existence of cross-network externalities enables digital financial platforms to both charge higher fees to merchant and adopt low fees, no fees, or even subsidies to consumer to attract more users to participate. This has led to the Matthew Effect in the digital financial industry. The development trend of “winner takes all” of strong digital financial platforms has strengthened the monopoly of the industry, showing an oligopolistic market pattern (Katz and Shapiro 1992). Monopoly will lead to higher industry barriers and suppress the entrepreneurial enthusiasm of latecomers. Furthermore, due to the decline in competitiveness, the consequent slow or even stagnant technological development leads to a reduction in energy efficiency (Feldman et al. 2021). According to the financial exclusion theory, even digital finance can solve the problems of opportunity exclusion, condition exclusion, price exclusion, and market exclusion to a certain extent. However, the problem of self-exclusion is something digital finance cannot solve. Digital finance can enable small and microenterprises to enjoy financial services that cannot be enjoyed under the traditional financial model, but the rich variety of financial products and services also puts forward higher financial awareness and financial literacy requirements for financial consumers. Financial consumers must be capable of correctly choosing products and services that suit them and their needs. This undoubtedly increases the cost of participation for financial consumers to learn and master financial instruments. Moreover, it is easy to buy financial products that they do not need, which brings unnecessary waste of funds to small innovative enterprises, which will hinder the improvement of energy efficiency (Zhang et al. 2020a, b). Even with the rapid development of digital finance, and even if the technology advances rapidly, energy efficiency will not be improved. Technological progress will have a “rebound effect” on energy consumption. Technological progress can lead to a decrease in real energy prices and an increase in real income levels, both of which lead to an increase in energy demand and thus a decrease in energy efficiency (Hanley et al. 2009). Therefore, this paper proposes hypothesis 1:

H1: There is a nonlinear relationship between digital finance and energy efficiency.

Herein, the micro-mechanism of digital finance affecting energy efficiency and how it affects energy efficiency are discussed. From the perspective of coverage breadth, digital finance overcomes the limitations of space and distance of traditional financial institutions and services and expands the coverage of the financial system. It enables groups in remote locations or with insufficient infrastructure to enjoy financial services, alleviating the problem of “opportunity exclusion.” It further promotes technological innovation and industrial upgrading and improves energy efficiency (Collard, 2001). Digital finance has subverted the traditional “28 rule.” According to the long tail theory, the digital financial industry attaches great importance to the long tail group, providing financial services for small science and technology innovation enterprises that find it difficult to obtain corresponding services under the traditional financial model and to solving the financing constraints encountered in the R&D process to create a relaxed financing environment (Aghion and Hauswald 2008). The loose financing environment will help enterprises to transfer funds and resources to R&D departments, increase R&D expenditure, and promote technological innovation to improve energy efficiency. Therefore, hypothesis 2 is proposed.

H2: The breadth of digital financial inclusion can affect energy efficiency.

Herein, digital financial inclusion is discussed from the perspective of using the depth dimension, according to Levine’s (1999) analysis theory of the five major functions of finance. The depth dimension of the use of digital finance can affect energy efficiency by exerting the function of resource allocation and risk diversification. Digital financial products and services can manage the aggregation, transaction, and transfer of risks and reconfigure social risks. It enables high-risk but high-benefit scientific and technological innovation projects to obtain corresponding financial support, promote technological innovation, promote the development of high-tech industries, and improve energy efficiency (Le et al. 2020). As a combination of financial services and credit services on digital platforms, digital credit services can more accurately understand financial customer information than previous credit service models and have more accurate digital portraits and credit ratings for financial customers (Gomber et al. 2017). To a certain extent, the phenomenon of “not changing the loan” and “not being able to borrow,” caused by factors such as information asymmetry and moral hazard between traditional financial institutions and financial customers, has been reduced. It promotes the increase of loan amount and quantity, eases financing constraints, and enables enterprises to increase the proportion of R&D investment funds to improve innovation efficiency, promote enterprise transformation, and improve energy efficiency (Beck et al. 2018; Wang and Guo 2022). The rapid development of digital insurance has led to the establishment of new digital insurance institutions. The accessibility of insurance services has been improved, and new micro-insurance products have been provided for small innovative enterprises and green enterprises. This reduces the operational risk of such enterprises, promotes enterprise development and technological progress, and improves energy efficiency (Wang and Guo 2022). Therefore, hypothesis 3 is proposed.

H3: Digital insurance can impact energy efficiency.

Herein, energy efficiency is discussed from the perspective of digitalization. According to the traditional financial model, small, medium, and micro enterprises and other companies and institutions with scarce funds tend to conceal business risks in order to obtain bank credit. At the same time, financial institutions such as banks choose to refuse loans because they are worried that the loaned funds cannot be recovered and the cost of searching for information is high. As a result, innovative enterprises and green enterprises with development prospects cannot obtain financial support and stop their development, resulting in distortion of energy allocation. The theory of the digital economy regards data as one of the factors of production and believes that data should be converted into information to give full play to its intrinsic value. Digital finance realizes accurate judgment of the user credit rating by aggregating and mining massive amounts of transaction data generated by the internet and combining other user behavior characteristics (Gomber et al. 2017), thereby promoting credit transactions between financial institutions and enterprises (Wan et al. 2022). Moreover, due to the development of digital technology, financial transactions and services are more convenient, the cost of financial services and transactions is reduced, and the use of digital finance by users is further promoted. Digitalization can solve the financing problems of enterprises and other users, support technological innovation of enterprises, promote enterprise transformation and industrial upgrading, and then promote the improvement of energy efficiency (Wan et al. 2022; Buchak et al. 2018). Therefore, this paper proposes hypothesis 4 and hypothesis 5.

H4: Digital credit can affect energy efficiency.

H5: The degree of digitization of digital financial inclusion can affect energy efficiency.

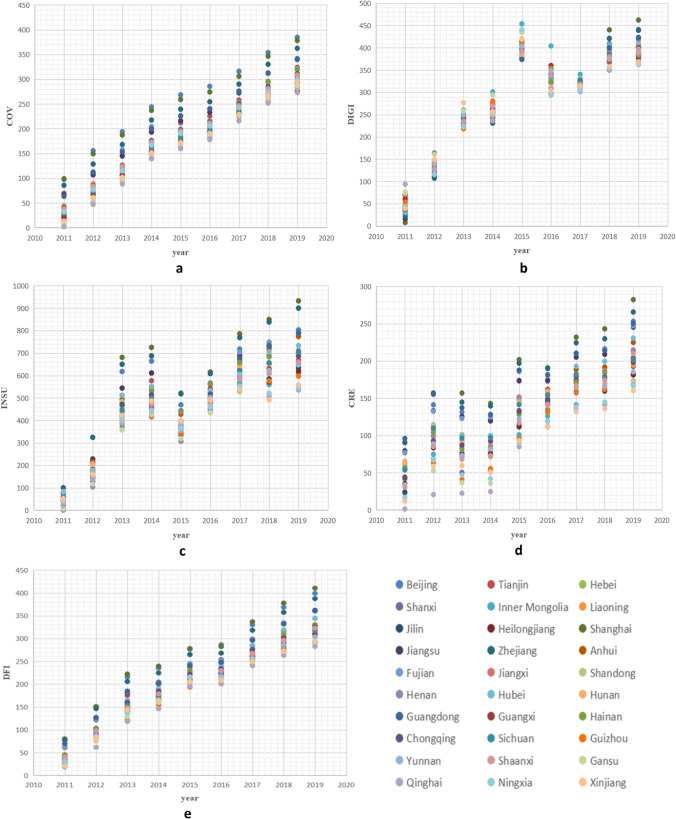

Since the reform and opening up, energy efficiency has been improving with the continuous improvement of China’s financial system and transportation infrastructure. However, due to the vast size and uneven spatial development of China, there are large differences in energy efficiency. Furthermore, there is regional heterogeneity in digital finance coverage, depth of use, and digitalization level dimensions (Ma and Li 2021), as shown in Figs. 2a-e. The overall digital financial inclusion index, digital inclusive financial coverage breadth index, digitalization degree index, digital credit service index, and digital insurance service index are quite different in different provinces. Therefore, the analysis of the impact of digital finance on energy efficiency from different regional scopes may yield different results. Therefore, hypothesis 6 is proposed in this paper.

Fig. 2.

a Coverage of digital finance in 30 provinces. b Digitization level of digital finance in 30 provinces in China from 2011 to 2019 provinces in China from 2011 to 2019. c Digital financial insurance in 30 provinces. d Digital financial credit in 30 provinces in China from 2011 to 2019. e Digital finance index of China’s 30 provinces from 2011 to 2019

H6: The impact of digital inclusive finance on energy efficiency is regionally heterogeneous.

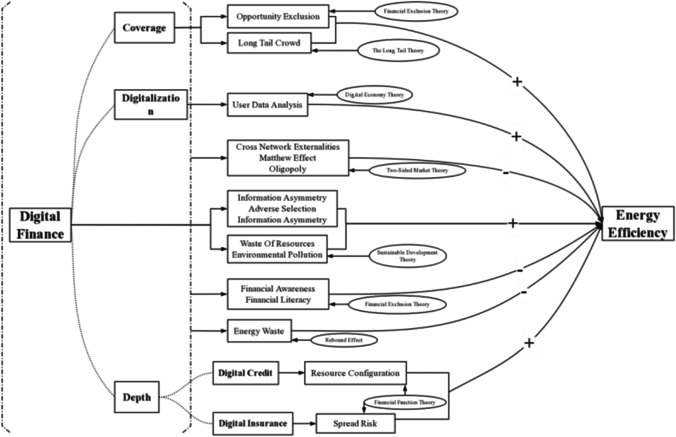

The above literature provides the theoretical basis for this paper to study the impact of digital finance on energy efficiency. However, there are some deficiencies in the related literature. There is little literature that discusses the impact on energy efficiency from the perspective of digital finance and deeply examines the transmission mechanism of digital finance on energy efficiency. Whether digital finance, as a new financial service method combining the internet and finance, can promote the transformation of the traditional “high energy consumption” extensive economic development mode is not yet known. Whether it can solve the problem of energy development and utilization, improve energy efficiency, and achieve high-quality economic development remains to be discussed in depth. To this end, this paper uses the super-efficiency three-stage SBM-DEA to measure energy efficiency. Moreover, at a theoretical and empirical level, the mechanism and characteristics of the impact of digital finance on energy efficiency are discussed in depth. Digital finance and energy efficiency transmission mechanism is shown in Fig. 3.

Fig. 3.

Digital finance and energy efficiency transmission mechanism

Variable selection, model construction, and data sources

Variable selection

Explained variables

In this paper, the energy efficiency index is constructed by super-efficient three-stage SBM-DEA.

Data envelopment analysis is widely used in efficiency evaluation (Chames et al. 1978). Compared to other efficiency analysis methods, data envelopment analysis can be used to evaluate similar decision units with multiple inputs. Since traditional DEA models are limited to the same proportional variation of inputs and outputs, the accuracy of the efficiency values of decision units is affected when there is slack in the variables. Tone (2001) proposed the SBM-DEA model, which can solve the problem of slack variables. In addition, Tone (2002) proposed the SE-SBM model to solve the problem that the SBM-DEA model cannot be further evaluated when there are multiple effective decision units. However, the SE-SBM model does not determine whether the efficiency of a decision unit is affected by uncontrollable factors such as external environment and random disturbances, so Fried et al. (2002) proposed a three-stage DEA model. In order to measure energy efficiency more accurately, a three-stage super-efficient SBM-DEA model is constructed in this paper.

- Stage 1: A three-stage super-efficiency SBM model is constructed to measure the input relaxation value and initial energy efficiency value of each decision unit. Since the energy efficiency is expected to be improved by changing the factor inputs, the input-oriented three-stage super-efficiency SBM-DEA model is chosen in this paper, which is modeled as

1

S.t.

| 2 |

where θ is the target efficiency value, and m and s are the number of input and output indicators, respectively. x0 and y0 are the input and output vectors. Xij and Yrj are the input and output matrices of decision units, respectively. xi0 and yr0 are the elements of vectors x0 and y0, respectively. S− and S+ are the input and output slack variables, respectively, and λj is the weight vector. When θ ≥ 1, the evaluated decision unit is relatively valid; when θ < 1, the evaluated decision unit is relatively invalid.

- Stage 2: Using the input-oriented example, the input slack values obtained in the first stage are decomposed using the stochastic frontier model (SFA). With N decision units and m inputs per decision unit, regression Eq. (3) is constructed to decompose the initial input slack values for each decision unit:where Xij denotes the slack value of the ith input of the jth decision unit, zj is the external environment variable. βi is the external environment variable coefficient. vij + uij is the mixed error term. vij denotes the random error term, and uij denotes the management inefficiency term.

3

After using Frontier 4.1 to obtain the regression results, the input quantity of the relatively fully effective decision unit is used as the benchmark, and the input quantity of other relatively ineffective decision units is further adjusted by using the regression results to increase the input quantity of the decision unit in a better external environment and luck, and to reduce the input quantity of the decision unit facing a worse external environment and luck. The specific method is as follows:

| 4 |

where is the adjusted input, Xij is the input before adjustment, is the adjustment of external environmental factors, and is the adjustment of random disturbance terms of all decision units to the same state. In this paper, the dynamic separation method is used to select the appropriate significance level according to the actual needs. When separating the environmental factors and random errors, the terms with insignificant parameters are not adjusted, and only the terms with significant parameters are separated. Subsequently, the input variables are adjusted according to the separated results, so that the adjusted input values are more accurate, and thus, more accurate efficiency values are measured.

Stage 3: The adjusted input values are eliminated from the external environment and random interference factors. The efficiency is measured with the initial output data using the super-efficient SBM-DEA model to obtain the real efficiency values. It can reflect the internal management and input scale level of each decision unit more accurately.

The specific indicators were selected. The energy efficiency establishment indicators are shown in Table 1.

Input–output indicators

Table 1.

Variable settings and descriptive statistics

| Category | Variables | Definition | Unit | Data processing | Mean | Std. Dev | Min | Max |

|---|---|---|---|---|---|---|---|---|

| Input variables | Total energy consumption | Tons of standard coal | Take logarithm | 4.094 | 0.282 | 4.617 | 3.204 | |

| Employment | 10,000 people | Take logarithm | 3.324 | 0.339 | 3.854 | 2.490 | ||

| Fixed asset investment | million RMB | Take logarithm | 6.128 | 0.345 | 6.771 | 5.157 | ||

| Output variables | GDP to SO2 emissions ratio | GDP/SO2 emissions | 100 million yuan/10,000 tons | Take logarithm | 2.796 | 0.586 | 5.270 | 1.709 |

| Environment variables | Economic structure | Secondary industry added value/GDP | 0.440 | 0.087 | 0.590 | 0.162 | ||

| Energy consumption structure | Coal consumption/Primary energy | 4.611 | 12.431 | 96.436 | 0.265 | |||

| Urbanization process | Urban Population/total Population | 0.576 | 0.122 | 0.896 | 0.350 | |||

| Technology Innovation | R&D investment | million | Take logarithm | 6.202 | 0.584 | 7.365 | 4.762 |

Referring to the literature on energy efficiency index measurement (Xiao et al. 2014; Cui and Li (2014), labor, capital, and energy consumption of the whole society are selected as input variables, which are expressed as the total number of employees at the end of the year, the total investment in fixed assets of the whole society, and the total energy consumption, respectively. For output variables, both economic output and environmental impact should be considered, and ignoring environmental factors will make the measured energy efficiency values deviate. Therefore, this paper uses the indicator of GDP divided by SO2 emissions in each province as the output variable (Zhao et al. 2019), which can avoid the adverse consequences of environmental pollution.

-

2.

External environmental factors indicators

In this paper, energy consumption structure, technological innovation, urbanization process, and economic structure are selected as the environmental variables affecting energy efficiency. The primary cause of environmental pollution is the consumption of coal, so this paper uses the proportion of coal consumption to primary energy consumption (energy mix) as one of the environmental variables affecting energy efficiency (Zhao et al. 2019). Since the reform and opening up, China’s economic growth has mainly come from the secondary industry, which is mainly energy intensive. This paper selects economic structure as one of the environmental variables affecting energy efficiency and uses the proportion of value added in the secondary industry to GDP to represent the economic structure. When people migrate between urban and rural areas, it causes differences in energy consumption and thus affects energy efficiency. Therefore, this paper selects the urbanization process as one of the environmental variables affecting energy efficiency and uses urban population over total population to represent economic structure. R&D investment, as a representative of technological innovation, will have an impact on the improvement of energy efficiency, so this paper selects R&D investment as one of the environmental variables, and the amount of R&D investment by province is used to represent the amount.

Core explanatory variables

In this paper, the explanatory variables are digital financial inclusion-related indices. Five digital financial inclusion–related indicators in four categories are selected as explanatory variables to facilitate comparison of the differences in the impact of different aspects of digital financial inclusion on energy efficiency. The first category of indicators is the total digital financial index, which explores the possible impact of the overall digital financial services on energy efficiency. The second category of indicators is the digital financial coverage breadth index, which explores the possible impact of digital financial coverage breadth on energy efficiency. The third category of indicators is the degree of digitalization, which explores the possible impact of the degree of digitalization of digital financial services on energy efficiency. The fourth category of indicators reflects the impact of the depth of use of digital financial services on energy efficiency, and the digital insurance service index and digital credit service index are chosen as explanatory variables to study their impact on energy efficiency.

Control variables

From the existing studies, Mi et al. (2015) argued that the adjustment of industrial structure can promote the improvement of energy efficiency. Wang et al. (2016) and Yang and Zhang (2016) argued that technological progress plays an important role in the improvement of energy efficiency. Xiong et al. (2019) argued that economic scale and energy structure have some influence on the improvement of energy efficiency. Based on data availability, this paper uses the ratio of R&D investment to per capita regional GDP, economic growth rate, and the ratio of coal consumption to total energy consumption in each province to measure technological progress, economic scale, and energy structure, respectively. The R&D investment unit is RMB 10,000. The unit of per capita GDP is CNY/person. The unit of coal consumption and energy consumption is 10,000 tons of standard coal. The adjustment of industrial structure is expressed by the industrial structure upgrading index (IS) (IS = q1 + q2 * 2 + q3 * 3, where qi denotes the value added of industry I as a proportion of regional GDP. Among them, the unit of industrial added value and regional GDP is CNY 100 million).

Model construction

The focus of this paper is to explore the impact of digital finance on energy efficiency. To address the endogeneity of variables, a dynamic GMM model is constructed in this paper. Using model (5) as the baseline model, we test whether digital finance can promote source efficiency improvement, thus testing hypothesis 1:

| 5 |

Second, model (6) is used as the benchmark model to test whether expanding the breadth of digital financial inclusion coverage can promote energy efficiency, thus testing hypothesis 2. Model (7) is used as the benchmark model to test whether digitization can promote energy efficiency, thus testing hypothesis 3. Model (8) is used as the benchmark model to test whether the development of digital credit services can promote energy efficiency, thus testing hypothesis 4. Model (10) is used as the benchmark model to test whether the development of digital insurance services can promote energy efficiency, thus testing hypothesis 4. Model (10) is used as the benchmark model to test whether the development of digital insurance services can promote energy efficiency, thus testing hypothesis 5:

| 6 |

| 7 |

| 8 |

| 9 |

Finally, model (10) is used as the baseline model to test whether there is regional heterogeneity in the relationship between digital finance and energy efficiency, thus testing hypothesis 6:

| 10 |

where i and t represent provinces and years, respectively. a1 indicates the degree of impact of the total digital inclusive finance index on energy efficiency. b1, c1, d1, and e1 indicate the degree of impact of digital insurance services, digital credit services, and digitalization on energy efficiency in the breadth of coverage and depth of use of digital inclusive finance, respectively. The coefficient before indicates the degree of impact of control variables on energy efficiency. The coefficient before coefficients indicate the magnitude of the effect of energy efficiency in a lagged period on its current energy efficiency, which is reflected in the degree of influence of a region’s energy efficiency based on current energy efficiency. represents regional energy efficiency. represents the inter-provincial individual effect. represents the degree of influence of regional differences on energy efficiency. µit is a random disturbance term obeying a mean of 0 and a variance of σ2 reflecting the influence of omitted variables, model errors, and random factors on the model.

The validity of the systematic GMM model setting depends on two prerequisites: first, the presence of significant first-order serial autocorrelation in the nuisance terms and the absence of second-order serial autocorrelation; second, the ability to pass the Hansen test or Sargan test and the overall validity of all instrumental variables. This paper reports the p-values of the second-order serial autocorrelation test (AR(2) test) and Hansen test or Sargan test for all GMM regressions, where the original hypothesis of the serial autocorrelation test is that there is no serial autocorrelation. The null hypothesis of the Hansen test and the Sargan test is that the instrumental variables satisfy exogeneity. To ensure the validity of the model, the p-values of AR(2) test are required to be greater than 0.1. The Hansen test or Sargan test is required to be greater than 0.05.

Data sources

The data related to digital inclusive finance used in this paper come from the Peking University Digital Inclusive Finance Index compiled by the Digital Finance Research Center of Peking University and Ant Financial Services Group. The index provides a comprehensive evaluation of digital inclusive finance in terms of different dimensions such as breadth of coverage, depth of use, and degree of digitization. The data of the total energy consumption index come from the China Energy Database. The data on employment, GDP, SO2 emissions, and the added value of the secondary industry are from local statistical yearbooks. The fixed asset investment, coal consumption, and primary energy consumption data come from the wind database. The urban population and total population data come from the China Statistical Yearbook. The R&D investment data come from the China Science and Technology Statistical Yearbook. The data of industrial structure upgrading indicators come from the local statistical yearbook. Combined with data availability, the sample interval selected in this paper is 2011–2019, and the panel data used in this paper contains 30 provinces due to the absence of some data from the Tibet Autonomous Region and Hong Kong, Macao, and Taiwan. The descriptive statistics of each indicator are shown in Table 2.

Table 2.

Variable settings and descriptive statistics

| Category | Variables | Definition | symbol | Data Processing | Mean | Std.Dev | min | max |

|---|---|---|---|---|---|---|---|---|

| Explained variables | Energy efficiency | EEF | 0.8693 | 0.0979 | 0.7062 | 1.2181 | ||

| Explanatory variables | Total digital finance index | Digital Inclusive Finance Index of Peking University | DFI | Divide by 1000 | 0.2034 | 0.0916 | 0.0183 | 0.4103 |

| Digital financial coverage breadth index | COV | Divide by 1000 | 0.1836 | 0.0902 | 0.0020 | 0.3847 | ||

| Digitization index | DIGI | Divide by 1000 | 0.2784 | 0.1180 | 0.0076 | 0.4622 | ||

| Digital credit services index | CRE | Divide by 1000 | 0.4494 | 0.2161 | 0.0003 | 0.9323 | ||

| Digital insurance service index | INSU | Divide by 1000 | 0.1298 | 0.0577 | 0.0012 | 0.2822 | ||

| Control variables | Technological advances | Ratio of R&D investment to GDP per capita | TEC | Divide by 1000 | 0.0543 | 0.0546 | 0.0015 | 0.2458 |

| Industrial structure upgrading index | STRUC | Divide by 1000 | 2.39E − 03 | 1.24E − 04 | 2.13E − 03 | 2.83E − 03 | ||

| Changes in the size of the economy | Economic growth rate | ECO | Divide by 1000 | 8.41E − 05 | 2.39E − 05 | 5.00E − 06 | 1.64E − 04 | |

| Energy mix | Ratio of coal consumption to total energy consumption | ENERGY | Divide by 1000 | 9.36E − 04 | 4.43E − 04 | 2.48E − 05 | 2.46E − 03 |

In order to compare and analyze the regional differences in the impact of digital inclusive finance on energy efficiency in China, the 30 provinces studied in this paper are divided into eastern, central, and western regions according to the criteria of the three economic zones of China’s Seventh Five-Year Plan. The eastern region includes 10 provinces: Beijing, Tianjin, Hebei, Liaoning, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan; the central region includes eight provinces: Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, and Hunan; and the western region includes 11 provinces: Sichuan, Chongqing, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang, Guangxi, and Inner Mongolia.

Empirical analysis and discussion

Evaluation of energy efficiency based on the three-stage super-efficiency SBM-DEA model

Results of the first stage of measurement

In this paper, the input–output efficiency of energy efficiency is analyzed empirically at the inter-provincial level based on the super-efficient SBM-DEA model using MaxDEA8.0 software. A larger energy efficiency value represents a better ability of the province or city to utilize the available resources, and the DMU is considered inefficient when the energy efficiency value is less than 1. The results are shown in Table 3.

Table 3.

Results of energy efficiency analysis by province in the first phase, 2011–2019

| Region | Province | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Average value |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Eastern Region | Beijing | 1.114388 | 1.09337 | 1.096915 | 1.075933 | 1.066788 | 1.037542 | 1.03405 | 1.046848 | 1.047957 | 1.068199 |

| Tianjin | 0.880493 | 0.884162 | 0.88917 | 0.891671 | 0.892916 | 0.942819 | 0.927352 | 0.911609 | 0.90186 | 0.90245 | |

| Hebei | 0.765536 | 0.770282 | 0.775124 | 0.779785 | 0.781373 | 0.783074 | 0.785319 | 0.785862 | 0.782856 | 0.778801 | |

| Liaoning | 0.787911 | 0.792383 | 0.799449 | 0.806229 | 0.816922 | 0.841907 | 0.847001 | 0.849123 | 0.845655 | 0.820731 | |

| Shanghai | 0.865943 | 0.878019 | 0.872827 | 0.893336 | 0.90497 | 0.903458 | 0.953888 | 0.937777 | 0.939095 | 0.905479 | |

| Jiangsu | 0.752541 | 0.758407 | 0.763218 | 0.76719 | 0.769857 | 0.771787 | 0.774713 | 0.774095 | 0.770936 | 0.766972 | |

| Zhejiang | 0.782954 | 0.788076 | 0.792327 | 0.796351 | 0.797834 | 0.807005 | 0.802289 | 0.801968 | 0.795693 | 0.796055 | |

| Fujian | 0.817038 | 0.819761 | 0.824291 | 0.824982 | 0.826057 | 0.827707 | 0.828995 | 0.825827 | 0.821925 | 0.824065 | |

| Shandong | 0.737198 | 0.742489 | 0.749549 | 0.753072 | 0.753719 | 0.75527 | 0.759283 | 0.760312 | 0.760633 | 0.752392 | |

| Guangdong | 0.753977 | 0.761287 | 0.765965 | 0.768713 | 0.770253 | 0.77137 | 0.771949 | 0.769065 | 0.766455 | 0.766559 | |

| Hainan | 1.107177 | 1.09826 | 1.091603 | 1.082973 | 1.077115 | 1.06007 | 1.053532 | 1.05024 | 1.050972 | 1.07466 | |

| Middle | Shanxi | 0.82183 | 0.824899 | 0.827405 | 0.832185 | 0.835505 | 0.837196 | 0.859006 | 0.860256 | 0.855581 | 0.839318 |

| Jilin | 0.849902 | 0.853617 | 0.862572 | 0.867198 | 0.875475 | 0.877915 | 0.883907 | 0.884401 | 0.886323 | 0.871257 | |

| Heilongjiang | 0.826974 | 0.829491 | 0.83626 | 0.84681 | 0.854647 | 0.8577 | 0.860257 | 0.862668 | 0.863176 | 0.848665 | |

| Anhui | 0.796316 | 0.79941 | 0.802761 | 0.806001 | 0.808058 | 0.809187 | 0.811938 | 0.808979 | 0.804515 | 0.80524 | |

| Jiangxi | 0.830802 | 0.835983 | 0.83913 | 0.841473 | 0.842268 | 0.84256 | 0.84412 | 0.841584 | 0.83703 | 0.839439 | |

| Henan | 0.757184 | 0.76225 | 0.768125 | 0.770471 | 0.772711 | 0.773996 | 0.777333 | 0.775306 | 0.773284 | 0.770073 | |

| Hubei | 0.787303 | 0.791182 | 0.798406 | 0.801437 | 0.805273 | 0.806466 | 0.809642 | 0.807277 | 0.803022 | 0.801112 | |

| Hunan | 0.786495 | 0.7914 | 0.798634 | 0.801791 | 0.805556 | 0.807065 | 0.809637 | 0.808192 | 0.804569 | 0.801482 | |

| West | Inner Mongolia | 0.825744 | 0.83019 | 0.835192 | 0.835528 | 0.845089 | 0.84445 | 0.849961 | 0.858311 | 0.854809 | 0.842141 |

| Guangxi | 0.822134 | 0.828148 | 0.832779 | 0.835816 | 0.836553 | 0.837204 | 0.838903 | 0.835861 | 0.831123 | 0.833169 | |

| Chongqing | 0.844307 | 0.848801 | 0.857077 | 0.859178 | 0.86422 | 0.864996 | 0.866819 | 0.865261 | 0.861309 | 0.859107 | |

| Sichuan | 0.772606 | 0.777715 | 0.784181 | 0.787803 | 0.793067 | 0.794042 | 0.796171 | 0.793409 | 0.789047 | 0.78756 | |

| Guizhou | 0.851812 | 0.852382 | 0.856653 | 0.857852 | 0.859394 | 0.858092 | 0.856874 | 0.854658 | 0.851358 | 0.855453 | |

| Yunnan | 0.825545 | 0.827915 | 0.832108 | 0.835077 | 0.838177 | 0.83623 | 0.836331 | 0.833633 | 0.82893 | 0.832661 | |

| Shaanxi | 0.826711 | 0.839882 | 0.843843 | 0.845419 | 0.845665 | 0.845137 | 0.844708 | 0.842152 | 0.835675 | 0.841021 | |

| Gansu | 0.870292 | 0.872896 | 0.874996 | 0.87737 | 0.880211 | 0.882861 | 0.897458 | 0.898803 | 0.895486 | 0.883375 | |

| Qinghai | 1.014691 | 1.014683 | 1.015595 | 1.01592 | 1.015649 | 1.01809 | 1.017925 | 1.019125 | 1.020577 | 1.016917 | |

| Ningxia | 0.978604 | 0.980929 | 0.981194 | 0.982158 | 0.980238 | 0.978825 | 1.00106 | 1.007502 | 1.010639 | 0.989016 | |

| Xinjiang | 0.872149 | 0.868947 | 0.865601 | 0.864916 | 0.863041 | 0.863335 | 0.860032 | 0.869507 | 0.866244 | 0.865975 |

For the convenience of comparison, the 30 provinces are divided into eastern, central, and western regions. From the results of the first-stage super-efficiency analysis, we learn that the regional differences in energy efficiency of each province are large, among which the average energy efficiencies of Beijing, Hainan, and Qinghai are 1.068199075, 1.074660218, and 1.016917406, respectively, and all 9 years show DEA validity. The average energy efficiency in the western region is generally higher, the average energy efficiency in the eastern region is second, and the average energy efficiency in the central region is generally lower.

The first stage is only the efficiency evaluation under the traditional super-efficiency SBM-DEA model, which contains the interference of environmental and stochastic factors, although the super-efficiency model can distinguish the difference between effective decision units. Therefore, the industrial energy efficiency measured by the super-efficiency model alone is undoubtedly unrealistic, and the influence of external environmental factors needs to be removed by applying the SFA model.

Second-stage SFA regression results

Using the SFA model with the slack variables of labor, energy, and capital inputs obtained in the first stage as the explanatory variables and the four environmental variables of industrial structure development, coal and energy structure, urbanization rate, and R&D inputs as explanatory variables for regression, the results of the second stage SFA regression are obtained using the Frontier 4.1 software, as shown in Table 4.

Table 4.

Table of SFA regression results in the second stage

| Variables | Labor input slack variable | Energy input slack variables | Capital input slack variables | |||

|---|---|---|---|---|---|---|

| Labor force factor | Standard deviation | Energy factor | Standard deviation | Capital factor | Standard deviation | |

| Constant term | − 0.267923 | 0.2429258 | 0.034946 | 0.34578 | 0.05083 | 0.347717 |

| − 1.102899 | 0.101064 | 0.146182 | ||||

| Industrial structure development | 0.3555592 | 0.3059045 | 0.168391 | 0.453259 | 0.271882 | 0.455922 |

| 1.1623207 | 0.371512 | 0.596335 | ||||

| Coal energy structure | 0.0010656 | 0.0018788 | − 0.00457** | 0.002202 | − 0.00072 | 0.002318 |

| 0.5671753 | − 2.07398 | − 0.3097 | ||||

| Urbanization rate | − 0.732657*** | 0.2508954 | 0.107842 | 0.351077 | − 0.14074 | 0.368665 |

| − 2.920167 | 0.307175 | − 0.38176 | ||||

| R&D investment | 0.1882084*** | 0.0445403 | 0.042221 | 0.070967 | 0.050258 | 0.071209 |

| 4.2255733 | 0.59494 | 0.705786 | ||||

| degama2 | 0.0895316 | 0.008227 | 0.135235 | 0.024727 | 0.110496 | 0.014515 |

| 10.882594 | 5.469114 | 7.612759 | ||||

| gama | 0.0075579 | 0.0213721 | 0.289927 | 0.127714 | 0.141249 | 0.101221 |

| 0.3536337 | 2.270121 | 1.395448 | ||||

| Log function value | − 61.421396 | − 82.614758 | − 84.837439 | |||

| LR one-sided test | 6.8534791 | 18.442006 | 38.006647 | |||

According to Table 4, the γ of for energy input slack variables and capital input slack variables are 0.289927 and 0.141249, respectively, and are significant at the 5% and 10% levels, respectively. γ indicates the proportion of the variance of input slack values due to inefficient internal management or input scale in the total variance of input slack values, and the greater the effect of inefficient internal management or input scale on energy efficiency, the larger the value of this statistic; it indicates that the adjustment of SFA for input variables is reasonable and necessary. For environmental variables, the input redundancy is considered as the opportunity cost of energy production and consumption in each province; that is, when the regression coefficient is positive, it leads to an increase in environmental variables, which creates waste of inputs or a decrease in outputs, which is not conducive to improving energy efficiency; conversely, when the regression coefficient is negative, the increase in environmental variables creates a saving of inputs or increase in outputs, which is conducive to improving energy efficiency, analyzed as follows.

Industrial structure development shows insignificant results for labor input, energy input, and capital input slack variables, indicating that an increase in the industrial structure development index increases the redundancy of capital, labor, and energy slack variables, leading to waste. The coal energy structure shows insignificant results for labor input and capital input slack variables and significant results for energy input slack variables at the 5% level. This indicates that an increase in the coal energy mix indicator increases the redundancy of labor and capital input slack variables, leading to waste. An increase in the coal energy mix indicator reduces the redundancy of energy slack variables, saving energy inputs. The urbanization rate is insignificant for the capital and energy slack variables and significant at the 1% level, with a negative coefficient for the labor slack variable. This indicates that an increase in the urbanization rate increases the redundancy of energy and capital input slack variables and leads to waste; an increase in urbanization rate reduces the redundancy of labor slack variables and saves energy inputs. R&D investment is insignificant for capital and energy slack variables and significant and negative for labor slack variables at the 1% level. This indicates that an increase in R&D investment increases the redundancy of the energy, labor, and capital input slack variables, leading to waste.

The differences in the effects of each environmental variable on different provinces may lead to better efficiency performance for some provinces facing a better external environment and worse efficiency performance for some provinces facing a worse external environment. Therefore, it is necessary to adjust the original input variables according to the regression results of the second stage, so that all provinces face the same external environment and thus obtain the true energy efficiency.

Phase 3 measurement results

The super-efficient SBM-DEA model was again applied to measure the efficiency based on the adjusted number of inputs and the initial amount of outputs in each province to obtain efficiency values that reflect the true internal management and input scale levels. The results are shown in Table 5.

Table 5.

Results of the analysis of energy efficiency by province in the third phase 2011–2019

| Region | Province | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Average value |

|---|---|---|---|---|---|---|---|---|---|---|---|

| East | Beijing | 1.156975 | 1.218058 | 1.16232 | 1.067273 | 1.048862 | 1.081241 | 1.010164 | 1.059567 | 1 | 1.089385 |

| Tianjin | 0.932598 | 0.867342 | 1.004331 | 1.034379 | 0.927898 | 1.078027 | 1.039647 | 1.026726 | 0.865812 | 0.975195 | |

| Hebei | 0.82915 | 0.761711 | 0.813714 | 0.800227 | 0.801476 | 0.850938 | 0.864531 | 0.860925 | 0.816717 | 0.822154 | |

| Liaoning | 0.733815 | 0.70624 | 0.754706 | 0.746755 | 0.771081 | 0.843884 | 0.800049 | 0.838684 | 0.891098 | 0.787368 | |

| Shanghai | 0.825793 | 0.804027 | 0.843816 | 0.918964 | 0.921365 | 1.026139 | 0.991747 | 0.976326 | 1.043603 | 0.927976 | |

| Jiangsu | 0.791658 | 0.757149 | 0.823393 | 0.864104 | 0.83725 | 0.838584 | 0.856114 | 0.844699 | 0.798031 | 0.823442 | |

| Zhejiang | 0.777163 | 0.730351 | 0.853544 | 0.813785 | 0.809865 | 0.880239 | 0.877817 | 0.84998 | 0.778605 | 0.819039 | |

| Fujian | 0.925735 | 0.819859 | 0.817797 | 0.880359 | 0.875468 | 0.80568 | 0.87162 | 0.928617 | 0.854189 | 0.864369 | |

| Shandong | 0.73901 | 0.736841 | 0.75789 | 0.768607 | 0.773197 | 0.779703 | 0.709333 | 0.75202 | 0.777807 | 0.754934 | |

| Guangdong | 0.8022 | 0.751489 | 0.787896 | 0.838592 | 0.798622 | 0.76266 | 0.803769 | 0.839137 | 0.826528 | 0.80121 | |

| Hainan | 1.074147 | 1.139734 | 1.075506 | 1.040253 | 1.091931 | 1.006031 | 1.055286 | 1.012022 | 1.00915 | 1.056007 | |

| Middle | Shanxi | 0.852684 | 0.792525 | 0.775426 | 0.785088 | 0.817261 | 0.837283 | 0.896118 | 0.90007 | 0.909513 | 0.840663 |

| Jilin | 0.811473 | 0.776705 | 0.893731 | 0.841676 | 0.873823 | 1.031719 | 0.940151 | 0.989758 | 1.001821 | 0.906762 | |

| Heilongjiang | 0.75731 | 0.726405 | 0.843125 | 0.820261 | 0.832634 | 0.903126 | 0.801429 | 0.870682 | 0.860019 | 0.823888 | |

| Anhui | 0.846919 | 0.771867 | 0.771613 | 0.816166 | 0.862687 | 0.844639 | 0.822138 | 0.872958 | 0.827111 | 0.826233 | |

| Jiangxi | 0.861216 | 0.808003 | 0.885559 | 0.881353 | 0.845059 | 0.799245 | 0.833266 | 0.936192 | 0.86323 | 0.857014 | |

| Henan | 0.814921 | 0.778122 | 0.779383 | 0.777184 | 0.790592 | 0.851955 | 0.840447 | 0.846181 | 0.861165 | 0.81555 | |

| Hubei | 0.877477 | 0.787803 | 0.745363 | 0.804797 | 0.845564 | 0.882929 | 0.883718 | 0.889034 | 0.846228 | 0.840324 | |

| Hunan | 0.816538 | 0.756707 | 0.723447 | 0.836944 | 0.857242 | 0.858504 | 0.826032 | 0.867928 | 0.894385 | 0.826414 | |

| West | Inner Mongolia | 0.859298 | 0.806287 | 0.795244 | 0.722187 | 0.73951 | 0.809853 | 0.850487 | 0.841519 | 0.911364 | 0.815083 |

| Guangxi | 0.83222 | 0.788097 | 0.832601 | 0.847284 | 0.821733 | 0.793648 | 0.892339 | 0.949009 | 0.893689 | 0.850069 | |

| Chongqing | 0.849722 | 0.832728 | 0.816189 | 0.909567 | 0.924165 | 0.943447 | 0.893906 | 0.941753 | 1.022047 | 0.903725 | |

| Sichuan | 0.778843 | 0.746546 | 0.753075 | 0.749807 | 0.755595 | 0.803428 | 0.809466 | 0.821906 | 0.901633 | 0.791144 | |

| Guizhou | 0.840097 | 0.796256 | 0.791717 | 0.781037 | 0.817737 | 0.850478 | 0.897089 | 1.001317 | 1.005966 | 0.864633 | |

| Yunnan | 0.91869 | 0.838573 | 0.798945 | 0.806219 | 0.88007 | 0.864763 | 0.924128 | 1.000535 | 0.857349 | 0.876586 | |

| Shaanxi | 0.794008 | 0.733343 | 0.742392 | 0.7916 | 0.834033 | 0.8757 | 0.855014 | 0.889837 | 0.887615 | 0.822616 | |

| Gansu | 0.855393 | 0.860528 | 0.843688 | 0.849262 | 0.873561 | 0.945701 | 0.847914 | 0.908577 | 1.000371 | 0.887222 | |

| Qinghai | 1.034355 | 1.01224 | 1.117752 | 1.090269 | 1.075491 | 1.100122 | 1.089547 | 1.065676 | 0.940147 | 1.0584 | |

| Ningxia | 0.978544 | 0.903956 | 1.003374 | 0.867935 | 0.852432 | 0.939147 | 1.004927 | 0.920878 | 1.04745 | 0.946516 | |

| Xinjiang | 0.844649 | 0.796439 | 0.76176 | 0.734655 | 0.806826 | 0.834862 | 0.792231 | 0.830126 | 0.848719 | 0.805585 |

The inter-provincial analysis shows that the energy efficiency of 30 provinces increases or decreases to different degrees after excluding the influence of external environment and random disturbances, which indicates that external environment, and random disturbances have a certain influence on the efficiency level, and the efficiency values measured by each province in the first stage are not very accurate. Overall, the energy efficiency gap is relatively obvious, and Beijing has the highest average energy efficiency, indicating that Beijing has a reasonable layout in terms of production capacity, pollutant emission control, and resource utilization efficiency. Shandong has the lowest average energy efficiency, indicating that the province has a large gap from obtaining effective energy efficiency and should focus on its own resource utilization efficiency and capacity planning.

Results of systematic GMM estimation of national energy efficiency impact factors

The estimation results of the generalized moments of the dynamic panel system are given in Table 6, where models (1) to (5) consider the square of the total digital inclusive finance index and the total digital inclusive finance index, the square of the breadth of digital inclusive finance coverage and the square of the breadth of digital inclusive finance coverage, the square of the degree of digitization and the degree of digitization, the square of the digital credit service and the digital credit service, and the square of the digital insurance service and the digital insurance service, respectively, on energy efficiency. As shown in Table 6, the overall regression results of the model are good, and the total digital inclusive financial index, the breadth of digital inclusive financial coverage, the degree of digitization, digital credit services, and digital insurance services all have significant positive effects on energy efficiency.

Table 6.

Systematic GMM estimation results for the impact of digital finance on energy efficiency

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| L.EFF | 0.681*** (13.342) | 0.668*** (12.763) | 0.655*** (13.168) | 0.680*** (12.297) | 0.662*** (9.215) |

| DIF | 0.966*** (4.409) | ||||

| DIF2 | − 1.902*** (− 4.043) | ||||

| COV | 0.903*** − 3.16 | ||||

| COV2 | − 1.963*** (− 2.945) | ||||

| DIGI | 1.130** − 2.321 | ||||

| DIGI2 | − 1.763** (− 2.136) | ||||

| INSU | 0.814*** − 2.859 | ||||

| INSU2 | − 0.780*** (− 2.713) | ||||

| CRE | 4.026** (2.405) | ||||

| CRE2 | − 13.103** (− 2.341) | ||||

| tec | − 0.300*** (− 5.481) | − 0.301*** (− 5.330) | − 0.272*** (− 5.098) | − 0.245*** (− 3.734) | − 0.387*** (− 4.421) |

| struct | 106.700** (2.482) | 104.401** (2.402) | 122.425*** (3.048) | 145.689*** (3.28) | 155.822*** (3.177) |

| eco | 0.5 (0.003) | 55.439 (0.272) | 55.828 (0.283) | 225.778 (0.967) | 350.066 (1.13) |

| energy | − 12.991 (− 1.627) | − 11.909 (− 1.443) | − 9.553 (− 1.244) | − 9.298 (− 1.173) | − 1.781 (− 0.168) |

| Constant term | − 0.055 (− 0.553) | − 0.025 (− 0.249) | − 0.137 (− 1.239) | − 0.252* (− 1.712) | − 0.352 (− 1.881) |

| AR(1) | 3.623*** | 3.552*** | − 3.651*** | − 3.477*** | 3.662*** |

| AR(2) | − 1.636 | − 1.444 | 1.121 | 1.263 | − 1.069 |

| Hansen J test | p = 0.356 | p = 0.192 | p = 0.267 | p = 0.651 | p = 0.100 |

Values in parentheses are t-values. The values in AR(1) and AR(2) are z-values

*Significant at the 10% level; ** significant at the 5% level; *** significant at the 1% levels

Model (1) reflects the effect of the total digital inclusive finance index and the square of the total digital inclusive finance index on energy efficiency. The parameter estimate of the total digital inclusive finance index of 0.966 corresponds to a p-value that is significant at the 1% level, which indicates that, when the total digital inclusive finance index increases by 1%, it causes an increase in energy efficiency of 0.966%. The coefficient of the squared term of the total digital inclusion index is significantly negative, which indicates that the total digital inclusion index has an inverted U-shaped effect on energy efficiency. One of the reasons is that the positive effect of digital finance on energy efficiency plays a greater role during the low level of digital finance. As the level of digital finance improves, on the one hand, a large number of long-tail enterprises are able to enjoy new financial services to ease financing constraints, while technology-based and green enterprises with spare money are able to invest their temporary balances to obtain more funds, which promotes the rational allocation of resources and improves the previous energy efficiency. Rational allocation can improve the previous situation of insufficient and unsustainable R&D funds to further promote technological innovation and improve energy efficiency. On the other hand, due to the extremely wide coverage of digital finance, when certain green guidance is given to financial consumers, it strengthens the green concept of financial consumers and promotes green consumption and green investment, which in turn improves the energy structure and promotes energy efficiency. Second, when the level of digital finance reaches the inflection point, when the level of digital finance development is high, as the level of digital finance continues to develop, the negative hindering effect of digital finance on energy efficiency gradually exceeds the positive promoting effect. The network platforms that obtain a large number of customers in the early stage of digital finance development use their existing advantages to suppress new entrants, form monopolies, and raise the cost of enjoying financial services, which not only reduces the level of competition, suppresses the passion for innovation, and hinders the discovery of new technologies, but also harms the interests of innovative companies that need corresponding services, which makes the R&D investment decrease and reduces energy efficiency. Therefore, hypothesis 1 holds.

Model (2) reflects the impact of digital inclusion coverage on energy efficiency with a parameter estimate of 0.903, corresponding to a p-value significant at the 1% level, which indicates that a 1% increase in the total digital inclusion index causes a 0.903% increase in energy efficiency. Model (3) captures the impact of digitalization on energy efficiency with a parameter estimate of 1.13, corresponding to a p-value significant at the 1% level, indicating that a 1% increase in digitalization causes a 1.13% increase in energy efficiency. Model (4) captures the impact of digital insurance on energy efficiency with a parameter estimate of 0.814, corresponding to a p-value significant at the 1% level, indicating that a 1% increase in digital insurance causes a 0.814% increase in energy efficiency. Model (5) captures the effect of digital credit on energy efficiency with a parameter estimate of 3.435, corresponding to a p-value significant at the 1% level, which indicates that when digital credit is increased by 1%, it causes a 3.435% increase in energy efficiency. Hypotheses 2, 3, 4, and 5 are verified, and the coefficients of the square of the breadth of digital financial inclusion, the square of digitalization, the square of digital insurance, and the square of digital credit in models (2), (3), (4), and (5) are all significantly negative, further verifying hypothesis 1.

In terms of control variables, the coefficients of technological progress in models (1), (2), (3), (4), and (5) are all significantly negative at the 1% level, indicating that technological progress can hinder energy efficiency. The possible reason is that although technological progress will reduce costs, it will cause an increase in production, consume natural resources, and increase the emission of pollutants, which may lead to a situation where supply exceeds demand, resulting in a waste of resources and lower energy efficiency. The coefficient of industrial structure upgrade is significantly positive, which indicates that the upgrade of industrial structures can promote the improvement of energy efficiency. The coefficients of both the economic growth rate and energy structure are insignificant, indicating that economic growth rate and energy structure have no effect on energy efficiency.

The results of GMM estimation of the system of factors influencing energy efficiency by region

Table 7 shows the results of the systematic GMM estimation of the impact of energy efficiency in different regions of the total digital inclusive finance index. The results of autocorrelation tests for all the models show that AR(1) and AR(2) are always insignificant, and the first-order and second-order disturbance terms are not autocorrelated, indicating that the random terms of all the models are not autocorrelated. Meanwhile, the p-values of the Hansen test for all models are not significant, indicating that the instrumental variables of the models are selected reasonably.

Table 7.

Systematic GMM estimates of the impact of digital finance on energy efficiency in different regions

| Variables | East | Middle | West |

|---|---|---|---|

| L.EFF | 0.698*** | 0.241* | 0.684** |

| 9.599 | 2.249 | 9.203 | |

| DFI | 0.883* | 1.259** | 1.146* |

| 1.915 | 2.955 | 2.026 | |

| DFI2 | − 1.887** | − 2.224* | − 2.375* |

| (− 2.100) | (− 2.417) | (− 2.162) | |

| tec | − 0.217** | − 0.824** | − 0.239** |

| (− 2.367) | (− 3.187) | (− 2.577) | |

| stuct | 63.862 | 201.567* | 49.837 |

| 0.894 | 1.854 | 0.685 | |

| eco | 172.583 | 69.913 | 242.629 |

| 0.463 | 0.156 | 0.638 | |

| energy | − 36.901 | − 25.517* | − 47.954 |

| (− 1.033) | (− 2.263) | (− 1.317) | |

| Constant term | 0.049* | 0.085 | 0.069 |

| 0.243 | 0.388 | 0.334 | |

| AR(1) | 1.192 | 1.131 | 1.075 |

| AR(2) | 1.573 | − 0.360 | 1.517 |

| Hansen J test | p = 0.530 | p = 0.921 | p = 0.683 |

Values in parentheses are t-values. The values in AR(1) and AR(2) are z-values

*Significant at the 10% level; ** significant at the 5% level; ***significant at the 1% level

From the estimation results, the coefficients of the total digital inclusive finance index on energy efficiency in the eastern, central, and western regions are positive, significant at the 10% level in the eastern and western regions, and significant at the 5% level in the central region, indicating that every 1% increase in energy efficiency in the eastern, central, and western regions causes an increase of 0.883%, 1.259%, and 1.146%, respectively. The coefficients of the impact of digital finance on energy efficiency in the eastern, central, and western regions differ significantly, which verifies hypothesis 6. The eastern region has the smallest contribution of digital finance to energy efficiency, the western region has the second largest contribution, and the central region has the largest contribution of digital finance to energy efficiency. The possible reasons are as follows: The western region has a lower level of digital finance development and a relatively lower level of economic development. Due to the existence of a large number of long-tail people, the development of digital finance will bring benefits to the majority of long-tail people and enterprises, promoting the rational allocation of resources and alleviating financing constraints, along with bringing significant improvements in energy efficiency. The level of digital finance development and economic development in the central region is higher than that in the western region. People and enterprises in the central region are further enjoying the benefits brought by digital finance development, and digital finance has further contributed to energy efficiency. In contrast, in the eastern region, the level of digital financial development and economic development is generally higher, and the negative effect of digital finance on energy efficiency is increasing. On the one hand, a more developed level of digital finance also means a higher risk of financial management and crime and a higher cost of failure. Furthermore, once a financial accident occurs, it may bring an incalculable economic blow to many innovative and green enterprises and reduce energy efficiency. On the other hand, the presence of a large number of business giants in the eastern region in the digital finance industry, the giants inevitably suppress small technology-based companies that threaten them in order to protect their own interests. To some extent, it also suppresses the passion for innovation, hinders the discovery of new technologies, and reduces energy efficiency.

In terms of control variables, similar to the results obtained from the national regression, technological progress has a negative impact on energy efficiency, with coefficients of − 0.217, − 0.824, and − 0.239 for the East, Central, and West regions, respectively, and all of them are significant at the 5% level. Energy structure has a negative impact on energy efficiency in the central region and is significant at the 10% level and has no impact on the east and west regions. Industrial structure upgrading has a positive impact on energy efficiency in the central region and is significant at the 10% level, but not in the east and west regions. Economic scale has no effect on energy efficiency in all regions.

It can be seen from the above estimation results that the overall digital financial inclusion index, the coverage of digital financial inclusion, the degree of digitalization, digital credit services, and digital insurance services can all significantly affect energy efficiency. Moreover, the relationship with energy efficiency shows an inverted U shape, and the impact of digital finance on energy efficiency has regional heterogeneity. The promotion effect of digital finance on energy efficiency is the least in the eastern region, followed by the western region, and the promotion effect of digital finance on energy efficiency in the central region is the largest.

Robustness test

In this paper, a variety of methods are used to test the robustness of the regression model. One is to change the model type. The second is to replace the explained variable. The third is to replace the control variable.

Change the model type

In order to further verify the robustness of the conclusions of this paper, a fixed-effect panel model is added and robust correction is used. The regression results are compared with the systematic GMM method to test whether the conclusions of this paper are robust. The regression results of the model are shown in Table 8. It can be seen that the primary items of the explanatory variables, digital financial inclusion index, the coverage breadth of digital financial inclusion, the degree of digitization, digital credit services, and digital insurance services are all negative, and the secondary items are all positive, and they all pass the significance test. It shows that there is an inverted U-shaped nonlinear relationship between digital finance and energy efficiency, which is consistent with the previous conclusions. The conclusions of this study are robust.

-

2.

Replace the explained variable

Table 8.

Robustness check: replacement of the model

| Variables | Model1 | Model2 | Model3 | Model4 | Model5 |

|---|---|---|---|---|---|

| L.EFF | 0.359*** | 0.340*** | 0.428*** | 0.417*** | 0.323*** |

| 4.54 | 4.31 | 6.08 | 5.42 | 3.89 | |

| DIF | 1.044*** | ||||

| 4.83 | |||||

| DIF2 | − 1.739*** | ||||

| − 3.33 | |||||

| COV | 0.916*** | ||||

| 4.7 | |||||

| COV2 | − 1.599*** | ||||

| − 3.03 | |||||

| DIGI | 0.953*** | ||||

| 4.04 | |||||

| DIGI2 | − 1.366*** | ||||

| − 3.33 | |||||

| INSU | 0.363*** | ||||

| 4.37 | |||||

| INSU2 | − 0.265*** | ||||

| − 2.86 | |||||

| CRE | 1.126*** | ||||

| 3.02 | |||||

| CRE2 | − 2.561* | ||||

| − 1.95 | |||||

| C | 0.61 | 0.663*** | 0.524*** | 0.524*** | 0.646*** |

| 0 | 5.58 | 4.85 | 4.85 | 5.2 | |

| Control variable | YES | YES | YES | YES | YES |

| Individual fixation | YES | YES | YES | YES | YES |

| R2 | 0.803 | 0.801 | 0.795 | 0.798 | 0.785 |

Values in parentheses are t-values.

*Significant at the 10% level; **significant at the 5% level; ***significant at the 1% level.

In order to exclude the interference of outliers, based on the energy efficiency quantile data from 2.5 to 97.5%, a systematic GMM regression was performed, and the results are shown in Table 9. The above results show that the primary items of the explanatory variables digital financial inclusion index, the coverage breadth of digital financial inclusion, the degree of digitization, digital credit services, and digital insurance services are all negative, and the secondary items are all positive; they all pass the significance test. The Ar test was passed. The Sargan’s test p-values were all greater than 0.05, which shows that there is an inverted U-shaped nonlinear relationship between digital finance and energy efficiency, which is consistent with the previous conclusions. The conclusions of this study are robust.

-

3.

Replace the control variable

Table 9.

Robustness test: replacement of explained variables

| Variables | Model1 | Model2 | Model3 | Model4 | Model5 |

|---|---|---|---|---|---|

| L.EFF | 0.502*** | 0.457*** | 0.640*** | 0.535*** | 0.496*** |

| 9.21 | 8.66 | 17.34 | 8.41 | 9.17 | |

| DIF | 0.908*** | ||||

| 11.02 | |||||

| DIF2 | − 1.409*** | ||||

| − 6.56 | |||||

| COV | 0.779*** | ||||

| 9.06 | |||||

| COV2 | − 1.292*** | ||||

| − 6.08 | |||||

| DIGI | 1.009*** | ||||

| 9.67 | |||||

| DIGI2 | − 1.488*** | ||||

| − 8.02 | |||||

| INSU | 0.343*** | ||||

| 10.38 | |||||

| INSU2 | − 0.236*** | ||||

| − 5.57 | |||||

| CRE | 0.656*** | ||||

| 3.37 | |||||

| CRE2 | − 1.206* | ||||

| − 1.74 | |||||

| C | 0.402*** | 0.511*** | 0.336*** | 0.423*** | 0.492*** |

| 4.58 | 4.02 | 4.34 | 4.16 | 3.39 | |

| Control Variable | YES | YES | YES | YES | YES |

| AR(1)P value | 0.001 | 0.001 | 0.001 | 0 | 0.001 |

| AR(2)P value | 0.209 | 0.169 | 0.21 | 0.139 | 0.165 |

| Sargan-P value | 1 | 1 | 1 | 1 | 1 |

Values in parentheses are z-values

*Significant at the 10% level; **significant at the 5% level; ***significant at the 1% level

This part adds four control variables of R&D investment (INV), innovation level (CEA), degree of opening to the outside world (OPE), and environmental regulation (GUI) onto the original regression. R&D investment can have a significant impact on green development (Zhang et al. 2022). Green development will lead the economy to transform from high pollution and low efficiency to green ecology, thereby promoting the improvement of energy efficiency. Therefore, this paper selects R&D investment as one of the control variables. R&D investment indicators use provincial R&D investment funds to measure R&D investment indicators. The data come from the China Science and Technology Statistical Yearbook, and the unit is CNY 10,000. Zhu and Zhu (2021) believe that innovation will promote the improvement of energy efficiency, so this paper takes technological innovation as one of the control variables. The innovation level indicator is measured by the number of authorized patents in each province. The data come from the China Statistical Yearbook, and the unit is an item. The “pollution halo hypothesis” argues that increased openness can promote green technology innovation and improve energy efficiency (Letchumanan and Kodama 2000). Therefore, this paper takes the degree of opening to the outside world as one of the control variables, and the degree of opening to the outside world is measured by the flow of foreign direct investment in each province. Ngo (2022) found through research that environmental regulation can have a significant impact on energy efficiency. Therefore, this paper takes environmental regulation as one of the control variables, and environmental regulation is measured by the total investment in pollution control/GDP, and the data come from the China Environmental Statistical Yearbook. In order to reduce heteroskedasticity, this paper utilizes the logarithm of R&D investment, innovation level, degree of opening to the outside world, and environmental regulation indicators. From the regression results in Table 10, it can be seen that the primary items of the overall digital financial inclusion index, the coverage breadth of digital financial inclusion, the degree of digitalization, digital credit services, and digital insurance services are all negative, and the secondary items are all positive. The general financial index, the coverage of digital inclusive finance, the degree of digitalization, and digital credit services have all passed the significance test. The Ar test was passed. Sargan’s test p-values were all greater than 0.05, which shows that there is an inverted U-shaped nonlinear relationship between digital finance and energy efficiency, which is consistent with the previous conclusions. The conclusions of this study are robust.

Table 10.

Robustness test: replacement of control variables

| Variables | Model1 | Model2 | Model3 | Model4 | Model5 |

|---|---|---|---|---|---|

| L.EFF | 0.498*** | 0.219 | 0.327* | 0.443*** | 0.622*** |

| 3.84 | 1.41 | 1.83 | 3.43 | 5.42 | |

| DIF | 1.093*** | ||||

| 4.94 | |||||

| DIF2 | − 1.818*** | ||||

| − 3.59 | |||||

| COV | 1.232*** | ||||

| 3.95 | |||||

| COV2 | − 1.997*** | ||||

| − 2.62 | |||||

| DIGI | 0.928*** | ||||

| 3.58 | |||||

| DIGI2 | − 1.595*** | ||||

| − 4.45 | |||||

| INSU | 0.421*** | ||||

| 3.56 | |||||

| INSU2 | − 0.302** | ||||

| − 2.13 | |||||

| CRE | − 0.253 | ||||

| − 0.44 | |||||

| CRE2 | 1.114 | ||||

| 0.77 | |||||

| tec | 0.006 | − 0.077 | − 0.286 | 0.087 | 0.079 |

| 0.05 | − 0.69 | − 1.64 | 0.84 | 0.72 | |

| struc | − 27.906 | − 64.061 | − 25.425 | − 64.005 | − 71.360* |

| − 0.79 | − 1.37 | − 0.45 | − 1.13 | − 1.74 | |

| eco | − 187.728 | 921.612 | − 1088.490* | − 360.075 | 272.374 |

| − 0.44 | 1.44 | − 1.77 | − 0.64 | 0.44 | |

| energy | 15.564 | − 17.348 | 11.789 | 30.139** | 30.559 |

| 1.01 | − 0.84 | 0.75 | 2.05 | 1.43 | |

| INV | − 0.018 | − 0.051* | 0.059 | − 0.064*** | 0.01 |