Abstract

Introduction

Hospital-based emergency departments have been a sustained source of overall hospital utilization in the United States. In 2019, an estimated 150 million hospital-based emergency department (ED) visits occurred in the United States, up from 90 million in 1993, 108 million in 2000 and 137 million in 2015. This study analyzes hospital ED visit registration data pre and post to the COVID-19 pandemic describe the impact of on hospital ED utilization and to assess long-term implications of COVID and other factors on the utilization of hospital-based emergency services.

Methods

We analyze real-time hospital ED visit registration data from a large sample of US hospitals to document changes in ED visits from January 2020 through March 2022 relative to 2019 (pre-COVID baseline) to describe the impact of the COVID-19 pandemic on EDs and assess long-term implications.

Results

Our data show an initial steep reduction in ED visits during the first half of 2020 (compared to 2019 levels) with rebounding occurring in 2021, but never reaching pre-pandemic levels. Overall, ED visit volumes across the study states declined in each year since 2019: 2020 declined by −18%, 2021 by −10% and the first quarter of 2022 is −12% below 2019 levels.

Conclusions

There is a wide range of potential long-term implications of the observed reduction in the demand for hospital-based emergency services not only for emergency physicians, but for hospitals, health plans and consumers.

Keywords: Emergency physician supply, ED visits, Emergency physician services market

1. Background

Hospital-based emergency departments have been a sustained source of overall hospital utilization in the United States. In 2019, an estimated 150 million hospital-based emergency department (ED) visits occurred in the United States, up from 90 million in 1993 [1], 108 million in 2000 and 137 million in 2015 [2]. In addition, the emergency department is the primary driver of inpatient admissions in most hospitals. In 2018, approximately 70% of all hospital inpatient admissions originated in the hospital ED [3] and one study estimates that EDs generate more than two-thirds of all economic activity in US hospitals, up from 40% in 2002 [4]. At the same time, there are growing efforts by health plans and health system planners to reduce utilization of hospital-based emergency services, especially for so-called “low-value” care. CDC data show that hospital ED visit rates (per hundred population) had grown consistently over time, from 35.5 in 1993 and then peaking at 46 per hundred population in 2015 and then declining to 40 per hundred by 2018. In addition, enrollment in managed care and “value- based” health plans increased substantially in recent years. These plans have incentives and tools to more aggressively manage and control how their members access health care including reducing utilization of hospital based-emergency services and are likely building upon the COVID-19 driven accelerated adoption of telehealth systems.

Previous studies of the COVID-19 pandemic have documented substantial reductions in emergency department (ED) visits, hospital inpatient admissions, physician visits, and other medical services compared to pre-COVID levels. This paper analyzes ED data covering the entire pandemic period through March 2022 to provide a complete, up-to-date picture of the effects of the COVID-19 pandemic on emergency department utilization.

1.1. Importance

Understanding how utilization of hospital EDs has changed over the entire pandemic is valuable to a wide audience, including emergency department physicians, hospital and health system planners and managers, policy makers, payors and ultimately consumers.

Specifically, we contextualize potential implications of the observed reduction in the demand for hospital-based emergency services for emergency physicians, hospitals, and health plans and consumers.

1.2. Goals of the this investigation

We use real-time hospital ED visit registration data to document changes in ED visits from January 2020 through March 2022 relative to 2019 (pre-COVID baseline) to describe the impact of the COVID-19 pandemic on EDs and assess long-term implications.

2. Methods

2.1. Study design and setting

The data for this analysis were supplied by Collective Medical, a care coordination software company that links to hospital operations and electronic medical records systems. We drew upon daily hospital registration data to measure ED visits from more than 1000 hospitals. The data cover between 40% to 100% of hospitals in nine states (California, Washington, Oregon, Virginia, Massachusetts, Arkansas, West Virginia, Idaho, New Mexico) for the period January 1, 2019 through March 31, 2022. The study sample includes only hospitals reporting for all months during this 39-month period.

2.2. Analysis

We conducted a simple descriptive trend analysis using a pre-post design. Data from 2019 serve as the pre-COVID baseline. Total ED visits across all study hospitals within each state are calculated for each quarter between January 2019 through December 2021 and for the first three months of 2022. Totals for each quarter in 2020 and 2021 are compared to 2019 and the percentage difference from 2019 is calculated for each of the nine states and for January, February and March of 2022. For example, within a given state, total ED visits in January of 2019 are compared with the total ED visits in January 2020 and January 2021 and the percentage difference from 2019 for 2020 and 2021 is calculated. An overall average difference in ED visits is estimated for all nine states combined.

3. Results

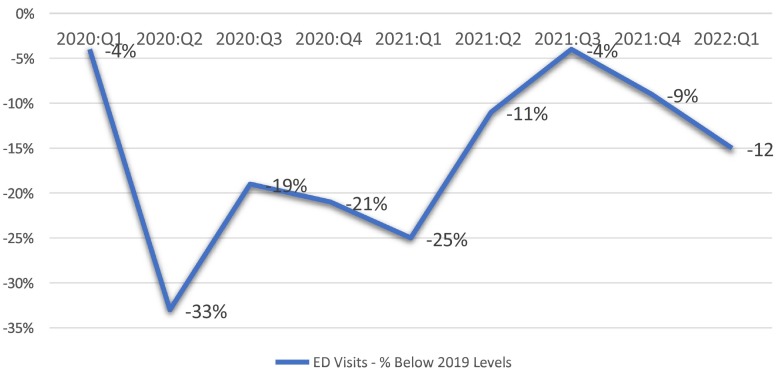

Fig. 1 summarizes percentage differences in ED visits by quarter for 2020: Q1–2022: Q1 compared to the same quarter in 2019. ED visits fell dramatically beginning with 2020:Q1 and remained well below 2019 levels through the remainder of 2020 and the first half of 2021. ED visit volumes almost returned to pre-COVID-19 levels in 2021:Q3 but then declined again and have stayed well below pre-COVID-19 levels through March 2022. Collectively, ED visit volumes have remained below pre-COVID levels consistently for all quarters since the onset of the pandemic.

Fig. 1.

Emergency department (ED) visits — % below 2019 levels, by Quarter: 2020: Q1 –.

3.1. 2022: Q1

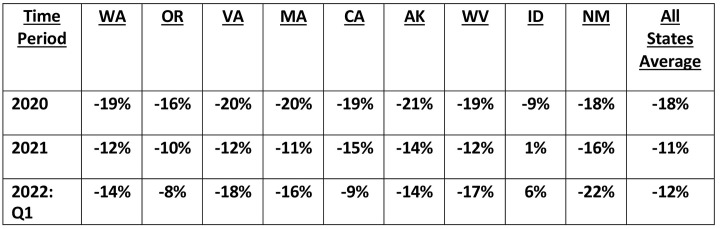

Fig. 2 summarizes the differences (relative to the pre-COVID baseline year 2019) in ED visit volume for each state by year for 2020 and 2021 and for 2022:Q1. Overall, ED visit volume averaged across the nine study states, declined in 2020, 2021 and 2022:Q1 by −18%, −11%, and - 12%, respectively. Examination of the differences across states within each year shows a fairly narrow range except for one (rural) state, Idaho, which consistently shows less of an impact of COVID-19 on ED visit volumes compared to the other states. These data suggest that our findings may be broadly representative for most (non-rural) states.

Fig. 2.

Changes in emergency department visits by State: 2020, 2021, 1st Quarter of 2022 (% difference from 2019 levels).

3.2. Limitations

It is important to note that, while the data used for this study are based on a large sample (1000+ hospitals across nine states), it is a convenience sample. However, it does represent a significant proportion of the hospitals and ED visits for these states, ranging from over 40% of hospitals in California to virtually 100% in the other states, and is broadly representative of hospitals nationally, across all states. On the other hand, with respect to data quality and validity, the data are drawn from hospitals that have been participating in the Collective Medical network well before the appearance of COVID-19 and the data systems and reporting have been tested and standardized and are highly reliable.

4. Discussion

Our data, drawn from a unique real-time hospital registration platform covering 1000+ hospitals in a cross-section of states, show an initial steep reduction in ED visits during the first half of 2020 (compared to 2019 levels) with rebounding occurring in 2021, but never reaching pre-pandemic levels. Moreover, the winter surges of 2021 and 2022 appear to have continued to reduce ED visits relative to 2019. Overall, ED visits volumes across the study states declined in each year since 2019: 2020 declined by −18%, 2021 by −10% and the first quarter of 2022 is - 12% below 2019 levels. This translates into substantially fewer ED visits compared to 2019. For context, these estimates, if applied nationally (compared to 2019 visit levels of 150 million according to CDC data [5]) equate to 26.9 million fewer hospital ED visits in 2020, 16.6 million fewer ED visits in 2021, and, if the 2022: Q1 rate is sustained throughout the year, 18.5 million fewer visits in 2022. Overall, this represents a reduction in ED volume of some 61.9 million visits compared to 2019, pre-pandemic levels.

These trends have a number of both short and long run potential implications for ED physicians, hospitals, health plans and consumers. In the short run, the demand for hospital-based emergency care and ED physician services has declined and stayed below 2019 for all of 2020 and 2021 and the first quarter of 2022 and the magnitude of the reduction has been substantial. For ED physicians that are not on salary, they have likely experienced significant financial disruption and reduced financial security. According to AMA data, approximately 50% of ED physicians were salaried in 2018, suggesting that half have been directly exposed to the slowdown in demand for ED physician services [6]. Even those on salary may have seen reductions in their hours and compensation as a result of the reduction in demand.

In the longer run, an important question relates to the degree to which the change in demand for hospital-based ED services is permanent or whether it will return to pre-COVID levels and growth trends after the pandemic passes. In a recent survey of emergency medicine physicians, about 25% of emergency medicine physicians whose pay decreased during the pandemic said they expected it to return to pre-COVID levels within the next year, while 42% expected it would take two to three years; 24% predicted their compensation will never return to their pre-COVID income level [7].

There are multiple factors that support forecasts of limited or negative growth in hospital- based emergency utilization and growing financial pressure on emergency physicians.

One school of thought is that consumers, having been forced to seek alternatives during the COVID-19 pandemic, have permanently adjusted their utilization of hospital-based ED services and will continue to seek out alternative sources for their care, including telehealth, urgent care centers and other non-hospital-based ED sites [8]. Substitution of less expensive non-hospital- based ED care is part of a longer-term strategy that has been a policy focus in both the literature and payors for some time. There is a large literature documenting what is considered “low value” use of hospital-based EDs and proposing policy and payment reforms to encourage reduction in the use of hospital-based EDs. One study estimated that between 13.7 and 27.1% of all emergency department visits could be treated at one of these alternative sites [9]. Multiple third-party payors have endorsed these recommendations and have instituted programs to encourage development and adoption of substitutes for hospital-based ED use.

For example, CMS has developed and promoted a “Tele-Emergency” model which promotes use of telemedicine as a substitute for hospital-based ED care [10]. More recently, and related to the COVID-19 pandemic, CMS adopted alternative reimbursement rules to allow for expansion of telehealth use by Medicare patients and other, commercial insurance plans, have followed suit, expanding their reimbursement for alternative sites for care [11]. One recent study found that twenty-two states changed laws or policies during the pandemic to require more robust insurance coverage of telemedicine [12]. These policy changes undoubtedly contributed to the observed reduction in hospital-based ED visits that we see in the Collective Medical data. A key question going forward concerns the extent to which these policy changes, adopted to manage the COVID-19 driven emergency conditions, remain in place, or are adopted in some modified form to support the continued use of alternative sites to substitute for hospital-based ED care [13]. A recent report by McKinsey identifies on-demand virtual care via telehealth as a likely mechanism that will reduce low-acuity visits to hospital EDs in the future [14].

Our data may provide insight into broader and longer-term effects of COVID-19 driven reductions on hospital utilization on our health care system. Hospitals are highly dependent on the activity generated by their emergency departments to support the operation of the hospital. As noted, EDs have become the main driver of total hospital revenues – both on an outpatient basis (ED treat and release visits) and as inpatients, as the majority of inpatients are admitted to hospitals through their EDs. Our data show a dramatic reduction in utilization of hospital-based ED visits. This reduction in ED visits can affect both hospital outpatient revenue as well hospital inpatient revenue, if patients that would have been admitted previously through the ED now avoid using the hospital both as outpatients and inpatients. Multiple studies have found that total hospital inpatient admissions have also declined as a result of the COVID 19 pandemic [15], although one study of pre-post COVID-19 data found that while there was a decrease in ED visits it was accompanied by an increase in the rate of hospital admissions from the ED [16]. This suggests that reductions in ED visits did not translate directly into lower inpatient admissions via the ED. In any case, total hospital volume has been negatively affected since the start of the COVID-19 pandemic and likely has resulted in lower hospital revenues at the same time operating expenses have increased due to COVID-19 safety protocols and rising labor costs. The net result is likely growing financial pressure on hospitals with the possibility of a surge in hospital prices in the coming months and years when hospitals renegotiate their third-party contracts with commercial health plans.

In sum, pre-COVID hospital ED demand and overall hospital operations and financial health may only be restored when patients feel safe to return to hospital EDs for their care. At the same time, it may also be true that we will never return to a pre-COVID ‘normal’ for hospital-based EDs as we may have just retrained much of the population to first seek care virtually, thus.

permanently reducing ‘avoidable’ ED utilization – which has been a long-sought goal in healthcare. In fact, ED utilization may then serve as a bellwether of a real shift in how healthcare is used. The pressures to reduce avoidable hospital ED utilization is also likely to intensify with the recent and apparent sustained growth in enrollment in HMOs for the Medicare and Medicaid populations. In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42% of the total Medicare population, up from 11 million in 2010 [17]. Enrollment in HMOs for the Medicaid population grew to 55+ million in 2019 [18]. These payment models incentivize “value-based” care and provide a structure for more direct care management, including reducing utilization of hospital ED visits for enrolled populations.

To the extent that the observed reduction in demand for hospital-based ED services represents a more permanent shift, the implication for emergency physicians could be significant. The total number of hospital-based ED visits had been growing fairly consistently before COVID-19. As a result, policies were implemented to expand the supply of emergency physicians, including expanding the number of emergency physician residency slots. Emergency medicine residency programs and the overall number of residency slots in the specialty have grown dramatically. In 2008, there were 4565 residents in 145 emergency medicine programs. By 2019 these numbers had grown to 247 programs (70% increase) with 7940 residents (74% increase), but now a 2021 report by the ACRP Emergency Medicine Physician Workforce forecasts an excess of 10,000 emergency physicians by 2030.

Moreover, this report likely did not factor in the most recent data on the decline in ED visits documented here nor take into account the implementation of the Federal “No-Surprises” legislation which strictly limits out-of-network prices for hospital-based emergency services including both physician and hospital services [19]. The “No-Surprises” law, if fully implemented, will likely result in reduced reimbursement for hospital-based emergency services from commercial insurance companies and therefore reduced revenue flowing into the emergency physician services market.

Finally, there has been substantial consolidation within the emergency physician market with the emergence and growth of large for-profit companies gaining much larger control of contracts with hospitals for the provision of hospital-based emergency services [20]. The combination of these factors could result in greater pressure to reduce compensation to hospital-based emergency physicians and the emergence of large physician management.

organizations that have “monopsony” power over the employment and compensation of emergency physicians in local markets [21].

The sustained, COVID-19 driven reduction in ED utilization reported here highlights the need for further research on both the potential negative health effects of patients avoiding emergency services, and whether changes in ED utilization patterns and behavior as either as a result of COVID-19 or simply accelerated by COVID-19 might be permanent, and if so, the implications for hospital emergency department planners and managers and especially emergency physicians.

Author contributions

GM, JFO, BAZ conceived the study and designed the analysis. GM and BAZ supervised the data collection and conducted the analysis. JFO and GM drafted the manuscript, LA contributed to the interpretation of results and discussion sections, and all authors contributed substantially to its revision. GM takes responsibility for the paper as a whole.

Meetings

None.

Funding

Funded in part by: Laura and John Arnold Foundation (21–05620).

Declaration of Competing Interest

Conflicts of interest: None of the authors report a conflict of interest.

References

- 1.Cairns C., Kang K. National Center for Health Statistics; April 2022. National Hospital Ambulatory Medical Care Survey: 2019 emergency department summary tables.https://www.cdc.gov/nchs/data/nhamcs/web_tables/2019-nhamcs-ed-web-tables-508.pdf [Google Scholar]

- 2.Clarke T.C., Schiller J.S. Division of Health Interview Statistics, National Center for Health Statistics. May 2020. Early release of selected estimates based on data from the January-June 2019 National Health Interview Survey.https://www.cdc.gov/nchs/data/nhis/earlyrelease/EarlyRelease202005-508.pdf [Google Scholar]

- 3.Augustine J.J. American College of Emergency Physicians; December 2019. Latest data reveal the ED’s role as hospital admission Gatekeeper.https://www.acepnow.com/article/latest-data-reveal-the-eds-role-as-hospital-admission-gatekeeper/ [Google Scholar]

- 4.Melnick G., Fonkych K., Abrishamian L. Emergency departments: The economic engine of hospitals - Evidence from California. Am J Emerg Med. December 2020;38(12) doi: 10.1016/j.ajem.2019.12.021. [DOI] [PubMed] [Google Scholar]

- 5.Kane C.K. American Medical Association; 2019. Updated data on physician practice arrangements: For the first time, fewer physicians are owners than employees.https://www.ama-assn.org/system/files/2019-07/prp-fewer-owners-benchmark-survey-2018.pdf [Google Scholar]

- 6.Hunter J. Weatherby Healthcare, CHG Company; September 2020. Emergency medicine physician salaries 2020: modest compensation growth but high job satisfaction.https://weatherbyhealthcare.com/blog/emergency-medicine-physician-salaries-2020 [Google Scholar]

- 7.Weinick R.M., Burns R.M., Mehrotra A. How many emergency department visits could be managed at urgent care centers and retail clinics. Health Aff. September 2010;29(9) doi: 10.1377/hlthaff.2009.0748. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.HRSA . Health Resources and Services Administration; February 2021. Telehealth for emergency departments.https://telehealth.hhs.gov/providers/telehealth-for-emergency-departments/tele-emergency/ [Google Scholar]

- 9.CMS . U.S. Centers for Medicare and Medicaid Services; March 2020. Medicare telemedicine health care provider fact sheet.https://www.cms.gov/newsroom/fact-sheets/medicare-telemedicine-health-care-provider-fact-sheet [Google Scholar]

- 10.Volk J., et al. The Commonwealth Fund; June 2021. States’ actions to expand telemedicine access during COVID-19 and future policy considerations.https://www.commonwealthfund.org/publications/issue-briefs/2021/jun/states-actions-expand-telemedicine-access-covid-19 [Google Scholar]

- 11.Weiner S. Association of American Medical Colleges; October 2021. What happens to telemedicine after COVID-19?https://www.aamc.org/news-insights/what-happens-telemedicine-after-covid-19 [Google Scholar]

- 12.Heist T., Schwartz K., Butler S. Kaiser Family Foundation; February 2021. Trends in overall and non-COVID-19 hospital admissions.https://www.kff.org/health-costs/issue-brief/trends-in-overall-and-non-covid-19-hospital-admissions/ [Google Scholar]

- 13.Melnick, G. et al. “Hospital utilization during the pandemic: an update” Epic Health Research Network (May 2021)https://epicresearch.org/articles/hospital-utilization-during-the-pandemic-an-update

- 14.Smulowitz P.B., et al. National trends in ED visits, hospital admissions, and mortality for medicare patients during the COVID-19 pandemic. Health Aff. September 2021;40(9) doi: 10.1377/hlthaff.2021.00561. [DOI] [PubMed] [Google Scholar]

- 15.Freed M., et al. Kaiser Family Foundation; June 2021. Medicare advantage in 2021: enrollment update and key trends.https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2021-enrollment-update-and-key-trends/ [Google Scholar]

- 16.KFF . Kaiser Family Foundation; 2022. Medicaid and CHIP.https://www.kff.org/state-category/medicaid-chip/medicaid-managed-care-market-tracker/ Accessed August 3 2022. [Google Scholar]

- 17.ACEP . American College of Emergency Physicians; 2022. The No Surprises Act.https://www.acep.org/federal-advocacy/no-surprises-act-overview/ [Google Scholar]

- 18.ACEP . American College of Emergency Physicians; March 2022. Impacted by EM consolidation? ACEP tells the feds.https://www.acep.org/federal-advocacy/workforce-issues/impacted-by-em-consolidation-tell-the-federal-government/ [Google Scholar]

- 19.Tkacik M. Private equity gloats over a doctor glut. Lever. May 2020 https://www.levernews.com/private-equity-gloats-over-a-doctor-glut/ [Google Scholar]

- 20.Marco C.A., Courtney D.M., Ling L.J., Salsberg E., Reisdorff E.J., Gallahue F.E., et al. The emergency medicine physician workforce: projections for 2030. Ann Emerg Med. 2022 Jul;80(1):92–93. doi: 10.1016/j.annemergmed.2022.03.017. [DOI] [PubMed] [Google Scholar]

- 21.Predmore Z.S., Roth E., Breslau J., Fischer S.H., Uscher-Pines L. Assessment of patient preferences for telehealth in post–COVID-19 pandemic health care. JAMA Netw Open. 2021;4(12) doi: 10.1001/jamanetworkopen.2021.36405. [DOI] [PMC free article] [PubMed] [Google Scholar]