Abstract

This paper provides a comprehensive assessment of financial intermediation and the economic effects of the Paycheck Protection Program (PPP), a large and novel small business support program that was part of the initial policy response to the COVID-19 pandemic in the US. We use loan-level microdata for all PPP loans and high-frequency administrative employment data to present three main findings. First, banks played an important role in mediating program targeting, which helps explain why some funds initially flowed to regions that were less adversely affected by the pandemic. Second, we exploit regional heterogeneity in lending relationships and individual firm-loan matched data to study the role of banks in explaining the employment effects of the PPP. We find the short- and medium-term employment effects of the program were small compared to the program’s size. Third, many firms used the loans to make non-payroll fixed payments and build up savings buffers, which can account for small employment effects and likely reflects precautionary motives in the face of heightened uncertainty. Limited targeting in terms of who was eligible likely also led to many inframarginal firms receiving funds and to a low correlation between regional PPP funding and shock severity. Our findings illustrate how business liquidity support programs affect firm behavior and local economic activity, and how policy transmission depends on the agents delegated to deploy it.

Keywords: PPP, Fiscal stimulus, Banking, Small business, Policy targeting

1. Introduction

The COVID-19 pandemic triggered an unprecedented economic freeze and a massive immediate policy response. Among the firms most affected by the freeze were millions of small businesses without access to public financial markets or other ways to manage short-term costs. Without an existing system of social insurance to support these firms, policymakers around the world rushed to develop new programs to contain the damage, including wage subsidies, small business grants, and guaranteed business loan schemes, often relying on banks to rapidly deploy funds to firms.1

This paper studies a large and novel business support program that was part of the crisis response in the US, the Paycheck Protection Program (PPP), and the role of banks in explaining the employment effects of the PPP. Part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the PPP offered guaranteed, forgivable loans to provide liquidity to small and mid-sized businesses and prevent job losses. The PPP deployed more than $500 billion within just four months of passage, making it one of the largest firm-based fiscal policy programs in US history. The program was administered by the Small Business Administration (SBA) with the loan application process operated by commercial banks. We document substantial heterogeneity across banks in disbursing PPP funds and find that this heterogeneity led to meaningful differences across firms and regions in terms of targeting and employment impacts.

We have three main findings. First, banks played an important role in mediating program targeting. The extent of bank participation in the initial phase of the program depends intuitively on ex ante bank characteristics, including relationships with the SBA, greater reliance on labor relative to automation, and active enforcement actions against banks. These differences in bank participation explain spatial differences in the initial distribution of funds and why some funds initially flowed to regions that were less adversely affected by the pandemic. Second, the short- and medium-term employment effects of the program were small compared to the program’s size. Our analysis reveals how bank performance differences in loan deployment contribute to these employment effects over time. Third, many firms used the loans to make non-payroll fixed payments and build up savings buffers, which can account for small employment effects and likely reflects precautionary motives in the face of heightened uncertainty.2 Limited targeting in terms of who was eligible likely also led to many inframarginal firms receiving funds and to a low correlation between regional PPP funding and shock severity.

We bring data from two sources to study the PPP. First, we use loan-level microdata from the SBA for all PPP loans, which includes lender, geography, and borrower- and loan-level information. The data offer a clear look at which lenders are most active in disbursing loans, how program participation evolves over time, and the geographic distribution of PPP lending across the US economy. Additionally, we obtained high-frequency employment data from Homebase, a software company that provides free scheduling, payroll reporting, and other services to small businesses, primarily in the retail and hospitality sectors. The granularity of the data, coupled with the focus on sectors most adversely affected by the pandemic, allows us to trace out the response of employment, wages, hours worked, and business closures in almost real-time and evaluate the effects of PPP support. We complement these primary data sources with a number of other sources, including county-level unemployment insurance claims, the Census Small Business Pulse survey, small business revenue data from Womply, and employment rates from the COVID-19 economic tracker (Chetty et al., 2020).

We consider three dimensions of program targeting. First, did the funds flow to where the economic shock was greatest? Second, given that the PPP used the banking system as a conduit to access firms, what role did the banks play in mediating policy targeting? Third, why did some banks systematically under- or overperform in disbursing PPP loans relative to their share of the small business loan market?

Preventing unnecessary mass layoffs and firm bankruptcies by injecting liquidity into firms were central goals of the program and the benefits of PPP were likely greatest in areas with more pre-policy economic dislocation. However, we find no evidence that funds flowed to areas that were more adversely affected by the economic effects of the pandemic, which we proxy using declines in hours worked, employee counts, business shutdowns, and coronavirus infections and deaths. If anything, we find evidence that funds flowed to areas less hard hit. Over both rounds of funding, the correlation between pre-policy economic dislocation and program participation was approximately zero, which likely reflects the program’s broad definition of eligibility (Barrios et al., 2020).

We find significant heterogeneity across banks in terms of disbursing PPP funds, which reflects more than mere differences in underlying loan demand and contributes to the weak correlation between economic declines and PPP lending. Ex ante bank characteristics, including greater labor capacity to process loans, pre-existing SBA relationships, and active enforcement actions against banks, predict banks’ relative performance in disbursing PPP loans. The PPP program required lenders to collect and enter information into a custom application and submit it via the SBA portal. Thus, reliance on labor rather than automation, as well as pre-existing access and familiarity with the SBA portal facilitated disbursement of PPP loans, especially in the initial phase. Conversely, banks subject to formal enforcement actions were not automatically approved to make PPP loans, initially leading to lower PPP disbursement for these banks.

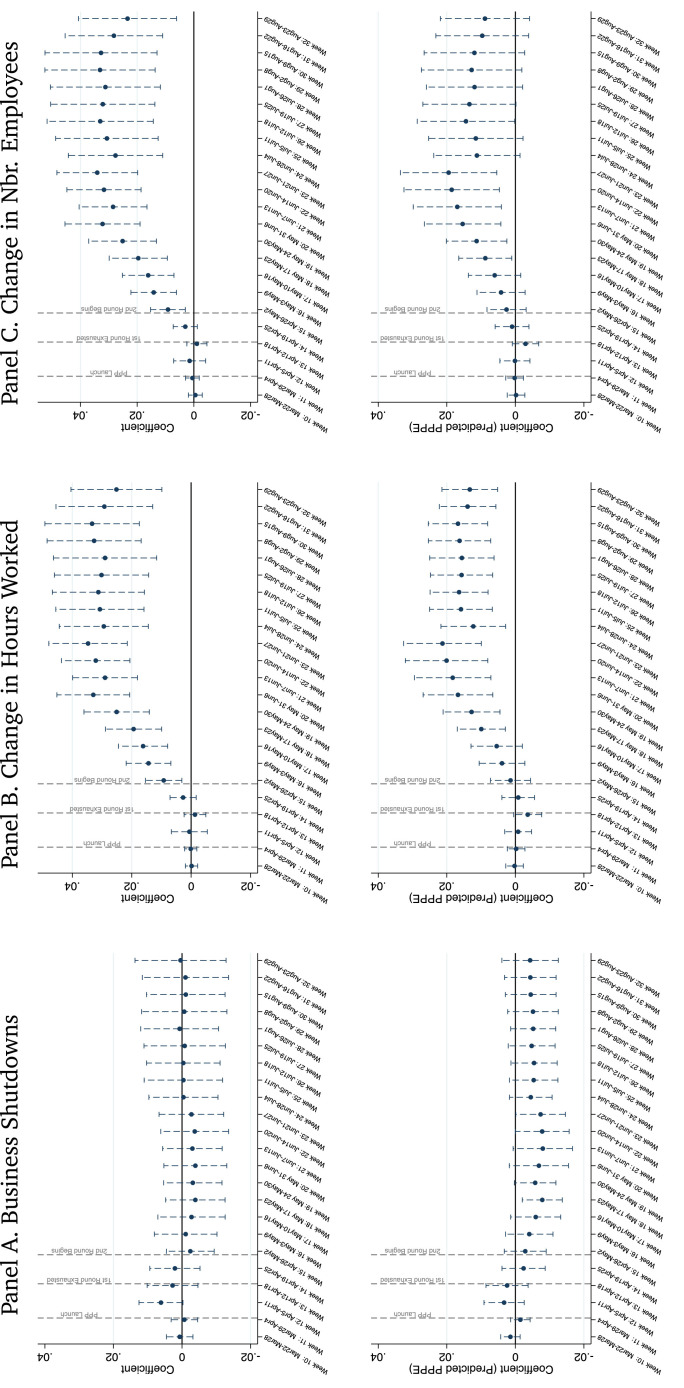

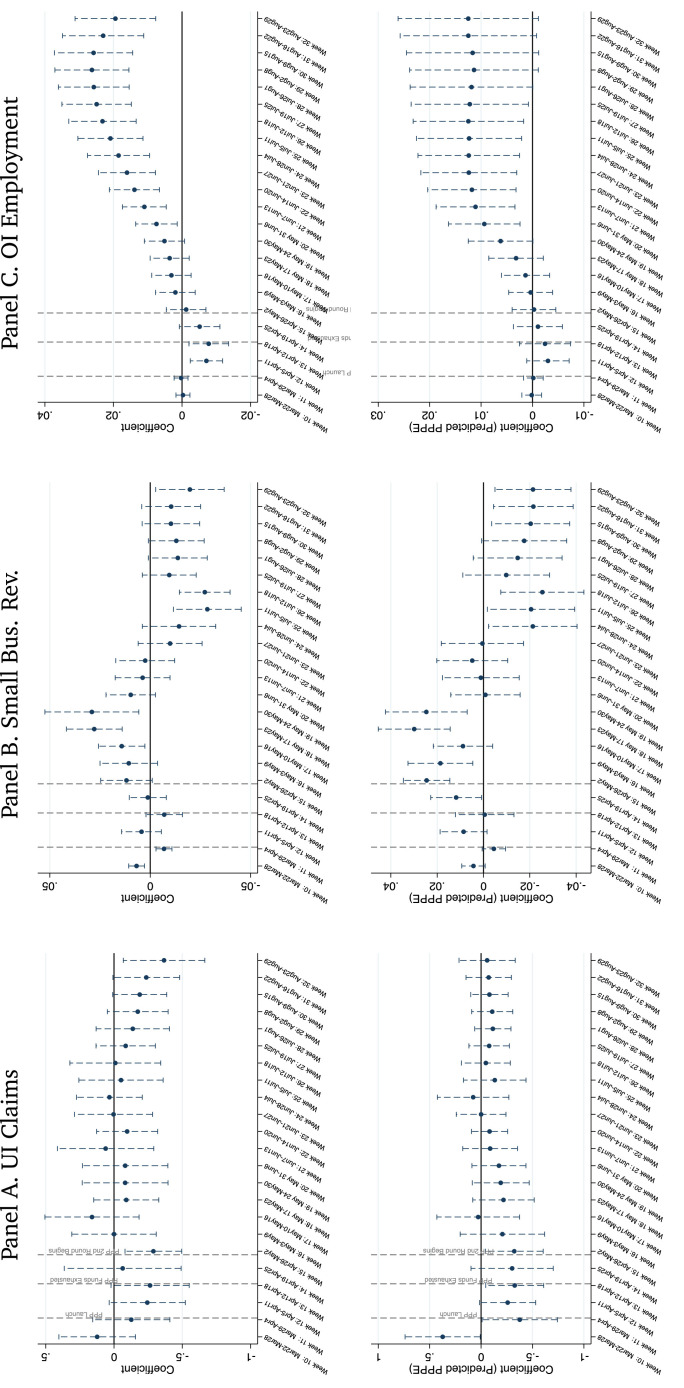

Our results on bank participation motivate two complementary research designs to evaluate the PPP using ZIP-level variation in banks’ propensity to disburse loans. We use these research designs to study business shutdowns, employment levels, reductions in hours worked, initial unemployment insurance (UI) claims, and small business revenues. We construct measures of geographic exposure to bank performance in the PPP using (1) the distribution of bank branches across geographic regions and (2) geographic exposure to the ex ante bank characteristics that predict PPP disbursement. Both measures exploit the fact that most small business lending is local (Brevoort, Holmes, Wolken, 2010, Granja, Leuz, Rajan, 2018). Our first measure compares regions exposed to high-performance banks—whose share of PPP lending exceeded what would be expected from them given their national share of the small business lending market—to regions exposed to low-performance banks—whose PPP lending share underperformed relative to their national share of the small business lending market. This bank-driven variation across regions allows us to isolate the effect of the PPP from differences in loan demand or confounding correlations between PPP funding and local economic outcomes. Our second measure further attempts to isolate specific elements of bank performance that we can trace back to bank-supply frictions prevailing prior to the pandemic.

We do not find evidence that the PPP had a substantial effect on local employment outcomes or business shutdowns during the first round of the program, and find modest effects on hours worked and employee counts during the second round. We confirm the firm-level evidence by documenting limited impacts on initial UI claims, small business revenues, and employment rates in small businesses at the county level. Our confidence intervals on employment outcomes are wide enough to permit modest effects of the program, but precise enough to reject large effects. Results are qualitatively and quantitatively similar for both measures of exposure to bank performance. Aggregate impacts over the first five months of the program equal 4% of eligible employment, implying a cost-per-job-year of at least $175,000. Our estimates suggest that more than 90% of jobs supported by the PPP were inframarginal. If wages for inframarginal workers did not adjust, then the bulk of the program’s economic benefits appear to accrue to other stakeholders, including owners, landlords, lenders, suppliers, customers, and possibly future workers.

Both research designs are akin to Bartik instruments and rely on the assumption that pre-policy bank branch shares in a given region are not correlated with the outcomes we study. This assumption likely holds once we condition on key observables, including the relationship between PPP funding and the initial severity of the crisis. Our preferred specification conditions on firm- and state-by-time fixed effects, which remove many potential confounding factors from the analysis. We present further evidence supporting the Bartik assumption from pre-trends comparisons between high- and low-exposure groups and diagnostics for unpacking the Bartik instrument following Goldsmith-Pinkham et al. (2020).

We complement our aggregate regional designs with a timing design using matched firm-loan data. We match by name 10,694 firms in Homebase to PPP loans and then compare firms that received loans earlier versus later. We instrument for the date of PPP receipt using regional exposure to lenders that disbursed different amounts of PPP funding or predicted PPP funding. This variation allows us to capture the effect of firms receiving loans during a crisis in earlier versus later weeks. Results from this research design also show modest effects that fall within the confidence interval of our bank exposure design.

The fact that the program disbursed significant funds, yet had little effect on employment, raises the natural question of what firms did with the money. We draw on the Census Small Business Pulse Survey to show that PPP funds allowed firms to build up liquidity and to meet loan and other non-payroll spending commitments. For these firms, the PPP may have strengthened balance sheets at a time when shelter-in-place orders prevented workers from doing work, and when UI was more generous than wages for a large share of workers.

This finding is important because it implies that, while employment effects are small in the short run, they may well be positive in the longer run because firms are less likely to close permanently. The program also likely had important effects in terms of promoting financial stability by avoiding corporate loan defaults and business evictions. Consistent with this notion, we find suggestive evidence that exposure to higher-performing banks is associated with fewer permanent firm shutdowns, defined as the firm being closed for all weeks from the beginning of the program through the end of August. This result suggests that initial bank-driven distortions may have had persistent effects on the ability of firms to reopen after the initial shock.

At the same time, because program eligibility was defined broadly, many less-affected firms received PPP funding and may have continued as they would have in the absence of the funds, either by spending less out of retained earnings or by borrowing less from other sources. For these firms, while the statutory incidence of funding falls on labor and creditors, the economic incidence falls mainly on business owners.

Our work complements several contemporaneous studies that also focus on the employment effects of the PPP, although with less emphasis on the role of financial institutions. Three studies (Autor, Cho, Crane, Goldar, Lutz, Montes, Peterman, Ratner, Villar, Yildirmaz, Chetty, Friedman, Hendren, Stepner, Hubbard, Strain, 2020) use the size threshold of 500 employees to study the employment effects of the program. This research design estimates a different treatment effect, as it uses variation local to larger firms, while most PPP loans were disbursed to much smaller firms. Approximately 0.4% of PPP loans were disbursed to firms with more than 250 employees, which account for only 13% of covered employment among all borrowers. Nevertheless, despite using different primary data sources and a different research design, these papers tend to find either modest or negligible effects on employment, consistent with our findings.3

Several other studies use differences in the timing of PPP receipt to examine the program’s employment effects, while also exploiting differences in timing due to pre-existing variation in bank lending relationships. Li and Strahan (2020) use variation in the strength of the relationships between local banks and firms and, similar to us, find modest employment effects of the program. Faulkender et al. (2020) leverage the faster pace that community banks approved and disbursed funds relative to their counterparts and find large employment effects of the program. Bartik et al. (2020b) find significantly lower self-reported survival probabilities for firms whose primary lender was a top-four bank. Doniger and Kay (2021) find that areas with a greater fraction of businesses receiving PPP funds right before the end of the first round rather than at the start of the second round had higher employment rates, with magnitudes that align with our uninstrumented matched sample analysis. While the conceptual approach in these papers is similar to ours, a key source of difference is the extent to which the research design accounts for nonrandom program targeting. Given the role lenders played in allocating funds to areas that were initially less affected by the pandemic, accounting for targeting differences across areas is crucial for identifying the employment effects of the PPP. Our paper also contributes by identifying and exploiting ex ante bank characteristics that affected banks’ ability to deploy funds quickly.4

More broadly, this paper joins a literature focusing on how government interventions following crises impact recovery and the broader economy (Agarwal, Amromin, Ben-David, Chomsisengphet, Piskorski, Seru, 2017, Mian, Sufi, 2012, Zwick, Mahon, 2017). Specifically, we offer a comprehensive evaluation of the role that banks played in allocating PPP funds, and the impact that this force had on program targeting and economic outcomes. We contribute to an understanding of government responses to crises, including subsidized lending, tax incentives, and loan guarantees, a widely-used form of government intervention in credit markets (Smith, 1983, Gale, 1990, Gale, 1991, Lucas, 2016, Kelly, Lustig, Van Nieuwerburgh, 2016, Atkeson, d’Avernas, Eisfeldt, Weill, 2019). A burgeoning empirical literature examines the transmission and effects of loan guarantees or tax-based stimulus on credit supply, employment, and small business outcomes (House, Shapiro, 2008, Lelarge, Sraer, Thesmar, 2010, Bachas, Kim, Yannelis, 2020, Barrot, Martin, Sauvagnat, Vallee, Mullins, Toro, Gonzalez-Uribe, Wang, Zwick, 2021). Our paper contributes directly to this literature by showing how policy transmission depends on the agents delegated to deploy it (e.g., banks). These results are consistent with those of studies that emphasize the importance of proximity (Granja et al., 2018), as well as emerging evidence from the pandemic that firms with pre-existing borrowing and lending relationships received access to PPP funds faster than their counterparts (Balyuk, Prabhala, Puri, Amiram, Rabetti, Li, Strahan).

The article is organized as follows. Section 2 describes the PPP. Section 3 discusses the main data sources used. Section 4 describes how the distribution of relative performance in the PPP is correlated with bank and other characteristics, documents how differences across banks in PPP activity imply geographic differences in PPP exposure, and explores the implications for PPP targeting to different geographic areas. Section 5 analyzes the effects of the PPP on local labor market and economic outcomes using our bank exposure and timing research designs. Section 6 presents aggregate impact estimates. Section 7 explores mechanisms behind our results. Section 8 concludes.

2. The Paycheck Protection Program (PPP)

The Paycheck Protection Program (PPP) began on April 3rd, 2020 as part of the CARES Act as a temporary source of liquidity for small businesses, authorizing $349 billion in forgivable loans to help small businesses pay their employees and additional fixed expenses during the COVID-19 pandemic. Firms applied for support through banks and the Small Business Administration (SBA) was responsible for overseeing the program and processing loan guarantees and forgiveness. A motivation for using the banking system (including FinTech) as a conduit for providing liquidity to firms is that, because nearly all small businesses have pre-existing relationships with banks, this connection could be used to ensure timely transmission of funds.5

The lending program was generally targeted toward small businesses of 500 or fewer employees.6 Although the initial round of funding was exhausted on April 16th, a second round of $320 billion in PPP funding was passed by Congress as part of the fourth COVID-19 aid bill. Small businesses were eligible as of April 3rd and independent contractors and self-employed workers were eligible as of April 10th. The initial deadline for firms to apply to the program was June 30th, but this was eventually extended to August 8th. Our analysis of the program runs through the end of August.7

The terms of the loan were the same for all businesses. The maximum amount of a PPP loan is the lesser of 2.5 times the average monthly payroll costs or $10 million. The average monthly payroll is based on prior year’s payroll after subtracting the portion of compensation to individual employees that exceeds $100,000.8 The interest rate on all loans is 1% and their maturity is two years. Under SBA’s interpretation of the initial bill, the PPP loans can be forgiven if two conditions are met. First, proceeds must be used to cover payroll costs, mortgage interest, rent, and utility costs over the eight-week period following the provision of the loan, but not more than 25% of the loan forgiveness amount may be attributable to non-payroll costs. Second, employee counts and compensation levels must be maintained. If companies cut pay or employment levels, loans may not be forgiven.9 However, if companies lay off workers or cut compensation between February 15th and April 26th, but subsequently restore their employment levels and employee compensation, their standing can be restored.

Congress expanded PPP on June 3rd, allowing more flexible terms for loan forgiveness. The updates to the PPP expanded the duration from eight weeks to twenty-four and extended the deadline to rehire workers until the end of the year. This change effectively gave small businesses more time to use program funds and rehire workers. Additionally, the minimum amount of funds used for payroll while still qualifying for forgiveness was lowered from 75% to 60%.

An important feature of the program is that the SBA waived its standard “credit elsewhere” test used to grant regular SBA 7(a) loans. This test determines whether the borrower has the ability to obtain the requested loan funds from alternative sources and poses a significant barrier in the access to regular SBA loans. Instead, under PPP rules, applicants were only required to provide documentation of their payroll and other expenses, together with a simple two-page application process where they certify that the documents are true and that current economic uncertainty makes this loan request necessary to support ongoing operations. In sum, the PPP program was designed to be a “first-come-first-served” program with eligibility guidelines that allowed it to reach a broad spectrum of small businesses.10

During the first weeks of April, demand for PPP loans outstripped supply, which was limited by statute. Between April 3rd and 16th all of the initial $349 billion was disbursed, and the program stopped issuing loans for a period of time. The House and Senate passed a bill to add an additional $320 billion in funding on April 21st and 23rd, respectively, which was signed into law on the 24th. The PPP began accepting applications on April 27th for the second round of funding. While 60% of the second round funds were allocated within two weeks of initial disbursement, the remaining second round funds were disbursed slowly, with unallocated PPP funds being available in late June. By early July, more than $130 billion remained available in PPP funds. Loan disbursement remained low throughout July and August, suggesting that the second round had sufficient funds to meet demand. The program stopped accepting applications on August 8th, culminating in $525 billion in total disbursements.

3. Data

Our primary source for data on the PPP comes from microdata made available through the Small Business Administration (SBA) and the Department of Treasury. We are able to observe all loans approved under the program. For all loans, the data include borrower and lender name, the borrower’s self-reported industry, location, corporate form, and workers covered by the loan. Our targeting analysis and bank exposure research design use data for all loans aggregated to either the regional or local geography level, while our individual research design uses a matched sample of loans that we were able to match to the Homebase dataset.

We merge this data set with the Reports of Condition and Income (Call Reports) filed by all active commercial banks as of the first quarter of 2020. We are able to match 4,370 bank participants in the PPP program to the Call Reports data set. We did not match 795 commercial and savings banks that filed a Call Report in the first quarter of 2020. We assume that these banks did not participate in the PPP program and made no PPP loans. Overall, lenders in the PPP sample that we match to the Call Reports account for 90.5% of all loans disbursed under the PPP.

We obtain information about the financial characteristics of each bank from the Call Reports. This data set includes information about the size, capital structure, and portfolio composition of all banks operating in the US. Importantly, we obtain information on the number and amount of small business loans outstanding of each commercial and savings bank from the “Loans to Small Business and Small Farms Schedule” of the Call Reports. Using this information, we benchmark the participation of all commercial and savings banks in the PPP program relative to their share of the small business lending market prior to the program. We also use Call Report data to compute measures of average capitalization and liquidity of banks serving a region and to compute some ex ante characteristics that limited banks’ ability to quickly deploy funds under the program.

To compute measures of exposure of each state, county, and ZIP to PPP lenders, we combine the matched-PPP-Call-Reports data set with Summary of Deposits data containing the location of all branches and respective deposit amounts for all depository institutions operating in the US as of June 30th, 2019. In our bank exposure research design, we take advantage of the idea that small business lending is mostly local (e.g., Granja et al., 2018) and use the distribution of deposits across geographic regions to create our Bartik-style measure of exposure of these regions to lenders that over- or underperformed. We define performance using each bank’s national share of PPP lending relative to its national share of the small business lending market. We use County Business Patterns data to approximate the amount of PPP lending per establishment and the fraction of establishments receiving PPP loans in the region and to investigate whether the fraction of establishments receiving PPP loans in a region is affected by that region’s exposure to the performance of its local banks in the PPP.

To evaluate whether PPP amounts were allocated to areas that were hardest-hit by the COVID-19 crisis and whether the program improved economic employment and other economic outcomes following its passage, we use data from multiple available sources on the employment, social distancing, and health impact of the crisis. We obtained detailed data on hours worked among employees of firms that use Homebase software to manage their scheduling and time clock.11 Homebase processes exact hours worked by the employees of a large number of businesses in the US. We use information obtained from Homebase to track employment indicators at a weekly frequency at the establishment level. The Homebase dataset disproportionately covers small firms in food and beverage service and retail; therefore, it is not representative of aggregate employment. At the same time, the Homebase data are quite useful for evaluating the employment impacts of the PPP specifically, since many hard-hit firms are in the industries Homebase covers and much of the early employment losses came from these firms. We use the Homebase data in our bank exposure and matched-sample analysis to measure the impact of PPP funding on employment and business shutdowns.

To broaden this analysis, we supplement the Homebase data with three additional data sources. First, we obtain county-by-week initial unemployment insurance claims from state web sites or by contacting state employment offices for data. Second, we obtain small business revenue data from Womply, a company that aggregates data from credit card processors. The Womply data includes aggregate card spending at small businesses at the county level, defined by the location where a transaction occurred. We complement these data sources with additional county-level employment data from Opportunity Insights, which are described in detail in Chetty et al. (2020).12 The employment data come from Paychex, Earnin, and Intuit.

We additionally obtain counts of COVID-19 cases by county and state from the Center for Disease Control and use data on the effectiveness of social distancing from Unacast. To understand the mechanisms underlying our results, we draw on data from the Census Bureau’s Small Business Pulse Survey (SBPS), a new representative survey that was launched to obtain real-time information tailored towards small businesses. In Appendix A, we provide a more detailed discussion of each data source and final dataset construction. Finally, we obtain data from the Bureau of Economic Analysis (BEA) on the median household income at the county level between 2017 and 2019 to control for differences in economic activity at the local level that could be related to the evolution of our outcomes of interest during the pandemic.

4. Program targeting and bank performance

4.1. Paycheck Protection Program exposure

Table 1 shows summary statistics for the 20 largest financial institutions in the US, as measured by total assets. Columns (2) and (3) report the share of total PPP volume in the first round and overall, respectively, while columns (7) and (8) report the share of the number of PPP loans of each bank in the first round and overall. Columns (4) and (9) show the share of the small business loan (SBL) market as of the fourth quarter of 2019 in terms of total volume and number of loans, respectively.

Table 1.

PPP Performance and PPPE for the Largest 20 Banks. Table 1 reports individual bank statistics and the PPPE index for the 20 largest financial institutions in the United States. Total Assets is computed using information from fourth quarter 2019 Call Reports. Share of PPP Volume is the total amount disbursed by each financial institution relative to the total amount disbursed under either the first round or both rounds of the program. Share of SBL Market is the share of the total outstanding amount of small business loans held by each financial institution relative to the total outstanding amount of small business loans as of the fourth quarter of 2019. PPPE (Vol.) is the volume-based bank PPPE index. Total assets are in millions of USD. Share of PPP Loans is the total number of loans processed by each financial institution relative to the total number of loans processed in either the first round or in both rounds of the program. Share of SBL Loans is the share of the total number of outstanding small business loans held by each financial institution relative to the total outstanding number of small business loans as of the fourth quarter of 2019. PPPE (Nbr.) is the number-based bank PPPE index.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Financial Institution Name | Total Assets | Share of PPP Volume R1 | Share of PPP Volume R1&2 | Share of SBL Market | PPPE R1 (Vol.) | PPPE R1&2 (Vol.) | Share of PPP Loans R1 | Share of PPP Loans R1&2 | Share of SBL Loans | PPPE R1 (Nbr.) | PPPE R1&2 (Nbr.) |

| JPMORGAN CHASE BANK, NATIONAL ASSOCIATION | 2337707 | 3.74% | 5.84% | 6.54% | -0.136 | -0.028 | 1.71% | 6.16% | 10.4% | -0.360 | -0.130 |

| BANK OF AMERICA, NATIONAL ASSOCIATION | 1866841 | 1.13% | 5.10% | 9.51% | -0.393 | -0.151 | .595% | 7.79% | 11.8% | -0.452 | -0.103 |

| WELLS FARGO BANK, NATIONAL ASSOCIATION | 1736928 | .038% | 2.08% | 6.50% | -0.494 | -0.257 | .066% | 4.14% | 4.30% | -0.485 | -0.009 |

| CITIBANK, N.A. | 1453998 | .394% | .702% | 2.12% | -0.343 | -0.251 | .456% | .693% | 9.72% | -0.455 | -0.433 |

| U.S. BANK NATIONAL ASSOCIATION | 486004 | .723% | 1.48% | 3.32% | -0.321 | -0.192 | 1.15% | 2.25% | 5.64% | -0.331 | -0.215 |

| TRUIST BANK | 461256 | 2.97% | 2.62% | 2.01% | 0.096 | 0.066 | 2.02% | 1.77% | 1.73% | 0.040 | 0.006 |

| CAPITAL ONE, NATIONAL ASSOCIATION | 453626 | .022% | .243% | 2.82% | -0.492 | -0.421 | .012% | .335% | 10.3% | -0.499 | -0.469 |

| PNC BANK, NATIONAL ASSOCIATION | 397703 | 2.75% | 2.60% | 1.12% | 0.210 | 0.199 | 1.35% | 1.70% | 1.37% | -0.004 | 0.054 |

| BANK OF NEW YORK MELLON, THE | 342225 | 0% | 0% | .002% | -0.500 | -0.500 | 0% | 0% | .000% | -0.500 | -0.500 |

| TD BANK, N.A. | 338272 | 1.83% | 1.69% | .687% | 0.228 | 0.212 | 1.70% | 1.88% | .569% | 0.249 | 0.268 |

| STATE STREET BANK AND TRUST COMPANY | 242148 | 0% | .000% | 0% | 0.000 | 0.500 | 0% | .000% | 4.49% | -0.500 | 0.413 |

| CHARLES SCHWAB BANK | 236995 | 0% | 0% | .074% | -0.500 | -0.500 | 0% | 0% | .003% | -0.500 | -0.500 |

| MORGAN STANLEY BANK, N.A. | 229681 | 0% | 0% | .144% | -0.500 | -0.500 | 0% | 0% | .008% | -0.500 | -0.500 |

| GOLDMAN SACHS BANK USA | 228836 | 0% | 0% | .003% | -0.500 | -0.500 | 0% | 0% | .000% | -0.500 | -0.500 |

| HSBC BANK USA, NATIONAL ASSOCIATION | 172888 | .129% | .240% | .084% | 0.105 | 0.240 | .067% | .093% | .014% | 0.328 | 0.369 |

| FIFTH THIRD BANK, NATIONAL ASSOCIATION | 167845 | 1.01% | 1.06% | .458% | 0.188 | 0.200 | .625% | .861% | .192% | 0.265 | 0.318 |

| ALLY BANK | 167492 | .213% | .145% | 2.11% | -0.408 | -0.436 | .055% | .021% | 1.38% | -0.461 | -0.485 |

| CITIZENS BANK, NATIONAL ASSOCIATION | 165742 | 1.14% | .992% | .807% | 0.086 | 0.051 | 1.60% | 1.15% | .527% | 0.253 | 0.187 |

| KEYBANK NATIONAL ASSOCIATION | 143390 | 2.19% | 1.59% | .729% | 0.251 | 0.186 | 2.14% | .932% | .274% | 0.387 | 0.273 |

| BMO HARRIS BANK NATIONAL ASSOCIATION | 137588 | 1.20% | .919% | 1.95% | -0.120 | -0.181 | .683% | .489% | .541% | 0.058 | -0.025 |

| ALL OTHER BANKS | 6889908 | 80.4% | 72.6% | 58.9% | -0.042 | -0.048 | 85.7% | 69.6% | 40.9% | 0.215 | 0.212 |

In columns (5)–(6) and (10)–(11), we compute a measure of relative bank performance in round one and for the whole program, which is measured as

where is the share of PPP for bank , and is the bank’s small business loan share. In our main analysis, we use the PPPE measure of relative bank performance that is based on the share of the number of PPP and SBL loans of each bank.13 We prefer the number-based measure of relative bank performance because larger businesses had prompter access to PPP loans (Balyuk et al., 2020) and the volume-based measure of bank performance puts greater weight on large loans and less weight on smaller loans to businesses whose access to the program was more likely constrained by lack of local access to commercial banks that were quick to deploy loans.

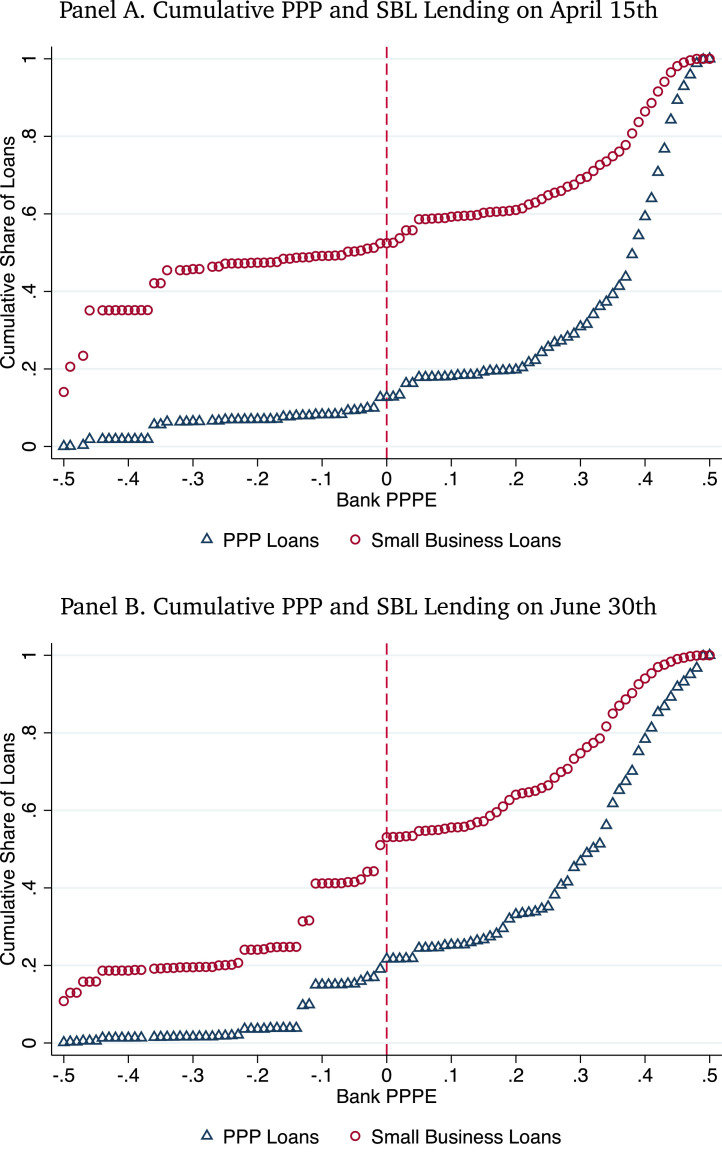

Fig. 1 shows the cumulative share of PPP (blue triangles) and small business loans (red circles) by all banks at the end of the first (Panel A) and second funding rounds (Panel B), with banks ordered by number-based PPPE.14 Recall that values close to -0.5 indicate little to no participation in the program relative to a bank’s initial small business lending share.

Fig. 1.

PPPE and PPP Allocation. Fig. 1 plots the cumulative share of PPP and small business lending by all banks whose PPPE is below x, where . Panel A plots cumulative amounts using PPP data as of the end of the first round (April 16th, 2020), and Panel B reports cumulative amounts using PPP data as of when the flow of second round funds approximately ends (June 30th, 2020). Data is obtained from the SBA and commercial bank Call Reports.

There are significant dislocations between the share of PPP lending of underperforming banks and the share of PPP that we would expect had these banks issued PPP loans in proportion to their share of the small business lending market. If there were no heterogeneity in PPP performance, the PPP and SBL shares would follow similar patterns. This is not the case, and the S-shaped pattern for PPP indicates that many banks disbursed relatively few PPP loans, while roughly a third of banks disbursed half of the PPP loans. Panel A shows that commercial and savings banks representing 20% of the small business lending market simply did not participate at all in the first round of the program . At the end of the first round, the group of banks whose share of the program was below their share of the small business lending market made less than 20% of the PPP loans, but account for approximately half of the entire small business lending market. The top-4 banks are central to this fact, as Table 1 shows that these banks accounted for 36% of total pre-policy small business loans, but disbursed less than 3% of all PPP loans in the first round.

Fig. 1, Panel B shows that these dislocations became less pronounced during the second round, which accounted for 30% of total PPP lending. In the second round, the banks that underperformed in the first round were able to catch up and partly close the performance gap. Yet, there remains a wide spread between banks. If most eligible borrowers ultimately received funding, this pattern suggests considerable reallocation of borrowers across lenders during the program. Overall, the evidence is consistent with substantial heterogeneity across lenders in their responses to the program’s rollout.

4.2. Bank performance over time

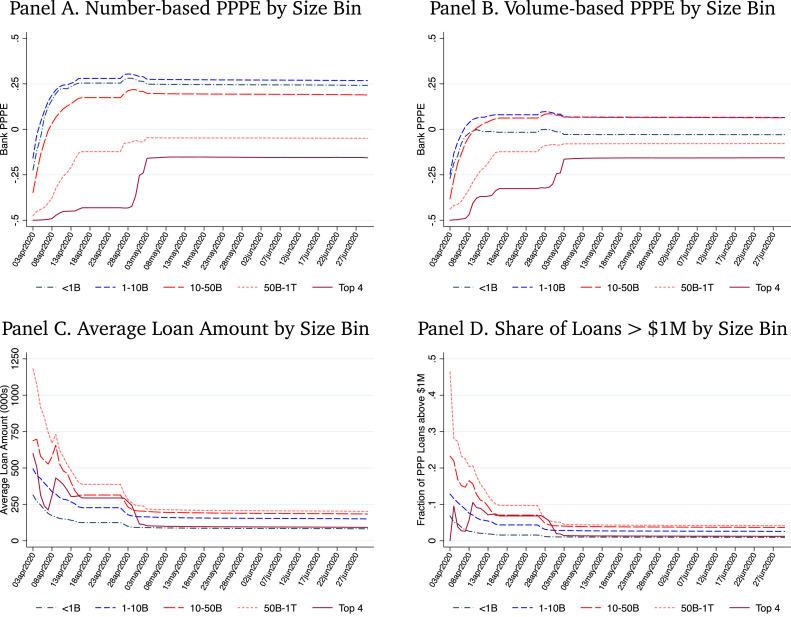

Fig. 2 traces the evolution of PPP lending over time and by bank size using different metrics. We plot cumulative average PPPE using a number-based approach (Panel A), average PPPE using a volume-based approach (Panel B), average loan size (Panel C), and the fraction of loans above $1 million (Panel D). Panels A and B show that banks with total assets below $50 billion deployed a greater share of PPP loans relative to their respective share of small business loans. In contrast, large banks underperformed relative to their share of small business lending. The differences in bank PPPE across categories of bank size were very large throughout the first round. These differences partly converged at the beginning of the second round.15 In spite of this partial convergence, large banks still underperformed overall, consistent with press accounts suggesting that clients were frustrated by large banks’ inability to process PPP loans and switched to smaller banks and non-banks. As demand for PPP funds waned during May, the evolution of bank PPPE across size categories stabilized.

Fig. 2.

Evolution of PPPE and Average Loan Size by Bank Size. Fig. 2 plots the evolution of average PPPE based on the number of PPP loans (Panel A), average PPPE based on the volume of PPP loans (Panel B), the average loan amount (Panel C), and the fraction of loans above $1 million (Panel D) by bank size bin. The size bins stratify all commercial banks operating as of the fourth quarter of 2019 based on their total assets. Data is obtained from the SBA and commercial bank Call Reports.

Fig. 2, Panels C and D suggest that all banks made larger loans in the earliest weeks of the program. The average size of loans declines significantly over time and jumps down at the beginning of the second round. Nearly 50% of the loans disbursed by banks whose total assets ranged between $50 billion and $1 trillion were over $1 million as of April 3rd. That figure falls to roughly 30% by April 8th and 20% by April 13th. By April 18th, loan sizes across banks of different sizes begin to converge between $200,000 and $450,000. This fact may be consistent with higher awareness and sophistication by larger borrowers (Humphries et al., 2020), or with banks prioritizing certain customers, such as existing loan customers who tend to be larger (Balyuk et al., 2020).16 Interestingly, the top-4 banks disbursed a relatively smaller fraction of large loans compared to other large banks, which likely reflects the large number of microbusinesses and small businesses connected to these banks, especially in urban regions.

Overall, these findings suggest that the banking system did not play a neutral role in mediating the allocation of PPP funds during the program. There were large differences in performance across banks, which likely reflect differences in the ability and willingness of banks to respond to the sudden influx of PPP applications. In the second round, most underperforming banks were able to improve their performance and ultimately process many PPP applications. Despite this improvement, differences in first round performance resulted in substantial differences in the timing of access to the program because of the first-come-first-served nature of the program and limited first round PPP budget. In Appendix B, we plot the Kaplan-Meier curve of the fraction of small businesses receiving PPP approval. Only 25% of all PPP borrowers located in ZIP codes whose banks underperformed obtained PPP approval prior to the end of the first round. By contrast, approximately 42% of all PPP borrowers in ZIP codes whose banks overperformed had access to funds in the first round.

4.3. Bank attributes and predicted PPPE

A potential concern with our PPPE measure of relative bank performance is that it might reflect differences in local demand for the program rather than differences in the ability or willingness to process applications. The broad eligibility criteria and generous terms of the program likely meant that demand for the program was high across most locations and industries. Nevertheless, we address this specific concern by attempting to isolate variation in relative bank performance that is explained by differences in banks’ ability to process applications under the program. Specifically, we focus on three factors that capture differences in pre-existing conditions and capacity constraints at the bank-level, which led some banks to respond more quickly to the program’s rollout.

The first factor is motivated by the fact that banks had to employ an unprecedented amount of labor hours in a short amount of time to process the unexpected and sudden influx of PPP loan applications. Bank staff had to interact with clients to collect and review their loan documentation and then submit the information in those applications through the SBA portal.17 Moreover, Bank Secrecy Act and Anti-Money Laundering regulations meant that the staff had to perform customer due diligence for new clients. Thus, banks with greater labor capacity had a relative advantage in processing PPP loans more quickly. We use Call Report data to measure how much a bank spends in wages relative to data processing expenses. This measure serves as a proxy for bank reliance on a lending model that depends relatively more on labor from loan officers and less on information technology.

Another critical factor in determining banks’ ability to quickly deploy PPP loans during the first round of PPP was whether they had a pre-existing SBA lending relationship. Lenders needed valid SBA portal credentials (E-Tran accounts) and access to the SBA’s Capital Access Financial System (CAFS) to submit PPP applications for their clients. Fintechs and other commercial banks with no previous SBA lending experience had to wait until almost the end of the first round of PPP to gain access to the SBA portal.18 To measure the role of prior relationships with the SBA in explaining relative bank performance during the first round, we create an indicator variable that captures whether the bank had any prior experience working with the SBA in the three years prior to the program. To capture the intensity of the SBA relationship, we compute the fraction of the number of SBA-guaranteed loans that the bank originated relative to the average number of small business loans in the bank’s balance sheet over the previous three years.

Finally, many banks were operating under active formal supervisory enforcement actions related to deficiencies in their commercial lending operations and in their compliance with the Bank Secrecy Act and Anti-Money Laundering requirements. Lenders subject to formal enforcement actions related to unsafe or unsound practices were not automatically approved to make PPP loans according to the April 2nd, Interim Final Rule of the SBA, which provided information for lenders interested in participating in the program. Accordingly, banks under a formal enforcement action could not submit PPP loan applications for their clients without first getting approval from the SBA, which likely delayed their ability to quickly submit those applications.19

The most important case of a bank whose ability to lend under the PPP was restricted by a formal enforcement action is that of Wells Fargo. Wells Fargo had been operating under an asset growth restriction imposed by its primary regulator since the aftermath of the 2016 fake accounts scandal. Because of this restriction, Wells Fargo could not make PPP loans because they would risk breaching the asset cap. It was not until April 8th, 2020 that the Federal Reserve issued a press release modifying the growth restriction such that the bank could disburse PPP loans. This delay meant that Wells Fargo could not process PPP loans until the asset cap restriction was modified. As a result, its share of PPP lending in the first round was just a small fraction of its share of small business lending.20

We examine how pre-PPP variation in these characteristics across banks affects their relative performance in deploying the PPP during the first round. We estimate cross sectional regressions of the form:

where is PPPE for bank at the end of the first round of the program, are size deciles, and are measures of the bank attributes: wages over wages plus data expenses, pre-existing SBA lending relationships, and enforcement actions.

The first three columns of Table 2 represent the three factors discussed above. Column (1) shows that a measure of labor capacity at the bank correlates positively with bank PPPE, consistent with our hypothesis that greater capacity to hand-process loan applications allowed banks to disburse PPP loans at a faster rate. Column (2) shows that the existence and strength of a prior relationship with the SBA are both positively associated with bank performance in rolling-out PPP funds.21 Column (3) shows that banks with active enforcement actions as well as Wells Fargo performed significantly worse, on average, during the first round. Column (4) shows that the explanatory power of each of these variables is not subsumed when we include them in a multivariate specification. In columns (5)–(8), we further show that these estimated coefficients are very similar when we include controls for bank size. Thus, these factors are not merely capturing differences in performance across banks of different sizes. We compute the predicted values of the empirical specification in column (8) of Table 2 as a measure of relative bank performance that is explained by these predetermined supply-side frictions and likely to be orthogonal to differences in local demand for PPP funds.

Table 2.

Bank PPPE and Capacity Constraints. Table 2 examines the relation between bank performance in deploying PPP during the first round of the program and bank characteristics. The dependent variable, Bank PPPE, is the number-based bank PPPE index. is a measure of labor intensity at the bank that we compute as the ratio between bank wages (RIAD4135) and the sum of wages and data processing expenses (RIADC017). I(SBA Lender=1) is an indicator variable that takes the value of one if the bank originated at least one SBA 7(a) guaranteed loan between 2017 and 2019. SBA Loans/SBL Loans is the ratio between the number of SBA government-guaranteed loans that a bank originated between 2017 and 2019 and the number of all small business loans (SBA and non-SBA) that the bank held on its balance sheet at the end of 2019. Active Enforcement Action is an indicator variable that takes the value of one if the bank had an active enforcement action when the PPP was launched. I(Wells Fargo=1) is an indicator variable that takes the value of one for Wells Fargo Bank. Columns (5) – (8) include controls for size deciles to ensure that the results are not driven by differences in size. Standard errors are presented in parentheses, and are clustered at the state level. ***, **, and *, represent statistical significance at 1%, 5%, and 10% levels, respectively.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| LHS is Bank PPPE | ||||||||

| 0.330*** | 0.251*** | 0.295*** | 0.283*** | |||||

| (0.072) | (0.060) | (0.060) | (0.055) | |||||

| I(SBA Lender=1) | 0.172*** | 0.170*** | 0.149*** | 0.150*** | ||||

| (0.012) | (0.011) | (0.016) | (0.016) | |||||

| SBA Loans/SBL Loans | 0.158*** | 0.173*** | 0.162*** | 0.176*** | ||||

| (0.036) | (0.036) | (0.038) | (0.037) | |||||

| Active Enforcement Action | -0.283*** | -0.280*** | -0.254*** | -0.256*** | ||||

| (0.054) | (0.052) | (0.051) | (0.050) | |||||

| I(Wells Fargo=1) | -0.418*** | -0.554*** | -0.470*** | -0.522*** | ||||

| (0.053) | (0.053) | (0.056) | (0.057) | |||||

| Observations | 5204 | 5212 | 5212 | 5204 | 5204 | 5212 | 5212 | 5204 |

| Adjusted | 0.005 | 0.076 | 0.009 | 0.088 | 0.058 | 0.103 | 0.062 | 0.114 |

| Other Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Size Deciles | No | No | No | No | Yes | Yes | Yes | Yes |

4.4. Geographic exposure to bank PPP performance

Significant heterogeneity across lenders in processing PPP loans would not necessarily result in aggregate differences in PPP lending across regions if small businesses can easily substitute to lenders that are willing to accept and expedite applications. If many lenders, however, prioritize their existing business relationships in the processing of PPP applications, firms’ pre-existing relationships might determine whether and when they are able to access PPP funds. In this case, the exposure of geographic areas to banks that underperformed as PPP lenders might significantly determine the aggregate PPP amounts received by small businesses located in these areas.

To examine if geographic areas that were exposed to underperforming banks received fewer PPP funds, we construct regional measures of PPPE by distributing bank-level PPPE and predicted PPPE based on the share of the number of branches of each bank in a region.22 We first consider the spatial distribution of PPPE during the first round of funding. Exposure varies across the United States with western areas exhibiting much lower levels of PPPE and more rural areas in the Midwest and Northeast showing higher PPPE.23

To further understand the conditional distribution of PPPE and predicted PPPE, Table 3 reports the results of bivariate regressions of ZIP-level PPPE and ZIP-level Predicted PPPE on ZIP-level observables. The variables are normalized so that coefficients can be interpreted as the effect of a one-standard-deviation change. The results are quite similar using both PPPE and predicted PPPE. The table confirms our earlier descriptive evidence—the top-4 banks disbursed significantly fewer PPP loans relative to their overall market share, while regions served by smaller banks performed better and were served by banks with fewer constraints in deploying PPPE. Perhaps surprisingly, ZIP codes with a greater branch density have slightly lower PPPE.

Table 3.

Correlates of PPPE Exposure. Table 3 presents bivariate regressions of PPPE and Predicted PPPE on ZIP-level observables. Both PPPE, Predicted PPPE, and observables are residualized with respect to state dummies. Variables have been normalized, so the coefficients can be interpreted as a one-standard deviation change in x produces a -standard deviation change in PPPE exposure, where is the reported coefficient. ***, **, and *, represent statistical significance at 1%, 5%, and 10% levels, respectively.

| LHS is Resid PPPE as of R1 |

LHS is Pred Resid PPPE as of R1 |

|||||

|---|---|---|---|---|---|---|

| Coefficient | N | Coefficient | N | |||

| Exposure Correlates: | ||||||

| Share of Top 4 Banks | -0.703*** | 0.3619 | 35882 | -0.603*** | 0.2584 | 35882 |

| (0.006) | (0.013) | |||||

| Number of Branches per Capita | -0.020*** | 0.0006 | 29545 | -0.010*** | 0.0002 | 29545 |

| (0.002) | (0.001) | |||||

| Share of Small Banks Deposits | 0.400*** | 0.1592 | 35830 | 0.193*** | 0.0364 | 35830 |

| (0.006) | (0.006) | |||||

| Other Correlates: | ||||||

| Log(Population) | -0.203*** | 0.0476 | 29545 | -0.065*** | 0.0046 | 29545 |

| (0.005) | (0.006) | |||||

| Log(Population Density) | -0.336*** | 0.1044 | 29545 | -0.116*** | 0.0118 | 29545 |

| (0.006) | (0.006) | |||||

| Social Distancing | 0.225*** | 0.0412 | 35549 | 0.099*** | 0.0078 | 35549 |

| (0.007) | (0.008) | |||||

| Covid Cases per Capita | -0.262*** | 0.0797 | 35870 | -0.120*** | 0.0161 | 35870 |

| (0.007) | (0.003) | |||||

| Deaths per Capita | -0.160*** | 0.0344 | 35870 | -0.059*** | 0.0045 | 35870 |

| (0.006) | (0.004) | |||||

| Unemployment Filing Ratios | 0.012 | 0.0001 | 24576 | 0.056*** | 0.0019 | 24576 |

| (0.008) | (0.008) | |||||

| Employment Opportunity Insights | -0.075*** | 0.0071 | 19525 | -0.012* | 0.0002 | 19525 |

| (0.007) | (0.007) | |||||

| Revenue Change of Small Business | 0.159*** | 0.0333 | 29715 | 0.075*** | 0.0073 | 29715 |

| (0.006) | (0.006) | |||||

The table suggests that early PPP disbursement may have been targeted towards areas less affected by the pandemic. More populous areas, areas with higher population density, and areas with higher COVID-19 cases and deaths see lower PPPE. Greater social distancing—measured by a greater decline in the social distancing index—also see lower PPPE. There is no statistically significant relationship between unemployment and PPPE and areas that saw a smaller decline in revenue for small businesses also have higher PPPE. In contrast, in the OI data, areas with greater employment declines have higher PPPE, which suggests better targeting by this measure. However, the magnitude of this relation is small. The coefficients from regressions using predicted PPPE have similar signs but smaller magnitudes than those using PPPE. This pattern is consistent with the idea that predicted PPPE captures supply-side frictions that are less correlated with local economic, demographic, and health factors.

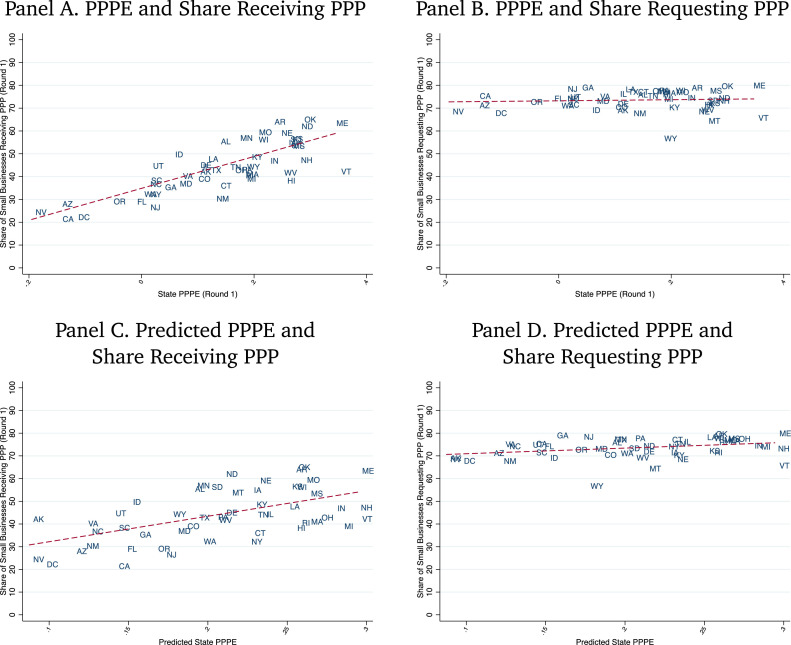

Fig. 3 explores the relation between PPPE and PPP lending at the state-level using data from the Census Small Business Pulse Survey at the end of the first round of the PPP.24 We plot the relationship between the percent of firms receiving funds and state exposure to bank performance. Panel A plots the fraction of all small businesses reporting receiving PPP loans in each state during the first round of lending. There is a strong positive relationship between PPP lending and PPPE at the state level. States with the highest PPPE saw nearly 50% of small businesses receiving PPP funding in round one; states with the lowest PPPE saw just 20% of small businesses receiving funding.

Fig. 3.

State Exposure to PPPE and Share of Small Businesses Requesting and Receiving PPP. Fig. 3 presents scatter plots comparing state-level exposure to PPPE and Predicted PPPE and Census survey outcomes from after the first round of funding. Panels A and C plots the percentage of firms receiving PPP at the end of the first round, and Panels B and D plots the percentage of small businesses reporting having applied to PPPE funds at the end of the first round of the PPP program. Data come from the Census Bureau Small Business Pulse Survey, SBA, Call Reports and Summary of Deposits.

A potential concern with these results is that the causality runs in reverse. That is, banks do relatively better in deploying PPP in areas where demand for PPP loans is strong. To address this concern, we compare survey measures on firm applications and PPP receipt. The Small Business Census survey includes questions on both PPP application and receipt. Fig. 3, Panel B compares PPPE to the percentage of businesses in each state that report having applied for PPP funds as of the end of round one in each state. Between 65% and 80% of small businesses in each state report having applied for PPP funds at the end of the first round. Importantly, the likelihood of PPP application is unrelated with state PPPE. In other words, demand for PPP funds at the state level does not seem to correlate with our state-level PPPE measure of relative bank performance.

The bottom panels of Fig. 3 repeat the analysis using predicted PPPE measure at the state level. We see very similar patterns as with our regular PPPE measure. Fig. 3, Panel C shows that there is a strong positive relationship between state exposure to banks with supply-side constraints and the percentage of small businesses receiving PPP at the end of the first round. Panel D shows that there is little to no relationship between our predicted PPPE and PPP applications. This fact supports the idea that our predicted PPPE measure captures supply-side frictions that affected banks’ ability to process PPP loans and not differences in exposure to local demand.

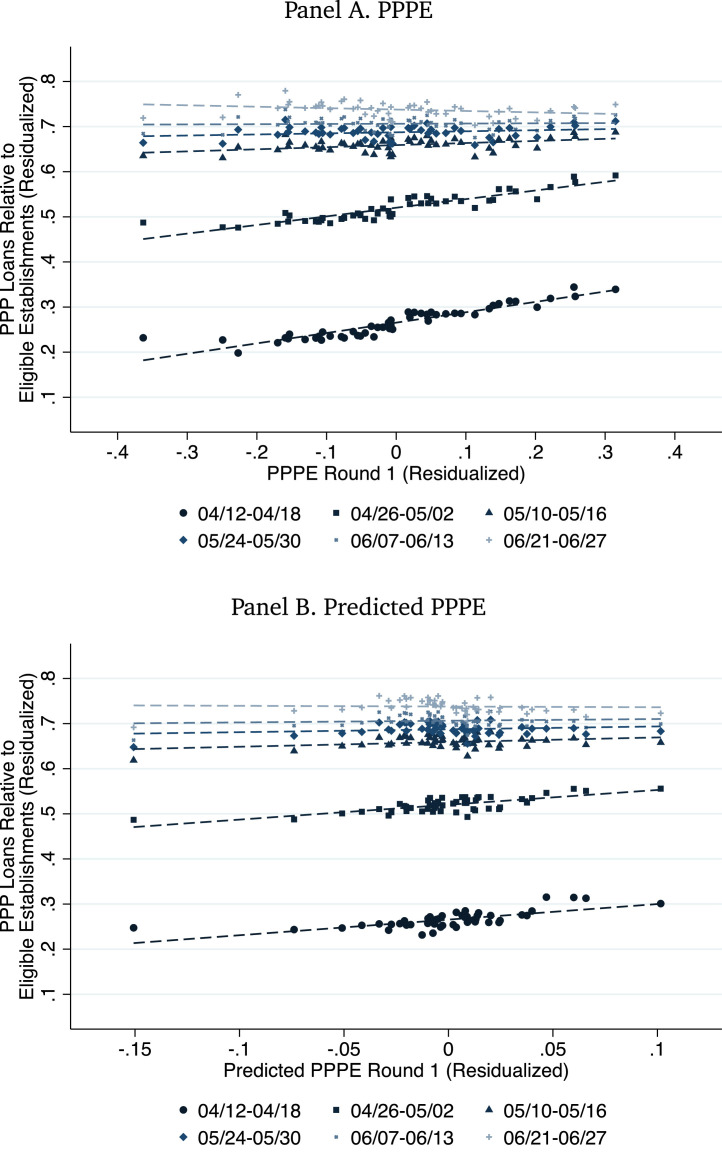

Fig. 4 explores the relation between exposure to bank PPP performance during the first round and PPP lending at a finer geographic level. Specifically, we compute the local exposure to bank performance at the ZIP level by taking the weighted average of bank PPPE or predicted PPPE for all branches that are either in the ZIP or within ten miles of the center of the respective ZIP code. We then partition ZIPs in bins based on their PPPE after demeaning using the average PPPE of their respective state to ensure that the empirical relations hold when we use only within-state variation. Panel A shows the relationship between zip-level PPPE and the fraction of businesses receiving PPP, while Panel B shows the same relationship replacing PPPE with predicted PPPE. Both panels show similar results. A strong positive relation between ZIP PPPE and ZIP predicted PPPE and the fraction of businesses receiving PPP during the first round further supports the idea that the initial allocation of funds was shaped by exposure to the performance of local banks.25

Fig. 4.

ZIP Exposure to First Round PPPE and PPP Coverage over Time. Fig. 4 plots binned scatter plots of the average fraction of small business establishments that received a PPP loan versus ZIP-level PPPE (Panel A) and Zip-level Predicted PPPE (Panel B). Eligible establishment counts equal all establishments in a ZIP less an estimate of the share of establishments with more than 500 employees (which are not eligible for PPP) plus an estimate of the number of proprietorships likely to apply for PPP. Both variables are demeaned at the state level to present the within-state relationship. Data come from SBA, Call Reports, Summary of Deposits, and County Business Patterns.

The strong positive relation between ZIP PPPE or predicted PPPE and the fraction of businesses receiving PPP during the first round of the program persists over the following weeks but becomes gradually weaker later in May and into June. This pattern offers further evidence that the relation between PPPE and the fraction of businesses receiving PPP in the first round is driven not by differences in demand for PPP loans across regions but rather by their exposure to banks that underperformed. Otherwise, this positive association would not necessarily disappear over time. The pattern suggests either that underperforming local banks improved their performance in deploying PPP over time or that small businesses in areas where local banks underperformed were able to obtain funds from other non-local lenders.

We further probe the relation between local PPPE and the allocation of PPP funds in Table 4 . There, we assess the association between ZIP PPPE or predicted PPPE and the fraction of businesses receiving PPP in each ZIP-by-industry group after conditioning on state-by-industry fixed effects. In each panel, the top row shows the relationship between PPPE and the fraction of businesses receiving PPP, while the bottom row shows the same relationship replacing PPPE with predicted PPPE. Again, both panels show broadly similar results. Thus, we evaluate whether businesses within the same state and industry had different access to PPP loans because they were located in ZIP codes whose nearest banks performed relatively well compared to businesses in the same state and industry but in ZIP codes whose banks underperformed.

Table 4.

ZIP PPPE in Round 1 and PPP Reallocation across Funding Sources. Table 4 shows the correlation between PPPE and the fraction of eligible establishments receiving PPP loans from different sources in the first and second rounds of the program. The left-hand-side variable in column (1) is the fraction of eligible establishments within a ZIP and 2-digit NAICS industry that received PPP in the first round in Panel A and in both rounds in Panel B. Left-hand-side variables in other columns represent a decomposition of the dependent variable in column (1) into the fraction of establishments within a ZIP and 2-digit NAICS industry that received PPP from local banks, non-local banks, credit unions, FinTech companies, and other nonbanks. ZIP PPPE (Round 1) is the weighted average of bank PPPE during the first round at the ZIP level. The weights are defined by the share of the number of branches of each bank within 10 miles of the center of the respective ZIP. ZIP PPPE is standardized to permit coefficients to be interpreted as the effect of a one-standard-deviation increase in ZIP PPPE and observations are weighted by the number of eligible establishments in each zip-industry pair. Predicted PPPE is the weighted average of predicted bank PPPE during the first round at the ZIP level. The predicted values of bank PPPE are obtained from estimating the empirical specification of column (8) of Table 2. The weights are defined by the share of the number of branches of each bank in the zip code or within 10 miles of the center of the respective ZIP. Eligible establishment counts equal all establishments in a ZIP less an estimate of the share of establishments with more than 500 employees (which are not eligible for PPP) plus an estimate of the number of proprietorships likely to apply for PPP. All regressions include state-by-NAICS fixed effects. Standard errors are presented in parentheses, and are clustered at the state level. ***, **, and *, represent statistical significance at 1%, 5%, and 10% levels, respectively.

| Panel A: Allocation in Round 1 | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| PPP Loans Relative to All Establishments by Lender Source |

||||||

| PPP/Est (%) | Local Banks | Non-Local Banks | Credit Unions | FinTech | Nonbanks | |

| Zip PPPE (Round #1) | 5.458*** | 5.401*** | 0.162 | 0.152 | -0.204*** | -0.007 |

| (0.736) | (0.581) | (0.117) | (0.109) | (0.021) | (0.020) | |

| Observations | 250078 | 250678 | 251344 | 251468 | 251488 | 251435 |

| Adjusted | 0.408 | 0.390 | 0.126 | 0.156 | 0.294 | 0.045 |

| StateIndustry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| PPP/Est (%) | Local Banks | Non-Local Banks | Credit Unions | FinTech | Nonbanks | |

| Predicted PPPE | 2.837*** | 2.961*** | -0.085 | 0.054 | -0.073*** | 0.003 |

| (0.981) | (0.866) | (0.149) | (0.093) | (0.024) | (0.017) | |

| Observations | 250078 | 250678 | 251344 | 251468 | 251488 | 251435 |

| Adjusted | 0.380 | 0.357 | 0.126 | 0.155 | 0.290 | 0.045 |

| StateIndustry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Panel B: Allocation in Round 1 and 2 | ||||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| PPP Loans Relative to All Establishments by Lender Source |

||||||

| PPP/Est (%) | Local Banks | Non-Local Banks | Credit Unions | FinTech | Nonbanks | |

| Zip PPPE (Round #1) | -1.580*** | 1.224*** | -1.942*** | 0.310 | -1.480*** | -0.139* |

| (0.345) | (0.350) | (0.271) | (0.336) | (0.191) | (0.080) | |

| Observations | 234128 | 244928 | 250263 | 251342 | 251377 | 251387 |

| Adjusted | 0.359 | 0.324 | 0.199 | 0.222 | 0.231 | 0.088 |

| StateIndustry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| PPP/Est (%) | Local Banks | Non-Local Banks | Credit Unions | FinTech | Nonbanks | |

| Predicted PPPE | -0.660 | 0.932* | -1.095*** | 0.031 | -0.751*** | -0.040 |

| (0.453) | (0.516) | (0.391) | (0.287) | (0.262) | (0.041) | |

| Observations | 234128 | 244928 | 250263 | 251342 | 251377 | 251387 |

| Adjusted | 0.358 | 0.323 | 0.193 | 0.221 | 0.213 | 0.087 |

| StateIndustry FE | Yes | Yes | Yes | Yes | Yes | Yes |

Column (1) of Table 4, Panel A, further supports the idea that local exposure to banks that overperformed in the PPP had a positive impact on the ability of businesses to obtain PPP funds during the first round. Even within a given state and industry, being in the same ZIP or within 10 miles of banks that overperformed in the first round was associated with a significantly higher share of businesses receiving PPP during the first round. We find similar conclusions when we measure local ZIP exposure to banks that were constrained processing PPP applications using our predicted PPPE measure.26 In column (1) of Panel B, we assess whether this impact persisted through both rounds of the program. Consistent with the findings above, local ZIP exposure to banks that over- or underperformed in the first round is no longer positively associated with the fraction of businesses receiving PPP after both rounds of the program. If anything, there is a modest negative relationship between round one PPPE and total PPP loans per establishment. This relationship is significant using PPPE, and insignificant at conventional levels using predicted PPPE. This result further suggests that as supply-side frictions subsided during the second round of the program, the relation between PPPE and the fraction of businesses receiving PPP flattened, which indicates that differences in demand for PPP funds were unlikely to explain the positive relation during the first round.

A potential explanation for the gradual weakening of the relation between local PPPE and the fraction of businesses receiving PPP is that non-local banks and nonbanks stepped in to substitute for underperforming local banks. To investigate this possibility, we decompose the total fraction of establishments receiving PPP in each ZIP and industry into the fraction of establishments receiving loans from local banks (defined as banks with a branch within 10 miles of a ZIP code centroid), non-local banks (defined as all banks with branches that are farther than 10 miles from the ZIP), credit unions, Fintechs, and all other nonbanks participants. Fig. 5 shows the average fraction of establishments receiving PPP during round one, round two, and the entire program by source of PPP funding. On average, approximately 20% of all establishments in a ZIP were able to obtain funding during the first round, and local banks accounted for most of these loans. Fintech lenders and non-banks participated very little during the first round. During the second round, local banks still accounted for the majority of disbursed loans, but Fintech lenders and especially non-local banks participated to a much larger extent. This pattern is consistent with Fintech institutions substituting for local banks in the area. Over the entire program, local banks accounted for more than two-thirds of all loans, while Fintechs and other non-banks institutions accounted for five percent of loans.27

Fig. 5.

Share of Establishments Receiving PPP by Lender Type. Figure 5 shows the number of PPP loans broken down by lender type and funding round, scaled by the total number of establishments. Data come from the SBA, FDIC Summary of Deposits, and Census.

Next, we evaluate whether the presence of non-local banks and Fintechs mattered most in areas that were exposed to local banks that underperformed in the PPP. Unsurprisingly, in column (2) of Table 4, Panel A, we show that local PPPE is associated with a greater fraction of establishments receiving loans from local banks in the first round of the program. Columns (3), (4), and (6) show that ZIP PPPE is unrelated with the fraction of establishments receiving loans from non-local banks, credit unions, and nonbank lenders in the first round. Column (5) shows a negative relation between local bank performance and the fraction of local establishments served by Fintechs, suggesting that these institutions played a greater role in PPP lending in areas with worse local bank performance. Despite the statistical significance of the effects of column (5), their economic magnitude is relatively small, indicating these substitute lenders were unable to offset the dislocations from underperforming local banks during the first round.

In columns (2) through (6) of Table 4, Panel B, we examine if these non-local sources of funding had an economically larger role in substituting for local banks during the second round of the PPP program. In column (2), local PPPE remains an important determinant of the fraction of loans from local banks, though the relationship is somewhat weaker. This weaker relationship possibly results from improved performance of low-PPPE banks during the second round. Consistent with the findings in Erel and Liebersohn (2020), we find in columns (3), (4), (5), and (6) that other financial institutions such as non-local banks and Fintechs substitute for underperforming local banks. Non-local banks are the most important source of substitute funds. Fintechs are less important but still quite elastic to the effect of weak local bank performance. By the end of the program, the total effect of substitute lenders is large enough to fully offset the weak performance of local banks in low PPPE areas.28

4.5. Are PPP allocations targeted to the hardest hit regions?

Were PPP funds disbursed to geographic areas that were initially most affected by the pandemic? Given that one of the policy goals of the program was to inject liquidity into small businesses and prevent unnecessary bankruptcies, we examine whether funds flowed to distressed areas with more pre-policy economic dislocation and disease spread. In addition, we ask whether the significant heterogeneity in bank performance and exposure to bank performance across regions played an important role in the targeting of the program.

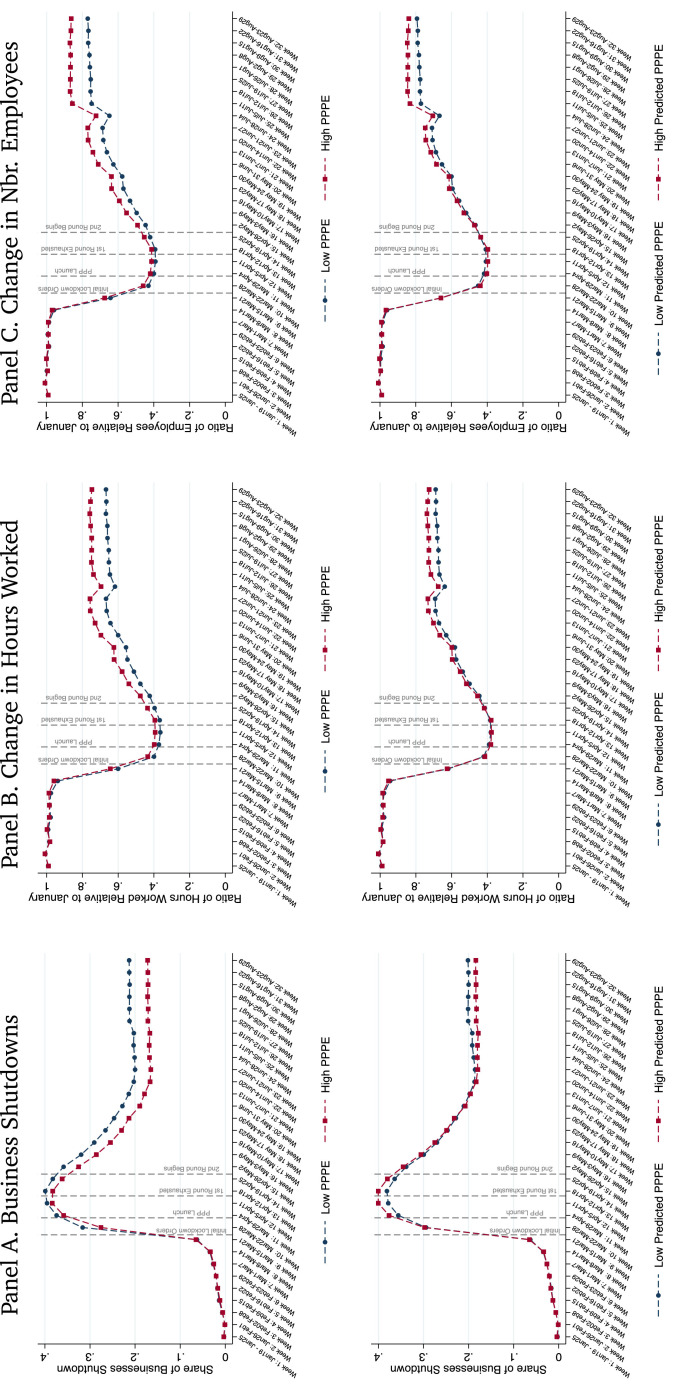

Fig. 6 partitions the distribution of ZIP codes according to the ratio of PPP loans in the first round to the number of establishments in the ZIP code. We then compare areas with high and low PPP allocations in terms of employment outcomes prior to any funds being distributed. In Panel A, we observe a negative relationship between the share of business shutdowns in the week of March 22nd–March 28th and the share of businesses receiving PPP in round one.29 Consistent with the broad definition of eligibility of the program and with a decline of the supply-side distortions during the second round, we find that the relationship between the share of business shutdowns in the week of March 22nd–March 28th and the share of businesses receiving PPP weakens substantially when we consider the share of businesses receiving PPP during both rounds. In Panel B, we repeat the analysis using the decline in hours worked between January and the week of March 22nd–March 28th. An analogous relationship holds, with regions receiving more PPP funding during the first round displaying smaller shocks in terms of the initial decline in hours worked and with this relationship becoming weaker or even nonexistent when we consider PPP funding over the two rounds. In Panel C, we repeat the analysis using the decline in the number of employees. The results mirror those in Panels A and B; regions receiving more PPP funding during the first round see a smaller reduction in the number of employees prior to the PPP. There is little relationship in the second round.

Fig. 6.

Targeting of PPP Allocation (First Round and Overall). Fig. 6 stratifies all businesses in Homebase in 10 bins based on the fraction of establishments in their ZIP code receiving PPP during the first round and during both rounds combined. Panel A plots for each bin the share of Homebase businesses that shut down in the week of March 22nd–March 28th. Panel B plots for each bin the average decline in hours worked in the week of March 22nd–March 28th relative to a baseline of the average weekly hours worked in the last two weeks of January. Panel C plots for each bin the average decline in the number of employees in the week of March 22nd–March 28th relative to a baseline of the average number of employees in the last two weeks of January. Data are from SBA, Homebase, and County Business Patterns.

In Appendix D, we further confirm our findings using the Homebase data with other levels of aggregation and using other data sources—we find no consistent relationship between PPP allocation and bank exposure with UI claims or small business revenues. We also explore whether funds initially flowed to areas with early pandemic outbreaks. There is a slight negative correlation between PPP receipt and COVID-19 confirmed cases and deaths at the state level. There is little correlation between the magnitude of social distancing at the state level and PPP allocations. The totality of the evidence suggests that there was little targeting of funds in the first round to geographic areas that were harder hit by the pandemic and, if anything, areas hit harder by the virus and subsequent economic impacts initially received smaller allocations.

This interpretation remains true when considering both rounds of funding, as the relationship between shock severity and PPP funding turns less negative without turning positive. Our findings are also consistent with the broad eligibility criteria for PPP loans—most firms below the size threshold could apply for funding—and the absence of conditionality in program generosity—loan forgiveness did not depend on shock severity. The argument in Barrios et al. (2020) that firm payroll closely predicted PPP loan receipt accords with this view. Nevertheless, our bank-level results also point to an important loan supply factor distorting the distribution of PPP loans, especially during the program’s initial rollout.

5. Employment impacts and local economic activity

5.1. Research design

Did banks’ unequal ability and willingness to quickly process PPP applications have any impact in explaining the employment effects of the PPP? Our results on PPP performance differences across banks motivate two complementary research designs for evaluating the PPP. The basic idea is to use differences in local area PPP exposure (PPPE), as well as pre-determined supply-side variation in PPPE (predicted PPPE), to partition geographies and compare the evolution of local outcomes for high versus low PPPE regions. By exploiting differential exposure to banks that performed poorly in distributing PPP funding during the first round of the program, we can isolate the effect of the PPP from other differences across regions that may drive differences in PPP loan demand. As described above, we map bank level aggregates for PPP lending from the SBA data onto local geographies using measures of local bank branch presence. The research design is akin to a Bartik instrument and therefore relies on the assumption that pre-policy bank branch shares are not correlated with the various outcomes we study, conditional on observables.30

We focus our analysis on the time period between the third week of January and the end of the program in the last week of August to study the short- and medium-term effects of the PPP in the immediate aftermath of the pandemic when the injection of liquidity was thought to matter the most for sustaining employment. Starting the sample period in January allows us to establish a baseline period prior to the pandemic, thereby controlling for time-invariant determinants of economic activity within the same location.

The PPP began accepting loans on April 3rd and all of the initial funds were exhausted by April 16th. During this period, banks played a key role in allocating limited funds, creating the variation we use to identify the effects of the program. We exploit the fact that firms are located in regions that vary in their exposure to bank performance, which mediates both the level of PPP loan disbursement and its timing. With the second round of funds, which began on April 27th, PPP funding limits were no longer binding and the gap between high and low PPPE exposure regions mostly closed. Thus, as we move to study the program later in May and through the end of August, we will interpret the research design as assigning some firms funding with a delay, instead of as assigning some firms no funding at all.

In our main analysis, we present reduced form regressions of employment and local economic outcomes on PPPE and predicted PPPE while allowing for separate treatment effects by week or month. Given the rapid nature and size of the economic shock, we highlight two important considerations when analyzing data from this time period. First, our targeting analysis shows that regions receiving more PPP funding were less hard hit by the initial shock, in part due to the banking channel we emphasize. Thus, it is important to properly condition on this non-random assignment of PPP funding. If one does not break out the data finely enough or condition properly for targeting differences—for example, by treating the last weeks of March as a pre-period benchmark—then one might detect a spurious effect of the program. This issue is very clear when we examine week-by-week outcomes around the policy window.

To account for these targeting differences, we estimate the effects of the program by comparing weeks in the post-PPP period to the two weeks in the post-lockdown, pre-PPP period. We also include time-varying controls and state-by-time-by-industry fixed effects to estimate treatment effects under weaker versions of the Bartik assumption. Controls include the social distance index, COVID cases per capita and deaths per capita measured as of week 9, all interacted with indicator variables for the months of April, May, June, July, and August. We also include bank controls for the average tier-1 capital and core deposit ratios of all banks within a 10-mile radius of the ZIP code, weighted by the number of banks’ branches within a 10-mile radius of the ZIP code. Once we adjust for targeting differences, including these more restrictive controls has little effect on our estimates.

A second consideration is that research designs that exploit differences in PPP receipt or application without an instrument for loan supply or eligibility will likely overstate the impact of the program. Demand for PPP loans is likely correlated with omitted firm-level factors, such as whether the firm anticipates being able to use the funds during the forgiveness window. Our PPPE and predicted PPPE instruments attempt to isolate loan supply drivers independent of loan demand.

5.2. Small business employment