Abstract

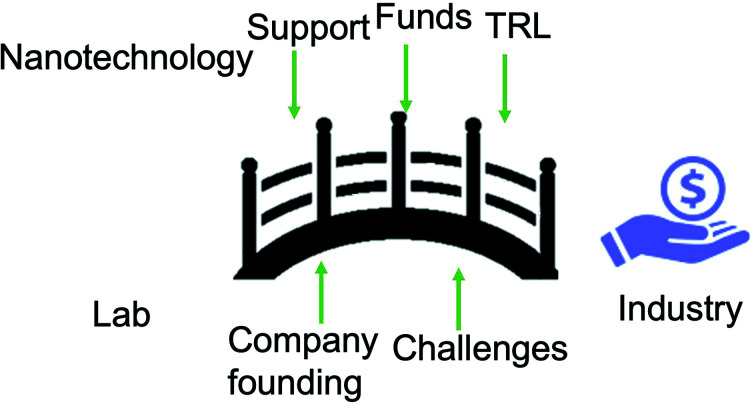

Nanotechnology holds great promise and is hyped by many as the next industrial evolution. Medicine, food and cosmetics, agriculture and environmental health, and technology industries already profit from nanotechnology innovations and their influence is expected to increase drastically in the near future. However, there are also many challenges that need to be overcome to bring a nanotechnological product or business to the market. In this article we discuss current examples of nanotechnology that have been successfully introduced in the market and their relevance and geographical spread. We then discuss different partners for scientists and their role in the commercialization process. Finally, we review the different steps it takes to bring a nanotechnology to the market, highlight the many difficulties related to these steps, and provide a roadmap for the journey from lab to industry which can be beneficial to researchers.

Nanotechnology holds great promise and is hyped by many as the next industrial evolution.

1. Introduction

Nanotechnology is foreseen by some experts as the next industrial revolution, being beneficial across various domains.1,2 Nanotechnology-enabled products have found applications in many sectors. These include transportation, materials, energy, electronics, medicine, agriculture and environmental science, and consumer and household products.3 These applications can be grouped into the general categories of medicine, food and cosmetics, agriculture and environmental health, and technology and industry (Fig. 1). Products resulting from the application of nanotechnology can be categorized as nanomaterials (such as nanoparticles, nanocomposites, nanotubes etc.), nanotools being nanoscale parts of larger equipment (such as scanning probe microscopes or other equipment with nanoscale parts), and nanodevices (such as nanosensors).4–7 With prolific investment into the research and development of nanotechnology products, more practical materials with unique applications continue to evolve. It is therefore critical that these technologies transcend the confines of the laboratory and help to solve current challenges in society. This paper offers an overview of the considerations and protocols necessary to launch a competitive nanotechnology-derived product or business in the commercial marketplace.

Fig. 1. Possible applications of nanomaterials.

2. Nanotechnology developments

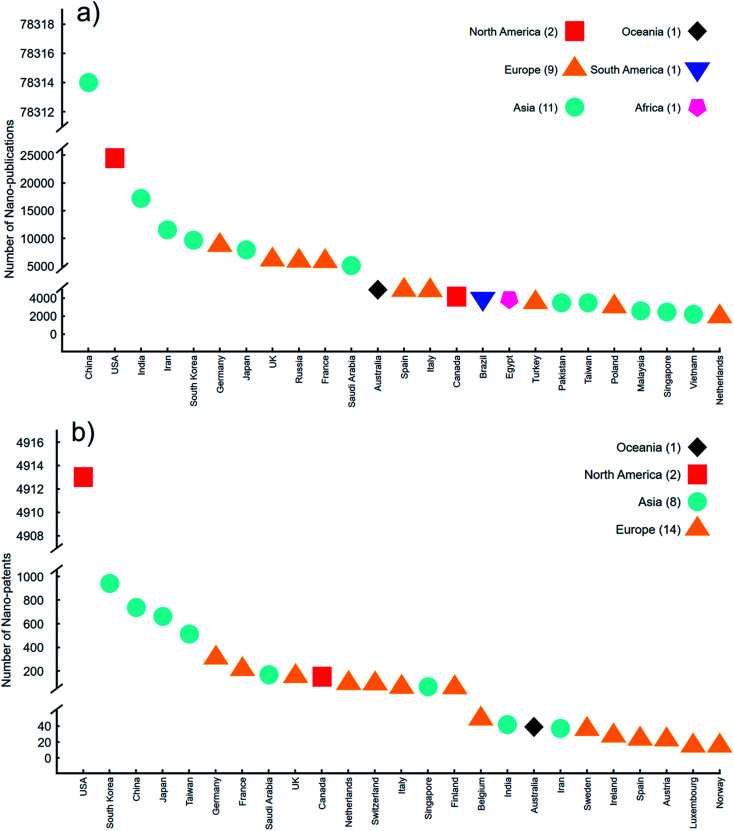

The booming global nanotechnology market is projected to exceed US$ 125 billion by 2024.8 The commercialization of research outcomes resulting from the synthesis and application of nanotechnology therefore not only bears significant potential for benefit to society through their various applications but is profitable. As a result, nanotechnology is attracting increasing investment from governments and private sector agencies globally. Between 2007 and 2011, approximately € 896 million was invested by the EU alone in nanotechnology-related research. The investment in nanotechnology worldwide is estimated to be close to a quarter of a trillion USD, with both China and The USA investing upwards of US$ 2 billion.9 While these two countries are considered nanotechnology giants, the USA remains the global leader in the volume of nanotechnology government investment.10,11 The increase in funding globally has impacted the number of scientific publications related to nanotechnology. During the year 2020, the top 25 countries producing the most nanotechnology-related scientific articles were determined by the publicly available database StatNano (https://statnano.com/) and are presented in Fig. 2a. StatNano provides the latest information and statistics in nano-based Science, Technology and Industry. As the number of publications increase, a concomitant increase in the number of patented technologies followed. Patents that include at least one claim related to nanotechnology or patents classified with an International Patent Classification (IPC) code related to nanotechnology in the year 2020 were examined. The top 25 countries with the most patents for the period are reported in Fig. 2b.

Fig. 2. The top 25 countries involved in the publishing of nanotechnology discoveries. (a) And patenting of inventions including at least one claim related to nanotechnology or patents classified with an International Patent Classification (IPC) code related to nanotechnology in the year 2020. (b) (https://statnano.com/).

All inhabited continents are represented among the top countries involved in scientific publishing; however, only Europe (14 countries), Asia (8 countries), North America (2 countries), and Oceania (1 country) are included among the top 25 countries involved in the patenting of nanotechnology developments. Seventeen countries were common factors among both publishing and patenting discoveries. It is also noteworthy that the two countries that had the highest investments in scientific research (China and The USA) produced highest numbers of publications and patents, respectively. Patents can be used as technological indicators as they provide an insight into the research and development activities that are intended for commercial gain.12 The transfer of these nanotechnology advancements to commercialized end products is however a major challenge that the scientific community faces. However, it has to be noted here that there are also quite some differences in culture when it comes to patenting. There are differences between countries in how buerocratic the patent process is. Additionally, there are differences in how much is patented at all. In some cultures, it might be more common to keep innovation a secret than to patent. There are also differences in how patents are made. In some places there is a high number of smaller patents while in others there are a few more elaborate ones.

2.1. Nanotechnology industries worldwide

In 2016, more than 60 countries had launched national nanotechnology programs.10 With increasing support from governments and the private sector, nanotechnology developments are expected to grow further. Nanotechnology has applications across all the science fields including chemistry, biomedicine, mechanics, and material science among others.13,14 Its projected global growth within industries is indicative of its expansive and fundamental impact on almost all sectors of the economy. Some global companies that currently manufacture nanotechnology-enabled products and the country of their headquarters are outlined in Table 1. These companies were selected from a list of members of the Nanotechnology Industries Association (NIA) (service companies were not considered) (https://nanotechia.org/). The spread of these companies globally can be attributed to the increase in research and development activities related to nanotechnology worldwide, their superior characteristics, and their subsequent demand within various sectors.

Some nanotechnology companies globally.

| Company | Operationa | Country |

|---|---|---|

| 3M | Manufactures numerous nanomaterials | USA |

| Advanced Material Development | Develops 2D nanotechnologies and metamaterial systems | UK |

| Applied Graphene Materials | Develops and applies graphene nanoplatelet dispersions | UK |

| BNNano, Inc. | Manufactures boron nitride nanotubes (NanoBarbs™) | USA |

| CelluForce | Produces a form of cellulose nanocrystals (CelluForce NCC™) | Canada |

| Cerion | Manufactures metal, metal oxide, and ceramic nanomaterials | USA |

| INNOVNANO | Manufactures ultra-fine nanostructured ceramic powders | Portugal |

| Nanogap | Manufactures novel nanomaterials from atomic quantum clusters | Spain |

| Nanomakers | Develops and commercializes nanoparticles of silicon carbide | France |

| OCSiAl Luxembourg | Produces graphene nanotubes | Luxembourg |

| RAS AG | Produces and distributes of nanomaterials | Germany |

| Rezenerate NanoFacial | Develops nanofacials using innovative devices for cosmetics delivery | USA |

| Superbranche | Develops functionalized metallic oxide nanoparticles | France |

| Zeon Corporation | Manufactures single-walled carbon nanotube | Japan |

| INNOVNANO | Manufactures ultra-fine nanostructured ceramic powders | Portugal |

| Nanogap | Manufactures novel nanomaterials from atomic quantum clusters | Spain |

| Nanomakers | Develops and commercializes nanoparticles of silicon carbide | France |

| OCSiAl Luxembourg | Produces graphene nanotubes | Luxembourg |

| RAS AG | Produces and distributes of nanomaterials | Germany |

| Rezenerate NanoFacial | Develops nanofacials using innovative devices for cosmetics delivery | USA |

| Superbranche | Develops functionalized metallic oxide nanoparticles | France |

| Zeon Corporation | Manufactures single-walled carbon nanotube | Japan |

Operations listed might not be exhaustive.

3. The business of ‘lab-to-industry’

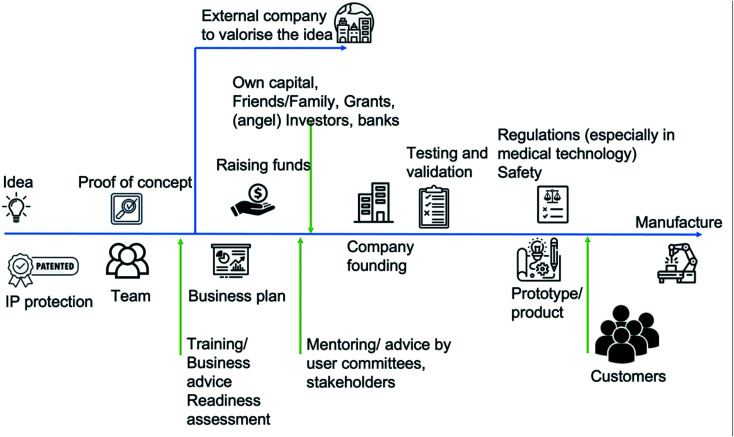

The output of scientific research must undergo a strategic sequence of activities to be implemented into new products, processes or services. The process of developing a new technology or capability is called an invention. A mere invention however might be insufficient for market entry as a key requirement for this is that the invention must first offer a solution to an existing problem or serve a demand or specific need. In other words, an innovation, which is distinct from an invention, is required. The sequence of activities in which researchers should engage to increase the market potential of their scientific efforts are summarized in Fig. 3. The steps are shown in a typical chronology but do not necessarily happen in this order. The blue line indicates the timeline including the decision to either approach an external company for commercialization or found a start-up company. Green arrows indicate external support to catalyse the progress.

Fig. 3. Roadmap for the commercialization of nanotechnology-derived products.

3.1. Ideation

The incorporation of innovative approaches into the research plan can increase the likelihood of a successful product fit for the industry. Two approaches that can be considered to facilitate innovative ideation are research-driven and data-driven innovations.12 With research-driven innovation, scientific or technological capabilities emerging from labs are used as a seed for innovative ideation. Researchers use these seeds to generate research plans though only a few of these ideas usually survive the complexities of scientific investigation. This approach can enhance innovation and value creation appreciably in the private sector. Research groups can therefore collaborate with suitable organizations to develop state-of-the-art technologies. Data-driven innovation, on the other hand, systematically gathers ideas from market analysis while also taking the internal capabilities of the research unit into consideration. This data is then strategically utilized to develop or improve products and services. The existing gaps or needs of consumers are therefore the impetus for this approach. Collaborations with suitable industries can also prove rewarding using this approach.

These two approaches show how innovation relies on technology seeds and market needs. One might ponder which of the two approaches is better. There are both merits and challenges associated with each approach. While each can lead to innovation, a pairing of the two is recommended. When closely integrated, the potential impact of the innovation increases. This synchronization of the ‘seed’ and ‘need’ approaches is called accelerated innovation. It enables the restructuring of research and development, and innovation processes to make new product development dramatically faster and less costly.15 Furthermore, it also facilitates functional thinking and exaptation where the latter refers to the discovery of unintended functions for technologies. Altogether creating the ideal conditions for researchers to make radical innovations and bridge the gap between academia and industry.

3.2. Business model

Innovative approaches can be used to generate new perspectives and find new applications for existing technological capabilities within the laboratory. They can also lead to the development of new products based on market needs. Regardless of the approach, the desired outcome of the research protocols is a product with superior characteristics to those currently available. This resulting innovative product is a grand feat for academics. One that might result after several years of failed attempts. The acquisition of this innovation however presents a new set of challenges. Since the population cannot benefit from the remarkable features of the technology while it is in the confines of a laboratory, it must now be commercialized. The right business and operating models can allow these innovations to fulfil their promise to society.

Breakthrough technologies, especially those incorporating the use of nanotechnology, are intended to create value. Value is created via this technology when there is meaningful performance improvement or when the cost of solving problems is significantly reduced. There is however a major challenge for nanotechnology innovations in terms of a business model, and that is, the challenge of taking the product to customers. Several factors can influence this (for example, having limited resources) and for this reason, a go-to-market strategy is critical.

3.2.1. Licensing arrangement and joint-development partnerships

Laboratories or organizations with strong research and development capabilities and outputs can earn revenue from resulting products without having to directly manufacture and sell products or services to mass consumers. This can have a massive impact on the success of the start-up since it is a great challenge to fund product development or manufacturing. Circumvention of this challenge can be achieved through licensing agreements. In such instances, a legal, written contract between two parties is drafted wherein the property owner (the licensor) permits another party (the licensee) to use their intellectual property. Some of the most popular types of intellectual property include copyrights, patents, and trademarks. The licensing agreement details the type of agreement as it relates to its exclusivity or non-exclusivity, the terms of usage, and how the licensor should be compensated. The services of an attorney are usually sought after when drafting a licensing agreement.

A joint-development partnership is an agreement between two organizations to develop a new product or service. It is a strategic alliance that serves to leverage the assets of each company to create a new offering for commercialization that would be difficult to achieve individually. This type of partnership is commonly used for product development or beta testing. Typically, these agreements are not binding and one party can quit at any time. Profits, access, expenses, and losses are usually shared between the companies. With this type of business partnership, it is important to have a close business relationship with the company before engaging in this agreement. As is the case with licensing arrangements, the most ideal joint-development partnership can be determined with the assistance of an attorney. Matters relating to the ownership and access to intellectual property, responsibilities, disengagement, and termination are some of the issues to be discussed with a suitable attorney before engaging a potential partner.

3.2.2. Not interested in a partnership?

Taking a business idea through the necessary stages of a start-up requires a significant amount of effort and resources; and even more so if this is being done without the use of partnerships. The field of nanotechnology is extremely specialized. It is therefore uncharacteristic that the individual or team that is responsible for the innovative idea can effectively execute all aspects of the start-up process. With 90% of start-ups failing, launching a successful venture is heavily dependent on the balancing of skills.16 A founder or president should be assigned and this can be decided based on the origin of the business idea. It is then recommended to identify a cofounder for the management team. This can include other members of the research team who can take significant roles at the vice-presidential level or the cofounder can be cleverly recruited based on additional skills needed to increase the likelihood of the success of the business. Based on a skill analysis, a decision can be made regarding the number of cofounders needed.

In partnerships, securing intellectual property early remains crucial. In an innovative nanotechnology business, the science underpinning the technology is critical and must be protected. This can be achieved by engaging an intellectual property counsel. The services of a corporate counsel should also be acquired early to ensure the start-up is properly incorporated. These parties should be appointed at the early stages as they help with structuring the company. The technology transfer process which is discussed in Section 3.3 helps to get these counsels on board.

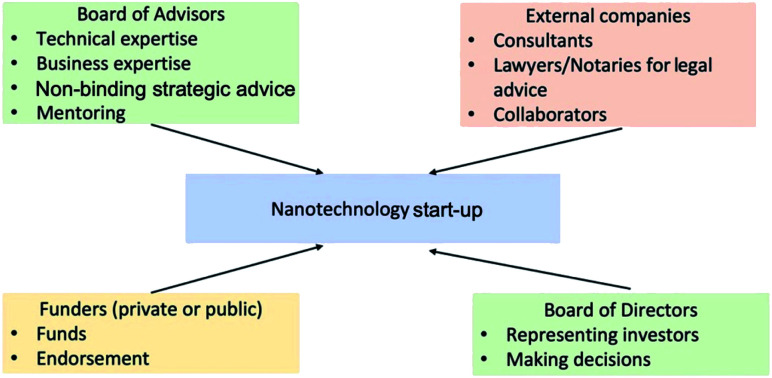

There are some key players that are needed to guarantee a good business model and these are outlined in Fig. 4. To assure a diversity of skills that are necessary for success, an often overlooked group of individuals is needed. This is a company board. This can include a board of advisors and a board of directors. The functions of these two bodies bear some similarities and differences. The board of advisors is composed of business professionals who fill skill and expertise gaps and can offer guidance to the management team. This can include matters concerning business performance, market trends, long-term goals of the company, and financing to name a few. While the additional skill set required in a science-based industry might be in business management, it is not unusual for additional technical expertise to be warranted. This can include the skills of fellow scientists who have had prior success in transitioning science to the marketplace. These scientists, when recruited, could form a scientific or technical advisory board. Regardless of the composition of the advisory board, their core function is to provide non-binding strategic advice. Their role is not fiduciary. This means that the team of experts and community leaders has no legal responsibility to the company. Their role however remains critical as they can compensate for some of the weaknesses within the management team and bring different opinions, perspectives, and experiences to the table. The board of advisors is particularly helpful for start-ups. A board of directors, on the other hand, is essentially a panel of people elected or appointed to represent shareholders. They oversee the activities of the company and have a fiduciary responsibility to represent and protect the members' or investors' interests in the company. The management team however reports to the board of directors. Larger companies that will require significant funding need a board of directors. Both the boards of advisors and directors can assist with strategic planning, the development of new ideas, improvement of management structure, improving company image and reputation, reassuring stakeholders and investors, and overall, help to ensure the success of the company.

Fig. 4. Key players to support a budding nanotechnology start-up.

The management team and the company board can together decide on the most suitable business model for the company. In making this decision, special focus should be placed on the model that will create and deliver great value to customers while simultaneously delivering great margins. The model should also hedge against customer dissatisfaction or dissonance and issues securing adequate funding. While the team is now multifaceted, additional support to make the right decisions that will position the company for success can be sought. This can be achieved using accelerators and incubators (which might be available within the university or municipality), government agencies such as the local chamber of commerce, and small business and technology development centers. Start-ups are generally encouraged to not employ at the early stages and to instead contract personnel for specific functions if necessary.

3.3. Technology transfer process

Technology transfer is an intrinsic part of the technological innovation process in research institutions. As defined by technology licensing offices, it is the process by which new inventions and innovations stemming from scientific and technological research created in these institutions are turned into products and commercialized. As outlined previously, this is typically done in one of two ways. That is, by licensing the patented intellectual property through partnership agreements to corporations, or through the establishment of start-up companies which also often license the intellectual property created by faculty. Numerous stakeholders are involved in the technology transfer process along with several non-scientific and non-technological factors. Protecting intellectual property is a major component of the technology transfer process. Additionally, some other activities can benefit a start-up include: evaluating the commercial potential of new inventions, marketing available technologies to potential licensees and partners, educating researchers on commercialization principles and strategies, supporting faculty start-up creation and development, securing funding for early-stage research and start-ups, negotiating partnerships and license agreements, organizing business plans and start-up competitions, helping to build innovation ecosystems and support structures that promote innovation and economic development, and creating programs that encourage both student and faculty to innovate in labs and engage in entrepreneurship so they can bring those innovations to the marketplace (https://techtransfercentral.com). These activities make the technology transfer process a big, multifaceted, and complex one. The benefits of a successful process however vindicate the effort required as it offers potential benefits to universities, companies, regional and national economies, and society at large. Benefits for universities can include bringing in revenues that can be reinvested into research, along with increasing recognition of its scientists and their innovations which can help with faculty recruitment and grant funding. For companies, potential benefits include the ability to gain from advances in research without spending on internal research and development activities, and introducing new products that can propel the company's success. Technology transfer can be a key factor for growth through innovation for regional and national economies by creating new ventures and stronger industries that can create more jobs. For society, the potential benefits are multitudinous in terms of saving lives, improving health and the environment, and availing a myriad of technological advances that bring not only new capabilities but that drive local, regional, national, and global economies forward through innovation.

The efficiency of the transfer of nanotechnology innovations from the lab to the industry is dependent on the efficacy of the technology transfer process. Countries that invest in improving nanotechnology transfer policies and practices have greater nanotechnology outputs. This is evident in the United States where the National Nanotechnology Initiative (NNI) was developed. It is a collaboration of federal departments and agencies with interests in nanotechnology research, development, and commercialization.17 Within the NNI are agencies such as the Nano manufacturing and Small Business Innovation Research (SBIR) programs, and the NNI's National Nanotechnology Coordination Office (NNCO) that are concerned with the transfer of newly developed nanotechnologies into products for commercial use. In Asia, there has been an increase in expenditure towards nanotechnology research and deliberate efforts to transfer research findings to industries. While the production of nanotechnology publications in China is higher than in other countries (Fig. 2a), the transfer of these technologies to industries is not equivalent.18 The National Steering Committee for Nanoscience and Nanotechnology (NSCNN) was established to oversee and coordinate nanotechnology policies and programs in China. Some key members of this group include the Chinese Academy of Sciences (CAS), the National Natural Science Foundation of China (NSFC), the National Development and Reform Commission (NDRC), and the Chinese Academy of Engineering. These agencies are expected to impact the technology transfer process within the country.

The success of the transfer of technology in The United States reveals that more favorable environments for nanotechnology transfer need to be created globally. This will create a stronger ecosystem for nanotechnology research and innovation, and in turn, result in greater success in the use of intellectual property to facilitate the creation of start-ups formed from the ground up or through partnerships. Some nanotechnology and nano-engineering associations across the world that can be modelled in other countries to positively impact the transfer of technology are outlined in Table 2. These associations were selected from the Nanotechnology 2020 Market Analysis.9

Some global nanotechnology and nano-engineering associations.

| Association | Country |

|---|---|

| Alliance for Nanotechnology in Cancer | USA |

| American National Standards Institute Nanotechnology Panel | USA |

| Centre for Nano and Soft Matter Sciences | India |

| Collaborative Centre for Applied Nanotechnology | Ireland |

| Indian Association for the Cultivation of Science | India |

| Iranian Nanotechnology Laboratory Network | Iran |

| Nano Medicine Roadmap Initiative | USA |

| National Cancer Institute | USA |

| National Institutes of Health | USA |

| National Research Council Nanotechnology Research Centre | Canada |

| Russian Nanotechnology Corporation | Russia |

| S.N. Bose national Centre for Basic Sciences | India |

| Waterloo Institute for Nanotechnology | Canada |

3.4. Readiness for commercialization

Determining the right time to enter a market can be very challenging for a new company. This is true regardless of whether the company started from the ground up or is operating through a partnership; however, the latter business model can offer significant support in several regards. To evaluate the readiness of new technology for commercialization and market entry, the “Cloverleaf Model” can be used. This model which can be modified to best suit the technology being commercialized is so-called because it involves four key criteria which are likened to the leaves of a four-leaf clover. These criteria as shown in Fig. 5 are technology readiness, market readiness, commercial readiness and management readiness.19

Fig. 5. A cloverleaf framework for market entry readiness assessment of nanotechnology inventions.

Technology readiness evaluates the technology itself and seeks to determine if the technology will maintain itself in the market. This is usually determined by performing a technology readiness assessment (TRA). It is recommended that this TRA is done at several points during the ‘life cycle’ of the new technology or system. Possible components of this assessment include an evaluation of the conceptual design, a clear protocol to facilitate a decision from among several competing design options, and similarly, a defined approach to decide when to begin full-scale development. These decisions might be made by the research team or they can be more complex and warrant an external, independent peer-review process.20 Market readiness assesses how marketable the technology is; that is, how well the technology will be accepted by the target market. This is generally done by examining whether the technology offers meaningful identifiable and quantifiable benefits, has distinct advantages over competing products, has access to a market of a suitable size that is defined and is growing (demand-based), has immediate market uses, and has feasible manufacturing requirements.21

The commercialization readiness assessment also evaluates the readiness of the technology's business model. This is done to verify the stability and readiness of the foundation upon which the technology will be delivered. Within this component, parameters for assessment include determining whether prospective licensees are identified, if industry contacts are available, and if further development or patenting is possible based on the availability of financial support for the licensee. Additionally, anticipated future royalty revenue of the license, access to venture capital, a profitable investment, and availability of government support for additional development for innovations resulting from universities are also crucial.22 The last key area is management readiness which assesses the readiness of the management team that is responsible for the technology. It addresses matters such as the ability of the inventor to champion the innovation as a team player, whether the inventor's expectations for success are realistic, if the inventor is recognized and reputable in the field, if commercialization skills such as sales and marketing skills are available, whether management capabilities are available, and also whether the inventor is the patent holder for innovations resulting from government labs.23

A method of quantifying the judgments made for each criterion of the four areas of the Cloverleaf framework to determine the degree to which each condition is met was suggested.19 If all components of the criteria list for the four ‘leaves’ assessing readiness are satisfied, then the technology is ready for commercialization. If a partnership agreement is being utilized, some components should be completed before engaging a partner and others should be finalized with the partner. Regardless of the business model, if any area is found lacking, additional preparation is warranted to ensure the success of the venture when it enters the market.

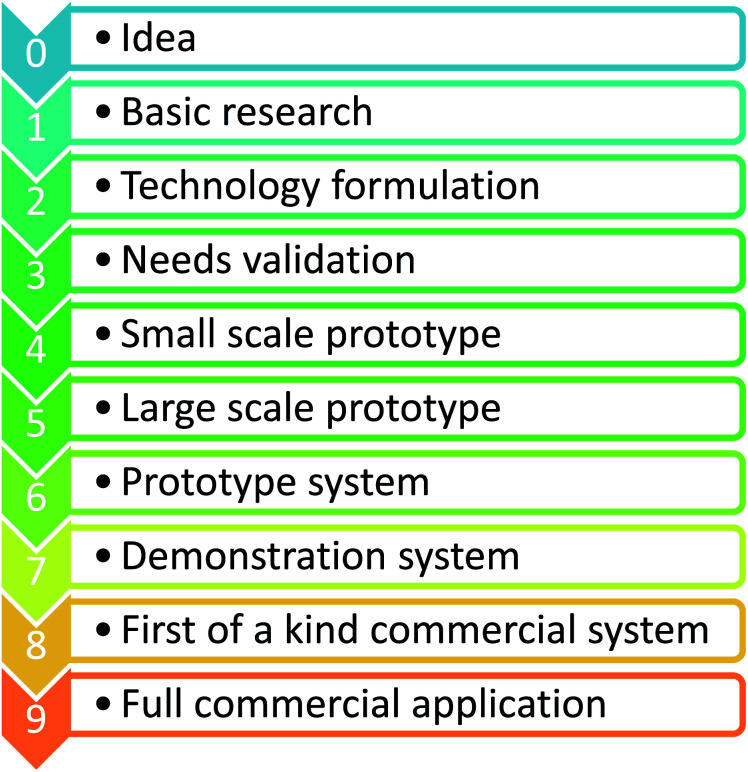

Alternative to the Cloverleaf framework is the Technology Readiness Levels (TRL) model. This was developed by NASA and is a type of measurement system that is used to permit more effective assessment and communication regarding the maturity of new technologies.20 The different levels of the framework are outlined in Fig. 6. There are nine technology readiness levels. A project is evaluated against the parameters for each technology level and is then assigned a TRL rating based on its progress. TRL 1 is the lowest level and indicates that a technology requires further research and development, and testing. TRL 9 is the highest level and signifies a mature technology that is proven to work and may be put into use and commercialized.

Fig. 6. Technology readiness levels (TRL).

3.5. Financials

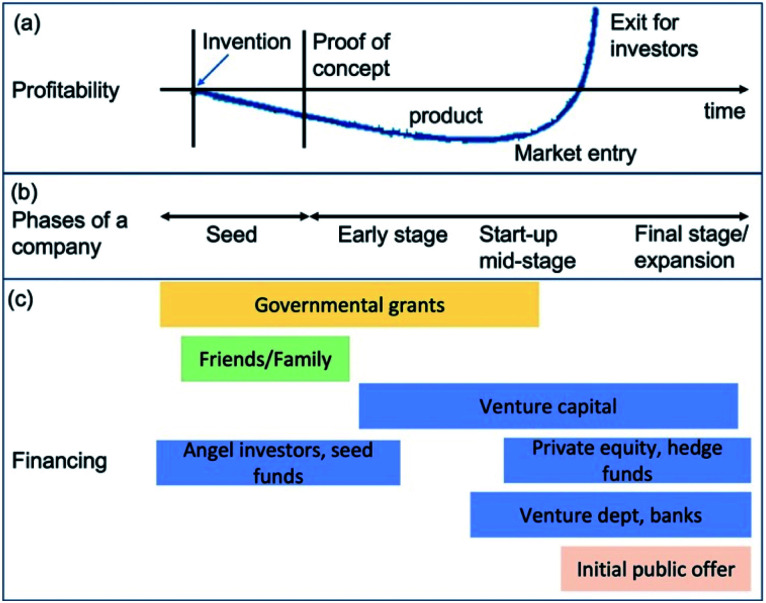

Figuring out how to finance a start-up can seem like a daunting task. This challenge can be mollified if the business developer knows whom to contact and when. To access most funding opportunities, a company must first be registered. This registration process attracts a cost that varies depending on the country. In some cases, all other costs that will be incurred by the business have to be calculated so the total expenditure can be determined before a potential investor is contacted. Some of these fixed and variable business costs usually include research and development costs, operating cost, production cost, the cost for company assets (for example machinery), server costs, and marketing costs. These costs will vary depending on the applied business model. A summary of the different stages of a start-up company and where certain types of funding are obtained is outlined in Fig. 7.

Fig. 7. Phases of a company's growth (a), (b) and the different funding instruments that are available at the different stages (c).24.

3.5.1. Loans

The different means through which the venture can be financed to launch the innovative product can now be considered. The type of capital sought can be dilutive or non-dilutive. The former refers to capital infusion that requires a share of equity or ownership in the company while the latter is funding that does not require this ‘dilution’ of ownership. Bank loans are non-dilutive capital sources that are often accessed for business financing. Small business loans can be obtained from many traditional and alternative lenders. There are several types of small business loans available based on existing business needs and included among these are accounts receivable financing, business line of credit, business term loans, working capital loans, small business administration (SBA) small business loans, and equipment loans. Depending on the type of loan accessed, the length of the loan and the specific terms of the loan will vary. Two common traditional lenders are community and commercial banks. Some of the advantages of using loans to finance a business venture include maintaining ownership and control of the business, and lenders do not have any claim on the profits of the business. The loan however has to be repaid as agreed and does not compensate for losses.

3.5.2. Investments

There are different types of investors that can be considered for funding. A common source of funding for business start-ups is angel investing. Angel investors are high-net-worth individuals who provide financial support at early stages for small start-ups, typically in exchange for ownership equity in the company. Angel investors are often found among an entrepreneur's family and friends. They can also be found through other means such as through other entrepreneurs, an angel investor network, venture capitalists and investment bankers, and crowdfunding sites. Along with cash, angel investors can also provide the start-up with advice and strategies of similar companies in addition to contacts to strategic partners, and other investors such as venture capitalists. Angel and seed investors are very similar and are customarily the first sources of external capital for start-ups. Seed investors however differ in that they represent a more formal option for early-stage capital and are usually professional investors. The point at which the company receives seed funding is normally the stage when the company starts gaining the attention of the bigger players in the venture capital space. Other seed funding options include crowdfunding, incubators, and accelerators. These platforms usually do not invest huge amounts of capital but instead provide entrepreneurs with valuable advice, training, office space, networking events, and contacts.

Another type of capital provider is venture capitalists. These private investors provide funds to early-stage companies that are pursuing big opportunities with high growth potential. Venture capital firms exchange capital for equity ownership and can also provide strategic assistance, and an invaluable network. To capture the interest of a venture capitalist, a start-up should have a good “elevator pitch” and a strong investor pitch deck for their innovative product. This should therefore include the strength of the management team and clearly outline the large potential market for the nanotechnology innovation, and a unique product or service with a strong competitive advantage. Another entity that can provide financing and has a similar structure to a venture capital firm is a family office. This is a special investment firm that manages the wealth owned by individuals and families with a high net worth.26 Family offices make optimal investors and are increasingly entering venture investment as a relatively new capital provider. They are comprised of qualified professionals with extensive experience and tend to offer more patient capital and expect lower returns than traditional investors.

3.5.3. Grants

Government grants are a source of non-dilutive capital and have become a popular means of funding science-based ventures. This is particularly favored because unlike taking out a loan or engaging investors, grants remove the need to repay a lender and also eliminate the need to give up equity in the business. Scientists can make the most of these funding opportunities by researching the types of grants available. These can be discovered by searching primary sources of funding such as the public sector (central and local government) and the private sector (foundations and corporations). Different grants have different application requirements and provide different benefits so the one most applicable should be targeted. As these funding options are competitive, the start-up project should be innovative, possess unique features or solutions to existing challenges, and have good commercial prospects of success.

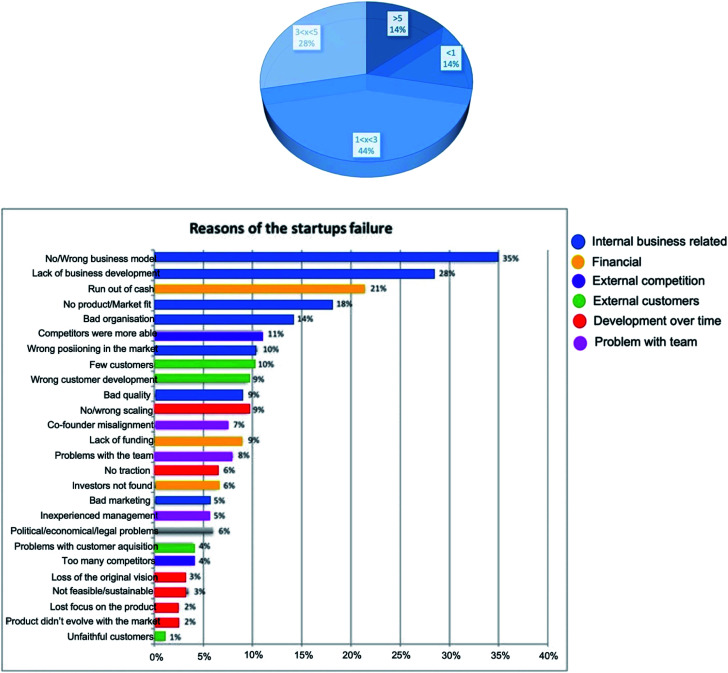

4. The challenge of moving technology from lab to industry

One of the biggest hurdles (if not the biggest) is that there is a gap between industry and academia in the middle TRLs also named the Valley of Death.27 While academia covers the lower TRLs, at some point the technology becomes less interesting for academics once it is well understood.28 However, industries are often risk averse and want to work in areas where the profit is earned soon and thus prefer to work in areas where the TRL is high. This leaves a gap where academics are not interested anymore and industrial partners not yet. There are many incentives to tackle this gap. But there it really needs collaboration between academics and industrial partners. Once there is a start-up founded, there are also many challenges that new founders face. As a result, many start-ups do not survive their initial stages. Fig. 8 shows the lifetime of start-up companies and a summary of the most important reasons for start-up failure. The diversity of the applications of nanotechnology causes the industries that can be impacted to be equally diverse. The challenges associated with nanotechnology are therefore quite varied. A general categorization of these challenges is technical, biological or environmental, economical, and regulatory. Among the technical challenges are those relating to the structure of the research institute (both organizational and infrastructure) and the technical knowledge of the team. The organizational structure of the institute can stifle an entrepreneurial culture by failing to facilitate networking between researchers and investors in nanotechnology, and not fostering valuable interactions between researchers and entrepreneurs within the nanotechnology industry. This limits the potential to create a multidisciplinary team that can develop a nanotechnology technical workforce. The lack of technical knowledge can also pose a significant challenge to commercialization efforts as this deficit can result in innovations that are not industrially viable. Some technical challenges associated with the successful development of nanotechnology products suitable for commercialization include failure to maintain superiority over existing products, unsuccessful integration of technology which causes the nanotechnology product to not retain its unique characteristics after scaling up, challenge controlling reproducibility or the batch-to-batch variations during product manufacture at the industrial scale, and inadequately trained staff to use, analyze, and interpret the results of a diverse range of analytical equipment.29 The design and development of the nanotechnology product must take into consideration the constraints faced during industrial manufacture so scalability can be achieved. Likewise, reproducibility should be built into the product development protocol under a validated manufacturing procedure. Adequate academic and risk management training along with sound knowledge of nanotechnology policies can also help to mitigate challenges associated with a lack of technical knowledge.

Fig. 8. Summary of start-up lifetime and the most common reasons for failure. Adapted from Cantamessa et al. with permissions from MDPI.25.

Biological or environmental challenges are other factors that can impede the transfer of nanotechnology from the lab to the industry. Biological challenges include insufficient knowledge involving the interaction of nanomaterials in vitro and in vivo, inadequate information on their bioaccumulation in target organs, tissues, and cells, and also limited information on their biocompatibility.30,31 Physical properties such as particle size, composition, surface area, surface charge, surface chemistry, and agglomeration state all influence the biocompatibility of nanomaterials and so more information is needed on their safety in vivo.31 Environmental challenges include nanomaterials entering the environment either directly or indirectly (for example, via landfills). Nanomaterials can have potentially adverse effects on natural systems and can enter the environment at different stages of their life cycle. Three emission scenarios that are generally of relevance are (i) release during the production of various nanotechnology products or nano-enabled products; (ii) release during use; and (iii) release after disposal.32 While present in the environment, nanomaterials can then undergo many transformations. These include chemical transformations (for example, photo-degradation), physical transformations (such as aggregation), biologically-mediated transformations (for instance, redox reactions in biological systems), and interactions with macromolecules (for example, flocculation).30 The interplay between these transformations and the transport of the nanomaterial within the ecosystem ultimately determine their fate and ecotoxicity.

Possible biological and environmental impacts of nanotechnology innovations should be determined with in vitro and in vivo models, as well as within aquatic and terrestrial ecosystems. The production process from which the nanomaterial results should also be considered so that any such material emitted during this time or released from nano-enabled devices during their fabrication, use, recycling or disposal can be studied and minimized. Biological and environmental challenges can also be mitigated by providing employers and the extended workforce with information on the potential toxicity of nanomaterials at different stages of their life cycle. With the help of modelling, recent developments have been geared towards predicting the fate, behavior, and concentration of nanomaterials in the environment.33 While these simulations can be helpful, more efficient and reliable analytical instruments and methods must be developed so that nanomaterials can be satisfactorily characterized and quantified, and the necessary tools developed to detect, monitor and track them in biological media and complex environmental matrixes.

The nanotechnology industry plays a major role in economic development; however, several economic challenges can hinder the transfer of innovations from the lab to the industry. Generally, these include limited investment in relevant research and development activities and a lack of appropriate mechanisms to secure these investments, lack of laboratory equipment and appropriate infrastructure to facilitate research and its commercialization, and insufficient funding opportunities to engage in research that has the potential for commercialization. Constraints imposed on the activities needed to commercialize nanotechnology outputs are also impacted by the socio-economic dynamics of innovation. While many believe the rapid growth in nanotechnology will have significant economic benefits, some advocate to reduce or halt its development. The backlash against nanotechnology by this group is based on the belief that it will exacerbate problems concerning existing socio-economic inequity and power imbalance caused by inequality. This, they suggest, will cause a nano-divide which refers to differing access to nanotechnology between low-, middle-, and high-income countries.34,35 The ethical criticism is mainly concerned with inequity based on where knowledge is developed and retained and a country's capacity to engage in these processes.35 An attempt to combat these challenges is outlined in the European Union's Framework Programs through the Responsible Research and Innovation (RRI) approach. This approach ‘anticipates and assesses potential implications and societal expectations concerning research and innovation, intending to foster the design of inclusive and sustainable research and innovation’ (https://ec.europa.eu). These measures which are intended to facilitate broader access to nano-technology and its innovations globally are critical in addressing a nano-divide.

The final category of challenges that can significantly impact the transfer of nanotechnology from the lab to the industry is regulatory challenges. These are concerned with a lack of clear regulatory guidelines for nanotechnology and nanotechnology-enabled products. Some regulatory challenges include inadequate policies to foster the development and operation of nanotechnology businesses or insufficient strategies implemented by governments to attract nanotechnology business initiatives. Additionally, a lack of technology transfer protocols, or requisites for regulatory approvals to facilitate the movement of innovation from the lab to commercial products are problematic.36 The multidisciplinary nature of nanotechnology also presents regulatory challenges. With its cross-industry applications, policing and enforcement nanotechnology patents have proven to be prohibitively expensive (WIPO, 2011). New intellectual property practices and protocols are therefore required to simplify the pathway from lab to industry thereby reducing time and expense.

The technical, biological, environmental, economic, and regulatory challenges of nanotechnology need to be addressed urgently. Policies governing all aspects of nanotechnology research and subsequent commercialization must balance its potential benefits with its current challenges. Combatting these challenges will require considerable efforts to prevent any possible harmful effects of nanotechnology while also facilitating the awareness of its benefits to society.37 The involvement of scientific, governmental, industry, and labor force representatives is therefore critical in decision making so the challenges associated with the commercialization of nanotechnology can be controlled, minimized or mitigated.

5. Conclusions

Geoffrey Nicholson, father of the Post-It, once said that ‘research transforms money into knowledge… while technology transfer transforms knowledge into money’ (https://knowledge4policy.ec.europa.eu/technology-transfer/what-technology-transfer_en). Efforts to transform nanotechnology-based knowledge into money have forged ahead. Nanotechnology-derived products serve numerous industrial and domestic purposes and research efforts to further enhance their properties and applications are increasing globally. These research endeavors however appear to substantially supersede commercialization efforts. As a result of this, research labs might need to consider plans for commercialization from the conceptualization stages. These plans should include a clear innovation strategy. The technology transfer protocol plays a critical role in the technological innovation process and so all participants must possess knowledge of it. The core steps of the technology transfer process will then help to determine key factors such as a suitable business model and licensing agreement, market readiness of the innovation, and revenue streams.

The necessary risk assessment to understand the potentially harmful effects of products resulting from nanotechnology have however not kept pace with their proliferation; and researchers are racing to address this knowledge gap.38 Companies resulting from the transfer of nanotechnology innovations from the lab to the marketplace must therefore have rigorous risk management protocols where risks are identified, control measures are planned and implemented, and risks communication.37 Identified regulatory impediments should also be addressed and technology transfer policies and practices implemented. Entrepreneurial education and training, and the establishment of business incubators should also be supported within the necessary departments or research institutes. Improvement in the understanding of nanotechnology within society would also help commercialization efforts. Overall, societal actors such as researchers, policymakers, investors, citizens etc. must work together during the research and commercialization stages so that the many benefits of nanotechnology outputs can be aligned with the needs and expectations of society.

Conflicts of interest

There are no conflicts to declare.

Supplementary Material

Notes and references

- Munir M. U., Phan D.-N. and Khan M. Q., Nanomaterials Recycling, 2022, pp. 209–222 [Google Scholar]

- Kosmowski K. T., Safety and Reliability of Systems and Processes, 2021 [Google Scholar]

- Nasrollahzadeh M. Sajadi S. M. Sajjadi M. Atarod Z. Issaabadi M. Interface Sci. Technol. 2019;28:113–143. doi: 10.1016/B978-0-12-813586-0.00004-3. [DOI] [Google Scholar]

- Nie L. Nusantara A. Damle V. Sharmin R. Evans E. Hemelaar S. Van der Laan K. Li R. Perona Martinez F. Vedelaar T. Chipaux M. Schirhagl R. Sci. Adv. 2021;7(21):eabf0573. doi: 10.1126/sciadv.abf0573. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hälg D. Gisler T. Tsaturyan Y. Catalini L. Grob U. Krass M.-D. Héritier M. Mattiat H. Thamm A.-K. Schirhagl R. Phys. Rev. Appl. 2021;15(2):L021001. doi: 10.1103/PhysRevApplied.15.L021001. [DOI] [Google Scholar]

- Munawar A. Ong Y. Schirhagl R. Tahir M. A. Khan W. S. Bajwa S. Z. RSC Adv. 2019;9(12):6793–6803. doi: 10.1039/C8RA10144B. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Rambaran T. F. Appl. Sci. 2020;2(8):1–26. [Google Scholar]

- Nanda A. Nanda S. Nguyen T. A. Rajendran S. Slimani Y. Nanocosmetics. 2020:3–16. [Google Scholar]

- Adiguzel O. Biomater. Med. Appl. 2020;3(1):1335. [Google Scholar]

- Dong H. Gao Y. Sinko P. J. Wu Z. Xu J. Jia L. Nano Today. 2016;11(1):7–12. doi: 10.1016/j.nantod.2016.02.001. [DOI] [Google Scholar]

- Inshakova E. and Inshakova A., IOP Conference Series: Materials Science and Engineering, 2020, IOP Publishing, vol. 3, p. 033020 [Google Scholar]

- Saura J. R. Ribeiro-Soriano D. Palacios-Marqués D. Int. J. Inf. Manag. 2004:102331. [Google Scholar]

- Rambaran T. F. Nordström A. Food Frontiers. 2021;2(2):140–152. doi: 10.1002/fft2.72. [DOI] [Google Scholar]

- Zhang L. Tang Y. Tong L. iScience. 2020;23(1):100810. doi: 10.1016/j.isci.2019.100810. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Williamson P. J. Glob. Strategy J. 2016;6(3):197–210. doi: 10.1002/gsj.1124. [DOI] [Google Scholar]

- Cunningham S. Drug Discovery Today. 2020;25(8):1291. doi: 10.1016/j.drudis.2020.06.024. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Roco M. C., Handbook on nanoscience, engineering and technology, vol. 2, 2007 [Google Scholar]

- Gao Y. Jin B. Shen W. Sinko P. J. Xie X. Zhang H. Jia L. Nanomed. Nanotechnol., Biol. Med. 2016;12(1):13–19. doi: 10.1016/j.nano.2015.09.007. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Heslop L. A. McGregor E. Griffith M. J. Technol. Tran. 2001;26(4):369–384. doi: 10.1023/A:1011139021356. [DOI] [Google Scholar]

- Mankins J. C. Acta Astronaut. 2009;65(9):1216–1223. doi: 10.1016/j.actaastro.2009.03.058. [DOI] [Google Scholar]

- Buchner G. A. Stepputat K. J. Zimmermann A. W. Schomäcker R. Ind. Eng. Chem. Res. 2019;58(17):6957–6969. doi: 10.1021/acs.iecr.8b05693. [DOI] [Google Scholar]

- Van Norman G. A. Eisenkot R. JACC Basic Transl. Sci. 2017;2(2):197–208. doi: 10.1016/j.jacbts.2017.03.004. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Oosthuizen R. Buys A. J. S. Afr. J. Ind. Eng. 2003;14(1):111–124. [Google Scholar]

- Successful founding and financing of nanotechnology companies, https://www.nanowerk.com/nanotechnology/investing/funding_nanotechnology_companies_1.php, accessed May 10, 2022

- Cantamessa M. Gatteschi V. Perboli G. Rosano M. Sustainability. 2018;10(7):2346. doi: 10.3390/su10072346. [DOI] [Google Scholar]

- Kenyon-Rouvinez D. Park J. E. J. Wealth Manag. 2020;22(4):8–20. doi: 10.3905/jwm.2019.1.093. [DOI] [Google Scholar]

- Kampers L. F. Asin-Garcia E. Schaap P. J. Wagemakers A. Dos Santos V. A. M. Trends Biotechnol. 2021;39(12):1240–1242. doi: 10.1016/j.tibtech.2021.04.010. [DOI] [PubMed] [Google Scholar]

- Prassler E. IEEE Robot. Autom. Mag. 2016;23(3):11–14. [Google Scholar]

- Kaur I. P. Kakkar V. Deol P. K. Yadav M. Singh M. Sharma I. J. Controlled Release. 2014;193:51–62. doi: 10.1016/j.jconrel.2014.06.005. [DOI] [PubMed] [Google Scholar]

- Lowry G. V., Gregory K. B., Apte S. C. and Lead J. R., Transformations of nanomaterials in the environment, ACS Publications, 2012 [DOI] [PubMed] [Google Scholar]

- Yoshioka Y., Higashisaka K. and Tsutsumi Y., Nanomaterials in Pharmacology, Springer, 2016, pp. 185–199 [Google Scholar]

- Bundschuh M. Filser J. Lüderwald S. McKee M. S. Metreveli G. Schaumann G. E. Schulz R. Wagner S. Environ. Sci. Eur. 2018;30(1):1–17. doi: 10.1186/s12302-017-0129-6. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Williams R. J. Harrison S. Keller V. Kuenen J. Lofts S. Praetorius A. Svendsen C. Vermeulen L. C. van Wijnen J. Curr. Opin. Environ. Sustain. 2019;36:105–115. doi: 10.1016/j.cosust.2018.11.002. [DOI] [Google Scholar]

- Miller G. and Scrinis G., Nanotechnology and the Challenges of Equity, Equality and Development, Springer, 2010, pp. 109–126 [Google Scholar]

- Schroeder D. Dalton-Brown S. Schrempf B. Kaplan D. NanoEthics. 2016;10(2):177–188. doi: 10.1007/s11569-016-0265-2. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Rambaran T. F. Trends Food Sci. Technol. 2022;120:111–122. doi: 10.1016/j.tifs.2022.01.011. [DOI] [Google Scholar]

- Iavicoli I. Leso V. Ricciardi W. Hodson L. L. Hoover M. D. Environ. Health. 2014;13(1):1–11. doi: 10.1186/1476-069X-13-78. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Wilson N. Bioscience. 2018;68(4):241–246. doi: 10.1093/biosci/biy015. [DOI] [Google Scholar]