Abstract

The COVID-19 pandemic provides a unique setting in which to evaluate the importance of a country’s fiscal capacity in explaining the relation between economic growth shocks and sovereign default risk. For a sample of 30 developed countries, we find a positive and significant sensitivity of sovereign default risk to the intensity of the virus’s spread for fiscally constrained governments. Supporting the fiscal channel, we confirm the results for Eurozone countries and U.S. states, for which monetary policy can be held constant. Our analysis suggests that financial markets penalize sovereigns with low fiscal space, impairing their resilience to external shocks.

Keywords: COVID-19, Coronavirus, Sovereign credit risk, Debt, Fiscal capacity

1. Introduction

Since the first reported case of COVID-19 at the end of 2019, the virus has spread rapidly throughout the world and developed into a global pandemic. As of January 18, 2021, there are close to 100 million reported cases and over 2 million deaths, according to the Johns Hopkins University Coronavirus Resource Center.1 Aside from the tragic medical and humanitarian challenges, the pandemic represents a major shock to economic growth due to the extreme disruptions in global economic activity.

Globally, public debt levels were at record highs, even in the pre-crisis period (Yared, 2019), and they are forecast to increase significantly (IMF, 2020). As tax revenues plummet and expenditures mount, governments around the world will inevitably find themselves saddled with rapidly expanding debt due to ballooning budget deficits. These effects are amplified by the launch of numerous comprehensive stimulus packages, which many governments have swiftly implemented to alleviate the economic effects of pandemic-induced lockdowns. The expected future increases in public debt and fiscal deficits are reflected in real time in the evolution of sovereign credit spreads, which spiked almost universally across the globe in response to the coronavirus news.

The ability to finance additional deficits, whether through the issuance of additional debt or an increase in taxation, varies greatly across countries. Similarly, the borrowing costs incurred for new debt issuances vary considerably between fiscally stronger countries, such as the United States and Germany, and more fiscally constrained countries like Italy or Greece.

In this paper, we ask whether countries’ fiscal constraints impair their resilience to economic shocks. Understanding whether fiscal capacity is a key channel in amplifying sovereign default risk is important; an impairment to a country’s credit quality may lead to a reduction in economic activity or limit its government’s ability to respond to future financial crises and natural disasters. There is empirical evidence that excessive public debt levels may depress economic growth (e.g., Reinhart and Rogoff, 2010; Reinhart et al., 2012; Romer and Romer, 2017), and that the economic costs after a financial crisis are more severe for countries with higher levels of public debt (Jordà, Schularick, Taylor, 2016, Romer, Romer, 2018, Romer, Romer). This evidence, however, is viewed with skepticism due to the challenges in identifying the causal effect of debt on growth (e.g., Krugman, 2013) and because the costs of public debt are considered to be low when safe interest rates are below expected growth rates (Blanchard, 2019).

The coronavirus pandemic provides researchers with a unique opportunity to shed new light on a sovereign’s resilience to external shocks. First, in contrast to the Global Financial Crisis in 2008 and the European Sovereign Debt Crisis in 2010 (which were triggered by an endogenous build-up of private and public leverage), the coronavirus pandemic represents an external shock to economic growth (and its expectations), which was unanticipated and affected every country around the world, albeit with varying intensity. Second, both the magnitude of the growth shocks and their impact on a country’s resilience are quantifiable and available in real time. We approximate the shocks to a country’s growth using the incidence of coronavirus cases, and identify the impact on a country’s resilience using sovereign default risk indicators. Third, and most importantly, while the dynamics of both the market-based measures of sovereign default risk and the COVID-19 infection rates are available at a daily frequency, a country’s fiscal capacity is determined prior to the onset of the crisis. Moreover, measures of economic fundamentals that determine a country’s fiscal capacity are measured before any additional debt is issued in response to the coronavirus-induced economic contractions. Finally, little was known about the coronavirus at the start of the crisis, so daily infection rates are especially informative in shaping growth expectations at the pandemic’s onset.

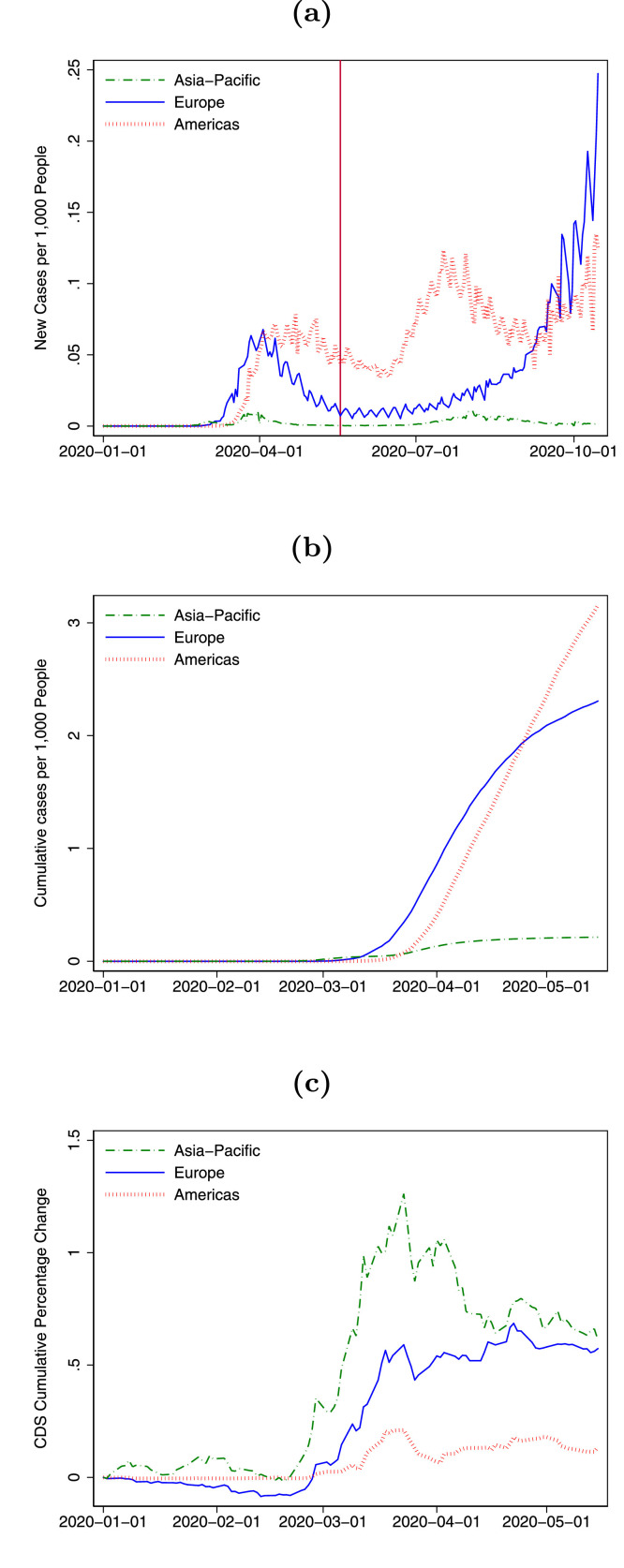

For these reasons, we implement our benchmark tests during the first wave of the pandemic, starting on January 1, 2020 (the day the World Health Organization activated its emergency response framework, following reports of clusters of a new form of pneumonia circulating in Wuhan City, Hubei Province), and ending on May 18, 2020 (the day of the unprecedented joint proposal for a € 500 billion European Union recovery fund by the German chancellor, Angela Merkel, and the French president, Emmanuel Macron). In Panel (a) of Fig. 1 , we show the dynamics of new COVID-19 infection rates, measured for Europe, the Americas, and the Asia-Pacific region during the first infection cycle as the number of new infections per 1000 citizens. We also show the dynamics of new infections during the second wave of the pandemic, until October 15, 2020, when our sample period ends. We consider the second wave only in our robustness tests because, during the later periods, infections rates are more likely to be influenced by country-specific policies, and the trajectory of the pandemic is better understood. In contrast, during the first wave, infections were essentially randomly dispersed across equally susceptible countries and, thus, represent a more meaningful shock.

Fig. 1.

Sovereign CDS and COVID-19 incidence by geographic area. In this figure, we show the time series evolution of sovereign credit default swap (CDS) spreads and incidence of COVID-19 cases for three geographical regions (Asia-Pacific, Europe, and the Americas), corresponding to a set of 30 developed countries, from the IMF economic database, for which we could obtain reliable information on both CDS spreads and COVID-19 infections. In Panel (a), we show the incidence of COVID-19 cases, measured as the number of infections per 1000 people. The vertical line corresponds to the end of our benchmark period on May 18, 2020. In Panel (b), we show the cumulative incidence of COVID-19 cases, measured as the number of infections per 1000 people. In Panel (c), we show the cumulative percentage changes of CDS spreads. Our sample consists of daily observations for five-year USD denominated CDS spreads with the full restructuring credit event clause. Panel (a) extends from January 1, 2020 to October 15, 2020, while Panel (b) and (c) cover our benchmark period ending on May 18, 2020. CDS data are from Markit. The COVID-19 data are from the European Centre for Disease Prevention and Control. We scale the number of cases by the population of the corresponding country, based on estimates for 2018 provided by the OECD.

In Panel (b) of Fig. 1, we show the dynamics of the COVID-19 infection rates, measured as the average number of cumulative infections per 1000 citizens, for the same three regions during the first wave of the pandemic. During this period, the figure shows that the timing of the crisis differs vastly across countries, with significant cross-country heterogeneity in the onset, speed of evolution, and intensity of the virus spread. Additionally, in Panel (c) of Fig. 1 we show the increase in sovereign default risk, as measured by the regional averages of cumulative percentage changes in credit default swap (CDS) premiums, i.e., the prices of insurance contracts that protect against sovereign default risk. CDS contracts are particularly well-suited to examine the impact of the pandemic on sovereign credit risk. In contrast to sovereign bonds, the prices of which may be influenced by differences in the currency of denomination, covenants, tenors, and legal jurisdictions, CDS contracts are uniformly comparable across countries, and their prices are available in real time. Surprisingly, the increases in sovereign default risk are not monotonic in the increase in infection rates. It is this rich, cross-sectional variation, both within and across geographic regions, that we exploit to identify whether fiscal capacity affects a sovereign’s resilience to the crisis.

We show that the sensitivity of a country’s default risk to adverse external shocks depends largely on its fiscal capacity level, broadly defined as the ability of its government to fund its fiscal policy and service its financial obligations [see Romer and Romer, 2019 for a discussion]. For our analysis, we use a sample of 30 developed economies from the International Monetary Fund (IMF) Economic database, for which we can obtain reliable information on sovereign credit spreads, COVID-19 infection rates, and fiscal and economic indicators, all of which are comparable across countries. We consider a battery of different fiscal capacity measures. In particular, we examine general gross government debt, aggregate government expenditures, and total interest expenses, all measured as a fraction of GDP. We also consider unemployment, GDP growth, and country credit ratings, as assigned by the three major rating agencies (Moody’s, Standard & Poor’s, and Fitch). We consider all of these metrics individually, while also aggregating them into a single measure that allows us to rank all countries in terms of their fiscal constraints.

Our results paint a stark picture: there is only a weak unconditional relation between the COVID-19 infection rates and increases in sovereign credit spreads during the coronavirus pandemic. However, conditional on having low fiscal capacity, there is a positive and statistically significant relation between the intensity of the virus’s spread and sovereign default risk. We find that a one-day 30% increase in the incidence of COVID-19 infections translates to a 1% (3%) increase in CDS premiums for a country ranked at the 25th (75th) percentile of the fiscal constraints distribution. These effects are economically meaningful, especially if accumulated over several days, because the average one-day increase in infection rates is 15% after COVID-19 infections reach a rate of one in a million.

Out of the 30 countries in our sample, 14 pursue independent fiscal and monetary policy, and 16 are constrained in their monetary policy because they belong to a common monetary union, the European Monetary System (Eurozone). While members of the Eurozone conduct independent fiscal policy, they are bound by a common monetary policy conducted by the European Central Bank (ECB). Thus, our results risk being influenced by differential cross-country sensitivity to, and coordination of, fiscal and monetary policies.

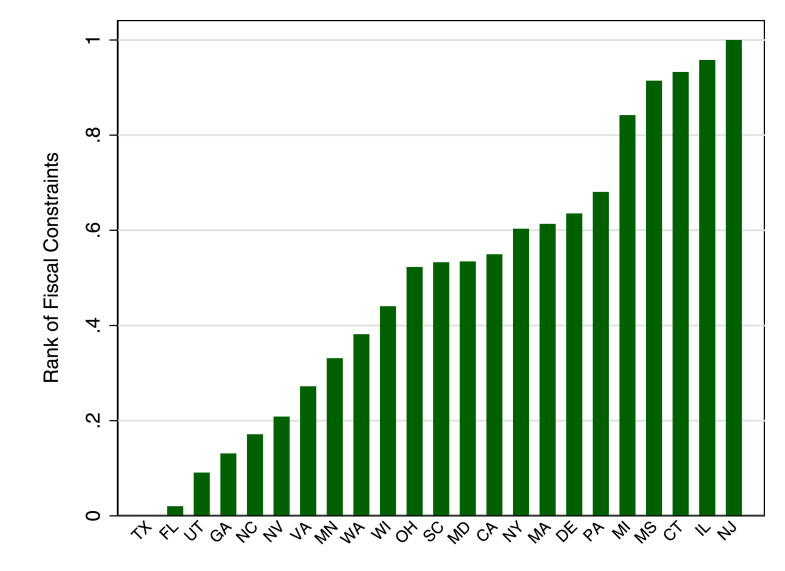

To further emphasize that fiscal capacity is an important amplifier of sovereign credit risk dynamics during the pandemic, we repeat our analysis in samples within which we can hold monetary policy constant. Specifically, we examine the relation for the sample of Eurozone countries and find that our results remain unchanged. In a similar vein, we study the 23 U.S. states for which we can obtain continuous information on sovereign CDS premiums. Although all 23 states have experienced varying infection rates, they are bound by a common monetary policy, which is determined at the federal level through the actions of the Federal Reserve System. Therefore, U.S. states represent a more homogeneous group for studying whether differences in fiscal capacity influence a sovereign’s risk exposure to a systemic crisis.

Similar to our country-level results, we find a statistically significant, positive sensitivity of sovereign default risk to COVID-19 infection rates for fiscally constrained U.S. states. In contrast, less fiscally constrained states are not significantly affected by an increase in COVID-19 cases. Specifically, we find that a weekly 30% increase in the incidence of COVID-19 infections translates to an increase in CDS premiums of 0.24% for a state at the 75th percentile of the distribution of our fiscal constraints measure.

An important consideration in our study relates to cross-country differences in governments’ preparedness to face a pandemic and in a population’s susceptibility to the virus. To verify that our results are not merely driven by confounding factors associated with a country’s healthcare quality or the social composition of the population, we verify whether our results on the sensitivity of sovereign risk to COVID-19 infections are preserved once we control for these factors.

First, we consider the strain on a country’s healthcare system, which we expect to be higher when there are fewer doctors per 1000 inhabitants and when a smaller fraction of GDP is spent on healthcare. Second, we examine the degree of inherent health risk COVID-19 poses to each country’s population, which we measure using the proportion of at-risk population, namely the elderly and the obese. Third, we consider each country’s population density, which can be a key factor in fueling the spread of the virus. We find that none of these variables is significant in amplifying the sensitivity between infection rates and sovereign credit risk. However, fiscal capacity remains a key determinant in explaining cross-sectional differences in the response of sovereign risk to the intensity of the virus’s spread.

Relatedly, we verify that our results are not explained by cross-country differences in the timing and intensity of government responses to the crisis. We consider school closures, workplace closures, restrictions on public gatherings, and other social distancing measures (such as restrictions on people’s movement). We find that the differential impact of COVID-19 infections on sovereign credit risk for fiscally constrained countries is similar during and outside of lockdown policies. Moreover, our analysis suggests that lockdown measures do not directly contribute to cross-sectional variation in the sensitivity of sovereign credit risk to COVID-19 infection rates for fiscally constrained countries. We also consider alternative country characteristics, which are known to relate to sovereign credit risk, as potential drivers of our results. For each country, we evaluate the health of the banking system, the reliance of the economy on tourism, the exposure to the volatility of exports and imports, and the propensity to save. We find that these characteristics do not subsume the statistical or economic significance of fiscal capacity in magnifying the exposure of sovereign risk to COVID-19 infections.

Our last step is to test for the existence of a fiscal threshold that significantly impairs a country’s resilience to external shocks. Following Hansen (2000), we implement endogenous threshold regressions to identify cutoff levels of fiscal capacity, around which there is a shift in the sensitivity of sovereign default risk to the spread of COVID-19 infections. We examine these thresholds for the aggregate fiscal capacity measure and its individual components.

Most notably, we find that the sensitivity of a country’s sovereign default risk to the virus’s spread increases sixfold above debt-to-GDP ratios of 61%. We identify a second significant, endogenous threshold at a debt-to-GDP ratio of 104%. The estimated elasticity for countries with leverage ratios above the second threshold is 13 times that of countries with the lowest ratios.

The rest of the paper proceeds as follows. In Section 2, we discuss the relevant literature. In Section 3, we present and develop our hypotheses. We provide an overview of our data and preliminary evidence in Section 4. We discuss the main results in Section 5, and conclude in Section 6.

2. Related literature

As we show that fiscally constrained countries are less resilient to economic shocks, our work relates most closely to Jordà et al. (2016), and Romer, Romer, 2018, Romer, Romer, who show that the economic costs of a financial crisis are more severe when countries have higher levels of public debt. In that context, our work also relates broadly to the debate in the public finance literature on whether public debt represents a burden to society (Ricardo, 1817, Buchanan, Meade, 1959, Hansen, 1959, Bowen, Davis, Kopf, 1960, Diamond, 1965, Tobin, 1965, Barro, 1974, Buchanan, 1976, Barro, 1979).

Using cross-country evidence from more than 200 years of public debt overhangs, Reinhart and Rogoff (2010), Reinhart et al. (2012), and Romer and Romer (2017) provide evidence that greater debt is associated with lower economic growth and output. Liu et al. (2019) suggest that excessive production of safe asset debt may be risky, as it can increase tax income and consumption volatility, while Croce et al. (2020b) show that too much debt can hamper innovation, lower expected growth, and increase uncertainty. For additional evidence on the relation between debt and growth, see Kumar and Woo (2010), Cecchetti et al. (2011), Checherita-Westphal and Rother (2011), Herndon et al. (2013), and Eberhardt and Presbitero (2015).

Blanchard (2019) argues that high levels of public debt bear little social cost as long as safe interest rates are below long-run expected growth rates. The argument that high debt levels lead to low growth has also been criticized because it is difficult to unequivocally prove the causality of the link (e.g., Krugman, 2013). We circumvent this issue by focusing on a short period of time in which publicly observable measures of fiscal capacity arguably do not change. Thus, we can examine how cross-sectional differences in ex ante fiscal capacity affect the relation between the incidence of COVID-19 cases and sovereign credit risk.

In contrast to previous work, we provide unique evidence regarding the pandemic’s implications for sovereign default risk in developed economies. This evidence is of utmost importance in light of the massive stimulus packages implemented by many countries, which are bound to exacerbate their default risk. Increases in sovereign credit risk are demonstrated to have real economic effects, leading to reductions in credit supply (Adelino, Ferreira, 2016, Bocola, 2016) and investment (Almeida et al., 2017) and an increase in corporate credit risk (Lee, Naranjo, Sirmans, 2016, Augustin, Boustanifar, Breckenfelder, Schnitzler, 2018). Excessive sovereign default risks may also lead to hazardous doom loops between sovereign and financial balance sheets (e.g., Acharya et al., 2014; Farhi and Tirole, 2018). In the context of the pandemic, Benmelech and Tzur-Ilan (2020) and Balajee et al. (2020) suggest that countries with lower credit ratings were hindered in implementing stimulus packages. Relatedly, Arellano et al. (2020) study the feedback effects between lockdown policies and sovereign default risk in emerging economies, while Espino et al. (2020) study the optimal fiscal and monetary policy response of developing economies in an equilibrium model with sovereign default.

Our work also relates to the literature on the dynamics of sovereign credit risk, which are driven by global risk factors (Pan, Singleton, 2008, Longstaff, Pan, Pedersen, Singleton, 2011, Augustin, Tédongap, 2016, Augustin, Sokolovski, Subrahmanyam, Tomio, 2018), local risk factors (Chernov, Creal, Hoerdahl, 2020, Hilscher, Nosbusch, 2010), or a combination of both (Augustin, 2018). We pinpoint the fiscal channel as an amplification mechanism for sovereign CDS spreads, consistent with Chernov et al. (2020b), who show how U.S. CDS premiums reflect the probability of fiscal default. Pallara and Renne (2019) infer fiscal limits from CDS premiums. By analyzing the credit risk of U.S. states, our work is closely related to the study on systemic sovereign risk by Ang and Longstaff (2013), and to Novy-Marx and Rauh (2012). Duffie et al. (2003) and Zhang (2008) study the default of Russia and Argentina, respectively. There is also evidence that sovereign default risk is tightly linked to the local financial sector (Gennaioli et al., 2014). Additional references are available in the surveys by Augustin (2014) and Augustin et al. (2014).

More broadly, our work relates to the growing literature that examines the impact of the COVID-19 pandemic on economic growth (Gormsen and Koijen, 2020) and financial markets, including corporate fixed income (O’Hara, Zhou, 2020, Haddad, Moreira, Muir, 2020, Kargar, Lester, Lindsay, Liu, Weill, Zúñiga, 2020, Boyarchenko, Kovner, Shachar, Fahlenbrach, Rageth, Stulz, 2020, Falato, Goldstein, Hortacsu, 2020), Treasury (He, Nagel, Song, 2020, Fleming, Ruela, 2020, Schrimpf, Shin, Sushko), stock (Boudoukh, Liu, Moskowitz, Richardson, 2020, Ding, Levine, Lin, Xie, 2020, Alfaro, Chari, Greenland, Schott, 2020, Croce, Farroni, Wolfskeil, 2020, Gerding, Martin, Nagler, 2020, Ramelli, Wagner, 2020, Albuquerque, Koskinen, Yang, Zhang, 2020, Bretscher, Hsu, Simasek, Tamoni, 2020, Schoenfeld, 2020, Acharya, Steffen, 2020), and foreign exchange markets (Bahaj and Reis, 2020). We provide an extended literature discussion in Section A-I of the Internet Appendix.

3. Hypotheses development and empirical setting

First, we discuss our testable hypotheses in Section 3.1. We then explain our empirical specification in Section 3.2.

3.1. Hypotheses

There is overwhelming evidence that the dynamics of sovereign credit spreads are affected by global risk factors (Pan, Singleton, 2008, Longstaff, Pan, Pedersen, Singleton, 2011, Augustin, 2018). Although there is a significant degree of cross-country heterogeneity in the scale and scope of the spread of the disease, the coronavirus crisis is a global phenomenon. Thus, ex ante, it is unclear whether the dynamics of sovereign credit spreads during the development of the pandemic would be affected by country-specific COVID-19 infection rates. This motivates our first hypothesis, which relates to whether sovereign CDS premiums are explained by the incidence of COVID-19 infections, after controlling for established global and country-specific factors of sovereign credit spreads.

Hypothesis 1: Changes in sovereign CDS spreads during the coronavirus pandemic are positively related to country-specific COVID-19 infection rates.

A country’s ability to weather the crisis, and potentially respond with fiscal and liquidity stimuli, depends to a large extent on its fiscal capacity prior to the crisis. We therefore examine whether cross-sectional differences in a country’s fiscal space change the relation between the dynamics of sovereign credit spreads and those of COVID-19 infections. Specifically, we examine whether the sensitivity of sovereign CDS premiums to the virus’s spread is stronger when the fiscal space of a country is limited.

Hypothesis 2: The sensitivity of sovereign CDS premiums to COVID-19 infection rates is stronger for countries with low fiscal capacity.

The effects of fiscal capacity on the resilience, to economic shocks, of a country’s credit quality may be affected by the heterogeneity in monetary policy. To test whether a country’s fiscal capacity autonomously affects the relation between sovereign credit risk and COVID-19 infections, we revisit the analysis, this time focusing on the members of two monetary unions: Eurozone countries and U.S. states. In both unions, monetary policy is common to all members and determined at the central bank level (i.e., the ECB and the Federal Reserve System, respectively). This analysis relates to our third hypothesis, which is that credit risk is more strongly associated with COVID-19 infection rates when fiscal capacity is low, while monetary policy is held constant.

Hypothesis 3: The increased sensitivity of sovereign CDS spreads to COVID-19 infection rates for fiscally constrained entities is not driven by differences in monetary policy.

3.2. Empirical setting

We implement a number of tests to examine hypotheses H1 to H3 described above. Our key variable of interest is a measure of a country’s or state’s default risk. Since we aim to estimate the elasticity between sovereign credit risk and COVID-19 infections, we use, as our dependent variable, percentage changes in sovereign CDS spreads () for country or state at time . To mitigate concerns that our estimates are influenced by cross-country differences in the levels and volatilities of CDS premiums, we use growth rates instead of CDS spread levels to estimate the elasticity between sovereign credit risk and the spread of the virus. In Section 5.5, we nevertheless show that our results are robust to using alternative specifications for the dependent variable. We examine how the dynamics of sovereign default risk relate contemporaneously to the intensity of the virus’s spread by projecting daily percentage changes in sovereign CDS premiums onto daily percentage changes in COVID-19 infection rates (), while controlling for standard country-specific and global determinants of sovereign credit risk (denoted by the vector of controls ):

| (1) |

where captures country or state fixed effects to absorb unobserved time-invariant country or state-level heterogeneity, represents time fixed effects, and is the i.i.d. residual. The main coefficient of interest is , which captures the elasticity between the dynamics of sovereign credit risk and COVID-19 infections, and which we expect to be positive. Using percentage changes in the total number of infections is consistent with the approach of forecasting the pandemic’s evolution in epidemiological models, in which infection growth rates are approximately linear in the empirical counterpart of the disease’s reproduction rate, .2

To examine whether there is a differential relation between sovereign credit risk and the intensity of the virus’s spread across countries or states, we include, as explanatory variables, metrics that measure the fiscal constraints of a country or state. All measures of fiscal constraints are predetermined and can be considered time-invariant during our benchmark sample period, which encompasses the first wave of the pandemic. This allows us to measure ex ante cross-sectional differences in fiscal capacity, which are instrumental for identifying any differential elasticity of sovereign default risk to COVID-19 infections. Specifically, in several of our tests, we interact the growth rate of COVID-19 infection rates with measures of fiscal constraints (), so that the regression specification is as follows:

| (2) |

where the country- or state-specific measures of fiscal constraints are omitted because they are absorbed by the fixed effects, .

4. Data, descriptive statistics, and preliminary evidence

We discuss our data in Section 4.1 and present our summary statistics in Section 4.2. We describe cross-country differences in fiscal capacity in Section 4.3, and provide our preliminary evidence in Section 4.4.

4.1. Data

We merge several data sets that encompass country-specific prices of sovereign default insurance, fiscal capacity, COVID-19 infection rates, and information on demographics and public health preparedness, in addition to global and country-specific macroeconomic and financial indicators. In Table A-1 of the Internet Appendix, we provide a detailed description of all of the variables in our analysis and their corresponding sources.

We focus on developed countries, as defined by the IMF, that are part of the Organization for Economic Cooperation and Development (OECD). Our sample consists of 30 countries for which we can find reliable data for sovereign credit risk, fiscal constraints, and COVID-19 infection rates. These 30 countries cover a broad geographic area, including the Americas (Canada and the United States), Europe (Austria, Belgium, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Iceland, Ireland, Israel, Italy, Latvia, Lithuania, Netherlands, Norway, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland, and the United Kingdom), and Asia-Pacific (Australia, Japan, Korea, and New Zealand). We expand on our country analysis to examine the credit risk of 23 U.S. states: Connecticut, California, Delaware, Florida, Georgia, Illinois, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, North Carolina, Nevada, New Jersey, New York, Ohio, Pennsylvania, South Carolina, Texas, Utah, Virginia, Wisconsin, and Washington.

Our benchmark analysis starts on January 1, 2020, the day the World Health Organization activated its emergency response framework, and ends on May 18, 2020, when the German chancellor, Angela Merkel, and the French president, Emmanuel Macron, jointly announced a proposal for a € 500 billion European Union recovery. May 18, represents a major turning point for the markets’ perception of the European Union’s ability to withstand the crisis, as demonstrated by a significant drop in CDS premiums for most countries in our sample. Around this time, we also observe an easing of the first set of lockdown measures. By excluding the period of the coordinated fiscal policy response, we are more likely to capture the impact of COVID-19 infections on sovereign default risk, without any influence of differential fiscal policy responses. In robustness tests, we extend our sample period to October 15, 2020.

We obtain data on CDS spreads from Markit. CDS contracts are identified by their tenor, currency, and definition of a credit event. For all countries and U.S. states, we consider contracts with a tenor of five years, under the full restructuring clause, denominated in USD, and referencing external debt. We focus on the more liquid EUR-denominated contracts for the U.S. government, but our results remain unchanged if we use the USD-denominated contract. CDS premium data are available at the daily frequency. Since sovereign credit risk is intimately connected to a country’s financial risk (Acharya et al., 2014) and currency depreciation (Reinhart, 2002, Na, Schmitt-Grohé, Uribe, Yue, 2018, Augustin, Chernov, Song, 2020), we obtain the return for each country’s major stock index and exchange rate from Capital IQ.

To understand the relation between the spread of the pandemic and sovereign credit risk, we characterize the incidence of COVID-19 infections in a particular area, using the number of presumptive positive and confirmed cases, in accordance with the Centers for Disease Control and Prevention (CDC) guidelines. For observations at the country level, we use data made available by the European Centre for Disease Prevention and Control, sourced via Oxford University’s “Our World in Data” platform, and the Johns Hopkins University Coronavirus Resource Center. We use data from the New York Times for observations at the state level.

Importantly, to characterize a country’s fiscal capacity, we obtain data on a government’s debt outstanding, interest payments, and expenditures. We capture recent macro-economic conditions through a country’s GDP level and growth, credit rating, and unemployment rate. Many of these variables are available only with a significant delay, leading us to focus on quantities for the 2018 fiscal year. In our robustness tests, we show that the ranking of these variables does not change materially across countries in the course of one year, which suggests that this delay is largely immaterial to our results. These data are obtained from the World Bank, the IMF, the OECD, the U.S. Census, the U.S. Bureau of Economic Analysis, and the Pew Trust.

To control for the development of a sovereign’s healthcare system and the ex ante exposure to coronavirus penetration, we also collect information on the number of doctors, the total spending on healthcare goods and services, the fraction of the population that is elderly, the share of the population that is overweight or obese, and the population density. These data come from the Kaiser Family Foundation, the OECD, the World Bank, the World Health Organization, the Centers for Medicare and Medicaid Services, and the CDC.

Finally, we employ global macroeconomic and financial indicators available in the Federal Reserve Bank of St. Louis economic database. We use the returns on the S&P 500 stock market index, the CBOE VIX volatility index, the U.S. (Treasury–LIBOR) TED spread, investment grade (sub-investment grade) credit spreads [defined as the difference between the corporate U.S. BBB (BB) and AAA (BBB) yields], and the Dollar factor, measured as the equally-weighted average exchange rate return relative to USD.

4.2. Descriptive statistics

In Table 1 , we provide detailed summary statistics for the variables in our study for our benchmark period, starting with the dynamics of countries’ sovereign credit spreads and COVID-19 infections. In Panel A, we show that the average CDS premium is 40 basis points (bps), reflecting the high credit quality of the developed economies in our sample. Nonetheless, there is ample cross-sectional variation, as demonstrated by premiums that range from 10 bps to 370 bps. As for infection rates, out of 1000 people, an average of less than one person (i.e., 0.588) is infected with the coronavirus. Reporting the same information after the virus’s spread reached a rate of one in a million, we find that the average daily infection rate increases to 1.066. The maximum number of infected people per 1000 inhabitants is above five. More importantly, the daily change in infection rates is about 15%, on average. Daily equity and exchange rate returns are, on average, close to zero.

Table 1.

Descriptive statistics.

In this table, we report the descriptive statistics for the variables that we employ in our analysis. Panel A reports country-specific time-varying variables, such as the country’s CDS spread, , the return of the country’s major stock index, , the foreign exchange rate, , and the number of COVID-19 cases per 1000 people, . () is the number of COVID-19 infections per 1000 people (percentage change in ) following the initial spread of the virus, which we define as more than one case per one million people. Panel B includes the cross-sectional variables, which, in our setting, are not time-varying. is the ratio of total central government gross debt to GDP. measures the government expenditures as a fraction of a country’s GDP, while is the ratio of central government interest payment to GDP. and capture a country’s economic conditions. represents the credit rating for a given country and ranges from zero (the lowest rating) to 21 (the highest rating). is the number of doctors per 1000 people. is the overall economy expenditure in health-related goods and services as a fraction of GDP. is the fraction of the population aged 65 and older. is the share of adults that self-report as obese based on their body mass index. is the number of people living in a country divided by the country’s area in square kilometers. Panel C shows time-varying global variables, such as the daily percentage changes in the VIX index, ; the TED Spread, ; the BBB (BB) minus AAA (BBB) Bank of America U.S. investment grade (speculative) corporate bond indices, (); and the Dollar factor, . Our benchmark sample covers the period between January 1, 2020 and May 18, 2020. Further details on the variables and their sources are provided in Table A-1 of the Internet Appendix.

| Panel A: Time Series Variables |

||||||||

|---|---|---|---|---|---|---|---|---|

| N | Mean | Std | Min | P25 | Median | P75 | Max | |

| 2970 | 0.004 | 0.004 | 0.001 | 0.001 | 0.003 | 0.006 | 0.037 | |

| 2970 | 0.588 | 1.101 | 0.000 | 0.000 | 0.008 | 0.600 | 5.109 | |

| 1638 | 1.066 | 1.299 | 0.001 | 0.119 | 0.481 | 1.674 | 5.109 | |

| 1638 | 0.150 | 0.672 | -0.072 | 0.008 | 0.036 | 0.135 | 18.000 | |

| 2794 | -0.001 | 0.025 | -0.169 | -0.009 | 0.001 | 0.009 | 0.129 | |

| 2970 | 0.000 | 0.007 | -0.038 | -0.003 | 0.001 | 0.003 | 0.080 | |

| Panel B: Cross-Sectional Variables | ||||||||

| N | Mean | Std | Min | P25 | Median | P75 | Max | |

| 30 | 71.820 | 48.816 | 8.265 | 37.923 | 60.022 | 97.092 | 237.130 | |

| 30 | 33.007 | 8.935 | 16.442 | 26.117 | 35.519 | 39.004 | 47.512 | |

| 30 | 1.603 | 1.007 | 0.076 | 0.960 | 1.403 | 2.385 | 3.820 | |

| 30 | 5.836 | 3.459 | 2.000 | 3.867 | 4.912 | 6.433 | 18.567 | |

| 30 | 2.777 | 1.493 | 0.774 | 1.725 | 2.519 | 3.454 | 8.170 | |

| 30 | 17.772 | 3.328 | 6.952 | 15.667 | 18.500 | 21.000 | 21.000 | |

| 28 | 3.534 | 0.707 | 2.340 | 3.120 | 3.400 | 3.995 | 5.180 | |

| 30 | 9.329 | 2.178 | 5.866 | 7.846 | 9.175 | 10.470 | 16.937 | |

| 30 | 18.627 | 3.239 | 11.654 | 16.026 | 19.152 | 19.861 | 28.137 | |

| 30 | 22.477 | 6.247 | 4.300 | 20.400 | 22.150 | 26.000 | 36.200 | |

| 30 | 147.282 | 152.104 | 3.249 | 30.386 | 104.923 | 215.521 | 529.652 | |

| Panel C: Common Control Variables | ||||||||

| N | Mean | Std | Min | P25 | Median | P75 | Max | |

| 91 | -0.000 | 0.033 | -0.120 | -0.016 | 0.002 | 0.012 | 0.094 | |

| 91 | 0.015 | 0.129 | -0.234 | -0.068 | -0.013 | 0.066 | 0.465 | |

| 88 | 0.011 | 0.211 | -0.286 | -0.087 | -0.013 | 0.049 | 1.533 | |

| 95 | 0.011 | 0.057 | -0.137 | -0.013 | 0.000 | 0.016 | 0.381 | |

| 95 | 0.021 | 0.110 | -0.198 | -0.056 | -0.004 | 0.080 | 0.382 | |

| 99 | 0.001 | 0.006 | -0.020 | -0.002 | 0.001 | 0.003 | 0.029 | |

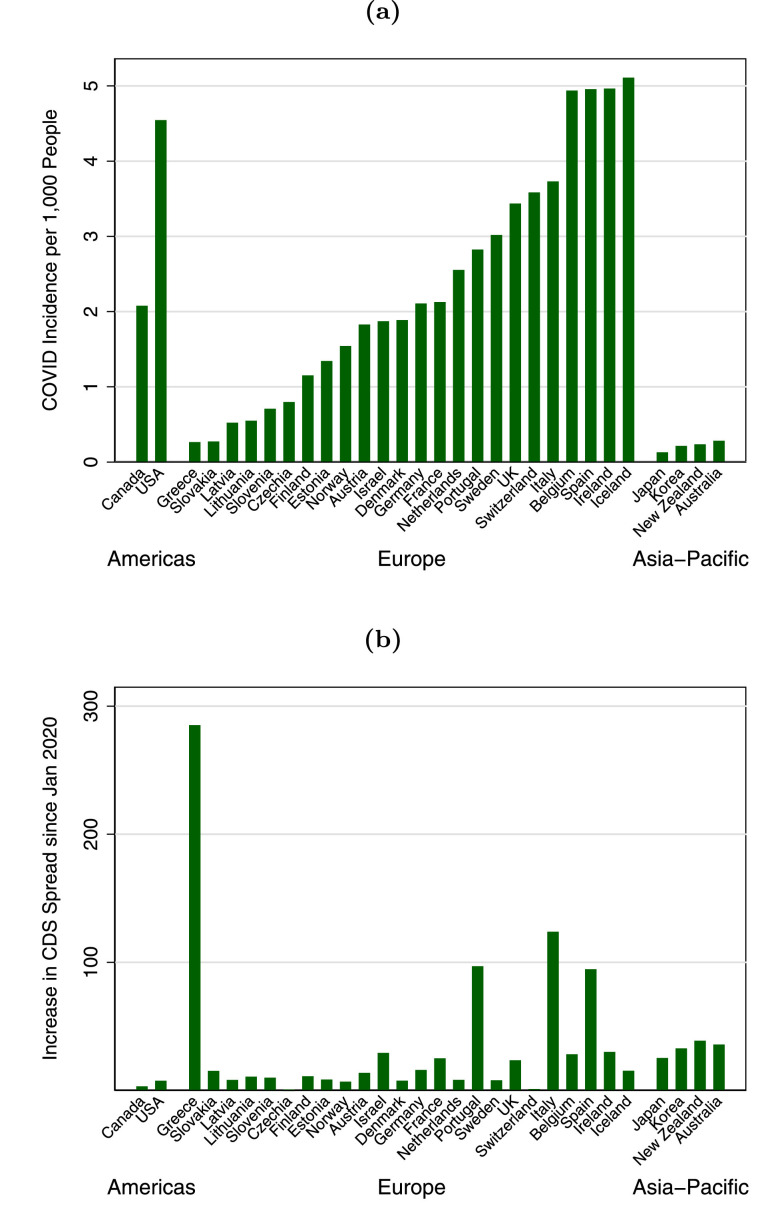

In Fig. 2 , we illustrate the severity of infections and the deterioration of sovereign risk during the pandemic. Panel A shows, for each country, the maximum number of COVID-19 cases per 1000 inhabitants recorded during our sample period. Europe was severely affected. Specifically, Belgium, Spain, and Ireland stand out with more than four infections per 1000 people. On a per-1000 capita basis, Iceland is the most affected country, with more than five cases. In the Americas, the U.S. has more than double the number of cases per 1000 people as Canada, while four developed economies in the Asia-Pacific region all experience low infection rates, compared to countries in Europe and the Americas.

Fig. 2.

Sovereign credit risk and COVID-19 infections. In Panel (a) of this figure, we show for each country in our sample the maximum number of registered COVID-19 infections per 1000 people. In Panel (b), we show for each country the change (in bps) in five-year sovereign CDS spreads from January 1, 2020 to their peak values before May 18, 2020. Our sample consists of 30 developed countries from the IMF economic database for which we could obtain reliable information on both CDS spreads and COVID-19 infections. For CDS contracts, we use five-year USD denominated CDS contracts on senior foreign debt with the full restructuring credit event clause. CDS data are from Markit. The COVID-19 data are from the European Centre for Disease Prevention and Control and cover the period from January 1, 2020 to May 18, 2020. We scale by the population of the corresponding country, based on estimates for 2018 provided by the OECD. We group countries into three regions: the Americas, Europe, and Asia-Pacific.

In Panel B of Fig. 2, we report, for the same countries, the increase in CDS premiums between January 1, 2020 and their peak during our benchmark sample period. While CDS spreads increased across all countries, they evolved quite heterogeneously. For example, the lowest increase, about 1 bp, is recorded for Switzerland, while Spain, Portugal, Italy, and Greece witness increases of 95 bps, 97 bps, 124 bps, and 285 bps, respectively. The cross-country differences in CDS spread increases are noteworthy because they do not align with the intensity of COVID-19 infections documented in Panel A. While Greece experienced the largest increase in sovereign credit spreads, it is among the countries with the lowest coronavirus incidence. In stark contrast, the sovereign credit risk of Switzerland, a country with a particularly high infection rate, did not change significantly relative to its pre-crisis level.

In Panel B of Table 1, we document the magnitude of total central government gross debt, government expenditures, and central government interest payments. We scale these variables by the countries’ corresponding GDP to make them comparable across countries. The average debt-to-GDP level is 71.82%. The large standard deviation of 48.82% is indicative of the vast cross-country differences in public debt levels, which range from a low of 8% for Estonia to a high of 237% for Japan. Total government expenditures represent, on average, 33% of a country’s GDP, while interest expenses are, on average, 1.60% (ranging up to 3.82%). The average unemployment level in our sample is 5.84%, and mean GDP growth is 2.78%. Sovereign credit ratings are another metric of fiscal capacity. We use the average rating of foreign currency long-term sovereign debt ratings among the three most popular rating agencies (Moody’s, Standard & Poor’s, and Fitch), as provided by the World Bank (Kose et al., 2017). The ratings of each agency are converted to a numerical scale, with 1 representing the least creditworthy and 21 the most creditworthy country. The average rating, 17.77, corresponds roughly to an AA- rating.

To control for the potential confounding effects due to the state of a country’s healthcare system, we collect measures of the development of each system. Specifically, we consider the density of doctors in the population, and each nation’s expenditure on healthcare-related goods and services as a fraction of GDP. Petrilli et al. (2020) show that obesity and old age are factors associated with hospitalization and critical illness due to COVID-19. Thus, we also collect information on the fraction of inhabitants aged over 65, the fraction of the population considered obese, and the population density. Most of these variables point toward large cross-country differences in countries’ vulnerability to the virus. Finally, in Panel C of Table 1, we report statistics for the macroeconomic and financial control variables.

In Table 2 , we show that the 23 U.S. states in our sample are mostly comparable to the countries in terms of their characteristics, although they have significantly smaller amounts of government debt, interest payments, and expenditures, measured as a fraction of state GDP. As we only compare credit risk across U.S. states, we do not adjust state-level debt for federal government debt. In terms of sovereign default risk, the distribution of CDS premiums for U.S. states, reported in Panel A of Table 2, is remarkably similar to that reported for countries in Panel A of Table 1. For example, the least creditworthy state, Illinois, has a maximum CDS spread of 400 bps during our sample period, compared to the 370 bps reported during that same period for Greece. Infection rates per capita are higher for states than for countries, ranging up to about 35 infections per 1000 inhabitants. Because we measure the dynamics for states at a weekly frequency, the spread of the disease appears more dramatic, with a 96% average weekly increase in infections, corresponding to a daily increase of 10%.

Table 2.

Descriptive statistics for U.S. states.

In this table, we report the descriptive statistics for the variables we employ in our analysis of the U.S. states sample. Panel A reports state-specific time-varying variables, such as the state’s CDS spread, , and the number of COVID-19 cases per 1000 people, . () is the number of COVID-19 infections per 1000 people (percentage change in ) following the initial spread of the coronavirus, which we define as there being more than one case per one million people. Panel B includes the cross-sectional variables, which, in our setting, are not time-varying. is the ratio of total state debt to GDP. measures the state’s expenditures as a fraction of the state’s GDP, while is the ratio of state interest payment to GDP. and capture a state’s current economic conditions. is the fraction of the state’s pension plan that is not funded bythe plan’s current assets. represents the credit rating for a given state and ranges from one (the lowest rating) to seven (the highest rating). is the number of doctors per 1000 people. is the overall economy’s expenditure in health-related goods and services as a fraction of GDP. is the fraction of the population aged 65 and older. is the share of adults that self-report as obese based on the body mass index. is the number of people living in a country divided by the country’s area in square kilometers. The observations in Panel A are based on weekly averages. Our benchmark sample covers the period between January 1, 2020 and October 15, 2020. Further details on the variables and their sources are provided in Table A-1 of the Internet Appendix.

| Panel A: Time Series Variables |

||||||||

|---|---|---|---|---|---|---|---|---|

| N | Mean | Std | Min | P25 | Median | P75 | Max | |

| 894 | 0.006 | 0.006 | 0.001 | 0.002 | 0.003 | 0.006 | 0.040 | |

| 894 | 7.517 | 8.551 | 0.000 | 0.001 | 3.742 | 13.361 | 35.502 | |

| 667 | 10.076 | 8.499 | 0.001 | 2.273 | 8.585 | 16.609 | 35.502 | |

| 657 | 0.961 | 2.755 | -0.019 | 0.048 | 0.111 | 0.292 | 26.000 | |

| Panel B: Cross-Sectional Variables | ||||||||

| N | Mean | Std | Min | P25 | Median | P75 | Max | |

| 23 | 6.495 | 3.320 | 2.045 | 4.460 | 6.385 | 7.222 | 14.457 | |

| 23 | 12.219 | 2.450 | 8.757 | 10.493 | 12.305 | 13.555 | 19.833 | |

| 23 | 0.243 | 0.129 | 0.078 | 0.126 | 0.219 | 0.306 | 0.574 | |

| 23 | 3.895 | 0.536 | 2.942 | 3.458 | 3.983 | 4.258 | 4.858 | |

| 23 | 5.093 | 1.261 | 2.760 | 4.440 | 4.700 | 5.440 | 8.220 | |

| 23 | 28.957 | 17.760 | -3.000 | 17.000 | 26.000 | 40.000 | 64.000 | |

| 23 | 5.478 | 1.675 | 1.000 | 4.000 | 6.000 | 7.000 | 7.000 | |

| 23 | 3.291 | 0.889 | 2.062 | 2.606 | 3.125 | 3.973 | 5.481 | |

| 23 | 13.606 | 2.405 | 10.357 | 11.974 | 13.199 | 15.653 | 20.757 | |

| 23 | 16.130 | 2.029 | 11.000 | 15.000 | 16.000 | 17.000 | 21.000 | |

| 23 | 30.852 | 3.378 | 25.700 | 27.800 | 30.900 | 33.000 | 39.500 | |

| 23 | 117.729 | 112.627 | 9.498 | 39.074 | 78.224 | 158.765 | 461.585 | |

4.3. Measuring fiscal capacity

For each metric of fiscal capacity, we calculate a country’s rank, such that the country with the largest fiscal constraint (e.g., the highest debt-to-GDP ratio) has a value of one, and the country with the lowest fiscal constraint has a value of zero. As higher GDP growth corresponds to fewer fiscal constraints, we sign this variable so that the rankings are comparable across metrics.

We construct a single measure of fiscal constraints, , rescaled to a range from zero to one, by averaging across the ranks of all six metrics. We find ranking to be a particularly powerful method with which to compare and interpret results across measures of fiscal and economic constraints, as it is less sensitive to outliers. In robustness tests, we show that employing rank variables rather than the underlying numerical values does not alter the regression parameters’ statistical significance.

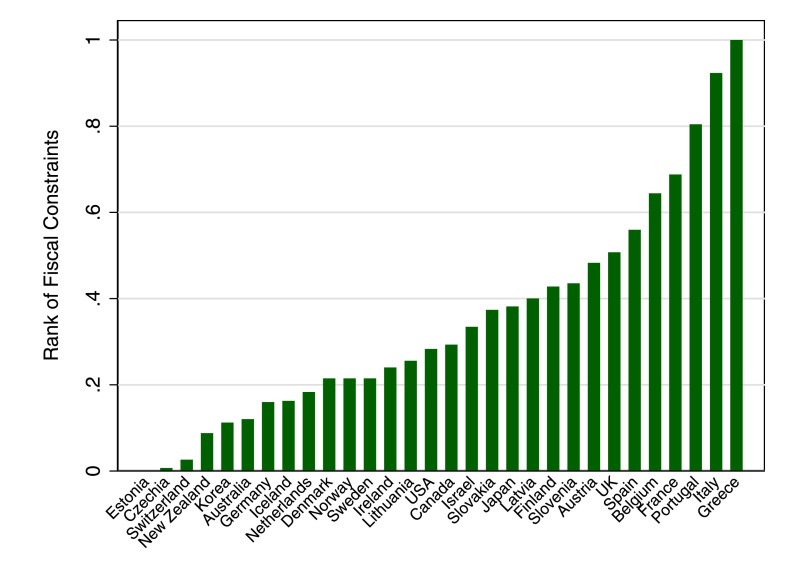

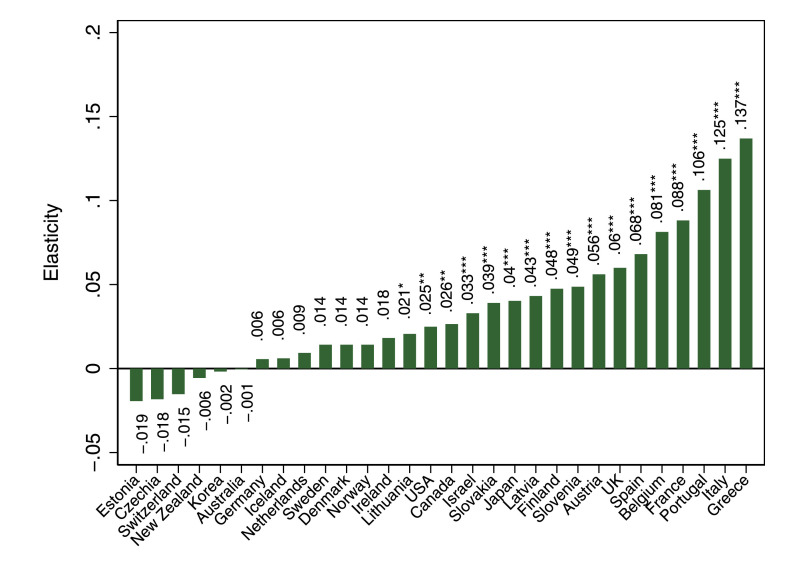

Fig. 3 shows the distribution of the variable and, hence, the fiscal capacity rank for the 30 countries in our sample. The most fiscally constrained countries among our sample of developed economies belong to Southern Europe, while Australia, Germany, and Switzerland are among the least constrained. We report the individual values of the fiscal constraints measure in Table A-2 in the Internet Appendix, together with the values of its components. Relying on a measure of fiscal capacity that summarizes the multiple dimensions of fiscal and economic health into a single variable allows us to identify fiscal capacity more completely than if we were to rely on any one of the six indicators.3

Fig. 3.

Rankings of fiscal capacity. In this figure, we show the value of the variable for our sample of 30 countries. The variable is an average of the rank of six fiscal and economic indicators: debt, expenditures, interest payments scaled by GDP, GDP growth, unemployment rate, and credit rating. All variables are ranked so that, for each indicator, the most fiscally constrained country has a rank of one, and the least fiscally constrained country has a rank of zero. Since credit ratings are already inherently ranked, we scale them so that they are bounded by zero and one. The average rank is then scaled to take a value between zero and one. Data are obtained from the OECD, World Bank, and IMF, and refer to the country’s standing in 2018.

4.4. Preliminary evidence

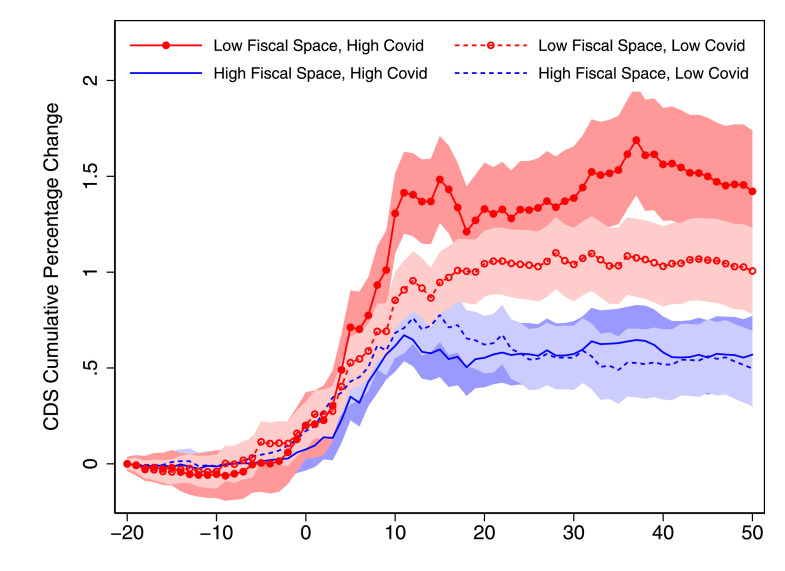

In Fig. 4 , we provide preliminary evidence on the disparate evolution of sovereign default insurance premiums between countries with high and low fiscal capacity and between countries with high and low COVID-19 penetration rates. Specifically, we consider countries to have low fiscal space if their fiscal capacity measure is below the sample median, and high otherwise. Similarly, we consider countries to have low (high) coronavirus penetration if they experience below (above) median COVID-19 infections per 1000 people in our sample.

Fig. 4.

CDS dynamics by COVID-19 infections and fiscal capacity. In this figure, we show the differences in evolution of sovereign CDS spread dynamics after double sorting countries into those that have above and below median fiscal space and those with above and below median COVID-19 infections. We implement an event study analysis, using as the event date the first day that the country-level incidence of COVID-19 surpasses one in a million cases. We determine fiscal capacity based on six indicators: government debt, expenditures, interest payments as a fraction of GDP, unemployment rate, GDP growth, and country credit ratings. We report for each group the average cumulative percentage change in CDS premiums from 20 days before to 50 days after the event day. We examine the increase in CDS spreads of countries with low and high fiscal space, conditioning on countries with high and low COVID-19 infection rates. Confidence bands indicate a two-standard-deviation range around the point estimate, and are calculated as , where is the number of days since day -20 and is the standard deviation of average returns for one of the four country groups . Our sample spans the period between January 1, 2020 and May 18, 2020. Fiscal space indicators are based on their value at the end of 2018. Data on CDS spreads are obtained from Markit, while fiscal space indicators are obtained from the IMF, the OECD, and the World Bank.

We implement an event study analysis, using, as the event date, the first day that the country-level incidence of COVID-19 surpasses one in a million cases. We double-sort the 30 countries in our sample into four groups based on the median levels of fiscal capacity and the median levels of COVID-19 infections, above and below in each case, and in combination, e.g., high fiscal capacity and high infection rate. For each group, we compute the average cumulative CDS percentage change from 20 days before to 50 days after the event day.

Fig. 4 underscores that the impact of a high number of COVID-19 infections on sovereign risk indicators is significantly greater for countries with low fiscal capacity than for countries with high fiscal capacity. Specifically, for countries with a low incidence of COVID-19 (dashed lines), the average cumulative CDS percentage increase is about 50 and 100% for fiscally unconstrained and fiscally constrained countries, respectively. In contrast, for countries with a high incidence of COVID-19 (solid lines), the average cumulative CDS percentage increase is about 50 and 150% for unconstrained and constrained countries, respectively.

Despite similar infection rates, markets thus perceive the sovereign credit risk of countries with low fiscal capacity to be more adversely affected by the pandemic. These differences are economically meaningful. Conditional on having a high incidence of COVID-19 infections, CDS spreads for countries with a limited fiscal space increase, on average, about three times as much over a window of 50 days than they do for fiscally unconstrained countries. Next, we proceed with a more formal analysis, which shows how fiscal space is a primary amplifier for the impact of the pandemic on sovereign credit risk.

5. Main results

In Section 5.1, we examine the unconditional relation between the intensity of the virus’s penetration and the measures of sovereign credit risk. In Section 5.2, we study how fiscal capacity contributes to this relation. We provide evidence on fiscal capacity thresholds in Section 5.3 and similar evidence on the sensitivity of sovereign credit risk to U.S. states’ COVID-19 infection rates in Section 5.4. We discuss robustness tests in Section 5.5, the effect of public health policies in Section 5.6, and channels in Section 5.7.

5.1. Sensitivity of sovereign credit spreads to COVID-19 infections

Guided by our first hypothesis, we test whether daily fluctuations in sovereign CDS premiums are related to daily fluctuations in COVID-19 infections in order to establish the relation between a country’s coronavirus spread and its credit risk.

We report these results in Table 3 . In column (1), we show the univariate relation between percentage changes in CDS spreads and percentage changes in the number of COVID-19 infections. The coefficient estimate of the sensitivity of sovereign risk to the coronavirus transmission is positive and statistically significant, with a value of 0.071. This number is also economically meaningful, as it translates to a 2.1% increase in CDS premiums for a 30% increase in COVID-19 infections. For 238 out of 2970 country-day observations in our benchmark sample period, the daily increase in the number of COVID-19 cases is larger than 30%. The of this univariate regression, 6.1%, reflects a noteworthy correlation of 25% between changes in credit risk and changes in COVID-19 cases.

Table 3.

COVID-19 infections and sovereign credit spreads.

In this table, we report the estimated coefficients from the panel regression analysis of the relation between the percentage changes in the number of COVID-19 cases for country on day , , and the corresponding percentage changes in sovereign CDS spreads, , for the 30 countries in our sample. We control for local determinants of credit risk, such as the return in the country’s major stock index, ; the foreign exchange rate return, ; and global determinants, which include the return on the S&P 500 index, ; the percentage changes in the VIX index, ; the TED spread, ; investment grade (speculative grade) bond spreads, defined as the difference between BBB (BB) and AAA (BBB) corporate bond yield indices, (); and the dollar factor, . We report the adjusted , the number of observations, and whether regressions contain daily time or country fixed effects. Standard errors are two-way clustered at the country- and day-level, and , , and refer to statistical significance at the , , and levels, respectively.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| 0.071 | 0.035 | 0.035 | 0.017 | |||

| (3.903) | (3.505) | (3.551) | (1.731) | |||

| -0.582 | -0.550 | -0.539 | -0.366 | |||

| (-4.182) | (-4.141) | (-4.138) | (-3.306) | |||

| -0.387 | -0.347 | -0.354 | -0.066 | |||

| (-0.732) | (-0.685) | (-0.696) | (-0.131) | |||

| -0.175 | -0.075 | -0.080 | -0.081 | |||

| (-1.691) | (-0.669) | (-0.738) | (-0.757) | |||

| -0.008 | -0.015 | -0.015 | -0.014 | |||

| (-0.267) | (-0.535) | (-0.552) | (-0.528) | |||

| 0.012 | 0.018 | 0.013 | 0.012 | |||

| (0.748) | (1.182) | (0.803) | (0.779) | |||

| 0.205 | 0.176 | 0.117 | 0.118 | |||

| (2.162) | (2.235) | (1.547) | (1.530) | |||

| 0.075 | 0.032 | 0.036 | 0.037 | |||

| (2.222) | (1.046) | (1.246) | (1.250) | |||

| 0.958 | 0.919 | 0.976 | 0.992 | |||

| (1.715) | (1.373) | (1.505) | (1.524) | |||

| Adj. R | 0.061 | 0.193 | 0.239 | 0.250 | 0.253 | 0.330 |

| Obs | 2970 | 2640 | 2559 | 2559 | 2559 | 2793 |

| # Countries | 30 | 30 | 30 | 30 | 30 | 30 |

| Time FE | No | No | No | No | No | Yes |

| Country FE | No | No | No | No | Yes | Yes |

As shown in Fig. 1, the pandemic shock affects almost all countries within a few weeks of each other. A potential issue with our finding may be that the univariate relation between sovereign risk and COVID-19 infections may pick up correlations with other factors that share the same time trend. To allay this concern, we regress percentage changes in CDS spreads on global macroeconomic and financial risk factors and present the results in column (2). Sovereign CDS spreads tend to be higher when returns on the S&P 500 stock index are low or corporate credit spreads are high. These spreads are also higher when the U.S. dollar strengthens. This evidence is consistent with global risk factors explaining part of the time variation in credit spreads, consistent with the findings of Pan and Singleton (2008) and Longstaff et al. (2011).

In column (3) of Table 3, we add the domestic stock market return and the exchange rate relative to the U.S. dollar as country-specific control variables. While the investment grade credit spread remains significant in explaining sovereign CDS dynamics, it is the domestic stock market return that is dominant in the specification. The estimated coefficient suggests that the economic magnitude is also large, as a 1% increase in domestic stock returns is matched, on average, with a 0.582% increase in CDS spreads. That a country’s own financial market metrics are more important than U.S. risk factors in explaining sovereign credit risk dynamics is consistent with the evidence on the time-varying relevance of global and local risk factors (Augustin, 2018). Accordingly, even while affecting essentially every country around the globe, the impact of the pandemic on sovereign credit risk perceptions appears to be country specific.

The specification in column (4) shows that sovereign credit spreads respond positively to country-specific increases in COVID-19 infections, lending support to our first hypothesis. This effect is above and beyond the effect that the pandemic may have on a country’s stock market. The elasticity of CDS spreads to COVID-19 infections is 0.035 and statistically significant at the 1% level. The elasticity parameter of 0.035 means that, after controlling for macro- and country-specific risk factors, a one-day 30% increase in the incidence of COVID-19 infections translates into a 1.1% increase in CDS spreads. The magnitude of this coefficient hardly changes when we include country fixed effects in column (5), indicating that this relation is primarily driven by within-country variations. Including daily time fixed effects, as we do in column (6), to absorb the positive trend in sovereign spreads and macro variables during the pandemic, reduces the magnitude of the estimated elasticity, but it remains marginally statistically significant.4 However, as we show in the next section, these specifications mask the important cross-country differences in fiscal capacity for explaining the dependence between a country’s credit risk and economic shocks.

5.2. The role of fiscal capacity

Our main question is whether a country’s fiscal capacity influences its resilience to a global crisis caused by an external shock, such as the coronavirus pandemic, as stated in our second hypothesis. In Table 4 , we, therefore, examine whether measures of fiscal capacity influence a country’s sovereign risk sensitivity to COVID-19 infection rates.

Table 4.

COVID-19 infections, credit risk, and fiscal capacity.

In this table, we report the estimated coefficients from the panel regression analysis aimed at investigating the determinants of the relation between daily percentage changes in COVID-19 infections for country- on day–, , and sovereign CDS spreads, . We interact the variable of interest, , with indicators of the fiscal health of a country: gross central government debt, ; government expenditures, ; and interest payments, , all measured as a fraction of GDP. We complement the analysis considering economic indicators, such as the country’s unemployment rate, , and GDP growth, . Finally, we consider the effect of cross-sectional differences in credit rating, . Rather than using the values of the indicators, we use their rank in the sample of countries normalized to one, i.e., the country with the smallest expenditures relative to GDP will have , while the country with the largest expenditures will have . Since rating is already a rank variable, we simply normalize it, so that the country with the highest credit rating has . We also include country-specific time-varying explanatory variables, such as the return in the country’s stock market index, , and foreign exchange rate return, . Further details on the variables and their sources are provided in Table A-1 of the Internet Appendix. All specifications include country- and day-fixed effects, and standard errors are two-way clustered at the country- and day-level. The superscripts , , and refer to statistical significance at the , , and levels, respectively.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| -0.033 | -0.002 | -0.024 | -0.028 | 0.069 | 0.089 | |

| (-1.376) | (-0.078) | (-1.151) | (-1.178) | (2.848) | (2.322) | |

| 0.098 | ||||||

| (2.233) | ||||||

| 0.044 | ||||||

| (1.007) | ||||||

| 0.080 | ||||||

| (1.889) | ||||||

| 0.084 | ||||||

| (2.283) | ||||||

| -0.106 | ||||||

| (-2.097) | ||||||

| -0.090 | ||||||

| (-1.973) | ||||||

| -0.356 | -0.362 | -0.362 | -0.360 | -0.359 | -0.362 | |

| (-3.356) | (-3.295) | (-3.368) | (-3.296) | (-3.327) | (-3.383) | |

| -0.014 | -0.046 | -0.040 | 0.009 | -0.047 | -0.030 | |

| (-0.027) | (-0.091) | (-0.080) | (0.017) | (-0.094) | (-0.060) | |

| Adj. R | 0.338 | 0.331 | 0.336 | 0.336 | 0.339 | 0.334 |

| Obs | 2793 | 2793 | 2793 | 2793 | 2793 | 2793 |

| # Countries | 30 | 30 | 30 | 30 | 30 | 30 |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Country FE | Yes | Yes | Yes | Yes | Yes | Yes |

We first consider three indicators of fiscal capacity that relate directly to a country’s financing constraints: gross central government debt, government expenditures, and interest payments. All three are measured as a fraction of GDP. We complement our analysis by considering two indicators of the country’s economic cycle (the unemployment rate and the GDP growth rate) and, finally, its sovereign credit rating. These indicators are intimately related to the fiscal space of the country. All else equal, a higher unemployment rate decreases income tax receipts and increases unemployment benefits. Lower GDP growth decreases consumption and tax revenue. A low fiscal rating decreases investors’ demand for the country’s debt, hampering the country’s ability to issue new debt at a low cost. Hence, all of these dimensions relate to the tightness of the country’s fiscal space.

We transform each indicator into a rank variable of fiscal capacity. Ranks are calculated such that the country with the lowest value for a given indicator has a rank of zero, and the country with the highest value a rank of one. We present all of our results using the rank variables, as they reduce the sensitivity of our results to outliers, such as Japan, which has a debt-to-GDP ratio of greater than 200. Our results are, however, robust to including the raw fiscal capacity variables. We discuss robustness tests in Section 5.5.

The results reported in columns (1)–(6) of Table 4 consistently show that sovereign credit risk is more sensitive to the intensity of the coronavirus penetration rate when a country is in worse fiscal shape, thereby supporting our second hypothesis. The coefficients of all of the relevant sovereign credit risk variables are statistically significant, except for the expenditure variable. All of the interaction terms also have the expected sign. Greater debt, expenditures, interest payments as a fraction of GDP, and higher unemployment all lead to larger coefficient estimates, while better credit ratings and higher GDP growth reduce the magnitude of the sovereign CDS–COVID-19 infection relation.

The magnitudes of the interaction coefficients are also economically meaningful. Based on the coefficient for and on its interaction term with debt-to-GDP in column (1), 0.098, a one-day 30% increase in COVID-19 infections translates into a 0.5% increase in CDS spreads for a country at the 50th percentile of the debt-to-GDP distribution. However, for a country at the 75th percentile of the rank distribution, the effect is significantly larger: a daily 30% increase in infection rates results in a daily increase of 1.2% in CDS premiums.5

In Table 5, we construct one aggregate metric of fiscal constraints. Specifically, we sign all measures of fiscal capacity such that higher values indicate lower fiscal capacity. We then aggregate them into one rank indicator, , which captures a country’s fiscal constraints across multiple dimensions. The results reported in columns (1)–(5) all indicate that, unconditionally, there is no meaningful relation between the intensity of the infection rates and sovereign credit risk after controlling for time-varying risk factors at the country level, unobserved time-invariant country characteristics, or common unobserved cross-country effects. Moreover, unconditionally, there is no significant relation between sovereign risk and fiscal constraints, as demonstrated by the insignificant estimated coefficient for the fiscally constrained rank variable reported in column (1).

Table 5.

COVID-19 infections, credit risk, and fiscal capacity.

In this table, we report the estimated coefficients from the panel regression analysis aimed at ruling out the supposition that the stronger relation between daily percentage changes in COVID-19 cases for country- on day-, , and sovereign CDS spreads, , for countries with low fiscal space is determined by confounding factors. We interact the variable of interest, , with a continuous rank variable that measures a country’s fiscal constraints, , and with continuous rank variables that capture a country’s exposure to a high penetration of COVID-19. Specifically, we create the following rank variables: the strain on a country’s health system, , which is decreasing in the number of doctors per 1000 inhabitants and the fraction of GDP spent on healthcare; the degree of risk that the coronavirus poses to the population, which is higher in the fractions of the elderly and obese, ; and the density of a country’s population, . The specification in column (1) includes the global variables employed in Table 4. All specifications include country-specific time-varying explanatory variables, such as the return in each country’s stock market index, , and the foreign exchange rate return, . The specifications in columns (2)–(5) include country- and day-fixed effects. Standard errors are two-way clustered at the country- and day-level for the specifications in columns (1)–(5), and at the day-level for column (6)–(7). For the analysis in this table, the sample consists of 30 countries, with the exceptions of column (6), where it is restricted to Eurozone countries, and column (7) where it is restricted to countries outside the Eurozone. The superscripts , , and refer to statistical significance at the , , and levels, respectively.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| -0.019 | -0.035 | -0.007 | -0.028 | -0.047 | -0.030 | -0.035 | |

| (-1.030) | (-1.714) | (-0.255) | (-0.787) | (-2.260) | (-1.111) | (-1.491) | |

| 0.156 | 0.154 | 0.158 | 0.159 | 0.153 | 0.145 | 0.110 | |

| (3.347) | (3.168) | (2.977) | (3.033) | (3.101) | (2.899) | (1.807) | |

| -0.056 | |||||||

| (-0.935) | |||||||

| -0.018 | |||||||

| (-0.273) | |||||||

| 0.021 | |||||||

| (0.687) | |||||||

| -0.002 | |||||||

| (-0.417) | |||||||

| -0.529 | -0.351 | -0.312 | -0.351 | -0.352 | -0.637 | -0.009 | |

| (-4.180) | (-3.349) | (-2.851) | (-3.352) | (-3.370) | (-5.760) | (-0.087) | |

| -0.250 | 0.035 | 0.166 | 0.033 | 0.033 | 0.408 | ||

| (-0.496) | (0.069) | (0.336) | (0.066) | (0.065) | (1.621) | ||

| Adj. R | 0.269 | 0.345 | 0.309 | 0.344 | 0.345 | 0.456 | 0.238 |

| Obs | 2559 | 2793 | 2608 | 2793 | 2793 | 1507 | 1286 |

| # Countries | 30 | 30 | 30 | 30 | 30 | 16 | 14 |

| Time FE | No | Yes | Yes | Yes | Yes | Yes | Yes |

| Country FE | No | Yes | Yes | Yes | Yes | Yes | Yes |

| Global Controls | Yes | No | No | No | No | No | No |

Nonetheless, regardless of the specification, we find a robust relation between the intensity of infection rates and sovereign credit risk for more fiscally constrained countries. The estimated coefficient is always significant at the 1% significance level. A magnitude of 0.156, based on the finding in column (1), means that a 30% increase in COVID-19 infections increases a country’s CDS spreads by 1% if the country is ranked at the 25th percentile of the distribution for fiscal constraints, and by 3% if it is ranked at the 75th percentile of that same distribution. Moving from column (1) to column (2), we observe that the coefficient remains unaffected even after including country and time fixed effects.

The sensitivity of sovereign default risk to the spread of COVID-19 infections increases non-linearly as a function of fiscal capacity. To illustrate this heterogeneity across countries, we plot in Fig. 5 the country-specific estimates, based on the regression specification reported in column (1) of Table 5 and each country’s rank value. It is noteworthy that the elasticity estimates for Portugal and France are between ten and 15 times larger than those for Germany and the Netherlands, despite the similarity in COVID-19 infection rates across these countries. Fig. A-1 in the Internet Appendix provides similar evidence of country heterogeneity in the sensitivity of sovereign default risk to each of the six fiscal capacity indicators.

Fig. 5.

Elasticity of sovereign credit risk to COVID-19 infections. This figure shows the sensitivity of percentage changes in sovereign CDS spreads to percentage changes in the number of COVID-19 cases for each country in our sample of 30 developed economies. The sensitivity parameters are calculated based on the regression analysis reported in column (1) of Table 5, and are a function of a country’s fiscal capacity. Together with the incidences of COVID-19 infections and their interaction with the country’s fiscal capacity, the regression includes local and global risk factors, such as the return of the country’s major stock market index, foreign exchange rate return, the return of the S&P 500, and the corresponding volatility index. The superscripts , , and refer to statistical significance at the , , and levels, respectively. Statistical significance is calculated based on the estimate of a Wald-test from a variance-covariance matrix that is two-way clustered at the country- and day-level. Data on CDS spreads are obtained from Markit. COVID-19 data are from the European Centre for Disease Prevention and Control. Fiscal space indicators are obtained from the IMF, the OECD, and the World Bank.

In columns (3)–(5) of Table 5, we attempt to rule out the possibility that our results are driven by confounding factors that capture a country’s ex-ante exposure to a health crisis. For example, if a government has better infrastructure and a more developed healthcare system, it may be better equipped to weather the pandemic. Similarly, if a country’s population is younger and fitter, it may be able to recover more quickly from the pandemic, thus limiting the economic consequences of the virus outbreak. We create additional rank variables that capture the strain on a country’s healthcare system (), which is decreasing both in the number of doctors per 1000 inhabitants and in the fraction of GDP spent on healthcare; the fraction of the population more vulnerable to COVID-19, which is increasing in the fractions of the elderly and the obese (); and the density of a country’s population ().

The results in columns (3)–(5) of Table 5 indicate that none of these variables alters how financial markets price sovereign creditworthiness as the COVID-19 infections unfold. All of the estimates of the coefficients are statistically insignificant. The coefficient of the variable capturing a country’s fiscal constraints is statistically significant and similar in size across all specifications.

5.3. Fiscal thresholds

Our findings from Fig. 5 suggest the existence of a fiscal threshold that determines a country’s resilience to external shocks. Specifically, out of our sample of 30 developed economies, the elasticity of sovereign credit risk to the coronavirus spread is significantly different from zero at the 1% (5%, 10%) significance level for the 14 (16, 17) most fiscally constrained countries.6

To better understand the economic determinants of that threshold, we review similar cutoff levels for the individual components of the aggregate fiscal capacity measure, using the regression specifications reported in Table 4. In Panel A of Table 6 (column (2)), we report, for each metric, the value of the first country for which the sensitivity is significant at the 1% level. Noteworthily, our results suggest that a country’s resilience to external shocks is significantly impaired at debt-to-GDP ratios above 59.3%. This threshold value is remarkably close to the 60% debt-to-GDP ratios predicated in the Eurozone convergence targets, also known as the Maastricht criteria. The existence of a fiscal threshold affecting sovereign borrowing costs is in line with the literature on fiscal limits (Poterba, 1996, Debrun, Moulin, Turrini, Ayuso-i Casals, Kumar, 2008), the relation between fiscal rules and financing costs (e.g., Eichengreen, Bayoumi, 1994, Poterba, Rueben, 1999, Heinemann, Osterloh, Kalb, 2014, Iara, Wolff, 2014, Hatchondo, Martinez, Sosa-Padilla, 2016), and the role of fiscal default (Chernov et al., 2020b).

Table 6.

Fiscal capacity threshold in the relation between COVID-19 infections and credit risk.

In this table, we report the values of the fiscal constraint measures that split our sample into subsamples of increasing sensitivity of credit risk to the spread of COVID-19 infections. In Panel A (B) we focus on specifications where the sample is split into two (three) subsamples. In column “Simple Threshold,” for each fiscal capacity variable, we report the value that separates countries into two subsamples, such that, for one of them, the relation between the coronavirus spread and credit risk is significant at the 1% level. We base this split on the specifications in columns (1)–(6) in Table 4, and the corresponding country-specific sensitivities shown in Fig. A-1 of the Internet Appendix. “Country Distribution” indicates how many countries fall above and below the threshold for each measure. For example, based on the specification reported in column (1) of Table 4, for the 15 countries with higher than 59.3%, is statistically different from zero at the 1% level. In columns (4)–(9) of Panel A, we report the results of estimating , where is one of the fiscal capacity measures and is an endogenously determined threshold that maximizes the explanatory power of the regression. contains country- and time-varying controls as per column (1) of Table 5. We report the estimated endogenous threshold , parameters and , and number of countries above and below the threshold, for each fiscal variable under the corresponding columns. Panel B reports similar quantities for the two-threshold specification, . Further details on the variables and their sources are provided in Table A-1 of the Internet Appendix. Standard errors are heteroskedasticity-robust, and the superscripts , , and refer to statistical significance at the , , and levels, respectively.

| Panel A: One Threshold | ||||||||

|---|---|---|---|---|---|---|---|---|

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

| Variable | Simple | Country | Endogenous | Country | Difference | Ratio | ||

| Threshold | Distribution | Threshold | Distribution | and | and | |||

| 59.3% | 15/15 | 60.8% | 16/14 | 0.007 | 0.060 | 0.053 | 8.57 | |

| 31.1% | 13/17 | 39.57% | 24/6 | 0.025 | 0.115 | 0.090 | 4.60 | |

| 1.4% | 15/15 | 2.64% | 27/3 | 0.029 | 0.146 | 0.117 | 5.03 | |

| 4.8% | 15/15 | 6.43% | 23/7 | 0.018 | 0.084 | 0.066 | 4.67 | |

| 2.4% | 16/14 | 2.67% | 17/13 | 0.057 | -0.010 | -0.067 | -0.18 | |

| 18.3 | 16/14 | 14.48 | 4/26 | 0.101 | 0.021 | -0.080 | 0.21 | |

| 0.334 | 13/17 | 0.435 | 22/8 | 0.012 | 0.081 | 0.069 | 6.75 | |

| -0.082 | 17/13 | 0.428 | 25/5 | 0.019 | 0.101 | 0.082 | 5.32 | |

| Panel B: Two Endogenous Thresholds | ||||||||

| Variable | Lower | Higher | Country | Difference | Difference | |||

| Threshold | Threshold | Distribution | and | and | ||||

| 60.80% | 104.27% | 16/10/4 | 0.009 | 0.051 | 0.120 | 0.042 | 0.069 | |

| 17.32% | 39.57% | 3/21/6 | -0.034 | 0.031 | 0.113 | 0.065 | 0.082 | |

| 0.31% | 2.64% | 3/24/3 | -0.028 | 0.034 | 0.145 | 0.062 | 0.111 | |

| 2.80% | 6.43% | 3/20/7 | -0.024 | 0.021 | 0.084 | 0.045 | 0.063 | |

| 2.67% | 4.63% | 17/11/2 | 0.057 | -0.022 | 0.049 | -0.079 | 0.071 | |

| 14.48 | 17.47 | 4/10/16 | 0.100 | -0.008 | 0.032 | -0.108 | 0.040 | |

| 0.026 | 0.435 | 3/19/8 | -0.048 | 0.019 | 0.087 | 0.067 | 0.068 | |

| 0.428 | 1.07 | 25/3/2 | 0.020 | 0.087 | 0.169 | 0.067 | 0.082 | |

For most measures, the threshold is roughly equal to the median of the metric’s sample distribution, as highlighted by the (approximately) equal sample splits reported in column (3). For example, the sensitivity of sovereign risk to the pandemic’s spread is significant if unemployment is larger than 4.8% or when expenditures surpass 31.1% of GDP.