Abstract

The COVID-19 pandemic spread rapidly in 2020 and led to full or partial lockdowns worldwide. The restrictions led to most economies contracting in the April–June quarter of 2020. As per the IMF World Economic Outlook of June 2020, the global economy was expected to contract by 4.9% in 2020, whereas the Indian economy was expected to contract by 4.5%, affecting a population of more than 1.3 billion. This led to disruption in the global supply chain network, adversely hitting all modes of transport, including ports and multimodal logistics.

Based on the survey results of 98 respondents in the Indian ports, multimodal logistics and transport (“PMT”) sector conducted during the lockdown in May–June 2020, an adverse impact on profitability, employment, operations and capital expenditure was identified, which is consistent with observations from previous economic crises. Additionally, we have estimated the financial impact on different categories of organisations in the industry. Based on these impacts, this study identified key factors required to support the sector and build resilience for the future through technology interventions, developing multimodal transport systems, and providing financial support and employment support for small and medium enterprises (SMEs). By providing an analysis of the impact of COVID-19 on the different categories of organisations based on data collected during and shortly after the lockdown, the study makes a novel contribution to understanding the impact of such crises on the PMT industry at a granular level and the aggregate-level impacts with guidance for policy and managers and in particular, in an emerging economy context.

Keywords: COVID-19 impact, Ports and multimodal logistics, Transport, India, Policy imperatives

1. Introduction

At the onset of 2020, the WHO declared a virus (now known as COVID-19) outbreak a public health emergency, and on March 11, 2020, it declared it a global pandemic (WHO, 2020a). As of 16 November 2021, the total number of cumulative confirmed cases of COVID-19 was more than 254 million worldwide and approximately 34 million in India.1 Due to the rapid transmission of the virus, the majority of the countries across the globe were put under complete or partial lockdowns to contain its spread. The lockdowns effectively shut down most economic activities, and primarily only essential services were permitted with adequate precautions and social distancing measures. Thus, the demand for nonessential goods and services suddenly declined, affecting domestic and global trade and thereby negatively impacting supply chains. This translated into an adverse impact on the international export-import trade (“EXIM”) and domestic logistics industry and affected the ports, multimodal logistics and transport (“PMT”) sector globally.

Economic downturns have occurred regularly, and in the past three decades, there have been specific events that triggered an economic crisis. These are economic (Narine, 2002; Berkmen et al., 2012), geopolitical (Jackson, 2008; Bachtler and Begg, 2017; Sab, 2014) or pandemic-related (Cherry and Krogstad, 2004; Bauch and Oraby, 2013; Calnan et al., 2018; Bloom et al., 2005; Lipsitch et al., 2011). However, COVID-19 has been unprecedented because it was not confined to only a region or a few countries and impacted all sectors of the economy due to the large-scale lockdowns across countries. In addition to the economic impact of the pandemic, there was significant physical disruption of supply chains globally. Finally, the physical disruption was also made complex because essential goods, and therefore by extension, their allied industries, such as packaging, printing inks and raw material supplies were required and permitted to move, but nonessential goods were not permitted. This led logistics companies and supply chain managers to segregate inventories and extensively document the need for the essential items to move and manage supply lines that would otherwise support both essential and nonessential goods, such as those for packaging items.

India was also severely impacted, as was its PMT sector. India is the sixth-largest economy in the world, with the second-largest population (IMF, 2020) and the seventh-largest country by size (Statista, 2019). The essential needs of 1.3 billion people being transported across such a large country is a complex supply chain system with both scale and scope issues from a logistics context. The total national freight is estimated to be 2,2602 billion metric tons-kilometre annually, of which roads carry approximately 60%, followed by rail at approximately 30% and the balance by coastal shipping/inland waterways3 and air cargo.4 The PMT sector is a key sector for India, which is estimated to employ more than 25 million workers.5 Indian ports handled 1.32 billion tonnes of cargo for the 12-month period from April 2019 to March 2,020..6 .7

COVID-19 Impact: India was put under complete lockdown on March 25, 20208 (named Phase 1.0) to break the chain of spread. It was followed by three more phases of complete lockdown, which lasted until May 31, 2020. From June 8, 2020 onwards,9 a phase-wise unlocking process began in the country, with guidelines providing some relaxations to the restrictions imposed during the lockdown.

As trucking is the largest mode of transportation in India, the impact on this sector is the first to be seen because any disruption in truck movement impacts the operations of ports and railway systems10 . The daily truck movement was down from 2.2 million to est. 0.1 to 0.2 million (less than 10% during the first week of April 2020).11 This was primarily due to the closure of factories, warehouses, and godowns, restrictions on the movement of people and nonessential commodities, as well as the unavailability of truck drivers, helpers and labour for cargo movement and handling operations12 .13 The unavailability was also affected due to the rapid migration of the workforce from large cities and industrial areas and hubs to their hometowns at the beginning of the lockdown (Mukhra et al., 2020). The subsequent challenge arose in re-mobilising the labour and truckers back to the work sites while ensuring prevention of the spread of the virus since public transport was not easily available from their hometowns.14 The problems persisted due to challenges in providing transit passes and relevant documentation to permit trucks and their drivers, helpers and labour to move back to the work sites and resume operations.15

The nationwide lockdown led to a reduction in domestic activity and a decline in EXIM trade, leading to an adverse impact on the PMT sector. India's total maritime trade volume (from major ports)16 declined by 19.8% year-on-year in the April–June quarter of 2020,17 similar to other ports globally (year-on-year volume decline in April–June quarter 2020: Port of Singapore 14.2%, Port of Rotterdam 8.95%, Port of Antwerp 12.82%).18 Although ports were declared essential services during the lockdown and continued to operate in India,19 due to the difficulties experienced by truckers, as discussed earlier, as well as the availability of staff and labour for both cargo operations and documentation (such as customs processes and trade finance), evacuation from ports was affected, resulting in detention and pileup of cargo at the ports and creating bottlenecks20 .

The rail freight was also impacted, and for the period from April 2020 to July 2020, it was 18.2% lower compared to the same period in the previous year.21 To provide an alternate mode to roadways, the railways stepped up their freight operations and moved various commodities across the country.22 However, these were again affected due to challenges in last-mile transport, which is primarily road based and requires significant labour and truck drivers. Overall, the PMT sector in India witnessed cargo (and therefore revenue) decline, a decline in profitability and employment reduction. The employment reduction was expected due to a mix of decline in cargo traffic and lack of availability of work-site labour.

The sudden slowdown in end-user logistics demand affected the PMT sector on one side, and on the other hand, the physical movement of goods was affected, as logistics and transportation companies were not able to operate normally. The other major supply-side factor that hit the sector in India was the large-scale migration of labour and truckers to their villages and native places from their current place of work. Hence, the Indian PMT sector bore both demand- and supply-side shocks. The impact of such shocks affected their employment, operations, financial performance, and ability to spend capital for future expansion.

Research on the impact of COVID has been conducted in various geographies and industries (Singh et al., 2020; Xu et al., 2020; Grida et al., 2020; Belhadi et al., 2021; De Vito and Gómez, 2020; Korankye, 2020; Ivanov and Dolgui, 2020; Karmaker et al., 2021; El Baz and Ruel, 2021; Loske, 2020). Scholars have studied the impact of COVID-19 on the supply chains of various end-user industries and their responses. Furthermore, they have provided lessons and opportunities for organisations to enhance supply chain resilience for future disruptions. However, a study of the PMT sector in its entirety and for India has not been conducted. The research interest that thus emerged was to investigate the extent of the impact, study the key factors influencing the PMT sector and identify options for the revival and recovery of the sector. Since such a wide-scale pandemic had not impacted India previously, and in the absence of prior research on the PMT sector, the authors selected an exploratory study to understand the phenomenon using a survey methodology. This paper intends to provide a perspective from the Indian transport sector and contribute to scholarship in areas of policy for developing a resilient PMT sector in India and broadly for other developing economies.

The paper is structured as follows: Section 2 covers the context of the Indian PMT sector during COVID-19 and a review of the literature on the impact of past economic crises and COVID-19, leading to the motivation for this research. This is followed by the methodology for the survey in Section 3, the results in Section 4, discussion and managerial and policy implications in Section 5, limitations in Section 6 and conclusions in Section 7.

2. Literature review

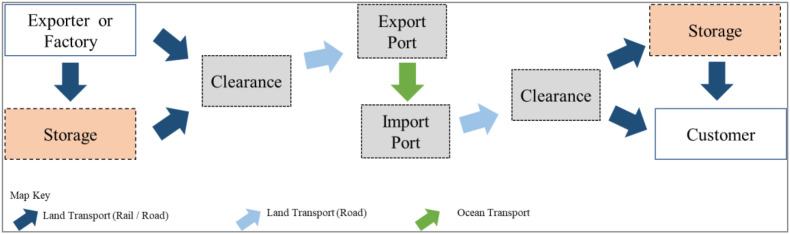

The PMT sector in India involves interactions among various actors that can be classified into three groups. The first group comprises infrastructure actors such as ports and terminals for exporting/importing goods and the actors facilitating the services at the ports/terminals; the second group includes the entities involved in storage and warehousing, such as the inland container depots (ICDs), dry ports, logistics parks, and container freight stations (CFS); and the third group includes the transportation actors, such as road transport and rail transport organisations. The flow of goods and the roles of these actors and sub actors within the supply chain are shown in Fig. 1 below 23 :

Fig. 1.

Supply chain system of the PMT sector.

Thus, there are multiple touchpoints and transactions in the information as well as the cargo handling process in which these diverse organisations are involved. The ports and terminals are large organisations with large fixed capital investments in infrastructure. The CFSs/ICDs are mid-to small-sized organisations with medium capital investments in container yards, rail terminal infrastructure, warehousing and customs inspection facilities. The rail and road trucking organisations have investments in rolling stock, while the agents and service providers are primarily service providers with small setups. Some global forwarders providing 3PL logistics services across multiple countries are also in the market and can be large organisations providing similar services as local firms in the micro markets.

Scholars have studied the impact of COVID-19 on supply chains in different sectors and countries and have suggested measures to alleviate the impact thereof. They demonstrated disruptions in the food supply chain by developing a simulation model of a public distribution system (PDS) network under three different scenarios and suggested mitigation strategies to manage disruptions in the supply chain (Singh et al., 2020). These mitigation strategies focused on the health care supply chain and medical equipment distribution, truck drone delivery systems for quarantine zones, and ensuring smooth food supply chain operations. Furthermore, enhancing supply chain resilience is a major driver of reduced vulnerability in disruptive times, as concluded by another study on disruptions to the mechanisms of global supply chains in the food, electronics, pharmaceutical and automotive industries (Xu et al., 2020). One of the studies discussed the impact of COVID-19 prevention policies on supply chain aspects under uncertainty and proposed a framework that evaluates the impact of these policies on the three main aspects of the supply chain (supply, demand, and logistics) to obtain the optimal decision (Grida et al., 2020). The framework ranks the three aspects based on the influence of COVID-19 prevention policies, and the results evaluated in the food, electronics, pharmaceutical and textile sectors show that the demand aspect of the supply chain was most affected. A similar detailed analysis of the automobile and airline sectors was also undertaken in Europe (Belhadi et al., 2021), and it identified technology, supply chain collaboration, and integrated risk management as key response strategies to develop supply chain resilience. Governments have also extended financial support or policy-driven demand generation to certain key industries, such as automobiles and airlines (Belhadi et al., 2021).

Based on the study of the effect of the COVID-19 pandemic on the liquidity of listed firms across 26 countries, scholars opined that approximately 1 in 10 firms would become illiquid within six months (De Vito and Gómez, 2020). Furthermore, the study suggested that the availability of bridge loans by governments would be supportive in preventing a cash crunch for these firms. Zhang suggested a comprehensive framework named PASS (P: Prepare–Protect–Provide, A: Avoid–Adjust; S: Shift–Share; S: Substitute–Stop) for systematically designing policy measures to address concerns related to COVID-19 and future pandemics (Zhang, 2020). The author mentioned major policy recommendations under each of the four categories by reflecting on the roles of citizens, firms and governments. Scholars have also studied disruptions due to pandemics or economic crises and their impacts on supply chains. Zhang, Hayashi and Frank (2021) conducted a survey of worldwide experts and obtained 284 valid responses to assess the impact of COVID-19 on the transport sector. Another study described the lessons from the Ebola pandemic in Western Africa and illustrated the need to develop a detailed structure for decision-making during and after such pandemics (Calnan et al., 2018). Based on research scoping exercises conducted in Guinea in 2017, the study identified seven broad research questions with an overarching theme that such epidemics or pandemics warrant a comprehensive health, social and economic impact study to identify strategies for response and recovery. A study in Ghana assessed the impact of COVID-19 on small and medium enterprises (SMEs) in the country through a sampling approach and analysed the responses using regression analysis to find correlations of the state of SMEs with various parameters, such as revenue reduction, downsizing, reduction in demand, organisational restructuring, and fear of exiting (Korankye, 2020). Recent research has focused on supply chain management and resilience, which, while useful to predict and manage future preparedness, appears to have few implications for policy-makers and physical logistics companies (Ivanov and Dolgui, 2020; Karmaker et al., 2021; El Baz and Ruel, 2021). Loske studied the impact of COVID-19 on food retailing trucking logistics and explained the local dynamics by using the number of cases, retail food (at home and in restaurants) and trucking demand (Loske, 2020). A similar study in the food sector in the UK highlighted the need for technology platforms to ease the spikes and slumps in supply and demand and collaborative efforts to address labour shortages and use technology such as robotics for future shocks (Mitchell et al., 2020). Scholars have also provided suggestions on the use of technology to enable remote working and expand the use of online truck shipping freight exchanges to facilitate the continuance of business (Dorofeev et al., 2020).

By analysing the past literature, we observe that there has not been much research that has captured the actual impact of COVID-19 on the PMT sector.

“While the research on coping with epidemic outbreaks from the humanitarian logistics point of view provides a mature body of knowledge … … the literature on analysing the impacts of epidemic outbreaks on the commercial SCs is scarce. We consider this as a research gap and an opportunity to develop substantial contributions.“.

- Ivanov (2020). (pp. 2)

The research interest thus emerged to understand the impact of the lockdown on the PMT sector in India, which could provide useful knowledge for various agencies to formulate targeted interventions, policies and programs to facilitate the revival of the sector while also supporting it during the difficult period. The research also would thus provide inputs to prepare the sector for future crises. This research interest led to the formulation and administration of a survey of industry participants to understand the impact on their businesses before and after COVID-19, key underlying factors and interventions required to support the sector.

Moreover, recent research on the impact of COVID-19 on Indian supply chains and, more specifically, the logistics and transport sector has been limited. Detailed analytical research in the sector is needed to understand the perspectives of stakeholders on the impact of COVID-19 and their future plans. The extant literature on the economic impact of COVID-19, previous pandemics and various economic crises indicates that the performance of organisations in the PMT sector is affected in terms of operations, profitability and the ability to invest for future expansion. There is also a loss of jobs, which in turn has an impact on the economy and capability of the sector due to the loss of learning and employee disengagement. Therefore, to assess the impact of COVID-19 on the PMT sector in the Indian context, these four aspects are evaluated in the study using survey-based research. The study captured responses from organisations across the supply chain network in India, from port operators to the last-mile service providers, and presented policy implications based on feedback from various stakeholders in the industry.

3. Methodology

A detailed questionnaire was designed covering organisations (those that either develop and operate or only operate) from the following three categories across the PMT sector:

-

1.

Category A: Port authorities, terminal operators, PPP operators and shipping lines

-

2.

Category B: Container freight stations (CFS), inland container depots (ICD), private freight terminal (PFT) operators, container train operators (CTO), and

-

3.

Category C: Logistics services, third-party logistics (3PL) services & warehousing companies.

The survey questionnaire was divided into three sections.

Section A of the questionnaire contained 15 questions that were common in nature for all three categories of respondents and covered an assessment of the organisations in the pre-COVID-19 and during COVID-19 situations. The questions in this section broadly covered details of facilities and operations, staff strength, key issues due to COVID-19, impact on capital expenditure plans, impact on future projects and strategies to combat the spread of COVID-19, and business continuity plans. Section B of the questionnaire also covered the pre-COVID-19 and during COVID-19 situations, but the questions were specific to each category of organisation. This section consisted of questions to assess the impact of COVID-19 on business performance, cost of operations and revenue. Section C of the questionnaire contained 14 questions that were common to all three categories of respondents and focused on assessing the post-COVID-19 situation. The questions in this section were designed to understand the anticipated level of operations, key operational challenges envisaged post-COVID-19, assistance required in the resumption of services post lockdown, measures taken for workers to return to normalcy, existing or planned initiatives to build resilience for such situations in the future, and support required from the government to recover from the impact of COVID-19. The details of the questionnaire are provided in Annexure A.

The survey was prepared on the www.research.net platform. It was first reviewed for any errors, and then pilot testing was performed with 15 stakeholders. Based on the pilot and initial feedback from respondents, the questionnaire was modified, and the final questionnaire was administered. The survey was sent online through email to more than 300 Indian organisations across the three categories over a time span of three weeks starting May 21, 2020. The list of organisations was obtained from various databases and directory listings of organisations from industry associations. A total of 177 organisations responded to the survey. The data were cleaned for minor errors and revalidated or clarified by the respondent over the phone and email for any discrepancies in the information. Out of 177 responses, 98 responses were finally found to be valid and analysed further. The response rate is thus close to 30%, which is healthy.

The data were analysed using statistical methods such as regression analysis (t-test) and Qlik Sense24 to draw insights. To further strengthen the insights, draft findings and recommendations were discussed with the government and key private stakeholders. The feedback interviews were 20–30 min in duration each and were conducted with stakeholders from government organisations. A feedback session on a webinar platform was conducted on August 11, 2020, with private companies to discuss the findings of the report and obtain their feedback to validate the findings of the study.

4. Results

The survey results are further categorised under various subheads and cover the assessment of impacts due to COVID-19 and the post-COVID-19 outlook. The summary of the respondent organisations is given in Table 1 below, along with the category-related details of the average cargo handled in tonnes per day before and during COVID-19. As mentioned in Table 1, cargo volume handled per day declined by 13% for Category A respondents. The impact was worse for Category B and Category C respondents, as there was less movement of cargo through the road, which served approximately 60% of the freight movement in the country. The average drop in cargo handled per day for Category B respondents was 43%, and for Category C respondents, it was 82%.

Table 1.

Summary of respondents by category type and impact on cargo handled.

| Item | Units | Category A | Category B | Category C |

|---|---|---|---|---|

| Size of category | Number of responding organisations | 37 | 26 | 35 |

| Average cargo handled per daya (before COVID) | Tons per day | 929,760 | 23,500 | 167 |

| Average cargo handled per daya (during COVID) | Tons per day | 812,195 | 13,549 | 30 |

| Drop in cargo | Percentage | 12.6% | 42.3% | 82.0% |

| Increase in cargo pendency | Percentage | 16.9% | 37.6% | – |

| Increase in dwell time (export cargo) in days | Percentage | ∼10.7% | ∼300.0% | – |

| Increase in dwell time (import cargo) in days | Percentage | ∼91.7% | ∼297.6% | – |

| Decrease in direct port delivery volume between March ‘20 to April ‘20 in Tonnes | Percentage | 62.2% | – | – |

| Decrease in traffic movement through rail between March ‘20 to April ‘20 in Tonnes | Percentage | 17.4% | ||

| Average year-on-year decrease in traffic movement through rail in April ‘20 in Tonnes | Percentage | 53.3% | – | – |

For Category C stakeholders, it is the average number of trucks loaded/unloaded per day.

4.1. Impact on profitability

Cargo evacuation became a major challenge, with the lockdown situation and unavailability of transporters leading to cargo pendency at the facilities. The cargo pendency increased by 16.9% for Category A respondents, which is reflected in an increase in dwell time (import) of 91.7%. For Category B respondents, the impact was even higher in terms of the increase in cargo pendency by 37.6%, increase in dwell time (import) by 297.6% and increase in dwell time (export) by ∼300.0%. For Category C respondents, the average number of trucks loaded/unloaded per day decreased by ∼82.0%. The decrease in cargo volume resulted in a decrease in average revenue per day for all the categories of respondents. As mentioned in Table 2 below, the average revenue per day decreased by 33.9% for Category A respondents and by more than 50% for Category B and Category C stakeholders.

Table 2.

Category impacts on financial parameters (INR per day).

| Respondent Category | Category A | Category B | Category C |

|---|---|---|---|

| Category impact (decrease) on average revenue | |||

| Maximum | −50.0% | −100.0% | −100.0% |

| Average | −33.9% | −52.6% | −57.9% |

| Minimum | −20.0% | 0.0% | 0.0% |

| Category impact (increase) on average cost of operation | |||

| Maximum | 35.0% | 75.0% | 100.0% |

| Average | 16.3% | 30.9% | 29.9% |

| Minimum | 0.0% | 0.0% | 0.0% |

| Category impact on average profitability in terms of the ratio of during-covid and pre-covid profita | |||

| Average | 32.6% | −74.7% | −93.7% |

Profitability was estimated based on the impact on revenue and cost received through survey responses. The assumed operating ratio for Cat A = 40%, and Cat B & C = 60%. The impact of tax has not been considered for computing the profitability. A negative value implies an organisation faced a loss.

The average operating cost per day also increased for all three stakeholder categories, as shown in Table 2. Due to the combined impact of a decrease in revenue and an increase in operating cost, the profitability of all categories decreased, although more significantly for Category C.

4.2. Impact on employment

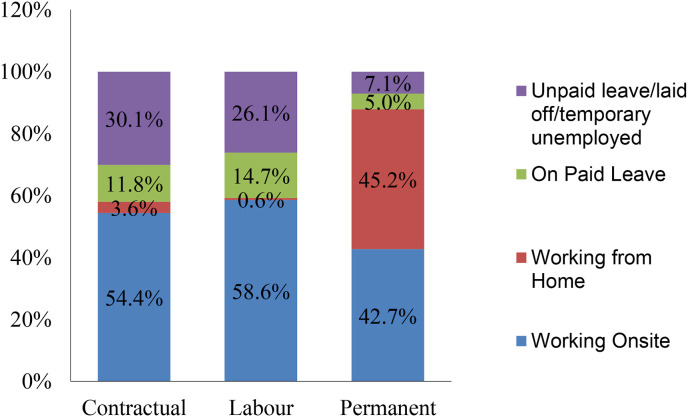

The survey revealed that approximately 31% of employees were permanent, 33% were on contract, and the remaining 36% were labour. The contract employees typically engage in non-labour and office activities such as supervision, documentation and liaison. Fig. 2 shows that 30.1% of contractual employees, 26.1% of labour employees and 7.1% of permanent employees were unemployed, resulting in an overall reduction in employment of 21.4%, which is corroborated in Table 3 . If we also include employees on paid leave in the computation of reduced workforce, the number of working employees is reduced by another 10.9%, or a total of 32.3% of employees were not working. Simultaneously, we note that the reduction in demand as manifested by port and rail traffic was 19.8% and 18.2%, respectively, which is different from the workforce reduction. One possible reason is a higher degree of manual operations, or conversely, a lower degree of automation and digitisation, wherein a unit reduction of cargo has a much higher reduction in employment.

Fig. 2.

Employee distribution (in percentage) during COVID-19.

Table 3.

t-test for testing the change in employment.

| Employment before COVID-19 scenario and during COVID-19 | ||

|---|---|---|

| Mean | SD | |

| Number of Employees Before COVID-19 | 2339 | 4667 |

| Number of Employees After COVID-19 | 1838 | 3848 |

| t (70) = 3.17 (0.002)*** | ||

[1] ***, **, *, refer to significance at the 1%, 5% and 10% levels, respectively.

Further, since labour and contract employees are primarily required in operations, they were working on-site despite COVID. This required the employers to quickly establish safe working conditions for employees, without which their operations would stop. On the other hand, permanent employees work in managerial capacities, and as transportation to their office or workplace became a challenge, they migrated to working from home. This was enabled by the use of IT tools since managerial tasks could be done remotely. We see that 45.2% of the permanent employees worked from home while 42.7% were still working on-site. We postulate that higher usage of IT tools and digitisation could have enabled a greater proportion of employees to work from home. In summary, the reduction of cargo and hence demand resulted in a reduction of employment in the sector, while the low incidence or adoption of IT tools resulted in approximately 52% of employees across categories to be working on-site.

To validate the change in the reduction in employment, we conducted a t-test on the data for employment before and after COVID-19, which confirmed a reduction of approximately 22% at a 99% confidence level (See Table 3).

4.3. Impact on capital expenditure

61.5% of the overall respondents anticipated delays in planned capital expenditure by 6 months or more during the financial years 2021 and 2022, which indicates an anticipated reduction in demand by the supply-side actors in the near future (see Table 4 ). Although more than half of respondents across all categories were expecting a delay of more than 6 months, notably, 83.3% of Category B respondents anticipated this. Further, 75 out of 92 respondents, or 81.6%, believe capital expenditure would reduce, resulting in lesser addition of handling capacity in the sector. This would, in turn, reduce the market for the construction and engineering industries because reduced capital expenditure means lesser procurement of construction contracts and material handling equipment. Chi-square tests at a 5% significance level showed that the differences between categories were not statistically significant.

Table 4.

Impact on capital expenditure by respondents.

| Impact on capital expenditure by timeline (by number of respondents) | ||||

|---|---|---|---|---|

| Impact on Timeline for Future Capital Expenditure | Overall | Category A | Category B | Category C |

| No impact | 13 | 7 | 1 | 5 |

| Postponement by up to 6 months | 22 | 9 | 3 | 10 |

| Postponement by 6 months to 1 year | 40 | 12 | 15 | 13 |

| Postponement by more than a year | 16 | 5 | 5 | 6 |

| χ2= 7.50 < 12.59 for df = 6 at 5% significance | ||||

| Impact on capital expenditure by amount (by number of respondents) | ||||

|---|---|---|---|---|

| Monetary Impact on Planned Capital Expenditure | Overall | Category A | Category B | Category C |

| No reduction | 17 | 10 | 3 | 4 |

| Reduction by up to 25% | 20 | 6 | 6 | 8 |

| Reduction by 25%–50% | 26 | 8 | 6 | 12 |

| Reduction by 50%–75% | 13 | 1 | 6 | 6 |

| Reduction by 75%–100% | 5 | 2 | 2 | 1 |

| Other | 11 | 6 | 1 | 4 |

| χ2= 13.90 < 18.30 for df = 10 at 5% significance | ||||

4.4. Impact on operations

The respondents were asked to rank the challenges they faced in operations, with Rank 1 being the highest-ranked challenge. The ranks given by all the respondents were then averaged to provide a simple average rank. Since results are presented as rank averages, multiple tests were adopted as an approach to achieve statistical accuracy. One-way ANOVA along with F-test was used to test for statistical significance of the difference in categorical responses for each item separately in Table 5 with a degree of freedom (df) of 2. Among the various items, Transport of Employees, Social distancing norms and Availability of CHAs were found to be statistically different across categories. The Delay in customs clearances had an F-value of 3.1 and a p-value of 0.053, which, although very close to the threshold of 0.05, we reject the null hypothesis that there is no difference between categories.

Table 5.

Ranking of operational challenges faced by respondents.

| Operational Challenges | Average | Category A | Category B | Category C |

|---|---|---|---|---|

| Availability of contract labour | 2.75 | 2.55 | 3.05 | 2.46 |

| Availability of drivers/helpers | 2.77 | 2.57 | 2.95 | 2.42 |

| Transport of employees | 4.09 | 4.68 | 4.33 | 3.33 |

| Social distancing norms affecting efficiency & productivity | 4.98 | 5.33 | 6.06 | 4.12 |

| Increased turnaround time for cargo handling | 5.17 | 5.31 | 5.26 | 5.13 |

| Delay in customs clearances | 5.45 | 5.19 | 4.44 | 6.52 |

| Congestion inside port/terminal | 5.81 | 5.73 | 5.39 | 6.08 |

| Availability of CHAs (customs handling agents) | 6.15 | 6.15 | 4.92 | 7.42 |

| Availability of rail rakes (trainsets) | 6.87 | 6.90 | 6.94 | 6.74 |

Thus, we note that the availability of labour and drivers was the top-ranked challenge faced by all the respondents across categories (see Table 5). All categories of respondents also indicated Increased turnaround time for cargo and Availability of rakes as challenges, although these were ranked relatively lower.

The customs agencies developed new norms and procedures to address the delays in customs clearances, which partly arose due to limited IT in trade processes and high dependence on physical documentation. However, it can be seen that Category B organisations such as CFS and ICD companies that interact extensively with customs officers for cargo clearance ranked challenges with the customs clearance and availability of CHAs higher than for Category A and C respondents and these items are statistically different as well.

With respect to the transport of employees, Category A and B companies tend to have their own buses to transport employees to the work-site and being relatively larger, and these organisations adjust quickly to the situation. Category A companies were also able to deploy IT solutions quicker (discussed in subsequent sections) to encourage remote working and hence did not rank this higher In reference to social distancing norms, Since category C companies engage in last mile logistics, they appear to have faced greater challenges with social distancing compared to Category A and B respondents, that tend to have single-site facilities, and were able to implement social distancing better. Having said that, it was still a significant challenge for the respondents.

The non-operational challenges were also studied and compared across categories. The response was similar across the categories of respondents (see Table 6 ). However, the response was more pronounced for Category B and C organisations compared to Category A when it came to delayed payments from customers, which indicates the vulnerability of the smaller and service-oriented organisations to financial challenges. On the other hand, the larger challenge for Category A respondents is the expected drop in export-import business. This is important for Category A due to the capital-intensive nature of their business segment coupled with the nature of such organisations to be large and well-funded. Category A companies might not have an acute need for financial support but might require large volumes to ensure that their assets are appropriately utilised on a regular basis.

Table 6.

Other key and non-operational challenges faced by respondents (by rank).

| Other Key Challenges | Average Rank | Average (Category A) | Average (Category B) | Average (Category C) |

|---|---|---|---|---|

| Delayed payments from customers | 2.43 | 2.97 | 2.38 | 1.90 |

| Reduction in demand for imports in the hinterland | 2.69 | 2.04 | 2.94 | 3.23 |

| Reduction in exports | 2.82 | 2.48 | 2.65 | 3.29 |

| Sourcing of raw materials and consumables | 3.24 | 3.29 | 3.53 | 3.03 |

| Working capital funding challenges | 3.27 | 3.68 | 2.86 | 3.10 |

Last, the respondents anticipated the challenges faced during the lockdown would persist even after the lockdown was lifted, with a similar ranking of challenges across respondent categories (see Table 7 ). We segregated the challenges into demand-side or supply-side factors. We notice that lack of market demand, delayed payments by customers and low asset utilisation are expected to affect business performance adversely after the end of lockdown. On the other hand, business performance is also likely to be affected by supply-side factors such as the availability of labour, drivers and fleet or train-sets. The double impact of demand and supply side factors would cumulatively affect or retard the business recovery.

Table 7.

Challenges anticipated post lockdown (by rank).

| Type of Factor | Key Operational Challenges Anticipated Post lockdown | Average | Category A | Category B | Category C |

|---|---|---|---|---|---|

| Demand | Lack of market demand | 2.58 | 2.17 | 2.82 | 2.86 |

| Delayed payments by the client | 4.73 | 4.93 | 5.00 | 4.25 | |

| Low asset utilisation pushing up fixed costs | 6.30 | 6.86 | 5.55 | 6.30 | |

| Loan repayments | 6.61 | 7.03 | 5.82 | 6.86 | |

| Royalty/revenue share obligations to concessioning authority | 7.47 | 6.57 | 7.73 | 8.55 | |

| Supply | Availability of drivers/helpers | 3.87 | 4.30 | 3.68 | 3.48 |

| Fleet readiness post lockdown | 5.45 | 5.73 | 5.73 | 4.83 | |

| Availability of working capital | 5.64 | 6.33 | 5.82 | 4.63 | |

| Higher cost of services, both internally and vendor services | 5.99 | 6.57 | 5.05 | 6.13 | |

| Unavailability of rakes | 7.54 | 7.28 | 7.32 | 8.15 | |

| Meeting statutory requirements (national & state) | 7.84 | 7.67 | 7.50 | 8.43 |

4.5. Responses undertaken by organisations

The initiatives undertaken by organisations are provided in Table 8 , which focuses on ensuring employee welfare, safety and workers' working conditions. Collaboration and sharing of information and resources were other notable initiatives undertaken.

Table 8.

Summary of initiatives undertaken/planned by respondents.

| A) Strategies Implemented by Organisations During COVID-19 | Number of Respondents |

|---|---|

| New sanitisation protocols–thermal scanning at entry, use of washing and cleaning agents on all surfaces, use of sanitisers, etc. | 94.7% |

| Work from home | 87.2% |

| Transport for employees | 76.6% |

| Operations replan with social distancing norms | 75.5% |

| Protective gear (PPEs) for all working staff | 75.5% |

| Stagger work time to reinforce social distancing | 71.3% |

| Collaborate with local authorities and representation to government agencies | 60.6% |

| Sharing resources and information with stakeholders and competitors | 53.2% |

| Quarantine facility/health clinics at work premises | 41.5% |

| Others | 8.5% |

| B) Planned Business/Strategic Initiatives to Build Operational Resilience | Number of Respondents |

|---|---|

| Digital transformation to improve operational efficiency | 78.8% |

| Use of technology to develop contactless procedures | 70.0% |

| Adopt remote working facilities for certain employees | 68.8% |

| Incorporate advanced automation and digitisation to reduce dependency of labour | 57.5% |

| Incentivise working in adverse conditions and insurance plans | 52.5% |

| Arrangements for temporary stay for minimum % of total labour force | 50.0% |

| Increased replacement of permanent employees by contractual employees | 12.5% |

| Others | 2.5% |

The responses on initiatives adopted or planned by the organisations to address the business challenges due to COVID-19 are provided in Table 9, Table 10 . These results indicate that the focus was on better physical hygiene and additional IT support (for example, data cards and laptops) to enable employees to continue working from home for business continuity. More than 80% of the respondents adopted IT-based applications to maintain or restore business service functionality. For Category B and Category C stakeholders, addressing the financial distress of labour and small business partners also helped to restore the functionality of business and the continuity of the supply chain. Digital transformation, the use of technology, and adopting a remote working environment have been identified as the most important strategic initiatives to build operational resilience for the future.

Table 9.

Steps taken to restore functionality (by number of respondents).

| Steps Taken to Restore Functionality | Overall | Category A | Category B | Category C |

|---|---|---|---|---|

| Adoption of IT-based applications | 70 | 24 | 21 | 25 |

| Addressing financial distress of labour/small business partners | 47 | 11 | 16 | 20 |

| Partial shift to local supply sources | 31 | 12 | 12 | 7 |

| Others | 13 | 4 | 3 | 6 |

| χ2= 5.03 < 12.59 for df = 6 at 5% significance | ||||

Table 10.

Assistance required in the resumption of services (by rank).

| Assistance in Resumption of Services Post lockdown | Category A | Category B | Category C |

|---|---|---|---|

| Develop solutions to identify consignments/containers carrying essential goods and medical supplies and introduce priority evacuation protocols/green channels in ports/airports/state borders | 2.21 | 1.95 | 1.97 |

| Enhance capability of digital platforms and digital inspection (e.g., scanning) frameworks for faster cargo handling | 2.13 | 2.00 | 1.83 |

| Establish ‘smart’ protocols and process to fully introduce paperless transactions and contactless inspections | 1.62 | 1.91 | 2.21 |

However, while respondents stressed the importance of IT-based solutions during the lockdown and the resumption of service post lockdown, Table 11 indicates that while the share of respondents who claimed to have IT systems for overall facility management was high (more than 75%), the use of collaborative platforms was not extensively available, which could address some of the procedural and coordination-related operational bottlenecks observed during the lockdown. We believe that the high share of 57.2% of respondents claiming to have a collaboration platform might refer to one of two types of digital systems or tools. The first type is a multiparty transaction processing system or IT platform for information exchange, such as a port community system (“PCS”), Indian Customs Electronic Gateway (“ICEGATE”) and ICC Tradeflow. The second type of application is video conference or communication applications such as Zoom and Microsoft Teams for interaction and collaboration among persons and organisations. Chi-square tests with a degree of freedom of 2 and 95% confidence levels applied on Table 9, Table 11 indicated no statistically significant difference between the categories and reaffirmed the uniformity of responses and consistency across the stakeholders in the sector.

Table 11.

Use of digital/IT systems for managing operations (share of respondents).

| Is there any digital data system/IT system for the overall facility management? | Overall | Category A | Category B | Category C |

|---|---|---|---|---|

| Yes | 76.6% | 76.8% | 86.4% | 69.0% |

| No | 23.4% | 23.2% | 13.6% | 31.0% |

| χ2= 1.95 < 5.99 for df = 2 at 5% significance | ||||

| Is there any collaboration platform/IT/data-sharing system to monitor incoming and outgoing shipments? | Overall | Category A | Category B | Category C |

|---|---|---|---|---|

| Yes | 57.2% | 55.2% | 66.7% | 51.9% |

| No | 42.9% | 44.8% | 33.3% | 48.1% |

| χ2= 1.81 < 5.99 for df = 2 at 5% significance | ||||

The financial stress seems to have influenced the preference for funding assistance expected by the respondents for operational sustenance and is reflected in Table 12 . The focus on payment of staff salaries and managing vendor payments ranked the highest across all categories of respondents.,

Table 12.

Funding assistance for operational sustenance (by rank).

| Funding Assistance for Operational Sustenance | Overall Rank |

Category A | Category B | Category C |

|---|---|---|---|---|

| Payment of staff salaries | 1.62 | 1.66 | 1.57 | 1.63 |

| Vendor payments | 2.62 | 2.62 | 2.57 | 2.65 |

| Working capital loan | 2.96 | 2.90 | 3.10 | 2.92 |

| Maintenance expenses | 3.68 | 3.62 | 3.33 | 4.04 |

| Medical and insurance requirements | 3.93 | 4.21 | 3.81 | 3.73 |

Furthermore, the preference for the various options from the government was primarily to provide collateral-free loans, relaxation in statutory payments and direct cash transfers, indicating that the organisations are interested in addressing the immediate cash-flow challenge rather than insisting on financial support to sustain the businesses (see Table 13 ).

Table 13.

Fiscal support announced by Government of India.

| Fiscal support initiatives announced by the government | Average Rank |

|---|---|

| Collateral-free loan to MSMEs (micro, small and medium enterprises) | 3.13 |

| Relaxation in statutory and regulatory compliances (income tax/GST) | 4.19 |

| Direct cash transfers | 4.64 |

| Easing of working capital financing | 4.74 |

| Equity infusion through a fund of funds for MSMEs (micro, small and medium enterprises) | 4.79 |

| Subordinated debt to stressed MSMEs | 5.04 |

| Reduction by 25% of existing rates of tax deduction at source and tax collection at source | 6.26 |

| Employee Provident Fund payment support | 6.34 |

| New definition of MSME | 6.87 |

| Extension up to 6 months for project completion without costs to contractors | 7.63 |

5. Discussion and policy implications

The survey highlighted the impact on the PMT sector at an overall level while also bringing out the differences across different categories of respondents. The results have borne out the adverse impact of the COVID lockdown on the operations, profitability and capital expenditure of PMT organisations. It has also brought out the impact on employment. It is important to understand the nature of the PMT sector in India to help understand the survey responses.

Category A organisations are typically larger firms with significant investments in capital infrastructure assets and operate in a regulated environment. The firms have a greater proportion of their capital in fixed assets and invest in technology and automation. Being infrastructure assets, they enjoy a certain degree of exclusivity in terms of the facility and services being offered. However, it appears that while they did experience a reduction in traffic and revenue, they were not heavy on operating expenses, and hence, the operating profit did not decline significantly. Such organisations require greater fixed capital financial support rather than operating financial support. Moreover, such large organisations were able to adopt advanced IT solutions and digitise their activities more quickly.

On the other hand, Category B and C organisations have a relatively lower proportion of their capital investments in infrastructure assets and are heavier in operations. They undertake cargo handling and management operations with selective automation or mechanisation and are manpower intensive. Such organisations faced greater disruption due to a lack of workforce availability from lockdown restrictions. Furthermore, they are not infrastructure assets and are often nonregulated but experience market-based competition. Thus, such organisations were expected to face greater financial challenges, lower profitability and require more operational financial support than capital financial support. Finally, the lower degree of digitisation and use of technology applications would have affected their operations during COVID-19 since it affected remote working. The observations of the impact on PMT organisations find support when we analyse their responses to the questions related to support required of them from the government, as well as the initiatives undertaken by them to address the challenges posed by COVID.

The highest-ranking area for operational sustenance in Table 12 is payment of staff salaries, followed by vendor payments and working capital loans. This can be explained by the high degree of manual operations in the Indian PMT sector, and hence staff cost is an important element for PMT organisations. This is an important characteristic of the Indian PMT sector, which has significant manual intervention in operations, primarily cargo handling and documentation. The decline in business was addressed by organisations to some extent by reducing employment; hence, we observe the reduction of contractual workers. Furthermore, the top 6 initiatives undertaken by the respondents, as given in Table 8 Section A, were to enable employees to continue working. If the degree of automation and digitisation had been higher, it might have been possible for employees to continue working remotely. Alternately, fewer employees might have been required for operations, and social distancing could have been easier to implement. However, a high degree of manual cargo handling, lack of robotic equipment and low digitisation of processes and documents necessitated the presence of people at the work site. This potentially explains the relatively higher importance of initiatives to enable staff to work from home, as per Table 8. These observations also align well with the data on employment in Fig. 2 and the accompanying findings.

The organisations also appear to have recognised this as a major concern for their business and have therefore identified the adoption of IT solutions as an important enabler for restoring functionality and operational resilience. Seventy respondents cited the adoption of IT-based applications, and they received the highest response amongst other options, indicating the high importance placed by all organisations on IT. Furthermore, as per Table 8 Section B, the top 4 initiatives for operational resilience are also based on digitisation, automation and IT. This implies a clear direction for the adoption of technology-based solutions and reducing manual operations in the Indian PMT sector. Finally, as per Table 10, the assistance required to support the resumption of services also indicates the necessity for smart protocols and digital platforms.

Among the response strategies, the one that appears to contradict these observations is the use of digital IT/systems for managing operations and the use of collaboration IT tools for data sharing. As per Table 11, more than 70% of the organisations have responded with a “yes”, whereas as per Table 8, it appears they have yet to adopt more technology solutions. We can attribute this to the understanding of respondents with the terms ‘digital/IT systems’ and collaboration platforms. It is likely that respondents consider the use of ERP systems, office software and basic IT systems for logistics management as a “digital/IT system” for overall facility management. Moreover, it appears that the respondents have IT systems for their internal operations but do not have sufficient collaboration platforms that operate across organisations that could enable the entire supply chain to operate smoothly. This aligns with the observations in Table 10, wherein respondents have requested assistance that would enable the entire sector to move to a digital platform and enable greater collaboration. Further, organisations were quick to adopt video conferencing tools such as Zoom, Microsoft Teams and Cisco Webex in the early days of the pandemic. There is also the port community system (“PCS”), which is officially used to clear import–export shipments and is mandatory. Respondents might be collectively referring to such video conferencing tools and the PCS as collaboration platforms for the purpose of the question. However, they have clearly cited in Table 8 that they need to digitise further and adopt automation, which indicates the need to move to higher levels of technology applications and greater interconnectivity among systems for better operational performance. Such automation solutions could be the use of robotic equipment or remotely operated equipment. The other areas could be the digitisation of processes by elimination of all or any physical documents, use of biometric attendance or access and security control, greater application integration across stakeholders or use of smart cameras for surveillance, tracking containers and cargo. Finally, the third area of digitisation would be the development and adoption of a sector-wide platform that allows data sharing and digital transactions beyond PCS and, therefore, covers other transportation modes and the entire supply chain.

The other important aspect is the need for working capital loans, and the first ranked choice for government support was collateral-free loans for MSMEs. It is understandable that MSMEs have limited capital, unlike large organisations, and depend on monthly cash flows to run their business. The MSME organisations would typically be Category C organisations, and as seen previously, the decline in business and profitability was highest for Category C organisations. Therefore, the very sustenance of MSMEs would be under threat and would require loan support to enable them to tide over the crisis.

5.1. Managerial and policy implications

The responses from organisations have important policy and managerial implications for stakeholders. The primary interventions that emerged were the immediate support to the sector to enable recovery while facilitating a transition to a stronger and more resilient sector. There are primarily three sets of stakeholders whose concerns need to be addressed: the PMT companies, their staff and the customers of PMT companies or end-user industries. The PMT companies’ desire is to retain profitability and grow their revenue through demand pickup. The need for staff is to be gainfully employed. PMT companies are service providers to end-user companies, and the inability of PMT companies to perform satisfactorily affects the supply chains of their customers or end-user industries. Hence, while the survey did not cover end-user industries specifically, we understand from extant research on the impact of COVID-19 on supply chains that resilience is a key target outcome. This is not for the sake of resilience itself but to be able to provide continuity of supply chain services to end users. Accordingly, the policy implications must focus on providing support for cost, capital and demand support for companies, employment support for labour and staff, and resilience to end users. Therefore, we suggest interventions around providing working capital and long-term debt relief for companies, employment-related support and building resilience in the PMT sector for the three stakeholder groups. These are briefly discussed hereafter.

-

a)

Financial support to the industry: The reduction in profitability as well as employment, particularly in the Category B and C organisations, indicates that the industry required support in speedy recovery through performance-based working capital loans for such organisations across the supply chain. They could also be provided support in the repayment of debt and extending debt/interest moratoriums to ease their financial burden.

-

b)

Employment support: Financial or working capital support could also be given to organisations to enable them to retain employees on their payroll, as well as facilitate employment support schemes to provide job security. Part of the support could also be channelled into upskilling or reskilling, as the workforce was required to adapt to the new ways of working with greater digital or technology workflows. There was also a need to provide support in recalling and re-mobilising the PMT workers and employees to the cities from their hometowns. This entails support from the authorities in obtaining transit and working passes, arranging for mass transport for PMT labour, employment search and skills training, and providing uninterrupted services to end users (resilience).

Given the nature of the pandemic and restricting the spread of the virus through contact, the adoption of contactless systems and processes for workflow and documentation, as well as automation to reduce the human–human or human–item contact, would be important. Thus, the adoption of digital technologies is a critical requirement and is no longer merely a desirable one.

-

c)

Digitisation: The Indian logistics and supply chain industry has been fragmented, and hence, the adoption of integrated technology systems appears to be limited to select integrated organization25 . However, due to COVID-19, the industry is expected to adopt digital solutions for business continuity on a wider scale.26 The role of IT and digitisation as a key enabler for timely and effective responses to ease the bottlenecks was highlighted in the pandemic.27 Some of the companies we surveyed subsequently responded in interviews that they have initiated digital workflows, avoided physical documentation, enabled working from home and set up collaboration platforms. The operating problems faced during COVID-19, such as the requirement of physical documents for verification and the lack of communication among agencies, were alleviated with e-passes28 and e-documentation being permitted for the movement of trucks and people, as well as the issuance of notifications permitting select movement. Digital technology adoption, however, needs the development of bespoke applications for Indian conditions and business contexts (e.g., language), especially for small-scale companies; therefore, investments in R&D and start-ups could enhance the adoption of various digital applications in day-to-day business. Moreover, there is an opportunity for the PMT industry to use this opportunity to expedite and accelerate their plans for adopting technology. This is an important area for both policy-makers and managers to collaborate on.

-

d)

Multimodal networks: The issue of cargo pendency due to evacuation bottlenecks highlighted the need to develop alternative transportation networks so that in case one part of the network fails due to any reason, the supply lines can use the alternate system. Thus, there appears to be a need to build an efficient, future-ready and robust multimodal transport infrastructure to enable the diversification of risk and help mitigate the impact brought about by future supply chain disruptions in case one mode of transport or a specific region is affected. The benefit of providing alternate transport modes is the ability of supply chains to switch quickly and keep supply lines running. This will not only help end users but also provide continued business and traffic to logistics companies and employment. This intervention requires the promotion of multimodal transport through the development of alternate modal solutions, such as the development of extensive ro-ro networks, innovations in bulk transport handling and cargo containerisation. It can be supported through alternate modes of transport, such as inland water transport (IWT) and coastal shipping. The economic costs and benefits would need a closer examination, however.

-

e)

Develop resilience across supply chains: Disruption caused by the present COVID-19 pandemic proved that a more resilient supply chain is needed (Linton and Vakil, 2020). A resilient supply chain can be developed by developing a national inventory of logistics assets (“NILA”), which could provide real-time visibility of the availability of logistics assets on a common technology and institutional platform, bring stakeholders together and allow the most efficient and cost-effective usage of logistics assets. Resiliency frameworks for stakeholders within the supply chain include disaster management, environment protection and risk management measures to safeguard the interest of the stakeholders and the environment in the event of crises (Zavala-Alcívar et al., 2020). The framework could include legal, regulatory and insurance frameworks and standard operating procedures (SOPs). This could be a joint initiative among public authorities, private-sector organisations, industry associations, special interest groups and policy-makers to facilitate the development and adoption of SOPs for various stakeholders since supply chain collaboration and visibility of assets across the supply chain appear to be important enablers for resilience (Belhadi et al., 2021; Linton and Vakil, 2020).

-

f)

Periodic review: A follow-up intervention could be to undertake a survey-based impact assessment, including collecting feedback on the effectiveness of initiatives and support at regular intervals. For example, a quarterly survey for the next 12 months–18 months could be conducted on the same set of respondents to derive insights from a longitudinal analysis of the parameters or variables comprising the items in the questionnaire.

6. Limitations and directions for future research

The study has four key limitations. The survey covered organisations in India only, whereas the findings might be different in other regions. The findings may not be generalised to other countries or regions due to geographic, economic, regulatory and other physical characteristics. For example, certain countries may not have a high share of road and truck transport in their modal mix and may rely more on rail or water-borne movement for cargo. Such regions may experience different impacts. Therefore, scholars may consider conducting similar research in other regions. Second, the assessment is based on the prevailing situation of the respondents, which may have a bias arising due to the immediate impact of the lockdown, and it is a perception survey. While the survey sought factual information to corroborate the views of the respondents, and in some instances, the respondents were contacted over the phone or email to confirm the basis for their responses, it was not available for all items across all respondents. Hence, the survey may have a perception bias as well as an immediacy bias or recency effect. The study also does not specifically compare the impact experienced in this sector in India in previous crises. Therefore, it would be useful to conduct a similar survey six months or twelve months later to evaluate the parameters and conduct a longitudinal study to derive longer-term and more sustained trends. The third limitation of the study is that while it attempts to segregate the different impacts and their causal factors, it does not provide a model that can connect the different factors for more detailed analyses. The study does not specifically explore a cause-effect relationship that might impair the ability of the sector actors to induce action since the specific outcomes of various actions and their direct or indirect influences on the performance of the firms or the sector are not known. This can be an important aspect for future research. Finally, the study derives policy implications primarily from the perspective of private-sector organisations, although there would be considerations from the perspective of the government as well. To this extent, the survey is limited in its responses being primarily from private organisations. Future research could consider these aspects to enhance the quality of the findings and identify other specific impacts on the sector and, therefore, policy imperatives. Furthermore, case studies or examples of how organisations overcame challenges and managed to reduce the impact of the pandemic can be studied, and lessons can be drawn for other organisations.

7. Conclusion

As highlighted at the beginning of the paper, COVID-19 was a global crisis with no precedent. Therefore, its impact was an important phenomenon to investigate from both academic and business perspectives to derive practical and meaningful insights and implications for managers and policy-makers alike. This study was an exploratory study to assess the impact of the pandemic on the PMT sector. While this study did not conduct a specific comparison of the impact of COVID-19 with any previous economic or physical crises or cause-effect relationships, the survey results indicate consistency with the extant literature. To this extent, the research lends support to the underlying factors that require policy or other support from the relevant agencies. This is expected to assist policy-makers in developing relevant interventions with greater confidence and better, more predictable outcomes. Moreover, the results of the survey indicate that if such policy interventions and other initiatives are undertaken, it is likely that any adverse business conditions in the future can be addressed more swiftly and effectively since the impacts and causal factors are expected to remain the same. This will help build the capability of the sector stakeholders and any other actors to withstand future crises and thereby impart resilience. Thus, this research provides a meaningful contribution to both academia and managerial practice.

Declaration of conflicting interests

The author(s) declare(s) that there is no conflict of interest.

Acknowledgements

This paper has drawn upon research done during a study assignment funded by the World Bank in India.

https://covid19.who.int/accessed on 17 November 2021.

Draft National Logistics Policy of India, 2020

Draft National Logistics Policy of India, 2020

Update on Indian port sector (31.03.2020), Ministry of Shipping, Government of India.

Source: All India Motor Transportation Congress (AIMTC).

There are 12 major ports in India under the administrative control of the Ministry of Shipping, Government of India.

Based on monthly cargo volume data for major ports in India published on http://www.ipa.nic.in/.

Source: Port of Rotterdam, Port of Antwerp, WPSP guidance document for ports, Maritime and Port Authority of Singapore.

Source: Railway Board (Indian Railway).

Data availability

The authors do not have permission to share data.

References

- Bachtler J., Begg I. Cohesion policy after Brexit: the economic, social and institutional challenges. J. Soc. Pol. 2017;46(4):745–763. [Google Scholar]

- Bauch C.T., Oraby T. Assessing the pandemic potential of MERS-CoV. Lancet. 2013;382(9893):662–664. doi: 10.1016/S0140-6736(13)61504-4. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Belhadi A., Kamble S., Jabbour C.J.C., Gunasekaran A., Ndubisi N.O., Venkatesh M. Manufacturing and service supply chain resilience to the COVID-19 outbreak: lessons learned from the automobile and airline industries. Technol. Forecast. Soc. Change. 2021;163 doi: 10.1016/j.techfore.2020.120447. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Berkmen S.P., Gelos G., Rennhack R., Walsh J.P. The global financial crisis: explaining cross-country differences in the output impact. J. Int. Money Finance. 2012;31(1):42–59. [Google Scholar]

- Bloom E., De Wit V., Carangal-San Jose M.J. 2005. Potential Economic Impact of an Avian Flu Pandemic on Asia.www.think-asia.com accessible on. [Google Scholar]

- Calnan M, Gadsby E W, Konde M K, Diallo A, Rossman J S. The response to and impact of the Ebola epidemic: towards an agenda for interdisciplinary research. Int. J. Health Pol. Manag. 2018;7(5):402. doi: 10.15171/ijhpm.2017.104. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Cherry J.D., Krogstad P. Sars: the first pandemic of the 21 st century. Pediatr. Res. 2004;56(1):1–5. doi: 10.1203/01.PDR.0000129184.87042.FC. [DOI] [PMC free article] [PubMed] [Google Scholar]

- De Vito A., Gómez J.P. Estimating the COVID-19 cash crunch: global evidence and policy. J. Account. Publ. Pol. 2020;39(2) [Google Scholar]

- Dorofeev A., Kurganov V., Fillipova N., Pashkova T. Ensuring the integrity of transportation and logistics during the COVID-19 pandemic. Transport. Res. Procedia. 2020;50:96–105. [Google Scholar]

- El Baz J., Ruel S. Can supply chain risk management practices mitigate the disruption impacts on supply chains' resilience and robustness? Evidence from an empirical survey in a COVID-19 outbreak era. Int. J. Prod. Econ. 2021;233 doi: 10.1016/j.ijpe.2020.107972. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Grida M., Mohamed R., Zaied A.N.H. Transportation Research Interdisciplinary Perspectives; 2020. Evaluate the Impact of COVID-19 Prevention Policies on Supply Chain Aspects under Uncertainty. [DOI] [PMC free article] [PubMed] [Google Scholar]

- IMF . IMF; 2020. World Economic Outlook October 2020.https://www.imf.org/en/Publications/WEO/Issues/2020/09/30/world-economic-outlook-october-2020 [Google Scholar]

- Ivanov D. Predicting the impacts of epidemic outbreaks on global supply chains: a simulation-based analysis on the coronavirus outbreak (COVID-19/SARS-CoV-2) case. Transport. Res. E Logist. Transport. Rev. 2020;136 doi: 10.1016/j.tre.2020.101922. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Ivanov D., Dolgui A. Viability of intertwined supply networks: extending the supply chain resilience angles towards survivability. A position paper motivated by COVID-19 outbreak. Int. J. Prod. Res. 2020;58(10):2904–2915. [Google Scholar]

- Jackson O.A. The impact of the 9/11 terrorist attacks on the US economy. Journal of 9/11 Studies. 2008;20(1):1–27. [Google Scholar]

- Karmaker C.L., Ahmed T., Ahmed S., Ali S.M., Moktadir M.A., Kabir G. Improving supply chain sustainability in the context of COVID-19 pandemic in an emerging economy: exploring drivers using an integrated model. Sustain. Prod. Consum. 2021;26:411–427. doi: 10.1016/j.spc.2020.09.019. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Korankye B. The impact of global COVID-19 pandemic on small and medium enterprises in Ghana. Int. J. Manag. Account. Econ. 2020;7(6):320–334. [Google Scholar]

- Linton T., Vakil B. Coronavirus is proving we need more resilient supply chains. Harv. Bus. Rev. 2020;5 [Google Scholar]

- Lipsitch M., Finelli L., Heffernan R.T., Leung G.M. Improving the evidence base for decision making during a pandemic: the example of 2009 influenza A/H1N1. Biosecur. Bioterrorism Biodefense Strategy, Pract. Sci. 2011;9(2):89–115. doi: 10.1089/bsp.2011.0007. Redd; for the 2009 H1N1 Surveillance Group, S. C. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Loske D. The impact of COVID-19 on transport volume and freight capacity dynamics: an empirical analysis in German food retail logistics. Transp. Res. Interdiscip. Perspect. 2020;6 doi: 10.1016/j.trip.2020.100165. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Mitchell R., Maull R., Pearson S., Brewer S., Collison M. 2020. The Impact of COVID-19 on the UK Fresh Food Supply Chain. arXiv preprint arXiv:2006.00279. [Google Scholar]

- Mukhra R., Krishan K., Kanchan T. COVID-19 sets off mass migration in India. Arch. Med. Res. 2020;51(7):736–738. doi: 10.1016/j.arcmed.2020.06.003. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Narine S. ASEAN in the aftermath: the consequences of the East Asian economic crisis. Global Govern. 2002;8(2):179–194. [Google Scholar]

- Sab M. International Monetary Fund; 2014. Economic Impact of Selected Conflicts in the Middle East: what Can We Learn from the Past? [Google Scholar]

- Singh S., Kumar R., Panchal R., Tiwari M.K. Impact of COVID-19 on logistics systems and disruptions in food supply chain. Int. J. Prod. Res. 2020:1–16. [Google Scholar]

- STATISTA 2019. https://www.statista.com/statistics/262955/largest-countries-in-the-world/ The 30 largest countries in the world by total area. accessed on.

- Who . 2020. TIMELINE: WHO's COVID-19 Response.https://www.who.int/emergencies/diseases/novel-coronavirus-2019/interactive-timeline#event-42 accessed on. [Google Scholar]

- Xu Z., Elomri A., Kerbache L., El Omri A. Impacts of COVID-19 on global supply chains: facts and perspectives. IEEE Eng. Manag. Rev. 2020;48(3):153–166. [Google Scholar]

- Zavala-Alcívar A., Verdecho M.J., Alfaro-Saíz J.J. A conceptual framework to manage resilience and increase sustainability in the supply chain. Sustainability. 2020;12(16):6300. [Google Scholar]

- Zhang J. Transport policymaking that accounts for COVID-19 and future public health threats: a PASS approach. Transport Pol. 2020;99:405–418. doi: 10.1016/j.tranpol.2020.09.009. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Zhang J., Hayashi Y., Frank L.D. Transport Policy; 2021. COVID-19 and Transport: Findings from a Worldwide Expert Survey. [DOI] [PMC free article] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Data Availability Statement

The authors do not have permission to share data.