This cross-sectional study evaluates the savings opportunities from therapeutic substitions for high-cost generic medications.

Key Points

Question

How much could payers and patients save if higher-cost generics were substituted for lower-cost options of same therapeutic value?

Findings

In this cross-sectional analysis of the top 1000 generics in Colorado’s all-payer claims database in 2019, 45 high-cost generics that had lower-cost therapeutic alternatives of same clinical value were identified. Overall, high-cost generics were 15.6 times more expensive than their therapeutic alternatives (median values); if the lower-cost alternatives had been used, total spending would have been reduced by 88.3%.

Meaning

The study suggests that substitution of high-cost generics by lower-cost generic options represents an easy-to-implement savings opportunity.

Abstract

Importance

Use of generics is generally understood as a cost-saving practice. However, pharmacy benefit managers have an incentive to place higher-priced generic drugs on insurers’ drug formularies to profit by creating a large difference between the price negotiated with pharmacies and the price paid by insurers (what is known as spread pricing).

Objective

To examine price differentials and savings potential between high-cost generics and corresponding therapeutic alternatives of same clinical value and lower cost.

Design, Setting, and Participants

This cross-sectional analysis examined the top 1000 generics in Colorado’s all-payer claims database (CO-APCD) in 2019. High-cost generics and lower-cost generic therapeutic alternatives of same clinical value constituted the study sample. Data were analyzed from January 2019 to December 2019.

Exposures

Generic drug prices measured by transaction prices, average wholesale price (AWP), and national drug acquisition average cost (NADAC).

Main Outcomes and Measures

Price differentials between the high-cost generics and the corresponding therapeutic alternatives. Levels of discounts and savings that could be achieved if the high-cost generics had been substituted by their therapeutic alternatives.

Results

This cross-sectional study of the top 1000 CO-APCD generics identified 45 high-cost products that had lower-cost therapeutic alternatives of same clinical value. Overall, high-cost generics were 15.6 times more expensive than their therapeutic alternatives (median values). If the lower-cost alternatives had been used, total spending would have been reduced from $7.5 million to $873 711, resulting in 88.3% savings. Most substitutions (28 of 45 [62.2]%) involved different dosage forms or different strengths of the same drug and provided mean (SD) discounts of 94.9% (3.8%) and 77.1% (19.9%), respectively.

Conclusions and Relevance

In this study, replacing high-cost generics with lower-cost alternatives of same clinical value would produce savings of nearly 90%. Plan sponsors should be aware that some generics are associated with higher spending and should periodically review the specific products driving their generic drug spending. Substitution of high-cost generics may provide a simple pathway to offer the same therapeutic benefit at lower cost to patients and insurers.

Introduction

Savings from generic substitution of branded drugs have been extensively documented.1 Use of generics is generally understood as a cost-saving practice, and insurers generally aim for high generic substitution rates as a cost containment measure.2 However, not all generics necessarily represent the lowest cost option. Pharmacy benefit managers (PBMs) have an incentive to place higher priced generic drugs on the formulary because these drugs allow PBMs to profit by creating a large difference between the price negotiated with pharmacies and the price paid by insurers (what is known as spread pricing).3,4

Generic substitution laws, present in most states, incentivize the substitution of a branded product for its generic, but when there are multiple generics available for the same drug, these laws do not necessarily promote the use of the less expensive generic.5 In addition, the highest cost generic may have a different strength, dosage form, or different active ingredient than a lower-cost generic option. Substitutions between products of different active ingredient, different strength, or different dosage form may not be performed by a pharmacy without a new prescription from a health care practitioner.

Like many states, Colorado has been attempting to lower drug spending for several years.6,7 This study examined the price differentials and savings potential between high-cost generics and therapeutic alternatives of same clinical value and lower cost among the top-1000 generics in Colorado’s all-payer claims database (CO-APCD). The CO-APCD congregates health insurance claims information for commercial health insurance plans, Medicare, and Medicaid, and represents the majority of covered lives in the state.8

Although generics typically account for a low percentage of prescription drug spending, substitution of high-cost generics by lower-cost generic options may represent an easy-to-implement savings opportunity. This is especially important for state payers, who face limited budgets and have ever-increasing costs from branded products and new technologies. Although this study focuses on Colorado, the findings are likely to be similar in other states because generic manufacturers set their prices nationally.

Method

Data and Sample

This cross-sectional study followed the Strengthening the Reporting of Observational Studies in Epidemiology (STROBE) reporting guideline.9 The study did not fulfill criteria for human participants research and institutional review board approval was not sought in accordance with 45 CFR §46. We analyzed the 1000 generic drugs with the highest total spending (plan plus patient) in 2019 in the CO-APCD. Drugs were identified by their National Drug Code (NDC). The information available in the CO-APCD is submitted by health insurers and includes pharmacy claims data.10,11 The total spending on each generic, the number of claims, and the number of units of each drug dispensed in 2019 was obtained from the CO-APCD aggregated at the drug level. No patient or claims data were included in this study.

We identified therapeutic alternatives for high-cost generics through an automated examination of pricing data in a hierarchical fashion (Table 1). First, the price of the high-cost generic was compared with the price of the same drug from different manufacturers—that is, drugs with the same active ingredient, dosage form, and strength but that are produced by different firms (multisource products). Next, we compared the price of the high-cost generic with the price of drugs with the same active ingredient but with a different strength or dosage form (eg, substituting a 200-mg tablet for 2 tablets of 100 mg or substituting a capsule for a tablet). Finally, we compared the price of the high-cost generic with the price of all other drugs in the same therapeutic class (eg, 2 different opioids). The drugs in the same therapeutic class did not have the same active ingredient as the high-cost generic, but they had the same mechanism of action and were approved for the same indication(s).

Table 1. Description and Examples of Each Type of Generic-Generic Therapeutic Substitutiona .

| Substitution type | Definition | Example of high-cost generic | Example of lower-cost therapeutic alternative |

|---|---|---|---|

| Same drug, different manufacturer (2 pairs) | Alternative drug has the same active ingredient, strength, and dosage form as the high-cost generic, but it is produced by a different manufacturer | Anucort-HC (hydrocortisone acetate) 25-mg suppository; unit price, $23.00b | Hydrocortisone acetate 25-mg suppository; unit price, $17.44 |

| Same drug, different strength (11 pairs) | Alternative drug has the same active ingredient and dosage form as the high-cost generic, but has a different strength | Fenofibrate 120-mg tablet; unit price, $31.34 | Fenofibrate 145-mg tablet; unit price, $4.90 |

| Same drug, different dosage form (17 pairs) | Alternative drug has the same active ingredient as the high-cost generic, but has a different dosage form. Strengths may be different. | Mupirocin calcium 2 mg/g cream; unit price, $16.34 | Mupirocin calcium 2 mg/g ointment; unit price, $4.04 |

| Different drug, same therapeutic class (15 pairs) | Alternative drug has a different active ingredient than the high-cost generic, but both have same mechanism of action. | Omeprazole-sodium bicarbonate 40-mg to 1100-mg capsule; unit price, $109.20 | Omeprazole 40-mg delayed-release capsule; unit price, $6.98 |

Source: Authors' analysis of the top 1000 generic drugs in the Colorado All Payer Claims Database. Each pair represents a high-cost generic and its therapeutic alternative(s). Average wholesale prices (AWP) as of December 31, 2019, were obtained from Medi-Span.12 Substitutions were identified in a hierarchical fashion (from the top to the bottom categories on this table). When multiple commercial versions of the same drug were available, price represents the average AWP across all available products.

Anucort-HC is a trademarked generic produced by Cosette Pharmaceuticals, Inc.

Comparisons were implemented using the classification provided in the Medi-Span drug database.12 All pairs where the high-cost generic had a higher price than the therapeutic alternative(s) were manually reviewed by 2 of the authors (T.C. and M.S.) to assess their clinical potential for therapeutic substitution. Potential disagreements were resolved by consensus. When multiple lower-cost therapeutic alternatives of the same type were available, all the alternatives were included in the sample. The drug pairs where the high-cost generic had higher price than the alternative(s) and where the high-cost generic and the therapeutic alternative(s) were assessed by the authors to have comparable clinical value constituted the study sample (eTable in the Supplement).

The US Food and Drug Administration’s Orange Book of Approved Drug Products with Therapeutic Equivalence Evaluations13 and NDC database14 were used to identify the number of manufacturers for each drug, which was available for 42 of the 45 pairs in our sample. For all high-cost generics and therapeutic alternatives, we collected 3 sets of price metrics. First, we collected transaction prices using the CO-APCD to obtain the price for the high-cost generics and using a proprietary database that congregates a similar mix of private and public payers to obtain the price of the therapeutic alternatives.15 Next, we collected Average Wholesale Prices (AWP) from Medi-Span12 and National Average Drug Acquisition Cost (NADAC) from Medicaid.gov.16 These databases did not contain rebate information, but, unlike branded drugs, generic prices are not influenced by manufacturer rebates.17 All metrics reflected the last available unit price recorded for each NDC as of December 31, 2019.

Statistical Analysis

We compared prices between high-cost generics and therapeutic alternatives using transaction prices at the unit level (price per tablet or capsule or per milliliter). When needed, prices were adjusted to reflect how many units of the therapeutic alternative would produce the same therapeutic effect as 1 unit of the high-cost generic. Therefore, if 2 tablets of the therapeutic alternative were required to substitute for 1 tablet of the high-cost generic, the price of the therapeutic alternative was multiplied by 2. Price differentials were calculated as the ratio between the unit price of the high-cost generic and the mean unit price of the therapeutic alternative(s), adjusted for dosage requirements as needed. Discounts were calculated as the difference between the price of the high-cost generic and the mean price of the therapeutic alternative(s) (adjusted for dosage requirements as needed), divided by the price of the high-cost generic. Comparisons of number of manufacturers were implemented using paired t tests. All P values were 2-tailed and were set at a critical significance level of 5%.

We estimated the potential savings that could be accrued if the high-cost generic had been substituted by its therapeutic alternatives by applying the percentage discount offered by the therapeutic alternatives to the spending on the high-cost generic according to the CO-APCD, assuming that all patients using the high-cost generic would switch to the therapeutic alternative. When multiple therapeutic alternatives were identified for the same drug, we assumed that an equal proportion of people would switch to each alternative. This aimed to account for the fact that, when multiple lower-cost therapeutic alternatives offer the same clinical value, insurers might choose to cover any or all of them in their formularies, according to therapeutic preferences or to favorable deals from manufacturers.

We implemented sensitivity analyses to check the robustness of the results by using 2 price metrics—AWP and NADAC—to estimate price differentials and potential savings resulting from the proposed therapeutic substitutions. AWP prices were available for all drugs in our sample. NADAC prices were available for 35 pairs (35 high-cost generics and 50 therapeutic alternatives). There were no other missing values. All analyses were implemented using Stata statistical software version 15 (StataCorp).18 Data were analyzed from January 2019 to December 2019.

Results

Overview of Drugs and Therapeutic Substitutions

Among the 1000 generics with the highest spending in the CO-APCD, a total of 45 drugs (4.5%) were identified as having 64 lower-cost generic therapeutic alternatives, comprising the 45 pairs in the study sample. The 45 high-cost generics represented 4% of CO-APCD's spending on the top 1000 generics ($7.5 million). Most high-cost generics with lower-cost therapeutic alternatives (13 drugs) were systemic treatments for pain, followed by topical agents (7 drugs), systemic antibiotics (6 drugs), antidepressants (6 drugs), and antidiabetic agents (4 drugs) (eTable in the Supplement).

Most substitutions (28 of 45 [62.2]%) involved different dosage forms or different strengths of the same drug. The most common type of substitution identified was for the same drug with a different dosage form, which comprised 17 pairs (7345 overall claims [26.3%]) (Table 2). Substitutions for different drugs in the same therapeutic class represented 15 pairs and 7553 claims (27.1%); substitutions for the same drug with a different strength represented 11 pairs and 9891 claims (35.5%); and substitutions for the same drug from a different manufacturer represented 2 pairs and 3090 claims (11.1%). A total of 34 out of the 45 pairs (77.8%) had only 1 therapeutic alternative identified, 3 pairs (6.7%) had 2 alternatives, 5 pairs (11.1%) had 3 alternatives, and 2 pairs (4.4%) had 4 therapeutic alternatives (eTable in the Supplement). Most pairs with more than 1 therapeutic alternative represented substitutions for different drugs in the same therapeutic class.

Table 2. Characteristics of Cost-Saving Generic-Generic Therapeutic Substitutionsa.

| Substitution type | No. (%) | Mean (SD), No. | P value | |||

|---|---|---|---|---|---|---|

| Drug pairs | Claims | Therapeutic alternatives | Manufacturers of the high-cost generic | Manufacturers of the therapeutic alternative | ||

| Same drug | ||||||

| Different manufacturer | 2 (4.4) | 3090 (11.1) | 1.0 (0.0) | 15.0 (0.0) | 15.0 (0.0) | NA |

| Different strength | 11 (24.4) | 9891 (35.5) | 1.0 (0.0) | 4.8 (3.1) | 8.2 (5.3) | .10 |

| Different dosage form | 17 (37.8) | 7345 (26.3) | 1.1 (0.3) | 7.9 (4.5) | 15.2 (7.9) | <.001 |

| Different drug, same therapeutic class | 15 (33.3) | 7553 (27.1) | 2.2 (1.1) | 6.0 (5.7) | 11.4 (3.5) | .003 |

| Overall | 45 (100) | 27 879 (100) | 1.4 (0.9) | 6.8 (5.0) [95% CI, 5.2-8.4] | 12.3 (6.4) [95% CI, 10.3-14.3] | <.001 |

Abbreviation: NA, not applicable.

Source: Authors' analysis of the top 1000 generic drugs in the Colorado All Payer Claims Database. Number of manufacturers was obtained from the Food and Drug Administration's Orange Book and National Drug Code Directory.11,12 A total of 45 drug pairs representing 45 high-cost generics and 64 therapeutic alternatives were examined. P values were obtained using 2-tailed paired t tests.

The 45 high-cost generics in our sample had a mean of 6.8 manufacturers (95% CI, 5.2-8.4 manufacturers). This was significantly lower than the number of manufacturers recorded for therapeutic alternatives (mean of 12.3 manufacturers; 95% CI, 10.3-14.3 manufacturers; P < .001), and mainly associated with substitutions for the same drug in a different dosage form and substitutions for a different drug in the same therapeutic class. On average, cheaper therapeutic alternatives in these categories had about twice as many manufacturers as the high-cost generics.

Discounts and Price Differentials

Overall, the price of high-cost generics was 15.6 times higher than the price of the therapeutic alternatives (median values) (Table 3). Therapeutic alternative prices had a mean of an 87% discount from the price of the high-cost generic. A total of 32 of the 45 drug pairs had discounts of more than 90% and 9 pairs had discounts between 50% and 90%. Only 4 pairs had discounts of less than 50% (eFigure 1 in the Supplement).

Table 3. Price Differentials and Savings Estimates From Cost-Saving Generic-Generic Therapeutic Substitutionsa.

| Substitution type | Pairs, No. | Price differential, median (IQR) | Discount per drug pair, mean (SD), % | US dollars | ||

|---|---|---|---|---|---|---|

| Total spending, thousands (% of total) | Would-be spending, thousands (% discount) | Total savings, thousands (% of total savings) | ||||

| Same drug | ||||||

| Different manufacturer | 2 | 1.4 (1.1-1.6) | 23.5 (21.4) | 329.8 (4.4) | 255.3 (22.6) | 74.4 (1.1) |

| Different strength | 11 | 4.3 (2.2-26.7) | 77.1 (19.9) | 1372 (18) | 293.4 (78.6) | 1078.6 (16.3) |

| Different dosage form | 17 | 20.2 (13.7-70.9) | 94.9 (3.8) | 3006 (40) | 106.4 (96.5) | 2899.6 (43.8) |

| Different drug, same therapeutic class | 15 | 20.6 (11.3-45.5) | 93.9 (4.9) | 2789 (37) | 218.4 (92.2) | 2570.6 (38.8) |

| Overall | 45 | 15.6 (9.5-45.5) | 87.0 (19.0) | 7496 (100) | 873.7 (88.3) | 6622.3 (100) |

Source: Authors' analysis of the top-1000 generic drugs in the Colorado All Payer Claims Database and corresponding therapeutic alternatives. A total of drug pairs representing 45 high-cost generics and 64 therapeutic alternatives were examined. Would-be spending represents the estimated spending using the transaction prices of the therapeutic alternatives, assuming that all patients taking a high-cost generic would switch to the therapeutic alternative. When more than 1 therapeutic alternative was available for the same high-cost generic, we assumed that an equal proportion of people would switch to each alternative. Percentages may not add to 100% due to rounding.

Generics substituted by different drugs in the same therapeutic class had 20.6 times higher prices than their therapeutic alternatives, and generics substituted by the same drug with a different dosage form had 20.2 times higher prices than their therapeutic alternatives (median values). These differences demonstrate that the ability to charge higher prices is greater when the formulation of the high-cost generic product is more differentiated from its therapeutic alternatives. The lowest price differential was between the same drugs from different manufacturers, which have no differentiation. These drugs had a mean (SD) of 1.4 (0.9) times higher prices than their alternatives.

Similarly, the highest discounts offered by the therapeutic alternatives were among substitutions for the same drugs of different dosage forms (mean [SD] discount of 94.9% [3.8%]) and different drugs in the same therapeutic class (mean [SD] discount of 93.9% [4.9%]); and the lowest discounts were among substitutions for the same drug from a different manufacturer (mean [SD] discount of 23.5% [21.4%]). Substitutions for the same drug from different strength provided a mean (SD) discount of 77.1% (19.9%).

Would-Be Spending Under Full Generic-Generic Therapeutic Substitution

Colorado payers spent a total of $7.5 million on the 45 high-cost generics in our study in 2019 (Table 3). If all drugs had been fully substituted by their alternatives, the total spending on these drugs would have been reduced to $873 711, resulting in 88.3% savings. Most of the savings would be concentrated among substitutions for the same drug with a different dosage form ($2.9 million [43.8%]) and drugs in the same therapeutic class ($2.57 million [38.8%]). Drugs with the highest spending tended to have the highest savings (eFigure 2 in the Supplement).

Sensitivity Analysis

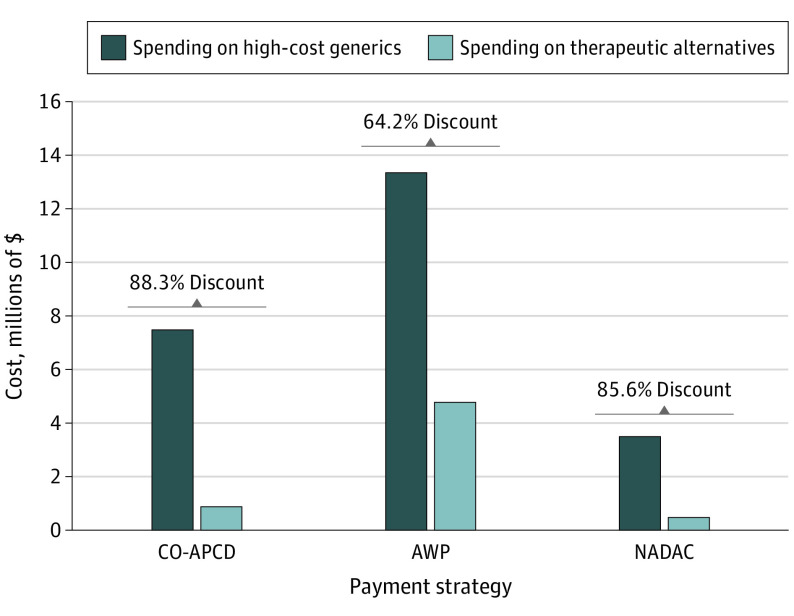

Results from the robustness checks using AWP and NADAC were qualitatively in line with the primary analysis using CO-APCD prices. Using AWP, the price of the therapeutic alternatives represented a discount of 64.2% compared with high-cost generics (Figure). Using NADAC, the discount was 85.6%. This number was closer to the estimates we obtained using transaction prices, likely because the NADAC more closely reflects transaction prices.

Figure. Savings Comparison Across 3 Price Metrics.

We analyzed the top 1000 generic drugs in the Colorado All Payer Claims Database (CO-APCD) and corresponding therapeutic alternatives. Average wholesale prices (AWP) as of December 31, 2019, were obtained from Medi-Span.12 National Average Drug Acquisition Cost (NADAC) data as of December 31, 2019, were obtained from Medicaid.gov.16 A total of 45 drug pairs representing 45 high-cost generics and 64 therapeutic alternatives, except for NADAC analysis (35 drug pairs representing 35 high-cost generics and 50 therapeutic alternatives). Under both AWP and NADAC, the therapeutic alternative was less expensive than the high-cost generic in all the pairs in our sample.

Keeping utilization constant at 2019 CO-APCD levels, at AWP prices the total spending on the 45 drugs in our sample would have been $13.4 million. Spending on therapeutic alternatives would have totaled $4.8 million, representing $8.6 million savings. At NADAC prices, total spending on the 35 drugs with available information would have been $3.5 million, and would-be spending on therapeutic alternatives would have been $0.51 million, representing about $3 million savings.

Discussion

Among the top 1000 generics in Colorado’s commercial health insurance plans, Medicare, and Medicaid programs, this cross-sectional study identified 45 high-cost generics that had lower-cost generic therapeutic alternatives. Overall, high-cost generics were 15.6 times more expensive than their therapeutic alternatives (median values). Colorado payers and patients spent a total of $7.5 million on these 45 high-cost generics in 2019. If the lower-cost alternatives had been used instead, total spending would have been reduced by 88.3%, resulting in approximately $6.6 million savings.

Most substitutions (62%) involved different dosage forms or different strengths of the same drug. Such substitutions provided, on average, discounts of 94.9% and 77.1% off the high-cost generic's price, respectively. Such substitutions cannot be implemented by the pharmacy without a medical prescription. Therefore, such substitutions require a change in the plan's formulary to prioritize lower cost but similarly effective therapeutic alternatives.

Multisource products may be substituted by the pharmacy without the need for a new medical prescription and, therefore, exert direct price competition on each other. Drugs with a different strength, dosage form, or active ingredient, however, may not be substituted by the pharmacy without a new medical prescription and do not pose direct price competition on one another. Generic manufacturers may choose to produce different forms of a drug to prevent substitution at the pharmacy.

High-cost generics tended to have fewer manufacturers than their lower-cost therapeutic alternatives, which is in line with findings from previous studies.19 A higher number of manufacturers has been associated with lower generic prices, and a drug with more manufacturers is assumed to represent a market with greater competition20 However, high-cost generics still had more than 5 manufacturers on average. This finding suggests that, even though these markets should be well functioning, generics can maintain higher prices when pharmacies cannot directly substitute them by a cheaper alternative.

It is important that plan sponsors acknowledge that high generic drug utilization is not a guarantee of lower spending. Plans typically aim for high generic dispensing rates as a measure of cost containment.21 However, plan sponsors should be aware that some generics are associated with higher spending and that therapeutic alternatives could offer substantial savings. Substitution of high-cost generics may provide a simple pathway to offer the same therapeutic benefit at lower cost to patients and insurers, with discounts reaching 80% or more.

It should not be difficult for plans to identify the additional spending associated with high-cost generics. Unlike branded drugs, generic prices are not influenced by manufacturer rebates.17 However, generic reimbursement rates are usually defined by maximum allowable costs (MAC) lists, which may not be disclosed to plan sponsors. MAC lists may allow for more favorable reimbursement of high-cost generics to enable greater spread pricing.22 Although we could not examine the decision-making process behind the coverage decisions that added high-cost generics to plan formularies, it is possible that high-cost generics may offer increased revenue for PBMs through spread pricing.23

The alternative price metrics that we examined, especially NADAC, may provide helpful alternatives to plan sponsors willing to reexamine their drug formularies. AWP is a price benchmark often used as a basis for generic drug pricing negotiations.24 The study findings suggest that AWP may provide an alternative pricing metric to identify generic drug targets for therapeutic substitutions, even if the magnitude of potential savings might vary. NADAC prices more closely approximated the level of discount estimated from transaction prices. However, NADAC was not available for all drugs, which could potentially limit its use as a tool to guide plans’ analyses.

Limitations

The main limitation of this study is that manufacturers may change prices any time, and potential savings may vary when prices change. In aggregate, generic drug prices have tended to decrease over time. However, approximately 30% of generic drugs have experienced extraordinary price increases in recent years, including frequently used drugs such as atenolol and captopril, and such increases have been long-lasting, without downward movement in subsequent years.25

It is possible that other states or payers may be able to negotiate better prices on certain drugs. However, generic manufacturers set prices nationwide, and the CO-APCD data combines data from all payers, including nationwide insurers and the Medicare program. Therefore, the results will most likely apply to payers in other states. In addition, the robustness checks using different price metrics suggest that substitutions would yield savings in most cases, even if the magnitude of those savings might vary.

Because generics typically account for a low percentage of prescription drug spending,26 savings from generic-generic substitutions are likely to be lower than savings from substitutions of high-cost drugs, such as biologics and biosimilars. Nevertheless, generic-generic substitutions represent an easy-to-implement savings opportunity. This is especially important for states, which face growing pharmaceutical costs and increasingly constrained budgets.

Additionally, the therapeutic substitutions that we proposed may not be fully achievable. Some patients may hesitate to switch drugs, particularly those who have been taking a particular medication long term or when changing a generic has perceived differential effects—for example, a within-class change of proton pump inhibitors or antimigraine triptans. Substitutions may be easier to implement for new users. By including all the available therapeutic alternatives for each high-cost generic, we provided a comprehensive but conservative estimate of the potential savings. Also, PBMs may resist making changes to drug formularies, especially if the drug to be substituted provides large spread prices and high profits.

Conclusions

Rather than serving as a prescriptive analysis of which drugs should or should not be covered in drug formularies, this study provides an evidentiary basis to suggest that insurers and plan sponsors should review their drug formularies for savings opportunities and that those reviews should include generic drugs. In addition, our findings support keeping close scrutiny of drugs with fewer manufacturers. The savings estimated in this study may represent a lower bound of attainable savings, because additional tools such as utilization controls restricting access to certain products could be implemented when spending on high-cost generics is identified. Future avenues for research include examining whether the estimated savings from generic substitution that we identified in this study would differ under different sample selection criteria or across payer type.

eTable. Study Sample: High Cost Generics, Therapeutic Classes, and Therapeutic Alternatives

eFigure 1. Distribution of Drug Discounts Across the 45 Drug Pairs in the Study Sample

eFigure 2. Association Between Total Spending and Total Savings Levels Across the 45 Drug Pairs in the Study Sample

References

- 1.Office of the Assistant Secretary for Planning and Evaluation, US Department of Health and Human Services . Savings available under full generic substitution of multiple source brand drugs in Medicare Part D. 2018. Accessed March 21, 2022. https://aspe.hhs.gov/system/files/pdf/259326/DP-Multisource-Brands-in-Part-D.pdf

- 2.Dusetzina SB, Cubanski J, Nshuti L, et al. Medicare Part D plans rarely cover brand-name drugs when generics are available. Health Aff (Millwood). 2020;39(8):1326-1333. doi: 10.1377/hlthaff.2019.01694 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Meador M. Squeezing the middleman: ending underhanded dealing in the pharmacy benefit management industry through regulation. Ann Health Law. 2011;20(1):77-112. [PubMed] [Google Scholar]

- 4.Socal MP, Bai G, Anderson GF. Favorable formulary placement of branded drugs in medicare prescription drug plans when generics are available. JAMA Intern Med. 2019;179(6):832-833. doi: 10.1001/jamainternmed.2018.7824 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Sacks CA, Van de Wiele VL, Fulchino LA, Patel L, Kesselheim AS, Sarpatwari A. Assessment of variation in state regulation of generic drug and interchangeable biologic substitutions. JAMA Intern Med. 2021;181(1):16-22. doi: 10.1001/jamainternmed.2020.3588 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Hawrluk M; Kaiser Health News . Colorado lawmakers wage multi-front assault on high drug costs. Fortune. May 24, 2021. Accessed March 21, 2022. https://fortune.com/2021/05/24/colorado-legislature-lower-prescription-drug-prices-pharmaceutical-regulation-out-of-pocket-costs/

- 7.Colorado Department of Health Care Policy and Financing . Reducing prescription drug costs in Colorado. 2021. Accessed March 21, 2022. https://hcpf.colorado.gov/sites/hcpf/files/Reducing%20Prescription%20Drug%20Costs%20in%20Colorado%20Second%20Edition.pdf

- 8.Center for Improving Value in Health Care . Colorado all payer claims database overview. Accessed March 21, 2022. https://www.civhc.org/get-data/co-apcd-info/

- 9.von Elm E, Altman DG, Egger M, Pocock SJ, Gotzsche PC, Vandenbroucke JP. The Strengthening the Reporting of Observational Studies in Epidemiology (STROBE) Statement: guidelines for reporting observational studies. Accessed August 31, 2022. https://www.equator-network.org/reporting-guidelines/strobe/

- 10.Buttorff C, Wang GS, Tung GJ, Wilks A, Schwam D, Pacula RL. APCDs can provide important insights for surveilling the opioid epidemic, with caveats. Med Care Res Rev. 2022;79(4):594-601. doi: 10.1177/10775587211062382 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Bartels K, Fernandez-Bustamante A, McWilliams SK, Hopfer CJ, Mikulich-Gilbertson SK. Long-term opioid use after inpatient surgery: a retrospective cohort study. Drug Alcohol Depend. 2018;187:61-65. doi: 10.1016/j.drugalcdep.2018.02.013 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.Wolters Kluwer . Medi-Span around the world. 2022. Accessed March 21, 2022. https://www.wolterskluwer.com/en/solutions/medi-span/medi-span-around-the-world

- 13.US Food and Drug Administration . Orange Book: approved drug products with therapeutic equivalence evaluations. 2022. Accessed March 21, 2022. https://www.accessdata.fda.gov/scripts/cder/ob/

- 14.US Food and Drug Administration . National drug code directory. 2022. Accessed March 21, 2022. https://www.accessdata.fda.gov/scripts/cder/ndc/index.cfm

- 15.Integrity Pharmaceutical Advisors . Integrity Pharmaceutical Advisors proprietary drug price database. Accessed March 25, 2022. https://integritypharmaceuticaladvisors.com/

- 16.Center for Medicare and Medicaid Services . NADAC (National Average Drug Acquisition Cost) 2019. Updated August 23, 2021. Accessed March 21, 2022. https://data.medicaid.gov/dataset/76a1984a-6d69-5e4d-86c8-65eb31f0506d

- 17.Kang SY, Bai G, DiStefano MJ, Socal MP, Yehia F, Anderson GF. Comparative approaches to drug pricing. Annu Rev Public Health. 2020;41(1):499-512. doi: 10.1146/annurev-publhealth-040119-094305 [DOI] [PubMed] [Google Scholar]

- 18.Stata Statistical Software Release 15. StataCorp LLC; 2021. [Google Scholar]

- 19.Tessema F, Kesselheim A, Sinha M. Generic but expensive: why prices can remain high for off-patent drugs. Hastings Law J. 2020;71(4):1019-1052. [Google Scholar]

- 20.Berndt ER, Conti RM, Murphy SJ. The landscape of US generic prescription drug markets, 2004-2016. July 2017. Accessed September 25, 2022. https://www.nber.org/papers/w23640

- 21.Liberman JN, Roebuck MC. Prescription drug costs and the generic dispensing ratio. J Manag Care Pharm. 2010;16(7):502-506. doi: 10.18553/jmcp.2010.16.7.502 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 22.ERISA Advisory Council . PBM compensation and fee disclosure. 2014. Accessed September 25, 2022. https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/about-us/erisa-advisory-council/2014-pbm-compensation-and-fee-disclosure.pdf

- 23.National Alliance of Healthcare Purchaser Coalitions . National Alliance releases findings on employer perspectives and recommendations to curb the high cost of drugs. January 8, 2020. Accessed March 21, 2022. https://www.nationalalliancehealth.org/www/news/news-press-releases/employer-rx-roundtable-findings

- 24.Gencarelli DM. Average wholesale price for prescription drugs: is there a more appropriate pricing mechanism? NHPF Issue Brief. 2002;(775):1-19. [PubMed] [Google Scholar]

- 25.Government Accountability Office (GAO) . Generic drugs under Medicare: Part D generic drug prices declined overall, but some had extraordinary price increases. Published: August 12, 2016. Publicly Released: September 12, 2016. Accessed August 31, 2022. https://www.gao.gov/products/gao-16-706

- 26.Association for Accessible Medicines . The case for competition: 2019 generic drug and biosimilars access and savings in the U.S. report. Accessed August 11, 2022. https://accessiblemeds.org/sites/default/files/2019-09/AAM-2019-Generic-Biosimilars-Access-and-Savings-US-Report-WEB.pdf

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

eTable. Study Sample: High Cost Generics, Therapeutic Classes, and Therapeutic Alternatives

eFigure 1. Distribution of Drug Discounts Across the 45 Drug Pairs in the Study Sample

eFigure 2. Association Between Total Spending and Total Savings Levels Across the 45 Drug Pairs in the Study Sample