Abstract

Policy makers in several countries are seeking to increase domestic value added in export. The purpose of this paper is to examine this emphasis in trade and industrial policy in the era of global value chains. The formal empirical analysis adopts Thailand as a case study, and employs a mixture of input–output analysis and panel econometrics to model the relationship between domestic value added and two export performances indicators (net-export earnings and export-led income). The findings from a system GMM estimator suggest that industries with greater domestic value added do not perform better than those with lower domestic value added. There is no significant relationship between domestic value added and net-export earnings and export-induced income. However, there is evidence that greater participation in global production networks significantly increases export performances. The upshot is that emphasis placed on domestic value added may run counter developmental gains from participation in global value chains.

Keywords: Global value chain, Domestic value added, Export performances, Thailand

Introduction

Since 1990, many developing countries have increasingly integrated into the world market through greater participation in global value chains (GVCs) (Antràs, 2016; Antràs & Chor, 2022; Athukorala, 2014; Baldwin, 2016; Feenstra, 2009; Helpman, 2011). This phenomenon is driven by improvements in production technology, innovations in transportation and communication, and liberal trade and investment policies. This results in the shift of export from primary products to manufacture and services, thereby reducing the share of domestic value added in total exports (hereafter ‘domestic value added’). Several countries (e.g., South Korea, Japan, and Thailand) have experienced this trend. Policy makers are then seeking to increase domestic value added (Dollar et al., 2019). This paper examines the rationale behind this policy emphasis by revisiting the case for using domestic value added as a policy guidance to promote export performances in the era of economic globalisation.

This study asks whether high domestic value added should be used as a guidance in trade and development policy in the era of GVCs. Previous research has demonstrated that the share of foreign value-added embodied in the gross exports, known as backward GVC participation, plays an important role in boosting economic growth, employment creation, productivity, and industrial upgrading (Constantinescu et al., 2019; Tian et al., 2022; Veeramani & Dhir, 2022; World Bank, 2020). The literature also describes the efficiency gained by a firm using more imported intermediates (Amiti & Konings, 2007; Goldberg et al., 2020; Kugler & Verhoogen, 2012; Pane & Patunru, 2022). However, domestic value added in exports seems to have a smaller role in explaining superior export performance for two reasons. First, its emphasis through tariff and non-tariff measures may run counter the ongoing development path through GVC-led export-oriented industrialization (Dollar et al., 2019). Second, total domestic value added in exports encompasses both forward GVC participation and trade in finished goods. The latter do not gain from the ‘volume effect’ in larger market enjoyed by GVC trade (Athukorala, 2014). Therefore, an increase in domestic value added may not necessarily contribute to a country’s export performance and economic growth.

This paper examines the justification of using domestic value added as a policy guidance to promote economic growth in the era of economic globalisation through a case study of Thailand. Thailand represents an excellent case study of this subject at hand because of high degree of engagement in global value chains. I use Thailand’s input–output tables covering 74 manufacturing sectors for six periods to study the relationship between domestic value added and two indicators of export performance: net-export earnings and export-induced income.

Using a system GMM estimator to address endogeneity concerns, this paper finds little empirical support for the view that industries with greater domestic value added has superior export performances than those with lower domestic value added. The findings are consistent when estimating the model using the sample excluding industries characterized by specifically high domestic value added (processed food sectors). In addition, there is a positive effect of domestic value added in export performances in low-productivity industries. This paper also finds that the relationship between domestic value added and export performances is not conditioned by industry’s engagement in global production network. Lastly, there is a positive effect of global production network orientation on export performances.

The paper is structured as follows: Sect. 2 sets out an analytical framework for the role of domestic value added in an era of global value chains. Section 3 illustrates Thailand’s engagement in global value chains. Section 4 shows methodology and discusses data. Section 5 reports the empirical results. The final section concludes.

The role of domestic value added in an era of global value chains

In the literature of global value chains, there is evidence that GVC trade is associated with economic growth. Using a system GMM method, World Bank (2020) reports that a one percent increase in GVC participation causes an increase in per capita income by more than one percent. In addition, the coefficient on GVC backward linkage, defined as the share of imported inputs in exports, is higher than that of GVC forward linkage, suggesting an important role of foreign content in exports.

Recent studies suggest a positive impact of backward GVC participation. A study by Constantinescu et al. (2019) deserves attention. They study the relationship between GVC participation and labor productivity by using international input–output tables from the WIOD. The results from an instrumental variable method suggest a significant effect of the foreign value-added in exports on labor productivity. The findings are consistent with Pahl and Timmer (2019), Urata and Baek (2020), and Yanikkaya and Altun (2020). Therefore, GVC backward participation can boost economic growth through an increase in productivity. Tian et al. (2022) find that backward GVC participation offers greater industrial upgrading opportunities for developing countries, compared to forward GVC participation. Altomonte et al. (2018) describe that countries that upgrade their positioning or improve their participation to GVCs experience stronger export effects on growth than other countries. A recent paper by Veeramani and Dhir (2022) also finds the positive impact of backward GVC participation on gross exports, domestic value added, and employment in India.

In addition, World Bank (2020) points to a less important role of GVC forward participation, which is defined as exporting domestically produced inputs to trading partners for the production of goods and services that they export. However, the current emphasis on domestic value added in trade and development policy in several countries encompasses both domestic value added that is further re-exported by partners and domestic value added absorbed directly by the partners (sold domestically). The latter case is not considered GVC participation, but a proxy for trade in finished goods that crosses borders only once (Antras and Chor, 2022; Borin & Mancini, 2019).

Despite empirical evidence suggesting some positive effects of forward GVC participation on economic growth and productivity (Kummritz et al., 2017;), it is important to distinguish between domestic value added in exports per se and domestic value added that is re-exported by its trading partners. Total domestic value added may not matter for growth and development since it encompasses both GVC forward linkages and trade in finished goods. Relative to forward GVC participation, trade in finished goods may have less relevant for growth and development. With this in mind, policy makers should focus more on both forward and, more importantly, backward GVC participation instead of domestic value added in exports.

However, several studies view an increase in domestic value added in exports as a gain from participating in GVCs (Banga, 2014; Beverelli et al., 2019). For example, China’s rising domestic value added is taken as evidence of the country’s moving up the value chains (Kee and Tang, 2016). Kummritz et al. (2017) also use domestic value added as a measure of an economic upgrading. They find that greater GVC participation results in higher industry’s value added. Yu and Luo (2018) find that the proportion of domestic value added in exports of China is lower than those of the advanced economies, for instance, the United States and Japan. The authors also find that the determinants of the growth of DVA include productivity enhancement, research and development, capital formation, and the interactions between R&D inputs and vertical specialization.

The purpose of this paper is to contribute to the policy debate regarding the role of domestic value added in fostering a country’s export performance. Dollar et al. (2019) describe that the ratio of domestic value added to gross export tends to fall as the country moves from export of primary products to export of manufacture and services through participating in global value chains. Policy makers in many developing countries worry about this trend and seek to increase domestic value added. However, Dollar et al. (2019) note that imported intermediate plays a crucial role in increasing competitiveness in several countries, especially most of ASEAN countries.

By using the data on Johnson (2018), Dollar et al. (2019) also find that Bangladesh experienced a higher rate of growth in export as compared to Pakistan despite having lower domestic value added in the textile and clothing sector. This is mainly because Bangladesh has integrated its textile and clothing sector in the international production networks by sourcing most of raw materials from abroad. Malaysia and Thailand also provide contrasting examples. While Malaysia has undertaken protectionist policies to promote its indigenous auto industry, Thailand has liberalized its automobile industry for decades. The results are striking since Malaysia is not competitive in the global car market but Thailand’s export-oriented automotive industry is widely regarded as an economic success story (Wad, 2009; Warr & Kohpaiboon, 2018). Dollar et al. (2019) conclude that seeking to increase domestic value added through tariffs and non-tariffs measures will increase the cost of production, thus making the product less competitive in the world market. This tends to worsen the well-being of the society.

Export-oriented industrialisation and global production sharing in Thailand

Policy context

In 1961, Thailand inaugurated the first National Economic and Social Development Plan. Despite there being no specific guidelines on foreign trade, private sector-led industrialisation was encouraged through various measures aimed at protecting domestic production, for example, taxation for foreign trade and tax exemption for domestic production (Akrasenee, 1980). In addition to the national plan, the establishment of the Board of Investment (BOI) in 1966 marked a revolution in industrial policy in Thailand. Its policies were conducive to the encouragement of private investment using tax and nontax incentives. These measures were valid under the Investment Promotion Act (1954). The most crucial feature was tax concessions on imported machinery, equipment, and other intermediate inputs used in promoted industries. Yet, those who enjoyed these concessions until the early 1970s were import-competing firms (Akrasenee, 1980).1 Export promotion was thus ignored while some primary exports were taxed (e.g., rice and rubber). The rapid growth of the manufacturing sector during the 1960s and early 1970s was arguably due to import substitution policies (Tambunlertchai, 1993; Warr, 2008).

A policy shift towards manufactured exports occurred in the early 1970s through strategies set out in the Third Development Plan (1972–1976) together with the Investment Promotion Act (1972) and Export Promotion Act (1972). There were several measures used to promote manufactured exports, for example, full exemption from tariffs and business taxes on imported inputs, exemption from business taxes as well as discounts on loans (Akrasenee, 1980). This strategy was continued to the next development plans as the industrial policy was used to promote export-oriented industries and to allocate factories to be installed in provincial areas in the meantime.

During the 1980s, there was strong growth in textile and clothing exports in Thailand, which significantly contributed to employment. This success was attributed to several factors such as credible macroeconomic and exchange rate management, depreciation of the Baht, credit assistance, and open foreign investment regimes (Hill & Suphachalasai, 1992). From 1988 to 1990, Thailand experienced rapid growth as its economy expanded by 2-digit growth. This boom was due to the depreciation of Thai currency and the international relocation of light manufacturing from the Newly Industrialized Countries (NICs) to several ASEAN countries (Warr, 1993). Moreover, the appreciation of the Japanese Yen after the Plaza Accord was considered as another driving force behind this growth (Jitsuchon & Sussangkarn, 2009).

In 1991, the Thai government further reformed industrial policies by liberalising investment and factory installation. The government also liberalised automobile industries by allowing the importation of complete vehicles and reducing tariffs on imported parts. Since then, the automobile industry has become a core industry in Thailand. This growth in manufacturing sector continued until the 1997 Asian Financial Crisis. After the crisis, the BOI allowed complete foreign ownership in supported industries in all areas aimed at attracting foreign investors whose financial status was stronger than that of domestic firms. Currently, no doubt Thailand is adopting an export-led growth strategy through foreign direct investments using generous tax incentives and Special Economic and Development Zones (Board of Investment, 2017; Kuroiwa & Techakanont, 2017; Warr, 1993).

Under the current government, there is a strong emphasis on high-value-added products.2 An apparent emphasis is spelt out in the 20-year national strategy (2017–2036) as its apex goal is to transform the Thai economy to a value-based and innovation-driven economy. A subsequent plan, for instance, a 5-year economic and social development plan and the investment plan, must be in line with this strategy. Additionally, industries using advanced technology to produce high value-added products are highly supported through many benefits provided by the BOI. Therefore, it is evident from the policy point of view that Thailand is now in the process of shifting from an economy relying on labor-intensive industries to one relying on high value-added industry.

Thailand’s engagement in global value chains

This section briefly describes Thailand’s engagement in global production sharing and global value chains. Global production sharing (GPS) is the internationalization of a manufacturing process in which many countries participate in different stages/tasks of the production process of a given product. Alternative terms are international production fragmentation, vertical specialization, and offshoring. GPS-related trade comprises of trade in parts and components and final assembly. Parts and components are relationship-specific intermediate goods, which are not sold on commodity exchanges (Athukorala, 2014). Therefore, GPS focuses narrowly on different stages of the production process within vertically integrated global manufacturing industries. Global value chain is a catch-all term for the governance structure covering the full range of economic activities involved in pre- and post-production processes including research and development, design, procession process, marketing, and logistics (Gentile et al., 2021). Each terminology has different measure and implication. This section starts with Thailand’s engagement in GPS and then proceeds to explain GVC participation. Despite different concepts and measures, the data reveal that Thailand’s internaitonal trade in the past few decades has been powered by a phenomenon of cross-border production.

Global production sharing (GPS) has been a major force in the economic dynamism of the Southeast Asian economies over the last half century (Athukorala & Kohpaiboon, 2014). Thailand’s engagement in GPS can be traced from the late 1970s when Thailand, together with other Southeast Asian countries (e.g., Malaysia and the Philippines), was an important area to assemble semiconductor devices (Flamm, 1985, p. 71). Today parts and components and final assembly exports within the global production network (‘network trade’)3 account for a sizable share of Thailand’s manufacturing exports.

Table 1 displays Thailand’s patterns of network trade between 2009 and 2018. Manufacturing exports (in current prices) increased from US$116 billion in 2009 to about US$165 billion in 2018. Global production sharing played a vital role in this expansion as GPN products accounted for around 70% of total manufacturing exports.4 Also, there was a shift in network trade composition. The share of parts and components in network products declined from 64% in 2009 to 56% in 2018 while the share of final assembly increased from 36 to 44% over the same period.

Table 1.

Thailand’s GPN-based export performance and their share in total manufacturing exports between 2009 and 2018

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2009–2018 (%) | 2014–2018 (%) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Panel A: Export value of GPN products (million USD) | ||||||||||||

| Parts and components | 53,113 | 69,429 | 72,272 | 69,281 | 69,877 | 74,530 | 72,964 | 74,898 | 80,005 | 63,880 | 20.27 | − 14.29 |

| Final assembly | 29,484 | 38,962 | 41,880 | 45,029 | 47,794 | 48,397 | 48,300 | 48,837 | 55,765 | 51,161 | 73.52 | 5.71 |

| Total GPN | 82,597 | 108,391 | 114,152 | 114,310 | 117,672 | 122,927 | 121,264 | 123,735 | 135,770 | 115,041 | 39.28 | − 6.42 |

| Manufactured products | 115,530 | 155,377 | 173,303 | 171,641 | 179,704 | 186,060 | 179,447 | 181,541 | 195,331 | 165,443 | 43.20 | − 11.08 |

| Total products | 155,931 | 205,881 | 239,749 | 235,160 | 236,454 | 241,117 | 229,704 | 233,339 | 252,434 | 206,964 | 32.73 | − 14.16 |

| Panel B: Share of GPN products in total GPN exports (%) | ||||||||||||

| Parts and components | 64.30 | 64.05 | 63.31 | 60.61 | 59.38 | 60.63 | 60.17 | 60.53 | 58.93 | 55.53 | − 13.65 | − 8.41 |

| Final assembly | 35.70 | 35.95 | 36.69 | 39.39 | 40.62 | 39.37 | 39.83 | 39.47 | 41.07 | 44.47 | 24.58 | 12.96 |

| Panel C: Share of GPN products in total manufacturing exports (%) | ||||||||||||

| Parts and components | 45.97 | 44.68 | 41.70 | 40.36 | 38.88 | 40.06 | 40.66 | 41.26 | 40.96 | 38.61 | − 16.01 | − 3.61 |

| Final assembly | 25.52 | 25.08 | 24.17 | 26.23 | 26.60 | 26.01 | 26.92 | 26.90 | 28.55 | 30.92 | 21.17 | 18.88 |

| Total GPN | 71.49 | 69.76 | 65.87 | 66.60 | 65.48 | 66.07 | 67.58 | 68.16 | 69.51 | 69.53 | − 2.74 | 5.24 |

| Panel D: Share of GPN products in total exports (%) | ||||||||||||

| Parts and components | 34.06 | 33.72 | 30.15 | 29.46 | 29.55 | 30.91 | 31.76 | 32.10 | 31.69 | 30.87 | − 9.38 | − 0.15 |

| Final assembly | 18.91 | 18.92 | 17.47 | 19.15 | 20.21 | 20.07 | 21.03 | 20.93 | 22.09 | 24.72 | 30.73 | 23.15 |

| Total GPN | 52.97 | 52.65 | 47.61 | 48.61 | 49.77 | 50.98 | 52.79 | 53.03 | 53.78 | 55.58 | 4.94 | 9.03 |

GPN is global production networks product, manufacturing sectors are SITC 5–8 excluding SITC 68 (non-ferrous metals)

Source: Compiled from UN Comtrade Database (SITC Rev. 4)

The commodity composition of manufacturing exports over the last decade is shown in Table 2. The data point to the concentration in electronics and electrical goods (SITC 75, 76 and 77) compared to the total network exports. However, due to the damage caused by flood in 2011, the electronics industry, in particular, semiconductor, was heavily affected as its share in total manufacturing exports fell by more than 2%.5 In 2018, automobiles and other transport equipment (SITC 78 and 79) accounted for a larger share compared to electronics.6

Table 2.

Commodity composition of Thailand’s network exports in total manufacturing exports between 2009 and 2018 (%)

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2009–2018 (%) | 2014–2018 (%) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Automatic data processing machines (75) | 18.95 | 16.45 | 14.08 | 15.92 | 14.06 | 14.19 | 14.05 | 13.40 | 12.57 | 12.57 | − 33.67 | − 11.40 |

| Telecommunication and sound recording equipment (76) | 10.00 | 9.51 | 9.31 | 9.10 | 8.46 | 8.19 | 8.94 | 8.97 | 9.45 | 9.05 | − 9.49 | 10.43 |

| Electrical machinery excluding semiconductors (77–776) | 7.23 | 7.13 | 7.14 | 6.82 | 6.92 | 7.20 | 7.24 | 7.43 | 7.46 | 7.40 | 2.26 | 2.73 |

| Semiconductor (776) | 9.67 | 9.92 | 8.35 | 6.22 | 6.34 | 6.90 | 7.22 | 7.93 | 8.77 | 7.53 | − 22.11 | 9.20 |

| Road vehicles (78) | 8.79 | 11.17 | 10.23 | 13.03 | 14.02 | 13.25 | 13.84 | 14.09 | 15.37 | 16.50 | 87.71 | 24.48 |

| Other transport equipment (79) | 0.09 | 0.22 | 0.37 | 0.19 | 0.14 | 0.15 | 0.12 | 0.09 | 0.12 | 0.30 | 237.44 | 96.83 |

| Professional and scientific equipment (87) | 1.38 | 1.39 | 1.43 | 1.57 | 1.64 | 1.93 | 2.33 | 2.76 | 2.50 | 1.86 | 34.84 | − 3.38 |

| Photographic apparatus and optical goods, watches and clocks (88) | 1.72 | 1.53 | 1.43 | 1.31 | 1.39 | 1.47 | 1.47 | 1.46 | 1.51 | 1.71 | − 0.41 | 16.08 |

| Others | 13.67 | 12.45 | 13.53 | 12.45 | 12.51 | 12.79 | 12.36 | 12.04 | 11.74 | 12.62 | − 7.69 | − 1.31 |

| Total GPN products | 71.49 | 69.76 | 65.87 | 66.60 | 65.48 | 66.07 | 67.58 | 68.16 | 69.51 | 69.53 | − 2.74 | 5.24 |

Manufacturing sectors are SITC 5–8 excluding SITC 68 (non-ferrous metals)

Source: Compiled from UN Comtrade Database (SITC Rev. 4)

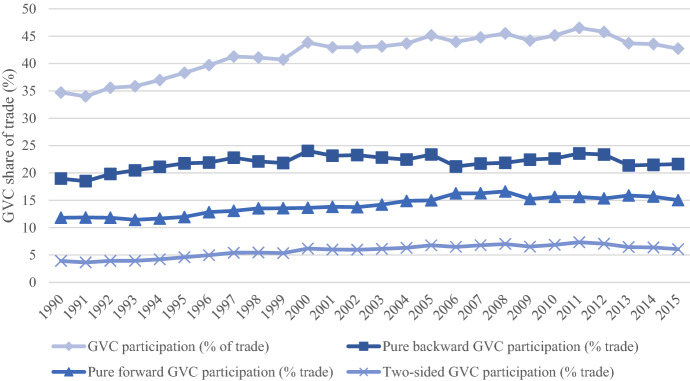

Participation in global value chains can also be measured by using global input–output tables. GVC trade is defined as the share of trade that flows through at least two countries (Borin & Mancini, 2019; World Bank, 2020). This indicator encompasses two broad types of GVC: backward GVC participation and forward GVC participation. Backward GVC participation is the ratio of the foreign value-added content of exports to the economy’s total gross exports while forward GVC participation is the ratio of the domestic value added sent to partners to the economy’s total gross exports. Another type of GVC participation is two-sided GVC participation, which is referred to value of goods and services produced with imported inputs, exported to partners which re-exports it to other countries. Figure 1 shows Thailand’s GVC-related trade participation in three measures7: pure backward participation, pure forward participation, and two-sided participation.

Fig. 1.

Thailand’s GVC trade-related participation.

Source: Eora (2022)

According to Fig. 1, the share of GVC trade in total trade increased rapidly from 34.70% in 1990 to a peak of 46.52% in 2011, but it appeared to decline subsequently. Subsequent decline in GVC participation between 2013 and 2015 was primarily driven by a decline in pure forward GVC participation. One possible reason is a decrease in agricultural raw materials exports over the same period (World Bank, 2022). In 2015, about 43% of Thailand’s trade are related to global value chains. This figure is lower than other countries in ASEAN such as Malaysia (57%) and Vietnam (49%). Pure backward GVC participation accounted for about 5% of total GVC participation. Table 3 shows GVC trade by sector.

Table 3.

Thailand’s GVC trade by sector

| 1990 | 1995 | 2000 | 2005 | 2010 | 2015 | |

|---|---|---|---|---|---|---|

| Agriculture, forestry and fishing | 2.45 | 2.25 | 2.12 | 2.10 | 2.27 | 2.24 |

| Mining and quarrying | 0.50 | 0.42 | 0.81 | 0.75 | 0.73 | 0.73 |

| Manufacturing | 80.56 | 82.83 | 84.73 | 82.84 | 81.32 | 81.24 |

| Electricity, gas and water | 0.03 | 0.02 | 0.08 | 0.02 | 0.02 | 0.02 |

| Construction | 0.30 | 0.17 | 0.14 | 0.18 | 0.25 | 0.26 |

| Services | 16.15 | 14.31 | 11.96 | 14.10 | 15.41 | 15.52 |

| Others | 0.01 | 0.01 | 0.16 | 0.01 | 0.00 | 0.00 |

| Total | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 |

Source: Eora (2022)

As reported in Table 3, manufacturing accounted for more than 80% of Thailand’s GVC trade. Its share in total GVC participation increased from 80.56% in 1990 to 84.73% in 2000, before declining to 81.24% in 2015. In 1990, electrical and machinery, textiles and wearing apparel, and petroleum, chemical, and non-metallic mineral products play an important role in GVC-related manufacturing trade. Food and beverages came to prominence in 2015 as it accounted for 6% of total GVC-related trade.

Methodology

This section first describes the methodology of calculating two key export performances indicators: net-export earnings and export-induced income. This is followed by the specification of the regression model used to investigate the relationship between domestic value added and export performances.

Input–output model

The non-competitive Input–Output system is employed in this paper. The input–output structure of the economy can be written as

| 1 |

where is a column vector of 1’s of n dimension. From the I–O coefficient matrix, it yields

| 2 |

where = L = [] is known as the Leontief inverse matrix. This shows the dependence of gross output on the values of final demand (the relationship can be written as ).

To be specific with a non-competitive type I-O table, it can be written as

| 3 |

where is referred to as a matrix of the domestic I-O coefficient.

Final demand, , can be decomposed to

| 4 |

where is a vector of domestic final demand and is export on domestically produced goods. is an output multiplier. It shows the total value of production in all sectors throughout the economy that is required to satisfy an increase in a unit of output of sector (final demand).

The sum of the column of gives a value of total backward linkages when domestic final demand or foreign final demand for the commodity increases by one unit. Backward linkage8 for sector is

| 5 |

Import intensity

Industry uses both domestically produced input and imported input in its production process. A diagonal matrix of imported input coefficients is

| 6 |

where is import used by sector and is thus imported input coefficient. It can be written in a matrix form:

To quantify the total imports as a part of the production, it gives

where is the import inverse matrix. This is a total import requirement matrix of domestic production. An element of matrix , , is the total amount of imports that sector needs to produce one unit of commodity in the economy. As sector uses imported intermediates from several sectors, the total import required to produce a unit of commodity is therefore

| 7 |

This shows a corresponding demand for imports when a final demand in sector increases.

Net-export earnings

Let be a value of total exports from sector . It is assumed that there is no difference in using imports in producing a unit of output whether the product is sold within the economy or exported to the foreign market.

Thus, each unit of export of commodity , , is embodied with imports used by sector . It yields

| 8 |

where is the total value of imports embodied in the export of commodity .

Let be net-export earnings of sector . This is estimated by:

| 9 |

Net-export earning can be defined as gross exports minus direct and indirect imported inputs that are embodied in exports.

Export-induced income

As an output expansion might not reflect an income received by the worker, an effect on household income (monetary earnings) is further analyzed.

Let be a row vector of wage and salary in payment sectors. Defining a diagonal matrix of household income coefficient as a proportion of household income to total output in each industry as:

| 10 |

where is wage and salary received by worker in sector and is then a household income coefficient. In matrix form, it can be written as:

To quantify total household income as a part of production (outlays), this can be spelt out as:

where is the wage and salary requirement matrix of domestic production. An element of matrix , , is the total amount of wage and salary in sector that sector needs to pay labor services to produce a unit of commodity in the economy. Total required payment to household from all sectors to produce a unit of commodity is

| 11 |

This shows a corresponding increase in received wage and salary when a final demand in sector increases.

How export can lead to an increase in household income can be illustrated by reproducing an expression of net export earnings. Let us assume that workers are paid indifferently in producing a commodity whether the product is sold domestically or exported. The total value of household income embodied in exports, , can be estimated as:

| 12 |

where is the total value of household income embodied in the export of commodity .

Thus, the total export-induced household income of the economy, , is therefore

| 13 |

Regression model

The regression model takes the following form:

| 14 |

where the subscripts refer to industry and is time (year). The explanatory variables are listed below, with the postulated sign of the regression coefficient for the explanatory variables in parenthesis.

: Net-export earnings

: Export-induced income

: Domestic value added ratio of gross export (+/−)

: Global Production Network

: Productivity

: A constant term

: A set of country dummy variables to control for time-invariant heterogeneity at the industrial level

: A set of time dummy variables to capture unobservable time effects

: A stochastic error term, representing the omitted influences on export performance

Net-export earnings and export-induced income are measured at constant (2010) producer’s price. All three dependent variables are in natural logarithms.

The main variable of interest is domestic value added ratio . It is postulated among policy makers, who use value added share as a policy criterion, to have a positive effect on export performances. However, as discussed, in the era of global production sharing, industry with employment potential does not necessarily to have high domestic value added. The expected sign of the coefficient of this variable is ambiguous.

Productivity is defined by the real value added per worker (labor productivity). It captures both total factor productivity (efficiency) and capital deepening which is measured by a change in capital per worker. Unfortunately, these two effects cannot be separated due to the limitation of data at industry level. Once efficiency in production improves, it can pull resources from other industries to be used in production process. At the same time, it can push or release labor to other activities. The expected sign of the coefficient can be both positive and negative. I include an interaction term between and to test whether the relationship between domestic value added and export performances varies across industries with different level of labor productivity. An increase in domestic value added in industries characterized by high productivity may result in lower export performances because replacing imported intermediate inputs with inferior, domestically made inputs could reduce efficiency in the production process.

Global production network orientation ( is included in the model to examine the direct impact of GPN orientation on developmental outcome variables. Appendix 2 provides a step-by-step methodology to calculate this variable. This variable captures trade in parts and components and final assembled products. It is important to note that even though trade in parts and components is often used as a proxy for GVC participation, assembly activities play a key role in GVC activities in many developing countries in Asia (Athukorala, 2014; Gereffi, 1999). The role of final assembly in GVC participation can be observed through the experience of China (de Vries et al., 2019; Kee and Tang, 2016). The interaction term between and is included in the model to examine whether the degree of global production networks orientation affects the relationship between domestic value added and export performances. An increase in domestic value added in industries that engage more in global production networks (e.g., electronics and automobile) may hamper their cost efficiency, resulting in lower export performances.

Data

This study uses the input–output tables of Thailand covering 74 manufacturing sectors for 1990, 1995, 2000, 2005, 2010, and 2015 to calculate net-export earnings and export-led income. Table 7 in the appendix shows the definitions of each sector.

Table 7.

Definition of manufacturing sector

| Sector | Definition | Sector | Definition |

|---|---|---|---|

| 15 | Slaughtering, canning and preservation of meat | 52 | Drugs and medicines |

| 16 | Dairy products | 53 | Soap, cleaning preparations, and cosmetics |

| 17 | Canning and preservation of fruit and vegetables | 54 | Other chemical products |

| 18 | Canning and preservation of fish and other seafoods | 55 | Petroleum refineries and other petroleum products |

| 19 | Oil from coconut, palm, animal, and vegetables | 56 | Types and tubes |

| 20 | Rice milling, grinding of maize, flour and other grain milling | 57 | Plastic ware |

| 21 | Tapioca milling | 58 | Ceramic, earthen ware, and structural clay products |

| 22 | Bakery products | 59 | Glass and glass products |

| 23 | Noodles and similar products | 60 | Cement |

| 24 | Sugar | 61 | Concrete, cement products, and other non-metallic products |

| 25 | Confectionery | 62 | Iron, steel, and secondary steel products |

| 26 | Other food products | 63 | Non-ferrous metal |

| 27 | animal feed | 64 | Cutlery and hand tools |

| 28 | Distilling and spirits blending | 65 | Metal furniture and fixtures |

| 29 | Breweries | 66 | Structure metal products |

| 30 | Soft drinks and carbonated water | 67 | Engines and turbines |

| 31 | Tobacco processing and tobacco products | 68 | Agricultural machinery and equipment |

| 32 | Spinning and weaving | 69 | Wood and metal working machines |

| 34 | Made-up textile goods | 70 | Special industrial machinery |

| 35 | Knitting | 71 | Office and household machinery and electrical appliances |

| 36 | Wearing apparel | 72 | Electrical industrial machinery and appliances |

| 37 | Carpets and rugs | 73 | Radio, television and communication equipment and apparatus |

| 38 | Jute mill products | 74 | Insulated wire and cable |

| 39 | Tanneries and leather finishing | 75 | Electric accumulators and batteries |

| 40 | Leather products | 76 | Other electrical apparatus and supplies |

| 41 | Rubber products | 77 | Ship building and repairing |

| 42 | Saw mills | 78 | Railroad equipment |

| 43 | Wood and cork products | 79 | Motor vehicles |

| 44 | Wooden furniture and fixtures | 80 | Motorcycles and bicycles |

| 45 | Pulp, paper and paperboard | 82 | Aircraft |

| 46 | Paper and paperboard products | 83 | Scientific equipment |

| 47 | Printing and publishing | 84 | Photographic and optical goods |

| 48 | Basic industrial chemicals | 85 | Watches and clocks |

| 49 | Fertilizer and pesticides | 86 | Jewelry |

| 50 | Petrochemical products | 87 | Recreational and athletic equipment |

| 51 | Paints | 88 | Other manufactured goods |

Even though the use of inter-country input–output (ICIO) table is standard in the literature of global value chains, this paper exploit Thailand’s national input–output table, taken from the National Economic and Social Development Council (NESDC), because the number of manufacturing sector available in the national I-O table (74 manufacturing sectors) is higher than that in the OEDC’s ICIO table (17 manufacturing sectors). Input–output table from other sources such as the Eora Global Supply Chain Database and the World Input–Output Database (WIOD) has only 11 manufacturing sectors. The regression model shown in Eq. (14) relies on variations in domestic value added across manufacturing sectors so that greater number of manufacturing sector is preferred. Perhaps more importantly, wage, profit, and tax are lumpted together in total value added. It is therefore not possible to calculate the share of wage in total value added, a key indicator of this paper, from this database. The limitation of using a national I-O table is that the structure of an I–O table for a given country may be different, making it difficult to compare the results across countries. However, insights from a single case country (Thailand in this study) should shed lights on other developing countries undertaking an export-oriented development strategy through greater participation in global value chains.

In addition, I use the data from the UN Comtrade database, based on the Standard International Trade Classification (SITC) Revision 3, to calculate GPN orientation. SITC Revision 4 only covers the data from 2007. Data from Thailand’s labor force survey (LFS) are used to calculate labor productivity. Table 4 presents summary statistics of each variable in Eq. (14).

Table 4.

Descriptive statistics

| 1990 | 1995 | 2000 | 2005 | 2010 | 2015 | |

|---|---|---|---|---|---|---|

| Panel A: Industry characteristics | ||||||

| Domestic value added (%) | 64.385 (18.803) | 63.031 (18.923) | 61.814 (18.776) | 59.088 (18.717) | 60.226 (18.173) | 60.596 (17.543) |

| Productivity (log) | 9.558 (2.411) | 9.682 (2.230) | 9.195 (2.000) | 9.548 (1.352) | 9.962 (1.284) | 9.763 (1.120) |

| GPN orientation (%) | 0.784 (3.061) | 0.824 (2.980) | 0.909 (3.503) | 0.867 (2.953) | 0.834 (2.665) | 0.810 (2.647) |

| Panel B: Export performances | ||||||

| Net-export earnings (Million US$) | 358.649 (637.809) | 649.765 (1,128.712) | 584.324 (1,030.389) | 754.478 (1,201.056) | 1,218.284 (2,013.232) | 1,623.794 (2,295.929) |

| Export-induced income (Million US$) | 98.150 (183.271) | 166.551 (289.540) | 157.971 (257.975) | 224.573 (334.790) | 331.832 (518.672) | 396.027 (525.171) |

Simple mean and standard deviation (in parenthesis) are reported for each indicator; summary statistics are based on manufacturing sectors excluding processed foods; key export performances are converted to US$ using the exchange rate for each year

Panel A of Table 4 describes industry’s basic characteristics: value added ratio, productivity, and GPN orientation. Panel B presents summary statistics of two key export performances: net-export earnings and export-led income.

From Panel A, domestic value added ratio slightly decreased over time from 0.5815 in 1990 to 0.5486 in 2010. It implies an increasing role of imported intermediate in the production process across manufacturing sectors. There was a slight increase in value added ratio from 2005 to 2010. Moreover, labor productivity increased from 1990 to 1995, and then declined significantly after the 1997 Asian Financial Crisis. Nevertheless, it increased again after 2000. For global production network orientation, it increases rapidly between 1990 and 2000, and declined continually afterwards. This trend is largely consistent with alternative indicators used to measure GVC (see Fig. 1). It is important to note that the figure shows in Table 4 is the average of GVC orientation across 74 manufacturing sectors. There are several sectors that do not engage in GVC such as printing and publishing (sector 47) and recreational and athletic equipment (sector 87). Meanwhile, there are many sectors that engage heavily in GVC such as office and household machinery (sector 71), radio and television (sector 79), and motor vehicles (sector 79).

Panel B suggests that all key export performances indicators rose sharply from 1990 to 2010. On average, net-export earnings (addition to GDP) doubled from 253.05 million US$ in 1990 to 552.78 million US$ in 2005 and further increased to 1206.52 million US$ in 2010. Export-led income (wage and salary) also grew from 79.05 million US$ to 324.56 million US$ in 2010.

Estimation technique

To address endogeneity concern (especially an omitted variable bias and a reverse causality between developmental outcome and domestic value added), Eq. (14) is estimated by a system GMM estimator (Arellano & Bover, 1995; Blundell & Bond, 1998). This estimator uses moment conditions in which the level equation is instrumented by lagged differences in addition to the moment conditions in which the difference equation is instrumented by lagged levels. The main identifying assumption is that the estimators have a first-order serial correlation but not a second-order correlation. There should also no over-identified instrumentation. A system GMM method is appropriate for a panel dataset which has large cross-section and small period. Compared to a panel ARDL method which requires a sufficiently long period, a system GMM is more appropriate for the subject at hand. To provide some evidence of the instruments’ validity, the results of the Sargan test of overidentifying restriction and the Arellano-Bond Test for autocorrelation are reported.

Furthermore, heteroscedasticity-consistent robust standard error is used to address the concern about heteroscedasticity. Industry fixed effects capture cross-industry differences in export performances, allowing us to focus on the determinants of within-industry variations. Year dummies are included to capture the effects of aggregate (time-series) trends.

Results

I report the regression result separately for total manufacturing and manufacturing excluding processed foods. Processed foods sectors have relatively high domestic value added due to its use of domestic resources, which may bias the estimation results.

The system GMM regression results on net-export earnings are presented in Table 5. As shown in Column 1 of Table 5, the coefficient on domestic value added is positive but not statistically significant at the 5% level. The coefficient on labor productivity is also not statistically significant at the 5% level. As shown in Column 2 of Table 5, the coefficient on domestic value added remains insignificant. However, the coefficient on GPN orientation is positive and statistically significant at the 1% level. This suggests that industries with higher degree of GPN orientation experience a faster rate of growth in exports. This positive impact is slightly lower when estimating the model without processed foods (Table 5, Column 6).

Table 5.

Value added ratio and net-export earnings (the system GMM estimator)

| Total manufacturing | Manufacturing excluding processed foods | |||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| DVA | 0.0016 (0.0019) | − 0.0011 (0.0012) | 0.0326*** (0.0033) | − 0.0019* (0.0011) | 0.0006 (0.0013) | 0.0003 (0.0008) | 0.0216*** (0.0033) | 0.0002 (0.0008) |

| PROD | 0.0079 (0.0100) | − 0.0103* (0.0053) | 0.1808*** (0.0183) | − 0.0102** (0.0051) | 0.0024 (0.0075) | − 0.0093** (0.0046) | 0.1149*** (0.0159) | − 0.0077 (0.0052) |

| GPN | 0.0355*** (0.0035) | 0.0454*** (0.0044) | 0.0309*** (0.0048) | 0.0308*** (0.0029) | 0.0347*** (0.0030) | 0.0329*** (0.0044) | ||

| DVA X PROD | − 0.0032*** (0.0003) | − 0.0022*** (0.0003) | ||||||

| DVA X GPN | 0.0002 (0.0001) | − 0.0001 (0.0001) | ||||||

| L.1 NEEX | 0.7004*** (0.0317) | 0.7150*** (0.0093) | 0.7192*** (0.0116) | 0.7116*** (0.0099) | 0.7673*** (0.0271) | 0.7949*** (0.0111) | 0.7961*** (0.0112) | 0.7944*** (0.0110) |

| Constant | 6.1188*** (0.5833) | 6.1336*** (0.1721) | 4.0477*** (0.2526) | 6.2458*** (0.2038) | 4.8551*** (0.5031) | 4.4177*** (0.2194) | 3.4793*** (0.2867) | 4.4179*** (0.2224) |

| Observations | 370 | 370 | 370 | 370 | 285 | 285 | 285 | 285 |

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Arellano-bond test for AR(1) | − 2.2526 (0.0243) | − 2.3623 (0.0182) | − 2.3453 (0.0190) | − 2.3719 (0.0177) | − 2.1208 (0.0339) | − 2.1959 (0.0281) | − 2.2050 (0.0275) | − 2.2022 (0.0277) |

| Arellano-bond test for AR(2) | 1.2556 (0.2093) | 1.2345 (0.2170) | 1.1190 (0.2631) | 1.2437 (0.2136) | 1.0903 (0.2756) | 1.0959 (0.2731) | 1.0168 (0.0275) | 1.0969 (0.2727) |

| Sargan test of overidentifying restrictions | 43.6935 (0.3982) | 56.6024 (0.4150) | 54.6006 (0.4516) | 55.5658 (0.4533) | 43.8013 (0.3535) | 47.7605 (0.7450) | 51.4252 (0.6120) | 47.9645 (0.7381) |

Standard errors are reported in parentheses; ***, **, * indicate significance level at 1, 5, and 10%, respectively; internal instruments (lags of dependent variables) are used as instruments to resolve an endogeneity issue in panel settings; Chi-squared statistics are reported in the Sargan test of overidentifying restrictions; z-statistics in Arellano-Bond Test for AR(1) and AR(2), respectively

As shown in Column 3 of Table 5, the coefficient on the interaction term between domestic value added and productivity is negative and statistically significant at the 1% level. This indicates that domestic value added has a positive effect on export performance in low-productivity industries. The implication is that emphasis on domestic value added may not be an appropriate policy guidance if a country seeks to boost export performance and foster economic growth through high-productivity industries. The coefficient on this interaction term is smaller when excluding processed foods (Column 7 of Table 5). In addition, the coefficient on the interaction term between domestic value added and GPN orientation is not statistically significant (Columns 4 and 8 of Table 5). This indicates that the relationship between domestic value added and export performance is not conditioned by GPN orientation.

Table 6 provides the system GMM regression results on export-led income. The results are largely consistent with those reported in Table 5—that is, domestic value added has no significant impact on export-led income. As shown in Columns 3 and 7 of Table 6, there is also evidence that domestic value added has positive impact on export-led income among industries characterized by low productivity. The coefficient on GPN orientation is positive and statistically significant at the 1% level (Columns 2 and 3 of Table 6). Similar to Table 5, the coefficient on the interaction term between domestic value added and GPN orientation is not statistically significant (Columns 4 and 8 of Table 6).

Table 6.

Value added ratio and export-led income (the system GMM estimator)

| Total manufacturing | Manufacturing excluding processed foods | |||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| DVA | 0.0011 (0.0023) | − 0.0021* (0.0012) | 0.0351*** (0.0030) | − 0.0019** (0.0007) | − 0.0002 (0.0014) | − 0.0006 (0.0007) | 0.0171*** (0.0030) | 0.0003 (0.0010) |

| PROD | 0.0166* (0.0099) | 0.0019 (0.0059) | 0.2197*** (0.0184) | 0.0017 (0.0054) | 0.0126* (0.0071) | 0.0089 (0.0062) | 0.1149*** (0.0137) | 0.0065 (0.0059) |

| GPN | 0.0447*** (0.0037) | 0.0505*** (0.0034) | 0.0484*** (0.0049) | 0.0436*** (0.0022) | 0.0453*** (0.0026) | 0.0481*** (0.0059) | ||

| DVA X PROD | − 0.0036*** (0.0003) | − 0.0018*** (0.0003) | ||||||

| DVA X GPN | − 0.0002 (0.0001) | − 0.0002 (0.0001) | ||||||

| L.1 EXIN | 0.6459*** (0.0295) | 0.6451*** (0.0119) | 0.6542*** (0.0127) | 0.6444*** (0.0120) | 0.6999*** (0.0235) | 0.7093*** (0.0111) | 0.7192*** (0.0116) | 0.7003*** (0.0122) |

| Constant | 6.5448*** (0.4681) | 6.8457*** (0.1991) | 4.4256*** (0.2428) | 6.8496*** (0.1975) | 5.6647*** (0.4006) | 5.4435*** (0.2198) | 4.4629*** (0.2336) | 5.5850*** (0.2356) |

| Observations | 370 | 370 | 370 | 370 | 285 | 285 | 285 | 285 |

| Year dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry dummies | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Arellano-bond test for AR(1) | − 2.3958 (0.0166) | − 2.4574 (0.0140) | − 2.4661 (0.0137) | − 2.4471 (0.0144) | − 2.2405 (0.0251) | − 2.3101 (0.0209) | − 2.3217 (0.0202) | − 2.2935 (0.0218) |

| Arellano-bond test for AR(2) | 1.5084 (0.1315) | 1.4327 (0.1520) | 1.3288 (0.1839) | 1.4438 (0.1488) | 1.3002 (0.1935) | 1.2822 (0.1998) | 1.2438 (0.2136) | 1.2730 (0.2030) |

| Sargan test of overidentifying restrictions | 42.8909 (0.3901) | 54.3313 (0.5001) | 54.7172 (0.4854) | 54.2155 (0.5046) | 44.1069 (0.3416) | 51.5996 (0.6053) | 49.9911 (0.6660) | 52.0829 (0.5868) |

Standard errors are reported in parentheses; ***, **, * indicate significance level at 1, 5, and 10%, respectively; internal instruments (lags of dependent variables) are used as instruments to resolve an endogeneity issue in panel settings; Chi-squared statistics are reported in the Sargan test of overidentifying restrictions; z-statistics in Arellano-Bond Test for AR(1) and AR(2), respectively

In the post estimation tests of the system GMM estimator shown at the bottom of Tables 5 and 6, it is found that there are AR(1) errors but not AR(2) errors in all model specifications. In addition, the Sargan test of over-identification restriction suggests that there is no over-identified instrumentation.

In summary, the results from the system GMM regression analysis suggest that industries with higher domestic value added do not perform significantly better in terms of export performances (measured by net-export earnings and export-led income) than other industries. However, there exists an evidence that domestic value added could have positive effect on export performances in low-productivity industries.

Conclusion

This paper has examined the relationship between domestic value added and two key export performance indicators (net-export earnings and export-led income) using input–output tables for Thailand covering 74 manufacturing sectors for six periods.

The results cast doubt on the validity of a policy emphasis on the domestic value added that is currently adopted across several developing countries including Thailand. Empirical evidence from a system GMM estimator suggests that there is no statistically significant relationship between domestic value added and net-export earnings and export-led income. There is a positive effect of domestic value added on two indicators of export performances in industries characterized by low productivity. The relationship between domestic value added and net-export earnings and export-led income does not vary across industries with different level of engagement in global production network. In addition, greater participation in global production network results in better export performances. The policy implication of the results is that, in a context where a country participates into the world economy through global production sharing, national industry policy should not be guided by an emphasis on domestic value added.

The findings from this study are also relevant to the current policy emphasis in trade and development policy debate. The COVID-19 pandemic has disrupted global value chains, spawning an emphasis on reshoring of production and greater self-sufficiency. However, a decrease in participation in global value chains is found, in this paper, to have some negative impacts on equity (measured by the share of wage to profit). A recent paper by Brenton et al. (2022) also find that reshoring may hurt trading nations and increase poverty incidence. Greater integration into GVCs could be recommended as a policy instrument for strengthening the recovery from the ongoing health and economic crisis.

Acknowledgements

The author is grateful to Professor Prema-chandra Athukorala for helpful comments. He is also indebted to two anonymous reviewers and the editor for constructive comments and suggestions. This paper also benefits from participants in several conferences at the Australian National University, National Taiwan University, and the Royal Melbourne Institute of Technology.

Appendix 1

See Table 7.

Appendix 2: GPN orientation

GPN orientation captures the degree of GPN participation of a given industry. GPN trade of a given industry is expressed as a percentage of total export of that industry. GPN trade encompasses trade in parts and components and final assembly. The standard (customs-records based) trade data are lineated into two components: parts and components and final assembled goods exchanged within production networks.

Following Athukorala (2014), here is the step-by-step calculation of GPN orientation variable used in the paper.

Step 1: Download manufacturing export data from the UN Comtrade database at SITC five-digit level. Products belonging to SITC Section 5 to 8 net of SITC 68 (non-ferrous metals) are classified as manufactured goods.

Step 2: Within manufactured goods, trade in parts and components are delineated using a list compiled by mapping parts and components in the UN Broad Economic Classification (BEC) with the SITC list at five-digit level of commodity disaggregation. The list of these parts and components are available on request.

Step 3: Calculate the share of trade in parts and components of a given industry in total exports of these product categories. Product categories are based on 2-digit level of commodity.

Step 4: Calculate the share of trade in final assembled goods of a given industry in total exports of that industry. It is approximately estimated as the difference between parts and components (from Step 3) and total export of these product categories. Product categories involved in final assembly are based on Athukorala (2014) which are office machines and automatic data processing machines (SITC 75), telecommunication and sound recording equipment (SITC 76), electrical machinery (SITC 77), road vehicles (SITC 78), other transport equipment (SITC 79), travel goods (SITC 83), clothing and clothing accessories (SITC 84), professional and scientific equipment (SITC 87), photographic apparatus (SITC 88), and toys and sport goods (SITC 894).

Step 5: Combine Step 3 with Step 4. GPN trade is a combination of trade in parts and components and trade in final assembled goods.

Step 6: Match GPN trade data at SITC 2-digit level with Thailand’s I-O table (74 manufacturing sector) using a correspondence table provided by the NESDC.

Data availability

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request.

Declarations

Conflict of interest

I would like to declare that I have no conflicts of interest.

Footnotes

From 1961 to 1671, there were several measures aimed to help domestic industries, for instance, industrial controls through regulations, import and export controls, and credit assistance (Akrasanee, 1980).

In 2014, Deputy Prime Minister Somkid Jatusripitak said that ‘Our economy has relied on industries providing low value-added, cheap goods. Thailand is determined to develop the next generation industry’ (Suruga, 2017). In the same year, a senior Board of Investment (BOI) Ajarin Pattanapanchai also said that ‘If the country has targeted a shift from middle income to higher income, we have to focus more on value-added industries and build up the competitiveness of our industries’ (Janssen, 2014).

Basically, there are two tasks within production networks: parts and components and final assembly. Data on network trade are used to measure GPN trade, following the publication of Yeats (2001). Detailed explanation about data compilation are shown in the methodology part of this paper.

Share of network products in total manufacturing exports fell in 2011 due to production disruption caused by flood. Exports of parts and components decreased by US$3,000 million.

Chip maker ON semiconductor decided to cease production at its Sanyo Semiconductor division as it could not restore the facility. About 1,600 workers were laid off (Reuters, 2011).

Automotive industry had a fast recovery from the 2011 flood, partly due to an initiative of the government of Prime Minister Yingluck Shinnawatra (2011–2014) to offer tax rebates for the first-time car buyers. It stimulated domestic demand by more than a million units (Warr and Kohpaiboon, 2018).

See Borin, Manchini, and Taglioni (2021) for the methodology of decomposing GVC-related trade participation.

Backward linkage shows the full impacts of an exogenous increase in final demand on all sectors. It can be interpreted through a chain of interactions. If the final demand in a given sector increases, it raises the demand for intermediate input from that sector itself and from other sectors. This leads to nth rounds of effects.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

References

- Akrasanee N. Trade strategy for employment growth in Thailand. In: Krueger AO, Lary HB, Monson T, Akrasanee N, editors. Trade and Employment in Developing Countries Volumn 1: Individual Studies. University of Chicago Press; 1980. pp. 393–434. [Google Scholar]

- Altomonte, C., Bonacorsi, L., & Colantobe, I. (2018). Trade and growth in the age of global value chains. BAFFI CAREFIN Working Papers No. 1897.

- Amiti M, Konings J. Trade liberalization, intermediate inputs, and productivity: Evidence from Indonesia. American Economic Review. 2007;97(5):1611–1638. doi: 10.1257/aer.97.5.1611. [DOI] [Google Scholar]

- Antràs P. Global Production: Firms, Contracts, and Trade Structure. Princeton University Press; 2016. [Google Scholar]

- Antràs P, Chor D. Global value chains. In: Gopinath G, Helpman E, Rogoff K, editors. Handbook of International Economics. Elsevier; 2022. pp. 297–376. [Google Scholar]

- Arellano M, Bover O. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics. 1995;68:29–51. doi: 10.1016/0304-4076(94)01642-D. [DOI] [Google Scholar]

- Athukorala P. Global production sharing and trade patterns in East Asia. In: Kaur I, Singh N, editors. The Oxford Handbook of the Economics of the Pacific Rim. Oxford University Press; 2014. pp. 333–361. [Google Scholar]

- Athukorala P, Kohpaiboon A. Global production sharing, trade patterns, and industrialization in Southeast Asia. In: Coxhead I, editor. Routledge Handbook of Southeast Asian Economics. Routledge Taylor and Francis Group; 2014. pp. 131–161. [Google Scholar]

- Baldwin RE. The Great Convergence. Information Technology and the New Globalisation. Harvard University Press; 2016. [Google Scholar]

- Beverelli C, Stolzenburg V, Koopman R, Neumueller S. Domestic value chains as stepping stones to global value chain integration. World Economy. 2019;42(5):1467–1494. doi: 10.1111/twec.12779. [DOI] [Google Scholar]

- Blundell R, Bond S. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics. 1998;87:115–143. doi: 10.1016/S0304-4076(98)00009-8. [DOI] [Google Scholar]

- Board of Investment (2017), A Guide to Investment in the Special Economic Development Zones. Retrieved from https://www.boi.go.th/upload/content/BOI-book%202015_20150818_95385.pdf.

- Borin, A., & Mancini, M. (2019). Measuring what matters in global value chains and value-added trade. Policy Research Working Paper No. 8804. Washington, DC: World Bank.

- Borin, A., Mancini, M., & Taglioni, D. (2021). Measuring exposure to risk in global value chains. Policy Research Working Paper No. 9785. Washington, DC: World Bank.

- Brenton, P., Ferrantino, M. J., & Maliszewska, M. (2022). Reshaping global value chains in light of COVID-19: Implications for trade and poverty reduction in developing countries. Washington, DC: World Bank. Retrieved from https://openknowledge.worldbank.org/handle/10986/37032.

- Constantinesucu C, Matto A, Ruta M. Does vertical specialization increase productivity. World Economy. 2019;42:2385–2402. doi: 10.1111/twec.12801. [DOI] [Google Scholar]

- De Vries G, Chen Q, Hasan R, Li Z. Do Asian countries upgrade in global value chains? A novel approach and empirical evidence. Asian Economic Journal. 2019;33(1):13–37. doi: 10.1111/asej.12166. [DOI] [Google Scholar]

- Dollar, D., Khan, B., & Pei, J. (2019). Should high domestic value added in exports be an objective of policy? In: Global Value Chain Development Report 2019: Technological Innovation, Supply Chain Trade, and Workers in a Globalized World (English), pp. 141–153. Washington, D. C.: World Bank Group.

- Eora. (2022). The Eora Global Supply Chain Database. Retrieved from https://worldmrio.com/.

- Feenstra RC. Offshoring in the Global Economy: Microeconomic Structure and Macroeconomic Implications. MIT Press; 2009. [Google Scholar]

- Flamm K. Internationalization in the semiconductor industry. In: Grundwald J, Flamm K, editors. The Global Factory: Foreign Assembly in International Trade. Brookings Institution; 1985. pp. 38–136. [Google Scholar]

- Gereffi G. International trade and industrial upgrading in the apparel commodity chain. Journal of International Economics. 1999;48:37–70. doi: 10.1016/S0022-1996(98)00075-0. [DOI] [Google Scholar]

- Gentile, E., Xing, Y., Rubinova, S., & Huang, S. (2021). Productivity growth, innovation, and upgrading along global value chains. In: Global Value Chain Development Report: Beyond Production, pp. 72–104. Geneva: World Trade Organization.

- Goldberg P, Khandelwal AK, Pavcnik N, Topalova P. Imported intermediate inputs and domestic product growth: Evidence from India. Quarterly Journal of Economics. 2010;125(4):1727–1767. doi: 10.1162/qjec.2010.125.4.1727. [DOI] [Google Scholar]

- Helpman E. Understanding Global Trade. Harvard University Press; 2011. [Google Scholar]

- Hill H, Suphachalasai S. The myth of export pessimism (even) under the MFA: Evidence from Indonesia and Thailand. Weltwirtschaftliches Archive. 1992;128:310–329. doi: 10.1007/BF02707549. [DOI] [Google Scholar]

- Janssen, P. (2014). Junta sends clear message: More foreign investment a must. Retrieved from https://asia.nikkei.com/Economy/Junta-sends-clear-message-More-foreign-investment-a-must.

- Jitsuchon, S., & Sussangkarn, C. (2009). Thailand’s Growth Rebalancing. ADBI Working Paper Series No. 154. Tokyo: Asian Development Bank Institution. Retrieved from https://www.adb.org/sites/default/files/publication/156009/adbi-wp154.pdf.

- Johnson RC. Measuring global value chains. Annual Review of Economics. 2018;10:207–236. doi: 10.1146/annurev-economics-080217-053600. [DOI] [Google Scholar]

- Kee HL, Tang H. Domestic value added in exports: Theory and firm evidence from China. American Economic Review. 2016;106(6):1402–1436. doi: 10.1257/aer.20131687. [DOI] [Google Scholar]

- Kugler M, Verhoogen E. Prices, plant size, and product quality. Review of Economic Studies. 2012;79(1):307–339. doi: 10.1093/restud/rdr021. [DOI] [Google Scholar]

- Kummritz, V., Tanglioni, D., & Winkler, D. (2017). Economic upgrading through global value chain participation: Which policies increase the value added gains? Policy Research Working Paper No. 8007. Washington DC: World Bank.

- Kuroiwa, I., & Techakanont, K. (2017), Formation of Automotive Manufacturing Clusters in Thailand. ERIA Discussion Paper Series No.32. Jakarta: Economic Research Institute for ASEAN and East Asia. Retrieved from http://www.eria.org/ERIA-DP-2016-32.pdf.

- National Economic and Social Development Council. (2022), Thailand Input-Output Tables. Retrieved from http://www.nesdc.go.th.

- OECD (2019), Trade in Value Added (TiVA). Retrieved from https://www.oecd.org/sti/ind/measuring-trade-in-value-added.htm.

- Pahl S, Timmer M. Patterns of vertical specialization in trade: Long-run evidence for 91 countries. Review of World Economics. 2019;155(3):459–486. doi: 10.1007/s10290-019-00352-3. [DOI] [Google Scholar]

- Pane, D. D., & Patunru, A. (2022). The role of imported inputs in firms’ productivity and exports: Evidence from Indonesia. Review of World Economics.

- Reuters (2011), ON Semiconductor ceases some Thai operations after flood. Retrieved from https://www.reuters.com/article/onsemiconductor-thailand-flood/on-semiconductor-ceases-some-thai-operations-after-flood-idUSL3E7N92K520111209.

- Suruga, T. (2017), Thai ministers seek tech, investments from Japan. Retrieved from https://asia.nikkei.com/Politics/International-relations/Thai-ministers-seek-tech-investments-from-Japan.

- Tambunlertchai S. Manufacturing. In: Warr PG, editor. The Thai Economy in Transition. Cambridge University Press; 1993. pp. 118–150. [Google Scholar]

- Tian K, Dietzenbacher E, Jong-A-Pin R. Global value chain participation and its impact on industrial upgrading. World Economy. 2022;45(5):1362–1385. doi: 10.1111/twec.13209. [DOI] [Google Scholar]

- Urata S, Baek Y. Does participation in global value chains increase productivity? An analysis of trade in value added data. Thailand and the World Economy. 2020;38(1):1–28. [Google Scholar]

- Veeramani, C., & Dhir, G. (2022). Do developing countries gain by participating in global value chains? Evidence from India. Review of World Economics.

- Wad P. The automobile industry of Southeast Asia: Malaysia and Thailand. Journal of the Asia Pacific Economy. 2009;14(2):172–193. doi: 10.1080/13547860902786029. [DOI] [Google Scholar]

- Warr PG. The Thai economy. In: Warr P, editor. The Thai Economy in Transition. Cambridge University Press; 1993. pp. 118–150. [Google Scholar]

- Warr PG. Trade policy and the structure of incentives in Thai agriculture. ASEAN Economic Bulletin. 2008;25(3):249–270. doi: 10.1355/AE25-3A. [DOI] [Google Scholar]

- Warr PG, Kohpaiboon A. Explaining Thailand’s automotive manufacturing success. Journal of Southeast Asian Economies. 2018;35(3):425–448. doi: 10.1355/ae35-3g. [DOI] [Google Scholar]

- World Bank . World Development Report 1987. Oxford University Press; 1987. [Google Scholar]

- World Bank . Trading for development in the age of global value chains. World Bank; 2020. [Google Scholar]

- World Bank. (2022), World Development Indicator. Retrieved from https://databank.worldbank.org.

- Yanikkaya H, Altun A. The impact of global value chain participation on sectoral growth and productivity. Sustainability. 2020;12(12):1–18. doi: 10.3390/su12124848. [DOI] [Google Scholar]

- Yeats A. Just how big is global production sharing? In: Arndt S, Kierzkowski H, editors. Fragmentation: New Production Patterns in the World Economy. Oxford University Press; 2001. pp. 108–143. [Google Scholar]

- Yu C, Luo Z. What are China’s real gains within global value chains? Measuring domestic value added in China’s exports of manufactures. China Economic Review. 2018;47:263–273. doi: 10.1016/j.chieco.2017.08.010. [DOI] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Data Availability Statement

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request.