Significance

To address the climate crisis, many experts urge governments to make fossil fuels more expensive for consumers. We investigate the role of political leaders in raising taxes on, and reducing subsidies for, gasoline. We find that, in most cases, leaders appear to have no effect. Moreover, in countries where they seem to have an impact, most of the subsidy reforms they adopted were reversed within a year, and the vast majority were reversed within 5 y. Our evidence suggests that reforming fossil fuel taxes and subsidies—and making these reforms stick—is exceptionally difficult. Political leaders might have more success promoting other, less politically sensitive decarbonization policies, such as subsidizing renewable energy and making it more widely available.

Keywords: climate change, fossil fuel subsidies, carbon pricing, leadership, political economy

Abstract

For countries to rapidly decarbonize, they need strong leadership, according to both academic studies and popular accounts. But leadership is difficult to measure, and its importance is unclear. We use original data to investigate the role of presidents, prime ministers, and monarchs in 155 countries from 1990 to 2015 in changing their countries’ gasoline taxes and subsidies. Our findings suggest that the impact of leaders on fossil fuel taxes and subsidies is surprisingly limited and often ephemeral. This holds true regardless of the leader’s age, gender, education, or political ideology. Rulers who govern during an economic crisis perform no better or worse than other rulers. Even presidents and prime ministers who were recognized by the United Nations for environmental leadership had no more success than other leaders in reducing subsidies or raising fuel taxes. Where leaders appear to play an important role—primarily in countries with large subsidies—their reforms often failed, with subsidies returning to prereform levels within the first 12 mo 62% of the time, and within 5 y 87% of the time. Our findings suggest that leaders of all types find it exceptionally hard to raise the cost of fossil fuels for consumers. To promote deep decarbonization, leaders are likely to have more success with other types of policies, such as reducing the costs and increasing the availability of renewable energy.

Effective climate policies require strong leadership, according to both academic studies and popular accounts (1–6). Yet ambitious declarations are often followed by tepid reforms, and even these are sometimes reversed by subsequent governments. The impact of leadership is difficult to measure, and social scientists are divided about its role. Traditionally, scholars of political economy have downplayed the role of leadership and focused on interest groups (7, 8), social movements (9–11), and political institutions (12, 13). Some recent studies, however, report that leadership has important effects in certain issue areas (14–20). There have been several studies of leadership on climate issues, although they focus on leadership in global diplomacy rather than domestic policy making (2, 21, 22).

If climate leadership matters, it could be especially important for politically sensitive issues like carbon pricing. Governments can reduce carbon pollution by removing fossil fuel subsidies and using taxes to raise the cost of consumption, but higher prices are often unpopular and difficult to sustain (23–25). Despite the endorsement of the G20 heads of government, the Intergovernmental Panel on Climate Change, the International Monetary Fund (IMF), and many other organizations, progress toward subsidy reform has been slow and erratic (26, 27). As a result, carbon taxes in most jurisdictions remain low, while fossil fuel subsidies in many countries remain high, costing governments between $400 billion and $5.2 trillion annually (28–30).

We analyze the relationship between the tenures of presidents, prime ministers, and monarchs on the one hand and their countries’ gasoline taxes and subsidies on the other, using original tax and subsidy data at the monthly level for 155 countries between 1990 and 2015. Our main approach is permutation inference, which we use to evaluate whether political leadership helps explain variations in gasoline taxes and subsidies within countries over time. We supplement this with ordinary least-squares (OLS) estimations with country fixed effects (CFE) and leader fixed effects (LFE) and time trends, as well as directly examining the change in prices in different subgroups of countries.

Gasoline taxes and subsidies are a uniquely valuable measure of climate mitigation policies, especially when making comparisons across countries and over time. Most types of mitigation policies are highly country specific: Reforms that are critical in one country might be meaningless in another; even within a single country, reforms that matter at one point might lose salience over time (31). But all countries sell gasoline, and all governments tax or subsidize it. Changes in these taxes and subsidies can reveal the degree to which governments are encouraging or discouraging gasoline consumption. Since gasoline is sold in retail markets, taxes and subsidies on gasoline are easier to measure than taxes and subsidies on other fossil fuels like coal and fossil gas. In 2020, petroleum accounted for 54% of all fossil fuel subsidies (32).

Prior research suggests that gasoline taxes and subsidies are largely driven by long-term changes in economic development and fossil fuel wealth; the role of political factors is highly contingent and linked to shifting opportunities and constraints (33–36). Here we investigate the role of political leadership in navigating these opportunities and constraints, looking at both the full set of countries and important subgroups.

Our analysis yields four broad findings. First, in most categories of countries, leadership has no observable relationship with gasoline taxes and subsidies. We interpret this as evidence that leaders do not substantially affect these taxes and subsidies. There are two apparent exceptions: countries with presidential political systems and countries that have maintained large fuel subsidies over long periods of time. In these two subgroups, either individual leaders are affecting taxes and subsidies or unobserved confounders make it appear this way. We consider the latter explanation implausible, which leads us to conclude that leaders are only affecting gas taxes and subsidies in these subgroups.

Second, we find no observable characteristics that explain why different leaders adopt different policies. Characteristics that are usually associated with support for more aggressive climate policies—age, gender, education, and political affiliation—do not account for differences in the records of leaders. Even presidents and prime ministers who are recognized by the United Nations for their environmental leadership perform no differently than their peers.

Third, times of economic crisis correspond to larger changes in net taxes, but in both directions, resulting in greater variance in reforms during periods of crisis than noncrisis. Thus, even if leaders are able to use crises as opportunities to change taxes and subsidies, such reforms are about equally likely to lead to reductions and increases in net taxes.

Finally, in the subgroups of countries where leadership tenures are most strongly associated with pricing—countries with large and persistent subsidies—most reforms are surprisingly ephemeral. On average, leaders in these countries adopted significant reforms about once every 43 mo. Most of the reforms, however, were soon reversed by political protests, fluctuating exchange rates, inflation, and changes in global oil prices. After 12 mo, 62% of these reforms had been reversed; after 5 y, 87% were reversed.

We interpret these findings as evidence that, in most countries, leaders have had little effect on gasoline taxes and subsidies. In countries where there is evidence they had an impact, reforms are usually ephemeral. We argue that this shows how profoundly difficult it is for leaders of all types to enact durable reforms of fossil fuel taxes and subsidies.

Our findings have implications for the study of political leadership, especially on climate issues. Scholars and advocates are divided over the merits of carbon pricing, a category of policies that includes increased taxes on fossil fuels, the removal of fossil fuel subsidies, and cap and trade systems. Some argue that carbon pricing is a “first best” approach and should be an essential component of climate policies (37, 38). Critics argue that carbon pricing is unpopular and hence politically unsustainable, and there is only weak evidence of its effectiveness (24, 39). Our findings suggest it is profoundly difficult for leaders of all types to adopt policies that raise the cost of gasoline—and perhaps other fossil fuels—for consumers. Leaders who favor deep decarbonization should employ other policy tools that are less unpopular and harder to reverse (36), such as subsidies for renewable energy, renewable energy portfolio standards, and investments in public transportation.

Leadership and Carbon Price Reforms

Earlier research suggests that gasoline taxes and subsidies are closely associated with slow-moving economic factors, principally, income per capita and fossil fuel wealth. The role of politics has been less clear. Once a country’s economic attributes are accounted for, there is no consistent link between gasoline taxes and subsidies, on the one hand, and political factors like government effectiveness or democratic institutions, on the other. Instead, most of the intertemporal variation in gas taxes and subsidies at the country level is associated with unobserved time-varying factors (36). These results are consistent with case study–based evidence that highlights the importance of idiosyncratic opportunities and fleeting local conditions (23, 33–35).

Among these local conditions, case studies often highlight the commitments and strategies of political leaders. In many countries, the head of government has considerable authority over gasoline taxes and subsidies (40). Yet it is not clear when and how a chief executive’s leadership matters. All kinds of carbon pricing—including carbon taxes, cap-and-trade programs, and fossil fuel subsidy reform—are politically challenging to implement, since they ask citizens to incur highly visible near-term costs in exchange for the promise of more-opaque long-term benefits (24, 41). Efforts to make carbon pricing more popular by distributing rebates have had, at best, a limited impact (39). Voters are also highly sensitive to changes in energy prices, especially for gasoline, which must be purchased regularly and whose price is closely followed by consumers (35, 42). Between 2006 and 2019, attempts to reduce gasoline subsidies or raise gasoline taxes were followed by protests in at least 24 countries (36, 43).

In theory, skillful leaders can facilitate carbon price reforms by strategically framing the public debate, exploiting windows of opportunity, designing policies that provide targeted benefits to vulnerable populations, and adopting communications strategies that clarify the costs of the status quo and the benefits of reform (44). Yet we have little evidence for the effectiveness of these approaches. Almost all prior research has been based on small samples of case studies with limited time frames. This makes it difficult to determine the effectiveness of leadership on carbon pricing in general, and why some leaders appear to be more successful than others.

Materials and Methods

Data.

Our analysis is based on original data on monthly gasoline taxes and subsidies in 155 countries from January 1990 to June 2015. Our data cover all sovereign states with populations greater than 1 million in 2012, except for four countries that lacked reliable data: Cuba, Eritrea, North Korea, and Turkmenistan (SI Appendix, Table S10).

We draw on a wide range of primary sources, including documents from government ministries, central banks, statistical agencies, regulatory bodies, state-owned oil companies, and official government decrees. In 17 countries, we employed local researchers to gather primary data that were not otherwise available. Our secondary sources include archives maintained by the European Commission, the International Road Transport Union, the Food and Agriculture Organization, CITAC Africa, the Organization of Arab Petroleum Exporting Countries, the IMF, and the World Bank. Whenever possible, we cross-validated our data using multiple sources.

We calculate the net size of taxes and subsidies at the monthly level using the price gap method, estimating the difference between the observed retail price and an inferred supply cost (45). This reveals a country’s net implicit tax, which can be either positive (when the retail gasoline price is above the supply cost, indicating a net tax) or negative (when the price is below the supply cost, indicating a net subsidy). It indicates the aggregate effect of all measures taken by governments—including all direct and indirect taxes, subsidies, tariffs, nontariff barriers, and regulations along the supply chain—that ultimately affect consumer prices.

Our data on political leadership—including presidents, prime ministers, and monarchs—are drawn from Goemans et al. (46), Scartascini et al. (47), and Baturo (48). We treat all consecutive months that a leader remains in office as a single “leader tenure” observation, even if it covers multiple terms. When a leader leaves office and later returns, we count it as a separate leader tenure observation. We drop tenures that lasted fewer than 6 mo in our data, whether it is due to the brevity of a leader’s tenure or left or right censoring. We also restrict our sample to countries with more than one political leader during the period of analysis. Our effective sample consists of 603 leaders who served a total of 653 tenures in office, lasting an average of 96 mo.

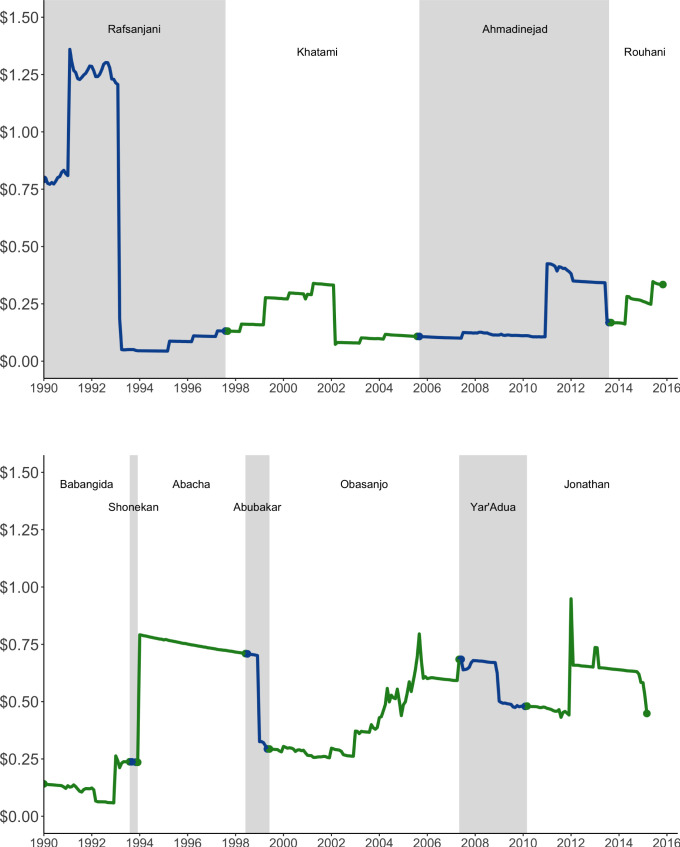

In many countries, our fine-grained data reveal sharp changes in the net implicit tax over time, both within and across the terms of successive leaders (Fig. 1). Among all countries over the 1990–2015 period, the average leader saw the real value of the net implicit tax decrease by 0.0028 US dollars per liter during their tenure, with an SD of 0.38 US dollars. The value is similar in each of the subgroups we examine—democracies and autocracies, presidential and parliamentary democracies, oil exporters and importers, and persistent taxers and persistent subsidizers—although the shape of the distribution differs slightly across the subgroups (SI Appendix, Figs. S1–S4).

Fig. 1.

Gasoline prices in real USD per liter in Iran (Top) and Nigeria (Bottom), 1990–2015. Price lines are shaded and colored to distinguish different leader tenures in each country.

Analyses.

We use four strategies to evaluate the relationship between political leadership and net implicit gas taxes. First, we ask whether accounting for the tenures of all country leaders helps explain variation in net implicit fuel taxes within countries over time. As a reference point, we start with a simple model in which each country has its own intercept and linear time trend, called the CFE model, to see how much of the variation in net implicit taxes can be explained (the R2) by this alone. We then construct the model of primary interest, an LFE model, in which the period of tenure for each leader (president, prime minister, or other national ruler) is given both its own intercept shift and its own linear time trend.

The inferential question is whether changes in net implicit fuel prices are explained by these LFEs above and beyond what is expected by chance. A conventional approach to significance testing would examine whether the increase in variance explained by the LFEs is more than expected by chance from a null model in which they have no true explanatory power, given the number of degrees of freedom used (i.e., an F test for the exclusion of all LFE compared to a model with only CFE). However, such a test faces several statistical challenges in this setting. First, the number of added covariates (two per leader tenure) is very large, raising concerns as to whether the requirements to use an asymptotic test such as the F test have been met and whether such an approach is sufficiently conservative in the face of potential overfitting. Second, we expect a great deal of clustering and autocorrelation in these residuals, that is, nonindependence of outcomes within country and within tenure.*

Instead, we appeal to a permutation-based approach, creating a distribution of R2 values for models in which we have permuted the underlying order of leader tenures within each country. Each permutation generates a sequence of tenures that have the same distribution of length, by country, but come in the incorrect order. Repeating this exercise 1,000 times, we obtain a distribution of R2 values under the null hypothesis that actual timing and ordering of leader tenures has no special explanatory power. We can compare the R2 from the model with the “correct” leader tenures to this distribution of R2 under the null. The proportion of permuted models with R2 values higher than the actual model is the P value. Such permutation-based inferential strategies have a long history in statistics [e.g., Fisher’s exact test (49)], and have increasingly been taught in place of or prior to conventional inference (see, e.g., ref. 50). Further, ref. 17 has used this approach—combining fixed effects with permutation-based inference—to examine the effects of leadership in various contexts, which they name “randomization inference for leader effects.” We refer readers there for additional discussion of the history, advantages, and limitations of such strategies.†

To summarize the logic of this approach differently, if one can model the outcome just as well when using incorrect dates for leadership transitions as when using correct dates for transitions, we would conclude that there is no evidence that leadership matters. Permuting the sequence of actual leaders and extracting the resulting dates for tenure transitions is the ideal tool for generating false tenure-transition dates, because it preserves the exact distribution of tenure lengths and the number of tenures, in each country.

Note that this approach is sensitive to leadership that generates departures from a stable trend in each country. In a country where fuel taxes have maintained a steady rate of change (or remained static) across different leader tenures, the permuted leader tenures will be able to explain a similar amount of change in taxes as the actual leader tenures, and we would conclude that the true order of leaders mattered little. By contrast, in countries with uneven prices and histories of reform, finding that the true timing and sequence of leader tenures explains more variation than permuted versions would offer evidence that the actual sequence of leaders mattered. This makes our approach sensitive to the types of leadership effects that arguably matter most, considering the need for path-breaking reform. The approach also depends on having leader tenures of varying length. For further analysis regarding the alternatives to which this type of approach is sensitive, we refer readers to ref. 17.

After analyzing the full set of countries in our sample, we repeat this exercise separately for eight subgroups of countries where the roles of leaders might systematically differ: autocracies and democracies, parliamentary democracies and presidential democracies, oil importers and oil exporters, and countries that generally tax gasoline and countries that generally subsidize it. We describe the 19 countries in the latter group as “persistent subsidizers” and scrutinize them more carefully below.‡ For additional description, we also estimate OLS models that include a series of time-varying covariates that prior research suggests are important confounders: income per capita, income growth, government debt, fossil fuel dependence, and value-added tax rates (36).

Second, we evaluate whether a country’s net implicit tax varies according to a leader’s gender, age, college education, or political ideology. There are good reasons why these traits should matter: According to global public opinion research, women, younger people, people with more education, and people who hold left-of-center political views tend to express greater concern about climate change (51, 52). If leaders with these same traits also care more about climate change, they might give greater priority to carbon pricing. We begin by comparing the distribution of changes in the monthly net implicit tax under leaders with different age, gender, education, and ideological traits using kernel density plots. We then add variables representing these traits to the same OLS model we employ above.

We also ask whether the nine presidents and prime ministers in our dataset who were recognized by the United Nations Environment Programme (UNEP) between 2010 and 2017 as “Champions of the Earth”—the United Nations’ highest environmental award—had different records than other leaders. If strongly proenvironment leaders made greater progress in trimming gasoline subsidies and increasing gasoline taxes, we should observe this difference in the mean monthly change in net implicit fuel taxes during their tenures.

Third, we investigate whether reform is more (or less) common during fiscal crises. In several countries, these crises seemed to trigger reforms: Yemeni President Hadi decontrolled gasoline prices in early 2015, after global oil prices had collapsed and his country was falling into civil war; Greek Prime Minister Papandreou hiked fuel prices in 2011, in the depths of the Greek financial crisis, to generate badly needed revenues. Still, it is difficult to know whether these crisis-induced reforms are part of a larger pattern: There may be many economic crises that are not followed by reform, and many reforms that are not preceded by crises. To address this question, we focus on the 19 persistent subsidizers: Since their gasoline prices are fixed by government fiat, we can measure the size and timing of their policy shifts with more precision, and, because their subsidies are so costly, their leaders have strong incentives to push for reforms. We employ a broad measure of fiscal crises created by the IMF to identify periods of “extreme funding difficulties” (8, 53). We add this to our baseline OLS model to see whether net taxes are higher or lower under crisis. Further, crisis may lead to more-varied outcomes in both directions. To examine this, using a variance ratio test, we compare changes in net implicit taxes during the tenures of leaders primarily under crisis to those who govern primarily during noncrisis times.

Finally, our high-frequency fuel price data allow us to measure the onset and survival of subsidy reforms at the monthly level, focusing on the 19 persistent subsidizers. If strong leadership leads to more successful subsidy reforms, we should observe them in these states. In this group of countries, leaders have considerable scope to change subsidies if they choose, and case studies and news reports often describe such reforms (5, 34). Since all 19 countries use fixed (rather than floating) gasoline prices, we can identify the timing of any price changes with greater precision. We define large reforms as any increase in the nominal gasoline price of 10% or more from the previous month. A reform fails if the net implicit tax returns to its former level.

Results

Leadership Role.

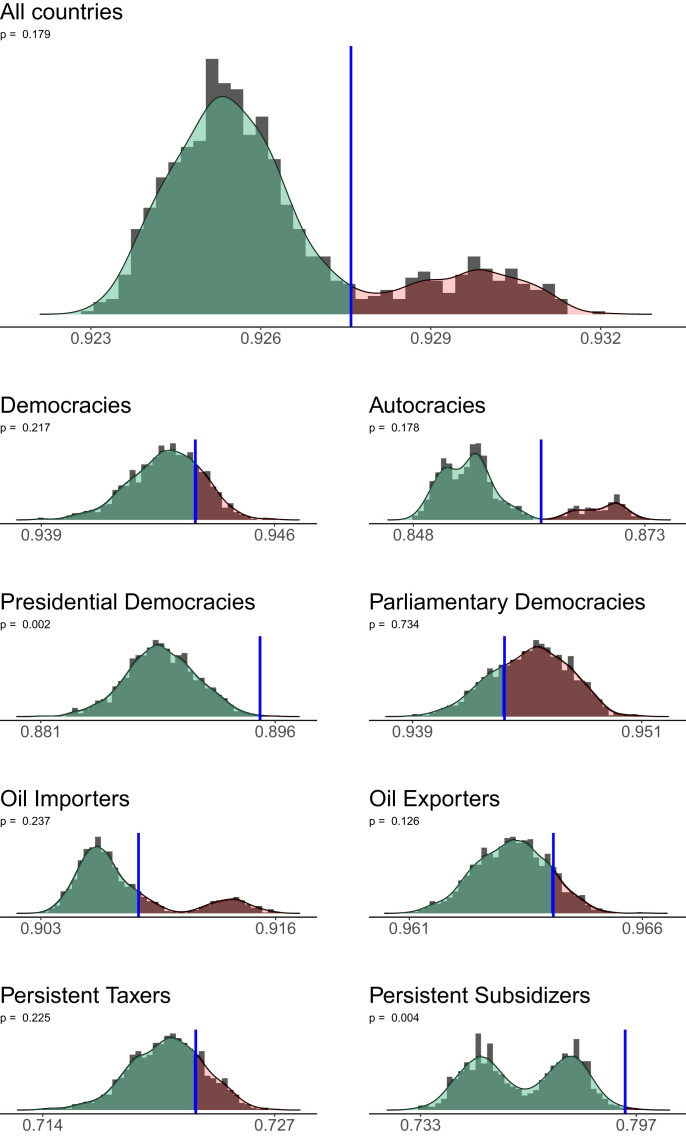

We first consider a CFE model to understand how much variation can be explained by country intercepts and slopes without accounting for individual tenures. The first column of Table 1 shows the resulting R2 values for all countries and the eight subgroups. The second column shows the R2 values for models with separate intercept and slope fixed effects for each leader’s tenure, thereby nesting the CFE model. The third column provides the P value from the permutation inference exercise. We see that, when pooling across all countries (first row), nearly 18% of models with the false, permuted leader tenures explain as much or more variation as the model with the actual tenures. We thus do not find substantial evidence that the true leadership sequence mattered.

Table 1.

Variation explained by CFE and by the LFE models. Each row represents a sample or subsample of data, comparing the adjusted R2 of the CFE model (column 2) to the LFE model (column 3), along with the P values of the null hypothesis as described above (column 4)

| P value | |||

|---|---|---|---|

| Sample | (LFE null) | ||

| All countries | 0.874 | 0.928 | 0.178 |

| Democracies | 0.874 | 0.943 | 0.217 |

| Autocracies | 0.818 | 0.862 | 0.178 |

| Presidential (democracies) | 0.803 | 0.895 | 0.002 |

| Parliamentary (democracies) | 0.854 | 0.944 | 0.742 |

| Oil importers | 0.848 | 0.909 | 0.236 |

| Oil exporters | 0.945 | 0.964 | 0.119 |

| Persistent taxers | 0.676 | 0.729 | 0.233 |

| Persistent subsidizers | 0.590 | 0.794 | 0.004 |

.

The same conclusion is reached for six of the eight subgroups of countries. The two exceptions are among presidential democracies and persistent subsidizers, where the R2 values from the LFE models are well above those we expect under the null distribution (P = 0.002 and P = 0.004, respectively). Fig. 2 illustrates these results, showing the entire distribution of R2 values obtained under the null across permutations, for all countries and by subgroup.

Fig. 2.

Each plot shows the distribution of R2 values from 1,000 estimates with differently permuted orderings of leader tenures used to produce LFEs. The vertical blue line indicates the R2 when the true sequence of leader tenures is used. The area under the curve to the right of the vertical line shows how often an R2 at least as large was observed among models with permuted leader tenure orders, that is, the P value, shown at the top left of each plot.

Using an OLS model with additional controls, we find similar results (Table 2, columns 1 and 2 and SI Appendix, Tables S1–S8).

Table 2.

Model results for all countries

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| (Intercept) | –6.6267 | –0.3088 | 0.6004 | –0.3061 |

| (3.5754) | (3.2097) | (4.2624) | (3.2109) | |

| GDPpc | 1.5174 | 0.0957 | 0.0543 | 0.0953 |

| (0.8086) | (0.7339) | (0.8715) | (0.7346) | |

| GDPpc2 | –0.0781 | –0.0047 | –0.0019 | –0.0047 |

| (0.0428) | (0.0403) | (0.0455) | (0.0403) | |

| GDP growth | –0.0008 | –0.0015 | –0.0015 | |

| (0.0009) | (0.0012) | (0.0013) | (0.0012) | |

| Government debt | –0.0005 | –0.0008 | –0.0013 | –0.0008 |

| (0.0005) | (0.0006) | (0.0007) | (0.0006) | |

| FF income dep. | –0.0061 | |||

| (0.0034) | (0.0023) | (0.0019) | (0.0023) | |

| VAT | 0.0029 | 0.0095 | 0.0048 | 0.0095 |

| (0.0043) | (0.0072) | (0.0074) | (0.0072) | |

| Leader age | 0.0013 | |||

| (0.0010) | ||||

| Male leader | 0.0194 | |||

| (0.0552) | ||||

| Leader education | –0.0669 | |||

| (0.0334) | ||||

| Leader ideology | –0.0209 | |||

| (0.0112) | ||||

| Economic crisis year | –0.0006 | |||

| (0.0153) | ||||

| R2 | 0.9531 | 0.9060 | 0.9078 | 0.9060 |

| Adjusted R2 | 0.9509 | 0.9051 | 0.9068 | 0.9051 |

| Country intercepts | N | Y | Y | Y |

| Country trends | N | Y | Y | Y |

| Leader intercepts | Y | N | N | N |

| Leader trends | Y | N | N | N |

| Number of observations | 26,171 | 26,171 | 22,660 | 26,171 |

| RMSE | 0.1101 | 0.1531 | 0.1496 | 0.1531 |

| N clusters | 121 | 121 | 114 | 121 |

The outcome is the net implicit tax on gasoline. The sample includes all countries with more than one political leader throughout the period of analysis. Coefficient estimates indicate the expected change in net implicit taxes for one-unit changes in each covariate; ; ; ; GDPpc, GDP per capita; GDPpc2, GDP per capita squared; FF income dep., fossil fuel income dependence; N, no; Y, yes; N clusters, number of clusters.

Personal Traits.

An OLS model using these traits as predictors shows that no personal characteristics are significantly associated with changes in a country’s net implicit tax for the full sample under analysis (Table 2, column 3). The results are broadly similar in the eight subgroups, although leader age is marginally significant in the autocracy subgroup, and ideology is marginally significant among the presidential democracies (SI Appendix, Tables S1–S8). We also examine whether these traits are associated with the change in net implicit tax under each leader. Density plots show similar distributions of changes in the net implicit tax regardless of stratification by age, gender, education, and ideology (SI Appendix, Fig. S6).

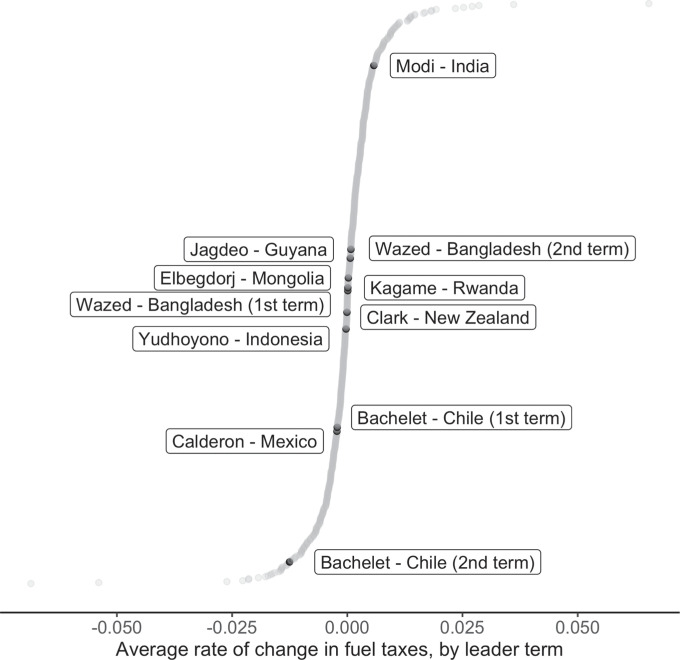

Nine presidents and prime ministers in our data were recognized by UNEP as Champions of the Earth. During their 11 tenures in office, the net implicit tax on gasoline decreased at an average rate of –0.0096 USD per liter annually; for the other leader tenures, it increased by an average of 0.0006 USD. Although the difference is not statistically significant at the conventional levels, this is the opposite direction of what might be expected. Fig. 3 displays the records of these nine Champions compared to the rest of the distribution. Just one of these leaders (India’s Narendra Modi) was among the top one-third of the distribution. We infer that the nine Champions did not have better records on fuel taxes than other leaders.

Fig. 3.

Distribution of leader average changes in fuel taxes, highlighting the UNEP Champions of the Earth. Each point refers to a leader’s rate of change in taxes, defined as the total change in fuel taxes from tenure start to end divided by the number of months in office (Δ USD per liter per month). Points are sorted from largest positive change (top right) to largest negative change (bottom left). The vertical dimension corresponds to the percentile rank of the same variable. For leaders with multiple tenures, suffixes are added based on term; for example, Michelle Bachelet I refers to the Chilean president’s 2006–2010 term, and Michelle Bachelet II refers to the 2014–2018 term.

Fiscal Crisis.

Times of crisis are not associated with higher or lower net implicit taxes, on average, but leader tenures during crisis show more extreme changes, in both directions, in net implicit taxes. In our baseline model (Table 2, column 4), the “fiscal crisis” measure is not significantly associated with changes in the net implicit tax. The results are similar for each of the eight subgroups (SI Appendix, Tables S1–S8, column 4). Periods of fiscal crisis are thus not, on average, associated with higher or lower net implicit taxes.

We then compared the average monthly changes in net implicit taxes under leaders who served during high-crisis periods (those with 50%, 75%, or 85% of their time in office during crisis) to others. As illustrated in SI Appendix, Fig. S5, leader tenures that occurred during crises do not appear different, on average, but many of the more extreme changes in price occurred during periods of crisis. The variance ratio test confirms that the variance of price changes was higher for leader tenures during crisis (p < 0.0001 using 50%, 75%, or 85% crisis-year thresholds). This does not necessarily indicate, however, that tax changes during these periods were the result of leadership rather than other factors, including, possibly, crises themselves.

Reform Duration.

We observe 118 reforms over 5,120 mo among the 19 persistent subsidizers, equivalent to one reform about every 43 mo. Reforms are defined as increases of 10% or more in the nominal monthly price. These reforms failed, however, at a remarkably high rate. The average reform lasted just 18 mo. After 1 y, 62% of all reforms had ended. After 5 y, 87% had failed. We discuss reasons for these failures below.

Discussion and Conclusion

We infer from these analyses that, thus far, political leadership has played a surprisingly small and ephemeral role in the reform of gasoline taxes and subsidies. In the full population of states, we detect no association between a country’s political leadership tenures, modeled using separate intercepts and slopes, and changes in gasoline taxes and subsidies. We interpret this as evidence that presidents, prime ministers, and monarchs are highly constrained in their ability to change gasoline taxes and subsidies.

Two caveats are important to our interpretation of these results. First, as noted above, the permutation analysis (Fig. 2) is sensitive to the role of leadership when it is associated with departures from a steady level or trajectory of fuel taxes. Of course, leadership might be required even to maintain a steady level or trend in the net implicit taxes in the face of opposing forces. That said, given the need for major reform and its slow pace to date, we are most interested in learning about the role of leadership in generating departures from the status quo. Second, the “true” effect of leadership might be obscured by unobserved confounders, whose countervailing effects were strong enough to conceal the true correlation between leader tenures and net implicit taxes. Such unobserved confounders would have to 1) be relatively synchronized with the timing of leader tenures and 2) cause net implicit taxes to move in the direction opposite to what the leader is causing. Such an arrangement seems unlikely, and we consequently interpret the low explanatory power of leader tenures on fuel taxes as plausible evidence for the lack of a causal effect.

We also detect no association between the personal characteristics of leaders—their age, gender, education, and political ideology—and changes in their countries’ gasoline taxes and subsidies. This might be surprising: Countries should be more likely to cut gasoline subsidies and raise gasoline taxes when their governments are headed by leaders dedicated to strong action on climate. Although we have no way to measure the ex ante views of leaders on climate mitigation, we find it striking that presidents and prime ministers who have the same traits as citizens with strong proclimate views—younger, female, more educated, and more politically left-of-center—have the same records as leaders who are older, male, less educated, and right-of-center.

Even when governments are headed by leaders recognized by UNEP for their environmental achievements, they make no more progress on gas taxes and subsidies than other countries. In fact, their records are slightly worse. This may suggest that progress on gasoline pricing has not come from leaders dedicated to reduced greenhouse gas emissions, but from leaders who raise gas taxes or cut gas subsidies for other reasons, such as balancing their government’s finances.

We also failed to find evidence that leaders make more (or less) progress, on average, when they confront an economic crisis. However, leaders who governed during crisis years did enact more extreme changes—some with atypically large fuel tax increases, and some with atypically large decreases (SI Appendix, Fig. S8). For example, some of the largest increases in fuel taxes between 1990 and 2015 occurred during fiscal crises, like the examples discussed above of Yemen and Greece. But our data also revealed leaders who, during crises, were associated with very large decreases in gas taxes and increases in subsidies, as in Nicaragua in 1990 and the Democratic Republic of Congo in 2001. And most of the fiscal crises recorded by the IMF were not accompanied by significant changes in gas taxes or subsidies.

In two subgroups of countries—presidential democracies and persistent subsidizers—our permutation analysis suggests that tenure timing is associated with net implicit taxes. In both sets of countries, leaders appear to have greater administrative control over their nations’ gasoline taxes and subsidies, and hence a greater capacity to affect the timing and scale of any changes in fuel taxes and subsidies. In presidential democracies—unlike parliamentary democracies—the chief executive has full authority over the executive branch and its regulatory powers. In the persistent subsidizers, leaders have even greater control over pricing: All of these countries are oil exporters, and all kept gasoline prices fixed for long periods, adjusting them, on average, once every 17 mo.

Yet, even in these subgroups, this heightened executive role did not lead to an observable change in their country’s net implicit tax trajectory: Taxes fell (and subsidies rose) at the same slow rate in both presidential and parliamentary democracies, and in both persistent subsidizers and persistent taxers. We believe this demonstrates how extraordinarily difficult it is to reform fuel taxes and subsidies. Many presidents in presidential democracies tried and failed to change their countries’ gasoline pricing: In France, President Emmanuel Macron tried to raise gasoline taxes in November 2018, only to reverse himself after the nationwide “gilets jaunes” protests. In other cases, gains made by one president were reversed by their successors: In Brazil, substantial increases in gas taxes under President Lula da Silva (2003–2010) were rolled back by his hand-picked successor, President Dilma Rousseff; in Ghana, gradual but steady reforms under President John Kufuor (2001–2009) were largely reversed by his successor, President John Atta Mills.

Among the persistent subsidizers, there was a similar pattern. In states with fixed gasoline prices, subsidies can place heavy pressures on public finances. Yet all of the persistent subsidizers were also oil exporters, where the leader’s survival may partly rest on the perception of citizens that they are getting a fair share of their countries’ petroleum wealth, including through low-price fossil fuels (54, 55). When leaders try to pare these subsidies back, the result is often widespread protest—for example, in Bolivia in 2010, Nigeria in 2012, Indonesia in 2008 and 2013, Iran in 2019, and Kazakhstan in 2021 (36). In many of these cases, leaders were forced to roll back their reforms.

Indeed, the overwhelming majority of reforms among the persistent subsidizers were quickly reversed: 62% failed within the first year, and 87% failed within 5 y. They appear to fail for three reasons (SI Appendix, Fig. S7). The first is political backtracking, when a leader or their successor rolls back a price increase to (or below) its prior nominal value. For example, after protests in Ecuador (1999), Bolivia (1997 and 2004), Indonesia (2009), and Nigeria (2012), leaders reversed their policies and restored prices to their prior nominal value. These reversals in nominal prices are relatively uncommon: About 90% of all reforms survived at least 1 y in nominal terms, and 85% lasted at least 5 y.

The second cause is currency depreciation—due to inflation, falling exchange rates, or both—which can cause the real price to return to its prereform level even if the nominal price increase is not reversed. For example, in April 1999, Iran’s President Khatami raised petrol prices from 200 rials per liter to 350 rials per liter, a large and politically contentious reform. In nominal terms, the reform was never reversed, but, in real terms, it lasted only 35 mo because of a massive currency devaluation in March 2002. Overall, the 1-y real price survival rate (which accounts for both nominal price reversals and currency depreciation) is 78%, and the 5-y survival rate is 60%.

The third source of reform failure is rising global oil prices, which can force governments that use fixed prices to return subsidies to prereform levels. For example, just 6 mo after Iranian President Khatami’s April 1999 reforms, the rising global oil price had wiped out any gains, forcing the government to once again subsidize gas at (and above) the prereform rate. By this metric, the 1-y survival rate of reforms drops to 38%, and the 5-y survival rate drops to 13%. Collectively, these measures imply that, within 5 y of enactment, 15% percent of reforms were explicitly reversed under political pressure, 25% percent were indirectly reversed by inflation and exchange rate fluctuations, and 47% percent were indirectly reversed by rising global oil prices.

Even this high failure rate understates the challenge of price reforms. The timing of the reforms in our data is not random, but is chosen by political leaders who believed the conditions were ripe for success. If strategically timed reforms fail at such a high rate, then reforms initiated under normal, nonstrategic conditions should fail at an even higher rate. In fact, many leaders probably anticipate these obstacles and decline to even attempt reforms. In the United States, for example, no president since Bill Clinton in 1994 has made a serious effort to raise the federal gasoline tax.

Overall, our analysis suggests that the role of leadership in reforming fossil fuel taxes and subsidies is surprisingly limited: It only appears to matter in a minority of countries, and, among those countries, leader-initiated reforms fail at a very high rate. Even leaders who share the personal traits of proclimate citizens have records that are no better or worse than other leaders. We take this as evidence that leaders working in all categories of countries find it profoundly challenging to enact lasting policies that raise the price of fossil fuels.

Recent developments in the United States illustrate some of our results. President Joseph Biden’s leadership was critical in the August 2022 passage of the Inflation Reduction Act, the most significant climate legislation in US history: His administration designed the legislation and worked closely with House and Senate leaders to gain its passage. But the new law had no carbon pricing measures—in fact, in June 2022, Biden proposed a temporary reduction in the US gasoline tax, even though it was already among the world’s lowest. Instead, the climate bill included $369 billion in tax credits and incentives to reduce the cost of renewable energy and promote clean energy manufacturing and development. Despite Biden’s successful leadership on climate spending and regulatory reform, he has made little effort to reduce fossil fuel subsidies or raise fossil fuel taxes.

Raising carbon prices is not impossible, but, thus far, the conditions that make for success have been exceedingly rare. Leaders who are committed to deep decarbonization—and do not want their policies reversed by their successors—might, instead, emphasize policies that are less contentious but can still lead to deep reductions in carbon pollution. These could include policies that make renewable energy less expensive and more widely available, investments in public transportation, renewable energy portfolio standards, collaborative renewable development (56), and green industrial policies (57).

Supplementary Material

Acknowledgments

We are grateful to the editor and reviewers for their valuable suggestions. Earlier versions of this study were presented at workshops at the University of California Riverside, University of California Santa Barbara, Notre Dame University, and Stanford University.

Footnotes

The authors declare no competing interest.

This article is a PNAS Direct Submission. D.T. is a guest editor invited by the Editorial Board.

*We could address this using a cluster-robust modification of the Wald test for the exclusion of all the tenure-timing variables. However, even though cluster-robust standard errors are quite general, they still require the assumption of “no between-cluster dependence,” which would not be credible in the context of oil pricing. While some suitable choice of error covariance may be possible, we, instead, preferred the fewness of assumptions, simplicity, and transparency of an alternative, permutation-based approach to inference.

†Our approach differs from the implementation in ref. 17 mainly in that, in addition to allowing the intercept to vary by leader, we also include varying slopes. This is because leaders could make changes at any time or set of times within their tenure, which we expect will better be captured by allowing both a shift in the level and in the rate-of-change in prices during each tenure.

‡The persistent subsidizers are defined as the countries whose median implicit tax is below zero across the 1990–2015 period. Nineteen countries meet this definition: Algeria, Angola, United Arab Emirates, Bahrain, Ecuador, Egypt, Indonesia, Iran, Iraq, Kuwait, Libya, Myanmar, Nigeria, Oman, Qatar, Saudi Arabia, Sudan, Venezuela, and Yemen.

This article contains supporting information online at https://www.pnas.org/lookup/suppl/doi:10.1073/pnas.2208024119/-/DCSupplemental.

Data, Materials, and Software Availability

Gasoline taxes and subsidies data have been deposited in Harvard Dataverse (https://doi.org/10.7910/DVN/UCHDJS) (58).

References

- 1.Andresen S., Agrawala S., Leaders, pushers and laggards in the making of the climate regime. Glob. Environ. Change 12, 41–51 (2002). [Google Scholar]

- 2.Karlsson C., Parker C., Hjerpe M., Linnér B.-O., Looking for leaders: Perceptions of climate change leadership among climate change negotiation participants. Glob. Environ. Polit. 11, 89–107 (2011). [Google Scholar]

- 3.Intergovernmental Panel on Climate Change, “Summary for policymakers” in Global Warming of 1.5 °C. An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhouse Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development, and Efforts to Eradicate Poverty, Masson-Delmotte V., et al., Eds. (Intergovernmental Panel on Climate Change, 2018), pp. 354–355. [Google Scholar]

- 4.Stiglitz J. E., et al., “Report of the high-level commission on carbon prices” (Carbon Pricing Leadership Coalition, 2017).

- 5.Victor D., We have climate leaders. Now we need followers. The New York Times, 13 December 2019. https://www.nytimes.com/2019/12/13/opinion/climate-change-madrid.html. Accessed 1 February 2022.

- 6.Carbon Pricing Leadership Coalition. “Carbon pricing leadership report 2020/2021” (Carbon Pricing Leadership Coalition, 2021).

- 7.Olson M., Some social and political implications of economic development. World Polit. 17, 525–554 (1965). [Google Scholar]

- 8.Olson M., Dictatorship, democracy, and development. Am. Polit. Sci. Rev. 87, 567–576 (1993). [Google Scholar]

- 9.Tilly C., Tarrow S. G., Contentious Politics (Oxford University Press, 2015). [Google Scholar]

- 10.McAdam D., Tarrow S., Tilly C., Dynamics of contention. Soc. Mov. Stud. 2, 99–102 (2003). [Google Scholar]

- 11.Lichbach M. I., The Rebel’s Dilemma (University of Michigan Press, 1998). [Google Scholar]

- 12.Hall P. A., Soskice D., “Coordinated market economies: The German case” in An Introduction to Varieties of Capitalism, Hall P. A., Soskice D., Eds. (Oxford Academic, 2001), pp. 21–27. [Google Scholar]

- 13.Hall P. A., Thelen K., Institutional change in varieties of capitalism. Socio-economic Rev. 7, 7–34 (2009). [Google Scholar]

- 14.Ferraz C., Finan F., Electoral accountability and corruption: Evidence from the audits of local governments. Am. Econ. Rev. 101, 1274–1311 (2011). [Google Scholar]

- 15.Ahlquist J. S., Levi M., Leadership: What it means, what it does, and what we want to know about it. Annu. Rev. Polit. Sci. 14, 1–24 (2011). [Google Scholar]

- 16.Krcmaric D., Nelson S. C., Roberts A., Studying leaders and elites: The personal biography approach. Annu. Rev. Polit. Sci. 23, 133–151 (2020). [Google Scholar]

- 17.Berry C. R., Fowler A., Leadership or luck? Randomization inference for leader effects in politics, business, and sports. Sci. Adv. 7, eabe3404 (2021). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Dube O., Harish S. P., Queens. J. Polit. Econ. 128, 2579–2652 (2020). [Google Scholar]

- 19.Jones B. F., Olken B. A., Do leaders matter? National leadership and growth since World War II. Q. J. Econ. 120, 835–864 (2005). [Google Scholar]

- 20.Jones B. F., Olken B. A., Hit or miss? The effect of assassinations on institutions and war. Am. Econ. J. Macroecon. 1, 55–87 (2009). [Google Scholar]

- 21.Skodvin T., Andresen S., Leadership revisited. Glob. Environ. Polit. 6, 13–27 (2006). [Google Scholar]

- 22.Busby J. W., Urpelainen J., Following the leaders? How to restore progress in global climate governance. Glob. Environ. Polit. 20, 99–121 (2020). [Google Scholar]

- 23.Rabe G. B., Can We Price Carbon? (MIT Press, 2018). [Google Scholar]

- 24.Cullenward D., Victor D. G., Making Climate Policy Work (John Wiley, 2020). [Google Scholar]

- 25.Bechtel M. M., Scheve K. F., van Lieshout E., Constant carbon pricing increases support for climate action compared to ramping up costs over time. Nat. Clim. Chang. 10, 1004–1009 (2020). [Google Scholar]

- 26.Ross M. L., Hazlett C., Mahdavi P., Global progress and backsliding on gasoline taxes and subsidies. Nat. Energy 2, 16201 (2017). [Google Scholar]

- 27.International Energy Agency, “CO2 emissions from fuel combustion: Highlights” (Technical Report, International Energy Agency, 2017).

- 28.Kojima M., Koplow D., Fossil fuel subsidies: Approaches and valuation. Policy Research Working Paper 7220, World Bank, 2015. https://elibrary.worldbank.org/doi/abs/10.1596/1813-9450-7220. Accessed 1 October 2021.

- 29.Matsumura W., Zakia A., “Fossil fuel consumption subsidies bounced back strongly in 2018” (International Energy Agency, Paris, 2019). https://www.iea.org/commentaries/fossil-fuel-consumption-subsidies-bounced-back-strongly-in-2018. Accessed 1 February 2022.

- 30.Coady M. D., Parry I., Le N.-P., Shang B., Global Fossil Fuel Subsidies Remain Large: An Update Based on Country-Level Estimates (International Monetary Fund, 2019). https://www.elibrary.imf.org/view/journals/001/2019/089/article-A001-en.xml?lang=en&language=en. Accessed 1 December 2021.

- 31.Aldy J. E., Pizer W. A., Alternative metrics for comparing domestic climate change mitigation efforts and the emerging international climate policy architecture. Rev. Environ. Econ. Policy 10, 3–24 (2016). [Google Scholar]

- 32.Organization for Economic Co-operation and Development, International Institute for Sustainable Development, Fossil fuel subsidy tracker. https://fossilfuelsubsidytracker.org/. Accessed 28 April 2022.

- 33.Clements B. J., Coady D., Fabrizio S., Gupta S., Alleyne T. S. C., Sdralevich C. A., “Energy subsidy reform: Lessons and implications” (International Monetary Fund, 2013).

- 34.Skovgaard J., van Asselt H., The Politics of Fossil Fuel Subsidies and Their Reform (Cambridge University Press, 2018). [Google Scholar]

- 35.Inchauste G., Victor D. G., The Political Economy of Energy Subsidy Reform (The World Bank, 2017). [Google Scholar]

- 36.Mahdavi P., Martinez-Alvarez C. B., Ross M. L., Why do governments tax or subsidize fossil fuels? J. Polit. 84, 10.1086/719272 (2022). [DOI] [Google Scholar]

- 37.Nordhaus W., Climate change: The ultimate challenge for economics. Am. Econ. Rev. 109, 1991–2014 (2019). [Google Scholar]

- 38.Climate Leadership Council. Economists’ statement on carbon dividends organized by the climate leadership council, 2019. https://clcouncil.org/economists-statement/. Accessed 1 February 2022.

- 39.Mildenberger M., Lachapelle E., Harrison K., Stadelmann-Steffen I., Limited impacts of carbon tax rebate programmes on public support for carbon pricing. Nat. Clim. Chang. 12, 141–147 (2022). [Google Scholar]

- 40.Kojima M., Fossil fuel subsidy and pricing policies: Recent developing country experience. Policy Research Working Paper 7531, World Bank, 2016. https://documents1.worldbank.org/curated/en/424341467992781075/pdf/WPS7531.pdf. Accessed 1 October 2021.

- 41.Finnegan J., Institutions, climate change, and the foundations of long-term policymaking. Comp. Polit. Stud. 55, 1198–1235 (2022). [Google Scholar]

- 42.Ansolabehere S., Konisky D. M., Cheap and Clean: How Americans Think About Energy in the Age of Global Warming (MIT Press, 2014). [Google Scholar]

- 43.Natalini D., Bravo G., Newman E., Fuel riots: Definition, evidence and policy implications for a new type of energy-related conflict. Energy Policy 147, 111885 (2020). [Google Scholar]

- 44.Rentschler J., Bazilian M., Reforming fossil fuel subsidies: Drivers, barriers and the state of progress. Clim. Policy 17, 891–914 (2017). [Google Scholar]

- 45.Koplow D., “Measuring energy subsidies using the price-gap approach: What does it leave out?” (International Institute for Sustainable Development, 2009). https://www.iisd.org/gsi/sites/default/files/bali_2_copenhagen_ff_subsidies_pricegap.pdf. Accessed 1 March 2019.

- 46.Goemans H. E., Gleditsch K. S., Chiozza G., Introducing Archigos: A dataset of political leaders. J. Peace Res. 46, 269–283 (2009). [Google Scholar]

- 47.Scartascini C., Cruz C., Keefer P., The Database of Political Institutions 2017 (DPI2017) (Banco Interamericano de Desarrollo, Washington, DC, 2018). https://publications.iadb.org/en/database-political-institutions-2017-dpi2017. Accessed 1 December 2021.

- 48.Baturo A., Cursus honorum: Personal background, careers and experience of political leaders in democracy and dictatorship—New data and analyses. Politics Gov. 4, 138–157 (2016). [Google Scholar]

- 49.Fisher R. A., Statistical Methods for Research Workers (Oliver & Boyd, Edinburgh: ), ed. 5, 1934). [Google Scholar]

- 50.Son J. Y., Blake A. B., Fries L., Stigler J. W., Modeling first: Applying learning science to the teaching of introductory statistics. J. Stat. Data Sci. Educ. 29, 4–21 (2021). [Google Scholar]

- 51.Poortinga W., Whitmarsh L., Steg L., Böhm G., Fisher S., Climate change perceptions and their individual-level determinants: A cross-European analysis. Glob. Environ. Change 55, 25–35 (2019). [Google Scholar]

- 52.Milfont T. L., Zubielevitch E., Milojev P., Sibley C. G., Ten-year panel data confirm generation gap but climate beliefs increase at similar rates across ages. Nat. Commun. 12, 4038 (2021). [DOI] [PMC free article] [PubMed] [Google Scholar]

- 53.Gerling M. K., Paulo M.Medas A, Poghosyan M. T., Farah-Yacoub J., Xu Y., Fiscal Crises (International Monetary Fund, 2017). [Google Scholar]

- 54.Ross M. L., The Oil Curse: How Petroleum Wealth Shapes the Development of Nations (Princeton University Press, 2012). [Google Scholar]

- 55.Fails M. D., Fuel subsidies limit democratization: Evidence from a global sample, 1990–2014. Int. Stud. Q. 63, 354–363 (2019). [Google Scholar]

- 56.Nahm J., Collaborative Advantage: Forging Green Industries in the New Global Economy (Oxford University Press, 2021). [Google Scholar]

- 57.Breetz H., Mildenberger M., Stokes L., The political logics of clean energy transitions. Bus. Polit. 20, 492–522 (2018). [Google Scholar]

- 58.Ross M., et al., Replication data for: Political leadership has limited impact on fossil fuel taxes and subsidies. Harvard Dataverse. 10.7910/DVN/UCHDJS. Deposited 31 October 2022. [DOI] [PMC free article] [PubMed]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Data Availability Statement

Gasoline taxes and subsidies data have been deposited in Harvard Dataverse (https://doi.org/10.7910/DVN/UCHDJS) (58).