Abstract

Stock markets across the world have exhibited varying degrees of volatility following the recent COVID-19 pandemic. We have examined the effect of this pandemic on stock market volatility and whether economic strength, measured by a set of selected country-level economic characteristics and factors such as economic resilience, intensity of capitalism, level of corporate governance, financial development, monetary policy rate and quality of health system, can potentially mitigate the possible detrimental effect of the global pandemic on stock market volatility. Using data from 34 developed and emerging markets, we have found that these country-level economic characteristics and factors do help to reduce the volatility arising due to the virus pandemic. The results of this paper are important as policymakers can use these economic factors to set policy responses to tackle extraordinary heat in the global stock market in order to avoid any possible future financial crisis.

Keywords: COVID-19, Stock Market Volatility, Economic Resilience, Capitalism, Financial Development, Corporate Governance

1. Introduction

The COVID-19 pandemic has affected almost every aspect of human life and the economy and has been labelled as a black swan event due to its sudden and severe nature (Verma & Gustafsson, 2020). Stock markets across the world have exhibited varying degrees of volatility following the pandemic. Our aim in this paper is dual: first to analyse quantitatively to what extent the surge in volatility can be attributed to COVID-19 and then to examine whether the relevant economic factors such as economic resilience, intensity of capitalism, level of corporate governance, financial development and level of health system development may reduce the already existing turmoil in the stock market to some extent so that a potential crisis following this extraordinary heat in global stock markets could be avoided in future.

The world has been experiencing a severe pandemic caused by COVID-19, which is an acute respiratory disease that originated in China and now has spread through the world and already killed hundreds of thousands of people1 . The shock and panic have caused severe falls in stock markets around the world. The BBC reported on 31st March 2020 that the Dow Jones Industrial Average and FTSE 100 had plunged by 23% and 25%, respectively – the biggest quarterly drops since 1987. The S&P 500 also lost 20% during the same time, which was the worst loss since the 2008 financial crisis. Economists made stark warnings about the sharp global slowdown. Global Economic Prospects (June 2020)2 reported that the pandemic would drag the majority of world economies into recession and global per capita output contraction would be the largest since 1870. The report also pointed out that the global contraction in real GDP would be 5.2%. The figures for advanced economies and emerging and developing economies would be 7% and 2.5%, respectively. A recent report by Deloitte3 stated that the COVID-19 pandemic has affected both the supply and demand sides of the global economy. In addition to significant numbers of infections and deaths, the global economy has been suffering very severely in many ways, such as a fall in bond yields, and a sharp drop in oil prices and stock markets, along with a potential liquidity crisis at both the institutional and individual levels. Baker et al., 2020, Baker et al., 2020 reported that, in the US stock market, there were 18 market jumps between 24th February and 24th March 2020 (a total of 22 trading days). This is more than any other period in history with the same number of trading days. The authors also reported that the volatility increase in US markets due to the COVID-19 outbreak is much bigger than any other past events such as global influenza in 1918, SARS in 2003 or Ebola in 2015. The COVID-19 outbreak created a significant amount of fear and uncertainty due to its rapid contamination and high death rates. Moreover, both demand and supply shocks have created panic in financial markets. This has increased the severity of stock market volatility, as Engle and Ng (1993) found that negative return shocks influence volatility more than positive return shocks. Borjigin, Gao, Sun, and An (2020) also find evidence of the stronger effect of negative news on market volatility compared to good news. Falling stock prices across the world mean that markets become more volatile due to the leverage effect – a drop in stock value leads to an increase in financial leverage. This eventually makes the stock riskier and increases volatility (Black, 1976, Christie, 1982). Moreover, using the volatility feedback effect, Anderson, Bollerslev, Diebold, and Ebens (2001) stated that asymmetry between stock market returns and volatility is stronger with negative returns rather than positive returns.

Examining volatility is important as a sudden and significant increase in volatility may lead to a financial crisis. Danielsson, Valenzuela, and Zer (2018) pointed out that unusual levels of financial market volatility increase the likelihood of a subsequent financial crisis. When the actual financial market volatility deviates from an expected level, that essentially affects economic decisions (Keynes, 1936, Hayek, 1960). In this vein, Baker et al., 2016, Gulen and Ion, 2016 find that higher levels of stock market volatility will have a detrimental effect on investment, output and employment and increase policy uncertainty. Similarly, Engle, Ghysels, and Sohn (2013) show that higher volatility increases output and inflation uncertainty. Using real option theory, Dixit and Pindyck (1994) show that uncertainty increases the value of the option to invest later. This essentially means that there is a scarcity of resources to maintain the required levels of investment in uncertain times. Wu (2001) stated that the leverage effect and feedback effect of asymmetric volatility can recur and damage stock values significantly, which might lead to a stock market crash. Other authors who have examined the link between higher volatility and real economic activities include Fornari and Mele, 2013, Choudhury et al., 2016. These authors conclude that higher volatility will have a negative effect on real economic activity, which may lead to an economic recession. Similarly, Fornari and Mele (2013) find that financial volatility explains between 30% and 40% of industrial production growth at the horizons of one and two years. They further conclude that, during the same time, stock market volatility alone can explain between 35% and 55% of future real economic activity.

Given the evidence of possible financial crises following episodes of increased financial market volatility (Engle et al., 2013, Baker et al., 2016, Gulen and Ion, 2016) or the negative effect of volatility on real economic activity (Fornari and Mele, 2013, Choudhury et al., 2016), it is essential to identify possible factors that may help us save the global economy from entering into any prolonged recession. Several factors have been pointed out in the existing literature in this context, such as economic resilience, intensity of capitalism, corporate governance and financial development.

Economic resilience is defined as the ability of a particular economy to cope with any uncertainty or adverse situation. Briguglio, Cordina, Farrugia, and Vella (2009) stated that economic resilience refers to the policy-induced ability of an economy to recover from or adjust to the negative impact of adverse exogenous shocks and to benefit from positive shocks. Sondermann (2018) pointed out that economic resilience is essential to cope with adverse economic shocks and reduce economic costs arising from those shocks. The author mentions that a country with weaker economic resilience suffers up to twice the output loss in a given year due to exogenous economic shocks compared to a country with stronger economic resilience. Comparing the performance of a group of OECD countries in facing common economic shocks, Duval and Vogel (2008) conclude that the countries that are more resilient performed better in managing the economic shocks. Didier et al., 2012, Abiad et al., 2015 conclude the same, using data from emerging countries and developing economies. In this study, we have examined whether the level of economic resilience of selected sample countries helps mitigate the effect of the global pandemic on stock market volatility. Economic resilience is measured using 12 different economic drivers. Details of these drivers are provided in Table 1 .

Table 1.

List of variables and their definitions.

| Variables | Definitions of the variables | Sources |

|---|---|---|

| Variables related to COVID-19 | ||

| CTC | Growth in total COVID-19 cases in the world | The World Health Organization, and ourworldindata.org |

| CTD | Growth in total COVID-19 deaths in the world | |

| CSC | Growth in total COVID-19 cases of each country in our sample | |

| CSD | Growth in COVID-19 deaths of each country in our sample | |

| Variables related to the capital market | ||

| RET | Log return of the broad stock market index from each country in our sample | Datastream |

| RME | Log return on MSCI Emerging Market index | |

| RMW | Log return of MSCI world index | |

| RVX | Log returns of CBOE VIX volatility index | |

| LVO | Log of total trading volume of each market index in our sample | |

| LVX | Log of CBOE VIX volatility index | |

| LDX | Log of the broad stock market index of each country in our sample | |

| LGX | GDP adjusted market Index | |

| Variables related to measures of country-level resilience | ||

| RES | Overall Resilience score. The score shows the strength and vulnerability in a country’s resilience, both broadly across factors (i.e., economic, risk quality or supply chain), and more precisely across the 12 different drivers. The score offers the opportunity to the government (managers) seeking to improve their country’s (company’s) resilience to disruptive events. The drivers included in this score are: (i) within Economic factors - productivity, political risk, oil intensity, and urbanisation rate; (ii) within Risk Quality factors – exposure to natural hazards, natural hazard risk quality, fire risk quality, and inherent cyber risk; and (iii) within Supply Chain factors – control of corruption, quality of infrastructure, corporate governance and supply chain visibility. The overall resilience score is an equally weighted composite measure of these three factors, where each factor is constructed using an equally weighted mean of four different drivers within each group. Therefore, in combination with additional information, this score provides business executives, investors, and government with a source of guidance on enterprise (country-level) risk when making decisions such as risk improvement priorities, sourcing suppliers, the destination of physical investment, and strength of the country (company) to withstand surprise events. | The FM Global |

| COG | Corporate governance score. Governance consists of the traditions and institution by which authority in a county is exercised. This includes the process by which governments are selected, monitored and replaced; the capacity of the government to effectively formulate and implement sound policies; and the respect of citizens and the state for the institutions that govern economic and social interactions among them. The score also shows the strength of auditing and accounting standards, conflicts of interest regulation and shareholder governance within a country. | World Economic Forum and the FM Global |

| CPS | Capitalism score. Capitalism is an ideology where the means of production is controlled by private business. This means that individual citizens run the economy without the government interfering in production and pricing. Instead, pricing is set by the free market. The score is based on aggregate Economic Freedom Scores from twelve quantitative and qualitative factors, grouped into four broad pillars (Rule of Law, Government Size, Regulatory Efficiency and Open Markets). | The Heritage Foundation and the World Population Review |

| INQ | Quality of infrastructure score. The quality and extent of transport infrastructure (road, rail, water and air) and utility infrastructure. Extensive and efficient infrastructure is critical for ensuring the effective functioning of the economy. Effective modes of transport enable entrepreneurs to get their goods and services to market in a secure and timely manner and facilitate the movement of workers to the most suitable jobs. Similarly, economic efficiency also depends on uninterrupted electricity supplies and an extensive telecommunications network. | The World Economic Forum and the FM Global |

| OIN | Oil intensity score. The score represents the vulnerability to an oil shock (shortage, disruption, price hike). The score is estimated by dividing oil consumption by GDP. Thus it measures dependency on oil for production. | The FM Global (US Energy Information Administration) |

| PRO | Productivity score. The score represents gross domestic product based on purchasing power parity, divided by the total population. | International Monetary Fund and the FM Global |

| HEL | Health pillar. The pillar measures the extent to which people are healthy and have access to the necessary services to maintain good health, including health outcomes, healthy systems, illness and risk factors, and mortality rates. | The Legatum Institute |

| FID | Financial development index. This is an aggregate measure of the development of financial markets and financial institutions of a country. It measures the relative ranking of countries’ financial markets and institutions in terms of their depth (size and liquidity), access (the ability of individuals and companies to access financial services), and efficiency (the ability of institutions to provide financial services at low cost and with sustainable revenues, and the level of activity of the capital market). | International Monetary Funds |

| FII | Financial institutions development index. This is a sub-component of financial development index, which show the development of financial institutions in terms of their depth, access and efficiency. | International Monetary Funds |

| Macroeconomic variables | ||

| LGD | Log of quarterly GDP (in billions of US dollars at current market prices) | Datastream |

| LOP | Log of Oil Price (Crude oil WTI in US dollar per barrel) | Datastream |

| MPR | Policy rate for monetary policy changes | International Monetary Fund |

| Other variables | ||

| EMG | Dummy for emerging markets. We use 1 for emerging markets and 0 for developed markets. | |

| MON | Monday dummy. We use 1 for Monday and 0 for other days of the week. | |

Note: This table shows the variables we apply in our empirical models to investigate the connectedness between the stock market and country-level resilience. These variables are collected from various sources, which include – Thomson Reuters Datastream, World Bank, World Economic Forum, International Monetary Fund, https://ourworldindata.org/., Legatum Institute, World Health Organization, The Heritage Foundation and The World Population Review.

The second factor is the intensity of capitalism. In general, capitalism is defined as an economic system where trade and industry are owned and controlled by private owners for profit rather than by the state. According to Hodgson (2016), capitalism is a socio-economic system where the legal system supports individual property rights, commodities are exchanged that involves money, the private ownership of production to earn profit, and a developed financial system with banking institutions to facilitate credit and debt. When capitalism is in place to solve an economic problem, the capital market plays a pivotal role in the allocation of capital (Gordon, 2005). Bakshi and Chen (1996) included wealth in the utility function in addition to consumption. This plausibly following the spirit of capitalism as the inclusion of wealth in the utility function increases risk aversion by investors and reduces the demand for risky assets. As such, there is a possibility that capitalism discourages risky investments during volatile times and contributes to reducing the heat of the market. This study examines whether the aggregate capitalism score of sample countries helps to explain the mitigation of stock market volatility arising due to the global pandemic. The study uses aggregate capitalism scores available at the Heritage Foundation and the World Population Review database. Details about the capitalism scores are provided in Table 1.

Corporate governance is another important issue that may have a direct impact on market volatility. Huang, Chan, Huang, and Chang (2011) state that corporate governance is the way that firms supervise and control corporate activities. Although minimising the agency problem is the main objective of corporate governance, other core objectives include protecting minority shareholders from expropriation by managers and controlling shareholders. Stronger corporate governance helps to reduce stock price volatility. Better corporate governance improves monitoring, reduces the agency problem and provides safety to minority shareholders. As a result, investors feel more confident to invest in firms with better corporate governance. Therefore, the stock prices of these firms tend to be less volatile (Huang et al., 2011). Mitton, 2002, Lemmon and Lins, 2003, Baek et al., 2004 also provide evidence of better performance of firms with strong corporate governance during economic uncertainty such as a financial crisis. Using data from 41 countries, Hu, Li, Taboada, and Zhang (2020) provide robust evidence that reforms in corporate board structure improve the financial transparency of firms and reduce crash risk. Using country-level governance quality, Johnson et al., 2000, La Porta et al., 2002 conclude that firms in countries with better corporate governance have higher values and better performance and are less affected by exogenous shocks. Given the evidence that better country-level corporate governance practice helps to reduce market volatility during a period of exogenous shocks, this study examines whether corporate governance practices among the sample countries help to reduce the detrimental effect of COVID-19 on stock market volatility. The country-level corporate governance scores are collected from the World Economic Forum and the FM Global database. Further details of corporate governance scores are provided in Table 1.

The level of financial development could help countries to minimise high stock market volatility caused by the virus outbreak. Dellas and Hess (2005) state that financial development should have a negative effect on stock market volatility. The authors point out that asset price movement is influenced by market liquidity, trading facilitation, hedging and diversification of risk and quality corporate control. A developed financial market with a stronger banking network and a well-structured capital market would facilitate these provisions and therefore would reduce stock price volatility. One of the important effects of this virus outbreak is the shock to both demand and supply. This two-way shock has made this more worrying for the global economy. However, authors such as Wang et al., 2018, Bekaert et al., 2005, Easterly et al., 2000 find that financial development has a significant negative relationship with macroeconomic volatility. These authors find that financial development helps to reduce the volatility of both aggregate consumption and aggregate output and thereby helps the economy to absorb both the demand and supply shocks. Given the evidence that financial development help to mitigate stock market volatility, this study will examine whether the level of financial development of the sample countries helps to reduce the effect of the global pandemic on stock market volatility. Data on the financial development index is available from the IMF database and is constructed using information on the size and liquidity of financial markets and by using access of financial services and efficiency of financial institutions. Further details on the financial development index are provided in Table 1.

Given the above literature, we contribute to the existing literature in the following ways: first, we examine the effect of COVID-19 on stock market volatility using data from 34 countries. Second, consistent with previous literature, we analyse the impact of economic resilience, level of capitalism, corporate governance and financial development on stock market volatility. Third, we depart from the existing literature and also look at the effect of macroeconomic policy on stock market volatility. We suggest that monetary policy adjustments such as a reduction in bank rate could be helpful for coming out of the economic constraints caused by the exogenous shock. However, changing policy rates during uncertain times may be considered as a sign of a gloomy future with more uncertainty, and could therefore trigger more volatility in the stock market.4 Fourth, we also have examined the effectiveness of health system development in helping to reduce market volatility. The COVID-19 pandemic has created a fear of infection and death among people. A sound, effective and robust health system should give people assurance and confidence. Anecdotal evidence suggests that, while most sectors have faced negative return shocks in recent times, the healthcare sector has seen the opposite. Baker, Bloom, Davis, and Kost (2019) state that an effective health policy is in the list of issues that contribute to stock market volatility. Finally, instead of examining return and volatility changes and the contagion effect of pandemics, as recent papers have done,5 we examine the relevant economic factors that may help to minimise volatility. Examining these factors is important as there is a possibility of another wave of virus outbreak, which might lead us to persistent higher stock market volatility in the coming months. As higher volatility could lead us to a financial crisis, policymakers should focus on these factors to avoid any future fallout.

Our results show that the COVID-19 pandemic has significantly increased stock market volatility across the world. However, economic resilience, intensity of capitalism, quality of corporate governance and level of financial development provide helpful support to reduce the excessive heat in global capital markets. Our results confirm the differential policy response by developed and emerging countries. For example, we have found robust evidence that an improved health system does help investors feel assured and thereby helps to reduce market volatility, and this effect is more prominent in emerging markets. Moreover, we have found that changing policy rates amid fear and uncertainty does not work very well in developed markets, but provides helpful support to stock markets in emerging countries. The rest of the paper is organised as follows: Section 2 describes the data and methodology. In Section 3, we present the empirical findings and Section 4 concludes.

2. Data and methodology

In this paper, we have applied data from various sources. A detailed list of the variables, their definitions and sources is provided in Table 1. Our dataset, including daily price indices, daily trading volumes and the daily CBOE VIX index cover the period 1 July 2019 to 14 August 2020. We have collected these capital market, resilience and macroeconomic data for 34 economies based on the data availability and comprehensiveness of the market. A description of our sample by country is presented in Table 2 . There are an equal number of observations for each country and thus we have a balanced panel.

Table 2.

Description of the data.

| List of the Market | Frequency of observations | Per cent | Cumulative Percentage |

|---|---|---|---|

| Australia | 295 | 2.94 | 2.94 |

| Austria | 295 | 2.94 | 5.88 |

| Belgium | 295 | 2.94 | 8.82 |

| Brazil | 295 | 2.94 | 11.76 |

| Canada | 295 | 2.94 | 14.71 |

| China | 295 | 2.94 | 17.65 |

| Czech | 295 | 2.94 | 20.59 |

| Egypt | 295 | 2.94 | 23.53 |

| Finland | 295 | 2.94 | 26.47 |

| France | 295 | 2.94 | 29.41 |

| Germany | 295 | 2.94 | 32.35 |

| Greece | 295 | 2.94 | 35.29 |

| Hungary | 295 | 2.94 | 38.24 |

| India | 295 | 2.94 | 41.18 |

| Indonesia | 295 | 2.94 | 44.12 |

| Italy | 295 | 2.94 | 47.06 |

| Japan | 295 | 2.94 | 50.00 |

| Malaysia | 295 | 2.94 | 52.94 |

| Mexico | 295 | 2.94 | 55.88 |

| Netherland | 295 | 2.94 | 58.82 |

| Norway | 295 | 2.94 | 61.76 |

| Philippine | 295 | 2.94 | 64.71 |

| Poland | 295 | 2.94 | 67.65 |

| Singapore | 295 | 2.94 | 70.59 |

| South Africa | 295 | 2.94 | 73.53 |

| South Korea | 295 | 2.94 | 76.47 |

| Spain | 295 | 2.94 | 79.41 |

| Sweden | 295 | 2.94 | 82.35 |

| Switzerland | 295 | 2.94 | 85.29 |

| Taiwan | 295 | 2.94 | 88.24 |

| Thailand | 295 | 2.94 | 91.18 |

| Turkey | 295 | 2.94 | 94.12 |

| UK | 295 | 2.94 | 97.06 |

| USA | 295 | 2.94 | 100 |

| Total | 10,030 | 100 |

Note: This table shows the list of countries we consider in the study.

The daily data on the number of COVID-19 reported cases and deaths start from the first official record of the World Health Organization, which is 31 December 2019, and continue until 14 August 2020. Before using our variables in empirical models, we have made sure that they are not suffering from the unit root problem. To control the stationarity problem, we use the first or second difference of the data where appropriate, based on various panel unit root tests, such as Levin et al., 2002, Im et al., 2003 and Fisher-types.

For empirical analysis, we develop a dynamic panel-based EGARCH (1,1) model following the approach suggested in earlier literature, such as Lee, 2010, Ribeiro et al., 2017. For a cross-section of N countries and T time periods, we express the conditional mean equation for index returns as a dynamic panel with fixed effects:

| (1) |

where captures the country-specific effects that are assumed to be fixed, is a vector of control (exogenous) variables, which includes log of trading volume (LVO), the VIX returns (RVX), the log of oil price (LOP) and the log of quarterly GDP (LGD). is the corresponding coefficient of this vector. In Eq. (1), and represent the vector of change in COVID-19-related cases and deaths worldwide (CTC and CTD) and in each country in our sample (CSC and CSD), respectively, where the corresponding coefficient are and . We have used both country-specific and global COVID-19-related data in this study because during a crisis financial markets observe a contagion effect and thus become not only prone to local information but also to global risk (see Akhtaruzzaman, Boubaker, & Sensoy, 2020). For example, the European and Asian markets have displayed higher volatility with the increasing numbers of COVID-19 cases and deaths in the US (see, Ali, Alam, & Rizvi, 2020). Similarly, news on the development of a coronavirus vaccine heated up financial markets across the world. Moreover, during this COVID-19 pandemic, commodity markets such as the oil price experienced an unforeseen fall, which had a spillover effect on equity markets across the world. Therefore, we use the global impact of COVID-19 on the local equity returns by including CTC and CTD in Eq. (1) with the local cases and deaths.

The N-dimensional vector of disturbances in Eq. (1) is assumed to have a normal distribution with mean zero along with the following conditional moments:

| (2) |

| (3) |

| (4) |

| (5) |

The conditions in Eqs. (2), (3) assume no non-contemporaneous cross-sectional correlation and no autocorrelation. The third and fourth assumptions define the general conditions of the conditional variance-covariance process. Empirically, the cross-sectional co-movements of conditional variance can be captured via other models, such as Bollerslev (1990) CCC and Engle (2002) DCC. However, in this paper, we opted to examine whether market resilience could reduce the extra stock market volatility induced by COVID-19, so we are only interested in the conditional variance process developed and estimated from Eq. (1). Therefore, ensuring our objective, we assume the conditional variance follows a Nelson (1991) EGARCH (1,1) process:

| (6) |

where , and the error term follows a Gaussian process. Like the earlier Eq. (1), and represent the vector of growth in global and country-specific COVID-19 cases and deaths (CTC, CTD, CSC and CSD) in Eq. (6). The , on the other hand, is a vector of our resilience score, its sub-components’ scores, and other macro characteristics as described in Table 1. Therefore, our prime objective is to determine the sign and value of the coefficients of the vectors , and , i.e. sign and value of , and in Eq. (6). For example, a positive sign of and would imply a volatility enhancement due to COVID-19, yet if the market resilience could lessen the variance in the stock market then we should expect a negative sign of for components. We also introduce an interaction term of and ; and of and . Our equation with the interaction terms is:

| (7) |

We run various post-estimation tests to confirm the statistical validity of our models. Moreover, we have applied between-effect models, and our results remain statistically robust.

3. Empirical findings

3.1. Preliminary statistics and basic volatility model

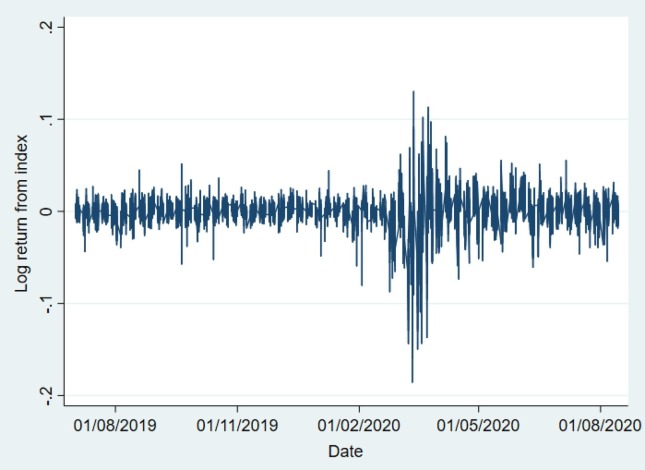

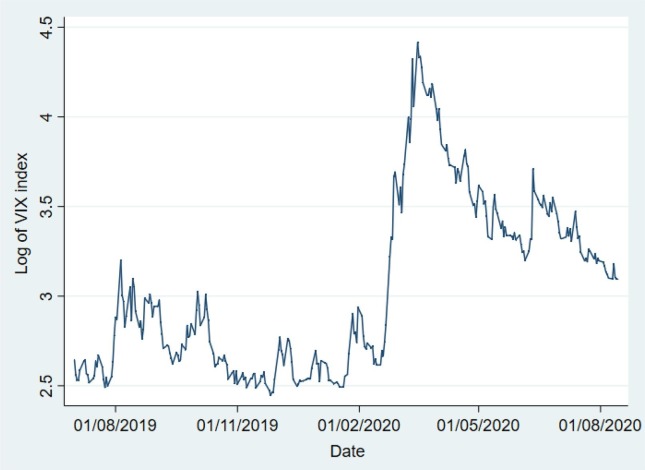

Graph 1 shows the distribution of the log return of indices under consideration over the sample period. A significant variance is observed from March 2020, when COVID-19 hits the European countries, e.g. Italy, France and Spain. That suggests COVID-19 has increased variations in returns among the equity markets in our study. The impact is further documented in Table 3 , where we report the summary statistics and correlation matrix between our main variables of interest. Panel A of Table 3 indicates that the mean index return of our sample markets is −0.03%, and the mean returns of MSCI World Index and Emerging Market Index are around nearly zero (0.03% and 0.01%, respectively) over the sample period. A possible effect of COVID-19 is further reflected in the trading volume. The mean of log of trading volume (LVO) is 12.50 with a high standard deviation of 2.87, implying a significant fluctuation in the trading volume following the increased volatility in the equity markets induced by the coronavirus. In support of the argument for high variance in market returns and fluctuations in trading volume, we observe the volatility index, VIX, reached the highest level around the time when COVID-19 hit the European markets, and the World Health Organization declared the situation to be a pandemic (see Graph 2 ). The VIX remains high until the end of our sample period, starting from March 2020, compared to before the pandemic.6

Graph 1.

Distribution of log returns (RET).

Table 3.

Summary statistics and correlation matrix.

| Panel A: Summary statistics | ||||||

|---|---|---|---|---|---|---|

| stats | Mean | Standard Deviation | Percentile Mean |

|||

| p25 | p50 | p75 | p95 | |||

| LDX | 8.5515 | 1.3457 | 7.3834 | 8.5869 | 9.2972 | 10.9485 |

| LGX | 1.6114 | 0.4515 | 1.3629 | 1.5457 | 1.7760 | 2.8221 |

| RET | −0.0003 | 0.0171 | −0.0056 | 0.0001 | 0.0068 | 0.0213 |

| LVO | 12.5034 | 2.8683 | 10.9516 | 12.1884 | 13.7328 | 18.9514 |

| LVX | 3.0428 | 0.4834 | 2.6203 | 2.8887 | 3.3820 | 3.9975 |

| RVX | 0.0015 | 0.0906 | −0.0541 | −0.0071 | 0.0363 | 0.1651 |

| RMW | 0.0003 | 0.0168 | −0.0037 | 0.0009 | 0.0061 | 0.0232 |

| RME | 0.0001 | 0.0139 | −0.0049 | 0.0006 | 0.0062 | 0.0184 |

| MPR | 2.2344 | 3.3537 | 0.0000 | 0.9000 | 3.7500 | 9.2500 |

| LOP | 3.7817 | 0.3724 | 3.6595 | 3.9691 | 4.0367 | 4.1097 |

| LGD | 5.5954 | 1.4127 | 4.5333 | 5.1880 | 6.3749 | 8.4725 |

| RES | 4.2159 | 0.3383 | 3.8895 | 4.3838 | 4.5017 | 4.5750 |

| CPS | 4.2256 | 0.1370 | 4.1558 | 4.2503 | 4.3202 | 4.4055 |

| COG | 4.2810 | 0.1904 | 4.1748 | 4.3192 | 4.4142 | 4.5801 |

| OIN | 4.2801 | 0.1511 | 4.1860 | 4.3122 | 4.3959 | 4.4443 |

| INQ | 4.3326 | 0.1893 | 4.1904 | 4.3668 | 4.5019 | 4.5689 |

| PRO | 3.2303 | 0.6428 | 2.7262 | 3.4398 | 3.6937 | 4.0508 |

| HEL | 4.3570 | 0.0848 | 4.3232 | 4.3830 | 4.4076 | 4.4597 |

| FID | 0.6490 | 0.1771 | 0.5160 | 0.6727 | 0.7912 | 0.8768 |

| FII | 0.6838 | 0.1731 | 0.5651 | 0.7013 | 0.8390 | 0.9400 |

| Panel B: Correlation Matrix | |||||||||||||

| CTC | CSC | CTD | CSD | RET | LVO | LVX | RMW | RME | RES | MPR | LOP | LGD | |

| CTC | 1.0000 | ||||||||||||

| CSC | 0.3802 | 1.0000 | |||||||||||

| CTD | 0.0898 | 0.1471 | 1.0000 | ||||||||||

| CSD | 0.0506 | 0.1363 | 0.8182 | 1.0000 | |||||||||

| RET | −0.0418 | −0.0750 | −0.1182 | −0.0669 | 1.0000 | ||||||||

| LVO | −0.0114 | 0.0056 | 0.0212 | 0.0284 | −0.0065 | 1.0000 | |||||||

| LVX | −0.0046 | 0.1012 | 0.1529 | 0.2014 | −0.1144 | 0.0762 | 1.0000 | ||||||

| RMW | −0.0211 | −0.0545 | −0.0873 | −0.0479 | 0.6424 | −0.0098 | −0.1197 | 1.0000 | |||||

| RME | −0.0834 | −0.1293 | −0.1222 | −0.0866 | 0.6545 | −0.0062 | −0.1236 | 0.6999 | 1.0000 | ||||

| RES | −0.0001 | 0.0004 | 0.0052 | 0.0031 | 0.0039 | −0.4801 | 0.0050 | −0.0030 | −0.0025 | 1.0000 | |||

| MPR | −0.0020 | −0.0055 | −0.0064 | −0.0072 | −0.0057 | 0.3190 | −0.0865 | −0.0057 | −0.0107 | −0.6763 | 1.0000 | ||

| LOP | 0.0058 | −0.1085 | −0.0861 | −0.1702 | −0.0089 | −0.0601 | −0.8343 | −0.0258 | −0.0056 | −0.0009 | 0.0861 | 1.0000 | |

| LGD | −0.0023 | −0.0090 | 0.0078 | 0.0133 | 0.0105 | 0.4870 | −0.0362 | −0.0018 | −0.0016 | 0.0977 | −0.0204 | 0.0390 | 1.0000 |

| Panel C: Developed versus Emerging Markets | |||||||

|---|---|---|---|---|---|---|---|

| Variables | Developed Markets |

Emerging Markets |

Comparison Tests |

Rank-Sum Tests | |||

| Mean | SD | Mean | SD | Mean | Variance | ||

| RES | 4.4927 | 0.0772 | 3.9391 | 0.2640 | −142.51*** | 6609.35*** | 83.16*** |

| CPS | 4.3032 | 0.0910 | 4.1481 | 0.1313 | −68.77*** | 655.77*** | 55.25*** |

| COG | 4.3653 | 0.1354 | 4.1967 | 0.1999 | −49.77*** | 684.64*** | 42.33*** |

| MPR | 0.3263 | 0.7379 | 4.1424 | 3.8302 | 69.28*** | 3529.95*** | −72.05*** |

| LGD | 5.9798 | 1.5022 | 5.2110 | 1.1910 | −28.32*** | 166.35*** | 26.85*** |

| OIN | 4.2625 | 0.1642 | 4.2967 | 0.1355 | 11.21*** | 219.94*** | −16.51*** |

| INQ | 4.4611 | 0.0985 | 4.2040 | 0.1701 | −95.98*** | 533.36*** | 68.75*** |

| PRO | 3.7074 | 0.2261 | 2.7531 | 0.5657 | −110.93*** | 4695.07*** | 78.36*** |

| HEL | 4.4061 | 0.0314 | 4.3079 | 0.0926 | −71.14*** | 3955.90*** | 69.66*** |

| FID | 0.7696 | 0.1011 | 0.5210 | 0.1482 | −97.16*** | 717.98*** | 69.11*** |

| FII | 0.7982 | 0.1112 | 0.5623 | 0.1414 | −91.75*** | 193.18*** | 67.85*** |

Note: In this table, we show the statistical difference in the macroeconomic characteristics between developed and emerging markets within our sample countries. We use the International Monetary Fund’s definitions to separate emerging markets from developed markets. We use a pairwise T-test, Levene (1960) robust F-test and the Wilcoxon rank-sun (Mann-Whitney) test to compare the mean, variance and median differences between the developed and emerging market groups.

***, ** and * indicates statistical significance at the 1%, 5% and 10% levels, respectively.

Graph 2.

Distribution of log of CBOE VIX index.

The correlation matrix further confirms the negative association between COVID-19 and equity market returns. In Panel B of Table 3, RET, RMW and RME are negatively correlated to the change in the number of coronavirus cases (CTC and CSC) and deaths (CTD and CSD). The association of COVID-19 is more negative with the emerging market index RME (up to −0.1293 with CSC) than the aggregate sample (up to −0.1182 with CTD) and the world index (up to −0.0873 with CTD). Similarly, the correlation of volatility index (LVX) is strongly positive with CSC (0.1012), CTD (0.1529) and CSD (0.2014), which shows an increase in market variance following the COVID-19 outbreak. As expected, on the other hand, we observe a significant negative correlation of COVID-19 with the oil price (up to −0.1702 with CSD), which supports the adverse impact of a recent reduction in oil prices in the international market. Surprisingly, the LGD is negatively associated (-0.0023 with CTC and −0.0090 with CSC), indicating that larger economies are critically affected by the growth in COVID-19 cases. Moreover, the sign of monetary policy response (MPR) and COVID-19 is negative (up to −0.0072 with CSD), suggest a reduction in the policy rate by central banks across the world after the outbreak of coronavirus. Finally, the resilience index (RES) is positively correlated with COVID-19 (except with CTC) and market returns (0.0039) but negatively with trading volume (−0.4801). The associations, therefore, specify that resilient economies might display desirable returns for investors despite their higher COVID-19-related cases and deaths. However, investors in these resilient economies may become highly sceptical around this COVID-19 shock, and significantly reduce their trading.

Panel C of Table 3 reports the statistics related to country-level macroeconomic characteristics of developed and emerging markets within our sample countries reported in Table 2 (Appendix A shows the country-level mean). The mean value of developed markets in Panel C of Table 3 is higher than that of emerging markets across all categories, except the monetary policy rate (MPR) and oil intensity score (OIN). The MPR is significantly low (0.3263) in developed markets, probably due to quantitative easing in monetary policy in various markets, such as in the US, UK and EU. The oil intensity score (OIN), on the other hand, is slightly higher in emerging markets such as China, India, Turkey, Indonesia and the Philippines (4.2967), which may be due to their strong dependency on oil-intensive manufacturing sectors (see Appendix A for their score).

In the last three columns of Panel C in Table 3, we report the results of the statistical tests to compare the mean, variance and median values between developed and emerging markets. The pairwise T-test confirms that the mean scores of each macroeconomic variable reported in Panel C for emerging markets are statistically and significantly different from those for developed markets. Similarly, Levene (1960) robust F-test and the Mann-Whitney test suggest that the variance and median, respectively, are also statistically different between developed and emerging markets in our sample. All the statistics are significant at the 1% level.

3.2. The basic conditional mean and variance model

Table 4 presents the results of conditional mean and conditional variance for index returns () using Eqs. (1), (2), respectively. Column (1) of this table exhibits the findings related to the dynamic panel with fixed effects applying Eq. (1), which shows that COVID-19 is negatively affecting the market returns of our sample economies. The growth in the total number of COVID-19 cases (CTC) and deaths (CTD) worldwide has reduced the overall index returns by −0.17% and −0.79%, respectively, and these are statistically significant at the 1 per cent level. The country-specific growth in COVID-19 deaths (CSD) is also significant at the 10 per cent level and reduced the returns by −0.51%. In addition to COVID-19, we have used VIX returns (RVX) and trading volume (LVO) to control for market sentiment and trading behaviour. RVX is negatively influencing the returns (−6.43%) in Table 4 and this also is statistically significant. The oil price (LOP) and quarterly GDP (LGD), however, are used to control the spillover effect and the size difference between the economies in our sample. They are positively affecting the returns by 4.69% and 0.01%, respectively, but only the coefficient of LOP is significant at the 1 per cent level. All these relationships are consistent with Table 3 and previous literature (e.g. Mollick and Assefa, 2013, Fernandes et al., 2014, Onali, 2020) except the effect of LOP.

Table 4.

Basic volatility model.

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | RET | Conditional Variance Process | Conditional Variance Process |

| RETt-1 | 0.0003 | ||

| (0.0251) | |||

| RVX | −0.0643*** | ||

| (0.0065) | |||

| LVO | 0.0003 | ||

| (0.0005) | |||

| LOP | 0.0469*** | ||

| (0.0046) | |||

| LGD | 0.0001 | ||

| (0.0003) | |||

| CTC | −0.0017*** | 4.3095*** | 2.2169 |

| (0.0003) | (0.5176) | (6.1079) | |

| CTD | −0.0079*** | 2.7830*** | −5.9128 |

| (0.0008) | (0.3749) | (4.7610) | |

| CSC | 0.0003 | 0.0561* | 1.1170** |

| (0.0019) | (0.0314) | (0.5408) | |

| CSD | −0.0051* | 0.2407*** | 1.5135** |

| (0.0029) | (0.0395) | (0.6985) | |

| RES | – | −0.2890*** | |

| (0.0469) | |||

| RES*CTC | – | 0.4601 | |

| (1.4461) | |||

| RES*CTD | – | 2.2313** | |

| (1.1241) | |||

| RES*CSC | – | −0.2414* | |

| (0.1237) | |||

| RES*CSD | – | −0.2904* | |

| (0.1593) | |||

| 0.0077 | 0.0008 | ||

| (0.0145) | (0.0139) | ||

| 0.4928*** | 0.4702*** | ||

| (0.0208) | (0.0213) | ||

| 0.3987*** | 0.3325*** | ||

| (0.0397) | (0.0385) | ||

| −5.3731*** | −4.7474*** | ||

| (0.3449) | (0.3695) | ||

| p-value for equality of CTC and CTD | 0.016 | 0.000 | |

| p-value for equality of CTC and CTD | 0.015 | 0.000 | |

| Observation | 9,848 | 5,989 | 5,989 |

| R2 | 0.1844 | ||

| No. of countries | 34 | ||

| Time FE | Yes | No | No |

| Country FE | Yes | No | No |

Note: This table shows the results of our conditional mean Eq. (1) using a dynamic panel model with fixed effects in column one. We capture the conditional variance process from Eq. (1) using EGARCH (1,1) in column two. Therefore, columns (1) and (2) are referred to as our basic return and volatility model, respectively. Our remaining analysis is based on the conditional variance process reported in column (2) of this table. Column (3) reports the results related to the impact of country-level resilience (RES) and its interaction with COVID-19 cases and deaths on volatility (Eq. (7)).

***, ** and * indicates statistical significance at the 1%, 5% and 10% levels, respectively.

In column (2) of Table 4 we report the results of the conditional variance process EGARCH (1, 1), applying Eq. (6) to capture the volatility in global equity markets. It is also our primary interest in this paper as our subsequent volatility models are developed based on that process. The coefficients of growth in total global and country-specific cases and deaths suggest that the conditional variance of an equity market is positively associated with COVID-19, and the association is statistically significant at the 10 per cent level. However, growth in global cases (4.31) and deaths (2.78) has a stronger impact on market variance than growth in local cases (0.06) and deaths (0.24) in our dataset. The upsurge in market volatility following the COVID-19 pandemic is also documented in Onali, 2020, Baker et al., 2020, Baker et al., 2020, Yilmazkuday, 2020. In addition, the coefficient of in column (2) shows the persistence of volatility. The positive coefficient implies that positive innovations are more destabilising than negative innovations during our sample episode. However, the symmetric effect (0.49) appears stronger than the positive innovation (0.008). Finally, the p-values for equality of growth in global and local cases and deaths confirm that their respective coefficients are statistically different in both the conditional mean (i.e. return) and conditional variance models.

We have reported the interaction of country-level resilience (RES) and COVID-19 in column (3) of Table 4. The interaction terms reflect the role of the resilience score in minimising the risk associated with COVID-19 cases and deaths on the equity market conditional variance. The resilience score (RES) and its interactions with country-specific cases (RES*CSC) and deaths (RES*CSD) are negative and statistically significant at the 10 per cent level. Our findings suggest that the resilience of a country could reduce the surge of equity market variance by 24.14% and 29.04%, respectively, via minimising the risk associated with local COVID-19 cases and deaths. Moreover, the resilience itself could reduce the volatility by 28.90 per cent.

3.3. Market resilience and COVID-19

In Table 5 , we present the impact of various resilience-related indices and scores (as listed in Table 1) on the conditional variance structure following Eq. (6). Findings are reported in columns (1) to (12) of Table 5. Changes in total COVID-19 cases (CTC and CSC) and total deaths (CTD and CSD) are positively and significantly related to market variance across the table. However, as found in Table 4 (column 2), the impact of global cases (up to 4.48) and deaths (up to 3.84) is stronger on the equity market variance across Table 5 than that of the local cases (up to 0.08) and deaths (up to 0.26).

Table 5.

Impact of Resilience Score.

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

(10) |

(11) |

(12) |

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Var. | Conditional Variance Process | |||||||||||

| CTC | 4.3020*** | 4.0567*** | 4.1910*** | 4.3933*** | 4.3159*** | 4.3071*** | 4.4816*** | 4.2993*** | 4.2842*** | 4.1902*** | 4.2002*** | 3.9934*** |

| (0.5228) | (0.5319) | (0.5231) | (0.5176) | (0.5175) | (0.5226) | (0.5212) | (0.5232) | (0.5196) | (0.5259) | (0.5261) | (0.5478) | |

| CTD | 2.7650*** | 3.8377*** | 3.2195*** | 2.5552*** | 2.6472*** | 2.7916*** | 2.0794*** | 2.9027*** | 2.7392*** | 2.4677*** | 2.4600*** | 3.4363*** |

| (0.3753) | (0.3772) | (0.3754) | (0.3744) | (0.3749) | (0.3754) | (0.3794) | (0.3755) | (0.3751) | (0.3801) | (0.3800) | (0.3896) | |

| CSC | 0.0565* | 0.0745** | 0.0790** | 0.0548* | 0.0517 | 0.0479 | 0.0530 | 0.0455 | 0.0412 | 0.0503 | 0.0503 | 0.0608 |

| (0.0308) | (0.0331) | (0.0312) | (0.0311) | (0.0317) | (0.0312) | (0.0327) | (0.0317) | (0.0317) | (0.0316) | (0.0314) | (0.0376) | |

| CSD | 0.2395*** | 0.1995*** | 0.2002*** | 0.2445*** | 0.2479*** | 0.2496*** | 0.2462*** | 0.2567*** | 0.2614*** | 0.2510*** | 0.2508*** | 0.2152*** |

| (0.0388) | (0.0417) | (0.0393) | (0.0392) | (0.0400) | (0.0393) | (0.0405) | (0.0400) | (0.0400) | (0.0399) | (0.0396) | (0.0466) | |

| RES | −0.2068*** | |||||||||||

| (0.0233) | ||||||||||||

| CPS | −0.8825*** | −0.8868*** | ||||||||||

| (0.0783) | (0.1128) | |||||||||||

| COG | −0.4614*** | −0.2955*** | ||||||||||

| (0.0471) | (0.0686) | |||||||||||

| MPR | 0.0104*** | −0.0029 | ||||||||||

| (0.0025) | (0.0040) | |||||||||||

| LGD | −0.0085 | −0.0170 | ||||||||||

| (0.0066) | (0.0104) | |||||||||||

| PRO | −0.1247*** | 0.0238 | ||||||||||

| (0.0132) | (0.0438) | |||||||||||

| OIN | 0.1426** | 0.0871 | ||||||||||

| (0.0566) | (0.0696) | |||||||||||

| INQ | −0.0045*** | −0.0012 | ||||||||||

| (0.0005) | (0.0017) | |||||||||||

| HEL | −0.6739*** | −0.2958 | ||||||||||

| (0.0979) | (0.2202) | |||||||||||

| FDI | −0.1704*** | 0.5320*** | ||||||||||

| (0.0459) | (0.0979) | |||||||||||

| FII | −0.1860*** | |||||||||||

| (0.0452) | ||||||||||||

| −0.0016 | −0.0115 | −0.0135 | −0.0001 | 0.0003 | −0.0034 | 0.0108 | −0.0020 | −0.0015 | 0.0094 | 0.0090 | 0.0033 | |

| (0.0137) | (0.0144) | (0.0149) | (0.0135) | (0.0135) | (0.0137) | (0.0142) | (0.0136) | (0.0136) | (0.0137) | (0.0138) | (0.0166) | |

| 0.4820*** | 0.4527*** | 0.4654*** | 0.4896*** | 0.4912*** | 0.4778*** | 0.5101*** | 0.4770*** | 0.4845*** | 0.4966*** | 0.4951*** | 0.4750*** | |

| (0.0210) | (0.0219) | (0.0219) | (0.0208) | (0.0207) | (0.0211) | (0.0211) | (0.0211) | (0.0209) | (0.0210) | (0.0211) | (0.0240) | |

| 0.4031*** | 0.3169*** | 0.3671*** | 0.4232*** | 0.4075*** | 0.3963*** | 0.4570*** | 0.3832*** | 0.4019*** | 0.4382*** | 0.4397*** | 0.3449*** | |

| (0.0408) | (0.0387) | (0.0389) | (0.0418) | (0.0402) | (0.0411) | (0.0426) | (0.0402) | (0.0410) | (0.0425) | (0.0427) | (0.0404) | |

| −4.4659*** | −2.3794*** | −3.6847*** | −5.1830*** | −5.2460*** | −4.9949*** | −5.4617*** | −5.1604*** | −2.4101*** | −4.9047*** | −4.8761*** | −0.1527 | |

| (0.3462) | (0.4036) | (0.3434) | (0.3621) | (0.3472) | (0.3496) | (0.4403) | (0.3434) | (0.5156) | (0.3681) | (0.3701) | (1.0911) | |

| Obs. | 5,989 | 5,989 | 5,989 | 5,989 | 5,989 | 5,989 | 5,812 | 5,989 | 5,989 | 5,812 | 5,812 | 5,635 |

Note: This table exhibits the impact of COVID-19, country-level resilience, resilience’s sub-components and other macro characteristics on the volatility of equity markets within our sample countries. We estimated each of these conditional variance processes using Eq. (6). From column (1) to (11) we follow the stepwise models and in column (12) we present the simultaneous association. However, the resilience score is excluded in column (12) as its sub-components are considered, such as governance (COG), productivity (PRO), oil intensity (OIN) and infrastructure quality (INF). Similarly, we excluded Financial institutions development index (FII) in the simultaneous model as we have included the aggregate development index FDI. The robust standard errors are reported in parentheses.

***, ** and * indicates statistical significance at the 1%, 5% and 10% levels, respectively.

The impact of overall resilience index (RES) within the conditional variance process is displayed in column (1). The coefficient is negative (-0.207) and statistically significant at the 1 per cent level, which implies that market resilience could reduce the returns volatility by 2.07% over the sample period. That means a market might focus on the enhancement of its aggregate resilience to avoid an equity market crisis following any unexpected shock such as the pandemic. In columns (2) to (11), we show the impact of various macro characteristics of a country with the assumption that these might contribute to the enhancement of economic resilience and might help to reduce the returns variance of their capital market. As expected, we find that the capitalism score (CPS), governance score (COG), size of the economy (LGD), productivity score (PRO), infrastructure quality (INF), health pillar (HEL), financial development index (FDI) and financial institutions development index (FII) are negatively affecting the conditional variance in our stepwise models. The coefficients are all statistically significant at the 1 or 5 per cent level. For example, the corresponding coefficient of CPS is −0.8825, and it is significant at the 1 per cent level, meaning that the aggregate economic freedom of a country could improve the resilience of a market and reduce the returns volatility by around 88.25% during a shock.

Interestingly, the health pillar (HEL) has become a significant determinant to market volatility during this COVID-19 pandemic. The pillar measures the extent to which people are healthy and have access to the necessary services to maintain good health. It has a significant impact on investors’ sentiment and could reduce the return volatility by 67.39% per cent over the sample period. Next to the health pillar, the governance quality (COG) has a coefficient of −0.4614 in column (3), showing the importance of a country’s governance quality on investors’ behaviour during a crisis period. This finding suggests that an economy could reduce its equity market volatility by 46.14% with the capacity of the government to effectively formulate and implement sound policies, with better auditing and accounting standards, with better regulation of conflicts of interest, and stronger shareholder protection than other countries.

The development of financial institutions (FII) and the aggregate development of financial markets and institutions (FDI) could also improve market resilience and minimise equity variance by 18.60 and 17.04 per cent, respectively. The productivity score (PRO) and infrastructure quality score (INQ), however, could reduce the volatility by 12.47% and 0.045%, respectively. Finally, the size of an economy (LGD) might also negatively influence the return variance by 0.85%, but it is not found to be statistically significant even at the 10 per cent level of significance.

In addition to the negative effects of the above-discussed variables on the conditional variance process, we find that oil intensity score (OIN) and monetary policy (MPR) are positively associated with returns volatility. As reported in Table 1, the OIN represents the vulnerability of a country to an oil shock (shortage, disruption, price hike); thus, it measures the country’s dependence on oil for its productivity. Therefore, the definition of oil intensity implies that the country’s dependence on oil will increase the equity market variance by 14.26% during an unexpected event such as COVID-19. This positive influence might be due to the uncertainty of oil production and oil supply during the global pandemic and lockdown (see Estrada, 2020). The monetary policy rate (MPR), on the other hand, specifies the impact of central banks’ response to COVID-19. We have seen that central banks across the world have reduced their policy rate to increase the money supply and boost consumer confidence during the COVID-19 pandemic7 . The coefficient of MPR in column (4) of Table 5 is 0.0104 and is statistically significant at the 1 per cent level. It suggests that increasing (lowering) the policy rate will increase (lower) the market variance.

The simultaneous impact of resilience’s sub-components and other country-level macro characteristics is presented in column (12). We have excluded RES and FII in this model as their sub-components and aggregate index, respectively, are included. Results indicate the power of capitalism and governance while a country faces a crisis such as a pandemic. An economy with a higher score in capitalism (CPS) and governance (COG) could reduce the equity market variance by 88.68 and 29.55 per cent, respectively, which are statistically significant at the 1 per cent level. However, unexpectedly, the aggregate financial development index (FDI) is found to be positive (0.5320) and significant in column (12). The coefficients of health pillar, infrastructure quality and size of the economy are still negative but not statistically significant, like all the other variables.

3.4. Robustness tests

We test the robustness of association using interaction terms and separating the samples between developed and emerging markets. In Table 6 , we exhibit the findings related to the interaction terms, and Table 7 exhibits the comparative analysis of developed and emerging markets. For interactions, we interact aggregate resilience scores (RES) with its sub-components and with other country-level macro attributes. The objectives of these interaction terms are to see, first, the joint effect; and, second, which country-level macro characteristic may relatively reduce the conditional variance during an uncertain situation such as the COVID-19 pandemic. As reported in Table 6, we have found the expected signs and statistical significance for several interaction terms. Like our earlier results in Table 4, the interaction term between resilience score (RES) and capitalism score (CPS), governance score (COG), economic size (LGD), productivity score (PRO), infrastructure quality (INQ), health pillar (HEL), financial development index (FDI) and development of financial institutions index (FII) are negative. It suggests that these variables could reduce the equity market variance within the given resilience of a country. However, the coefficients of CPS (−0.9090), COG (−0.0107) and INQ (-0.7688) are only statistically significant at the 10 per cent level. In columns (3) and (6), the joint effects of RES*MPR and RES*OIN are also significant at the 5 per cent level, but the signs are positive. That implies a country with higher policy rate and higher intensity of oil consumption would experience relatively larger equity variance during COVID-19 compared to other markets with a similar resilience score.

Table 6.

Interaction of Sub-component with Resilience Index.

| (1) |

(2) |

(3) |

(4) |

(5) |

(6) |

(7) |

(8) |

(9) |

(10) |

|

|---|---|---|---|---|---|---|---|---|---|---|

| Var. | Conditional Variance Process | |||||||||

| CTC | 3.7192*** | 3.7973*** | 3.7676*** | 3.8831*** | 3.8515*** | 4.0456*** | 3.8477*** | 3.8941*** | 3.8691*** | 3.8431*** |

| (0.5356) | (0.5326) | (0.5337) | (0.5304) | (0.5313) | (0.5359) | (0.5305) | (0.5298) | (0.5377) | (0.5378) | |

| CTD | 3.8359*** | 3.5326*** | 3.3763*** | 3.1636*** | 3.3033*** | 2.6754*** | 3.1766*** | 3.1207*** | 2.9978*** | 3.0019*** |

| (0.3792) | (0.3782) | (0.3789) | (0.3777) | (0.3784) | (0.3830) | (0.3784) | (0.3777) | (0.3833) | (0.3834) | |

| CSC | 0.1568*** | 0.1414*** | 0.1338*** | 0.1263*** | 0.1178*** | 0.1240*** | 0.1227*** | 0.1198*** | 0.1163*** | 0.1172*** |

| (0.0331) | (0.0313) | (0.0312) | (0.0308) | (0.0314) | (0.0368) | (0.0309) | (0.0310) | (0.0313) | (0.0309) | |

| CSD | 0.0854** | 0.1121*** | 0.1265*** | 0.1382*** | 0.1473*** | 0.1416*** | 0.1384*** | 0.1469*** | 0.1526*** | 0.1525*** |

| (0.0417) | (0.0395) | (0.0390) | (0.0386) | (0.0393) | (0.0446) | (0.0387) | (0.0388) | (0.0394) | (0.0387) | |

| RES | 3.9869*** | −0.0024 | −0.1296*** | −0.0357 | 0.2973** | −1.8248** | −3.2894*** | −0.8538 | 0.0704* | −0.0478 |

| (1.0395) | (0.5825) | (0.0363) | (0.0311) | (0.1894) | (0.9078) | (0.7705) | (2.1232) | (0.1090) | (0.1138) | |

| CPS | 2.9999*** | |||||||||

| (1.0332) | ||||||||||

| RES*CPS | −0.9090*** | |||||||||

| (0.2471) | ||||||||||

| COG | −0.2958** | |||||||||

| (0.5627) | ||||||||||

| RES*COG | −0.0107* | |||||||||

| (0.1365) | ||||||||||

| MPR | 0.0293 | |||||||||

| (0.0255) | ||||||||||

| RES*MPR | 0.0116* | |||||||||

| (0.0066) | ||||||||||

| LGD | 0.0036 | |||||||||

| (0.0098) | ||||||||||

| RES*LGD | −0.0005 | |||||||||

| (0.0014) | ||||||||||

| PRO | 0.0598 | |||||||||

| (0.2352) | ||||||||||

| RES*PRO | −0.0438 | |||||||||

| (0.0575) | ||||||||||

| OIN | −1.8074** | |||||||||

| (0.9017) | ||||||||||

| RES*OIN | 0.4177** | |||||||||

| (0.2103) | ||||||||||

| INQ | −3.2103*** | |||||||||

| (0.7469) | ||||||||||

| RES*INQ | −0.7688*** | |||||||||

| (0.1796) | ||||||||||

| HEL | −1.0224 | |||||||||

| (1.9835) | ||||||||||

| RES*HEL | −0.1968 | |||||||||

| (0.4873) | ||||||||||

| FDI | 1.4210* | |||||||||

| (0.7647) | ||||||||||

| RES*FDI | −0.2926 | |||||||||

| (0.1804) | ||||||||||

| FII | 0.9174 | |||||||||

| (0.7389) | ||||||||||

| RES*FII | −0.1481 | |||||||||

| (0.1755) | ||||||||||

| −0.0176 | −0.0154 | −0.0077 | −0.0092 | −0.0119 | 0.0025 | −0.0125 | −0.0103 | 0.0042 | 0.0050 | |

| (0.0149) | (0.0152) | (0.0142) | (0.0145) | (0.0141) | (0.0146) | (0.0140) | (0.0141) | (0.0147) | (0.0145) | |

| 0.4517*** | 0.4597*** | 0.4678*** | 0.4724*** | 0.4685*** | 0.4917*** | 0.4717*** | 0.4733*** | 0.4810*** | 0.4828*** | |

| (0.0223) | (0.0225) | (0.0213) | (0.0215) | (0.0214) | (0.0218) | (0.0211) | (0.0211) | (0.0216) | (0.0216) | |

| 0.3320*** | 0.3610*** | 0.3619*** | 0.3879*** | 0.3725*** | 0.4228*** | 0.3801*** | 0.3902*** | 0.4063*** | 0.4049*** | |

| (0.0427) | (0.0435) | (0.0439) | (0.0445) | (0.0439) | (0.0464) | (0.0442) | (0.0448) | (0.0456) | (0.0456) | |

| −19.2976*** | −4.6917* | −5.1780*** | −5.3872*** | −6.5106*** | 2.6809 | 8.0966*** | −1.0744 | −5.7678*** | −5.3642*** | |

| (4.4180) | (2.4051) | (0.3850) | (0.4112) | (0.8420) | (3.8632) | (3.1237) | (8.6434) | (0.6197) | (0.6200) | |

| Observations | 5,989 | 5,989 | 5,989 | 5,989 | 5,989 | 5,812 | 5,989 | 5,989 | 5,812 | 5,812 |

Note: In this table, we present the results of interaction terms between country-level resilience score, its sub-components and other macro characteristics. We use the interaction terms to estimate whether sub-components and other macro variables could affect the equity market variance via improving the market’s resilience. There is no simultaneous model in this table, as we have used the interaction terms of resilience score with its sub-components. The robust standard errors are reported in parentheses.

***, ** and * indicates statistical significance at the 1%, 5% and 10% levels, respectively.

Table 7.

Impact of Market Resilience on Developed vs. Emerging Markets.

| (1) |

(2) |

(3) |

|

|---|---|---|---|

| Var | Conditional Variance Process | ||

| CTC | 4.0330*** | 3.8783*** | 3.7916*** |

| (0.7299) | (0.7376) | (0.7704) | |

| EMG*CTC | 0.1721 | 0.2757 | −0.0018 |

| (0.9719) | (0.9789) | (1.0223) | |

| CTD | 4.8344*** | 5.4064*** | 6.4624*** |

| (0.5288) | (0.5310) | (0.5512) | |

| EMG*CTD | −2.7840*** | −3.2286*** | −3.8241*** |

| (0.7512) | (0.7552) | (0.7887) | |

| CSC | −0.1642*** | −0.1146*** | −0.0957* |

| (0.0414) | (0.0414) | (0.0574) | |

| EMG*CSC | 0.6134*** | 0.5987*** | 0.6112*** |

| (0.0704) | (0.0712) | (0.0958) | |

| CSD | 0.4878*** | 0.4184*** | 0.3747*** |

| (0.0523) | (0.0523) | (0.0688) | |

| EMG*CSD | −0.6573*** | −0.6566*** | −0.6339*** |

| (0.0890) | (0.0904) | (0.1187) | |

| EMG | 0.1396*** | −3.0079*** | −2.2836 |

| (0.0313) | (0.6113) | (4.6431) | |

| RES | −1.1023*** | ||

| (0.1329) | |||

| EMG*RES | 0.6472*** | ||

| (0.1382) | |||

| CPS | −0.5276** | ||

| (0.2644) | |||

| EMG*CPS | 0.2398 | ||

| (0.3466) | |||

| COG | −0.0279 | ||

| (0.1529) | |||

| EMG*COG | −0.6429*** | ||

| (0.1907) | |||

| MPR | −0.0692 | ||

| (0.0628) | |||

| EMG*MPR | 0.0932 | ||

| (0.0634) | |||

| LGD | 0.1126*** | ||

| (0.0212) | |||

| EMG*LGD | −0.3262*** | ||

| (0.0345) | |||

| PRO | −0.2976** | ||

| (0.1375) | |||

| EMG*PRO | −0.1493 | ||

| (0.1756) | |||

| OIN | 0.3477*** | ||

| (0.1186) | |||

| EMG*OIN | −0.0163 | ||

| (0.2414) | |||

| INQ | −0.0029 | ||

| (0.0034) | |||

| EMG*INQ | 0.5437 | ||

| (0.3878) | |||

| HEL | 0.0375 | ||

| (0.9191) | |||

| EMG*HEL | 0.5014 | ||

| (0.9569) | |||

| FDI | −0.8955*** | ||

| (0.1788) | |||

| EMG*FDI | 2.3223*** | ||

| (0.2771) | |||

| 0.0001 | −0.0167 | −0.0114 | |

| (0.0136) | (0.0154) | (0.0177) | |

| 0.4777*** | 0.4605*** | 0.4360*** | |

| (0.0213) | (0.0227) | (0.0257) | |

| 0.3448*** | 0.3121*** | 0.2297*** | |

| (0.0375) | (0.0369) | (0.0371) | |

| −5.9238*** | −1.2724** | −4.8607 | |

| (0.3278) | (0.5841) | (4.0841) | |

| Observations | 5,989 | 5,989 | 5,635 |

Note: In this table we compare the impact of resilience, its sub-components and other macro characteristics between developed and emerging markets within our sample countries listed in Table 2. Results in this table are generated from interaction terms with the emerging market dummy. Column (1) reports the results of COVID-19, column (2) reports the resilience score, and column (3) reports all other variables except the financial institutions development index (FII), as we have included the aggregate index, FDI. The growth in global and local COVID-19 cases and deaths are also included in (2) and (3). Standard errors are reported in parentheses.

***, ** and * indicates statistical significance at the 1%, 5% and 10% level, respectively.

In addition to the signs and significance, the magnitudes of joint effects suggest that the level of capitalism (CPS), infrastructure quality (INQ) and oil intensity score (OIN) are the three most critical macro characteristics which contribute to the country-level resilience and help to reduce the return variance over the sample period. For example, markets with similar overall resilience scores could reduce capital market volatility by 90.90% with a higher level of economic freedom (see column 1). Likewise, with a higher level of infrastructure quality a market could reduce market volatility by 76.88 per cent. The coefficient of OIN, however, suggests that, with a reduction of oil dependency by one unit, an economy would minimise the conditional variance of their equity market by 0.4177. The financial development index, health pillar, development of financial institutions, productivity score and size of the economy could reduce the volatility by 29.26%, 19.68%, 14.81%, 4.38% and 0.05%, respectively, for countries with a similar level of resilience scores (RES). However, these interaction terms are not statistically significant in our model and for the period of study.

In Table 7, we check the robustness of the association by introducing an interaction term of the resilience score and its sub-components with the emerging market dummy. Panel C of Table 3 shows that the descriptive statistics, such as the mean, median and variance of resilience score, its sub-components and other country-level macro characteristics of emerging markets, are statistically different from those for developed markets. Therefore, our objective is to see how the country-level resilience dynamic is affecting the equity market volatility in two different economic settings. For analytical purposes, we separate the markets based on the definitions of the International Monetary Fund and apply the conditional variance process determined in Section 3.2. Results of interest in Table 7 are generated from the coefficients of the interactions terms. Findings suggest several interesting conclusions about the emerging markets in comparison to developed markets in our sample.

First, emerging markets could significantly reduce the adverse impact of global COVID-19 news on equity variance by their economic resilience and macro characteristics. For example, the interaction term EMG*CTD is −2.7840 in column (1) and becomes −3.2286 and −3.8241 in columns (2) and (3), respectively. That means, in the absence of resilience, its sub-components and other macro characteristics (see column 1), emerging equity markets are less affected by global COVID-19 deaths (CTD) as compared to developed markets by 278.40 per cent. However, the variance in equity markets reduced by 322.86 per cent with resilience and 382.41 per cent with sub-components and macro characteristics. All these coefficients are statistically significant at the 1 per cent level. The risk associated with the growth in global COVID-19 cases (EMG*CTC) is also reduced by 0.18% in column (3), but it is not significant at the 10 per cent level.

Second, the conditional variances of emerging equity markets are more sensitive to country-level COVID-19 cases than deaths. The interaction term EMG*CSC is positive across Table 7, and it suggests that the volatility increases with local COVID-19 cases (up to 61.34%) in emerging markets. The interaction term EMG*CSD, on the other hand, is negative and it means that, compared to developed markets, the conditional variance is reduced (by up to 65.73% in column 1) with the growth in country-level COVID-19 deaths in an emerging market. However, like the local cases, the risk associated with local deaths hardly varies with the country-level resilience or macro strengths.

Third, surprisingly, the interaction term EMG*RES is positive in column (2) of Table 7 and statistically significant at the 1 per cent level. The coefficient (0.6472) implies that, in emerging markets, equity variance increases with their country-level resilience compared to a developed market. It further suggests that, during a shock, investors’ risk attitude in emerging markets may not be boosted by economic strength, and is instead impacted by the lack of sustainable development, the fragility of the economic structure, and the fragility of firm performance. For example, Alfaro, Asis, Chari, and Panizza (2019) recently highlighted the exposure of emerging market firms to exchange rate shocks. They find that larger firms in emerging markets are more financially vulnerable to shocks, and that shocks to sales growth of these large firms are positively and significantly correlated with economic growth. Therefore, both firms and the economy suffer from unexpected shocks.

Fourth, relative to developed markets, the governance quality and size of the economy are vital in reducing the equity variance in emerging markets. The interaction terms EMG*COG and EMG*LGD are −0.6429 and −0.3262, respectively, in column (3) of Table 7, and these are significant at the 1 per cent level. That indicates that, during a crisis, investors in emerging markets give more importance to factors such as the capacity of the government to formulate and implement sound policies, effective regulations in conflict resolutions, and shareholder governance within a country. Similarly, investors place importance on the size of an economy as it helps to absorb a sudden shock such as COVID-19. The productivity of emerging markets (EMG*PRO) could also reduce the conditional variance by 14.93%, but it is not found to be statistically significant in our sample.

Finally, the interaction of EMG*FDI is positive (2.3223) in column (3) and statistically significant at the 1 per cent level. This suggests that, relative to developed markets, the development of financial markets and institutions makes emerging equity markets more sensitive to a shock such as COVID-19.

4. Conclusion

We have been going through the global COVID-19 pandemic for several months now. The first case was recognised in China on 17th November 2019. Wuhan officials reported an epidemic in January 2020.8 The first definitely identified case (albeit retrospectively) of the virus in Europe was in Paris on 27th December 2019. The virus outbreak has now reached almost every country in the world. The Coronavirus Resource Center at John Hopkins University, USA, has reported that as of 29th January 2021 there were over 102 million COVID-19 cases across the world and there were over 2.2 million deaths caused by the virus outbreak. In addition to this, the pandemic has had a significant indirect effect. Most European countries – with the notable exceptions of Sweden and Belarus – have imposed lockdown for varying periods of weeks, even though this has never been the response to any epidemic before. All except seven US states (all with Republican governors) have also followed the lockdown route.9 Unsurprisingly, putting a country’s entire population under lockdown for weeks on end is economically disastrous. The Bank of England has warned that the UK is entering the worst recession since the Great Frost of 1709, with output down by almost 30% in the first half of 2020.10 At the peak of the furlough scheme, one-third of the UK workforce were being paid 80% of their salary under the furlough scheme. 11 How many of these people will find they are unemployed when the scheme ends is unknown. Similar gloomy figures are applicable to most other developed nations. Lockdowns have also been imposed in many emerging countries which are part of the global supply chain and therefore suffer severe supply disruption.

In this paper, we have examined these direct and indirect effects of the COVID-19 pandemic on stock market volatility and we have also examined how certain economic factors can help to reduce the volatility shock so that we can avoid any potential financial crisis. Using data from 34 developed and emerging countries, we have found that resilience scores (RES) could significantly reduce the equity market variance in both developed and emerging markets, but the magnitude of the negative impact is higher in developed countries. The capitalism score (CPS), governance score (COG), productivity score (PRO), health pillar (HEL) and development of financial institutions index (FII) are the crucial determinants and could significantly reduce market volatility. In developed markets, economic freedom, governance and productivity are more important than the other factors in facing a pandemic crisis. However, for emerging markets, their quality of health services and availability of infrastructure are far more critical. The central bank strategy to reduce the policy rate is only working in emerging markets. In the developed markets, lowering the policy rate creates further uncertainty about the future and increases the returns variance. Oil intensity is only relevant to the developed markets. The quality of financial institutions has a stronger negative effect on the equity market variance in emerging countries. Interestingly, we have found that the impact on the developed economies is far more potent than that on the emerging economies. In particular, the total number of COVID-19-related deaths (CTD) has increased the return variance by five to six times more in developed capital markets compared to their emerging counterparts. However, developed markets are more successful in managing the market volatility than the emerging markets, as evidenced by the positive relationship between market volatility and the interaction term of emerging market and economic resilience. This essentially indicates the fragility in emerging market structure and lack of trust among investors in emerging stock markets. To further support this conjecture, this paper has found that governance quality is an important factor that helps to mitigate stock market volatility in emerging countries. Therefore, in times of exogenous shocks such as a global pandemic, emerging market investors rely more on the capacity of governments to formulate and implement sound policies and regulations to safeguard their interests.

The findings of this paper have confirmed the effect of fear arising from the severity of a global pandemic on global stock markets. We need to be very careful about the further effect of this significant volatility effect of the virus outbreak as it could lead us to a potential financial crisis. To avoid this, we can emphasise the selected economic factors that we have found to be particularly effective in reducing volatility in stock markets. Verma and Gustafsson (2020) emphasise the importance of an urgent policy response from the government to face the change caused by the global pandemic. The authors point out the necessity of proactive and forward-looking business strategies and economic policies. The findings of our paper will help governments and policymakers to investigate various country-level factors that may be of use to cope with the situation. Doidge, Karolyi, and Stulz (2007) mention that country-level factors are more important than firm-level factors to ensure discipline in the economy. Therefore, faced with economic turmoil due to the global pandemic, governments and policymakers can emphasise the adoption and implementation of the right economic policies by using a set of economic factors that we have shown to be effective.

Biographies

Dr. Moshfique Uddin Moshfique has been working as an Associate Professor of Finance at Leeds University Business School, University of Leeds, UK. He has published a number of research papers in various reputed journals including British Journal of Management, Journal of Business Research, International Business Review, International Review of Financial Analysis.

Dr. Anup Chowdhury Anup has been working as a Senior Lecturer in Finance at Leeds Business School, Leeds Beckett University, UK. He has published a number of papers in various reputed journals including International Business Review, Emerging Market Review.

Dr. Keith Anderson Keith has been working as a Senior Lecturer at the York Management School, University of York, UK. He has published a number of research papers in various reputed journals including International Review of Financial Analysis, Journal of Empirical Finance, Journal of Investing, Corporate Governance: A European Review.

Dr. Kausik Chaudhuri Kausik has been working as a Senior Lecturer in Economics at Leeds University Business School, University of Leeds, UK. He has published a number of research papers in various reputed journals including European Journal of Operations Research, Journal of Money, Credit and Banking, Economic Letters, Energy Policy, Empirical Economics, Small Business Economics, Oxford Development Studies, Journal of Development Studies.

Footnotes

As of 29th January 2021, there were over 102 million people affected globally and over 2.2 million people died since the first COVID-19 case was detected in November 2019 in China.

Global Economic Prospects published in June 2020 by World Bank Group (DOI: https://doi.org//10.1596/978-1-4648-1553-9).

Baret, S., Celner, A., O’Reilly, M. and Shilling, M. (2020). COVID-19 potential implications for the banking and capital markets sector. Deloitte Center for Financial Services.

Ashraf (2020), Sharif, Aloui, and Yarovaya (2020), Al-Awadhi, Alsaifi, Al-Awadhi, and Alhammadi (2020), Zaremba, Kizys, Aharon, and Demir (2020),Corbet, Hou, Hu, Lucey, and Oxley (2020) and Akhtaruzzaman et al. (2020).

The World Health Organization (WHO) declared the COVID-19 to be a pandemic on 11 March 2020.

see the International Monetary Fund for detail monetary policy responses to COVID-19: https://www.imf.org/en/Topics/imf-and-COVID-19/Policy-Responses-to-COVID-19.

“Coronavirus: China’s first confirmed COVID-19 case traced back to November 17”, South China Morning Post, 13th March 2020.

“7 governors still haven't issued stay-at-home orders. Here's why”, CNN politics, 13th April 2020.

“BoE warns UK set to enter worst recession for 300 years”, Financial Times, 7th May 2020.