Abstract

We examine the microstructure of liquidity provision in the COVID-19 corporate bond liquidity crisis. During the two weeks leading up to Federal Reserve System interventions, volume shifted to liquid securities, transaction costs soared, trade-size pricing inverted, and dealers, particularly non-primary dealers, shifted from buying to selling, causing dealers’ inventories to plummet. Liquidity provisions in electronic customer-to-customer trading increased, though at prohibitively high costs. By improving dealer funding conditions and providing a liquidity backstop, the Primary Dealer Credit Facility and the Secondary Market Corporate Credit Facility (SMCCF) stabilized trading conditions. Most of the impact of SMCCF on bond liquidity seems to have materialized following its announcement. We argue that the Federal Reserve's actions reflect a new role as market maker of last resort.

Keywords: Corporate bonds, Liquidity crisis, COVID-19, PDCF, SMCCF, Electronic trading, Customer-to-customer, Market maker of last resort

1. Introduction

The COVID-19 crisis almost claimed a new and unexpected victim: the US corporate bond market. Beginning in early March 2020, the bond market faltered, with yield spreads soaring and liquidity seemingly evaporating. Factors influencing liquidity are often complex, reflecting both supply-side issues, such as funding difficulties and challenges posed by one-sided trading, and demand-side factors, such as changes in risk preferences or asset value expectations. Over a remarkably short time period, the Federal Reserve System created a variety of credit and liquidity facilities to address this liquidity crisis, even taking the unprecedented step of agreeing to buy corporate bonds and bond exchange-traded funds (ETFs). Our focus in this paper is on understanding the evolution of the corporate bond market liquidity crisis and, equally important, what contributed to its resolution.

We focus on the microstructure of liquidity provision in corporate bond markets during the COVID-19 crisis. Our approach aligns with the Buiter and Sibert (2007) observation that, in current markets, a credit crunch or liquidity crisis arises in a different way from the lender-based problems of times past. A liquidity crisis manifests in disorderly markets in which “there is no market maker with both the knowledge … and the deep pockets to credibly post buying and selling prices.”1 They argue that the solution to such a crisis is for the central bank to act as the market maker of last resort, i.e., be willing to buy assets directly or to facilitate such buying by taking such assets as collateral. As we show, that is an apt description of what happened here.

We measure the extent and evolution of corporate bond illiquidity by examining transaction costs in both investment-grade (IG) and high-yield (HY) bond trading. We analyze how the heightened demand for liquidity during the crisis differed across bonds. We investigate the actions of market players who provide liquidity (primary dealers and non-primary dealers) with a particular focus on their ability and willingness to trade and their resultant inventory positions. We also examine the robustness of liquidity provided directly by customers through electronic trading and establish how customers fared in these new trade settings during the crisis. Equally important, we demonstrate how and when Federal Reserve actions affected the liquidity crisis, both directly through the Fed's provision of liquidity and indirectly through its effects on other liquidity providers.

Our analysis provides a number of results. We show that bond markets rapidly deteriorated after March 6, with average transaction costs rising sharply and peaking at more than 90 basis points (bps) before the Fed interventions, almost triple their levels in early February. Trading was particularly challenging for large quantities. Transaction costs for block trades in investment-grade bonds were only 24 bps in February but jumped to more than 150 bps on March 23. Transaction costs also invert, with block trade costs moving from about 10 bps below micro lot costs to more than 60 bps above. Similar movements are observed in high-yield bonds. We show that when market liquidity started to evaporate, trading shifts to bonds that were more liquid during normal times. Meanwhile, dealers, particularly the non-primary dealers, shift from buying bonds to selling bonds, exacerbating market illiquidity and resulting in a cumulative negative $8 billion inventory position for the dealer community. These negative inventory positions could have exacerbated the liquidity crisis, as bonds sold more aggressively by dealers experienced a greater increase in transaction costs.

Unlike in times past, dealers were not the only source of bond liquidity, with electronic trading platforms offering buy-side institutions the ability to trade directly with each other. We find that customer-to-customer (C-to-C) trade volume did increase, almost tripling compared with its levels prior to the start of the crisis, but it still remained small relative to overall bond market volume. More significant is that transaction costs in C-to-C trades, which were below those of customer-to-dealer (C-to-D) trades before the crisis, shift dramatically during the crisis, with C-to-C trading costs more than double the level in C-to-D. Trade sizes in C-to-C trades also remain much below those of the C-to-D trades. Obtaining liquidity from other customers, therefore, proved an expensive, and limited, alternative in the crisis period.2 With neither dealers nor customers inclined to provide liquidity, little evidence exists that market forces were moving to resolve the bond market crisis.

The Fed responded quickly to the strained conditions in the corporate bond markets with the creation of the Primary Dealer Credit Facility (PDCF) and the Secondary Market Corporate Credit Facility (SMCCF). By offering term funding to primary dealers, PDCF sought to improve market liquidity through enhancing funding conditions for dealers. The SMCCF, by agreeing to purchase bonds (and bond ETFs), aimed to improve liquidity by directly rebalancing order flows in case of excessive selling. The PDCF was announced on Tuesday, March 17, and started operations on Friday, March 20. The SMCCF was announced on the following Monday, with an estimated implementation in early May.

We find that the Fed's actions were effective in mitigating but not completely ameliorating these liquidity problems. Within one week following the launch of PDCF and the creation of the SMCCF, bond transaction costs drop from their peak of more than 90 bps right before Fed interventions to about 70 bps. Transaction costs decline further amid the expansion of SMCCF in early April. By the end of April, transaction costs decline to about 40 bps and have been stable ever since. Cost for trading large blocks decline dramatically following Fed interventions but remain substantially higher than their levels in February. Starting in late April, block trade costs have been similar to those for micro trades, which have largely returned to their February levels. While high-yield bonds as a whole benefit from the SMCCF expansion, we do not find any significant effects on the transaction costs of fallen angels (i.e., downgraded bonds), which were deemed eligible for purchase under the SMCCF on April 9.

What is particularly intriguing is how these facilities change dealer behavior. The PDCF had an almost immediate effect on primary dealers, who shift back to more balanced inventory positions. Such improvement is consistent with the Fed's actions easing funding liquidity problems via direct lending. Most of the impact of SMCCF on bond liquidity seems to materialize following its announcement. Despite the fact that during our sample period the Fed did not buy a single bond, the announcement of the SMCCF caused non-primary dealers to shift from off-loading bonds. The purchases of exchange-trade funds by SMCCF starting on May 12 did not induce any noticeable improvement in bond liquidity provision. To some, the strong announcement SMCCF effect coupled with its minimal implementation effect could seem puzzling. We argue that these effects are consistent with the Fed's market maker role. By signaling a liquidity backstop for corporate bonds, the SMCCF reduced the risk to dealers of facing a one-sided market and, by extension, the risk of holding inventory.

We further investigate how PDCF and SMCCF each contributed to the improvement in corporate bond liquidity. Disentangling the PDCF effect from the SMCCF effect is challenging because SMCCF was created right after the PDCF became operational, and we use a variety of approaches to deal with this identification issue. Consistent with PDCF effects, the incremental liquidity improvement in investment-grade bonds following Fed interventions was stronger in trades intermediated by primary dealers, the only eligible participants in PDCF. Consistent with SMCCF effects, the additional liquidity increase in investment-grade bonds after Fed interventions was even greater in trades in bonds with remaining maturities of five years or less, as SMCCF accepts only short-term bonds below the five-year cutoff, while PDCF has no maturity requirement on eligible collaterals.

Overall, our analysis provides some of the first evidence on the efficacy of the Federal Reserve's efforts to stem the COVID-19 liquidity crisis in the corporate bond market. The decision by the Fed to purchase corporate bonds and bond ETFs represents a new and, arguably, controversial direction for the central bank. Our results suggest that the Fed's immediate actions were effective at stemming the growing liquidity crisis. Through outright purchases of corporate bonds and accepting corporate bonds as collateral for funding, the Feb would inevitably influence the assessing and pricing of credit risks (Small and Clouse, 2005). Whether and how such Fed actions ultimately affect the allocation of credit in the economy remains to be seen.

Our paper is related to several strands of research in the literature. A variety of authors looked at issues connected with liquidity and credit crises, with notable papers by Allen and Carletti (2008), Brunnermeir (2009), and Kacpercyzk and Schnabl (2010). Analyses examining the impact and effectiveness of Federal Reserve and central bank actions in financial crises include Campbell et al. (2011), Wu (2011), Duygan-Bump et al. (2013), and Covitz et al. (2013). Recent disruptions in the bond markets are also discussed extensively (see, e.g., Aramonte and Avalos, 2020a,2020b; Duffie, 2020; Falato et al., 2020; Haddad et al., 2020; He et al., 2020; Kargar et al., 2020; Ma et al., 2020). Research by Haddad et al. (2020) is particularly relevant as they provide evidence that asset pricing explanations for the crisis such as cash flow changes or compensation for risk are not supported by the data. They argue that financial frictions are a more likely explanation, a view akin to the microstructure focus taken here. Also related to our paper are Boyarchenko et al. (2020) and Kargar et al. (2020), which both study liquidity movements in the corporate bond markets during the COVID-19 crisis. Our work complements this research but differs in that our richer data set allows a comprehensive analysis of dealer behavior and electronic customer-to-customer trading, as well as a cleaner identification of the impact of the Fed's unprecedented initiatives to support the corporate bond markets.

Our paper focuses on understanding the microstructure of liquidity provisions under extraordinary selling pressures. What triggers such unusual high selling pressure remains to be further explored. Although our analysis reveals trading shifts to bonds that were more liquid during normal times, consistent with redemption-induced fire sales by fixed income funds (Falato et al., 2020; Ma et al., 2020), trading activities by other bond investors, such as insurance firms, could have also exacerbated the selling pressures, as suggested by Haddad et al. (2020). In addition, our study identifies the net effects of the announcement of the SMCCF on corporate bond liquidity. While we believe that the announcement effects were largely achieved by both reducing investors’ incentives to liquidate their bond holdings and increasing dealers’ willingness to provide liquidity, quantifying their respective contributions to the stabilization of market conditions would be useful to further evaluate the effectiveness of this liquidity facility.

Our analysis on the PDCF effects highlights the role of dealer funding liquidity in affecting financial market liquidity. Brunnermeier and Pedersen (2008) argue that a trader's ability to provide market liquidity relies on its availability of funding. Duffie (2018) and Andersen et al. (2019) show that dealer funding costs are important determinants of their bid and ask quotes. Empirically, several studies find that dealer balance sheet constraints and funding conditions affect the liquidity in the corporate bond markets (Rapp, 2016; Adrian et al., 2017; Macchiavelli and Zhou, 2019). Our study contributes to this line of research by showing how funding condition improvements brought by Fed liquidity facilities affect dealer inventory changes and investor transaction costs.

Our work contributes to the growing literature on bond market microstructure. Recent papers by O'Hara et al. (2018), Hendershott et al. (2020), and Goldstein and Hotchkiss (2020) analyze dealer behavior in bond markets, and Hendershott and Madhavan (2015) and O'Hara and Zhou (2021) investigate electronic bond market trading. Other recent work studied bond markets in the post–financial crisis era, with particular focus on how financial regulations affected dealer liquidity provision and corporate bond liquidity (Schultz, 2017; Bao et al., 2018; Bessembinder et al., 2018; Choi and Huh, 2019; Dick-Nielson and Rossi, 2019; Flanagan et al., 2019; Saar et al., 2019). Although a number of studies examine corporate bond liquidity during the financial crisis (Bao et al., 2011; Friewald et al., 2012; Dick-Nielson, Feldhutter, and Lando, 2012; Feldhutter, 2012; Di Maggio et al., 2017), we differ from these works by focusing on individual dealer behavior and customer liquidity provision through electronic trading. Our study provides new perspectives on the complex evolution of liquidity in corporate bond markets and highlights the limitations inherent in both dealer and electronic markets in a crisis period.

This paper is organized as follows. Section 2 provides a brief primer on corporate bond trading, sets out the time line of the crisis, recounts the specific Federal Reserve actions taken to contain the bond market crisis, and discusses the data used in this analysis. Section 3 analyzes the behavior of transaction costs in investment-grade and high-yield bonds, the disparate effects on trading size costs, and the immediate impact of the Federal Reserve's actions. Section 4 examines the microstructure of the crisis by looking at how trading shifted across bonds in the crisis and who provides liquidity, focusing on dealer inventory, the differential behavior of primary and non-primary dealers, and electronic customer-to customer trading. In Section 5, we conduct a battery of analyses to evaluate further the impact of the Federal Reserve's bond liquidity programs. Section 6 is a conclusion.

2. Corporate bond trading, federal reserve programs, and sample construction

As a useful preliminary, we begin with a brief overview of corporate bond trading before turning to the specific events of interest in this paper and the data we will use in our analyses.

2.1. A short primer on corporate bond market trading

The US corporate bond market totals almost $8.8 trillion, with investment-grade bonds approximately six times larger than high-yield bonds. Many institutional investors have limits (in some cases, zero) on the amount of high-yield debt they can hold. In 2019, the average daily trading volumes were $22.1 billion and $7.8 billion for investment-grade and high-yield segments, respectively.3

Corporate bonds trade primarily in the over-the-counter dealer market. Corporate bonds are primarily held by institutional investors, so trade sizes tend to be large. Bond dealers act as counterparties, buying when a trader wishes to sell and selling when a trader wishes to buy. Although about six hundred dealers intermediated trading in the first quarter of 2020, the largest ten dealers controlled approximately 70% of volume. Most of these large dealers are bank-affiliated. Of particular importance are the primary dealers, a subset of 24 dealers who are trading counterparties of the New York Federal Reserve Bank in its implementation of monetary policy.4

Trading between customers and dealers primarily involves voice trading, whereby a customer calls a dealer, gets a quote, trades or not, and then could sequentially call other dealers until finally consummating a trade. Trading also can take place in electronic venues. Electronic trading is still a relatively small, but growing, part of corporate bond trading. Trading mechanisms used in most electronic corporate bond trading platforms can be classified into request for quote (RFQ) or all-to-all trading. In an RFQ trade, a customer can specify a list of pre-screened dealers, the trading platform sends to each dealer the desired trading information (i.e., bond CUSIP, trade size, and direction), a dealer responds (or not) with a quote, and the quotes are then given simultaneously to the customer, who can select (or not) a dealer with whom to trade.5 In all-to-all trade, a customer's trade request is sent to all of the platform's participants, including both dealers and other customers. As many customers manage large bond portfolios, allowing them to bid against dealers introduces a new source of liquidity to the market. This can be particularly valuable during market stress when the dealer community is unwilling or unable to provide liquidity.

2.2. Setting the stage

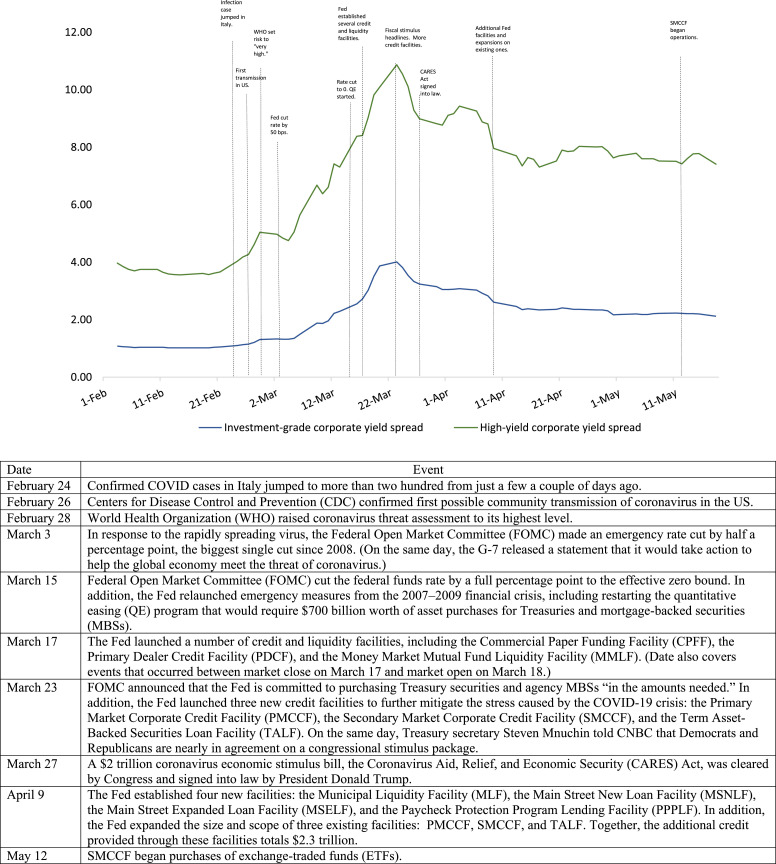

The COVID-19 pandemic led to acute stress not only in the global economy but also in many parts of the global financial system. In the US, when concerns over the coronavirus escalated in early to mid-March, many financial markets faced unusually high selling pressure. Fixed income funds suffered an unprecedented 12% outflow within a month (Ma et al., 2020). Less liquid and more vulnerable bond mutual funds, as well as those holding bonds in COVID-19–affected industries, suffered greater outflows (Falato et al., 2020). Total assets under management for institutional prime money market funds dropped by around 30% within two weeks (Li et al., 2020). Amid the broad risk-off sentiment, equity prices plunged, Treasury yields declined, and corporate yield spreads widened substantially (Fig. 1 ).

Fig. 1.

Timeline of the COVID-19 crisis evolution and macro policy responses, 2020.

This figure shows movements in ICE BofA option-adjusted yield spreads for US investment-grade and high-yield bonds around the COVID-19 crisis period. Data are obtained through Federal Reserve Bank of St. Louis, Missouri. The figure also presents the timeline of the COVID-19 pandemic and macro policy responses in the US.

Meanwhile, liquidity provision by security dealers was limited. Some dealers reportedly reached their balance sheet capacity and hence were unable to absorb more sales. In addition, funding costs for dealers increased sharply amid higher demand for repo financing. Together, the surging demand for liquidity, accompanied by limited liquidity provision by securities dealers, led to severely constrained liquidity conditions in a number of dealer-intermediated markets, including the Treasury, agency mortgage-backed securities (MBSs), municipal, and corporate bond markets.6

The COVID crisis led to a number of policy actions involving fiscal stimulus [including the 2020 Coronavirus Aid, Relief, and Economic Security (CARES) Act] and monetary policy responses, such as the creation of numerous liquidity and credit facilities. In this study, we restrict our attention to examining the liquidity challenges in the corporate bond markets. We study the impact of dealer and customer behavior on corporate bond liquidity around the COVID-19 crisis and the effectiveness of the Fed credit and liquidity facilities that were directly targeted at the corporate bond markets.

2.3. What the fed did

Starting in mid-March, the Federal Reserve took actions to improve market functioning. A number of liquidity and credit facilities were created to either enhance the supply of liquidity or directly increase the demand for debt. The most relevant facilities for improving secondary market liquidity in the corporate bond markets were the Primary Dealer Credit Facility and the Secondary Market Corporate Credit Facility.

The PDCF offers overnight and term funding with maturities up to 90 days to primary dealers at the discount rate offered by the Federal Reserve Bank of New York. All credit extended by the PDCF must be collateralized by a broad range of investment-grade debt securities, including investment-grade corporate and municipal bonds and commercial paper. The Fed announced the creation of PDCF on Tuesday, March 17, with credit extended to primary dealers starting on Friday, March 20.

On Monday, March 23, for the first time in its history, the Federal Reserve, together with the Department of the Treasury, created a facility to purchase investment-grade corporate bonds of US companies from the secondary markets. Under the SMCCF, the Federal Reserve Bank of New York would provide recourse loans to a special purpose vehicle (SPV) that would purchase eligible investment-grade securities at fair market value. The corporate bonds to be purchased, which would be collateral for the loan, must have a remaining maturity of five years or less. The Department of Treasury would provide $10 billion in equity investment, and the SMCCF would leverage Treasury's equity at ten to one when acquiring corporate bonds.

Although the PDCF also operated in 2008 in response to the subprime mortgage crisis and the collapse of Bear Stearns, it offered overnight loans only to primary dealers. The PDCF launched in 2020 provides term funding with maturities up to 90 days and hence can be particularly helpful for corporate bond dealers to fund illiquid inventories. It is important to note that any improvement of funding conditions brought by the PDCF alone perhaps would not be sufficient for dealers to enhance their liquidity provision. If excessive selling pressure were to persist, dealers would be reluctant to take bonds into inventories as they perceive future challenges in turning them over. By providing a liquidity backstop for corporate bonds, the announcement of SMCCF not only reduced investors’ concerns, but also reassured dealers on their ability to turn over inventories and so increased their willingness to intermediate bond trading.

The liquidity focus of the SMCCF differentiates this program from the corporate sector purchase program (CSPP) launched by the European Central Bank (ECB) in June 2016 as the corporate arm of its quantitative easing. When interest rates were already negative, ECB directly purchased corporate bonds to improve the financing conditions of euro area firms and provide further stimulus. As the European corporate bond market is not particularly large or liquid, concerns arose that such direct ECB asset purchases could harm liquidity for investors due to a scarcity of eligible bonds. To mitigate potential negative effects on secondary market liquidity, CSPP considered scarcity of specific debt instruments and general market conditions in its purchases and made its corporate bond holdings available for securities lending by the purchasing national central banks. Differing from CSPP, the primary objective of SMCCF is to support credit by providing liquidity to the corporate bond markets.

2.4. Data and sample

Our study relies primarily on a regulatory version of corporate bond transaction data from the Trade Reporting and Compliance Engine (TRACE), provided by the Financial Industry Regulatory Authority (FINRA). These data provide detailed information for each secondary market corporate bond trade, including bond CUSIP, trade execution date and time, trade price and quantity, and an indicator for whether the dealer buys or sells the bond. In addition, the regulatory version of the data provides information on dealer identity for each trade. For inter-dealer trades, identities of both counterparties are included in the data. Information on dealer identity is essential to our study, allowing us to examine transaction costs and liquidity provision by individual dealers, as well as the impact of Fed liquidity facilities on different types of dealers. In addition, dealer identity is key to our identification of customer-to-customer trades and our analyses on direct customer liquidity provisions around the COVID-19 crisis. For bonds included in TRACE, we obtain from the Mergent Fixed Income Securities Database (FISD) characteristic information, such as credit rating, time of issuance and maturity, and total par amount outstanding.

To construct our sample, we start with all secondary market trades in corporate bonds executed from February 1, 2020 to May 19, 2020. To be included in our sample, we require each bond to be issued in US dollars by US firms in the following three broad FISD industry groups: industrial, financial, and utility. In addition, each bond is required to be rated by at least one of the three major rating agencies: Standard & Poor's (S&P), Moody's, and Fitch. After removing private placements, we end up with a sample of 12,323 bonds issued by 1470 firms.

One criterion for determining whether a bond is eligible for Fed facilities, either as an asset to be purchased or as collateral for pledge, is its credit rating. We follow the principle used in both SMCCF and PDCF in determining a bond's credit quality and assign a composite rating to each bond on each day. We give a numeric value to each notch of an S&P, Moody's, and Fitch credit rating, with 1, 2, 3, 4 … denoting AAA, Aaa, and AAA; AA+, Aa1, and AA+; AA, Aa2, and AA; AA-, and Aa3, AA-, …, respectively. If a bond is rated by only one of the three rating agencies, the rating it receives is set as its composite rating. For a bond rated by two rating agencies, we take the lower of the two ratings as its composite rating. For those rated by all three rating agencies, their composite ratings are determined by the median of the three ratings. Bonds with composite ratings lower than 10 are considered investment grade, with the rest classified as high yield.

3. Corporate bond market liquidity and the COVID-19 crisis

We capture a bond's transaction cost by measuring its price impact. As in Hendershott and Madhavan (2015), we use the closest in time inter-dealer trade in that bond as a benchmark price. This measure allows us to obtain an estimate of transaction cost for each trade between a customer and a dealer. Compared with other transaction cost measures that have to be estimated at lower frequencies, this measure has at least three advantages. First, it is essential for tracking movements in bond liquidity within a short time window. Second, it allows us to study the cost imposed by different types of dealers (and customers) while controlling for both bond and trade characteristic (such as trade size) that have been shown to affect transaction costs. Third, the measure is particularly useful when the market is predominantly one-sided, and so obtaining information on both bids and asks is challenging.

We estimate the transaction cost for each trade by

| (1) |

where refers to the transaction price for trade , is the transaction price of the prior trade in that bond in the interdealer market, and is an indictor variable for trade direction. takes the value of +1 for an investor purchase and −1 for an investor sale. We multiple by ten thousand to compute transaction cost in basis points of value. Given the infrequent trading in corporate bonds, the benchmark inter-dealer trade could have occurred much earlier and hence be stale. To reduce the potential effects from noisy transaction cost measurement, we winsorize the top and the bottom 1% of the transaction cost estimates.

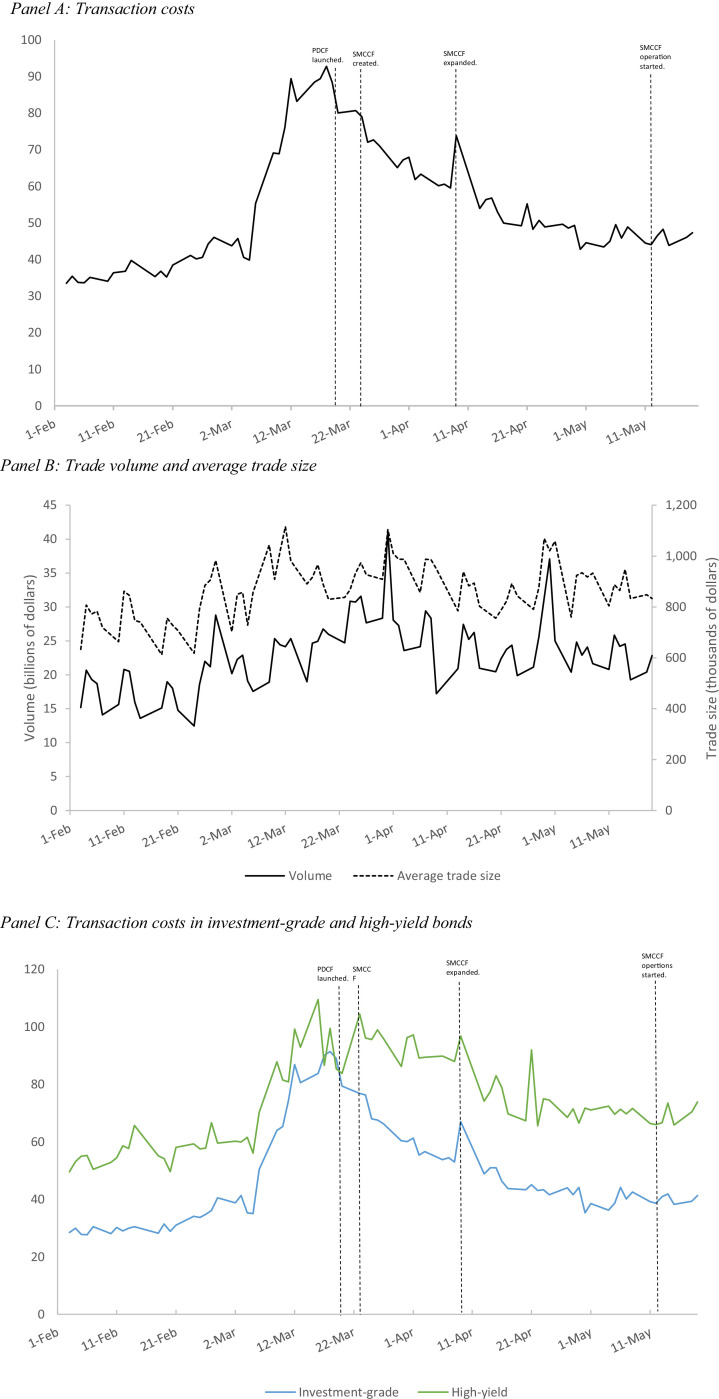

As shown in Fig. 2 , Panel A, liquidity conditions in corporate bond markets deteriorate precipitously in early March. Bond transaction costs skyrocket from about 40 bps on March 5 to close to 90 bps within a week. Compared with February, average trade size increased amid higher trade volume, consistent with traders seeking to offload large positions into what was becoming an increasingly illiquid market (Fig. 2, Panel B).

Fig. 2.

Corporate bond trading and Federal Reserve System liquidity facilities.

Panel A presents daily average transaction costs in corporate bonds. Transaction cost is calculated for each customer trade using Eq. (1). The transaction-level estimates are then averaged across trades and bonds within the day to obtain daily estimates for the market, which are plotted in Panel A. Panel B presents daily aggregate trade volume (in billions of dollars) and average trade size (in thousands of dollars). Panel C plots daily average transaction costs for investment-grade and high-yield bonds separately. PDCF = Primary Dealer Credit Facility; SMCCF = Secondary Market Corporate Credit Facility.

The creation of these Federal Reserve liquidity and credit facilities had an immediate and significant impact on corporate bond liquidity. Bond transaction costs fell immediately following the launch of PDCF, and larger improvements to transaction costs follow the announcement of SMCCF. Transaction costs drop from more than 90 bps right before the launch of PDCF, to about 70 bps two days after the announcement of SMCCF (March 25), and continue to decline afterward (Fig. 2, Panel A). The scale and scope of SMCCF were increased on April 9. Treasury raised its equity investment in SMCCF from $10 billion to $25 billion, and eligible assets for purchase under SMCCF were expanded to include both high-yield bonds downgraded from investment-grade to BB-/Ba3 after March 22 (recent fallen angels) and ETFs primarily exposed to high-yield US corporate bonds.7 Although transaction costs spike on April 9 when S&P led the other two major rating agencies and downgraded a total of 143 bonds, the increase in transaction costs is more than retracted in the following couple of days and continues its downward trend afterward. By the end of April, transaction costs decline to about 40 bps and have remained stable ever since. When the SMCCF starts operations by buying ETFs on May 12, its purchases have little discernible impact on bond liquidity.

Panel C of Fig. 2 displays the movements in transactions costs separately for investment-grade and high-yield bonds. Despite their similar overall patterns, transaction costs in the two broad categories diverge between the launch of PDCF and the creation of SMCCF around March 20 and the expansion of SMCCF on April 4. While transaction costs in investment-grade bonds decrease substantially immediately after PDCF became operational on March 20, with further reductions after the creation of SMCCF, high-yield trading costs do not exhibit a clear decline until after April 9 when the scope of SMCCF is expanded to include recent fallen angels and high-yield ETFs. Such differential movements across investment-grade and high-yield bonds potentially reflect the effects of Fed credit and liquidity facilities as both the PDCF and the initial version of SMCCF were targeted only at the investment-grade segment. We turn in the following sections to examining how Fed credit and liquidity facilities affected corporate bond liquidity more generally.

While the general patterns of transaction cost movements provide a useful picture on liquidity dynamics around the COVID-19 crisis and are consistent with policy responses having a positive impact on corporate bond markets, they are subject to potential selection biases. At the peak of the crisis, trading migrates to bonds that tend to be more liquid during normal times. The possibility also exists that some dealers were more reluctant to engage in intermediate bond trading than others, resulting in a change in the distribution of trades across dealers. To address these concerns, we rely on trade-level transaction cost measures and leverage our information on trade, bond characteristics, and dealer identities to further analyze liquidity movements around the crisis. To facilitate our empirical analysis, we divide our sample period into three subperiods: normal period (February 1—March 5), crisis period (March 6—March 19), and regulation period (March 20—May 19). This division is mainly dictated by the data and the timing of Fed interventions. As shown in Panel A of Fig. 2, bond trading costs rise sharply on March 6. The PDCF start operations on the Friday, March 20, followed by the established of SMCCF on the following Monday (March 23).8

We estimate the following empirical model:

| (2) |

The dependent variable refers to the transaction cost for trade , estimated using Eq. (1). () is a dummy that takes the value of one if the execution date () is March 6 (March 20) or after. represents a set of time-varying bond-level controls for bond i on day t, including the log of the number of years since issuance [Log(Age)], the log of the residual time to maturity of the bond in years [Log(Time to Maturity)], and a set of dummy variables for the 21 numeric composite credit ratings. We include, and to control for bond fixed effects, trade size fixed effects, and dealer fixed effects, respectively, as bond time-unvarying characteristics (such as issuance size and industry classifications), trade size, and dealer characteristic have all been shown to play important roles in determining bond transaction costs.9 Transaction costs tend to increase at times when a bond experiences rating downgrades, so we exclude trades on days when bonds are downgraded from our sample to avoid potential influence from differential distributions of rating changes across the three subperiods.10 Standard errors are clustered at bond and day levels.

Results in Table 1 show that after controlling for bond and trade characteristics and dealer identities, bond transaction costs exhibit a similar pattern as in Fig. 2, Panel A. Transaction costs during the crisis period are on average 57 bps higher than during the normal period. After the launch of PDCF, costs decline by 24 bps but remain significantly higher compared with the normal period. We split our sample into investment-grade and high-yield bonds, and we find similar results in the investment-grade subsample (Column 2). For high-yield bonds, liquidity costs rise substantially after the crisis started, but they do not show significant improvement following the launch of PDCF. Although both the PDCF and initial SMCCF reportedly lifted overall market confidence, this finding suggests that the spillover effect of these facilities to the high-yield segment, if any, is limited.

Table 1.

Corporate bond trading costs around the COVID-19 crisis.

This table present results from estimating Eq. (2) and its variants. Sample is from Febuary 1, 2020 to May 19, 2020. The dependent variable is , the transaction cost for trade , estimated using Eq. (1). () is a dummy that takes the value of one if the execution date () is March 6 (March 20) or after. takes the value of one if a trade occurred on or after April 9. Log(Age) and Log(Time to Maturity) refer to the log of number of years since issuance and number of years to maturity, respectively. Credit rating fixed effects are based on each bond's composite rating. Trade size fixed effects are based on the four size categories (i.e., micro, odd lot, round lot, and block). Standard errors are clustered at bond and day levels.

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Crisis | 56.977*** | 58.652*** | 49.663*** | 49.057*** |

| (140.69) | (135.58) | (50.50) | (50.04) | |

| Regulation | −23.555*** | −25.858*** | −13.042*** | 2.314** |

| (−56.91) | (−58.74) | (−12.35) | (1.99) | |

| SMCCF Expansion | −28.265*** | |||

| (−34.88) | ||||

| Log(Time to Maturity) | 49.845*** | 49.014*** | 52.098*** | 21.380*** |

| (38.77) | (36.85) | (12.97) | (5.79) | |

| Log(Age) | −0.412 | −0.787** | −1.469 | 2.535 |

| (−1.12) | (−2.21) | (−0.66) | (1.32) | |

| Bond fixed effects | Yes | Yes | Yes | Yes |

| Credit rating fixed effects | Yes | Yes | Yes | Yes |

| Dealer fixed effects | Yes | Yes | Yes | Yes |

| Trade size fixed effects | Yes | Yes | Yes | Yes |

| Number of observations | 1224,923 | 966,286 | 258,637 | 258,637 |

| R2 | 0.29 | 0.29 | 0.30 | 0.31 |

More direct liquidity impact on high-yield bonds should be evident after the SMCCF was expanded to include some fallen angels and high-yield ETFs. For that purpose, we create a new dummy,, that takes the value of one if a trade occurs after April 9. We include as an additional explanatory variable and reestimate Eq. (2). As shown in Column 4, while average trading cost in high-yield bonds is still slightly higher than before the regulation period, it declines by 28 bps following the expansion of SMCCF. Although our model allows for better control for other potential influences on transaction cost movements, the estimated coefficients capture only the average transaction costs for each subperiod and hence can underestimate the severity of the crisis, as well as the immediate effects of Fed facilities. We turn to Section 4 to evaluate further the impact of policy interventions.

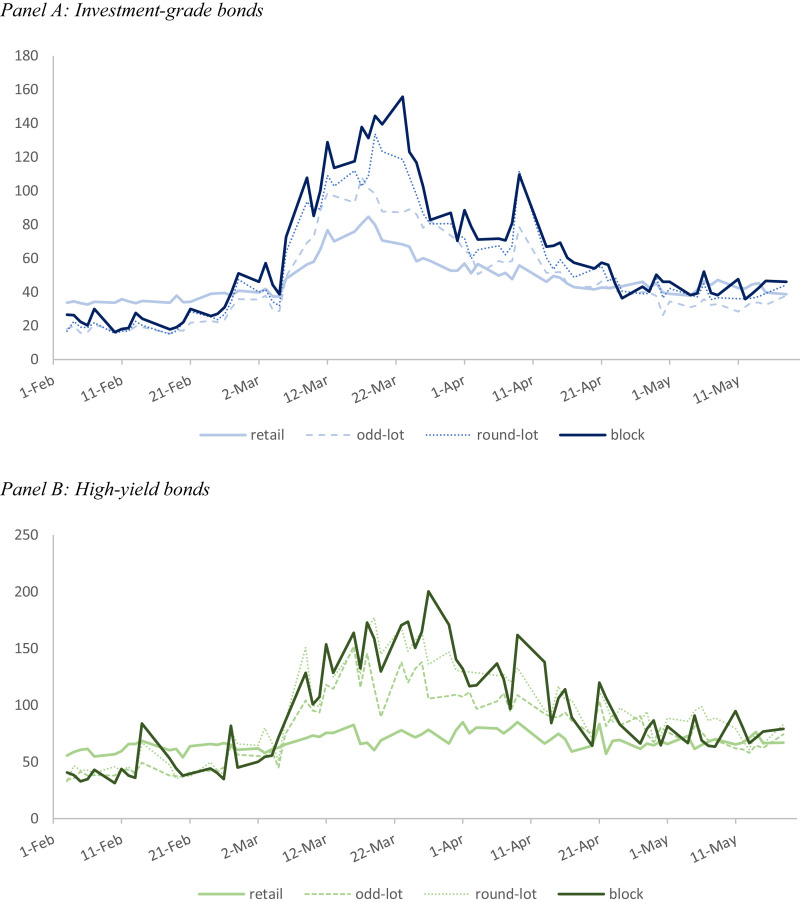

One interesting feature of corporate bond trading is that transaction costs usually decrease with trade size. This negative relation between trade size and transaction costs is widely shown in the literature and is generally attributed to either dealer bargaining power or fixed costs in executing bond trades. O'Hara and Zhou (2021) show that odd-lot trades have particularly benefited from the recent development of electronic trading in corporate bonds, as almost 50% of odd-lot trades in investment-grade bonds executed electronically by 2017. Given the lower trading costs on electronic trading platforms (Hendershott and Madhavan, 2015) and the spillover effects of electronic trading on traditional voice trades (O'Hara and Zhou, 2021), it is not surprising to see odd-lot transaction costs comparable to, and often times lower than, costs for trading round lots and blocks in the precrisis period (Fig. 3 , Panel B). Nevertheless, trading the even smaller micro lots was generally more expensive than trading in larger quantities.

Fig. 3.

Transaction cost and trade size around the COVID-19 crisis.

This figure presents the daily average transaction cost for trades with different sizes separately for investment-grade bonds (Panel A) and high-yield bonds (Panel B). Transaction cost is calculated for each customer trade using Eq. (1). Trades are classified into four size categories based on their par amount: micro ($1 to $100,000), odd lot ($100,000 to $1000,000), round lot ($1000,000 to $5000,000), and block (above $5000,000).

The relation between transaction costs and trade size completely reverses shortly after the beginning of March when liquidity supply fell short of liquidity demand. With dealers facing increasing selling pressures from customers, as well as balance sheet capacity and funding constraints, costs for trading larger quantities, especially blocks, soar and became much higher than for trading micro lots. In February, costs for trading blocks are only 24 bps, about 10 bps lower than for micro lots. They jump to more than 150 bps at the time of the creation of SMCCF, more than 60 bps higher than micro-lot costs. This inversion between block trade costs and micro-lot costs shrinks substantially as strains in the corporate bond markets ease following the establishment of liquidity facilities by the Fed. High-yield bonds exhibit a similar pattern with respect to transaction costs and trade size, but a significant shrinkage in the gap between small and large trades does not occur until after the expansion of SMCCF.

4. The microstructure of a liquidity crisis

The evolution of corporate bond liquidity around the COVID-19 crisis reflects the interplay of a number of forces that drove both the supply and the demand for liquidity. In this section, we expand understanding of the liquidity crisis by examining the microstructure of liquidity provision under unusual high demand for liquidity. We start by analyzing how investors’ trading activities migrated across bonds when demand for liquidity surges in March. We then focus on studying liquidity provision by both dealers and customers.

4.1. Which bonds are traded during the crisis?

In March 2020, demand for liquidity in the corporate bond market surged as investors rushed to sell their bond holdings amid escalating concerns over the coronavirus spread. While liquidity conditions were extremely strained in the overall corporate bond markets, certain bonds could come under particularly strong selling pressures. In this section, we study how trading activities in corporate bonds relate to bond characteristics and how such relations change during the crisis period.

We start by estimating the average transaction cost for each bond separately for the normal period and the crisis period. We first estimate the daily volume weighted average transaction costs for each bond (i) and then average it across days within each subperiod to obtain bond i’s transaction cost during the normal period () and during the crisis period (). We focus our analysis on the 7308 bonds for which we are able to obtain transaction and volume estimates during both subperiods. We then estimate the following empirical model:

| (3) |

where refers to either the normal period or the crisis period. refers to the total trade volume in bond i during subperiod p, and and represent credit rating and industry fixed effects, respectively. Standard errors are clustered at the firm level.

Column 1 in Table 2 reports that the coefficient for is negative and highly significant, suggesting that, during the normal period, more liquid bonds trade more. turns insignificant when we control for bond i’s total par amount outstanding (Column 2), suggesting that the previous result is driven by investors’ preference for trading in larger issues. The relation between trade volume and cost changes during the crisis period, with more heavily traded bonds experiencing higher transaction costs (Column 3). This result holds even when we control for bond i’s amount outstanding (Column 4).

Table 2.

Liquidity and trading activities.

This table presents results from estimating Eq. (3) and its variants. Sample is from March 6, 2020 to March 19, 2020. For Columns 1 and 2, the dependent variable is , and for Columns 3 to 5, the dependent variable is . and represent bond i’s trade volume during the normal period and the crisis period, respectively. and represent bond i’s average transaction costs during the normal period and the crisis period, respectively. Age and Time to Maturity refer to the number of years since issuance and the number of years to maturity, respectively. Amount Outstanding refers to the total par amount outstanding of bond i. Credit rating fixed effects are based on each bond's composite rating. Industry fixed effects are based on each bond's two-digit industry code from Mergent Fixed Income Securities Database. Standard errors are clustered at firm level.

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Costnormal | −0.024*** | −0.001 | −0.005*** | ||

| (−10.48) | (−1.05) | (−5.78) | |||

| Costcrisis | 0.007*** | 0.004*** | 0.003*** | ||

| (8.99) | (8.76) | (7.11) | |||

| Log(Time to Maturity) | 0.176*** | 0.060*** | −0.339*** | −0.181*** | −0.138*** |

| (4.39) | (2.69) | (−8.36) | (−8.38) | (−6.94) | |

| Log(Age) | −0.682*** | −0.579*** | −0.935*** | −0.688*** | −0.251*** |

| (−12.30) | (−22.64) | (−14.09) | (−21.85) | (−10.58) | |

| Log(Amount Outstanding) | 1.251*** | 1.246*** | 0.418*** | ||

| (51.17) | (44.17) | (15.10) | |||

| Log(Volumenormal) | 0.639*** | ||||

| (36.32) | |||||

| Rating fixed effects | Yes | Yes | Yes | Yes | Yes |

| Industry fixed effects | Yes | Yes | Yes | Yes | Yes |

| Number of observations | 7308 | 7308 | 7308 | 7308 | 7308 |

| R2 | 0.32 | 0.35 | 0.11 | 0.12 | 0.76 |

To investigate further which bonds trade more heavily during the crisis period, we include each bond's average transaction cost and total trade volume during the normal period as additional explanatory variables and reestimate Eq. (3). Column 4 shows that continues to be positively related to , confirming our previous finding that, during the crisis period, greater trading activities are associated with larger transaction costs. More important, the coefficient for is negative and highly significant, suggesting that more liquid bonds during the normal period are traded more during the crisis period.

Ma et al. (2020) argue that bond mutual funds meet redemption requests by first selling more liquid assets in their portfolios to reduce liquidation discounts. They show that, during the COVID-19 crisis, bond mutual funds reduced their holdings of liquidity assets (cash, cash equivalents, and Treasuries) when facing increasing outflows. Our findings suggest that bond mutual funds’ pecking order of liquidation also could have occurred within the corporate bond space. Even after controlling for bond characteristics, such as credit rating and maturity, greater trade volume occurred in bonds that were considered more liquid during normal times. Our results are consistent with liquidity management by bond mutual funds during other time periods (e.g., Chernenko and Sunderam, 2019; Jiang et al., 2020).

4.2. Liquidity provision around the crisis

Despite elevated selling pressures, the bond market could still function properly if liquidity providers stand ready to buy. To gain a deeper understanding of the liquidity dynamics around the COVID crisis, we turn to studying the behavior of both bond dealers and some customers who could absorb some of the sales through direct customer-to-customer trading.

4.2.1. Dealer inventory changes

Dealers play an important role in the proper functioning of corporate bond markets. With orders arriving in large lots at irregular times, liquidity of the bond markets is essentially determined by dealers’ ability to match buyers and sellers and absorb order imbalances. At the same time, dealers are professional traders who aim to profit from their trades using their information and expertise on the markets. When market conditions are strained, and are likely to deteriorate further, these roles can conflict, leading dealers to turn their back on customer demands and shift from providing liquidity to consuming liquidity.

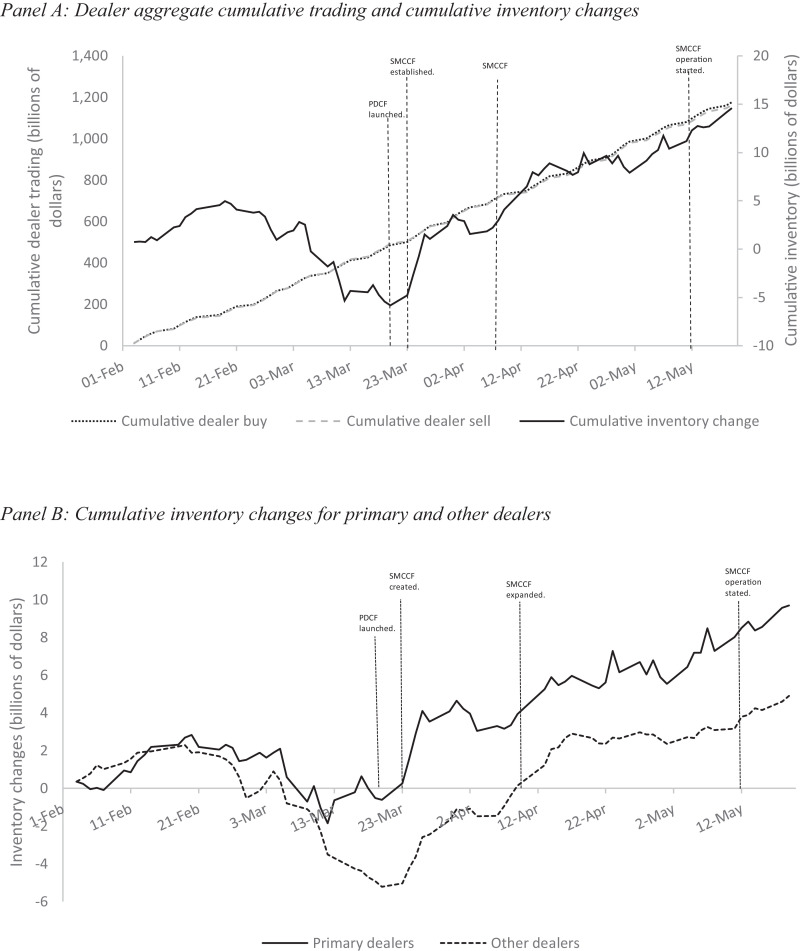

Fig. 4, Panel A, depicts dealers trading activities and the resulting inventory changes around the COVID-19 crisis area. From the beginning of February, aggregate cumulative purchases and sales by corporate bond dealers grow steadily, with both reaching more than $1.1 trillion by May 19. Trading activities do not exhibit a significant slowdown during early to mid-March, suggesting that dealers were still trading actively under stress conditions. We find that the number of active dealers on each trading day stayed remarkably stable over our sample period. Similarly, we find that the share of volume done by primary dealers and the top ten dealers remains generally the same.11

Fig. 4.

Dealer cumulative inventory changes around the COVID-19 crisis.

Panel A presents bond dealers’ aggregate cumulative buying from customers (cumulative dealer buy) and aggregate cumulative selling to customers (cumulative dealer sell), as well as cumulative inventory changes since February 1, 2020. Cumulative inventory changes are defined as cumulative dealer buy less cumulative dealer sell. Panel B plots cumulative inventory changes separately for prime dealers and other dealers. PDCF = Primary Dealer Credit Facility; SMCCF = Secondary Market Corporate Credit Facility.

When the crisis period began on March 6, dealers’ cumulative inventory, defined as the difference between their cumulative purchase and cumulative sales, starts to decline substantially. Within one week, dealer inventories decline by about $8 billion. Although the magnitude of the decline is small compared with the aggregate trade volume (about $150 billion during the same week), this finding suggests that, together, the dealer community is not fully absorbing customer sales when the market becomes stressed. Dealers do not increase inventories until the PDCF started operating on March 20 and more significantly so following the announcement of SMCCF on March 23. By mid-May, dealers’ aggregate corporate bond inventories have risen to substantially higher levels than they were at the beginning of February.

Panel B shows cumulative inventory changes for primary dealers and other dealers separately. Consistent with market commentaries that, due to their already elevated inventories, primary dealers were unable to absorb sales when selling pressure increased in early March, we find that cumulative inventories by primary dealers stay relatively stable since mid-February, before they begin to drop when the crisis period starts. Net selling by other dealers is much larger in magnitude and accounts for most of the decline in dealer inventories during the crisis period. This behavior also lasts much longer than that by primary dealers, and it does not stop until the launch of PDCF and SMCCF.

How did a dealer's inventory behavior change around the Fed's policy actions? To address this issue, we first estimate the following model:

| (4) |

is defined as the difference between dealer ’s net purchase and its net sales on day in rating category r (i.e., either investment grade or high yield). The other variables are defined as in Eq. (2). Table 3 shows that, on average, a dealer's daily net purchasing decline by $1.8 million after the crisis started on March 6. This decline is more than reversed following the launch of PCDF and the creation of SMCCF, with daily net buying in the regulation period even higher than during the normal period. Most of the increase in dealer inventory changes occur prior to the SMCCF expansion, as the coefficients for both and are not significant after we include them as additional explanatory variables in the estimation of Eq. (4) (Column 2).

Table 3.

Dealer inventory changes around the COVID-19 crisis.

This table presents the results from estimating Eq. (4), its variant, and Eq. (5). For Columns 1 and 2, sample is from Febuary 1, 2020 to May 19, 2020. For Column 3, sample is from March 6, 2020 to May 11, 2020. The dependent variable is , defined as the difference between dealer ’s net purchase and its net sales in a broad rating category r (i.e., investment grade or high yield) on day . () is a dummy that takes the value of one if date () is March 6 (March 20) or after. takes the value of one if date () is April 9 or after. takes the value of one if date () is May 12 or after. is a dummy for investment-grade bonds. takes the value of one if a dealer is a primary dealer. Log(Age) and Log(Time to Maturity) refer to the log of number of years since issuance and number of years to maturity, respectively. Trade size effects are based on the four size categories (i.e., micro, odd lot, round lot, and block). Standard errors are clustered at dealer and day levels.

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Crisis | −1.835** | −1.834** | |

| (−2.46) | (−2.46) | ||

| Regulation | 2.551** | 2.893** | |

| (2.44) | (2.33) | ||

| SMCCF Expansion | −0.613 | ||

| (−1.34) | |||

| SMCCF Implementation | 0.362 | ||

| (0.82) | |||

| IG*Prime Dealer | −8.576 | ||

| (−1.38) | |||

| IG*Regulation | −0.15 | ||

| (−0.36) | |||

| Prime Dealer*Regulation | −1.419 | ||

| (−0.91) | |||

| IG*Prime Dealer*Regulation | 14.225** | ||

| (2.02) | |||

| Dealer fixed effects | Yes | Yes | Yes |

| Day fixed effects | Yes | Yes | Yes |

| Rating category fixed effects | Yes | Yes | Yes |

| Number of observations | 38,541 | 38,541 | 23,641 |

| R2 | 0.01 | 0.01 | 0.02 |

One potential channel for dealers to absorb more sales into their inventory is that the credit lent under PDCF eased their funding conditions. To test this hypothesis, we explore the differential changes in primary dealers’ inventory changes in investment-grade bonds as they are directly affected by the launch of PDCF. For the period spanning both the crisis period and the regulation period that ends prior to the implementation of the SMCCF (as the SMCCF started trading only with primary dealers), we estimate the following model:

| (5) |

where is a dummy for primary dealers. All other variables are defined as in Eq. (4). Column 3 of Table 3 shows that after PDCF implementation, primary dealers on average increase their daily net buying by about $14 million. This finding is consistent with the hypothesis that PDCF improved corporate bond liquidity by enhancing dealer funding liquidity.

To understand further how dealer trading behavior affected bond liquidity and the potential policy impacts, we link bond transaction costs to dealer inventory changes and study how this relation changes over the COVID-19 crisis period. During the crisis, dealers as a whole shifted to net selling, suggesting that they were becoming unwilling to hold inventory positions in some bonds. We conjecture that such behavior could lead to higher liquidity costs for such bonds.

To address this issue, we estimate for each bond on each day both net buying across all dealers () and the accumulation of the daily net dealer buying since the beginning of February (). We then estimate the following model:

| (6) |

Table 4 shows that, during our sample period, transaction costs tend to be higher for bonds that were sold more by dealers on the previous day (i.e., net buying was negative). Replacing with yields similar results, suggesting that bonds sold more aggressively by dealers in the past tend to have higher transaction costs. This behavior is consistent with dealer inventory directly affecting bond illiquidity.

Table 4.

Dealer inventory and transaction costs.

This table presents results from estimating Eq. (6) and its variants. Sample is from Febuary 1, 2020 to May 19, 2020. The dependent variable is , the transaction cost for trade , estimated using Eq. (1). is the net buying across all dealers for bond on day . is the accumulation of the daily net dealer buying since the beginning of February. () is a dummy that takes the value of one if the execution date () is March 6 (March 20) or after. Log(Age) and Log(Time to Maturity) refer to the log of number of years since issuance and number of years to maturity, respectively. Credit rating fixed effects are based on each bond's composite rating. Trade size fixed effects are based on the four size categories (i.e., micro, odd lot, round lot, and block). Standard errors are clustered at bond and day levels.

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Dealer Net Buy | −0.025*** | ||

| (−4.19) | |||

| Cum Dealer Net Buy | −0.068*** | 0.016 | |

| (−4.98) | (0.71) | ||

| Crisis*Cum Dealer Net Buy | −0.064⁎⁎⁎ | ||

| (−3.43) | |||

| Regulation*Cum Dealer Net Buy | 0.053⁎⁎⁎ | ||

| (3.01) | |||

| Log(Time to Maturity) | 11.596*** | 11.577*** | 11.589*** |

| (11.48) | (11.45) | (11.46) | |

| Log(Age) | 6.789*** | 6.720*** | 6.689*** |

| (19.96) | (20.18) | (20.09) | |

| Bond fixed effects | Yes | Yes | Yes |

| Credit rating fixed effects | Yes | Yes | Yes |

| Dealer fixed effects | Yes | Yes | Yes |

| Trade size fixed effects | Yes | Yes | Yes |

| Day fixed effects | Yes | Yes | Yes |

| Number of observations | 1224,923 | 1224,923 | 1224,923 |

| R2 | 0.32 | 0.32 | 0.32 |

The relation between past dealer trading and current transaction costs changes over time. We interact with and and include both interaction terms as explanatory variables when reestimating Eq. (6). Table 4 shows that, during the normal period, past dealer trading has no significant impact on current transaction costs. Following the start of the crisis period, bonds sold more by dealers in the past experience higher transaction costs. This effect weakens following Fed policy interventions.

4.2.2. Customer-to-customer trading

Recent growth in electronic trading has brought additional sources of liquidity to the corporate bond market. Customers, including many asset managers, insurance firms, and hedge funds, are now able to trade directly with each other without involving dealers. Such liquidity provision by customers can be particularly valuable when the whole dealer community is unable or unwilling to make markets.12

In this section, we study liquidity provided directly by customers around the recent crisis. We start by identifying customer-to-customer trades in our TRACE data. Although details in the trading protocols used for execution can differ across different electronic trading platforms, most trades between two customers are executed on an anonymous basis. Electronic trading platforms facilitate the matching of buyers and sellers and are responsible for reporting the trades to FINRA. Using dealer names in our TRACE data, we identify trades between two customers on all active electronic trading platforms, for which we obtain a list of their names from FINRA.

Because C-to-C trades are reported by trading platforms, each trade shows up twice in the TRACE tape: first when the seller trades with the platform and second when the buyer trades with the platform. At first glance, this seems unreasonable as only one buyer and one seller are involved and the platform is not taking a risk position. One can argue that a trade between two customers should be considered two trades because the trading platform replaces the dealer in matching the buyer and the seller. If the trade were intermediated by a dealer, two reports would be on the TRACE tape, i.e., a dealer buy from customer A and a dealer sell to customer B.13 In addition, the price the buying customer pays is usually higher than what the selling customer receives, with the difference going to the platform as the fee for using its service. Therefore, for one C-to-C trade, there are two prices. For these reasons, we double-count each C-to-C trade in our analysis of the C-to-C trade volume.

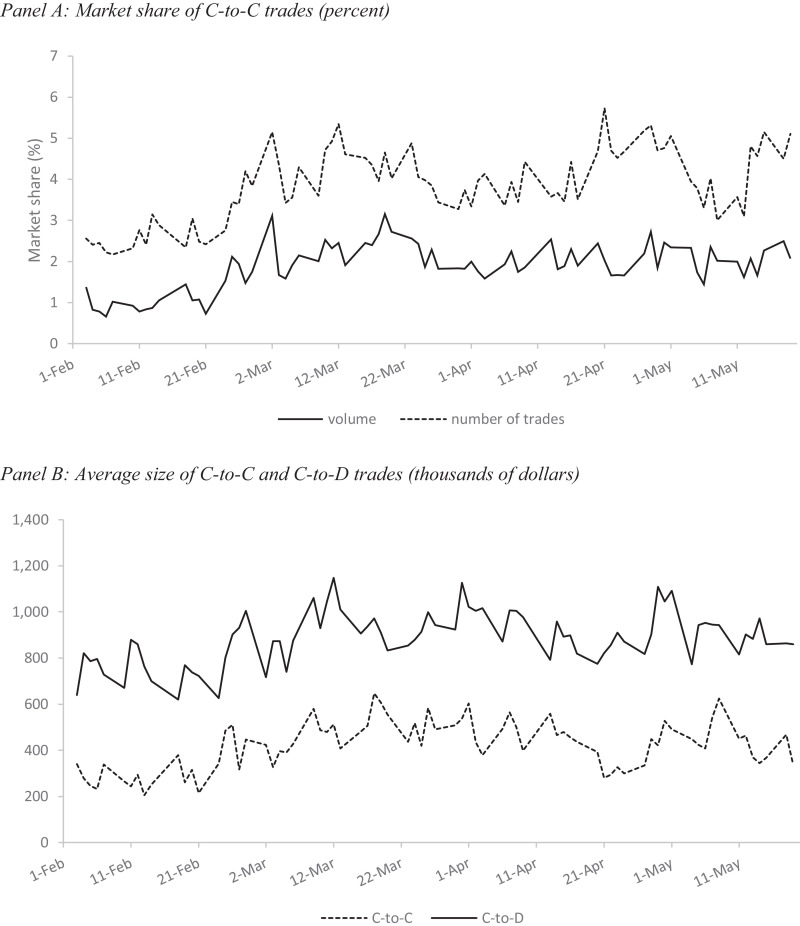

As shown in Fig. 5 , Panel A, the share of C-to-C trade out of total bond trade starts to drift higher starting in late February. During the crisis period, C-to-C trade is volatile, but overall it remains elevated before starting a significant decline following policy interventions. This finding is consistent with customers stepping up at times when liquidity provision by the dealer community is hampered. The share of C-to-C trade is higher in the number of trades, not trade volume, as trade size for C-to-C trade tends to be significantly smaller than for C-to-D trade. The increase in volume share around the crisis period does not outpace the increase in number of trades, as the ability of C-to-C to handle large trades seems to be limited when demand for trading in large quantities rises (Fig. 5, Panel B).

Fig. 5.

Customer-to-customer (C-to-C) trades.

Panel A presents daily share of customer-to-customer trades that are executed on electronic trading platforms out of total customer trades, both in terms of number of trades and total par amount traded. The list of electronic trading platforms is obtained from the Financial Industry Regulatory Authority. Panel B presents the daily average trade size of C-to-C trades and customer-to-dealer (C-to-D) trades.

Of particular interest is the cost that customers incur for obtaining liquidity provided outside the dealer community. Capturing such cost can be challenging, especially because when a customer trades with another customer, the resulting two trade prints (with opposite directions but similar prices) are evaluated against the same benchmark. Consider the following case in which customer A sold one bond at to customer B, who received a price that is equal to less a small fee charged by the platform. As and are both likely to be lower than the benchmark price (i.e., the previous inter-dealer price), Eq. (1) would generate a positive transaction cost estimate for the seller A. However, the cost estimate for the buyer B is negative, suggesting a profit, not a cost, to the customer who provided the liquidity. To focus on the cost paid by the customer who consumed liquidity through C-to-C trading, we use the price from one leg of the C-to-C trade to estimate Eq. (1).

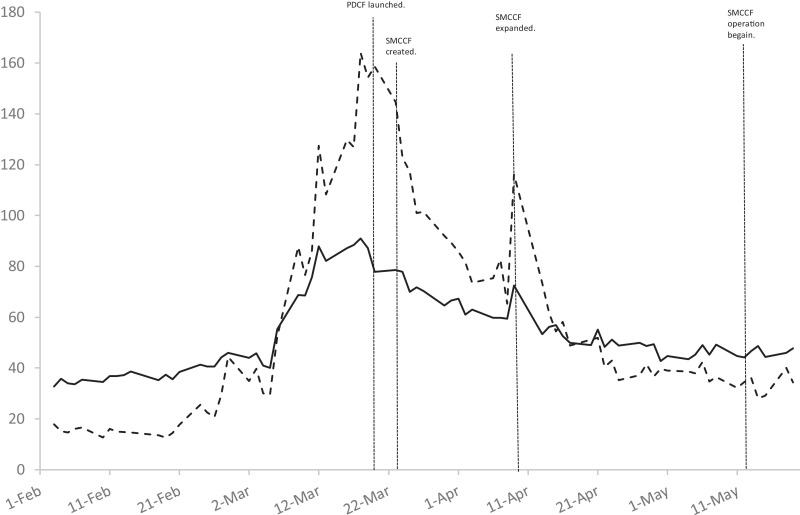

Fig. 6 shows that although customers provide more liquidity in stress times, this liquidity is very costly. Prior to the crisis period, transaction costs in C-to-C trading are consistently lower than in C-to-D trading. During the normal period, C-to-C trading costs average 24 bps, about 40% lower than in C-to-D trading. At the onset of the crisis period, C-to-C trading costs soar and surpass C-to-D trading costs. The gap in trading costs between C-to-C and C-to-D widens sharply and peaks right before the launch of Fed facilities, when C-to-C costs reach 165 bps, more than double C-to-D costs. This trading cost gap then shrinks during the regulation period. By late April, transaction costs for C-to-C trades fall below those for C-to-D and remain stable.

Fig. 6.

Transaction costs: customer-to-customer (C-to-C) versus customer-to-dealer (C-to-D).

This figure presents daily average transaction costs for C-to-C trades and C-to-D trades. Transaction cost is calculated for each customer trade using Eq. (1). For each of the two types of trades, the transaction-level estimates are averaged across trades and bonds within the day to obtain daily estimates. As C-to-C trades are double-counted in the data, we use only one record for each C-to-C trade in our sample. PDCF = Primary Dealer Credit Facility; SMCCF = Secondary Market Corporate Credit Facility.

One potential concern for the pattern exhibited by these average transaction costs is that the respective liquidity provisions by dealers and customers could change over time. The types of trades and bonds intermediated by dealers versus customers could be different across the subperiods. Transaction costs are heavily affected by both trade and bond characteristics, so the picture revealed by Fig. 6 could reflect a time series shift in the composition of the C-to-C and C-to-D subsamples.

This conjecture is not supported by our data. Table 5 provides summary information on both bond and trade characteristics for C-to-C and C-to-D trades and over time. Although bonds for C-to-C trading differ somewhat from those for C-to-D trading during the normal period (i.e., greater outstanding amount, shorter time to maturity, younger, and less risky), the characteristics of bonds for C-to-C trading remain remarkably stable across the three subperiods. Characteristics of bonds for C-to-D trading also change little over time. These results suggest that the pattern in the trading costs in the two types of trades is unlikely attributable to potential shifts in bond trading composition.

Table 5.

Bond and trade characteristics: customer-to-customer (C-to-C) versus customer-to-dealer (C-to-D).

This table presents summary information on bond and trade characteristics for both C-to-C and C-to-D trades across the three subperiods in our sample: normal period (February 1—March 5), crisis period (March 6—March 19), and regulation period (March 20—May 19). Amount Outstanding is a bond total par amount outstanding at the time of trade. Credit Rating is the composite rating we assigned based on the ratings that each bond receives from Standard & Poor's (S&P), Moody's, and Fitch. Time to Maturity and Age refer to the number of years to maturity and the number of years since issuance, respectively. Trade Size is the par amount traded. Transaction Cost is estimated using Eq. (1).

| Customer-to-customer |

Customer-to-dealer |

|||||

|---|---|---|---|---|---|---|

| Variable | Normal | Crisis | Regulation | Normal | Crisis | Regulation |

| Amount Outstanding (millions of dollars) | 1425 | 1486 | 1476 | 1212 | 1321 | 1253 |

| Credit Rating | 8 | 8 | 8 | 9 | 8 | 8 |

| Time to Maturity (years) | 7 | 7 | 7 | 9 | 8 | 8 |

| Age (years) | 4 | 4 | 4 | 5 | 5 | 4 |

| Trade Size (thousands of dollars) | 342 | 517 | 442 | 786 | 959 | 925 |

| Transaction Cost (basis points) | 24 | 117 | 60 | 39 | 80 | 55 |

Trade size is known to play an important role in determining transaction costs in corporate bond trading, so the gap in transaction costs can be due to differential changes in trade size for C-to-C and C-to-D trading. Table 5 shows that, during the normal period, C-to-C trades are smaller than C-to-D trades, with average trade size less than half that of C-to-D trades. Both types of trades experience similar increases in trade size during the crisis period. This finding refutes the argument that the extraordinary increase in C-to-C trading costs during the crisis period is due to a shift in the distribution of trades across sizes.

To control for the influence of bond and trade characteristics, as well as potential time trends in transaction costs, we estimate the following model:

| (7) |

is a dummy for C-to-C trades. All the other variables are defined as in Eq. (2).

Results in Table 6 shows that after controlling for bond characteristics, trade size fixed effects, and time fixed effects, the pattern in transaction costs for C-to-C and C-to-D trades remains. C-to-C costs are lower during the normal period but become substantially larger with the crisis onset. The gap in costs between the two types of trades narrows during the regulation period. The magnitude of the cost differences between C-to-C and C-to-D estimated from the regression is lower compared with that in Table 5, suggesting that bond and trade characteristics and potential time trends have some effect on the transaction costs for the two types of trades. We replace bond fixed effects, day fixed effects, and trade size fixed effects with bond–day–trade size fixed effects and reestimate Eq. (7). This allows us to compare transaction costs between C-to-C and C-to-D in the same bond on the same day within the same trade size category. Column 2 shows that our results change little.

Table 6.

Transaction costs in customer-to-customer (C-to-C) trades and market liquidity.

This table presents results from estimating Eq. (7) and its variants. Sample is from Febuary 2, 2020 to May 19, 2020. The dependent variable is , the transaction cost for trade , estimated using Eq. (1). is a dummy for C-to-C trades. () is a dummy that takes the value of one if the execution date () is March 6 (March 20) or after. takes the value of one if a trade occurred on or after April 9. Log(Age) and Log(Time to Maturity) refer to the log of number of years since issuance and number of years to maturity, respectively. Credit rating fixed effects are based on each bond's composite rating. Trade size fixed effects are based on the four size categories (i.e., micro, odd lot, round lot, and block). Standard errors are clustered at bond and day levels.

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| C-to-C | −4.495⁎⁎⁎ | −5.247⁎⁎⁎ | −5.656⁎⁎⁎ | −2.823 | −2.823 |

| (−10.32) | (−10.43) | (−12.25) | (−1.31) | (−1.31) | |

| C-to-C*Crisis | 48.940⁎⁎⁎ | 41.826⁎⁎⁎ | 40.445⁎⁎⁎ | 48.949⁎⁎⁎ | 48.949⁎⁎⁎ |

| (26.03) | (18.16) | (16.55) | (7.43) | (7.43) | |

| C-to-C*Regulation | −30.932⁎⁎⁎ | −26.954⁎⁎⁎ | −26.949⁎⁎⁎ | −20.805⁎⁎⁎ | −7.953 |

| (−16.16) | (−11.54) | (−10.90) | (−2.95) | (−0.88) | |

| C-to-C*SMCCF Expansion | −21.331⁎⁎⁎ | ||||

| (−2.89) | |||||

| Log(Time to Maturity) | 16.216⁎⁎⁎ | ||||

| (17.03) | |||||

| Log(Age) | 5.962⁎⁎⁎ | ||||

| (17.87) | |||||

| Bond fixed effects | Yes | No | No | No | No |

| Credit rating fixed effects | Yes | No | No | No | No |

| Trade size fixed effects | Yes | No | No | No | No |

| Day fixed effects | Yes | No | No | No | No |

| Bond–day–trade size fixed effects | No | Yes | Yes | Yes | Yes |

| Number of observations | 1224,923 | 966,286 | 751,811 | 214,475 | 214,475 |

| R2 | 0.19 | 0.51 | 0.52 | 0.46 | 0.46 |

To examine differential transaction costs over time for investment-grade and high-yield bonds, we estimate Eq. (7) with bond–day–trade size fixed effects separately in the subsamples for the two broad categories of bonds. The findings for investment-grade bonds are very similar to the full sample (Column 3). For high-yield bonds, C-to-C trades did not appear to have lower costs during the normal period. Just as in C-to-D trading, they became substantially more expensive after the crisis started. We also find that the gap between C-to-C and C-to-D costs declines in high-yield bonds during the regulation period (Column 4), and most of the narrowing in gap occurs after the SMCCF expansion (Column 5).

In summary, our results portray interesting interactions involving liquidity provision between customers and dealers. While customers can step in and provide liquidity in stress times when dealers are unable or unwilling to warehouse inventory risks, such customer-provided liquidity can be extremely costly. The costs for consuming liquidity provided directly by customers declined when dealers increased liquidity provision following Fed interventions.

5. Policy interventions and bond liquidity

Our analyses on transaction cost movements and liquidity provision are consistent with an important role played by Fed credit and liquidity facilities during the bond liquidity crisis. However, one could argue that these findings are subject to identification problems. As shown in Fig. 1, in addition to PDCF and SMCCF, other facilities were established and monetary policy actions were made around both March 20 and April 9. These policy actions could have also boosted investors’ appetite for risk and improved overall financial market functioning.

To address this concern, we take a difference-in-differences approach by focusing on the segment of the bond market directly related to the objectives of the facilities. As PDCF accepts only bonds rated investment grade as collateral for funding to dealers, the impact of PDCF through the funding liquidity channel should be stronger in the investment-grade segment after its launch on March 20. At its initial creation, SMCCF also considered purchasing only investment-grade bonds. Therefore, we expect the regulation effect observed previously to be stronger in investment-grade bonds after March 20.

To test this hypothesis, we use a sample that contains all trades one week before and one week after the launch of PDCF (i.e., from March 13 to March 26). We estimate the following empirical model:

| (8) |

takes the value of one if trade occurred in a bond rated investment grade, and controls for day fixed effects. The other variables are defined as in Eq. (2).

Results in Table 7 , Column 1, support the view that the PDCF and SMCCF had a positive impact on bond liquidity. The estimate of is negative and highly significant, suggesting that after controlling for time trends, bond and trade characteristics, and dealer identities, the average transaction costs in investment-grade bonds declines more compared with high-yield bonds during the week following the launch of the PDCF.

Table 7.

The effects of Secondary Market Corporate Credit Facility and Primary Dealer Credit Facility on bond liquidity in the crisis period.

This table presents results from estimating Eq. (8), Eq. (9), and their variants. The dependent variable is , the transaction cost for trade , estimated using Eq. (1). is a dummy that takes the value of one if the execution date () is March 20 or after. takes the value of one if trade occurred in a bond rated investment grade. takes the value of one if trade was executed with a primary dealer. takes the value of one if trade was in a bond with remaining maturity of five years or less. Log(Age) and Log(Time to Maturity) refer to the log of number of years since issuance and number of years to maturity, respectively. Credit rating fixed effects are based on each bond's composite rating. Trade size fixed effects are based on the four size categories (i.e., micro, odd lot, round lot, and block). Standard errors are clustered at bond and day levels.

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| IG*Regulation | −5.181*** | −2.44 | 13.089*** | 6.261 | 0.779 | 0.112 | 10.642 | 6.074 |

| (−2.70) | (−1.26) | (4.74) | (1.35) | (0.20) | (0.04) | (1.26) | (0.85) | |

| IG*Primary Dealer | −9.289*** | −12.918*** | 7.498 | −1.669 | ||||

| (−3.02) | (−2.59) | (1.11) | (−0.49) | |||||

| Primary Dealer*Regulation | −1.741 | 9.956* | 4.409 | 7.953 | ||||

| (−0.44) | (1.72) | (0.62) | (1.27) | |||||

| IG*Primary Dealer*Regulation | −10.420** | −5.44 | −16.380* | −13.315* | ||||

| (−2.50) | (−0.88) | (−1.85) | (−1.86) | |||||

| Short Term | −19.586 | −57.533** | −12.138 | |||||

| (−1.34) | (−1.99) | (−1.23) | ||||||

| Short Term*Regulation | 7.348** | 14.333 | 7.58 | |||||

| (2.05) | (1.33) | (0.83) | ||||||

| IG*Short Term | 12.77 | 52.304* | 16.387 | |||||

| (1.10) | (1.66) | (1.50) | ||||||

| IG*Short Term*Regulation | −9.367** | −21.234* | −16.631* | |||||

| (−2.45) | (−1.80) | (−1.67) | ||||||

| Log(Time to Maturity) | −6.24 | −3.895 | 51.374* | −25.037 | 25.970*** | −8.57 | ||

| (−0.68) | (−0.43) | (1.79) | (−1.45) | (3.56) | (−0.91) | |||

| Log(Age) | 37.103*** | 38.371*** | 71.333*** | 46.951 | 331.635*** | 37.279*** | 54.28 | 307.021*** |

| (8.56) | (8.84) | (7.66) | (1.37) | (6.17) | (8.35) | (0.16) | (3.62) | |

| Bond fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Credit rating fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Dealer fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Trade size fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Day fixed effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Number of observations | 178,581 | 178,581 | 62,299 | 20,565 | 54,014 | 178,581 | 13,598 | 33,113 |

| R2 | 0.36 | 0.37 | 0.42 | 0.39 | 0.34 | 0.36 | 0.32 | 0.31 |

Can these improved liquidity conditions during the regulation period be attributed to both PDCF and SMCCF? If not, which one is more effective in improving the severely strained liquidity conditions? Both facilities’ objective is to support the credit needs of business, but they are designed to achieve the goal through different channels. PDCF is targeted at enhancing dealer funding liquidity and hence their market-making capabilities. SMCCF seeks to directly increase the demand for corporate bonds by having the Fed buy the bonds, essentially stepping in as a market maker on the buy side. This can both boost investor sentiment when markets are largely one-sided and increase dealers’ willingness to absorb bonds into their inventories.

To disentangle the PDCF effect from the SMCCF effect, we exploit differences in eligible participants and assets for these two facilities to shed light on their respective impact on bond liquidity. Funding is provided only to primary dealers under PDCF, and eligible sellers for SMCCF include a broad range of US institutions provided they satisfy the conflict of interest requirements of Section 4019 of the CARES Act. Therefore, if PDCF was effective, we hypothesize that the incremental liquidity improvement in investment-grade bonds following PDCF is even stronger in trades intermediated by primary dealers. SMCCF accepts bonds only with remaining maturities of five years or less, and PDCF has no maturity requirement on eligible collateral. Therefore, if SMCCF increased bond liquidity, we hypothesize that the additional liquidity increase in investment-grade bonds during the regulation period is even greater in trades in bonds with time to maturity no longer than five years.

To test these hypotheses, we take a triple differences approach. To test the PDCF effect, we create a dummy,, that takes the value of one if trade was executed with a primary dealer. We then estimate the following panel regression:

| (9) |

If transaction costs in investment-grade bonds decline further for primary dealers due to the launch of PDCF, we would expect to be negative and highly significant. Table 7, Column 2, shows that this is the case. During the week following the launch of PDCF and for investment-grade bonds, trades intermediated by primary dealers have an additional 10 bps lower transaction costs. The coefficient for () is also negative but not significant, both statistically and economically, which is consistent with improved market-making abilities mainly for primary dealers through PDCF. One could ask whether the announcement of PDCF in the evening of March 17 had already started to affect liquidity before any credit was extended to dealers on March 20. Using a sample of all trades executed between two days before the announcement and two days after the announcement (i.e., from March 16 to March 19), we redefine the Regulation dummy using March 18 as the beginning of regulation period and we reestimate Eq. (9). The coefficient for the triple interaction term (i.e., ) is not significant. This finding suggests that the PDCF effect is mainly after it started providing funding to dealers.