Abstract

The COVID-19 pandemic created enormous uncertainty for achieving the sustainable development goals in waste management. China implemented a number of new policies recently to encourage waste-to-energy (WTE) and waste-to-material (WTM) industry, which was also impacted by the spread of COVID-19, while the impact on the solid waste industry was merely discussed. In this work, the quarter-level financial statement data of thirty listed companies in Chinese Stock Market were analyzed by applying ARIMA intervention analysis, moreover, a system dynamic model was established for examining the impacting pathway of the pandemic. Main results are: (1) the total annual turnover of total solid waste industry increased by 28.2 times in recent 14 years, however, the estimated turnover of solid waste industry in 2020 dropped around 55.8 billion CNY; (2) the WTE industry kept growing (+21%), the WTM industry dropped significantly (−28%), while the waste disposal industry and other solid waste industry varied slightly (−10% and +9%), comparing their turnovers in 2019 and 2020; (3) the average trade-prices of the secondary materials during the COVID-19 pandemic were only 43.4%–85.8% of the maximum price from 2017 to 2019, resulting in the decline of the WTM industry. Considering a possible sluggish growth of the solid waste industry, the waste separation and zero waste programs in China may meet non-trivial challenges in the future. Policy implications are put forward, such as quantitative simulating the long-term impact, increasing investment and incentive on waste recycling, and building an internal circulation system for waste management.

Keywords: Solid waste industry, Waste-to-energy, Waste-to-material, COVID-19 pandemic, Listed company, Financial statement, China

Abbreviations: SDGs, Sustainable development goals; WTE, Waste-to-energy; WTM, Waste-to-material; MSW, Municipal solid waste

1. Introduction

The COVID-19 pandemic has caused infections and deaths, created enormous uncertainty to the world, and changed the profiles of solid waste management [[1], [2], [3]]. The COVID-19 pandemic affected people's behavior pattern and consumption habits, and resulted in a sudden shift in municipal solid waste (MSW) generation and composition [1,4]. It suggested that MSW production is positively correlated to the consumption level [5,6]. In China, the average expenditure of urban residents and the retail sales of consumer goods in the first quarter of 2020 were 10% and 15.8% less than those of 2019, respectively [7]. This may be the main reason for less MSW generation during the COVID-19 pandemic in the cities [4]. Furthermore, it suggested that the use of plastic products for epidemic preventing surged during the COVID-19 pandemic [1,2]. On the contrary, people tended to save food and thus reduce food waste due to the anxiety of insufficient food supply during the epidemic [8]. People were inclined to rely on the online shopping during the COVID-19 pandemic, bringing challenge to the recycling and disposal of package waste. The online retail sales increased by 5.9% in March 2020, year on year, and the total number of postal packages in the first quarter of 2020 was 12.5 billion, 1.6 times of that in 2017 [9].

Global solid waste management system met both opportunities and threats owing to the spread of COVID-19 [1,3,10]. In response to the increasing pressure of resource consumption and environmental impact, more and more attentions have been paid on elevating sustainability of waste management system [5]. According to the report by United Nations Environment Program and International Solid Waste Association, at least seven sustainable development goals (i.e. SDG 1, 2, 3, 8, 9, 11, 12) are related to the solid waste management [11]. For instance, the SDGs highlighted increasing the percentage of renewable energy, paying special attention on MSW management, and reducing waste generation through recycling and reuse [11]. Achieving those global goals was relied on a sustainable-developing solid waste industry, such as waste-to-energy (WTE), waste-to-material (WTM), and other waste disposal industries. Different categories of solid waste industries shifted in different way during the epidemic. First of all, in-time collection and safe disposal of medical waste and MSW were considered as crucial measures for preventing and controlling the epidemic [3,5], therefore, it might be beneficial to the MSW and medical waste industry. Besides, the COVID-19 pandemic raised the use of plastic products to public, patients and hospital staffs, hence it increased the demand for plastic waste treatment [1,2]. Furthermore, similar with other economic sector, the solid waste industry may also be struck due to the economic recession caused by the COVID-19 pandemic, e.g. labor cost rising and financial investment declining, similar to other economic sectors [12,13]. Although there were researches examining the shifts of waste generation and management during the pandemic [[1], [2], [3], [4]], the impact on the solid waste industry was merely discussed.

Before outbreak of the COVID-19 pandemic, there was generally optimistic expectation for the development of solid waste industry in China [14,15]. Solid waste generation in China was huge and kept increasing, 1.55 billion tons of industrial solid waste, 46.4 million tons of hazardous waste, 0.8 million tons of medical waste and 211.5 million tons of MSW were generated from the cities in 2018 [16]. The national fixed-asset investment on MSW disposal increased by 1.5 times (from 19.9 to 29.9 billion CNY·a−1), between 2011 and 2018 [17]. In order to promote sustainable solid waste management, China has implemented a number of new policies in recent years, including circular economy [18,19], MSW classification [20,21], zero waste pilot cities [22], plastic pollution control [23], and so forth, aiming at promoting cascade utilization of solid waste and minimizing the quantity of waste landfilling [24]. Benefiting from those policies, a fast increment of the WTE and WTM industry was observed in recent years. The amount of MSW incinerating and recycling increased by 8.7 and 1.9 times between 2011 and 2018 [11,12]. In China, the most common used WTE technology was grate furnace incinerating system, accounting for 68% of the total treatment capacity [25], while centralized anaerobic digestion system was applied in recent years for harvesting methane from organic waste (e.g. kitchen waste and livestock manure) [26,27]. Diverse technologies were used in the WTM industry, such as regenerating pulp from waste paper, melting and regenerating plastics, recycling precious metals from printed circuit board, and so forth [28,29].

The COVID-19 pandemic is a typical “black swan event”, which refers to an event with a minimum probability of occurrence or unexpected for some people [30]. It is necessary to quantify the impact of black swan event for searching potential countermeasures. In the field of resource and waste management, Sprecher et al. (2017) [31] simulated the change of supply and demand of associated rare metals under extreme events through scenario analysis. China's waste import ban was considered as a black swan event to the solid waste industry for many countries. Brooks et al. (2018) [32] found that the value of global waste plastics import and export decreased by more than 20% after the ban was took into effect. The Intervention analysis model and vector auto-regression (VAR) model were applied for quantitatively analyzing the impact of a black swan event [33,34]. A number of researches have addressed the impact of COVID-19 pandemic on the economic sectors, such as the airline, tourism, mining industry [12,34,35], however, the solid waste industry was ignored. In particular, the next two years are vital time-nodes for implementing the new plans for achieving the SDGs of waste management in China. The first batch of pilot cities on MSW source separation was requested to be fully implemented by 2020 [20]; while the zero waste pilot cities should accomplish their goals by 2021 [22]. Does the COVID-19 pandemic lower the speed and shift the direction of developing solid waste industry in China? How many economic losses of the solid waste industry were caused by the epidemic? It merits studies to fill this knowledge gap.

In this work, the quarter-level financial statement data of thirty listed companies in the Stock Market of China were analyzed. To examine the impacting pathway of COVID-19 pandemic on the WTE and WTM industry, a conceptual system dynamic model was established. The economic reduction of the solid waste industry caused by COVID-19 pandemic was estimated, and the historic and most recent financial performance of four main types of solid waste industry (i.e. WTE, WTM, waste disposal and other waste industry) were examined. Policy implications were put forward for protecting the solid waste industry in China.

2. Methods and materials

2.1. Selection of listed companies

Ministry of Ecology and Environment of China classified solid waste as MSW, non-hazardous industrial solid waste, hazardous solid waste and medical waste, and agricultural waste, according to their generating source and toxicity [16]. In particular, organic urban waste (incl. Restaurant food waste, household kitchen waste and garden waste) accounted for 53.7% of the total MSW in China in 2017 [36]. The Chinese government emphasized energy recycling from restaurant food waste, more than 100 cities have built treatment plants and 90% of them applied anaerobic digestion technology for harvesting methane [26,27]. While the garden waste and household kitchen waste were underutilized for renewable biofuel in China [37].

There are different methods for classifying the solid waste industry. According to the North American Industry Classification System, the solid waste industry consists of three groups, i.e. collection, treatment and disposal, and other waste remediation services [38]. The solid waste industry is divided by the type of solid waste (MSW, industrial solid waste, hazardous waste, etc.) and the category of service (collection, treatment, consultation, etc.) in China [39]. In reference to those classification principles, a review of industrial reports was conducted to find the listed companies who carried out solid waste related business [40]. Moreover, the availability of annual financial statement data for each company was checked, and thirty-seven companies were selected in this step [41]. In order to represent the impact of COVID-19 pandemic on the solid waste industry, the listed companies who did not publish the financial statements in the first quarter of 2020 were removed. In total, thirty listed companies in the Shanghai and Shenzhen Stock Market of China were selected to represent the development of solid waste industry in China (details can be found in Appendix B (Table B.1)). Those listed companies show high representativeness of the solid waste industry in China. For example, the market share of the listed companies accounted for about 60% in the field of WTE industry [39], meanwhile, their business spread through all the provinces in China, representing the solid waste industry in different regions of China.

2.2. Analysis of the financial data

To examine the historical trend of solid waste industry in China, total turnovers and profits for each selected listed company, in quarter-level and annual-level, were obtained from their financial statements from year 2006–2019. In 2020, only the first-quarter turnover and profit data were available. Here, turnover refers to the total amount of goods or services sold by a company, while profit means the net income after paid cost in business. An autoregressive integrated moving average (ARIMA) Intervention analysis model was applied to reveal the impact of the COVID-19 pandemic on solid waste industry in China. The ARIMA-Intervention model was established followed by Ref. [33], and the impact (i.e. turnover reduction) was analyzed by (1), (2).

| (1) |

| (2) |

where, Y p is the total annual turnover of selected listed companies in the solid waste industry in China, the historic data are from 2006 to 2019; t is year; f(t) is the regression model between historic turnover and year; I is the impact of COVID-19 on the solid waste industry; is the predicted value of turnover in 2020 b y following f(t), without the intervention of the COVID-19 pandemic; Y a is the actually observed value of turnover in the first quarter of 2020, the period of increasing COVID-19 infected cases in China; c is the average ratio between the first-quarter turnover and the annual turnover for each year, from 2006 to 2019.

The listed company may get involved in multiple categories of businesses, e.g. dealing with different types of solid waste, or operating in different stage of waste management. In order to further reveal the impact of COVID-19 pandemic on different sectors of solid waste industry in China, the financial indicators of each listed company were decomposed by the following steps. First of all, ten categories of subdivisions were found according to the financial statements of the selected listed companies, namely, MSW incineration (IN), restaurant food waste digestion (RW), energy harvesting from agricultural waste (AW), WTM industry (i.e. secondary materials recycling and recovery), MSW landfill, hazardous waste and medical waste treatment (HW&MW), non-hazardous industrial waste treatment (IW), cleaning and waste collection services (C&WC), waste disposal equipment production (WDE), consulting and technical innovation services for solid waste management (C&T). According to the scope and definition of WTE, its subdivisions include IN, RW, and AW were classified as WTE industry [42]. Other subdivisions were consolidated into three main sectors based on the directory of environmental service industry in China [39], namely, WTM industry, waste disposal industry (MSW landfill, HW&MW, and IW), and other waste industry (C&WC, WDE, and WDE). Turnovers and profits of the four main sectors in solid waste industry, in the first quarter of 2017, 2018, 2019 and 2020, were compared. The financial data in the first quarter were used for showing the impact of COVID-19 pandemic due to the following reasons: (1) the strict shutdown period in China was almost the first quarter of 2020, e.g. Hubei Province started the shutdown policy since January 23rd and gradually re-opened since April 8th; (2) the first-quarter financial statement is the best available data for assessing the economic performance of the listed companies during the COVID-19 pandemic. The listed companies were only mandatorily requested to state their financial status into subdivided sectors in the end of each year. Therefore, it was assumed that the shares of the turnover and profit for each subdivision in the first quarter were the same as those of the whole year. The shares in the first quarter of 2020 were assumed to be the same as those in 2019.

2.3. Influential factor and impacting pathway

A conceptual system dynamic model was established by applying Vensim 7.0, for illustrating the impact of COVID-19 pandemic on the WTE and WTM industry in China. In order to establish the dynamic model, telephone investigations were completed to understand the impact of COVID-19 pandemic on the key players in the WTE and WTM industry, e.g. waste treatment companies, environmental sanitation agencies, community administrators, and residents. The interviewees were required to provide the impacting factors and their feedback loops, which threw impacts on them during the COVID-19 pandemic. To learn the shift of recycling market, a key factor to the WTM industry, historic prices of different categories of secondary materials were automatically crawled from the Bianbao website [43] by applying the tools of Google Chrome, programming by using Visual Basic 6.0. This website provides the most complete and up-to-date price data of secondary materials in China, covering almost all the provinces with WTM industry. The programming environment was Visual Studio 2009, by applying 2 third-party libraries of Html Agility Pack and Newtonsoft to resolve the html and JavaScript Object Notation webpage. Main steps were: (1) applying Newtonsoft to analyze the item list from the website and finding keywords for the categories of secondary materials; (2) cyclic-URL selecting for each category from the first to the latest webpage; and (3) crawling the price data in each URL by using Html Agility Pack. The programming code by Visual Basic 6.0 was provided in Appendix A (Text A.1). Abnormal data due to incompatible format were removed. By following this method, twelve categories of recyclables were selected, incl. Stainless steel, steel, aluminum, iron, copper, zinc, newsprint, cardboard, ABS, PET, PP, and PS. Around 0.2 million pieces of daily price-data from January 1st, 2017 to March 31st, 2020, were obtained and then aggregated to monthly average data (Table B.4).

3. Results

3.1. Solid waste industry before and during the COVID-19 pandemic

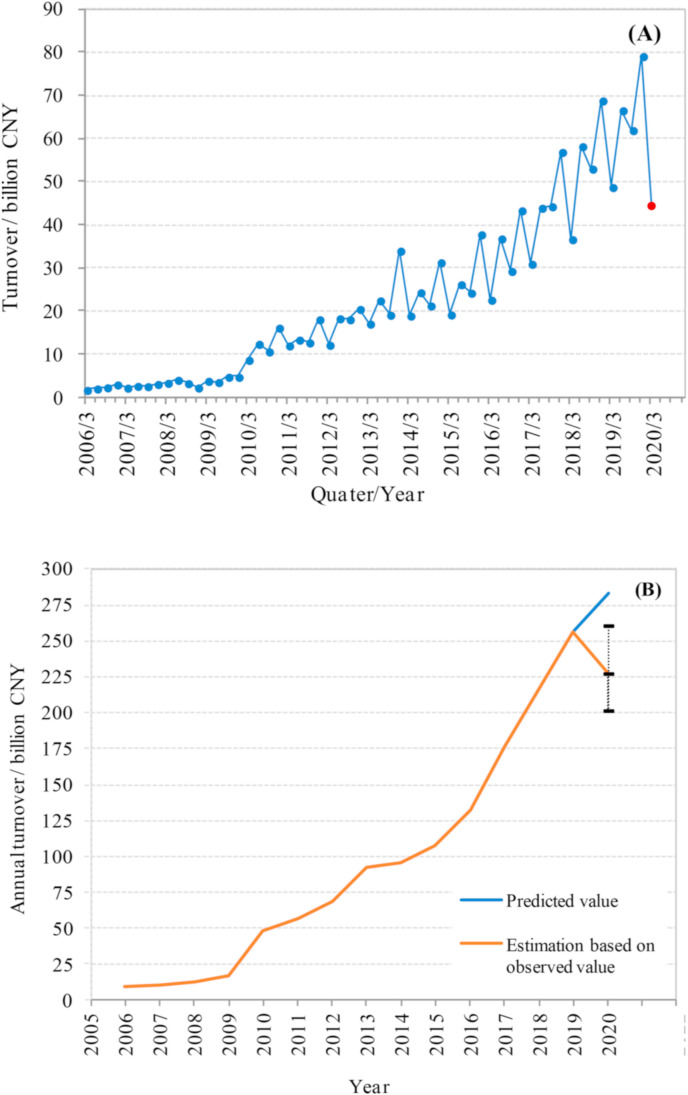

Historic quarter-level turnovers of thirty listed companies in solid waste industry in China are shown in Fig. 1 (A). Total annual turnovers were 9.1 billion CNY·a−1 in 2006 and 256.6 billion CNY·a−1 in 2019, increased by 28.2 times, with an average increment of 29% per year. Linear and binomial regression analysis between historic turnover and year were done, from 2006 to 2019 (see Fig. A.1). It was well-fitting a binomial model (adjusted R2 = 0.983), f(t) = 1.365t 2 - 2.445t+12.304, t equals the year minus 2005. There was an increasing trend from the first quarter to the fourth quarter in each year. The volatility of the ratio (c) between the turnover in the first quarter and that in the whole year was 19.5 ± 2.5% from 2006 to 2019. By using the first-quarter turnover in 2020 and this ratio, the “observed” total turnover in 2020 can be estimated. Based on the ARIMA-Intervention model, the impact (i.e. turnover reduction) of COVID-19 pandemic on the listed companies in solid waste industry in China was estimated to be 55.8 billion CNY·a−1 in 2020, accounting for 22% of the turnover in 2019 (see Fig. 1(B)). This negative impact may fluctuate between 22.4 and 81.6 billion CNY·a−1 (the range of the error bar) when consider the volatility of the coefficient c.

Fig. 1.

Historic and estimated turnovers of the thirty listed companies in solid waste industry in China. (A) The quarter-level turnover from 2006 to 2020; (B) estimate of the annual turnover reduction by applying the ARIMA-Intervention model.

3.2. Financial performances of the subdivided sectors

Fig. 2 presents the turnovers and profits of different sectors and subdivisions of the solid waste industry in the first quarter of 2017, 2018, 2019 and 2020 (Table B.2 and B.3). As shown in Figure (A), the WTE industry kept growing (+21%), the WTM industry dropped significantly (−28%), and the waste disposal industry and other solid waste industry varied slightly (−10% and +9%), comparing the first-quarter turnover in 2019 and 2020. With respect to the subdivided sectors in WTE industry, the turnover of IN, RW and AW in the first quarter of 2020 were 23%, 16% and 3% greater than that in 2020, respectively. In particular, the turnover of MSW incineration industry (IN) reached 4.39 billion CNY, exceeded the material recycling industry and became the subdivision with the largest quarter-level turnover in 2020. Regarding to the subdivided sectors in waste disposal industry, the first-quarter turnover of MSW landfill industry increased from 0.39 billion CNY to 0.48 billion CNY, between 2019 and 2020. The first-quarter turnover of HW&MW disposal industry decreased from 1.01 to 0.75 billion CNY, while that of the IE disposal industry dropped from 0.80 to 0.76 billion CN, between 2019 and 2020. It may due to the sudden recession of the industrial department in China during the COVID-19 pandemic. The first-quarter turnover of C&WC industry increased by 18% between 2019 and 2020, which was consistent with the fact that Chinese government highlighted in-time MSW collection and street cleaning for preventing the epidemic.

Fig. 2.

The first-quarter turnovers and profits of different categories of solid waste industry in China. (A) Turnover; (B) profit. WTE industry, incl. MSW incineration (IN), restaurant food waste digestion (RW), and energy harvesting from agricultural waste (AW); WTM industry, i.e. secondary materials recycling and recovery; waste disposal industry, incl. MSW landfill, hazardous waste and medical waste treatment (HW&MW), and non-hazardous industrial waste treatment (IW); other waste industry, cleaning and waste collection services (C&WC), waste disposal equipment production (WDE), consulting and technical innovation services for solid waste management (C&T).

Fig. 2(B) shows the profit of the solid waste industry in the first quarter of recent four years, suggesting a different performance to the results of turnover. The first-quarter profits of the WTE and WTM industry decreased by 10% and 43% between 2019 and 2020, respectively. The profits of IN, RW, HW&MW, IW, C&WC, WDE, and C&T were 2%, 7%, 73%, 46%, 13%, 67%, 3% lower than the maximum profit over the last four years. Decline in profits may due to the rise of labor and logistic costs, decrease of the benefit from secondary material, and potential delay of receivable accounts during the COVID-19 pandemic.

3.3. Influential factors for the shift of WTE and WTM industry

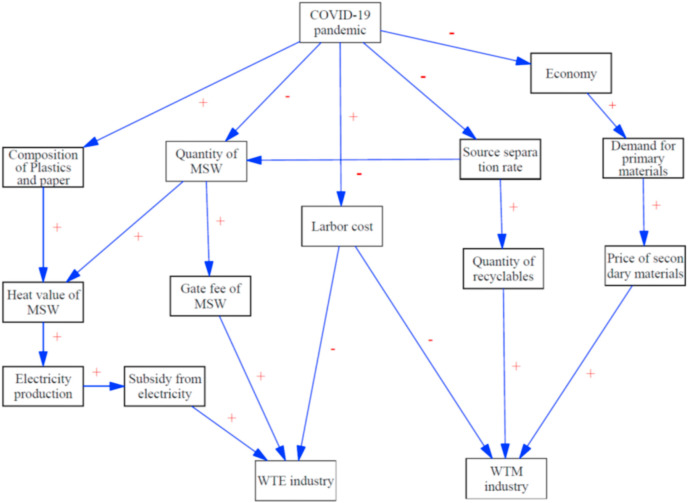

Based on the investigations on the main stakeholders in WTE and WTM industry, a conceptual system-dynamic model is shown in Fig. 3 , illustrating the pathway of how COVID-19 pandemic affect the WTE and WTM industry. Only the direction of the feedback loops, as well as the positive and negative attributes of them, can be determined, due to insufficient data during the COVID-19 pandemic. Although a quantitative model was not established herein, useful information can still be obtained from the conceptual model. First of all, it suggests that both positive and negative impact of the COVID-19 pandemic were thrown on the WTE industry. MSW incinerators were temporarily used for disposing non-hazardous medical waste (e.g. mask and protective clothing) to guarantee the capacity of in-time medical waste disposal for many cities in China [44], which may raise the average heat value of the fed waste. Therefore, the total subsidy gained from electricity sale may increase during the COVID-19 pandemic. On the other hand, the amount of MSW generation in China decreased by 30% [44], therefore the gate fee for MSW disposal in the WTE facilities may decrease. It was consistent with the first-quarter data of the listed companies in the WTE industry, i.e. the turnover raised but the increasing rate was not as high as expectation.

Fig. 3.

Conceptual system-dynamic analysis of the impact of COVID-19 on WTE and WTM industry by Vensim 7.0.

Different from the WTE industry, the WTM industry tended to be negatively affected by almost all the factors, based on the conceptual dynamic model. First, the mobilization of MSW source separation was inhibited due to the shutdown policy upon communities, thus the quantity of collected recyclables decreased. Meanwhile, demand for the primary material decreased and the price of secondary materials could be impacted, owing the economic recession during the COVID-19 pandemic. Price-decline of secondary materials could be verified by the month level data crawled from Bianbao website, providing a quantitative explanation for the feedback loop “price of secondary materials” to “WTM industry”. The trade prices of all the twelve secondary materials dropped in China. The average trade-prices of the secondary materials during the COVID-19 pandemic were only 43.4%–85.8% of the maximum price from 2017 to 2019. Since the outbreak of the epidemic (from January to March 2020), the prices of secondary metals, i.e. stainless steel, steel, iron, aluminum, copper, zinc, declined by 9.4%, 2.8%, 17.7%, 1.3%, 14.1%, and 18.5%, respectively (see Fig. 4 (A) ); the prices of secondary paper, i.e. news paper and cardboard, decreased by 13.9% and 15.1%, respectively (see Fig. 4 (B)); and the prices of secondary plastics, i.e. ABS, PET, PP, PS, dropped by 15.7%, 2.3%, 2.4%, and 8.2%, respectively (see Fig. 4 (C)).

Fig. 4.

Historic prices of secondary materials in China from 2017 to 2020. (A) Metals; (B) paper; (C) plastics.

4. Discussion

4.1. Impact of the pandemic on solid waste industry

COVID-19 pandemic, a “black swan even”, threw both negative and positive impact on the solid waste industry. In the short-term (i.e. the next two years), the solid waste industry of China is most likely to confront decreasing revenue and rising operate cost post the COVID-19 pandemic. The estimated turnover reduction of the thirty listed companies in the solid waste industry is 55.8 billion CNY·a−1 in 2020, according to the estimation by ARIMA-Intervention model. The solid waste industry was largely relied on the in-time payment from governments and waste-producers [5,39], who were also deeply trapped by the pandemic. The COVID-19 is still spreading all over the world, therefore, the negative impact of COVID-19 pandemic on the economic sectors may transmit to the solid waste industry in China. The pilot-city programs on MSW source separation and zero waste were requested to be fully implemented by the end of 2020 and 2021, respectively, according the plan of Chinese government [20,22]. Considering a possible sluggish growth of the solid waste industry in China, those programs may meet non-trivial challenges in the next two years. Regarding the long-term impacts, Chinese government formulated action plans on reducing waste generation, promoting recycling, and elevating level of waste management in the 2030 agenda of SDGs [45]. In response to the changes of solid waste industry during COVID-19 pandemic, different sectors of solid waste industry may shift in varied way.

The WTM industry tends to be impacted in long-term by the recession of global economy and international trade. It was found that the turnover and profit of the WTM industry in China declined 28% and 43% during the COVID-19 pandemic, while price-drop of secondary materials may be the key reason for the decline. The Great Financial Crash of 2008 also caused the recession of global economy, and it was found that the prices of recyclables drastically dropped and global recycling industry was greatly stroke for many years after 2008 [12,46]. A recent research suggested that the price of six main primary metals decreased by 2%–15% in April 2020 [12], after the worldwide spread of the COVID-19. Besides, the international crude oil price has declined by more than 30% during the COVID-19 pandemic due to pessimistic expectations on the world economy [47], which may result in a decline of plastic waste recycling. Furthermore, many other factors related to the COVID-19 pandemic may throw negative impacts on the WTM industry. For instance, the waste pickers are still restricted to free access to communities by following the epidemic prevention policy [4,44]. For the long-term consideration, the pandemic is still progressing rapidly worldwide, and the uncertainty of global economy keeps accumulating. Consequently, demand for the primary material is likely to be continuously decline before global economic recovery. Although the recycling system has a certain degree of resilience, namely, the industry will follow a “buy low sell high” strategy [32]. Nevertheless, if the negative impact of the COVID-19 pandemic last for a long period, the scale and capacity of the WTM industry is likely to shrink, and then impeding to achieve the SDGs for solid waste management in the world [10].

On the contrary, the WTE industry, which is also vital for elevating the waste management level for both urban and rural areas, is expected to be booming during and post the COVID-19 pandemic. The National Health Commission of China announced a Work Plan for Comprehensive Treatment of Medical Waste in the end of February 2020, emphasizing medical waste control during the epidemic [48]. WTE facilities were used for non-hazardous medical waste disposal during the pandemic to fill the capacity-gap, showing its advantage to achieve both aims of energy utilization and safe disposal of waste [44]. Agricultural waste industry was not significantly affected by the pandemic, because the COVID-19 pandemic was comparatively mild in the rural areas in China. However, due to the possible decline of WTM industry, as well as the above advantages of WTE solution, it might pose a dilemma to China's zero waste and source separation policy, i.e. incineration dominates and material recycling declines, which is not completely in line with the whole concept of sustainable waste management.

There are limitations in data and model of this research. First of all, the financial data only covered the listed companies in China due to insufficient statistics. The total turnover of the WTM industry in China was estimated at 755 billion CNY in 2017 [19], while the total turnover of the selected listed companies was only 176.2 billion CNY (23%) in 2017. There were a number of small and middle size companies also engaged in the solid waste industry, and they were more inclined to be affected by the COVID-19 pandemic due to lower financial and market resource. Furthermore, a quantitative-based system dynamic model was not established in this work, although some useful information could be found through the conceptual model. In future works, it merits further works on the quantitative models and relative scenarios for guiding the waste management practices in responding the epidemic.

4.2. Policy implications

It demonstrates that the COVID-19 pandemic has affected and may keep throwing impact on the solid waste industry in China. When the “black swan event” occurred, risk conceptualization and treatment frameworks should be expanded, to develop a new risk assessment and decision assistant methodology [[49], [50], [51]]. The shift of solid waste management in China will throw great impact on the material flow in the world. For instance, when the Chinese government ban the waste import, recyclables flowed to the South Asia countries [52,53]. Therefore, the measures taken by China to the solid waste industry will be beneficial to achieve the SDGs over the world. Here, several policy implications during and post COVID-19 for the solid waste industry in China were put forward: (1) quantitative simulate the long-term impact of COVID-19 pandemic on solid waste industry, e.g. predict the volatility in the price of secondary material, analyze the financial variation for different categories of solid waste industry, early warn the shifts and challenges for solid waste industry; (2) implement policies to protect the WTM industry for achieving SDGs in waste management, e.g. keep increasing the government investment and incentive on waste recycling program, and establish a mechanism for temporary storing the secondary materials; (3) examine the possible mass diversion from WTM to WTE facilities, simulate the heat value changes of incinerated waste, and formulate contingency plan for this diversion, incl. Plan of collection routine, allocation of facility capacity, and adjustment of running parameters of facilities; (4) build an internal circulation system for waste management with consideration of decreasing international trade of secondary materials.

5. Conclusion

The solid waste industry in China developed rapidly in recent years owing to the new policies on promoting sustainable solid waste management. However, due to the impact of the COVID-19 pandemic, the solid waste industry in China met both opportunities and challenges. ARIMA-Intervention analysis suggests that it is reasonable to expect a significant turnover reduction of the solid waste industry in China in 2020. During the COVID-19 pandemic, four main sectors in solid waste industry showed different financial performance. The WTE industry kept growing, the WTM industry dropped significantly, while the waste disposal and other solid waste industry varied slightly, comparing their first-quarter turnovers in 2019 and 2020. The system dynamic model indicates that there were both positive and negative impacts of the COVID-19 pandemic on WTE industry, however, the WTM industry has met great challenges such as price drop of secondary materials, inaccessibility to community for waste pickers, and increment of operating cost. Several measurements may be vital for protecting the solid waste industry in China, such as enhancing information collection and early warning, establishing mechanism for temporary storing the recyclables, and increasing the government investment and financial input.

6. Credit author statement

Chuanbin Zhou, Conceptualization, Methodology, Investigation, Writing, Visualization; Guang Yang Methodology, Validation, Writing - review & editing; Shijun Ma, Writing - review & editing; Yijiu Liu, Writing - review & editing; Zhilan Zhao, Investigation.

Declaration of competing interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Acknowledgements

This research was supported by grants from National Key R&D Program of China (2018YFC1903601), National Natural Science Foundation of China (Grant No. 41871206), and Youth Innovation Promotion Association CAS (2017061). We thank Professor Shuai Shao for sharing his ideas with us and all the anonymous reviewers who help us to improve the paper.

Footnotes

Supplementary data to this article can be found online at https://doi.org/10.1016/j.rser.2020.110693.

Appendix A. Supplementary data

The following are the Supplementary data to this article:

References

- 1.Klemeš J.J., Van Fan Y., Tan R.R., Jiang P. Minimizing the present and future plastic waste, energy and environmental footprints related to COVID-19. Renew Sustain Energy Rev. 2020;127:109883. doi: 10.1016/j.rser.2020.109883. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Prata J.C., Silva A.L.P., Walker T.R., Duarte A.C., Rocha-Santos T. COVID-19 pandemic repercussions on the use and management of plastics. Environ Sci Technol. 2020;54:7760–7765. doi: 10.1021/acs.est.0c02178. [DOI] [PubMed] [Google Scholar]

- 3.Penteado C.S.G., de Castro M.A.S. Covid-19 effects on municipal solid waste management: what can effectively be done in the Brazilian scenario? Resour Conserv Recycl. 2020;164:105152. doi: 10.1016/j.resconrec.2020.105152. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Van Fan Y., Jiang P., Hemzal M., Klemeš J.J. An update of COVID-19 influence on waste management. Sci Total Environ. 2020;754:142014. doi: 10.1016/j.scitotenv.2020.142014. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Kaza S., Yao L., Bhada-Tata P., Van Woerden F. The World Bank; 2018. What a waste 2.0: a global snapshot of solid waste management to 2050. [Google Scholar]

- 6.Chen Y.C. Effects of urbanization on municipal solid waste composition. Waste Manag. 2018;79:828–836. doi: 10.1016/j.wasman.2018.04.017. [DOI] [PubMed] [Google Scholar]

- 7.National Bureau of Statistics of China National database. http://data.stats.gov.cn/

- 8.Jribi S., Ben Ismail H., Doggui D., Debbabi H. COVID-19 virus outbreak lockdown: what impacts on household food wastage? Environ Dev Sustain. 2020;22:3939–3955. doi: 10.1007/s10668-020-00740-y. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.State of Post Bureau of China Operating status of postal services in the first quarter of 2020. 2020. http://www.spb.gov.cn/sj/

- 10.Naidoo R., Fisher B. Reset sustainable development goals for a pandemic world. Nature. 2020;583:198–201. doi: 10.1038/d41586-020-01999-x. [DOI] [PubMed] [Google Scholar]

- 11.Wilson D.C., Rodic L., Modak P., Carpintero A., Velis C., Iyer M., Simonett O. United Nations Environment Program (UNEP) and International Solid Waste Association (ISWA); 2015. Global waste management outlook. [Google Scholar]

- 12.Laing T. The economic impact of the Coronavirus 2019 (Covid-2019): implications for the mining industry. Extr Ind Soc. 2020;7:580–582. doi: 10.1016/j.exis.2020.04.003. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Atkeson A. What will Be the economic impact of COVID-19 in the US? Rough estimates of disease scenarios. Natl Bur Econ Res. 2020 https://www.nber.org/papers/w26867 [Google Scholar]

- 14.Cheng H., Hu Y. Municipal solid waste (MSW) as a renewable source of energy: current and future practices in China. Bioresour Technol. 2010;101:3816–3824. doi: 10.1016/j.biortech.2010.01.040. [DOI] [PubMed] [Google Scholar]

- 15.Zhao X., Jiang G., Li A., Wang L. Economic analysis of waste-to-energy industry in China. Waste Manag. 2016;48:604–618. doi: 10.1016/j.wasman.2015.10.014. [DOI] [PubMed] [Google Scholar]

- 16.Ministry of Ecology and Environment of China . 2019. Annual report on environmental pollution prevention and control of large and middle cities in China. [Google Scholar]

- 17.Ministry of Housing and Urban-Rural Development of China Statistical yearbook of urban and rural construction. 2019. http://www.mohurd.gov.cn/xytj/tjzljsxytjgb/index.html

- 18.National Development and Reform Commission of China Leading action plan for circular development. 2017. http://www.gov.cn/xinwen/2017-05/04/content_5190902.htm

- 19.Ministry of Commerce of China . 2019. Report on the development of China's resources recycling industry. [Google Scholar]

- 20.General Office of the Chinese State Council of China Implementation plan of municipal solid waste classification and management. 2017. http://www.gov.cn/zhengce/content/2017-03/30/content_5182124.htm

- 21.Ministry of Housing and Urban-Rural Development of China Comprehensively promoting municipal solid waste classification system in all 293 prefecture-level cities. 2019. http://www.mohurd.gov.cn/wjfb/201906/t20190606_240787.html

- 22.General Office of the Chinese State Council of China Implementation plan of zero waste demonstrating cities. 2018. http://www.gov.cn/zhengce/content/2019-01/21/content_5359620.htm

- 23.National Development and Reform Commission of China Opinions on further strengthening the control of plastic pollution. 2020. http://www.gov.cn/zhengce/zhengceku/2020-01/20/content_5470895.htm

- 24.Law on the Prevention and Control of Environmental Pollution by Solid Waste of People’s Republic of China First issued in 1995, amended in 2016 and 2020. http://www.gov.cn/xinwen/2020-04/30/content_5507561.htm

- 25.Lu J., Zhang S., Hai J., Lei M. Status and perspectives of municipal solid waste incineration in China: a comparison with developed regions. Waste Manag. 2017;69:170–186. doi: 10.1016/j.wasman.2017.04.014. [DOI] [PubMed] [Google Scholar]

- 26.Li L., Peng X., Wang X., Wu D. Anaerobic digestion of food waste: a review focusing on process stability. Bioresour Technol. 2018;248:20–28. doi: 10.1016/j.biortech.2017.07.012. [DOI] [PubMed] [Google Scholar]

- 27.Negri C., Ricci M., Zilio M., D'Imporzano G., Qiao W., Dong R., Adani F. Anaerobic digestion of food waste for bio-energy production in China and Southeast Asia: a review. Renew Sustain Energy Rev. 2020;133:110138. [Google Scholar]

- 28.China Paper Association . 2019. China paper industry annual report: 2012-2018. [Google Scholar]

- 29.China National Resources Recycling Association . 2019. Industry development report of recycled resources of China; pp. 2018–2019. [Google Scholar]

- 30.Ale B.J.M., Hartford D.N.D., Slater D.H. Dragons, black swans and decisions. Environ Res. 2020;183:109127. doi: 10.1016/j.envres.2020.109127. [DOI] [PubMed] [Google Scholar]

- 31.Sprecher B., Reemeyer L., Alonso E., Kuipers K., Graedel T.E. How “black swan” disruptions impact minor metals. Resour Pol. 2017;54:88–96. [Google Scholar]

- 32.Brooks A.L., Wang S., Jambeck J.R. The Chinese import ban and its impact on global plastic waste trade. Sci Adv. 2018;4 doi: 10.1126/sciadv.aat0131. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 33.Chung R.C.P., Ip W.H., Chan S.L. An ARIMA-intervention analysis model for the financial crisis in China's manufacturing industry. Int J Eng Bus Manag. 2009;1:5. [Google Scholar]

- 34.Sobieralski J.B. COVID-19 and airline employment: insights from historical uncertainty shocks to the industry. Transp Res Interdiscip Perspect. 2020;5:100123. doi: 10.1016/j.trip.2020.100123. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35.Sigala M. Tourism and COVID-19: impacts and implications for advancing and resetting industry and research. J Bus Res. 2020;117:312–321. doi: 10.1016/j.jbusres.2020.06.015. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 36.Ma S., Zhou C., Chi C., Liu Y., Yang G. Estimating physical composition of municipal solid waste in China by applying artificial neural network method. Environ Sci Technol. 2020;54:9609–9617. doi: 10.1021/acs.est.0c01802. [DOI] [PubMed] [Google Scholar]

- 37.Shi Y., Ge Y., Chang J., Shao H., Tang Y. Garden waste biomass for renewable and sustainable energy production in China: potential, challenges and development. Renew Sustain Energy Rev. 2013;22:432–437. [Google Scholar]

- 38.US Census Bureau North American industry classification system. https://www.census.gov/eos/www/naics

- 39.Ministry of Ecology and Environment of China . 2015. Report on the development of environmental service industry in China.http://www.mee.gov.cn/ywgz/kjycw/tzyjszd/hbcy/201811/P020181129552554076322.pdf [Google Scholar]

- 40.Yuncaijing Big-data Technology Co., Ltd The listed companies with business in solid waste management. https://www.yuncaijing.com/story/details/id_489.html

- 41.Zhejiang Hexin Tonghuashun Network Information Co., Ltd http://stockpage.10jqka.com.cn

- 42.Rogoff M.J., Screve F. third ed. William Andrew Publishing; New York: 2019. Waste-to-energy: technologies and project implementation. [Google Scholar]

- 43.Xiamen Bianbaowang Network Information Co., Ltd http://www.bianbao.net

- 44.Joint Prevention and Control Mechanism of the State Council 2020. www.gov.cn/xinwen/gwylflkjz53/index.htm

- 45.China’s National Plan on Implementation of the 2030 Agenda for Sustainable Development 2016. http://www.nwccw.gov.cn/site22/20170907/b8aeed3566841b1b4b981c.pdf

- 46.Steuer B., Ramusch R., Salhofer S. Can Beijing's informal waste recycling sector survive amidst worsening circumstances? Resour, Conserv Recycl. 2018;128:59–68. [Google Scholar]

- 47.Sharif A., Aloui C., Yarovaya L. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: fresh evidence from the wavelet-based approach. Int Rev Financ Anal. 2020;70:101496. doi: 10.1016/j.irfa.2020.101496. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 48.National Health Commission of China Work plan for comprehensive treatment of medical waste. 2020. http://www.gov.cn/zhengce/zhengceku/2020-02/27/content_5483928.htm

- 49.Aven T. Implications of black swans to the foundations and practice of risk assessment and management. Reliab Eng Syst Saf. 2015;134:83–91. [Google Scholar]

- 50.Berner C.L., Staid A., Flage R., Guikema S.D. The use of simulation to reduce the domain of “black swans” with application to hurricane impacts to power systems. Risk Anal. 2017;37:1879–1897. doi: 10.1111/risa.12742. [DOI] [PubMed] [Google Scholar]

- 51.Houck M.M. Tigers, black swans, and unicorns: the need for feedback and oversight. Forensic Sci Int. 2019;1:79–82. doi: 10.1016/j.fsisyn.2019.04.002. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 52.Tan Q., Li J., Boljkovac C. Responding to China's waste import ban through a new, innovative, cooperative mechanism. Environ Sci Technol. 2018;52:7595–7597. doi: 10.1021/acs.est.8b01852. [DOI] [PubMed] [Google Scholar]

- 53.Lin S., Man Y., Chow K., Zheng C., Wong M. Impacts of the influx of e-waste into Hong Kong after China has tightened up entry regulations. Crit Rev Environ Sci Technol. 2020;50:105–134. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.