Abstract

Objective:

To provide insight into the context and public health implications of the South African sugar-sweetened beverage (SSB) tax (Health Promotion Levy; HPL) by describing SSB and added sugar intakes, as well as BMI, 1 year prior to, at the time of and 1 year after implementation of the HPL.

Design:

Longitudinal dietary intake was assessed using a quantitative food frequency questionnaire (QFFQ) and BMI was measured via anthropometry.

Setting:

Soweto, Johannesburg, South Africa.

Participants:

Adolescents, young adults and middle-aged adults (n 617).

Results:

At baseline, median SSB intakes were 36 ml/d, 214 ml/d and 750 ml/d for those in low, medium and high consumption tertiles, respectively. SSB intake decreased by two times/week in medium consumers and seven times/week in high consumers between baseline and 12 months, equivalent to 107 ml/d and 536 ml/d reductions, respectively. These reduced levels were maintained in the following year (i.e. to 24 months). There was an overall decrease in the amount of energy consumed as added sugar in the low (−48 kJ/d), medium (−153 kJ/d) and high (−106 kJ/d) SSB consumption groups between baseline and 24 months; however, the percentage of total energy consumed as added sugar remained relatively consistent (between 10 and 11 %). There were small overall increases in BMI across low (0·6 kg/m2), medium (0·9 kg/m2) and high (1·0 kg/m2) SSB tertiles between baseline and 24 months.

Conclusions:

These findings suggest reductions in SSB and added sugar consumption contemporaneous to the introduction of the HPL – particularly for those with higher baseline intakes.

Keywords: Sugar-sweetened beverages, Added sugar, Health Promotion Levy, Obesity, South Africa

Non-communicable diseases are responsible for 15 million global premature deaths each year, with 85 % of these occurring in low- and middle-income countries(1). Specifically in South Africa, overweight and obesity affects 68 % of women and 31 % of men and the probability of dying prematurely (i.e. between 30 and 69 years of age) from CVD, cancer, diabetes or chronic respiratory disease is 27 %(2,3). These rising burdens of obesity and non-communicable diseases are driven by spatial, economic and social conditions that have encouraged increasing adoption of obesogenic behaviours – particularly poor quality diets and low levels of physical activity(4,5). The health consequences are complex and multi-faceted; however, research shows that high sugar consumption is particularly linked to sugar-sweetened beverage (SSB) intake and is associated with weight gain, diabetes and multiple metabolic risk factors and is now widely accepted as a global health concern(6).

The implications of the growing SSB industry on global health have been recognised, with fiscal policies focused on the taxation of SSB being introduced in several high- and middle-income countries since 2014. In Mexico, the USA and Chile, taxation has been shown to effectively reduce purchasing and consumption of SSB within 2 years after implementation(7–11). In addition, many studies have proposed positive health and economic implications of taxing SSB – including reductions in obesity prevalence, NCD morbidity and mortality and national healthcare costs(12–16). In South Africa, a 20 % price increase in SSB was projected to reduce energy intakes by 36 kJ/d and the number of obese adults by over 220 000, consequently preventing 85 000 incident stroke cases and 72 000 deaths, as well as reducing health care costs by R58 million over a period of 20 years(17,18).

In April 2018, following a 2-year consultation process, a 10 % tax on SSB titled the Health Promotion Levy (HPL) was implemented in South Africa – only half of the originally proposed 20 %(19,20). A unique feature of the South African HPL was that rather than being levied at a flat rate per volume, the HPL is levied by the sugar content of beverages – with the aim to not only encourage consumer responses but also to incentivise a supply-side effort to reduce the sugar content of SSB(19). Early evidence suggests that the prices of taxed beverages have increased, whilst those of untaxed beverages remain unchanged(21). However, from a previous qualitative study, we showed that adults living in urban Soweto, South Africa, believed that the degree of taxation would need to be increased further in order to influence their purchasing patterns(22). In addition, habit and addiction, as well as the accessibility and the widespread advertising of SSB, were perceived to drive participants’ SSB consumption and could potentially restrict the effect that changes in price have on purchasing patterns(22). South African data have also shown that, in addition to the documented increase in consumption of SSB, other sources of added sugar such as table sugar, jam, biscuits, sweets and breakfast cereals also contribute substantially to total intakes(23,24). For this reason, without accounting for other sources of added sugar, the HPL may have limited impact on overall added sugar consumption and potentially on obesity risk.

The current study aimed to provide insight into the context and public health implications of the South African SSB tax by describing SSB and overall added sugar intakes, as well as BMI, of adolescents, young adults and middle-aged adults living in urban South Africa prior to, at the time of, and 1 year after, implementation of the HPL.

Methods

Research setting

This study was conducted at the South African Medical Research Council (SAMRC)/Wits Developmental Pathways for Health Research Unit (DPHRU) at Chris Hani Baragwanath Academic Hospital in Soweto. Chris Hani Baragwanath Academic Hospital is one of the largest hospitals worldwide and a public tertiary care institution that serves the low-income urban community of greater Soweto in Johannesburg, South Africa.

Participants

Recruitment

A total of 750 black South African participants were recruited for the study. Specifically, a purposive sampling method was used to recruit 250 adolescent participants from Soweto. During this process, research assistants entered the community to issue recruitment letters to community members. These recruitment letters clearly explained the purpose and details of the study and provided contact information for DPHRU. Prospective participants provided their contact details directly to the research assistants and/or contacted the research unit using the details provided on the recruitment letters. Additionally, in some cases, information about the study was shared between community members, and the research unit was contacted for more information by those interested in participating. Research assistants at DPHRU collated the information on prospective participants and these participants were called back to make appointments. In addition, 250 young adults and 250 middle-aged adults were purposefully selected from those who were part of the Birth to Twenty Plus cohort study (Bt20+). Bt20+, the longest running birth cohort study in Africa, recruited singleton children born to women living in Soweto from April 1990 and has tracked their growth, health and educational progress(25). The Bt20+ study has also monitored the health of the biological mothers or caregivers of the participants, and it is from these subjects that the middle-aged participants were drawn. Participants were selected for inclusion in the current study if they had attended the most recent data collection wave for Bt20+ and were contactable at the time of recruitment.

Selection criteria

Selection criteria for the study were (1) adolescent boys (n 125) and girls (n 125) aged 13–17 years, all of whom needed to be accompanied by their parent/caregiver and live in Soweto; (2) young adult males (n 125) and females (n 125) aged 26–27 years and (3) middle-aged males (n 125) and females (n 125) aged 45+.

Data collection

Following recruitment and enrolment of adolescents, young adults and middle-aged adults into the study, all data collection took place at the DPHRU site using the same methodology. Baseline data collection took place in May 2017, 1 year prior to the introduction of the SSB tax. Follow-up visits took place at DPHRU at 12 months (i.e. at the time the tax was introduced) and 24 months (i.e. 1 year after the tax was introduced).

Questionnaires

Participant socio-demographic variables were collected using interviewer-administered questionnaires. Household socio-economic status (SES) was assessed using an asset index which scored each participant according to the number of assets that they possessed out of a possible 12 (electricity, radio, television, DSTV/satellite television, refrigerator, mobile phone, personal computer, bicycle, motorcycle/scooter, car, agricultural land and farm animals). This was based on standard measures used in the Demographic and Health Surveys household questionnaire (available at: www.measuredhs.com) and extensively utilised in this setting(26,27). Asset index scores were subsequently grouped into low (<5), medium (5–7) and high (>7) SES categories.

A standardised quantitative FFQ (QFFQ), designed for the South African population, was used to collect dietary intake data. This tool was developed by the SAMRC using results from dietary surveys in both urban and rural areas since 1983(28). The QFFQ consists of 214 food items that are representative of foods consumed by at least 3 % of the population. This tool has been piloted and utilised extensively in Soweto(29–32). In order to complete the QFFQ, trained research assistants used high-quality photographs of food items to trigger participant’s memories of all foods and beverages consumed during the previous 7 days. The participants were asked to arrange the cards into three piles: foods eaten in the last seven days, foods eaten occasionally or foods never eaten, and this was recorded. The QFFQ was then administered and took approximately 40–50 min to complete. In the case of food items that were consumed in the past 7 days, additional data on the frequency and quantity of consumption were recorded. For SSB specifically, unbranded information on the intake of sugar-sweetened carbonated soft drinks, energy drinks and concentrates were collected. As fruit juices are exempt from the SSB tax in South Africa, data on the frequency and quantity of fruit juice consumption were collected separately. Portion sizes were estimated using a combination of high-quality two-dimensional drawings of foods, household utensils and three-dimensional food models which have been described and validated by Steyn et al.(33). Estimated portion sizes were converted to grams to allow for calculation of the participant’s average intake over the previous 7 d. The QFFQ was captured and managed online using REDCap electronic data capture tools hosted at The University of the Witwatersrand(34).

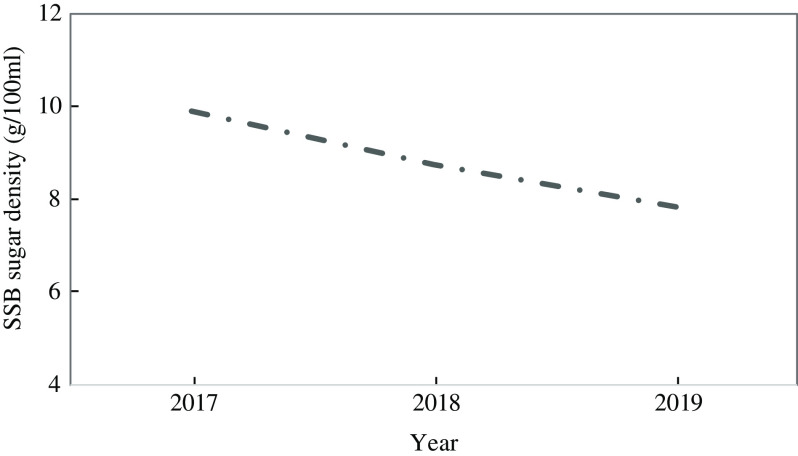

Nutrient composition (energy and macronutrients) was calculated from conversion of single food item intakes by the SAMRC using the South African Food Composition Tables. As a result of the introduction of the HPL, significant reformulation took place whereby the sugar density of SSB was reduced by manufacturers by an average of 2 g/100 ml between the baseline (2017) and 24 months (2019) visit (Fig. 1). As this is not yet reflected in the South African Food Composition Tables, the amount of added sugar consumed from SSB was manually adjusted for participants by 11·65 % at the 12 months and 20·82 % at the 24 months visits to more accurately reflect sugar intake across the 2-year follow-up. The approach to estimating these values is described in Supplementary Appendix A. Since the baseline visit occurred prior to reformulation of SSB, the South African Food Composition Tables provided appropriate figures for added sugar consumption from SSB at this time point and, thus, no adjustment was needed at baseline.

Fig. 1.

Change in sugar density of sugar-sweetened beverages (SSB) in South Africa between 2017 and 2019

Anthropometry

All anthropometric measurements were taken by trained members of research staff. Weight was measured to the nearest 0·1 kg using a portable electronic scale (Seca Gmbh & Co. KG, Germany), and height was measured to the nearest 1 mm using a stadiometer (Holtain Ltd, UK). BMI was calculated as: weight (kg)/height (m2). For adults, BMI was classified as underweight (BMI < 18·5 kg/m2), normal weight (BMI 18·5–24·9 kg/m2), overweight (BMI 25·0–29·9 kg/m2) and obese (BMI ≥ 30·0 kg/m2)(35). In the case of adolescents, age- and sex-specific BMI Z-scores were calculated, and BMI was classified according to International Obesity Task Force (IOTF) references(36–38).

Data analysis

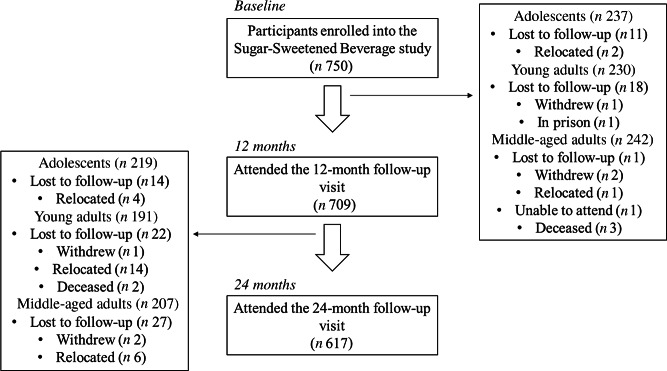

Data were analysed for 617 adolescents (n 219), young adults (n 191) and middle-aged adults (n 207) with complete data across the baseline, 12-month and 24-month visits using StataSE version 16·0 (StataCorp.). The flow of participants through the study to reach the final sample size is depicted in Figure 2. Continuous variables were described as median (interquartile range), and categorical variables were described as percentages (%). Differences in socio-demographic, anthropometric and dietary variables by age group (i.e. adolescents, young and middle-aged adults) and sex were assessed using either the Kruskal–Wallis test (continuous variables) or the χ2 test (categorical variables). Changes in SSB and added sugar intakes, as well as BMI, across the follow-up period were described for the total sample, as well as according to tertiles of SSB consumption (times/week) at baseline. Stratification according to low, medium and high intakes at baseline allowed us to explore sub-group changes over time which may have been missed in the total population due to the variance in intakes across the whole study sample. Differences in longitudinal SSB and added sugar intakes and BMI were compared across tertiles of baseline SSB consumption (times/week) using linear regression analyses adjusted for sex and age at baseline (medium and high baseline SSB intake v. low baseline SSB intake; reference category). We also ran an additional model which was also adjusted for household SES as a potential covariate; however, the associations were found to be independent of SES and therefore this was not included in the final models presented. A two-tailed P-value of <0·05 was considered statistically significant.

Fig. 2.

Flow chart of participants within the study

Results

Participants’ baseline socio-demographic, anthropometric and dietary characteristics are described in Table 1. Median ages of adolescents, young adults and middle-aged adults were 14, 27 and 53 years, respectively. Overall, median height, weight and BMI increased significantly across the age groups (P < 0·001) with the exception of height which was comparable for young and middle-aged adults (P = 0·274). The proportion of participants within the various BMI categories differed significantly across age groups, with the majority of adolescents classified as underweight or normal weight (85 %), the majority of young adults as normal weight or overweight (70 %) and the majority of middle-aged adults classified as overweight or obese (76 %). A significantly lower proportion of adolescents lived in high SES households v. both young and middle-aged adults. Total energy (TE) intake differed significantly by age group, with middle-aged adults reporting the lowest (6615 kJ/d) and young adults the highest (14 632 kJ/d) median intakes. Adolescents consumed median TE intakes of 11 135 kJ/d. Middle-aged adults consumed a significantly higher proportion of energy from protein and a significantly lower proportion from fat compared with adolescents and young adults (P < 0·001), whereas young adults consumed a significantly lower proportion of their energy from carbohydrate compared with the other two groups (P < 0·001). The percentage of TE from added sugar was 11 %, 12 % and 10 % for adolescents, young and middle-aged adults, respectively, with significant differences shown between the young and middle-aged adults (P = 0·026).

Table 1.

Baseline characteristics

| Adolescents (A) | Young adults (YA) | Middle-aged adults (OA) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total (n 219) | Male (n 108) | Female (n 111) | Total (n 191) | Male (n 88) | Female (n 103) | Total (n 207) | Male (n 104) | Female (n 103) | |||||||||||||

| Median | Interquartile range | Median | Interquartile range | Median | Interquartile range | Median | Interquartile range | Median | Interquartile range | Median | Interquartile range | Median | Interquartile range | Median | Interquartile range | Median | Interquartile range | P (A v. YA) | P (A v. OA) | P (YA v. OA) | |

| Age (year) | 14 | 13, 15 | 14 | 13, 15 | 14 | 13, 15 | 27 | 27, 27 | 27 | 27, 27 | 27 | 27, 27 | 53 | 47, 57 | 55 | 50, 60 | 50 46, 55*** | <0·001 | <0·001 | <0·001 | |

| Height (m) | 1·60 | 1·54, 1·66 | 1·63 | 1·55, 1·69 | 1·58 | 1·53, 1·62*** | 1·64 | 1·59, 1·72 | 1·64 | 1·59, 1·72 | 1·65 | 1·60, 1·71 | 1·64 | 1·58, 1·71 | 1·71 | 1·66, 1·75 | 1·58 | 1·54, 1·62*** | <0·001 | <0·001 | 0·274 |

| Weight (kg) | 52·6 | 46·8, 59·8 | 51·0 | 44·4, 58·4 | 53·2 | 48·6, 61·8* | 65·5 | 57·7, 75·1 | 67·9 | 57·6, 75·7 | 65·2 | 57·7, 74·2 | 79·5 | 68·2, 93·7 | 74·5 | 63·4; 89·4 | 83·8 | 74·5, 98·0*** | <0·001 | <0·001 | <0·001 |

| BMI (kg/m2)† | 0·21 | −0·58, 1·08 | −0·19 | −0·90, 0·71 | 0·57 | −0·22 1·48*** | 24·2 | 20·6, 28·2 | 24·7 | 21·0, 28·2 | 23·7 | 20·4, 28·2 | 29·7 | 25·2, 35·9 | 25·6 | 22·3, 31·3 | 34·6 | 29·2, 38*** | N/A | N/A | <0·001 |

| BMI category (%)†,‡ | |||||||||||||||||||||

| Underweight | 9 | 13 | 5*** | 6 | 8 | 5 | 4 | 7 | 0*** | <0·001 | <0·001 | <0·001 | |||||||||

| Normal weight | 69 | 77 | 61 | 50 | 45 | 54 | 20 | 34 | 6 | ||||||||||||

| Overweight | 17 | 8 | 26 | 24 | 25 | 23 | 27 | 32 | 23 | ||||||||||||

| Obese | 5 | 2 | 8 | 20 | 22 | 18 | 49 | 27 | 71 | ||||||||||||

| Household SES score§ | 8 | 6, 9 | 7·5 | 6, 9 | 8 | 6, 9 | 9 | 8, 11 | 9 | 8, 11 | 9 | 8, 11 | 9 | 8, 11 | 10 | 8, 11 | 9 | 8, 11 | <0·001 | <0·001 | 0·853 |

| Low | 10 | 6 | 12* | 4 | 5 | 4 | 3 | 3 | 3 | <0·001 | <0·001 | 0·760 | |||||||||

| Medium | 36 | 44 | 29 | 16 | 16 | 16 | 17 | 16 | 18 | ||||||||||||

| High | 54 | 50 | 59 | 80 | 79 | 80 | 80 | 81 | 79 | ||||||||||||

| TE (kJ/d) | 11 135 | 8503, 14 270 | 11 347 | 8694, 13 919 | 11 068 | 8040, 14 705 | 13 385 | 9613, 18 027 | 14 632 | 10 749, 18 754 | 11 921 | 9267, 16 863* | 6615 | 5152, 8920 | 7266 | 5184, 9488 | 6154 | 4975, 8366 | <0·001 | <0·001 | <0·001 |

| % TE from protein | 10 | 9, 12 | 10 | 9, 12 | 10 | 9, 12 | 11 | 9, 12 | 11 | 9, 12 | 10 | 9, 12 | 12 | 10, 14 | 12 | 10, 15 | 11 | 10, 13* | 0·192 | <0·001 | <0·001 |

| % TE from fat | 34 | 29, 40 | 32 | 28, 39 | 36 | 32, 42* | 35 | 30, 41 | 34 | 28, 38 | 37 | 32, 44** | 32 | 26, 37 | 30 | 25, 37 | 33 | 28, 37* | 0·382 | <0·001 | <0·001 |

| % TE from carbohydrate | 53 | 47, 56 | 53 | 48, 58 | 51 | 46, 55* | 48 | 42, 52 | 50 | 43, 53 | 47 | 42, 52 | 51 | 45, 56 | 50 | 44, 55 | 52 | 47, 56* | <0·001 | 0·254 | <0·001 |

| % TE from added sugar | 11 | 8, 15 | 11 | 8, 15 | 10 | 8, 15 | 12 | 8, 16 | 12 | 8, 15 | 11 | 8, 15 | 10 | 7, 15 | 8 | 5, 12 | 12 | 8, 17*** | 0·435 | 0·078 | 0·026 |

| Fibre (g/d) | 23 | 17, 30 | 25 | 17, 30 | 21 | 16, 29 | 24 | 17, 33 | 27 | 18, 36 | 22 | 16, 30* | 15 | 12, 20 | 16 | 12, 22 | 15 | 11, 19 | 0·258 | <0·001 | <0·001 |

SES, socio-economic status; TE, total energy intake.

P < 0·05.

P < 0·01.

P < 0·001 male v. female.

Adolescent BMI calculated as age- and sex-specific BMI Z-scores and classified according to International Obesity Task Force (IOTF) references(36–38).

Adult BMI classified as: underweight (BMI < 18·5 kg/m2), normal weight (BMI 18·5–24·9 kg/m2), overweight (BMI 25·0–29·9 kg/m2) and obese (BMI ≥ 30·0 kg/m2)(35).

Asset index scores grouped into low (<5), medium (5–7) and high (>7) SES categories. Between-group comparisons assessed via Kruskal–Wallis test (continuous) or χ2 test.

Within the age groups, BMI was similar between young adult males and females; however, adolescent and middle-aged adult females exhibited significantly higher BMI compared with the males (P < 0·001). In addition, within the adolescent group, a significantly higher proportion of males were underweight, with females exhibiting a higher overweight prevalence (P < 0·001). Similarly, there was a significantly higher prevalence of obesity in middle-aged adult females v. males (P < 0·001). Sex differences in household SES were only evident in the adolescent group, where a higher proportion of females v. males lived in low SES households (P < 0·05). TE intake was significantly higher in young adult males v. females (P < 0·05); however, there were no sex differences for adolescents or middle-aged adults. Females consumed a significantly higher proportion of TE from fat across all age groups (P < 0·05), as well as a significantly lower proportion from carbohydrate in the adolescent group (P < 0·05). In middle-aged adults, females also consumed a significantly higher proportion of total energy from carbohydrate (P < 0·05) and added sugar (P < 0·001), but a lower proportion from protein (P < 0·05).

The longitudinal changes in SSB and added sugar consumption, as well as BMI, for the whole study sample are provided in Supplementary Appendix B. Only small reductions in median SSB consumption (−54 (−310; 107) ml/d), and the amount of sugar consumed from SSB (−6 (−32; 8) g/d), were observed between baseline and 12 months. These changes were maintained at the 24- month follow-up. There were no changes in the frequency of SSB consumption or in BMI across the 2-year period. A total of 84, 87 and 92 participants reported consuming no SSB at baseline, 12 months and 24 months, respectively (data not shown).

Table 2 summarises the longitudinal changes in SSB and added sugar consumption and BMI according to tertiles of baseline SSB intake (times/week). There were no differences in age group or sex between the low, medium and high intake tertiles. At baseline, the median amounts of SSB consumed were 36 ml/d, 214 ml/d and 750 ml/d in the low, medium and high intake groups, respectively. The frequencies (times/week) and amounts (ml/d) of SSB consumed, as well as the amounts of sugar consumed from SSB, were significantly higher in the median and high intake v. low intake groups. However, there were no differences in the amount of table sugar, fruit juice or %TE from added sugar across the tertiles, with fruit juice intake being low overall throughout the study. There was a decrease in the frequency of SSB consumption in the medium and high intake groups between baseline and 12 months, with the medium and high intake groups consuming SSB two and seven fewer times/week, respectively. This reduction equated to a median decrease in SSB intake of 107 ml/d in the medium and 536 ml/d in the high intake groups. Changes in SSB consumption across groups between 12 and 24 months were negligible, resulting in a net reduction in SSB intake of 106 ml/d in the medium and 540 ml/d in the high intake groups between baseline and 24 months. In contrast, there was an increase in the frequency (+2 times/week) and amount (+71 ml/d) of SSB consumed by the low intake group between baseline and 24 months. The amount of energy consumed as added sugar increased by 35 kJ/d in the low and 105 kJ/d in the high SSB intake tertiles and decreased by 29 kJ/d in the medium SSB intake tertile between baseline and 12 months. Between 12- and 24-months energy consumed as added sugar decreased across all tertiles of SSB intake, resulting in net reductions of 48 kJ/d, 153 kJ/d and 106 kJ/d in the low, medium and high intake tertiles, respectively, between baseline and 24 months. The percentage of TE from added sugar remained comparable overall across SSB tertiles between baseline (T1: 10 %; T2: 11 %; T3: 10 %) and 24 months (T1: 10 %, T2: 10 %; T3: 11 %). Only the medium-intake group experienced a 1·7 % reduction in the TE consumed from added sugar over the 2-year period, with the low and high intake groups experiencing a <1 % reduction and increase, respectively.

Table 2.

Longitudinal changes in sugar-sweetened beverage, added sugar intakes and BMI according to tertiles of sugar-sweetened beverage consumption at baseline†

| Baseline SSB intake (times/week) | ||||||

|---|---|---|---|---|---|---|

| T1 (n 243) | T2 (n 202) | T3 (n 172) | ||||

| Median | Interquartile range | Median | Interquartile range | Median | Interquartile range | |

| Baseline | ||||||

| Sex | ||||||

| Male | 53 | 45 | 48 | |||

| Female | 47 | 55 | 52 | |||

| Age | 27 | 15, 48 | 27 | 15, 46 | 27 | 16, 47 |

| Adolescents | 39 | 34 | 32 | |||

| Young adults | 26 | 34 | 34 | |||

| Middle-aged adults | 35 | 32 | 34 | |||

| SSB (times/week) | 1 | 0, 2 | 4 | 3, 6** | 10 | 8, 14** |

| SSB (ml/d) | 36 | 0, 71 | 214 | 143, 357* | 750 | 411, 1786** |

| Sugar from SSB (g/d) | 4 | 0, 7 | 21 | 14, 35* | 74 | 41, 177** |

| Table sugar (g/d) | 24 | 11, 46 | 23 | 14, 45 | 22 | 10, 39 |

| Fruit juice (ml/d) | 0 | 0, 54 | 0 | 0, 71 | 36 | 0, 143 |

| Energy from added sugar (kJ/d) | 1003 | 600, 1722 | 1128 | 650, 1910 | 993 | 586, 1635 |

| % TE from added sugar | 10 | 7, 15 | 11 | 8, 15 | 10 | 7, 14 |

| BMI (kg/m2) | 23·4 | 20·0, 29·3 | 23·9 | 20·0, 29·2 | 24·9 | 19·8, 29·8 |

| 12 months | ||||||

| SSB (times/week) | 3 | 1, 6 | 3 | 1, 6 | 3 | 1, 6 |

| SSB (ml/d) | 134 | 47, 250 | 142 | 47, 250 | 143 | 41, 280 |

| Sugar from SSB (g/d) | 12 | 4, 22 | 12 | 4, 22 | 13 | 4, 24 |

| Table sugar (g/d) | 27 | 12, 48 | 24 | 10, 46 | 24 | 8, 44 |

| Fruit juice (ml/d) | 0 | 0, 36 | 0 | 0, 50 | 0 | 0, 71 |

| Energy from added sugar (kJ/d) | 1091 | 717, 1757 | 1053 | 601, 1742 | 1119 | 666, 1651 |

| % TE from added sugar | 11 | 8, 15 | 10 | 7, 14 | 12 | 7, 15 |

| BMI (kg/m2) | 23·6 | 19·9, 30·0 | 25·0 | 20·7, 29·9 | 25·1 | 19·8, 30·8 |

| Changes from baseline | ||||||

| SSB (times/week) | 2 | 0, 5 | –2 | –3, 1** | −7 | –11, −4** |

| SSB (ml/d) | 94 | 0, 226 | –107 | –250, 36* | −536 | –1598, –205** |

| Sugar from SSB (g/d) | 8 | 0, 19 | –11 | –28, 1* | −55 | –160, –23** |

| Table sugar (g/d) | 3 | –12, 23 | –1 | –18, 19 | 0 | –15, 17 |

| Energy from added sugar (kJ/d) | 35 | –525, 584 | –29 | –571, 380 | 105 | –460, 711 |

| % TE from added sugar | –0·2 | –4·3, 4·1 | –1·2 | –5·4, 3·5 | 0·8 | –3·3, 4·5 |

| BMI (kg/m2) | 0·4 | –2·2, 2·2 | 0·5 | –2·2, 3·3 | 0·2 | –3·6, 3·4 |

| 24 months | ||||||

| SSB (times/week) | 3 | 1, 7 | 3 | 1, 6 | 4 | 2, 7 |

| SSB (ml/d) | 119 | 36, 286 | 143 | 47, 286 | 143 | 71, 321 |

| Sugar from SSB (g/d) | 9 | 3, 22 | 11 | 4, 22 | 11 | 6, 25 |

| Table sugar (g/d) | 21 | 10, 44 | 21 | 11, 39 | 18 | 9, 40 |

| Fruit juice (ml/d) | 0 | 0, 71 | 0 | 0, 71 | 0 | 0, 36 |

| Energy from added sugar (kJ/d) | 996 | 579, 1626 | 1084 | 640, 1478 | 967 | 612, 1477 |

| % TE from added sugar | 10 | 7, 14 | 10 | 7, 13 | 11 | 7; 15 |

| BMI (kg/m2) | 24·1 | 20·2, 30·3 | 25·2 | 21·0, 30·3 | 25·1 | 20·2, 31·7 |

| Changes from 12 months | ||||||

| SSB (times/week) | 0 | –2, 2 | 0 | –2; 3 | 0 | –1; 3 |

| SSB (ml/d) | 0 | –96, 107 | 0 | –107, 116 | 0 | –90, 107 |

| Sugar from SSB (g/d) | –1 | –10, 7 | –1 | –9, 8 | –1 | –10, 8 |

| Table sugar (g/d) | 0 | –18, 11 | 0 | –15; 8 | –1 | –19; 8 |

| Energy from added sugar (kJ/d) | –96 | –575, 414 | –67 | –499, 318 | –129 | –588, 292 |

| % TE from added sugar | –0·6 | –4·7, 3·9 | 0·5 | –3·5, 4·1 | –0·2 | –3·9, 3·8 |

| BMI (kg/m2) | 0·2 | –0·5, 0·9 | 0·3 | –0·4, 1·3 | 0·3 | –0·6, 1·2 |

| Changes from baseline | ||||||

| SSB (times/week) | 2 | 0, 6 | –1 | –3, 1** | –6 | –10, –3** |

| SSB (ml/d) | 71 | 0, 250 | –106 | –250, 46* | –540 | –1523, –221** |

| Sugar from SSB (g/d) | 6 | –1, 19 | –11 | –28, 1* | –57 | –157, –26** |

| Table sugar (g/d) | 0 | –17, 17 | –3 | –20, 11 | –2 | –17, 11 |

| Energy from added sugar (kJ/d) | –48 | –600, 475 | –153 | –673, 298 | –106 | –576, 384 |

| % TE from added sugar | –0·4 | –5·3, 3·6 | –1·7 | –5·1, 3·0 | 0·5 | –4·1, 4·7 |

| BMI (kg/m2) | 0·6 | –2·3, 3·2 | 0·9 | –2·0, 3·7 | 1·0 | –3·3, 3·8 |

Data presented as median (interquartile range) (continuous variables) or % (categorical variables).

SSB, sugar-sweetened beverage; TE, total energy intake (kJ/d); sugar per SSB defined as 9·90 g/100 ml (2017); 8·75 g/100 ml (2018); 7·84 g/100 ml (2019).

Between-group comparisons assessed via linear regression analysis adjusted for age and sex; *P < 0·05, **P < 0·001 medium and high intakes v. low intake (reference category).

There were no significant differences in BMI across the low, medium and high SSB intake tertiles at baseline, 12 months or 24 months. However, there were small overall increases in BMI between baseline and 24 months in the low (0·6 kg/m2), medium (0·9 kg/m2) and high (1·0 kg/m2) intake groups.

Discussion

Motivated by concerns regarding obesity rates and added sugar intakes, South Africa joined a growing number of countries and jurisdictions levying taxes on SSB in April 2018. The design of this particular tax, the HPL, is somewhat unique in that the rate due depends on the sugar content of the beverage. This is intended to incentivize reformulation and a reduction in the sugar content of SSB – with the UK, and later Portugal, also following this approach. While prior studies sought to estimate the potential impact of SSB taxation in South Africa, there is little evidence on the effects of the policy on consumer behaviour.

Within the context of the introduction of the HPL, this study therefore explored longitudinal SSB and added sugar intakes of adolescents, young adults and middle-aged adults living in urban Soweto. We found that baseline SSB consumption in Soweto was similar to that estimated for middle-income countries overall, where intakes are the highest globally(6). Specifically, for those with the highest levels of SSB consumption at baseline, average intakes were equivalent to four 250 ml servings per day. Given that previous data suggest a 26 % greater likelihood of overweight and obesity in adolescents who consume >1 v. <1 SSB serving/d, intakes of this magnitude are a concern and support the introduction of SSB taxation in this setting(39).

As shown in Supplementary Appendix A, data from a forthcoming study (Stacey et al., unpublished) show that that South African manufacturers had reduced the sugar density of SSB by 21 % on average across the 2-year follow-up period. While there was little overall change in SSB consumption for the whole study sample, our study additionally demonstrates a substantial reduction in the frequency and amount of SSB consumed by participants between baseline (at the time the intention of an SSB tax was announced) and 12 months (at the time the SSB tax was implemented) by those with medium and high SSB intakes at baseline. These levels remained consistent 1 year after the SSB tax was introduced (i.e. at 24 months) and therefore indicate positive overall reductions in the amount of added sugar consumed from SSB in the population. Of the seventeen studies included in a recent meta-analysis, eleven similarly showed significant reductions in SSB sales, purchases or intakes after introduction of an SSB tax(40). In Hungary – where taxation was placed on products according to their sugar, salt and caffeine content – the sale of taxable products decreased by 27 % 1 year after tax introduction; with a resulting 25–35 % reduction in the consumption of taxed products by the public(3). Tax introduction was also shown to positively influence reformulation of food and beverage items in this setting, with 40 % of manufacturers reducing the amount of the taxable ingredient in their products(3).

Interestingly, our findings show that the reductions in SSB consumption may have taken place prior to tax introduction but after the announcement and were maintained in the following year. As described in previous studies, one potential explanation for this may be linked to a ‘health signalling pathway’, whereby even at low levels of taxation, public awareness of the tax and its motivating health implications promote reductions in SSB purchasing and consumption(17,40,41). Such findings are encouraging and suggest that strategies to increase awareness of fiscal policies and the serious health implications that motivate them may have a positive impact on purchasing and consumption patterns even before the financial effects would be felt. However, ensuring that effective promotion campaigns are received and understood is critical, with our qualitative data also indicating limited awareness by participants of any of the taxes national promotion and education strategies and thus a level of suspicion towards the governments motivation for the tax, as well as doubts about its potential impact on behaviour change(22). This is echoed by results from Chile which suggest that the effectiveness of public health messaging aimed at reducing consumption of SSB may differ by SES and that tailoring health messages and motivational strategies towards target groups is critical to their understanding and effectiveness(11,40).

Data from this and previous studies show that SSB contribute to only a proportion of the overall intake of added sugar in South Africa(23,24). Specifically, our findings showed that, while there were beneficial reductions in SSB and added sugar intakes, as well as reductions in the amount of energy consumed as added sugar, the contribution that added sugar made to TE intakes remained relatively stable across the study duration. In addition, overall energy intakes and the amount of sugar consumed from other sources (e.g. table sugar) remained consistently high. This suggests that for the population studied, targeting individual components of the diet in isolation may not be enough to improve overall diet quality and associated health outcomes such as obesity. For example, we showed that, alongside higher than recommended added sugar intakes, urban South African adolescents and adults consumed higher than the WHO recommended levels of fat (i.e. ≥30 % TE) and relatively low levels of protein and fibre. As dietary components are not consumed in isolation and reductions in one energy source or food are often compensated for by increases in another (for example a substitution of saturated fat with polyunsaturated fat v. carbohydrate), improving broader patterns of dietary intake may be critical to optimising diversity and quality of diets overall(42,43). Previous studies have indicated that, in particular, increasing the consumption of whole-grain, high fibre foods and reducing the overall intakes of energy-dense, micronutrient-poor foods and fast-food products, alongside SSB and fruit juice intakes may be protective against obesity(44).

Strengths and limitations

The main strength of our study was the longitudinal design which followed the dietary behaviours and anthropometric changes in males and females living in Soweto – giving us the opportunity to understand the SSB and added sugar consumption patterns at three time points. The age categories were selected in order to clearly distinguish between adolescents, young adults and middle-aged adults and therefore to allow comparison with baseline characteristics and dietary intake according to life stages. However, while the dropout rate reduced the sample sizes for stratified analyses between the distinct age and gender groups over the 2-year follow-up, we were effectively able to monitor longitudinal changes in over 600 participants. While it is not possible to causally link changes in SSB consumption to the introduction of the HPL, we were able to identify when changes in SSB consumption patterns occurred in conjunction with tax implementation by exploring relative change across the 2-year period. However, as national data show, longitudinal declines in both added sugar and SSB intake were documented in the USA without widespread taxation or the introduction of alternative policies(45,46) and, as the HPL is a national policy, it was not possible to assess SSB intakes in a comparison group who were not subject to SSB taxation. Thus, the possibilities that the decline in SSB consumption in our study may have occurred independent of the HPL (e.g. as a result of education and awareness) or due to natural regression toward the mean should be considered. In addition, longer-term follow-up is needed to determine whether the changes in SSB consumption were sustained after the 2-year period, as well as to fully explore the potential impact of SSB reformulation and intakes on body size outcomes.

A further limitation of the study was that dietary nutrient composition – and thus added sugar intakes in particular – were assessed using the South African Food Composition Tables which have not been revised according to manufacturing changes to the sugar density of SSB (and potentially other food products) as a result of the SSB tax. While we were able to account for these changes in our analyses by manually adjusting the added sugar consumption from SSB, there is an urgent need to update the current tables and thus to ensure accuracy of dietary assessment across South African studies in future. It is also important to consider the limitations in assessing dietary intake via subjective recall – specifically in relation to quantitative methods such as QFFQ in this case. While such questionnaires provide the opportunity to estimate habitual dietary intake over a specified period in a relatively simple and inexpensive manner which places a low burden on the respondent, their ability to provide accurate estimates of the individual nutrients consumed and to test relationships with health outcomes is debated(47). This is particularly related to inaccuracies in portion size estimation by participants, the varying contribution of individual food items to composite dishes and the conversion of food items to their individual nutrient components overall(47). However, while previous research suggests that subjective dietary assessment methods may be better suited to describing overall patterns of dietary intake in populations, studies which aim to assess individual components of the diet – e.g. added sugar – do require a degree of quantification to allow for relative comparison within populations(48). As such, the need for objective measures which provide more accurate estimation of consumption (and absorption) of specified nutrients is apparent(49). While these tools have their own challenges – particularly regarding their cost and the respondent burden – a promising biomarker for the assessment of added sugar intake (i.e. the natural abundance carbon isotope ratio) has been identified in studies from high-income countries and its use is currently being explored in this and other settings(50,51).

Implications and conclusion

Our findings suggest reductions in SSB and added sugar consumption contemporaneous to the introduction of the HPL in an urban South African setting. These changes were particularly evident for those with higher consumption levels at baseline. However, we also show that the nutritional benefits of reduced SSB consumption may have been mitigated by high added sugar intake from other sources. Thus, while targeted policies such as SSB taxation may be effective in reducing SSB intake and, if designed appropriately, reducing the sugar density of SSB, other policies and interventions which complement these are critical. Through this and other dietary studies conducted in our setting(52–56), we have shown that, in urban South African populations, diets are relatively homogenous over time, as well as between age and sex groups. This is promising from a public health perspective, as it suggests the potential for developing viable intervention strategies across demographic groups in which the dietary targets for recommendations are consistent. For example, front of pack labelling and regulating the marketing of unhealthy food products to children have been shown to effectively draw attention of consumers to nutritional information and to influence unhealthy food preferences, so should be explored in this setting(57–59). Unlike the current HPL which focuses particularly on SSB and may have limited scope on shifting overall patterns of dietary intake, these measures may contribute to more general changes in food choices. Since the drivers of obesity are complex and interrelated, a broader range of fiscal and legislative policies which aim not only to deter consumption of junk and ultra-processed foods but also simultaneously stimulate the demand for, and access to, healthier foods should be considered to achieve substantial improvements in population health outcomes(60,61).

Acknowledgements

Acknowledgements: The authors thank the participants who took part in this research and the research teams whose work we represent here. Financial support: The study was funded by the International Development Research Centre (Canada; 10824-001). S.V.W. and S.A.N. are supported by the DSI-NRF Centre of Excellence in Human Development at the University of the Witwatersrand, Johannesburg, South Africa. S.V.W. is also supported by the University Research Office and School of Clinical Medicine at the University of the Witwatersrand, Johannesburg, South Africa. K.J.H. and N.S. are supported by the South African Medical Research Council Centre for Health Economics and Decision Science – PRICELESS SA; extra mural unit grant number 23108. The funders had no role in study design, data collection and analysis, decision to publish or preparation of the manuscript. Conflict of interest: The authors have conflicts of interest. Authorship: S.A.N., N.S. and K.J.H. were responsible for study design and funding acquisition. G.M. acquired and managed the data collected. S.V.W. analysed the data. All authors contributed to interpretation of the analyses. S.V.W. wrote the manuscript. All authors contributed to critical review of the manuscript, approved the final version to be submitted and agree to be accountable for all aspects of the work. Ethics of human subject participation: This study was conducted according to the guidelines laid down in the Declaration of Helsinki, and all procedures involving human participants were approved by the University of the Witwatersrand’s Human Research Ethics Committee (HREC; ethical clearance numbers M170663 and M160604). Written informed consent was obtained from all participants.

Supplementary material

For supplementary material accompanying this paper visit https://doi.org/10.1017/S1368980020005078.

click here to view supplementary material

References

- 1. Forouzanfar MH, Afshin A, Alexander LT et al. (2016) Global, regional, and national comparative risk assessment of 79 behavioural, environmental and occupational, and metabolic risks or clusters of risks, 1990–2015: a systematic analysis for the Global Burden of Disease Study 2015. The Lancet 388, 1659–1724. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2. National Department of Health (NDoH), Statistics South Africa (Stats SA), South African Medical Research Council (SAMRC) and ICF (2017) South Africa Demographic and Health Survey 2016: Key Indicators. Pretoria, South Africa, and Rockville, Maryland, USA: NDoH, Stats SA, SAMRC, and ICF; available at http://dhsprogram.com/pubs/pdf/PR84/PR84.pdf (accessed July 2017).

- 3. World Health Organization (2014) Global Status Report on Noncommunicable Diseases 2014. Geneva, Switzerland: World Health Organisation; available at http://www.who.int/nmh/publications/ncd-status-report-2014/en/ (accessed September 2017).

- 4. Popkin BM, Adair LS, Ng SW (2012) Now and then: the global nutrition transition: the pandemic of obesity in developing countries. Nutr Rev 70, 3–21. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5. Kac G, Pérez-Escamilla R (2013) Nutrition transition and obesity prevention through the life-course. Int J Obes 3 (Suppl 1), S6–S8. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6. Singh GM, Micha R, Khatibzadeh S et al. (2015) Global, regional, and national consumption of sugar-sweetened beverages, fruit juices, and milk: a systematic assessment of beverage intake in 187 countries. PloS One 10, e0124845. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7. Colchero MA, Rivera-Dommarco J, Popkin BM et al. (2017) In Mexico, evidence of sustained consumer response 2 years after implementing a sugar-sweetened beverage tax. Health Aff Proj Hope 36, 564–571. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8. Colchero MA, Guerrero-López CM, Molina M et al. (2016) Beverages sales in Mexico before and after implementation of a sugar sweetened beverage tax. PloS One 11, e0163463. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9. Falbe J, Thompson HR, Becker CM et al. (2016) Impact of the Berkeley excise tax on sugar-sweetened beverage consumption. Am J Public Health 106, 1865–1871. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10. Zhong Y, Auchincloss AH, Lee BK et al. (2018) The short-term impacts of the Philadelphia beverage tax on beverage consumption. Am J Prev Med 55, 26–34. [DOI] [PubMed] [Google Scholar]

- 11. Caro JC, Corvalán C, Reyes M et al. (2018) Chile’s 2014 sugar-sweetened beverage tax and changes in prices and purchases of sugar-sweetened beverages: An observational study in an urban environment. PLoS Med 15, e1002597. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12. Andreyeva T, Chaloupka FJ, Brownell KD (2011) Estimating the potential of taxes on sugar-sweetened beverages to reduce consumption and generate revenue. Prev Med 52, 413–416. [DOI] [PubMed] [Google Scholar]

- 13. Wang YC, Coxson P, Shen Y-M et al. (2012) A penny-per-ounce tax on sugar-sweetened beverages would cut health and cost burdens of diabetes. Health Aff 31, 199–207. [DOI] [PubMed] [Google Scholar]

- 14. Novak NL & Brownell KD (2011) Taxation as prevention and as a treatment for obesity: the case of sugar-sweetened beverages. Curr Pharm Des 17, 1218–1222. [DOI] [PubMed] [Google Scholar]

- 15. Cabrera Escobar MA, Veerman JL, Tollman SM et al. (2013) Evidence that a tax on sugar sweetened beverages reduces the obesity rate: a meta-analysis. BMC Public Health 13, 1072. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 16. Schwendicke F & Stolpe M (2017) Taxing sugar-sweetened beverages: impact on overweight and obesity in Germany. BMC Public Health 17, 88. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17. Manyema M, Veerman LJ, Chola L et al. (2014) The potential impact of a 20 % tax on sugar-sweetened beverages on obesity in South African adults: a mathematical model. PLoS One 9, e105287. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18. Manyema M, Veerman LJ, Tugendhaft A et al. (2016) Modelling the potential impact of a sugar-sweetened beverage tax on stroke mortality, costs and health-adjusted life years in South Africa. BMC Public Health 16, 405. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19. Department of National Treasury (2016) Taxation of Sugar Sweetened Beverages: Policy Paper. Pretoria, South Africa: Department of National Treasury, South Africa; available at http://www.treasury.gov.za/public%20comments/sugar%20sweetened%20beverages/policy%20paper%20and%20proposals%20on%20the%20taxation%20of%20sugar%20sweetened%20beverages-8%20july%202016.pdf (accessed June 2020).

- 20. Department of National Treasury (2018) Budget Review 2018. Pretoria, South Africa: Department of National Treasury, South Africa; available at http://www.treasury.gov.za/documents/national%20budget/2018/review/FullBR.pdf (accessed June 2020).

- 21. Stacey N, Mudara C, Ng SW et al. (2019) Sugar-based beverage taxes and beverage prices: evidence from South Africa’s Health Promotion Levy. Soc Sci Med 238, 112465. [DOI] [PubMed] [Google Scholar]

- 22. Bosire EN, Stacey N, Mukoma G et al. (2020) Attitudes and perceptions among urban South Africans towards sugar-sweetened beverages and taxation. Public Health Nutr 23, 374–383. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 23. Vorster HH, Kruger A, Wentzel-Viljoen E et al. (2014) Added sugar intake in South Africa: findings from the Adult Prospective Urban and Rural Epidemiology cohort study. Am J Clin Nutr 99, 1479–1486. [DOI] [PubMed] [Google Scholar]

- 24. Vorster HH, Badham J, Venter CS (2013) An introduction to the revised food-based dietary guidelines for South Africa. Afr J Clin Nutr 26, S1–S164. [Google Scholar]

- 25. Richter L, Norris S, Pettifor J et al. (2007) Cohort Profile: Mandela’s children: the 1990 Birth to Twenty study in South Africa. Int J Epidemiol 36, 504–511. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 26. Griffiths PL, Johnson W, Cameron N et al. (2013) In urban South Africa, 16 year old adolescents experience greater health equality than children. Econ Hum Biol 11, 502–514. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 27. Kagura J, Adair LS, Pisa PT et al. (2016) Association of socioeconomic status change between infancy and adolescence, and blood pressure, in South African young adults: birth to Twenty Cohort. BMJ Open 6, e008805. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28. Zingoni C, Norris SA, Griffiths PL et al. (2009) Studying a population undergoing nutrition transition: a practical case study of dietary assessment in urban South African adolescents. Ecol Food Nutr 48, 178–198. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 29. Wrottesley SV, Micklesfield LK, Hamill MM et al. (2014) Dietary intake and body composition in HIV-positive and -negative South African women. Public Health Nutr 17, 1603–1613. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 30. Wrottesley SV, Pisa PT, Norris SA (2017) The influence of maternal dietary patterns on body mass index and gestational weight gain in urban Black South African women. Nutrients 9, 732. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31. Feely AB, Musenge E, Pettifor JM et al. (2012) Investigation into longitudinal dietary behaviours and household socio-economic indicators and their association with BMI Z-score and fat mass in South African adolescents: the Birth to Twenty (Bt20) cohort. Public Health Nutr 16, 693–703. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 32. Gradidge PJ, Norris SA, Jaff NG et al. (2016) Metabolic and body composition risk factors associated with metabolic syndrome in a cohort of women with a high prevalence of cardiometabolic disease. PLoS One 11, 1–13. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 33. Steyn NP, Senekal M, Norris SA et al. (2006) How well do adolescents determine portion sizes of foods and beverages? Asia Pac J Clin Nutr 15, 35–42. [PMC free article] [PubMed] [Google Scholar]

- 34. Harris P, Taylor R, Thielke R et al. (2009) Research electronic data capture (REDCap) - a metadata-driven methodology and workflow process for providing translational research informatics support. J Biomed Inf 42, 377–381. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35. Purnell JQ (2000) Definitions, classification, and epidemiology of obesity. In Endotext [Feingold KR, Anawalt B, Boyce A et al. , editors]. South Dartmouth (MA): MDText.com, Inc. http://www.ncbi.nlm.nih.gov/books/NBK279167/ (accessed October 2020). [Google Scholar]

- 36. Cole TJ, Flegal KM, Nicholls D et al. (2007) Body mass index cut offs to define thinness in children and adolescents: international survey. BMJ 335, 194. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 37. Cole TJ, Bellizzi MC, Flegal KM et al. (2000) Establishing a standard definition for child overweight and obesity worldwide: international survey. BMJ 320, 1240–1243. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 38. de Onis M, Onyango AW, Borghi E et al. (2007) Development of a WHO growth reference for school-aged children and adolescents. Bull World Health Organ 85, 660–667. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 39. Bleich SN & Vercammen KA (2018) The negative impact of sugar-sweetened beverages on children’s health: an update of the literature. BMC Obes 5, 6. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 40. Teng AM, Jones AC, Mizdrak A et al. (2019) Impact of sugar-sweetened beverage taxes on purchases and dietary intake: systematic review and meta-analysis. Obes Rev 20, 1187–1204. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 41. Álvarez-Sánchez C, Contento I, Jiménez-Aguilar A et al. (2018) Does the Mexican sugar-sweetened beverage tax have a signaling effect? ENSANUT 2016. PLoS One 13, e0199337. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 42. Forouhi NG, Krauss RM, Taubes G et al. (2018) Dietary fat and cardiometabolic health: evidence, controversies, and consensus for guidance. BMJ 361, k2139. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 43. Forouhi NG, Misra A, Mohan V et al. (2018) Dietary and nutritional approaches for prevention and management of type 2 diabetes. BMJ 361, k2234. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 44. Swinburn BA, Caterson I, Seidell JC et al. (2004) Diet, nutrition and the prevention of excess weight gain and obesity. Public Health Nutr 7, 123–146. [DOI] [PubMed] [Google Scholar]

- 45. Marriott BP, Hunt KJ, Malek AM et al. (2019) Trends in intake of energy and total sugar from sugar-sweetened beverages in the United States among children and adults, NHANES 2003–2016. Nutrients 11, 2004. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 46. Mendez MA, Miles DR, Poti JM et al. (2019) Persistent disparities over time in the distribution of sugar-sweetened beverage intake among children in the United States. Am J Clin Nutr 109, 79–89. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 47. Shim J-S, Oh K, Kim HC (2014) Dietary assessment methods in epidemiologic studies. Epidemiol Health 36, e2014009. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 48. Hu FB (2002) Dietary pattern analysis: a new direction in nutritional epidemiology. Curr Opin Lipidol 13, 3–9. [DOI] [PubMed] [Google Scholar]

- 49. Freedman LS, Schatzkin A, Thiebaut ACM et al. (2007) Abandon neither the food frequency questionnaire nor the dietary fat-breast cancer hypothesis. Am Soc Prev Oncol 16, 1321–1322. [DOI] [PubMed] [Google Scholar]

- 50. Yeung EH, Saudek CD, Jahren AH et al. (2010) Evaluation of a novel isotope biomarker for dietary consumption of sweets. Am J Epidemiol 172, 1045–1052. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 51. Hedrick VE, Davy BM, Wilburn GA et al. (2016) Evaluation of a novel biomarker of added sugar intake (δ13C) compared with self-reported added sugar intake and the Healthy Eating Index-2010 in a community-based, rural US sample. Public Health Nutr 19, 429–436. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 52. Wrottesley SV, Micklesfield LK, Hamill MM et al. (2014) Dietary intake and body composition in HIV-positive and -negative South African women. Public Health Nutr 17, 1603–1613. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 53. Wrottesley SV, Pisa PT, Norris SA (2017) The influence of maternal dietary patterns on body mass index and gestational weight gain in urban black South African women. Nutrients 9, 732. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 54. Feeley AB, Musenge E, Pettifor JM et al. (2013) Investigation into longitudinal dietary behaviours and household socio-economic indicators and their association with BMI Z-score and fat mass in South African adolescents: the Birth to Twenty (Bt20) cohort. Public Health Nutr 16, 693–703. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 55. Feeley A, Musenge E, Pettifor JM et al. (2012) Changes in dietary habits and eating practices in adolescents living in urban South Africa: the birth to twenty cohort. Nutr Burbank Los Angel Cty Calif 28, e1–e6. [DOI] [PubMed] [Google Scholar]

- 56. Steyn NP, Jaffer N, Nel J et al. (2016) Dietary intake of the urban black population of Cape Town: the cardiovascular risk in Black South Africans (CRIBSA) study. Nutrients 8, 285. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 57. Shangguan S, Afshin A, Shulkin M et al. (2019) A meta-analysis of food labeling effects on consumer diet behaviors and industry practices. Am J Prev Med 56, 300–314. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 58. Becker MW, Bello NM, Sundar RP et al. (2015) Front of pack labels enhance attention to nutrition information in novel and commercial brands. Food Policy 56, 76–86. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 59. Smith R, Kelly B, Yeatman H et al. (2019) Food marketing influences children’s attitudes, preferences and consumption: a systematic critical review. Nutrients 11, 875. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 60. Gortmaker SL, Swinburn B, Levy D et al. (2011) Changing the future of obesity: science, policy and action. Lancet 378, 838–847. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 61. Moodie M, Sheppard L, Sacks G et al. (2013) Cost-effectiveness of fiscal policies to prevent obesity. Curr Obes Rep 2, 211–224. [DOI] [PMC free article] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

For supplementary material accompanying this paper visit https://doi.org/10.1017/S1368980020005078.

click here to view supplementary material