Abstract

Rising consumer demand is driving concerns around the “availability” and “criticality” of metals. Methodologies have emerged to assess the risks related to global metal supply. None have specifically examined the initial supply source: the mine site where primary ore is extracted. Environmental, social, and governance (“ESG”) risks are critical to the development of new mining projects and the conversion of resources to mine production. In this paper, we offer a methodology that assesses the inherent complexities surrounding extractives projects. It includes eight ESG risk categories that overlay the locations of undeveloped iron, copper, and aluminum orebodies that will be critical to future supply. The percentage of global reserves and resources that are located in complex ESG contexts (i.e., with four or more concurrent medium-to-high risks) is 47% for iron, 63% for copper, and 88% for aluminum. This work contributes to research by providing a more complete understanding of source level constraints and risks to supply.

Introduction

Human development, as an objective, involves enhancing people’s freedoms and opportunities, and improving their well-being. This objective relies on the viability of the education, health care, telecommunications, agriculture, transportation, construction, water, and energy sectors. Technology is a fundamental enabler across these sectors, and requires metals for manufacture or application. As technologies advance, the number of metals in use has increased to 60 out of 91 known metals.1 Future demand for the most widely used metals—iron, aluminum, manganese, copper, zinc, lead, and nickel—is predicted to at least double, and possibly triple, by midcentury1,84 with a potential 8-fold increase in aluminum demand.2−4 A doubling or tripling of demand is likewise anticipated for specialty metals such as lithium, rhenium, and some rare earths.2 Two concurrent drivers for this demand include the continued increase in global population and human development measured in per-capita wealth.5,84 A third driver is the rise in metal demand to support the decarbonization of economies to mitigate climate change. Renewable energy generation, transmission, and storage systems have considerably higher metal requirements on a per kWh basis than their fossil fuels counterparts.6,7

Such radical increases in demand can only be satisfied if there is sufficient global supply of the appropriate metals. Presently, these metals are primarily sourced from mining, as recycling can only supply a fraction of the demand in the foreseeable future.8 Even for steel and aluminum, which have substantial recycling programs in place, predictive modeling indicates that the majority of these metals will be from primary sources for at least another 30 years.9,85

Several publications, including Vidal et al.,10 Kleijn et al.,11 Graedel et al.,12 Northey et al.,13 and the reports of the International Panel on Climate Change (IPCC),14 acknowledge potential material constraints in the global transition to renewable energy sources. Methodologies are emerging to assess the supply risk of metals across the value chain, according to reviews by Northey et al.,15 Achzet et al.,16 and Erdmann and Graedel.17 The methodology on metal “criticality” developed by Graedel et al.18 includes 16 macro-level indicators that aggregate either national or global supply chain data, and three types of users: global analysts, national governments, and corporations. None of the above-mentioned methodologies have conducted a detailed examination of the initial supply “source”, the mine site where primary ore is extracted.

Mines are the gateway through which metals enter the economy. There is a wide range of geological, technological, economic, political, social, and environmental factors that can constrain the development of new mining projects. Recent research indicates that supply risk assessment should extend to the source of supply, and include factors that influence the production of metals from mineral resources.19 In recent years, supply chain standards and certification schemes have sought to include risks at the source of extraction.20,21 Environmental, social, and governance (“ESG”) risks are increasingly acknowledged by investors as factors that are material to the development of new mining projects and the extraction of metallic minerals.22−24 Management of ESG risks is key for mineral resource rich nations that seek to transform their natural capital into economic growth and human development.86 We argue that ESG risks are becoming more pertinent in assessing the inherent complexities of extractive projects and the extent to which supply might be constrained as a result.

In this paper, we propose a methodology that assesses ESG risks at the source of supply. This methodology is applied to a large sample of “undeveloped orebodies” and associated mining projects in preproduction phase (i.e., projects for which a resource has been defined, but which have not yet been fully permitted and moved to construction phase). The results characterize the possible future of global metals supply based on a representative sample of the world’s largest undeveloped copper, iron, and aluminum orebodies. These may come into production in the near future, or be held up and remain unexploited for decades to come. Copper, iron, and aluminum have the widest application among known metals. This work contributes to research on criticality and supply risk assessment, and has major implications for the mining industry and mineral resource rich countries.

Our methodology builds on an initial framework for analyzing the co-occurrence of ESG risks in undeveloped copper orebodies (Valenta et al., ref (19)). Valenta et al. conclude that the presence of multiple concurrent technical and ESG risks in the vast majority of the world’s 300 largest undeveloped copper orebodies has the potential to restrict global supply. We advance this initial framework by improving the ESG risk categories; overlaying these categories to the locations of future mines; and extending the commodities of interest. This approach characterizes the local context of future mines, and quantifies the risks at the source of metal supply chains.

In the next section, we provide an overview of issues related to supply risk, and situate our approach within the literature. We then present our methodology, including the selection and definition of eight ESG risk categories comprising 11 spatial variables. In the following section, we apply our methodology. Finally, we discuss the current and future implications of the results of our work for the global mining industry.

Research Context: Gaps in the Availability and Criticality Literature

Geological Availability

The literature on metal supply risk ranges from the issue of “availability”, including “geological availability” and “accessibility”, to the complex multifactor definition of “criticality”.25−27 These issues are reviewed in turn. The literature on geological availability analyses the data on global mineral resources provided by geological surveys for geographical distribution, grade and tonnage estimates. Copper is commonly singled out as the main metal of concern (e.g., ref (13)), alongside zinc, lead (e.g., ref (28)), and silver (e.g., ref (29)). Concerns around geological availability are based on the finite nature of mineral deposits from which metals are produced, and primarily arise from the observed global decline in ore grades.15 In other words, the increasing scarcity of high grade, easily accessible deposits implies new mines will be larger, deeper, and more complex. The technical and economic challenges associated with accessing and extracting future mineral resources could constrain global supply.

Accessibility

Concerns about availability are often inclusive of nongeological considerations around the issue of access.13,25,30−32 Arndt et al.33 and Mudd and Jowitt34 argue that resource depletion is overstated because reporting codes represent conservative estimates of available resources. Such estimates are based on economic considerations and are bound to evolve as metal prices and available technologies influence which portion of the orebody is considered to be extractable at a profit. Declining ore grades raise technical and economic challenges that can be and have been addressed through technological innovation. Greater project footprint area, larger material movements, greater quantities of waste rock, and increased water and energy requirements—all consequences of lower grades—can partially be offset through enhanced selectivity, for example, underground block caving, ore sorting, or in situ leaching. ESG factors, however, are not easily overcome by technological innovation, can restrict access to the orebody, and affect the longer term feasibility of mineral extraction.15,19,25 ESG factors tend to accumulate, and are exacerbated by geological scarcity. Local ESG factors remain an unresolved gap for researchers conducting assessments on metal availability,15 as well for asset managers undertaking due diligence for the acquisition of mining properties.24

Criticality

The work on metal criticality considers global commodity markets and assesses supply risk and its implications. While availability focuses on mineral resources, the criticality approach extends to the resource supply chain, covering factors that represent macro-scale supply and demand dynamics. Graedel et al’s.18 methodology uses a three-dimensional definition of metal criticality, consisting of “supply risk” (i.e., the likelihood of supply disruption), “vulnerability to supply restrictions” (i.e., the severity of the consequences of a disruption for societal needs), and the “environmental implications” (i.e., the environmental impacts embedded in metal supply chains). The supply risk dimension includes several geological, technological, economic, social, and political factors that echo the literature on availability, and acknowledge the relevance of ESG risks. Numerous other methodologies propose a wide variety of factors to include in the assessment of metal criticality.16,35

Erdmann and Graedel17 and Hatayama and Tahara36 warn that methodological choices significantly influence the results of criticality assessments. For instance, criticality methodologies issued by governments (e.g., the European Union and the United States) focus on identifying the materials that are crucial to national or regional development and emphasize security of supply.37,38 Graedel et al.18 base their approach on corporations and nations that utilize metals (both manufacturers and consumers). Studies that apply criticality methodologies tend to identify solutions based on risks identified on the user side of the supply chain, for example, the dematerialization of consumption or the reduction of dissipative uses.39,40 Graedel’s methodology captures the environmental impacts of supplying metals, however, these impacts are not localized, as they are generated throughout the supply chain. By design, criticality methodologies do not consider source factors that affect mineral resource extraction, as do availability studies.

Source Level Assessment of Risk

Both availability and criticality literatures note the importance of ESG factors in supply risk. The availability literature acknowledges the ability of local ESG risks to constrain mining development.15 Valenta et al.19 represent the first commodity-scale attempt to characterize these risks. As the source of supply, metal mines are subject to local risks that differ from the supply risks defined in criticality methodologies. The extensive work dedicated to understanding the risks for users of metal requires parallel work that characterizes the risk for source countries, regions, corporations, and project sites. This parallel work is important considering the expected reliance on primary mining to supply future demand for metals. For this, we return to availability and accessibility, positioned at the source of supply, and expand these notions to encompass the ESG context.

The following section presents our methodology. It is applicable to a global sample of mines, and relies on precise spatial coordinates to provide a geographically localized assessment. Our methodology provides a global overview of “source risk”.

Methodology: Source Risk and ESG Risks

As the first link in metal supply chains, mines are influenced by global metal demand and market prices, which incentivize new mine development41 and closures.42 At the same time, mines are influenced by local factors that do not depend exclusively on macro-economic dynamics. Local factors are the focus of our methodology, constituting the context—the source risk—in which mines develop and operate. How miners respond to these factors, is not encompassed by our methodology. The industry’s conceptualization and engagement with risk in different operating contexts influences whether these risks are exacerbated or reduced.

The local context of mining development is characterized by a range of ESG risks. In the private sector, these risks are defined by the UNEP Finance Initiative and the World Business Council for Sustainable Development.24 Previously considered to be “externalities” not well captured by market mechanisms, ESG risks are now being viewed as financially material.43 The investor community is increasingly aware of the financial consequences of the mining industry’s ESG failures.19,23 Numerous mining projects have been stalled or abandoned due to materialized ESG risks. The Pebble project in Alaska,44 Reko Diq in Pakistan,45 or the Benga project in Mozambique,46 are examples, among others. Franks et al.47 reported that 15 out of a sample of 50 mine-community conflicts resulted in project suspension or abandonment, and that the majority of abandonment cases occurred during the early stages of development, prior to construction or production.

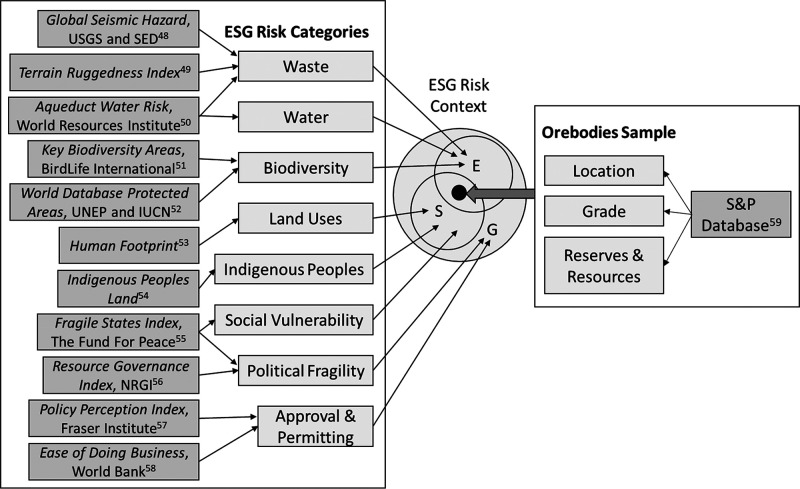

Our framework for the assessment of source-based risk is presented in the figure below. It overlays two types of spatial data, a selection of public indexes, variables representing particular ESG risks categories, and the subscription based S&P Global Market Intelligence database (herein the “S&P database”), the latter of which provides source information about the size and spatial location of orebodies.59 By overlaying ESG risks at specific source locations, we can determine the presence of concurrent ESG risk categories across the sample of undeveloped orebodies. For more details on data collection and risk calculation, refer to the Supporting Information (SI) SI-1 and SI-2.

Our methodology uses spatial data related to the location of undeveloped orebodies. This distinguishes our source-focused approach from criticality methodologies that rely on country-level geological surveys. The ESG risk categories overlap to some extent with Graedel’s criticality methodology,18 which include social and governance country level indexes. Three of the risk categories—Social Vulnerability, Political Fragility, and Approval & Permitting—are also based on country level indexes, and represent the influence of regulatory institutions and wider societal dynamics. These risk factors can constrain mining and users downstream in the supply chain. Our remaining five Social and Environmental risk categories, are built from seven high resolution variables, and provide site-specific data that uses the precise location of the orebodies.

Our methodological framework incorporates three risk dimensions, which encompass eight risk categories, built from 11 indexes (four country-level and seven local-level). All 11 indexes were selected for their completeness, quality, and level of detail, enabling a comprehensive overview of the ESG risk context for each orebody. The orebody is positioned at the center of the framework (see Figure 1).

Figure 1.

Methodological framework–spatial coincidence between the set of ESG risk categories and the orebodies sample.

The Orebodies Sample (SI-1)

Our methodology involves sourcing information from the S&P database on a sample of mining projects in the early stages of development, prior to construction, and production. The S&P database is one of the most comprehensive and up-to-date databases for the mining sector.60,61 It comprises data on mining properties from across the globe, for a wide range of commodities at all stages of development, from exploration to closure. Spatial coordinates for each orebody were extracted from the S&P database, and assembled into a global map, which was then overlaid with the ESG data sets.

Information on the “grade” (i.e., the average metal concentration in the orebody) and the “reserves and resources” (i.e., the estimated metal content) was also extracted to provide an approximation of the size of the mineral orebody. Reserves and resources are materials considered for extraction, the terms correspond to varying levels of certainty as to their economic extraction and recovery. Resources are converted to reserves by factoring in the specified mining and processing methods (see SI-1.1 for a more extensive definition). A sample of mining projects will exhibit particular grade and reserves and resources distributions. Risk assessment results (see next section) are plotted as a function of these two variables.

The ESG Risk Set

The following paragraphs present the ESG risk categories. For additional information on the ESG risk categories and corresponding indexes, see SI-2.

Waste

Mining produces large volumes of waste, requiring some of the largest waste facilities ever built.62 These include tailings dams and waste rock dumps, both of which can contain large volumes of potentially hazardous material. The design of mine waste and tailings storage facilities, their location, and their structural integrity is central to the long-term containment of polluting substances. Mine waste can potentially leave environmental, social, and economic legacies that last for thousands of years.63,64 There have been 40 recorded tailings dam failures over the past decade,65 and the number of severe failures appears to be increasing.66 The Waste category includes three spatial variables: the Terrain Ruggedness Index,49 which conveys topographic challenges to waste storage; the global map for seismic risk,48 a key factor to take into account when building tailings dams;67 and the Flood Occurrence indicator,50 noting that floods can compromise the containment of waste.68

Water

Mines commonly have high freshwater requirements.69 To some extent, mines are able to adapt their operations to the local hydrological context. This increasingly involves, in case of limited freshwater resources, an investment in desalination infrastructure. In some cases, however, water access issues can severely constrain mining developments.70 Similarly, water abundance, or high seasonal variations, can also pose challenges in managing mine voids, heap leaches, and waste deposits.70 Mining activities can impact water resources, which can in turn affect surrounding ecosystems and communities. When water is scarce, withdrawals can adversely affect other water users. In addition, leaks from mine waste impoundments can contaminate surface and groundwater.71 For this category, we use the Aqueduct Water Risk Atlas by Reig et al.,72 a global, high-resolution database comprising 12 indicators relevant to mining, including groundwater and baseline water stress, seasonal variability, and drought severity. The Aqueduct Water Risk Atlas also measures regulatory and reputational risk.

Biodiversity

Metal mines are physically destructive of natural habitats, not only within the mining lease but also through project corridors used for transportation and power (e.g., access roads, rail networks, pipelines, and power stations).73 Previous work60,61 studied the proximity between mines and critical biodiversity preservation areas. Duran et al.60 estimate that 7% of mines directly overlap with a protected area as defined by the World Database for Protected Areas (WDPA),52 and a further 27% lie within 10 km. Oakleaf et al’s.74 calculation indicates that only 5% of the Earth’s at-risk natural lands are under strict legal protection. We represent biodiversity risk with two data sets: the above-mentioned WDPA,52 and the Key Biodiversity Areas (KBA).51 This category considers both the proximity to strictly protected areas (i.e., areas that apply legal restrictions to mining) and the adverse impact mines can have on natural habitat.

Land Uses

The Mining Minerals and Sustainable Development project identified the “control, use and management of land” as one of the main challenges faced by the mining industry (p 6).62 The potential conflict between mining and natural conservation lands is part of this challenge, as is the competition between mining and human land uses, which is anticipated to increase alongside population growth, urbanization, and the expansion of agriculture and other industries.74 Land use changes that occur throughout the life of mining projects can directly stimulate the movement of people, such as displacement and resettlement,75 and project-induced in-migration.76 These movements can become sources of tension among land users in areas affected by mining activities. In the context of mining, conflicts are common77 and can be costly.47 The Land Uses risk category applies four indicators of the global terrestrial Human Footprint maps developed by Venter et al.,53 to capture the presence of built environments, croplands, pasturelands, and the density of human population.

Indigenous Peoples

The social and environmental impacts caused by mining activities affect some social groups more than others. Indigenous and tribal peoples often experience higher levels of poverty, marginalization, dispossession, and discrimination.78 These peoples also tend to have “deep spiritual and cultural ties to their land”, and “frequently retain de facto influence over their ancestral lands” (p 369), regardless of state recognition of collective rights.54 The presence of indigenous or tribal peoples on or near a mining area may involve additional processes before access to land for mining purposes can proceed. In certain regions, mining is a major employer of indigenous people, which adds further complexity to these relationships.87 The data set used for this category was compiled by Garnett et al.,54 who gathered information from 127 data sources to generate a global map of terrestrial lands managed or owned by indigenous peoples.

Social Vulnerability

Added to the Land Uses and Indigenous Peoples categories, nation-wide social vulnerability exacerbates the project’s risk profile. The Social Vulnerability risk category is represented by the Fund for Peace’s Fragile States Index.55 This index includes population inflows (e.g., refugees) and outflows (e.g., human flight), as well as intracountry displacements, as indicators of state-wide instability. The index also includes economic measures of poverty and inequalities, and records the presence of group-level grievances and discontent. Each project stakeholder, be they an employee, a contractor, a host community member, an artisanal miner, or a citizen of a country relying on mining revenues, has the potential to both experience and generate social risks.19

Political Fragility

Political fragility can place constraints on mining development.30 Indicators of political fragility and instability include state illegitimacy, fragmentation of state institutions, and poor public services.55 In these settings, the national or state level political context provide a permissive environment for suboptimal social and environmental performance from the operator and the regulator.79 For a sample of 448 significant disruptions in mining production, Hatayama et al.36 estimate that 11% were due to political and policy issues. A robust governance framework is a key factor determining the fair distribution of resource revenues.80 One-quarter of known copper resources are in countries with “less than satisfactory governance” (ref,81, p 368). The Political Fragility category encompasses the political indicators of the Fragile States Index55 and the Resource Governance Index.56

Approval and Permitting

Large-scale mines typically follow a defined permitting and approval process. While variations are observable across jurisdictions, Ali et al.81 evaluate that, on average, 13–23 years can elapse between mineral discovery and construction of a mine. Unexpected delays in project approvals can compromise mining projects that can generate revenue only once production starts. The efficiency and quality of a country’s mining-related regulatory framework ensures that mining activities are not unnecessarily constrained by complicated procedures, while complying with minimum social and environmental standards.82 This category applies two indexes: the Policy Potential Index57 and Ease of Doing Business index,58 which characterize how a country’s rules affect or are perceived to affect mining development.

Application

We apply the methodology to undeveloped iron, aluminum, and copper projects, with the aim of assessing and comparing the ESG risk context for the three metals. Iron, aluminum, and copper are the three most widely used metals and represent 95% by mass of all industrial metals produced annually.83 Iron ore alone totals 90% of global metal mine production and is the base metal for steel making, a primary material for the construction and manufacturing sectors. Aluminum’s lightweight and malleability makes it a popular material for power transmission, packaging, and a wide range of other applications. Copper is valued for its high electrical and thermal conductivity and increasingly for its antibacterial properties..

The three metals present contrasting profiles: an outcome of being mined in different areas of the globe and in different orebody types. These metals present distinct technical challenges, varying in their crustal abundance and extraction processes. Because iron is an abundant metal, iron mines usually produce iron ore, a concentrate ready for metallurgical processing. For aluminum, mines extract bauxite, the primary ore of aluminum, which is then converted into alumina, and later aluminum. Copper is less abundant than either iron or aluminum, and usually requires an on-site concentration process.

For each metal, we selected a sample of undeveloped orebodies and their associated mining projects. By applying the methodology to these samples, we indicate the magnitude and characteristics of source risk. The selected samples include the largest orebodies of copper, iron ore, or bauxite, and comprise approximately 50% of global copper reserves and resources, 92% of iron ore reserves and resources, and 72% of bauxite reserves and resources reported in the S&P database.59 On this basis, we consider the sample of the orebodies for each metal to be a representative sample of the global orebody for that metal.

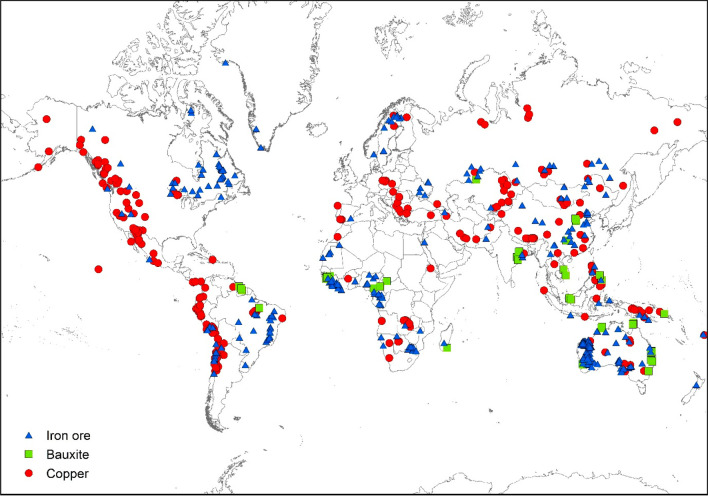

The samples are represented in the global map below (Figure 2). They include 296 copper orebodies, 324 iron ore orebodies, and 50 bauxite orebodies. For additional information on the sample selection process, see SI-1.1.

Figure 2.

Global distribution of iron ore, bauxite, and copper orebodies samples considered in the analysis (source: S&P database 2019).

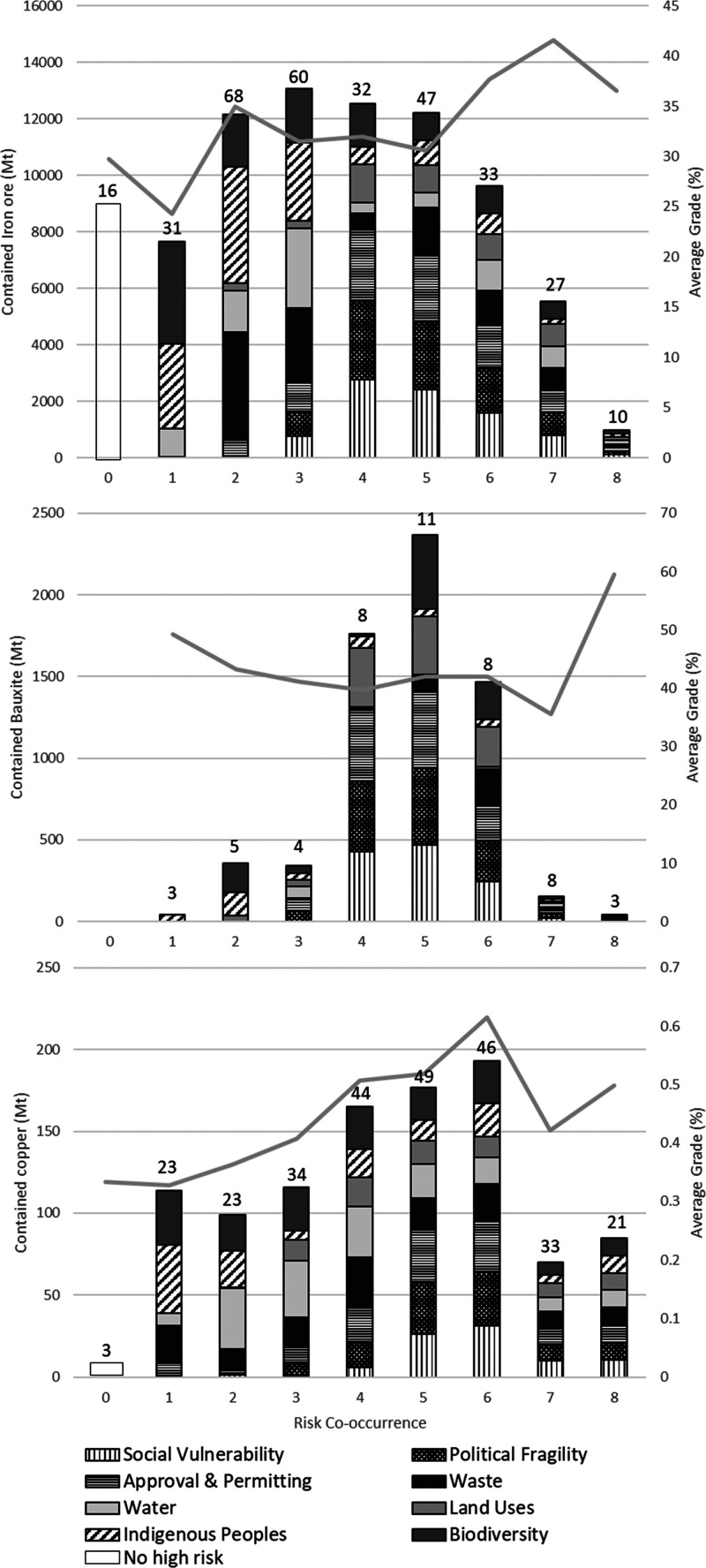

Results are presented in Figures 3 and 4 below. It should be noted that as there are data uncertainties inherent to global-scale multifactor analyses, results should be regarded with caution. Uncertainties are reduced here by considering global commodity trends rather than orebody-by-orebody results.

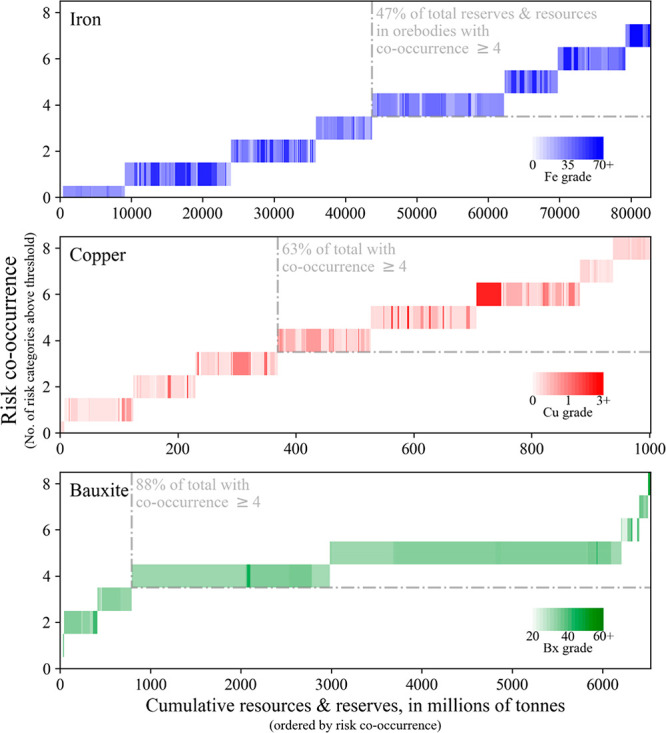

Figure 3.

Cumulative reserves and resources for iron ore, copper and bauxite, ordered by risk co-occurrence. Color shades correspond to the average grades of individual orebodies, expressed in percentages. Dashed lines highlight the portion of the sample that is located in high risk co-occurrence contexts (i.e., four or more concurrent ESG risks).

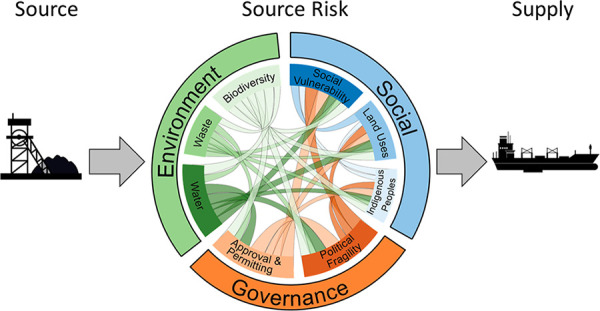

Figure 4.

Distribution of tonnage and average grade by medium-to-high risk co-occurrence for iron ore (top), bauxite (center), and copper (bottom). Proportion of specific ESG risk categories represented by different pattern and shading scale. Numbers above bars correspond to the number of orebodies.

What is most notable from the analysis of the three samples is the high co-occurrence of ESG risks (see Figure 3). Co-occurrence is present when more than one risk category has a value above a defined medium risk threshold. The number of categories for which an orebody has risk values above the threshold gives it an overall co-occurrence number between 0 and 8 (for definitions on thresholds, see SI 1.3).

This co-occurrence number serves as an estimator of the complexity associated with mining an orebody. In turn, the fraction of global reserves and resources that lie in orebodies with a high co-occurrence score provides insight into the complexities associated with mining that commodity at a future point in time. For example, the complexity of mining a commodity can be defined as the percentage of global reserves and resources that are located in orebodies with a co-occurrence number of four or more. For iron, this percentage is 47%. For copper, this increases to 63%, and for bauxite, 88%. Based on this calculation, bauxite has the highest source risk of the three metals.

Figure 4 shows that some of the highest grades are found in orebodies with six or more concurrent ESG risks. This trend appears significant for copper orebodies, for which the highest average grades also correspond to a high copper tonnage, and have a co-occurrence number of 6. Some of the most technically feasible copper orebodies are situated in complex ESG contexts.

A more in-depth analysis characterizes the ESG risks across the three samples. The iron ore sample is characterized by disparities between low co-occurrence (three or less risks) and high co-occurrence (four or more risks) orebodies. Water, Waste, Biodiversity, and Indigenous Peoples risks are mostly present in low co-occurrence orebodies, whereas Social Vulnerability, Political Fragility, and Approval and Permitting are present in high co-occurrence orebodies. Social Vulnerability, Political Fragility, and Approval and Permitting tend to be found together in all three samples because they are closely correlated (see SI-4 for more correlation results). The bauxite sample exhibits an overall imbalance due to its small size and because it is dominated in tonnage by six large orebodies, all located in the four to six risk co-occurrence contexts. Land Uses, Social Vulnerability, Political Fragility, Approval and Permitting, and to a lesser extent, Biodiversity are predominant in the bauxite sample. The copper sample is characterized by a more evenly distributed profile, and by relatively strong Water and Waste risks compared to the iron ore and bauxite samples. 186 orebodies out of 296, or 65% of the contained copper, are located in medium to extremely high water risk regions. 42% of contained copper faces medium-to-high Waste risk. For more results, including individual risk graphs and orebody-by-orebody result tables, see SI-3 and SI-5.

Discussion

Research on metal criticality has predominately assessed the supply risk for metals at a macro-scale. Our methodology expands current thinking about resource criticality by including source-based risks. Criticality studies focus on the likelihood of supply disruption and its consequences for importing nations. Scholars have called for a restructuring of global supply and demand networks, and propose strategies of supply diversification, subsidies for national production, and development of strategic stockpiles. Our methodology assesses source risks for the supplying regions of the globe. Without this, understandings of metal criticality are incomplete.

This research has major implications for the mining industry, investors, governments, and downstream users of metals. The results indicate the presence of multiple concurrent risks and raise concerns about the ability of the mining industry to meet demand, which has been projected to grow significantly for copper and iron1 as well as for aluminum.85 To address the complexity associated with these factors, major innovations are required in the design and development of resource projects. Innovations will not only need to “cut across” disciplines but also stakeholder groups to ensure that the responsibility for solutions extends beyond governments and individual companies.

Our methodology identifies critical issues associated with the future supply of metals. This is best highlighted in the case of Water, which rated as medium to high risk for two-thirds of the undeveloped world copper orebodies. By building a global picture of the ESG risks surrounding current undeveloped orebodies, we draw attention to the feasibility and potential consequences of taking these projects forward into production. This information can be utilized by a range of stakeholders, such as governments at the approval stage of new mining projects, and by investors and/or multinational mining companies in managing their portfolios.

The work opens avenues for further assessments. Future applications can expand the analysis to other commodities, and compare them based on the assemblage of risks. Risk contexts should also be evaluated and compared between geographic regions where large reserves and resources are located. Case study research focusing on the influence of ESG factors and project development costs would provide additional insight into the interplay between external risk and the effect of company controls. Projects that face multiple complex ESG risks and advance through to production should remain a point of focus given their potential for disruption and delay.

Acknowledgments

We are grateful for the strategic funds received from The University of Queensland (UQ) in support of the Sustainable Minerals Institute’s (SMI) cross-disciplinary research on “complex orebodies”. We acknowledge the organizations and people that have produced the datasets we used in our analysis: G. Amatulli and colleagues, S. Garnett and colleagues, O. Venter and colleagues, BirdLife International, World Resources Institute, Fraser Institute, Fund for Peace, Natural Resources Governance Institute, International Union for Conservation of Nature, the U.S. Geological Survey, the World Bank, and S&P Global Market Intelligence. Particular thanks to S. Garnett and colleagues for sharing data from their work and their feedback on the draft.

Supporting Information Available

The Supporting Information is available free of charge on the ACS Publications website at DOI: 10.1021/acs.est.9b02808.

1. Data collection, risk calculation, determination of medium risk thresholds and risk co-occurrence number. 2. ESG risk categories and associated global data sets. 3. Additional results, iron ore, bauxite, and copper sample graphs for each ESG risk category. 4. Correlation graphs for each of the three samples. 5. Orebody-by-orebody result tables (PDF)

The authors declare no competing financial interest.

Supplementary Material

References

- Elshkaki A.; Graedel T. E.; Ciacci L.; Reck B. K. Resource Demand Scenarios for the Major Metals. Environ. Sci. Technol. 2018, 52 (5), 2491–2497. 10.1021/acs.est.7b05154. [DOI] [PubMed] [Google Scholar]

- Christmann P. Towards a More Equitable Use of Mineral Resources. Nat. Resour. Res. 2018, 27 (2), 159–177. 10.1007/s11053-017-9343-6. [DOI] [Google Scholar]

- Liu G.; Bangs C. E.; Müller D. B. Stock dynamics and emission pathways of the global aluminium cycle. Nat. Clim. Change 2013, 3 (4), 338. 10.1038/nclimate1698. [DOI] [Google Scholar]

- Cullen J. M.; Allwood J. M. Mapping the global flow of aluminum: From liquid aluminum to end-use goods. Environ. Sci. Technol. 2013, 47 (7), 3057–3064. 10.1021/es304256s. [DOI] [PubMed] [Google Scholar]

- Graedel T. E.; Harper E. M.; Nassar N. T.; Reck B. K. On the materials basis of modern society. Proc. Natl. Acad. Sci. U. S. A. 2015, 112 (20), 6295–6300. 10.1073/pnas.1312752110. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hertwich E. G.; Gibon T.; Bouman E. A.; Arvesen A.; Suh S.; Heath G. A.; Bergesen J. D.; Ramirez A.; Vega M. I.; Shi L. Integrated life-cycle assessment of electricity-supply scenarios confirms global environmental benefit of low-carbon technologies. Proc. Natl. Acad. Sci. U. S. A. 2015, 112 (20), 6277–6282. 10.1073/pnas.1312753111. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Allwood J. M.; Cullen J. M.; Milford R. L. Options for achieving a 50% cut in industrial carbon emissions by 2050. Environ. Sci. Technol. 2010, 44 (6), 1888–1894. 10.1021/es902909k. [DOI] [PubMed] [Google Scholar]

- Graedel T. E.; Allwood J.; Birat J.-P.; Buchert M.; Hagelüken C.; Reck B. K.; Sibley S. F.; Sonnemann G. What Do We Know About Metal Recycling Rates?. J. Ind. Ecol. 2011, 15 (3), 355–366. 10.1111/j.1530-9290.2011.00342.x. [DOI] [Google Scholar]

- Van der Voet E.; Van Oers L.; Verboon M.; Kuipers K. J. J. o. I. E. J. Ind. Ecol. 2019, 23 (1), 141–155. 10.1111/jiec.12722. [DOI] [Google Scholar]

- Vidal O.; Goffé B.; Arndt N. Metals for a low-carbon society. Nat. Geosci. 2013, 6, 894. 10.1038/ngeo1993. [DOI] [Google Scholar]

- Kleijn R.; van der Voet E.; Kramer G. J.; van Oers L.; van der Giesen C. Metal requirements of low-carbon power generation. Energy 2011, 36 (9), 5640–5648. 10.1016/j.energy.2011.07.003. [DOI] [Google Scholar]

- Graedel T. E. On the future availability of the energy metals. Annu. Rev. Mater. Res. 2011, 41, 323–335. 10.1146/annurev-matsci-062910-095759. [DOI] [Google Scholar]

- Northey S.; Mohr S.; Mudd G. M.; Weng Z.; Giurco D. Modelling future copper ore grade decline based on a detailed assessment of copper resources and mining. Resources, Conservation and Recycling 2014, 83, 190–201. 10.1016/j.resconrec.2013.10.005. [DOI] [Google Scholar]

- Bruckner T.; Bashmakov I. A.; Mulugetta Y.; Chum H.; de la Vega Navarro A.; Edmonds J.; Faaij A.; Fungtammasan B.; Garg A.; Hertwich E. G.; Honnery D.; Infield D.; Kainuma M.; Khennas S.; Kim S.; Nimir H. B.; Riahi K.; Strachan N.; Wiser R.; Zhang X., Energy Systems. In Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; Edenhofer O.; Pichs-Madruga R.; Sokona Y.; Farahani E.; Kadner S.; Seyboth K.; Adler A.; Baum I.; Brunner S.; Eickemeier P.; Kriemann B.; Savolainen J.; Schlömer S.; von Stechow C.; Zwickel T.; Minx J. C., Eds.; Cambridge University Press: Cambridge, 2014.

- Northey S. A.; Mudd G. M.; Werner T. Unresolved complexity in assessments of mineral resource depletion and availability. Nat. Resour. Res. 2018, 27 (2), 241–255. 10.1007/s11053-017-9352-5. [DOI] [Google Scholar]

- Achzet B.; Helbig C. How to evaluate raw material supply risks—an overview. Resour. Policy 2013, 38 (4), 435–447. 10.1016/j.resourpol.2013.06.003. [DOI] [Google Scholar]

- Erdmann L.; Graedel T. E. Criticality of non-fuel minerals: a review of major approaches and analyses. Environ. Sci. Technol. 2011, 45 (18), 7620–7630. 10.1021/es200563g. [DOI] [PubMed] [Google Scholar]

- Graedel T. E.; Barr R.; Chandler C.; Chase T.; Choi J.; Christoffersen L.; Friedlander E.; Henly C.; Jun C.; Nassar N. T. Methodology of metal criticality determination. Environ. Sci. Technol. 2012, 46 (2), 1063–1070. 10.1021/es203534z. [DOI] [PubMed] [Google Scholar]

- Valenta R.; Kemp D.; Owen J.; Corder G.; Lèbre É. Re-thinking complex orebodies: Consequences for the future world supply of copper. J. Cleaner Prod. 2019, 220, 816–826. 10.1016/j.jclepro.2019.02.146. [DOI] [Google Scholar]

- ASI, ASI Chain of Custody (CoC) Standard V1 . In Aluminium Stewardship Initiative; Aluminium Stewardship Initiative: VIC, Australia, 2017; p 28. [Google Scholar]

- RJC Responsible Jewellery Council - Code of Practices; London, UK, 2019. [Google Scholar]

- LME LME Launches Consultation on the Introduction of Responsible Sourcing Standards Across All Listed Brands; London Metal Exchange, 2019. [Google Scholar]

- Sanderson H.; Hume N., Global miners count the cost of their failings. Environmental, social and governance metrics steer investors away from sector making news for all the wrong reasons. Financial Times 16 February, 2019. [Google Scholar]

- UNEP-FI; WBCSD . Translating ESG into sustainable business value - Key insights for companies and investors; United Nations Environment Programme. UNEP Finance Initiative. World Business Council for Sustainable Development, 2010. [Google Scholar]

- Prior T.; Giurco D.; Mudd G. M.; Mason L.; Behrisch J. Resource depletion, peak minerals and the implications for sustainable resource management. Global Environmental Change 2012, 22 (3), 577–587. 10.1016/j.gloenvcha.2011.08.009. [DOI] [Google Scholar]

- Elshkaki A.; Graedel T. E.; Ciacci L.; Reck B. K. Copper demand, supply, and associated energy use to 2050. Global Environmental Change 2016, 39, 305–315. 10.1016/j.gloenvcha.2016.06.006. [DOI] [Google Scholar]

- European Commission On the 2017 list of Critical Raw Materials for the EU; Brussels, Belgium, September 13, 2017. [Google Scholar]

- Mudd G. M.; Jowitt S. M.; Werner T. T. The world’s lead-zinc mineral resources: Scarcity, data, issues and opportunities. Ore Geol. Rev. 2017, 80, 1160–1190. 10.1016/j.oregeorev.2016.08.010. [DOI] [Google Scholar]

- Hatayama H.; Tahara K.; Daigo I. Worth of metal gleaning in mining and recycling for mineral conservation. Miner. Eng. 2015, 76, 58–64. 10.1016/j.mineng.2014.12.012. [DOI] [Google Scholar]

- Meinert L.; Robinson G.; Nassar N. Mineral Resources: Reserves, Peak Production and the Future. Resources 2016, 5 (1), 14. 10.3390/resources5010014. [DOI] [Google Scholar]

- West J. Decreasing metal ore grades - Are They Really Being Driven by the Depletion of High-Grade Deposits?. J. Ind. Ecol. 2011, 15 (2), 165–168. 10.1111/j.1530-9290.2011.00334.x. [DOI] [Google Scholar]

- Tilton J. E.; Lagos G. Assessing the long-run availability of copper. Resour. Policy 2007, 32 (1), 19–23. 10.1016/j.resourpol.2007.04.001. [DOI] [Google Scholar]

- Arndt N. T.; Fontboté L.; Hedenquist J. W.; Kesler S. E.; Thompson J. F.; Wood D. G. Future global mineral resources. Geochemical Perspectives 2017, 6 (1), 1–171. 10.7185/geochempersp.6.1. [DOI] [Google Scholar]

- Mudd G. M.; Jowitt S. M. Growing Global Copper Resources, Reserves and Production: Discovery Is Not the Only Control on Supply. Econ. Geol. Bull. Soc. Econ. Geol. 2018, 113 (6), 1235–1267. 10.5382/econgeo.2018.4590. [DOI] [Google Scholar]

- Helbig C.; Wietschel L.; Thorenz A.; Tuma A. How to evaluate raw material vulnerability - An overview. Resour. Policy 2016, 48, 13–24. 10.1016/j.resourpol.2016.02.003. [DOI] [Google Scholar]

- Hatayama H.; Tahara K. Adopting an objective approach to criticality assessment: Learning from the past. Resour. Policy 2018, 55, 96–102. 10.1016/j.resourpol.2017.11.002. [DOI] [Google Scholar]

- Blengini G. A.; Blagoeva D.; Dewulf J.; Torres de Matos C.; Nita V.; Vidal-Legaz B.; Latunussa C. E. L.; Kayam Y.; Talens Peirò L.; Baranzelli C.; Manfredi S.; Mancini L.; Nuss P.; Marmier A.; Alves-Dias P.; Pavel C.; Tzimas E.; Mathieux F.; Pennington D.; Ciupagea C.. Assessment of the Methodology for Establishing the EU List of Critical Raw Materials; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- National Research Council Minerals, Critical Minerals, and the U.S. Economy; 500 Fifth Street, NW, Washington, DC, 2008. [Google Scholar]

- Sverdrup H. U.; Ragnarsdottir K. V.; Koca D. An assessment of metal supply sustainability as an input to policy: security of supply extraction rates, stocks-in-use, recycling, and risk of scarcity. J. Cleaner Prod. 2017, 140, 359–372. 10.1016/j.jclepro.2015.06.085. [DOI] [Google Scholar]

- Gordon R. B.; Bertram M.; Graedel T. E. Metal stocks and sustainability. Proc. Natl. Acad. Sci. U. S. A. 2006, 103 (5), 1209–1214. 10.1073/pnas.0509498103. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Connolly E.; Orsmond D.. The Mining Industry: From Bust to Boom; The Pennsylvania State University: State College, PA, 2011. [Google Scholar]

- Laurence D. Establishing a sustainable mining operation: an overview. J. Cleaner Prod. 2011, 19 (2–3), 278–284. 10.1016/j.jclepro.2010.08.019. [DOI] [Google Scholar]

- van Duuren E.; Plantinga A.; Scholtens B. ESG Integration and the Investment Management Process: Fundamental Investing Reinvented. Journal of Business Ethics 2016, 138 (3), 525–533. 10.1007/s10551-015-2610-8. [DOI] [Google Scholar]

- Holley E. A.; Mitcham C. The Pebble Mine Dialogue: A case study in public engagement and the social license to operate. Resour. Policy 2016, 47, 18–27. 10.1016/j.resourpol.2015.11.002. [DOI] [Google Scholar]

- Barrick Gold . Driven by return - Barrick Gold Corporation Annual Report 2012; Toronto, Canada, 2012.

- Ker P., How Rio Tinto’s Mozambique mess unfolded. Australian Financial Review, 18 October 2017. [Google Scholar]

- Franks D. M.; Davis R.; Bebbington A. J.; Ali S. H.; Kemp D.; Scurrah M. Conflict translates environmental and social risk into business costs. Proc. Natl. Acad. Sci. U. S. A. 2014, 111 (21), 7576–7581. 10.1073/pnas.1405135111. [DOI] [PMC free article] [PubMed] [Google Scholar]

- SED , Global Seismic Hazard Assessment Programme (GSHAP). In Swiss Seismological Service (SED); USGS Earthquake Hazard Programme, 2018. [Google Scholar]

- Amatulli G.; Domisch S.; Tuanmu M.-N.; Parmentier B.; Ranipeta A.; Malczyk J.; Jetz W. A suite of global, cross-scale topographic variables for environmental and biodiversity modeling. Sci. Data 2018, 5, 180040. 10.1038/sdata.2018.40. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Gassert F.; Landis M.; Luck M.; Reig P.; Shiao T.. Aqueduct Metadata Document - Aqueduct Global Maps 2.0; World Resources Institute: Washington DC, 2013. [Google Scholar]

- BirdLife International, Digital boundaries of Important Bird and Biodiversity Areas from the World Database of Key Biodiversity Areas, February 2018, 2019.

- UNEP-WCMC ; IUCN. Protected Planet: The World Database on Protected Areas (WDPA). UNEP-WCMC and IUCN: Cambridge, United Kingdom, 2019.

- Venter O.; Sanderson E. W.; Magrach A.; Allan J. R.; Beher J.; Jones K. R.; Possingham H. P.; Laurance W. F.; Wood P.; Fekete B. M.; Levy M. A.; Watson J. E. M.. Global terrestrial Human Footprint maps for 1993 and 2009. In Dryad Digital Repository, 2016. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Garnett S. T.; Burgess N. D.; Fa J. E.; Fernández-Llamazares Á.; Molnár Z.; Robinson C. J.; Watson J. E. M.; Zander K. K.; Austin B.; Brondizio E. S.; Collier N. F.; Duncan T.; Ellis E.; Geyle H.; Jackson M. V.; Jonas H.; Malmer P.; McGowan B.; Sivongxay A.; Leiper I. A spatial overview of the global importance of Indigenous lands for conservation. Nature Sustainability 2018, 1 (7), 369–374. 10.1038/s41893-018-0100-6. [DOI] [Google Scholar]

- Haken N.; Fiertz C.; Messner J. J.; Taft P.; Blyth H.; Maglo M.; Murphy C.; Quinn A.; Carlson T.; Chandler O.; Horwitz M.; Jesch L.; Mathias B.; Wilson W., Fragile States Index. In Peace; Washington, DC, 2018. [Google Scholar]

- NRGI . 2017 Resource Governance Index; Natural Resource Governance Institute, 2017. [Google Scholar]

- Stedman A.; Green K. P., Annual survey of mining companies: 2017. In Institute; Fraser Institute: 2018. [Google Scholar]

- Djankov S., Ease of doing business index. World Development Indicators; The World Bank Group: Washington, DC, 2018. [Google Scholar]

- S&P S&P Global Market Intelligence; Thomson Reuters: New York, 2019. [Google Scholar]

- Durán A. P.; Rauch J.; Gaston K. J. Global spatial coincidence between protected areas and metal mining activities. Biological Conservation 2013, 160, 272–278. 10.1016/j.biocon.2013.02.003. [DOI] [Google Scholar]

- Murguía D. I.; Bringezu S.; Schaldach R. Global direct pressures on biodiversity by large-scale metal mining: Spatial distribution and implications for conservation. J. Environ. Manage. 2016, 180, 409–420. 10.1016/j.jenvman.2016.05.040. [DOI] [PubMed] [Google Scholar]

- MMSD . Breaking New Ground: Mining Minerals and Sustainable Development; Mining, Minerals and Sustainable Development project: London, United Kingdom, 2002; p 476. [Google Scholar]

- Franks D. M.; Boger D. V.; Côte C. M.; Mulligan D. R. Sustainable development principles for the disposal of mining and mineral processing wastes. Resour. Policy 2011, 36 (2), 114–122. 10.1016/j.resourpol.2010.12.001. [DOI] [Google Scholar]

- Owen J. R.; Kemp D. Displaced by mine waste: The social consequences of industrial risk-taking. Extractive Industries and Society 2019, 6 (2), 424–427. 10.1016/j.exis.2019.02.008. [DOI] [Google Scholar]

- UNEP; GRID-Arendal Mine Tailings Storage: Safety Is No Accident; United Nations Environment Programme and GRID-Arendal: Geneva, Switzerland, October 2017,2017. [Google Scholar]

- Bowker L. N.; Chambers D. M.. The Risk, Public Liability, And Economics of Tailings Storage Facility Failures; Bowker Associates Science & Research In The Public Interest: Stonington, ME, July 21, 2015. [Google Scholar]

- LPSDP Tailings Management - Leading Practice Sustainable Development Program for the Mining Industry; Australian Government: Canberra, Australia, 2016. [Google Scholar]

- WISE Chronology of major tailings dam failures. http://www.wise-uranium.org/mdaf.html (accessed February 3, 2019).

- Gunson A. J.; Klein B.; Veiga M.; Dunbar S. Reducing mine water requirements. J. Cleaner Prod. 2012, 21 (1), 71–82. 10.1016/j.jclepro.2011.08.020. [DOI] [Google Scholar]

- Northey S. A.; Mudd G. M.; Werner T. T.; Jowitt S. M.; Haque N.; Yellishetty M.; Weng Z. The exposure of global base metal resources to water criticality, scarcity and climate change. Global Environmental Change 2017, 44, 109–124. 10.1016/j.gloenvcha.2017.04.004. [DOI] [Google Scholar]

- Huang X.; Sillanpää M.; Gjessing E. T.; Peräniemi S.; Vogt R. D. Environmental impact of mining activities on the surface water quality in Tibet: Gyama valley. Sci. Total Environ. 2010, 408 (19), 4177–4184. 10.1016/j.scitotenv.2010.05.015. [DOI] [PubMed] [Google Scholar]

- Reig P.; Shiao T.; Gassert F.. Aqueduct Water Risk Framework - WRI Working Paper; World Resources Institute: Washington DC, 2013. [Google Scholar]

- Bebbington A. J.; Humphreys Bebbington D.; Sauls L. A.; Rogan J.; Agrawal S.; Gamboa C.; Imhof A.; Johnson K.; Rosa H.; Royo A.; Toumbourou T.; Verdum R. Resource extraction and infrastructure threaten forest cover and community rights. Proc. Natl. Acad. Sci. U. S. A. 2018, 115, 201812505. 10.1073/pnas.1812505115. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Oakleaf J. R.; Kennedy C. M.; Baruch-Mordo S.; West P. C.; Gerber J. S.; Jarvis L.; Kiesecker J. A World at Risk: Aggregating Development Trends to Forecast Global Habitat Conversion. PLoS One 2015, 10 (10), e0138334 10.1371/journal.pone.0138334. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Owen J. R.; Kemp D. Mining-induced displacement and resettlement: a critical appraisal. J. Cleaner Prod. 2015, 87, 478–488. 10.1016/j.jclepro.2014.09.087. [DOI] [Google Scholar]

- Bainton N.; Vivoda V.; Kemp D.; Owen J.; Keenan J.. Project-Induced In-Migration and Large-Scale Mining: A Scoping Study; St Lucia, Queensland, Australia, 2017. [Google Scholar]

- Andrews T.; Elizalde B.; Le Billon P.; Hoon Oh C.; Reyes D.; Thomson I.. The Rise in Conflict Associated with Mining Operations: What Lies Beneath?; Canadian International Resources and Development Institute (CIRDI), 2017. [Google Scholar]

- FAO Policy on Indigenous and Tribal Peoples; Food and Agriculture Organisation of the United Nations: Rome, Italy, March 2015, 2015. [Google Scholar]

- Ballard C.; Banks G. Resource wars: the anthropology of mining. Annu. Rev. Anthropol. 2003, 32 (1), 287–313. 10.1146/annurev.anthro.32.061002.093116. [DOI] [Google Scholar]

- Robinson J. A.; Torvik R.; Verdier T. Political foundations of the resource curse. Journal of Development Economics 2006, 79 (2), 447–468. 10.1016/j.jdeveco.2006.01.008. [DOI] [Google Scholar]

- Ali S. H.; Giurco D.; Arndt N.; Nickless E.; Brown G.; Demetriades A.; Durrheim R.; Enriquez M. A.; Kinnaird J.; Littleboy A. Mineral supply for sustainable development requires resource governance. Nature 2017, 543 (7645), 367–372. 10.1038/nature21359. [DOI] [PubMed] [Google Scholar]

- World Bank . Ease of Doing Business Score and Ease of Doing Business Ranking. 2019. 10.2139/ssrn.3359082 [DOI] [Google Scholar]

- USGS Mineral Commodity Summaries 2018; U.S. Department of the Interior. U.S. Geological Survey: Reston, VA, United States, 2018. [Google Scholar]

- OECD Global Material Resources Outlook to 2060 - Economic Drivers and Environmental Consequences; Organisation for Economic Cooperation and Development: Paris, France, October, 2018. [Google Scholar]

- Bertram M.; Ramkumar S.; Rechberger H.; Rombach G.; Bayliss C.; Martchek K. J.; Müller D. B.; Liu G.. Global Aluminium Cycle 2017; International Aluminium Institute: London, UK, 2017. [Google Scholar]

- Ayuk E. T.; Pedro A. M.; Ekins P.; Gatune J.; Milligan B.; B O.; Christmann P.; Ali S.; Kumar S. V.; Bringezu S.; Acquatella J.; Bernaudat L.; Bodouroglou C.; Brooks S.; Burgii Bonanomi E.; Clement J.; Collins N.; Davis K.; Davy A.; Dawkins K.; Dom A.; Eslamishoar F.; Franks D.; Hamor T.; Jensen D.; Lahiri-Dutt K.; Petersen I.; Sanders A. R. D.. Mineral Resource Governance in the 21st Century - Gearing Extractive Industries Towards Sustainable Development; International Resource Panel: Nairobi, Kenya, 2019. [Google Scholar]

- Brereton D.; Parmenter J. Indigenous Employment in the Australian Mining Industry. Journal of Energy & Natural Resources Law 2008, 26 (1), 66–90. 10.1080/02646811.2008.11435178. [DOI] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.