Abstract

Why do we age? Since ageing is a near-universal feature of complex organisms, a convincing theory must provide a robust evolutionary explanation for its ubiquity. This theory should be compatible with the physiological evidence that ageing is largely due to deterioration, which is, in principle, reversible through repair. Moreover, this theory should also explain why natural selection has favoured organisms that first improve with age (mortality rates decrease) and then deteriorate with age (mortality rates rise). We present a candidate for such a theory of life history, applied initially to a species with determinate growth. The model features both the quantity and the quality of somatic capital, where it is optimal to initially build up quantity, but to allow quality to deteriorate. The main theoretical result of the paper is that a life history where mortality decreases early in life and then increases late in life is evolutionarily optimal. In order to apply the model to humans, in particular, we include a budget constraint to allow intergenerational transfers. The resultant theory then accounts for all our basic demographic characteristics, including menopause with extended survival after reproduction has ceased.

Keywords: aging, evolution, hunter–gatherers, life history, disposable soma, somatic capital

1. Introduction

Why has natural selection not produced complex organisms that do not age? As George Williams (1957) wrote, ‘It is indeed remarkable that after a seemingly miraculous feat of morphogenesis a complex metazoan should be unable to perform the much simpler task of merely maintaining what is already formed.’ After 50 years, evolutionary theory has yet to completely solve this basic mystery of why complex life forms, such as human beings, grow and improve during a first phase of life, only then to deteriorate and senesce later. Indeed, biologists have usually modelled the evolution of growth and development separately from the evolution of ageing. In this paper, we provide an integrated theory of ageing that shows why this pattern is evolutionarily optimal, at least in species with irreversible growth.

2. Evolutionary theories of ageing

The classical biological theory of ageing argues that natural selection on genes with age-specific phenotypic effects become progressively weaker at older ages. That is, since death occurs with some positive probability, traits expressed at older ages have a smaller impact. Since the frequency of deleterious mutations is a balance between the mutation rate and the force of natural selection against them, the frequency of such mutations should increase with age (Medawar 1952). In addition, pleiotropic genes with positive effects early in life but negative effects at later ages should tend to accumulate in the population, also resulting in an increase in the mortality rate with age (Williams 1957). Hamilton (1966) was the first to formalize this theory, and argued that senescence was an inevitable consequence of the progressive weakening of selection with age. Since then, the theory has been further elaborated by Charlesworth (1994), and generalized to include intergenerational transfers by Lee (2003).

Recent work shows that this theory is not likely to provide an adequate explanation of ageing. The claim that senescence is an inevitable consequence of natural selection has recently come under vigorous attack on both empirical and theoretical grounds. From an empirical perspective, it is now known that some species exhibit negligible senescence (Finch 1998). From a theoretical perspective, Hamilton's model is not very general, since his results depend critically on how mutations affect mortality rates (Steinsaltz et al. 2005), and under some conditions mortality rates may even decrease late in life (Vaupel et al. 2004). Next, a model on age-specific mutations does not readily account for the progressive deterioration of somatic tissue and functional abilities. There is now increasing evidence that both intracellular and organ damage accumulates gradually and progressively with age, and this results in cancers and decreased functional abilities. An adequate theory of ageing must not only account for rising mortality rates with age, but also with the physiological evidence concerning the ageing process itself. In summary, the classical theory fails on two accounts: (i) lack of generality and (ii) inability to account for the physiology of ageing.

Kirkwood's (1990) disposable soma theory of ageing solved some of these problems and inspired an optimality approach to ageing. Kirkwood argued that the repair of somatic tissue must be optimized by natural selection. At some point, greater returns will be obtained through reproduction than through repair. Perhaps, then, optimal repair is less than complete and the soma deteriorates with age, ultimately being replaced by descendants. The segregation of the somatic and germ lines permits the degradation of the former.

While the disposable soma theory points to imperfect repair as the key to understanding ageing, it does not provide a convincing reason why optimal repair is incomplete. Kirkwood's original model, and others that build upon it (e.g. Cichon & Kozlowski 2000), simply assume costly repair functions that make it impossible for mortality to decrease over time and prohibitively expensive at the margin to even keep it constant. This assumption assures ageing without explaining it. In fact, there is no obvious reason why cell quality could not improve with age. If organisms can invest in growth, an increase in the quantity of somatic capital, why could they not also invest in increasing somatic quality as well? In fact, Sozou & Seymour (2004) showed that constant mortality may be optimal if the assumption that a perfect repair is infinitely costly is relaxed. Indeed, a familiar property of optimal growth models from economics is that the capital stock should grow until an optimal long-run level is reached, after which this level should be maintained. If initially it is worth investing in some asset, such as the body, it is worth maintaining it at the optimal long-run level indefinitely.

Other models of optimal ageing also assume exogenous conditions that assure ageing without explaining it. For example, Chu & Lee (2004) showed that optimal mortality rates decrease and increase in response to exogenous increases and decreases in production. That is, ageing is built into the production function, and hence the model, by assumption, rather than being explained within the model. Similarly, Grossman (1972) and Ehrlich & Chuma (1990) presented economic models of optimal mortality that generate senescence by assuming that the depreciation rate for health capital is an exogenously given increasing function of time. If it is assumed that it becomes increasingly expensive to maintain health, mortality rates will increase in response—but this raises the question of why the cost of health maintenance should rise with age.

Finally, neither mutation–selection balance nor previous optimality models have fully accounted for the decrease in mortality during the first phase of life. The disposable soma models imply that mortality should increase monotonically with age. Hamilton's (1966) analysis implies that mortality should be constant across all ages up to sexual maturity. Lee (2003) showed how mutation–selection models can lead to a decrease in mortality with age, if individuals receive transfers when they are young and provide them when they are old. However, these transfer functions have an exogenously given age dependence. Charnov (2005) also developed a model that assumes size-dependent mortality and hence an initial decrease in mortality with age.

Our paper is in the same tradition as Lee (2003). However, we assume that all of the functions used as building blocks in the model have no exogenously given time dependence. Nevertheless, we prove that all the empirically observable functions exhibit reasonable endogenously derived age dependence. As a key example, mortality decreases in an initial phase of life, but rises thereafter.

In summary, given that ageing is a near-universal feature of complex organisms, an adequate theory should provide a general evolutionary explanation for its occurrence, without making assumptions about exogenous conditions that build ageing into the model. It should be compatible with the physiological evidence that ageing is largely due to deterioration, which is, in principle, reversible through repair. Moreover, an adequate theory must explain why mortality rates decrease during the first phase of life, but rise during the final phase. It must explain why natural selection favoured organisms that first improve with age and then deteriorate. Finally, it should also have the potential to accommodate the key specific attributes of human life history, such as menopause.

This paper presents a candidate for such a theory. Our theory is restricted here to organisms with age-structured life cycles in which growth is irreversible. For specificity, it models the deterministic growth of mammals and birds, but its results can easily be extended to organisms that have no precise age at which growth ceases (indeterminate growth). There are certainly issues with extending the model to organisms with complex life cycles with metamorphosis, such as many insects, amphibians and marine organisms, where the body mass decreases, perhaps dramatically. However, the insight here that somatic maintenance may be too expensive for a larger organism will retain much of its force for any multicellular organism, even those with complex life cycles.

3. An overview of the theory

The basis of the theory is that complex multicellular organisms evolved because investments in growth and cell differentiation maximized the intrinsic rate of growth. Thus, natural selection resulted in individuals who invest in somatic capital, which is then used to produce energy to support continued life and reproduction. A novel feature of this theory is that such somatic capital is characterized here by both quantity and quality. The quantity of capital is the number of cells, which is closely related to mass. There is initial investment in quantity, so cell number increases irreversibly up to some age, but is thereafter constant, capturing the determinate growth pattern of humans, most birds and mammals. Cell quality, as measured by functional efficiency, is also assumed to be capable of improvement by investment. Without such investment, however, cell quality depreciates over time due to environmental assaults and the build-up of deleterious by-products of cell metabolism.

The model then generates a new theory of ageing, as follows. At each age, individuals are selected to optimize the quantity and quality of somatic capital, and their investments in mortality reduction and fertility, so as to maximize the intrinsic rate of increase in their genetic lineage. The time profiles affect fitness directly through their impact on energy production. However, the cost of investment in quality depends on the quantity of capital, because each cell is subject to deterioration and has its own maintenance costs. Under plausible conditions, it is now evolutionarily optimal to generate a high level of initial quality, but then to let it decrease with age. This is because the quality of the relatively small number of cells in the germ line can be maintained cheaply. Just as somatic cells differentiate to accomplish specialized functions (digestion, immune function, etc), germ cells and stem cells are specialized to maintain genetic quality.

Optimal investments in mortality reduction respond to the overall value of the remaining life. In an initial phase of life there is somatic growth, and the net expected future total production increases with age. Thus, optimal investment in mortality reduction increases and mortality decreases. In a second phase of life, since quality continues to decrease, the net expected future total production declines with age. Thus, optimal investment in mortality reduction decreases and mortality rises. These effects occur even though the quantity and quality of capital have no direct effects on mortality, but only indirect ones via their impacts on productivity.

For specificity, our model allows extensive intergenerational transfers, as is relevant to the human case. Transfers do not end at any particular age of the offspring, and there is a looser social budget constraint rather than a budget constraint that applies to each family. Allowing intergenerational transfers permits us to explain menopause—selection favours mortality reduction among post-reproductive individuals, given they provide such transfers. Our model is therefore compatible with all of the basic demographic characteristics of humans. At the same time, there would be no difficulty in adapting our model of ageing to any system of intergenerational transfers, even if they were strictly from parent to offspring, and ended with weaning or even at birth. The basic explanation of ageing provided here would accordingly apply to a wide variety of multicellular organisms with irreversible growth.

Consider then a formal model of ageing in humans.

4. The model

(a) Gross energy

Suppose that the gross energy production rate, G, of an individual is an increasing function of the quantity, K, and the quality, Q, of somatic capital. If either quantity or quality of capital were zero, there would be no energy production. (These and further assumptions below are formulated more completely and technically in the appendix in the electronic supplementary material.)

(b) Fertility and its energy cost

Reproduction requires energy. Define F, then, as the amount of energy remaining from gross energy G, net of the energy costs of fertility, s. F is an increasing function of G but a decreasing function of s. It is further assumed that, as the gross energy increases, reproduction becomes cheaper at the margin, implying the following condition on the second mixed partial derivative of F: −FGs(G,s)>0.

(c) Growth of somatic capital

Given the interpretation of the quantity of somatic capital as the number of somatic cells, it is assumed that an investment in somatic capital is irreversible and capital does not depreciate. Thus, for some investment function, v(t), the capital stock, K(t), evolves as

The energetic cost of such an investment is αv. For simplicity, growth is determinate and follows a bang-bang trajectory, with an initial period of maximal growth, so that the investment function until age t*, say, followed by a growth plateau, so that v(t)=0 for all ages beyond t*.

Thus, the choice of the investment trajectory for the quantity of somatic capital reduces to the choice of how long to grow, i.e. to finding the optimal t*≥0. The most fundamental insights of the theory are robust if growth is indeterminate or even reversible. These issues are addressed in §8.

(d) Quality of capital

Quality, Q, is endogenously determined in this model as follows. In the absence of investment in quality, it depreciates at a constant rate ρ, due to the damage induced by metabolism and external assaults. However, it is possible to offset or reverse such depreciation through investments in quality w. Hence, quality evolves according to

Such an investment incurs an energetic cost. In order to capture the idea that each cell requires such maintenance, a key assumption is that this cost is an increasing function of the quantity of somatic capital K. The energetic cost of quality improvement is βd(w,K), where β is an exogenous parameter that scales cost and d is the cost of w, given K.

(e) Mortality

Another major component of the model concerns mortality, which can be reduced through energetic investment. Consider the operation of the immune system, for example. The larger the number of antibodies of a given type in the system, the better protected the individual is against the corresponding disease; the wider the spectrum of types of antibodies, the greater the variety of diseases to which the individual is immune. But the larger the total number of antibodies maintained, the greater the metabolic cost. Lower mortality is then assumed to be possible, but at a greater cost and, indeed, at a greater marginal cost, as follows: if μ(t) is the rate of mortality at age t, and p(t) is the probability of survival to age t, then

The energetic cost of some given μ is e(μ), where e′(μ)<0.

Suppose now that the population is in a steady-state growth equilibrium, with growth rate r. The Euler–Lotka equation must then hold.1 That is,

| (4.1) |

In the light of the above definitions and assumptions, the energy flow surplus for an individual of age t is

which may be either positive or negative.

Intergenerational transfers arise with all parentally investing organisms, including humans. With unrestricted transfers, but no energy storage, as with most foragers, economic feasibility requires that the total energy excess generated by the old cover the total energy deficits of the young, so that the steady-state budget balance condition is

| (4.2) |

This is equivalent to requiring that an individual respect an intertemporal budget constraint, where borrowing or lending are freely permitted, with an interest factor e−rtp(t) to discount the energy flow at age t back to age zero.

This analysis involves an idealization of hunter–gatherer society—that is, despite these having typically 20–50 people, it is assumed that a continuous steady-state age structure has been attained. Indeed, perhaps this capacity to smooth out intergenerational transfers was one of the key factors leading to the formation of hunter–gatherer societies and influencing group size; a factor additional to the risk-sharing usually stressed.

For simplicity, reproduction is considered to be asexual and individuals in each lineage are genetically identical. This removes the biological incentive problems for each adult to repay the transfer that was made to her when she was young. That is, she would willingly make the transfer if they favour her own fully related offspring.

The main theoretical result of the paper is the following theorem, which provides an explanation of ageing.

Theorem 1

If α is small enough, but β and are large enough, then any solution to the basic evolutionary problem of maximizing the Malthusian parameter, r, subject to the above assumptions, the Euler–Lotka equation (4.1), and the budget balance inequality (4.2), has the properties that t*>0 and w>0, at all ages t≥0. Quality nevertheless declines throughout life. Furthermore, there exist tL≥0 and tH>t*>tL such that fertility, s(t), is zero for all t≤tL and for all t≥tH, and has a unique maximum at t*. Finally, mortality, μ(t), is U-shaped with a unique minimum at some .

The assumptions on α and are required to generate a non-trivial initial phase of somatic growth in which the increase in somatic quantity raises productivity. This is clearly realistic given that growth is observed in all complex organisms.

The assumption that β is large reflects the idea that each cell has its own non-trivial maintenance costs. Hence, the cost of maintaining the quality of the germ line is vanishingly small relative to the cost of maintaining the quality of the somatic line, given the wide disparity in the numbers of cells involved.2 This interpretation of β is elaborated in the appendix in the electronic supplementary material.

Below we verify that the predictions of theorem 1 are consistent with a complete stylized picture of the demography of humans.

5. Intuitions for theorem 1

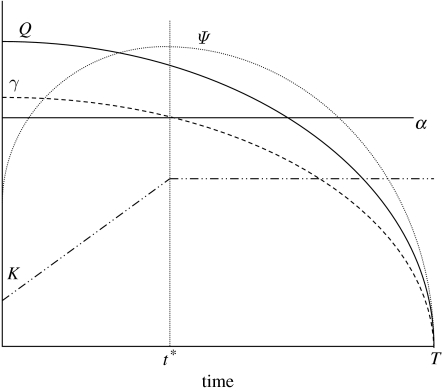

Figure 1 illustrates the optimal trajectories of quantity, K, and quality, Q, of capital, as obtained in theorem 1. With respect to quantity of capital, it will pay to grow as long as the marginal benefit of growth is greater than the marginal cost. The marginal cost of one unit of quantity is α. The marginal benefit of growth is realized over the remainder of life. Larger body size has two effects on net production. A larger body has a direct positive effect on energy production but increases the marginal cost of investment in quality. The age, t*, at which it pays to cease growing is where the lifetime marginal net benefit of growth is equal to the marginal cost:

Figure 1.

First-order conditions for optimal choice of quantity and quality of somatic capital. The γ and Ψ functions plot the marginal value of growth/mass and quality, respectively, on the expected future net energy production.

In figure 1, it can be seen that the net marginal benefit of growth, γ, will generally be high when the individual is small, and decrease with age. Body size, K, increases at the rate until t* and then remains constant.

A similar logic governs optimal investments in quality. At each age, t, investments in quality, w, will be optimized when the marginal cost of an extra unit of quality is equal to its lifetime marginal benefit:

Figure 1 illustrates that, as the organism grows, the lifetime marginal benefit of investments in quality, ψ, may increase because mortality is decreasing, but it will then decrease as mortality increases later in life. At the same time, however, the marginal cost of investment depends on body size, so each unit increase in quality is more costly as the organism grows. As long as β is large enough, the level of w satisfying the above equation will be less than the depreciation rate, ρ, and Q will decrease monotonically throughout life.

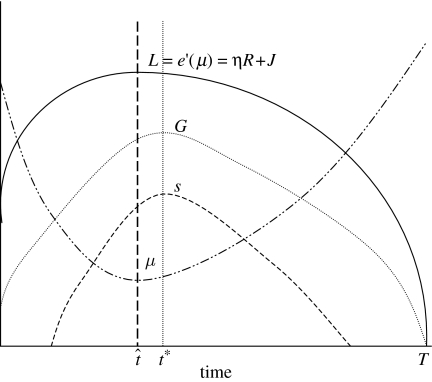

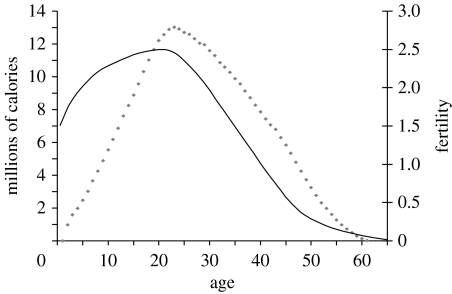

The demographic results for fertility and mortality are illustrated in figure 2. Fertility will be optimized by comparing the marginal energetic cost of producing offspring and the marginal benefit of producing offspring, say η. Thus, the first-order condition for optimal choice of fertility, s, is

Figure 2.

First-order conditions for optimal choice of fertility and mortality over the life course.

The marginal cost of fertility is constant over those ages where fertility is positive. However, there may be ages at which it does not pay to reproduce because the marginal cost is greater than η. This generally arises when the organism is young, and at old ages after the quality decline has occurred. Since d/dG(−Fs(G,s))<0, the marginal cost of fertility is a decreasing function of gross energy G. It follows that fertility will generally be positive where G exceeds a threshold value, but zero otherwise. As depicted in the figure, theorem 1 implies that maximum fertility occurs at age t*, when gross energy is at its maximum.

Finally, mortality reduction is optimized when its marginal cost, −e′(μ(t)), equals its marginal benefit. This marginal benefit is the value of life, say L. This is the sum of all expected net future energy production plus the energetic value of all expected future fertility. The first-order condition for optimal choice of μ is

where

and

The marginal gain from mortality reduction, L(t), has two components. The second of these involves the term R(t), which is precisely Fisher's notion of reproductive value.3 This is the expected future fertility contribution of an individual of age t, conditional on this individual being alive. The constant η, as defined above, can also be interpreted as the exchange rate that converts fertility into energy terms.

The first of these components, V(t), is the expected future net energy contribution of an individual of age t. This is analogous to Fisher's reproductive value, except that it derives from the net economic contribution of the individual rather than from her fertility. The sum of these two components is the overall value of life. The presence of the first term means that there will be selection in favour of mortality reduction for post-menopausal individuals.

6. An outline of the proof of theorem 1

The appendix in the electronic supplementary material provides the formal proof of theorem 1. Here, we provide an overview of the steps involved in the proof with the goal of further explicating the theorem.4

The proof proceeds in five steps, each with an associated lemma. We seek to characterize the solution to the basic problem of maximizing the intrinsic growth rate r in terms of the optimal trajectories of the quantity and quality of somatic capital, fertility and mortality. The first step shows that any solution to this basic problem is also a solution to the transformed problem of maximizing total expected discounted energy surplus, for a given value of r, together with the requirement that this maximum surplus be zero. This step is for mathematical convenience.

The second step constructs time paths for somatic quality and mortality, which are candidates as partial solutions to the transformed problem. (This assumes a sufficiently large value of β, to reflect the relatively large somatic quality maintenance relative to that of the germ line.) These time paths are only partial solutions because the length of the growth phase, t*, and the marginal benefit of fertility, η, are left arbitrary for the moment.

The third step proves that these candidate time paths are indeed partial solutions. This step also then ties down the value of η and hence derives the time path of fertility, s. All the time paths obtained are optimal for an arbitrary choice of t*, but the fourth step then characterizes the optimal choice of t*>0, given a sufficiently small value of α, as required for non-trivial growth.

The fifth step then completes the proof of theorem 1 by showing that the stated properties of the time paths of fertility and mortality hold, given that the quantity cost parameter α is small enough, but the upper bound on the investment rate and the quality cost parameter β are large enough. This step shows that the gross energy output, G, is hump-shaped, implying that fertility will be zero at first, then increase as production increases until t*. Fertility will then decrease after t* generally again being zero in a terminal phase of life, capturing menopause. Mortality, on the other hand, first decreases, reaching a minimum at some age prior to or at t*, but increases thereafter.

7. Verifying the predictions for humans

First note that, since the actual growth rate of hominids over the last two million years must have been almost zero, on average, the above results are interpreted to hold for a maximized value of r=0.

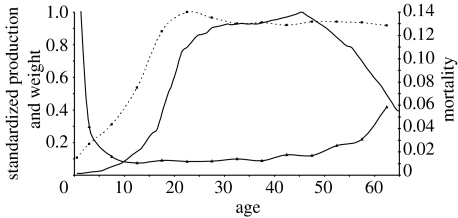

Figure 3 presents data collected from hunter–gatherers living under conditions perhaps similar to those in our evolutionary past (Kaplan et al. 2000, 2003). It shows the body weight and food production, scaled as a proportion of the maximal level attained, and mortality rates, as a function of age, averaged across males and females. Mortality rates decline until adolescence and then increase at an increasing rate, after age 35–40. After age 65–70, mortality rates become especially high, and it is not typical to live much past the eighth decade of life. Food production reflects a similar improvement and then deterioration with age, increasing monotonically throughout the first phase of life, peaking around age 45 and declining thereafter. Body weight, on the other hand, increases until adulthood but it remains relatively stable after that age.

Figure 3.

Net production, weight and mortality by age among foragers. Data on production (thick solid line) and mortality (thin solid line) are derived from Kaplan et al. (2000) and represent the average production and age-specific mortality of males and females by age among three foraging groups: the Ache of Paraguay, the Hiwi of Venezuela and the Hadza of Tanzania. Data on weight (dashed line) are derived from unpublished measures of Ache males and females made by Kaplan along with co-workers Kim Hill, A. Magdalena Hurtado and K. Hawkes.

Theorem 1 states that, under reasonable conditions, the optimal life history has the following form: an individual begins life with tissue quantity at its lowest level, but tissue quality at its highest; he or she will then invest in growth, increasing tissue quantity until some optimal age, t*. Growth drives increasing productivity during the first phase of life and this helps to produce a decline in mortality. Quality optimally depreciates throughout. Deterioration in quality then drives the decline in productivity later in life and this drives an endogenous increase in mortality. For some of the growth period, optimal fertility is zero and then it increases monotonically as somatic quantity increases. At t*, when growth ceases, fertility is at its maximum. Since tissue quantity remains constant after t*, but quality continues to deteriorate, fertility also decreases with age, ultimately becoming zero again in a final post-menopausal phase of life.

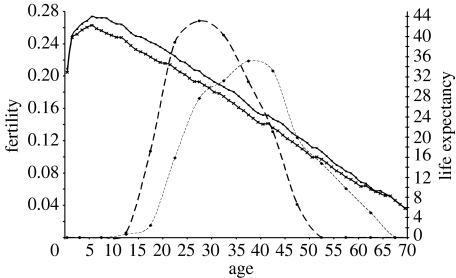

Figure 4 shows the relationship between the human survival and fertility curves. At the end of fertility for women, there is an expected lifespan of approximately 20 years (Gurven & Kaplan 2007)!

Figure 4.

Fertility and life expectancy by age among foragers. Data on fertility are based upon the Ache of Paraguay (from Hill & Hurtado 1996) and the !Kung of Botswana (from Howell 1979). Thick dashed line, female fertility; thin dashed line, male fertility. Data on life expectancy are derived from the mortality data in figure 1. Thick solid line, female life expectancy; thin solid line, male life expectancy.

These theoretical implications are consistent with the data. In particular, note that the body mass increases until the early twenties for human females in traditional societies, which is not far off the age of maximum realized female fertility for hunter–gatherers, at age 25.

Note now that the optimal investment in mortality reduction in the model is positively related to the value of life, so mortality is negatively related to this value. This implies that mortality will first decrease with age until some age prior or equal to t*, and thereafter increase monotonically. This is also consistent with the facts, since minimum mortality may be around age 13 for hunter–gatherers, and a similar age obtains for modern humans. Figure 5 shows how empirical estimates of the two components determining the value of life, expected future reproduction R and expected future net production V, increase and decrease with age at different rates. These are then in broad agreement with the empirical U-shaped mortality profile in figure 3.

Figure 5.

Cumulative expected future production, V(t) (diamonds), and reproduction, R(t) (solid line). Expected future production is derived from the production and mortality data in figure 1. Expected future reproduction is based upon the fertility data in figure 2 and the mortality data in figure 1.

Consider in further detail the theoretical condition that for optimal choice of μ. This condition implies that mortality is governed mostly by narrow reproductive considerations when young (as reflected in R), and by purely economic considerations at the other end of life (as reflected in V). It is therefore evolutionarily optimal to live beyond the age at which fertility declines to zero, given net energy production remains positive there. Thus, the theory also shows why post-reproductive life can evolve. Maximization of the growth rate r generally entails transfers from older individuals to younger individuals, sustaining the value of life at older ages.

As an explanation of ageing, the crucial feature of the theory is that it predicts that mortality will initially decrease and then increase with age. During the initial part of the growth period, expected future contributions to fitness grow with age, and so mortality decreases. Ultimately, however, future contributions decrease with age, and mortality rises. While it is generally possible in the model to maintain the value of life, and hence keep mortality constant, this is not optimal. A type that did this would not maximize the intrinsic growth rate. We grow old because the marginal cost of not growing old, of keeping mortality constant, exceeds the marginal benefit. This is in the light of the option of using the pristine germ line blueprints to create another individual, and is despite the enormous biological and economic costs that must be incurred in bringing such an individual to adulthood.

8. Discussion and conclusions

The novel features of this theory account for all the key characteristics of life history involving fertility, production and mortality. These features amplify Kirkwood's (1990) original hypothesis that the soma is disposable since quality is maintained in the germ line.

(a) Generality of the model

Several assumptions of the model were employed for specificity and for empirical application to humans. Specifically, the model assumed determinate non-reversible growth and unrestricted intergenerational transfers. Here, we consider the implications of changing those assumptions.

Indeterminate growth, in which growth continues throughout life, and so overlaps with reproduction, is very common across plant and animal taxa. Consider how allowing this might affect figures 1 and 2. In figure 1, the quantity of capital, K, would then continue to increase with age, although probably with a rate of increase tending to zero. This might tend to prolong the period of life during which fertility, s, is positive. In figure 2, both the reproductive value and expected future reproduction, R(t) and V(t) curves, respectively, would probably peak at older ages. This, in turn, would shift the age of minimum mortality to the right as well. However, somatic quality Q would continue to decrease monotonically with age, and eventually mortality would increase with age, thus preserving the central result of theorem 1. There is now increasing evidence that even in long-lived indeterminately growing plants and animals mortality eventually increases with age, even though it continues to decrease for significant periods after reproduction commences.

The possibility of reversible growth poses a more challenging problem. For example, seasonal environments spur fluctuations in fat mass in many species of animals and leaf loss in plants. The effects of these fluctuations in the quantity of capital on the time path of Q might be quite complex. Nevertheless, without a complete reversal in body size, Q would tend to decline over the long run and mortality would tend to increase, thus preserving the key features established here. A more complex situation arises in various species of marine organisms, amphibians and insects having life histories that include metamorphoses where much of the body mass is discarded. Furthermore, some multicellular organisms, especially plants, engage in asexual, vegetative reproduction in which somatic and reproductive cells are not so clearly divided. These cases also present challenges for the current theory. Clearly, future work should focus on extending the theory to such more complex situations, since the key intuition why somatic repair would be too expensive seems robust.

The assumption of unrestricted intergenerational transfers could also be relaxed. If all investment in offspring occurs prior to birth, for example, then the curves of expected future reproduction and production in figure 2 would taper off together, and we should find no menopause. After expending the surplus provided by parental investment, individuals would have to ‘self-finance’ growth and reproduction, and would be constrained by their energy budget at each point in time. This might force them to grow more slowly and to reproduce at a later age. Nevertheless, if all other assumptions hold, we would still find that reproduction would peak at t*, mortality rates would decrease and then increase with age, and Q would decrease monotonically with age.

In summary, the present model is widely applicable to ageing in species with irreversible growth. Changes in the assumptions about growth and intergenerational transfers affect important details in the time paths of fertility, mortality and quality decline, but the generality of ageing as a response to growth remains.

(b) Other extensions

The theory allows for various extensions. The most obvious extensions involve comparative static results to examine how changes in parameters affect optimal schedules of senescence. One particularly illuminating extension might be to examine parameter shifts that affect optimal body size. Even though bigger bodies are more costly to maintain, they might still be predicted to age more slowly, as is consistent with a strong empirical regularity.

It will also be worthwhile to consider varying assumptions about depreciation and mortality rates. The parameter ρ in the current model assumes a constant depreciation rate that depends neither on mass nor on cell quality. Just as the total metabolism increases (albeit less than proportionately) with increasing body size, it may be that depreciation rate also depends on body size, and perhaps cell quality as well. In addition, here we assume that it is only production that is affected by cell quantity and quality; however, mortality rates may also decrease as a function of body mass and cell quality. If that were the case, there would be larger declines in mortality prior to and a more rapid increase in mortality thereafter.

Results from previous models that featured only the quantity of capital, K, and not its quality, Q, are likely to extend to the current model (Kaplan & Robson 2002; Robson & Kaplan 2003). One such result was that an increase in the productivity of capital led to greater optimal investments in mortality reduction at every age. We also found that exogenous reductions in mortality increased the optimal level of capital and of endogenous mortality reduction expenditures. There should be similar effects for investments in quality maintenance in the present model. A result of particular interest for the human case was that a shift in productivity from younger to older ages, as derived from greater learning by doing, increased investment in mortality reduction and longevity. The accumulating evidence that humans age more slowly than chimpanzees (Gurven & Kaplan 2007) is consistent with humans being particularly reliant on learning. Virtually all chimpanzees die before age 45, which is when humans reach peak net economic productivity (figure 3).

The present approach may, more generally, shed new light on the evolution of species with long lifespans with negligible senescence. While existing models of senescence emphasize the role of exogenous components in mortality, our theory shows how the productivity of capital affects life-history evolution. Circumstances where various types of capital investment are highly productive may favour reduced senescence in humans and in diverse non-human species. For example, the extreme longevity of queens in social insect colonies may be due to the productivity of capital investments that are not only somatic, but also include the physical hive or nest.

An adequate theory of lifespan evolution, and its diversity across living organisms, requires an integrated view of growth, reproduction and senescence. Economic models incorporating quantity and quality of somatic tissue illuminate the biological basis of demographic phenomena, and explain why ageing is so pervasive.

Acknowledgments

A.J.R. was supported by the Social Sciences Research Council of Canada and the Canada Research Chairs programme. H.S.K. was supported by the National Science Foundation (BCS-0422690) and the National Institute on Aging (R01AG024119-01). We thank Caleb Finch, Ken Wachter and the referees for their very helpful comments. The paper also benefitted from numerous presentations.

Endnotes

See Charlesworth (1994, ch. 1), for example.

There is evidence that germ line quality is less prone to deterioration over time than is somatic quality—see Stambrook (2007), for example.

See Charlesworth (1994, ch. 1), for example.

Robson & Kaplan (2007) states and proves a simpler version of theorem 1.

Supplementary Material

Detailed assumptions, and proof of theorem

References

- Charlesworth B. Cambridge University Press; Cambridge, UK: 1994. Evolution in age-structured populations. [Google Scholar]

- Charnov E.L. Mammal life-history evolution with size-dependent mortality. Evol. Ecol. Res. 2005;7:795–799. [Google Scholar]

- Chu C.Y.C., Lee R. University of California; Berkeley, CA: 2004. The co-evolution of intergenerational transfers and longevity: an optimal life history approach. Working paper. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Cichon M., Kozlowski J. Aging and typical survivorship curves result from optimal resource allocation. Evol. Ecol. Res. 2000;2:857–870. [Google Scholar]

- Ehrlich I., Chuma H. A model of the demand for longevity and value of life extension. J. Polit. Econ. 1990;98:761–782. doi: 10.1086/261705. doi:10.1086/261705 [DOI] [PubMed] [Google Scholar]

- Finch C.E. Variations in senescence and longevity include the possibility of negligible senescence. J. Gerontol. Biol. Sci. 1998;53A:B235–B239. doi: 10.1093/gerona/53a.4.b235. [DOI] [PubMed] [Google Scholar]

- Grossman M. On the concept of health capital and the demand for health. J. Polit. Econ. 1972;80:223–255. doi:10.1086/259880 [Google Scholar]

- Gurven M., Kaplan H. Longevity among hunter-gatherers: a cross-cultural examination. Popul. Dev. Rev. 2007;33:321–365. doi:10.1111/j.1728-4457.2007.00171.x [Google Scholar]

- Hamilton W.D. The moulding of senescence by natural selection. J. Theor. Biol. 1966;12:12–45. doi: 10.1016/0022-5193(66)90184-6. doi:10.1016/0022-5193(66)90184-6 [DOI] [PubMed] [Google Scholar]

- Hill K., Hurtado M. Aldine; Hawthorne, NY: 1996. Ache life history: the ecology and demography of a foraging people. [Google Scholar]

- Howell N. Academic Press; New York, NY: 1979. Demography of the Dobe !Kung. [Google Scholar]

- Kaplan H., Robson A. The emergence of humans: the coevolution of intelligence and longevity with intergenerational transfers. Proc. Natl Acad. Sci. USA. 2002;99:10221–10226. doi: 10.1073/pnas.152502899. doi:10.1073/pnas.152502899 [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kaplan H., Hill K., Lancaster J.B., Hurtado A.M. A theory of human life history evolution: diet, intelligence, and longevity. Evol. Anthropol. 2000;9:156–185. doi:10.1002/1520-6505(2000)9:4<156::AID-EVAN5>3.0.CO;2-7 [Google Scholar]

- Kaplan H., Robson A., Lancaster J.B. Embodied capital and the evolutionary economics of the human lifespan. In: Carey J.R., Tuljapurkar S., editors. Lifespan: evolutionary, ecology and demographic perspectives. The Population Council; New York, NY: 2003. pp. 152–182. Population and Development Review29, Supplement 2003. [Google Scholar]

- Kirkwood T.B.L. Embodied capital and the evolutionary economics of the human lifespan. In: Harrison D.E., editor. Genetic effects on aging II. Telford Press; Caldwell, NY: 1990. pp. 9–19. [Google Scholar]

- Lee R. Rethinking the evolutionary theory of aging: transfers, not births, shape senescence in social species. Proc. Natl Acad. Sci. USA. 2003;100:9637–9642. doi: 10.1073/pnas.1530303100. doi:10.1073/pnas.1530303100 [DOI] [PMC free article] [PubMed] [Google Scholar]

- Medawar P.B. Lewis; London, UK: 1952. An unsolved problem in biology. [Google Scholar]

- Robson A., Kaplan H. The evolution of human longevity and intelligence in hunter-gatherer economies. Am. Econ. Rev. 2003;93:150–169. doi: 10.1257/000282803321455205. doi:10.1257/000282803321455205 [DOI] [PubMed] [Google Scholar]

- Robson A., Kaplan H. Why do we die? Economics, biology and aging. Am. Econ. Rev. 2007;97:492–495. doi:10.1257/aer.97.2.492 [Google Scholar]

- Sozou P., Seymour R. To age or not to age. Proc. R. Soc. B. 2004;271:457–463. doi: 10.1098/rspb.2003.2614. doi:10.1098/rspb.2003.2614 [DOI] [PMC free article] [PubMed] [Google Scholar]

- Stambrook P.J. An ageing question: do embryonic stem cells protect their genomes? Mechanism of Ageing and Development. 2007;128:31–35. doi: 10.1016/j.mad.2006.11.007. doi:10.1016/j.mad.2006.11.007 [DOI] [PubMed] [Google Scholar]

- Steinsaltz D., Evans S.N., Wachter K.W. A generalized model of mutation–selection balance with applications to aging. Adv. Appl. Math. 2005;35:16–33. doi:10.1016/j.aam.2004.09.003 [Google Scholar]

- Vaupel J.W., Baudisch A., Drolling M., Roach D.A., Gampe J. The case for negative senescence. Theor. Popul. Biol. 2004;65:339–351. doi: 10.1016/j.tpb.2003.12.003. doi:10.1016/j.tpb.2003.12.003 [DOI] [PubMed] [Google Scholar]

- Williams G.C. Pleiotropy, natural selection, and the evolution of senescence. Evolution. 1957;11:398–411. doi:10.2307/2406060 [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Detailed assumptions, and proof of theorem