Abstract

Much of the extensive empirical literature on insurance markets has focused on whether adverse selection can be detected. Once detected, however, there has been little attempt to quantify its welfare cost, or to assess whether and what potential government interventions may reduce these costs. To do so, we develop a model of annuity contract choice and estimate it using data from the U.K. annuity market. The model allows for private information about mortality risk as well as heterogeneity in preferences over different contract options. We focus on the choice of length of guarantee among individuals who are required to buy annuities. The results suggest that asymmetric information along the guarantee margin reduces welfare relative to a first best symmetric information benchmark by about £127 million per year, or about 2 percent of annuitized wealth. We also find that by requiring that individuals choose the longest guarantee period allowed, mandates could achieve the first-best allocation. However, we estimate that other mandated guarantee lengths would have detrimental effects on welfare. Since determining the optimal mandate is empirically difficult, our findings suggest that achieving welfare gains through mandatory social insurance may be harder in practice than simple theory may suggest.

Keywords: Annuities, contract choice, adverse selection, structural estimation

1. INTRODUCTION

Ever since the seminal works of Akerlof (1970) and Rothschild and Stiglitz (1976), a rich theoretical literature has emphasized the negative welfare consequences of adverse selection in insurance markets and the potential for welfare-improving government intervention. More recently, a growing empirical literature has developed ways to detect whether asymmetric information exists in particular insurance markets (Chiappori and Salanie (2000), Finkelstein and McGarry (2006)). Once adverse selection is detected, however, there has been little attempt to estimate the magnitude of its efficiency costs, or to compare welfare in the asymmetric information equilibrium to what would be achieved by potential government interventions. In an attempt to start filling this gap, this paper develops an empirical approach that can quantify the efficiency cost of asymmetric information and the welfare consequences of government intervention.1

We apply our approach to the semi-compulsory market for annuities in the United Kingdom. Individuals who have accumulated funds in tax-preferred retirement saving accounts (the equivalents of an IRA or 401(k) in the United States) are required to annuitize their accumulated lump sum balances at retirement. These annuity contracts provide a survival-contingent stream of payments. As a result of these requirements, there is a sizable volume in the market. In 1998, new funds annuitized in this market totalled £6 billion (Association of British Insurers (1999)).

Although they are required to annuitize their balances, individuals are allowed choice in their annuity contract. In particular, they can choose from among guarantee periods of 0, 5, or 10 years. During a guarantee period, annuity payments are made (to the annuitant or to his estate) regardless of the annuitant's survival. The choice of a longer guarantee period comes at the cost of lower annuity payments while alive. When annuitants and insurance companies have symmetric information about an annuitant's mortality rate, a longer guarantee is more attractive to an annuitant who cares more about their wealth when they die relative to consumption while alive; as a result, the first-best guarantee length may differ across annuitants. When annuitants have private information about their mortality rate, a longer guarantee period is also more attractive, all else equal, to individuals who are likely to die sooner. This is the source of adverse selection, which can affect the equilibrium price of guarantees and thereby distort guarantee choices away from the first-best symmetric information allocation.

The pension annuity market provides a particularly interesting setting in which to explore the welfare costs of asymmetric information and the welfare consequences of potential government intervention. Annuity markets have attracted increasing attention and interest as Social Security reform proposals have been advanced in various countries. Some proposals call for partly or fully replacing government-provided defined benefit, pay-as-you-go retirement systems with defined contribution systems in which individuals would accumulate assets in individual accounts. In such systems, an important question concerns whether the government would require individuals to annuitize some or all of their balance, and whether it would allow choice over the type of annuity product purchased. The relative attractiveness of these various options depends critically on consumer welfare in each alternative allocation.

In addition to their substantive interest, several features of annuities make them a particularly attractive setting for our purpose. First, adverse selection has already been detected and documented in this market along the choice of guarantee period, with private information about longevity affecting both the choice of contract and its price in equilibrium (Finkelstein and Poterba (2004, 2006)). Second, annuities are relatively simple and clearly defined contracts, so that modeling the contract choice requires less abstraction than in other insurance settings. Third, the case for moral hazard in annuities is arguably less compelling than for other forms of insurance; our ability to assume away moral hazard substantially simplifies the empirical analysis.

We develop a model of annuity contract choice and use it, together with individual-level data on annuity choices and subsequent mortality outcomes from a large annuity provider, to recover the joint distribution of individuals’ (unobserved) risk and preferences. Using this joint distribution and the annuity choice model, we compute welfare at the observed allocation, as well as allocations and welfare for counterfactual scenarios. We compare welfare under the observed asymmetric information allocation to what would be achieved under the first-best, symmetric information benchmark; this comparison provides our measure of the welfare cost of asymmetric information. We also compare equilibrium welfare to what would be obtained under mandatory social insurance programs; this comparison sheds light on the potential for welfare improving government intervention.

Our empirical object of interest is the joint distribution of risk and preferences. To estimate it, we rely on two key modeling assumptions. First, to recover mortality risk we assume that mortality follows a mixed proportional hazard model. Individuals’ mortality tracks their own individual-specific mortality rates, allowing us to recover the extent of heterogeneity in (ex-ante) mortality rates from (ex-post) information about mortality realization. Second, to recover preferences, we use a standard dynamic model of consumption by retirees. In our baseline model we assume that retirees perfectly know their (ex-ante) mortality rate, which governs their stochastic time of death. This model allows us to evaluate the (ex-ante) value-maximizing choice of a guarantee period as a function of ex ante mortality rate and preferences for wealth at death relative to consumption while alive.

Given the above assumptions, the parameters of the model are identified from the variation in mortality and guarantee choices in the data, and in particular from the correlation between them. However, no modeling assumptions are needed to establish the existence of private information about the individual's mortality rate. This is apparent from the existence of (conditional) correlation between guarantee choices and ex post mortality in the data. Given the annuity choice model, rationalizing the observed choices with only variation in mortality risk is hard. Indeed, our findings suggest that unobserved mortality risk and preferences are both important determinants of the equilibrium insurance allocations.

We measure welfare in a given annuity allocation as the average amount of money an individual would need to make him as well off without the annuity as with his annuity allocation and his pre-existing wealth. We also examine the optimal government mandate among the currently existing guarantee options of 0, 5, or 10 years. In a standard insurance setting – that is, when all individuals are risk averse, the utility function is state-invariant, and there are no additional costs of providing insurance – it is well-known that mandatory (uniform) full insurance can achieve the first best allocation, even when individuals vary in their preferences. In contrast, we naturally view annuity choices as governed by two different utility functions, one from consumption when alive and one from wealth when dead. In such a case, whether and which mandatory guarantee can improve welfare gains relative to the adverse selection equilibrium is not clear without more information on the cross-sectional distribution of preferences and mortality risk. The investigation of the optimal mandate – and whether it can produce welfare gains relative to the adverse selection equilibrium – therefore becomes an empirical question.

While caution should always be exercised when extrapolating estimates from a relatively homogeneous subsample of annuitants of a single firm to the market as a whole, our baseline results suggest that a mandatory social insurance program that required individuals to purchase a 10 year guarantee would increase welfare by about £127 million per year or £423 per new annuitant, while one that requires annuities to provide no guarantee would reduce welfare by about £107 million per year or £357 per new annuitant. Since determining which mandates would be welfare improving is empirically difficult, our results suggest that achieving welfare gains through mandatory social insurance may be harder in practice than simple theory would suggest. We also estimate welfare in a symmetric information, first-best benchmark. We find that the welfare cost of asymmetric information within the annuity market along the guarantee margin is about £127 million per year, £423 per new annuitant, or about two percent of the annuitized wealth in this market. Thus, we estimate that not only is a 10 year guarantee the optimal mandate, but also that it achieves the first best allocation.

To put these welfare estimates in context given the margin of choice, we benchmark them against the maximum money at stake in the choice of guarantee. This benchmark is defined as the additional (ex-ante) amount of wealth required to ensure that if individuals were forced to buy the policy with the least amount of insurance, they would be at least as well off as they had been. We estimate that the maximum money at stake in the choice of guarantee is only about 8 percent of the annuitized amount. Our estimates therefore imply that the welfare cost of asymmetric information is about 25 percent of this maximum money at stake.

Our welfare analysis is based on a model of annuity demand. This requires assumptions about the nature of the utility functions that govern annuity choice, as well as assumptions about the expectation individuals form regarding their subsequent mortality outcomes. Data limitations, particularly lack of detail on annuitant's wealth, necessitate additional modeling assumptions. Finally, our approach requires several other parametric assumptions for operational and computational reasons. The assumptions required for our welfare analysis are considerably stronger than those that have been used in prior work to test whether or not asymmetric information exists. This literature has tested for the existence of private information by examining the correlation between insurance choice and ex-post risk realization (Chiappori and Salanie (2000)). Indeed, the existing evidence of adverse selection along the guarantee choice margin in our setting comes from examining the correlation between guarantee choice and ex-post mortality (Finkelstein and Poterba (2004)). By contrast, our effort to move from testing for asymmetric information to quantifying its welfare implications requires considerably stronger modeling assumptions. Our comfort with this approach is motivated by a general “impossibility” result which we illustrate in the working paper version (Einav, Finkelstein, and Schrimpf (2007)): even when asymmetric information is known to exist, the reduced form equilibrium relationship between insurance coverage and risk occurrence does not permit inference about the efficiency cost of this asymmetric information without strong additional assumptions.

Of course, a critical question is how important our particular assumptions are for our central results regarding welfare. We therefore explore a range of possible alternatives, both for the appropriate utility model and for our various parametric assumptions. We are reassured that our central results are quite stable. In particular, the finding that the 10 year guarantee is the optimal mandate, and achieves virtually the same welfare as the first best outcome, persists under all the alternative specifications that we have tried. However, the quantitative estimates of the welfare cost of adverse selection can vary with the modeling assumptions by a non trivial amount; more caution should therefore be exercised in interpreting these quantitative estimates.

The rest of the paper proceeds as follows. Section 2 describes the environment and the data. Section 3 describes the model of guarantee choice, presents its identification properties, and discusses estimation. Section 4 presents our parameter estimates and discusses their in-sample and out-of-sample fit. Section 5 presents the implications of our estimates for the welfare costs of asymmetric information in this market, as well as the welfare consequences of potential government policies. The robustness of the results is explored in Section 6. Section 7 concludes by briefly summarizing our findings and discussing how the approach we develop can be applied in other insurance markets, including those where moral hazard is likely to be important.

2. DATA AND ENVIRONMENT

Environment

All of the annuitants we study are participants in the semi-compulsory market for annuities in the U.K.. In other words, they have saved for retirement through tax-preferred defined contribution private pensions (the equivalents of an IRA or 401(k) in the United States) and are therefore required to annuitize virtually all of their accumulated balances.2 They are however offered choice over the nature of their annuity product. We focus on the choice of the length of the guarantee period, during which annuity payments are made (to the annuitant or to his estate) regardless of annuitant survival. Longer guarantees therefore trade off lower annuity payments in every period the annuitant is alive in return for payments in the event that the annuitant dies during the guarantee period.

The compulsory annuitization requirement is known to individuals at the time (during working age) that they make their pension savings contributions, although of course the exact nature of the annuity products (and their pricing) that will be available when they have to annuitize is uncertain. Choices over annuity products are only made at the time of conversion of the lump-sum defined contribution balances to an annuity and are based on the products and annuity rates available at that time.

All of our analysis takes the pension contribution decisions of the individual during the accumulation phase (as well as their labor supply decisions) as given. In other words, in our analysis of welfare under counterfactual pricing of the guarantee options, we do not allow for the possibility that the pre-annuitization savings and labor supply decisions may respond endogenously to the change in guarantee pricing. This is standard practice in the annuity literature (Brown (2001), Davidoff, Brown, and Diamond (2005), and Finkelstein, Poterba, and Rothschild (2009)). In our context, we do not think it is a particularly heroic assumption. For one thing, as we will discuss in more detail in Section 5.1, the maximum money at stake in the choice over guarantee is only about 8 percent of annuitized wealth under the observed annuity rates (and only about half that amount under the counterfactual rates we compute); this should limit any responsiveness of preannuitization decisions to guarantee pricing. Moreover, many of these decisions are made decades before annuitization and therefore presumably factor in considerable uncertainty (and discounting) of future guarantee prices.

Data and descriptive statistics

We use annuitant-level data from one of the largest annuity providers in the U.K. The data contain each annuitant's guarantee choice, several demographic characteristics (including everything on which annuity rates are based), and subsequent mortality. The data consist of all annuities sold between 1988 and 1994 for which the annuitant was still alive on January 1, 1998. We observe age (in days) at the time of annuitization, the gender of the annuitant, and the subsequent date of death if the annuitant died before the end of 2005.

For analytical tractability, we make a number of sample restrictions. In particular, we restrict our sample to annuitants who purchase at age 60 or 65 (the modal purchase ages), and who purchased a single life annuity (that insures only his or her own life) with a constant (nominal) payment profile.3 Finally, the main analysis focuses on the approximately two-thirds of annuitants in our sample who purchased an annuity with a pension fund that they had accumulated within our company; in Section 6 we re-estimate the model for the remaining individuals who had brought in external funds. Appendix A discusses these various restrictions in more detail; they are made so that we can focus on the purchase decisions of a relatively homogenous subsample.

Table I presents summary statistics for the whole sample and for each of the four age-gender combinations. Our baseline sample consists of over 9,000 annuitants. Sample sizes by age and gender range from a high of almost 5,500 for 65 year old males to a low of 651 for 65 year old females. About 87 percent of annuitants choose a 5 year guarantee period, 10 percent choose no guarantee, and only 3 percent choose the 10 year guarantee. These are the only three options available to annuitants in our sample and the focus of our subsequent analysis.

Table I.

Summary statistics

| 60 Females | 65 Females | 60 Males | 65 Males | All | |

|---|---|---|---|---|---|

| No. of obs. | 1,800 | 651 | 1,444 | 5,469 | 9,364 |

| Fraction choosing 0 year guarantee | 14.0 | 16.0 | 15.3 | 7.0 | 10.2 |

| Fraction choosing 5 year guarantee | 83.9 | 82.0 | 78.7 | 90.0 | 86.5 |

| Fraction choosing 10 year guarantee | 2.1 | 2.0 | 6.0 | 3.0 | 3.2 |

| Fraction who die within observed mortality period: | |||||

| Entire sample | 8.4 | 12.3 | 17.0 | 25.6 | 20.0 |

| Among those choosing 0 year guarantee | 6.7 | 7.7 | 17.7 | 22.8 | 15.7 |

| Among those choosing 5 year guarantee | 8.7 | 13.3 | 17.0 | 25.9 | 20.6 |

| Among those choosing 10 year guarantee | 8.1 | 7.7 | 16.1 | 22.9 | 18.5 |

Recall that we only observe individuals who are alive as of January 1, 1998, and we observe mortality only for individuals who die before December 31, 2005.

Given our sample construction described above, our mortality data are both left-truncated and right-censored, and cover mortality outcomes over an age range of 63 to 83. About one-fifth of our sample dies between 1998 and 2005. As expected, death is more common among men than women, and among those who purchase at older ages.

There is a general pattern of higher mortality among those who purchase 5 year guarantees than those who purchase no guarantees, but no clear pattern (possibly due to the smaller sample size) of mortality differences for those who purchase 10 year guarantees relative to either of the other two options. This mortality pattern as a function of guarantee persists in more formal hazard modeling that takes account of the left truncation and right censoring of the data (not shown).4

As discussed in the introduction, the existence of a (conditional) correlation between guarantee choice and mortality – such as the higher mortality experienced by purchasers of the 5 year guarantee relative to purchasers of no guarantee – indicates the presence of private information about individual mortality risk in our data, and motivates our exercise. That is, this correlation between mortality outcomes and guarantee choices rules out a model in which individuals have no private information about their idiosyncratic mortality rates, and guides our modeling assumption in the next section that allow individuals to make their guarantee choices based on information about their idiosyncratic mortality rate.

Annuity rates

The company supplied us with the menu of annuity rates, that is the annual annuity payments per £1 of the annuitized amount. These rates are determined by the annuitant's gender, age at the time of purchase, and the date of purchase; there are essentially no quantity discounts.5 All of these components of the pricing structure are in our data.

Table II shows the annuity rates by age and gender for different guarantee choices from January 1992; these correspond to roughly the middle of the sales period we study (1988-1994) and are roughly in the middle of the range of rates over the period. Annuity rates decline, of course, with the length of guarantee. Thus, for example, a 65 year old male in 1992 faced a choice among a 0 guarantee with an annuity rate of 0.133, a 5 year guarantee with a rate of 0.1287, and a 10 year guarantee with a rate of 0.1198. The magnitude of the rate differences across guarantee options closely tracks expected mortality. For example, our mortality estimates (discussed later) imply that for 60 year old females the probability of dying within a guarantee period of 5 and 10 years is about 4.3 and 11.4 percent, respectively, while for 65 year old males these probabilities are about 7.4 and 18.9 percent. Consequently, as shown in Table II, the annuity rate differences across guarantee periods are much larger for 65 year old males than they are for 60 year old females.

Table II.

Annuity payment rates

| Guarantee Length | 60 Females | 65 Females | 60 Males | 65 Males |

|---|---|---|---|---|

| 0 | 0.1078 | 0.1172 | 0.1201 | 0.1330 |

| 5 | 0.1070 | 0.1155 | 0.1178 | 0.1287 |

| 10 | 0.1049 | 0.1115 | 0.1127 | 0.1198 |

These are the rates from January 1992, which we use in our baseline specification. A rate is per pound annuitized. For example, a 60 year old female who annuitized X pounds and chose a 0 year guarantee will receive a nominal payment of 0.1078X every year until she dies.

The firm did not change the formula by which it sets annuity rates over our sample of annuity sales. Changes in nominal payment rates over time reflect changes in interest rates. To use such variation in annuity rates for estimation would require assumptions about how the interest rate that enters the individual's value function covaries with the interest rate faced by the firm, and whether the individual's discount rate covaries with these interest rates. Absent any clear guidance on these issues, we analyze the guarantee choice with respect to one particular menu of annuity rates. For our baseline model we use the January 1992 menu shown in Table II. In the robustness analysis, we show that the welfare estimates are virtually identical if we choose pricing menus from other points in time; this is not surprising since the relative payouts across guarantee choices is quite stable over time. For this reason, the results hardly change if we instead estimate a model with time-varying annuity rates, but constant discount factor and interest rate faced by annuitants (not reported).

Representativeness

Although the firm whose data we analyze is one of the largest U.K. annuity sellers, a fundamental issue when using data from a single firm is how representative it is of the market as a whole. We obtained details on market-wide practices from Moneyfacts (1995), Murthi, Orszag, and Orszag (1999), and Finkelstein and Poterba (2002).

On all dimensions we are able to observe, our sample firm appears typical of the industry as a whole. The types of contracts it offers are standard for this market. In particular, like all major companies in this market during our time period, it offers a choice of 0, 5, and 10 year guaranteed, nominal annuities.

The pricing practices of the firm are also typical. The annuitant characteristics that the firm uses in setting annuity rates (described above) are standard in the market. In addition, the level of annuity rates in our sample firm's products closely match industry-wide averages.

While market-wide data on characteristics of annuitants and the contracts they choose are more limited, the available data suggest that the annuitants in this firm and the contracts they choose are typical of the market. In our sample firm, the average age of purchase is 62, and 59 percent of purchasers are male. The vast majority of annuities purchased pay a constant nominal payment stream (as opposed to one that escalates over time), and provide a guarantee, of which the 5 year guarantee is by far the most common.6 These patterns are quite similar to those in another large firm in this market analyzed by Finkelstein and Poterba (2004), as well as to the reported characteristics of the broader market as described by Murthi, Orszag, and Orszag (1999).

Finally, the finding in our data of a higher mortality rate among those who choose a 5 year guarantee than those who choose no guarantee is also found elsewhere in the market. Finkelstein and Poterba (2004) present similar patterns for another firm in this market, and Finkelstein and Poterba (2002) present evidence on annuity rates that is consistent with such patterns for the industry as a whole.

Thus, while caution must always be exercised in extrapolating from a single firm, the available evidence suggests that the firm appears to be representative – both in the nature of the contracts it offers and its consumer pool – of the entire market.

3. MODEL: SPECIFICATION, IDENTIFICATION, AND ESTIMATION

We start by discussing a model of guarantee choice for a particular individual. We then complete the empirical model by describing how (and over which dimensions) we allow for heterogeneity. We finish this section by discussing the identification of the model, our parameterization, and the details of the estimation.

3.1. A model of guarantee choice

We consider the utility-maximizing guarantee choice of a fully rational, forward looking, risk averse, retired individual, with an accumulated stock of wealth, stochastic mortality, and time-separable utility. This framework has been widely used to model annuity choices (Kotlikoff and Spivak (1981), Mitchell, Poterba, Warshawsky, and Brown (1999), Davidoff, Brown, and Diamond (2005)). At the time of the decision, the age of the individual is t0, and he expects a random length of life7 characterized by a mortality hazard κt during period t > t0.8 We also assume that there exists time T after which individual i expects to die with probability one.

Individuals obtain utility from two sources. When alive, they obtain flow utility from consumption. When dead, they obtain a one-time utility that is a function of the value of their assets at the time of death. In particular, if the individual is alive as of the beginning of period t ≤ T , his period t utility, as a function of his current wealth wt and his consumption plan ct, is given by

| (1) |

where u(·) is his utility from consumption and b(·) is his utility from wealth remaining after death. A positive valuation for wealth at death may stem from a number of possible underlying structural preferences, such as a bequest motive (Sheshinski (2006)) or a “regret” motive (Braun and Muermann (2004)). Since the exact structural interpretation is not essential for our goal, we remain agnostic about it throughout the paper.

In the absence of an annuity, the optimal consumption plan can be computed by solving the following program:

| (2) |

where δ is the per-period discount rate and r is the per-period real interest rate. That is, we make the standard assumption that, due to mortality risk, the individual cannot borrow against the future. Since death is expected with probability one after period T, the terminal condition for the program is given by .

Suppose now that the individual annuitizes a fraction η of his initial wealth, w0. Broadly following the institutional framework discussed earlier, individuals take the (mandatory) annuitized wealth as given. In exchange for paying ηw0 to the annuity company at t = t0, the individual receives a per-period real payout of zt when alive. Thus, the individual solves the same problem as above, with two small modifications. First, initial wealth is given by (1 – η)w0. Second, the budget constraint is modified to reflect the additional annuity payments zt received every period.

For a given annuitized amount ηw0, consider a choice from a set of possible guarantee lengths; during the guaranteed period, the annuity payments are not survival-contingent. Each guarantee length g ∈ G corresponds to a per-period payout stream of zt(g), which is decreasing in . For each g, the optimal consumption plan can be computed by solving

| (3) |

where is the present value of the remaining guaranteed payments. As before, since after period T death is certain and guaranteed payments stop for sure (recall, ), the terminal condition for the program is given by .

The optimal guarantee choice is then given by

| (4) |

Information about the annuitant's guarantee choice combined with the assumption that this choice was made optimally thus provides information about the annuitant's underlying preference and expected mortality parameters. Intuitively, everything else equal, a longer guarantee will be more attractive for individuals with higher mortality rate and for individuals who obtain greater utility from wealth after death. We later check that this intuition in fact holds in the context of the specific parametrized model we estimate.

3.2. Modeling heterogeneity

To obtain our identification result in the next section, we make further assumptions that allow only one-dimensional heterogeneity in mortality risk and one-dimensional heterogeneity in preferences across different individuals in the above model.

We allow for one-dimensional heterogeneity in mortality risk by using a mixed proportional hazard (MPH) model. That is, we assume that the mortality hazard rate of individual i at time t is given by

| (5) |

where mi denotes the realized mortality date, ψ(t) the baseline hazard rate, xi is an observable that shifts the mortality rate, and αi ∈ R+ represents unobserved heterogeneity. We also assume that individuals have perfect information about this stochastic mortality process; that is, we assume that individuals know their θit's. This allows us to integrate over this continuous hazard rate to obtain the vector that enters the guarantee choice model.

We allow for one-dimensional heterogeneity in preferences by assuming that ui(c) is homogeneous across all individuals and that bi(w) is the same across individuals up to a multiplicative factor. Moreover, we assume that

| (6) |

and

| (7) |

That is, we follow the literature and assume that all individuals have a (homogeneous) CRRA utility function, but, somewhat less standard, we specify the utility from wealth at death using the same CRRA form with the same parameter γ, and allow (proportional) heterogeneity across individuals in this dimension, captured by the parameter βi. One can interpret βi as the relative weight that individual i puts on wealth when dead relative to consumption while alive. All else equal, a longer guarantee is therefore more attractive when βi is higher. We note, however, that since u(·) is defined over a flow of consumption while b(·) is defined over a stock of wealth, it is hard to interpret the level of βi directly. We view this form of heterogeneity as attractive both for intuition and for computation; in Section 6 we investigate alternative assumptions regarding the nature of preference heterogeneity.

Since we lack data on individuals’ initial wealth , we chose the utility function above to enable us to ignore . Specifically, our specification implies that preferences are homothetic, and – combined with the fact that guarantee payments are proportional to the annuitized amount (see Section 2) – that an individual's optimal guarantee choice is invariant to initial wealth . This simplifies our analysis, as it means that in our baseline specification unobserved heterogeneity in initial wealth is not a concern. It is, however, potentially an unattractive modeling decision, since it is not implausible that wealthier individuals care more about wealth after death. In Section 6 we explore specifications with non-homothetic preferences, but this requires us to make an additional assumption regarding the distribution of initial wealth. With richer data that included we could estimate a richer model with non-homothetic preferences.

Finally, we treat a set of other parameters that enter the guarantee choice model as observable (known) and identical across all annuitants. Specifically, as we describe later, we use external data to calibrate the values for risk aversion γ, the discount rate δ, the fraction of wealth which is annuitized η, and the real interest rate r. While in principle we could estimate some of these parameters, they would be identified solely by functional form assumptions. We therefore consider it preferable to choose reasonable calibrated values, rather than impose a functional form that would generate these reasonable values. Some of these calibrations are necessitated by the limitations of our existing data. For example, we observe the annuitized amount so with richer data on wealth we could readily incorporate heterogeneity in ηi into the model.

3.3. Identification

In order to compute the welfare effect of various counterfactual policies, we need to identify the distribution (across individuals) of preferences and mortality rates. Here we explain how the assumptions we made allow us to recover this distribution from the data we observe about the joint distribution of mortality outcomes and guarantee choices. We make the main identification argument in the context of a continuous guarantee choice set, a continuous mortality outcome, and no truncation or censoring. In the end of the section we discuss how things change with a discrete guarantee choice and mortality outcomes that are left truncated and right censored, as we have in our setting. This requires us to make additional assumptions, which we discuss later.

Identification with a continuous guarantee choice (and uncensored mortality outcomes)

To summarize briefly, our identification is achieved in two steps. In the first step we identify the distribution of mortality rates from the observed marginal (univariate) distribution of mortality outcomes. This is possible due to the mixed proportional hazard model we assumed. In the second step we use the model of guarantee choice and the rest of the data – namely, the distribution of guarantee choices conditional on mortality outcomes – to recover the distribution of preferences and how it correlates with the mortality rate. The key conceptual step here is an exclusion restriction, namely that the mortality process is not affected by the guarantee choice. We view this “no moral hazard” assumption as natural in our context.

We start by introducing notation. The data about individual i is (mi, gi, xi), where mi is his observed mortality outcome, gi ∈ G his observed guarantee choice, and xi is a vector of observed (individual) characteristics. The underlying object of interest is the joint distribution of unobserved preferences and mortality rates F(α, β|x), as well as the baseline mortality hazard rate (θ0(xi) and ψ(t)). Identification requires that, with enough data, these objects of interest can be uniquely recovered.

At the risk of repetition, let us state four important assumptions that are key to the identification argument.

Assumption 1 Guarantee choices are given by , which comes from the solution to the guarantee choice model of Section 2.1.

Assumption 2 (MPH) Mortality outcomes are drawn from a mixed proportional hazard (MPH) model. That is, θit = αi θ0(xi)ψ(t) with αi ∈ R+.

Assumption 3 (No moral hazard) mi is independent of βi, conditional on αi.

Assumption 4 (Complete information) .

The first assumption simply says that all individuals in the data make their guarantee choices using the model. It is somewhat redundant, as it is only the model that allows us to define κi and βi, but we state it for completeness. The second assumption (MPH) is key for the first step of the identification argument. This assumption will drive our ability to recover the distribution of mortality rates from mortality data alone. Although this is a non-trivial assumption, it is a formulation which is broadly used in much of the duration data literature (Van den Berg (2001)). We note that assuming that αi is one-dimensional is not particularly restrictive, as any multidimensional αi could be summarized by a one-dimensional statistic in the context of the MPH model.

The third assumption formalizes our key exclusion restriction. It states that θit is a sufficient statistic for mortality, and although βi may affect guarantee choices gi, this in turn doesn't affect mortality. In other words, if individuals counterfactually change their guarantee choice, their mortality experience will remain unchanged. This seems a natural assumption in our context. We note that, unconditionally, βi could be correlated with mortality outcomes indirectly, through a possible cross-sectional correlation between αi and βi.

The fourth and final assumption states that individuals have perfect information about their mortality process; that is, we assume that individuals know their θit's. This allows us to integrate over this continuous hazard rate to obtain the vector that enters the guarantee choice model, so we can write g(αi, βi) instead of . This is however a very restrictive assumption, and its validity is questionable. Fortunately, we note that any other information structure – that is, any known (deterministic or stochastic) mapping from individuals’ actual mortality process θit to their perception of it κi – would also work for identification. Indeed, we investigate two such alternative assumptions in Section 6.4. Some assumption about the information structure is required since we lack data on individuals’ ex ante expectations about their mortality.

Before deriving our identification results, we should point out that much of the specification decisions, described in the previous section, were made to facilitate identification. That is, many of the assumptions were made so that preferences and other individual characteristics are known up to a one-dimensional unobservable βi. This is a strong assumption, which rules out interesting cases of, for example, heterogeneity in both risk aversion and utility from wealth after death.

We now show identification of the model in two steps, in Proposition 1 and Proposition 2.

Proposition 1 If (i) Assumption 2 holds; (ii) E[α] < ∞; and (iii) θ0(xi) is not a constant, then the marginal distribution of αi, Fα(αi), as well as θ0(xi) and ψ(t), are identified – up to the normalizations E[α] = 1 and θ0(xi) = 1 for some i – from the conditional distribution of Fm(mi|xi).

This proposition is the well known result that MPH models are non-parameterically identified. It was first proven by Elbers and Ridder (1982). Heckman and Singer (1984) show a similar result, but instead of assuming that α has a finite mean, they make an assumption about the tail behavior of α. Ridder (1990) discusses the relationship between these two assumptions, and Van den Berg (2001) reviews these and other results. The key requirement is that xi (such as a gender dummy variable in our context) shifts the mortality distribution.

We can illustrate the intuition for this result using two values of θ0(xi), say θ1 and θ2. The data then provides us with two distributions of mortality outcomes, Hj(m) = F(m|θ0(xi) = θj) for j = 1, 2. With no heterogeneity in αi, the MPH assumption implies that the hazard rates implied by H1(m) and H2(m) should be a proportional shift of each other. Once αi is heterogeneous, however, the difference between θ1 and θ2 leads to differential composition of survivors at a given point in time. For example, if θ1 is less than θ2, then high αi people will be more likely to survive among those with θ1. Loosely, as time passes, this selection will make the hazard rate implied by closer to that implied by . With continuous (and uncensored) information about mortality outcomes, these differential hazard rates between the two distributions can be used to back out the entire distribution of αi, Fα (αi), which will then allow us to know θ0(xi) and ψ(t).

This result is useful because it shows that we can obtain the (marginal) distribution of αi (and the associated θ0(xi) and ψ(t) functions) from mortality data alone, i.e. from the marginal distribution of mi. We now proceed to the second step, which shows that given θ0(xi), ψ(t), and Fα(·), the joint distribution F(α, β|x) is identified from the observed joint distribution of mortality and guarantee choices. Although covariates were necessary to identify θ0(xi), ψ(t), and Fα(·), they will play no role in what follows, so we will omit them for convenience for the remainder of this section.

Proposition 2 If Assumptions 1-4 hold, then the joint distribution of mortality outcomes and guarantee choices identifies Pr(g(α, β ) ≤ y|α). Moreover, if, for every value of α, g(α, β) is invertible with respect to β then Fβ|α is identified.

The proof is provided in Appendix B. Here we provide intuition, starting with the first part of the proposition. If we observed αi, identifying Pr(g(α, β) ≤ y|α) would have been trivial. We could simply estimate the cumulative distribution function of gi for every value of αi off the data. While in practice we can't do exactly this because αi is unobserved, we can almost do this using the mortality information mi and our knowledge of the mortality process (using Proposition 1). Loosely, we can estimate Pr(g(α, β) ≤ y|m) off the data , and then “invert” it to Pr(g(α, β) ≤ y|α) using knowledge of the mortality process. That is, we can write

| (8) |

where the left hand side is known from the data, and fm(m|α) (the conditional density of mortality date) and Fα(α) are known from the mortality data alone (Proposition 1). The proof (in Appendix B) simply verifies that this integral can be inverted. The second part of Proposition 2 is fairly trivial. If Pr(g(α, β) ≤ y|α) is identified for every α, and g(α, β) is invertible (with respect to β) for every α, then it is straightforward to obtain Pr(β ≤ y|α) for every α. This together with the marginal distribution of α, which is identified through Proposition 1, provides the entire joint distribution.

One can see that the invertibility of g(α, β) (with respect to β) is important. The identification statement is stated in such a way because, although intuitive, proving that the guarantee choice is monotone (and therefore invertible) in βis difficult. The difficulty arises due to the dynamics and non-stationarity of the guarantee choice model, which require its solution to be numerical and make general characterization of its properties difficult. One can obtain analytic proofs of this monotonicity property in simpler (but empirically less interesting) environments (e.g., in a two period model, or in an infinite horizon model with log utility). We note, however, that we are reassured about our simple intuition based on numerical simulations; the monotonicity result holds for any specification of the model and/or values of the parameters that we have tried, although absent an analytical proof some uncertainty must remain regarding identification.

Implications of a discrete guarantee choice and censored mortality outcomes

In many applications the (guarantee) choice is discrete, so – due to its discrete nature – g(β|α) is only weakly monotone in β, and therefore not invertible. In that case, the first part of Proposition 2 still holds, but Pr(β ≤ y|α) is identified only in a discrete set of points, so some parametric assumptions will be needed to recover the entire distribution of β, conditional on α. In our specific application, there are only three guarantee choices, so we can only identify the marginal distribution of α, F(α), and, for every value of α, two points of the conditional distribution Fβ|α. We therefore recover the entire joint distribution by making a parametric assumption (see below) that essentially allows us to interpolate Fβ|α from the two points at which it is identified to its entire support. We note that, as in many discrete choice models, if we had data with sufficiently rich variation in covariates or variation in annuity rates that was exogenous to demand, we would be non-parameterically identified even with a discrete choice set.

Since our data limitations mean that we require a parametric assumption for Fβ|α we try to address concerns about such (ad hoc) parametric assumptions by investigating the sensitivity of the results to several alternatives in Section 6. An alternative to a parametric interpolation is to make no attempt at interpolation, and to simply use the identified points as bounds on the cumulative distribution function. In Section 6 we also report such an exercise.

A second property of our data that makes it not fully consistent with the identification argument above is the censoring of mortality outcomes. Specifically, we do not observe mortality dates for those who are alive by the end of 2005, implying that we have no information in the data about mortality hazard rates for individuals older than 83. While we could identify and estimate a non-parametric baseline hazard for the periods for which mortality data are available (as well as a non-parametric distribution of αi), there is obviously no information in the data about the baseline hazard rate for older ages. Because evaluating the guarantee choice requires knowledge of the entire mortality process (through age T , which we assume to be 100), some assumption about this baseline hazard is necessary. We therefore make (and test for) a parametric assumption about the functional form of the baseline hazard.

3.4. Parameterization

Mortality process

As we have just mentioned, due to the censored mortality data, we make a parametric assumption about the mortality hazard rate. Specifically, we assume that the baseline hazard rate follows a Gompertz distribution with shape parameter λ. That is, the baseline hazard rate is given by ψ(t) = eλt and individual i's mortality hazard at time t = agei 60 is therefore given by ψi(t) = αieλt. We can test the Gompertz assumption in our sample against more flexible alternatives by focusing on individuals’ mortality experience prior to the age of 83. We are reassured that the Gompertz assumption cannot be rejected by our (censored) mortality data.9 We also note that the Gompertz distribution is widely used in the actuarial literature that models mortality (Horiuchi and Coale (1982)).

We model mortality as a continuous process and observe mortality at the daily level. However, since the parameterized version of the guarantee choice model is solved numerically, we work with a coarser, annual frequency, reducing the computational burden. In particular, given the above assumption, let

| (9) |

be the Gompertz survival function, and the discrete (annual) hazard rate at year t is given by .

Unobserved heterogeneity

An individual in our data can be characterized by an individual-specific mortality parameter αi and an individual-specific preference parameter βi. Everything else is assumed common across individuals. Although, as we showed, the joint distribution F(α, β) is non-parameterically identified with continuous guarantee choice, in practice only three guarantee lengths are offered, so we work with a parametrized distribution.

In the baseline specification we assume that αi and βi are drawn from a bivariate lognormal distribution

| (10) |

In Section 6 we explore other distributional assumptions.

Calibrated values for other parameters

As mentioned, we treat a set of other parameters – γ, δ, η, and r – as observables, and calibrate their values. Here, we list the calibrated values and their source; in Section 6 we assess the sensitivity of the results to these values.

Since the insurance company does not have information on the annuitant's wealth outside of the annuity, we calibrate the fraction of wealth annuitized (η) based on Banks and Emmerson (1999), who use market-wide evidence from the Family Resources Survey. They report that for individuals with compulsory annuity payments, about one-fifth of income (and therefore presumably of wealth) comes from the compulsory annuity. We therefore set η = 0.2. In Section 6 we discuss what the rest of the annuitants’ wealth portfolio may look like and how this may affect our counterfactual calculations.

We use γ = 3 as the coefficient of relative risk aversion. A long line of simulation literature uses this value (Hubbard, Skinner, and Zeldes (1995), Engen, Gale, and Uccello (1999), Mitchell, Poterba, Warshawsky, and Brown (1999), Scholz, Seshadri, and Khitatrakun (2003), Davis, Kubler, and Willen (2006)). Although a substantial consumption literature, summarized in Laibson, Repetto, and Tobacman (1998), has found risk aversion levels closer to 1, as did Hurd's (1989) study among the elderly, other papers report higher levels of relative risk aversion (Barsky, Kimball, Juster, and Shapiro (1997), Palumbo (1999)).

For r we use the real interest rate corresponding to the inflation-indexed zero-coupon ten-year Bank of England bond, as of the date of the pricing menu we use (January 1, 1992, in the baseline specification). This implies a real interest rate r of 0.0426. We also assume that the discount rate δ is equal to the real interest rate r.

Finally, since the annuities make constant nominal payments, we need an estimate of the expected inflation rate π to translate the initial nominal payment rate shown in Table II into the real annuity payout stream zt in the guarantee choice model. We use the difference between the real and nominal interest rates on the zero-coupon ten year Treasury bonds on the same date to measure the (expected) inflation rate. This implies an (expected) inflation rate π of 0.0498.10

Summary and intuition

Thus, to summarize, in the baseline specification we estimate six remaining structural parameters: the five parameters of the joint distribution of αi and βi, and the shape parameter λ of the Gompertz distribution. We also allow for observable shifters to the means of the distribution. Specifically, we allow μα and μβ to vary based on the individual's gender and age at the time of annuitization. We do this because annuity rates vary with these characteristics, presumably reflecting differential mortality by gender and age of annuitization; so that our treatment of preferences and mortality is symmetric, we also allow mean preferences to vary on these same dimensions.

To gain intuition, note that one way to summarize the mortality data is by a graph of the log hazard mortality rate with respect to age. The Gompertz assumption implies that, without heterogeneity, this graph is linear with a slope of λ. Heterogeneity implies a concave graph, as over time lower mortality individuals are more likely to survive. Thus, loosely, the level of this graph affects the estimate of μα, the average slope affects the estimate of λ, and the concavity affects the estimate of σα . Since σα is a key parameter (which determines the extent of adverse selection), in Section 6 we explore the sensitivity of the results to more and less concave baseline hazard models.

Consider now the data on guarantee choices, and its relationship to mortality outcomes. Suppose first that there was no heterogeneity in mortality rates (σα = 0). In such a case, the guarantee choice model would reduce to a standard ordered probit with three choices (see equation (14) below), and the thresholds would be known from the guarantee choice model and estimates of μα and λ. In this simple case the mean and variance of β would be directly estimated off the observed shares of the three different guarantee choices.

It is the presence of unobserved heterogeneity in mortality risk (σα > 0) that makes intuition more subtle. The guarantee choice is still similar to an ordered probit, but the thresholds (which depend on αi) are now unobserved. Therefore, the model is similar to an ordered probit with random effects. This is where the relationship between mortality and guarantee choices is crucial. By observing mi, we obtain information about the unobserved αi. Although this information is noisy (due to the inherent randomness of any hazard model), it is still useful in adjusting the weights Pr(mi|α, λ) in the integral in equations (13) and (14) below. Loosely, individuals who (ex post) die earlier are more likely (from the econometrician's perspective) to be of higher (ex ante) mortality rate αi. Therefore, the mortality data is used as a stochastic shifter of the individual random effects. This allows separate identification of σβ and the correlation parameter ρ.

3.5. Estimation

For computational convenience, we begin by estimating the shape parameter of the Gompertz hazard λ using only mortality data. We then use the guarantee choice and mortality data together to estimate the parameters of the joint distribution F(α, β). We estimate the model using maximum likelihood. Here we provide a general overview; more details are provided in Appendix C.

Estimation of the parameters of the baseline hazard rate (λ)

We observe mortality in daily increments, and treat it as continuous for estimation. We normalize ti = agei – 60 (as 60 is the age of the youngest individual who makes a guarantee choice in our sample). For each individual i, the mortality data can be summarized by mi = (ci; ti; di) where ci is the (normalized) age at which individual i entered the sample (due to left truncation) and ti is the age at which he exited the sample (due to death or censoring). di is an indicator for whether the person died (di = 1) or was censored (di = 0).

Conditional on α, the likelihood of observing mi is

| (11) |

where S(·) is the Gompertz survival function (see equation (9)) and is the Gompertz density. Our incorporation of ci into the likelihood function accounts for the left truncation in our data.

We estimate λ using only mortality data. We do so by using equation (11) and integrating over αi. That is, we maximize the following likelihood

| (12) |

to obtain a consistent estimate of λ.11

Estimation of the parameters of F(α, β)

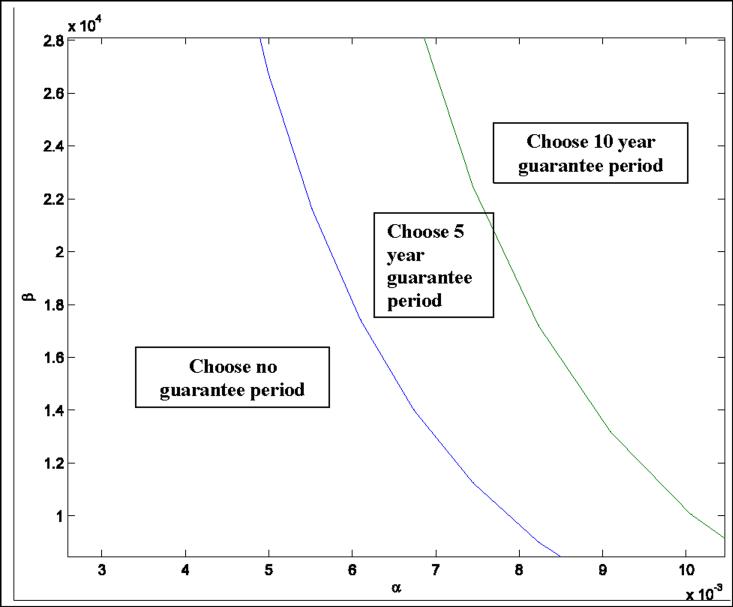

Having estimated λ, we can then use the guarantee choice model to numerically compute the optimal guarantee choice for each combination of αi and βi. This choice is also a function of the other (calibrated) parameters of the model and of the observed annuity rates. Consistent with intuition, the numerical solution to the model has the property that the relative value that individual i obtains from a (longer) guarantee is increasing in both αi and βi. Recall that this monotonicity property is important for identification; specifically, it is key to proving the second part of Proposition 2. This implies that for any value of αi, the guarantee choice can be characterized by two cutoff points: and . The former is the value of βi that makes an individual (with parameter αi) indifferent between choosing no guarantee and a 5 year guarantee, while the latter is the value of βi that makes an individual (with parameter αi) indifferent between choosing a 5 year and a 10 year guarantee. For almost all relevant values of αi the baseline model – as well as other variants we estimated – and its specification results in , implying that there exists a range of βi's that implies a choice of a 5 year guarantee (the modal choice in the data). For some extreme values of αi this does not hold, but because αi is unobserved this does not create any potential problem. Figure 1 illustrates the optimal guarantee choice in the space of αi and βi, in the context of the baseline specification and the mortality data (which were used to estimate λ).

Figure 1.

Schematic indifference sets

The figure provides an illustration of the pairs of points (α, β) which would make individuals indifferent between choosing 0 year guarantee and 5 year guarantee (lower left curve) and between 5 year guarantee and 10 year guarantee (upper right curve). These particular curves are computed based on our baseline estimate of λ and the annuity rates faced by 65 year old males; the sets are not a function of the other estimated parameters. Individuals are represented as points in this space, with individuals between the curves predicted to choose 5 year guarantee, and individuals below (above) the lower (upper) curve predicted to choose 0 (10) year guarantee.

Keeping λ fixed at its estimate, we then estimate the parameters of F(α, β) by maximizing the likelihood of guarantee choices and mortality. The likelihood depends on the observed mortality data mi and on individual i's guarantee choice gi ∈ {0, 5, 10}. We can write the contribution of individual i to the likelihood as

| (13) |

where F(α; μ, Σ) is the marginal distribution of αi, F(β|α; μ, Σ) is the conditional distribution of βi, λ is the Gompertz shape parameter, Pr(mi|α, λ ) is given in equation (11), 1(·) is the indicator function, and the value of the indicator function is given by the guarantee choice model discussed in Section 3.1.

Given the monotonicity of the optimal guarantee choice in βi (and ignoring – for presentation only – the rare cases of ), we can rewrite equation (13) as

| (14) |

That is, the inner integral in equation (13) becomes an ordered probit, where the cutoff points are given by the location in which a vertical line in Figure 1 crosses the two curves.

The primary computational challenge in maximizing the likelihood is that, in principle, each evaluation of the likelihood requires us to resolve the guarantee choice model and compute these cutoff points for a continuum of values of α. Since the guarantee choice model is solved numerically, this is not trivial. Therefore, instead of recalculating these cutoffs at every evaluation of the likelihood, we calculate the cutoffs on a large grid of values of α only once and then interpolate to evaluate the likelihood. Unfortunately, since the cutoffs also depend on λ, this method does not allow us to estimate λ jointly with all the other parameters. We could calculate the cutoffs on a grid of values of both α and λ, but this would increase computation time substantially. This is why, at some loss of efficiency but not of consistency, we first estimate λ using only the mortality portion of the likelihood, fix λ at this estimate, calculate the cutoffs, and estimate the remaining parameters from the full likelihood above. To compute standard errors, we use a nonparametric bootstrap.

4. ESTIMATES AND FIT OF THE BASELINE MODEL

4.1. Parameter estimates

Table III reports the parameter estimates. We estimate significant heterogeneity across individuals, both in their mortality and in their preference for wealth after death. We estimate a positive correlation (ρ) between mortality and preference for wealth after death. That is, individuals who are more likely to live longer (lower α) are likely to care less about wealth after death. This positive correlation may help to reduce the magnitude of the inefficiency caused by private information about risk; individuals who select larger guarantees due to private information about their mortality (i.e. high α individuals) are also individuals who tend to place a relatively higher value on wealth after death, and for whom the cost of the guarantee is not as great as it would be if they had relatively low preferences for wealth after death.

Table III.

Parameter estimates

| Estimate | Std. Error | ||

|---|---|---|---|

| μ α | 60 Females | −5.76 | (0.165) |

| 65 Females | −5.68 | (0.264) | |

| 60 Males | −4.74 | (0.223) | |

| 65 Males | −5.01 | (0.189) | |

| σ α | 0.054 | (0.019) | |

| λ | 0.110 | (0.015) | |

| μ β | 60 Females | 9.77 | (0.221) |

| 65 Females | 9.65 | (0.269) | |

| 60 Males | 9.42 | (0.300) | |

| 65 Males | 9.87 | (0.304) | |

| σ β | 0.099 | (0.043) | |

| ρ | 0.881 | (0.415) | |

| No. of Obs. | 9,364 |

These estimates are for the baseline specification described in the text. Standard errors are in parentheses. Since the value of λ is estimated separately, in a first stage, we bootstrap the data to compute standard errors using 100 bootstrap samples.

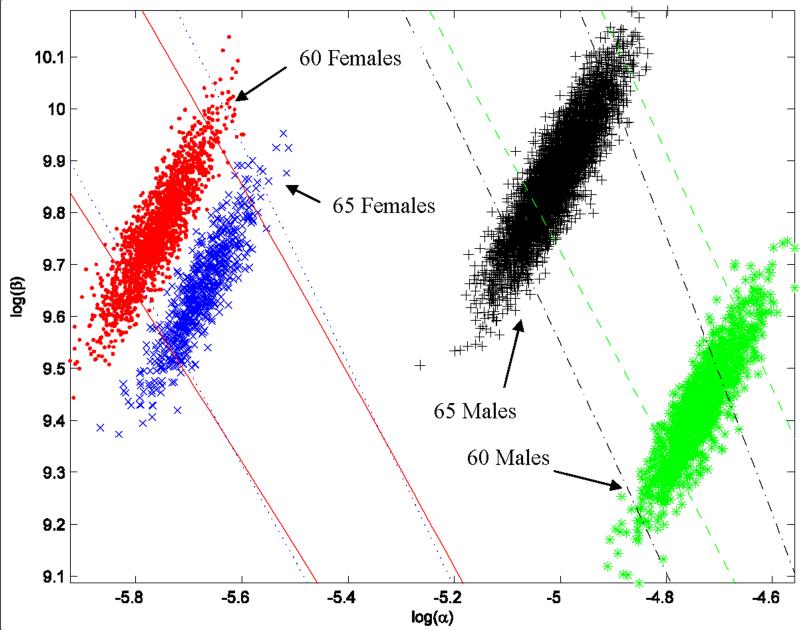

For illustrative purposes, Figure 2 shows random draws from the estimated distribution of log α and log β for each age-gender cell, juxtaposed over the estimated indifference sets for that cell. The results indicate that both mortality and preference heterogeneity are important determinants of guarantee choice. This is similar to recent findings in other insurance markets that preference heterogeneity can be as or more important than private information about risk in explaining insurance purchases (Finkelstein and McGarry (2006), Cohen and Einav (2007), Fang, Keane, and Silverman (2008)). As discussed, we refrain from placing a structural interpretation on the β parameter, merely noting that a higher β reflects a larger preference for wealth after death relative to consumption while alive. Nonetheless, our finding of heterogeneity in β is consistent with other estimates of heterogeneity in the population in preferences for leaving a bequest (Laitner and Juster (1996), Kopczuk and Lupton (2007)).

Figure 2.

Estimated distributions

The figure presents the estimated indifference sets for each age-gender cell, with a scatter plots from the estimated joint distribution of (logα,logβ) super-imposed; each point is a random draw from the estimated distribution in the baseline specification. The estimated indifference sets for the 65 year old males are given by the pair of dark dashed lines, for the 60 year old males by the pair of lighter dashed lines, for the 65 year old females by the pair of dotted lines, and for the 60 year old females by the pair of solid lines. The estimated indifference sets for the 65 year old males are the same as those shown in Figure 1 (but a “close up” and in log scale).

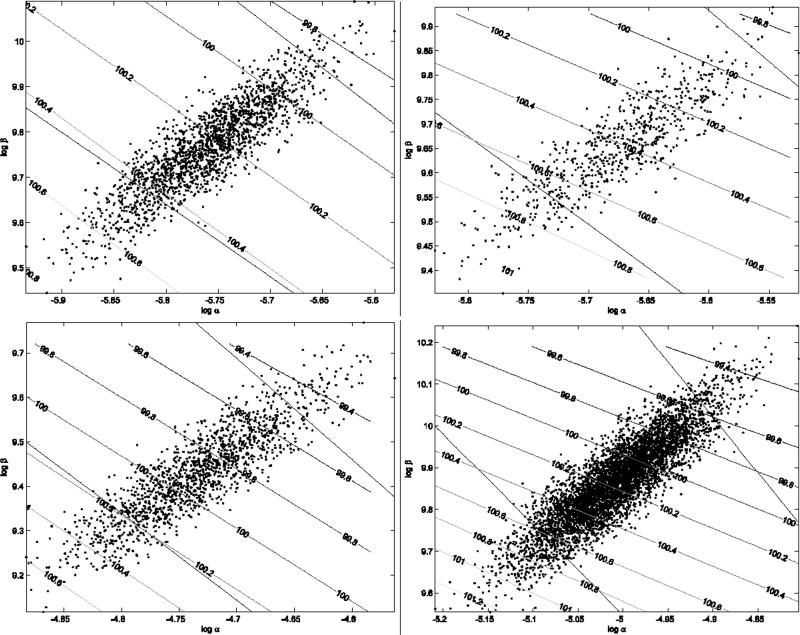

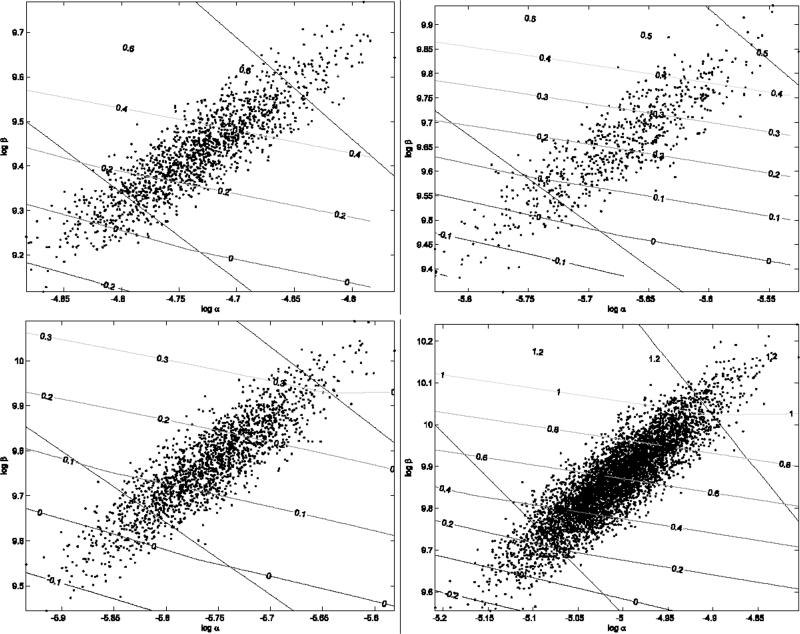

4.2. Model fit

Table IV and Table V present some results on the in-sample and out-of-sample fit of the model, respectively. We report results both overall and separately for each age-gender cell. Table IV shows that the model fits very closely the probability of choosing each guarantee choice, as well as the observed probability of dying within our sample period. The model does, however, produce a monotone relationship between guarantee choice and mortality rate, while the data show a non-monotone pattern, with individuals who choose a 5 year guarantee period associated with highest mortality. As previously discussed (see footnote 4), the non-monotone pattern in the data may merely reflect sampling error; we are unable to reject the null that the 5 and 10 year guarantees have the same mortality rate.

Table IV.

Within-sample fit

| 60 Females | 65 Females | 60 Males | 65 Males | Overall | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Observed | Predicted | Observed | Predicted | Observed | Predicted | Observed | Predicted | Observed | Predicted | |

| Fraction choosing 0 year guarantee | 14.00 | 14.42 | 15.98 | 15.32 | 15.30 | 14.49 | 6.99 | 7.10 | 10.24 | 10.22 |

| Fraction choosing 5 year guarantee | 83.94 | 83.16 | 82.03 | 83.21 | 78.67 | 80.27 | 89.98 | 89.75 | 86.52 | 86.57 |

| Fraction choosing 10 year guarantee | 2.06 | 2.42 | 2.00 | 1.47 | 6.03 | 5.25 | 3.04 | 3.15 | 3.24 | 3.22 |

| Fraction who die within observed mortality period: | ||||||||||

| Entire sample | 8.44 | 7.56 | 12.29 | 14.23 | 17.04 | 19.73 | 25.56 | 25.80 | 20.03 | 20.20 |

| Among those choosing 0 year guarantee | 6.75 | 6.98 | 7.69 | 13.21 | 17.65 | 18.32 | 22.77 | 23.14 | 15.75 | 18.60 |

| Among those choosing 5 year guarantee | 8.74 | 7.63 | 13.30 | 14.39 | 16.99 | 19.86 | 25.87 | 25.31 | 20.60 | 20.31 |

| Among those choosing 10 year guarantee | 8.11 | 8.48 | 7.69 | 16.05 | 16.09 | 21.67 | 22.89 | 27.88 | 18.48 | 22.37 |

This table summarizes the fit of our estimates within sample. For each age-gender cell, we report the observed quantity (identical to Table I) and the corresponding quantity predicted by the model. To construct the predicted death probability, we account for the fact that our mortality data is both censored and truncated, by computing predicted death probability for each individual in the data conditional on the date of annuity choice, and then integrating over all individuals.

Table V.

Out–of-sample fit

| 60 Females | 65 Females | 60 Males | 65 Males | Overall | |

|---|---|---|---|---|---|

| Life Expectency: | |||||

| 5th percentile | 87.4 | 86.7 | 79.4 | 81.4 | 79.8 |

| Median individual | 88.1 | 87.4 | 80.0 | 82.1 | 82.2 |

| 95th percentile | 88.8 | 88.2 | 80.7 | 82.8 | 88.4 |

| U.K. mortality table | 82.5 | 83.3 | 78.9 | 80.0 | 80.5 |

| Expected value of payments: | |||||

| 0 year guarantee | 19.97 | 20.34 | 20.18 | 21.41 | 20.63 |

| 5 year guarantee | 19.77 | 20.01 | 19.72 | 20.64 | 20.32 |

| 10 year guarantee | 19.44 | 19.49 | 19.12 | 19.61 | 19.45 |

| Entire sample | 19.79 | 20.05 | 19.74 | 20.66 | 20.32 |

| Break-even interest rate | 0.0414 | 0.0430 | 0.0409 | 0.0473 | 0.0448 |

This table summarizes the fit of our estimates out of sample. The top panel report life expectancies for different percentiles of the mortality distribution, using the parametric distribution on mortality to predict mortality beyond our mortality observation period. The bottom row of this panel presents the corresponding figures for the average pensioner, based on the PFL/PML 1992 period tables for “life office pensioners” (Institute of Actuaries (1992)). While the predicted life expectancy is several years greater, this is not a problem of fit; a similar difference is also observed for survival probabilities within sample. This simply implies that the average “life office pensioner” is not representative of our sample of annuitants. The bottom panel provides the implications of our mortality estimates for the profitability of the annuity company. These expected payments should be compared with 20, which is the amount annuitized for each individual in the model. Of course, since the payments are spread over a long horizon of several decades, the profitability is sensitive to the interest rate we use. The reported results use our baseline assumption of a real, risk-free interest rate of 0.043. The bottom row provides the interest rate that would make the annuity company break even (net of various fixed costs).

Table V compares our mortality estimates to two different external benchmarks. These speak to the out-of-sample fit of our model in two regards: the benchmarks are not taken from the data, and the calculations use the entire mortality distribution based on the estimated Gompertz mortality hazard, while our mortality data are right censored. The top panel of Table V reports the implications of our estimates for life expectancy. As expected, men have lower life expectancies than women. Men who purchase annuities at age 65 have higher life expectancies than those who purchase at age 60, which is what we would expect if age of annuity purchase were unrelated to mortality. Women who purchase at 65, however, have lower life expectancy than women who purchase at 60, which may reflect selection in the timing of annuitization, or the substantially smaller sample size available for 65 year old women. As one way to gauge the magnitude of the mortality heterogeneity we estimate, Table V indicates that in each age-gender cell, there is about a 1.4 year difference in life expectancy, at the time of annuitization, between the 5th and 95th percentile.

The fourth row of Table V contains life expectancy estimates for a group of U.K. pensioners whose mortality experience may serve as a rough proxy for that of U.K. compulsory annuitants.12 We would not expect our life expectancy estimates – which are based on the experience of actual compulsory annuitants in a particular firm – to match this rough proxy exactly, but it is reassuring that they are in a similar ballpark. Our estimated life expectancy is about 2 years higher. This difference is not driven by the parametric assumptions, but reflects higher survival probabilities for our annuitants than our proxy group of U.K. pensioners; this difference between the groups exists even within the range of ages for which we observe survival in our data and can compare the groups directly (not shown).

The bottom of Table V presents the average expected present discounted value (EPDV) of annuity payments implied by our mortality estimates and our assumptions regarding the real interest rate and the inflation rate. Since each individual's initial wealth is normalized to 100, of which 20 percent is annuitized, an EPDV of 20 would imply that the company, if it had no transaction costs, would break even. Note that nothing in our estimation procedure guarantees that we arrive at reasonable EPDV payments. It is therefore encouraging that for all the four cells, and for all guarantee choices within these cells, the expected payout is fairly close to 20; it ranges across the age-gender cells from 19.74 to 20.66. One might be concerned by an average expected payment that is slightly above 20, which would imply that the company makes negative profits. Note, however, that if the effective interest rate the company uses to discount its future payments is slightly higher than the risk-free rate of 0.043 that we use in the individual's guarantee choice model, the estimated EPDV annuity payments would all fall below 20. It is, in practice, likely that the insurance company receives a higher return on its capital than the risk free rate, and the bottom row of Table V shows that a slightly higher interest rate of 0.045 would, indeed, break even. In Section6 we show that our welfare estimates are not sensitive to using an interest rate that is somewhat higher than the risk free rate used in the baseline model.

As another measure of the out-of-sample fit, we examined the optimal consumption trajectories implied by our parameter estimates and the guarantee choice model. These suggest that most of the individuals are saving in their retirement (not shown). This seems contrary to most of the empirical evidence (e.g., Hurd (1989)), although there is evidence consistent with positive wealth accumulation among the very wealthy elderly (Kopczuk (2007)), and evidence, more generally, that saving behavior of high wealth individuals may not be representative of the population at large (Dynan, Skinner, and Zeldes (2004)); individuals in this market are higher wealth than the general U.K. population (Banks and Emmerson (1999)). In light of these potentially puzzling wealth accumulation results, we experimented with a variant of the baseline model that allows individuals to discount wealth after death more steeply than consumption while alive. Specifically, we modified the consumer per-period utility function (as shown in equation (1)) to be

| (15) |

where ζ is an additional parameter to be estimated. Our benchmark model corresponds to ζ = 1. Values of ζ < 1 imply that individuals discount wealth after death more steeply than consumption while alive. Such preferences might arise if individuals care more about leaving money to children (or grandchildren) when the children are younger than when they are older. We find that the maximum likelihood value of ζ is 1. Moreover, when we re-estimate the model imposing values of ζ relatively close to 1 (such as ζ = 0.95), we are able to produce more sensible wealth patterns in retirement, but do not have a noticeable effect on our core welfare estimates.

5. WELFARE ESTIMATES

We now take our parameter estimates as inputs in calculating the welfare consequences of asymmetric information and government mandates. We start by defining the welfare measure we use, and calculating welfare in the observed, asymmetric information equilibrium. We then perform two counterfactual exercises in which we compare equilibrium welfare to what would arise under a mandatory social insurance program that does not permit choice over guarantee, and under symmetric information. Although we focus primarily on the average welfare, we also briefly discuss distributional implications.

5.1. Measuring welfare

A useful monetary metric for comparing utilities associated with different annuity allocations is the notion of wealth-equivalent. The wealth-equivalent denotes the amount of initial wealth that an individual would require in the absence of an annuity, in order to be as well off as with his initial wealth and his annuity allocation. The wealth-equivalent of an annuity with guarantee period g and initial wealth of w0 is the implicit solution to

| (16) |

where both and are defined in Section 3. This measure is commonly used in the annuity literature (Mitchell, Poterba, Warshawsky, and Brown (1999), Davidoff, Brown, and Diamond (2005)).

A higher value of wealth-equivalent corresponds to a higher value of the annuity contract. If the wealth equivalent is less than initial wealth, the individual would prefer not to purchase an annuity. More generally, the difference between the wealth-equivalent and the initial wealth is the amount an individual is willing to pay in exchange for having access to the annuity contract. This difference is always positive for a risk averse individual who does not care about wealth after death and faces an actuarially fair annuity rate. It can take negative values if the annuity contract is over-priced (compared to the individual-specific actuarially fair rate) or if the individual sufficiently values wealth after death.

Our estimate of the average wealth-equivalent in the observed equilibrium provides a monetary measure of the welfare gains (or losses) from annuitization given equilibrium annuity rates and individuals’ contract choices. The difference between the average wealth equivalent in the observed equilibrium and in a counterfactual allocation provides a measure of the welfare difference between these allocations.

We provide two ways to quantify these welfare differences. The first provides an absolute monetary estimate of the welfare gain or loss associated with a particular counterfactual scenario. To do this, we scale the difference in wealth equivalents by the £6 billion which are annuitized annually (in 1998) in the U.K. annuity market (Association of British Insurers (1999)). Since the wealth equivalents are reported per 100 units of initial wealth and we assume that 20 percent of this wealth is annuitized, this implies that each unit of wealth-equivalent is equivalent, at the aggregate, to £300 million annually. We also occasionally refer to a per-annuitant welfare gain, which we compute by dividing the overall welfare effect by 300,000, which is our estimate of new annuitants in the U.K. market in 1998.13 Of course, one has to be cautious about these specific numbers, as they rely on extrapolating our estimates from our specific sample to the entire market.

While an absolute welfare measure may be a relevant benchmark for policies associated with the particular market we study, a relative measure may be more informative when considering using our estimates as a possible benchmark in other contexts, or examining the quantitative sensitivity of our estimates. For example, if we considered the decision to buy a one month guarantee, we would not expect efficiency costs associated with this decision to be large relative to life-time wealth. A relative welfare estimate essentially requires a normalization factor.

Therefore, to put these welfare estimates in perspective, we measure the welfare changes relative to how large this welfare change could have been, given the observed annuity rates. We refer to this maximum potential welfare change as the “Maximum Money at Stake” (MMS). We define the MMS as the minimum lump sum that individuals would have to receive to insure them against the possibility that they receive their least-preferred allocation in the observed equilibrium, given the observed equilibrium pricing. The MMS is therefore the additional amount of pre-existing wealth an individual requires so that they receive the same annual annuity payment if they purchase the maximum guarantee length (10 years) as they would receive if they purchase the minimum guarantee length (0 years).

The nature of the thought experiment behind the MMS is that the welfare loss from buying a 10 year guarantee is bounded by the lower annuity payment that the individual receives as a result. This maximum welfare loss would occur in the worst case scenario, in which the individual had no chance of dying during the first 10 years (or alternatively, no value of wealth after death). We report the MMS per 100 units of initial wealth (i.e., per 20 units of the annuitized amount)

| (17) |