Abstract

The coronavirus disease 2019 (COVID-19) pandemic resulted in widespread disruption to the global economy, including demand for imaging services. The resulting reduction in demand for imaging services had an abrupt and substantial impact on private radiology practices, which are heavily dependent on examination volumes for practice revenues. The goal of this article is to describe the specific experiences of radiologists working in various types of private radiology practices during the initial peak of the COVID-19 pandemic.

Herein, the authors describe factors determining the impact of the pandemic on private practices, the challenges these practices have faced, the cost levers leaders adjusted, and the government subsidies sought. In addition, the authors describe adjustments practices are making to their mid- and long-term strategic plans to pivot for long-term success while managing the COVID-19 pandemic. Private practices have crafted tiered strategies to respond to the impact of the pandemic by pulling various cost levers to adjust service availability, staffing, compensation, benefits, time off, and expense reductions. In addition, they have sought additional revenues, within the boundaries of their practice, to mitigate ongoing financial losses. The longer-term impact of the pandemic will alter existing practices, making some of them more likely than others to succeed in the years ahead.

This report synthesizes the collective experience of private practice radiologists shared with members of the Radiological Society of North America (RSNA) COVID-19 Task Force, including discussions with colleagues and leaders of private practice radiology groups from across the United States.

Summary

Private radiology practices were especially impacted by the COVID-19 pandemic, and the ways they mitigated the impact of the pandemic on their practice will shape the future of radiology.

Key Results

■ The coronavirus disease 2019 (COVID-19) pandemic has resulted in dramatic decreases in examination volumes, of up to 80% in some cases, for private radiology practices that solely depend on revenues from examination interpretation.

■ To survive the pandemic, private radiology practices reflected on their values and priorities to decide which levers to pull to reduce costs, such as decreasing compensation, paid time off, benefits, and hours of work, while increasing work responsibilities. In many cases it is unclear when or if these measures may be returned to the pre-COVID-19 state.

■ The future of private radiology practices will be impacted by the pandemic in that practices are likely to restructure operational policies and business risks to account for potential sudden volume decreases, as were experienced during the pandemic.

Introduction

The coronavirus disease 2019 (COVID-19) global pandemic has resulted in 12.1 million confirmed infections and 551,384 deaths worldwide as of July 8, 2020.(1) Businesses have paused operations or significantly adjusted their operations, and the U.S. economy has contracted at the fastest rate since the Great Depression.(2-5)

Patients have shunned hospitals and medical services.(6) Examination volumes in radiology practices have decreased by 40-90%, which some anticipate could persist for a few months to a few years.(7-10) The initial surge of the pandemic is thought to be subsiding, the next phase is uncertain, and the full impact of the pandemic has yet to be determined.(4)

Herein, we describe the impact of COVID-19 on private radiology practices, which are particularly vulnerable to the pandemic. These radiologists who work outside of academic university settings accounted for approximately 83% of all practicing radiologists in 2019.(11) While we use the term “private radiology practices,” that it is not the ideal term to describe these diverse practices.

The goal of this article is to describe specific experiences of radiologists working in various types of private practices during the initial peak of the COVID-19 pandemic. We present a detailed case study of a private radiology practice impacted by the pandemic. Subsequently, we describe factors determining the impact of the pandemic on private practices, the challenges practices have faced, the cost levers leaders adjusted, government subsidies sought, and strategic adjustments that practices are making to their mid- and long-term plans to pivot for long-term success while managing the COVID-19 pandemic. It is our hope that all types of radiology groups may benefit from early dissemination of the impact of the pandemic on private practices.

The report synthesizes publicly available data with the collective experience of private practice radiologists informally shared with members of the Radiological Society of North America (RSNA) COVID-19 Task Force, including discussions with colleagues and leaders of private radiology practices from across the United States.

Case Study: COVID-19 Impact on Practice A

Background

Practice A is a private radiology practice established in the mid-1970s that owns three outpatient imaging centers in Michigan. Practice A performs and interprets approximately 55,000 examinations per year. 2019 exam volume by modality for Practice A was approximately: 30,000 MRI, 6,500 US, 6,000 CT, 5,000 radiography, 4,000 interventional radiology, and 4,000 mammography. Full-time employees include 4 radiologists, 4 imaging 4 technologists, 29 office staff, and 3 administrators. Part-time staff include 4 radiologists, 10 office staff and 26 imaging technologists.

Fixed costs for Practice A include building mortgages ($2.4 million), equipment loans ($3.0 million), full-time employee salaries, picture archiving and communications system fees ($6,000 per month), and service contracts. The practice has a $3 million credit line.

Variable costs comprise a significant fraction of Practice A’s operating expenses as it has a large percentage of part-time technologists and work relative value unit (wRVU)-based payments for radiologists, who are assigned cases to interpret daily. A national billing vendor receives 3% of revenues.

During the COVID-19 pandemic, Practice A adjusted its processes to safely image persons with mild symptoms suggesting, or a recent positive test for, COVID-19. The imaging centers implemented safety measures, including patient and employee screenings at the entrances, temperature checks, universal masking and mandatory self-isolation policy. Two employees tested positive for COVID-19, bothwere exposed at other healthcare jobs they concurrently held. They self-isolated for more than 14 days.

How The Pandemic Impacted Practice A

The first COVID-19 case in Michigan was confirmed on March 10, 2020.(12, 13). As of July 9, 2020, 75,063 patients have tested positive for COVID-19 within the state of Michigan, accounting for 2.4% of the 3,193,554 cases in the USA. 11 states have more COVID-19 patients than does Michigan.(14)

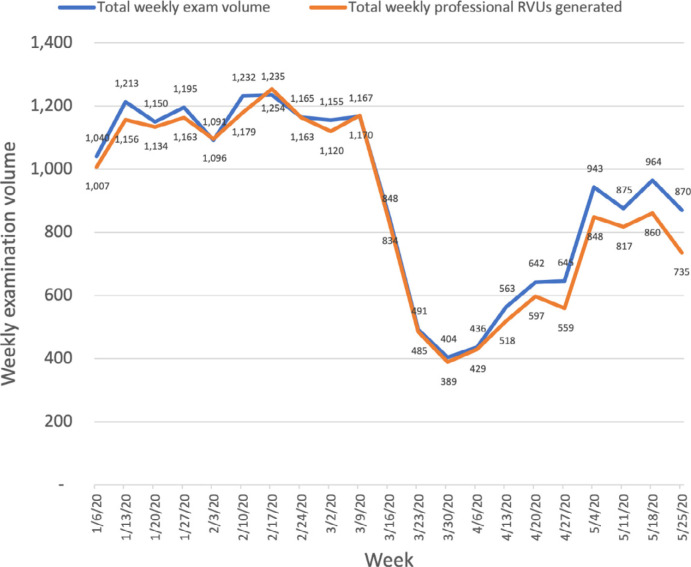

From January 6, 2020 to March 22, 2020, Practice A interpreted an average of 1,165 examinations and had 1,144 wRVU’s each week, which decreased to 520 (-645, 55.4%, P<0.0001) and 496 (-648, -56.6%, P<0.0001 [unpaired t test, alpha of 0.05]) respectively, from March 23-May 3, 2020 (Figure 1). From May 4, 2020 to May 10, 2020, Practice A interpreted an average of 913 examinations per week (+393, +76%, P<0.0001) and had 815 wRVU’s each week (317, 64%, P<0.0001).

Figure 1:

Graph of weekly examination volumes and work relative value units (RVUs) generated in Practice A. Examination volume was steady in January and February 2020, followed by an abrupt decrease in early March 2020 and subsequent increase thereafter, not returning to baseline by the end of May 2020.

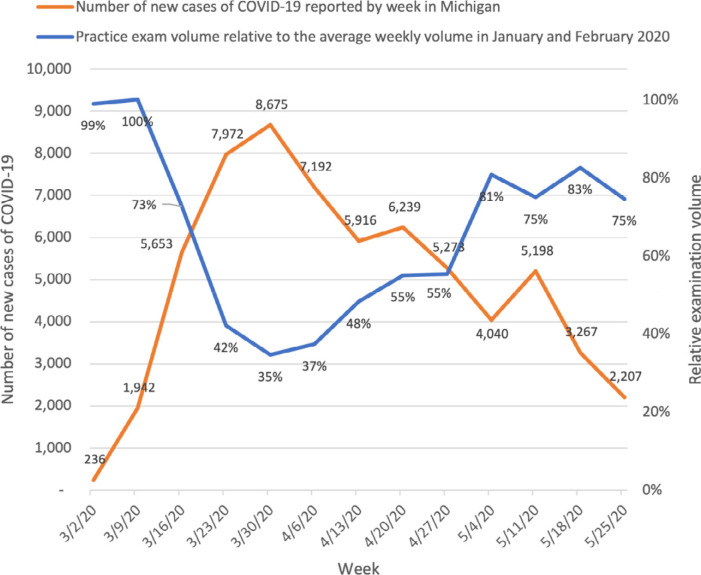

In March 2020, increases in the number of new COVID-19 cases per week reported to the Michigan Department of Health and Human Services coincided with a decrease in examination volumes for Practice A. This trend reversed in April 2020 (Figure 2). Late May 2020 examination volumes had recovered to 75% of the pre-COVID-19 examination volume.

Figure 2:

Graph of examination volume in Practice A and confirmed coronavirus disease 2019 (COVID-19) cases in Michigan according to week of onset. Increases in the local new case tallies of COVID-19 coincided with abrupt decreases in practice examination volume. Subsequent decreases in the local new case tallies of COVID-19 coincided with increases in practice examination volume.

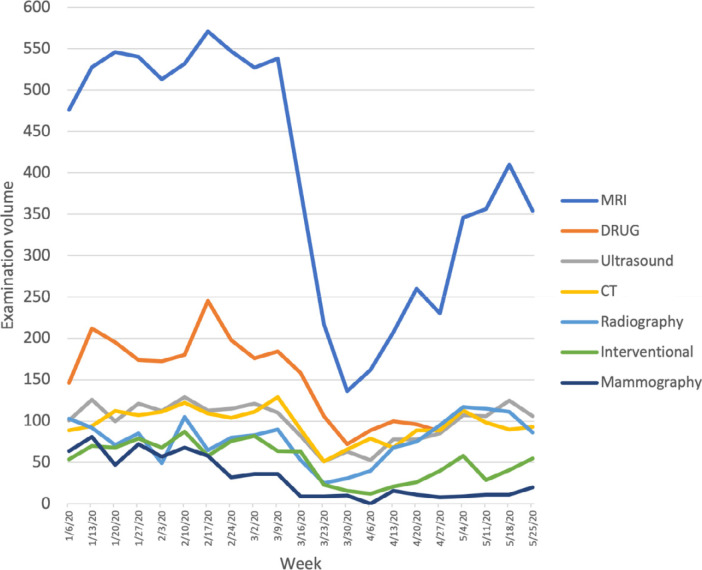

Decreases in examination volumes occurred in each of the performed imaging modalities (Figure 3). MRI was the most impacted, as the group performed and interpreted more than 500 per week prior to COVID-19 and interpreted a low of 136 the week of March 30, 2020.

Figure 3:

Graph of examination volume in Practice A according to imaging modality. All modalities experienced a decrease in examination volume in March 2020, with the largest decrease occurring in MRI volume. Subsequent modest increases did not return to pre-COVID-19 levels through May 2020.

Strategies to Manage During the Pandemic

As examination volumes decreased, maintaining full operations would exhaust Practice A’s cash reserves within a few months and could place the practice into bankruptcy. The practice reflected on the family-like practice culture to balance protecting and supporting employees, caring for patients, and remaining financially solvent.

The early response to the pandemic focused on reducing practice expenses. Office hours and radiologist daily work hours were decreased. Radiologists were paid per-wRVU, and thus costs were reduced due to reduced interpreted volume. Part-time technologists are paid on an hourly basis, and the reduced days of operation and reduced volume lowered these payments. The practice received $90,000 from the Center for Medicare and Medicaid Services Accelerated and Advance Payments Program, which reimbursed providers for expected future services.

Mid-term strategies implemented March 16, 2020 further reduced future expenses and identified additional sources of revenue. Part-time employees’ hours were reduced, allowing the full-time staff to continue to receive their expected salaries. Service contracts were reevaluated and renegotiated to account for pandemic-related periods of very low equipment utilization. The practice received $500,000 from the paycheck protection program.

Continued Concerns of the Practice

Several factors contributed to Practice A remaining financially solvent. The practice took early decisive actions to reduce part-time radiologist and technologist staffing, reduce expenses, and secure governmental financial support when possible.

Despite entering the pandemic from a position of relative financial strength, the impact of COVID-19 on Practice A has already been severe. Radiologists estimate a decrease in compensation of 40% for calendar year 2020. Most part-time radiologists and staff members had few if any assigned shifts during April 2020. A variety of factors resulted in 10 office staff members and 4 technologists leaving the practice. The previous close-knit family culture will need growth and nourishment to return to its pre-COVID state. Practice A is both guarded and optimistic that the pandemic will subside, that their practice will flourish beyond its pre-COVID-19 state.

Factors Determining the Pandemic Impact on Private Radiology Practices

For many practices, caring for patients with COVID-19 increased the complexity of the financial impact. Volumes of advanced imaging, a higher reimbursement service for many practices, were reduced while low reimbursement services, such as radiography, often increased. At the same time, performing these low reimbursement services in ways that minimized the risk of virus transmission to staff and other patients increased the time and resources required to perform these services. These challenges were often most pronounced in private practices that included a hospital-based component to their practice, and which cared for COVID-19 patients with moderate and severe symptoms.

Radiology practices generally have 3 different practice models: physician owned, corporate entity owned, and hospital or health system employed.

For physician-owned private practices, revenue is earned from fees for imaging interpretation. Radiologists are typically paid a base salary plus a bonus from revenues remaining after expenses are paid. These practices are not generally financially affiliated with larger entities. These practices could experience dramatically high or low profits depending on market factors.

In the case of the COVID-19 pandemic, may not have the same access to financial markets as do larger corporations. As a result, these practices experienced abrupt and substantial hardships. We anticipate that some physician-owned private radiology practices, such as small practices and those with large amounts of debt prior to the pandemic, may struggle to remain both independent and financially solvent.

Decreasing reimbursements, increasing technology costs, increasing regulations, and increasing market competition over the past two decades have led to some physician-owned private radiology practices selling their practices to corporate and private equity investors.(14-17) These investors saw healthcare as being recession-resistant and aimed to consolidate fragmented networks of providers and extract resulting profits.

Prior to the pandemic, radiologists saw these entities as having access to capital markets, expertise in consolidation, and stability in a tumultuous radiology market.(15, 16) Investors in these private equity firms and/or publicly traded companies own a portion of the practice. These firms re-invest to develop business infrastructure and growth, and in turn receive a portion of profits generated by physician professional activity.

However, the COVID-19 pandemic exposed some of these firms as being more fragile than initially anticipated. Like a slingshot already retracted to its breaking point, some of these firms were excessively leveraged at the outset of the pandemic. This was the result of a trend of leveraged buy-outs that depended on growth to succeed, and left little room for increased financial backing during the pandemic. Some firms are now considering bankruptcy.(10, 18)

Finally, hospital systems also employ radiologists. Radiologists may have heterogeneous experiences in these practices. While some hospital systems operated on thin operating margins before the pandemic, others may be able to absorb some short-term financial losses by using financial reserves and securing government funds due to their essential role in providing care to local communities.(19, 20)

Alignment with COVID-19 Best Practices

Private radiology practices monitored evolving information from news sources, government officials, radiology specialty societies, and the RSNA. At times, practices struggled to identify a single source of truth regarding the spread of the pandemic.. Recommendations made by local, state and federal agencies were varied widely and were often vague. A lack of uniformity in messaging about the risks of COVID, the projected length of the pandemic, and best practice strategies to address the clinical impact resulted in dramatically different interpretations among private radiology practices.

Tremendous variability in interpretations of state-level practice guidance existed, even in the early affected Seattle area. For example, some practices in Seattle maintained elective imaging appointments (21, 22), while other groups only indicated plans to reschedule screening examinations, without mention of other elective imaging studies (23). Still others have requested that patients postpone all elective imaging (24-26). One group directed patients to reschedule only if they were symptomatic (22).

Cost Levers to Mitigate the Impact of the Pandemic

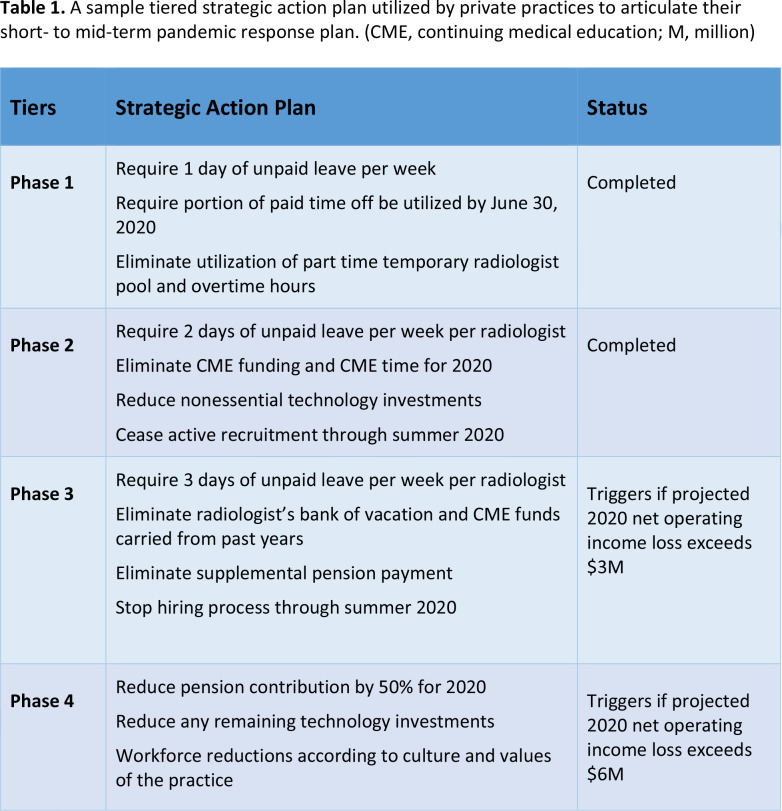

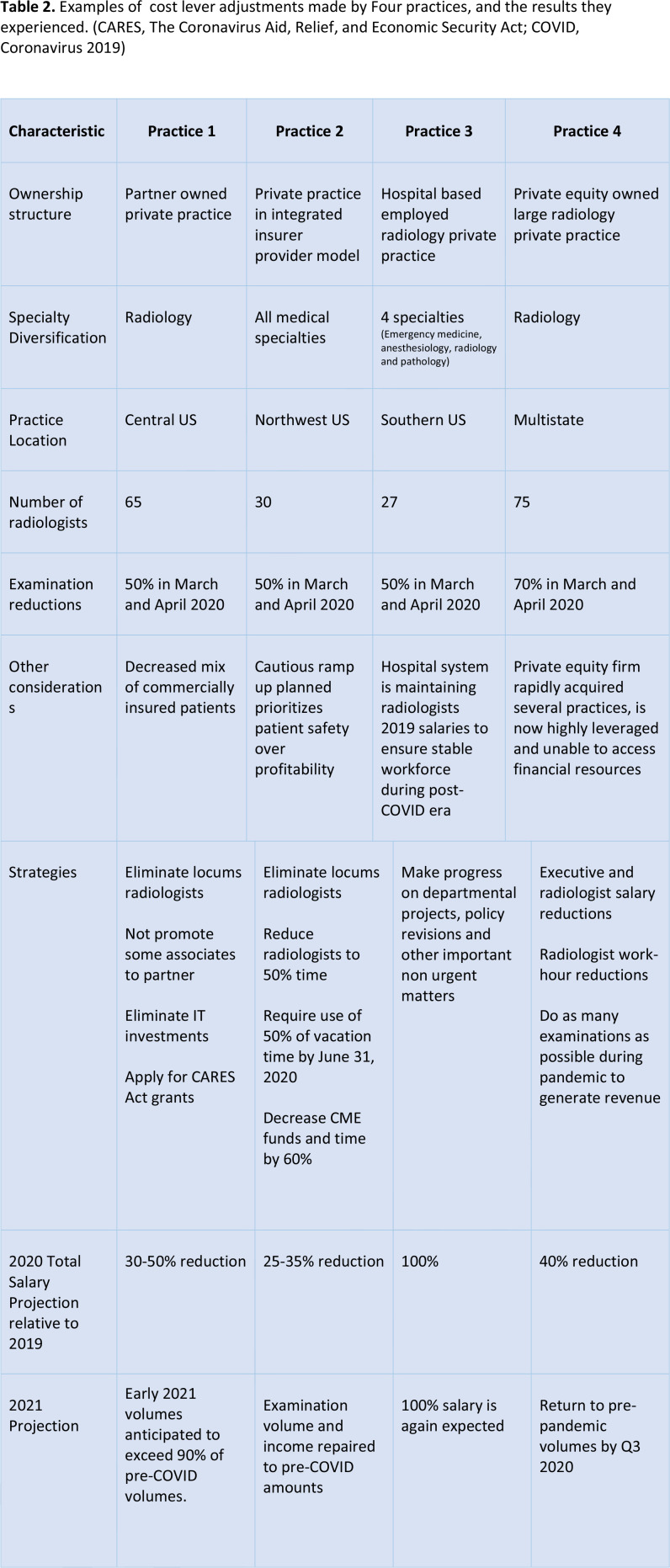

Practice leaders carefully assess a group's culture, values, and expectations while pulling various cost levers in response to financial challenges. They thread a needle by pulling enough levers to capture cost reduction opportunities while minimizing the impact on group morale and practice effectiveness. Table 1 provides a sample multi-tiered strategic action plan similar to that used by several practices to respond to the pressures of the pandemic. Table 2 presents real world examples of the extent to which several practices pulled each of the common practice levers and details the impact of such adjustments.

Table 1:

A sample tiered strategic action plan utilized by private practices to articulate their short- to mid-term pandemic response plan. (CME, continuing medical education; M, million)

Table 2:

Examples of cost lever adjustments made by Four practices, and the results they experienced. (CARES, The Coronavirus Aid, Relief, and Economic Security Act; COVID, Coronavirus 2019)

Personnel costs often underwent dramatic adjustments. Radiology executives in large private practice firms reduced their base salaries from 10-50%.(27, 28) Radiologists anecdotally described similar substantial salary reductions. Radiologist salaries were often reduced to maintain compensation for technologists, nurses, and other staff. Some practices reduced full-time radiologist work schedules to 3-4 days per week, required unpaid leave, and reduced or eliminated bonuses. These changes impacting radiologists were similar to media reports of other physicians experiencing work reductions and furloughs.(29-32)

Several practices terminated or curtailed work for temporary and locum tenens contracted radiologists. Some associate pre-partner radiologists were dismissed. Administrative and educational time were often reduced. Some practices removed stipends or extra compensation for after-hours, on-call, and contrast material injection coverage tasks, and incorporated them into regular work expectations. One practice absorbed after-hours contrast material coverage into the regular staff responsibilities for much of 2020 and plans to save $100,000 per practice site per year. Some pension contributions were reduced by 50-100%.

Several practices have suspended investment and system and infrastructure improvements. Other practices have renegotiated facility or equipment leases and maintenance contracts and/or requested forbearance or interest rate reduction for outstanding debt expenses.(33)

Practices carefully weighed the emerging financial picture of the COVID-19 pandemic with commitments to those hired prior to the pandemic who were scheduled to begin work between March and July 2020. Some practices have rescinded offers for employment while others are honoring employment offers with modifications, such as salary decreases, work hour adjustments, unpaid leave, and delayed starting dates.

Government Financial Support

The Coronavirus Aid, Relief and Economic Security (CARES) Act, the Paycheck Protection Program, and Health Care Enhancement Act provided $175 billion in relief funds to hospitals and other healthcare providers that were supporting the coronavirus response, including radiology practices. Individual publicly-traded hospital operators received up to $700 million, and individual hospital systems received up to $180 million.(20)

Several radiology practices have applied for and received funding. Los Angeles, CA based Radnet has publicly announced receiving almost $15 million under the first CARES Act appropriation and almost $40 million of accelerated Medicare advance payments.(33) Smaller allocations are not yet publicly available, and practices are understandably hesitant to share these financial details.

Details of these government programs are complex and beyond the scope of this manuscript. Essentially, federal programs sought to provide cash infusions to practices experiencing financial distress as a result of the COVID-19 pandemic. Some of the funds are or may become grants, while others are loans. The precise criteria used to evaluate and award these distributions are not clear.

Various provisions of the CARES Act and related government assistance programs include payroll tax deferrals, income tax deferral, interest deductibility, temporary suspension of the Medicare sequester, Medicare Advanced Payment loans, and funding of a Public Health Emergency Fund. These programs can be critical for private practices attempting to support their teams while enduring volume losses.

“Pain Now” versus “Pain Later”

Most of the private practices with which we have communicated aimed to closely pair expense reductions with revenue decreases. Radiologists in these practices experienced a substantial income reduction, as their practice quickly adjusted to the new economic reality. This rapid “pain now” strategy aims to reduce cash expenses by modifying a previous operational model and aims to sustain the practice in the long term by more slowly utilizing financial reserves.

Larger and better capitalized practices may be able to amortize the impact of the pandemic over a longer time horizon. Several radiologists whose practices are closely aligned with large hospital systems or corporations indicated they have not experienced changes from the pandemic, despite their practices experiencing substantial decreases in examination volumes. We believe these practices are pursuing a “pain later” strategy that is likely to have delayed or prolonged yet-to-be determined adjustments.

Long-Term Impact of the Pandemic

Increased unemployment is likely to increase use of government healthcare insurance, effectively decreasing average revenue per examination across fee-for-service practice models. This could challenge future investment in technology and practice growth and may slow the rate of private equity and corporate investments in radiology practices. We anticipate practices will reduce costs and debt to preserve financial flexibility to protect against future unexpected decreases in imaging demand.

Some groups may prove unable to survive the COVID-19 pandemic, potentially fueling trends either toward consolidation into larger radiology groups or toward increased employment by hospitals. We anticipate that small radiology practices may be at greatest risk for consolidation with larger radiology groups that have a more diversified practice model regarding inpatient-outpatient mix, subspecialty service lines, and geography.

Practices developed capabilities for radiologist remote reading during the pandemic that may persist offering more variable approach to work-life balance and to earning partnership while also controlling costs and managing potential future disruptions.

We anticipate practices may adjust employed physician contracts to better mitigate practice risk from potential future volume disruptions. Base salary may comprise a smaller portion of overall compensation, with the balance dependent on the overall financial performance of the organization and/or individual productivity.

A,s organizations look to control costs and senior radiologists opt to delay retirement, the radiologist job market may change. There is precedent for this effect following the financial crisis of 2007-2008. The popularity and subsequent availability of subspecialties hardest hit by volume decreases, such as breast imaging, may be impacted in the near-term.

The COVID-19 outbreak highlights the potential role of outpatient imaging centers in protecting patients from exposure while providing efficient urgent and emergent imaging. (34, 35) Some groups designated COVID-19 imaging centers and facilitated efficient outpatient management of many suspected or confirmed cases.

Private practices appreciate the rapid dissemination of new data related to COVID-19 by their academic radiology colleagues. Variations in how academic and private practices, particularly those in more rural communities, have experienced the burden of disease has led to differing views on important issues, including the timing of starting and stopping routine screening mammography and non-urgent outpatient imaging. This phenomenon highlights the need for private practice community-based physicians to participate in the development of national trends and standards, and for those national trends and standards to incorporate appropriate flexibility for local healthcare environments.

Conclusion

Private practice radiology groups were especially vulnerable to abrupt financial losses as demand for imaging services greatly declined during the coronavirus disease 2019 (COVID-19) pandemic. After reflecting on their values and priorities, private radiology practices crafted tiered strategies to respond to the impact of the pandemic by pulling various cost levers to adjust service availability, staffing, compensation, benefits, time off, and expense reductions. In addition, they have sought additional revenues, within the boundaries of their practice, to mitigate ongoing financial losses. The longer-term impact of the pandemic will alter existing practices, making some of them more likely than others to succeed in the years ahead.

Acknowledgments

Acknowledgments

The members of the RSNA COVID-19 Task Force are as follows:

Mahmud Mossa-Basha, MD, University of Washington Medical Center (Chair)

Javad R. Azadi, MD, Johns Hopkins Medicine

Christopher Filippi, MD, North Shore LIJ Health System

Maryellen L. Giger, PhD, University of Chicago

Jeffrey S. Klein, MD, University of Vermont

Jane Ko, MD, New York University Langone Health

Brian S. Kuszyk, MD, Eastern Radiologists

Christine O. Menias, MD, Mayo Clinic, Arizona

Richard E. Sharpe, Jr, MD, Kaiser Permanente, Denver

Bien Soo Tan, MD, Singapore General Hospital

Erik M. Velez, MD, University of Southern California

Carolyn C. Meltzer, MD, Emory University (RSNA Board liaison)

Footnotes

Funding: No funding sources were utilized.

References

- 1.Coronavirus Resource Center . Johns Hopkins University School of Medicine. https://coronavirus.jhu.edu. Accessed May 18, 2020. [Google Scholar]

- 2.Horsley S. The Coronavirus Crisis: U.S. Economic Slowdown In Coming Months Expected To Be Worst On Record. https://www.npr.org/sections/coronavirus-live-updates/2020/03/20/818906241/the-economy-is-getting-hit-hard-and-the-forecasts-are-scary. Published 2020. Accessed April 20, 2020.

- 3.Louis FRBoS. Economic Research: Unemployment Rate. https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&cad=rja&uact=8&ved=2ahUKEwiv59GNrbpAhXBr54KHQ5BBtoQFjAAegQIAhAB&url=https%3A%2F%2Ffred.stlouisfed.org%2Fseries%2F UNRATE&usg=AOvVaw2-5LSJafQA1gcebj32lbH-. Accessed 2020 April 24, 2020. [Google Scholar]

- 4.COVID-19: Briefing Materials- Global Health and Crisis Response. McKinsey and Company. https://www.mckinsey.com/∼/media/McKinsey/Business%20Functions/Risk/Our%20Insights/C OVID%2019%20Implications%20for%20business/COVID%2019%20April%2013/COVID-19-Facts-and-Insights-April-24.ashx. Updated April 24, 2020. Accessed April 29, 2020. [Google Scholar]

- 5.Coronavirus: US economy shrinks at fastest rate since 2008. British Broadcasting Corporation. https://www.bbc.com/news/business-52466864. Published 2020. Accessed 2020. [Google Scholar]

- 6.Masroor S. Collateral damage of COVID-19 pandemic: Delayed medical care. J Card Surg 2020. doi: 10.1111/jocs.14638 [DOI] [PMC free article] [PubMed]

- 7.Kacik A. Independent physicians push for expedited COVID-19 aid. Modern Healthcare. https://www.modernhealthcare.com/physicians/independent-physicians-push-expedited-covid-19-aid. Accessed April 29, 2020.

- 8.Cavallo JJ, Forman HP. The Economic Impact of the COVID-19 Pandemic on Radiology Practices. Radiology 2020:201495. doi: 10.1148/radiol.2020201495 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.Planning Framework for Hospital Leaders for the Next Phases of COVID-19. General Electric Company, 2020; p. 1-7. [Google Scholar]

- 10.Doherty K. Envision Healthcare to Consider Bankruptcy Filing. Bloomberg News. https://www.bloomberg.com/news/articles/2020-04-20/kkr-s-envision-healthcare-said-to-consider-bankruptcy-filing. Accessed May 10, 2020. [Google Scholar]

- 11.Bender CE, Bansal S, Wolfman D, Parikh JR. 2019 ACR Commission on Human Resources Workforce Survey. J Am Coll Radiol 2020;17(5):673-675. doi: 10.1016/j.jacr.2020.01.012 [DOI] [PubMed] [Google Scholar]

- 12.Whitmeer G. Executive Order 2020-04 - Declaration of State of Emergency. https://www.michigan.gov/whitmer/0,9309,7-387-90499_90705-521576--,00.html. Published 2020. Accessed 2020 May 15, 2020.

- 13.Coronavirus Michigan Data Daily Counts . https://www.michigan.gov/coronavirus/0,9753,7-406-98163_98173_99207---,00.html. Published 2020. Accessed 2020 May 18, 2020.

- 14.Fleishon HB. Mergers and acquisitions for the radiologist. J Am Coll Radiol 2008;5(5):644-651. doi: 10.1016/j.jacr.2007.10.003 [DOI] [PubMed] [Google Scholar]

- 15.Stern EJ, Everett C, Friedberg EB, Kotsenas AL, Glover M, Lightfoote JB, Lall N, Swan TL. 2017 ACR Annual Meeting Open-Microphone Session: Navigating the Landscape of Changing Practice Models: Private Practice, Corporate Radiology, and Enterprise Systems. J Am Coll Radiol 2017;14(11):1384-1387. doi: 10.1016/j.jacr.2017.07.017 [DOI] [PubMed] [Google Scholar]

- 16.Fleishon HB, Vijayasarathi A, Pyatt R, Schoppe K, Rosenthal SA, Silva E, 3rd. White Paper: Corporatization in Radiology. J Am Coll Radiol 2019;16(10):1364-1374. doi: 10.1016/j.jacr.2019.07.003 [DOI] [PubMed] [Google Scholar]

- 17.Moser JW. 2007 survey of radiologists: practice characteristics, ownership, and affiliation with imaging centers. J Am Coll Radiol 2008;5(9):965-971. doi: 10.1016/j.jacr.2008.03.011 [DOI] [PubMed] [Google Scholar]

- 18.KKR-Backed Envision Is Rebuffed by Most Bondholders on Debt Swap . Bloomberg Law. https://news.bloomberglaw.com/securities-law/kkr-backed-envision-is-rebuffed-by-most-bondholders-on-debt-swap. Accessed April 25, 2020.

- 19.Kutscher B. Hospital margins slump due to squeeze from volume, rates, investments. Mod Healthc 2014;44(25):8, 10. [PubMed] [Google Scholar]

- 20.Ellison A. HHS unveils plan to deliver $40B in COVID-19 aid to hospitals. Becker Hospital Review. https://www.beckershospitalreview.com/finance/hhs-unveils-plan-to-deliver-40b-in-covid-19-aid-to-hospitals.html. Updated April 23, 2020. Accessed April 29, 2020. [Google Scholar]

- 21.Patient info: Visiting a Radia Imaging Center . Radia- Patient Centerd Imaging and Technology Solutions. https://radiax.com/Patient-Info/Coronavirus, . Accessed 2020 April 29, 2020.

- 22.Coronavirus Update - 3/30/2020. Skagit Radiology Incorporated Professional Services. https://covid19.skagitradiology.com. Accessed 2020 April 29, 2020. [Google Scholar]

- 23.Coronavirus (COVID-19) : Patient Safety Message. CDI Diagnostic Imaging. https://www.mycdi.com/coronavirus-safety-message/. Accessed 2020 April 29, 2020.

- 24.Services Update | Covid-19 . TRA Medical Imaging. https://live-tra-medical-imaging.pantheonsite.io/for-patients/safeguarding-against-the-coronavirus/services-updatedcovid-19/. Published 2020. Accessed 2020 April 29, 2020.

- 25.O’Sullivan J. Gov. Inslee to extend coronavirus stay-at-home order, outline how Washington’s economy will reopen. The Seattle Times Published 2020. Accessed 2020 April 29, 2020.

- 26.Coronavirus (COVID-19) Update . Inland Imaging. http://www.inlandimaging.com/coronavirus. Published 2020. Accessed 2020 April 29, 2020. [Google Scholar]

- 27.Stempniak M. Mednax top execs take 50% pay cut as radiology firm eyes COVID-19 bounce back. Radiology Business. https://www.radiologybusiness.com/topics/leadership/mednax-pay-cut-coranvirus-ct-covid-19-radiology-imaging. Published 2020. Accessed 2020 April 29, 2020. [Google Scholar]

- 28.Richert C. Mayo Clinic announces sweeping pay cuts, furloughs. MPR News. https://www.mprnews.org/story/2020/04/10/mayo-clinic-announces-sweeping-pay-cuts-furloughs. Published 2020. Updated April 10, 2020 Accessed 2020 April 29, 2020. [Google Scholar]

- 29.Arnsdorf I. A Major Medical Staffing Company Just Slashed Benefits for Doctors and Nurses Fighting Coronavirus. ProPublica. https://www.propublica.org/article/coronavirus-er-doctors-nurses-benefits. Published 2020. Accessed 2020 April 24, 2020. [Google Scholar]

- 30.Tenet Health cuts employee benefits to meet COVID-19 demand. https://www.wvtm13.com/article/tenet-health-cuts-employee-benefits-to-meet-covid-19-demand/31988812. Accessed 2020 April 24, 2020. [Google Scholar]

- 31.Paavola A. 10 hospitals furloughing staff in response to COVID-19. Becker Hospital Review. https://www.beckershospitalreview.com/finance/10-hospitals-furloughing-staff-in-response-to-covid-19.html.April 24, 2020.

- 32.Ostriker R. Cutbacks for some doctors and nurses as they battle on the front line. The Boston Globe. https://www.bostonglobe.com/2020/03/27/metro/coronavirus-rages-doctors-hit-with-cuts-compensation/.April 24, 2020. [Google Scholar]

- 33.RadNet Reports First Quarter Financial Results and Announces Strong Liquidity Position as a Result of Completing Cost Savings and Cash Conservation Measures. GlobeNewswire. https://finance.yahoo.com/news/radnet-reports-first-quarter-financial-100010256.html. Accessed 2020 May 17, 2020. [Google Scholar]

- 34.Mossa-Basha M, Meltzer CC, Kim DC, Tuite MJ, Kolli KP, Tan BS. Radiology Department Preparedness for COVID-19: Radiology Scientific Expert Panel. Radiology 2020:200988.. doi: 10.1148/radiol.2020200988 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35.Mossa-Basha M, Medverd J, Linnau K, Lynch JB, Wener MH, Kicska G, Staiger T, Sahani D. Policies and Guidelines for COVID-19 Preparedness: Experiences from the University of Washington. Radiology 2020:201326. doi: 10.1148/radiol.2020201326 [DOI] [PubMed] [Google Scholar]