Abstract

This study examines the relationships between small and medium-sized enterprises (SMEs) and economic growth in Pakistan from 1990 to 2019. It focuses on SMEs and the other factors responsible for the economic growth by evaluating their effects in the long-run and short-run by employing the autoregressive distributed lag bounds cointegration approach. In the long-run, the SME's output, human development index, and credit to the SME sector's expansion are identified as the main driving force behind economic growth. However, in the short-run, SME's output, human development index, credit to SME, and annual export rate are the main drivers of economic development. Empirical results are important to policy makers to promote, stimulate and support the growth of small and medium-sized enterprises through their strategies.

Keywords: SMEs, Economic development, Autoregressive distributed lag, Cointegration, Pakistan

SMEs; Economic development; Autoregressive distributed lag; Cointegration; Pakistan

1. Introduction

SMEs play a critical role in the economic growth of every nation, such as generating work opportunities, income and wealth creation, and poverty reduction. These enterprises are very important in less developed economies. SMEs have become preferred economic entities and an easy and quick adaptation (Bauchet and Morduch, 2013; Savlovschi and Robu, 2011). The existence of SMEs helps inefficient consumption of nearby assets and boosts economies all over the world. SMEs constitute an integral part in developing economies through imports and the commodities price, which generates global economic success. In the worldwide economy, they assume a vital role through their critical commitment to GDP (Gross Domestic Product) and boosts the comfort of societies. It also provides more employment to people in various economies as compared to larger organizations and therefore leads to poverty alleviation (Oba and Onuoha, 2013). Generally, advanced nations have 90 percent of their enterprises in the SMEs sector, and it's one of the remarkable reasons for their financial development (De Giorgi and Rahman, 2013). In developing nations, the SME sector plays an essential role in achieving Sustainable Development Goals (SDGs) by creating job opportunities, alleviating poverty, promoting innovation and fostering sustainable industrialization, and reducing income inequalities (Littlewood and Holt, 2018).

Like other developing nations, Pakistan's economy also relies on the SME sector. The SME sector is acting as a major part of economic growth, the advancement of technological innovation, promoting economic renewal, and sourcing to large firms and social progress. They can be developed in urban as well as rural areas for any form of business operation. The establishment and development of such kinds of enterprises are generating income, employment, and alleviation of poverty. Subsequently, employment generation by the SMEs promotes economic development in remote areas (Grimes, 2000; Oyelana and Adu, 2015).

In developing countries, the SME sector is facing a range of challenges, such as lack of capital and financial opportunities, loans with high-interest rates, inadequate infrastructure and unavailability of modern technology, weak trade, and investment opportunities. It should be noted that there are barriers to the growth of SMEs, but they also have a major role to play in increasing employment levels and improving people's socio-economic conditions and living standards. As stated by the Economic Census of Pakistan 2005) (this is the latest census in Pakistan) 3.24 million well-established enterprises are working in the country. In Pakistan, SMEs constitute nearly 90 percent of entirely private businesses and employ almost 78 percent of the non-agricultural labor force (PBS, 2019).

Researchers have made many attempts to explain the connection between SME operation and economic conditions (Aina & RTP, 2007; Cravo et al., 2012; Kongolo, 2010; Minniti and Lévesque, 2010; Spencer and Gómez, 2004). Numerous studies have been conducted on SMEs in various developing, emerging and developed nations (Eze and Okpala, 2015; Harrison and Baldock, 2015; Kandasamy et al., 2015; Van Stel, Carree and Thurik, 2005). SMEs have drawn the attention and interest of policymakers and academics for decades; however, there is still a dearth of research analysing SMEs and economic growth in developing countries and Pakistan particularly. Clearly there is a strong need to examine the current state of the SME sector in Pakistan and it is therefore important that the necessary factors for this growth be implemented in time to prevent the worst from occurring in the future. Therefore, the evaluation of SMEs and their effect on economic growth and the quantification of their relative effects will have important implications for the development and management of SMEs in the future. Moreover, some of the studies have shown mixed results about the role of SMEs in impacting economic growth. Also, they found outcomes that have reduced the assessment of SMEs as the panacea for job creation and economic development (Kadiri, 2012). Furthermore, previous studies have used primary data for examining the role of SMEs in economic growth (Qureshi and Herani, 2011; Shaikh et al., 2011). This study has focused on the secondary data for empirical analysis, which has not yet been examined empirically in Pakistan. Also, this study provides clear points in the SME literature about the association of SMEs and economic development.

2. Theories of economic growth and prior literatur

From the very beginning of the industrial revolution, Mercantilism was the most popular. Mercantilism is an economic theory where the government seeks to regulate the economy and trade in order to promote domestic industry – often at the expense of other countries. Mercantilism is associated with policies which restrict imports, increase stocks of gold and protect domestic industries. Mercantilism stands in contrast to the theory of free trade – which argues countries economic well-being can be best improved through the reduction of tariffs and fair free trade (Reinert, 1999). In the Classical model introduced by Adam Smith in “Wealth of Nations” (1776), he asserted that many factors can improve economic growth. For instance, the role of the market in determining demand and supply, the role of trade in enabling greater specialization and income per capita were set by “the state of the skill, dexterity, and judgment with which labor is applied in any nation” (Elsner, 1989).

The neoclassical theory of economic growth states that there needs to be a rise in the share of GDP that is financed. Though, this is inadequate as a greater share of investment leads to declining return and convergence on the steady-state of growth, and high-tech improvement that boosts the efficiency of labor or capital.

The Endogenous growth model developed by Romer (1994) placed great weight on the notion of human capital, stating that employees with a high level of education, training, and knowledge could support to increased rates of technological advancement. The model emphasizes the increased value of spillover effects from a knowledge-based economy and also needs to keep economies open to evolving forces.

In the literature two main theories “the classical and the modern” are dominant in the discussion of SME's role in the inclusive development of developing nations (Tambunan, 2006). Various studies (Anderson, 1982; Morse and Staley, 1965) are categorized under the ‘classical’ theories about the development of SMEs. The ‘classical’ theories suppose that the gains and profits of SMEs will be decreased over time and large enterprises will eventually contribute to the economic growth marked by an increase in income.

From the perspective of ' modern theories,' the SME sector plays two vital roles at the same time. They speed up economic development via growth of their output contribution to GDP and alleviate poverty through setting up jobs and the special effects of their produced output growth in income generation.

Additionally, SME's have direct and indirect effects on poverty alleviation and economic progression through the linked effects of their development. An increase in employment and production in SMEs leads to an increase in employment and production in the rest of the economy across three major bonds: production, investment, and consumption. The World Bank provides three main assertions in support of the SME sector in developing nations; which are in order with the assertions of the ‘modern’ pattern on the significance of the SME sector in the economy (World Bank, 2018). First, SMEs boost entrepreneurship and competition and thus have external benefits for development, invention, and cumulative productivity growth across the economy. Second, they are usually more competitive than large companies, but the financial system plus other systemic vulnerabilities and a non-conductive macroeconomic environment impede the growth of SMEs. Third, the expansion of SMEs raises employment faster than larger enterprises can move forward, as the SME sector is more labor-intensive. Particularly, the World Bank assumes that straight government support for SMEs in less developed nations helps these countries take advantage of the social profits of their increased entrepreneurship and competition, and their SMEs will improve economic growth (World Bank, 2018). However, the above assumptions do not mean that large enterprises are no longer important, or that SMEs will fully replace the position of large enterprises in the economy. Large businesses and organizations can optimize economies and control research and development (R&D) fixed costs more efficiently, with a positive impact on productivity (Habib et al., 2019). The theoretical framework adopted in the present study is based on the modern economic theory on SMEs.

Most scholars are of the view that there exists a positive relationship between SMEs and economic growth. According to Miller (1990) employment growth rate is much faster in small size enterprises than in large enterprises. The development of new firms and SMEs expansions was the key component of employment generation which played a key role in the economy. Gebremariam, Gebremedhin, and Jackson (2004) revealed the critical role of SMEs in West Virginia. They observed a positive and significant association between SMEs, poverty alleviation, and economic development. Furthermore, Rohra and Panhwar (2009) specified that a huge amount of high-income nations yield the importance of the SME segment in helping their economies. Similarly, Mateev and Anastasov (2010) explored the main determinants of SME growth in Eastern and Central Europe and revealed that growth in SMEs means a development in the local economies. Wen (2011) and Ayanda and Laraba (2011) stated that the growth and expansion in the SME sector are unified to the national economic development, and it has eventually been a driving engine for the development of the rural areas. It was also well-known that the SME sector is the key engine behind employment creation, wealth formation, income distribution, poverty reduction in income disparities.

Dixit and Kumar Pandey (2011) envisaged the role of SMEs in the Indian economic growth. They employed the cointegration technique to observe the relationship between SME's productivity, India's GDP, total exports, and employment (private and public) for the period 1973 to 2007. Their results indicated a positive connection between SME's productivity and GDP. Moreover, a few studies have found an insignificant effect of SMEs on economic growth. For example; Kadiri (2012) investigates SME's role in employment creation. He has conducted his study in Nigeria. For statistical analysis, he employed the binomial logistic regression analysis. The findings illustrate that SMEs do not influence economic growth positively; due to a lack of finances and obligations from the government. Vijayakumar (2013) has conducted his study in Sri Lanka. He used time-series data and found an insignificant nexus among SMEs and the Sri Lankan economy's development. On the other side, Uma (2013) attempted the study in India and showed that SMEs have a noteworthy part in economic growth and this sector is a fixed formula to solve the problems of poverty, unemployment, insecurity, and overpopulation of the modern world.

Oyelana and Adu (2015) have analysed the contribution of SMEs in improving socio-economic conditions in South Africa. Their study revealed that SMEs have a major role in generating work opportunities and reducing poverty.

Ilegbinosa and Jumbo (2015) encompassed the effect of SMEs on Nigerian economic growth. For the study SMEs access to finance, inflation rate and the interest rate taken as regressors' variables and GDP as the output variable. The findings of their study revealed that SMEs access to finance had a positive correlation with economic development. Thus, the inflation rate was positive and the interest rate showed a negative influence on economic development. The authors determined that SMEs provide a significant influence on economic development. Another study by Folorunso et al. (2015) also studied the SMEs and economic expansion in Nigeria. The results of their study indicated that the availability of funding is a big challenge for SMEs ' growth and Nigeria's SME growth is a better solution to unemployment and poverty reduction. Additionally, micro and SMEs have a considerably high contribution rate to economic development. This sector generate around four million employment opportunities in a year and appoint unskilled and semi-skilled rural inhabitants, thereby improving the living standard of rural areas. Therefore the SMEs role in nation's total GDP, Export, and industrial production is quite praiseworthy (Perwaiz, 2015). According to Karadag (2016), SMEs are considered as a driving force of socio-economic progress all over the world.

Neagu (2016) asserted that SMEs play a pivotal share in the modern economy, verifying to be a tremendous and best fetching inventive system. From the previous literature, therefore, it could be noted that research regarding the SME's effect on economic development remains inconclusive due to the mixed outcomes. In the context of Pakistan, besides the inconclusiveness of the outcomes, numerous studies have applied descriptive statistics (Qureshi and Herani, 2011). Limited research studies have used econometric strategies and authors have not accurately examined the time-series features of the data.

Once more, this one is noted from the literature that prior studies addressed the small size of the sample that influenced the reliability of their results. So, by expanding the study period and employing rigorous econometric techniques, this study plans to recover the shortcomings found in the literature.

3. Methods and description of the variable

This study employs annual time-series data from 1990 to 2019. Due to the lack of data availability, especially in Pakistan (as a developing country) and most particularly on SMEs, these analyses have been made fixed for a specific sample period. Following the work of Cravo et al. (2012), this study explores the role of SMEs in economic development. We analysed Gross Domestic Product growth (GDP) as a proxy for economic growth (Amirat and Zaidi, 2020). A total output of SMEs (SMEO), export rate (EXPR), Human development index (HDI), and bank credit to SMEs (BCSME) are taken as explanatory variables.

In the study the variables are selected based on previous literature; the SME's output as a percentage of GDP was used as a proxy variable of SMEs (Subhan, 2010). The export rate is an annual export rate of SME's products (Fosu, 1990). HDI comprises different social and economic parameters (i-e literacy rate; life expectancy; GDP per capita, etc.) which depict the clear image of the current status of the residents (Cahill, 2002). Bank credit for SMEs is used in the study as a proxy for the annual financing percentage to the SME sector (Bello et al., 2018). Annual data has been retrieved from different sources that are various issues of Economic Survey of Pakistan, Ministry of Finance of Pakistan, SMEDA (small and medium enterprises development authority) and HDI report.

Data on GDP was sourced from the World Bank (2019), while different issues of the Economic Survey of Pakistan provide data about the total output of SMEs (SMEO). Information on the annual export rate of SME products and HDI were collected from the Trade Development Authority of Pakistan (TDAP), Ministry of finance, and HDI report. Data for bank credit to SME was assembled from the State Bank of Pakistan.

3.1. The model specification

Models of economic growth were drawn up by Barro (1991); Mankiw et al. (1992). From previous decades, these models were used by numerous practitioners and researchers offered a theoretical outline for the examination of the indicators which are helpful to promote economic growth. In addition, this development has seen a breakthrough in the growth literature for traditional components such as capital, labor and technology. Various other variables are also being measured in the growth frame. Likewise, the present study follows Cravo et al. (2012) approach to particularly examine the role of SMEs in the economic growth of Pakistan.

Therefore, the description employed in this article to study SMEs and economic growth in Pakistan sets out the following form:

| GDPt = β0+ β1SMEOt+ β2EXPRt+ β3HDIt+ β4BCSMEt+μt | (1) |

where GDP represents Gross Domestic Product (a proxy for measuring economic growth), SMEO is total SMEs output as a percentage of GDP, EXPR is an annual export rate of SMEs products, HDI is the Human Development Index, BCSME is Banks Credit to SME sector, t denotes time. The betas (βs) measure each factor's relative significance in explaining the underlying conduct of economic development. For the interpretation of these coefficients as elasticity, we convert the above equation through pleasing the natural logs. Therefore Eq. (1) transforms;

| lnGDPt = β0 + β1lnSMEOt+ β2lnEXPRt+ β3lnHDIt+ β4lnBCSMEt+μt | (2) |

The selection of regressors is generally well-versed by the relevance of the feature to the Pakistani economy and the availability of data during the study period.

3.2. Tools of estimation

For the study, we adopted the ARDL bounds cointegration technique. "ARDL" stands for "Autoregressive-Distributed Lag". Regression models of this type have been in use for decades, but in more recent times they are a very useful method for assessing the presence of long-term economic time-series. ARDL initially introduced by Pesaran et al. (1999) and further revised by Pesaran et al. (2001) has commonly been useed in the most recent empirical research.

The ARDL bounds cointegration approach enables a cointegration test when the regressors are integrated in order 0 or 1 or a combination of both, as opposed to the Johansen approach, which specifically requires both variables to be integrated in order 1, i.e. stationary at the first difference (Frimpong Magnus and Oteng-Abayie, 2006). ARDL can be used with smaller sample size and the ARDL technique recognized as providing unbiased long-term evaluations where few variables are endogenous. Amusa et al. (2009) have shown that bounds testing usually provides unbiased long-term measurements and reliable t-statistics, although some of the explanatory variables are endogenous. However, the method is not considered to be efficient in presence of variables which are stationary at a second difference. In view of the above characteristics of the ARDL bounds cointegration technique, we have adopted this econometric technique for modeling SMEs and economic growth for Pakistan. Previous literature indicates that ARDL bounds cointegration being carried out in many studies (Kumar et al., 2015; Moh'd Hemed et al., 2019; Pan and Mishra, 2018).

First, the stationary properties of the time-series variables in Eq. (2) are investigated by performing the unit root test. All variables are tested in levels and the first difference using the augmented Dickey-Fuller (ADF) test and Phillip–Perron unit root test. Next, we tested the presence of a long-term relationship between SMEs, economic development, and all other regressors within univariate framework.

The model is mathematically specified as:

| (3) |

The bounds cointegration test includes calculating Eq. (3) and confining the factors of the lag level variables to zero. Hence we check the hypothesis from Eq. (3) that is stated below:

| H0: φ1 = φ2 = φ3 = φ4 = φ5 = 0 |

| H1: φ1 ≠ φ2 ≠ φ3 ≠ φ4 ≠ φ5 ≠ 0 |

The corresponding measured F-statistic is then compared with the Pesaran et al. (2001) two asymptotic critical value limits to confirm the existence of cointegration.

The final step is the assessment of error correction model (ECM) stated as:

| (4) |

Although ARDL cointegration technique does not require pre-testing for unit roots, to avoid ARDL model crash in the presence of integrated stochastic trend of I (2), we are of the view the unit root test should be carried out to know the number of unit roots in the series under consideration (Altinay and Karagol, 2004; Debela, 2019). For this purpose, we have used the ADF and PP unit root techniques. ADF is based on an estimation of the following equations:

| (5) |

| (6) |

where: Δ is the first difference, Y is the time series, t denotes linear time trend, α is constant, n is a number of lags on the dependent variable, and is the error term. Eq. (5) includes time trend and drift and Eq. (6) includes only drift.

4. Empirical results and discussion

Table 1 shows the mean, standard deviation, and correlations between the study variables. The descriptive analysis presents that the average annual growth rate of GDP is around about 0.552. The average of the small enterprise's output as a percentage of GDP (SMEO) is 0.206. Export rate (EXPR) and HDI have been 0.463 and -0.270 respectively. The bank credit to the SME sector (BCSME) stood on the average at 0.460.

Table 1.

Variable descriptive measurements and Pearson Correlations.

| Variables | Mean | Std. Devi. | Min | Max | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|---|---|---|

| lnGDP | 0.552 | 0.205 | 0.006 | 0.884 | 1 | ||||

| lnSMEO | 0.206 | 0.112 | 0.105 | 0.332 | -0.512∗∗∗ | 1 | |||

| lnEXPR | 0.463 | 0.141 | 0.161 | 0.6 | 0.253 | -0.622∗∗∗ | 1 | ||

| lnHDI | -0.270 | 0.043 | -0.351 | -0.18 | 0.343∗ | -0.723∗∗∗ | 0.911∗∗∗ | 1 | |

| lnBCSME | 0.460 | 0.179 | 0.250 | 0.808 | 0.322∗ | -0.469∗∗∗ | 0.698∗∗∗ | 0.830∗∗∗ | 1 |

Notes: ∗∗∗,∗∗,∗ significant at 1%; 5%; &10%.

RGDP: Real Gross Domestic Product.

SMEO: Total SMEs output as a percentage of GDP.

EXPR: Annual export rate of SMEs products.

HDI: Human Development Index.

BCSME: Banks credit to SME sector.

Data is log Transformed.

The table reports the detail of the correlation matrix that SMEO has a negative correlation with GDP (measured as a proxy of economic growth). HDI and BCSME are positively associated with GDP but EXPR is a positive and insignificant correlation with GDP. Normally, multicollinearity is small and does not exist as a serious concern.

The findings of ADF and P–P unit root tests are illustrated in Tables 2 and 3 respectively. It depicts that all the variables of the study except GDP are non-stationary at level; then after differentiate at a 5% level of significance they become stationary. GDP is stationary at the 5% significance level in both cases.

Table 2.

ADF Unit root test.

| At level |

At First difference |

||||||

|---|---|---|---|---|---|---|---|

| Variables | AIC | constant | constant & trend | AIC | constant | constant & trend | Conclusion |

| lnGDP | 7 | -3.416∗∗ | -3.754∗∗ | 0 | -7.219∗∗∗ | -7.079∗∗∗ | I (0) I (1) |

| lnSMEO | 0 | -1.476 | -2.598 | 0 | -5.541∗∗∗ | -5.482∗∗∗ | I (1) |

| lnEXPR | 0 | -2.054 | -2.229 | 0 | -6.358∗∗∗ | -6.478∗∗∗ | I (1) |

| lnHDI | 0 | -0.149 | -1.968 | 0 | -3.890∗∗∗ | -3.795∗∗∗ | I (1) |

| lnBCSME | 0 | -2.346 | -2.549 | 0 | -8.735∗∗∗ | -8.580∗∗∗ | I (1) |

Note: ∗∗∗, ∗,∗ denotes null hypothesis rejected at1%; 5% & 10% significance level respectively.

Table 3.

PP Unit root test.

| At level |

At First difference |

||||

|---|---|---|---|---|---|

| Variables | constant | constant & trend | constant | constant & trend | Conclusion |

| lnGDP | -3.295∗∗ | -3.625∗∗ | -9.361∗∗∗ | -9.063∗∗∗ | I (0) I (1) |

| lnSMEO | -1.507 | -2.685 | -6.166∗∗∗ | -6.219∗∗∗ | I (1) |

| LnEXPR | -2.892∗∗ | -2.017 | -6.574∗∗∗ | -13.721∗∗∗ | I (0) I (1) |

| lnHDI | 0.149 | -2.085 | -3.357∗∗ | -3.444∗ | I (1) |

| lnBCSME | -2.346 | -4.470∗∗ | -13.435∗∗∗ | -12.070∗∗∗ | I (0) I (1) |

Note: ∗∗∗, ∗∗, ∗ denotes null hypothesis rejected at 1%, 5% & 10% significance level respectively.

4.1. Bounds cointegration test

The results of the bounds cointegration test are shown in Table 4. This one is obvious that for the normalized equation, the respective calculated F-statistic is overhead the upper bound critical value of 9.178 at the 5% significance level. Therefore, the null hypothesis of no cointegration is not supported, consequently there is a steady long-run cointegration among the set of variables.

Table 4.

Bounds Test for the presence of a relationship level.

| Test Statistic | Value | Sig. | I (0) | I (1) |

|---|---|---|---|---|

| F-statistic | 9.178 | |||

| 1% | 3.74 | 5.06 | ||

| 5% | 2.86 | 4.01 | ||

| 10% | 2.45 | 3.52 |

Source: Authors' computation.

4.2. Log-linear long run coefficient

Driven by an assumption that the model of the study has GDP (economic growth) as the predicted variable we have estimated a log-linear long-run economic growth for Pakistan. The assessed log-linear long-run coefficient is found from the subsequent estimations of ARDL given in Table 5 below.

Table 5.

Long Run Estimates using ARDL approach.

| Dependent variable: lnGDP | |||

|---|---|---|---|

| Regressors | Coefficient | Std. Error | T- [P-value] |

| LNSMEO | 1.723 | 0.552 | 3.118 [0.052] |

| LNHDI | 3.357 | 0.786 | 4.270 [0.023] |

| LNEXPR | 1.000 | 2.230 | 0.448 [0.684] |

| LNBCSME | 0.745 | 0.264 | 2.819 [0.066] |

| C | -18.028 | 3.894 | -4.629 [0.019] |

| R-squared | 0.992 | DW stat | 2.265 |

| Adjusted R-squared | 0.938 | ||

| F-statistic | 18.451 | ||

| Prob (F-statistic) | 0.017 | ||

Note: The maximum lag length was set to4.The ARDL (3,4,3,4) was based on the.

AIC. Source: Authors' computation.

From Table 5 the result suggests that SMEO is influencing GDP. The coefficient for the variable is positive and significant at the level of 5%. The coefficient of SMEO identifies that, with every 1% increase in SMEO, the GDP has increased by 1.7%, in other words the economic growth of the country hs increased. This empirical evidence confirms that SMEs have a positive effect on Pakistan's economic development. These findings are consistent with the prior study of Bauchet and Morduch (2013).

The Human Development Index (HDI) is elastic, positive, and statistically significant at the 5% significance level. In particularly, a 1% improvement in HDI leads to a 3.3% increase in GDP. In other words there is an increase in HDI, it has a significant effect on economic development. The P-value (0.02) shows the significant effect of HDI on the GDP which is less than the cutoff point.

Therefore, the coefficient for export rate (EXPR) is positive and statistically insignificant. The estimated multiplier means that a 1% change in the export rate would result in a 1.00% rise in GDP. Thus an insignificant effect is explained by the fact that Pakistan a developing country has production barriers and cannot export goods. Production of enterprises can meet the needs at the domestic level, the quantity of surplus goods in Pakistan is poor. This means that the export is very small and Pakistan cannot take advantage of the export. The government should focus on this and develop some policies to improve it, as the country can be economically strong due to exports.

Finally, the empirical result indicates that the bank's credit to the SME sector (BCSME) has positive and significant effect on GDP. BCSME is highly significant (P < 0.05) and the value of coefficient is positive. The estimated coefficient of BCSME means that a 1% rise in BCSME would result in a 0.74% increase in GDP in Pakistan. The positive coefficient is explained by the fact that bank loans to SME imply development and extensive growth in the SME sector. Also, youth who are suffering from unemployment are most likely to set up their businesses; alternatively, they are developing the economy in the country.

The results of the long-run estimates using ARDL suggest that the predicted variable (GDP) and explanatory variables (SMEO, EXPR, HDI, BCSME) are in line with our a priori expectations. The findings of this study are consistent with previous studies such as Singh and Mahmood (2014), Chughtai (2014), Cravo (2010), Tambunan (2008), Bernard and Jensen (1999), and Leegwater and Shaw (2008) and in contrast with the studies of Kadiri (2012) and Vijayakumar (2013).

According to Westlund and Hannon (2008), the acceptable DW range is between 1.5 to 2.5. Thus, the value of D.W confirms that there is no autocorrelation issue. The F-statistic value proves that the overall model is significant. Additionally, the result in Table 5 reveals that R-squared is 0.99 that shows only 99% of predicted variable GDP is elaborated by explanatory variables. In the context of this model, the explanatory variables explicate approximately 99% variability in economic growth for the study period.

4.3. Log-linear error correction model (ECM)

Table 6 presents the results of the estimated ECM, and these findings indicate that the coefficient of SME is positive and statistically significant at the 5% significance level. The short-run SMEO states that a total of 0.945% of GDP is increased with each 1% rise in SMEO. The short-run SMEO coefficient is slightly rigid relative to long-run estimates. In short, the positive effect of SMEs is less apparent than it is in the long run. The Human Development Index in the short-run is positive and significant at the 5% significance level. The short-run HDI suggests that a 1% change in HDI would result in a rise in GDP of 0.215%. That indicates that the positive HDI effect is less pronounced in the short-run. Export rate, though, in the short-run is found to be significant and negative.

Table 6.

Log-linear short-run estimates and ECM.

| Regressors | dlnSMEO | dlnHDI | DlnEXPR | dlnBCSME | ECT |

|---|---|---|---|---|---|

| Coefficient | 0.945∗∗∗ (0.1593) | 0.215∗∗ (0.0664) | -3.219∗∗∗ (0.2657) | 0.745∗∗∗ (0.0886) | -3.955∗∗∗ (0.3821) |

| R-squared | 0.993826 | ||||

| Adjusted R-squared | 0.977949 | ||||

| F-statistic | 62.59712 | ||||

| Prob (F-statistic) | 0.000005 | ||||

| DW stat | 2.265566 |

Note: The ARDL (3, 4, 3, 4) was based on the AIC. Standard errors are in the parentheses. ∗∗∗,∗∗, ∗ indicates 1%; 5%; & 10% significance level.

The estimated coefficient of the Bank credit for the SME sector (BCSME) is found to be positive and statistically significant at the 1% significance level. In particularly, a 1% increase in the bank's credit for SMEs would lead to a 0.74% increment in GDP. In the short run the estimated coefficient of the bank's credit for SME (BCSME) is consistent with the coefficient of the long-run.

The approximate coefficient of the (ECT) error correction term is pretty high, negative, and statistically significant at 1%. The outcome implies that the short-run deviation adjustment procedure is very high. The ECT coefficient -3.95 defines a rapid rate of adjustment to the equilibrium at 3.95% per year if there is a shock to economic growth in the previous period.

4.4. Diagnostic test

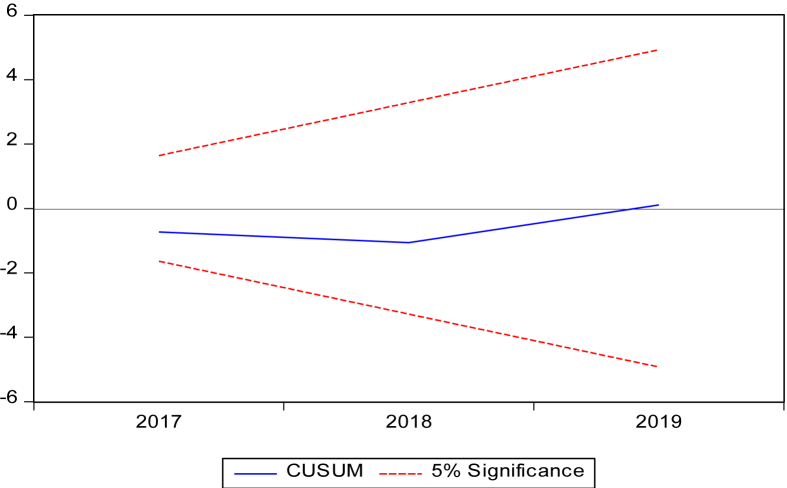

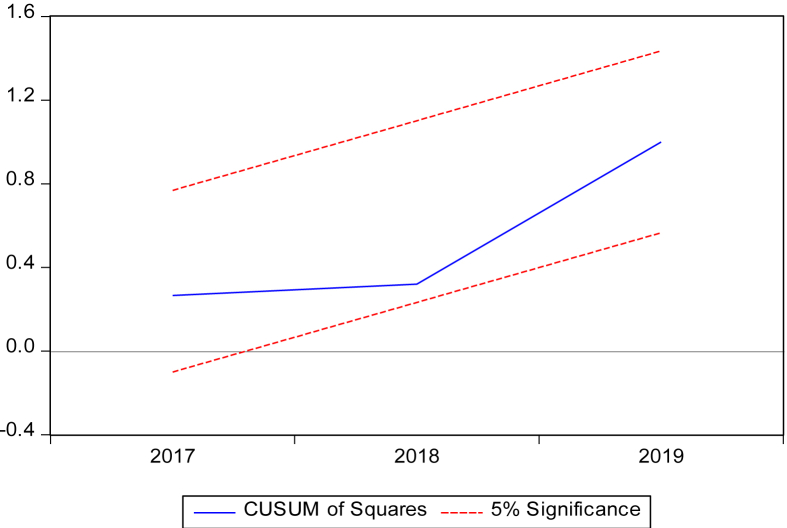

The evaluated ARDL model is tested on serial correlation problems, heteroscedasticity, misspecification of the functional form, and non-normal errors and stability of the parameters. The results of diagnostic assessments are summarized in Table 7 and Figures 1 and 2 below. From Table 7, it is evident that the assessed ARDL model passed out all the tests of serial correlation, heteroscedasticity, functional form misspecification, and non-normal errors. The Cumulative Sum (CUSUM) and Cumulative Sum of Squares (CUSUMS) parameter stability test plot show that the estimated parameters within the sample considered are stable.

Table 7.

Diagnostic test for ECM based ARDL model.

| Test Statistic | F- statistic | Prob. Values |

|---|---|---|

| a: Serial Correlation | 0.231 | 0.678 |

| b: Functional Form | 1.969 | 0.295 |

| c: Normality | 2.756 | 0.251 |

| d: Heteroscedasticity | 0.569 | 0.814 |

| e: CUSUM | Stable | |

| f: CUSUMS | Stable |

a: Lag range multiplier test of residual serial correlation.

b: Ramsey's RESET test using the square of the fitted values.

c: Based on a test of skewness and kurtosis of residuals.

d: Based on the Breusch-Pagan-Godfrey Test.

e: Stability test by Cumulative Sum.

f: Cumulative Sum of Squares.

Figure 1.

Plot of cumulative sum of recursive residuals.

Figure 2.

Plot of cumulative sum of squares of recursive residuals.

5. Conclusion and recommendation

SME are a noteworthy driver of economic development, and are vital to most economies across the world, particularly in developing and emerging nations. This sector is a considerable root of employment creation, poverty alleviation, and economic promotion (Beck et al., 2005; Singer, 2006).

SMEs are well recognized worldwide due to their significant role in economic growth and in fostering honorable progress. Today, instead of large enterprises, SMEs have increased their value in developing countries; this is attributed to the higher labor intensity and the fact that they operate with less resources and low management costs. The developmental process of economic growth in developing countries requires high growth in SMEs.

This paper examined the role of the prevalence of SMEs in Pakistan's economic growth. on the basis of previous studies, some economic and social variables have been chosen in order to achieve the basic goal. The key results are in favor of a positive and significant effect of SME output on the country's economic growth. It is found from the study that SMEs are making a positive contribution to economic development in Pakistan.

This study contributes to the SME literature and expands knowledge by illustrating the contribution of SMEs to the country's economic development. Due to economic and social challenges in developing nations like Pakistan, the people of this region have a dearth of employment opportunities. Poverty extremes can be eased by fostering the SME sector as well as bilateral trade with other countries. The findings of this study have shown the importance of SMEs to economic development in developing countries, such as Pakistan.

Despite the considerable effect of SMEs on the country's economic development; based on the results of the study, there are few recommendations for policy action: the government and its agencies and policy makers must provide the technological, financial, technical, managerial and infrastructure support needed for the huge growth opportunities of SMEs. The government should enhance investment conditions for SMEs and strengthen their capacity to respond to investment and trade opportunities. Henceforth, the strength of the economic performance of SMEs could have a positive impact on the growth of a nation. Eventually, these will enable SMEs to play a huge role in the economy and help the government to reduce poverty and eliminate the unemployment rate in the country.

Furthermore; the government should develop strong ties with other developed, emerging, and developing countries. The respective economy can be turned into a prosperous region by the collective efforts of other countries. It is, therefore, the government's responsibility to create policies that favor public interests and promote the welfare of the people in the country. To reduce deprivation and poverty, the government should focus on increasing sustainable economic growth, price stability, and job creation.

It is extremely important to emphasize some limitations in this study that may help in future perspectives. First, this study used secondary data; however future studies can use primary data for analysis. Second, the present study is limited to one developing country Pakistan. Future research studies should be planned by exploring the role of SMEs in economic development in other developing as well as emerging countries to boost the findings. Finally, future research can enquire about other dependent variables specifically RGDP, Foreign Direct Investment (FDI), and employment rate.

Declarations

Author contribution statement

Faiza Manzoor: Performed the experiments; Analyzed and interpreted the data; Contributed reagents, materials, analysis tools or data; Wrote the paper.

Longbao Wei: Conceived and designed the experiments; Wrote the paper.

Funding statement

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Data availability statement

The authors do not have permission to share data.

Declaration of interests statement

The authors declare no conflict of interest.

Additional information

No additional information is available for this paper.

References

- Aina O.C.M., RTP A. The role of SMEs in poverty alleviation in Nigeria. J. Land Use Develop. Stud. 2007;3(1):124–131. [Google Scholar]

- Altinay G., Karagol E. Structural break, unit root, and the causality between energy consumption and GDP in Turkey. Energy Econ. 2004;26(6):985–994. [Google Scholar]

- Amirat A., Zaidi M. Estimating GDP growth in Saudi Arabia under the government’s vision 2030: a knowledge-based economy approach. J. Knowl. Econ. 2020;11(3):1145–1170. [Google Scholar]

- Amusa H., Amusa K., Mabugu R. Aggregate demand for electricity in South Africa: an analysis using the bounds testing approach to cointegration. Energy Pol. 2009;37(10):4167–4175. [Google Scholar]

- Anderson D. Small industry in developing countries: a discussion of issues. World Dev. 1982;10(11):913–948. [Google Scholar]

- Ayanda A.M., Laraba A.S. Small and medium scale enterprises as a survival strategy for employment generation in Nigeria. J. Sustain. Dev. 2011;4(1):200. [Google Scholar]

- Barro R.J. Economic growth in a cross section of countries. Q. J. Econ. 1991;106(2):407–443. [Google Scholar]

- Bauchet J., Morduch J. Is micro too small? Microcredit vs. SME finance. World Dev. 2013;43:288–297. [Google Scholar]

- Beck T., Demirguc-Kunt A., Levine R. SMEs, growth, and poverty: cross-country evidence. J. Econ. Growth. 2005;10(3):199–229. [Google Scholar]

- Bello A., Jibir A., Ahmed I. Impact of small and medium scale enterprises on economic growth: evidence from Nigeria. Glob. J. Econ. Busin. 2018;4(2):236–244. [Google Scholar]

- Bernard A.B., Jensen J.B. Exceptional exporter performance: cause, effect, or both? J. Int. Econ. 1999;47(1):1–25. [Google Scholar]

- Cahill M.B. Diminishing returns to GDP and the human development index. Appl. Econ. Lett. 2002;9(13):885–887. [Google Scholar]

- Chughtai M. Impact of small and medium enterprises on economic growth: evidence from Pakistan. Stand. Res. J. Busin. Manag. 2014;2(2):19–24. [Google Scholar]

- Cravo T.A. SMEs and economic growth in the Brazilian micro-regions. Pap. Reg. Sci. 2010;89(4):711–734. [Google Scholar]

- Cravo T.A., Gourlay A., Becker B. SMEs and regional economic growth in Brazil. Small Bus. Econ. 2012;38(2):217–230. [Google Scholar]

- De Giorgi G., Rahman A. SME’s registration: evidence from an RCT in Bangladesh. Econ. Lett. 2013;120(3):573–578. [Google Scholar]

- Debela G. AAU; 2019. The Effect of Real Exchange Rate on the Trade Balance of Ethiopia: Does MARSHALL LERNER Condition Holds? Evidence from (VECM) Analysis. [Google Scholar]

- Dixit A., Kumar Pandey A. SMEs and economic growth in India: cointegration analysis. IUP J. Financ. Econ. 2011;9(2) [Google Scholar]

- Elsner W. Adam Smith’s model of the origins and emergence of institutions: the modern findings of the classical approach. J. Econ. Issues. 1989;23(1):189–213. [Google Scholar]

- Eze T., Okpala C. Quantitative analysis of the impact of small and medium scale enterprises on the growth of Nigerian economy:(1993-2011) Int. J. Develop. Emer. Econ. 2015;3(1):26–38. [Google Scholar]

- Folorunso O., Abodunde S., Kareem T. Small and medium scale enterprises and economic growth and development in Nigeria: an empirical investigation. Int. J. Manag. Soc. Sci. 2015;3(4):459–469. [Google Scholar]

- Fosu A.K. Export composition and the impact of exports on economic growth of developing economies. Econ. Lett. 1990;34(1):67–71. [Google Scholar]

- Frimpong Magnus J., Oteng-Abayie E.F. Bounds testing approach: an examination of foreign direct investment, trade, and growth relationships. Am. J. Appl. Sci. Forthcoming. 2006 [Google Scholar]

- Gebremariam G.H., Gebremedhin T.G., Jackson R.W. Paper Presented at the the Paper at the American Agricultural Economics Association Annual Meeting, Denver, Colorado, August. 2004. The role of small business in economic growth and poverty alleviation in West Virginia: an empirical analysis. [Google Scholar]

- Grimes S. Rural areas in the information society: diminishing distance or increasing learning capacity? J. Rural Stud. 2000;16(1):13–21. [Google Scholar]

- Habib M., Abbas J., Noman R. Are human capital, intellectual property rights, and research and development expenditures really important for total factor productivity? An empirical analysis. Int. J. Soc. Econ. 2019 [Google Scholar]

- Harrison R.T., Baldock R. Taylor & Francis; 2015. Financing SME Growth in the UK: Meeting the Challenges after the Global Financial Crisis. [Google Scholar]

- Ilegbinosa I.A., Jumbo E. Small and medium scale enterprises and economic growth in Nigeria: 1975-2012. Int. J. Bus. Manag. 2015;10(3):203. [Google Scholar]

- Kadiri I.B. Small and medium scale enterprises and employment generation in Nigeria: the role of finance. Kuwait Chap. Arab. J. Busin. Manag. Rev. 2012;33(845):1–15. [Google Scholar]

- Kandasamy S., Chay Yoke C., Leng Yean U., Peck Ling T., Wei Fong P., Nai-Chiek A. Contribution of SMEs to economic development of ASEAN countries: the three focus areas. Global J. Busin. Soc. Sci. Rev. 2015;3(3):1–13. [Google Scholar]

- Karadag H. The role of SMEs and entrepreneurship on economic growth in emerging economies within the post-crisis era: an analysis from Turkey. J. Small Bus. Enterprise Dev. 2016;4(1):22–31. [Google Scholar]

- Kongolo M. Job creation versus job shedding and the role of SMEs in economic development. Afr. J. Bus. Manag. 2010;4(11):2288–2295. [Google Scholar]

- Kumar R.R., Stauvermann P.J., Loganathan N., Kumar R.D. Exploring the role of energy, trade and financial development in explaining economic growth in South Africa: a revisit. Renew. Sustain. Energy Rev. 2015;52:1300–1311. [Google Scholar]

- Leegwater A., Shaw A. United States Agency for International Development; 2008. The Role of Micro, Small, and Medium Enterprises in Economic Growth: a Cross-Country Regression Analysis. [Google Scholar]

- Littlewood D., Holt D. Emerald Publishing Limited; 2018. How Social Enterprises Can Contribute to the Sustainable Development Goals (SDGs)–A Conceptual Framework Entrepreneurship And the Sustainable Development Goals. [Google Scholar]

- Mankiw N.G., Romer D., Weil D.N. A contribution to the empirics of economic growth. Q. J. Econ. 1992;107(2):407–437. [Google Scholar]

- Mateev M., Anastasov Y. Determinants of small and medium sized fast growing enterprises in central and eastern Europe: a panel data analysis. Financ. Theor. Pract. 2010;34(3):269–295. [Google Scholar]

- Miller J.P. United States Department of Agriculture, Economic Research Service; 1990. Survival and Growth of Independent Firms and Corporate Affiliates in Metro and Nonmetro America. [Google Scholar]

- Minniti M., Lévesque M. Entrepreneurial types and economic growth. J. Bus. Ventur. 2010;25(3):305–314. [Google Scholar]

- Moh’d Hemed I., Faki S.M., Suleiman S.H. 2019. Economic growth and environmental pollution in Brunei: ARDL bo. [Google Scholar]

- Morse R., Staley E. Vol. 4. McGraw-Hill Book Company; Australia, Canada, UK, USA: 1965. pp. 36–44. (Modern Small Industry for Developing Countries). [Google Scholar]

- Neagu C. The importance and role of small and medium-sized businesses. Theor. Appl. Econ. 2016;23(3):331–338. [Google Scholar]

- Oba U.O., Onuoha B.C. The role of small and medium scale enterprises in poverty reduction in Nigeria: 2001–2011. Afr. Res. Rev. 2013;7(4):1–25. [Google Scholar]

- Oyelana A.A., Adu E.O. Small and medium enterprises (SMEs) as a means of creating employment and poverty reduction in fort beaufort, eastern cape province of South Africa. J. Soc. Sci. 2015;45(1):8–15. [Google Scholar]

- Pan L., Mishra V. Stock market development and economic growth: empirical evidence from China. Econ. Modell. 2018;68:661–673. [Google Scholar]

- PBS Pakistan Bureau of Statistics: Government of Pakistan. 2019. https://www.pbs.gov.pk/publications Retrieved from.

- Perwaiz S.Z. Role of micro, small and medium enterprises for holistic development of Jharkhand. Anusandhanika. 2015;7(1):85. [Google Scholar]

- Pesaran M.H., Shin Y., Smith R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001;16(3):289–326. [Google Scholar]

- Pesaran M.H., Shin Y., Smith R.P. Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 1999;94(446):621–634. [Google Scholar]

- Qureshi J., Herani G.M. 2011. The Role of Small and Medium-Size Enterprises (SMEs) in the Socio-Economic Stability of Karachi. [Google Scholar]

- Reinert E.S. The role of the state in economic growth. J. Econ. Stud. 1999;26(4/5):268–326. [Google Scholar]

- Rohra C., Panhwar I.A. The role of SMEs towards exports in Pakistan economy. Austr. J. Basic Appl. Sci. 2009;3(2):1070–1082. [Google Scholar]

- Romer P.M. The origins of endogenous growth. J. Econ. Perspect. 1994;8(1):3–22. [Google Scholar]

- Savlovschi L.I., Robu N.R. The role of SMEs in modern economy. Econ. Seria Manag. 2011;14(1):277–281. [Google Scholar]

- Shaikh F.M., Shafiq K., Shah A.A. Impact of small and medium enterprises SMEs on rural development in sindh. Mod. Appl. Sci. 2011;5(3):258. [Google Scholar]

- Singer A.E. Business strategy and poverty alleviation. J. Bus. Ethics. 2006;66(2-3):225–231. [Google Scholar]

- Singh H., Mahmood R. Manufacturing strategy and export performance of small and medium enterprises in Malaysia: moderating role of external environment. Int. J. Bus. Commer. 2014;3(5):37–52. [Google Scholar]

- Spencer J.W., Gómez C. The relationship among national institutional structures, economic factors, and domestic entrepreneurial activity: a multicountry study. J. Bus. Res. 2004;57(10):1098–1107. [Google Scholar]

- Subhan Q.A. Role of small and medium enterprises (SME's) in poverty alleviation in SAARC countries (an econometric approach) Global Rev. Bus. Econ. Res. 2010;6(1):67–82. [Google Scholar]

- Tambunan T. LPFE-University of Trisakti; 2006. Development of Small and Medium Enterprises in Indonesia from the Asia-Pacific Perspective. [Google Scholar]

- Tambunan T. SME development, economic growth, and government intervention in a developing country: the Indonesian story. J. Int. Enterpren. 2008;6(4):147–167. [Google Scholar]

- Uma P. Role of SMEs in economic development of India. Asia Pac. J. Mark. Manag. Rev. 2013;2(6):120–126. [Google Scholar]

- Van Stel A., Carree M., Thurik R. The effect of entrepreneurial activity on national economic growth. Small Bus. Econ. 2005;24(3):311–321. [Google Scholar]

- Vijayakumar S. An empirical investigation on the association between small and medium enterprises and the economic growth of Sri Lanka. Trends Econ. Manag. 2013;7(15):82–91. [Google Scholar]

- Wen J. 2011. Report on the Work of Government, Delivered at the Fourth Session of the Eleventh National People's Congress.http://www.china.org.cn/china/NPC_CPPCC_2011/2011-03/15/content_22143099.%20htm [Google Scholar]

- Westlund S.G., Hannon J.C. Retaining talent: assessing job satisfaction facets most significantly related to software developer turnover intentions. J. Inf. Technol. Manag. 2008;19(4):1–15. [Google Scholar]

- World Bank Small and Medium Enterprises (SMEs) Finance. 2018. https://www.worldbank.org/en/topic/smefinance Retrieved from.

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Data Availability Statement

The authors do not have permission to share data.