Abstract

The earned income tax credit (EITC) is the largest U.S. poverty alleviation program for families with children, and state EITC policies provide a modest supplement to the federal program. Yet there are few studies of the effects of state EITC policies on population health. We examined whether state EITC policies affect mental health and health behaviors. Participants were drawn from the 1995–2015 waves of the Panel Study of Income Dynamics, a diverse national cohort study (N=10,567). We used a quasi-experimental difference-in-differences analysis to examine the effects of state EITC programs among eligible individuals, accounting for secular trends among similar individuals in non-EITC states. Outcomes included self-reported general health, psychological distress, alcohol use, and smoking. The average size of state EITC refunds in our sample was $265 for eligible individuals. In the overall sample, state EITC programs were not associated with any health outcomes of interest. This finding was robust to alternative specifications, and similar in subgroup analyses by gender and marital status. This study suggests that state EITC programs, which tend to provide smaller refunds than the federal program, may not be large enough to have a positive impact on mental health and health behaviors. These findings may inform policymaking related to the generosity of state EITC programs, especially as states seek to address the socioeconomic consequences of the COVID-19 pandemic.

Keywords: earned income tax credit, poverty alleviation, mental health, health behaviors, policy evaluation, difference-in-differences

INTRODUCTION

Poverty rates are soaring in the wake of the COVID-19 pandemic, and many state governments are actively exploring policy options to strengthen the social safety net to support vulnerable families (Parolin & Wimer, 2020). A large body of evidence demonstrates that poverty is associated with worsened mental health and health behaviors such as smoking and alcohol use (Adler & Newman, 2002). In the U.S., individuals living below poverty are at higher risk of mental illness and have higher rates of smoking and alcohol consumption than the general population (Centers for Disease Control and Prevention, 2019; Cerda et al., 2011; Ettman et al., 2020; Everson et al., 2002; Jamal et al., 2018; Substance Abuse and Mental Health Services Administration, 2016). Hypothesized mechanisms include limited psychosocial resources, reduced access to medical care and housing, as well as reduced “cognitive bandwidth” contributing to poor decision-making around health behaviors (Alderman, 2011; Dohrenwend et al., 1992; Jackson et al., 2010; Kawachi et al., 2010; Mani et al., 2013). At the same time, interventions to alleviate poverty do not consistently lead to improvements in these outcomes, perhaps due to the ways in which these programs are implemented. For example, prior work has shown that less frequent of distribution of cash benefits may paradoxically lead to increased expenditures on “temptation goods” such as alcohol and higher levels of depressive symptoms (Andrade et al., 2017; White & Basu, 2016).

In the U.S., the earned income tax credit (EITC) is the largest poverty alleviation program for families with children. It is distributed in the form of an annual lump-sum tax refund to low-income working families. In 2019, 25 million eligible individuals and families received about $63 billion, with an average refund of $2,476 per household (Internal Revenue Service, 2019c). Receipt of the refund is dependent on employment and is larger for families with children and married couples (Supplemental Figure 1). In addition to the federal EITC, over half of U.S. states have implemented supplemental EITC programs. In 1988 only four states had implemented their own EITC programs, with the number growing to 10 in 1998, and 30 states (including Washington, DC) by 2019 (Internal Revenue Service, 2019b; National Conference of State Legislatures, 2019). Indeed, state EITC programs are an active area of ongoing policymaking, and there have been proposals to expand the EITC to address the socioeconomic consequences of the COVID-19 pandemic (Maag, 2020).

The potential mechanisms through which the EITC affects health include: 1) increased income to spend on healthy food, housing, and other relevant resources; 2) improved health insurance coverage resulting in better healthcare access for treatments of physical and mental health conditions; and 3) reduced financial stress resulting in improved mental health, with related changes in health-related “coping” behaviors such as smoking and drinking (Burns, 2015; Cerda et al., 2011; Jamal et al., 2018; Lenhart, 2019a). Empirical studies have confirmed several of these hypothesized pathways. Those examining the economic impact of the EITC have found that it increases family income, reduces poverty, and increases labor force participation, especially among single mothers (Chetty et al., 2013; Hoynes et al., 2015; Molly et al., 2009). The EITC has also been linked to increased health insurance coverage (Baughman & Duchovny, 2016; Hoynes et al., 2015; Lenhart, 2019a), improvements in self-reported health and reductions in non-drug suicides (Benjamin & Nathan, 2012; Dow et al., 2019; Hamad et al., 2018; Lenhart, 2019a; Rehkopf et al., 2011), and reduced smoking among mothers (Averett & Wang, 2013; Hoynes et al., 2015).

The impact of state-level EITC programs has received less attention. While state EITC refunds are generally smaller than the federal refund, existing studies have found improved child health, increased birth weight, reduced maternal smoking, and reduced suicide rates (Baughman & Duchovny, 2016; Dow et al., 2019; Komro et al., 2019; Lenhart, 2019b; Markowitz et al., 2017; Strully et al., 2010; Wagenaar et al., 2019). A limitation of virtually all prior studies of state EITC programs is an inability to identify families eligible for the EITC due to a lack of individual sociodemographic information, with these studies relying instead on ecologic measures of state EITC policy implementation or individual educational attainment as a proxy for EITC receipt.

This study expands on previous work in several key ways. First, we examined mental health and health behaviors among EITC recipients, providing some of the first evidence on outcomes that may be more likely to be affected by a cash transfer, relative to more downstream outcomes. Second, we used individual-level data on sociodemographic characteristics to identify individuals eligible for state EITC programs, enabling us to carry out a rigorous difference-indifferences approach to estimate the impact of state EITC programs on eligible individuals. Third, we focus on state EITC policies as a realm where active policymaking is ongoing, and which represent an additional source of variation that we leverage to examine effects a cash transfer. To do so, we used a large diverse cohort spanning two decades, including recent variation in state EITC implementation to best inform ongoing policymaking.

METHODS

Sample

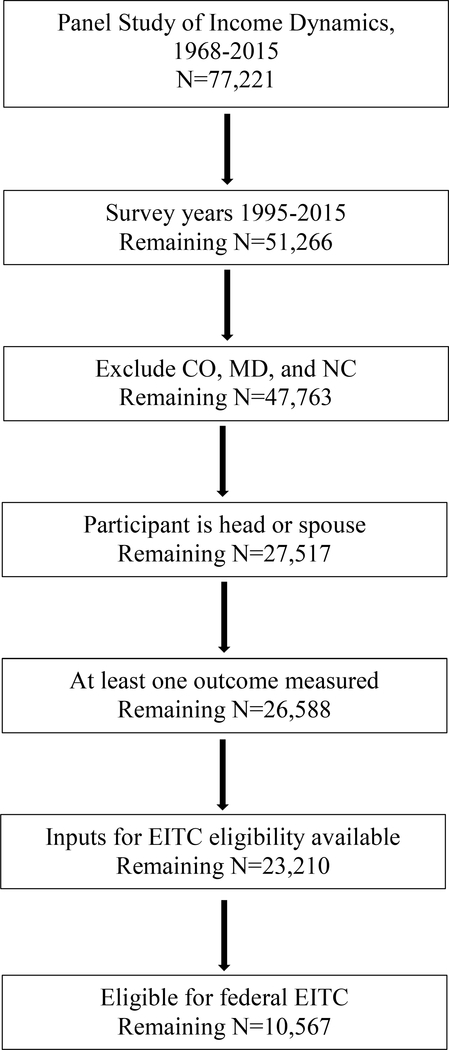

Data for this study were drawn from the Panel Study of Income Dynamics (PSID), a large national household panel survey. PSID collected data annually starting in 1968 and biennially since 1997. We included participants surveyed since 1995, when PSID began to include questions on the health outcomes of interest (see sample selection flowchart, Figure 1). We included data through 2015, the most recent year of data available at the time our analysis began (N = 51,266). We excluded participants in Colorado, Maryland, and North Carolina due to the unique structure of their state EITC laws, which do not align with our analytic approach (remaining N = 47,763). We further restricted our sample to heads of households and spouses (N = 27,517), as these were the only participants for whom PSID asked the outcomes of interest, and specifically to those with at least one health outcome measured during our study period (N = 26,588). We then restricted our sample to those with available sociodemographic information to calculate EITC refund size (N = 23,210). Finally, in order to obtain estimates for the specific population likely to be affected by the policies of interest, we restricted our sample to those eligible for the federal EITC, as the criteria for state EITC eligibility closely match federal criteria (final N = 10,567) (National Conference of State Legislatures, 2019).

Figure 1. Sample selection.

Note: EITC = earned income tax credit; CO = Colorado; MD = Maryland; NC = North Carolina.

Exposure

The main predictor was a binary variable for whether each individual lived in a state after implementation of a state-level EITC, drawn from prior studies that have compiled these data and updated with the latest state policies (Markowitz et al., 2017). State-level EITCs are usually set as a percentage of the federal refund, although several states calculate EITC refunds differently (Supplemental Table 1). As in most national surveys, however, PSID does not ask respondents about EITC receipt. In each survey year, EITC eligibility was therefore computed using the Taxsim27 package for Stata, which calculates refund amounts using formulas determined by the U.S. Internal Revenue Service (Feenberg & Coutts, 1993). Inputs included household head’s age and marital status, household pre-tax earned income, number of children, state of residence, and tax year. We assumed that all eligible households received the EITC refund, an approach used in previous studies of the EITC (Dahl & Lochner, 2012; Hamad et al., 2018; Hamad & Rehkopf, 2015; Rehkopf et al., 2011). This strategy may result in measurement error, although prior studies have shown that about 80% of eligible households actually received the refund (Internal Revenue Service, 2019a; Scholz, 1994). This approach is analogous to an intent-to-treat analysis, and is an alternative—and perhaps an improvement—on previous studies of the EITC that used educational attainment alone or ecologic measures of state EITC implementation as proxies for EITC receipt (Komro et al., 2019; Markowitz et al., 2017; Strully et al., 2010).

Health Outcomes

We examined several measures of mental health and health behaviors. Participants self-reported their general health using a 5-item scale, which we recoded as a binary variable, representing excellent, very good, or good health versus fair or poor health. Self-reported health has been shown to be a valid and reliable measure of overall health that has been used extensively in prior work, and that has been strongly correlated with measures of mental health and chronic disease (Adda et al., 2009; Bombak, 2013; Lenhart, 2019a; Nielsen, 2016; Strawbridge & Wallhagen, 1999). Psychological distress was captured using the Kessler-6 scale (K6). The K6 is a widely used tool for screening or assessing severity of mental health problems, with higher scores indicating higher levels of psychological distress (range 0–24). We also included questions on current alcohol consumption (binary) and whether the individual consumed three or more drinks per day (binary, zero for non-drinkers). While the latter does not correspond directly to binge-drinking (defined as four or more drinks per day for women and five or more for men), PSID survey waves did not include consistent question wording to capture binge-drinking. We also included questions on current smoking (binary) and the number of cigarettes smoked daily (continuous, zero for non-smokers). The K6 was asked preferentially for heads of household, while other outcomes were available for the head and spouse. Not all questions were asked in all survey years (Supplemental Table 2), resulting in slightly differing numbers of observations for each analysis. We did not impute missing outcome variables, as this is thought to add noise to resulting estimates (von Hippel, 2007).

Covariates

Covariates included age, age-squared, head of household marital status, number of children, inflation-adjusted household pre-tax income, and income-squared. The percent of missing values was less than 5% for each covariate; since complete case analysis does not introduce bias at such low levels of missingness, we did not perform imputation of missing values (Allison, 2009; Langkamp et al., 2010). State-level covariates included gross domestic product (GDP) per capita, unemployment rate, and percent of population with a high school degree or less. These state-level variables were obtained from online governmental public sources (Bureau of Economic Analysis, 2018; Bureau of Labor Statistics, 2019; US Census, 2019).

Analysis

We first tabulated sample characteristics separately for those living in states that implemented state-level EITC programs during the study period and in states that did not. We then estimated the effects of state-level EITC implementation using a difference-in-differences (DiD) approach. DiD compares pre-post changes in a “treatment” group (in this case, EITC-eligible individuals living in states that implemented an EITC program) while “differencing out” secular trends in the outcomes in a “control” group (i.e., EITC-eligible individuals living in states without EITC programs). We restricted our analyses to those eligible for the federal EITC in states that did and did not implement their own EITC programs, as state EITC eligibility criteria are identical to federal eligibility criteria in almost all states. Eligibility was determined in each survey year, therefore individuals may be included in some years and excluded in others depending on their eligibility status. To our knowledge, no prior study of state EITC programs has used this approach, which is a strength of this study given the granular sociodemographic data available for PSID participants.

A benefit of DiD is that it leverages geographic and temporal variation in state-level EITC policy implementation, which is unlikely to be correlated to individual characteristics that typically confound the association between income and health. Practically speaking, the primary independent variable in a DiD analysis is an indicator variable for whether the observation was recorded in a state with EITC after implementation of the policy. As this study involved multiple treatment units (i.e., states) implementing the policy at different time points, we followed a generalized DiD analytic approach, including fixed effects (i.e., indicator variables) for year and individual. The longitudinal nature of the PSID sample enabled us to include individual fixed effects which help to account for individual time-invariant heterogeneity. Thus, identification of the effects was based on exposure of individuals in states with EITC programs, before versus after EITC implementation or when individuals moved across states with and without EITC policies.

As is standard in DiD analyses, we used multivariable linear regressions to analyze both binary and continuous outcomes, due to differences in the interpretation of interaction terms in non-linear models (Karaca-Mandic et al., 2012). For binary outcomes, coefficients can therefore be interpreted as percent change in risk. Additional details on the methodology, including the equation, are available in the Supplement.

DiD Assumptions

DiD analysis relies on several assumptions. First, the method assumes that pre-post differences in the outcomes would be the same in the treatment and control groups in the absence of the intervention (i.e. implementation of state-level EITC policies). While this assumption fundamentally cannot be tested, we graphically examined whether trends in the outcomes during the years before state-level EITC implementation were parallel in EITC and non-EITC states among EITC-eligible individuals. States varied in when they first implemented their EITC programs, so we graphed the trends for each outcome using an event study approach, graphing trends in the outcomes relative to the year of state EITC policy implementation (Clarke & Schythe, 2020). While it is standard in DiD analysis to test for differential compositional changes over time between the treatment and control groups, due to the panel nature of the sample and inclusion of sample characteristics as covariates in our models, we did not test for compositional changes (Ryan et al., 2015).

Subgroup Analyses

Prior work has shown that the economic and health benefits of the EITC are stronger for marginalized groups, including single mothers and women of color (Evans & Garthwaite, 2014; Markowitz et al., 2017; Marr & Huang, 2019). Therefore, we conducted stratified analyses by marital status (single vs. married), gender, and race/ethnicity (White, Black, Hispanic/other). Due to the small number of Hispanic and individuals of other races in our sample, and the inconsistent categorization by PSID of Hispanic individuals across survey waves, we grouped these individuals together for the subgroup analyses.

Sensitivity Analyses

To examine the robustness of our results, we repeated our main analysis using additional model specifications. First, to reduce the possibility of selection bias that may be caused by health status or by individuals who may adjust their income to maximize their EITC benefits, we further restricted our sample to individuals who are eligible in all years before state EITC policy enactment. Next, to account for potential increases in state EITC levels during the study period, we conducted an analyses in which we use the computed a continuous variable representing an individual’s state EITC refund size as the main exposure, rather than a binary variable for state policy implementation. Lastly, to account for within-state variation rather than within-person variation, we repeated our main and subgroup analyses using state-level rather than individual-level fixed effects.

Ethics Approval

This study involved the use of public deidentified data, so ethics approval was not required.

RESULTS

Sample Characteristics

Sample characteristics were generally similar between states that did and did not implement state-level EITC programs (Table 1), although states that implemented EITC programs had a higher percentage of white participants. In states that implemented EITC programs, the average federal and state EITC refunds for eligible individuals were $1,912 (SD 1,666) and $265 (SD 349) respectively. In states that did not implement EITC programs, the average federal EITC refund was $2,014 (SD 1,682).

Table 1.

Sample characteristics, Panel Study of Income Dynamics, 1995–2015

| Living in states with EITC | Living in states without EITC | |||

|---|---|---|---|---|

| Panel A. Demographics | Mean (SD) or % | Mean (SD) or % | ||

| Female | 60.5 | 60.8 | ||

| Age (years) | 39.1 (14.4) | 38.7 (13.4) | ||

| Education | ||||

| Less than high school | 19.5 | 22.4 | ||

| High school | 43.8 | 43.8 | ||

| Some college | 24.8 | 23.7 | ||

| College or more | 11.8 | 10.2 | ||

| Race | ||||

| White | 51.2 | 33.8 | ||

| Black | 42.5 | 50.6 | ||

| Hispanic | 4.1 | 13.4 | ||

| Other | 2.3 | 2.3 | ||

| Married | 42.2 | 41.4 | ||

| Number of children | 1.5 (1.3) | 1.6 (1.3) | ||

| Household pre-tax earned incomea | 17,979 (12,596) | 18,667 (12,527) | ||

| Federal EITCa | 1,912 (1,666) | 2,014 (1,682) | ||

| State EITCa | 265 (348) | 0 | ||

| Panel B. Outcomes | Mean (SD) or % | No. Person-years | Mean (SD) or % | No. Person-years |

| General health excellent/very good/good | 82.7 | 10,473 | 80.2 | 16,426 |

| Psychological distress | 4.2 (4.4) | 4,800 | 4.2 (4.5) | 7,339 |

| Currently drinks alcohol | 57.1 | 8,197 | 51.1 | 12,699 |

| 3+ alcoholic drinks per day | 16.4 | 8,113 | 14.5 | 12,559 |

| Currently smokes | 32.1 | 8,201 | 26.4 | 12,710 |

| Number of cigarettes per day | 4.1 (7.8) | 8,174 | 3.2 (7.1) | 12,690 |

| No. persons | 4,333 | 6,488 | ||

| No. person-years | 10,491 | 16,463 | ||

Study sample was drawn from the Panel Study of Income Dynamics for survey years 1995–2015. Sample living in states with EITC includes individuals living in those states before and after policy implementation. EITC: earned income tax credit.

Inflation-adjusted US dollars

Outcomes were also generally similar for individuals in states that implemented EITC programs compared with states that did not, although participants in states that implemented EITC programs were more likely to drink alcohol and smoke. Of note, DiD requires that the trends (i.e., slopes) in the outcomes are similar during the pre-policy period, not the levels.

DiD Assumptions

In event study difference-in-difference models (Supplemental Figure 2), for all outcomes, the difference between EITC states and non-EITC states do not differ during the pre-implementation years, suggesting that the parallel trends assumption may hold.

Effects of State EITC Programs

We first examined the effects of state EITC policies in the sample overall. We were unable to rule out the null hypothesis that there was no association between state EITC programs and any of the health outcomes of interest (Table 2). We were also unable to rule out the null hypothesis of no association in subgroup analyses by marital status, gender and race (Table 3). Results were similar for other sensitivity analyses (Supplemental Table 3).

Table 2.

Effects of state-level EITC programs on mental health and health behaviors, Panel Study of Income Dynamics, 1995–2015

| Outcome | Effect of State EITC Program |

|---|---|

| β (95% CI) | |

| General health excellent/very good/good | 0.0060 (−0.019, 0.031) |

| Psychological distress | 0.31 (−0.068, 0.70) |

| Currently drinks alcohol | 0.010 (−0.033, 0.054) |

| 3+ alcoholic drinks per day | 0.0073 (−0.024, 0.039) |

| Currently smokes | −0.0094 (−0.052, 0.033) |

| Number of cigarettes per day | −0.27 (−1.06, 0.52) |

Study sample was drawn from the Panel Study of Income Dynamics for survey years 1995–2015. Coefficients represent the effect of living in a state after implementation of state-level EITC. All models adjusted for age, age-squared, head of household marital status, number of children, inflation-adjusted household pre-tax income, and income-squared, state gross domestic product per capita, state unemployment rate, state percent of population with a high school degree or less, and fixed effects for individual and year. Robust standard errors were clustered at the state level. EITC: earned income tax credit.

Table 3.

Effects of state-level EITC programs on mental health and health behaviors, Panel Study of Income Dynamics, 1995–2015

| Effect of State EITC Program by Subgroup β (95% CI) |

|||||||

|---|---|---|---|---|---|---|---|

| Marital Status | Gender | Race | |||||

| Outcome | Model 1: Single | Model 2: Married | Model 3: Male | Model 4: Female | Model 5: White | Model 6: Black | Model 7: Hispanic/Other |

| Excellent/very good/good health | −0.012 (−0.047, 0.023) |

0.017 (−0.034, 0.068) |

0.023 (−0.030, 0.075) |

−0.0036 (−0.036, 0.028) |

0.011 (−0.028, 0.050) |

−0.012 (−0.049, 0.024) |

0.10 (−0.0038, 0.21) |

| Psychological distress | 0.13 (−0.44, 0.71) |

0.013 (−0.55, 0.57) |

0.47 (−0.058, 1.00) |

0.20 (−0.26, 0.66) |

0.45 (−0.20, 1.10) |

0.46 (−0.22, 1.14) |

−0.97 (−2.48, 0.55) |

| Currently drink alcohol | −0.026 (−0.083, 0.031) |

0.048 (−0.022, 0.12) |

0.041 (−0.033, 0.12) |

−0.0056 (−0.055, 0.043) |

0.049 (−0.0083, 0.11) |

−0.031 (−0.083, 0.021) |

−0.036 (−0.24, 0.17) |

| 3+ alcoholic drinks per day | 0.012 (−0.021, 0.045) |

−0.0085 (−0.081, 0.064) |

−0.024 (−0.072, 0.024) |

0.023 (−0.013, 0.060) |

0.018 (−0.020, 0.056) |

0.0029 (−0.042, 0.048) |

−0.056 (−0.19, 0.075) |

| Currently smoke | −0.0092 (−0.072, 0.054) |

−0.015 (−0.037, 0.0084) |

−0.012 (−0.057, 0.032) |

−0.0097 (−0.064, 0.044) |

−0.012 (−0.066, 0.042) |

0.0052 (−0.044, 0.054) |

−0.0091 (−0.098, 0.079) |

| Number of cigarettes per day | −0.35 (−1.41, 0.71) |

−0.56 (−1.40, 0.28) |

−0.089 (−1.10, 0.93) |

−0.38 (−1.18, 0.42) |

−0.20 (−1.22, 0.81) |

−0.097 (−1.20, 1.01) |

−0.064 (−1.52, 1.39) |

Study sample was drawn from the Panel Study of Income Dynamics for survey years 1995–2015. Coefficients represent the effect of living in a state after implementation of state-level EITC. All models adjusted for age, age-squared, head of household marital status, number of children, inflation-adjusted household pre-tax income, and income-squared, state gross domestic product per capita, state unemployment rate, state percent of population with a high school degree or less, and fixed effects for individual and year. Robust standard errors were clustered at the state level. EITC: earned income tax credit.

In analyses using state fixed effects, state EITCs were not associated with any of the outcomes in the overall sample and results were also largely null in subgroup analyses (Supplemental Table 4). However, in these state fixed analyses state EITC programs were associated with higher likelihood of having good or better health among men (3.3 percentage points; 95%CI: 0.5, 6.1), increased consumption of alcohol among women (2.8 percentage points; 95%CI: 0.3, 5.2), and lower consumption of alcoholic drinks (−9.2 percentage points; 95%CI: −18.0, −0.7), as well as higher likelihood of smoking among individuals of Hispanic/other race/ethnicity (13.0 percentage points, 95%CI: 0.7, 26.0).

DISCUSSION

This study used a large longitudinal cohort and a quasi-experimental design to provide some of the first estimates of the impact of state EITC programs on mental health and health behaviors. State EITCs were not associated with any of the outcomes in the overall sample nor in subgroup analyses, and results were robust to different model specifications. When using state-level fixed effects, results were also null for the overall sample. In these models, results were also largely null in subgroup analyses, although state EITC programs were associated with higher likelihood of having good or better health among men, increased consumption of alcohol among women, and lower consumption of alcoholic drinks as well as higher likelihood of smoking among individuals of Hispanic/other race/ethnicity. However, these state fixed effect models do not account for individual time-invariant heterogeneity as in the individual fixed effect models.

Prior work has shown that the federal EITC is associated with improvements in general health, mental health, and reduced smoking (Boyd-Swan et al., 2016; Evans & Garthwaite, 2014; Lenhart, 2019a). Importantly, state EITC programs provide a smaller refund than the federal program ($265 vs. $1,912 in our sample) and therefore may have more modest effects on these health outcomes (Lenhart, 2019a). A handful of other studies have found that state EITC programs improve infant and perinatal health (Komro et al., 2019; Markowitz et al., 2017; Strully et al., 2010) and reduced suicide rates (Dow et al., 2019; Lenhart, 2019b). It may be that those outcomes are more responsive to changes in state EITC programs, that prior work used larger samples, or that these previous studies used crude measures to determine EITC eligibility or older data compared to the current study. For instance, while one study using data through 2002 found that state EITC programs were associated with reduced maternal smoking, more recent studies using data through 2015 have found inconsistent and mostly null results with respect to smoking and prenatal care (Markowitz et al., 2017; Strully et al., 2010; Wagenaar et al., 2019). Our current study used more recent data through 2015 and more granular sociodemographic data to estimate EITC eligibility.

To our knowledge, this is the first study to examine the effect of state EITC programs on alcohol use. Alcohol, in economic terms, is believed to be a normal good (i.e. purchases increase with increased income), especially among low-income adults, and prior work has suggested that additional income due to the EITC may lead to increased cigarette consumption (Gallet, 2007; Kenkel et al., 2014; Lenhart, 2019a). Our main analyses did not show a significant association between state EITC programs and alcohol use, indicating that state refunds may not be large enough to have a significant effect on the purchase of alcohol. However, our subgroup analyses using state fixed effects showed that state EITC programs were associated with higher alcohol consumption among women, which is consistent with a prior study examining cigarette consumption in relation to Washington DC’s EITC (Wagenaar et al., 2019). The increase in alcohol consumption among women is also consistent with results from analyses of cash transfer programs showing that larger less frequent payments increase expenditure on alcohol (Catalano et al., 2000; White & Basu, 2016). State EITC programs were associated with lower alcohol consumption among individuals of Hispanic/other race/ethnicity. Prior work on the federal EITC showed that recipients primarily use their refund on paying down debt and purchases of durable goods (e.g. appliances, household goods, vehicles) (Goodman-Bacon & McGranahan, 2008; Mendenhall et al., 2012; Shaefer et al., 2013). Therefore, our null results for alcohol and other outcomes may indicate that individuals may be spending the state refund in a similar way.

This study has several strengths. First, detailed income and demographic data in PSID allowed us to estimate individual-level EITC eligibility and refund size. Second, by using more recent data, our study accounted for more recent changes in federal and state EITC policies in the context of an evolving safety net. Third, by restricting our sample to only those eligible for the federal EITC, we compared individuals in states with EITC before and after policy implementation to individuals in states without EITC who are more likely to be a comparable comparison group. Our main analyses using individual fixed effects and additional analyses allowed us to account for time-invariant individual-level differences and to establish a consistent composition of our sample during the study period.

Our study also has several limitations. First, demographic and outcome data were self-reported, which may introduce measurement error. Second, while we were able to calculate EITC eligibility, we cannot determine who actually received the refunds. Our results are thus an average effect among individuals who are eligible for the state EITC refunds, and the presence of potentially ineligible individuals may reduce the magnitude of our estimates. Second, there may be residual confounding in our models due to unobserved individual and state characteristics. Inclusion of individual fixed effects accounts for unobserved time-invariant individual characteristics, and inclusion of year fixed effects accounts for some unmeasured time-varying confounders that are similar across all states, such as national policies and changes to the federal EITC. Any remaining unmeasured time-varying confounders would include those that changed at the same time as implementation of state EITCs. We adjusted for a handful of state-level time-varying socioeconomic characteristics to reduce possible confounding of this sort. Moreover, prior work suggests that this possibility is unlikely given that states would have to make significant legislative changes to their social welfare programs simultaneously with changes in EITC programs, and is supported by evidence that changes in Medicaid eligibility by states during 1997–2013 did not significantly change estimates of state EITC effects on health outcomes in prior work (Markowitz et al., 2017). Finally, while we conducted subgroup analyses by marital status, gender, and race, we were unable to conduct analyses for even smaller relevant subgroups like single women or women of color due to unstable estimates. Future work using larger data sets could explore effects among these groups.

In conclusion, while an increasing number of states have implemented state-level EITC programs, the results of this study suggest that the generosity of these refunds may not be enough to make substantial changes in mental health and health behaviors. This evidence is important to keep in mind as policymakers decide on the generosity and scope of interventions to alleviate financial stress in the wake of the COVID-19 pandemic and its economic impacts.

Supplementary Material

Acknowledgments

Funding: This work was supported by grants from the Robert Wood Johnson Foundation, the National Institutes of Health (grant number K08 HL132106), the UCSF Hellman Fellows Fund, the UCSF Irene Perstein Award, and the UCSF National Center of Excellence in Women’s Health. The collection of Panel Study of Income Dynamics data used in this study was partly supported by the National Institutes of Health under grant number R01 HD069609 and R01 AG040213, and the National Science Foundation under award numbers SES 1157698 and 1623684. The views expressed here do not necessarily reflect the views of the funders. The study funders had no role in study design; collection, analysis, and interpretation of data; writing the report; and the decision to submit the report for publication.

Footnotes

Publisher's Disclaimer: This is a PDF file of an unedited manuscript that has been accepted for publication. As a service to our customers we are providing this early version of the manuscript. The manuscript will undergo copyediting, typesetting, and review of the resulting proof before it is published in its final form. Please note that during the production process errors may be discovered which could affect the content, and all legal disclaimers that apply to the journal pertain.

Financial disclosure: No financial disclosures were reported by the authors of this paper.

References

- Adda J, Gaudecker H.-M.v., & Banks J (2009). The Impact of Income Shocks on Health: Evidence from Cohort Data. Journal of the European Economic Association, 7, 1361–1399. [Google Scholar]

- Adler NE, & Newman K (2002). Socioeconomic disparities in health: pathways and policies. Health affairs (Project Hope), 21, 60–76. [DOI] [PubMed] [Google Scholar]

- Alderman H (2011). No small matter: The impact of poverty, shocks, and human capital investments in early childhood development. Washington, DC: World Bank Publications. [Google Scholar]

- Allison PD (2009). Missing Data. The SAGE Handbook of Quantitative Methods in Psychology pp. 72–90). London: SAGE Publications Ltd. [Google Scholar]

- Andrade FCD, Kramer KZ, Monk JK, Greenlee AJ, & Mendenhall R (2017). Financial stress and depressive symptoms: the impact of an intervention of the Chicago Earned Income Tax Periodic Payment. Public Health, 153, 99–102. [DOI] [PubMed] [Google Scholar]

- Averett S, & Wang Y (2013). The Effects of EITC Payment Expansion on Maternal Smoking. Health Economics, 22, 1344–1359. [DOI] [PubMed] [Google Scholar]

- Baughman R, & Duchovny N (2016). State Earned Income Tax Credits and the Production of Child Health: Insurance Coverage, Utilization, and Health Status. National Tax Journal, 69, 103–132. [Google Scholar]

- Benjamin C, & Nathan T (2012). Education, Maternal Smoking, and the Earned Income Tax Credit. The B.E. Journal of Economic Analysis & Policy, 12, 1–39. [Google Scholar]

- Bombak AE (2013). Self-Rated Health and Public Health: A Critical Perspective. Frontiers in public health, 1, 15. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Boyd-Swan C, Herbst CM, Ifcher J, & Zarghamee H (2016). The earned income tax credit, mental health, and happiness. Journal of Economic Behavior & Organization, 126, 18–38. [Google Scholar]

- Bureau of Economic Analysis. (2018). BEA Data. Bureau of Economic Analysis.

- Bureau of Labor Statistics. (2019). Local Area Unemployment Statistics Home Page. Bureau of Labor Statistics. [Google Scholar]

- Burns JK (2015). Poverty, inequality and a political economy of mental health. Epidemiology and Psychiatric Sciences, 24, 107–113. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Catalano R, McConnell W, Forster P, McFarland B, Shumway M, & Thornton D (2000). Does the Disbursement of Income Increase Psychiatric Emergencies Involving Drugs and Alcohol? Health Services Research, 35, 813-813. [PMC free article] [PubMed] [Google Scholar]

- Centers for Disease Control and Prevention. (2019). Cigarette and Tobacco Use Among People of Low Socioeconomic Status. Centers for Disease Control and Prevention. [Google Scholar]

- Cerda M, Johnson-Lawrence V, & Galea S (2011). Lifetime income patterns and alcohol consumption: Investigating the association between long-and short-term income trajectories and drinking. Social Science & Medicine, 73, 1178–1185. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Chetty R, Friedman JN, & Saez E (2013). Using Differences in Knowledge across Neighborhoods to Uncover the Impacts of the EITC on Earnings. American Economic Review, 103, 2683–2721. [Google Scholar]

- Clarke D, & Schythe KT (2020). Implementing the Panel Event Study. IZA Discussion Papers.

- Dahl GB, & Lochner L (2012). The Impact of Family Income on Child Achievement: Evidence from the Earned Income Tax Credit. American Economic Review, 102, 1927–1956. [Google Scholar]

- Dohrenwend BP, Levav I, Shrout PE, Schwartz S, Naveh G, Link BG, et al. (1992). Socioeconomic status and psychiatric disorders: the causation-selection issue. Science 255, 946–952. [DOI] [PubMed] [Google Scholar]

- Dow WH, Godøy A, Lowenstein CA, & Reich M (2019). Can Economic Policies Reduce Deaths of Despair? National Bureau of Economic Research Working Paper Series, No. 25787.

- Ettman CK, Cohen GH, & Galea S (2020). Is wealth associated with depressive symptoms in the United States? Annals of Epidemiology, 43, 25–31.e21. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Evans WN, & Garthwaite CL (2014). Giving Mom a Break: The Impact of Higher EITC Payments on Maternal Health. American economic Journal: economic policy, 6, 258–290. [Google Scholar]

- Everson SA, Maty SC, Lynch JW, & Kaplan GA (2002). Epidemiologic evidence for the relation between socioeconomic status and depression, obesity, and diabetes. Journal of Psychosomatic Research, 53, 891–895. [DOI] [PubMed] [Google Scholar]

- Feenberg D, & Coutts E (1993). An introduction to the TAXSIM model. Journal of Policy Analysis and Management, 12, 189–194. [Google Scholar]

- Gallet CA (2007). The demand for alcohol: a meta-analysis of elasticities. The Australian Journal of Agricultural and Resource Economics, 51, 121–135. [Google Scholar]

- Goodman-Bacon A, & McGranahan L (2008). How do EITC recipients spend their refunds? Economic Perspectives, 17–32. [Google Scholar]

- Hamad R, Collin DF, & Rehkopf DH (2018). Estimating the Short-Term Effects of the Earned Income Tax Credit on Child Health. American Journal of Epidemiology, 187, 2633–2641. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hamad R, & Rehkopf DH (2015). Poverty, Pregnancy, and Birth Outcomes: A Study of the Earned Income Tax Credit. Paediatric and Perinatal Epidemiology, 29, 444–452. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hoynes H, Miller D, & Simon D (2015). Income, the Earned Income Tax Credit, and Infant Health. American Economic Journal: Economic Policy, 7, 172–211. [Google Scholar]

- Internal Revenue Service. (2019a). EITC participation rate by states Internal Revenue Service.

- Internal Revenue Service. (2019b). States and Local Governments with Earned Income Tax Credit Internal Revenue Service.

- Internal Revenue Service. (2019c). Statistics for tax returns with EITC | EITC & Other Refundable Credits. Internal Revenue Service. [Google Scholar]

- Jackson JS, Knight KM, & Rafferty JA (2010). Race and Unhealthy Behaviors: Chronic Stress, the HPA Axis, and Physical and Mental Health Disparities Over the Life Course. American Journal of Public Health, 100, 933–939. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Jamal A, Phillips E, Gentzke AS, Homa DM, Babb SD, King BA, et al. (2018). Current Cigarette Smoking Among Adults — United States, 2016. MMWR. Morbidity and mortality weekly report, 67, 53–59. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Karaca-Mandic P, Norton EC, & Dowd B (2012). Interaction terms in nonlinear models. Health Services Research, 47, 255–274. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kawachi I, Adler NE, & Dow WH (2010). Money, schooling, and health: Mechanisms and causal evidence. Annals of the New York Academy of Sciences, 1186, 56–68. [DOI] [PubMed] [Google Scholar]

- Kenkel D, Schmeiser M, & Urban C (2014). Is Smoking Inferior?: Evidence from Variation in the Earned Income Tax Credit. Journal of Human Resources, 49, 1094–1120. [Google Scholar]

- Komro KA, Markowitz S, Livingston MD, & Wagenaar AC (2019). Effects of State-Level Earned Income Tax Credit Laws on Birth Outcomes by Race and Ethnicity. Health Equity, 3, 61–67. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Langkamp DL, Lehman A, & Lemeshow S (2010). Techniques for handling missing data in secondary analyses of large surveys. Academic Pediatrics, 10, 205–210. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lenhart O (2019a). The effects of income on health: new evidence from the Earned Income Tax Credit. Review of Economics of the Household, 17, 377–410. [Google Scholar]

- Lenhart O (2019b). The effects of state-level earned income tax credits on suicides. Health Economics, 28, 1476–1482. [DOI] [PubMed] [Google Scholar]

- Maag E (2020). HEROES Act Would Expand The EITC For Childless Workers And Help Fight Recession. Washington, D.C.: Tax Policy Center. Urban Institute & Brookings Institution. [Google Scholar]

- Mani A, Mullainathan S, Shafir E, & Zhao J (2013). Poverty Impedes Cognitive Function. Science, 341, 976–980. [DOI] [PubMed] [Google Scholar]

- Markowitz S, Komro KA, Livingston MD, Lenhart O, & Wagenaar AC (2017). Effects of state-level Earned Income Tax Credit laws in the U.S. on maternal health behaviors and infant health outcomes. Social Science & Medicine, 194, 67–75. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Marr C, & Huang Y (2019). Women of Color Especially Benefit From Working Family Tax Credits.

- Mendenhall R, Edin K, Crowley S, Sykes J, Tach L, Kriz K, et al. (2012). The Role of Earned Income Tax Credit in the Budgets of Low-Income Households. Social Service Review, 86, 367–400. [Google Scholar]

- Molly D, Thomas D, & Jonathan S (2009). Stepping Stone or Dead End? The Effect of the EITC on Earnings Growth. National Tax Journal, 62, 329–346. [Google Scholar]

- National Conference of State Legislatures. (2019). Tax credits for working families: earned income tax credit. National Conference of State Legislatures. [Google Scholar]

- Nielsen TH (2016). The Relationship Between Self-Rated Health and Hospital Records. Health Economics, 25, 497–512. [DOI] [PubMed] [Google Scholar]

- Parolin Z, & Wimer C (2020). Forecasting Estimates of Poverty During the COVID-19 Crisis. Center on Poverty and Social Policy at Columbia University, 4.

- Rehkopf DH, Strully KW, & Dow WH (2011). The impact of poverty reduction policy on child and adolescent overweight: a quasi-experimental analysis of the earned income tax credit. Am J Epidemiol, S238. [Google Scholar]

- Ryan AM, Burgess JF Jr., & Dimick JB (2015). Why We Should Not Be Indifferent to Specification Choices for Difference-in-Differences. Health Services Research, 50, 1211–1235. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Scholz JK (1994). The Earned Income Tax Credit: Participation, Compliance, and Anti-Poverty Effectiveness. National Tax Journal, 47. [Google Scholar]

- Shaefer H, Song X, & Shanks TW (2013). Do single mothers in the United States use the Earned Income Tax Credit to reduce unsecured debt? Review of Economics of the Household, 11, 659–680. [Google Scholar]

- Strawbridge WJ, & Wallhagen MI (1999). Self-Rated Health and Mortality Over Three Decades: Results from a Time-Dependent Covariate Analysis. Research on Aging, 21, 402–416. [Google Scholar]

- Strully KW, Rehkopf DH, & Xuan Z (2010). Effects of Prenatal Poverty on Infant Health: State Earned Income Tax Credits and Birth Weight. American Sociological Review, 75, 534–562. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Substance Abuse and Mental Health Services Administration. (2016). Serious Mental Illness Among Adults Below the Poverty Line. Substance Abuse and Mental Health Services Administration. [Google Scholar]

- US Census. (2019). Census Bureau. US Census. [Google Scholar]

- von Hippel PT (2007). Regression with Missing Ys: An Improved Strategy for Analyzing Multiply Imputed Data. Sociological Methodology, 37, 83–117. [Google Scholar]

- Wagenaar AC, Livingston MD, Markowitz S, & Komro KA (2019). Effects of changes in earned income tax credit: Time-series analyses of Washington DC. SSM - Population Health, 7, 100356. [DOI] [PMC free article] [PubMed] [Google Scholar]

- White JS, & Basu S (2016). Does the benefits schedule of cash assistance programs affect the purchase of temptation goods? Evidence from Peru. Journal of Health Economics, 46, 70–89. [DOI] [PMC free article] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.