Abstract

Background and Aims

Washington Initiative 1183 (I-1183), a 2012 law that privatized liquor retail sales and distribution in Washington state, USA, has had two opposing effects on liquor purchases: it has increased access to liquor and imposed new fees on retailers and distributors. This study aimed to estimate the effect of I-1183 on monthly alcohol purchases in the post-I-1183 period (June 2012-December 2014) compared with the pre-I-1183 period (January 2010-May 2012).

Design

Differences-in-differences study.

Setting and participants

The study included households participating in the Nielsen Consumer Panel Dataset living in metropolitan and surrounding areas in Washington State and 10 control states.

Measurements

Outcomes were alcohol purchases by type (ounces of liquor, wine, beer, and total alcohol or ethanol).

Findings

I-1183 was associated with a 6.34-ounce (p<0.001) and a 2.01-ounce (p<0.001) increase in monthly liquor and ethanol purchases, respectively, per household in the post-policy period spanning 31 months compared with monthly purchases in control states. In a longitudinal subgroup analysis, low and moderate alcohol purchasers increased monthly purchases of ethanol, and high purchasers decreased purchases of ethanol.

Conclusions

Enacting ‘Washington Initiative 1183’, a law that privatized sale and distribution of liquor and imposed new fees on retailers and distributors, appears to have been associated with an approximate 82% increase in monthly liquor purchases and 26% increase in monthly ethanol purchases by households in metropolitan and surrounding areas in the state of Washington, USA.

Introduction

Excessive alcohol consumption is responsible for 88,668 deaths per year1 and is the fourth leading underlying cause of death in the United States (U.S.),2 preceded by tobacco use, poor diet, and physical inactivity. Despite the public health effects of excessive alcohol consumption, state and local governments have largely loosened their regulatory control of alcohol for decades. Privatization is where one type of alcohol is no longer sold by state-run stores and becomes available for purchase in stores that obtain licenses. From the 1960s through the 1980s, several monopoly control states privatized the retail sale of wine, with studies reporting subsequent increases in wine and total alcohol sales.4–6 Iowa privatized retail liquor sales in March of 1987, resulting in a 9.5% increase in liquor consumption.7 West Virginia followed in 1990.8

Community Preventive Services Task Force, convened by the Centers for Disease Control and Prevention, has issued recommendations on eight policies to decrease excessive alcohol consumption. The Task Force recommends against privatization of alcohol sales based on evidence that privatization of alcohol is associated with increased per-capita alcohol sales, a proxy for excessive alcohol consumption.9 The Task Force also recommends increasing alcohol taxes,10 maintaining limits on hours of sale,11 and regulating alcohol outlet density.12

Passed by popular vote in 2011, Washington’s Initiative 1183 (I-1183) privatized the retail sale of liquor, took an unprecedented step of privatizing the distribution of liquor, and included increases in taxes and fees to maintain revenue in the absence of state stores. I-1183 is the most significant change in alcohol regulation by a state since the repeal of prohibition.13 The Washington State Liquor Control Board ceased state liquor store and liquor distribution operations on June 1, 2012. Ending a monopoly would decrease the price of liquor; however, the initiative included taxes and fees equaling 10% of the wholesale price and 17% of the retail price, both of which were included in the retail price. These taxes and fees were in addition to excise taxes that were the highest among all states prior to I-1183.14 Liquor prices rose by an average of 15.5% for a standard bottle of liquor (750 ml) post-privatization.15 Two other studies report higher liquor sales in bordering states, Idaho16,17 and Oregon,17 and this is likely due to increased liquor prices in Washington.

Privatization in Washington through I-1183 resulted in an almost five-fold increase (328 to 1,600) in the number of off-premise locations licensed to sell liquor.18 After I-1183, stores selling alcohol can be open 20 hours a day, 7 days a week, almost doubling the hours of access. Grocery stores and other retailers may sell liquor, making its purchase more convenient. I-1183 included policies that would be expected to have opposing effects, with privatization increasing access and increasing purchases, and higher taxes and fees increasing the price of liquor and decreasing purchases.

One published study examined the effects of I-1183 on individual-level consumption in Washington through 2015. Using retrospective self-reported consumption, the study found no change in alcohol volume and a decrease in spirits volume.19 A published report using Behavioral Risk Factor Surveillance System data found 0.9% increase in self-reported any alcohol use but no change in binge or heavy drinking.20 However, Washington’s Office of Financial Management reports a 13% increase in liquor sales through 2014.21 Each of these findings are based on data from within Washington, which do not account for cross-border sales or for potential changing trends in alcohol consumption in the region or the U.S.

We examine the effect of I-1183 in Washington on household-level monthly alcohol purchases among households in metropolitan areas. We employ differences-in-differences (pre-post with treatment-control) which improves on the pre-post design by adding a control group not exposed to the policy change, accounting for time-dependent trends. Our research questions are: (1) What is the direct net effect of I-1183 on liquor purchases, wine purchases and beer purchases? (2) What is the net effect of I-1183 on household total alcohol purchases? (3) Are there differential effects of I-1183 on household alcohol purchases by baseline level of alcohol purchases?

Methods

Data

We use data from the Nielsen Consumer Panel Dataset which tracks household purchases from various retailers. Panelists are provided an in-home bar code scanner to record each product purchased from any retailer. These data include detailed information on the type and quantity of alcohol purchased off-premise.22 Approximately 60,000 households have participated in the panel annually since 2007. Our study uses data from calendar years 2010 to 2014 to capture data prior to I-1183 (January 2010-May 2012) and after I-1183 (June 2012-December 2014). The panel of households is an overlapping unbalanced panel with some households participating for several years. Nielsen Consumer Panel data are representative of purchases at the level of metropolitan areas called “scantrack markets”.23 Our analytic sample includes data from metropolitan and surrounding areas within Washington and 10 control states.

Outcome variables

The outcome variable of interest is total ounces of liquor purchases by households per month across all shopping trips. Since I-1183 could affect households’ purchasing of other types of alcoholic beverage, other variables of interest include total ounces of wine and total ounces of beer purchases by households per month across all shopping trips. We computed a variable, total ethanol ounces, by multiplying each type of alcoholic beverage by its estimated proportion of ethanol content (0.411 for spirits, 0.129 for wine, and 0.045 for beer) and summing across the types.24

Independent variables

Each analysis controls for the following categorical demographic variables: income level, hours of employment, age group, marital status, whether there are children living in the home, racial group and Hispanic ethnicity. Indicators for each state are entered into the model to control for time-invariant confounders at the state level. Year and month indicators are included to control for time trends and seasonality in alcohol purchasing. We include two state-level variables, annual unemployment rate and annual beer taxes rates per gallon, to control for factors at the state level that could affect trends in alcohol purchases. The beer excise tax in Washington temporarily increased from $0.26 per gallon in 2009 to $0.76 per gallon from 2010 to 2013, returning to $0.26 per gallon in 2014.25

Washington residents approved Initiative 502, marijuana legalization for personal use, by popular vote on November 6, 2012. Retail stores began opening July 8, 2014. In the intervening time period, marijuana was decriminalized. To control for the potential confounding effects of changes in marijuana laws, an indicator for the decriminalization (equal to one from November 2012 to June 2014) and an indicator for the legal retail sale of marijuana (equal to one from July to December 2014) in Washington are entered into the main analyses.

Analytic approach: main analysis

To test whether I-1183 had a significant effect on alcohol purchases by households in Washington, we employ a differences-in-differences (DID) approach. The analytic model can be written as:

| (1) |

where the data vary by household (i), state (s) and time (t). Yit is the outcome of interest: ounces of liquor, wine, beer, or ethanol purchases by households per month. Xist is a vector of household demographic variables. St is a vector of state-level indictor variables and state-level unemployment and beer tax rates. T is a vector of time variables, including year and month indicators. The variable, WAit, represents households residing in Washington and β4 captures differences in alcohol purchases in Washington, the treatment state, versus a set of other monopoly control states, which collectively serve as controls. A variable representing the timing of the dissolution of state control of liquor stores and distribution, I-1183ist, is equal to one in the post-I-1183 period (June 2012 onward) and zero beforehand. We are interested in the coefficient on the variable, WAit*I-1183ist, an interaction between WAit and I-1183ist, equaling one for households residing in Washington in the post-I-1183 period. The DID estimate is the predicted change in volume of alcohol purchases by households per month among people living in Washington minus the predicted change in volume of alcohol purchases by households per month among people living in monopoly control states. Predicted differences are estimated using non-linear post-estimation techniques to obtain the DID estimates and standard errors.26 For ease of interpretation, we also report the DID effect in equivalent monthly drinks.a

The dependent variables are continuous. A large fraction of the population has no purchases of alcohol within a given month, and the data are skewed. We estimate the models using the negative binomial to accommodate for over-dispersion. The error terms are clustered at the state level. All analyses and post-estimations are conducted using Nielsen-projection factor weights.

To examine whether Washington and monopoly control states had parallel trends in liquor purchases in the pre-policy period, an assumption of the DID approach, we first conduct a visual inspection of the unadjusted average volume of liquor purchases by households per month in Washington compared to 10 monopoly control states with comparable alcohol systems pre-I-1183: Alabama, Idaho, Maine, Mississippi, Montana, New Hampshire, North Carolina, Oregon, Vermont, and Virginia. Other monopoly states were not included in the control group for a number of reasons8: Iowa and West Virginia previously privatized liquor retail sales, Michigan and Wyoming allow liquor sales in grocery stores, Ohio licenses retail stores, and lastly, Pennsylvania and Utah do not allow beer (higher than 3.2% in Utah) and wine sales in grocery stores. We formally test whether Washington has differential trends in liquor purchasing in the pre-policy period.

Robustness check: accounting for changes in marijuana access

Literature on the relationship between marijuana and alcohol is mixed.27 Using cross-sectional variation in state beer taxes, two studies found marijuana moved in the same direction as alcohol, leading the authors to conclude the two substances are complements.28,29 Studies using quasi-experimental methods report marijuana and alcohol are substitutes, because increases in marijuana use lead to decreases in alcohol use.30–32 We address the concern that ignoring legalization of marijuana could underestimate or overestimate the impact of I-1183 in our estimation strategy by conducting the main analysis excluding the six months (July through December 2014) when marijuana was legally available to purchase in retail stores in Washington.

Longitudinal subgroup analysis: the effect of I-1183 by pre-policy levels of alcohol purchasing

We explore whether there was a heterogeneous response to I-1183 by baseline level of household alcohol purchases. We construct a longitudinal panel of households that participated in the Nielsen Consumer Panel for three continuous years surrounding I-1183 (2011–2013). The National Institute on Alcohol Abuse and Alcoholism (NIAAA) defines low-risk drinking as no more than a total of 14 drinks a week for men and a total of 7 drinks a week for women in addition to daily limits.33 We translated NIAAA’s weekly guidelines to household purchasing thresholds for the pre-policy period from January 2011 to May 2012. We created household-specific total ethanol purchase thresholds based on the number of adult men and women in each household. For example, a household with one adult male and one adult female would have a weekly threshold of 21 drink purchases and threshold of 1,551 total drink purchases for all of the pre-policy period. Households were labeled high alcohol purchasers (>threshold), moderate alcohol purchasers (<threshold & >0.5*threshold) and low alcohol purchasers (>0 & <0.5*threshold). We repeated the DID estimations separately for each of these subgroups. The analysis plan for this study was not pre-registered and the results should be considered exploratory.

Results

Table 1 reports the pre-policy means of households in the outcomes and covariates across Washington and control states. Washington households earn slightly higher incomes and are more likely to be white than households in other states. Washington households purchased much more wine than households in other states.

Table 1.

Pre-privatization (January 2010-May 2012) means by household in WA and Control states

| Controls | WA | Prob > F | Controls | WA | Prob > F | ||

|---|---|---|---|---|---|---|---|

| Dependent variables | Dependent variables cont. | ||||||

| Monthly oz liquor purchases | 7.33 | 9.81 | 0.00 | Monthly oz beer purchases | 56.68 | 59.40 | 0.17 |

| Monthly oz wine purchases | 14.71 | 24.96 | 0.00 | Monthly oz ethanol purchases | 7.45 | 9.92 | 0.00 |

|

| |||||||

| Covariates (annual) | Covariates (annual) cont. | ||||||

| Income | Household composition | ||||||

| Under $25,000 (base) | 0.24 | 0.20 | 0.00 | Any children in the home | 0.34 | 0.33 | 0.02 |

| $25,000–34,000 | 0.11 | 0.09 | 0.00 | Number of adults | 1.91 | 1.92 | 0.61 |

| $35,000–49,000 | 0.16 | 0.15 | 0.04 | Household size | 2.50 | 2.53 | 0.02 |

| $50,000–69,000 | 0.16 | 0.18 | 0.00 | Race and ethnicity | |||

| $70,000–99,000 | 0.15 | 0.17 | 0.00 | White (base) | 0.78 | 0.83 | 0.00 |

| $100,000 & up | 0.18 | 0.21 | 0.00 | Black | 0.16 | 0.03 | 0.00 |

| Marital status | Asian | 0.02 | 0.06 | 0.00 | |||

| Married (base) | 0.49 | 0.47 | 0.00 | Other race | 0.04 | 0.08 | 0.00 |

| Widowed | 0.10 | 0.11 | 0.00 | Hispanic | 0.05 | 0.07 | 0.00 |

| Divorced | 0.21 | 0.22 | 0.00 | State level covariates | |||

| Single | 0.21 | 0.21 | 0.87 | State beer tax | 0.50 | 0.47 | 0.00 |

| State unemployment | 8.77 | 9.37 | 0.00 | ||||

|

| |||||||

| Covariates by male head of household (annual) | Covariates by female head of household (annual) | ||||||

| Male head age cateogories | Female head age categories | ||||||

| Age 18–24 (base) | 0.00 | 0.01 | 0.01 | Age 18–24 (base) | 0.01 | 0.01 | 0.02 |

| Age 25–44 | 0.18 | 0.20 | 0.00 | Age 25–44 | 0.22 | 0.24 | 0.00 |

| Age 45–64 | 0.33 | 0.33 | 0.27 | Age 45–64 | 0.39 | 0.33 | 0.00 |

| Age 65 & up | 0.12 | 0.11 | 0.00 | Age 65 & up | 0.11 | 0.12 | 0.10 |

| Male head employment status | Female head employment status | ||||||

| Not employed (base) | 0.21 | 0.20 | 0.00 | Not employed (base) | 0.35 | 0.33 | 0.00 |

| Employed 30 hours | 0.04 | 0.03 | 0.02 | Employed 30 hours | 0.09 | 0.10 | 0.04 |

| Employed 30–34 hours | 0.02 | 0.02 | 0.02 | Employed 30–34 hours | 0.04 | 0.04 | 0.00 |

| Employed 35 hours & up | 0.44 | 0.47 | 0.00 | Employed 35 hours & up | 0.32 | 0.31 | 0.02 |

| Male head education | Female head education | ||||||

| < high school grad (base) | 0.06 | 0.04 | 0.00 | < high school grad (base) | 0.03 | 0.02 | 0.00 |

| High school grad | 0.23 | 0.19 | 0.00 | High school grad | 0.28 | 0.22 | 0.00 |

| Some college | 0.20 | 0.25 | 0.00 | Some college | 0.26 | 0.28 | 0.00 |

| College graduate | 0.22 | 0.23 | 0.01 | College graduate | 0.23 | 0.25 | 0.00 |

Notes: N in control states (AL, ID, MS, MT, NC, NH, OH, OR, VT & VA) =200,739. N in WA=43,948. Observations are household-months from January 2010-May 2012. Income, marital status and race variables are binary and percentages sum to one. State unemployment is the percentage*100. State beer tax, number of adults and household size are continuous variables. Male head and female head percentages are unconditional means and do not sum to one. All means are calculated using sampling weights.

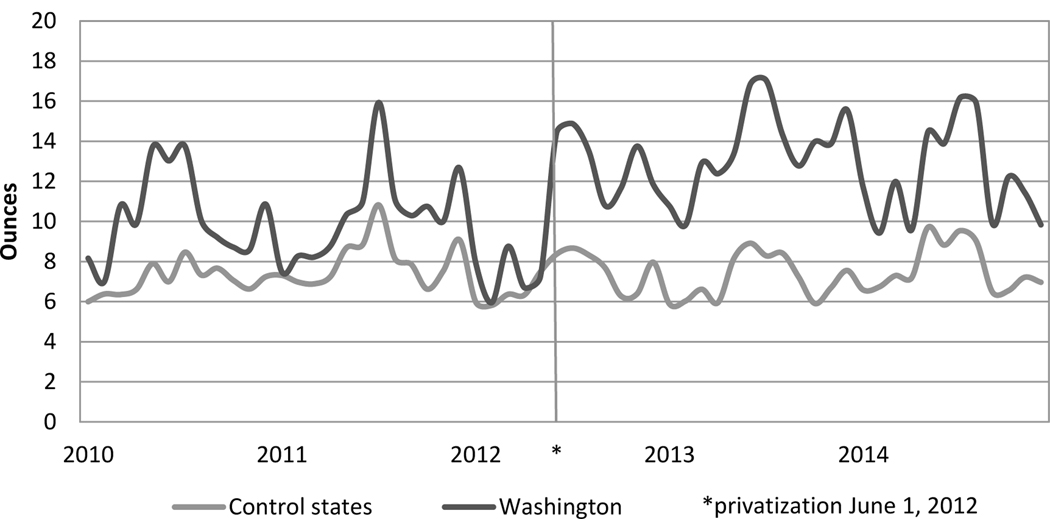

Figure 1 plots the average unadjusted values of ounces of liquor purchases by households in Washington and the control states every month from January 2010 through December 2014. Metropolitan households in Washington had higher liquor purchases than those in the control states, even prior to privatization of liquor from I-1183. Overall, there is seasonal variation, but trends are relatively stable from 2010 to May 2012. Despite the differences in levels, trends in Washington and other states are approximately parallel. In the formal test of parallel trends in the pre-policy period, the variable representing Washington’s trend is statistically insignificantly different from the control states (p=0.241), lending further support that the 10 monopoly control states is an appropriate control group for conducting DID analyses. Post-I-1183, Washington’s liquor purchases trend line appears to shift upward in a parallel manner as opposed to a change in the slope. Statistically, Washington’s trend remains insignificant (p=0.252) in the post-policy period and thus we do not estimate differential trends in the model. Note that the shift in liquor purchases precedes marijuana decriminalization in November 2012.

Figure 1.

Unadjusted mean monthly household liquor purchases pre- and post-privatization

DID estimates of monthly household-level purchases are presented in Table 2 with the “DID effect” representing the monthly change in purchases at the household level in the post-policy period (31 months). Using other monopoly control states as controls, I-1183 is significantly associated with a 6.34-ounce increase in monthly liquor purchases, a 6.9-ounce increase in monthly beer purchases, and a 2.01-ounce increase in monthly ethanol purchases. Volume of wine purchases did not significantly change. These increases represent an approximate 82% increase in liquor purchases, 12% increase in beer purchases and 26% increase in ethanol purchases in comparison to mean monthly purchases by households pre-I-1183. Excluding the time period when marijuana was available for legal sale in retail stores, the effects of I-1183 are equivalent to our main analysis (results not shown).

Table 2.

Difference-in-Difference Estimates: Effect of privatization on alcohol purchases in the post-policy period (June 2012-December 2014)

| oz liquor | oz wine | oz beer | oz ethanol | |

|---|---|---|---|---|

| DID effect | 6.34 *** | −8.37 | 6.9 ** | 2.01 *** |

| 95% CI | [2.09, 10.59] | [−18.03, 1.29] | [0.47, 13.33] | [0.64, 3.38] |

| p-value | 0.00 | 0.09 | 0.04 | 0.00 |

| DID equivalent monthly drinks | 4.23 | −1.67 | 0.58 | 3.35 |

| Baseline mean monthly drinks | 5.16 | 3.28 | 4.76 | 13.10 |

| N=510,276 |

Notes: Observations are household-months. All specifications are estimated using sampling weights. Differences-in-differences (DID) effect is estimated using -predictnl- in stata. Analytic standard errors (SE) are clustered at the state level and are calculated using the delta method. Equivalent mean monthly drinks=DID effect/ounces in a standard drink. Baseline mean monthly drinks are means in the pre-policy period.

Significantly different at the

5% level;

1% level.

The longitudinal subgroup analyses are presented in Table 3. The top panel repeats the main analysis using the longitudinal subsample of households, spanning 19 months post-I-1183. In the longitudinal subsample, I-1183 is associated with increases in monthly purchases of 4.97 ounces of liquor and 1.56 ounces of ethanol. Among low alcohol purchasers, I-1183 is associated with monthly increases of 7.52 and 4.78 ounces, for liquor and ethanol, respectively. I-1183 is similarly associated with a 4.54-ounce increase in monthly ethanol purchases among moderate alcohol purchasers but there was not a corresponding increase in liquor purchases. I-1183 is associated with a 7.16-ounce decrease in monthly ethanol purchases among high alcohol purchasers. There were no significant changes in wine or beer purchases in the overall longitudinal sample or in the subgroups.

Table 3.

2011–2013 Longitudinal Panel DID Estimates: Effect of privatization on alcohol purchases in the post-policy period (June 2012-December 2013)

| Full longitudinal panel | oz liquor | oz wine | oz beer | oz ethanol | |

|---|---|---|---|---|---|

| N=214,128 | DID effect | 4.97 ** | −3.95 | 1.1 | 1.56 *** |

| 100% longitudinal sample | CI | [0.03, 9.91] | [−12.97, 5.07] | [2.10, 9.04] | [0.68, 2.44] |

| p-value | 0.05 | 0.39 | 0.79 | 0.00 | |

| DID equivalent monthly drinks | 3.31 | −0.79 | 0.09 | 2.60 | |

| Baseline mean monthly drinks | 5.72 | 3.95 | 4.90 | 14.52 | |

|

| |||||

| Low alcohol purchasers | oz liquor | oz wine | oz beer | oz ethanol | |

| N=119,940 | DID effect | 7.52 *** | −0.85 | 4.78 | 3.08 *** |

| 56% longitudinal sample | CI | [2.56, 12.48] | [−3.26, 1.56] | [−0.83, 10.39] | [1.51, 4.65] |

| p-value | 0.00 | 0.57 | 0.09 | 0.00 | |

| DID equivalent monthly drinks | 5.01 | −0.17 | 0.40 | 5.13 | |

| Baseline mean monthly drinks | 3.39 | 2.24 | 3.08 | 8.64 | |

|

| |||||

| Moderate alcohol purchasers | oz liquor | oz wine | oz beer | oz ethanol | |

| N=12,360 | DID effect | 39.29 | −0.70 | 46.53 | 4.54 ** |

| 5.4% longitudinal sample | CI | [−56.53, 135.11] | [−58.30, 56.90] | [103.84, 196.90] | [0.70, 8.37] |

| p-value | 0.42 | 0.98 | 0.54 | 0.02 | |

| DID equivalent monthly drinks | 26.19 | −0.14 | 3.88 | 7.57 | |

| Baseline mean monthly drinks | 19.98 | 18.75 | 19.18 | 57.92 | |

|

| |||||

| High alcohol purchasers | oz liquor | oz wine | oz beer | oz ethanol | |

| N=11,292 | DID effect | −22.96 | 5.21 | −88.81 | −7.16 ** |

| 5.1% of longitudinal sample | CI | [−69.55, 23.63] | [−141.22, 151.64] | [382.12, 204.50] | [−13.00, −1.32] |

| p-value | 0.33 | 0.94 | 0.55 | 0.016 | |

| DID equivalent monthly drinks | −15.31 | 1.04 | −7.40 | −11.93 | |

| Baseline mean monthly drinks | 54.86 | 33.97 | 43.06 | 131.63 | |

Notes: Observations are household-months. All specifications are estimated using sampling weights. Differences-in-differences (DID) effect is estimated using -predictnl- in stata. Analytic standard errors (SE) are clustered at the state level and are calculated using the delta method. Equivalent mean monthly drinks=DID effect/ounces in a standard drink. Baseline mean monthly drinks are means in the pre-policy period. Households that did not purchase any alcohol in the pre-policy period are included in full longitudinal panel estimation.

Significantly different at the

5% level;

1% level.

Discussion

Our study is the first to examine the effect of I-1183 in metropolitan areas on household-level off-premise monthly alcohol purchases. Self-reported total alcohol use (on-premise and off-premise) covers about half of all alcohol sales,34 meaning that people do not report about half of their total alcohol use. Individual-level purchasing is predictive of future alcohol consumption.35 Although the Nielsen Consumer Panel Dataset includes a higher percentage of alcohol non-purchasers, alcohol purchases aligns closely with the Consumer Expenditure Survey when non-purchasers are excluded.36 Self-scanned purchases may provide greater coverage for the proportion of sales that are consumed off-premise, albeit for those who participate in the Nielsen Consumer Panel Dataset.

Studies of the elasticity of alcohol purchases have consistently found that alcohol purchases decrease when price increases even among people characterized as addicted. A meta-analysis leads to the conclusion that liquor is the most responsive to price among the different types of alcohol with an elasticity of −0.8.37 In the absence of other changes, this increase in the price of liquor would be expected to decrease liquor purchases by about 12% (0.8*the percentage price change or 15.5%15). Yet, we found an increase in liquor purchases for households in metropolitan areas, suggesting that increased access to liquor substantially reduced the convenience costs of purchasing, more than simply offsetting the effect of the price increase. For metropolitan residents in Washington, the distance to a store that sells liquor decreased and because of I-1183, and liquor is sold for longer and later hours.

One study evaluating the overall effect of I-1183 reports no significant change in alcohol volume.19 Per capita total ethanol sales in Washington appears relatively flat across I-1183. We compute an unadjusted differences-in-differences of reported annual mean per capita ethanol sales24 pre- (2010 and 2011) and post- (2013 and 2014) I-1183 in Washington compared to the 10 control states as a group and find about a 3 percentage-point decrease in total ethanol volume. We hypothesize households in metropolitan areas experienced and responded to greater increase in access, which might explain why our study found an increase in monthly ethanol purchases in the short term following I-1183. An alternative explanation is that an increase in purchases may have been offset by a decrease in on-premise purchases which are not included in the Nielsen data.

In the subgroup analysis where households were separated by pre-policy level of alcohol purchases, we found a differential response to I-1183, which is expected, and calls into question what aspects of alcohol behavior are mutable by privatization and changes in alcohol prices. We found that low and moderate purchasers increased monthly overall ethanol purchases. We found that high purchasers decreased their monthly overall ethanol purchases. Given the opposing effects of increased price and increased access, a potential explanation for the subgroup findings is that access may have a dominant effect for low purchasers and price may have a dominant effect for high purchasers. The confidence intervals for some of the estimates are wide; and therefore, additional research is needed to estimate the magnitude of these opposing effects.

I-1183 increased liquor purchases by about one drink a week at the household level, consisting of an average of 2 adults, in the first 2.5 years post-I-1183. Even a modest increase in alcohol consumption could have negative health consequences particularly for people who are more vulnerable to potential negative health consequences associated with alcohol, including people with chronic conditions or taking medications, pregnant women, or those at the margin of developing an alcohol use disorder. Additionally, the protective effect of alcohol has been challenged.38 A large-scale study concluded that reductions in alcohol consumption, even for light and moderate drinkers, is beneficial to cardiovascular health.39 Experts now agree that any level of regular drinking increases health risks, including having a causal link to many cancers,40 and has led Canada, Australia and UK to change their recommendations on alcohol consumption in recent years. Alcohol misuse also causes harms to others. A study of Seattle found significant increases in aggravated and non-aggravated assaults related to increases in on- and off-premise alcohol outlets following I-1183.41 Evaluations of the effects of I-1183 on a range of health effects would contribute to our overall understanding of the total effects of I-1183.

Limitations

We examine the overall effect of Washington’s unprecedented package policy, I-1183, on monthly alcohol purchases by metropolitan households, encompassing both a change in access to liquor and prices of liquor, both of which change over time and cannot be disentangled by the current study design. Future work should attempt to tease out these effects. We use household-level purchasing data, which is not equivalent to consumption.

Because our analyses are conducted at the household-level, we implicitly assume that alcohol purchases are distributed evenly among all adults in the household. We are not able to directly account for stockpiling prior to I-1183 and do not observe an increase in unadjusted mean monthly household liquor purchases prior to I-1183. Although Nielsen uses data from select retailers to validate purchases, panel participants’ purchases may not be generalizable if they do not scan all of the alcohol they purchase or if people who are heavy users of alcohol are less likely to participate in the panel. Each of these concerns would bias our results downward.

The Nielsen Consumer Panel data are not representative of households at the state level so our findings are not representative of all households in Washington. The Nielsen Consumer Panel data are representative of “scantrack markets”, which are metropolitan areas. As a sensitivity analysis, when we exclude 25.8% of the sample from surrounding metropolitan areas, the results (not shown) do not change. The effect of I-1183 may be different in non-metropolitan areas. People living in urban areas tend to have lower abstinence and higher rates of AUD whereas underage drinking appears to be higher in rural areas.42 Additional research is needed to examine the effects of I-1183 across urban, suburban and rural areas.

Using data through 2014, our study reports on the short-term impacts of I-1183. The immediate post-policy period may be the most accurate assessment of I-1183 because marijuana retail stores began opening in the summer of 2014. Our study includes the time when marijuana was decriminalized, meaning there was no penalty for adult personal use of marijuana but no legal means to purchase it. Because the change was simultaneous with I-1183, our findings of the net effect of I-1183 include potential substitution or complementary effects of decriminalized marijuana and alcohol purchases. A recent study found a non-significant 1.2 percentage point increase in past-year use of marijuana associated with the passage of I-502 and no significant change in simultaneous use with alcohol.43

Policy implications

The effects of I-1183 are both relevant from a public health perspective and from a policy perspective among monopoly control states. Although purchasers of liquor in Washington report greater satisfaction with convenience and store hours,44 a study of voting behavior and opinions of I-1183 indicates that if the measure were re-proposed with full knowledge of the post-policy environment, it would fail.45 Measures to privatize liquor sales have been proposed in Oregon and Pennsylvania in 2016, and the issue may arise in one of the other remaining monopoly control states. Although the movement from public to private sale and/or distribution of alcohol is rarely reversed, states considering changes to their alcohol policy systems should carefully consider the policy composition of I-1183 and its outcomes.

Acknowledgements

The authors thank William Kerr, Director of the National Alcohol Research Center, for discussions of characterizing state alcohol policy systems. The results of this paper are calculated (or Derived) based on data from Copyright © 2107 The Nielsen Company (US), LLC and marketing databases provided by the Kilts Center for Marketing Data Center at The University of Chicago Booth School of Business. Information about the data and access are available at http://research.chicagobooth.edu/nielsen/. Any errors are our own.

Funding sources:

(1) ITHS TL1 TR000422 Multidisciplinary Predoctoral Clinical Research Training Program from the NIH National Center for Advancing Translational Sciences

(2) 5 T32 AA 007240-39 Graduate Research Training on Alcohol Problems from the NIH National Institute on Alcohol Abuse and Alcoholism

Its contents are solely the responsibility of the authors and do not necessarily represent the official views of the NIH.

Footnotes

Declarations of competing interest: None

Equivalent monthly drinks = DID effect in ounces/ounces in a standard drink by type. A standard drink is defined as 1.5 ounces of liquor (40% alcohol), 5 ounces of wine (12% alcohol), or 12 ounces of beer (5% alcohol), all of which have about 0.6 ounces of ethanol.

References

- 1.Alcohol Related Disease Impact (ARDI) online application. Centers for Disease Control and Prevention. https://nccd.cdc.gov/DPH_ARDI/default/default.aspx. Retrieved March 5, 2019. [Google Scholar]

- 2.Mokdad AH, Stroup D, Marks J, Gerberding J. Actual causes of death in the U.S., 2000. JAMA. 2004; 291:1238–45. [DOI] [PubMed] [Google Scholar]

- 3.SAMHSA. 2014 National Survey on Drug Use and Health (NSDUH). Alcohol Use, Binge Alcohol Use, and Heavy Alcohol Use in the Past Month among Persons Aged 18 or Older, by Demographic Characteristics: Percentages, 2014 and 2015. https://www.samhsa.gov/data/sites/default/files/NSDUH-DetTabs-2015/NSDUH-DetTabs-2015/NSDUH-DetTabs-2015.htm#tab2-46b. Retrieved March 5, 2019. [Google Scholar]

- 4.Macdonald S. The impact of increased availability of wine in grocery stores on consumption: Four case histories. British Journal of Addiction. 1986;81:381–387. [DOI] [PubMed] [Google Scholar]

- 5.Wagenaar AC, Holder HD. A change from public to private sale of wine: Results from natural experiments in Iowa and West Virginia. Journal of Studies on Alcohol. 1991; 52:162–173. [DOI] [PubMed] [Google Scholar]

- 6.Wagenaar AC, Holder HD. Changes in alcohol consumption resulting from elimination of retail wine monopolies: Results from five U.S. states. Journal of Studies on Alcohol. 1995;56:566–572. [DOI] [PubMed] [Google Scholar]

- 7.Holder HD, Wagenaar AC. Effects of the elimination of a state monopoly on distilled spirits’ retail sales: a time-series analysis of Iowa. British Journal of Addition. 1990;85(12):1615–1625. [DOI] [PubMed] [Google Scholar]

- 8.Control State Information Sheets. National Alcohol Beverage Control Association. https://www.nabca.org/control-state-directory-and-info. Retrieved March 5, 2019.

- 9.Hahn RA, Middleton JC, Elder R, et al. Effects of alcohol retail privatization on excessive alcohol consumption and related harms: A Community Guide systematic review. American Journal of Preventive Medicine. 2012;42(4):418–427. [DOI] [PubMed] [Google Scholar]

- 10.Elder RW, Lawrence B, Ferguson A, et al. The effectiveness of tax policy interventions for reducing excessive alcohol consumption and related harms. American Journal of Preventive Medicine. 2010;38(2):217–29. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Hahn RA, Kuzara JL, Elder R, et al. Effectiveness of policies restricting hours of alcohol sales in preventing excessive alcohol consumption and related harms. American Journal of Preventive Medicine. 2010;39(6):590–604. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.Campbell CA, Hahn RA, Elder R, et al. The effectiveness of limiting alcohol outlet density as a means of reducing excessive alcohol consumption and alcohol-related harms. American Journal of Preventive Medicine. 2009;37(6):556–69. [DOI] [PubMed] [Google Scholar]

- 13.Kerr WC, Barnett SBL. Alcohol retailing systems: Private vs. government control. In Giesbrecht N, Bosma LM, ed. Preventing Alcohol-Related Problems: Evidence and Community-based Initiatives. 2017. [Google Scholar]

- 14.Tax foundation. State excise tax rates on spirits, 2007–2013. https://taxfoundation.org/state-excise-tax-rates-spirits-2007-2013/. Retrieved March 5, 2019.

- 15.Kerr WC, Williams E, Greenfield TK. Analysis of price changes in Washington following the 2012 liquor privatization. Alcohol and Alcoholism. 2015;50(6)654–660. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 16.Winfree JA, Watson P. Substitution of liquor sales across states. Applied Economic Letters. 2014;22(11):891–894. [Google Scholar]

- 17.Ye Y, Kerr WC. Estimated increase in cross-boarder purchases by Washington residents following liquor privatization and implications for alcohol consumption trends. Addiction. 2016; 111(11); 1948–1953. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Washington State Liquor and Cannabis Board. Frequently requested lists: Off-premise licensees. http://www.liq.wa.gov/records/frequently-requested-lists. Retrieved October 29, 2017.

- 19.Kerr WC, Williams E, Ye Y, Subbaraman MS, Greenfield TK. Survey estimates of changes in alcohol use following the 2012 privatization of the Washington liquor monopoly. Alcohol and Alcoholisum. 2018;53(4):470–476. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Dilley J, Becker L. Changes in Liquor Laws in Washington State: Evaluating the Impact of I-1183. 2015. http://adai.uw.edu/1183/. Retrieved October 29, 2017.

- 21.Office of Financial Management. Washington State privatization of liquor: The impact of initiative 1183. 2015. https://ofm.wa.gov/sites/default/files/public/legacy/fiscal/pdf/liquor_privatization_initiative1183.pdf. Retrieved October 29, 2017.

- 22.Nielson Consumer Panel Database Details. Copyright © 2017 The Nielsen Company (US), LLC. Kilts Center for Marketing at The University of Chicago Booth School of Business. https://www.chicagobooth.edu/research/kilts/datasets/nielsen. Retrieved March 5, 2019.

- 23.Nielsen consumer panel dataset manual. A Kilts Center Archive of The Nielsen Company. 2016. [Google Scholar]

- 24.Haughwout SP, Slater ME. Surveillance Report#110: Apparent per capita alcohol consumption: National, state, and regional trends, 1977–2016. Report and data available at: https://pubs.niaaa.nih.gov/publications/surveillance.htm

- 25.Tax foundation. State beer excise tax rates, 2009–2013. https://taxfoundation.org/state-beer-excise-tax-rates-2009-2013/ Retrieved March 5, 2019.

- 26.Karaca-Mandic P, Norton EC, Dowd B. Interaction terms in nonlinear models. Health Services Research. 2012;47:255–274. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 27.Subbaraman MS. Substitution and complementarity of alcohol and cannabis: A review of the literature. Substance Use & Misuse. 2016;51(11):1399–1414. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28.Pacula RL. Does increasing the beer tax reduce marijuana consumption? J Health Econ. 1998;17(5):557–585. doi: 10.1016/S0167-6296(97)00039-8. [DOI] [PubMed] [Google Scholar]

- 29.Williams J, Pacula RL, Chaloupka FJ, Wechsler H. Alcohol and marijuana use among college students: Economic complements or substitutes? Health Econ. 2004;13(9):825–843. doi: 10.1002/hec.859. [DOI] [PubMed] [Google Scholar]

- 30.DiNardo J, Lemieux T. Alcohol, marijuana, and American youth: The unintended consequences of government regulation. J Health Econ. 2001;20(6):991–1010. [DOI] [PubMed] [Google Scholar]

- 31.Crost B, Rees DI. The minimum legal drinking age and marijuana use: New estimates from the NLSY97. J Health Econ. 2013;32(2):474–476. [DOI] [PubMed] [Google Scholar]

- 32.Mark Anderson D, Hansen B, Rees DI. Medical Marijuana Laws, Traffic Fatalities, and Alcohol Consumption. J Law Econ. 2013;56(2):333–369. [Google Scholar]

- 33.National Institute of Alcohol Abuse and Alcoholism. Rethinking Drinking: Alcohol & your health. What’s “low-risk” drinking? 2016. http://rethinkingdrinking.niaaa.nih.gov/How-much-is-too-much/Is-your-drinking-pattern-risky/Whats-Low-Risk-Drinking.aspx. Retrieved October 29, 2017.

- 34.Kerr WC & Greenfield TK. Distribution of alcohol consumption and expenditures and the impact of improved measurement on coverage of alcohol sales in the 2000 National Alcohol Survey. Alcoholism Clinical & Experimental Research. 2007;31(10):1714–1722. [DOI] [PubMed] [Google Scholar]

- 35.MacKillop J, Murphy JG. A behavioral economic measure of demand for alcohol predicts brief intervention outcomes. Drug and Alcohol Abuse. 2007;89(2–3):227–233. [DOI] [PubMed] [Google Scholar]

- 36.Cotti C, Dunn RA, Tefft N. The great recession and consumer demand for alcohol: A dynamic panel data analysis of households. American Journal of Health Economics. 2015; 1(3):297–325. [Google Scholar]

- 37.Wagenaar AC, Solois MJ & Komro KA. Effects of beverage alcohol price and tax levels on drinking: a meta-analysis of 1003 estimates from 112 studies. Addiction. 2009;104:179–190. [DOI] [PubMed] [Google Scholar]

- 38.Roereche M, Rehm J. The cardioprotective association of average alcohol consumption and ischaemic heart disease: a systematic review and meta-analysis. Addiction. 2012;107(7):1246–1260. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 39.Holmes MV, Dale CE, Zuccolo L et al. Association between alcohol and cardiovascular disease: Mendelian randomisation analysis based on individual participant data. British Medical Journal. 2014;349: 1–16. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 40.International Agency for Research on Cancer. Consumption of alcoholic beverages, monograph 100E. IARC Monographs on the evaluation of carcinogenic risks to humans. 2012. http://monographs.iarc.fr/ENG/Monographs/vol100E/mono100E-11.pdf. Retrieved October 29, 2017. [Google Scholar]

- 41.Tabb LP, Ballester L, Grubesic TH The spatio-temportal relationship between alcohol outlets and violence before and after privatization: A natural experiment, Seattle, Wa 2010–2013. Spatial and Spatio-temoporal Epidemiology. 2016; 19:115–124. [DOI] [PubMed] [Google Scholar]

- 42.Dixon MA, Chartier KG. Alcohol use patterns among urban and rural residents. Alcohol Research. 2016;38(1):69–77. [PMC free article] [PubMed] [Google Scholar]

- 43.Kerr WC, Ye Y, Subbaraman MS, Williams E, Greenfield TK. Changes in marijuana use across 2012 state recreational legalization: Is retrospective assessment of use before legalization more accurate? Journal of Studies on Alcohol and Drugs. 2018; 79(3):495–502. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 44.Greenfield TK, Williams E, Kerr WC, Subbaraman MS. Washington State spirits privatization: How satisfied were liquor purchasers before and after, and type of retail stores in 2014? Substance Use & Misues. 2018;53(8):1260–1266. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 45.Subbaraman MS, Kerr WC. Opinions on the privatization of distilled-spirits sales in Washington State: Did voters change their minds? Journal of Studies on Alcohol and Drungs. 2016; 77(4):568–576. [DOI] [PMC free article] [PubMed] [Google Scholar]