Abstract

Low fruit and vegetable (FV) intake and high sugar-sweetened beverage (SSB) consumption are independently associated with an increased risk of developing cardiovascular disease (CVD). Many people in New York City (NYC) have low FV intake and high SSB consumption, partly due to high cost of fresh FVs and low cost of and easy access to SSBs. A potential implementation of an SSB tax and an FV subsidy program could result in substantial public health and economic benefits. We used a validated microsimulation model for predicting CVD events to estimate the health impact and cost-effectiveness of SSB taxes, FV subsidies, and funding FV subsidies with an SSB tax in NYC. Population demographics and health profiles were estimated using data from the NYC Health and Nutrition Examination Survey. Policy effects and price elasticity were derived from recent meta-analyses. We found that funding FV subsidies with an SSB tax was projected to be the most cost-effective policy from the healthcare sector perspective. From the societal perspective, the most cost-effective policy was SSB taxes. All policy scenarios could prevent more CVD events and save more healthcare costs among men compared to women, and among Black vs. White adults. Public health practitioners and policymakers may want to consider adopting this combination of policy actions, while weighing feasibility considerations and other unintended consequences.

Supplementary Information

The online version contains supplementary material available at 10.1007/s11524-022-00699-3.

Keywords: Food policy, Urban health, Policy modeling, Economic evaluation

Introduction

Healthful diets are an important protective factor for cardiovascular disease (CVD) [1, 2]. Specifically, low fruit and vegetable (FV) intake and high sugar-sweetened beverage (SSB) consumption are independently associated with an increased risk of developing CVD [3–6]. Yet, approximately half of US adults report consuming at least one SSB on a given day [7]. Moreover, only one in three women and one in five men report eating the recommended amount of fruits and vegetables per day (5 + servings/day) nationally [8].

As CVD continues to place a heavy burden on society and the healthcare system in the USA, public health professionals and policymakers have increasingly looked to SSB taxes as a strategy for decreasing sugar intake and lowering the risk of CVD in the population. To date, 8 jurisdictions enacted SSB excise taxes across the USA—including in Albany (NY), Berkeley (CA), Boulder (CO), Oakland (CA), Philadelphia (PA), San Francisco (CA), Santa Fe (NM), Seattle (WA), and Cook County (IL) [9]. Evidence indicates that the taxes discouraged the purchase and consumption of SSBs [10–12]. An SSB excise tax also generates new revenue that can be earmarked, or directed, towards programs to promote health. One such program that has been implemented in several cities with tax revenues is FV financial incentives for those shopping with Supplemental Nutrition Assistance Program (SNAP) benefits [13], which have been linked to an increase in FV purchases in farmers markets [14], mobile produce markets [15], and supermarkets [16, 17]; and have the potential to increase FV intake that is protective against CVD [18]. Pairing SSB taxes and FV subsidies may improve dietary behaviors from multiple dimensions and have a greater positive combined effect on health than either singly policy action alone [19].

In New York City (NYC), the high cost of living and existence of areas that are and have been historically impacted by food apartheid (areas with limited access to fresh FVs) make fresh FVs less affordable and accessible [20, 21]. These and multiple other factors may contribute to the low observed prevalence of consumption of 5 servings of FVs amongst NYC adults of 10%; nationally, this percentage is 12% [20, 22]. In addition, SSB consumption in NYC remains high and has plateaued after several years of decline, with 24% of residents reporting drinking one or more SSB per day, and 84% reporting drinking an SSB in a typical week [23]. A potential implementation of an SSB tax and an FV subsidy program could result in substantial public health and economic benefits.

In this study, we used a microsimulation model of CVD to assess the impact of implementing SSB taxes and FV subsidies on long-term CVD outcomes and healthcare costs in NYC. We simulated the potential implementation of each policy alone as well as funding FV subsidies with an SSB tax (a combined policy). We also assessed the cost-effectiveness of each policy in preventing CVD compared to the status quo.

Methods

Model Development

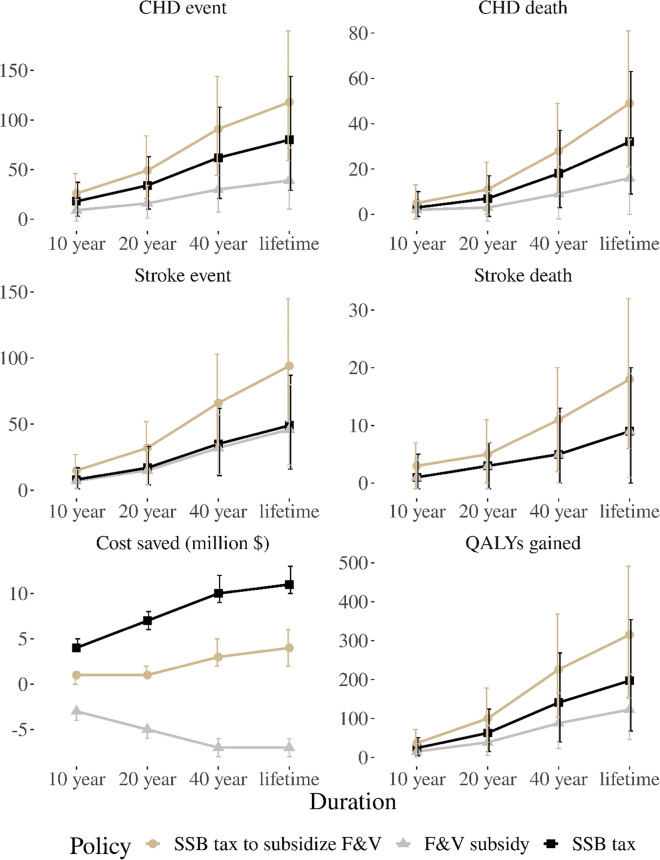

We developed a microsimulation model of CVD for NYC adults based on the well-established CVD Policy Model [24–27]. Model details and a model schematic are included in the Online Supplementary Document. Briefly, the model simulates healthy individuals (i.e., no history of CVD) and their risk of CVD over time. Within each year of the simulation, individuals are at risk of experiencing coronary heart disease (CHD), stroke, both CHD and stroke, CVD-related death, and non-CVD-related death (Fig. 1). The annual probability of incident CHD, incident stroke, and non-CVD related death are estimated by functions accounting for age, body mass index (BMI), smoking status, systolic blood pressure, diabetes status, high-density lipoprotein cholesterol, low-density lipoprotein cholesterol, and estimated glomerular filtration rate (a list of model parameters is presented in Table S1 in the Supplementary Document). Once a CHD or stroke event occurs, individuals are at risk of secondary or recurrent CVD events and CVD-related death (Table S2). We assumed each individual can experience at most two CVD-related events per year. As individuals progress through the model, their CVD event history, survival, quality-adjusted life years (QALYs), direct healthcare costs, and program implementation costs are recorded at 10 years, 20 years, 40 years, and over their entire lifetime (death or 100 years of age). The model was programmed in R (version 3.6.1). The study was approved by the Institutional Review Board at the Icahn School of Medicine at Mount Sinai.

Fig. 1.

Model schematic. Notes: CHD, coronary heart disease; CVD, cardiovascular disease

Simulated Population

We simulated a population representative of NYC adults by sampling 10,000 individuals and their characteristics from the NYC Health and Nutrition Examination Survey (NYC HANES, 2003–2004 and 2013–2014). We matched NYC HANES participants on CVD risk factors to participants from the National Heart, Lung, and Blood Institute Pooled Cohorts for whom lifetime CVD risk factor trajectories were previously developed (Table S3) [28–30]. We assigned each individual daily intake of SSB and FV using data from the 2018 NYC Community Health Survey [31]. We fit truncated normal distributions using race and sex stratified mean per-capita intake of FVs (number of cups) and SSBs (number of drinks) from daily dietary recall questions (Table S4).

Policy Scenarios

We modeled three policy scenarios, including (1) an SSB tax; (2) an FV subsidy; and (3) a combined policy that uses the SSB tax revenue to fund FV subsidies. We compared each of the above policy scenarios to the status quo. We modeled the effect of the SSB tax and FV subsidy on consumption outcomes through price changes and their associated price elasticity based on Eq. 1 below (Table S2). To model the relationship, we assumed that (1) the effects from an SSB tax and an FV subsidy were independent (i.e., an SSB tax only influences SSB consumption and FV subsidies would only impact FV consumption), (2) the time lag between policy implementation and changes in SSB and FV consumptions is less than a year, and (3) the policy effects remain constant as long as taxes and subsidies continue [32].

Change in SSB and F&V consumption

| 1 |

where Cold and Cnew are SSB consumption and FV consumption before and after policy implementation, pold and pnew are SSB and FV prices before and after policy implementation, and ε is price elasticity, which reflects the percentage of consumption change with a 1-percent price change. We used the SSB price change percentage and mean FV prices to derive the purchase price percentage changes for FV subsidies (Table S5). We assumed tax revenues would be equally distributed to fund FV subsidies.

The Effects of SSB and FV Consumption Changes on CVD and Diabetes Risk

We estimated the relative risk (RR) of CHD and stroke incidence with SSB and FV consumption based on findings from recent meta-analyses (Table S6) [33, 34]. We also included an RR for the effect of SSB and FV intake on the incidence of diabetes mellitus [2, 34]. We modeled the effects of changes in consumption on the risk of CHD, stroke, and diabetes as RR = , where RRincremental is the RR per one-unit reduction in SSB or FV consumption per day and is multiplied by the probability of an incident event without SSB or FV policies.

Cost and Utility Model Parameters

We estimated the implementation costs for SSB taxes to be 2% of the tax revenue collected and for FV subsidies to be 20% of the subsidies in the first year and 5% for the years afterward. Details about our estimation of the policy implementation costs are provided in the Supplementary Document. We estimated the QALYs for different disease stages based on the published literature [35–37]. The model includes disutility associated with acute CHD and stroke events that are applied for 30 days and subsequent chronic disutility that are applied each cycle afterward. The healthcare costs and disutility values are presented in Tables S7-S8 in the Supplementary Document. The QALY and cost parameters were also used in the other studies with the microsimulation version of the CVD Policy Model [24, 25]. Healthcare costs were inflated to 2019 US dollars using the medical component of the US Consumer Price Index.

Model Validation

Our model was calibrated to match contemporary CHD, stroke, and mortality rates for the US from the Centers for Disease Control and Prevention (CDC), National Hospital Discharge Survey, National Inpatient Sample, National Vital Statistics System, and NHLBI Pooled Cohort Study, and cross-validated against the dynamic population version of the CVD Policy Model (Figure S5-S8 in the Supplementary Document). We then compared the estimated CVD, non-CVD, and all-cause mortality rates from our model to those observed in the NYC metropolitan area derived from the CDC’s Wide-ranging ONline Data for Epidemiologic Research (WONDER) [38].

Statistical Analyses

For the primary analysis, we compared the costs, QALYs, and cost-effectiveness of the status quo, SSB taxes only, FV subsidies only, and a combined policy over 10 years. Each policy was evaluated from the healthcare sector perspective (direct medical costs regardless of payer) and societal perspective (direct medical costs plus policy and implementation costs). Incremental cost-effectiveness ratios (ICERs) for each policy were calculated as the mean difference in costs divided by the mean difference in QALYs. Future costs and QALYs were discounted annually at 3% [39]. We used a threshold of $50,000/QALY to determine if a strategy was cost-effective [40]. We also used the incremental net monetary benefit (INMB) to determine the cost-effectiveness of a strategy. INMB represents the monetary value of a strategy at a given willingness-to-pay threshold and is calculated as: INMB = incremental QALYs*willingness-to-pay – incremental costs. For this analysis, when the monetized incremental health gains are greater than the incremental costs (i.e., INMB > $0), the strategy is cost-effective relative to the status quo. Further, the strategy with the highest INMB is the most cost-effective and, thus, preferred strategy at the willingness-to-pay threshold.

We conducted deterministic sensitivity analyses to assess the potential impact of time horizon, price elasticity, and policy implementation costs on cost-effectiveness results. We accounted for joint uncertainty of model parameters in the cost-effectiveness analysis by probabilistically sampling parameter values from prespecified distributions in 1000 model iterations (Table S5). Results are presented as the mean and 95% uncertainty intervals (UI; 2.5th to 97.5th percentile) of 1000 iterations. Our analysis adhered to the requirements from the Consolidated Health Economic Evaluation Reporting Standards (CHEERS) 2022 Checklist (Table S9).

Results

Compared with the status quo over 10 years, our model projected that, per 10,000 adults in NYC, an SSB tax would prevent 26 (95%UI, 4 to 92) CVD events, FV subsidies 16 (95%UI, − 1 to 36) CVD events, and a combined policy 41 (95%UI, 15 to 73) CVD events (Table 1). Compared with the status quo, an SSB tax would increase total QALYs by 24 (95%UI, 4 to 51), FV subsidies by 15 (95%UI, 2 to 35), and the combined policy by 37 (95%UI, 9 to 72). Each policy was estimated to result in reduced healthcare costs compared with the status quo, with the largest savings projected when funding FV subsidies with an SSB tax at $1,200,000 (95%UI, $620,000 to $1,900,000). An SSB tax policy was revenue generating compared with the status quo and was projected to save $3,280,000 (95%UI, $3,040,000 to $3,530,000) in policy costs over 10 years. However, FV subsidies would increase policy costs by $3,950,000 (95%UI, $3,870,000 to $4,020,000), and the combined policy would increase costs by $660,000 (95%UI $400,000 to $910,000). From the healthcare sector perspective, the INMBs for an SSB tax, FV subsidies, and a combined policy were $1,933,000, $1,210,000, and $3,065,000, respectively, which suggested that the combined policy was the most cost-effective compared to the status quo. From the societal perspective, the most cost-effective policy was the SSB tax.

Table 1.

Projected health and economic outcomes in 10 years under different policies

| Status quo | SSB taxes | FV subsidies | SSB taxes + FV subsidies | |

|---|---|---|---|---|

| Healthcare outcomes | ||||

| CHD events | 592 (542 to 648) | 574 (523 to 631) | 584 (534 to 638) | 566 (518 to 622) |

| Stroke events | 275 (241 to 313) | 267 (232 to 304) | 268 (233 to 304) | 260 (225 to 296) |

| CVD deaths | 165 (133 to 202) | 161 (128 to 196) | 163 (129 to 199) | 158 (125 to 193) |

| QALYs |

81,702 (81,380 to 81,996) |

81,726 (81,406 to 82,020) |

81,717 (81,400 to 82,020) |

81,739 (81,416 to 82,036) |

| Costs (2019 USD, thousands) | ||||

| Total (Societal) |

670,900 (661,111 to 680,489) |

666,869 (657,206 to 676,306) |

674,380 (664,683 to 683,884) |

670,366 (660,656 to 679,850) |

| Healthcare |

670,900 (661,111 to 680,489) |

670,153 (660,544 to 679,564) |

670,434 (660,745 to 679,937) |

669,703 (659,982 to 679,049) |

| Prevented healthcare outcomes | ||||

| CHD events | – | 18 (3 to 75) | 9 (− 2 to 20) | 26 (9 to 46) |

| Stroke events | – | 8 (1 to 17) | 7 (1 to 16) | 15 (6 to 27) |

| CVD deaths | – | 4 (− 2 to 151) | 3 (− 3 to 10) | 8 (− 3 to 20) |

| QALYs gained | – | 24 (4 to 51) | 15 (2 to 35) | 37 (9 to 72) |

| Incremental costs (2019 USD, thousands) | ||||

| Total (societal) | – |

− 4030 (− 4580 to − 3640) |

3,480 (3130 to 3770) |

− 540 (− 1150 to − 20) |

| Healthcare | – |

− 750 (− 1390 to − 260) |

− 470 (− 820 to − 180) |

− 1200 (− 1900 to − 620) |

| Policy | – |

− 3280 (− 3530 to − 3040) |

3950 (3870 to 4020) |

660 (400 to 910) |

| Implementation | – | 70 (60 to 70) | 250 (250 to 260) | 320 (310 to 330) |

| Incremental cost-effectiveness | ||||

| Healthcare sector perspective | ||||

| ICER ($/QALY) | – | Dominated* | Dominated* | Dominant** |

| INMB ($, thousands) | 1933 (543 to 3813) | 1210 (382 to 2467) | 3065 (1248 to 5290) | |

| Societal perspective | ||||

| ICER ($/QALY) | – | Dominant** | Dominated*** | Dominant** |

| INMB ($, thousands) | 5216 (386 to 6941) |

− 2736 (− 3566 to − 1513) |

2402 (682 to 4492) |

|

SSB sugar sweetened beverage, FV fruit and vegetable, CHD coronary heart disease, CVD cardiovascular disease, QALY quality-adjusted life year; ICER incremental cost-effectiveness ratio; INMB = Incremental net monetary benefit

1All numerical results are presented as mean estimate with (95% UIs)

2INMB represents the monetary value of an intervention at a given willingness-to-pay threshold. INMB is calculated as: INMB = incremental QALYs*willingness-to-pay – incremental costs. For this analysis, willingness-to-pay was set at $50,000 per QALY. When the monetized incremental health gains are greater than the incremental costs (i.e., INMB > $0), the strategy is cost-effective relative to the status quo. Further, the strategy with the highest INMB is the most cost-effective and, thus, preferred strategy at the willingness-to-pay threshold

*Dominated (i.e., costs more and less effective) by combining SSB taxation with F&V subsidies

**Dominant (i.e., cost less and more effective) vs. status quo

***Dominated by SSB taxation alone and combining SSB taxation with F&V subsidies

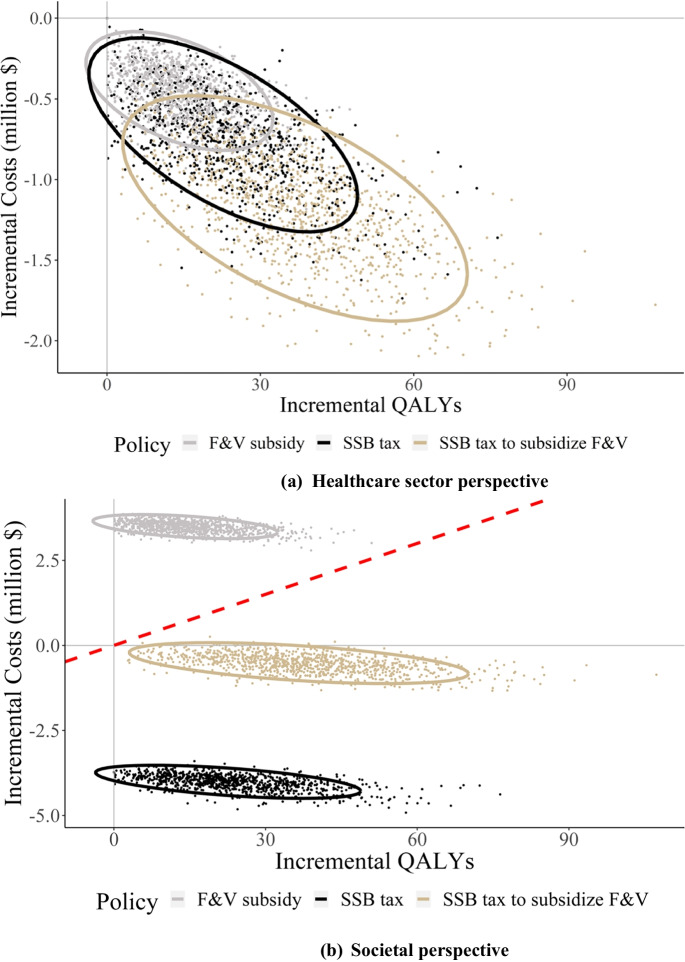

Figure 2 shows the projected health and economic outcomes under each of the three policies in 10, 20, and 40 years as well as lifetime. As the number of years increased, the numbers of CHD and stroke events, CHD and stroke deaths, and QALYs gained increased steadily for each policy scenario. SSB taxes and FV subsidies could avert similar numbers of stroke events and deaths across different years, while SSB taxes could avert more CHD events and deaths compared to FV subsidies. The combined policy could avert more CHD and stroke events and their related deaths compared to implementing either of the two policies alone. However, SSB taxes could save more total costs compared to the other two policies.

Fig. 2.

Projected long-term clinical and economic outcomes compared with the status quo (numbers of CHD and stroke events, QALYs, and healthcare costs per 10,000 adults in NYC over 10, 20, and 40 years and lifetime were reported). Notes: SSB, sugar sweetened beverage; FV, fruit and vegetable; CHD, coronary heart disease; CVD, cardiovascular disease; QALY, quality-adjusted life year

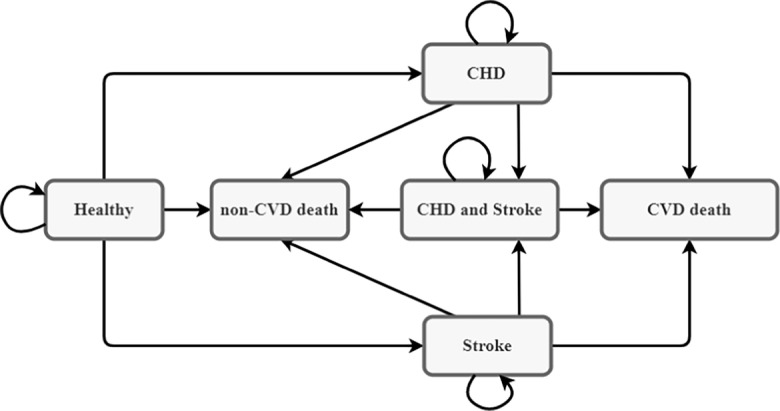

Figure 3 shows the scatter plots of incremental costs and QALYs with 1,000 simulation iterations under each of the three policies from different perspectives. From a healthcare sector perspective (Fig. 3a), the combined policy was dominant (i.e., reduced costs and increased QALYs) compared to all the other policies and had a 100% probability of being the preferred strategy at a $50,000/QALY cost-effectiveness threshold. However, from a societal perspective when policy costs were included, the combined policy was not cost-effective compared to the SSB taxes policy (Fig. 3b). More specifically, the combined policy would result in an ICER of $268,462/QALY compared to the SSB taxes policy. With a cost-effectiveness threshold of $50,000/QALY, SSB taxes alone had a 100% probability of being the preferred strategy from a societal perspective.

Fig. 3.

Incremental costs and quality-adjusted life years compared with the status quo. Notes: The red dashed line is the $50 k/QALY cost-effectiveness threshold. SSB, sugar sweetened beverage; FV, fruit and vegetable; QALY, quality-adjusted life year

Our subgroup analyses showed that the policy could have differential impact across population groups by sex and race (Table S11 in the Supplementary Document). For example, funding FV subsidies with an SSB tax could avert 39 (95%UI, 9 to 73) CHD events and 18 (95%UI, 4 to 36) stroke events per 10,000 men compared to the status quo, while the averted cases for CHD and stroke were 16 (95%UI, 0 to 36) and 13 (95%UI, 4 to 27), respectively, among women. The averted CVD cases by the other policies were also more pronounced among men compared to women. Our results also showed that Black adults were estimated to benefit more from the policies compared to White adults. For example, the combined policy could avert 34 (95%UI, 5 to 76) CHD events and 23 (95%UI, 0 to 48) stroke events per 10,000 Black adults, while the averted cases for CHD and stroke were 27 (95%UI, 0 to 57) and 14 (95%UI, 0 to 31) per 10,000 White adults. In addition, the one-way sensitivity analysis on cost parameters shows that the cost-effectiveness of SSB taxes was more sensitive to the price and price elasticity changes compared with that of the FV subsidies policy (Figure S4 in the Supplementary Document).

Discussion

In this modeling study, SSB taxes, FV subsidies, or a combined policy where SSB taxes funded FV subsidies were projected to prevent a substantial number of incident CVD events and CVD deaths among adults in NYC. Our estimates equate roughly to 18,000, 11,000, and 29,000 CVD events being averted over 10 years in NYC if an SSB tax, FV subsidies, or the combined policy were implemented city-wide. The combined policy was estimated to also increase more QALYs compared to the other policies over time. However, the cost-effectiveness of the combined policy depended on the specific perspective: the combined policy was the most cost-effective from the healthcare sector perspective, while from the societal perspective that considers both direct medical costs and policy and implementation costs, the most cost-effective policy was SSB taxes. In addition, the simulated policies could be more effective and cost-effective among men compared to women, and among Black adults compared to White adults. This implies that the policy has the potential to reduce racial and gender health disparities.

Several recent studies have assessed the cost-effectiveness of a potential national SSB tax policy or FV subsidy policy [41, 42]. To our knowledge, our study is the first cost-effectiveness analysis of using SSB taxes to fund FV subsidies in a large city. Our study is particularly policy relevant because both quantitative and qualitative research indicates that SSB taxes garner greater support among stakeholders when emphasis is placed on using the revenue for health-related programs in the taxed communities [43–45]. Across the US cities that implemented SSB taxes, $135 million per year in revenue has been generated, with a substantial proportion spent directly on health-related programs [11]. Empirical studies suggested that SSB taxes discourage the purchase and consumption of SSBs [46, 47]. Reducing SSB consumption through tax policy may have benefits beyond those captured in our analysis. For example, although evidence is still scarce, SSB consumption is associated with multimorbidity among adults [48], and SSB taxes are expected to reduce the burden of such multimorbidity. A recent modeling study estimated that SSB taxes could reduce the burden of CVD and diabetes mellitus and result in substantial long-term healthcare expenditure savings in the USA [42]. Another modeling study projected that within one year an SSB tax policy could reduce mean BMI by 0.16 kg/m2 among youth and 0.08 kg/m2 among adults in the USA [49]. Furthermore, our analysis may be an underestimate of the long-term cost savings and health benefits of SSB tax policy because we did not include heart failure as an outcome, which may be preceded by CHD and is associated with high costs and a significant reduction in quality of life. Notably, the ultimate impact of an SSB tax and FV subsidies is policy and context specific; their effects may be dependent on factors such as the tax rate, baseline SSB and FV consumption, population demographics, and more [11]. This points towards the importance of evaluating the effects of a specific policy within its proposed location, using a model such as the one presented in this study.

NYC is a promising site for implementation of an SSB tax and FV subsidies. NYC recently received $5.5 million to expand the programs that offer FV financial incentives to SNAP recipents [50], including Get the Good Stuff, which currently offers a one-to-one matching credit for eligible produce at six supermarket locations, and Health Bucks [51], which offers coupons to reduce the cost of fresh FVs at all farmers markets. NYC also started offering a discount on prepackaged bags of locally grown produce purchased from local community-based organizations and urban farmers. As for SSB taxes, although more than 50 countries have implemented SSB taxes [52], the USA has not implemented the policy nationwide because there has been opposition from the food and beverage industry against the policy [53], and there are legal barriers such as state preemption [54, 55]. Despite these challenges, several cities in the US and the Navajo Nation have implemented SSB taxes. NYC, however, lacks the authority to pass such a tax outright. The current study provides support for NYC to seek approval from the state legislature to grant the city the authority to pass such an excise tax and make decisions with respect to revenue allocation to ensure that at least a portion of the revenue is dedicated to low-resource communities in NYC to support FV affordability.

Funding FV subsidies with an SSB tax has the potential to reduce health disparities and address equity concerns associated with implementation of the tax. Low-resource communities and people of color experience higher rates of CVD and are disproportionately targeted through marketing by the SSB industry [56]. Concerns that an SSB tax would be regressive and weigh heavily on these communities are valid. However, young people and those with lower income have been shown to have a larger decrease in the purchase of SSBs as a result of a tax [46, 47]. In this way, the potential health benefits from an SSB tax can be progressive [11]. To ensure that the greatest benefit goes to those currently bearing the greatest health burden from SSBs, the tax revenue should be dedicated to supporting the health of these low-resource communities and development and implementation of such programs should be done by guidance by community members themselves. In this way, programs will not only reflect the local needs of the communities themselves, but also build capacity and ideally, lead to longer term sustainability and community-driven approaches [9]. Impacts of the tax and subsidy program on equity should be evaluated regularly, findings publicly reported and as needed, adjustments made, as possible. As such, an SSB tax and FV subsidies can serve as a strong strategy for reducing the burden of CVD and promoting health equity.

This study has several limitations. First, our analysis only focused on the CVD-related health and economic outcomes, so the potential benefits of SSB taxes and FV subsidies could have been underestimated. For example, research has shown that reduced SSB consumption and increased FV consumption are associated with a reduced risk of cancer [57, 58], which warrants further investigation into the effect of SSB taxes and FV subsidies in preventing cancer. Second, we assumed that CVD risk functions derived in national data would replicate the natural history of CVD among NYC adults. While it is difficult to test the validity of this assumption, our simulated mortality rates closely approximated those in NYC. Third, we did not model Latina/x/o or Asian Americans in the study due to poor representation and small sample sizes in the pooled cohort data and NYC HANES. Lastly, the nutrition policy environment is dynamic, and other local and federal legislation, as well as industry efforts, might be synergistic or antagonistic with SSB taxes or FV subsidies. However, we were not able to capture these potential complex interactions between the modeled policies and other nutrition policies in the current study.

Despite these limitations, to our knowledge, our study is the first assessment of the potential health and economic impact of combining an SSB tax with FV subsidies in a large city. The projected substantial health gains and cost saving associated with the policy could help relevant stakeholders and policymakers justify the implementation of this innovative policy in NYC and potentially other cities around the world.

Supplementary Information

Below is the link to the electronic supplementary material.

Acknowledgements

This research was supported by a grant from the National Heart, Lung, and Blood Institute (R01HL141427) of the National Institutes of Health. The contents of this article are solely the responsibility of the authors and do not necessarily represent the official views of the National Institutes of Health.

Footnotes

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Contributor Information

Brandon K. Bellows, Email: bkb2132@cumc.columbia.edu

Nan Kong, Email: nkong@purdue.edu.

Yan Li, Email: yanliacademic@gmail.com.

References

- 1.Martinez-Gonzalez MA, Ros E, Estruch R. Primary prevention of cardiovascular disease with a Mediterranean diet supplemented with extra-virgin olive oil or nuts. N Engl J Med. 2018;379(14):1388–1389. doi: 10.1056/NEJMc1809971. [DOI] [PubMed] [Google Scholar]

- 2.Mozaffarian D. Dietary and policy priorities for cardiovascular disease, diabetes, and obesity: a comprehensive review. Circulation. 2016;133(2):187–225. doi: 10.1161/CIRCULATIONAHA.115.018585. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Keller A, Heitmann BL, Olsen N. Sugar-sweetened beverages, vascular risk factors and events: a systematic literature review. Public Health Nutr. 2015;18(07):1145–1154. doi: 10.1017/S1368980014002122. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Xi B, Huang Y, Reilly KH, et al. Sugar-sweetened beverages and risk of hypertension and CVD: a dose–response meta-analysis. Br J Nutr. 2015;113(05):709–717. doi: 10.1017/S0007114514004383. [DOI] [PubMed] [Google Scholar]

- 5.Wang X, Ouyang Y, Liu J, et al. Fruit and vegetable consumption and mortality from all causes, cardiovascular disease, and cancer: systematic review and dose-response meta-analysis of prospective cohort studies. BMJ. 2014;349:g4490. doi: 10.1136/bmj.g4490. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Dauchet L, Amouyel P, Hercberg S, Dallongeville J. Fruit and vegetable consumption and risk of coronary heart disease: a meta-analysis of cohort studies. J Nutr. 2006;136(10):2588–2593. doi: 10.1093/jn/136.10.2588. [DOI] [PubMed] [Google Scholar]

- 7.Rehm CD, Penalvo JL, Afshin A, Mozaffarian D. Dietary intake among US adults, 1999–2012. JAMA. 2016;315(23):2542–2553. doi: 10.1001/jama.2016.7491. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Blanck HM, Gillespie C, Kimmons JE, Seymour JD, Serdula MK. Trends in fruit and vegetable consumption among US men and women, 1994–2005. Prev Chronic Dis. 2008;5(2):A35. http://www.ncbi.nlm.nih.gov/pmc/articles/PMC2396974/. Accessed 11 Nov 2021. [PMC free article] [PubMed]

- 9.Healthy Food America. Compare tax policies. Healthy Food America. 2021. https://www.healthyfoodamerica.org/compare_tax_policies. Accessed 11 Nov 2021.

- 10.Crosbie E, Pomeranz JL, Wright KE, Hoeper S, Schmidt L. State preemption: an emerging threat to local sugar-sweetened beverage taxation. Am J Public Health. 2021;111(4):677–686. doi: 10.2105/AJPH.2020.306062. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Krieger J, Bleich SN, Scarmo S, Ng SW. Sugar-sweetened beverage reduction policies: progress and promise. Annu Rev Public Health. 2021;42:439–461. doi: 10.1146/annurev-publhealth-090419-103005. [DOI] [PubMed] [Google Scholar]

- 12.Moran AJ, Gu Y, Clynes S, Goheer A, Roberto CA, Palmer A. Associations between governmental policies to improve the nutritional quality of supermarket purchases and individual, retailer, and community health outcomes: an integrative review. Int J Environ Res Public Health. 2020;17(20):7493. doi: 10.3390/ijerph17207493. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Krieger J, Magee K, Hennings T, Schoof J, Madsen KA. How sugar-sweetened beverage tax revenues are being used in the United States. Prev Med Rep. 2021;23:101388. doi: 10.1016/j.pmedr.2021.101388. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Engel K, Ruder EH. Fruit and vegetable incentive programs for supplemental nutrition assistance program (SNAP) participants: a scoping review of program structure. Nutrients. 2020;12(6):1676. doi: 10.3390/nu12061676. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Rummo PE, Lyerly R, Rose J, Malyuta Y, Cohen ED, Nunn A. The impact of financial incentives on SNAP transactions at mobile produce markets. Int J Behav Nutr Phys Act. 2021;18(1):1–8. doi: 10.1186/s12966-021-01093-z. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 16.Moran A, Thorndike A, Franckle R, et al. Financial incentives increase purchases of fruit and vegetables among lower-income households with children. Health Aff (Millwood) 2019;38(9):1557–1566. doi: 10.1377/hlthaff.2018.05420. [DOI] [PubMed] [Google Scholar]

- 17.Rummo PE, Noriega D, Parret A, Harding M, Hesterman O, Elbel BE. Evaluating a USDA program that gives SNAP participants financial incentives to buy fresh produce in supermarkets. Health Aff (Millwood) 2019;38(11):1816–1823. doi: 10.1377/hlthaff.2019.00431. [DOI] [PubMed] [Google Scholar]

- 18.Pearson-Stuttard J, Bandosz P, Rehm CD, et al. Comparing effectiveness of mass media campaigns with price reductions targeting fruit and vegetable intake on US cardiovascular disease mortality and race disparities. Am J Clin Nutr. 2017;106(1):199–206. doi: 10.3945/ajcn.116.143925. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Pearson-Stuttard J, Bandosz P, Rehm CD, et al. Reducing US cardiovascular disease burden and disparities through national and targeted dietary policies: a modelling study. PLoS Med. 2017;14(6):e1002311. doi: 10.1371/journal.pmed.1002311. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Jack D, Neckerman K, Schwartz-Soicher O, et al. Socio-economic status, neighbourhood food environments and consumption of fruits and vegetables in New York City. Public Health Nutr. 2013;16(07):1197–1205. doi: 10.1017/S1368980012005642. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21.Loftfield E, Yi SS, Curtis CJ, Bartley K, Kansagra SM. Potassium and fruit and vegetable intakes in relation to social determinants and access to produce in New York City. Am J Clin Nutr. 2013;98(5):1282–1288. doi: 10.3945/ajcn.113.059204. [DOI] [PubMed] [Google Scholar]

- 22.Lee-Kwan SH, Moore LV, Blanck HM, Harris DM, Galuska D. Disparities in state-specific adult fruit and vegetable consumption—United States, 2015. MMWR Morb Mortal Wkly Rep. 2017;66(45):1241. doi: 10.15585/mmwr.mm6645a1. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 23.Jiang N, Stella SY, Russo R, et al. Trends and sociodemographic disparities in sugary drink consumption among adults in New York City, 2009–2017. Prev Med Rep. 2020;19:101162. doi: 10.1016/j.pmedr.2020.101162. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 24.Kohli-Lynch CN, Bellows BK, Thanassoulis G, et al. Cost-effectiveness of low-density lipoprotein cholesterol level–guided statin treatment in patients with borderline cardiovascular risk. JAMA Cardiol. 2019;4(10):969–977. doi: 10.1001/jamacardio.2019.2851. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25.Kohli-Lynch CN, Bellows BK, Zhang Y, et al. Cost-effectiveness of lipid-lowering treatment in young adults. J Am Coll Cardiol. 2021;78(20):1954–1964. doi: 10.1016/j.jacc.2021.08.065. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 26.Moran AE, Odden MC, Thanataveerat A, et al. Cost-effectiveness of hypertension therapy according to 2014 guidelines. N Engl J Med. 2015;372(5):447–455. doi: 10.1056/NEJMsa1406751. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 27.Weinstein MC, Coxson PG, Williams LW, Pass TM, Stason WB, Goldman L. Forecasting coronary heart disease incidence, mortality, and cost: the coronary heart disease policy model. Am J Public Health. 1987;77(11):1417–1426. doi: 10.2105/ajph.77.11.1417. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28.Zhang Y, Vittinghoff E, Pletcher MJ, et al. Associations of blood pressure and cholesterol levels during young adulthood with later cardiovascular events. J Am Coll Cardiol. 2019;74(3):330–341. doi: 10.1016/j.jacc.2019.03.529. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 29.Oelsner EC, Balte PP, Cassano PA, et al. Harmonization of respiratory data from 9 US population-based cohorts: the NHLBI pooled cohorts study. Am J Epidemiol. 2018;187(11):2265–2278. doi: 10.1093/aje/kwy139. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 30.Zeki Al Hazzouri A, Vittinghoff E, Zhang Y, et al. Use of a pooled cohort to impute cardiovascular disease risk factors across the adult life course. Int J Epidemiol. 2019;48(3):1004–1013. doi: 10.1093/ije/dyy264. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31.New York City Department of health and mental hygiene. New York City Community Health Survey (CHS). Published 2018. Accessed July 14, 2019. https://www1.nyc.gov/site/doh/data/data-sets/community-health-survey.page

- 32.Afshin A, Peñalvo JL, Del Gobbo L, et al. The prospective impact of food pricing on improving dietary consumption: a systematic review and meta-analysis. PLoS ONE. 2017;12(3):e0172277. doi: 10.1371/journal.pone.0172277. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 33.Narain A, Kwok CS, Mamas MA. Soft drinks and sweetened beverages and the risk of cardiovascular disease and mortality: a systematic review and meta-analysis. Int J Clin Pract. 2016;70(10):791–805. doi: 10.1111/ijcp.12841. [DOI] [PubMed] [Google Scholar]

- 34.Micha R, Peñalvo JL, Cudhea F, Imamura F, Rehm CD, Mozaffarian D. Association between dietary factors and mortality from heart disease, stroke, and type 2 diabetes in the United States. JAMA. 2017;317(9):912–924. doi: 10.1001/jama.2017.0947. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35.Moran AE, Forouzanfar MH, Roth GA, et al. Temporal trends in ischemic heart disease mortality in 21 world regions, 1980 to 2010: the Global Burden of Disease 2010 study. Circulation. 2014;129(14):1483–1492. doi: 10.1161/CIRCULATIONAHA.113.004042. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 36.Moran AE, Forouzanfar MH, Roth GA, et al. The global burden of ischemic heart disease in 1990 and 2010: the Global Burden of Disease 2010 study. Circulation. 2014;129(14):1493–1501. doi: 10.1161/CIRCULATIONAHA.113.004046. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 37.Murray CJL, Vos T, Lozano R, et al. Disability-adjusted life years (DALYs) for 291 diseases and injuries in 21 regions, 1990–2010: a systematic analysis for the Global Burden of Disease Study 2010. The Lancet. 2012;380(9859):2197–2223. doi: 10.1016/S0140-6736(12)61689-4. [DOI] [PubMed] [Google Scholar]

- 38.Centers for Disease Control and Prevention. CDC WONDER. Atlanta, GA. Available at: https://wonder.cdc.gov. Accessed 21 Feb 2019.

- 39.Sanders GD, Neumann PJ, Basu A, et al. Recommendations for conduct, methodological practices, and reporting of cost-effectiveness analyses: second panel on cost-effectiveness in health and medicine. JAMA. 2016;316(10):1093–1103. doi: 10.1001/jama.2016.12195. [DOI] [PubMed] [Google Scholar]

- 40.Eze-Nliam CM, Zhang Z, Weiss SA, Weintraub WS. Cost-effectiveness assessment of cardiac interventions: determining a socially acceptable cost threshold. Interv Cardiol. 2014;6(1):45. doi: 10.2217/ica.13.81. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 41.Mozaffarian D, Liu J, Sy S, et al. Cost-effectiveness of financial incentives and disincentives for improving food purchases and health through the US Supplemental Nutrition Assistance Program (SNAP): a microsimulation study. PLoS Med. 2018;15(10):e1002661. doi: 10.1371/journal.pmed.1002661. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 42.Lee Y, Mozaffarian D, Sy S, et al. Health impact and cost-effectiveness of volume, tiered, and absolute sugar content sugar-sweetened beverage tax policies in the United States: a microsimulation study. Circulation. 2020;142(6):523–534. doi: 10.1161/CIRCULATIONAHA.119.042956. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 43.Purtle J, Langellier B, Lê-Scherban F. A case study of the Philadelphia sugar-sweetened beverage tax policymaking process: implications for policy development and advocacy. J Public Health Manag Pract. 2018;24(1):4–8. doi: 10.1097/PHH.0000000000000563. [DOI] [PubMed] [Google Scholar]

- 44.Jou J, Niederdeppe J, Barry CL, Gollust SE. Strategic messaging to promote taxation of sugar-sweetened beverages: lessons from recent political campaigns. Am J Public Health. 2014;104(5):847–853. doi: 10.2105/AJPH.2013.301679. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 45.Long MW, Polacsek M, Bruno P, et al. Cost-effectiveness analysis and stakeholder evaluation of 2 obesity prevention policies in Maine, US. J Nutr Educ Behav. 2019;51(10):1177–1187. doi: 10.1016/j.jneb.2019.07.005. [DOI] [PubMed] [Google Scholar]

- 46.Teng AM, Jones AC, Mizdrak A, Signal L, Genç M, Wilson N. Impact of sugar-sweetened beverage taxes on purchases and dietary intake: systematic review and meta-analysis. Obes Rev. 2019;20(9):1187–1204. doi: 10.1111/obr.12868. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 47.Popkin BM, Ng SW. Sugar-sweetened beverage taxes: lessons to date and the future of taxation. PLoS Med. 2021;18(1):e1003412. doi: 10.1371/journal.pmed.1003412. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 48.Shi Z, Ruel G, Dal Grande E, Pilkington R, Taylor AW. Soft drink consumption and multimorbidity among adults. Clin Nutr ESPEN. 2015;10(2):e71–e76. doi: 10.1016/j.clnesp.2015.01.001. [DOI] [PubMed] [Google Scholar]

- 49.Long MW, Gortmaker SL, Ward ZJ, et al. Cost effectiveness of a sugar-sweetened beverage excise tax in the US. Am J Prev Med. 2015;49(1):112–123. doi: 10.1016/j.amepre.2015.03.004. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 50.NYC Health. Good health, good value: NYC Receives $5.5 Million Grant to Make Healthy Food More Affordable to New Yorkers.; 2021. https://www1.nyc.gov/site/doh/about/press/pr2021/good-health-good-value-nyc-receives-grant-for-affordable-healthy-food.page. Accessed 11 Nov 2021.

- 51.Payne GH, Wethington H, Olsho L, Jernigan J, Farris R, Walker DK. Peer Reviewed: implementing a farmers’ market incentive program: perspectives on the New York City Health Bucks Program. Prev Chronic Dis. 2013;10. [DOI] [PMC free article] [PubMed]

- 52.The Obesity Evidence Hub. Countries That have taxes on sugar-sweetened beverages (SSBs). Cancer Council Victoria; 2022. www.obesityevidencehub.org.au. Accessed 11 Nov 2021.

- 53.Crosbie E, Florence D. Expanding our understanding of industry opposition to help implement sugar-sweetened beverage taxation. Public Health Nutr. Published online 2021:1–3. [DOI] [PMC free article] [PubMed]

- 54.Pomeranz JL, Pertschuk M. State preemption: a significant and quiet threat to public health in the United States. Am J Public Health. 2017;107(6):900–902. doi: 10.2105/AJPH.2017.303756. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 55.Crosbie E, Schillinger D, Schmidt LA. State preemption to prevent local taxation of sugar-sweetened beverages. JAMA Intern Med. 2019;179(3):291–292. doi: 10.1001/jamainternmed.2018.7770. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 56.Falbe J, Madsen K. Growing momentum for sugar-sweetened beverage campaigns and policies: costs and considerations. Am J Public Health. 2017;107(6):835–838. doi: 10.2105/AJPH.2017.303805. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 57.Romanos-Nanclares A, Toledo E, Gardeazabal I, Jiménez-Moleón JJ, Martínez-González MA, Gea A. Sugar-sweetened beverage consumption and incidence of breast cancer: the Seguimiento Universidad de Navarra (SUN) Project. Eur J Nutr. 2019;58(7):2875–2886. doi: 10.1007/s00394-018-1839-2. [DOI] [PubMed] [Google Scholar]

- 58.Terry P, Terry JB, Wolk A. Fruit and vegetable consumption in the prevention of cancer: an update. J Intern Med. 2001;250(4):280–290. doi: 10.1046/j.1365-2796.2001.00886.x. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.